2023 Annual Meeting of Shareholders Proxy Statement Martin Marietta ANNUAL MEETING OF SHAREHOLDERS | PROXY STATEMENT

☐ |

Preliminary Proxy Statement | |||

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☒ |

Definitive Proxy Statement | |||

☐ |

Definitive Additional Materials | |||

☐ |

Soliciting Material under §240.14a-12 | |||

(Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check all boxes that apply): | ||||

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-(6)(i)(1) and 0-11 | |||

2023 Annual Meeting of Shareholders Proxy Statement Martin Marietta ANNUAL MEETING OF SHAREHOLDERS | PROXY STATEMENT

|

April 13, 2023 |

Dear Shareholders:

| It is my pleasure to invite you to attend Martin Marietta’s 2023 Annual Meeting of Shareholders on Thursday, May 11, 2023. This document provides some of the highlights of our key actions and important decisions in 2022, as well as information about our financial and other performance. Please review this Proxy Statement and the 2022 Annual Report for more information about these topics.

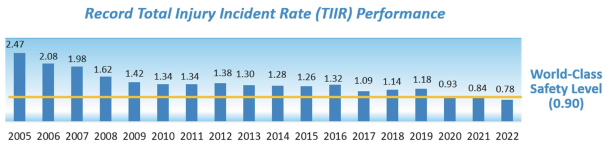

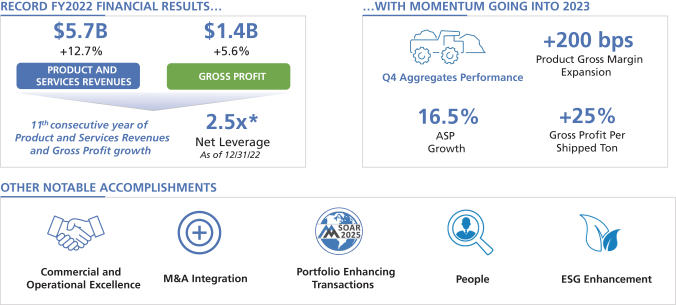

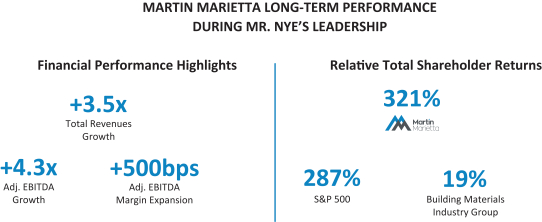

Record 2022 Financial Performance

In 2022 Martin Marietta delivered another year of strong financial results marking eleven years of consecutive growth for consolidated products and services revenues, gross profit and Adjusted EBITDA. We achieved product and services revenues from continuing operations of $5.7 billion, up 13% from $5.1 billion in 2021. We increased our dividend 8% in August 2022 (following a 7% increase in 2021) and during the year returned $309 million to shareholders through a combination of meaningful and sustainable dividends and share repurchases. Our five-year Total Shareholder Return (TSR) is 59% and ten-year TSR is 295%. These significant accomplishments demonstrate the continued success of our deliberate strategic planning process, our team’s outstanding operational execution, and the long-term resiliency and earnings power of our aggregates-led business. |

|

Important Investments for Long-Term Success

Over recent years we have made tremendous progress on our Strategic Operating Analysis and Review (SOAR) 2025 initiatives. Since the launch of SOAR in 2010, the Company has invested nearly $8.0 billion in acquisitions, resulting in an enviable coast-to-coast geographic footprint in which we enjoy leading positions in many of the nation’s most attractive high-growth markets. In 2022, we also invested in our newly acquired West Coast operations with financial and management resources that improved training, safety, equipment, and financial performance. We also divested our Northern California cement facilities, our concrete operations in Southern California, Colorado and Central Texas, and entered into an agreement to divest our Southern California cement facilities. These important portfolio-shaping undertakings help position the Company for continued long-term success and are a testament to our team’s commitment to Martin Marietta’s vision and strategic priorities.

Environmental, Social and Governance Priorities

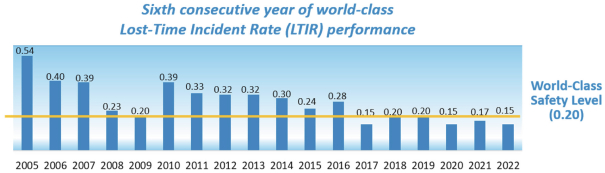

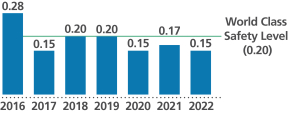

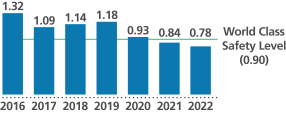

We continued our relentless focus on world-class safety performance, delivering a company-wide Total Injury Incident Rate (TIIR) of 0.78 in 2022, exceeding the world-class rate of 0.90 for the second consecutive year. Moreover, our fidelity to our Guardian Angel culture meant that 99.8% of our over 9,000 employees experienced ZERO lost-time incidents. Our safety performance sets the foundation for our long-term financial strength and successful SOAR execution. Martin Marietta’s goal is ZERO incidents.

Our stakeholders are increasingly focused on environmental, social, and governance (ESG) matters. We recognize the importance of building a resilient and sustainable company; our management’s engagement and the Board of Director’s oversight of our sustainability efforts are focused on transparency, responsiveness and vision. Our senior management team and I engage personally and continuously with our stakeholders to listen carefully and share thoughts regarding ESG; the important feedback we receive on these issues helps inform our policies, practices and disclosures. Among other things, since 2022:

| • | We enhanced transparency of our diversity and inclusion progress by publishing our EEO-1 report data. |

| • | We joined the CEO Pledge for Diversity & Inclusion supporting a trusting environment where all ideas are welcomed and employees comfortable and empowered to have discussions about diversity and inclusion. |

| • | We launched a dedicated section on our Company’s website highlighting Inclusion, Engagement and Diversity at Martin Marietta and elevated the Head of Inclusion and Engagement to a vice president level position. Our Head of Inclusion and Engagement implements programs and training and advances a culture in furtherance of development, retention and engagement of our employees. |

|

| • | We will publish our 9th annual Sustainability Report in April 2023, which will expand our ESG disclosures, add clarity to our business’ related performance, our opportunities and challenges, and commit to goals we can achieve. |

| • | In last year’s letter to you, published in April 2022, I noted our continued progress on sustainability matters, including our Scope 1 reduction targets for greenhouse gas emissions (GHGs) and goals to reduce or offset our Scope 2 GHGs including a Scope 2 goal with a net zero target for 2050 as well as a roadmap for achieving our 2030 and 2050 reduction targets. In our 2022 Sustainability Report published later this month, we will provide more detail on our ambition to be net zero by 2050 across our entire value chain, including various initiatives we have implemented, and plan to implement, to fulfil our commitments. |

| • | We are adding a new website section providing additional transparency with respect to the Company’s political contributions and lobbying activities. |

| • | We refreshed the leadership of the Audit Committee and the Ethics, Environment, Safety and Health (EESH) Committee with a continued focus on diversity and ensuring our Board composition and skills are aligned with our strategy. |

Over the past seven years, we have added seven new independent directors. Almost half (45 percent) of our Board is diverse, including three women, two African American and one Hispanic director, each of whom brings strong backgrounds and experience with publicly-traded companies and adds unique insights to our Board mix. At this year’s Annual Meeting, Smith W. Davis will retire in accordance with the mandatory retirement provision in our bylaws. Mr. Davis has been a superb and insightful member of our Board; we are extremely grateful for his steady guidance and thoughtful leadership throughout his Board tenure and as Chair of our EESH Committee. We wish him well in retirement.

Your Vote Matters

I urge you to promptly cast your vote, You may do so by either returning the enclosed Proxy Card or by the electronic or telephone options described in our Proxy Statement. On behalf of our Board of Directors, thank you for your investment in Martin Marietta. We look forward to continuing to deliver strong and responsible performance, innovation and growth to our customers, our shareholders and our other stakeholders.

Sincerely,

C. Howard Nye

Chairman of the Board, President and Chief Executive Officer

|

Notice of 2023 Annual Meeting of Shareholders

| Item of Business | For More Information See Page | Board Recommendation | ||||||||

|

Annual Meeting of Shareholders

When: Thursday, May 11, 2023, 11:30 a.m. ET

Place: 4123 Parklake Avenue, Raleigh, NC 27612 (our principal executive offices)

Who Can Vote: Shareholders of record at the close of

| ||||||||||

| Item 1 | To elect 10 directors | 23 |

FOR |

|||||||

| Item 2 | To ratify the appointment of PricewaterhouseCoopers LLP as independent auditors for 2023 | 37 |

FOR |

|||||||

| Item 3 | To vote on an advisory resolution to approve the compensation of our named executive officers | 88 |

FOR |

|||||||

| Item 4 | To vote on an advisory resolution regarding the frequency of shareholder votes on executive compensation | 89 |

EVERY 1 YEAR |

|||||||

| Item 5 | To vote on a shareholder proposal, if properly presented at the meeting, described in the accompanying proxy statement |

90 |

AGAINST |

|||||||

| Any other matters that may properly come before the meeting |

| Date of Availability: This Notice, Proxy Statement, the Proxy Card, and the Notice of Meeting are being sent commencing on approximately April 13, 2023 to shareholders of record at the close of business on March 6, 2023.

Your vote is important. You may vote in person at the 2023 Annual Meeting of Shareholders (Annual Meeting) or submit a proxy over the internet. If you have received a paper copy of the Proxy Card (or if you request a paper copy of the materials), you may submit a proxy by telephone or by mail.

Whether or not you expect to attend the meeting, we hope you will date and sign the enclosed Proxy Card and mail it promptly in the enclosed stamped envelope. Submitting your proxy now will not prevent you from voting your shares at the meeting, as your proxy is revocable at your option.

If you submit your proxy by telephone or over the internet, you do not need to return your Proxy Card by mail.

Sincerely,

Roselyn R. Bar Executive Vice President, General Counsel and Corporate Secretary Martin Marietta Materials, Inc. Raleigh, North Carolina April 13, 2023 |

How to Vote: It is important that your shares be represented and voted at the Annual Meeting. We urge you to vote by using any of these methods.

| |||

|

Via the internet www.voteproxy.com | |||

|

|

By Telephone 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from outside the United States | |||

|

|

By Mail Sign, date and mail your proxy card in the envelope provided | |||

|

|

In Person Attend the Annual Meeting and vote by ballot

| |||

| Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Shareholders: The Proxy Statement and Annual Report on Form 10-K are available at https://ir.martinmarietta.com/reports-filings/annual-reports-and-proxies.

|

Table of Contents

| Proxy Statement Highlights | 1 | |||

| The Board of Directors | 14 | |||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| Proposal 1: Election of Directors | 23 | |||

| 28 | ||||

| 29 | ||||

| Beneficial Owners and Management | 30 | |||

| 30 | ||||

| Corporate Governance Matters | 32 | |||

| 32 | ||||

| 33 | ||||

| Proposal 2: Independent Auditors | 37 | |||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| Audit Committee Report | 39 | |||

| Management Development and Compensation Committee Report | 40 | |||

| Compensation Committee Interlocks and Insider Participation in Compensation Decisions | 40 | |||

| Compensation Discussion and Analysis | 41 | |||

| 41 | ||||

| 42 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 48 | ||||

| Compensation Decisions Yielding Alignment with Performance and Enhancing our Corporate Resilience |

52 | |||

| 54 | ||||

| 55 | ||||

| 55 | ||||

| 2022 Named Executive Officers’ Compensation – Our Compensation Strategy |

56 | |||

| 58 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 65 | ||||

| 67 | ||||

| 67 | ||||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| 69 | ||||

| 69 | ||||

| 69 | ||||

| 70 | ||||

| 70 | ||||

| 70 | ||||

| 71 | ||||

| Executive Compensation | 72 | |||

| 72 | ||||

| 72 | ||||

| 73 | ||||

| 75 | ||||

| 76 | ||||

| 76 | ||||

| 78 | ||||

| 79 | ||||

| Required Pay Disclosures | 82 | |||

| 82 | ||||

| 83 | ||||

| Proposal 3: Advisory Vote on the Compensation of Our Named Executive Officers | 88 | |||

| Proposal 4: Advisory Vote on the Frequency of Executive Compensation Vote | 89 | |||

| Proposal 5: Shareholder Proposal, if Properly Presented at the Meeting, Requesting the Establishment Within a Year of GHG Reduction Targets | 90 | |||

| Securities Authorized for Issuance Under Equity Compensation Plans | 96 | |||

| 96 | ||||

| 96 | ||||

| 97 | ||||

| Annual Meeting and Voting Information | 98 | |||

| 101 | ||||

| 101 | ||||

| Appendix A: Martin Marietta Guidelines for Potential New Board Members | A-1 | |||

| Appendix B: Non-GAAP Measures | B-1 | |||

| 2023 PROXY STATEMENT |

|

◆ PROXY

Proxy Statement Highlights

Shareholders Benefit from Martin Marietta’s Record 2022 Performance

This summary provides highlights of selected information about Martin Marietta Materials, Inc. (the Company, Martin Marietta, we or us) from this Proxy Statement. The Board of Directors is providing the Notice of 2023 Annual Meeting of Shareholders, this Proxy Statement and Proxy Card (the Proxy Materials) in connection with the Company’s solicitation of proxies for the 2023 Annual Meeting (the Annual Meeting) to be held on May 11, 2023, and at any adjournment or postponement thereof.

This proxy summary highlights information contained elsewhere in our Proxy Statement. The summary does not contain all the information that you should consider, and we encourage you to read the entire Proxy Statement before voting.

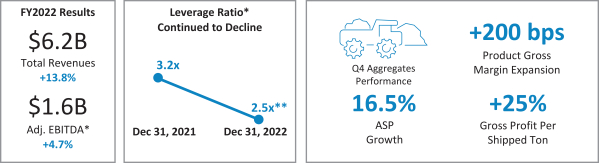

These are highlights of our financial performance in 2022:

| • |

Product and services revenues from continuing operations of $5.7 billion, up 13% |

| • |

Net earnings attributable to continuing operations of $856 million |

| • |

Gross profit from continuing operations of $1.4 billion, an increase of 6% |

| • |

Earnings from operations from continuing operations of $1.2 billion |

| • |

Adjusted EBITDA from continuing operations increased 5% to $1.6 billion* |

| • |

Quarterly dividend increase of 8%, resulting in total annual dividends paid of $159 million, or $2.64 per share on an annualized basis |

| • |

Diluted earnings per share from continuing operations of $13.70 |

| • |

Adjusted diluted earnings per share from continuing operations of $12.07* |

| • |

Capital investments into operations of $482 million |

| • |

Announced and/or completed over $1 billion of non-core asset divestitures in 2022, continuing our long track record of delevering following acquisitions, returning net leverage to 2.5x at December 31, 2022* |

*Please see Appendix B for a reconciliation of non-GAAP measures to GAAP measures

| RECORD FINANCIAL

PRODUCTS AND SERVICES $5.7 B +13%

GROSS PROFIT $1.4 B +6%

ADJUSTED EBITDA $1.6 B +5%

|

| Proposal 1 | Election of 10 Directors The Board recommends a vote FOR each of the Directors |

See pages 23-27 for more information | ||

| Proposal 2 | Ratification of the Appointment of PricewaterhouseCoopers LLP as our Independent Auditors for 2023 The Board recommends a vote FOR ratification of PricewaterhouseCoopers for 2023 |

See pages 37-38 for more information | ||

| Proposal 3 | Advisory Vote to Approve the Compensation of our Named Executive Officers The Board recommends a vote FOR our Say-On-Pay proposal |

See page 88 for more information | ||

| Proposal 4 | Advisory Vote on the Frequency of Executive Compensation Vote The Board recommends EVERY 1 YEAR as the frequency of Executive Compensation Votes |

See page 89 for more information | ||

| Proposal 5 | Vote on a Shareholder Proposal, if properly presented at the meeting The Board recommends AGAINST |

See pages 90-95 for more information | ||

|

MARTIN MARIETTA 1 |

PROXY ◆

Measuring our Performance

|

|

|

|

World-Class Safety We are committed to our Guardian Angel safety culture where Zero is Possible, and achieved a world-class lost-time incident rate (LTIR) for the sixth consecutive year. With a company-wide Total Injury Incident Rate (TIIR) of 0.78, we exceeded the world-class rate of 0.90. |

|

|

|

|

Record Financial Performance We achieved record financial performance in 2022 |

* Please see Appendix B for a reconciliation of non-GAAP measures to GAAP measures.

| 2 2023 PROXY STATEMENT |

|

◆ PROXY

|

|

|

|

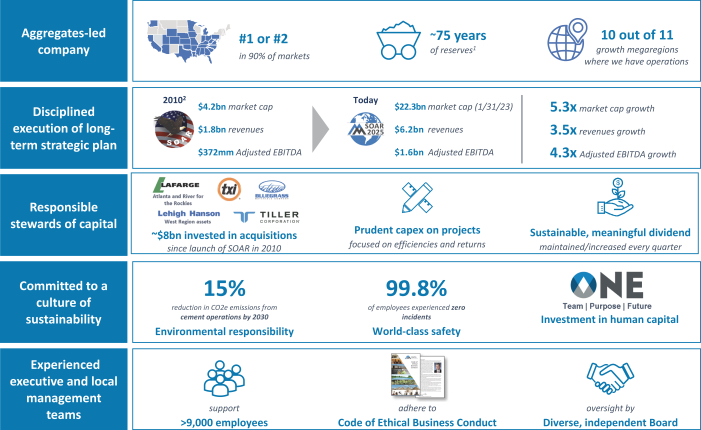

Execution of Strategic Plan Our strategic plan inclusive of targeted platform and bolt-on acquisitions has resulted in best-in-class short- and long-term shareholder returns and has given us a meaningful presence in ten of the 11 U.S. megaregions, large networks of metropolitan population centers covering thousands of square miles. |

|

|

|

|

Creation of Long-Term Value Our accomplishments in 2022 and execution of our strategic plan have helped position the Company for continued long-term success and are a testament to our team’s commitment to Martin Marietta’s vision and strategic priorities |

* Leverage ratio includes the discharge of $700 million in notes due 2023.

|

MARTIN MARIETTA 3 |

PROXY ◆

|

Commitment to Sustainability Sustainability is part of our culture, including operating in an environmentally responsible manner

|

|

|

2050 Net Zero ambition with strong 2030 commitments Martin Marietta has an ambition to be Net Zero by 2050 across our entire value chain. We have made a commitment to reduce the intensity of our Scope 1 CO2e process emissions from our heritage cement operations as compared to 2010 levels by 2030. We have made a commitment to reduce the intensity of our Scope 1 CO2e process emissions from our magnesia specialties business as compared to 2010 levels by 2030. We have made a commitment to reduce or offset 30% of our Scope 2 CO2e emissions by 2030 with a baseline year of 2021 and a goal of Net Zero Scope 2 emissions by 2050.1 We are expanding our Net Zero goals to include a Net Zero by 2050 ambition for our Scope 1 emissions. | |

|

|

Strategy As outlined in our Sustainability Report, Martin Marietta has a roadmap for achieving its sustainability goals including our ambitions and commitments. We seek ways to create lower carbon products. We have a growing recycled aggregates business in Texas, Minnesota and California. We are invested in our Magnesia Specialties business which produces magnesia-based products that help our customers reduce their harmful air emissions and chemical usage, as well as help purify water and neutralize nuclear waste among other applications. Our Management Development and Compensation Committee reviews management’s performance with regard to its sustainability goals and considers those achievements in determining incentive pay. | |

|

|

Resilience We review physical and transition climate risks and the impact on the business of various climate scenarios and opportunities. We disclose those risks and the materiality of those potential impacts in our Annual Report. Our risk management process and sustainability oversight structure allow the Board and management to address and manage climate risks in the same manner as other material risks to the Company. | |

|

|

Collaboration We actively participate in a dialogue to reduce emissions and the related impact on climate change. We participate in working groups both at the Portland Cement Association (PCA) and National Ready Mixed Concrete Association to evaluate the feasibility and/or opportunity associated with PCA’s 2050 “Net Zero Roadmap,” along with other developments relevant to commercial-scale carbon capture and storage (CCS) technologies that we anticipate being considered by the industry in the coming years. We work with Fortera, a Silicon Valley-based materials technology company, that is permitting and constructing a pilot carbon capture plant and determining the feasibility of this technology at other locations. | |

| 1 | Facilities in most source categories subject to the United States Environmental Protection Agency’s (USEPA’s) Greenhouse Gas Reporting Program (codified at 40 CFR Part 98), including cement production, began reporting emissions in 2010. Thus, we believe 2010 is a year with reliable and comparable data across a side range of facilities in the U.S. Our Scope 1 CO2e emissions intensity associated with our cement operations in 2010 was 0.836. Notably, when we announced our 2030 emissions reduction targets in 2019, as described above, we took into account that we have been investing heavily over the past decade to reduce our cement and magnesia emissions, which is reflected in our favorable CO2e intensity performance relative to the U.S. cement industry average. We also believe this has allowed us to achieve significant environmental benefits from reduced emissions well ahead of many other operators in the industry and will position us not only to achieve our targets but to be in a good position to evaluate additional actions in the future. |

| 4 2023 PROXY STATEMENT |

|

◆ PROXY

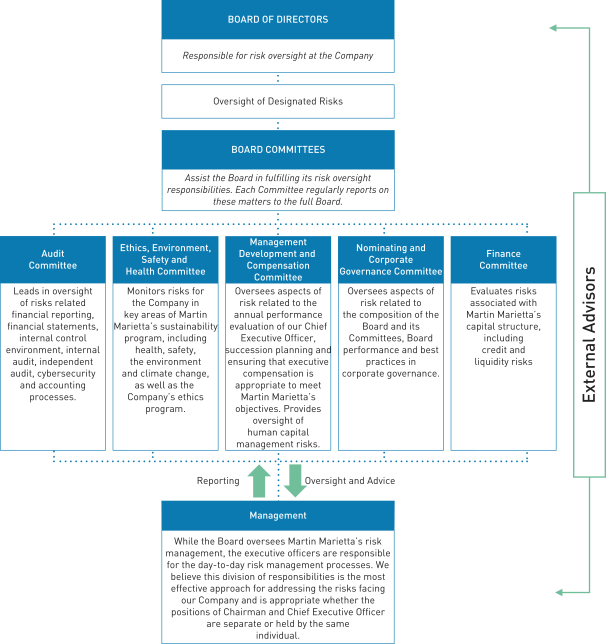

Board Oversight of Risk Management

Our Board currently has ten independent members and only one non-independent member, Mr. Nye. A number of our independent Board members are serving or have served as members of senior management of other public companies, have served as directors of other public companies, and otherwise have experience and/or educational backgrounds that we believe qualify them to effectively assess risk. Each of our Board Committees, including our Audit, Management Development and Compensation, and Nominating and Corporate Governance Committees, are comprised solely of independent Directors, each with a different independent Director serving as Chair of the Committee (other than the Executive Committee, which does not meet on a regular basis).

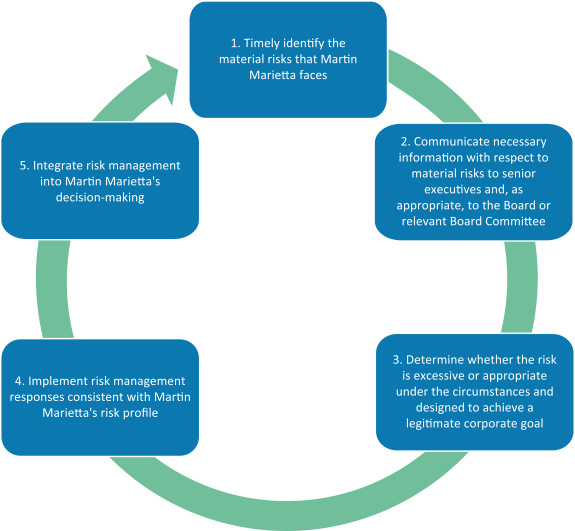

The Board has overall responsibility for oversight of risk management. The Board believes that an effective risk management system will accomplish the following goals:

The Board delegates certain responsibilities to the Committees to assist in fulfilling its risk oversight responsibilities. Each of the Committees reports regularly to the full Board of Directors as to actions taken and topics discussed. In addition, the Board regularly reviews with management the most significant risks facing Martin Marietta, the probabilities of those risks occurring, the steps taken to mitigate any impact of risks, and management’s general risk management strategy. This risk management approach includes consideration of risks and opportunities relating to climate change, sustainability and other ESG matters. In addition, the Board encourages management to promote a corporate culture that incorporates risk management into Martin Marietta’s day-to-day operations.

|

MARTIN MARIETTA 5 |

PROXY ◆

Cybersecurity Risk Management

Our Cybersecurity strategy is overseen by the Audit Committee of our Board of Directors and directed by our Chief Information Officer. Senior management briefs the Audit Committee regarding cybersecurity at least four times per year, and reports to the Board on a regular basis. We provide cybersecurity training to employees on a regular basis; starting in 2023, we will do so on at least an annual basis. Our auditors perform IT general controls testing in connection with their audit compliance work, and we commission recognized external partners in top information security standards to perform penetration testing at least every two years. We believe these audits are an important part of our cybersecurity risk management program.

| 6 2023 PROXY STATEMENT |

|

◆ PROXY

Our Sustainability Governance

Our Board plays an essential role in determining strategic priorities and considers sustainability issues an integral part of its business oversight. Our Corporate Governance Guidelines, set forth a flexible framework within which the Board, assisted by its Committees, directs the affairs of Martin Marietta.

|

Board of Directors |

| • Provides oversight of sustainability issues for the Company.

• Receives a report from each of the Committees on its work relating to sustainability matters.

• Engages in strategic review and risk assessments which also includes management’s sustainability goals, our performance relating to sustainability and our engagement with investors with regard to sustainability matters. | ||

|

Ethics, Environment, Safety and Health Committee |

| • Established in 1994 and meets at least four times annually.

• Comprised wholly of independent directors, whose members are diverse and have relevant expertise to provide appropriate oversight in helping us achieve sustainable growth and reduce our risks.

• Reviews our Sustainability Report and our sustainability performance commitments and goals, including those relating to climate change, as well as capital investments and improved practices that reduce greenhouse gas (GHG) and other emissions.

• Reviews the input we have received from, and our engagement with, investors on climate, sustainability and other ESG matters.

• Monitors our safety performance, Ethics Office activity and compliance with environmental, health and safety laws and regulations, as well as our public reporting and disclosure with respect to climate change-related risks and opportunities and other environmental issues.

• Has the authority to investigate any matter falling within its purview. | ||

|

Management Development and Compensation Committee |

| • Reviews matters relating to human capital management, diversity, equity and inclusion (DEI), talent acquisition and retention, and compensation matters related thereto.

• Reviews management’s performance with regard to its sustainability goals and considers those achievements in determining incentive pay. | ||

|

Audit Committee |

| • Reviews our significant environmental matters and assesses the potential risks and liabilities they may pose to our business. | ||

|

MARTIN MARIETTA 7 |

PROXY ◆

|

Finance Committee |

| • Reviews large capital projects relating to sustainability and growth.

• Oversees our policies and practices relating to political contributions and political activities, including lobbying and/or trade associations of which we are a member, and expenditures.

• Reviews and approves charitable contributions and community support budgets. | ||

|

Nominating and Corporate Governance Committee |

| • Oversees the development and implementation of a set of corporate governance principles applicable to Martin Marietta

• Oversees the review and implementation of best practices in corporate governance matters affecting the Board, its Committees and the Company. | ||

|

Management |

| • The Chairman and CEO, as well as the executive leadership team, guides and governs corporate-wide sustainability objectives and initiatives.

• Our dedicated employees help drive performance of our sustainability agenda, including:

○ Chief Ethics Officer

○ Head of Sustainability

○ Inclusion and Engagement Task Force

○ Head of Inclusion and Engagement

○ Safety teams

○ Environmental managers | ||

| 8 2023 PROXY STATEMENT |

|

◆ PROXY

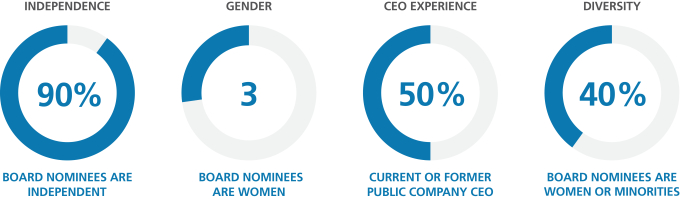

Our Board Practices Promote Sustainable Long-Term Shareholder Value

Corporate Governance Highlights

| Our Board is accountable to our shareholders

• Annual election of Directors

• Majority voting for uncontested Director elections

• Proxy access right for shareholders

• No poison pill

• Disclosure of governance processes implemented by the Board and its committees

Our Board is responsive to our shareholders and is proactive to understand their perspectives

• Proactive, year-round engagement with shareholders

• Engagement topics include Board refreshment, environmental, social and governance (ESG) matters, management compensation, and Board and management diversity

Our shareholders are entitled to voting rights in proportion to their economic interest

• One class of voting stock

• One share, one vote standard |

Our Board adopted practices that enhance its effectiveness

• 10 of 11 Directors are independent

• 3 of our Directors are women comprising 30% of our independent directors

• 3 of our Directors are ethnically diverse

• Significant Board refreshment with 7 new directors in the past 7 years

• Directors reflect a diverse mix of skills and experience

• Annual Board, committee and individual self-assessments

• Board access to management and employees

• Overboarding, anti-hedging and stock ownership policies

| |

| Our Board has strong, independent leadership

• Independent Lead Director

• Annual review of Board leadership structure

• Independent chairs of Board committees

• Only one Director is a Company employee

Our Board has developed a management compensation structure that is aligned with the long-term strategy of the company

• Compensation programs reviewed to include short-and long-term goals tied to the long-range plan and to attract, retain, incentivize and reward excellent performance |

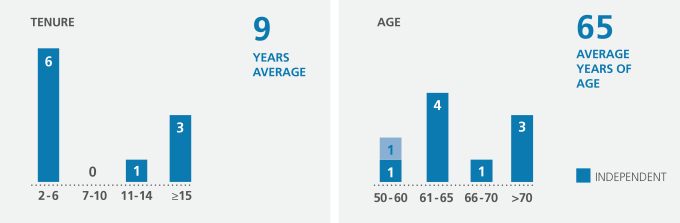

Board Composition and Effectiveness

We seek to include a diverse group of Directors on our Board to provide different perspectives to the Board’s oversight responsibilities. Our Directors demonstrate diversity in the form of experience, geography, gender, ethnicity, age and tenure. We were recognized in 2021, 2019, 2017 and 2015 at the Women’s Forum of New York at its Biennial Breakfast of Corporate Champions for our Board diversity. We were also recognized by 2020 Women on Boards as a Winning ‘W’ Company for eight consecutive years for championing Board diversity.

| 3 | Women represent 3 of our Directors comprising 30% of our current independent directors and 33% of our independent director nominees |

|||||

| 3 | Racially and ethnically diverse – 2 Board members are African American and 1 Board member is Hispanic |

|||||

| 45% |

45% of our Directors bring diversity in gender or ethnicity |

|||||

| 8.5 years

|

The average tenure of our current Directors is 8.5 years |

|||||

|

MARTIN MARIETTA 9 |

PROXY ◆

Practices Contributing to Board Effectiveness

| • | Identification of diverse Board candidates |

| • | Meaningful refreshment |

| • | Rotation of Board committee assignments based on experience and expertise |

| • | Robust onboarding |

| • | Tenure and overboarding guidelines |

| • | Our Board refreshment has resulted in a decrease of the Board’s average tenure, with a greater mix of Directors with long-term knowledge of the Company, its strategy, opportunities and challenges, and those with new perspectives |

Director Nominees

Board Attendance

In 2022, during their terms of service, all directors attended 100% of the Board meetings and all directors attended at least 75% of the committee meetings to which they were assigned. All directors then in office attended the May 2022 Annual Meeting.

| 10 2023 PROXY STATEMENT |

|

◆ PROXY

Effective Shareholder Engagement

| Accountability to our shareholders is an important component of the Company’s success. We recognize the value of building informed relationships with our investors that promote further transparency and accountability. While proxy voting is one direct way to influence corporate behavior, proactive engagement with our investors can be effective and impactful. Investor views are communicated to the Board and are instrumental in the development of our governance, compensation and sustainability policies and inform our business strategy.

During 2022, we engaged in person, through virtual meetings, by telephone, and/or written correspondence with our largest institutional investors and other significant shareholders on an array of governance topics, including our executive compensation programs. We also engaged by telephone conference or written correspondence with stakeholders or other parties on various topics including board composition, executive compensation, human capital management, and ESG matters, as well as other topics of interest. |

||

|

2022 INVESTOR OUTREACH

~ 200 INVESTMENT GROUPS

| ||

At our 2022 Annual Meeting of Shareholders, 94% of the shares cast voted in favor of the advisory vote on executive compensation, or Say On Pay. We have made meaningful changes to our compensation program in recent years based on feedback from shareholders consisting of:

| • | The elimination of the excise tax gross-up in executive officers’ Employment Protection Agreements |

| • | The elimination of the walk-right and value of perks in the severance calculation in executive officers’ Employment Protection Agreements |

| • | The decision to not include these provisions in future Employment Protection Agreements |

| • | The elimination of the single-trigger vesting for equity awards beginning in 2019 |

|

MARTIN MARIETTA 11 |

PROXY ◆

Proactively Engaging and Responding to Shareholders

Shareholder Governance Highlights:

|

Majority voting standard for uncontested Director elections

|

|

Annual advisory vote to approve executive compensation | |||||

|

Longstanding active shareholder engagement

|

|

Annual Sustainability Report that provides information on our environmental footprint, safety record and community engagement • Created a new position to better focus on these important issues • Our Board committees review the Company’s goals and accomplishments with regard to sustainability

| |||||

|

|

|||||||

|

|

No shares with enhanced voting rights |

|

Updated Board Committee Charters for ESG matters, Diversity, Engagement and Inclusion, and Political Contributions | |||||

| 12 2023 PROXY STATEMENT |

|

◆ PROXY

Our Commitment to Our People and Pay-for-Performance

In 2022, we advanced our initiatives relating to employee engagement

| ✓ | Developed and launched an inclusion and engagement awareness communications campaign to help managers and employees better understand why inclusion and engagement matters and how inclusion and engagement are already ingrained in Martin Marietta’s culture and values. The campaign highlights that ensuring we maintain an inclusive and engaging culture will help create a competitive advantage for the Company. |

| ✓ | Launched a dedicated section on our Company’s external website to highlight Inclusion, Engagement and Diversity at Martin Marietta. |

| ✓ | Developed guidelines and strategies to launch Martin Marietta’s first three Employee Resource Groups, supporting veterans, women and diverse cultures, in early 2023. |

| ✓ | Joined the CEO Action for Diversity & Inclusion coalition. |

| ✓ | Elevated the Head of Inclusion and Engagement position to a Vice President level. |

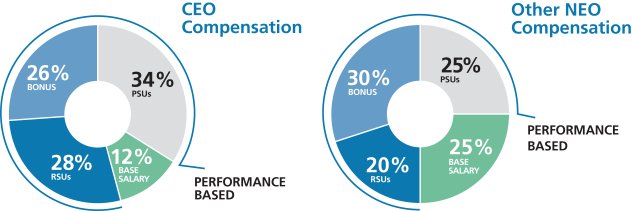

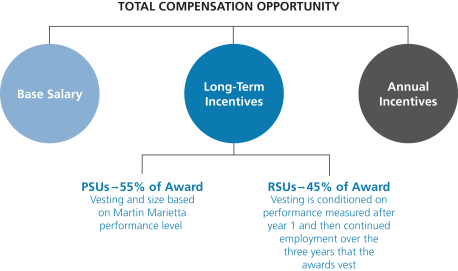

Our Compensation Approach and Highlights

A substantial portion of compensation paid to our named executive officers (NEOs) is variable and performance-based. We use the 50th percentile of our peer group as a reference point when determining target compensation, but target pay is set based on a variety of factors and actual pay realized by our NEOs is dependent on our financial, operational and other related performance. Based on our record levels of performance in 2022, variable compensation payable under both our short-term and long-term incentive plans exceeded the target amounts established for each NEO, which is consistent with our pay-for-performance philosophy. All compensation paid to our CEO and other NEOs for 2022 was performance-based other than base salary; approximately 88% of our CEO’s compensation was performance-based and 75% of our other NEOs’ actual compensation was performance based.*

* Based on grant date value of Performance Share Units (PSUs) and Restricted Stock Units (RSUs).

|

MARTIN MARIETTA 13 |

The Board of Directors

The Board of Directors currently consists of eleven members, ten of whom are non-employee Directors. Under our Bylaws, nominations of persons for election to the Board may be made at an Annual Meeting of Shareholders by the Board and by any shareholder who complies with the notice procedures set forth in the Bylaws. As described in the Proxy Statement for our 2022 Annual Meeting, for a nomination to be properly made by a shareholder at the 2023 Annual Meeting, the shareholder’s notice must have been sent to, and received by, our Secretary at our principal executive offices between January 13, 2023 and February 12, 2023. No such notice was received during this period.

The Bylaws of the Company provide that a Director will retire at the Annual Meeting of Shareholders following the Director’s 75th birthday. One of our current Directors, Smith W. Davis, reached this mandatory retirement age this year and is not eligible for election at the Annual Meeting for a new term. Mr. Davis has stated that he intends to serve as a Director through the commencement of the 2023 Annual Meeting of shareholders, after which he will retire from the Board. The Board extends its sincere appreciation to Mr. Davis for his years of service and thoughtful Board leadership. Mr. Davis gave generously of his time and consistently provided the Board with independent insight and advice, which have been invaluable to the Board and to Martin Marietta. In light of the retirement of Mr. Davis, the Board of Directors has set the size of the Board at ten effective upon the commencement of the 2023 Annual Meeting.

The Nominating and Corporate Governance Committee from time to time retains a search firm to help identify director prospects, perform candidate outreach, assist in reference checks, and provide other related services. The recruiting process typically involves either the Chairman, President and CEO, the search firm or a member of the Nominating and Corporate Governance Committee contacting a prospect to gauge their interest and availability. A candidate will then meet with several members of the Nominating and Corporate Governance Committee and sometimes the Board. At the same time, the Nominating and Corporate Governance Committee and the search firm will contact references for the prospect. A background check is completed before a final recommendation is made to the Board to appoint a candidate to the Board.

The Board has nominated ten persons for election as Directors to serve a one-year term expiring in 2024. Unless otherwise directed, proxies will be voted in favor of these nominees. Each nominee has agreed to serve if elected. Each of the nominees is currently serving as a Director. Should any nominee become unable to serve as a Director, the persons named in the enclosed form of proxy will, unless otherwise directed, vote for the election of such other person for such position as the present Board of Directors may recommend in place of such nominee. Proxies cannot be voted for a greater number of persons than the number of nominees named. Should any of the listed nominees be unavailable for election by reason of death or other unexpected occurrence, the proxy, to the extent permitted by applicable law, may be voted with discretionary authority in connection with the nomination by the Board and the election of any substitute nominee.

Board Effectiveness and Refreshment

Board composition is one of the most critical areas of focus for the Board of Directors. Having the right mix of people who bring diverse perspectives, business and professional experiences, and skills provides a foundation for robust dialogue, informed advice and collaboration in the boardroom. The Nominating and Corporate Governance Committee develops criteria for open Board positions, taking into account a variety of factors, which may include current Board member skills, composition, age, tenure, other diversity factors, the range of talents and experience that would best complement those already represented on the Board, the need for specialized expertise, and anticipated retirements to define gaps that may need to be filled through the Board refreshment process. The Board strives to ensure an environment that encourages diverse critical thinking and values innovative, strategic discussions to achieve a higher level of success for the Company.

The Nominating and Corporate Governance Committee screens and recommends candidates for nomination by the full Board. It uses a variety of methods to help identify potential Board candidates with the desired skills and background needed for the Company’s business, including from time to time informal networks, third-party search firms and other channels. When the Committee is assisted from time to time with its recruitment efforts by an outside search firm, the firm recommends candidates that satisfy the criteria defined by the Board, and provides background research and pertinent information regarding prospective candidates.

| 14 2023 PROXY STATEMENT |

|

BOARD EFFECTIVENESS AND REFRESHMENT ◆ THE BOARD OF DIRECTORS

Once the Committee has identified a prospective nominee, it makes an initial determination as to whether to conduct a full evaluation. In making this determination, the Committee takes into account various information, including information provided at the time of the candidate recommendation, the Committee’s own knowledge, and information obtained through inquiries to third parties to the extent the Committee deems appropriate. The preliminary determination is based primarily on the need for additional Board members and the likelihood that the prospective nominee can satisfy the criteria that the Committee has established. If the Committee determines, in consultation with the Chairman, President and CEO and other Directors as appropriate, that additional consideration is warranted, it may request management or a third-party search firm to gather additional information about the prospective nominee’s background and experience and to report its findings to the Committee. The Committee then evaluates the prospective nominee against the specific criteria that it has established for the position, as well as the standards and qualifications set out in the Company’s Corporate Governance Guidelines, including:

| • | the ability of the prospective nominee to represent the interests of the shareholders of the Company; |

| • | the prospective nominee’s standards of integrity, commitment and independence of thought and judgment; |

| • | the prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of their duties, including the prospective nominee’s service on other public company boards, as specifically set out in the Company’s Corporate Governance Guidelines; |

| • | the extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board; and |

| • | the extent to which the prospective nominee helps the Board reflect the diversity of the Company’s shareholders, employees, customers and the communities in which it operates. |

If the Committee decides, on the basis of its preliminary review, to proceed with further consideration, members of the Committee, the Chairman, President and CEO, as well as other members of the Board as appropriate, interview the nominee. After completing this evaluation and interview, the Committee makes a recommendation to the full Board, which makes the final determination whether to nominate or appoint the new Director after considering the Committee’s report. A background check is completed before a final recommendation is made to the Board to appoint a candidate to the Board.

In selecting nominees for the Board, the Board seeks to achieve a mix of members who together bring experience and personal backgrounds relevant to the Company’s strategic priorities and the scope and complexity of the Company’s business. The Board also seeks a demonstrated ability to manage complex issues that involve a balance of risk and reward. The background information on current nominees beginning on page 23 and the skills matrix on page 16 set out how each of the current nominees contributes to the mix of experience and qualifications the Board seeks. In making its recommendations with respect to the nomination for re-election of existing Directors at the annual shareholders meeting, the Committee assesses the composition of the Board at the time and considers the extent to which the Board continues to reflect the criteria set forth above.

|

MARTIN MARIETTA 15 |

THE BOARD OF DIRECTORS ◆ BOARD QUALIFICATIONS, GENDER AND DIVERSITY

Board Qualifications, Gender and Diversity

The following sets forth certain information for each nominee for election regarding age, gender, diversity, tenure and skills that are important to the Board of Directors.

|

Demographics and Background |

|

|

|

|

|

|

|

|

|

| ||||||||||

| Age |

65 |

72 |

51 |

72 |

60 |

69 |

63 |

74 |

61 |

63 | ||||||||||

| Gender |

F | F | M | M | M | F | M | M | M | M | ||||||||||

| African American/Black |

● | |||||||||||||||||||

| Hispanic |

● | |||||||||||||||||||

| White |

● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Tenure |

4 | 21 | 2 | 6 | 13 | 18 | 3 | 15 | 6 | 2 | ||||||||||

| Qualification & Experience |

||||||||||||||||||||

| Corporate Governance/Legal Ensures background and knowledge necessary to provide effective oversight and governance |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Current or Former CEO of Public Company Strong leadership skills and critical experience with demands and challenges of managing a large public organization |

● | ● | ● | ● | ● | |||||||||||||||

| Financial or Accounting Enables in-depth analysis of our financial statements, capital structure, financial transactions, and financial reporting process |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Government Relations/Regulatory/Sustainability Critical for understanding complex regulatory and governmental environment that impacts our business and our strategic goals relating to sustainability |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Logistics/Operations Necessary in overseeing a sustainable company that relies heavily on logistics |

● | ● | ● | ● | ● | ● | ● | |||||||||||||

| Other Public Boards Adds perspective important to shareholders and public company governance |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Risk Management Facilitates understanding of the risks facing the Company and appropriate process and procedures for managing them |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Strategy/M&A Supports setting of long-term corporate vision, disciplined strategic development and integration to facilitate the Company’s growth |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Technology Facilitates business objectives and security of the Company’s proprietary and confidential data |

● | ● | ● | ● | ● | |||||||||||||||

The Board has implemented a number of processes to assist it in refreshing the Board in an appropriate manner that helps create shareholder value.

| 16 2023 PROXY STATEMENT |

|

BOARD QUALIFICATIONS, GENDER AND DIVERSITY ◆ THE BOARD OF DIRECTORS

|

Board Refreshment Elements

|

| Review of Board Candidates |

The Board seeks a diverse group of candidates who, at a minimum, possess the background, skills, expertise and time to make a significant contribution to the Board, the Company and its shareholders. The Corporate Governance Guidelines list criteria against which candidates may be assessed. In addition, the Nominating and Corporate Governance Committee considers, among other things:

• input from the Board’s self-assessment process to prioritize areas of expertise that were identified;

• investor feedback and perceptions;

• the candidates’ skills and competencies to ensure they are aligned with the Company’s future strategic challenges and opportunities; and

• the needs of the Board in light of recent and anticipated Board vacancies.

During the process of identifying and selecting director nominees, the Nominating and Corporate Governance Committee screens and recommends candidates for nomination by the full Board. The Bylaws provide that the size of the Board may range from 9 to 11 members.

Director candidates also may be identified by shareholders and will be evaluated under the same criteria applied to other director nominees and considered by the Nominating and Corporate Governance Committee. Information on the process and requirements for shareholder nominees may be found in our Bylaws on the Company’s website at https://ir.martinmarietta.com/corporate-governance/governance-documents-and-charters. | |

| Board Assignments |

Each February, the Nominating and Corporate Governance Committee reviews the membership, tenure, leadership and commitments of each of the Committees and considers possible changes given the qualifications and skill sets of members on the Board or a desire for committee rotation or refreshment. The Nominating and Corporate Governance Committee also takes into consideration the membership requirements and responsibilities set forth in each of the respective Committee charters and the Corporate Governance Guidelines as well as any upcoming vacancies on the Board due to our mandatory retirement age. The Nominating and Corporate Governance Committee recommends to the Board any proposed changes to Committee assignments and leadership to be made effective at the next Annual Meeting of Shareholders. The Nominating and Corporate Governance Committee also reviews the operation of the Board generally. | |

| Refreshment |

The Board has added seven new directors in the past seven years. At the same time, obtaining a detailed understanding of the Company’s business takes time. We believe that implementing term limitations may prevent the Board from taking advantage of insight that longer tenure brings. | |

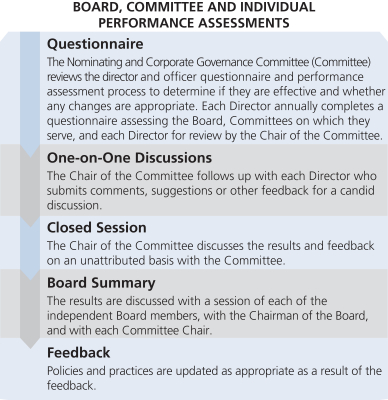

| Annual Performance Assessment |

The Board conducts a self-assessment of its performance and effectiveness as well as that of its Committees on an annual basis. The self-assessment helps the Nominating and Corporate Governance Committee track progress in certain areas targeted for improvement from year-to-year and to identify ways to enhance the Board’s and its Committees’ effectiveness. For 2022, each director completed a written questionnaire. The questions were open-ended to solicit candid feedback. The collective ratings and comments are compiled and summarized and then discussed by the Nominating and Corporate Governance Committee and the full Board. | |

| Onboarding and Education |

New directors are provided with an orientation about the Company, including our business operations, strategy and governance. Directors also are provided continuing education by subject matter experts and/or continuing education programs sponsored by educational and other institutions to assist them in staying abreast of developments in corporate governance and critical issues relating to the operation of public company boards. Members of our senior management regularly review with the Board the operating plan of each of our business segments and the Company as a whole. The Board also conducts periodic visits to our facilities as part of its regularly scheduled Board meetings. | |

|

Tenure Guidelines

|

| Mandatory Retirement Age |

Directors must retire at the annual meeting following their 75th birthday. | |

| Employment Change |

Directors must report to the Chairman of the Board and Chairman of the Nominating and Corporate Governance Committee regarding any significant change in principal employment or responsibilities to assure they can continue to commit the appropriate time to Board service. | |

|

MARTIN MARIETTA 17 |

THE BOARD OF DIRECTORS ◆ BOARD, COMMITTEE AND INDIVIDUAL DIRECTOR EVALUATIONS

Board, Committee and Individual Director Evaluations

As a part of our continuous improvement process intended to enhance the Board’s overall effectiveness, the Board regularly evaluates its performance through self-assessments, corporate governance reviews and periodic charter reviews. Those evaluations, changes in our business strategy or operating environment, and the future needs of the Board in light of anticipated director retirements are used to identify desired backgrounds and skill sets for future Board members. The feedback solicited from Board members regarding the Board, each Committee on which they serve, and individual Board members is one of the tools used to assist the Nominating and Corporate Governance Committee in its responsibility to evaluate Board and Committee performance annually.

| 18 2023 PROXY STATEMENT |

|

BOARD COMMITTEES ◆ THE BOARD OF DIRECTORS

Board Committees

Martin Marietta’s Board of Directors has six standing Committees: the Audit Committee; the Ethics, Environment, Safety and Health Committee; the Executive Committee; the Finance Committee; the Management Development and Compensation Committee; and the Nominating and Corporate Governance Committee. Each Committee has a written charter that describes its purposes, membership, meeting structure, authority and responsibilities. These charters are reviewed by the respective Committee on an annual basis with any recommended changes adopted upon approval by our Board. The charters of our six standing Committees are posted on our website.

Below is a summary of our current Committee structure and membership information.

| Director |

Independent Director |

Audit Committee |

Ethics, Environment, Safety and Health Committee |

Executive Committee |

Finance Committee |

Management Development and Compensation Committee |

Nominating and Corporate Governance Committee | |||||||

| Dorothy M. Ables Financial Expert |

Yes |

✓ |

Chair |

|||||||||||

| Sue W. Cole |

Yes | ✓ | ✓ | |||||||||||

| Smith W. Davis |

Yes | ✓ | ✓ | |||||||||||

| Anthony R. Foxx |

Yes | ✓ | ✓ | |||||||||||

| John J. Koraleski Lead Independent Director Financial Expert |

Yes |

✓ |

✓ |

Chair |

||||||||||

| C. Howard Nye* |

Chair | |||||||||||||

| Laree E. Perez Financial Expert |

Yes |

✓ |

✓ | |||||||||||

| Thomas H. Pike |

Yes | ✓ | ✓ | |||||||||||

| Michael J. Quillen |

Yes | ✓ | Chair | ✓ | ||||||||||

| Donald W. Slager |

Yes | ✓ | Chair | |||||||||||

| David C. Wajsgras Financial Expert |

Yes |

Chair |

✓ | |||||||||||

*Mr. Nye is the only member of management on the Board.

The Executive Committee held no meetings during 2022. It has the authority to act during the intervals between the meetings of the Board of Directors and may exercise the powers of the Board in the management of the business and affairs of Martin Marietta as may be authorized by the Board of Directors, except to the extent such powers are reserved to the full Board by statute, by our Articles of Incorporation, or by our Bylaws. The Executive Committee’s current members are Directors Nye (Chair), Koraleski, and Quillen.

|

MARTIN MARIETTA 19 |

THE BOARD OF DIRECTORS ◆ BOARD COMMITTEES

The primary responsibilities, membership and meeting information for our other standing Committees are summarized below

|

Audit Committee |

| Current Members: David C. Wajsgras (Chair) Dorothy M. Ables John J. Koraleski Laree E. Perez |

Primary Responsibilities:

• Reviews our significant accounting principles, policies and practices in reporting our financial results under generally accepted accounting principles.

• Reviews our annual audited financial statements and related disclosures.

• Reviews management letters or internal control reports, and reviews our system of internal control over financial reporting.

• Appoints, retains and oversees the work of the independent auditors.

• Reviews the effectiveness of the independent audit effort.

• Pre-approves audit and permissible non-audit services provided by the independent registered public accounting firm.

• Reviews our interim financial results for each fiscal quarter.

• Reviews the qualifications and the plan and scope of work of the corporate internal audit function.

• Reviews and discusses the reports of our internal audit group.

• Reviews and discusses management’s assessment of the effectiveness of Martin Marietta’s system of internal control over financial reporting.

• Discusses Martin Marietta’s earnings press releases, as well as financial information and earnings guidance provided to analysts, investors and rating agencies.

• Discusses matters related to risk assessment and risk management and how the process is handled by management.

• Reviews and oversees related party transactions.

• Reviews complaints regarding accounting, internal controls or auditing matters.

• Considers allegations of possible financial fraud or other financial improprieties.

• Reviews annually the adequacy of the Committee charter and recommends proposed changes to the Board.

• Prepares the annual Audit Committee Report to be included in the Proxy Statement.

Other Governance Matters:

All members of the Audit Committee, including the Chair, are audit committee financial experts under applicable U.S. Securities and Exchange Commission (SEC) regulations.

The Chair of the Audit Committee is an independent Director.

The Chair of the Audit Committee has experience serving as a Chair and member of other public company audit committees.

All members satisfy the audit committee experience and independence standards required by the New York Stock Exchange (NYSE). | |

|

Meetings in 2022 6 | ||

|

Average Attendance in 2022: 100% | ||

| 20 2023 PROXY STATEMENT |

|

BOARD COMMITTEES ◆ THE BOARD OF DIRECTORS

|

Ethics, Environment, Safety and Health Committee |

| Current Members: Dorothy M. Ables (Chair) Sue W. Cole Smith W. Davis Anthony R. Foxx |

Primary Responsibilities:

• Monitors compliance with our Code of Ethical Business Conduct and reviews all matters presented to it by the Corporate Ethics Officer concerning the ethical practices of Martin Marietta and its Directors, officers, and employees, including conflicts or potential conflicts of interest between Martin Marietta and any of its Directors, officers, and employees.

• Reviews and discusses our sustainability efforts, goals and risks, and our annual Sustainability Report.

• Reviews and monitors the adequacy of our policies and procedures and organizational structure for ensuring compliance with environmental laws and regulations.

• Reviews matters relating to our health and safety programs and performance.

• Reviews annually the adequacy of the Committee charter and recommends proposed changes to the Board.

• Oversees environmental performance, initiatives and results, including annual and long-term targets and commitments.

• Reviews the Company’s strategy, programs, initiatives and performance with respect to climate change and other sustainability matters. | |

|

Meetings in 2022 3 | ||

|

Average Attendance 100% | ||

|

Finance Committee |

| Current Members: Michael J. Quillen (Chair) Anthony R. Foxx Thomas H. Pike Donald W. Slager |

Primary Responsibilities:

• Provides general oversight relating to the management of our financial affairs.

• Reviews and approves establishment of lines of credit or other short-term borrowing arrangements and investing excess working capital funds on a short-term basis.

• Reviews and makes recommendations to the Board concerning changes to capital structure, including the incurrence of long-term debt, issuance of equity securities, share repurchases, and the payment of dividends, as well as capital expenditures.

• Reviews annually the adequacy of the Committee charter and recommends proposed changes to the Board.

• Oversees our policies and practices on political contributions, including those contained in our Code of Ethical Business Conduct, and reviews our political activities, including lobbying and/or through trade associations of which we are a member, and expenditures, and ensure that any such activities are consistent with and serve to promote our business strategy and goals.

• Reviews and approves charitable contributions and community support budgets. | |

|

Meetings in 2022 4 | ||

|

Average Attendance 100% | ||

|

MARTIN MARIETTA 21 |

THE BOARD OF DIRECTORS ◆ BOARD COMMITTEES

|

Management Development and Compensation Committee |

| Current Members: John J. Koraleski (Chair) Thomas H. Pike Michael J. Quillen David C. Wajsgras |

Primary Responsibilities:

• Establishes an overall strategy with respect to compensation for officers and management to enable Martin Marietta to attract and retain qualified employees.

• Reviews and oversees executive succession and management development plans.

• Reviews and approves management’s assessment of the performance of executive officers, and reviews and approves the salary, incentive compensation, and other compensation of such officers.

• Approves and administers our equity and other plans relating to compensation of Martin Marietta’s directors and executive officers.

• Reviews and discusses the Compensation Discussion and Analysis and produces a compensation committee report as required by the SEC to be included in this Proxy Statement.

• Provides oversight of our Benefit Plan Committee, which administers Martin Marietta’s defined benefit and contribution plans.

• Reviews and approves the goals and objectives for the CEO’s compensation, evaluates the CEO’s performance in light of those goals and objectives, and determines and approves the CEO’s compensation.

• Makes recommendations to the Board on changes in the compensation of non-employee directors.

• Reviews annually the adequacy of the Committee charter and recommends proposed changes to the Board.

• Has the authority, in its sole discretion, to retain, pay, and terminate any consulting firm, if any, used to assist in evaluating director, CEO, or senior executive compensation.

• Reviews matters relating to human capital management, diversity, equity and inclusion (DEI), talent acquisition and retention, and compensation matters related thereto.

Other Governance Matters:

All members are non-employee, independent Directors as required by the rules of the NYSE, the Martin Marietta Guidelines for Director’s Independence, applicable rules of the SEC, and the Committee’s charter. | |

|

Meetings in 2022 4 | ||

|

Average Attendance in 2022: 100% | ||

|

Nominating and Corporate Governance Committee |

| Current Members: Donald W. Slager (Chair) Sue W. Cole Smith W. Davis Laree E. Perez |

Primary Responsibilities:

• Develops criteria for nominating and appointing directors, including Board size and composition, corporate governance policies, and individual director expertise, attributes and skills.

• Recommends to the Board the individuals to be nominated as directors.

• Recommends to the Board the appointees to be selected for service on the Board Committees.

• Oversees an annual review of the performance of the Board and each Committee.

• Reviews annually the adequacy of the Committee charter and recommends proposed changes to the Board.

• Oversees the development and implementation of a set of corporate governance principles applicable to Martin Marietta.

Other Governance Matters:

All members are non-employee, independent Directors as required by the rules of the NYSE.

Upon recommendation of this Committee, the Board of Directors has adopted a set of Corporate Governance Guidelines for Martin Marietta. The Guidelines are posted and available for public viewing on our website at https://ir.martinmarietta.com/corporate-governance. A copy may also be obtained upon request from Martin Marietta’s Corporate Secretary. | |

| Meetings in 2022 3 | ||

| Average Attendance in 2022: 100% | ||

| 22 2023 PROXY STATEMENT |

|

| Proposal 1: |

Election of Directors |

The following sets forth the age, experience, key attributes and other biographical information for each nominee for election as a director for a one-year term until the 2024 Annual Meeting of Shareholders.

DOROTHY M.

Director Since: 2018 Age: 65 Committees:

Chair |

Ms. Ables joined the Martin Marietta Board in November 2018. Ms. Ables held a number of executive positions with Spectra Energy and predecessor companies, including serving from 2008 to 2017 as the Chief Administrative Officer of Spectra Energy Corp. where she was responsible for human resources, information technology, support services, community relations and audit services. Prior to that, she served as Vice President of Audit Services and Chief Ethics and Compliance Officer for Spectra Energy, Vice President and Chief Compliance Officer for Duke Energy Corporation, an American electric power holding company, and Senior Vice President and Chief Financial Officer for Duke Energy Gas Transmission. Spectra Energy was a Fortune 500 Company and one of North America’s leading pipeline and midstream companies prior to its acquisition by Enbridge Inc. in 2017. (NYSE: ENB) Ms. Ables started her career in the audit department of Peat, Marwick, Mitchell & Co. Ms. Ables serves as Chair of the Audit Committee and a member of the Governance and Social Responsibility Committee of Coterra Energy (NYSE: CTRA), an independent oil and gas company, which is the result of the merger of Cabot Oil & Gas Corporation (NYSE: COG) and Cimerex Energy Co. in October 2021. Ms. Ables served as an Independent Director of Cabot, an independent oil and gas company, where she was chair of the Audit Committee from 2019 to 2021 and a member of the Audit and Compensation Committees from 2015 to 2021. She served as a Director of Spectra Energy Partners, an affiliate of Spectra Energy Corp., from 2013 to 2017. Ms. Ables attended the University of Texas at Austin where she earned a Bachelor of Business Administration degree in Accounting. |

Key attributes, experience and skills:

• More than nine years of C-Suite experience

• Financial expertise acquired through serving as CFO of Duke Energy Gas Transmission and as Vice President of Audit Services and Chief Compliance Officer of Spectra Energy Corp. and Duke Energy Corporation

• Valuable business leadership in human resources, information technology, community relations, finance and financial statements

• Strong leadership skills and familiarity with Texas, an important state for the Company | ||

SUE W. COLE Director Since: 2002 Age: 72 Committees:

|

Ms. Cole is the managing partner of SAGE Leadership & Strategy, LLC, an advisory firm for businesses, organizations and individuals relating to strategy, governance and leadership development. Ms. Cole was previously a principal of Granville Capital Inc., a registered investment advisory firm, from 2006 to 2011, and before that she was the Regional CEO, Mid-Atlantic Region, of U.S. Trust Company, N.A., where she was responsible for the overall strategic direction, growth, and leadership of its North Carolina, Philadelphia and Washington, D.C. offices. Ms. Cole previously held various positions in the U.S. Trust Company, N.A. and its predecessors. Ms. Cole has previously served on the public-company board of UNIFI, Inc. (NYSE: UFI), a manufacturer of textured yarns. She has also been active in community and charitable organizations, including previously serving as Chairman of the North Carolina Chamber of Commerce, the North Carolina Biotech Center and the Greensboro Science Center. She is currently Chair of the National Association of Corporate Directors. Ms. Cole attended the University of North Carolina at Greensboro where she earned a Bachelor of Science degree in Business Administration and a Masters in Business Administration in Finance. |

Key attributes, experience and skills:

• Valuable experience in executive compensation, corporate governance, human resources, finance and financial statements, and customer service

• Chief executive officer of several financial services businesses as well as several non-profit organizations

• Strong leadership skills and familiarity with North Carolina, an important state for the Company | ||

|

MARTIN MARIETTA 23 |

PROPOSAL 1: ELECTION OF DIRECTORS ◆ DIRECTOR NOMINEES

ANTHONY R.

Director Since: 2020 Age: 51 Committees:

|

Mr. Foxx served from October 2018 to January 2022 as Chief Policy Officer and advisor to the President and Chief Executive Officer of Lyft, Inc. Prior to joining Lyft, he served as the seventeenth United States Secretary of Transportation from 2013 to 2017, where he led an agency with more than 55,000 employees and a $70 billion budget, whose primary goal was to ensure that America maintains the world’s safest, most efficient transportation system. Previously, Mr. Foxx served as the Mayor of Charlotte, North Carolina, from 2009 to 2013. Since January 2021, Mr. Foxx also serves as an independent director and member of the Audit Committee and Nominating and Governance Committee of CDW Corporation (NASDAQ: CDW), a leading multi-brand technology solutions provider to business, government, education, and healthcare customers, and since May 2021, Mr. Foxx has served as an independent director for NXP Semiconductors, a world leader in secure connectivity solutions for embedded applications. Mr. Foxx earned his Bachelors degree at Davidson College and his Juris Doctor degree at New York University Law School. |

Key attributes, experience and skills:

• Extensive experience in legal, compliance and corporate governance

• Brings valuable experience from his elected position as Mayor of Charlotte, North Carolina and as United States Secretary of Transportation relating to leadership, finance matters, corporate governance, legal, governmental and regulatory issues, safety, health and environmental matters

• Brings additional perspective to the Board on diversity and corporate citizenship | ||

JOHN J.

Director Since: 2016 Age: 72

Lead Independent

Committees:

Chair |

Mr. Koraleski joined the Martin Marietta Board in 2016. Mr. Koraleski served from February 2015 through his retirement in September 2015 as executive Chairman of the Board of the Union Pacific Corporation (UP) (NYSE: UNP), which through its subsidiaries operates North America’s premier railroad franchise, covering 23 states across the western two-thirds of the United States. Prior to that, he was named President and Chief Executive Officer of the UP in March 2012, elected as a Director of the UP in July 2012 and appointed Chairman of the Board in 2014. Since joining the Union Pacific (Railroad) in 1972, Mr. Koraleski held a number of executive positions in the UP and the Railroad, including, Executive Vice President – Marketing and Sales from 1999 to 2012, Executive Vice President – Finance and Information Technology, Chief Financial Officer and Controller. Mr. Koraleski served as the Chairman of The Bridges Investment Fund, Inc., a general equity fund whose primary investment objective is to seek long-term capital appreciation, from 2005 through March 2012 and is a past Chairman of the Association of American Railroads. Mr. Koraleski earned a Bachelor’s and Master’s degree in business administration from the University of Nebraska at Omaha. |

Key attributes, experience and skills:

• Experience with the demands and challenges associated with managing a large publicly-traded organization from his experience as Chairman and CEO of Union Pacific

• Extensive knowledge of financial system management, public company accounting, disclosure requirements and financial markets

• Valuable expertise in talent management, compensation, governance and succession planning

• Understanding of complex logistic operations, safety and rail operations

• Broad strategic analysis and experience with acquisitions, integration, marketing and information technologies | ||

| 24 2023 PROXY STATEMENT |

|

DIRECTOR NOMINEES ◆ PROPOSAL 1: ELECTION OF DIRECTORS

C. HOWARD

Director Since: 2010 Age: 60 Committees:

Chair |

Mr. Nye has served as Chairman of the Board of Martin Marietta since 2014, as President since 2006 and as Chief Executive Officer and a Director since 2010. Mr. Nye previously served as Chief Operating Officer from 2006 to 2009. Prior to joining Martin Marietta in 2006, Mr. Nye spent nearly 13 years in a series of increasingly responsible positions with Hanson PLC, an international building materials company. Mr. Nye received a Bachelor’s degree from Duke University and a Juris Doctor degree from Wake Forest University. In addition to his educational, professional, executive and related roles, Mr. Nye is a past Chairman of the Board of each of the National Stone, Sand & Gravel Association (NSSGA), the North Carolina Chamber, and the American Road & Transportation Builders Association (ARTBA). Mr. Nye is also a member of the Board of Directors and the Executive Committee of the United States Chamber of Commerce, the world’s largest business organization. Since 2018, Mr. Nye has been a member of the Board of Directors of General Dynamics Corporation (NYSE: GD), a global aerospace and defense company. From 2015 to 2018, Mr. Nye was also an independent director for Cree, Inc. (NASDAQ: CREE), an American manufacturer and marketer of lighting-class lighting products. In 2019, Forbes magazine recognized Mr. Nye as one of America’s Most Innovative Leaders; he was previously recognized by both Aggregates Manager and Pit & Quarry magazines, as Aggman of the Year and a Hall of Fame inductee, respectively. Mr. Nye has also served on numerous other state, local and/or philanthropic organizations including the boards of directors of the University of North Carolina Health System and the Research Triangle Foundation, as well as the Board of Governors of the Research Triangle Institute. He also served as Co-Chair of the NC FIRST Commission (evaluating North Carolina’s current and future transportation investment needs). |

Key attributes, experience and skills:

• Extensive knowledge of the building materials industry

• Extensive leadership, business, operating, marketing, mergers and acquisitions, legal, customer-relations, and safety and environmental experience

• Understands the competitive nature of the business and has strong management skills, broad executive experience, and corporate governance expertise

• Broad strategic vision for the future growth of Martin Marietta | ||

LAREE E.

Director Since: 2004 Age: 69 Committees:

|

Ms. Perez is an investment consultant with DeRoy & Devereaux, an independent investment adviser, where she has provided client consulting services since 2015. She was previously Owner and Managing Partner of The Medallion Company, LLC, a consulting firm, from 2003 to 2015. Ms. Perez was previously a Director of GenOn Energy, Inc. (NYSE: GEN), one of the largest power producers in the United States, from 2002 to 2012, and served as the Chairman of the audit committee of GenOn Energy, Inc. from 2002 to 2007 and a member of its audit and risk and finance oversight committees from 2008 to 2012. Previously, she was Vice President of Loomis, Sayles & Company, L.P. and co-founder, President and Chief Executive Officer of Medallion Investment Company, Inc. In addition to civic and charitable organizations, Ms. Perez served as Vice Chairman of the Board of Regents at Baylor University and previously served on the Board of Trustees of New Mexico State University, where she was also Chairman of the Board. Ms. Perez earned a Bachelor’s degree from Baylor University in Finance and Economics. |

Key attributes, experience and skills:

• Significant business, financial and private investment experience

• Significant expertise with respect to financial statements, corporate finance, accounting and capital markets, mergers and acquisitions, and strategic analysis

• Insight into auditing best practices

• Familiarity with the southwestern United States | ||

|

MARTIN MARIETTA 25 |

PROPOSAL 1: ELECTION OF DIRECTORS ◆ DIRECTOR NOMINEES

THOMAS H.

Director Since: 2019 Age: 63 Committees:

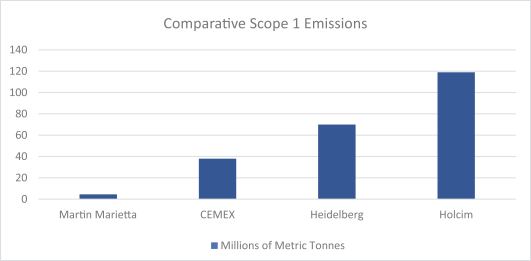

|