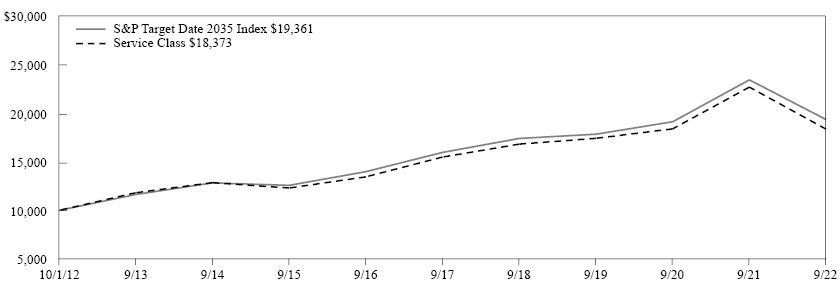

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-08274 | ||||

| MassMutual Select Funds | |||||

| (Exact name of registrant as specified in charter) | |||||

| 1295 State Street, Springfield, MA | 01111 | ||||

| (Address of principal executive offices) | (Zip code) | ||||

| Paul LaPiana | |||||

| 1295 State Street, Springfield, MA 01111 | |||||

| (Name and address of agent for service) | |||||

| Registrant's telephone number, including area code: | (413) 744-1000 | ||||

| Date of fiscal year end: | 9/30/2022 | ||||

| Date of reporting period: | 9/30/2022 | ||||

Item 1. Reports to Stockholders.

| (a) | The Reports to Stockholders are attached herewith. |

Table of Contents |

|

This material must be preceded or accompanied by a current prospectus (or summary prospectus, if available) for the applicable MassMutual Funds. Investors should consider a Fund’s investment objective, risks, and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus (or summary prospectus, if available). Read it carefully before investing.

[THIS PAGE INTENTIONALLY LEFT BLANK]

MassMutual Funds Annual Report – President’s Letter to Shareholders (Unaudited) |

To Our Shareholders

Paul LaPiana

“At MassMutual, our goal is to help you build the future you want for yourself and your family. We want to help you with your retirement plans today, so you can feel more comfortable about tomorrow.”

September 30, 2022

Continued market volatility challenges retirement investors

I am pleased to present you with the MassMutual Funds Annual Report. During the fiscal year ended September 30, 2022, U.S. stocks were down over 15%, with investors concerned that stimulus-fueled recovery from the COVID-19 pandemic was over and that domestic monetary policy had turned toward combating heightened inflation. Stocks in foreign developed markets and emerging markets also experienced significant losses in the fiscal year, hurt by elevated energy prices, a strengthening U.S. dollar, and concerns that consumer spending and corporate earnings growth would slow. U.S. bond investors experienced negative returns in the rising interest rate environment, fueled by aggressive interest rate hikes by the U.S. Federal Reserve Board that were aimed at reducing demand-driven inflationary pressures.

Suggestions for retirement investors under any market conditions

|

● |

You are likely in it for the long term. Retirement planning involves what financial professionals refer to as “long-term investing,” since most people save and invest for retirement throughout their working years. Even in retirement, many individuals will systematically withdraw their retirement savings over a number of years, keeping a portion of their funds invested. Although the financial markets will go up and down, individuals who take a long-term approach to investing don’t focus on current headlines – because they realize that they have time to ride out the downturns. |

|

● |

Keep contributing. While you have no control over the investment markets, you can control how often and how much you contribute to your retirement account. Saving as much as possible and increasing your contributions regularly is one way retirement investors can help boost their retirement savings, regardless of the performance of the stock and bond markets. |

|

● |

Invest continually.1 Financial professionals often advise their clients to stay in the market, regardless of short-term results. Here’s why: Those who can invest in all market conditions have the potential to be rewarded even during market downturns, when more favorable prices may enable them to accumulate larger positions. |

|

● |

Monitor your asset allocation and diversify. Stocks, bonds, and short-term/money market investments are asset classes that tend to behave differently, depending upon the economic and market environment. These broad asset classes contain an even greater array of asset sub-categories (such as small-cap stocks, international stocks, and high-yield bonds). Most financial professionals agree that investors can take advantage of different opportunities in the market and reduce the risk of over-exposure to one or two poorly performing asset types by selecting a number of investments that represent a mix of asset classes and sub-categories. |

1 Systematic investing and asset allocation do not ensure a profit or protect against loss in a declining market. Systematic investing involves continuous investment in securities regardless of fluctuating price levels. Investors should consider their ability to continue investing through periods of low price levels.

(Continued)

1

MassMutual Funds Annual Report – President’s Letter to Shareholders (Unaudited) (Continued) |

Is this a good time to track your progress?

If you work with a financial professional, you may wish to consider checking in with him or her to help you determine if:

|

● |

you are saving enough for retirement – and, if in retirement, you are withdrawing an appropriate amount each year, based on your personal circumstances; |

|

● |

your retirement account is invested appropriately for all market conditions, based on your goals and objectives, as well as your investment time horizon; and |

|

● |

you are taking steps to help reduce your longevity risk, which is the chance that you could “run out” of retirement savings during your lifetime. |

Get to where you want to be

At MassMutual, our goal is to help you build the future you want for yourself and your family. We want to help you with your retirement plans today, so you can feel more comfortable about tomorrow. That’s why we continue to encourage you to maintain perspective when it comes to retirement investing, regardless of any headline-making events. MassMutual’s view is that changing market conditions have the potential to reward patient investors. Thank you for your continued confidence and trust in MassMutual.

Sincerely,

Paul LaPiana

President

MassMutual Funds

MML Investment Advisers, LLC

© 2022 Massachusetts Mutual Life Insurance Company (MassMutual®), Springfield, MA 01111-0001. All rights reserved. www.MassMutual.com.

MML Distributors, LLC (MMLD) serves as the exclusive wholesale marketing agent for all MassMutual Funds, as well as the distributor for all MassMutual Funds, except the MassMutual Global Floating Rate Fund, MassMutual Global Credit Income Opportunities Fund, MassMutual Emerging Markets Debt Blended Total Return Fund, MassMutual Global Emerging Markets Equity Fund, MassMutual High Yield Fund, and MassMutual Short-Duration Bond Fund. MMLD Member FINRA and SIPC (www.FINRA.org and www.SIPC.org), 1295 State Street, Springfield, MA 01111-0001. Investment advisory services are provided to all MassMutual Funds by MML Investment Advisers, LLC (MML Advisers). MMLD and MML Advisers are subsidiaries of MassMutual.

The information provided is the opinion of MML Advisers and is subject to change without notice. It is not to be construed as tax, legal, or investment advice. Of course, past performance does not guarantee future results.

MM202310-303203

2

MassMutual Funds Annual Report – Economic and Market Overview (Unaudited) |

September 30, 2022

Continued market volatility challenges retirement investors

During the fiscal year ended September 30, 2022, U.S. stocks were down over 15%, with investors concerned that stimulus-fueled recovery from the COVID-19 pandemic was over and that domestic monetary policy had turned toward combating heightened inflation. Stocks in foreign developed markets and emerging markets also experienced significant losses in the fiscal year, hurt by elevated energy prices, a strengthening U.S. dollar, and concerns that consumer spending and corporate earnings growth would slow. U.S. bond investors experienced negative returns in the rising interest rate environment, fueled by aggressive interest rate hikes by the U.S. Federal Reserve Board (the “Fed”) that were aimed at reducing demand-driven inflationary pressures.

Market Highlights

|

● |

For the reporting period from October 1, 2021 through September 30, 2022, U.S. stocks were down over 15%, in a market environment where the Fed aggressively raised interest rates in an effort to combat heightened inflation. |

|

● |

In the fourth quarter of 2021, expectations for strong economic and earnings growth in 2022, bolstered by the possibility of a $2 trillion economic stimulus and social spending plan, allowed investors to look past sharp increases in COVID-19 Omicron variant cases and heightened inflationary pressures. |

|

● |

In the first quarter of 2022, investors in both stocks and bonds were challenged by a sharp rise in energy prices after Russia’s invasion of Ukraine, a stalled domestic economic stimulus plan, and the Fed raising interest rates for the first time since 2018. |

|

● |

The second quarter of 2022 was another difficult quarter, as Fed interest rate hikes, investor concerns over high inflation, and concern about the potential of an impending global recession dominated the narrative. |

|

● |

The third quarter of 2022 was an extension of the difficult second quarter, with continued inflationary pressures, weakening economic data, and aggressive Fed interest rate hikes. |

|

● |

Foreign stocks in developed markets and emerging markets also experienced losses in the fiscal year, against the backdrop of Russia’s invasion of Ukraine (and the resulting economic sanctions that kept energy prices elevated), the strengthening U.S. dollar, and threatened consumer spending and corporate earnings growth. |

|

● |

U.S. bond investors experienced negative returns in the rising interest rate environment, fueled by an increase in short-term interest rates, heighted inflationary pressures, and the reversal of monetary and fiscal policy support. |

Market Environment

For the fiscal year beginning on October 1, 2021, global stock investors experienced significant losses. U.S. stocks fell sharply in the period in response, with the S&P 500 Index® (“S&P 500”)1 entering bear market territory after declining more than 20% from its previous highs. Investors sought safety from high inflation, rising interest rates, and the increasing possibility of a recession. Consumer sentiment fell sharply, down 17.2% in the period2, as high inflation – driven by rising energy, food, and housing costs – overwhelmed low unemployment and strong wage growth. As of August 2022, more Americans are borrowing to make ends meet in these inflationary times, resulting in consumer loan levels at record highs, having increased by 12.4% year-over-year3.

1 The S&P 500 Index measures the performance of 500 widely held stocks in the U.S. equity market. Standard and Poor’s chooses member companies for the index based on market size, liquidity, and industry group representation. Included are the stocks of industrial, financial, utility, and transportation companies. Since mid-1989, this composition has been more flexible and the number of issues in each sector has varied. It is market capitalization-weighted. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

2 June 24, 2022, University of Michigan: Consumer Sentiment (UMCSENT), retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UMCSENT

3 Board of Governors of the Federal Reserve System (US), Consumer Loans, All Commercial Banks [CONSUMER], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CONSUMER, October 11, 2022.

3

MassMutual Funds Annual Report – Economic and Market Overview (Unaudited) (Continued) |

As a result, the broad market S&P 500 fell 15.47% for the period. The technology-heavy NASDAQ Composite Index4 performed even worse, dropping 26.25%. The more economically sensitive Dow Jones Industrial AverageSM5 was down 13.40%. During the reporting period, small-cap stocks underperformed their larger-cap peers, while value stocks outperformed their growth brethren. The communication services, consumer discretionary, and information technology sectors were all down by 20% or more. The energy sector was the strongest performer for the fiscal year, up 45.70%, aided by an 18% increase in the price of West Texas Intermediate (WTI) crude oil. The utilities sector also ended the period positively, gaining 5.58% for the period.

Developed international markets, as measured by the MSCI EAFE® Index6, trailed their domestic peers, ending the fiscal year down 25.13%. Emerging-market stocks, as measured by the MSCI Emerging Markets Index7, also fell sharply, ending down 28.11% for the period. Investors sold off developed international and emerging-market stocks on concerns that higher interest rates and commodity prices would impair consumer spending and corporate earnings growth.

Bond yields rose sharply during the fiscal year, with the 10-year U.S. Treasury bond yield rising from a low of 1.52% on October 1, 2021 to close the period at 3.83%. Rising yields generally produce falling bond prices; consequently, bond index returns suffered. The Bloomberg U.S. Aggregate Bond Index8 ended the period down 14.60%. Investment-grade corporate bonds fared even worse. The Bloomberg U.S. Corporate Bond Index9, which tracks investment-grade corporate bonds, ended the period with an 18.53% loss. The Bloomberg U.S. Corporate High-Yield Bond Index10 also ended in negative territory, declining 14.14% for the period.

4 The NASDAQ Composite Index measures the performance of all domestic and international based common type stocks listed on the NASDAQ Stock Market. It includes common stocks, ordinary shares, ADRs, shares of beneficial interest or limited partnership interests and tracking stocks. The index is market capitalization-weighted. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

5 The Dow Jones Industrial Average Index measures the performance of stocks of 30 U.S. blue-chip companies covering all industries with the exception of transportation and utilities. It is price-weighted. The Index does not reflect any deduction for fees or expenses and cannot be purchased directly by investors.

6 The MSCI EAFE Index measures the performance of the large- and mid-cap segments of developed markets, excluding the U.S. and Canada equity securities. It is free float-adjusted market-capitalization weighted. The Index does not reflect any deduction for fees or expenses and cannot be purchased directly by investors.

7 The MSCI Emerging Markets Index measures the performance of the large- and mid-cap segments of emerging market equity securities. It is free float-adjusted market-capitalization weighted. The Index does not reflect any deduction for fees or expenses and cannot be purchased directly by investors.

8 The Bloomberg U.S. Aggregate Bond Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market securities, including Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS). It rolls up into other Bloomberg flagship indexes, such as the multi-currency Global Aggregate Index and the U.S. Universal Index, which includes high yield and emerging markets debt. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

9 The Bloomberg U.S. Corporate Bond Index measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate, taxable corporate bond market. It includes U.S. dollar-denominated securities publicly issued by U.S. and non-U.S. industrial, utility, and financial issuers that meet specified maturity, liquidity, and quality requirements. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

10 The Bloomberg U.S. Corporate High-Yield Bond Index measures the performance of U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bonds, including corporate bonds, fixed-rate bullet, putable, and callable bonds, SEC Rule 144A securities, original issue zeros, pay-in-kind bonds, fixed-rate and fixed-to-floating capital securities. The Index does not reflect any deduction for fees, expenses, or taxes and cannot be purchased directly by investors.

4

MassMutual Funds Annual Report – Economic and Market Overview (Unaudited) (Continued) |

Review and maintain your strategy

MassMutual is committed to helping people secure their long-term future and protect the ones they love. While the current market volatility, including the reality of market sell-offs, can test an investor’s mettle, we’d like to remind you that, as a retirement investor, it’s important to maintain perspective and have realistic expectations about the future performance of your investment accounts. As described in this report, financial markets can reverse suddenly with little or no notice. That’s why we continue to believe that retirement investors should create and maintain a plan that focuses on their goals, how long they have to invest, and how comfortable they are with market volatility. Our multi-managed and sub-advised mutual funds tap into the deep expertise of seasoned asset managers who are committed to helping long-term investors prepare for retirement – in all market conditions. As always, we recommend that you work with a personal financial professional, who can help you define an investment strategy that aligns with your comfort level with respect to market volatility, how long you have to save and invest, and your specific financial goals. Thank you for your confidence in MassMutual.

© 2022 Massachusetts Mutual Life Insurance Company (MassMutual®), Springfield, MA 01111-0001. All rights reserved. www.MassMutual.com.

MML Distributors, LLC (MMLD) serves as the exclusive wholesale marketing agent for all MassMutual Funds, as well as the distributor for all MassMutual Funds, except the MassMutual Global Floating Rate Fund, MassMutual Global Credit Income Opportunities Fund, MassMutual Emerging Markets Debt Blended Total Return Fund, MassMutual Global Emerging Markets Equity Fund, MassMutual High Yield Fund, and MassMutual Short-Duration Bond Fund. MMLD Member FINRA and SIPC (www.FINRA.org and www.SIPC.org), 1295 State Street, Springfield, MA 01111-0001. Investment advisory services are provided to all MassMutual Funds by MML Investment Advisers, LLC (MML Advisers). MMLD and MML Advisers are subsidiaries of MassMutual.

The information provided is the opinion of MML Advisers and is subject to change without notice. It is not to be construed as tax, legal, or investment advice. Of course, past performance does not guarantee future results.

5

MassMutual Total Return Bond Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MassMutual Total Return Bond Fund, and who is the Fund’s subadviser?

The Fund seeks maximum total return, consistent with preservation of capital and prudent investment management, by investing, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in a diversified portfolio of investment grade fixed income securities (rated Baa3 or higher by Moody’s, BBB- or higher by Standard & Poor’s, BBB- or higher by Fitch, or A-2 by S&P, P-2 by Moody’s, or F-2 by Fitch for short-term debt obligations, or, if unrated, determined by the Fund’s subadviser to be of comparable quality). The Fund’s subadviser is Metropolitan West Asset Management, LLC (MetWest).

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Class I shares returned -15.97%, underperforming the -14.60% return of the Bloomberg U.S. Aggregate Bond Index (the “benchmark”), which measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market securities, including Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS).

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

For the fiscal year ended September 30, 2022, although the Fund began the year positioned defensively, Fund management extended the portfolio’s duration position in a disciplined fashion alongside the rise in Treasury yields. Ultimately, the Fund ended the period with a duration that was longer than the benchmark’s. This modestly weighed on returns, while further headwinds resulted from the curve-steepening bias that was maintained throughout the fiscal year. (Duration is a measure of a bond fund’s sensitivity to interest rates. The longer the duration, the greater the price impact on the bond or portfolio when interest rates rise or fall. The yield curve is a graph showing the term structure of interest rates by plotting the yields of all bonds of comparable quality with maturities ranging from the shortest – typically one month – to the longest – typically 30 years – available. The resulting curve shows whether short-term interest rates are higher or lower than long-term rates.)

Elsewhere, the Fund’s residential MBS exposure was a drag on performance, given the struggles faced by both agency- and non-agency-backed collateral during the year, in addition to volatility, increased costs of financing – and, in the agency MBS space, reduced Federal Reserve purchasing activity. (“Agency” refers to debt issued by U.S. federal government agencies or government-sponsored entities for financing purposes). The Fund’s small allocation to CMBS and ABS modestly reduced returns, as yield spreads in both sectors widened in sympathy with the broader market.

Turning to corporate securities, returns were decreased by the Fund’s emphasis on defensive sectors, including consumer non-cyclicals and communications, as they were among the poorer performers during the fiscal year. Nevertheless, the Fund’s relative underweight to overall corporate credit throughout the first half of the period benefited performance and helped to blunt the impact of the downdraft faced by corporates in early 2022. As market dislocations and price declines became more pronounced in the latter part of the fiscal year, the Fund expanded its risk budget, meaningfully increasing its corporate credit allocation in the process and ending the fiscal year overweight relative to the benchmark. These additions, made during times of yield premiums rising and asset prices falling, ultimately weighed on performance.

The Fund’s use of derivatives to manage duration and yield curve positioning had a minimal impact on performance. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Most derivatives are used for hedging, speculation, or both.

Subadviser outlook

MetWest notes that any attempt to understand the full economic fallout of a tightening cycle this aggressive against the competing crosswinds of a consumer still fairly flush with cash – and anxious to spend that money on services and experiences post-pandemic – is a nearly impossible task. In Fund management’s view, possibly clouding the outlook further will be the often overlooked, but impactful repercussions of quantitative tightening, which could take many more months to become apparent. Meanwhile, unlike in recessions past, as of the end of the fiscal year, there was no major economy well positioned to pull the

6

MassMutual Total Return Bond Fund – Portfolio Manager Report (Unaudited) (Continued) |

rest of the world along on its coattails of strong growth. In MetWest’s view, synchronized global tightening, combined with the lagged effects of policy, could mean that volatility will come in a generally declining market, with credit of all types weakening as the cumulative impact of these changes takes hold. As long as economic and monetary policy continues to shift, MetWest believes that the current period of volatility could persist for some time. On the positive side, however, Fund management notes that these market conditions create opportunities that can be exploited by disciplined active managers, potentially setting the stage for strong performance as the volatility ultimately subsides.

7

MassMutual Total Return Bond Fund – Portfolio Manager Report (Unaudited) (Continued) |

MassMutual |

|

U.S. Government Agency Obligations and Instrumentalities* |

37.9% |

Corporate Debt |

29.5% |

U.S. Treasury Obligations |

28.7% |

Non-U.S. Government Agency Obligations |

17.2% |

Mutual Funds |

2.3% |

Bank Loans |

2.2% |

Sovereign Debt Obligations |

1.1% |

Municipal Obligations |

0.2% |

Common Stock |

0.1% |

Rights |

0.0% |

Total Long-Term Investments |

119.2% |

Short-Term Investments and Other Assets and Liabilities |

(19.2)% |

Net Assets |

100.0% |

|

* |

May contain securities that are issued by a U.S. Government Agency, but are unsecured and are not guaranteed by a U.S. Government Agency. |

8

MassMutual Total Return Bond Fund – Portfolio Manager Report (Unaudited) (Continued) |

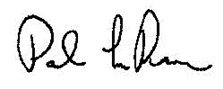

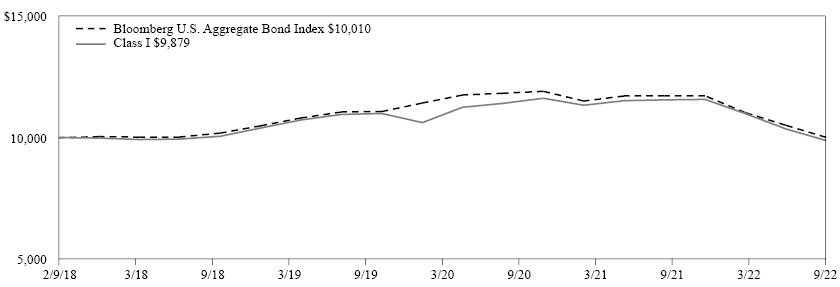

GROWTH OF $10,000 INVESTMENT - Class I

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 09/30/2022) |

|||||

|

Inception Date |

1 Year |

5 Years |

10 Years |

Since Inception |

Class I |

07/06/2010 |

-15.97% |

-0.09% |

0.98% |

|

Class R5 |

07/06/2010 |

-15.99% |

-0.17% |

0.87% |

|

Service Class |

07/06/2010 |

-16.14% |

-0.30% |

0.76% |

|

Administrative Class |

07/06/2010 |

-16.20% |

-0.37% |

0.67% |

|

Class R4 |

07/06/2010 |

-16.35% |

-0.52% |

0.53% |

|

Class A |

04/01/2014 |

-16.40% |

-0.63% |

0.51% |

|

Class A (sales load deducted)* |

04/01/2014 |

-19.96% |

-1.49% |

0.00% |

|

Class R3 |

07/06/2010 |

-16.54% |

-0.78% |

0.28% |

|

Bloomberg U.S. Aggregate Bond Index |

|

-14.60% |

-0.27% |

0.89% |

1.05% |

* Class A (sales load deducted) returns include the 4.25% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

9

MassMutual Strategic Bond Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MassMutual Strategic Bond Fund, and who are the Fund’s subadvisers?

The Fund seeks a superior total rate of return by investing in fixed income instruments. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in U.S. dollar-denominated fixed income securities and other debt instruments of domestic and foreign entities, including corporate bonds, securities issued or guaranteed as to principal or interest by the U.S. Government or its agencies or instrumentalities, mortgage-backed securities, and money market instruments. The Fund’s subadvisers are Western Asset Management Company, LLC (Western Asset) and its affiliate, Western Asset Management Company Limited (Western Asset Limited), which were responsible for approximately 59% of the Fund’s portfolio (Western Asset Limited manages the non-U.S. dollar denominated investments of the Fund); and Brandywine Global Investment Management, LLC (Brandywine Global), which was responsible for approximately 41% of the Fund’s portfolio, as of September 30, 2022.

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Class R5 shares returned -17.14%, underperforming the -14.60% return of the Bloomberg U.S. Aggregate Bond Index (the “benchmark”), which measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market securities, including Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS).

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

With respect to the Western Asset component of the Fund, in aggregate, their top-down macro strategies detracted from performance. For most of the reporting period, the Western Asset Fund component had more interest rate exposure (duration) than the benchmark, which significantly detracted from performance as interest rates rose considerably from the beginning to the end of the period. Duration is a measure of a bond fund’s sensitivity to interest rates. The longer the duration, the greater the price impact on the bond or portfolio when interest rates rise or fall. Over the period, the 10-year U.S. Treasury yield rose from 1.52% to 3.83%. During the fiscal year, the 5s-30s section of the curve, which compares 5-year rates to 30-year rates, ended the period inverted at -0.27%, versus 1.10% at the beginning of the period. Thus, the portfolio’s yield curve positioning, which was focused on an overweight to the back end of the curve, contributed to returns. (The yield curve is a graph showing the term structure of interest rates by plotting the yields of all bonds of comparable quality with maturities ranging from the shortest – typically one month – to the longest – typically 30 years – available. The resulting curve shows whether short-term interest rates are higher or lower than long-term rates.)

For the fiscal year ended September 30, 2022, the Western Asset Fund component’s exposures to non-U.S. developed markets negatively impacted performance, mainly due to currency positioning, as the U.S. dollar (USD) appreciated versus long currency positions. The portfolio’s emerging-markets exposures, which included both local currency and USD-denominated positions, also meaningfully detracted from results over the period, mainly due to the sell-off in Russian assets as a result of sanctions and the Ukraine invasion, but also as USD-denominated emerging-market bond spreads widened, though some local currency positions provided a partial offset. In terms of contributors, an underweight to agency MBS contributed, as spreads gradually widened during the period. (“Agency” refers to debt issued by U.S. federal government agencies or government-sponsored entities for financing purposes.) Finally, exposures to structured products – including non-agency residential mortgage-backed securities (RMBS), CMBS and ABS – positively contributed to performance due to selection, as spreads generally widened during the 12-month period. Finally, Western Asset used derivative instruments to manage its overall duration and yield curve exposure, overall interest rate sensitivity, and exposures to certain international bond markets – as well as to manage against anticipated changes in interest rates. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Derivatives are used for hedging, speculation, or both. Overall, the Fund component portfolio’s use of derivatives detracted from performance during the period.

For the Brandywine Global component of the Fund, an overweight allocation to long-dated U.S. Treasuries was the key detractor from performance on both a relative and absolute basis, as U.S. interest rates increased during the Fund’s fiscal year. Fund management materially increased Brandywine Global’s allocation to these securities in the spring of 2022, after yields initially

10

MassMutual Strategic Bond Fund – Portfolio Manager Report (Unaudited) (Continued) |

surged higher and macroeconomic concerns appeared. In Brandywine Global’s view, it is not atypical for the Fund component to underperform in the latter innings of a blow-off top in yields, like the current market environment. Brandywine Global believes that the Fund component’s overweight allocation to U.S. Treasuries remains a high-conviction trade. On a positive note, Brandywine Global’s underweight allocation to both investment-grade corporate credits and mortgage-backed securities proved beneficial during the fiscal year, as yields were rising and spreads were (marginally) widening over the period. Credit spreads represent the difference in yields between nearly identical bonds with comparable maturities but different quality ratings. From September 2021 through August 2022, the Fund component utilized derivatives to add duration to its portfolio. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Most derivatives are used for hedging, speculation, or both. Overall, the Fund component portfolio’s use of derivatives detracted from absolute performance during the period.

Subadviser outlook

In Western Asset’s view, the key to an improved tone and more stability in fixed income markets is a moderation in inflation. Western Asset’s base case is that supply chains will slowly begin to normalize. Fund management believes that this trend, combined with the Federal Reserve and other major central banks around the world tightening monetary policy (along with negative real incomes slowing consumption), has the potential to cause inflation to moderate. Western Asset anticipates that inflationary pressures could peak in the third quarter of 2022 and potentially decline into 2023. While global central banks are expected to raise interest rates further in the short term, Fund management believes that more aggressive action is already anticipated by the markets.

Brandywine Global expects market volatility to remain elevated against a backdrop of central bank tightening, sticky inflation, the war in Ukraine, and weakening economic data. At the end of the fiscal year, in Brandywine Global’s view, the U.S. economy was holding up relatively well, despite the recession in housing. Fund management believes that there is still the possibility of a “goldilocks” outcome if inflation retreats enough, with limited weakness in the labor market. But Brandywine Global believes that the odds of recession are growing, given the Fed’s haste to push interest rates higher.

11

MassMutual Strategic Bond Fund – Portfolio Manager Report (Unaudited) (Continued) |

MassMutual |

|

U.S. Treasury Obligations |

34.0% |

Corporate Debt |

27.1% |

U.S. Government Agency Obligations and Instrumentalities* |

20.5% |

Non-U.S. Government Agency Obligations |

9.3% |

Sovereign Debt Obligations |

4.1% |

Bank Loans |

3.5% |

Mutual Funds |

0.6% |

Municipal Obligations |

0.0% |

Purchased Options |

0.0% |

Total Long-Term Investments |

99.1% |

Short-Term Investments and Other Assets and Liabilities |

0.9% |

Net Assets |

100.0% |

|

* |

May contain securities that are issued by a U.S. Government Agency, but are unsecured and are not guaranteed by a U.S. Government Agency. |

12

MassMutual Strategic Bond Fund – Portfolio Manager Report (Unaudited) (Continued) |

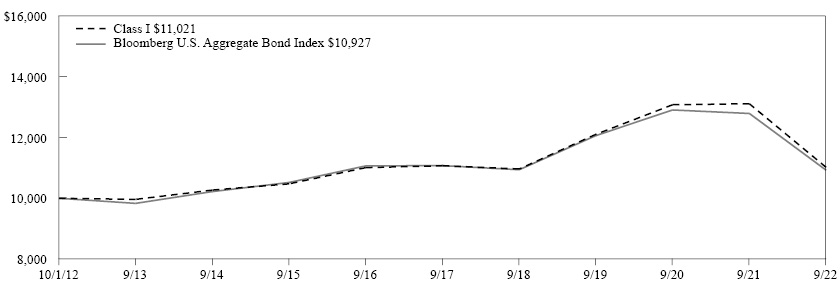

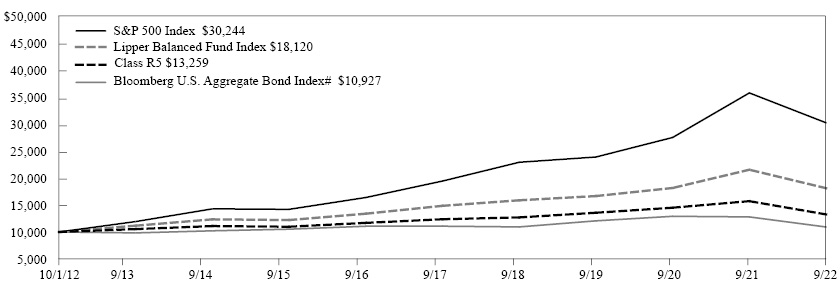

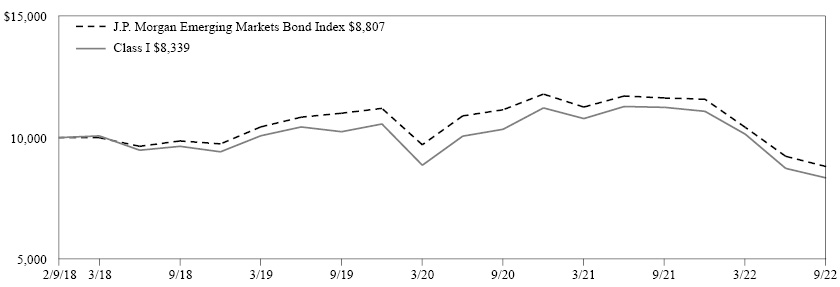

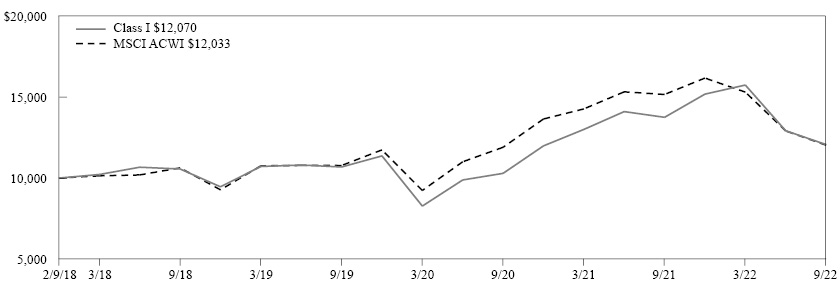

GROWTH OF $10,000 INVESTMENT - Class R5

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 09/30/2022) |

|||||

|

Inception Date |

1 Year |

5 Years |

10 Years |

Since Inception |

Class I |

04/01/2014 |

-17.05% |

-0.31% |

1.58% |

|

Class R5 |

12/31/2004 |

-17.14% |

-0.41% |

1.46% |

|

Service Class |

12/31/2004 |

-17.25% |

-0.50% |

1.36% |

|

Administrative Class |

12/31/2004 |

-17.29% |

-0.61% |

1.26% |

|

Class R4 |

04/01/2014 |

-17.50% |

-0.77% |

1.12% |

|

Class A |

12/31/2004 |

-17.56% |

-0.87% |

0.99% |

|

Class A (sales load deducted)* |

12/31/2004 |

-21.06% |

-1.73% |

0.56% |

|

Class R3 |

12/31/2004 |

-17.61% |

-1.00% |

0.83% |

|

Bloomberg U.S. Aggregate Bond Index |

|

-14.60% |

-0.27% |

0.89% |

1.05% |

* Class A (sales load deducted) returns include the 4.25% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

13

MassMutual Diversified Value Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MassMutual Diversified Value Fund, and who are the Fund’s subadvisers?

The Fund seeks to achieve long-term growth of capital and income by investing primarily in a diversified portfolio of equity securities of larger, well-established companies. The Fund invests primarily in stocks of companies that the subadvisers believe are undervalued in the marketplace. While the Fund does not limit its investments to issuers in a particular capitalization range, the subadvisers currently focus on securities of larger size companies. The Fund normally invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in stocks, securities convertible into stocks, and other securities, such as warrants and stock rights, whose value is based on stock prices. The Fund’s subadvisers are T. Rowe Price Associates, Inc. (T. Rowe Price), which was responsible for approximately 36% of the Fund’s portfolio; and Brandywine Global Investment Management, LLC (Brandywine Global), which managed approximately 64% of the Fund’s portfolio, as of September 30, 2022.

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Class R5 shares returned -8.48%, outperforming the -11.36% return of the Russell 1000® Value Index (the “benchmark”), which measures the performance of the large-cap value segment of U.S. equity securities. It includes the Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. It is market-capitalization weighted.

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

With respect to the Brandywine Global component of the Fund, the largest sector-related contribution to outperformance came from the health care sector. The Fund component benefited from an underweight allocation to the medical devices group, which underperformed, and strong returns from pharmaceuticals distributor McKesson and the biotech firm AbbVie. Within the industrial sector, allocations to defense contractors Lockheed Martin, Northrop Grumman, and General Dynamics contributed to the Fund’s performance during the period, as they performed well after the Russian invasion of Ukraine. Within the communication services sector, not owning entertainment company Disney, due to its unattractive valuation, and telecom giants AT&T and Verizon, due to poor price momentum, was a positive for the Fund component, as all three stocks lagged the market. The largest detractors from relative performance were Brandywine Global’s positions in large U.S. banks, including JP Morgan, Bank of America, and US Bank. In Brandywine Global’s experience, while these banks generally benefit from rising interest rates, the impact of a slowing economy on loan growth and potentially increased loan defaults more than offset any advantage that higher rates generally offer.

For the T. Rowe Price segment of the Fund, both sector allocation and security selection drove the Fund component’s outperformance. The financial sector was the top contributor for the period. There, Fund component holding Chubb continued to benefit from the rising property and casualty (P&C) pricing cycle. Over the one-year period, Chubb delivered earnings that exceeded consensus estimates, driven by a higher underwriting premium amid the longest P&C upcycle in history. Another Fund component holding, Qualcomm, and an underweight allocation to the information technology sector also contributed to relative performance. Shares of Qualcomm outperformed the information technology benchmark over the one-year period. Late in 2021, the company’s shares advanced, as company management raised guidance. Within the utilities sector, Fund component holding Sempra Energy, in tandem with an overweight allocation to the sector, further aided relative results. On the contrary, adverse security selection in the energy sector detracted from relative returns. Shares of TotalEnergies (a French multinational integrated energy and petroleum company) hampered relative performance over the period, as shares lagged the broader energy sector. During the first quarter of 2022, as Russia invaded Ukraine, shares of TotalEnergies were pressured as the company’s Russian assets and investments were quickly written down by the market. In addition, detrimental stock choices in the industrial and business services sector weighed on relative results for the fiscal year. The T. Rowe Price component of the Fund held warrants during the period, which had a negligible impact on performance. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Derivatives can be used for hedging, speculation, or both.

14

MassMutual Diversified Value Fund – Portfolio Manager Report (Unaudited) (Continued) |

Subadviser outlook

As of the end of the Fund’s fiscal year, Brandywine Global observed that the investing world remained more volatile than usual, as measured by the VIX benchmark of stock variability. Although this index was down from its highs in 2008 and 2020, as of the end of the fiscal year, it remained above its typical level. Value investing outperformed over the last two years after an extended period of growth dominance. However, growth valuations as of the end of the fiscal year remained elevated compared to value stock valuations – as high as during the 2000 technology bubble – suggesting, in Brandywine Global’s view, the potential for more value performance gains. Regardless of the market environment, Brandywine Global continues to implement its process-oriented investment approach.

T. Rowe Price notes that as the market continues to focus on inflation, they recognize that the range of potential outcomes moving forward is abnormally wide. Their view is that, at current levels as of the end of the fiscal year, markets have generally priced in a considerable amount of bad information, and the domestic economy is potentially entering what could be the most widely anticipated economic slowdown and potential recession, on record. Despite this, Fund management notes that the magnitude of the slowdown is difficult to predict, as the lag in domestic monetary policy implementation and the impact on the U.S. economy leave investors and companies vulnerable to a misstep from the Federal Reserve. Amid this backdrop, Fund management plans to continue to build a portfolio that is balanced for a variety of market environments. Their view is that the market could be choppy moving forward, and they will continue to look for investment opportunities where the risk/reward ratio is particularly attractive. Ultimately, their focus will remain on names where, in Fund management’s view, there is considerable downside already priced in, there are secular winners that are reasonably priced, and there are companies that can help provide defense against an inflationary environment.

15

MassMutual Diversified Value Fund – Portfolio Manager Report (Unaudited) (Continued) |

MassMutual |

|

Exxon Mobil Corp. |

2.7% |

Elevance Health, Inc. |

2.7% |

AbbVie, Inc. |

2.6% |

JP Morgan Chase & Co. |

2.2% |

QUALCOMM, Inc. |

2.2% |

United Parcel Service, Inc. Class B |

2.0% |

Bank of America Corp. |

2.0% |

Pfizer, Inc. |

1.9% |

Wells Fargo & Co. |

1.8% |

Sempra Energy |

1.8% |

21.9% |

|

MassMutual |

|

Consumer, Non-cyclical |

25.7% |

Financial |

23.4% |

Industrial |

9.9% |

Energy |

9.4% |

Technology |

7.6% |

Utilities |

6.2% |

Consumer, Cyclical |

5.9% |

Communications |

5.5% |

Basic Materials |

4.2% |

Mutual Funds |

1.3% |

Total Long-Term Investments |

99.1% |

Short-Term Investments and Other Assets and Liabilities |

0.9% |

Net Assets |

100.0% |

16

MassMutual Diversified Value Fund – Portfolio Manager Report (Unaudited) (Continued) |

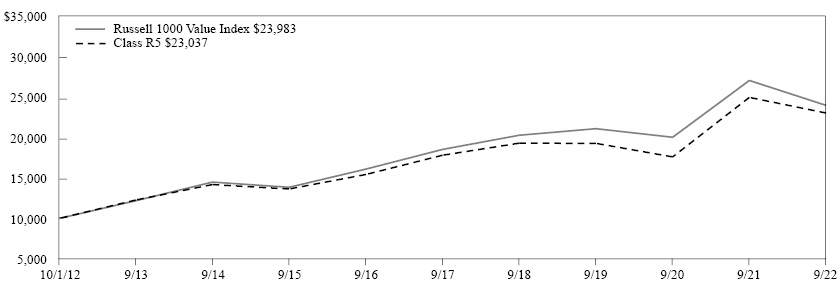

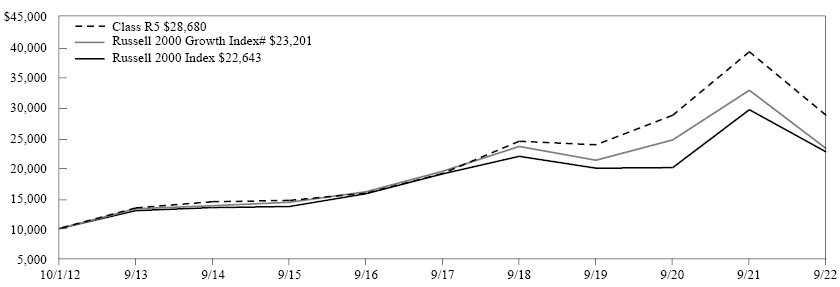

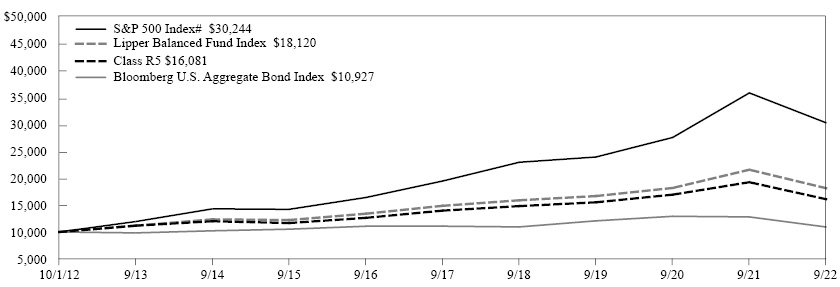

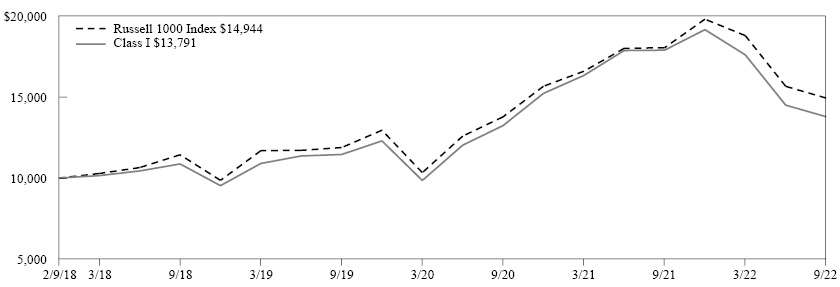

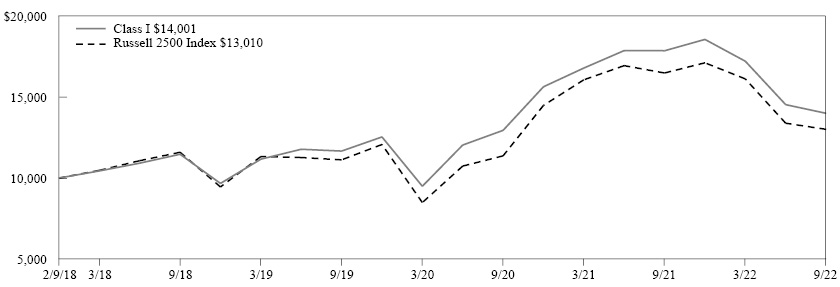

GROWTH OF $10,000 INVESTMENT - Class R5

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 09/30/2022) |

|||||

|

Inception Date |

1 Year |

5 Years |

10 Years |

Since Inception |

Class I |

04/01/2014 |

-8.47% |

6.34% |

7.22% |

|

Class R5 |

10/15/2004 |

-8.48% |

6.23% |

9.58% |

|

Service Class |

10/15/2004 |

-8.57% |

6.13% |

9.48% |

|

Administrative Class |

10/15/2004 |

-8.76% |

6.01% |

9.36% |

|

Class R4 |

04/01/2014 |

-8.83% |

5.87% |

6.75% |

|

Class A |

10/15/2004 |

-8.93% |

5.75% |

9.09% |

|

Class A (sales load deducted)* |

10/15/2004 |

-13.94% |

4.56% |

8.47% |

|

Class R3 |

10/15/2004 |

-9.09% |

5.60% |

8.90% |

|

Russell 1000 Value Index |

|

-11.36% |

5.29% |

9.17% |

6.70% |

* Class A (sales load deducted) returns include the 5.50% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

17

MassMutual Fundamental Value Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MassMutual Fundamental Value Fund, and who are the Fund’s subadvisers?

The Fund seeks long-term total return by investing primarily in equity securities of issuers that the Fund’s subadvisers believe are undervalued. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities. Although the Fund may invest in companies of any size, the Fund will tend to focus on companies with large market capitalizations (which the Fund’s subadvisers believe are generally above $1 billion). The Fund’s subadvisers are Boston Partners Global Investors, Inc. (Boston Partners), which managed approximately 50% of the Fund’s portfolio; and Barrow, Hanley, Mewhinney & Strauss, LLC (Barrow Hanley), which was responsible for approximately 50% of the Fund’s portfolio, as of September 30, 2022.

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Class R5 shares returned -7.73%, outperforming the -11.36% return of the Russell 1000® Value Index (the “benchmark”), which measures the performance of the large-cap value segment of U.S. equity securities. It includes the Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. It is market-capitalization weighted.

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

For the fiscal year ended September 30, 2022, within the Boston Partners component of the Fund, the primary driver of performance was stock selection within the health care, consumer discretionary, and industrial sectors. In health care, health insurers Cigna and Centene were two Fund component holdings that outperformed due to strong earnings and guidance, and better-than-expected rate increases for government-sponsored insurance. In consumer discretionary, Fund component holding AutoZone continued to gain share with commercial customers, resulting in better-than-expected sales and earnings. Within the industrial sector, aerospace and defense companies General Dynamics and Howmet were two Fund component holdings that outperformed after Russia’s invasion of Ukraine. Fund component holdings within the materials and consumer staples sectors detracted from returns. In the materials sector, chemical companies Axalta and Dupont both struggled. Construction materials company CRH lagged, despite strong construction trends, as rising interest rates tempered investor sentiment. In consumer staples, US Foods detracted from relative performance, as food cost inflation and labor costs eroded the company’s margins. From a sector perspective, Boston Partners’ overweight allocation to information technology and its underweight allocation to utilities and consumer staples detracted from its relative performance.

Within the Barrow Hanley segment of the Fund, component holdings in the health care sector added to Barrow Hanley’s relative performance. Also contributing to their results was strong stock selection within, and underweight allocations to, the technology and financial sectors. Conversely, stock selection within the consumer staples, materials, and energy sectors detracted from the Fund component’s performance.

Subadviser outlook

Boston Partners plan to continue to maintain a focus on finding investments that not only have attractive valuation characteristics and solid business fundamentals, but also improving business momentum and catalysts to help drive stock prices higher. Boston Partners’ view is that the global economy has the potential to experience a steady cyclical recovery over the next few years. In their opinion, the starting point was exceptional at fiscal year-end 2022, since valuation spreads were at such extreme levels. They remain cautiously optimistic about the coming 12-month period and beyond.

Barrow Hanley notes that, while uncertainty surrounding the markets remains elevated, Barrow Hanley believes that the primary conditions needed for a sustained, impactful value run remain the same: rising interest rates, higher inflation, and reasonable economic growth. In Barrow Hanley’s view, although economic growth remains less certain, higher interest rates and inflation remains persistent as of the end of the fiscal year, when compared to the prior decade. While their opinion is that expectations are high for a recession in the coming year, there remain several areas of strength related to consumer and corporate spending that have the potential to mitigate some of the possible headwinds. Barrow Hanley remains focused on stock selection as the key determinant of its Fund component’s performance.

18

MassMutual Fundamental Value Fund – Portfolio Manager Report (Unaudited) (Continued) |

MassMutual |

|

UnitedHealth Group, Inc. |

2.6% |

Johnson & Johnson |

2.4% |

CVS Health Corp. |

2.4% |

Cigna Corp. |

2.4% |

JP Morgan Chase & Co. |

2.3% |

Wells Fargo & Co. |

2.3% |

Berkshire Hathaway, Inc. Class B |

2.0% |

Merck & Co., Inc. |

1.9% |

ConocoPhillips |

1.9% |

Deere & Co. |

1.9% |

22.1% |

|

MassMutual |

|

Consumer, Non-cyclical |

28.3% |

Financial |

19.1% |

Industrial |

11.9% |

Energy |

10.9% |

Technology |

8.1% |

Basic Materials |

5.2% |

Communications |

5.1% |

Consumer, Cyclical |

4.9% |

Utilities |

4.0% |

Mutual Funds |

0.7% |

Total Long-Term Investments |

98.2% |

Short-Term Investments and Other Assets and Liabilities |

1.8% |

Net Assets |

100.0% |

19

MassMutual Fundamental Value Fund – Portfolio Manager Report (Unaudited) (Continued) |

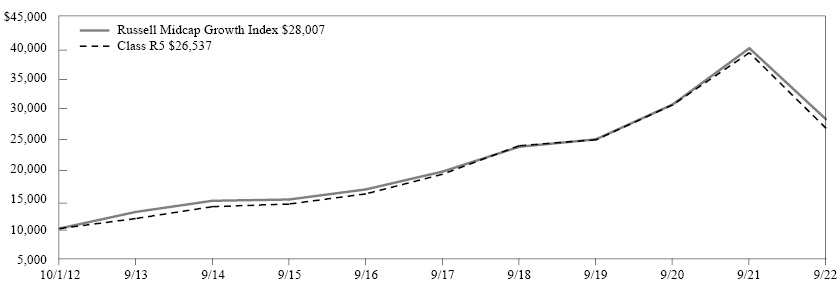

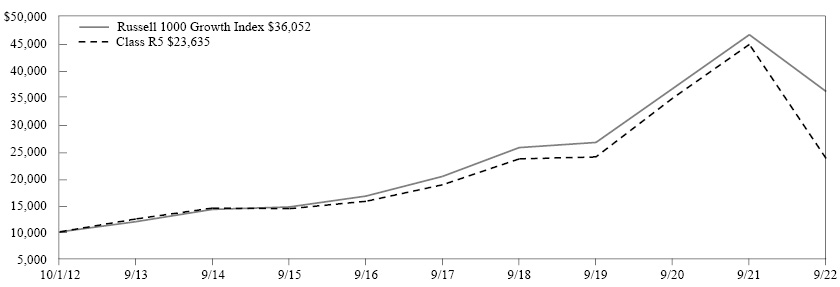

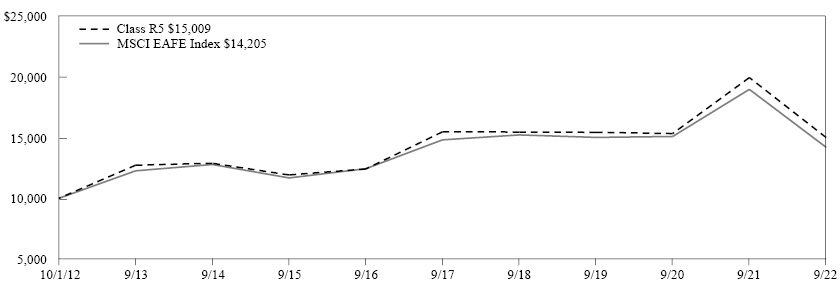

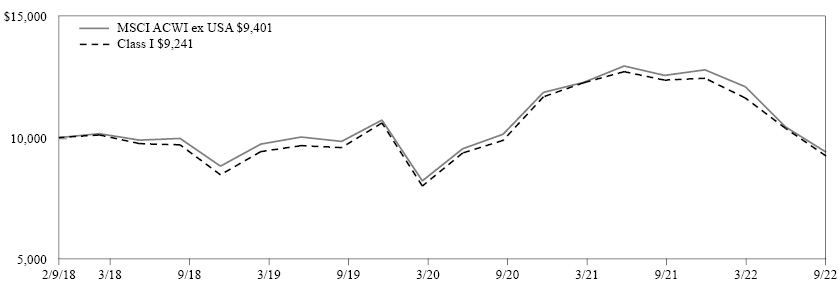

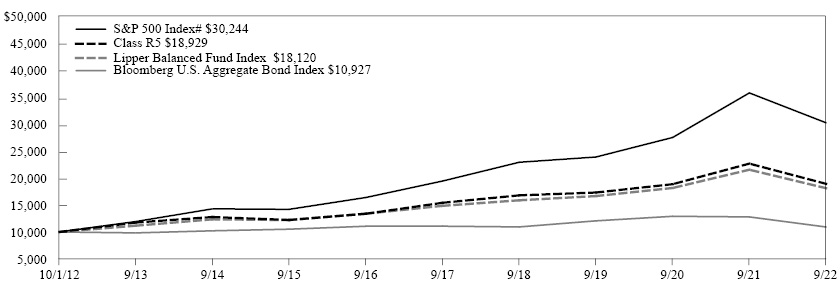

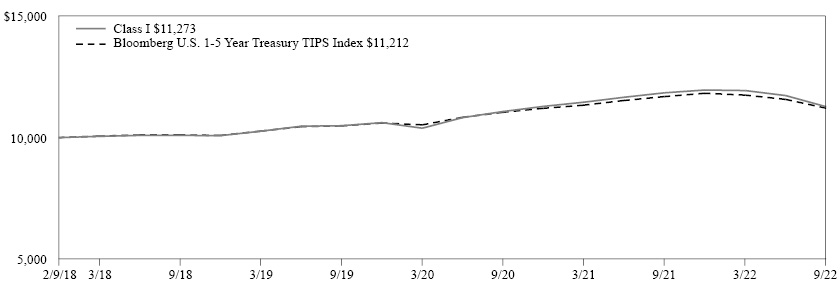

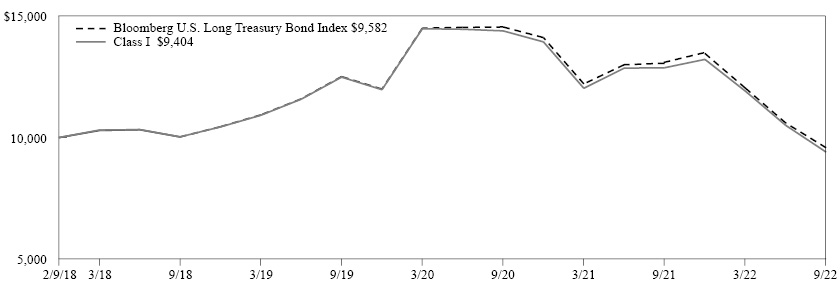

GROWTH OF $10,000 INVESTMENT - Class R5

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 09/30/2022) |

|||||

|

Inception Date |

1 Year |

5 Years |

10 Years |

Since Inception |

Class I |

11/15/2010 |

-7.69% |

5.37% |

8.82% |

|

Class R5 |

12/31/2001 |

-7.73% |

5.27% |

8.70% |

|

Service Class |

12/31/2001 |

-7.76% |

5.17% |

8.60% |

|

Administrative Class |

12/31/2001 |

-7.94% |

5.06% |

8.48% |

|

Class R4 |

04/01/2014 |

-8.06% |

4.89% |

6.05% |

|

Class A |

12/31/2001 |

-8.13% |

4.80% |

8.21% |

|

Class A (sales load deducted)* |

12/31/2001 |

-13.18% |

3.62% |

7.60% |

|

Class R3 |

12/31/2002 |

-8.26% |

4.65% |

8.03% |

|

Russell 1000 Value Index |

|

-11.36% |

5.29% |

9.17% |

6.70% |

* Class A (sales load deducted) returns include the 5.50% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

20

MM S&P 500® Index Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MM S&P 500® Index Fund, and who is the Fund’s subadviser?

The Fund seeks to approximate as closely as practicable (before fees and expenses) the capitalization-weighted total rate of return of that portion of the U.S. market for publicly-traded common stocks composed of larger-capitalized companies. Under normal circumstances, the Fund invests at least 80% (and, typically, substantially all) of its net assets (plus the amount of any borrowings for investment purposes) in the equity securities of companies included within the S&P 500® Index* (the “Index”), in weightings that approximate the relative composition of the securities contained in the Index, and in Index futures contracts. The Fund’s subadviser is Northern Trust Investments, Inc. (NTI).

* The “S&P 500 Index” is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by MassMutual. Standard & Poor’s®, S&P®, and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). The Fund is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Service Class shares returned -15.84%, underperforming the -15.47% return of the Index, which measures the performance of 500 widely held stocks in the U.S. equity market.

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Generally, the Fund’s underperformance versus the Index was mainly attributable to the impact of fees and expenses necessary for the management and operation of the Fund. The Index is not subject to fees or expenses and it is not possible to invest directly in the Index.

For the fiscal year ended September 30, 2022, U.S. large-cap equities underperformed their mid-cap counterparts, but outperformed small-cap equities. Global equities finished 2021 strong, despite higher inflation and rising short-term interest rates. Companies were largely able to pass on cost pressures, profit margins were durable, and earnings marched higher. In the first quarter of 2022, global equities were dominated by headlines surrounding high inflation and geopolitical unrest, which led to declines across developed and emerging markets. Continued high inflation, compounded by Russia’s invasion of Ukraine, led to a pullback in investor risk appetite. Headwinds for global financial markets continued in the second quarter, with negative returns in most major asset classes outside of cash. Elevated inflationary pressures led to increased investor expectations for monetary policy tightening throughout the second quarter, which in turn heightened investor concerns on the economic growth outlook.

The third quarter of 2022 was another challenging one for financial markets. Negative returns in most asset classes outside of cash, the inflation trajectory, and central bank tightening were once again top considerations for investors amid a difficult backdrop – including the continuing Russia-Ukraine war, energy price concerns in Europe, and China growth worries. Despite seeing double-digit gains by mid-August, U.S. equity markets ended with a loss for the third quarter, as investor hopes of a dovish Federal Reserve (the “Fed”) pivot evaporated following hawkish Fed leader rhetoric and more durable core inflation. Interest rates increased sharply in August and September, including a late-September rise stemming from U.K. financial stability concerns. Overall, the central banks’ focus on lowering inflation led to both the Fed and the European Central Bank raising their interest rates in the quarter by 1.50% and 1.25%, respectively – leaving the Bank of Japan as the only developed market central bank with a negative interest rate policy at the end of the Fund’s fiscal year.

The top-performing sectors of the Index during the reporting period were energy and utilities, returning 45.70% and 5.55%, respectively. Communication services and consumer discretionary were the worst-performing sectors for this period, with returns of -39.07% and -20.89%, respectively.

21

MM S&P 500® Index Fund – Portfolio Manager Report (Unaudited) (Continued) |

The Fund generally uses equity futures to equitize/gain market exposure for relatively small amounts of cash in the Fund in an effort to minimize the uninvested cash balances and reduce the impact of any cash drag. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Derivatives can be used for hedging, speculation, or both.

Subadviser outlook

NTI notes that economic growth has slowed as of the end of the fiscal year, after a strong rebound from the pandemic’s disruptions. In Fund management’s view, companies may look to shift their supply chains to mitigate exposures to inflation and begin prioritizing stability and sustainability over pure cost-effectiveness and profit maximization. NTI believes that, while these shifts could have the potential to benefit company stakeholders, they could also create uncertainty among shareholders – ultimately contributing to continued volatility within the markets.

22

MM S&P 500® Index Fund – Portfolio Manager Report (Unaudited) (Continued) |

MM S&P 500 Index Fund |

|

Apple, Inc. |

6.9% |

Microsoft Corp. |

5.8% |

Amazon.com, Inc. |

3.3% |

Tesla, Inc. |

2.3% |

Alphabet, Inc. Class A |

1.9% |

Alphabet, Inc. Class C |

1.7% |

Berkshire Hathaway, Inc. Class B |

1.6% |

UnitedHealth Group, Inc. |

1.6% |

Johnson & Johnson |

1.4% |

Exxon Mobil Corp. |

1.2% |

|

27.7% |

MM S&P 500 Index Fund |

|

Technology |

22.6% |

Consumer, Non-cyclical |

22.5% |

Financial |

14.9% |

Communications |

12.5% |

Consumer, Cyclical |

10.0% |

Industrial |

7.7% |

Energy |

4.8% |

Utilities |

3.2% |

Basic Materials |

2.0% |

Total Long-Term Investments |

100.2% |

Short-Term Investments and Other Assets and Liabilities |

(0.2)% |

Net Assets |

100.0% |

23

MM S&P 500® Index Fund – Portfolio Manager Report (Unaudited) (Continued) |

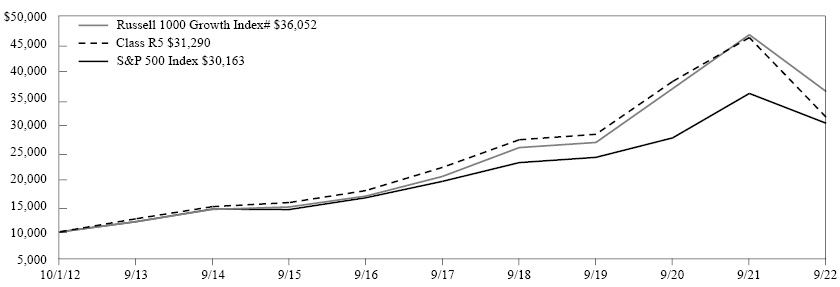

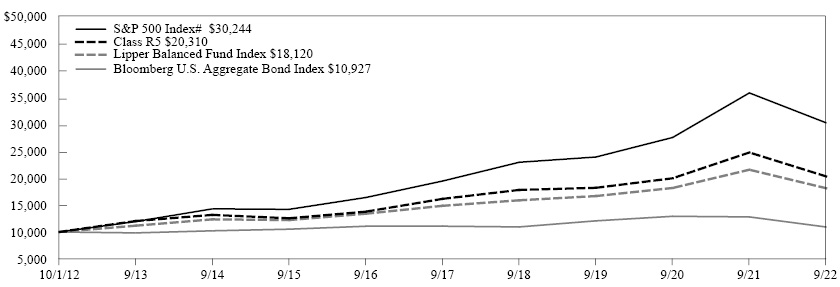

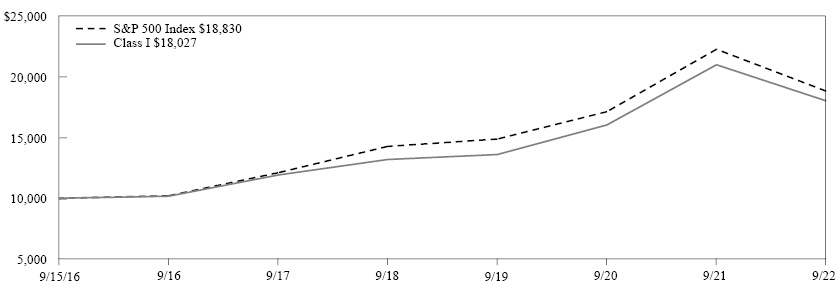

GROWTH OF $10,000 INVESTMENT - Service Class

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

Average Annual Total Returns (for the periods ended 09/30/2022) |

|||||

|

Inception Date |

1 Year |

5 Years |

10 Years |

Since Inception |

Class I |

12/07/2011 |

-15.56% |

9.14% |

11.59% |

|

Class R5 |

05/01/2001 |

-15.68% |

9.01% |

11.47% |

|

Service Class |

03/01/1998 |

-15.84% |

8.85% |

11.29% |

|

Administrative Class |

03/01/1998 |

-15.88% |

8.74% |

11.20% |

|

Class R4 |

03/01/1998 |

-16.01% |

8.58% |

11.02% |

|

Class A |

04/01/2014 |

-16.06% |

8.47% |

9.25% |

|

Class A (sales load deducted)* |

04/01/2014 |

-20.68% |

7.25% |

8.53% |

|

Class R3 |

12/31/2002 |

-16.25% |

8.31% |

10.74% |

|

S&P 500 Index |

|

-15.47% |

9.24% |

11.70% |

10.02% |

* Class A (sales load deducted) returns include the 5.50% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

24

MassMutual Equity Opportunities Fund – Portfolio Manager Report (Unaudited) |

What is the investment approach of MassMutual Equity Opportunities Fund, and who are the Fund’s subadvisers?

The Fund seeks growth of capital over the long-term by investing primarily in equity securities of U.S. companies that the Fund’s subadvisers believe are financially sound, valued conservatively by the market, and have improving prospects. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities. The Fund’s subadvisers are T. Rowe Price Associates, Inc. (T. Rowe Price), which was responsible for approximately 27% of the Fund’s portfolio; and Wellington Management Company LLP (Wellington Management), which managed approximately 73% of the Fund’s portfolio, as of September 30, 2022.

How did the Fund perform during the 12 months ended September 30, 2022?

The Fund’s Class R5 shares returned -7.05%, significantly outperforming the -17.22% return of the Russell 1000® Index (the “benchmark”), which measures the performance of the large-cap segment of U.S. equity securities. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership.

For a discussion on the economic and market environment during the 12-month period ended September 30, 2022, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Within the Wellington Management component of the Fund, strong stock selection drove outperformance, particularly within the industrial, financial, and information technology sectors. This was partially offset by stock selection within the materials and health care sectors. Sector allocation, a result of Wellington Management’s bottom-up stock selection process, also contributed to its strong relative performance. The Fund component’s lack of exposure to communication services, an overweight allocation to consumer staples, and an underweight to information technology contributed the most. This was partially offset by a lack of exposure to the energy and utilities sectors. From a Fund component holdings standpoint, top relative contributors included aerospace and defense technology company Northrop Grumman (industrials sector) and UnitedHealth Group (health care sector), a health care and insurance company. In the first three quarters of 2022, shares of Northrop Grumman rose on strength in the industry as the conflict in Ukraine has led to increased military spending. Shares of UnitedHealth Group rose throughout the fiscal year following the company’s announcement of third-calendar quarter results, 2021 guidance, and initial commentary around 2022 guidance – all of which came in slightly ahead of consensus. On the downside, Fund component holdings that were among the top relative detractors included athletic apparel company Nike (consumer discretionary sector) and not holding technology giant Apple (information technology sector). Shares of Nike fell during the period, as China lockdowns continued to weigh on sales. Shares of benchmark constituent Apple were down slightly over the period. However, the company reported strong earnings for the second and third fiscal quarters, beating consensus estimates, as iPhone sales set all-time revenue records.

For the T. Rowe Price segment of the Fund, both sector allocation and security selection drove the Fund component’s outperformance. The financial sector was the top contributor for the period. There, Fund component holding Chubb continued to benefit from the rising property and casualty (P&C) pricing cycle. Over the one-year period, Chubb delivered earnings that exceeded consensus estimates, driven by higher underwriting premiums amid the longest P&C upcycle in history. Another Fund component holding, Qualcomm, and an underweight allocation to the information technology sector also contributed to relative performance. Shares of Qualcomm outperformed the information technology benchmark over the one-year period. Late in 2021, the company’s shares advanced, as management raised guidance. Within the utilities sector, Fund component holding Sempra Energy, along with an overweight allocation to the sector, further aided relative results. On the other hand, adverse security selection in the energy sector detracted from relative returns. Shares of TotalEnergies (a French multinational integrated energy and petroleum company) hampered relative performance over the period, as shares lagged the broader energy sector. During the first quarter of 2022, as Russia invaded Ukraine, shares of TotalEnergies were pressured as the company’s Russian assets and investments were quickly written down by the market. Finally, detrimental stock choices in the industrial and business services sector also weighed on T. Rowe Price’s relative results for the fiscal year.

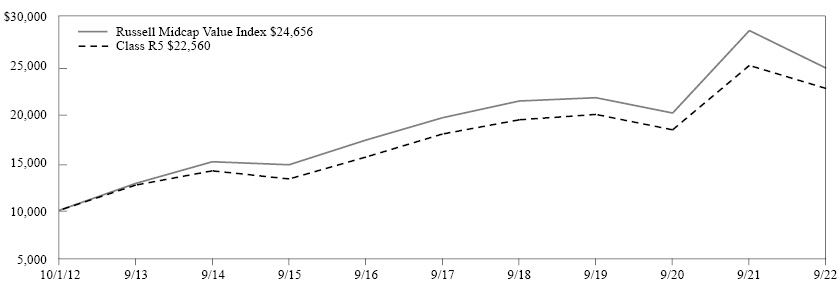

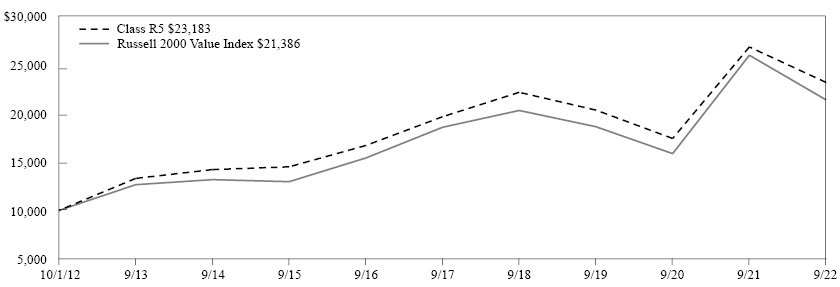

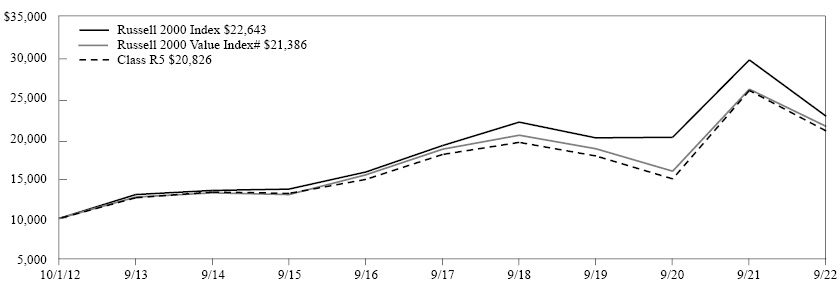

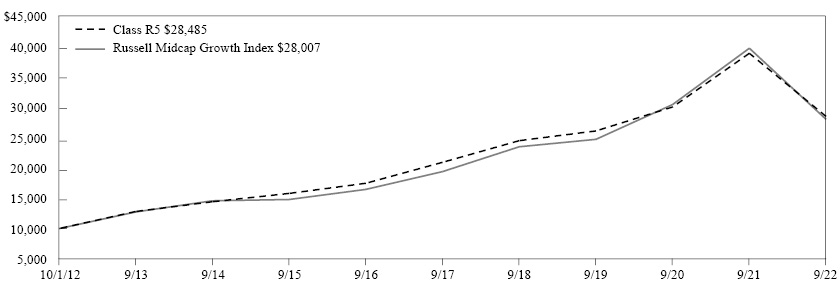

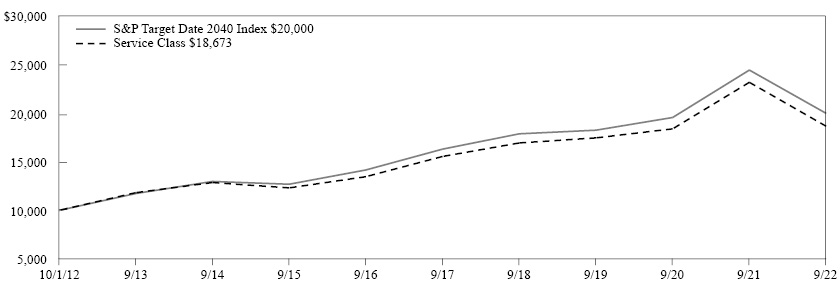

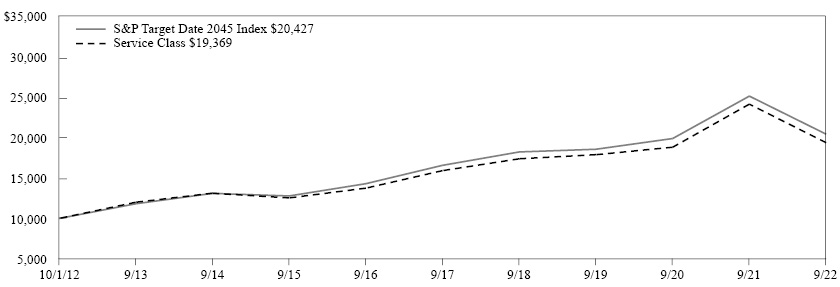

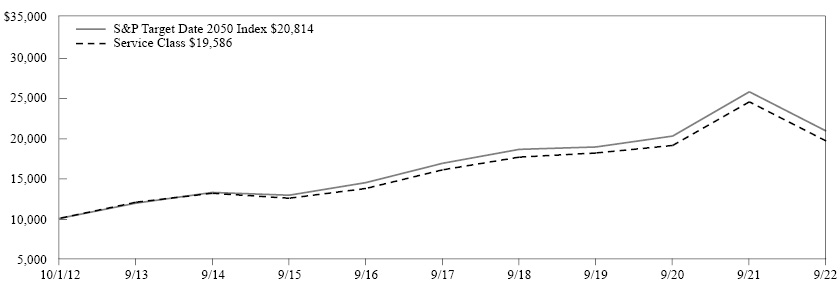

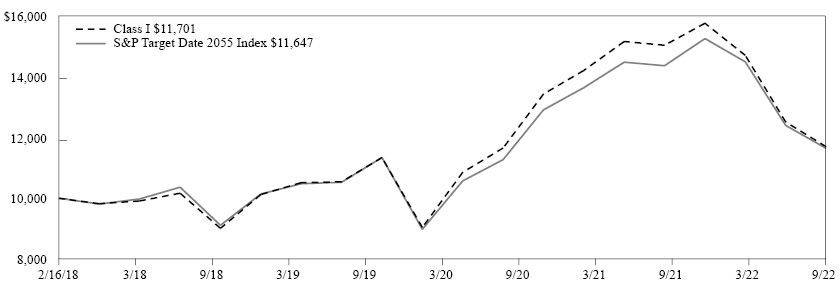

25