As filed with the Securities and Exchange Commission on December 27, 2012

Securities Act File No. 333-

Investment Company Act File No. 811-8220

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No.

Post-Effective Amendment No.

ING VARIABLE PRODUCTS TRUST

(Exact Name of Registrant as Specified in Charter)

7337 East Doubletree Ranch Road, Scottsdale, Suite 100, Arizona 85258-2034

(Address of Principal Executive Offices) (Zip Code)

1-800-992-0180

(Registrant’s Area Code and Telephone Number)

Huey P. Falgout, Jr.

ING U.S. Legal Services

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, AZ 85258-2034

(Name and Address of Agent for Service)

With copies to:

Jeffrey S. Puretz, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, DC 20006-2401

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on January 28, 2013 pursuant to Rule 488.

ING BLACKROCK SCIENCE AND TECHNOLOGY OPPORTUNITIES PORTFOLIO

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 992-0180

February 7, 2013

Dear Shareholder:

On behalf of the Board of Directors (the “Board”), we are pleased to invite you to a special meeting of shareholders (the “Special Meeting”) of ING BlackRock Science and Technology Opportunities Portfolio (“ING BlackRock Portfolio”). The Special Meeting is scheduled for 10:00 A.M., Local time, on March 12, 2013, at 7337 Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting shareholders of ING BlackRock Portfolio will be asked to vote on the proposed reorganization (the “Reorganization”) of ING BlackRock Portfolio into ING MidCap Opportunities Portfolio (“ING MidCap Portfolio”) (together with ING BlackRock Portfolio, the “Portfolios” and each, a “Portfolio”). Each Portfolio is a member of the mutual fund group called the “ING Funds.”

Shares of ING BlackRock Portfolio have been purchased by you or at your direction through your qualified pension or retirement plan (collectively, “Qualified Plans”), or at your direction by your insurance company through its separate accounts to serve as investment options under your variable annuity contract or variable life insurance policy (“Separate Accounts”). If the Reorganization is approved by shareholders, the Separate Account in which you have an interest or the Qualified Plan in which you are a participant will own shares of ING MidCap Portfolio instead of shares of ING BlackRock Portfolio beginning on the date the Reorganization occurs. The Reorganization would provide the Separate Account in which you have an interest or the Qualified Plan in which you are a participant with an opportunity to participate in a portfolio with greater scale that seeks long-term capital appreciation.

Formal notice of the Special Meeting appears on the next page, followed by the Proxy Statement/Prospectus. The Reorganization is discussed in detail in the enclosed Proxy Statement/Prospectus, which you should read carefully. After careful consideration, the Board has concluded that the Reorganization is in the best interests of the ING BlackRock Portfolio and that the interests of shareholders will not be diluted as a result of the Reorganization and recommends that you vote “FOR” the Reorganization.

Your vote is important regardless of the number of shares you own. To avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the Proxy Statement/Prospectus and cast your vote. It is important that your vote be received no later than March 11, 2013.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

|

|

|

Sincerely, |

|

|

|

|

|

|

|

|

|

|

|

Shaun P. Mathews |

|

|

|

President and Chief Executive Officer |

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

OF

ING BLACKROCK SCIENCE AND TECHNOLOGY OPPORTUNITIES PORTFOLIO

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 992-0180

Scheduled for March 12, 2013

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders (the “Special Meeting”) of ING BlackRock Science and Technology Opportunities Portfolio (“ING BlackRock Portfolio”) is scheduled for 10:00 A.M., Local time, on March 12, 2013 at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting, ING BlackRock Portfolio’s shareholders will be asked:

1. To approve an Agreement and Plan of Reorganization (the “Reorganization Agreement”) by and between ING BlackRock Portfolio and ING MidCap Opportunities Portfolio (“ING MidCap Portfolio”), providing for the reorganization of ING BlackRock Portfolio into ING MidCap Portfolio; and

2. To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournment(s) or postponement(s) thereof, in the discretion of the proxies or their substitutes.

Please read the enclosed Proxy Statement/Prospectus carefully for information concerning the Reorganization Agreement to be placed before the Special Meeting.

The Board of Directors has concluded that the Reorganization is in the best interests of ING BlackRock Portfolio and that the interests of shareholders will not be diluted as a result of the Reorganization and recommends that you vote “FOR” the Reorganization Agreement.

Shareholders of record as of the close of business on December 28, 2013, are entitled to notice of, and to vote at, the Special Meeting, and are also entitled to vote at any adjournments or postponements thereof. Your attention is called to the accompanying Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, please complete, sign, and return promptly, but in no event later than March 11, 2013, the enclosed Proxy Ballot or Voting Instruction Card so that a quorum will be present and a maximum number of shares may be voted. Proxies or voting instructions may be revoked at any time before they are exercised by submitting a revised Proxy Ballot or Voting Instruction Card, by giving written notice of revocation to the ING BlackRock Portfolio or by voting in person at the Special Meeting.

|

|

|

By Order of the Board of Directors |

|

|

|

|

|

|

|

|

|

|

|

Huey P. Falgout, Jr. |

|

|

|

Secretary |

February 7, 2013

PROXY STATEMENT/PROSPECTUS

FEBRUARY 7, 2013

PROXY STATEMENT FOR:

ING BLACKROCK SCIENCE AND TECHNOLOGY OPPORTUNITIES PORTFOLIO

(A series of ING Variable Portfolios, Inc.)

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 992-0180

Special Meeting of Shareholders

of ING BlackRock Science and Technology Opportunities Portfolio

Scheduled for March 12, 2013

PROSPECTUS FOR:

ING MIDCAP OPPORTUNITIES PORTFOLIO

(A series of ING Variable Products Trust)

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 992-0180

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on March 12, 2013

This Proxy Statement/Prospectus and Notice of Special Meeting are available at: www.proxyvote.com/ing

THE U.S. SECURITIES AND EXCHANGE COMMISSION (“SEC”) HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

|

INTRODUCTION |

1 |

|

What’s happening? |

1 |

|

Why did you send me this booklet? |

1 |

|

What Proposals will be considered at the Special Meeting? |

1 |

|

Who is eligible to vote? |

1 |

|

How do I vote? |

1 |

|

How does the Board recommend that I vote? |

2 |

|

When and where will the Special Meeting be held? |

2 |

|

How can I obtain more information about the Portfolios? |

2 |

|

SUMMARY OF THE REORGANIZATION |

3 |

|

PROPOSAL ONE — APPROVAL OF THE REORGANIZATION |

5 |

|

What is the proposed Reorganization? |

5 |

|

Why is a Reorganization proposed? |

5 |

|

How do the Investment Objectives compare? |

5 |

|

How do the Annual Portfolio Operating Expenses compare? |

5 |

|

Annual Portfolio Operating Expenses |

5 |

|

Expense Example |

7 |

|

How do the Principal Investment Strategies compare? |

7 |

|

How do the Principal Risks of Investing in the Portfolios compare? |

9 |

|

How does ING BlackRock Portfolio’s Performance compare to that of ING MidCap Portfolio? |

11 |

|

How do certain characteristics of the Portfolios compare? |

12 |

|

How does the Management of the Portfolios compare? |

13 |

|

Adviser to the Portfolios |

14 |

|

Sub-Advisers to the Portfolios |

14 |

|

The Administrator |

16 |

|

The Distributor |

16 |

|

What are the Key Differences in the Rights of Shareholders of ING BlackRock Portfolio and ING MidCap Portfolio? |

16 |

|

Additional Information about the Reorganization |

17 |

|

The Reorganization Agreement |

17 |

|

Expenses of the Reorganization |

17 |

|

Tax Considerations |

17 |

|

Portfolio Transitioning |

17 |

|

Future Allocation of Premiums |

18 |

|

What is the IVPI Board’s recommendation? |

18 |

|

What factors did the Board consider? |

18 |

|

What is the required vote? |

18 |

|

What happens if shareholders do not approve the Reorganization Agreement? |

18 |

|

ADDITIONAL INFORMATION ABOUT THE PORTFOLIOS |

19 |

|

Form of Organization |

19 |

|

Dividends and Other Distributions |

19 |

|

Capitalization |

19 |

|

GENERAL INFORMATION ABOUT THE PROXY STATEMENT |

21 |

|

Who is asking for my vote? |

21 |

|

How is my proxy being solicited? |

21 |

|

What happens to my proxy once I submit it? |

21 |

|

Can I revoke my proxy after I submit it? |

21 |

|

What are the voting rights and quorum requirements? |

21 |

|

Can shareholders submit proposals for consideration in a Proxy Statement? |

22 |

|

What if a proposal that is not in the Proxy Statement/Prospectus comes up at the Special Meeting? |

22 |

|

What is “Householding”? |

22 |

|

How can shareholders obtain other Portfolio documents? |

22 |

|

Who pays for this Proxy Solicitation/Prospectus? |

23 |

|

APPENDIX A: AGREEMENT AND PLAN OF REORGANIZATION |

A-1 |

|

APPENDIX B: ADDITIONAL INFORMATION REGARDING ING MIDCAP OPPORTUNITIES PORTFOLIO |

B-1 |

|

Portfolio Holdings Information |

B-1 |

|

How Shares Are Priced |

B-1 |

|

How to Buy and Sell Shares |

B-2 |

|

Shareholder Service and Distribution Plans (Class ADV and Class S2 Shares) |

B-2 |

|

Shareholder Services Plan (Class S Shares) |

B-3 |

|

Frequent Trading - Market Timing |

B-3 |

|

Payments to Financial Intermediaries |

B-4 |

|

Dividends and Distributions |

B-5 |

|

Tax Matters |

B-5 |

|

Financial Highlights |

B-5 |

|

APPENDIX C: SECURITY OWNERSHIP OF CERTAIN BENEFICIAL AND RECORD OWNERS |

C-1 |

INTRODUCTION

What’s happening?

On December 12, 2012 the Board of Directors (the “Board”) of ING BlackRock Science and Technology Opportunities Portfolio (“ING BlackRock Portfolio”), a series of ING Variable Portfolios Inc. (“IVPI”), and on December 21, 2012, the Board of Trustees of ING MidCap Opportunities Portfolio (“ING MidCap Portfolio”), a series of ING Variable Products Trust (“IVPT”) (each, a “Portfolio” and together, the “Portfolios”) approved an Agreement and Plan of Reorganization (the “Reorganization Agreement”), which provides for the reorganization of ING BlackRock Portfolio with and into ING MidCap Portfolio (the “Reorganization”). The Reorganization requires shareholder approval and, if approved, is expected to be effective on or about March 23, 2013, or such other date as the parties may agree (the “Closing Date”).

Why did you send me this booklet?

Shares of ING BlackRock Portfolio have been purchased by you or at your direction through your qualified pension or retirement plan (“Qualified Plans”), or at your direction by your insurance company through its separate accounts (“Separate Accounts”) to serve as investment options under your variable annuity and/or variable life contract (“Variable Contracts”).

This booklet includes a combined proxy statement and prospectus (“Proxy Statement/Prospectus”) and a Proxy Ballot or Voting Instruction Card for ING BlackRock Portfolio. It provides you with information you should review before providing voting instructions on the matters listed below and in the Notice of Special Meeting.

The insurance companies and Qualified Plans or their trustees, as record owners of ING BlackRock Portfolio shares, are, in most cases, the true “shareholders” of ING BlackRock Portfolio; however, participants in Qualified Plans (“Plan Participants”) or holders of Variable Contracts (“Variable Contracts Holders”) may be asked to instruct their Qualified Plan trustee or insurance company, as applicable, as to how they would like the shares attributed to their Qualified Plan or Variable Contract to be voted. For clarity and ease of reading, references to “shareholder” or “you” throughout this Proxy Statement/Prospectus do not refer to the technical shareholder but rather refer to the persons who are being asked to provide voting instructions on the proposals, unless the context indicates otherwise. Similarly, for ease of reading, references to “voting” or “vote” do not refer to the technical vote but rather to the voting instructions provided by Variable Contracts Holders or Plan Participants.

Because you, as a shareholder of ING BlackRock Portfolio, are being asked to approve the Reorganization Agreement that will result in a transaction in which you will ultimately hold shares of ING MidCap Portfolio, this Proxy Statement also serves as a prospectus for ING MidCap Portfolio. ING MidCap Portfolio is an open-end management investment company, which seeks, long-term capital appreciation, as described more fully below.

What Proposals will be considered at the Special Meeting?

A special meeting of shareholders (the “Special Meeting”) of ING BlackRock Portfolio is scheduled for the following purposes:

1. To approve an Agreement and Plan of Reorganization by and between ING BlackRock Portfolio and ING MidCap Portfolio, providing for the reorganization of ING BlackRock Portfolio into ING MidCap Portfolio; and

2. To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournment(s) or postponement(s) thereof, in the discretion of the proxies or their substitutes.

Who is eligible to vote?

Shareholders holding an investment in shares of ING BlackRock Portfolio as of the close of business on December 28, 2012 (the “Record Date”) are eligible to vote. (See “General Information” for a more detailed discussion of voting procedures.)

How do I vote?

If a shareholder wishes to participate in the Special Meeting, he or she may submit the Voting Instruction Card originally sent with the Proxy Statement/Prospectus or attend the Special Meeting in person. Shareholders can vote by completing, signing, and

returning the enclosed Voting Instruction Card promptly in the enclosed envelope, through telephone touch-tone voting, via Internet voting, or by attending the Special Meeting in person and voting. Joint owners must each sign the Voting Instruction Card. To vote by telephone or Internet, follow the voting instructions as outlined on your Voting Instruction Card. These options require shareholders to input a control number, which is located on your Voting Instruction Card. After entering this number, shareholders will be prompted to provide their voting instructions on the proposals, as applicable. Shareholders will have the opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their telephone call or Internet link. Shareholders who vote on the Internet, in addition to confirming their voting instructions prior to submission, may also request an e-mail confirming their instructions.

How does the Board recommend that I vote?

The Board recommends that shareholders vote “FOR” the Reorganization.

When and where will the Special Meeting be held?

The Special Meeting is scheduled to be held at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034, on March 12, 2013, at 10:00 A.M., Local time, and, if the Special Meeting is adjourned or postponed, any adjournment(s) or postponement(s) of the Special Meeting will also be held at the above location. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at (800) 992-0180.

How can I obtain more information about the Portfolios?

Should you have any questions about the Portfolios, please do not hesitate to contact Shareholder Services toll free at (800) 992-0180. The prospectuses, annual and semi-annual reports, and other information regarding the Portfolios are available on the Internet at http://www.ingfunds.com/literature.

SUMMARY OF THE REORGANIZATION

You should read this entire Proxy Statement/Prospectus carefully. You should also review the Reorganization Agreement, which is attached hereto as Appendix A. For more information about ING MidCap Portfolio, please consult Appendix B and the prospectus for ING MidCap Portfolio dated April 30, 2012.

On December 12, 2012 and December 21, 2012, the Board approved the Reorganization Agreement. Subject to shareholder approval, the Reorganization Agreement provides for:

· the transfer of all of the assets of ING BlackRock Portfolio to ING MidCap Portfolio in exchange for shares of beneficial interest of ING MidCap Portfolio;

· the assumption by ING MidCap Portfolio of all of the known liabilities of ING BlackRock Portfolio;

· the distribution of shares of ING MidCap Portfolio to the shareholders of ING BlackRock Portfolio; and

· the complete liquidation of ING BlackRock Portfolio.

If shareholders approve the Reorganization, each owner of Class ADV, Class I, Class S, and Class S2 shares of ING BlackRock Portfolio would become a shareholder of Class ADV, Class I, Class S, and Class S2 shares, respectively, of ING MidCap Portfolio. The Reorganization is expected to be effective on the Closing Date. Each shareholder of ING BlackRock Portfolio will hold, immediately after the Closing Date, shares of ING MidCap Portfolio having an aggregate value equal to the aggregate value of the shares of ING BlackRock Portfolio held by that shareholder as of the close of business on the Closing Date.

In considering whether to approve the Reorganization, you should note that:

· Each Portfolio’s investment objective is to seek long-term capital appreciation;

· ING BlackRock Portfolio is a sector fund, investing under normal market conditions at least 80% of its net assets (plus borrowings for investment purposes) in equity securities issued by science and technology companies in all market capitalization ranges. In comparison, the ING MidCap Portfolio invests under normal market conditions at least 80% of its net assets (plus borrowings for investment purposes) in common stock of mid-sized U.S. companies, without regard to sector;

· ING MidCap Portfolio outperformed ING BlackRock Portfolio for the prior year-to-date (as of September 30, 2012), 1-, 3-, and 5-year periods;

· Morningstar Inc. (“Morningstar”) categorizes the ING BlackRock Portfolio as a Technology fund and the ING MidCap Portfolio as a Mid-Cap Growth fund. Morningstar rates ING BlackRock Portfolio with three stars and ING MidCap Portfolio with five stars;

· ING Investments, LLC (“ING Investments”) serves as adviser to both Portfolios. BlackRock Advisors, LLC (“BlackRock”) serves as sub-adviser to ING BlackRock Portfolio, while ING Investment Management Co. LLC (“ING IM”) serves as sub-adviser to ING MidCap Portfolio. ING Investments and ING IM are both indirect, wholly-owned subsidiaries of ING Groep, N.V. (“ING Groep”);

· ING MidCap Portfolio is the larger fund. As of September 30, 2012, ING MidCap Portfolio had approximately $1.16 billion in assets, while ING BlackRock Portfolio had approximately $333.5 million in assets;

· Shareholders of Class ADV, Class I, Class S, and Class S2 of ING BlackRock Portfolio are expected to experience lower gross and net expenses as shareholders of the ING MidCap Portfolio;

· If shareholders approve the Reorganization, ING BlackRock Portfolio’s investment portfolio is expected to be aligned with ING MidCap Portfolio’s investment strategies by a transition manager shortly prior to the Closing Date, as discussed in “Portfolio Transitioning” on page 17; and

· The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”); accordingly, pursuant to this treatment, neither ING BlackRock Portfolio nor its shareholders, nor ING MidCap Portfolio nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement.

PROPOSAL ONE — APPROVAL OF THE REORGANIZATION

What is the proposed Reorganization?

Shareholders of ING BlackRock Portfolio are being asked to approve the Reorganization Agreement, providing for the reorganization of ING BlackRock Portfolio into ING MidCap Portfolio. If the Reorganization Agreement is approved, shareholders in ING BlackRock Portfolio will become shareholders in ING MidCap Portfolio as of the close of business on the Closing Date.

Why is a Reorganization proposed?

During a December 12, 2012 meeting of the Board and a December 21, 2012 meeting of the Board of Trustees of ING Variable Products Trust (“IVPT Board”), ING Investments and ING IM (“Management”) presented the Reorganization for consideration by the respective Boards. In support of its proposal, Management noted the steady and ongoing outflows being experienced by the ING BlackRock Portfolio and expressed concern about the long-term viability of the Portfolio. Management recommended the Reorganization with the ING MidCap Portfolio for several reasons, including the significantly larger asset size of the ING MidCap Portfolio as compared to the ING BlackRock Portfolio, the lower gross and net expense ratios of the ING MidCap Portfolio, and the superior investment performance of the ING MidCap Portfolio over the prior year-to-date (as of September 30, 2012), 1-, 3- and 5-year periods. Each Board, including a majority of the directors/trustees who are not “interested persons” (as defined by the Investment Company Act of 1940 (“1940 Act”)) of IVPI or IVPT, respectively, determined that the interests of the shareholders of the Portfolio it oversees would not be diluted as a result of the Reorganization and that the Reorganization would be in the best interests of such Portfolio.

The Reorganization will allow ING BlackRock Portfolio’s shareholders to remain invested in a professionally managed portfolio that seeks long-term capital appreciation.

How do the Investment Objectives compare?

ING BlackRock Portfolio and ING MidCap Portfolio have the same investment objective of seeking long-term capital appreciation.

How do the Annual Portfolio Operating Expenses compare?

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Portfolios. Pro forma fees and expenses, which are the estimated fees and expenses of ING MidCap Portfolio after giving effect to the Reorganization, assume hypothetically that the Reorganization occurred on June 30, 2012. The gross and net expense ratios for the pro forma ING MidCap Portfolio are lower than for ING BlackRock Portfolio. The table does not reflect fees or expenses that are, or may be, imposed under your Variable Contracts or a Qualified Plans. For more information on these charges, please refer to the documents governing your Variable Contract or consult your plan administrator.

Annual Portfolio Operating Expenses

Expenses you pay each year as a % of the value of your investment

|

|

|

|

|

ING BlackRock |

|

ING MidCap |

|

ING MidCap |

|

|

Class ADV |

|

|

|

|

|

|

|

|

|

|

Management Fee |

|

% |

|

0.95 |

|

0.70 |

|

0.69 |

|

|

Distribution and/or Shareholder Services (12b-1) Fees |

|

% |

|

0.50 |

|

0.50 |

|

0.50 |

|

|

Administrative Services Fee |

|

% |

|

0.06 |

|

0.10 |

|

0.10 |

|

|

Other Expenses |

|

% |

|

0.05 |

|

0.06 |

|

0.06 |

|

|

Acquired Fund Fees and Expenses |

|

% |

|

0.01 |

|

— |

|

— |

|

|

Total Annual Portfolio Operating Expenses(3) |

|

% |

|

1.57 |

|

1.36 |

|

1.35 |

|

|

Waivers and Reimbursements(4) |

|

% |

|

None |

|

(0.01 |

) |

None |

|

|

Total Annual Portfolio Operating Expenses |

|

% |

|

1.57 |

|

1.35 |

|

1.35 |

|

|

After Waivers and Reimbursements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ING BlackRock |

|

ING MidCap |

|

ING MidCap |

|

|

Class I |

|

|

|

|

|

|

|

|

|

|

Management Fee |

|

% |

|

0.95 |

|

0.70 |

|

0.69 |

|

|

Distribution and/or Shareholder Services (12b-1) Fees |

|

% |

|

— |

|

— |

|

— |

|

|

Administrative Services Fee |

|

% |

|

0.06 |

|

0.10 |

|

0.10 |

|

|

Other Expenses |

|

% |

|

0.05 |

|

0.06 |

|

0.06 |

|

|

Acquired Fund Fees and Expenses |

|

% |

|

0.01 |

|

— |

|

— |

|

|

Total Annual Portfolio Operating Expenses(3) |

|

% |

|

1.07 |

|

0.86 |

|

0.85 |

|

|

Waivers and Reimbursements(4) |

|

% |

|

None |

|

(0.01 |

) |

None |

|

|

Total Annual Portfolio Operating Expenses |

|

% |

|

1.07 |

|

0.85 |

|

0.85 |

|

|

After Waivers and Reimbursements |

|

|

|

|

|

|

|

|

|

|

Class S |

|

|

|

|

|

|

|

|

|

|

Management Fee |

|

% |

|

0.95 |

|

0.70 |

|

0.69 |

|

|

Distribution and/or Shareholder Services (12b-1) Fees |

|

% |

|

0.25 |

|

0.25 |

|

0.25 |

|

|

Administrative Services Fee |

|

% |

|

0.06 |

|

0.10 |

|

0.10 |

|

|

Other Expenses |

|

% |

|

0.05 |

|

0.06 |

|

0.06 |

|

|

Acquired Fund Fees and Expenses |

|

% |

|

0.01 |

|

— |

|

— |

|

|

Total Annual Portfolio Operating Expenses(3) |

|

% |

|

1.32 |

|

1.11 |

|

1.10 |

|

|

Waivers and Reimbursements(4) |

|

% |

|

None |

|

(0.01 |

) |

None |

|

|

Total Annual Portfolio Operating Expenses |

|

% |

|

1.32 |

|

1.10 |

|

1.10 |

|

|

After Waivers and Reimbursements |

|

|

|

|

|

|

|

|

|

|

Class S2 |

|

|

|

|

|

|

|

|

|

|

Management Fee |

|

% |

|

0.95 |

|

0.70 |

|

0.69 |

|

|

Distribution and/or Shareholder Services (12b-1) Fees |

|

% |

|

0.50 |

|

0.50 |

|

0.50 |

|

|

Administrative Services Fee |

|

% |

|

0.06 |

|

0.10 |

|

0.10 |

|

|

Other Expenses |

|

% |

|

0.05 |

|

0.06 |

|

0.06 |

|

|

Acquired Fund Fees and Expenses |

|

% |

|

0.01 |

|

— |

|

— |

|

|

Total Annual Portfolio Operating Expenses(3) |

|

% |

|

1.57 |

|

1.36 |

|

1.35 |

|

|

Waivers and Reimbursements(4) |

|

% |

|

None |

|

(0.11 |

) |

(0.10 |

) |

|

Total Annual Portfolio Operating Expenses |

|

% |

|

1.57 |

|

1.25 |

|

1.25 |

|

|

After Waivers and Reimbursements |

|

|

|

|

|

|

|

|

|

|

(1) |

Expense ratios based on audited financial information as of December 31, 2011 as published in the April 30, 2012 prospectus and adjusted for current terms of contractual waivers. |

|

|

|

|

(2) |

Expenses have been adjusted to reflect current contractual rates. |

|

|

|

|

(3) |

Total Annual Portfolio Operating Expenses may be higher than the Portfolio’s ratio of expenses to average net assets shown in the Portfolio’s Financial Highlights, which reflects the operating expenses of the Portfolio and does not include Acquired Fund Fees and Expenses. |

|

|

|

|

(4) |

For the ING BlackRock Portfolio, ING Investments is contractually obligated to limit expenses for Class ADV, Class I, Class S, and Class S2 shares to 1.55%, 1.05%, 1.30%, and 1.45%, respectively, through May 1, 2013; the obligation does not extend to interest, taxes, brokerage commissions, Acquired Fund Fees and Expenses and extraordinary expenses. The obligation will automatically renew for one-year terms unless it is terminated by the Portfolio or the adviser with prior approval of the Board upon written notice within 90 days of the end of the current term or upon termination of the management agreement and is subject to possible recoupment by the adviser within three years. The Distributor is contractually obligated to waive 0.10% of the distribution fee for Class S2 shares of the Portfolio through May 1, 2013. There is no guarantee that the distribution fee waiver will continue after May 1, 2013. |

|

|

|

|

|

For the ING MidCap Portfolio, ING Investments is contractually obligated to limit expenses for Class ADV, Class I, Class S, and Class S2 shares to 1.40%, 0.90%, 1.10%, and 1.30%, respectively, through May 1, 2014. The obligation will automatically renew for one-year terms unless it is terminated by the Portfolio or the adviser upon written notice within 90 days of the end of the then current term or upon termination of the advisory agreement and is subject to possible recoupment by the adviser within three years. In addition, the adviser is contractually obligated to further limit expenses for Class ADV, Class I, Class S, and Class S2 shares to 1.35%, 0.85%, 1.10%, and 1.25%, respectively, through |

May 2, 2014. There is no guarantee this obligation will continue after May 2, 2014 and the obligation will continue only if the adviser elects to renew it. Any fees waived pursuant to this obligation shall be eligible for recoupment by the adviser within three years. These obligations do not extend to interest, taxes, brokerage commissions, extraordinary expenses, and Acquired Fund Fees and Expenses. The Distributor is contractually obligated to waive 0.10% of the distribution fee for Class S2 shares of the Portfolio through May 1, 2014. There is no guarantee that the distribution fee waiver will continue after May 1, 2014.

Expense Example

The Examples are intended to help you compare the cost of investing in shares of a Portfolio with the costs of investing in other mutual funds. The Examples do not reflect expenses and charges which are, or may be, imposed under your Variable Contract or Qualified Plan. The Examples assume that you invest $10,000 in a Portfolio for the time periods indicated. The Examples also assume that your investment had a 5% return each year and that the Portfolio’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

ING BlackRock Portfolio |

|

ING MidCap Portfolio |

|

ING MidCap Portfolio |

| ||||||||||||||||||||||||||||||

|

Class |

|

1 Yr |

|

3 Yrs |

|

5 Yrs |

|

10 Yrs |

|

1 Yr |

|

3 Yrs |

|

5 Yrs |

|

10 Yrs |

|

1 Yr |

|

3 Yrs |

|

5 Yrs |

|

10 Yrs |

| ||||||||||||

|

ADV |

|

$ |

160 |

|

$ |

496 |

|

$ |

855 |

|

$ |

1,867 |

|

$ |

137 |

|

$ |

430 |

|

$ |

744 |

|

$ |

1,634 |

|

$ |

137 |

|

$ |

428 |

|

$ |

739 |

|

$ |

1,624 |

|

|

I |

|

$ |

109 |

|

$ |

340 |

|

$ |

590 |

|

$ |

1,306 |

|

$ |

87 |

|

$ |

273 |

|

$ |

476 |

|

$ |

1,060 |

|

$ |

87 |

|

$ |

271 |

|

$ |

471 |

|

$ |

1,049 |

|

|

S |

|

$ |

134 |

|

$ |

418 |

|

$ |

723 |

|

$ |

1,590 |

|

$ |

112 |

|

$ |

352 |

|

$ |

611 |

|

$ |

1,351 |

|

$ |

112 |

|

$ |

350 |

|

$ |

606 |

|

$ |

1,340 |

|

|

S2 |

|

$ |

160 |

|

$ |

496 |

|

$ |

855 |

|

$ |

1,867 |

|

$ |

127 |

|

$ |

420 |

|

$ |

734 |

|

$ |

1,626 |

|

$ |

127 |

|

$ |

418 |

|

$ |

730 |

|

$ |

1,615 |

|

The Examples reflect applicable expense limitation agreements and/or waivers in effect, if any, for the one-year period and the first year of the three-, five-, and ten-year periods.

How do the Principal Investment Strategies compare?

As described in more detail in the table that follows, the ING BlackRock Portfolio is a sector fund which pursues its investment objective by investing in equity securities issued by science and technology companies in all market capitalization ranges, while the ING MidCap Portfolio invests in common stock of mid-sized U.S. companies with market capitalizations that fall within the range of companies in the Russell Midcap® Growth Index at the time of purchase. Each Portfolio may invest in foreign securities, and the ING BlackRock Portfolio may invest up to 25% of its assets in emerging markets. Both Portfolios focus on growth companies: BlackRock invests in U.S. and non-U.S. companies that are expected to offer the best opportunities for growth and high investment return and ING IM uses a stock selection process that combines the discipline of quantitative screens with rigorous fundamental security analysis to identify companies with above average prospects for growth. Both Portfolios may invest in certain derivatives and other investment companies, while the ING BlackRock Portfolio may also invest in preferred stock and securities convertible into common and preferred stock, initial public offerings, and Rule 144A securities. The table below also compares the asset size of the Portfolios as of September 30, 2012.

|

|

|

ING BlackRock Portfolio |

|

ING MidCap Portfolio |

|

Sub-Adviser |

|

BlackRock |

|

ING IM |

|

|

|

|

|

|

|

Investment Strategies |

|

Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes) in equity securities issued by science and technology companies in all market capitalization ranges. The Portfolio will provide shareholders with at least 60 days’ prior notice of any change in this investment policy. |

|

Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes) in common stock of mid-sized U.S. companies. The Portfolio will provide shareholders with at least 60 days’ prior notice of any change in this investment policy. |

|

|

|

ING BlackRock Portfolio |

|

ING MidCap Portfolio |

|

|

|

The Portfolio is primarily focused in investments in equity securities of companies selected for their rapid and sustainable growth potential from the development, advancement, and use of science and/or technology. The sub-adviser (“Sub-Adviser”) considers science and technology companies to be companies defined as such by the Global Industrial Classification Standards. Some of the industries that are likely to be represented in the Portfolio’s portfolio holdings include: application software, IT consulting and services, Internet software and services, networking equipment, telecom equipment, computer hardware, computer storage and peripherals, electronic equipment and instruments, semiconductor equipment, semiconductors, aerospace and defense, electrical components and equipment, biotechnology, pharmaceuticals, healthcare equipment and supplies, healthcare distribution and services, healthcare facilities, industrial gasses, specialty chemicals, advanced materials, integrated telecom services, alternative carriers, and wireless telecommunication services. |

|

The Portfolio normally invests in companies that the sub-adviser (“Sub-Adviser”) believes have above average prospects for growth. For this Portfolio, mid-sized companies are those companies with market capitalizations that fall within the range of companies in the Russell Midcap® Growth Index at the time of purchase. Capitalization of companies in the Russell Midcap® Growth Index will change with market conditions. The market capitalization of companies in the Russell Midcap® Growth Index as of December 31, 2011, ranged from $117.3 million to $20.5 billion. |

|

|

|

|

|

|

|

|

|

The Sub-Adviser will invest in U.S. and non-U.S. companies that are expected to offer the best opportunities for growth and high investment returns. The Sub-Adviser uses a multi-factor screen to identify stocks that have above-average return potential. The factors and the weight assigned to a factor may change depending on market conditions. The most influential factors over time have been revenue and earnings growth, estimate revisions, profitability, and relative value. The Sub-Adviser uses a broad set of technical tools to enhance the timing of purchase or sell decisions. |

|

The Sub-Adviser uses a stock selection process that combines the discipline of quantitative screens with rigorous fundamental security analysis. The quantitative screens focus the fundamental analysis by seeking to identify the stocks of companies with strong business momentum that demonstrate relative price strength, and have a perceived value not reflected in the current price. The objective of the fundamental analysis is to confirm the persistence of the company’s revenue and earnings growth and validate the Sub-Adviser’s expectations for earnings estimate revisions, particularly relative to consensus. A determination of reasonable valuation for individual securities is based on the judgment of the Sub-Adviser. |

|

|

|

|

|

|

|

|

|

The Sub-Adviser, in an attempt to reduce portfolio risk, will diversify by investing in equity securities of companies in a number of different countries, including the United States. The Portfolio may invest up to 25% of its assets in stocks of issuers in countries with emerging securities markets. |

|

The Portfolio may also invest in foreign securities. |

|

|

|

|

|

|

|

|

|

The Portfolio primarily buys common stocks but can also invest in preferred stocks and securities convertible into common and preferred stocks, initial public offerings, and Rule 144A securities. |

|

|

|

|

|

|

|

|

|

|

|

The Portfolio may invest in derivative instruments including, among others, options, futures, and foreign currency contracts. The Portfolio typically uses derivatives as a substitute for taking a position in the underlying asset and/or as part of a strategy designed to reduce exposure to other risks, such as currency risk. |

|

The Portfolio may also invest in derivative instruments including futures or index futures that have a similar profile to the benchmark of the Portfolio. The Portfolio typically uses derivatives for the purpose of maintaining equity market exposure on its cash balance. |

|

|

|

ING BlackRock Portfolio |

|

ING MidCap Portfolio |

|

|

|

The Portfolio generally will sell a stock when, in the Sub-Adviser’s opinion, there is a deterioration in the company’s fundamentals, a change in macroeconomic outlook, technical deterioration, valuation issues, a need to rebalance the Portfolio, or a better opportunity elsewhere. |

|

The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. |

|

|

|

|

|

|

|

|

|

The Portfolio may invest in other investment companies, including exchange-traded funds, to the extent permitted under the 1940 Act. |

|

The Portfolio may invest in other investment companies, including exchange-traded funds, to the extent permitted under the 1940 Act. |

|

|

|

|

|

|

|

|

|

The Portfolio may lend portfolio securities on a short-term or long-term basis, up to 33 1/3% of its total assets. |

|

The Portfolio may lend portfolio securities on a short-term or long-term basis, up to 33% of its total assets. |

|

|

|

|

|

|

|

Total Assets as of September 30, 2012 |

|

$333.5 million |

|

$1.158.7 billion |

How do the Principal Risks of Investing in the Portfolios compare?

Many of the risks of investing in ING BlackRock Portfolio are the same as the risks of investing in ING MidCap Portfolio. The following summarizes and compares the principal risks of investing in the Portfolios.

|

Risks |

|

ING BlackRock |

|

ING |

|

Company The price of a given company’s stock could decline or underperform for many reasons including, among others, poor management, financial problems, or business challenges. If a company declares bankruptcy or becomes insolvent, its stock could become worthless. |

|

P |

|

P |

|

|

|

|

|

|

|

Convertible Securities Convertible securities are securities that are convertible into or exercisable for common stocks at a stated price or rate. Convertible securities are subject to the usual risks associated with debt securities, such as interest rate and credit risk. In addition, because convertible securities react to changes in the value of the stocks into which they convert, they are subject to market risk. |

|

P |

|

|

|

|

|

|

|

|

|

Currency To the extent that a portfolio invests directly in foreign currencies or in securities denominated in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged. |

|

P |

|

P |

|

|

|

|

|

|

|

Derivative Instruments Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in interest rates and liquidity risk. The use of certain derivatives may also have a leveraging effect which may increase the volatility of a portfolio and reduce its returns. |

|

P |

|

P |

|

|

|

|

|

|

|

Focused Investing To the extent that the Portfolio invests a substantial portion of its assets in a particular industry, sector, market segment, or geographical area, its investments will be sensitive to developments in that industry, sector, market segment, or geographical area. The Portfolio assumes the risk that changing economic conditions; changing political or regulatory conditions; or natural and other disasters affecting the particular industry, sector, market segment, or geographical area in which the Portfolio focuses its investments could have a significant impact on its investment performance and could ultimately cause the Portfolio to underperform, or be more volatile than, other funds that invest more broadly. |

|

P |

|

|

|

|

|

|

|

|

|

Foreign Investments Investing in foreign (non-U.S.) securities may result in ING MidCap |

|

|

|

P |

|

Risks |

|

ING BlackRock |

|

ING |

|

Portfolio experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies due to smaller markets, differing reporting, accounting and auditing standards, and nationalization, expropriation or confiscatory taxation, foreign currency fluctuations, currency blockage or replacement, potential for default on sovereign debt, or political changes or diplomatic developments. |

|

|

|

|

|

|

|

|

|

|

|

Foreign Investments/Developing and Emerging Markets Investing in foreign (non-U.S.) securities may result in the Underlying Funds experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies, due to smaller markets, differing reporting, accounting and auditing standards, and nationalization, expropriation or confiscatory taxation, foreign currency fluctuations, currency blockage or replacement, potential for default on sovereign debt, or political changes or diplomatic developments. Foreign investment risks may be greater in developing and emerging markets than in developed markets. |

|

P |

|

|

|

|

|

|

|

|

|

Initial Public Offerings Initial Public Offerings (“IPOs”) and companies that have recently gone public have the potential to produce substantial gains for the Portfolio. However, there is no assurance that the Portfolio will have access to profitable IPOs or that IPOs in which the Portfolio invests will rise in value. Furthermore, the value of securities of newly public companies may decline in value shortly after the IPO. When the Portfolio’s asset base is small, the impact of such investments on the Portfolio’s return will be magnified. If the Portfolio’s assets grow, it is likely that the effect of the Portfolio’s investment in IPOs on the Portfolio’s return will decline. |

|

P |

|

|

|

|

|

|

|

|

|

Investment Model The manager’s proprietary model may not adequately allow for existing or unforeseen market factors or the interplay between such factors. |

|

|

|

P |

|

|

|

|

|

|

|

Liquidity If a security is illiquid, a portfolio might be unable to sell the security at a time when the portfolio’s manager might wish to sell, and the security could have the effect of decreasing the overall level of the portfolio’s liquidity. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount the portfolio could realize upon disposition. A portfolio may make investments that become less liquid in response to market developments or adverse investor perception. A portfolio could lose money if it cannot sell a security at the time and price that would be most beneficial to the portfolio. |

|

P |

|

P |

|

|

|

|

|

|

|

Market Stock prices may be volatile and are affected by the real or perceived impacts of such factors as economic conditions and political events. The stock market tends to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. From time to time, the stock market may not favor the growth- or value-oriented securities in which a portfolio invests. Rather, the market could favor securities to which the portfolio is not exposed or may not favor equities at all. |

|

P |

|

P |

|

|

|

|

|

|

|

Market Capitalization Stocks fall into three broad market capitalization categories - large, mid, and small. Investing primarily in one category carries the risk that, due to current market conditions, that category may be out of favor with investors. If valuations of large-capitalization companies appear to be greatly out of proportion to the valuations of mid- or small-capitalization companies, investors may migrate to the stocks of mid- and small-sized companies causing a portfolio that invests in these companies to increase in value more rapidly than a fund that invests in larger, fully-valued companies. Investing in mid- and small-capitalization companies may be subject to special risks associated with narrower product lines, more limited financial resources, smaller management groups, and a more limited trading market for their stocks as compared with larger companies. As a result, stocks of mid- and |

|

P |

|

P |

|

Risks |

|

ING BlackRock |

|

ING |

|

small-capitalization companies may decline significantly in market downturns. |

|

|

|

|

|

|

|

|

|

|

|

Mid-Capitalization Company Investments in mid-capitalization companies may involve greater risk than is customarily associated with larger, more established companies due to the greater business risks of smaller size, limited markets and financial resources, narrow product lines and the frequent lack of depth of management. Consequently, the securities of smaller companies may have limited market stability and may be subject to more abrupt or erratic market movements than securities of larger, more established growth companies or the market averages in general. |

|

|

|

P |

|

|

|

|

|

|

|

Other Investment Companies The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Because a portfolio may invest in other investment companies, you will pay a proportionate share of the expenses of that other investment company (including management fees, administration fees, and custodial fees) in addition to the expenses of the portfolio. |

|

P |

|

P |

|

|

|

|

|

|

|

Securities Lending Securities lending involves two primary risks: “investment risk” and “borrower default risk.” Investment risk is the risk that a portfolio will lose money from the investment of the cash collateral received from the borrower. Borrower default risk is the risk that a portfolio will lose money due to the failure of a borrower to return a borrowed security in a timely manner. |

|

P |

|

P |

How does ING BlackRock Portfolio’s Performance compare to that of ING MidCap Portfolio?

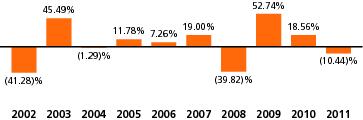

The following information is intended to help you understand the risks of investing in the Portfolios. The following bar charts show the changes in the performance of the Portfolios’ Class I shares from year to year and the table compares the Portfolios’ Class ADV, Class I, Class S, and Class S2 performance to the performance of certain broad-based securities market indices for the same period. The Portfolios’ performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance in the Average Annual Total Returns table does not include insurance-related charges imposed under a Variable Contract or expenses related to a Qualified Plan. If these charges or expenses were included, performance would be lower. Thus, you should not compare the Portfolios’ performance directly with the performance information of other investment products without taking into account all insurance-related charges and expenses payable under your Variable Contract or Qualified Plan. The Portfolios’ past performance is no guarantee of future results.

ING BlackRock Portfolio – Class I - Calendar Year Total Returns

(as of December 31 of each year)

Best quarter: 2nd, 2003, 19.77% and Worst quarter: 3rd, 2002, (28.96)%

The Portfolio’s Class I shares’ year-to-date total return as of September 30, 2012: 11.67%

ING MidCap Opportunities Portfolio – Class I – Calendar Year Total Returns

(as of December 31 of each year)

Best quarter: 3rd, 2009, 17.82% and Worst quarter: 4th, 2008, (23.35)%

The Portfolio’s Class I shares’ year-to-date total return as of September 30, 2012: 13.91%.

Average Annual Total Returns%

(for the periods ended December 31, 2011)

|

|

|

|

|

1 Year |

|

5 Years |

|

10 Years |

|

Inception Date |

|

|

ING BlackRock Portfolio |

|

|

|

|

|

|

|

|

|

|

|

|

Class ADV |

|

% |

|

(10.81 |

) |

16.24 |

|

N/A |

|

12/16/08 |

|

|

S&P 500® Index(2) |

|

% |

|

2.11 |

|

14.11 |

(3) |

N/A |

|

— |

|

|

NYSE Arca Tech 100 Index(2) |

|

% |

|

0.27 |

|

22.00 |

(3) |

N/A |

|

— |

|

|

Class I |

|

% |

|

(10.44 |

) |

3.04 |

|

1.62 |

|

05/01/00 |

|

|

S&P 500® Index(2) |

|

% |

|

2.11 |

|

(0.25 |

) |

2.92 |

|

— |

|

|

NYSE Arca Tech 100 Index(2) |

|

% |

|

0.27 |

|

5.08 |

|

5.21 |

|

— |

|

|

Class S(1) |

|

% |

|

(10.58 |

) |

2.82 |

|

1.40 |

|

11/01/01 |

|

|

S&P 500® Index(2) |

|

% |

|

2.11 |

|

(0.25 |

) |

2.92 |

|

— |

|

|

NYSE Arca Tech 100 Index(2) |

|

% |

|

0.27 |

|

5.08 |

|

5.21 |

|

— |

|

|

Class S2 |

|

% |

|

(10.77 |

) |

21.38 |

|

N/A |

|

02/27/09 |

|

|

S&P 500® Index(2) |

|

% |

|

2.11 |

|

23.44 |

(3) |

N/A |

|

— |

|

|

NYSE Arca Tech 100 Index(2) |

|

% |

|

0.27 |

|

27.05 |

(3) |

N/A |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ING MidCap Portfolio |

|

|

|

|

|

|

|

|

|

|

|

|

Class ADV |

|

% |

|

(1.05 |

) |

6.91 |

|

6.90 |

|

12/29/06 |

|

|

Russell Midcap® Growth Index(2) |

|

% |

|

(1.65 |

) |

2.44 |

|

2.44 |

(3) |

— |

|

|

Russell Midcap® Index(2) |

|

% |

|

(1.55 |

) |

1.41 |

|

1.41 |

(3) |

— |

|

|

Class I |

|

% |

|

(0.51 |

) |

7.54 |

|

6.81 |

|

05/05/00 |

|

|

Russell Midcap® Growth Index(2) |

|

% |

|

(1.65 |

) |

2.44 |

|

5.29 |

|

— |

|

|

Russell Midcap® Index(2) |

|

% |

|

(1.55 |

) |

1.41 |

|

6.99 |

|

— |

|

|

Class S |

|

% |

|

(0.79 |

) |

7.28 |

|

6.59 |

|

05/07/01 |

|

|

Russell Midcap® Growth Index(2) |

|

% |

|

(1.65 |

) |

2.44 |

|

5.29 |

|

— |

|

|

Russell Midcap® Index(2) |

|

% |

|

(1.55 |

) |

1.41 |

|

6.99 |

|

— |

|

|

Class S2 |

|

% |

|

(0.96 |

) |

28.97 |

|

N/A |

|

02/27/09 |

|

|

Russell Midcap® Growth Index(2) |

|

% |

|

(1.65 |

) |

29.08 |

(3) |

N/A |

|

— |

|

|

Russell Midcap® Index(2) |

|

% |

|

(1.55 |

) |

29.52 |

(3) |

N/A |

|

— |

|

(1) On December 16, 2003 all outstanding shares of Class S were fully redeemed. On July 20, 2005, Class S shares recommenced operations. The returns for Class S shares include the performance of Class I shares adjusted to reflect the higher expenses of Class S shares, for the period between December 17, 2003 to July 19, 2005.

(2) The index returns do not reflect deductions for fees, expenses, or taxes.

(3) Reflects index performance since the date closest to the Class’ inception for which data is available.

How do certain characteristics of the Portfolios compare?

The following table compares certain characteristics of the Portfolios.

|

|

|

ING BlackRock Portfolio |

|

ING MidCap Portfolio |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

Top Sectors(1) |

|

Information Technology |

|

92.6 |

% |

Information Technology |

|

19.6 |

% |

|

|

|

Consumer Discretionary |

|

4.5 |

% |

Consumer Discretionary |

|

19.0 |

% |

|

|

|

Health Care |

|

0.5 |

% |

Industrials |

|

16.2 |

% |

|

|

|

|

|

|

|

Health Care |

|

11.7 |

% |

|

|

|

|

|

|

|

Energy |

|

9.7 |

% |

|

|

|

|

|

|

|

Financials |

|

8.1 |

% |

|

|

|

|

|

|

|

Materials |

|

6.4 |

% |

|

|

|

|

|

|

|

Consumer Staples |

|

6.0 |

% |

|

|

|

|

|

|

|

Telecommunications |

|

1.7 |

% |

|

|

|

|

|

|

| ||||

|

Number of Portfolio Holdings and Percentage of Holdings in Top Ten Holdings(2) |

|

78/39% |

|

77/19.9% |

| ||||

|

Approximate Net Assets(2) |

|

$333.5 million |

|

$1.16 billion |

| ||||

|

|

|

|

|

|

| ||||

|

Inception Date |

|

May 1, 2000 |

|

May 5, 2000 |

| ||||

|

Portfolio Turnover Rate(2) |

|

325% |

|

148% |

| ||||

|

|

|

|

|

|

| ||||

|

Average Market Capitalization(2) |

|

$29.6 billion |

|

$9.1 billion |

| ||||

|

|

|

|

|

|

| ||||

|

Percentage of U.S./Non-U.S. Equity Holdings(2) |

|

91%/6% |

|

98%/0% |

| ||||

(1) As of June 30, 2012.

(2) As of September 30, 2012.

Portfolio holdings are subject to change daily.

How does the Management of the Portfolios compare?

The following table describes the management of the Portfolios.

|

|

|

ING BlackRock Portfolio |

|

ING MidCap Portfolio |

|

Investment Adviser |

|

ING Investments, LLC |

|

ING Investments, LLC |

|

|

|

|

|

|

|

Investment Advisory Fee (as a percentage of average daily net assets) |

|

0.95% on first $500 million; 0.85% on next $500 million; and 0.75% thereafter. |

|

0.75% on the first $250 million of the Portfolio’s average daily net assets; 0.70% on the next $400 million of the Portfolio’s average daily net assets; 0.65% on the next $450 million of the Portfolio’s average daily net assets; and 0.60% of the Portfolio’s average daily net assets in excess of $1.1 billion. |

|

|

|

|

|

|

|

Sub-Adviser |

|

BlackRock Advisors, LLC |

|

ING Investment Management Co. LLC |

|

|

|

|

|

|

|

Sub-Advisory Fee (as a percentage of average daily net assets) |

|

0.50% on first $200 million of the Portfolio’s average daily net assets; 0.425% on next $300 million of the Portfolio’s average daily net assets; and 0.40% in excess of $500 million.(1) |

|

0.3375% on the first $250 million of the Portfolio’s average daily net assets; 0.3150% on the next $400 million of the Portfolio’s average daily net assets; 0.2925% on the next $450 million of the Portfolio’s average daily net assets; and 0.2700% on the Portfolio’s average daily net assets in excess of $1.1 billion. |

|

|

|

|

|

|

|

Portfolio Manager(s) |

|

Thomas P. Callan (since 03/04) Erin Xie (since 03/05) Jean M. Rosenbaum (since 12/05) |

|

Jeff Bianchi (since 07/05) Kristin Manning (since 04/12) Michael Pytosh (since 04/12) |

|

|

|

ING BlackRock Portfolio |

|

ING MidCap Portfolio |

|

Administrator |

|

ING Funds Services, LLC |

|

ING Funds Services, LLC |

|

|

|

|

|

|

|

Administrative Fee (as a percentage of average daily net assets) |

|

0.055% on the first $5 billion; and |

|

0.10% |

(1) For purposes of calculating fees under this agreement, the assets of the Portfolio shall be aggregated with the assets of ING BlackRock Health Sciences Opportunities Portfolio, a series of ING Investors Trust, a registered investment company that is not a party to this agreement. The aggregated assets will be applied to the above schedule and the resulting fee shall be prorated back to these two Portfolios and their respective Sub-Adviser based on relative net assets.

Adviser to the Portfolios

ING Investments, an Arizona limited liability company, serves as the adviser to the Portfolios. ING Investments began providing investment management services on April 1995. ING Investments’ principal offices are located at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034. As of September 28, 2012, ING Investments managed approximately $45.2 billion in assets.

ING Investments, subject to the authority of the Board, has the overall responsibility for the management of the relevant Portfolio’s investment portfolio subject to delegation of certain responsibilities to other investment advisers. ING Investments is an indirect, wholly-owned subsidiary of ING Groep. ING Groep is a global financial institution of Dutch origin offering banking, investments, life insurance and retirement services to over 85 million private, corporate and institutional clients in more than 40 countries.

ING Groep has adopted a formal restructuring plan that was approved by the European Commission in November 2009 under which the ING life insurance businesses, including the retirement services and investment management businesses, which include the Adviser, ING IM and certain affiliates, would be separated from ING Groep. ING Groep has agreed that the divestment of at least 25% of these U.S. businesses has to be completed by year-end 2013, more than 50% has to be divested by year-end 2014, with the remaining interest divested by year-end 2016. To achieve this goal, in a series of announcements beginning in November 2010, ING Groep announced its plans to pursue transactions to restructure certain businesses, including an initial public offering for its U.S. based insurance, retirement services, and investment management operations and other transactions, which could include an initial public offering or other type of transaction, for its European based insurance and investment management operations and Asian based insurance and investment management operations. There can be no assurance that all or part of the restructuring plan will be carried out.

The restructuring plan and the uncertainty about its implementation, whether implemented through the planned public offerings or through other means, in whole or in part, may be disruptive to the businesses of ING entities, including the ING entities that service the Funds, and may cause, among other things, interruption or reduction of business and services, diversion of management’s attention from day-to-day operations, and loss of key employees or customers. A failure to complete the offerings or other means of implementation on favorable terms could have a material adverse impact on the operations of the businesses subject to the restructuring plan. The restructuring plan may result in the Adviser’s or ING IM’s loss of access to services and resources of ING Groep, which could adversely affect its businesses and profitability. In addition, the divestment of ING businesses, including the Adviser and ING IM, may potentially be deemed a “change of control” of the entity. A change of control would result in the termination of the Funds’ advisory and sub-advisory agreements, which would trigger the necessity for new agreements that would require approval of the Funds’ Board, and may trigger the need for shareholder approval. Currently, the Adviser does not anticipate that the restructuring will have a material adverse impact on the Funds or their operations and administration.

Sub-Advisers to the Portfolios

ING Investments has engaged BlackRock to serve as sub-adviser to ING BlackRock Portfolio to provide the day-to-day management of the Portfolio.

BlackRock, a Delaware limited liability company, is a wholly-owned subsidiary of BlackRock, Inc. BlackRock and its affiliates offer a full range of equity, fixed-income, cash management and alternative investment products with strong representation in both retail and institutional channels in U.S. and in non-U.S. markets. The company has over 10,000 employees in 27 countries and

a major presence in most key markets including the United States, the United Kingdom, Asia, Australia, the Middle East and Europe. The principal address of BlackRock is 100 Bellvue Parkway, Wilmington, Delaware 19809. As of December 31, 2011 BlackRock and its affiliates had over $3.513 trillion in investment company and other portfolio assets under management.

The following individuals are jointly responsible for the day-to-day management of the ING BlackRock Portfolio.

Thomas P. Callan, CFA, Managing Director, and Senior Portfolio Manager, is the head of BlackRock’s global opportunities team and is the strategist for all the team’s portfolios. Before becoming part of BlackRock, Mr. Callan had been with the PNC Asset Management Group, which he joined in 1994. Mr. Callan began his career at PNC Bank as a personal trust portfolio manager in 1988 and became a research analyst in 1992.

Jean M. Rosenbaum, CFA, Managing Director and Portfolio Manager, is a senior member of BlackRock’s Global Opportunities Team and is responsible for coverage of stocks in the technology sector for all of the team’s portfolios. Prior to joining BlackRock in 1998, Ms. Rosenbaum was a healthcare analyst with the PNC Asset Management Group.

Erin Xie, Ph.D., Managing Director and Portfolio Manager, is a senior member of BlackRock’s global opportunities team and is responsible for coverage of stocks in the healthcare sector. Before becoming part of BlackRock in 2005, Dr. Xie was with State Street Research & Management since 2001. She began her investment career as a pharmaceutical analyst for Sanford Bernstein in 1999.

ING Investments has engaged ING IM to serve as sub-adviser to ING MidCap Portfolio to provide the day-to-day management of the Portfolio.

ING IM, a Delaware limited liability company, was founded in 1972 and is registered with the SEC as an investment adviser. ING IM is an indirect, wholly-owned subsidiary of ING Groep and is an affiliate of ING Investments and ING IM. ING IM has acted as adviser or sub-adviser to mutual funds since 1994 and has managed institutional accounts since 1972. The principal office of ING IM is located at 230 Park Avenue, New York, New York 10169. As of December 31, 2011, ING IM managed approximately $64.4 billion in assets.

The Sub-Adviser utilizes a team for portfolio construction of the Portfolios. The senior portfolio managers and all of the sector analysts on the team participate in the process, with the sector analysts determining the security selection for each of their sectors for the dedicated portion of the overall portfolio. The senior portfolio manager is responsible for the overall allocation of assets for the portfolio, including management of the portfolio’s overall risk profile.

The following individuals are jointly responsible for the day-to-day management of the Portfolios.

Jeff Bianchi is the Lead Portfolio Manager of ING IM’s large cap growth and mid cap growth strategies. Mr. Bianchi joined ING IM in 1994 as a fundamental research analyst on the growth strategies. Mr. Bianchi has had primary responsibility for the health care sector as well as other growth sectors, including technology and consumer. He assumed portfolio manager duties on the large cap growth strategy in 2000, and was named lead portfolio manager on the strategy in 2010. He also assumed lead portfolio manager responsibilities of the mid cap growth strategy in 2005.

Michael Pytosh, Portfolio Manager, joined ING IM in 2004 as a senior sector analyst covering the technology sector. Prior to 2004, Mr. Pytosh was with Lincoln Equity Management, LLC, since 1996, where he started as a technology analyst and ultimately took on the role of the firm’s president. Prior to that, Mr. Pytosh was a technology analyst at JPMorgan Investment Management and an analyst at Lehman Brothers.

Kristin Manning, CFA, is a Portfolio Manager on the mid cap growth strategies team and is an analyst on the fundamental research team covering the consumer sector. Ms. Manning joined ING IM in 2006 and prior to that she was a research analyst at Wells Capital Management where she was responsible for the financial, auto, IT services, and utilities sectors.

For information regarding the basis for the Board’s approval of the investment advisory and investment sub-advisory relationships, please refer to each Portfolio’s annual shareholder report dated December 31, 2011.

The Administrator

ING Funds Services, LLC (“Administrator”) serves as administrator to ING BlackRock Portfolio and receives an annual administrative services fee payable in monthly installments equal to 0.055% on the first $5 billion and 0.030% in excess of $5 billion of that Portfolio’s average daily net assets. The Administrator also serves as the administrator to the ING MidCap Portfolio and receives an administrative services fee equal to 0.10% of that Portfolio’s average daily net assets.

The administrative services provided to the Portfolios include acting as a liaison among the various service providers to the Portfolios, including the custodian, portfolio accounting agent, the sub-advisers, and the insurance companies to which a Portfolio offers its shares. The Administrator also reviews the Portfolios for compliance with applicable legal requirements and monitors the sub-advisers for compliance with requirements under applicable law and with the investment policies and restrictions of the Portfolios.

The Distributor

ING Investments Distributor, LLC is the principal underwriter and distributor of each Portfolio. The Distributor is a Delaware limited liability company with its principal offices at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

The Distributor is a member of the Financial Industry Regulatory Authority (“FINRA”). To obtain information about FINRA member firms and their associated persons, you may contact FINRA at www.finra.org or the Public Disclosure Hotline at 800-289-9999.

What are the Key Differences in the Rights of Shareholders of ING BlackRock Portfolio and ING MidCap Portfolio?

ING BlackRock Portfolio is a series of IVPI, a Maryland corporation, and is governed by Articles of Incorporation and Bylaws. ING MidCap Portfolio is a series of IVPT, which is a Massachusetts business trust, and is governed by a Declaration of Trust and Bylaws. The Articles of Incorporation and Bylaws for IVPI and the Declaration of Trust and Bylaws for IVPT provide shareholders with differing rights. The key differences are described in the table below.

|

ING BlackRock Portfolio |

|

ING MidCap Portfolio |

|

|

|

|

|