| Timothy Conservative Variable | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

INVESTMENT OBJECTIVE |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This Portfolio seeks to achieve moderate levels of long-term capital growth. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FEES AND EXPENSES |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Investors using a Portfolio to fund a Separate Account will pay certain fees and expenses in connection with the Portfolio, which are estimated in the table below. Each Portfolio pays annual operating expenses from its assets, so their effect is included in the Portfolio's share price. These figures do not reflect any fees or charges imposed by any Insurance Company or Qualified Plan. Separate Account Owners and Plan Participants should refer to the Insurance Company's prospectus or plan document, as applicable, for information on those fees or charges. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Annual Portfolio Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment.) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Example: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated, reinvest dividends and distributions, and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio's operating expenses remain the same. The example does not reflect any insurance product fees or any additional expenses that participants in a qualified plan may bear relating to the operations of their plan. Although your actual costs may be higher or lower, based on these assumptions your costs would be: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

PRINCIPAL INVESTMENT STRATEGIES |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Conservative Growth Portfolio normally will invest at least 75% of its total assets in the following Timothy Funds according to the following approximate range of percentages:

The Conservative Growth Portfolio normally will invest its remaining cash, if any, in the Fidelity Select Money Market Portfolio. The Advisor determines the specific asset allocation program. On each day that the Portfolio is open for business, the Advisor reviews the asset allocation program and reallocates, as necessary, for any new moneys invested in the Portfolio. In order to achieve its investment objective, the Portfolio typically allocates its assets within the predetermined percentage ranges. Even so, the Portfolio may temporarily exceed one or more of the applicable percentage limits for short periods. The percentages reflect the extent to which the Portfolio will normally invest in the particular market segment represented by each underlying Traditional Fund, and the varying degrees of potential investment risk and reward represented by the Portfolio's investments in those market segments and their corresponding Traditional Funds. The Advisor may alter these percentage ranges when it deems appropriate. The assets of the Portfolio will be allocated among the Traditional Funds in accordance with its investment objective, the Advisor's outlook for the economy and the financial markets, and the relative market valuations of the Traditional Funds. The Advisor also reallocates the Portfolio's investments in the Traditional Funds at the end of each fiscal quarter to maintain the asset allocation program. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

PRINCIPAL RISKS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

PAST PERFORMANCE |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

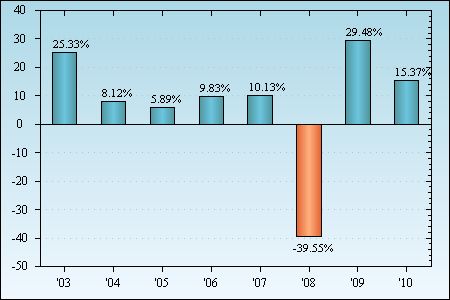

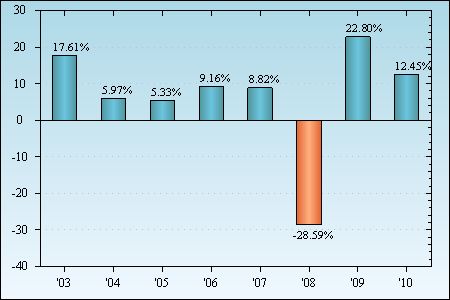

Although past performance of the Portfolio is no guarantee of how it will perform in the future, historical performance may give you some indication of the risk of investing in the Portfolio because it demonstrates how the Portfolio's returns have varied over time. The bar chart shows changes in the Portfolio's returns since its inception. The performance table shows how the Portfolio's average annual total returns compare over time to the returns of a broad-based securities market index. The performance information in this prospectus does not reflect charges associated with the Separate Accounts, variable contracts, or Qualified Plans that an investor in the Portfolio may pay. Past performance is no guarantee of future performance. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Year-by-year Annual Total Returns for Portfolio Shares (for calendar years ending on December 31(1))

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Portfolio's total return for the most recent quarter ended March 31, 2011 was 4.20%.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Average Annual Total Returns (for period ending on December 31, 2010) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||