UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

|

|

No ☐ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

|

|

Yes ☐ |

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|

|

No ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

|

|

|

No ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

☒ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

|

☐ |

Smaller reporting company |

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|

Yes |

No ☒ |

As of June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $

Indicate the number of shares outstanding of each of the issuer’s classes of common stock on the latest practicable date.

|

Class |

|

Outstanding at February 15, 2022 |

|

Common Stock, $.01 par value per share |

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

Document |

|

Parts Into Which Incorporated |

|

Proxy Statement for the Annual Meeting of Shareholders to be held May 12, 2022 (Proxy Statement) |

|

Part III |

|

|

|

|

|

Auditor Firm Id: |

|

Auditor Name: |

|

Auditor Location: |

|

TABLE OF CONTENTS

|

1 |

||

|

|

|

|

|

ITEM 1. |

1 |

|

|

|

|

|

|

ITEM 1A. |

12 |

|

|

|

|

|

|

ITEM 1B. |

25 |

|

|

|

|

|

|

ITEM 2. |

25 |

|

|

|

|

|

|

ITEM 3. |

30 |

|

|

|

|

|

|

ITEM 4. |

30 |

|

|

|

|

|

|

31 |

||

|

|

|

|

|

32 |

||

|

|

|

|

|

ITEM 5. |

32 |

|

|

|

|

|

|

ITEM 6. |

33 |

|

|

|

|

|

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

34 |

|

|

|

|

|

ITEM 7A. |

69 |

|

|

|

|

|

|

ITEM 8. |

70 |

|

|

|

|

|

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

115 |

|

|

|

|

|

ITEM 9A. |

115 |

|

|

|

|

|

|

ITEM 9B. |

116 |

|

|

|

|

|

|

ITEM 9C. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

116 |

|

|

|

|

|

|

|

|

|

117 |

||

|

|

|

|

|

ITEM 10. |

117 |

|

|

|

|

|

|

ITEM 11. |

117 |

|

|

|

|

|

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

117 |

|

|

|

|

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

117 |

|

|

|

|

|

ITEM 14. |

117 |

|

|

118 |

||

|

|

|

|

|

ITEM 15. |

118 |

|

|

|

|

|

|

ITEM 16. |

124 |

|

|

|

|

|

|

125 |

||

Part I ♦ Item 1 – Business

PART I

ITEM 1 – BUSINESS

General

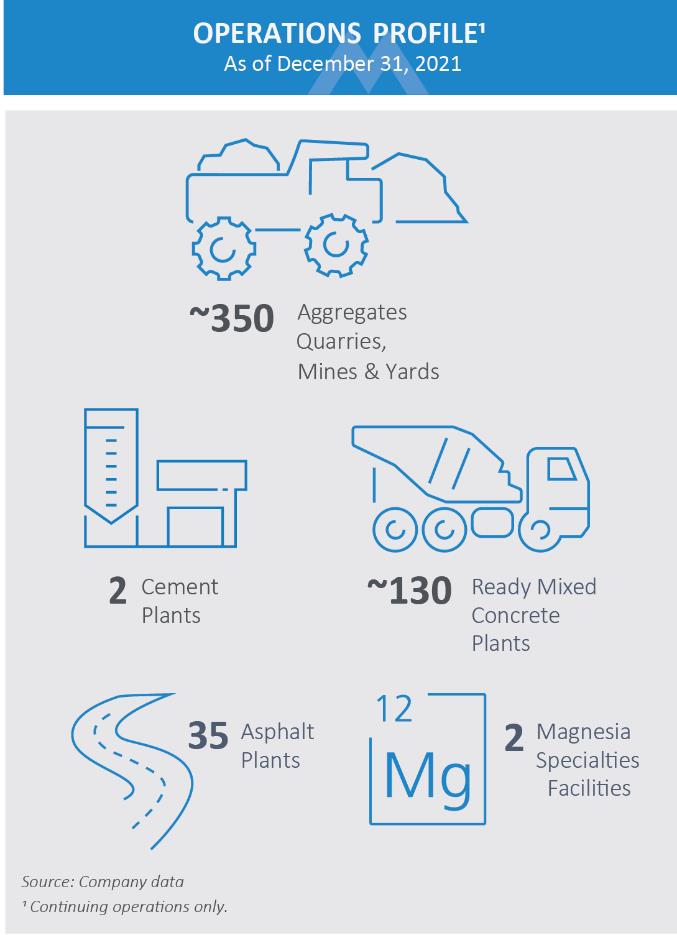

Martin Marietta Materials, Inc. (the Company or Martin Marietta) is a natural resource-based building materials company. The Company supplies aggregates (crushed stone, sand and gravel) through its network of approximately 350 quarries, mines and distribution yards in 28 states, Canada and The Bahamas. In 2021, the aggregates product gross profit accounted for 67% of the Company’s consolidated total product and services gross profit. Martin Marietta also provides cement and downstream products, namely, ready mixed concrete, asphalt and paving services, in markets that are naturally vertically integrated and where the Company has a leading aggregates position. The Company’s heavy-side building materials are used in infrastructure, nonresidential and residential construction projects. Aggregates are also used in agricultural, utility and environmental applications and as railroad ballast. The aggregates, cement, ready mixed concrete and asphalt and paving operations are reported collectively as the “Building Materials business”. The Company also operates a Magnesia Specialties business with production facilities in Michigan and Ohio. The Magnesia Specialties business produces magnesia-based chemical products that are used in industrial, agricultural and environmental applications. It also produces dolomitic lime sold primarily to customers for steel production and land stabilization. Magnesia Specialties’ products are shipped to customers domestically and worldwide.

On October 1, 2021, the Company acquired the Lehigh Hanson West Region business (Lehigh West Region) for $2.28 billion in cash. The acquisition included a portfolio of 17 active aggregates quarries, two cement plants with related distribution terminals, and targeted downstream operations in California, Arizona, Nevada and Oregon. These operations provided a new upstream, materials-led growth platform across several of the nation’s largest megaregions in California and Arizona, solidifying the Company’s position as a leading coast-to-coast aggregates producer. The acquired cement plants, distribution terminals and California ready mixed concrete operations are classified as assets held for sale and discontinued operations as of December 31, 2021. The Lehigh West Region business is reported in the Company’s West Group.

On July 30, 2021, the Company acquired assets of Southern Crushed Concrete (SCC). SCC is a leading producer of recycled concrete in the Houston area, one of the country’s largest aggregates markets. Recycled concrete is principally used as a base aggregates product in infrastructure, commercial and residential construction applications. SCC is reported in the Company’s West Group.

On April 30, 2021, the Company completed its acquisition of Tiller Corporation (Tiller), a leading aggregates and hot mix asphalt supplier in the Minneapolis/St. Paul area, a large and fast-growing midwestern metropolitan area. The Tiller acquisition complements the Company’s existing product offerings in the surrounding areas. Additionally, Tiller sells asphalt solely as a materials provider and does not offer paving or other associated services. Tiller is reported in the Company’s East Group.

FOR FURTHER INFORMATION WITH RESPECT TO THE DEVELOPMENT OF THE COMPANY’S BUSINESS PRIOR TO 2021, SEE THE INFORMATION APPEARING UNDER THE HEADING “GENERAL” INCLUDED IN PART I, ITEM 1 OF THE COMPANY’S FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2019, WHICH INFORMATION IS INCORPORATED BY REFERENCE.

Business Segment Information

The Company conducts its Building Materials business through two reportable segments, organized by geography: East Group and West Group. The East Group provides aggregates and asphalt products only. The West Group provides aggregates, cement and downstream products. The ten largest revenue-generating states accounted for 84% of the Building Materials business total revenues in 2021: Texas, Colorado, North Carolina, Georgia, Minnesota, Iowa, Florida, South Carolina, Indiana and Maryland. The Company’s Magnesia Specialties business is reported as a separate segment, which includes its magnesia-based chemicals and dolomitic lime businesses. For more information on the organization and geographic area of the Company’s business segments, see “Note A: Accounting Policies” and “Note P: Segments” of the “Notes to Financial Statements” of the Company’s consolidated financial statements, which appear in Item 8, “Financial Statements and Supplementary Data,” of this Annual Report on Form 10-K (this Form 10-K), which information is incorporated by reference.

Building Materials Business

The profitability of the Building Materials business, which serves customers in the construction marketplace, is sensitive to national, regional and local economic conditions and cyclical swings in construction spending, which are in turn affected by fluctuations in levels of public-sector infrastructure funding; interest rates; access to capital markets; and demographic,

|

SOAR to a Sustainable Future |

|

Form 10-K ♦ Page 1 |

Part I ♦ Item 1 – Business

geographic, employment and population dynamics. The heavy-side construction business is conducted outdoors, as are much of the Building Materials business’s operations. Therefore, erratic weather patterns, seasonal changes, and other weather-related conditions, including precipitation, flooding, hurricanes, snowstorms, extreme temperatures, wildfires, earthquakes and droughts, can significantly affect production schedules, shipments, costs, efficiencies and profitability. Generally, the financial results for the first and fourth quarters are subject to the impacts of winter weather, while the second and third quarters are subject to the impacts of heavy precipitation.

The Building Materials business markets its products primarily to the construction industry, with 34% of its 2021 organic aggregates shipments sold to contractors in connection with highway and other public infrastructure projects and the balance of its organic shipments sold primarily to contractors for nonresidential and residential construction projects. The Company also believes exposure to fluctuations in nonresidential and residential, or private-sector, construction spending is lessened by the business’ mix of public sector-related shipments.

Funding of public infrastructure, historically the Company’s largest end-use market, is discussed in greater detail under “Building Materials Business’ Key Considerations—Public Infrastructure” in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,’’ of this Form 10-K.

The Building Materials business covers a wide geographic area. The five largest revenue-generating states, determined by state of destination, (Texas, Colorado, North Carolina, Georgia and Minnesota) accounted for 68% of the Building Materials business’ total revenues by state of destination in 2021. The Building Materials business is accordingly affected by the economies in these regions and has been adversely affected in part by recessions and weaknesses in these economies from time to time. In 2020, the coronavirus (COVID-19) pandemic impacted the global economy. The Company, being considered an essential business, continued to operate but experienced a modest decline in aggregates shipments in 2020 due to a slowdown in overall construction activity and only modest growth in organic aggregates shipments in 2021.

Aggregates

Aggregates, consisting of crushed stone, sand and gravel, are an engineered, granular material that is manufactured to specific sizes, grades and chemistry for use primarily in construction applications. The Company’s operations consist primarily of open pit quarries; however, the Company is the largest operator of underground aggregates mines in the United States, with 14 active underground mines located in the East Group.

Natural aggregates sources can be found in relatively homogeneous deposits in certain areas of the United States. As a general rule, the distance covered by truck shipments from an individual quarry is limited because the cost of transporting processed aggregates to customers is high in relation to the price of the product itself. As described below, the Company’s distribution system mainly uses trucks, but also has access to a waterborne network where the per-mile unit cost of transporting aggregates is much lower. In addition, acquisitions have enabled the Company to extend its customer base through increased access to rail transportation. Proximity of quarry facilities to customers’ construction sites or to long-haul transportation corridors is an important factor in competition for aggregates businesses.

The Company’s distribution network moves aggregates materials from certain domestic and offshore sources via its long-haul rail and waterborne distribution network, to markets where aggregates supply is limited. The Company’s rail network primarily serves its Texas, Florida, Colorado and Gulf Coast markets while the Company’s locations in The Bahamas and Nova Scotia transport materials via oceangoing ships. The Company’s strategic focus includes expanding inland and offshore capacity and acquiring distribution facilities and port locations to offload transported material. At December 31, 2021, the Company’s aggregates distribution facilities consisted of 84 terminals. The long-haul distribution network can diversify market risk for locations that engage in long-haul transportation of their aggregates products. The risk of a downturn in one market may be somewhat mitigated by other markets served by the location, particularly where a producing quarry serves a local market and transports products via rail, water and/or truck to be sold in other markets. However, the Company’s expansion of its rail-based distribution network, coupled with the extensive use of rail service, increases the Company’s dependence on and exposure to railroad performance, including track congestion, crew availability, railcar availability, locomotive availability, and the ability to renegotiate favorable railroad shipping contracts. The waterborne distribution network also increases the Company’s exposure to certain risks, including, among other items, meeting minimum tonnage requirements of shipping contracts, demurrage costs, fuel costs, ship availability and weather disruptions. The Company has long-term agreements with shipping companies to provide ships to transport the Company’s aggregates to various coastal ports.

The Company generally acquires contiguous property around existing quarry locations. This property can serve as buffer property or additional mineral reserve capacity, assuming the underlying geology supports economical aggregates mining. In

|

Form 10-K ♦ Page 2 |

|

SOAR to a Sustainable Future |

Part I ♦ Item 1 – Business

either instance, the acquisition of additional property around an existing quarry allows the expansion of the quarry footprint and extension of quarry life. Some locations having limited reserves may be unable to expand.

A long-term capital focus for the Company, primarily in the midwestern United States due to the nature of its indigenous aggregates supply, is underground limestone aggregates mines. Production costs are generally higher at underground mines than surface quarries since the depth of the aggregates deposits and the access to the reserves result in higher costs related to development, explosives and depreciation costs. However, these locations often possess marketplace transportation advantages that can lead to higher average selling prices than more distant surface quarries.

The construction aggregates industry has been consolidating, and the Company has actively participated in the industry’s consolidation. When acquired, new locations sometimes do not satisfy the Company’s internal safety, maintenance, pit development, or other standards, and may require additional resources before benefits of the acquisitions are fully realized. Acquisition opportunities include public and large private, family-owned businesses, as well as asset swaps and divestitures from companies executing their strategic plans, rationalizing non-core assets, and repairing financially-constrained balance sheets. The Company’s Board of Directors and management continue to review and monitor the Company’s long-term strategic plans, commonly referred to as SOAR (Strategic Operating Analysis and Review), which include assessing business combinations and arrangements with other companies engaged in similar businesses, increasing the Company’s presence in its core businesses, investing in internal expansion projects in high-growth markets, and pursuing new opportunities related to the Company’s existing markets.

Environmental and zoning regulations have made it increasingly difficult for the aggregates industry to expand existing quarries and to develop new quarry operations. Although it cannot be predicted what policies will be adopted in the future by federal, state, and local governmental bodies regarding these matters, the Company anticipates that future restrictions will likely make zoning and permitting more difficult, thereby potentially enhancing the value of the Company’s existing mineral reserves.

Management believes its aggregates reserves are sufficient to permit production at present operational levels for the foreseeable future. The Company does not anticipate any significant difficulty in obtaining reserves used for production. The Company’s aggregates reserves average approximately 78 years, based on current production levels. However, certain locations may be subject to more limited reserves and may not be able to expand. Moreover, as noted above, environmental and zoning regulations will likely make it harder for the Company to expand its existing quarries or develop new quarry operations.

The Company generally sells its aggregates, ready mixed concrete and asphalt products upon receipt of customer orders or requests. The Company generally maintains inventories of aggregates products in sufficient quantities to meet the requirements of customers.

Cement and Downstream Operations

Cement is the basic agent used to bind aggregates, sand and water in the production of ready mixed concrete. The Company has a strategic and leading cement position in Texas, with production facilities in Midlothian, Texas, south of Dallas/Fort Worth, and Hunter, Texas, north of San Antonio. These plants, which produce Portland and specialty cements, have a combined annual clinker capacity of 4.5 million tons, and operated at 76% utilization in 2021. The Midlothian plant permit allows the Company to expand production by up to 0.8 million additional tons. In 2021, as part of the Lehigh West Region acquisition, the Company acquired two cement production facilities, including one in Redding, California and one in Tehachapi, California, and several cement distribution terminals. These operations are classified as assets held for sale as of December 31, 2021. Calcium carbonate in the form of limestone is the principal raw material used in the production of cement. The Company owns more than 600 million tons of limestone reserves adjacent to its Texas cement production plants and more than 50 million tons of limestone reserves adjacent to its California cement production plants.

The cement operations of the Building Materials business produce Portland and specialty cements. Similar to aggregates, cement is used in infrastructure projects, nonresidential and residential construction, and the railroad, agricultural, utility and environmental industries. Consequently, the cement industry is cyclical and dependent on the strength of the construction sector.

Cement consumption is dependent on the time of year and prevalent weather conditions. According to the Portland Cement Association, nearly two-thirds of U.S. cement consumption occurs in the six months between May and October. Approximately 70% to 75% of all cement shipments are sent to ready mixed concrete operators. The rest are shipped to manufacturers of concrete-related products, contractors, materials dealers and oil well/mining/drilling companies, as well as government entities.

|

SOAR to a Sustainable Future |

|

Form 10-K ♦ Page 3 |

Part I ♦ Item 1 – Business

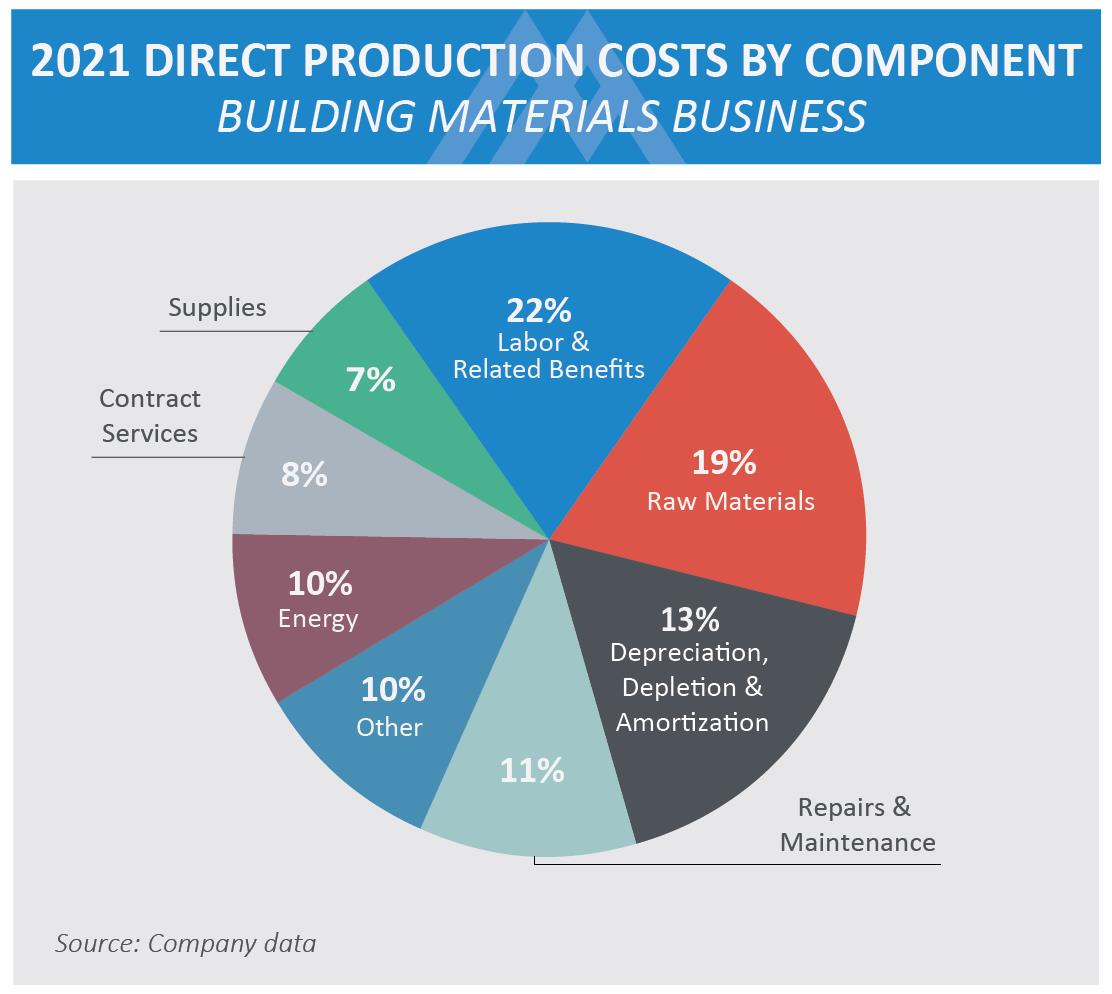

Energy accounted for approximately 23% of the cement production cost profile in 2021. Therefore, profitability of cement is affected by changes in energy prices and the available supply of these products. The Company currently has fixed-price supply contracts for coal and natural gas, but also consumes alternative fuel and petroleum coke. Further, profitability of the cement operations is also impacted by kiln maintenance, which typically requires a plant to be shut down for a period of time.

The limestone reserves used as a raw material for cement are located on Company-owned property, adjacent to each of the cement plants. Management believes that its reserves of limestone are sufficient to permit production at the current operational levels for the foreseeable future.

The cement operations generally deliver their products upon receipt of customer orders or requests. Inventory for products is generally maintained in sufficient quantities to meet rapid delivery requirements of customers.

Ready mixed concrete, a mixture primarily consisting of cement, aggregates, sand and water, is measured in cubic yards and specifically batched or produced for customers’ construction projects and then transported and poured at the project site. The aggregates used for ready mixed concrete is a washed material with limited amounts of fines (such as dirt and clay). The Company operates 150 ready mix plants in Texas, Colorado, California, Arizona and Wyoming. The California ready mixed concrete operations are classified as assets held for sale as of December 31, 2021. Asphalt is most commonly used in surfacing roads and parking lots and consists of liquid asphalt, or bitumen, the binding medium, and aggregates. Similar to ready mixed concrete, each asphalt batch is produced to customer specifications. The Company operates 35 asphalt plants in Arizona, California, Colorado and Minnesota. The Company also provides paving services in Colorado and California. Market dynamics for these downstream product lines include a highly competitive environment and lower barriers to entry compared with aggregates and cement.

The cement and downstream operations results are affected by volatile factors, including energy-related costs, operating efficiencies and weather, to a greater extent than the Company’s aggregates operations. Liquid asphalt and cement serve as key raw materials in the production of hot mix asphalt and ready mixed concrete, respectively. Therefore, fluctuations in prices for these raw materials directly affect the Company’s operating results.

Magnesia Specialties Business

The Magnesia Specialties business produces and sells dolomitic lime from its Woodville, Ohio facility and manufactures magnesia-based chemical products for industrial, agricultural and environmental applications at its Manistee, Michigan facility. These magnesia-based chemical products have varying uses, including flame retardants, wastewater treatment, pulp and paper production and other environmental applications. In 2021, 69% of Magnesia Specialties’ total revenues were attributable to chemical products, 30% to lime, and 1% to stone sold as construction materials.

In 2021, 76% of the lime produced in the Magnesia Specialties business was sold to third-party customers, while the remaining 24% was used internally as a raw material in making the business’ chemical products. Dolomitic lime products sold to external customers are used primarily by the steel industry. In 2021, 34% of the Magnesia Specialties’ total revenues were attributable to products used in the steel industry, primarily dolomitic lime. Accordingly, a portion of the revenues and profitability of the Magnesia Specialties business is affected by production and inventory trends in the steel industry. These trends are guided by the rate of consumer consumption, the flow of offshore imports, and other economic factors. The dolomitic lime business runs most profitably at 70% or greater steel capacity utilization. According to the Federal Reserve, domestic capacity utilization averaged 81% in 2021 versus 65% in 2020, which was negatively impacted by COVID-19.

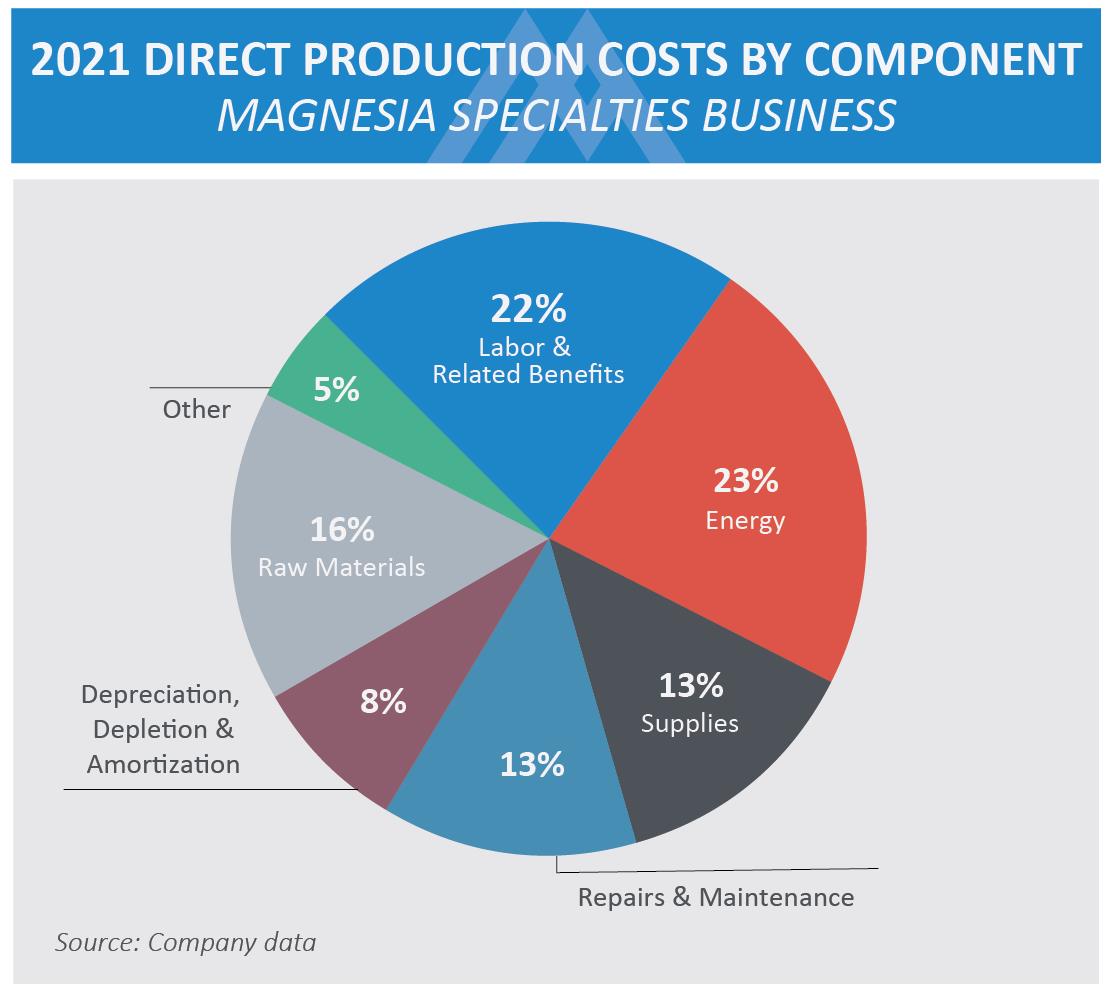

In the Magnesia Specialties business, a significant portion of costs is of a fixed or semi-fixed nature. The production process requires the use of natural gas, coal and petroleum coke. Therefore, fluctuations in their pricing directly affect operating results. To help mitigate this risk, the Magnesia Specialties business has fixed-price agreements for approximately 64% of its 2022 coal, natural gas and petroleum coke needs. For 2021, the Company’s average cost per MCF (thousand cubic feet) of natural gas increased 21% versus 2020.

Given high fixed costs, low capacity utilization can negatively affect the segment’s results from operations. Management expects future organic profit growth to result from increased pricing, efficiency enhancements, rationalization of the current product portfolio and/or further cost reductions. Management has shifted the strategic focus of the magnesia-based business to specialty chemicals that can be produced at volume levels that support efficient operations. Accordingly, these products are not as dependent on the steel industry as the dolomitic lime product line. Demand for chemicals products recovered in 2021 after being negatively impacted by COVID-19 in 2020.

|

Form 10-K ♦ Page 4 |

|

SOAR to a Sustainable Future |

Part I ♦ Item 1 – Business

The principal raw materials used in the Magnesia Specialties business are dolomitic limestone and magnesium-rich brine. Management believes that its reserves of dolomitic limestone and brine are sufficient to permit production at the current operational levels for the foreseeable future.

Magnesia Specialties generally delivers its products upon receipt of customer orders or requests. Inventory for products is generally maintained in sufficient quantities to meet rapid delivery requirements of customers. A significant portion of the 275,000-ton dolomitic lime capacity from a lime kiln at Woodville, Ohio is committed under a long-term supply contract.

The Magnesia Specialties business is highly dependent on rail transportation, particularly for movement of dolomitic lime from Woodville to Manistee and direct customer shipments of dolomitic lime and magnesia chemicals products from both Woodville and Manistee. The segment can be affected by the specific transportation and other risks and uncertainties outlined under Item 1A, “Risk Factors,” of this Form 10-K.

Patents and Trademarks

As of January 31, 2022, the Company owns, has the right to use, or has pending applications for patents pending or granted by the United States and various countries and trademarks related to its business. The Company believes that its rights under its existing patents, patent applications and trademarks are of value to its operations, but no one patent or trademark or group of patents or trademarks is material to the conduct of the Company’s business as a whole.

Customers

No material part of the business as a whole, or of any segment of the Company, is dependent upon a single customer or upon a few customers. The loss of any single customer would not have a material adverse effect on the segment. The Company’s products are sold principally to commercial customers in private industry. Although large amounts of construction materials are used in public works projects, relatively insignificant sales are made directly to federal, state, county, or municipal governments, or agencies thereof.

Competition

The nature of the Company’s competition varies among its products due to the widely differing amounts of capital necessary to build and maintain production facilities. Crushed stone production from quarries or mines, and sand and gravel production by dredging, is moderately capital intensive. Construction of cement production facilities is highly capital intensive and requires long lead times to complete engineering design, obtain regulatory permits, acquire equipment and construct a plant. Most domestic cement producers are owned by large foreign companies operating in multiple international markets. Many of these producers maintain the capability to import cement from foreign production facilities. Ready mixed concrete production requires relatively small amounts of capital to build a concrete batching plant and acquire delivery trucks. Accordingly, economics can lead to lower barriers to entry in some concrete markets. As a result, depending on the local market, the Company may face competition from small producers as well as large, vertically-integrated companies with facilities in many markets.

The Company operates in a largely-fragmented industry with over 5,000 domestic aggregates producers, including large, public companies and a large number of small, privately-held companies. Other publicly traded companies among the ten largest U.S. aggregates producers include the following:

|

|

• |

Cemex S.A.B. de C.V. |

|

|

• |

CRH plc |

|

|

• |

HeidelbergCement AG |

|

|

• |

LafargeHolcim |

|

|

• |

MDU Resources Group, Inc. |

|

|

• |

Summit Materials, Inc. |

|

|

• |

Vulcan Materials Company |

Due to the localized nature of the industry resulting from the high cost of transportation relative to the price of the product, the Building Materials business primarily operates in smaller distinct areas that can vary from one another.

Capacity for cement plants is often stated in terms of “clinker” capacity; clinker is the initial product of cement production. According to the U.S. Geological Survey, United States cement production is widely dispersed, with the top five companies collectively producing approximately 58% of U.S. clinker capacity. An estimated 83% of U.S. clinker capacity is owned by

|

SOAR to a Sustainable Future |

|

Form 10-K ♦ Page 5 |

Part I ♦ Item 1 – Business

companies headquartered outside of the United States. The Company’s cement operations also compete with imported cement because of the higher value of the product and the existence of major ports or terminals in Texas and California.

The Company’s ready mixed concrete and asphalt and paving operations are also in markets with numerous operators, large and small.

The Company believes that its ability to transport materials by rail and waterborne vessels has enhanced its ability to compete in the building materials industry.

The Magnesia Specialties business competes with various companies in different geographic and product areas principally on the basis of quality, price, technological advances, and technical support for its products. While the revenues of the Magnesia Specialties business in 2021 were predominantly domestic, a portion was derived from customers located outside the United States.

Environmental and Governmental Regulations

Overview

The Company’s operations are subject to and affected by federal, state, and local laws and regulations relating to zoning, land use, mining, air emissions (including CO2 and other greenhouse gases), water use, allocation and discharges, waste management, noise and dust exposure control, reclamation and other environmental, health and safety, and regulatory matters. Certain of the Company’s operations may from time to time involve the use of substances that are classified as toxic or hazardous within the meaning of these laws and regulations. Environmental operating permits are, or may be, required for certain of the Company’s operations, and such permits are subject to modification, renewal and revocation.

Environmental Compliance and Accruals

The Company regularly monitors and reviews its operations, procedures, and policies for compliance with existing laws and regulations, changes in interpretations of existing laws and enforcement policies, new laws that are adopted, and new laws that the Company anticipates will be adopted that could affect its operations. The Company has a full-time team of environmental engineers and managers that perform these responsibilities. The direct costs of ongoing environmental compliance were approximately $31.0 million in 2021 and $32.8 million in 2020 and are related to the Company’s environmental staff, ongoing monitoring costs for various matters (including those matters disclosed in this Form 10-K), and asset retirement costs. Capitalized costs related to environmental control facilities were approximately $12.0 million in 2021 and are expected to be approximately $18.0 million in each of 2022 and 2023. The Company’s capital expenditures for environmental matters were not material to its results of operations or financial condition in 2021 and 2020. However, the Company’s expenditures for environmental matters generally have increased over time and are likely to increase in the future. Despite the Company’s compliance efforts, risk of environmental liability is inherent in the Company’s businesses, and environmental liabilities could have a material adverse effect on the Company in the future. Complying with governmental and environmental regulations did not have and is not expected to have a material effect on the Company’s capital expenditures, earnings and competitive position, other than as discussed in this section.

Many of the applicable requirements of environmental laws are satisfied by procedures that the Company adopts as best business practices in the ordinary course of its operations. For example, plant equipment that is used to crush aggregates products may, in the ordinary course of operations, have an attached water spray bar that is used to clean the stone. The water spray bar also serves as a dust control mechanism that complies with applicable environmental laws. Moreover, the Company does not separate the portion of the cost, depreciation, and other financial information relating to the water spray bar that is attributable only to environmental purposes, as such an allocation would be arbitrary. The incremental portion of such operating costs that is attributable to environmental compliance rather than best operating practices is impractical to quantify. Accordingly, the Company expenses costs in that category when incurred as operating expenses.

As is the case with others in the cement industry, the Company’s cement operations produce varying quantities of cement kiln dust (CKD). This production by-product consists of fine-grained, solid, highly alkaline material removed from cement kiln exhaust gas by air pollution control devices. Since much of the CKD is unreacted raw materials, it is generally permissible to recycle the CKD back into the production process, and large amounts often are treated in such manner. CKD that is not returned to the production process or sold as a product itself is disposed in landfills. CKD is currently exempted from federal hazardous waste regulations under Subtitle C of the Resource Conservation and Recovery Act.

|

Form 10-K ♦ Page 6 |

|

SOAR to a Sustainable Future |

Part I ♦ Item 1 – Business

The environmental accruals recorded by the Company are based on internal studies of the required remediation costs and estimates of potential costs that arise from time to time under federal, state and/or local environmental protection laws. Many of these laws and their attendant regulations are complex, and are subject to challenges and new interpretations by regulators and the courts. In addition, new laws are also adopted from time to time. It is often difficult to accurately and fully quantify the costs to comply with new rules until it is determined to which type of operations they will apply and the manner in which they will be implemented is more accurately defined. This process typically takes years to finalize, and the rules often change significantly from the time they are proposed to the time they are final. The Company typically has several appropriate alternatives available to satisfy compliance requirements, which could range from nominal costs to some alternatives that may be satisfied in conjunction with equipment replacement or expansion that also benefits operating efficiencies or capacities and carry significantly higher costs.

Management believes that its current accrual for environmental costs is reasonable, although those amounts may increase or decrease depending on the impact of applicable rules as they are finalized or amended from time to time and changes in facts and circumstances. The Company believes that its operations and facilities, both owned or leased, are in substantial compliance with applicable laws and regulations and that any noncompliance is not likely to have a material adverse effect on the Company’s operations or financial condition. See “Legal Proceedings” under Item 3 of this Form 10-K, “Note O: Commitments and Contingencies” of the “Notes to Financial Statements” of the Company’s consolidated financial statements included under Item 8, “Financial Statements and Supplemental Data,” of this Form 10-K, and the “Environmental Regulation and Litigation” section included under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” of this Form 10-K. However, future events, such as changes in or modified interpretations of existing laws and regulations or enforcement policies, or further investigation or evaluation of the potential health hazards of certain products or business activities, may give rise to additional compliance and other costs that could have a material adverse effect on the Company.

Mine Safety and Land Reclamation

In general, mining, production and distribution facilities for aggregates, cement, ready mixed concrete, and asphalt must comply with air quality, water quality, and other environmental regulations, zoning and special use permitting requirements, applicable mining regulations, and federal health and safety requirements. As the Company locates and acquires new production and distribution facilities, the Company works closely with local authorities during the zoning and permitting processes to design new quarries, mines, production and distribution facilities in such a way as to minimize disturbances. The Company frequently acquires large tracts of land so that quarry, mine, production and distribution facilities can be situated at a substantial distance from surrounding property owners. Also, in certain markets the Company’s ability to transport material by rail and water allows it to locate its facilities further away from residential areas. The Company has established policies designed to minimize disturbances to surrounding property owners from its operations.

As is the case with other similarly situated companies, some of the Company’s products contain varying amounts of crystalline silica, a common mineral also known as quartz. Excessive, prolonged inhalation of very small-sized particles of crystalline silica has been associated with lung diseases, including silicosis, and several scientific organizations and some states, such as California, have reported that crystalline silica can cause lung cancer. The Mine Safety and Health Administration (MSHA) and the Occupational Safety and Health Administration (OSHA) have established occupational thresholds for crystalline silica exposure as respirable dust. The Company monitors occupational exposures at its facilities and implements dust control procedures and/or makes available appropriate respiratory protective equipment to maintain the occupational exposures at or below the required levels. The Company, through safety information sheets and other means, also communicates appropriate warnings and cautions its employees and customers about the risks associated with excessive, prolonged inhalation of mineral dust in general and crystalline silica in particular.

The Company is generally required by state or local laws or pursuant to the terms of an applicable lease to reclaim quarry sites after use. Future reclamation costs are estimated using statutory reclamation requirements and management’s experience and knowledge in the industry, and are discounted to their present value using a credit-adjusted, risk-free interest rate. The future reclamation costs are not offset by potential recoveries. For additional information regarding compliance with legal requirements, see “Note O: Commitments and Contingencies” of the “Notes to Financial Statements” of the Company’s consolidated financial statements included in Item 8, “Financial Statements and Supplemental Data,” of this Form 10-K. The Company performs activities on an ongoing basis, as an integral part of the normal quarrying process, that may reduce the ultimate reclamation obligations. For example, the perimeter and interior walls of an open pit quarry are sloped and benched as they are developed to prevent erosion and provide stabilization. This sloping and benching meets both safety regulations required by MSHA for ongoing operations as well as final reclamation requirements. Therefore, these types of activities are included in normal operating costs and are not a part of the asset retirement obligation. Historically, the

|

SOAR to a Sustainable Future |

|

Form 10-K ♦ Page 7 |

Part I ♦ Item 1 – Business

Company has not incurred substantial reclamation costs in connection with the closing of quarries. Reclaimed quarry sites owned by the Company are from time to time available for sale, typically for commercial development or use as reservoirs, or have been converted for recreational use by the local community.

Greenhouse Gases and Climate Change

We have identified certain risks and opportunities below with respect to the physical impacts of climate change and the transition to a low carbon economy.

Policy and Regulatory Matters A number of governmental bodies, including the U.S. Congress and various U.S. states, have proposed, enacted or are contemplating legislative and regulatory changes to mitigate or address the potential impacts of climate change, including provisions for greenhouse gas (GHG) emissions reporting or reductions, the use of alternative fuels, carbon credits (such as a "cap and trade" system) and a carbon tax. For example, in the United States, the United States Environmental Protection Agency (USEPA) promulgated a rule mandating that sources considered to be large emitters of GHGs report those emissions. The manufacturing operations of the Company’s Magnesia Specialties business release carbon dioxide, methane and nitrous oxides during the production of lime, magnesium oxide and hydroxide products. The Company’s two magnesia-based chemicals facilities, as well as its two cement plants in Texas and two newly-acquired cement plants in California, file annual reports of their GHG emissions in accordance with the USEPA reporting rule. The primary operations of the Company, however, including its aggregates, ready mixed concrete and asphalt and paving product lines, are not so-called “major” sources of GHG emissions subject to the USEPA reporting rule. In fact, most of the GHG emissions from aggregates plant operations are tailpipe emissions from mobile sources, such as heavy construction and earth-moving equipment.

In 2010, the USEPA also issued a GHG emissions permitting rule, referred to as the “Tailoring Rule,” which may require some industrial facilities to obtain permits for GHG emissions under the U.S. Clean Air Act’s Prevention of Significant Deterioration (PSD) and Title V operating permit programs. The U.S. Supreme Court ruled in June 2014 that the USEPA exceeded its statutory authority in issuing the Tailoring Rule but upheld the Best Available Control Technology (BACT) requirements for GHGs emitted by sources already subject to PSD or Title V permitting requirements for other pollutants. The Company’s cement plants, as well as its Magnesia Specialties plants, hold Title V Permits, and each (other than the Redding, California cement plant and the Manistee, Michigan facility) is also subject to PSD requirements. With the change of the U.S. presidential administration in 2021, it is currently unclear whether the USEPA will proceed with revisions of the Tailoring Rule or proceed otherwise. It is also unknown how the USEPA may revise BACT requirements. In fact, although several large-scale projects for carbon capture are in the development phase, no technologies or methods of operation for reducing or capturing GHGs have yet been proven successful in large scale applications, other than improvements in fuel efficiency. Thus, if future modifications to our facilities require PSD review for other pollutants, GHG BACT requirements could be triggered and may require significant additional costs. However, it is currently impossible to estimate the cost of any such future requirements.

U.S. President Biden also has taken a number of steps to make climate change a central focus of his administration, including issuing a pair of executive orders and a presidential memorandum making climate change central to U.S. policy and setting out several administrative priorities and undertakings. President Biden reentered the Paris Agreement in January 2021 and later announced the United States’ reduction commitments under the Paris Agreement, including a 50% to 52% economy-wide reduction in net GHG emissions from 2005 levels by 2030. More recently, President Biden set out a pact with 103 countries and jurisdictions, known as the Global Methane Pledge, to reduce global methane emissions by 30% from 2020 levels by the end of the decade. In November 2021, President Biden signed into law the Infrastructure Investment and Jobs Act (the “IIJ Act”), which provides billions of dollars in new funding for public transit and clean energy projects intended, in part, to address climate change, including road, bridge and other major infrastructure projects. In addition, the currently-proposed Build Back Better bill (the “BBB bill”) calls for significant U.S. government investments in the commercialization and scale-up of energy and climate technologies, as well as tax credits for businesses that invest in clean energy. Although it is still too early to determine the actions the federal government will ultimately take to implement these orders, commitments and laws, or the full scope, timing or ramifications of such measures, it is clear that the current administration intends and has already begun to make a significant and sweeping push on the climate front and, like other signatories to the Paris Agreement, intends to pursue a goal of a Net Zero GHG by 2050. These measures, combined with Democratic control of both chambers of the 117th U.S. Congress, also suggest that additional executive and/or legislative action is reasonably likely, although the timing and scope of such action is unclear. It also seems probable that the USEPA and other agencies will use their rule-making authority and procurement decisions to further address climate change. Various states where the Company has operations have enacted or are considering climate change initiatives as well, and the Company may be subject to state regulations in addition to any federal laws and rules that are passed. The Company’s cement plants in California have not taken part in the auctions because the state previously allocated emission rights free of charge to the cement industry, which

|

Form 10-K ♦ Page 8 |

|

SOAR to a Sustainable Future |

Part I ♦ Item 1 – Business

have been sufficient for operations to date. The Company will continue to monitor the cap-and-trade program closely as part of its production planning to assess the impact of potentially stricter requirements in the future and/or the need to purchase rights to emit GHGs in California.

If and when the USEPA issues new regulations and/or Congress passes additional legislation restricting GHGs emissions, the Woodville, Ohio and Manistee, Michigan Magnesia Specialties operations, as well as the Company’s cement plants in Texas and California, which release CO2 in certain of their processes and use carbon-based fuels for power equipment, kilns and the Company’s mobile fleet, will likely be subject to any new requirements. The Company anticipates that any increased operating costs or taxes relating to GHG emission limitations at the Woodville or cement facilities would be passed on to customers. The magnesium oxide products produced at the Manistee operation, however, compete against other products that, due to the form and/or structure of the source material, require less energy in the calcination process, resulting in the generation of fewer GHGs per ton of production. Due to GHG emissions requirements, the Manistee facility may be required to absorb additional costs, including for taxes or capital investments in order to maintain competitive pricing in that market. In addition, the cement produced by the Company’s cement plants, like other U.S. operators, is subject to strict limits set by the U.S. Department of Transportation (USDOT) and other agencies, including those relating to “clinker substitution”, or the replacement of ground clinker in cement with alternate materials such as pozzolan, slag and fly ash, which has implications for the Company’s fuel use and efforts to reduce GHG emissions from its cement operations. For example, various industry associations are engaged in an effort to ask the USDOT and other agencies to revise their standards allowing for greater rates of clinker substitution, similar to the rates currently permitted for European cement producers. If higher rates of substitution and blending are, in fact, permitted in the future, the result is likely to be both reduced clinker and power consumption in cement production, which would, in turn, reduce GHGs emitted in connection with each ton of cement produced in the United States.

In light of the various regulatory uncertainties, the Company at this time cannot reasonably predict what the costs of any future compliance requirements may be. Nonetheless, the Company does not believe it will have a material adverse effect on the financial condition or results of the operations of either the Magnesia Specialties business or Building Materials business. The Company’s four cement plants, like those of other cement operators, require combustion of significant amounts of fuel to generate high kiln temperatures and creates carbon dioxide as a product of the calcination process, which is an unavoidable step in making cement clinker. Accordingly, the Company continues to closely monitor GHG regulations and legislation and its potential impact on the Company’s cement business, financial condition and product demand. The Company does not currently expect the impact to the cement business to be material to the Company.

Physical Impacts In addition to impacts from increased regulation, climate change may result in physical and financial impacts that could have adverse effects on the Company’s operations or financial condition. Physical impacts may include disruptions in production and/or regional supply or product distribution networks due to major storm events, shifts in regional rainfall and temperature patterns and intensities, as well as flooding from sea level changes. In addition, production and shipment levels for the Building Materials business correlate with general construction activity, which occurs outdoors and, as a result, is affected by erratic weather patterns, seasonal changes and other unusual or unexpected weather-related conditions, which can significantly affect that business. Excessive rainfall and other severe weather jeopardize production, shipments and profitability in all markets served by the Company. In addition, climate and inclement weather can reduce the useful life of an asset. In particular, the Company’s operations in the southeastern and Gulf Coast regions of the United States and The Bahamas are at risk for hurricane activity, most notably in August, September and October. The last few years brought an unprecedented amount of precipitation to the United States and particularly to Texas and the southeastern United States, notably the Carolinas, Florida and Georgia, where it impacted the Company’s facilities. In California and Arizona, continuing drought has led to water use restrictions in numerous water districts, and insufficient supply of water for our operations in those areas could impact production.

Other Transition Risks and Opportunities The Company’s businesses also are dependent on reliable sources of electricity and fuels. The Company could incur increased costs or disruptions in its operations if climate change regulation or severe weather impacts the price or availability of electricity or fuels or other materials used in its operations. These and other climate-related risks, such as a downturn in the construction sector due to harsh weather, high precipitation or other changes in weather, also could impact the Company’s customers, which could lead to reduced demand for the Company’s products. The Company may not be able to pass on to its customers all the costs relating to these risks.

Notwithstanding the foregoing risks and uncertainties relating to climate change, there may also be opportunities for the Company to increase its business or revenues, both in terms of the physical impacts of climate change and market opportunities associated with the transition to a low carbon economy. For example, warm and/or moderate temperatures in March and November allow the construction season to start earlier and end later, respectively, which could have meaningful positive impacts on the Company’s first- and fourth-quarter results, respectively. From a regulatory standpoint, as noted

|

SOAR to a Sustainable Future |

|

Form 10-K ♦ Page 9 |

Part I ♦ Item 1 – Business

above, the recently-passed IIJ Act provides billions of dollars in new funding for roads, bridge and other major infrastructure projects. This may result in new public transit and clean energy projects that address climate change. In addition, the Company’s magnesium hydroxide products are used to increase fuel efficiency in various industries, including both coal- and gas-fired electricity generation, which has a direct impact on reducing energy use and GHG emissions by more GHG-intense companies. Finally, the desire for sustainable building solutions has led to greater recognition of the benefits of concrete construction in the effort to move to a circular economy thorough innovative products, longevity and recyclability, and increased demand for green construction projects would have a direct impact on the Company’s cement and concrete business.

Organization and Governance The Company’s Board of Directors plays an essential role in determining strategic priorities and considers sustainability issues an integral part of its business oversight. The Company established an Ethics, Environment, Safety and Health (EESH) Committee in 1994, which today meets at least three times annually and receives reports directly from management relating to environmental, safety, ethics and other sustainability matters, including GHG and climate matters. The EESH Committee reports to the full Board, and number of other Board committees have overlapping responsibility for sustainability matters. Management receives at least quarterly updates from operating personnel directly responsible for compliance relating to EESH matters. The Company’s sustainability function is led by a Head of Sustainability, who reports to the Executive Vice President and General Counsel on climate and other sustainability matters. The Company believes the above approach has been effective in integrating sustainability as a core element of its corporate governance.

In an effort to mitigate the risks to the Company associated with GHG emissions while ensuring and improving financial sustainability, the Company has adopted a corporate-wide management strategy that has resulted in multiple operating initiatives to implement or evaluate GHG reduction processes and technologies that also improve operational efficiencies, including: using alternative fuels such as biodiesel; reducing overall fuel use by converting from quarry trucks to conveyor belt systems; right-sizing quarry trucks to marry the appropriately sized truck with the size of production to reduce the number of required trips; replacing older railcars with more efficient, high-capacity models that reduce the number of required trips; adding rail capacity in lieu of truck movements; and installing state-of-the-art emissions control equipment at one of the Company’s magnesia plants and tire processing systems for fuel, as well as a larger natural gas line, at one of the Company’s cement plants. The Company’s Midlothian cement plant has been recognized by the USEPA as a high-performing, energy-efficient facility following investments in innovative air pollution control technologies and usage of alternative fuels.

Land Management

The Company owns approximately 170,000 acres of land, the vast majority of which is used in connection with active facilities. The Company regularly reviews its land holdings to determine their highest and best use based on its management expertise, and sell or develop for sale surplus property. Land holdings that do not have economically recoverable reserves for current or future mining or are otherwise not in locations that complement the Company’s operating facilities are considered as candidates for sale.

Human Capital Resources

As of January 31, 2022, the Company has approximately 10,000 employees, of which approximately 7,600 are hourly employees and approximately 2,400 are salaried employees. Approximately 1,400 hourly employees (14% of the Company’s employees) are represented by labor unions, representing 19% of the Building Materials business’ hourly employees and 100% of the Magnesia Specialties segment’s hourly employees. The Company’s principal union contracts for the Magnesia Specialties business cover employees at the Manistee, Michigan, magnesia-based chemicals plant and the Woodville, Ohio, lime plant. The Woodville and Manistee collective bargaining agreements expire June 2022 and August 2027, respectively. The Company believes it has good relations with its employees, including its unionized workforce. While the Company’s management does not expect material difficulties in renewing these labor contracts, there can be no assurance that a successor agreement will be reached at any of these locations.

Management believes the Company’s success depends on its ability to attract, develop and retain key personnel. None of Martin Marietta’s accomplishments are possible without its employees; the people who both drive the work and are most affected by it. These individuals are the heart of Martin Marietta. The Company’s management oversees various employee initiatives to foster and improve its employees and the Management Development and Compensation Committee regularly reviews the compensation program to achieve those objectives. In 2020, the Company also launched an Inclusion and Engagement Task Force, comprised of employees with diverse race, gender, background and experience, which is focused on hiring, developing, and retaining diverse employees to strengthen our talent pipeline and increase employee engagement and retention.

|

Form 10-K ♦ Page 10 |

|

SOAR to a Sustainable Future |

Part I ♦ Item 1 – Business

Health and safety in the workplace is one of the Company’s core values. The Guardian Angel safety program provides that every employee has the right, and the obligation, to stop any unsafe condition and that zero safety incidents is achievable. It includes the concept that every employee acts as a wingman for other employees, to observe and act on any situation that potentially creates unsafe circumstances. The companywide safety performance, inclusive of its more recently acquired operations, delivered better than world-class safety levels in 2021, the fifth consecutive year for the Company’s lost-time incident rate.

The COVID-19 pandemic has underscored the importance of keeping the Company’s employees safe and healthy. In response to the pandemic, the Company has taken actions aligned with the Centers for Disease Control and Prevention to implement robust protocols to protect its workforce so that they can safely perform their jobs.

In 2019, the Company established a new employer brand — ONE — that reflects the thoughts, feelings and hearts of employees at every level of Martin Marietta. This included a standard approach to safety mentoring that ensures every employee has the knowledge and resources needed to complete their work safely and efficiently. The Company also established a World Class Task Force, whose mission is to improve Martin Marietta and is fostering a level of communication never before seen at the Company. In 2020, the Company launched an Inclusion and Engagement Steering Committee, comprised of diverse employees across the Company. The Company has taken these steps to better allow it to grow responsibly and encourage employee engagement.

Available Information

The Company maintains an internet address at www.martinmarietta.com. The Company makes available free of charge through its internet website its Annual Report on Form 10‑K, Quarterly Reports on Form 10‑Q, Current Reports on Form 8‑K, and amendments to those reports, if any, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act). You can access the Company’s filings with the SEC through the SEC website at www.sec.gov or through our website, and the Company strongly encourages you to do so. Martin Marietta routinely posts information that may be important to investors on our website at www.ir.martinmarietta.com, and we use this website address as a means of disclosing material information to the public in a broad, non-exclusionary manner for purposes of the SEC’s Regulation Fair Disclosure (Reg FD). The contents of our website are not incorporated by reference in this Form 10-K and shall not be deemed “filed” under the Securities Exchange Act of 1934, as amended. The Company undertakes no obligation to update any statements herein for revisions or changes after the filing date of this Form 10-K other than as required by law.

The Company has adopted a Code of Ethical Business Conduct that applies to all of its Board of Directors, officers and employees. The Company’s code of ethics is available on the Company’s website at www.martinmarietta.com. The Company will disclose on its internet website any waivers of or amendments to its code of ethics as it applies to its directors and executive officers.

The Company has adopted a set of Corporate Governance Guidelines to address matters of fundamental importance relating to the corporate governance of the Company, including director qualifications and responsibilities, responsibilities of key board committees, director compensation and similar matters. Each of the Audit Committee, the Management Development and Compensation Committee, and the Nominating and Corporate Governance Committee of the Board of Directors has adopted a written charter addressing various matters of importance relating to each committee, including the committee’s purposes and responsibilities, an annual performance evaluation of each committee and similar matters. These Corporate Governance Guidelines, and the charters of each of these committees, are available on the Company’s website at www.martinmarietta.com.

The Company’s Chief Executive Officer and Chief Financial Officer are required to file with the SEC each quarter and each year certifications regarding the quality of the Company’s public disclosure of its financial condition. The annual certifications are included as exhibits to this Form 10‑K. The Company’s Chief Executive Officer is also required to certify to the New York Stock Exchange each year that he is not aware of any violation by the Company of the New York Stock Exchange corporate governance listing standards.

|

SOAR to a Sustainable Future |

|

Form 10-K ♦ Page 11 |

Part I ♦ Item 1A – Risk Factors

ITEM 1A – RISK FACTORS

An investment in Martin Marietta common stock or debt securities involves risks and uncertainties. You should consider the following factors carefully, in addition to the other information contained in this Form 10-K, before deciding to purchase or otherwise trade the Company’s securities.

This Form 10-K and other written reports and oral statements made from time to time by the Company contain statements that, to the extent they are not recitations of historical fact, constitute forward-looking statements within the meaning of federal securities law. Investors are cautioned that all forward-looking statements involve risks and uncertainties, and are based on assumptions that the Company believes in good faith are reasonable, but which may be materially different from actual results. Investors can identify these statements by the fact that they do not relate only to historic or current facts. The words “may,” “will,” “could,” “should,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “outlook,” “plan,” “project,” “scheduled,” and similar expressions in connection with future events or future operating or financial performance are intended to identify forward-looking statements. Any or all of the Company’s forward-looking statements in this Form 10‑K and in other publications may turn out to be wrong.

Statements and assumptions on future revenues, income and cash flows, performance, economic trends, the outcome of litigation, regulatory compliance, and environmental remediation cost estimates are examples of forward-looking statements. Numerous factors, including potentially the risk factors described in this section, could affect our forward-looking statements and actual performance.

Investors are also cautioned that it is not possible to predict or identify all such factors. Consequently, the reader should not consider any such list to be a complete statement of all potential risks or uncertainties. Other factors besides those listed may also adversely affect the Company and may be material to the Company. The Company has listed the known material risks it considers relevant in evaluating the Company and its operations. The forward-looking statements in this document are intended to be subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. These forward-looking statements are made as of the date hereof based on management’s current expectations, and the Company does not undertake an obligation to update such statements, whether as a result of new information, future events, or otherwise, other than as required by law.

For a discussion identifying some important factors that could cause actual results to vary materially from those anticipated in the forward-looking statements, see the factors listed below, along with the discussion of “Competition” under Item 1 of this Form 10-K, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under Item 7 of this Form 10-K, and “Note A: Accounting Policies” and “Note O: Commitments and Contingencies” of the “Notes to Financial Statements” of the Company’s consolidated financial statements included under Item 8, “Financial Statements and Supplemental Data,” of this Form 10-K.

|

Form 10-K ♦ Page 12 |

|

SOAR to a Sustainable Future |

Part I ♦ Item 1A – Risk Factors

Industry and COVID-19 Risk Factors

Our business is cyclical and depends on activity within the construction industry

Economic and political uncertainty can impede growth in the markets in which we operate. Demand for our products, particularly in the private nonresidential and residential construction markets, could decline if companies and consumers are unable to obtain credit for construction projects or if an economic slowdown causes delays or cancellations of capital projects. State and federal budget issues may also hurt the funding available for infrastructure spending. The lack of available credit may limit the ability of states to issue bonds to finance construction projects. As a result of these issues, several of our top revenue-generating states, from time to time, stop bidding or slow bid projects in their transportation departments.

We sell most of our aggregates (our primary business) and our cement products to the construction industry and, therefore, our results depend on that industry’s strength. Since our businesses depend on construction spending, which can be cyclical, our profits are sensitive to national, regional and local economic conditions and the intensity of the underlying spending on aggregates and cement products. Construction spending is affected by economic conditions, changes in interest rates, demographic and population shifts, and changes in construction spending by federal, state and local governments. If economic conditions change, a recession in the construction industry may occur and affect the demand for our products. The recession of the late 2000s and early 2010s (the Great Recession) was an example, and our shipment volumes were significantly reduced. Construction spending can also be disrupted by terrorist activity and armed conflicts.

While our business operations cover a wide geographic area, our earnings depend on the strength of the local economies in which we operate because of the high cost to transport our products relative to their selling price. If economic conditions and construction spending decline significantly in one or more areas, particularly in the Building Materials business’ top five revenue-generating states of Texas, Colorado, North Carolina, Georgia and Minnesota, our profitability will decrease. We experienced this situation during the Great Recession.

The Great Recession resulted in large declines in shipments of aggregates products in our industry. Subsequent to the Great Recession and until the impact from COVID-19 beginning in the first quarter of 2020, we experienced slow-but-steady construction growth that coincided with the longest economic recovery in United States history.

While historical spending on public infrastructure projects has been, comparatively, more stable as governmental appropriations and expenditures are typically less interest rate-sensitive than private sector spending, we experienced a slight retraction in aggregates shipments to the infrastructure market after uncertainty regarding the passage of the Highway and Transportation Funding Act of 2014. Contractors were not able to get any certainty on the availability of federal infrastructure funding until late 2015 with the enactment of the Fixing America’s Surface Transportation (FAST) Act. We expect that the passage of the Infrastructure Investment and Jobs Act (the IIJ Act) should provide funding visibility for the foreseeable future.

Our Building Materials business is seasonal and subject to the weather, which can significantly impact operations

Since the heavy-side construction business is conducted outdoors, erratic weather patterns, seasonal changes and other weather-related conditions affect our business. Adverse weather conditions, including hurricanes and tropical storms, cold weather, snow, heavy or sustained rainfall, wildfires and earthquakes, reduce construction activity, restrict the demand for our products and impede our ability to efficiently transport material. Adverse weather conditions also increase our costs and reduce our production output as a result of power loss, needed plant and equipment repairs, time required to remove water from flooded operations and similar events. Severe drought conditions can restrict available water supplies and restrict production. Production and shipment levels of the Building Materials business’ products follow activity in the construction industry, which typically are strongest in the spring, summer and fall. Because of the weather’s effect on the construction industry’s activity, the production and shipment levels for the Company’s Building Materials business, including all of its aggregates-related downstream operations, vary by quarter. The second and third quarters are generally subject to heavy precipitation, and thus are more profitable if precipitation is lighter, while the first and fourth quarters are subject to the impacts of winter weather, and thus are generally the least profitable and are more profitable if the impact of winter weather is less. The Company’s operations in the southeastern and Gulf Coast regions of the United States and The Bahamas are at risk for hurricane activity, most notably in August, September and October. The Company’s California operations are at risk for wildfire activity and water use restrictions given ongoing severe drought conditions.

|

SOAR to a Sustainable Future |

|

Form 10-K ♦ Page 13 |

Part I ♦ Item 1A – Risk Factors

Our businesses could be adversely affected by the ongoing COVID-19 pandemic, or any other outbreak of disease, epidemic or pandemic, or similar public health threat, or fear of such an event and its related economic and societal response