SCHEDULE 14A (RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the registrant /X/

Filed by a party other than the registrant / /

Check the appropriate box:

| / / | Preliminary proxy statement |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /X/ | Definitive proxy statement |

| / / | Definitive additional materials |

| / / | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

(Name of Registrant as Specified in its Charter)

TIMOTHY PLAN

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

NOT APPLICABLE

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 6. | Amount Previously Paid: |

| 7. | Form, Schedule or Registration Statement No.: |

| 8. | Filing Party: |

| 9. | Date Filed: |

iv

Proxy Statement

April 14, 2015

Important Voting Information Inside

The Timothy Plan Defensive Strategies Fund

A Series of the Timothy Plan

Please vote immediately!

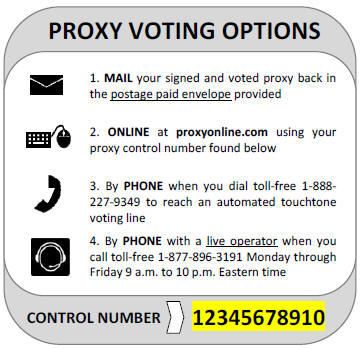

You can vote through the internet, by telephone, or by mail.

Details on voting can be found on your proxy card.

1

Timothy Plan

1055 Maitland Center Commons

Maitland, FL 32751

Toll Free 800-846-7526

SPECIAL MEETING OF THE SHAREHOLDERS OF

The Timothy Plan Defensive Strategies Fund

Important Voting Information Inside

TABLE OF CONTENTS

| Notice of Special Meeting of Shareholders | 3 | |||

| Important Information to Help You Understand the Proposals | 5 | |||

| Proxy Statement | 6 | |||

| Proposal 1: | To replace the fundamental investment limitations of the Fund with new updated fundamental investment limitations: | |||

| Proposal 1a: |

To amend the fundamental investment limitation with respect to borrowing money and issuing senior securities; | |||

| Proposal 1b: |

To amend the fundamental investment limitation with respect to purchasing and selling commodities, and to add a restriction allowing the Fund to purchase and sell gold and other precious metals in amounts not to exceed ten percent (10%) of the Fund’s net assets, in the aggregate; | |||

| Proposal 1c: |

To amend the fundamental investment limitation with respect to concentrating investments in a particular industry or group of industries; | |||

| Proposal 1d: |

To amend the fundamental investment limitation with respect to investing in real estate; | |||

| Proposal 1e: |

To amend the fundamental investment limitation with respect to underwriting securities; | |||

| Proposal 1f: |

To amend the fundamental investment limitation with respect to loans: | |||

| Proposal 1g: |

To eliminate fundamental investment limitations no longer required by law. | |||

| Proposal 2: | To transact any other business, not currently contemplated, that may properly come before the special meeting of shareholders or any adjournment thereof in the discretion of the proxies or their substitutes. | |||

| Outstanding Shares and Voting Requirements | 16 | |||

| Additional Information on the Operation of the Trust | 17 | |||

| Other Matters | 18 | |||

2

of the

SHAREHOLDERS OF THE

TIMOTHY PLAN DEFENSIVE STRATEGIES FUND

1055 Maitland Center Commons

Maitland, FL 32751

Toll Free 800-846-7526

The Board of Trustees (the “Board”) of the Timothy Plan (the “Trust”) has voted to call a special meeting of all shareholders of the Timothy Plan Defensive Strategies Fund (the “Fund”), in order to seek shareholder approval of the proposals set forth below. The Special Meeting will be held at the offices of Gemini Fund Services, LLC. (“Gemini”), located at 80 Arkay Drive, Suite 110, Hauppauge, NY 11788, at 10:00 a.m., Eastern Time, on Wednesday, May 13, 2015. Gemini serves as Administrator to the Trust. If you expect to attend the Special Meeting in person, please call the Trust at 1-800-662-0201 to inform them of your intention. This proxy was first mailed to eligible shareholders on or about April 13, 2015.

The Trust is a Delaware business trust, registered with the Securities and Exchange Commission (“SEC”) and operating as an open-end management investment company. The Trust has authorized the division of its shares into various series (“funds”) and currently offers shares of thirteen funds to the public. The Trust further has authorized the division of its shares into various classes, each with different sales charges and/or ongoing fees.

The Timothy Plan Defensive Strategies Fund (the “Fund”), which is the subject of this Special Meeting, offers Class A shares, which are sold to the public with a front-end sales charge, Class C Shares, which are sold to the public and have no sales charges, but do charge an ongoing distribution (i.e., 12b-1) fee, and Institutional Class Shares, which are sold without a contingent deferred sales charge or an ongoing distribution and servicing (12b-1) fee.

This Special Meeting is being held for all Fund shareholders, without regard to share class.

The Meeting is being held so that shareholders can vote on the following proposals:

| Proposal 1: | To replace the fundamental investment limitations of the Fund with new updated fundamental investment limitations: | |||

| Proposal 1a: | To amend the fundamental investment limitation with respect to borrowing money and issuing senior securities; | |||

| Proposal 1b: | To amend the fundamental investment limitation with respect to purchasing and selling commodities, and to add a restriction allowing the Fund to purchase and sell gold and other precious metals in amounts not to exceed ten percent (10%) of the Fund’s net assets, in the aggregate; | |||

| Proposal 1c: | To amend the fundamental investment limitation with respect to concentrating investments in a particular industry or group of industries; | |||

| Proposal 1d: | To amend the fundamental investment limitation with respect to investing in real estate; | |||

| Proposal 1e: | To amend the fundamental investment limitation with respect to underwriting securities; | |||

| Proposal 1f: | To amend the fundamental investment limitation with respect to loans: | |||

| Proposal 1g: | To eliminate fundamental investment limitations no longer required by law. | |||

| Proposal 2: | To transact any other business, not currently contemplated, that may properly come before the special meeting of shareholders or any adjournment thereof in the discretion of the proxies or their substitutes. | |||

3

You may vote at the Special Meeting if you are the record owner of any class of shares of the Fund as of the close of business on March 31, 2015. If you attend the Special Meeting, you may vote your shares in person. If you expect to attend the Special Meeting, please call the Trust at 1-800-846-7526 to inform them.

Your vote on each proposal is very important. If you own Fund shares in more than one account of the Trust, you will receive a proxy statement and one proxy card for each of your accounts. You will need to fill out each proxy card in order to vote the shares you hold for each account.

Whether or not you plan to attend the Special Meeting, please fill in, date, sign and return your proxy card(s) in the enclosed postage paid envelope. You may also return your completed proxy card by faxing it to the Trust at 631-951-0573. PLEASE VOTE NOW TO HELP SAVE THE COST OF ADDITIONAL SOLICITATIONS.

As always, we thank you for your confidence and support.

| By Order of the Board of Trustees, |

| Arthur D. Ally |

| Chairman |

April 14, 2015

4

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND THE PROPOSALS

While we encourage you to carefully read the entire text of the Proxy Statement, for your convenience we have provided answers to some of the most frequently asked questions, and a brief summary of the proposals we are asking you to approve.

QUESTIONS AND ANSWERS

| Q: | What is happening? Why did I get this package of materials? |

| A: | A special meeting of shareholders of the Timothy Plan Defensive Strategies Fund (the “Fund”) is scheduled to be held at 10:00 a.m., Eastern Time, on May 13, 2015. According to our records, you are a shareholder of record in the Fund as of the Record Date for this meeting. |

PROPOSAL 1: Updated Fundamental Investment Limitations

| Q: | Why am I being asked to vote on changes to the Fund’s fundamental investment limitations? |

| A: | The Fund’s Adviser is proposing to update and simplify the Fund’s fundamental investment limitations in order to provide the Fund with more investment flexibility, to make the Fund more responsive to changing regulatory and market environments, and to save money by reducing the need for future shareholder approvals. The proposed revisions to the fundamental investment limitations are intended to more closely reflect the requirements of the Investment Company Act of 1940, as amended (the “1940 Act”) and standards adopted by the Securities and Exchange Commission. Since the Fund’s current limitations were originally adopted, there have been many changes to federal and state regulatory oversight and the operation of the capital markets. Additionally, the Fund’s Adviser is proposing a new fundamental investment limitation which would allow the Fund to purchase and sell gold and other precious metals in amounts not to exceed ten percent (10%) of the Fund’s net assets, in the aggregate. The Adviser is making this proposal because it believes that giving the Fund the flexibility to invest in precious metals will provide an additional hedging tool for the Fund and will enhance the Fund’s ability to achieve its investment objective. |

| Q: | How will the Fund’s new fundamental limitations differ from their existing limitations? |

| A: | The proposed changes will have the effect of updating and simplifying the Fund’s fundamental investment limitations. The 1940 Act requires the Fund to adopt fundamental policies with respect to certain activities and provides that such policies may not be changed except by a majority vote of shareholders. These activities are: |

Although the Fund currently has a fundamental limitation addressing each of these activities, the Fund’s current fundamental limitations are unnecessarily restricting the Fund’s ability to respond to changing circumstances and market opportunities. A comparison of the Fund’s existing and proposed fundamental limitations appears in this Proxy beginning on page 8.

| Q: | How does the Board of Trustees recommend that I vote? |

| A: | After careful consideration of each proposal, the Board of Trustees unanimously recommends that you vote FOR all the proposals. The various factors that the Board of Trustees considered in making these determinations are described in this Proxy Statement. |

| Q: | What will happen if there are not enough votes to hold the Meeting? |

| A: | It is important that shareholders vote by telephone, internet or complete and return signed proxy cards by mail or fax promptly, but no later than May 12, 2015, to ensure there is a quorum for the Meeting. You may be contacted by a representative of the Trust or the Adviser or a proxy solicitor, if we do not hear from you. If we have not received sufficient votes to have a quorum at the Meeting or have not received enough votes to approve one or more of the Proposals, we may adjourn the Meeting to a later date so we can continue to seek more votes. |

| Q: | Whom should I call for additional information about the Proxy Statement? |

| A: | If you have any questions regarding the Proxy Statement or completing and returning your proxy card, please call 800-846-7526. |

5

TIMOTHY PLAN

SPECIAL MEETING OF SHAREHOLDERS OF

THE TIMOTHY PLAN DEFENSIVE STRATEGIES FUND

To Be Held on May 13, 2015

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board of Trustees”) of the Timothy Plan (the “Trust”) for use at the Special Meeting of Shareholders (the “Meeting”) of the Timothy Plan Defensive Strategies Fund (the “Fund”), to be held at 10:00 a.m., Eastern Time, on May 13, 2015 at the offices of the Trust’s Administrator, Gemini Fund Services, Inc., located at 80 Arkay Drive, Suite 110, Hauppauge, NY 11788. or at any adjournment thereof. The principal business address of the Fund is 1055 Maitland Center Commons, Maitland, FL 32751.

As described in more detail below, at the Meeting, the Fund’s shareholders are being asked to consider the following proposals:

| Proposal 1: | To replace the fundamental investment limitations of the Fund with new updated fundamental investment limitations: | |||

| Proposal 1a: |

To amend the fundamental investment limitation with respect to borrowing money and issuing senior securities; | |||

| Proposal 1b: |

To amend the fundamental investment limitation with respect to purchasing and selling commodities, and to add a restriction allowing the Fund to purchase and sell gold and other precious metals in amounts not to exceed ten percent (10%) of the Fund’s net assets, in the aggregate; | |||

| Proposal 1c: |

To amend the fundamental investment limitation with respect to concentrating investments in a particular industry or group of industries; | |||

| Proposal 1d: |

To amend the fundamental investment limitation with respect to investing in real estate; | |||

| Proposal 1e: |

To amend the fundamental investment limitation with respect to underwriting securities; | |||

| Proposal 1f: |

To amend the fundamental investment limitation with respect to loans: | |||

| Proposal 1g: |

To eliminate fundamental investment limitations no longer required by law. | |||

| Proposal 2: | To transact any other business, not currently contemplated, that may properly come before the special meeting of shareholders or any adjournment thereof in the discretion of the proxies or their substitutes. | |||

Your proxy, if properly executed, duly returned and not revoked, will be voted in accordance with your directions on the proxy. If you properly execute and return your proxy but do not provide instructions with respect to a proposal, your proxy will be voted for that proposal. You may revoke a proxy at any time prior to the Meeting by filing with the Secretary of the Trust an instrument revoking the proxy, by submitting a proxy bearing a later date, or by attending and voting at the Meeting in person. This Proxy Statement and proxy card were first mailed to shareholders on or about April 13, 2015.

The Fund will pay the cost of preparing, printing and mailing the enclosed proxy card(s) and Proxy Statement and certain other costs incurred by the Fund in connection with matters presented to the Meeting, including the fees and expenses of counsel to the Trust and its Independent Trustees.

The Trust has retained AST Fund Solutions (“AST”) to solicit proxies for the Meeting. AST is responsible for printing proxy cards, mailing proxy material to shareholders, soliciting broker-dealer firms, custodians, nominees and fiduciaries, tabulating the returned proxies and performing other proxy solicitation services.

In addition to solicitation through the mail, proxies may be solicited by representatives of the Fund without cost to the Fund. Such solicitation may be by telephone, facsimile or otherwise. It is anticipated that broker-dealer firms, custodians, nominees, fiduciaries and other financial institutions will be requested to forward proxy materials to beneficial owners and to obtain approval for the execution of proxies.

6

| PROPOSAL 1: |

TO REPLACE THE FUNDAMENTAL INVESTMENT LIMITATIONS OF THE FUND WITH NEW UPDATED FUNDAMENTAL LIMITATIONS |

You are being asked to adopt a revised set of fundamental investment limitations that conform to the provisions of the Investment Company Act of 1940, as amended (the “1940 Act”), and positions of the staff of the Securities and Exchange Commission (the “SEC”). Under the 1940 Act, the Fund is required to adopt certain “fundamental” investment policies that can be changed only by a shareholder vote. Because the Fund has been in operation for several years, many of its fundamental investment limitations reflect certain regulatory, business or industry conditions that are no longer in effect.

After conducting an analysis of the Fund’s fundamental investment limitations, the Adviser has recommended to the Board that certain fundamental investment limitations be amended or eliminated in order to (i) clarify certain language; (ii) simplify certain fundamental investment limitations by omitting unnecessary language regarding non-fundamental exceptions or explanations; (iii) eliminate fundamental investment limitations that are no longer required under state securities laws, the 1940 Act or the positions of the staff of the SEC in interpreting the 1940 Act; and, (iv) provide additional flexibility to the Fund’s portfolio management process by permitting the Funds to engage in certain investment activities consistent with current law and to better respond to changing markets, new investment opportunities and future changes to applicable law. It is possible and even likely that, as the financial markets continue to evolve over time, the 1940 Act and other applicable law may be amended to address changed circumstances and new investment opportunities. It is also possible that the 1940 Act and other law could change for other reasons. Because many of the existing fundamental investment limitations are more restrictive than the law requires, their presence unnecessarily limits the Fund’s investment activities without a meaningful benefit to shareholders. The new updated fundamental investment limitations will provide the Board of Trustees with broader discretion to determine the Fund’s investment policies to the full extent permitted by the 1940 Act and other applicable law as they may be amended from time to time, or new rules, interpretations and exemptions implemented by the SEC or other agencies without seeking costly and time-consuming shareholder approval.

The Board has reviewed the proposed new updated fundamental investment limitations of the Fund as set forth in Proposals 1a-g and has concluded that the Proposals are in the best interests of the Fund and its shareholders and has unanimously approved the Proposals, subject to approval of the Fund’s shareholders.

You are being asked to vote on each Proposal separately on the enclosed proxy card. If a Proposal is not approved by shareholders, the Fund’s current limitation will remain unchanged and the Board may consider other courses of action.

7

Proposal No. 1a

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION

WITH RESPECT TO BORROWING MONEY

AND ISSUING SENIOR SECURITIES

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding borrowing money and the issuance of senior securities. The Funds’ existing fundamental investment limitation with respect to borrowing money and issuing senior securities will be separated into two fundamental limitations as follows:

Proposal No. 1a(i)

BORROWING MONEY

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding borrowing money. The 1940 Act generally permits a fund to borrow money in an amount equal to or less than 33 1/3% of its total assets (including the amount borrowed) from banks, or an amount equal to or less than 5% of its total assets for temporary purposes from any unaffiliated lender. Mutual funds typically borrow money to cover short-term cash needs (such as to cover large and unexpected redemptions) without having to sell portfolio securities at a time when a sale would be disadvantageous for investment reasons. The Fund’s existing investment limitation is more prohibitive than the requirements of the 1940 Act and has the effect of unnecessarily limiting the Fund’s borrowing practices.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to borrowing money and the implications of the Proposal:

|

Current Fundamental Limitation

|

Proposed Fundamental Limitation

| |||

| The Fund will not borrow money, except that the Fund may borrow from banks (i) for temporary or emergency purposes in an amount not exceeding the Fund’s assets or (ii) to meet redemption requests that might otherwise require the untimely disposition of portfolio securities, in an amount not to exceed 33% of the value of the Fund’s total assets (including the amount borrowed) at the time the borrowing is made; and whenever borrowings by the Fund, including reverse repurchase agreements, exceed 5% of the value of the Fund’s total assets, the Fund will not purchase any securities. Interest paid on borrowing will reduce net income.

|

The Fund may not engage in borrowing except as permitted by the 1940 Act, any rules and regulations promulgated thereunder or interpretations of the SEC or its staff. | |||

|

Purpose of Proposal

|

Effect of Proposal

| |||

| The purpose of this Proposal is to make the Fund’s fundamental investment limitation on borrowing consistent with applicable limitations under the 1940 Act. The proposed change would expand the Fund’s flexibility to borrow to the extent permitted by the 1940 Act and simplify the current limitation by omitting unnecessary exceptions and explanations. |

The proposed amendment is not expected to change the way the Fund is managed or affect its operations. The Fund currently does not intend to change its borrowing activities in response to the change in the policy. Any change to the Fund’s borrowing activities would be subject to review by the Board and would be reflected in the Fund’s disclosures to shareholders, including any material risks, as appropriate. If this Proposal is approved, the Fund would be permitted to borrow for any purpose permitted under the 1940 Act, including for leveraging purposes, which means that the Fund would be able to use borrowed money to increase its investments in securities.

Risks of Proposal. To the extent that borrowing involves leveraging, the Fund’s share price may be subject to increased volatility because borrowing may magnify the effect of an increase or decrease in a Fund’s holdings. In addition, any money borrowed would be subject to interest and other costs.

|

The Board of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1a (i)

8

Proposal No. 1a(ii)

ISSUING SENIOR SECURITIES

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding the issuance of senior securities. A senior security is generally any security that gives its holder a priority claim on a mutual fund’s assets or on dividends paid by a fund. A number of different investment instruments and strategies – forward and futures contracts, repurchase agreements, short selling, options writing and certain derivatives – may involve the issuance of a senior security. The 1940 Act prohibits funds from issuing or selling senior securities, but the SEC has taken the position that instruments and strategies that otherwise might be considered to involve senior securities will not be considered senior securities if funds use certain protective techniques. These techniques include holding an offsetting position or segregating liquid assets in an amount sufficient to meet the fund’s obligations under the instrument or strategy. The Fund’s existing investment limitation is more prohibitive than the requirements of the 1940 Act and has the effect of unnecessarily restricting the Fund’s ability to issue senior securities.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to issuing senior securities and the implications of the Proposal:

|

Current Fundamental Limitation

|

Proposed Fundamental Limitation

| |

| The Fund will not issue senior securities. |

The Fund will not issue senior securities. This limitation is not applicable to activities that may be deemed to involve the issuance or sale of a senior security by the Fund, provided that the Fund’s engagement in such activities is consistent with or permitted by the 1940 Act, the rules and regulations promulgated thereunder or interpretations of the SEC or its staff.

| |

|

Purpose of Proposal

|

Effect of Proposal

| |

| The purpose of this Proposal is to make the Fund’s fundamental investment limitation on issuing senior securities consistent with applicable limitations under the 1940 Act. The proposed change would expand the Fund’s flexibility to issue senior securities to the extent permitted by the 1940 Act and clarify the Fund’s ability to engage in permissible types of transactions which have been interpreted as not constituting the issuance of senior securities. | The proposed amendment is not expected to change the way the Fund is managed or affect its operations. The Fund currently does not intend to change its approach to issuing senior securities in response to the change in the policy. Any change to the Fund’s approach to issuing senior securities would be subject to review by the Board and would be reflected in the Fund’s disclosures to shareholders, including any material risks, as appropriate.

The proposed senior securities policy would clarify the Fund’s ability to engage in the permissible types of transactions discussed above, which, while appearing to raise senior security concerns, have been interpreted as not constituting the issuance of senior securities under the federal securities laws when certain conditions are met.

Risks of Proposal. The principal risk created by the use of senior securities is leverage risk, i.e., that it is possible that the Fund’s loss on the transaction may exceed the amount invested. In addition, the Fund may incur additional expenses, such as interest expense.

|

The Board of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1a(ii).

9

Proposal No. 1b

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION

WITH RESPECT TO PURCHASING AND SELLING COMMODITIES

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding the purchase and sale of commodities. Commodities include physical commodities such as grains, metals and foods. Commodities may also include financial derivative or commodities contracts, such as futures contracts, and options thereon, including currency, stock index, or interest rate futures. The 1940 Act and the Internal Revenue Code contain provisions that, as a practical matter, limit how much a mutual fund can invest in commodities; however, the Fund’s existing limitation is more prohibitive than the requirements of the 1940 Act and the Internal Revenue Code and has the effect of unnecessarily limiting the Fund’s commodity investments.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to purchasing and selling commodities and the implications of the Proposal:

|

Current Fundamental Limitation

|

Proposed Fundamental Limitation

| |||

| The Fund will not purchase or sell commodities or commodity futures contracts, other than those related to stock indexes. | The Fund will not purchase or sell commodities unless acquired as a result of ownership of securities or other investments to the extent permitted under the 1940 Act and the regulations of any other agency with authority over the Fund. This limitation does not preclude the Fund from purchasing or selling options or futures contracts, from investing in securities or other instruments backed by commodities or from investing in companies that are engaged in a commodities business or have a significant portion of their assets in commodities. This limitation does not preclude the Fund from purchasing and selling gold and other precious metals in amounts not to exceed ten percent (10%) of the Fund’s net assets, in the aggregate.

| |||

|

Purpose of Proposal

|

Effect of Proposal

| |||

| The proposed amendments would simplify the current restriction with respect to commodities by omitting an unnecessary discussion of exceptions and explanations and clarify that financial derivative or commodity contracts are not limited by this restriction. |

The proposed amendments would provide the Fund with greater flexibility with respect to investing in options and commodities to the extent permitted by the 1940 Act.

Any use of commodities or financial derivative or commodities contracts, or put or call options implemented by the Fund would be subject to review by the Board and would be reflected in the Fund’s disclosures to shareholders, including any material risks, as appropriate.

Risks of Proposal. The risks of the use of commodities or financial derivative or commodities contracts by the Fund may include the risk that options and futures contracts may be more volatile or less liquid than traditional investments and that their use may result in a capital loss if the price of the underlying security rises or falls dramatically. |

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1b.

10

Proposal No. 1c.

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION

WITH RESPECT TO CONCENTRATING INVESTMENTS IN A PARTICULAR INDUSTRY OR GROUP OF INDUSTRIES

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding concentrating investments in a particular industry or group of industries. The SEC staff has taken the position that a fund concentrates its investments if it invests more than 25% of its assets in any particular industry or group of industries. For this purpose, investments do not include certain items such as cash, U.S. government securities, securities of other investment companies and certain tax-exempt securities.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to concentrating investments and the implications of the Proposal:

|

Current Fundamental Limitation

|

Proposed Fundamental Limitation

| |

| The Fund will not invest more than 25% of the value of the Fund’s total assets in one particular industry, except for temporary defensive purposes. | The Fund will not invest more than 25% of its total assets in a particular industry or group of industries. This limitation is not applicable to investments in obligations issued or guaranteed by the U.S. government, its agencies and instrumentalities or repurchase agreements with respect thereto, or investments in other investment companies.

| |

|

Purpose of Proposal

|

Effect of Proposal

| |

| The purpose of this Proposal is to make the Fund’s fundamental policy on concentrating investments consistent with the provisions of the 1940 Act and positions of the staff of the SEC in interpreting the 1940 Act. The proposed amendments would clarify that investments in obligations issued or guaranteed by the U.S. government, its agencies and instrumentalities or repurchase agreements with respect thereto, or investments in other investment companies are not subject to the Fund’s industry concentration policy. The proposed amendments would further clarify that the Fund will not invest “more than 25%” rather than “25% or more” of its total assets in a particular industry or group of industries.

|

The proposed amendments are not expected to change the way the Fund is managed or to affect its operations. |

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1c.

11

Proposal No. 1d

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION WITH RESPECT TO INVESTING IN REAL ESTATE

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding the purchase and sale of real estate. Since the 1940 Act does not prohibit funds from investing in real estate, either directly or indirectly, the Fund’s investment limitation unnecessarily limits the Fund’s investments in real estate.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to real estate and the implications of the Proposal:

|

Current Fundamental Limitation

|

Proposed Fundamental Limitation

| |

| The Fund will not purchase or sell real estate or interests therein, although the Fund may purchase debt instruments or securities of issuers which engage in real estate operations; | The Fund will not purchase or sell real estate directly. This limitation is not applicable to investments in marketable securities which are secured by or represent interests in real estate. This limitation does not preclude the Fund from holding or selling real estate acquired as a result of the Fund’s ownership of securities or other instruments, investing in mortgage-related securities or investing in companies engaged in the real estate business or that have a significant portion of their assets in real estate (including real estate investment trusts).

| |

|

Purpose of Proposal

|

Effect of Proposal

| |

| The purpose of this Proposal is to permit the Fund to hold or sell real estate acquired as a result of the Fund’s ownership of securities or other instruments. The Fund would remain prohibited from investing directly in real estate. | The proposed change is not expected to change the way the Fund is managed or to affect its operations. Risks of Proposal. If the Fund were to invest in companies engaged in the real estate business, it would be subject to certain risks. These include declines in the value of real estate, lack of available mortgage funds, overbuilding and extended vacancies, increased property taxes and operating expenses, zoning and environmental problems and changes in interest rates.

|

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1d.

12

Proposal No. 1e.

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION WITH RESPECT TO UNDERWRITING SECURITIES

The 1940 Act requires every mutual fund to have a fundamental investment policy with respect to engaging in the business of underwriting securities issued by other persons. Under the federal securities laws, a person or company generally is considered an underwriter if it participates in the public distribution of securities of other issuers, usually by purchasing the securities from the issuer with the intention of re-selling the securities to the public.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to underwriting and the implications of the Proposal:

|

Current Fundamental Limitation

|

Proposed Fundamental Limitation

| |

| The Fund will not engage in the underwriting of securities except insofar as the Fund may be deemed an underwriter under the Securities Act of 1933 (the “1933 Act”) in disposing of a portfolio security. | The Fund will not act as underwriter of securities issued by other persons. This limitation is not applicable to the extent that, in connection with the disposition of portfolio securities (including restricted securities), the Fund may be deemed an underwriter under certain federal securities laws or in connection with investments in other investment companies.

| |

|

Purpose of Proposal

|

Effect of Proposal

| |

| The purpose of this Proposal is to clarify that the Fund is permitted to invest in other investment companies even if, as a result of the investment, a Fund could be deemed an underwriter under federal securities laws.

|

The proposed change is not expected to change the way the Fund is managed or to affect its operations. |

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1e.

13

Proposal No. 1f.

TO AMEND THE FUNDAMENTAL INVESTMENT LIMITATION WITH RESPECT TO LOANS

The 1940 Act requires every mutual fund to have a fundamental investment policy regarding making loans to other persons. As a general matter, the 1940 Act permits funds to lend their portfolio securities, subject to certain restrictions and guidelines developed by the SEC staff. The following guidelines for lending portfolio securities have been developed by SEC staff:

| > | A Fund may loan securities equal in value to not more than 1/3 of its total assets. |

| > | A Fund must receive 100% collateral in the form of cash or U.S. government securities. This collateral must be valued daily and, should the market value of the loaned securities increase, the borrower must furnish additional collateral to the Fund. |

| > | During the time portfolio securities are on loan, the borrower must pay the Fund a reasonable return on the loaned securities. |

| > | The loans must be subject to termination by a Fund or the borrower at any time. |

The Fund’s existing limitation is more restrictive than the requirements of the 1940 Act and has the effect of unnecessarily limiting the Fund’s lending practices.

Listed below is a description of the Fund’s current and proposed fundamental limitation with respect to loans and the implications of the Proposal:

|

Current Fundamental Limitation

|

Proposed Fundamental Limitation

| |

| The Fund will not make loans of money or securities, except (i) by purchase of fixed income securities in which the Fund may invest consistent with its investment objective and policies; or (ii) by investment in repurchase agreements. | The Fund will not make loans to other persons, except (a) by loaning portfolio securities, (b) by engaging in repurchase agreements, (c) by purchasing non publicly offered debt securities, (d) by purchasing commercial paper, or (e) by entering into any other lending arrangement permitted by the 1940 Act, any rules and regulations promulgated thereunder or interpretation of the SEC or its staff. For purposes of this limitation, the term “loans” shall not include the purchase of a portion of an issue of publicly distributed bonds, debentures or other debt securities.

| |

|

Purpose of Proposal

|

Effect of Proposal

| |

| The purpose of this Proposal is to make the Fund’s fundamental investment limitation with respect to loans consistent with applicable limitations under the 1940 Act. The proposed amendments would expand the Fund’s ability to enter into lending arrangements to the extent permitted by the 1940 Act and clarify certain types of arrangements that are specifically permitted. | The proposed amendments are not expected to change the way the Fund is managed or to affect its operations. The Fund currently does not intend to change its investment strategies with respect to loans. If the Fund were to avail itself of the ability to engage in lending practices to a greater extent than is currently permitted, such practices would be subject to review by the Board and would be reflected in the Fund’s disclosures to shareholders, including any material risks, as appropriate.

Risks of Proposal. The risks of engaging in lending practices include a delay in the recovery of the loaned securities or a loss of rights in the collateral received, if the borrower fails financially.

|

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1f.

14

Proposal No. 1g.

TO ELIMINATE FUNDAMENTAL INVESTMENT LIMITATIONS NOT REQUIRED BY LAW

The fundamental investment limitations that shareholders are being asked to adopt include only those policies that are required by the 1940 Act. A number of the Fund’s fundamental investment limitations were adopted many years ago in order to satisfy state regulatory requirements. In 1996, Congress preempted the states from imposing such requirements. Many of these limitations relate to instruments or strategies that the Fund does not use today and does not expect to use in the future. Even after the unnecessary policies are eliminated, the Fund will still be limited with regards to many of the activities covered by the policies. For example, federal law limits the degree to which the Fund may invest in illiquid securities, purchase securities on margin or sell securities short.

Listed below is a description of the Fund’s current fundamental limitations that are no longer required and the implications of the Proposal:

|

Current Fundamental Limitations

|

|

1. invest for the purpose of exercising control or management of another company;

2. purchase oil, gas or other mineral leases, rights or royalty contracts or exploration or development programs, except that the Fund may invest in the debt instruments or securities of companies which invest in or sponsor such programs;

3. invest more than 25% of the value of the Fund’s total assets in one particular industry, except for temporary defensive purposes;

4. make purchases of securities on “margin”, or make short sales of securities, provided that the Fund may enter into futures contracts and related options and make initial and variation margin deposits in connection therewith;

5. invest in securities of any open-end investment company, except that the Fund may purchase securities of money market mutual funds, but such investments in money market mutual funds may be made only in accordance with the limitations imposed by the 1940 Act and the rules thereunder, as amended. But in no event may the Fund purchase more than 10% of the voting securities, or more than 10% of any class of securities, of another investment company. For purposes of this restriction, all outstanding fixed income securities of an issuer are considered a single class;

6. invest in securities of any company if any officer or trustee of the Fund or the Fund’s Adviser owns more than 0.5% of the outstanding securities of such company and such officers and trustees, in the aggregate, own more than 5% of the outstanding securities of such company;

7. pledge, mortgage, hypothecate, or otherwise encumber its assets, except in an amount up to 33% of the value of its net assets, but only to secure borrowing for temporary or emergency purposes, such as to effect redemptions; and

8. purchase the securities of any issuer, if, as a result, more than 10% of the value of the Fund’s net assets would be invested in securities that are subject to legal or contractual restrictions on resale (“restricted securities”), in securities for which there is no readily available market quotations (“illiquid securities”), or in repurchase agreements maturing in more than 7 days, if all such securities would constitute more than 10% of the Fund’s net assets.

|

|

Purpose of Proposal

|

Effect of Proposal

| |||

| The purpose of this Proposal is to eliminate existing fundamental investment policies that are no longer required by law. The removal of these limitations would enable the Fund to change any strategies now governed by these policies without having to incur the expense or delay of obtaining shareholder approval.

|

The removal of these limitations is not expected to change the way the Fund is managed or to affect its operations. |

The Board Of Trustees, Including The Independent Trustees, Unanimously Recommends That Shareholders of The Fund Vote “FOR” Approval of Proposal No. 1g.

15

| PROPOSAL 2: |

TO TRANSACT ANY OTHER BUSINESS, NOT CURRENTLY CONTEMPLATED, THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENT THEREOF IN THE DISCRETION OF THE PROXIES OR THEIR SUBSTITUTES |

The proxy holders have no present intention of bringing any other matter before the Meeting other than the matters described herein or matters in connection with or for the purpose of effecting the same. Neither the proxy holders nor the Board of Trustees are aware of any matters which may be presented by others. If any other business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best judgment.

OUTSTANDING SHARES AND VOTING REQUIREMENTS

Record Date. The Board of Trustees has fixed the close of business on March 31, 2015 (the “Record Date”) as the record date for determining shareholders of the Fund entitled to notice of and to vote at the Meeting or any adjournment thereof. As of the Record Date, there were 6,184,490.947 outstanding shares of beneficial interest of the Fund. Each share is entitled to one vote, with proportionate voting for fractional shares.

5% Shareholders. As of the Record Date, the following shareholders owned of record more than 5% of the outstanding shares of the Fund. Accounts with an asterisk may be deemed to control the Fund by virtue of owning more than 25% of the outstanding shares. No other person owned of record and, according to information available to the Trust, no other person owned beneficially, 5% or more of the outstanding shares of the Fund on the Record Date.

| Name and Address of Record Owner |

Share Class | Percentage Ownership | ||

| US Bank, FBO Client Accounts P.O. Box 1787, Milwaukee, WI 53201-1787 |

A | 9.90% | ||

| US Bank, FBO Client Accounts P.O. Box 1787, Milwaukee, WI 53201-1787 |

A | 12.83% | ||

| US Bank, FBO Client Accounts P.O. Box 1787, Milwaukee, WI 53201-1787 |

A | 6.76% | ||

| US Bank, FBO Client Accounts P.O. Box 1787, Milwaukee, WI 53201-1787 |

A | 6.53% | ||

| Wayne G. Pence TTEE Mary L. Pence Residuary Trust 3221 S. Reed Road, Kokomo, IN 46902 |

I | 14.56% | ||

| National Financial Services, FBO Wayne G. Pence Rev Living Trust 3221 S. Reed Road, Kokomo, IN 46902 |

I | 13.75% | ||

| National Financial Services, FBO Custom Model 30009 LadyFace Ct., Agoura Hills, CA 91301 |

I | 15.65% | ||

| National Financial Services, FBO Charlene B. Hodson 48 Friendship Circle, Dayton, OH 45426 |

I | 27.63% | ||

| National Financial Services FBO Stanley W. Wertz 899 Pugh Road, Mansfield, OH 44903 |

I | 13.42% | ||

| National Financial Services FBO Catherine L. Wertz 899 Pugh Road, Mansfield, OH 44903 |

I | 13.42% | ||

16

Quorum. A quorum is the number of shares legally required to be at a meeting in order to conduct business, which is more than 50% of the outstanding shares of the Fund at the meeting. The vote of a “majority of the outstanding shares” of the Fund is required to replace the Fundamental investment limitations of the Fund (Proposal 1). The vote of a “majority of the outstanding shares” means the vote of the lesser of (1) 67% or more of the shares present or represented by proxy at the Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (2) more than 50% of the Fund’s outstanding shares. Proxies properly executed and marked with a negative vote or an abstention will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business. If the Meeting is called to order but a quorum is not present at the Meeting, the persons named as proxies may vote those proxies that have been received with respect to adjournment of the Meeting to a later date. If a quorum is present at the Meeting but sufficient votes to approve the proposals described herein are not received, the persons named as proxies may propose one or more adjournments of the Meeting not to exceed 120 days from the record date for the meeting, to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares of the Fund represented at the Meeting in person or by proxy. The persons named as proxies will vote those proxies received that voted in favor of a proposal in favor of such an adjournment and will vote those proxies received that voted against the proposal against any such adjournment.

Abstentions and “broker non-voters” are counted for purposes of determining whether a quorum is present but do not represent votes cast with respect to the proposal. “Broker non-votes” are shares held by a broker or nominee for whom an executed proxy is received by the Trust, but are not voted as to one or more proposals because instructions have not been received from the beneficial owners or persons entitled to vote and the broker or nominee does not have discretionary voting power. Notwithstanding the foregoing, “broker non-votes” will be excluded from the denominator of the calculation of the number of votes required to approve any proposal to adjourn the Meeting. Accordingly, abstentions and “broker non-votes” will effectively be a vote against the proposal, for which the required vote is a percentage of the outstanding voting shares and will have no effect on a vote for adjournment.

ADDITIONAL INFORMATION ON THE OPERATION OF THE TRUST

Principal Underwriter

Timothy Partners, Ltd. (“TPL”) 1055 Maitland Center Commons, Maitland, FL 32751, in addition to serving as investment adviser to the Fund, also serves as principal underwriter to the Trust’s shares. TPL is a broker/dealer registered as such with the Securities and Exchange Commission and is a member in good standing of the Financial Industry Regulatory Administration (“FINRA”).

TPL is not directly compensated by the Trust for its distribution services. However, TPL generally retains dealer concessions on sales of Class A Fund shares as set forth in the Trust’s prospectus and may retain some or all of the fees paid by the Fund pursuant to 12b-1 Plans of Distribution. With respect to Class A shares, TPL may pay some or all of the dealer concession to selling brokers and dealers from time to time, at its discretion. A broker or dealer who receives more than 90% of a selling commission may be considered an “underwriter” under federal law. With respect to both Class A and Class C shares, TPL may pay some or all of the collected 12b-1 fees to selling brokers and dealers from time to time, at its discretion

Administrator, Transfer Agent and Fund Accounting

Gemini Fund Services, LLC, 80 Arkay Drive, Suite 110, Hauppauge, NY 11788, provides transfer agent, administrative, and accounting services to the Fund pursuant to a written agreement with the Trust.

Independent Registered Public Accounting Firm

The Audit Committee and the Board of Trustees have selected Cohen Fund Audit Services, 1350 Euclid Avenue, Suite 800, Cleveland, OH 44115 (“Cohen”), to serve as the Trust’s independent registered public accounting firm for the fiscal year ending September 30, 2015. Representatives of Cohen are not expected to be present at the Meeting although they will have an opportunity to attend and to make a statement, if they desire to do so. If representatives of Cohen are present at the Meeting, they will be available to respond to appropriate questions from shareholders.

| Fees Billed by Cohen Fund Audit Services to the Trust During the Previous Two Fiscal Years | ||

| Audit Fees |

The aggregate fees billed for professional services rendered by Cohen for the audit of the annual financial statements of the Trust or for services that are normally provided by Cohen in connection with statutory and regulatory filings or engagements were $166,400 with respect to the fiscal year ended September 30, 2014 and $149,400 with respect to the fiscal year ended September 30, 2013. | |

| Audit-Related Fees |

No fees were billed in either of the last two fiscal years for assurance and related services by Cohen that are reasonably related to the performance of the audit of the Trust’s financial statements and are not reported as “Audit Fees” in the preceding paragraph. | |

| Tax Fees |

No fees were billed in either of the last two fiscal years for professional services rendered by Cohen for tax compliance, tax advice and tax planning. | |

17

| All Other Fees |

No fees were billed in either of the last two fiscal years for products and services provided by Cohen other than the services reported above. | |

| Aggregate Non- Audit Fees |

No fees were billed in either of the last two fiscal years for non-audit services by Cohen rendered to the Trust and any entity controlling, controlled by, or under common control with the Trust that provides ongoing services to the Trust. |

Annual and Semi-Annual Reports

The Trust will furnish, without charge, a copy of its most recent annual report and most recent semi-annual report succeeding such annual report, if any, upon request. To request the annual or semi-annual report, please call us toll free at 800-846-7526, or write to the Trust at 1055 Maitland Center Commons, Maitland, FL 32751. The Fund’s most recent annual and semi-annual reports are available for download at www.timothyplan.com.

Shareholder Proposals

As a Delaware business trust, the Trust does not intend to, and is not required to hold annual meetings of shareholders, except under certain limited circumstances. The Board of Trustees does not believe a formal process for shareholders to send communications to the Board of Trustees is appropriate due to the infrequency of shareholder communications to the Board of Trustees. The Trust has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the Securities and Exchange Commission, shareholder proposals may, under certain conditions, be included in the Trust’s proxy statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Trust’s proxy materials must be received by the Trust within a reasonable time before the solicitation is made. The fact that the Trust receives a shareholder proposal in a timely manner does not insure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. Annual meetings of shareholders of the Funds are not required as long as there is no particular requirement under the 1940 Act or the Declaration of Trust, which must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Joseph Boatwright, Secretary of the Trust, 1055 Maitland Center Commons, Maitland, FL 32751.

Shareholder Communications with Trustees

Shareholders who wish to communicate with the Board or individual Trustees should write to the Board or the particular Trustee in care of the Fund, at the offices of the Trust as set forth below. All communications will be forwarded directly to the Board or the individual Trustee. Shareholders also have an opportunity to communicate with the Board at shareholder meetings. The Trust does not have a policy requiring Trustees to attend shareholder meetings.

Proxy Delivery

The Trust may only send one proxy statement to shareholders who share the same address unless the Fund has received different instructions from one or more of the shareholders. The Fund will deliver promptly to a shareholder, upon oral or written request, a separate copy of the proxy statement to a shared address to which a single copy of this Proxy was delivered. By calling or writing the Fund, a shareholder may request separate copies of future proxy statements, or if the shareholder is receiving multiple copies of the proxy statement now, may request a single copy in the future. To request a paper or e-mail copy of the proxy statement or annual report at no charge, or to make any of the aforementioned requests, write to the Fund at 1055 Maitland Center Commons, Maitland, FL 32751, or call the Fund toll-free at 1-800-846-7526.

| By Order of the Board of Trustees, | ||

| Joseph Boatwright | ||

| Secretary | ||

Date: April 13, 2015

Please complete, date and sign the enclosed Proxy and return it promptly in the enclosed reply envelope. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. You may also vote by telephone or through the Internet by following the instructions on your proxy card.

18

| 1. MAIL your signed and voted proxy back in the postage paid envelope provided |

|

|||||

| 2. ONLINE at proxyonline.com using your proxy control number found below |

|

|||||

| 3. By PHONE when you dial toll-free 1-888-227-9349 to reach an automated touchtone voting line |

|

|||||

| 4. By PHONE with a live operator when you call toll-free 1-877-896-3191 Monday through Friday 9 a.m. to 10 p.m. Eastern time |

|

|||||

The Timothy Plan Defensive Strategies Fund

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 13, 2015

The signers of this proxy hereby appoint James P. Ash, Esq. and Emile R. Molineaux, Esq., and each of them, attorneys and proxies, with power of substitution in each, to vote all shares for the signers at the special meeting of shareholders to be held May 19, 2014 at 10:00 a.m. Eastern Time, and at any adjournments thereof, as specified herein, and in accordance with their best judgment, on any other business that may properly come before this meeting to be held at the offices of Gemini Fund Services, LLC. (“Gemini”), located at 80 Arkay Drive, Suite 110, Hauppauge, NY 11788.

Do you have questions? If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free 1-877-896-3191. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on May 13, 2015. The proxy statement for this meeting is available at:

proxyonline.com/docs/timothyplan2015.pdf

| [PROXY ID NUMBER HERE] | [BAR CODE HERE] | [CUSIP HERE] |

The Timothy Plan Defensive Strategies Fund

This proxy is solicited on behalf of the Fund’s Board of Trustees, and the Proposals have been unanimously approved by the Board of Trustees and recommended for approval by shareholders. When properly executed, this proxy will be voted as indicated or “FOR” the proposal if no choice is indicated. The proxy will be voted in accordance with the proxy holders’ best judgment as to any other matters that may arise at the Special Meeting.

THE BOARD OF TRUSTEES OF THE TRUST UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example: —

Proposal 1.

To replace the fundamental investment limitations of the Fund with new updated fundamental investment limitations:

| FOR | AGAINST | ABSTAIN | ||||||||

| 1a. |

To amend the fundamental investment limitation with respect to borrowing money and issuing senior securities; | O | O | O | ||||||

| 1b. |

To amend the fundamental investment limitation with respect to purchasing and selling commodities, and to add a restriction allowing the Fund to purchase and sell gold and other precious metals in amounts not to exceed ten percent (10%) of the Fund’s net assets, in the aggregate; | O | O | O | ||||||

| 1c. |

To amend the fundamental investment limitation with respect to concentrating investments in a particular industry or group of industries; | O | O | O | ||||||

| 1d. |

To amend the fundamental investment limitation with respect to investing in real estate; | O | O | O | ||||||

| 1e. |

To amend the fundamental investment limitation with respect to underwriting securities; | O | O | O | ||||||

| 1f. |

To amend the fundamental investment limitation with respect to loans: | O | O | O | ||||||

| 1g. |

To eliminate fundamental investment limitations no longer required by law. | O | O | O | ||||||

| [PROXY ID NUMBER HERE] | [BAR CODE HERE] | [CUSIP HERE] |

|

PROXY CARD

| |

| YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. PLEASE CAST YOUR PROXY VOTE TODAY!

|

| |

The Timothy Plan Defensive Strategies Fund

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 13, 2015

The signers of this proxy hereby appoint James Ash and Dawn Dennis, and each of them, attorneys and proxies, with power of substitution in each, to vote all shares for the signers at the special meeting of shareholders to be held May 13, 2015 at 10:00 a.m. Eastern Time, and at any adjournments thereof, as specified herein, and in accordance with their best judgment, on any other business that may properly come before this meeting to be held at the offices of Gemini Fund Services, LLC. (“Gemini”), located at 80 Arkay Drive, Suite 110, Hauppauge, NY 11788.

Do you have questions? If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free 1-877-896-3191. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Important Notice Regarding the Availability of Proxy Materials for this Special Meeting of Shareholders to Be Held on May 13, 2015. The proxy statement for this meeting is available at:

proxyonline.com/docs/timothyplan2015.pdf

| [PROXY ID NUMBER HERE] | [BAR CODE HERE] | [CUSIP HERE] |

| The Timothy Plan Defensive Strategies Fund | PROXY CARD |

| YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. The signer(s) acknowledges receipt with this Proxy Statement of the Board of Trustees. Your signature(s) on this should be exactly as your name(s) appear on this Proxy (reverse side). If the shares are held jointly, each holder should sign this Proxy. Attorneys-in-fact, executors, administrators, trustees or guardians should indicate the full title and capacity in which they are signing. |

| |

|

SIGNATURE (AND TITLE IF APPLICABLE) DATE

SIGNATURE (IF HELD JOINTLY) DATE |

This proxy is solicited on behalf of the Fund’s Board of Trustees, and the Proposals have been unanimously approved by the Board of Trustees and recommended for approval by shareholders. When properly executed, this proxy will be voted as indicated or “FOR” the proposal if no choice is indicated. The proxy will be voted in accordance with the proxy holders’ best judgment as to any other matters that may arise at the Special Meeting.

THE BOARD OF TRUSTEES OF THE TRUST UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example: —

Proposal 1.

To replace the fundamental investment limitations of the Fund with new updated fundamental investment limitations:

| FOR | AGAINST | ABSTAIN | ||||||

| 1a. |

To amend the fundamental investment limitation with respect to borrowing money and issuing senior securities; |

O | O | O | ||||

| 1b. |

To amend the fundamental investment limitation with respect to purchasing and selling commodities, and to add a restriction allowing the Fund to purchase and sell gold and other precious metals in amounts not to exceed ten percent (10%) of the Fund’s net assets, in the aggregate; |

O | O | O | ||||

| 1c. |

To amend the fundamental investment limitation with respect to concentrating investments in a particular industry or group of industries; |

O | O | O | ||||

| 1d. |

To amend the fundamental investment limitation with respect to investing in real estate; |

O | O | O | ||||

| 1e. |

To amend the fundamental investment limitation with respect to underwriting securities; |

O | O | O | ||||

| 1f. |

To amend the fundamental investment limitation with respect to loans: |

O | O | O | ||||

| 1g. |

To eliminate fundamental investment limitations no longer required by law. |

O | O | O | ||||

| [PROXY ID NUMBER HERE] | [BAR CODE HERE] | [CUSIP HERE] |