UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08228

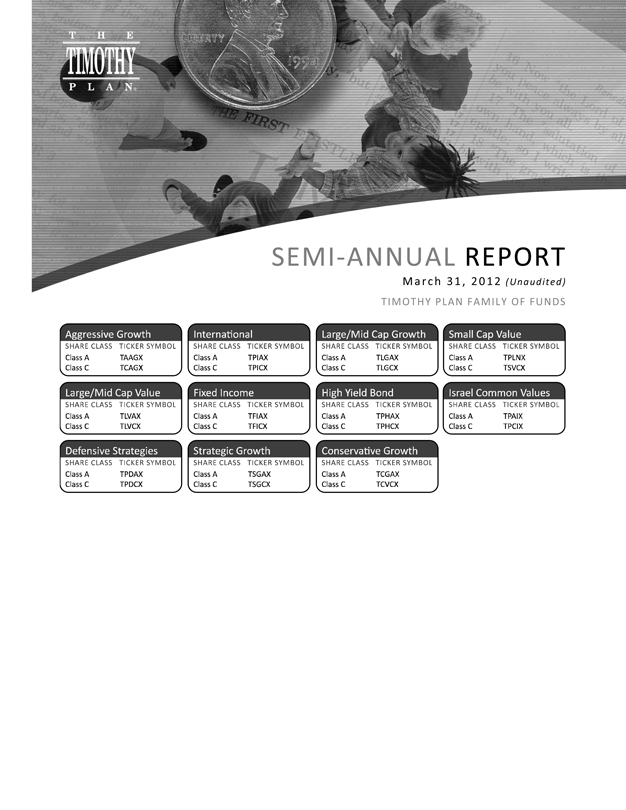

| The Timothy Plan |

(Exact name of registrant as specified in charter)

| 1055 Maitland Center Commons, Maitland, FL 32751 |

(Address of principal executive offices)(Zip code)

| Art Ally, The Timothy Plan 1055 Maitland Center Commons, Maitland, FL 32751 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-846-7526

Date of fiscal year end: 9/30

Date of reporting period: 3/31/12

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Registrant’s audited annual financial reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are as follows:

-1-

Letter from the President

March 31, 2012

Arthur D. Ally

Dear Shareholder,

As you no doubt have noticed, the economic uncertainty that has plagued the capital markets over the past several years seems to be hanging on. I am pleased to report, however, that the six-month period (from our Annual Report of September 30, 2011 through this Semi-Annual Report of March 31, 2012) has seen the market rebound rather nicely.

Our sub-advisors continue to remain mildly positive on the market but they do look for a more moderate but mixed performance leading up to this year’s November elections. I would like to remind you, however, as respected and knowledgeable as we believe our sub-advisors to be, it is simply their opinion and cannot be considered to be a guarantee of future results.

With the advent of our two relatively new funds, Timothy Plan now offers nine traditional funds and two asset-allocation funds which provide our shareholders the opportunity to broadly diversify their investment dollars while staying consistent with their moral convictions.

Please do not consider that statement to be touting any particular fund in our fund family. Asset allocation has always tended to be and should continue to be considered by investors as a prudent approach to investing – particularly in these unsettled times.

Once again, we hope you understand just how seriously we take our responsibility for the trust you have placed in us to morally, ethically and economically look after your investment assets. Thank you for being part of the Timothy Plan family.

| Sincerely, |

|

|

| Arthur D. Ally, |

| President |

Fund Profile

As of March 31, 2012 - (Unaudited)

Aggressive Growth

| Top Ten Holdings | Top Ten Industries | ||||||||||||||||

| (% of Net Assets) | (% of Net Assets) | ||||||||||||||||

| Sally Beauty Holdings, Inc. |

2.44% | Information Technology |

15.90% | ||||||||||||||

| United Rentals, Inc. |

2.43% | Retail |

15.90% | ||||||||||||||

| Autozone, Inc. |

2.19% | Healthcare |

10.50% | ||||||||||||||

| Ross Stores, Inc. |

2.13% | Oil & Natural Gas |

7.10% | ||||||||||||||

| Fiserv, Inc. |

1.96% | Industrials/Machinery |

6.80% | ||||||||||||||

| HFF, Inc. - Class A |

1.81% | Financial/Investment Services |

5.50% | ||||||||||||||

| FleetCor Technologies, Inc. |

1.64% | Pharmaceuticals |

2.90% | ||||||||||||||

| Kodiak Oil & Gas Corp. |

1.61% | Commercial Services |

2.80% | ||||||||||||||

| Clean Harbors, Inc. |

1.59% | Miscellaneous Manufacturing |

2.80% | ||||||||||||||

| Wesco International, Inc. |

1.57% | Distribution/Wholesale |

2.60% | ||||||||||||||

| 19.37% | Other Assets Less Liabilities |

27.20% | |||||||||||||||

| 100.00% | |||||||||||||||||

| International |

|||||||||||||||||

| Top Ten Holdings | Top Ten Industries | ||||||||||||||||

| (% of Net Assets) | (% of Net Assets) | ||||||||||||||||

| Henkel AG & Co. (ADR) |

5.87% | Banks |

11.30% | ||||||||||||||

| Singapore Telecommunications, Ltd. (ADR) |

4.60% | Chemicals |

10.30% | ||||||||||||||

| Fresenius Medical Care AG & Co. (ADR) |

4.08% | Telecommunications |

8.10% | ||||||||||||||

| DBS Group Holdings, Ltd. (ADR) |

3.84% | Oil & Natural Gas |

7.70% | ||||||||||||||

| Smith & Nephew PLC (ADR) |

3.24% | Healthcare |

7.30% | ||||||||||||||

| WM Supermarkets PLC (ADR) |

3.04% | Minerals & Mining |

5.40% | ||||||||||||||

| Hitachi, Ltd. (ADR) |

2.97% | Automotive |

4.20% | ||||||||||||||

| Zurich Insurance Group AG |

2.85% | Consumer Goods |

4.20% | ||||||||||||||

| Lukoil OAO (ADR) |

2.73% | Retail |

4.10% | ||||||||||||||

| ITOCHU Corp. |

2.52% | Electric Power |

3.30% | ||||||||||||||

| 35.74% | Other Assets Less Liabilities |

34.10% | |||||||||||||||

| 100.00% | |||||||||||||||||

| Large/Mid Cap Growth |

|||||||||||||||||

| Top Ten Holdings | Top Ten Industries | ||||||||||||||||

| (% of Net Assets) | (% of Net Assets) | ||||||||||||||||

| Exxon Mobil Corp. |

3.80% | Healthcare |

13.30% | ||||||||||||||

| Autozone, Inc. |

3.76% | Information Technology |

11.40% | ||||||||||||||

| Occidental Petroleum Corp. |

3.41% | Oil & Natural Gas |

10.90% | ||||||||||||||

| Sirona Dental Systems, Inc. |

3.12% | Retail |

10.30% | ||||||||||||||

| Dick’s Sporting Goods, Inc. |

2.59% | Electronics |

6.70% | ||||||||||||||

| Ross Stores, Inc. |

2.44% | Financial/Investment Services |

5.40% | ||||||||||||||

| Western Union Co. |

2.38% | Industrials/Machinery |

4.10% | ||||||||||||||

| United Rentals, Inc. |

2.34% | Aerospace/Defense |

3.80% | ||||||||||||||

| McCormick & Co., Inc. |

2.26% | Consumer Goods |

3.50% | ||||||||||||||

| General Dynamics Corp. |

2.04% | Commercial Services |

3.20% | ||||||||||||||

| 28.14% | Other Assets Less Liabilities |

27.40% | |||||||||||||||

| 100.00% | |||||||||||||||||

Fund Profile (Continued)

As of March 31, 2012 - (Unaudited)

Small Cap Value

| Top Ten Holdings | Top Ten Industries | |||||||

| (% of Net Assets) | (% of Net Assets) | |||||||

| Coresite Realty Corp. |

2.65% | Banks |

15.00% | |||||

| Wintrust Financial Corp. |

2.48% | REITs |

11.70% | |||||

| Harsco Corp. |

2.45% | Industrials |

6.70% | |||||

| Matrix Services Co. |

2.42% | Miscellaneous Services |

6.10% | |||||

| Landstar System, Inc. |

2.39% | Transportation |

5.90% | |||||

| SVB Financial Group |

2.37% | Electric Power |

5.50% | |||||

| Children’s Place Retail Stores |

2.36% | Insurance |

5.50% | |||||

| Columbia Banking System, Inc. |

2.34% | Retail |

4.40% | |||||

| BBCN Bancorp, Inc. |

2.33% | Computers |

4.30% | |||||

| AMERISAFE, Inc. |

2.28% | Healthcare |

4.20% | |||||

| 24.07% | Other Assets Less Liabilities |

30.70% | ||||||

| 100.00% | ||||||||

| Large/Mid Cap Value |

||||||||

| Top Ten Holdings | Top Ten Industries | |||||||

| (% of Net Assets) | (% of Net Assets) | |||||||

| Exxon Mobil Corp. |

3.29% | Oil & Natural Gas |

19.80% | |||||

| CA, Inc. |

3.12% | Healthcare |

12.80% | |||||

| Advanced Auto Parts |

3.10% | Consumer Goods |

8.80% | |||||

| Covidien PLC |

3.08% | Insurance |

8.70% | |||||

| Sherwin Williams Co. |

2.94% | Financial & Investment Services |

6.60% | |||||

| Invesco, Ltd. |

2.78% | Electric Power |

6.20% | |||||

| Union Pacific Corp. |

2.62% | Retail |

6.00% | |||||

| Occidental Petroleum Corp. |

2.55% | Information Technology |

5.30% | |||||

| ACE, Ltd. |

2.55% | Industrials |

4.40% | |||||

| Public Storage, Inc. |

2.52% | REITs |

4.40% | |||||

| 28.55% | Other Assets Less Liabilities |

17.00% | ||||||

| 100.00% | ||||||||

| Fixed Income |

||||||||

| Top Ten Holdings | Top Ten Industries | |||||||

| (% of Net Assets) | (% of Net Assets) | |||||||

| U.S Treasury Bond, 3.125%, 5/15/2019 |

5.83% | Government Mortgage- |

||||||

| GMNA Pool 701961, 4.50%, 6/15/2039 |

5.06% | Backed Securities |

31.90% | |||||

| Federal Farm Credit Bank, 5.125%, 8/25/2016 |

3.88% | Corporate Bonds |

28.70% | |||||

| GMNA Pool 4947, 5.00%, 2/15/2041 |

3.53% | Government Notes & Bonds |

28.10% | |||||

| GMNA Pool 4520, 5.00%, 8/20/2039 |

3.17% | TIPS |

4.80% | |||||

| U.S Treasury Bond, 3.875%, 5/15/2018 |

3.04% | Other Assets Less Liabilities |

6.50% | |||||

| U.S. Treasury Note, 3.125%, 05/15/2021 |

2.88% | 100.00% | ||||||

| GNMA Pool 783060, 4.00%, 08/15/2040 |

2.69% | |||||||

| TIPS, 2.50%, 7/15/2016 |

2.60% | |||||||

| U.S. Treasury Bond, 4.375%, 05/15/2040 |

2.39% | |||||||

| 35.07% | ||||||||

Fund Profile (Continued)

As of March 31, 2012 - (Unaudited)

High Yield Bond

| Top Ten Holdings | Top Ten Industries | |||||||

| (% of Net Assets) | (% of Net Assets) | |||||||

| Genesis Energy LP, 7.875%, 12/15/2018 |

2.47% | Corporate Bonds |

93.70% | |||||

| Nova Chemicals Corp., 8.625%, 11/1/2019 |

1.84% | Other Assets Less Liabilities |

6.30% | |||||

| Energy Transfer Equity LP, 7.50%, 10/15/2020 |

1.79% | 100.00% | ||||||

| Omnicare, Inc., 7.75%, 6/01/2020 |

1.79% | |||||||

| United Rentals North America, Inc., 9.25%, 12/15/2019 |

1.78% | |||||||

| MarkWest Energy Partners L.P., 6.75%, 11/1/2020 |

1.75% | |||||||

| Covanta Holding Corp., 7.25%, 12/01/2020 |

1.74% | |||||||

| Targa Resources Partners LP, 7.875%, 10/15/2018 |

1.73% | |||||||

| Servicemaster Co., 8.00% 2/15/2020 |

1.72% | |||||||

| Crosstex Energy LP, 8.875%, 2/15/2018 |

1.72% | |||||||

| 18.33% | ||||||||

| Israel Common Values |

||||||||

| Top Ten Holdings | Top Ten Industries | |||||||

| (% of Net Assets) | (% of Net Assets) | |||||||

| Protalix BioTherapeutics, Inc. |

2.90% | Telecommunications |

14.50% | |||||

| Allot Communications, Ltd. |

2.85% | Real Estate |

11.00% | |||||

| RADWARE, Ltd. |

2.85% | Software |

7.90% | |||||

| Mellanox Technologies, Ltd. |

2.72% | Oil & Natural Gas |

6.40% | |||||

| ClickSoftware Technologies, Ltd. |

2.69% | Chemicals |

5.10% | |||||

| NICE Systems, Ltd. |

2.69% | Healthcare Products |

4.90% | |||||

| Ceragon Networks, Ltd. |

2.64% | Internet |

4.70% | |||||

| Israel Chemicals, Ltd. |

2.62% | Electronics |

4.40% | |||||

| SodaStream International, Ltd. |

2.60% | Food |

4.00% | |||||

| Given Imaging, Ltd. |

2.58% | Banks |

3.70% | |||||

| 27.14% | Other Assets Less Liabilities |

33.40% | ||||||

| 100.00% | ||||||||

Fund Profile (Continued)

As of March 31, 2012 - (Unaudited)

Defensive Strategies

| Top Ten Holdings | Top Ten Industries | |||||||

| (% of Net Assets) | (% of Net Assets) | |||||||

| SPDR Gold Shares |

6.22% | TIPS |

26.60% | |||||

| TIPS, 1.75%, 1/15/2028 |

4.16% | Exchange Traded Funds |

15.40% | |||||

| TIPS, 2.00%, 1/15/2014 |

4.08% | REITs |

13.90% | |||||

| TIPS, 2.125%, 1/15/2019 |

3.17% | Mining |

7.90% | |||||

| PowerShares DB Agriculture Fund |

3.04% | Iron/Steel |

6.80% | |||||

| TIPS, 2.375%, 1/15/2017 |

2.15% | Coal |

4.40% | |||||

| PowerShares DB Energy Fund |

2.08% | Food |

3.50% | |||||

| TIPS, 1.125%, 1/15/2021 |

2.05% | Oil & Gas Services |

3.40% | |||||

| PowerShares DB Commodity Fund |

2.03% | Government Mortgage-Backed Securities |

2.50% | |||||

| TIPS, 2.50%, 1/15/2029 |

1.79% | Machinery |

2.20% | |||||

| 30.77% | Other Assets Less Liabilities |

13.40% | ||||||

| 100.00% | ||||||||

| Strategic Growth |

||||||||

| Top Ten Holdings | Top Ten Industries | |||||||

| (% of Net Assets) | (% of Net Assets) | |||||||

| Timothy Plan - Defensive Strategies Fund |

22.06% | Mutual Funds |

100.21% | |||||

| Timothy Plan - Large/Mid Cap Value Fund |

16.59% | Other Liabilities Less Assets |

-0.21% | |||||

| Timothy Plan - International Fund |

16.30% | 100.00% | ||||||

| Timothy Plan - Large/Mid Cap Growth Fund |

15.74% | |||||||

| Timothy Plan - High Yield Bond Fund |

9.32% | |||||||

| Timothy Plan - Israel Common Values Fund |

7.00% | |||||||

| Timothy Plan - Small Cap Value Fund |

6.98% | |||||||

| Timothy Plan - Aggressive Growth Fund |

6.22% | |||||||

| 100.21% | ||||||||

| Conservative Growth |

||||||||

| Top Ten Holdings | Top Ten Industries | |||||||

| (% of Net Assets) | (% of Net Assets) | |||||||

| Timothy Plan - Fixed Income Fund |

25.76% | Mutual Funds |

99.70% | |||||

| Timothy Plan - Defensive Strategies Fund |

25.14% | Other Assets Less Liabilities |

0.30% | |||||

| Timothy Plan - Large/Mid Cap Value Fund |

14.48% | 100.00% | ||||||

| Timothy Plan - Large/Mid Cap Growth Fund |

9.18% | |||||||

| Timothy Plan - High Yield Bond Fund |

7.26% | |||||||

| Timothy Plan - International Fund |

5.97% | |||||||

| Timothy Plan - Small Cap Value Fund |

4.95% | |||||||

| Timothy Plan - Israel Common Values Fund |

4.48% | |||||||

| Timothy Plan - Aggressive Growth Fund |

2.48% | |||||||

| 99.70% | ||||||||

Schedule of Investments | Aggressive Growth

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| COMMON STOCKS - 93.6% | ||||||

| AEROSPACE/DEFENSE - 1.2% | ||||||

| 1,825 |

BE Aerospace, Inc. * | $ | 84,808 | |||

| 1,100 |

Transdigm Group, Inc. * | 127,336 | ||||

|

|

|

|||||

| 212,144 | ||||||

|

|

|

|||||

| APPAREL - 0.6% | ||||||

| 2,700 |

Wolverine World Wide, Inc. | 100,386 | ||||

|

|

|

|||||

| BANKS - 1.5% | ||||||

| 10,190 |

Cardinal Financial Corp. | 115,147 | ||||

| 2,825 |

First Midwest Bancorp, Inc. | 33,843 | ||||

| 4,943 |

Webster Financial Corp. | 112,058 | ||||

|

|

|

|||||

| 261,048 | ||||||

|

|

|

|||||

| BIOTECHNOLOGY - 1.9% | ||||||

| 3,200 |

Dynavax Technologies Corp. * | 16,096 | ||||

| 4,000 |

Incyte Corp, Ltd. * | 77,200 | ||||

| 3,450 |

InterMune, Inc. * | 50,612 | ||||

| 12,175 |

NPS Pharmaceutical, Inc. * | 83,277 | ||||

| 825 |

Regeneron Pharmaceuticals, Inc. * | 96,212 | ||||

|

|

|

|||||

| 323,397 | ||||||

|

|

|

|||||

| CHEMICALS - 1.7% | ||||||

| 2,040 |

Airgas, Inc. | 181,499 | ||||

| 1,800 |

Ashland, Inc. | 109,908 | ||||

|

|

|

|||||

| 291,407 | ||||||

|

|

|

|||||

| COMMERCIAL SERVICES - 2.8% | ||||||

| 5,700 |

Kenexa Corp. * | 178,068 | ||||

| 1,575 |

Team, Inc. * | 48,746 | ||||

| 2,850 |

Verisk Analytics, Inc. * | 133,865 | ||||

| 9,650 |

WNS Holdings, Ltd. * | 116,283 | ||||

|

|

|

|||||

| 476,962 | ||||||

|

|

|

|||||

| CONSUMER GOODS - 1.5% | ||||||

| 6,385 |

Brunswick Corp. | 164,414 | ||||

| 1,100 |

Tempur-Pedic International, Inc. * | 92,873 | ||||

|

|

|

|||||

| 257,287 | ||||||

|

|

|

|||||

| DISTRIBUTION/WHOLESALE - 2.6% | ||||||

| 2,000 |

MWI Veterinary Supply, Inc. * | 176,000 | ||||

| 4,075 |

Wesco International, Inc. | 266,138 | ||||

|

|

|

|||||

| 442,138 | ||||||

|

|

|

|||||

| EDUCATION - 0.5% | ||||||

| 3,890 |

K12, Inc. * | 91,921 | ||||

|

|

|

|||||

| ELECTRICAL - 1.4% | ||||||

| 1,740 |

Belden CDT, Inc. | 65,963 | ||||

| 1,175 |

Hubbell, Inc. | 92,332 | ||||

| 2,175 |

Universal Display Corp. * | 79,453 | ||||

|

|

|

|||||

| 237,748 | ||||||

|

|

|

|||||

| ELECTRONICS - 0.9% | ||||||

| 2,475 |

Sensata Technologies Holding NV * | 82,863 | ||||

| 1,325 |

Trimble Navigation, Ltd. * | 72,106 | ||||

|

|

|

|||||

| 154,969 | ||||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Aggressive Growth (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| FINANCIAL / INVESTMENT SERVICES - 5.5% | ||||||

| 1,025 |

Affiliated Managers Group, Inc. * | $ | 114,605 | |||

| 5,105 |

Cardtronics, Inc. * | 134,006 | ||||

| 2,429 |

Discover Financial Services | 80,983 | ||||

| 7,186 |

FleetCor Technologies, Inc. * | 278,601 | ||||

| 675 |

IntercontinentalExchange, Inc. * | 92,759 | ||||

| 6,805 |

Ocwen Financial Corp. * | 106,362 | ||||

| 5,975 |

XL Group PLC | 129,598 | ||||

|

|

|

|||||

| 936,914 | ||||||

|

|

|

|||||

| HEALTHCARE - 10.5% | ||||||

| 16,275 |

Bruker Corp.* | 249,170 | ||||

| 2,700 |

Catalyst Health Solutions, Inc. * | 172,071 | ||||

| 2,755 |

Cepheid, Inc. * | 115,242 | ||||

| 4,950 |

Cyberonics, Inc. * | 188,743 | ||||

| 2,300 |

Hill-Rom Holdings, Inc. | 76,843 | ||||

| 975 |

ICU Medical, Inc. * | 47,931 | ||||

| 2,475 |

Insulet Corp. * | 47,372 | ||||

| 350 |

Intuitive Surgical, Inc. * | 189,612 | ||||

| 3,500 |

IPC The Hospitalist Co. * | 129,185 | ||||

| 1,850 |

NxStage Medical, Inc. * | 35,649 | ||||

| 3,882 |

Sirona Dental Systems, Inc. * | 200,078 | ||||

| 10,000 |

Tornier NV * | 257,000 | ||||

| 2,700 |

Volcano Corp. * | 76,545 | ||||

|

|

|

|||||

| 1,785,441 | ||||||

|

|

|

|||||

| HOME BUILDERS - 0.4% | ||||||

| 4,290 |

D R Horton, Inc. | 65,079 | ||||

|

|

|

|||||

| INDUSTRIALS / MACHINERY - 6.8% | ||||||

| 4,010 |

Clean Harbors, Inc. * | 269,993 | ||||

| 1,043 |

Gardner Denver, Inc. | 65,730 | ||||

| 675 |

HEICO Corp. | 34,823 | ||||

| 800 |

HEICO Corp. - Class A | 32,120 | ||||

| 2,075 |

Robbins & Myers, Inc. | 108,004 | ||||

| 7,000 |

Rush Enterprises, Inc. - Class A * | 148,540 | ||||

| 9,635 |

United Rentals, Inc. * | 413,245 | ||||

| 2,800 |

Waste Connections, Inc. | 91,084 | ||||

|

|

|

|||||

| 1,163,539 | ||||||

|

|

|

|||||

| INFORMATION TECHNOLOGY - 15.9% | ||||||

| 5,461 |

Ariba, Inc. * | 178,629 | ||||

| 5,000 |

Aspen Technology, Inc. * | 102,650 | ||||

| 1,495 |

Cerner Corp. * | 113,859 | ||||

| 1,150 |

Citrix Systems, Inc. * | 90,747 | ||||

| 1,730 |

Cognizant Technology Solutions Corp. - Class A * | 133,124 | ||||

| 3,230 |

ComScore, Inc. * | 69,090 | ||||

| 4,805 |

Fiserv, Inc. * | 333,419 | ||||

| 1,612 |

Gartner Group, Inc. * | 68,736 | ||||

| 13,050 |

Greenway Medical Technologies * | 199,404 | ||||

| 1,425 |

Informatica Corp. * | 75,382 | ||||

| 4,345 |

Interactive Intelligence Group * | 132,566 | ||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Aggressive Growth (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| INFORMATION TECHNOLOGY - 15.9% (Continued) | ||||||

| 1,440 |

Jack Henry & Associates, Inc. | $ | 49,133 | |||

| 14,615 |

KIT Digital, Inc. * | 105,228 | ||||

| 1,475 |

Manhattan Associates, Inc. * | 70,107 | ||||

| 8,770 |

Parametric Technology Corp. * | 245,034 | ||||

| 2,100 |

Quality Systems, Inc. | 91,833 | ||||

| 9,155 |

Saba Software, Inc. * | 89,811 | ||||

| 950 |

Super Micro Computer, Inc. * | 16,587 | ||||

| 5,639 |

Synchronoss Technologies, Inc. * | 179,997 | ||||

| 2,090 |

Syntel, Inc. | 117,040 | ||||

| 1,325 |

Teradata Corp. * | 90,299 | ||||

| 5,075 |

Tibco Software, Inc. * | 154,787 | ||||

|

|

|

|||||

| 2,707,462 | ||||||

|

|

|

|||||

| METAL FABRICATE HARDWARE - 1.6% | ||||||

| 2,225 |

RBC Bearing, Inc. * | 102,639 | ||||

| 3,225 |

Timken Co. | 163,636 | ||||

|

|

|

|||||

| 266,275 | ||||||

|

|

|

|||||

| MISCELLANEOUS MANUFACTURING - 2.8% | ||||||

| 1,875 |

Parker Hannifin Corp. | 158,531 | ||||

| 4,200 |

Polypore International, Inc. * | 147,672 | ||||

| 7,850 |

Trimas Corp. * | 175,761 | ||||

|

|

|

|||||

| 481,964 | ||||||

|

|

|

|||||

| MISCELLANEOUS SERVICES - 2.3% | ||||||

| 18,675 |

HFF, Inc. - Class A * | 307,577 | ||||

| 8,250 |

MDC Partners, Inc. - Class A | 91,740 | ||||

|

|

|

|||||

| 399,317 | ||||||

|

|

|

|||||

| OIL & NATURAL GAS - 7.1% | ||||||

| 1,625 |

Cabot Oil & Gas Corp. | 50,651 | ||||

| 950 |

Concho Resources, Inc. * | 96,976 | ||||

| 7,075 |

Gulfport Energy Corp. * | 206,024 | ||||

| 13,055 |

Key Energy Services, Inc. * | 201,700 | ||||

| 27,445 |

Kodiak Oil & Gas Corp * | 273,352 | ||||

| 2,450 |

Oil States International * | 191,247 | ||||

| 6,119 |

Rex Energy Corp. * | 65,351 | ||||

| 2,172 |

Whiting Petroleum Corp. * | 117,940 | ||||

|

|

|

|||||

| 1,203,241 | ||||||

|

|

|

|||||

| PHARMACEUTICALS - 2.9% | ||||||

| 14,010 |

Akorn, Inc. * | 163,917 | ||||

| 2,195 |

Herbalife, Ltd | 151,060 | ||||

| 900 |

Jazz Pharmaceuticals PLC * | 43,623 | ||||

| 2,285 |

Questcor Pharmaceuticals, Inc. * | 85,962 | ||||

| 2,525 |

Sagent Pharmaceuticals, Inc. * | 45,122 | ||||

|

|

|

|||||

| 489,684 | ||||||

|

|

|

|||||

| RESTAURANTS - 0.8% | ||||||

| 4,535 |

Cheesecake Factory, Inc. * | 133,284 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Aggressive Growth (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| RETAIL - 15.9% | ||||||

| 1,000 |

Autozone, Inc. * | $ | 371,800 | |||

| 4,050 |

Caribou Coffee Co., Inc. * | 75,492 | ||||

| 4,400 |

Dick’s Sporting Goods, Inc. | 211,552 | ||||

| 10,255 |

Express, Inc. * | 256,170 | ||||

| 3,275 |

Genesco, Inc. * | 234,654 | ||||

| 7,145 |

GNC Acquisition Holdings, Inc. * | 249,289 | ||||

| 3,660 |

Group 1 Automotive, Inc. | 205,582 | ||||

| 2,825 |

Hibbett Sports, Inc. * | 154,104 | ||||

| 850 |

Nu Skin Enterprises, Inc. - Class A | 49,223 | ||||

| 6,810 |

Pier 1 Imports, Inc. * | 123,806 | ||||

| 6,240 |

Ross Stores, Inc. | 362,544 | ||||

| 16,745 |

Sally Beauty Holdings, Inc. * | 415,276 | ||||

|

|

|

|||||

| 2,709,492 | ||||||

|

|

|

|||||

| SEMICONDUCTORS - 1.5% | ||||||

| 3,660 |

Avago Technologies, Ltd. | 142,630 | ||||

| 1,125 |

Cavium, Inc. * | 34,807 | ||||

| 2,100 |

Volterra Semiconductor Corp. * | 72,271 | ||||

|

|

|

|||||

| 249,708 | ||||||

|

|

|

|||||

| TELECOMMUNICATIONS - 1.1% | ||||||

| 4,300 |

Finisar Corp. * | 86,645 | ||||

| 5,420 |

Polycom, Inc. * | 103,359 | ||||

|

|

|

|||||

| 190,004 | ||||||

|

|

|

|||||

| TRANSPORTATION - 1.9% | ||||||

| 1,675 |

Genesse & Wyoming, Inc. - Class A * | 91,422 | ||||

| 4,855 |

Old Dominion Freight Line, Inc. * | 231,438 | ||||

|

|

|

|||||

| 322,860 | ||||||

|

|

|

|||||

| TOTAL COMMON STOCKS (Cost $13,579,548) | 15,953,671 | |||||

|

|

|

|||||

| MONEY MARKET FUND - 6.6% | ||||||

| 1,128,332 |

Fidelity Institutional Money Market Portfolio, 0.00% (A) (Cost $1,128,332) |

1,128,332 | ||||

|

|

|

|||||

| TOTAL INVESTMENTS (Cost $14,707,880)(B) - 100.2% | $ | 17,082,003 | ||||

|

|

|

|||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (0.2)% | (76,680) | |||||

|

|

|

|||||

| NET ASSETS - 100.00% | $ | 17,005,323 | ||||

|

|

|

|||||

| * Non-income producing securities. |

| |||||

| (A) Variable rate security; the rate shown represents the yield at March 31, 2012. |

| |||||

| (B) Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is substantially the same and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: | ||||||

| Unrealized appreciation | $ | 2,605,808 | ||||

| Unrealized depreciation | (231,685) | |||||

|

|

|

|||||

| Net unrealized appreciation | $ | 2,374,123 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | International

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| COMMON STOCKS - 96.0% | ||||||

| AIRLINES - 1.1% | ||||||

| 4,400 |

Copa Holdings SA | $ | 348,480 | |||

|

|

|

|||||

| AEROSPACE/DEFENSE - 2.0% | ||||||

| 33,000 |

BAE Systems PLC | 636,900 | ||||

|

|

|

|||||

| AUTOMOTIVE - 4.2% | ||||||

| 41,000 |

Fiat SpA (ADR) | 244,770 | ||||

| 11,800 |

Magna International, Inc. | 563,332 | ||||

| 18,600 |

Valeo SA | 488,250 | ||||

|

|

|

|||||

| 1,296,352 | ||||||

|

|

|

|||||

| BANKS - 11.3% | ||||||

| 41,000 |

Banco Bilbao Vizcaya Argentaria SA | 327,590 | ||||

| 19,100 |

Banco Bradesco SA (ADR) | 334,250 | ||||

| 9,000 |

Bank Hapoalim BM (ADR) | 165,375 | ||||

| 13,000 |

BOC Hong Kong Holdings, Ltd. (ADR) | 726,180 | ||||

| 26,639 |

DBS Group Holdings, Ltd. (ADR) | 1,198,222 | ||||

| 57,000 |

Sberbank of Russia * | 763,230 | ||||

|

|

|

|||||

| 3,514,847 | ||||||

|

|

|

|||||

| BUILDING & CONSTRUCTION - 2.3% | ||||||

| 40,000 |

Vinci SA (ADR) | 520,000 | ||||

| 89,000 |

Wienerberger AG (ADR) | 206,480 | ||||

|

|

|

|||||

| 726,480 | ||||||

|

|

|

|||||

| CHEMICALS - 10.3% | ||||||

| 9,000 |

Agrium, Inc. | 777,330 | ||||

| 29,400 |

Henkel AG & Co. (ADR) * | 1,830,150 | ||||

| 8,500 |

Syngenta AG - (ADR)* | 585,055 | ||||

|

|

|

|||||

| 3,192,535 | ||||||

|

|

|

|||||

| COMMERCIAL SERVICES - 0.5% | ||||||

| 30,000 |

Anhui Expressway Co., Ltd. * | 165,378 | ||||

|

|

|

|||||

| CONSUMER GOODS - 4.2% | ||||||

| 10,550 |

FUJIFILM Holdings Corp. (ADR) | 248,030 | ||||

| 14,000 |

Kerry Group PLC | 650,300 | ||||

| 24,000 |

Shiseido Co, Ltd. (ADR) | 412,320 | ||||

|

|

|

|||||

| 1,310,650 | ||||||

|

|

|

|||||

| DISTRIBUTION/WHOLESALE - 2.5% | ||||||

| 36,000 |

ITOCHU Corp. | 786,600 | ||||

|

|

|

|||||

| ELECTRIC POWER - 3.3% | ||||||

| 5,000 |

International Power PLC (ADR) | 323,050 | ||||

| 95,000 |

Power Assets Holdings, Ltd. (ADR) | 696,350 | ||||

|

|

|

|||||

| 1,019,400 | ||||||

|

|

|

|||||

| ELECTRICAL - 3.0% | ||||||

| 14,300 |

Hitachi, Ltd. (ADR) | 925,067 | ||||

|

|

|

|||||

| FINANCIAL / INVESTMENT SERVICES - 2.5% | ||||||

| 16,300 |

ORIX Corp. (ADR) * | 786,475 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | International (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| FOOD - 0.7% | ||||||

| 20,000 |

Marine Harvest ASA (ADR) | $ | 204,600 | |||

|

|

|

|||||

| HEALTHCARE - 7.3% | ||||||

| 18,000 |

Fresenius Medical Care AG & Co. (ADR) | 1,271,700 | ||||

| 20,000 |

Smith & Nephew PLC (ADR) | 1,010,000 | ||||

|

|

|

|||||

| 2,281,700 | ||||||

|

|

|

|||||

| INDUSTRIALS - 3.1% | ||||||

| 27,000 |

Atlas Copco AB (ADR) | 583,470 | ||||

| 35,000 |

Cookson Group PLC (ADR) | 386,418 | ||||

|

|

|

|||||

| 969,888 | ||||||

|

|

|

|||||

| INFORMATION TECHNOLOGY - 2.1% | ||||||

| 14,000 |

Canon, Inc. (ADR) | 667,240 | ||||

|

|

|

|||||

| INSURANCE - 2.9% | ||||||

| 33,000 |

Zurich Insurance Group AG * | 890,340 | ||||

|

|

|

|||||

| MEDIA - 1.0% | ||||||

| 6,200 |

ProSiebenSat.1 Media AG * | 317,595 | ||||

|

|

|

|||||

| MINERALS & MINING - 5.4% | ||||||

| 22,380 |

Anglo American PLC (ADR) | 420,968 | ||||

| 7,500 |

Barrick Gold Corp. | 326,100 | ||||

| 10,000 |

BHP Billiton PLC (ADR) | 613,800 | ||||

| 14,600 |

Vale SA (ADR) | 331,274 | ||||

|

|

|

|||||

| 1,692,142 | ||||||

|

|

|

|||||

| OIL & NATURAL GAS - 7.7% | ||||||

| 62,000 |

Afren PLC (ADR) * | 661,044 | ||||

| 14,000 |

Lukoil OAO (ADR) | 851,200 | ||||

| 32,400 |

Precision Drilling Corp. * | 324,972 | ||||

| 20,168 |

Statoil ASA (ADR) | 546,754 | ||||

|

|

|

|||||

| 2,383,970 | ||||||

|

|

|

|||||

| OIL & GAS SERVICE - 1.7% | ||||||

| 20,000 |

Subsea 7 SA * | 527,800 | ||||

|

|

|

|||||

| PHARMACEUTICAL - 2.4% | ||||||

| 8,000 |

Shire PLC (ADR) | 758,000 | ||||

|

|

|

|||||

| RETAIL - 4.1% | ||||||

| 3,000 |

Arcos Dorados Holdings, Inc. (ADR) | 54,270 | ||||

| 14,900 |

Arcos Dorados Holdings, Inc. | 269,541 | ||||

| 40,000 |

WM Supermarkets PLC (ADR) | 949,200 | ||||

|

|

|

|||||

| 1,273,011 | ||||||

|

|

|

|||||

| SERVICES - 1.8% | ||||||

| 27,000 |

ABB, Ltd. (ADR) * | 551,070 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | International (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| TELECOMMUNICATIONS - 8.1% | ||||||

| 13,000 |

Globe Telecom, Inc. | $ | 343,356 | |||

| 13,000 |

Nippon Telegraph & Telephone Corp. | 294,060 | ||||

| 7,000 |

Philippine Long Distance Telephone Co. (ADR) | 435,330 | ||||

| 57,000 |

Singapore Telecommunications, Ltd. (ADR) | 1,434,690 | ||||

|

|

|

|||||

| 2,507,436 | ||||||

| TRANSPORTATION - 0.5% | ||||||

| 2,100 |

Canadian Pacific Railway Ltd | 159,495 | ||||

|

|

|

|||||

| TOTAL COMMON STOCKS (Cost $26,787,967) | 29,893,451 | |||||

|

|

|

|||||

| MONEY MARKET FUND - 3.2% | ||||||

| 1,022,126 |

Fidelity Institutional Money Market Portfolio, 0.00% (A) (Cost $1,022,126) |

1,022,126 | ||||

|

|

|

|||||

| TOTAL INVESTMENTS (Cost $27,810,093)(B) - 99.2% | $ | 30,915,577 | ||||

|

|

|

|||||

| ASSETS IN EXCESS OF OTHER LIABILITIES - 0.8% | 271,654 | |||||

|

|

|

|||||

| NET ASSETS - 100.00% | $ | 31,187,231 | ||||

|

|

|

|||||

| * Non-income producing securities. | ||||||

| (ADR) American Depositary Receipt. | ||||||

| (A) Variable rate security; the rate shown represents the yield at March 31, 2012. | ||||||

| (B) Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is substantially the same and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: | ||||||

| Unrealized appreciation | $ | 4,359,518 | ||||

| Unrealized depreciation | (1,254,034) | |||||

|

|

|

|||||

| Net unrealized appreciation | $ | 3,105,484 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | International (Continued)

As of March 31, 2012 (Unaudited)

|

Diversification of Assets |

||||

| Country |

% of Net Assets | |||

| Argentina |

1.04% | |||

| Austria |

0.66% | |||

| Brazil |

2.13% | |||

| Canada |

6.90% | |||

| China |

0.53% | |||

| France |

3.23% | |||

| Germany |

10.96% | |||

| Hong Kong |

4.56% | |||

| Ireland |

4.52% | |||

| Israel |

0.53% | |||

| Italy |

0.78% | |||

| Japan |

13.21% | |||

| Mexico |

0.00% | |||

| Netherlands |

0.00% | |||

| Norway |

2.41% | |||

| Panama |

1.12% | |||

| Phillipines |

2.50% | |||

| Russia |

5.18% | |||

| Singapore |

8.44% | |||

| Spain |

1.05% | |||

| Sweden |

1.87% | |||

| Switzerland |

6.50% | |||

| United Kingdom |

17.73% | |||

|

|

|

|||

| Total |

95.85% | |||

| Money Market Fund |

3.20% | |||

| Assets in Excess of Other Liabilities |

0.95% | |||

|

|

|

|||

| Grand Total |

100.00% | |||

|

|

|

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Large/Mid Cap Growth

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| COMMON STOCKS - 95.9% | ||||||

| APPAREL - 0.5% | ||||||

| 5,825 |

Wolverine World Wide, Inc. | $ | 216,573 | |||

|

|

|

|||||

| AEROSPACE/DEFENSE - 3.8% | ||||||

| 6,050 |

BE Aerospace, Inc. | 281,144 | ||||

| 11,565 |

General Dynamics, Corp. | 848,640 | ||||

| 4,050 |

Transdigm Group, Inc.* | 468,828 | ||||

|

|

|

|||||

| 1,598,612 | ||||||

|

|

|

|||||

| BANKS - 0.7% | ||||||

| 13,497 |

Webster Financial Corp. | 305,977 | ||||

|

|

|

|||||

| BIOTECHNOLOGY - 0.9% | ||||||

| 3,360 |

Regeneron Pharmaceuticals | 391,843 | ||||

|

|

|

|||||

| CHEMICALS - 2.7% | ||||||

| 9,010 |

Airgas, Inc. | 801,620 | ||||

| 5,600 |

Ashland, Inc. | 341,936 | ||||

|

|

|

|||||

| 1,143,556 | ||||||

|

|

|

|||||

| COMMERCIAL SERVICES - 3.2% | ||||||

| 7,450 |

Verisk Analytics, Inc. | 349,927 | ||||

| 56,415 |

Western Union Co. | 992,904 | ||||

|

|

|

|||||

| 1,342,831 | ||||||

|

|

|

|||||

| CONSUMER GOODS - 3.5% | ||||||

| 9,730 |

Emerson Electric Co. | 507,711 | ||||

| 17,270 |

McCormick & Co., Inc. | 940,006 | ||||

|

|

|

|||||

| 1,447,717 | ||||||

|

|

|

|||||

| DISTRIBUTION/WHOLESALE - 1.9% | ||||||

| 12,130 |

Wesco International, Inc. | 792,210 | ||||

|

|

|

|||||

| ELECTRONICS - 6.7% | ||||||

| 10,650 |

Amphenol Corp. - Class A | 636,551 | ||||

| 26,835 |

Jabil Circuit, Inc. | 674,095 | ||||

| 7,400 |

Sensata Technologies Holding | 247,752 | ||||

| 14,010 |

Thermo Fisher Scientific, Inc. | 789,884 | ||||

| 7,875 |

Trimble Navigation, Ltd. | 428,558 | ||||

|

|

|

|||||

| 2,776,840 | ||||||

|

|

|

|||||

| ELECTRICAL COMPONENTS & EQUIPMENT - 0.6% | ||||||

| 3,325 |

Hubbell Inc. - Class B | 261,279 | ||||

|

|

|

|||||

| ENVIRONMENTAL CONTROL - 1.5% | ||||||

| 3,655 |

Clean Harbors, Inc. * | 246,091 | ||||

| 11,500 |

Waste Connections, Inc. | 374,095 | ||||

|

|

|

|||||

| 620,186 | ||||||

|

|

|

|||||

| FINANCIAL / INVESTMENT SERVICES - 5.4% | ||||||

| 2,425 |

Affiliated Managers Group, Inc. * | 271,139 | ||||

| 2,265 |

Blackrock, Inc. | 464,099 | ||||

| 7,370 |

Discover Financial Services | 245,716 | ||||

| 17,530 |

FleetCor Technologies, Inc. * | 679,638 | ||||

| 17,145 |

GNC Acquisition Holdings, Inc. | 598,189 | ||||

|

|

|

|||||

| 2,258,781 | ||||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Large/Mid Cap Growth (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| HEALTHCARE - 13.3% | ||||||

| 20,060 |

AmerisourceBergen Corp. | $ | 795,981 | |||

| 6,870 |

C.R. Bard, Inc. | 678,206 | ||||

| 5,410 |

Catalyst Health Solutions, Inc. * | 344,779 | ||||

| 14,105 |

Covidien PLC | 771,261 | ||||

| 1,350 |

Intuitive Surgical, Inc. * | 731,363 | ||||

| 25,195 |

Sirona Dental Systems, Inc. * | 1,298,550 | ||||

| 15,040 |

St. Jude Medical, Inc. | 666,422 | ||||

| 8,800 |

Volcano Corp. | 249,480 | ||||

|

|

|

|||||

| 5,536,042 | ||||||

|

|

|

|||||

| HOME BUILDERS - 0.9% | ||||||

| 25,790 |

D R Horton, Inc. | 391,234 | ||||

|

|

|

|||||

| HOME FURNISHINGS - 0.6% | ||||||

| 3,000 |

Tempur-Pedic International | 253,290 | ||||

|

|

|

|||||

| INDUSTRIALS / MACHINERY - 4.1% | ||||||

| 3,885 |

Gardner Denver, Inc. | 244,833 | ||||

| 14,800 |

Johnson Controls, Inc. | 480,704 | ||||

| 22,770 |

United Rentals, Inc. * | 976,605 | ||||

|

|

|

|||||

| 1,702,142 | ||||||

|

|

|

|||||

| INFORMATION TECHNOLOGY - 11.4% | ||||||

| 25,540 |

Ariba, Inc. * | 835,413 | ||||

| 11,055 |

Avago Technologies Ltd. | 430,813 | ||||

| 7,555 |

Cerner Corp. * | 575,389 | ||||

| 6,345 |

Cognizant Technology Solutions Corp. - Class A * | 488,248 | ||||

| 10,765 |

Fiserv, Inc. * | 746,983 | ||||

| 3,596 |

Informatica Corp. * | 190,228 | ||||

| 23,525 |

Parametric Technology Corp. * | 657,289 | ||||

| 20,475 |

Polycom, Inc. * | 390,458 | ||||

| 6,250 |

Teradata Corp. * | 425,938 | ||||

|

|

|

|||||

| 4,740,759 | ||||||

|

|

|

|||||

| INSURANCE - 2.5% | ||||||

| 11,460 |

Ace Ltd. | 838,872 | ||||

| 8,825 |

XL Group PLC | 191,414 | ||||

|

|

|

|||||

| 1,030,286 | ||||||

|

|

|

|||||

| INTERNET - 1.3% | ||||||

| 17,440 |

Tibco Software, Inc. * | 531,920 | ||||

|

|

|

|||||

| METAL FABRICATE/HARDWARE - 1.1% | ||||||

| 8,700 |

Timken, Co. | 441,438 | ||||

|

|

|

|||||

| MISCELLANEOUS SERVICES - 2.9% | ||||||

| 14,295 |

Danaher Corp. | 800,520 | ||||

| 2,800 |

Parker Hannifin Corp. | 236,740 | ||||

| 4,575 |

Polypore International, Inc. | 160,857 | ||||

|

|

|

|||||

| 1,198,117 | ||||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Large/Mid Cap Growth (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| OIL & NATURAL GAS - 10.9% | ||||||

| 3,500 |

Cabot Oil & Gas Corp. | $ | 109,095 | |||

| 2,425 |

Concho Resources, Inc. | 247,544 | ||||

| 8,330 |

Ensco PLC (ADR) | 440,907 | ||||

| 16,000 |

Express, Inc. | 399,680 | ||||

| 18,260 |

Exxon Mobil Corp. | 1,583,690 | ||||

| 14,910 |

Occidental Petroleum Corp. | 1,419,879 | ||||

| 6,355 |

Whiting Petroleum Corp. * | 345,076 | ||||

|

|

|

|||||

| 4,545,871 | ||||||

|

|

|

|||||

| OIL & NATURAL GAS SERVICES - 1.9% | ||||||

| 20,300 |

Key Energy Services, Inc. * | 313,635 | ||||

| 5,900 |

Oil States International, Inc. * | 460,554 | ||||

|

|

|

|||||

| 774,189 | ||||||

|

|

|

|||||

| PHARMACEUTICALS - 2.6% | ||||||

| 10,975 |

Herbalife, Ltd. | 755,299 | ||||

| 6,725 |

Jazz Pharmaceuticals PLC | 325,961 | ||||

|

|

|

|||||

| 1,081,260 | ||||||

|

|

|

|||||

| RETAIL - 10.3% | ||||||

| 4,210 |

Autozone, Inc. * | 1,565,278 | ||||

| 22,460 |

Dick’s Sporting Goods, Inc. | 1,079,877 | ||||

| 17,510 |

Ross Stores, Inc. | 1,017,331 | ||||

| 25,295 |

Sally Beauty Holdings, Inc. | 627,316 | ||||

|

|

|

|||||

| 4,289,802 | ||||||

|

|

|

|||||

| SOFTWARE - 0.7% | ||||||

| 3,900 |

Citrix Systems, Inc. | 307,750 | ||||

|

|

|

|||||

| TOTAL COMMON STOCKS (Cost $34,816,195) | 39,980,505 | |||||

|

|

|

|||||

| MONEY MARKET FUND - 3.9% | ||||||

| 1,629,773 |

Fidelity Institutional Money Market Portfolio, 0.00% (A) (Cost $1,629,773) |

1,629,773 | ||||

|

|

|

|||||

| TOTAL INVESTMENTS (Cost $36,445,968)(B) - 99.8% | $ | 41,610,278 | ||||

|

|

|

|||||

| ASSETS IN EXCESS OF OTHER LIABILITIES - 0.2% | 74,752 | |||||

|

|

|

|||||

| NET ASSETS - 100.00% | $ | 41,685,030 | ||||

|

|

|

|||||

| *Non-income producing securities. | ||||||

| (ADR) American Depositary Receipt. | ||||||

| (A) Variable rate security; the rate shown represents the yield at March 31, 2012. | ||||||

| (B) Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is substantially the same and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: | ||||||

| Unrealized appreciation | $ | 5,698,347 | ||||

| Unrealized depreciation | (534,037) | |||||

|

|

|

|||||

| Net unrealized appreciation | $ | 5,164,310 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Small Cap Value

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| COMMON STOCKS - 81.8% | ||||||

| AEROSPACE EQUIPMENT - 2.2% | ||||||

| 26,900 |

Moog, Inc. - Class A * | $ | 1,153,741 | |||

|

|

|

|||||

| BANKS - 15.0% | ||||||

| 15,428 |

Bancfirst Corp. | 672,044 | ||||

| 112,599 |

BBCN Bancorp, Inc. | 1,253,227 | ||||

| 49,503 |

Chemical Financial Corp. | 1,160,350 | ||||

| 55,108 |

Columbia Banking System, Inc. | 1,255,360 | ||||

| 63,800 |

First Financial Bancorp | 1,103,740 | ||||

| 19,800 |

SVB Financial Group * | 1,273,932 | ||||

| 37,200 |

Wintrust Financial Corp. | 1,331,388 | ||||

|

|

|

|||||

| 8,050,041 | ||||||

|

|

|

|||||

| BUILDING MATERIALS - 1.1% | ||||||

| 33,900 |

Quanex Building Products Co. | 597,657 | ||||

|

|

|

|||||

| COAL - 2.2% | ||||||

| 74,600 |

Cloud Peak Energy, Inc. * | 1,188,378 | ||||

|

|

|

|||||

| CONSUMER GOODS - 2.1% | ||||||

| 30,100 |

Wolverine World Wide, Inc. | 1,119,118 | ||||

|

|

|

|||||

| COMPUTERS - 4.3% | ||||||

| 19,534 |

CACI International, Inc. | 1,216,773 | ||||

| 38,700 |

J2 Global, Inc. | 1,109,916 | ||||

|

|

|

|||||

| 2,326,689 | ||||||

|

|

|

|||||

| ELECTRIC POWER - 5.5% | ||||||

| 28,500 |

Allete | 1,182,465 | ||||

| 14,600 |

Cleco Corp. | 578,890 | ||||

| 33,500 |

NorthWestern Corp. | 1,187,910 | ||||

|

|

|

|||||

| 2,949,265 | ||||||

|

|

|

|||||

| ELECTRIC & EQUIPMENT - 2.2% | ||||||

| 34,500 |

EnerSys * | 1,195,425 | ||||

|

|

|

|||||

| FINANCIAL & INVESTMENT SERVICES - 1.9% | ||||||

| 81,100 |

Knight Capital Group, Inc. - Class A * | 1,043,757 | ||||

|

|

|

|||||

| FOOD - 2.2% | ||||||

| 22,665 |

J & J Snack Food Corp. | 1,189,006 | ||||

|

|

|

|||||

| HEALTHCARE - 4.2% | ||||||

| 98,617 |

Natus Medical, Inc. * | 1,176,501 | ||||

| 28,080 |

Orthofix International NV * | 1,055,246 | ||||

|

|

|

|||||

| 2,231,747 | ||||||

|

|

|

|||||

| INDUSTRIALS - 6.7% | ||||||

| 25,597 |

A.O. Smith Corp. | 1,150,585 | ||||

| 22,505 |

Hurco Cos., Inc. * | 635,766 | ||||

| 22,900 |

Kaydon Corp. | 584,179 | ||||

| 33,100 |

TAL International Group, Inc. | 1,215,101 | ||||

|

|

|

|||||

| 3,585,631 | ||||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Small Cap Value (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| INFORMATION TECHNOLOGY - 3.2% | ||||||

| 84,006 |

Pervasive Software, Inc. * | $ | 503,196 | |||

| 32,000 |

SYNNEX Corp. * | 1,220,480 | ||||

|

|

|

|||||

| 1,723,676 | ||||||

|

|

|

|||||

| INSURANCE - 5.5% | ||||||

| 49,423 |

AMERISAFE, Inc. * | 1,222,725 | ||||

| 31,500 |

Employers Holdings, Inc. | 557,865 | ||||

| 27,670 |

Safety Insurance Group, Inc. | 1,152,179 | ||||

|

|

|

|||||

| 2,932,769 | ||||||

|

|

|

|||||

| MISCELLANEOUS SERVICES - 6.1% | ||||||

| 56,100 |

Harsco Corp. | 1,316,106 | ||||

| 92,766 |

Matrix Service Co. * | 1,299,652 | ||||

| 77,400 |

Pioneer Drilling Co. * | 681,120 | ||||

|

|

|

|||||

| 3,296,878 | ||||||

|

|

|

|||||

| OIL & NATURAL GAS - 3.8% | ||||||

| 40,254 |

Basic Energy Services, Inc. * | 698,407 | ||||

| 31,700 |

Bonanza Creek Energy Inc. | 692,645 | ||||

| 213,326 |

Gastar Exploration Ltd. * | 637,845 | ||||

|

|

|

|||||

| 2,028,897 | ||||||

|

|

|

|||||

| RETAIL - 4.4% | ||||||

| 24,500 |

Children’s Place Retail Stores | 1,265,915 | ||||

| 68,600 |

Kirkland’s, Inc. * | 1,109,948 | ||||

|

|

|

|||||

| 2,375,863 | ||||||

|

|

|

|||||

| SEMICONDUCTORS - 2.3% | ||||||

| 25,400 |

Kraton Performance Polymers, Inc. * | 674,878 | ||||

| 20,038 |

Veeco Instruments, Inc. * | 573,086 | ||||

|

|

|

|||||

| 1,247,964 | ||||||

|

|

|

|||||

| TRANSPORTATION - 5.9% | ||||||

| 12,900 |

Genesee & Wyoming, Inc. - Class A * | 704,082 | ||||

| 22,264 |

Landstar System, Inc. | 1,285,078 | ||||

| 69,513 |

Saia, Inc. * | 1,182,416 | ||||

|

|

|

|||||

| 3,171,576 | ||||||

|

|

|

|||||

| TELECOMMUNICATIONS - 1.0% | ||||||

| 133,100 |

Tellabs, Inc. | 539,055 | ||||

|

|

|

|||||

| TOTAL COMMON STOCKS (Cost $40,117,493) | 43,947,133 | |||||

|

|

|

|||||

| REITs - 11.7% | ||||||

| 60,365 |

Coresite Realty Corp. | 1,424,010 | ||||

| 51,400 |

CubeSmart | 611,660 | ||||

| 203,700 |

DCT Industrial Trust, Inc. | 1,201,830 | ||||

| 118,457 |

DiamondRock Hospitality | 1,218,923 | ||||

| 30,100 |

Healthcare Realty Trust, Inc. | 662,200 | ||||

| 37,900 |

Potlatch Corp. | 1,187,786 | ||||

|

|

|

|||||

| TOTAL REITs (Cost $5,267,663) | 6,306,409 | |||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Small Cap Value (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| MONEY MARKET FUND - 8.0% | ||||||

| 4,297,306 |

Fidelity Institutional Money Market Portfolio, 0.00% (A) (Cost $4,297,306) |

$ | 4,297,306 | |||

|

|

|

|||||

| TOTAL INVESTMENTS (Cost $49,682,462)(B) - 101.5% | $ | 54,550,848 | ||||

|

|

|

|||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (1.5)% | (820,996) | |||||

|

|

|

|||||

| NET ASSETS - 100.00% | $ | 53,729,852 | ||||

|

|

|

|||||

| * Non-income producing securities. | ||||||

| (A) Variable rate security; the rate shown represents the yield at March 31, 2012. | ||||||

| (B) Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is substantially the same and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: | ||||||

| Unrealized appreciation | $ | 6,466,872 | ||||

| Unrealized depreciation | (1,598,486) | |||||

|

|

|

|||||

| Net unrealized appreciation | $ | 4,868,386 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Large/Mid Cap Value

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| COMMON STOCKS - 88.4% | ||||||

| AEROSPACE/DEFENSE - 0.8% | ||||||

| 7,173 |

Goodrich, Corp. | $ | 899,781 | |||

|

|

|

|||||

| AUTO - 0.9% | ||||||

| 21,300 |

Lear Corp. | 990,237 | ||||

|

|

|

|||||

| BANKS - 2.1% | ||||||

| 54,400 |

CIT Group, Inc. * | 2,243,456 | ||||

|

|

|

|||||

| CONSUMER GOODS - 8.8% | ||||||

| 28,500 |

BorgWarner, Inc. * | 2,403,690 | ||||

| 56,900 |

Dr Pepper Snapple Group, Inc. | 2,287,949 | ||||

| 51,500 |

Emerson Electric Co. | 2,687,270 | ||||

| 26,100 |

JM Smucker Co./The | 2,123,496 | ||||

|

|

|

|||||

| 9,502,405 | ||||||

|

|

|

|||||

| ELECTRIC POWER - 6.2% | ||||||

| 49,000 |

American Electric Power Co., Inc. | 1,890,420 | ||||

| 47,000 |

Dominion Resources, Inc. | 2,406,870 | ||||

| 53,300 |

FirstEnergy Corp. | 2,429,947 | ||||

|

|

|

|||||

| 6,727,237 | ||||||

|

|

|

|||||

| FINANCIAL & INVESTMENT SERVICES - 6.6% | ||||||

| 69,300 |

Eaton Vance Corp. | 1,980,594 | ||||

| 17,100 |

Franklin Resources, Inc. | 2,120,913 | ||||

| 112,600 |

Invesco, Ltd. | 3,003,042 | ||||

|

|

|

|||||

| 7,104,549 | ||||||

|

|

|

|||||

| HEALTHCARE - 12.8% | ||||||

| 79,700 |

CareFusion Corp. * | 2,066,621 | ||||

| 60,900 |

Covidien PLC | 3,330,012 | ||||

| 22,800 |

CR Bard, Inc. | 2,250,816 | ||||

| 28,800 |

DENTSPLY International, Inc. | 1,155,744 | ||||

| 117,000 |

Hologic, Inc. * | 2,521,350 | ||||

| 56,400 |

St. Jude Medical, Inc. | 2,499,084 | ||||

|

|

|

|||||

| 13,823,627 | ||||||

|

|

|

|||||

| INDUSTRIALS - 4.4% | ||||||

| 30,800 |

General Dynamics Corp. | 2,260,104 | ||||

| 14,200 |

Precision Castparts Corp. | 2,455,180 | ||||

|

|

|

|||||

| 4,715,284 | ||||||

|

|

|

|||||

| INFORMATION TECHNOLOGY - 5.3% | ||||||

| 122,300 |

CA, Inc. | 3,370,588 | ||||

| 63,500 |

TE Connectivity, Ltd. | 2,333,625 | ||||

|

|

|

|||||

| 5,704,213 | ||||||

|

|

|

|||||

| INSURANCE - 8.7% | ||||||

| 37,700 |

ACE, Ltd. | 2,759,640 | ||||

| 63,100 |

Arch Capital Group, Ltd. * | 2,349,844 | ||||

| 67,700 |

Axis Capital Holdings, Ltd. | 2,245,609 | ||||

| 60,100 |

Willis Group Holdings, PLC (ADR) | 2,102,298 | ||||

|

|

|

|||||

| 9,457,391 | ||||||

|

|

|

|||||

| MACHINERY - 2.4% | ||||||

| 22,200 |

Flowserve Corp. | 2,564,322 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Large/Mid Cap Value (Continued)

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| OIL & NATURAL GAS - 19.8% | ||||||

| 28,300 |

Anadarko Petroleum Corp. | $ | 2,217,022 | |||

| 20,600 |

Apache Corp. | 2,069,064 | ||||

| 18,600 |

ConocoPhillips | 1,413,786 | ||||

| 45,200 |

EQT Corp. | 2,179,092 | ||||

| 41,000 |

Exxon Mobil Corp. | 3,555,930 | ||||

| 44,400 |

Marathon Oil Corp. | 1,407,480 | ||||

| 29,300 |

Marathon Petroleum Corp. | 1,270,448 | ||||

| 34,700 |

Murphy Oil Corp. | 1,952,569 | ||||

| 33,000 |

National Oilwell Varco, Inc. | 2,622,510 | ||||

| 29,000 |

Occidental Petroleum Corp. | 2,761,670 | ||||

|

|

|

|||||

| 21,449,571 | ||||||

|

|

|

|||||

| RETAIL - 6.0% | ||||||

| 37,900 |

Advance Auto Parts, Inc. | 3,356,803 | ||||

| 29,300 |

Sherwin-Williams Co./The | 3,184,031 | ||||

|

|

|

|||||

| 6,540,834 | ||||||

|

|

|

|||||

| SEMICONDUCTORS - 0.9% | ||||||

| 26,900 |

Microchip Technology, Inc. | 1,000,680 | ||||

|

|

|

|||||

| TRANSPORTATION - 2.6% | ||||||

| 26,400 |

Union Pacific Corp. | 2,837,472 | ||||

|

|

|

|||||

| TOTAL COMMON STOCKS (Cost $73,076,088) | 95,561,059 | |||||

|

|

|

|||||

| MASTER LIMITED PARTNERSHIPS - 2.1% | ||||||

| 78,800 |

Lazard, Ltd. - Class A | 2,250,528 | ||||

|

|

|

|||||

| TOTAL MASTER LIMITED PARTNERSHIPS (Cost $2,711,146) | 2,250,528 | |||||

|

|

|

|||||

| REITs - 4.4% | ||||||

| 51,100 |

HCP, Inc. | 2,016,406 | ||||

| 19,700 |

Public Storage, Inc. | 2,721,949 | ||||

|

|

|

|||||

| TOTAL REITs (Cost $3,033,852) | 4,738,355 | |||||

|

|

|

|||||

| MONEY MARKET FUND - 5.2% | ||||||

| 5,574,089 |

Fidelity Institutional Money Market Portfolio, 0.00% (A) (Cost $5,574,089) |

5,574,089 | ||||

|

|

|

|||||

| TOTAL INVESTMENTS (Cost $84,395,175)(B) - 99.9% | $ | 108,124,031 | ||||

|

|

|

|||||

| ASSETS IN EXCESS OF OTHER LIABILITIES - 0.1% | 8,540 | |||||

|

|

|

|||||

| NET ASSETS - 100.00% | $ | 108,132,571 | ||||

|

|

|

|||||

| * Non-income producing securities. | ||||||

| (ADR) American Depositary Receipt. | ||||||

| (A) Variable rate security; the rate shown represents the yield at March 31, 2012. | ||||||

| (B) Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is substantially the same and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: | ||||||

| Unrealized appreciation | $ | 25,297,188 | ||||

| Unrealized depreciation | (1,568,332) | |||||

|

|

|

|||||

| Net unrealized appreciation | $ | 23,728,856 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Fixed Income

As of March 31, 2012 (Unaudited)

| Par Value |

Fair Value | |||||

| BONDS AND NOTES - 93.5% | ||||||

| CORPORATE BONDS - 28.7% | ||||||

| $ 440,000 |

Analog Devices, Inc., 3.00%, 04/15/2016 | $ | 462,233 | |||

| 1,000,000 |

Cameron International Corp., 6.375%, 07/15/2018 | 1,182,601 | ||||

| 750,000 |

Canadian National Railway Co., 5.80%, 06/01/2016 | 873,045 | ||||

| 750,000 |

Cliffs Natural Resources Inc., 4.875%, 04/01/2021 | 777,450 | ||||

| 500,000 |

Covidien International Finance SA, 5.45%, 06/15/2015 | 521,310 | ||||

| 750,000 |

Energy Transfer Partners LP, 6.70%, 07/01/2018 | 860,950 | ||||

| 500,000 |

Enterprise Products Operating, LLC, 6.125%, 10/15/2039 | 565,057 | ||||

| 900,000 |

Equity Residential, 5.125%, 03/15/2016 | 986,948 | ||||

| 750,000 |

Freeport-McMoran Copper & Gold, 3.55%, 03/01/2022 | 721,799 | ||||

| 1,000,000 |

John Sevier, 4.626%, 01/15/2042 | 1,034,710 | ||||

| 500,000 |

Johnson Controls, Inc., 5.00%, 03/30/2020 | 563,265 | ||||

| 1,000,000 |

Kennametal Inc., 3.875%, 02/15/2022 | 987,750 | ||||

| 750,000 |

Kinder Morgan Energy Partners LP, 5.125%, 11/15/2014 | 819,969 | ||||

| 500,000 |

L-3 Communications, Corp., 5.20%, 10/15/2019 | 534,884 | ||||

| 750,000 |

Marathon Oil Corp., 6.00%, 10/01/2017 | 877,747 | ||||

| 750,000 |

Nisource Finance Corp., 5.40%, 07/15/2014 | 815,973 | ||||

| 500,000 |

Oneok, Inc., 4.25%, 02/01/2022 | 506,090 | ||||

| 500,000 |

Oneok, Inc., 5.20%, 06/15/2015 | 548,255 | ||||

| 750,000 |

Petrobras Intl. Financial Co., 3.50%, 02/06/2017 | 767,122 | ||||

| 1,000,000 |

Phillips 66, 2.95%, 05/01/2017 | 1,017,596 | ||||

| 1,000,000 |

Plains All American Pipeline, 3.65%, 06/01/2022 | 979,360 | ||||

| 750,000 |

Rabobank Nederland, 2.125%, 10/13/2015 | 753,038 | ||||

| 750,000 |

Simon Property Group LP, 5.75%, 12/01/2015 | 846,425 | ||||

| 500,000 |

Teck Cominco Ltd. - Cl. B, 6.00%, 08/15/2040 | 523,970 | ||||

| 500,000 |

Transocean, Inc., 6.00%, 03/15/2018 | 552,380 | ||||

| 350,000 |

Tyco Electronics Group SA, 6.00%, 10/01/2012 | 415,439 | ||||

| 500,000 |

Valero Energy Corp., 6.625%, 06/15/2037 | 545,935 | ||||

| 750,000 |

Weatherford International, Ltd., 4.95%, 10/15/2013 | 787,433 | ||||

| 750,000 |

Willis North America, Inc., 6.20%, 03/28/2017 | 840,151 | ||||

|

|

|

|||||

| TOTAL CORPORATE BONDS (Cost $20,516,330) | 21,668,885 | |||||

|

|

|

|||||

| U.S. GOVERNMENT & AGENCY OBLIGATIONS - 64.8% | ||||||

| GOVERNMENT NOTES & BONDS - 28.1% | ||||||

| 1,500,000 |

Federal Farm Credit Bank, 4.875%, 01/17/2017 | 1,768,517 | ||||

| 2,500,000 |

Federal Farm Credit Bank, 5.125%, 08/25/2016 | 2,934,688 | ||||

| 1,000,000 |

Federal Home Loan Bank, 5.00%, 11/17/2017 | 1,199,573 | ||||

| 1,500,000 |

Federal Home Loan Bank, 5.50%, 08/13/2014 | 1,678,901 | ||||

| 4,000,000 |

U.S. Treasury Bond, 3.125%, 05/15/2019 | 4,405,312 | ||||

| 1,500,000 |

U.S. Treasury Bond, 4.375%, 05/15/2040 | 1,802,812 | ||||

| 1,000,000 |

U.S. Treasury Bond, 5.00%, 05/15/2037 | 1,311,094 | ||||

| 2,000,000 |

U.S. Treasury Note, 3.125%, 05/15/2021 | 2,175,859 | ||||

| 2,000,000 |

U.S. Treasury Note, 3.875%, 05/15/2018 | 2,296,562 | ||||

| 1,550,000 |

U.S. Treasury Note, 4.75%, 05/15/2014 | 1,692,346 | ||||

|

|

|

|||||

| TOTAL GOVERNMENT NOTES & BONDS (Cost $19,665,755) | 21,265,664 | |||||

|

|

|

|||||

| GOVERNMENT MORTGAGE-BACKED SECURITIES - 31.9% | ||||||

| 88,609 |

GNMA Pool 3584, 6.00%, 07/20/2034 | 100,874 | ||||

| 203,136 |

GNMA Pool 3612, 6.50%, 09/20/2034 | 233,474 | ||||

| 633,300 |

GNMA Pool 3625, 6.00%, 10/20/2034 | 716,402 | ||||

| 258,775 |

GNMA Pool 3637, 5.50%, 11/20/2034 | 289,348 | ||||

| 405,039 |

GNMA Pool 3665, 5.50%, 01/20/2035 | 452,892 | ||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Fixed Income (Continued)

As of March 31, 2012 (Unaudited)

| Par Value |

Fair Value | |||||

| GOVERNMENT MORTGAGE-BACKED SECURITIES - 31.9% (Continued) | ||||||

| $ 205,983 |

GNMA Pool 3679, 6.00%, 02/20/2035 | $ | 233,012 | |||

| 519,348 |

GNMA Pool 3711, 5.50%, 05/20/2035 | 579,083 | ||||

| 458,571 |

GNMA Pool 3865, 6.00%, 06/20/2036 | 517,884 | ||||

| 330,737 |

GNMA Pool 3910, 6.00%, 10/20/2036 | 373,516 | ||||

| 618,281 |

GNMA Pool 3939, 5.00%, 01/20/2037 | 682,247 | ||||

| 743,673 |

GNMA Pool 4058, 5.00%, 12/20/2037 | 820,612 | ||||

| 804,894 |

GNMA Pool 4072, 5.50%, 01/20/2038 | 895,713 | ||||

| 2,172,224 |

GNMA Pool 4520, 5.00%, 08/20/2039 | 2,395,599 | ||||

| 1,344,769 |

GNMA Pool 4541, 5.00%, 09/20/2039 | 1,483,055 | ||||

| 2,414,319 |

GNMA Pool 4947, 5.00%, 02/20/2041 | 2,665,607 | ||||

| 962,225 |

GNMA Pool 5204, 4.50%, 10/20/2041 | 1,047,411 | ||||

| 1,886,691 |

GNMA Pool 783060, 4.00%, 08/15/2040 | 2,030,193 | ||||

| 30,014 |

GNMA Pool 585163, 5.00%, 02/15/2018 | 32,893 | ||||

| 27,793 |

GNMA Pool 585180, 5.00%, 02/15/2018 | 30,458 | ||||

| 17,860 |

GNMA Pool 592492, 5.00%, 03/15/2018 | 19,573 | ||||

| 23,979 |

GNMA Pool 599821, 5.00%, 01/15/2018 | 26,294 | ||||

| 392,749 |

GNMA Pool 604182, 5.50%, 04/15/2033 | 441,544 | ||||

| 256,547 |

GNMA Pool 663776, 6.50%, 01/15/2037 | 294,460 | ||||

| 3,504,333 |

GNMA Pool 701961, 4.50%, 06/15/2039 | 3,824,545 | ||||

| 1,544,210 |

GNMA Pool 717072, 5.00%, 05/15/2039 | 1,707,590 | ||||

| 896,677 |

GNMA Pool 734437, 4.50%, 05/15/2041 | 978,892 | ||||

| 86,934 |

GNMA Pool 781694, 6.00%, 12/15/2031 | 98,949 | ||||

| 980,297 |

GNMA Pool 782858, 6.00%, 11/15/2039 | 1,106,890 | ||||

|

|

|

|||||

| TOTAL GOVERNMENT MORTGAGE-BACKED SECURITIES (Cost $22,747,911) | 24,079,010 | |||||

|

|

|

|||||

| TREASURY INFLATION PROTECTED SECURITIES (TIPS) - 4.8% | ||||||

| 1,250,000 |

TIPS, 2.00%, 01/15/2014 | 1,639,539 | ||||

| 1,500,000 |

TIPS, 2.50%, 07/15/2016 | 1,965,270 | ||||

|

|

|

|||||

| TOTAL TREASURY INFLATION PROTECTED SECURITIES (TIPS) (Cost $3,240,229) | 3,604,809 | |||||

|

|

|

|||||

| TOTAL U.S. GOVERNMENT & AGENCY OBLIGATIONS (Cost $45,653,895) | 48,949,483 | |||||

|

|

|

|||||

| TOTAL BONDS AND NOTES (Cost $66,170,225) | 70,618,368 | |||||

|

|

|

|||||

| Shares | ||||||

| MONEY MARKET FUND - 5.9% | ||||||

| 4,432,627 |

Fidelity Institutional Money Market Portfolio, 0.00% (A) (Cost $4,432,627) |

4,432,627 | ||||

|

|

|

|||||

| TOTAL INVESTMENTS (Cost $70,602,852)(B) - 99.3% | $ | 75,050,995 | ||||

|

|

|

|||||

| ASSETS IN EXCESS OF OTHER LIABILITIES - 0.7% | 500,077 | |||||

|

|

|

|||||

| NET ASSETS - 100.00% | $ | 75,551,072 | ||||

|

|

|

|||||

| (A) Variable rate security; the rate shown represents the yield at March 31, 2012. | ||||||

| (B) Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is substantially the same and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: | ||||||

| Unrealized appreciation | $ | 4,544,573 | ||||

| Unrealized depreciation | (96,430) | |||||

|

|

|

|||||

| Net unrealized appreciation | $ | 4,448,143 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | High Yield Bond

As of March 31, 2012 (Unaudited)

| Par Value |

Fair Value | |||||

| CORPORATE BONDS - 93.6% | ||||||

| $ 250,000 |

Actuant Corp., 6.875%, 6/15/2017 | $ | 260,000 | |||

| 500,000 |

AmeriGas Partners LP, 6.50%, 5/20/2021 | 511,250 | ||||

| 500,000 |

Arch Coal Inc., 7.25%, 6/15/2021 | 459,375 | ||||

| 500,000 |

ArcelorMittal, 6.25%, 2/25/2022 | 506,476 | ||||

| 500,000 |

Basic Energy Services, Inc., 7.75%, 2/15/2019 | 513,750 | ||||

| 500,000 |

Berry Petroleum Co., 8.25%, 11/01/2016 | 521,875 | ||||

| 500,000 |

Calfrac Holdings LP, 7.50%, 12/01/2020 (A) | 505,000 | ||||

| 500,000 |

Calumet Special, 9.375%, 5/1/2019 (A) | 522,500 | ||||

| 500,000 |

Cemex Finance LLC, 9.50%, 12/14/2016 (A) | 501,300 | ||||

| 500,000 |

Cloud Peak Energy Resources LLC, 8.50%, 12/15/2019 | 523,750 | ||||

| 500,000 |

CommScope, Inc., 8.25%, 1/15/2019 (A) | 529,375 | ||||

| 500,000 |

Comstock Resources, Inc., 8.375%, 10/15/2017 | 488,750 | ||||

| 250,000 |

Continental Resources, Inc., 7.125%, 4/01/2021 | 278,750 | ||||

| 500,000 |

Copano Energy Finance Corp., 7.75%, 6/01/2018 | 526,250 | ||||

| 500,000 |

Covanta Holding Corp., 7.25%, 12/01/2020 | 540,430 | ||||

| 500,000 |

Crosstex Energy LP, 8.875%, 2/15/2018 | 533,750 | ||||

| 500,000 |

Energy Transfer Equity LP, 7.50%, 10/15/2020 | 557,500 | ||||

| 250,000 |

EV Energy Partners/Fin, 8.00%, 4/15/2019 | 259,375 | ||||

| 500,000 |

FMG Resources August 2006 Pty Ltd., 7.00%, 11/01/2015 (A) | 512,500 | ||||

| 500,000 |

Forest Oil Corp., 7.25%, 6/15/2019 | 491,250 | ||||

| 500,000 |

Frac Tech Services LLC, 7.125%, 11/15/2018 (A) | 525,000 | ||||

| 750,000 |

Genesis Energy LP, 7.875%, 12/15/2018 (A) | 768,750 | ||||

| 500,000 |

Geo Group, Inc./The, 6.625%, 2/15/2021 | 525,625 | ||||

| 500,000 |

Helix Energy Solutions Group, Inc., 9.50%, 1/15/2016 (A) | 524,375 | ||||

| 500,000 |

Hypermarcas SA, 6.50%, 4/20/2021 (A) | 490,000 | ||||

| 500,000 |

Intergen NV, 9.00%, 6/30/2017 (A) | 528,750 | ||||

| 250,000 |

Iron Mountain, 7.75%, 10/1/2019 | 272,813 | ||||

| 500,000 |

Kindred Healthcare, 8.25%, 6/1/2019 (A) | 436,875 | ||||

| 500,000 |

MarkWest Energy Partners L.P., 6.75%, 11/01/2020 | 542,500 | ||||

| 500,000 |

Masco Corp., 5.95% 3/15/2022 | 502,095 | ||||

| 500,000 |

MedAssets, Inc., 8.00%, 11/15/2018 (A) | 527,500 | ||||

| 500,000 |

MEMC Electronic Materials, Inc., 7.75%, 4/01/2019 (A) | 404,375 | ||||

| 500,000 |

MPT Operating Partnership LP, 6.875%, 5/1/2021 (A) | 525,000 | ||||

| 500,000 |

Navios Maritime Holdings, Inc., 8.875%, 11/01/2017 | 515,000 | ||||

| 449,000 |

Navistar International Corp., 8.25%, 11/01/2021 | 491,655 | ||||

| 500,000 |

Nova Chemicals Corp., 8.625%, 11/01/2019 | 572,500 | ||||

| 500,000 |

NRG Energy, Inc., 7.375%, 1/15/2017 | 521,250 | ||||

| 500,000 |

NRG Energy, Inc., 7.625%, 1/15/2018 | 503,750 | ||||

| 500,000 |

OGX Petroleo, 8.50%, 6/1/2018 (A) | 505,625 | ||||

| 500,000 |

Omnicare, Inc., 7.75%, 6/01/2020 | 557,500 | ||||

| 500,000 |

PolyOne Corp., 7.375%, 9/15/2020 | 531,250 | ||||

| 250,000 |

Polypore International, Inc., 7.50%, 11/15/2017 | 265,000 | ||||

| 500,000 |

QBE Cap Funding II LP, 7.25%, 5/24/2041 (A) | 472,016 | ||||

| 250,000 |

R R Donnelley & Sons Co., 7.25%, 5/15/2018 | 243,750 | ||||

| 500,000 |

Reynolds Group Issuer, Inc., 9.00%, 4/15/2019 (A) | 490,000 | ||||

| 500,000 |

Samson Investment Co., 9.75% 2/15/2020 | 506,875 | ||||

| 500,000 |

Sanmina-SCI Corp., 7.00%, 5/15/2019 (A) | 512,500 | ||||

| 500,000 |

Sealy Mattress Co., 8.25%, 6/15/2014 | 492,500 | ||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | High Yield Bond (Continued)

As of March 31, 2012 (Unaudited)

| Par Value |

Fair Value | |||||

| CORPORATE BONDS - 93.6% (continued) | ||||||

| $ 500,000 |

Servicemaster Co., 8.00% 2/15/2020 | $ | 535,000 | |||

| 125,000 |

Schaeffler Finance BV, 8.50% 2/15/2019 | 134,062 | ||||

| 500,000 |

SLM Corp., 6.25% 1/25/2016 | 521,295 | ||||

| 500,000 |

Suncoke Energy, 7.625%, 8/1/2019 (A) | 516,250 | ||||

| 500,000 |

Swift Energy Co., 7.125%, 6/01/2017 | 521,250 | ||||

| 500,000 |

Targa Resources Partners LP, 7.875%, 10/15/2018 | 537,500 | ||||

| 410,000 |

Tesoro Corp., 9.75%, 6/01/2019 | 469,450 | ||||

| 500,000 |

United Rentals North America, Inc., 9.25%, 12/15/2019 | 553,749 | ||||

| 500,000 |

United States Steel Corp., 6.05%, 06/01/2017 | 512,500 | ||||

| 500,000 |

United States Steel Corp., 7.50%, 03/15/2022 | 502,500 | ||||

| 500,000 |

USG Corp., 9.75%, 01/15/2018 | 498,750 | ||||

| 500,000 |

Vanguard Health Holding Co., LLC, 7.75%, 02/01/2019 (A) | 500,000 | ||||

|

|

|

|||||

| TOTAL CORPORATE BONDS (Cost $28,280,767) | 29,100,341 | |||||

|

|

|

|||||

| Shares |

||||||

| MONEY MARKET FUND - 4.2% | ||||||

| 1,311,553 |

Fidelity Institutional Money Market Portfolio, 0.00% (B) | |||||

| (Cost $1,311,553) | 1,311,553 | |||||

|

|

|

|||||

| TOTAL INVESTMENTS (Cost $29,592,320)(C) - 97.8% | $ | 30,411,894 | ||||

|

|

|

|||||

| ASSETS IN EXCESS OF OTHER LIABILITIES - 2.2% | 670,887 | |||||

|

|

|

|||||

| NET ASSETS - 100.00% | $ | 31,082,781 | ||||

|

|

|

|||||

| (A) 144A Security - Security exempt from registration under Rule 144A of the Securities Act of 1933. The securities may be resold in transactions exempt from registration typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid. | ||||||

| (B) Variable rate security; the rate shown represents the yield at March 31, 2012. | ||||||

| (C) Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is substantially the same and differs from fair value by net unrealized appreciation (depreciation) of securities as follows: | ||||||

| Unrealized appreciation | $ | 1,145,150 | ||||

| Unrealized depreciation | (325,576) | |||||

|

|

|

|||||

| Net unrealized appreciation | $ | 819,574 | ||||

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

Schedule of Investments | Israel Common Values

As of March 31, 2012 (Unaudited)

| Shares |

Fair Value | |||||

| COMMON STOCKS - 87.0% | ||||||

| AEROSPACE/DEFENSE - 2.5% | ||||||

| 5,901 |

Elbit Systems, Ltd. | $ | 227,189 | |||

|

|

|

|||||

| BANKS - 3.7% | ||||||

| 12,500 |

Bank Hapoalim BM (ADR) * | 229,688 | ||||

| 35,000 |

Bank Leumi Le-Israel BM | 110,290 | ||||

|

|

|

|||||

| 339,978 | ||||||

|

|

|

|||||

| BIOTECHNOLOGY - 2.9% | ||||||

| 42,000 |

Protalix BioTherapeutics, Inc. * | 267,540 | ||||

|

|

|

|||||

| CHEMICALS - 5.1% | ||||||

| 23,000 |

Frutarom Industries, Ltd. | 224,192 | ||||

| 21,000 |

Israel Chemicals, Ltd. (ADR) | 241,080 | ||||

|

|

|

|||||

| 465,272 | ||||||

|

|

|

|||||

| COMMERCIAL SERVICES - 2.3% | ||||||

| 25,000 |