UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08200

Bridgeway Funds, Inc.

(Exact name of registrant as specified in charter)

20 Greenway Plaza, Suite 450

Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Tammira Philippe, President

Bridgeway Funds, Inc.

20 Greenway Plaza, Suite 450

Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 661-3500

Date of fiscal year end: June 30

Date of reporting period: December 31, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

|

Semi-Annual Report

December 31, 2019 (Unaudited)

| ||||

| AGGRESSIVE INVESTORS 1 |

BRAGX | |||

| ULTRA-SMALL COMPANY |

BRUSX | |||

|

(Open to Existing Investors — Direct Only) |

||||

|

ULTRA-SMALL COMPANY MARKET |

BRSIX | |||

| SMALL-CAP GROWTH |

BRSGX | |||

| SMALL-CAP VALUE |

BRSVX | |||

| BLUE CHIP |

BRLIX | |||

| (Formerly, Blue Chip 35 Index) |

||||

| MANAGED VOLATILITY |

BRBPX | |||

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (bridgeway.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800-661-3550.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 800-661-3550 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or to all Funds held with the fund complex if you invest directly with a Fund.

|

bridgeway.com

| ||||

| TABLE OF CONTENTS |

|

| 1 | ||||

| 7 | ||||

| 11 | ||||

| 14 | ||||

| 18 | ||||

| 22 | ||||

| 26 | ||||

| 34 | ||||

| 38 | ||||

| 40 | ||||

| 44 | ||||

| 47 | ||||

| 52 | ||||

| 53 | ||||

| 57 | ||||

| 64 | ||||

| 66 | ||||

| 68 | ||||

| 71 | ||||

| 78 | ||||

| 91 | ||||

| 92 | ||||

|

Bridgeway Funds Standardized Returns as of December 31, 2019* (Unaudited)

| Annualized | |||||||||||||||||||||||||

| Fund | Quarter | Six Months | 1 Year | 5 Years | 10 Years | 15 Years | Inception to Date |

Inception Date |

Gross Expense Ratio2 |

Net Expense Ratio2 | |||||||||||||||

| Aggressive Investors 1 |

6.10% | 3.01% | 21.85% | 3.82% | 9.74% | 5.18% | 11.88% | 8/5/1994 | 0.35% | 0.35% | |||||||||||||||

| Ultra-Small Company |

5.60% | 1.63% | 9.51% | -1.70% | 6.44% | 4.07% | 12.13% | 8/5/1994 | 2.13% | 2.13% | |||||||||||||||

| Ultra-Small Co Market |

7.34% | 3.84% | 15.34% | 3.67% | 10.05% | 5.34% | 9.67% | 7/31/1997 | 0.96%1 | 0.94%1 | |||||||||||||||

| Small-Cap Growth |

11.03% | 4.53% | 15.10% | 8.29% | 11.22% | 6.32% | 6.74% | 10/31/2003 | 1.11%1 | 0.94%1 | |||||||||||||||

| Small-Cap Value |

6.47% | 8.10% | 14.98% | 4.22% | 9.45% | 6.14% | 6.91% | 10/31/2003 | 1.00%1 | 0.94%1 | |||||||||||||||

| Blue Chip |

8.01% | 10.68% | 31.05% | 12.07% | 13.06% | 8.77% | 7.87% | 7/31/1997 | 0.25%1 | 0.15%1 | |||||||||||||||

| Managed Volatility |

2.09% | 3.18% | 11.88% | 3.58% | 4.67% | 3.76% | 4.03% | 6/30/2001 | 1.25%1 | 0.95%1 | |||||||||||||||

Bridgeway Funds Returns for Calendar Years 2003 through 2019* (Unaudited)

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||||||

| Aggressive Investors 1 |

14.93% | 7.11% | 25.80% | -56.16% | 23.98% | 17.82% | -10.31% | 21.58% | 42.21% | 14.99% | -9.82% | 19.47% | 18.44% | -22.44% | 21.85% | |||||||||||||||

| Ultra-Small Company |

2.99% | 21.55% | -2.77% | -46.24% | 48.93% | 23.55% | -14.64% | 24.49% | 55.77% | -0.56% | -16.12% | 14.06% | 3.88% | -15.68% | 9.51% | |||||||||||||||

| Ultra-Small Co Market |

4.08% | 11.48% | -5.40% | -39.49% | 25.96% | 24.86% | -7.86% | 19.83% | 50.91% | 4.61% | -8.28% | 21.47% | 12.47% | -17.12% | 15.34% | |||||||||||||||

| Small-Cap Growth |

18.24% | 5.31% | 6.87% | -43.48% | 15.05% | 11.77% | -0.63% | 11.05% | 48.52% | 6.13% | 4.93% | 16.10% | 19.62% | -11.21% | 15.10% | |||||||||||||||

| Small-Cap Value |

18.92% | 12.77% | 6.93% | -45.57% | 26.98% | 16.56% | 1.05% | 20.99% | 39.72% | 0.79% | -9.43% | 26.79% | 7.11% | -13.06% | 14.98% | |||||||||||||||

| Blue Chip |

0.05% | 15.42% | 6.07% | -33.30% | 26.61% | 10.60% | 3.17% | 15.20% | 31.67% | 11.51% | 2.17% | 13.18% | 18.43% | -1.48% | 31.05% | |||||||||||||||

| Managed Volatility |

6.96% | 6.65% | 6.58% | -19.38% | 12.39% | 5.41% | 1.94% | 6.46% | 9.25% | 5.95% | 0.17% | 2.42% | 8.18% | -3.97% | 11.88% | |||||||||||||||

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than original cost. To obtain performance current to the most recent month-end, please visit bridgeway.com or call 1-800-661-3550. Total return figures include the reinvestment of dividends and capital gains. Periods of less than one year are not annualized.

| 1 | Some of the Fund’s fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Adviser is contractually obligated to waive fees and/or pay expenses. Any material change to this Fund policy would require a vote by shareholders. |

| 2 | Expense ratios are as stated in the current prospectus. Please see financial highlights for expense ratios as of December 31, 2019. |

* Numbers highlighted indicate periods when the Fund outperformed its primary benchmark.

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding a Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Investors should read the prospectus carefully before investing in a Fund. For questions or other Fund information, call 1-800-661-3550 or visit the Funds’ website at bridgeway.com. Funds are available for purchase by residents of the United States, Puerto Rico, U.S. Virgin Islands and Guam only.

The views expressed here are exclusively those of Fund management. These views, including those relating to the market, sectors, or individual stocks, are not meant as investment advice and should not be considered predictive in nature.

Effective May 31, 2019, the name of the Blue Chip 35 Index Fund was changed to Blue Chip Fund. Effective July 31, 2019, the Fund’s principal strategies were modified, as indicated in the Supplement dated May 31, 2019 to the Prospectus dated October 31, 2018.

| i | bridgeway.com |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM |

|

December 31, 2019

Dear Fellow Shareholders,

Performance across all segments of the domestic equity markets was positive for the December quarter, contributing to strong returns for the 2019 calendar year. Stocks in all major size and style categories rose substantially, although larger stocks and growth stocks outpaced smaller stocks and value stocks. As a result, large growth stocks recorded the year’s best returns. Market highlights appear on page 2. In this environment, the Bridgeway Funds performed within design expectations, guided by our statistically driven, evidence-based investment approach. Please see the enclosed letters for a detailed explanation of each Fund’s performance during the quarter and calendar year. We hope you find the letters helpful.

Market conditions such as the continued strength of large growth stocks have contributed to the underperformance of many Bridgeway Funds. But they’ve also provided an opportunity to examine the last decade of equity performance in the context of longer-term market data. You can read about this research, and what we’ve learned from it, in “A Decade of Performance in Perspective: Headwinds, but Reasons for Optimism” on page 2.

Another investing trend we’ve been studying recently is the use of Environmental, Social and Governance (ESG) criteria to assemble portfolios. Naturally, we’re interested in finding evidence that “good” companies make good investments, and whether there is any connection between ESG criteria and the investment factors that have been shown to provide long-term return premiums. One of our studies generated some intriguing results, which you can read about in “Examining the Link Between Factors and ESG” on page 4.

Finally, Bridgeway Partner Tony Ledergerber reflects on how joining Bridgeway 14 years ago helped him channel his desire to give back through volunteer work with a therapeutic riding center. He shares his story in “Transformative Change: Creating Opportunities to Find and Nurture our Passions” on page 6.

As always, we appreciate your feedback. We take your comments very seriously and regularly discuss them to help us manage our Funds and this company. Please keep your ideas coming — both favorable and critical. They provide us with a vital tool to serve you better.

Sincerely,

Your Investment Management Team

|

|

| ||

| John Montgomery | Christine L. Wang | Michael Whipple | ||

|

|

|||

| Elena Khoziaeva | Dick Cancelmo | |||

| bridgeway.com | 1 |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

Market Review

Domestic equities advanced steadily during the quarter ended December 31, 2019, capping a year of strong stock market performance. Investors’ risk tolerance remained high, buoyed by healthy economic results, lower interest rates and signs that global trade tensions were easing. The S&P 500 returned +9.07% for the quarter and the Dow Jones Industrial Average returned +6.67%. For the 2019 calendar year, the S&P 500 and the DJIA gained +31.49% and +25.34%, respectively.

All U.S. equity style categories, as defined by Russell Indices, posted positive returns for the quarter. Smaller stocks outperformed larger stocks across style categories, and growth outperformed value. Small growth stocks delivered the quarter’s best performance (+11.39%) while mid-cap value stocks produced the lowest returns (+6.36%). However, larger stocks outperformed smaller stocks for the calendar year.

All of the S&P 500 sectors except Real Estate posted positive returns for the quarter. The Information Technology and Health Care sectors were the best performers, both returning +14.4%. The Financials sector also performed well, returning +10.4%. The Utilities and Real Estate sectors lagged, returning +0.75% and -0.54%, respectively.

Below are the stock market style box returns for the quarter and the calendar year.

A Decade of Performance in Perspective: Headwinds, but Reasons for Optimism

Much of this semi-annual report focuses on how the Bridgeway Funds have performed in the past quarter and calendar year. But if you’ve kept your eye on longer time periods, or if you glance at the returns table on page i, you’ve probably noticed that most of our Funds are underperforming their benchmarks in the 1-, 5-, and 10-year periods.

Falling behind over longer periods like this doesn’t feel good to us as financial professionals nor to you (and us) as shareholders. But even as we acknowledge that we’re in a period of poor relative performance, we are not discouraged. We want to share some historical perspective that explains some of the causes for this performance deficit, what we are doing about it, especially what we’re not doing about it, and why we’re very optimistic about the future.

Three conditions created substantial headwinds for our Funds over the past 10 years:

1. The value factor has been out-of-favor

We are big believers in the value factor. Every Bridgeway Fund, even those on the growth side of the investment spectrum, has some exposure to value relative to its primary market benchmark. The reason for this tilt is simple: historical data shows that the value premium has been remarkably pervasive and consistent. We like to call it the “granddaddy of investment factors.” In 10-year periods since 1926, the value factor provided additional return 93% of the time based on Bridgeway analysis of the Ken French data library. To “bet” purely on growth is to bet on the other slim 7%. We are currently in one of those “7%” periods. And history strongly suggests they don’t last.

However, we know that any factor can be out of favor for periods of time — and that’s where we’ve found ourselves for the past decade. Value has been so out of favor for so long that value stocks are now in the 94th percentile of relative “cheapness” as measured by a key academic measure, median book to market going back to 1980 and using the stock components of the

| 2 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

Russell 1000 value and growth universes. In other words, value stocks have only been cheaper 7% of the time in the last 40 years. Because we believe, as history has shown, that this trend eventually turns around, we are very optimistic about the next decade.

Suffering through a period when something is this out of favor isn’t fun. But there’s potential upside to being in the 94th percentile. Think of the value factor like a spring that’s under pressure. The farther down that spring compresses, the more loaded it is to bounce back. And when you’re at the 94th percentile of something, you’re loaded in a powerful way.

Of course, we can’t predict exactly when that turning point will come. We believe trying to time the market or even a factor is an expensive and fruitless exercise. But historical data does tell us something about the magnitude of previous bouncebacks of value. During the period 1980-2019, when the value factor as measured by the Russell 1000 value and growth universes was in the cheapest 10%, as it is currently, the Russell 1000 Value Index outperformed the Russell 1000 Growth Index by an average of roughly five percentage points/year. By carefully rebalancing our portfolios to maintain their value exposure, our Funds appear poised to ride the tailwind we hope to see when value returns to favor.

What are we doing about value being out of favor? Nothing. We maintain our positioning and the discipline of our process.

All together, while we don’t like our trailing returns, we love the positioning of our Funds. Statistics indicate we are positioned to benefit from a return to value driven markets. We’ve identified ways to help mitigate the deleterious effects of high correlation spikes. Our people, systems, data, and technology are stronger than they’ve ever been. And we hope this explanation helps put your long-term Fund performance in perspective. Thank you for your continued investment and the trust you place in us.

2. An increase in high-correlation markets

A high-correlation market is when stocks in an asset class move together, reducing the benefit you’d expect to get from diversification. Until about 11 years ago, a high-correlation market, as Bridgeway measures it, happened roughly every other decade. For the past 11 years, we’ve experienced one at the rate of nearly one a year — and they’ve corresponded with all four of the last quarters with negative returns.

This trend is due, we believe substantially, to major structural changes in the market, such as the growth of passive investing, index funds, and exchange traded funds that allow one to press a single button and sell hundreds or thousands of stocks at once, without regard to the differences in the fundamental economic health of these companies. Our research has shown that these broad selloffs work against some of our price momentum and company financial health models, reducing the diversification benefit we expect to get from them.

What are we doing about high-correlation markets? We now believe high-correlation markets are here to stay. In response, we’ve developed a new company financial health model that, based on history, has less exposure to these high correlation spikes. We are currently implementing it in some of our select funds. We’re also updating some of our other models, including a risk adjusted momentum model that already has less exposure than classical price momentum. This will remain a topic of further research in 2020.

3. The phenomenon of “shrinking alpha”

Alpha is the term for the excess, risk-adjusted return of an investment over the market itself. Twenty years ago, when the Bridgeway Funds were relatively new, using factor-based analysis in investment management was like shooting fish in a barrel — with solid research and extreme discipline, you could achieve some big returns, and the Bridgeway Funds enjoyed a lot of those. Since then, a number of developments have narrowed that gap. We have better data, faster machines, and more skilled investors using these sophisticated tools to search for better returns. The “easy” years may be in our history, but there is also good news.

The good news is that there is still irrationality in our complex capital markets, and a continuing opportunity to harvest it. Furthermore, Bridgeway itself is much more sophisticated in the application of technology, and has a far more experienced and talented team of researchers and portfolio managers than 20 years ago. What are we doing about shrinking alpha? One of the pillars of Bridgeway’s investment philosophy is continuous investment in research. In our 26 year history, we’ve relied on data and statistics, discipline, and a factors-based investment world view. We don’t make radical changes and our threshhold for

| bridgeway.com | 3 |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

changes is high — we want to see compelling data over decades of market and economic cycles and we want to establish an economic reason why a factor exists. Nevertheless, we are continually conducting research to examine new potential factors, to better measure and implement established factors, and to improve upon how we put these together into each of our strategies.

Examining the Link Between Factors and ESG

By John Montgomery, Founder and Chief Investment Officer, and Christine Wang, CFA, CPA, Portfolio Manager

Environmental, social and governance (ESG) investing has become increasingly popular among people who want to support companies that uphold sustainable and ethical business practices. Besides aligning their portfolios with their values, many investors also use ESG criteria because they believe sustainable businesses practices translate to better long-term stock performance.

We have been watching the rise of ESG investing with interest, because we run Bridgeway on many of the same ethical, sustainable and socially responsible practices included in ESG criteria. We also share the belief that “good” companies also make good investments. Yet we are equally committed to our evidence-based investment philosophy and our quantitative approach to investment management using data over longer time periods. For that reason, and because more data is becoming available, we’ve been examining some of the data that purport to show ESG’s effectiveness.

A number of authors have published articles and books arguing that sustainable/ethical companies reward investors with better stock performance. However, some of the data falls victim to research flaws like “survivorship bias,” which means looking at companies that fit the study’s criteria and are still in business, while ignoring ones that failed.

The best way to validate studies like these is to conduct further testing using out-of-sample data — that is, a set of data that wasn’t used to create the model in the first place. And, as our Bridgeway colleague Kai Liu says, “the only true out-of-sample time period is called the future.” With that in mind, our research team recently examined companies featured in the 2007 bestseller Firms of Endearment: How World-Class Companies Profit from Passion and Purpose to see how those stocks have performed since publication.

Firms of Endearment (FoE) argues that the most successful companies are driven by a higher purpose than just financial gain. Instead, these businesses focus on ensuring all their stakeholders thrive — from customers, employees, suppliers and investors to their communities and society at large. Through this positive impact, say authors Raj Sisodia, Jag Sheth and David B. Wolfe, they become companies that people love to buy from, work for, and partner with.

Some of the FoE names are familiar to ESG investors, such as Whole Foods, Southwest Airlines and Chipotle. Others might be more surprising, including oilfield services company Schlumberger. But in addition to meeting the authors’ criteria for admired and respected companies, their stocks collectively had delivered exceptional shareholder returns. Over 15 years, the authors reported, U.S. FoE stocks delivered a cumulative 1,681% return and outperformed the S&P 500 by 15 times.

The real question, though, is what the future held for these stocks after the book’s publication.

Re-Examining Firms of Endearment: Out-of-sample data

By studying returns from 12 years of out-of-sample data, we found strong and consistent outperformance by FoE stocks: For the years 2007-2018, the FoE portfolio had an average annualized return of 11.15%, versus an average annualized return of 7.11% for the S&P 500 Index.

This analysis offered promising evidence that “good” companies might consistently provide higher potential returns. But when we see intriguing data like this, we always ask if there is a reason why a performance advantage would exist.

One of the pillars of Bridgeway’s investment philosophy is that factors shape returns. To understand a portfolio’s performance, we analyze its exposure to specific factors — characteristics that have been shown through rigorous analysis to define the risk and return of a broad set of securities. Naturally, we wanted to see what factor exposures we could find in the FoE portfolio.

| 4 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

Specifically, we ran the FoE portfolio through a Fama-French 6 Factor regression analysis, which examines the impact of exposure to the factors Value, Momentum, Small Size, Market, Investment Intensiveness, and Profitability. That analysis revealed that the FoE portfolio was slightly loaded to the small size factor and negatively loaded to the momentum factor. The largest impact, however, was attributable to the profitability factor.

The evidence of a strong premium from the profitability factor helps support the central idea articulated by the Firms of Endearment authors: It makes good business sense to create a company in which all stakeholders prosper. Treating employees, customers, suppliers and your communities better earns the admiration of all those stakeholders. It stands to reason such firms might be better able to attract and retain good employees, build customer loyalty, and maintain profitability.

However, our analysis comes with a few important caveats. We would like to test our findings on a larger set of companies and a longer period. Likewise, the outperformance by FoE stocks coincided with a period in which the profitability factor performed relatively well. These results should be tested during a period in which the profitability factor isn’t in favor.

While not conclusive, our analysis revealed potentially corroborating evidence that ESG criteria help give exposure to classic factors that provide long-term return premiums. It also shows that ESG and factor-based investing don’t have to be kept separate. For example, if further studies show that the profitability factor helps explain the returns of sustainable, ethical, and well-managed companies, you could screen the entire universe of high-profitability names for those that also meet ESG criteria — helping a portfolio gain factor exposure alongside ESG preferences.

We believe this connection is worth further investigation and analysis. As the financial industry develops more data around ESG investing, it will have greater ability to build models that can help investors pursue long-term success in terms of both shareholder value and shareholder values.

| bridgeway.com | 5 |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued) |

|

Transformative Change: Creating Opportunities to Find and Nurture our Passions

By Tony Ledergerber, Director of Marketing and Communications

When you read the personal stories of transformative change in our annual and semi-annual reports you might think that everyone working here came from a strong philanthropic background. While many of us did, for others it’s an aspect of our lives that we’ve been fortunate to develop through our service to Bridgeway. I know, because I’m in that latter group.

I was working at another asset management firm 14 years ago when I learned there was an opening for a marketing leader at Bridgeway Capital Management. As I began researching Bridgeway’s investment approach and philosophy, I got excited about joining a firm that followed a quantitative investment strategy, that was committed to providing cost-efficient funds, and that had a strong reputation for transparency. Then I came into the office for an interview and learned there was a lot more that made Bridgeway unique.

The Partners who interviewed me told me about Bridgeway’s practice of donating at least 50% of its profits to charity and the firm’s commitment to creating transformative change. Then they asked me about the causes I was passionate about and my personal history of giving back.

I was caught by surprise, and I realized that to that point I hadn’t had any significant experience in philanthropic activity. So I answered honestly, saying that while I lacked the background, I had the heart and the desire to give back — and that I saw an opportunity to change my life and the lives of others. I came out of the interview wanting the job even more than when I’d walked in.

Fortunately, Bridgeway hired me, and I soon learned how much the company culture helps each Partner nurture their own passions. We are all given time off for volunteer work, are offered the chance to join service trips, and are even given designations to donate to causes that are important to us. Just as valuable is the intangible benefit of being surrounded by people who talk passionately about the organizations they support, and who provide examples of giving back through service on boards and volunteer work.

This environment inspired me to imagine ways that I could make a difference. I thought about my family background spending my free time on a ranch, and the positive experiences I’d had working with horses. I had heard about organizations that use horse riding as a therapeutic activity for young people with physical, mental or emotional challenges, and I figured I could lend my time in some way — maybe saddling horses, caring for the equipment, or even just fixing fences.

I decided to get involved with a local ranch dedicated to therapeutic riding. Soon, I saw how I could contribute more than just manual labor. I’ve been able to put my professional experience to work helping raise awareness, contributing to fundraising activities, and guiding long-term planning. That organization has become a huge part of my life over the past 12 years — and what I’ve witnessed first-hand has been miraculous.

I’ve watched a nonverbal boy on the autism spectrum speak his first words — telling a horse “whoa!” when he needed it to slow down — and gradually learn more communication skills. I’ve seen children with physical limitations build up their core strength through the act of riding a large animal. And I’ve seen groups of at-risk teenagers forming strong bonds with horses that have helped them overcome depression.

I’m grateful to have joined a company that’s taught me how to use my time, talent and treasure to support an organization making such a difference in children’s lives. I appreciate the fact that Bridgeway was willing to look past my lack of previous charitable experience, which is why I’ve become a strong proponent of hiring others like me who might not have a complete philanthropic resume. I look at it as another way that I can give back — by sharing the opportunity that Bridgeway provided me to find fulfillment through helping others.

| 6 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Aggressive Investors 1 Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) | ||

December 31, 2019

Dear Fellow Aggressive Investors 1 Fund Shareholder,

For the quarter ended December 31, 2019, our Fund returned +6.10%, trailing our primary market benchmark, the S&P 500 Index (+9.07%), our peer benchmark, the Lipper Capital Appreciation Funds Index (+8.84%), and the Russell 2000 Index (+9.94%). It was a poor quarter on a relative basis.

For the calendar year, our Fund returned +21.85%, underperforming our primary market benchmark, the S&P 500 Index (+31.49%), our peer benchmark, the Lipper Capital Appreciation Funds Index (+29.65%), and the Russell 2000 Index (+25.52%).

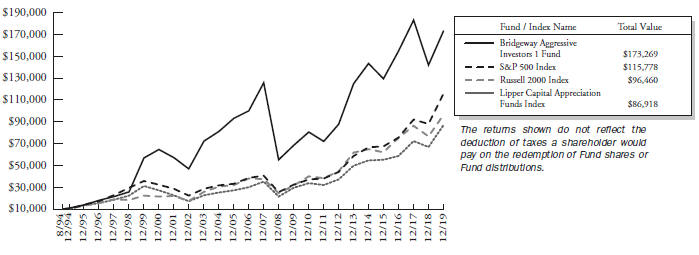

The table below presents our December quarter, six-month, one-year, five-year, 10-year, 15-year, and inception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of December 31, 2019

| Annualized | |||||||||||||||||||||||||||||||||||

| Quarter | 6 Months | 1 Year | 5 Years | 10 Years | 15 Years | Since Inception (8/5/94) | |||||||||||||||||||||||||||||

| Aggressive Investors 1 Fund |

6.10% | 3.01% | 21.85% | 3.82% | 9.74 | % | 5.18 | % | 11.88 | % | |||||||||||||||||||||||||

| S&P 500 Index |

9.07% | 10.92% | 31.49% | 11.70% | 13.56 | % | 9.00 | % | 10.09 | % | |||||||||||||||||||||||||

| Russell 2000 Index |

9.94% | 7.30% | 25.52% | 8.23% | 11.83 | % | 7.92 | % | 9.30 | % | |||||||||||||||||||||||||

| Lipper Capital Appreciation Funds Index |

8.84% | 8.79% | 29.65% | 9.65% | 11.43 | % | 8.56 | % | 8.81 | % | |||||||||||||||||||||||||

Performance figures quoted in the table above represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions, based on the average of 500 widely held common stocks with dividends reinvested. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in the category of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

| bridgeway.com | 7 |

| Aggressive Investors 1 Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Growth of a $10,000 Investment

from Inception August 5, 1994 to December 31, 2019

Detailed Explanation of Quarterly Performance

The Fund’s company financial health and price momentum models underperformed the benchmark during the quarter and detracted from relative results. However, outperformance by the Fund’s value metrics models offset some of this negative impact. An overweighting in high momentum stocks hurt relative performance during the quarter as the momentum factor was strongly out of favor. The Fund’s tilt toward the benchmark’s smaller stocks also detracted from relative results during the period when larger names outperformed smaller ones.

By design, the Fund tends to invest in higher beta and higher volatility stocks, and the impact of this positioning was positive during the “risk-on” quarter. The Fund’s tilt toward deeper value stocks produced mixed results during the quarter.

From a sector perspective, the Fund’s allocation effect was negative, with overweightings in the Consumer Discretionary and Industrials sectors and an underweighting in the Information Technology sector detracting the most from relative performance. The Fund’s stock selection effect also was negative, primarily due to poor performance from holdings in the Financials, Information Technology, and Consumer Staples sectors.

Detailed Explanation of Calendar Year Performance

The Fund’s company financial health models significantly underperformed the benchmark and detracted from relative results during the year, while its value metrics models modestly underperformed. However, the Fund’s price momentum model outperformed the benchmark, offsetting some of this negative impact.

The Fund’s main design features also faced headwinds during the 12-month period. Overweightings in higher beta and higher volatility stocks detracted from relative performance, as did overweight exposure to high momentum stocks that slightly lagged lower momentum stocks. The Fund’s tilts toward smaller and deeper value stocks also hurt relative results amid market conditions that favored larger, growth-oriented stocks.

From a sector perspective, the Fund’s allocation effect was negative, primarily driven by overweightings in the Consumer Discretionary and Materials sectors. The Fund’s stock selection effect was significantly negative, with holdings in the Energy, Health Care, and Industrials sectors detracting the most from relative performance.

| 8 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Aggressive Investors 1 Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Top Ten Holdings as of December 31, 2019

| Rank | Description | Industry | % of Net Assets |

|||||

| 1 | Micron Technology, Inc. | Information Technology | 2.7% | |||||

| 2 | Apple, Inc. | Information Technology | 2.7% | |||||

| 3 | Cadence Design Systems, Inc. | Information Technology | 2.3% | |||||

| 4 | Target Corp. | Consumer Discretionary | 2.2% | |||||

| 5 | RH | Consumer Discretionary | 2.2% | |||||

| 6 | CDW Corp. | Information Technology | 2.1% | |||||

| 7 | Merck & Co., Inc. | Health Care | 2.0% | |||||

| 8 | Fiat Chrysler Automobiles NV | Consumer Discretionary | 1.8% | |||||

| 9 | Credit Acceptance Corp. | Financials | 1.7% | |||||

| 10 | Ensign Group, Inc. (The) | Health Care | 1.6% | |||||

| Total | 21.3% | |||||||

Industry Sector Representation as of December 31, 2019

| % of Net Assets | % of S&P 500 Index |

Difference | |||||||||||||

| Communication Services |

3.3 | % | 10.4 | % | -7.1% | ||||||||||

| Consumer Discretionary |

17.6 | % | 9.8 | % | 7.8% | ||||||||||

| Consumer Staples |

4.1 | % | 7.2 | % | -3.1% | ||||||||||

| Energy |

4.4 | % | 4.3 | % | 0.1% | ||||||||||

| Financials |

15.0 | % | 13.0 | % | 2.0% | ||||||||||

| Health Care |

13.0 | % | 14.2 | % | -1.2% | ||||||||||

| Industrials |

14.4 | % | 9.0 | % | 5.4% | ||||||||||

| Information Technology |

19.9 | % | 23.2 | % | -3.3% | ||||||||||

| Materials |

5.3 | % | 2.7 | % | 2.6% | ||||||||||

| Real Estate |

3.1 | % | 2.9 | % | 0.2% | ||||||||||

| Utilities |

0.0 | % | 3.3 | % | -3.3% | ||||||||||

| Liabilities in Excess of Other Assets |

-0.1 | % | 0.0 | % | -0.1% | ||||||||||

| Total |

100.0 | % | 100.0 | % | |||||||||||

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2019, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage can magnify the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk,” which may add to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

| bridgeway.com | 9 |

| Aggressive Investors 1 Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Conclusion

Thank you for your continued investment in Aggressive Investors 1 Fund. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

The Investment Management Team

| 10 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Aggressive Investors 1 Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

bridgeway.com |

11 |

| Aggressive Investors 1 Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

12 |

Semi-Annual Report | December 31, 2019 (Unaudited) |

| Aggressive Investors 1 Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

bridgeway.com |

13 |

| Ultra-Small Company Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) | ||

December 31, 2019

Dear Fellow Ultra-Small Company Fund Shareholder,

For the quarter ended December 31, 2019, our Fund returned +5.60%, underperforming our primary market benchmark, the CRSP Cap-Based Portfolio 10 Index (+12.55%). The Fund also lagged our peer benchmark, the Lipper Micro-Cap Stock Funds Index (+8.07%), as well as the Russell 2000 Index (+9.94%) and the Russell Microcap Index (+13.45%). It was a poor quarter on a relative basis.

For the calendar year, our Fund returned +9.51%, underperforming the CRSP Cap-Based Portfolio 10 Index (+25.87%), the Lipper Micro-Cap Stock Funds Index (+20.62%), the Russell 2000 Index (+25.52%), and the Russell Microcap Index (+22.43%).

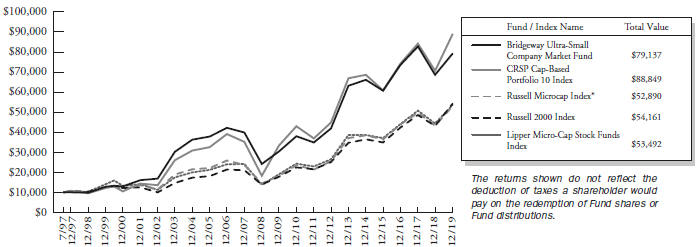

The table below presents our December quarter, six-month, one-year, five-year, 10-year, 15-year, and inception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of December 31, 2019

| Annualized | |||||||||||||||||||||||||||||||||||

| Quarter | 6 Months | 1 Year | 5 Years | 10 Years | 15 Years | Since Inception (8/5/94) | |||||||||||||||||||||||||||||

| Ultra-Small Company Fund |

5.60% | 1.63% | 9.51% | -1.70% | 6.44 | % | 4.07 | % | 12.13 | % | |||||||||||||||||||||||||

| CRSP Cap-Based Portfolio 10 Index |

12.55% | 8.59% | 25.87% | 5.29% | 10.33 | % | 7.31 | % | 11.37 | % | |||||||||||||||||||||||||

| Russell 2000 Index |

9.94% | 7.30% | 25.52% | 8.23% | 11.83 | % | 7.92 | % | 9.30 | % | |||||||||||||||||||||||||

| Russell Microcap Index |

13.45% | 7.26% | 22.43% | 6.57% | 11.26 | % | 6.16 | % | N/A | ||||||||||||||||||||||||||

| Lipper Micro-Cap Stock Funds Index |

8.07% | 4.31% | 20.62% | 6.74% | 10.88 | % | 6.80 | % | N/A | ||||||||||||||||||||||||||

Performance figures quoted in the table above represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The CRSP Cap-Based Portfolio 10 Index is an unmanaged index of 643 of the smallest publicly traded U.S. stocks (with dividends reinvested), as reported by the Center for Research on Security Prices. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market (with dividends reinvested). The Russell Microcap Index is an unmanaged, market value weighted index that measures performance of 1,000 of the smallest securities in the Russell 2000 Index. The Lipper Micro-Cap Stock Funds Index is an index of micro-cap funds compiled by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

| 14 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Growth of a $10,000 Investment

from Inception August 5, 1994 to December 31, 2019

| * | The Lipper Micro-Cap Stock Funds Index began on 12/31/1995, and the line graph for the Index begins at the same value as the Fund on that date. |

| ** | The Russell Microcap Index began on 6/30/2000, and the line graph for the Index begins at the same value as the Fund on that date. |

Detailed Explanation of Quarterly Performance

The Fund’s company financial health, price momentum and value metrics models all lagged the benchmark during the quarter and detracted from relative performance. The Fund’s tilt toward deeper value stocks across multiple valuation metrics also hurt relative results. Likewise, an underweighting in the highest-momentum stocks had a negative effect on relative returns.

During the quarter, the Fund held approximately 26% of its assets, on average, outside of CRSP 10, including stocks that appreciated into the CRSP 9 decile. The Fund’s holdings in CRSP 9 underperformed the CRSP 10 benchmark, detracting from relative results.

From a sector perspective, the Fund’s allocation effect was slightly negative. An underweighting in the Health Care sector and an overweighting in the Materials sector were the largest detractors from relative results. The Fund’s stock selection effect also was negative, driven largely by poor performance from holdings in the Health Care and Financials sectors.

| bridgeway.com | 15 |

| Ultra-Small Company Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

The table below presents index performance numbers for stocks in the different CRSP deciles during various time periods.

| Annualized | ||||||||||||||||||||||||

| CRSP Decile1 | Quarter | 6 Months | 1 Year | 5 Years | 10 Years | 94 Years | ||||||||||||||||||

| 1 (ultra-large) | 9.73% | 11.38% | 31.05% | 12.28% | 13.56% | 9.52% | ||||||||||||||||||

| 2 | 7.01% | 7.23% | 31.55% | 10.04% | 13.69% | 10.62% | ||||||||||||||||||

| 3 | 8.42% | 6.24% | 28.39% | 10.12% | 13.73% | 11.07% | ||||||||||||||||||

| 4 | 7.43% | 5.20% | 31.01% | 8.65% | 12.68% | 10.88% | ||||||||||||||||||

| 5 | 7.92% | 4.41% | 22.86% | 6.26% | 11.57% | 11.31% | ||||||||||||||||||

| 6 | 10.16% | 6.62% | 24.32% | 7.02% | 12.04% | 11.29% | ||||||||||||||||||

| 7 | 11.36% | 7.81% | 29.47% | 10.40% | 13.89% | 11.59% | ||||||||||||||||||

| 8 | 14.36% | 8.63% | 21.95% | 6.62% | 11.67% | 11.38% | ||||||||||||||||||

| 9 | 14.56% | 7.98% | 22.04% | 7.76% | 11.81% | 11.43% | ||||||||||||||||||

| 10 (ultra-small) | 12.55% | 8.59% | 25.87% | 5.29% | 10.33% | 13.07% | ||||||||||||||||||

| 1 | Performance figures are as of the period ended December 31, 2019. The CRSP Cap-Based Portfolio Indexes are unmanaged indexes of publicly traded U.S. stocks with dividends reinvested, grouped by market capitalization, as reported by the Center for Research in Security Prices. Past performance is no guarantee of future results. |

Detailed Explanation of Calendar Year Performance

All three of the Fund’s model categories underperformed the benchmark and detracted from relative results for the year. The Fund’s tilt toward deeper value stocks across multiple valuation metrics also hurt relative results, as did an underweighting in highest-momentum stocks.

During the year, the Fund held approximately 28% of its assets, on average, outside of CRSP 10, including stocks that appreciated into the CRSP 9 decile. The Fund’s holdings in CRSP 9 underperformed the CRSP 10 benchmark, detracting from relative results.

From a sector perspective, the Fund’s allocation effect was slightly positive. An underweighting in the Energy sector and an overweighting in the Information Technology sector contributed most to relative results. However, the Fund’s stock selection effect was negative, driven largely by holdings in the Health Care, Financials, and Information Technology sectors.

Top Ten Holdings as of December 31, 2019

| Rank | Description | Industry | % of Net Assets |

|||||

| 1 | InfuSystem Holdings, Inc. | Health Care | 3.2% | |||||

| 2 | Electromed, Inc. | Health Care | 2.5% | |||||

| 3 | Citi Trends, Inc. | Consumer Discretionary | 2.5% | |||||

| 4 | Consumer Portfolio Services, Inc. | Financials | 2.1% | |||||

| 5 | Rocky Brands, Inc. | Consumer Discretionary | 2.1% | |||||

| 6 | Harvard Bioscience, Inc. | Health Care | 2.0% | |||||

| 7 | Lifevantage Corp. | Consumer Staples | 2.0% | |||||

| 8 | Capitala Finance Corp. | Financials | 2.0% | |||||

| 9 | Orion Energy Systems, Inc. | Industrials | 1.9% | |||||

| 10 | Transcat, Inc. | Industrials | 1.9% | |||||

| Total | 22.2% | |||||||

| 16 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Industry Sector Representation as of December 31, 2019

| % of Net Assets | % of CRSP 10 Index | Difference | |||||||||||||

| Communication Services |

4.7 | % | 4.1 | % | 0.6% | ||||||||||

| Consumer Discretionary |

14.2 | % | 11.0 | % | 3.2% | ||||||||||

| Consumer Staples |

5.0 | % | 2.0 | % | 3.0% | ||||||||||

| Energy |

8.2 | % | 9.0 | % | -0.8% | ||||||||||

| Financials |

16.7 | % | 21.6 | % | -4.9% | ||||||||||

| Health Care |

22.1 | % | 29.7 | % | -7.6% | ||||||||||

| Industrials |

12.7 | % | 10.0 | % | 2.7% | ||||||||||

| Information Technology |

11.7 | % | 8.5 | % | 3.2% | ||||||||||

| Materials |

3.9 | % | 2.6 | % | 1.3% | ||||||||||

| Real Estate |

0.9 | % | 1.0 | % | -0.1% | ||||||||||

| Utilities |

0.0 | % | 0.5 | % | -0.9% | ||||||||||

| Liabilities in Excess of Other Assets |

-0.1 | % | 0.0 | % | -0.1% | ||||||||||

| Total |

100.0 | % | 100.0 | % | |||||||||||

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2019, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

The Fund is subject to very high, above market risk (volatility) and is not an appropriate investment for short-term investors. Investments in ultra-small companies generally carry greater risk than is customarily associated with larger companies and even “small companies” for various reasons, such as narrower markets (fewer investors), limited financial resources and greater trading difficulty.

Conclusion

Ultra-Small Company Fund remains closed to new investors. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

The Investment Management Team

| bridgeway.com | 17 |

| Ultra-Small Company Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

18 |

Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

bridgeway.com |

19 |

| Ultra-Small Company Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

20 |

Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

bridgeway.com |

21 |

| Ultra-Small Company Market Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) | ||

December 31, 2019

Dear Fellow Ultra-Small Company Market Fund Shareholder,

For the quarter ended December 31, 2019, our Fund returned +7.34%, underperforming our primary market benchmark, the CRSP Cap-Based Portfolio 10 Index (+12.55%). Our Fund also underperformed our peer benchmark, the Lipper Micro-Cap Stock Funds Index (+8.07%), as well as the Russell 2000 Index (+9.94%) and the Russell Microcap Index (+13.45%). It was a poor quarter on a relative basis.

For the calendar year, our Fund returned +15.34%, trailing the CRSP Cap-Based Portfolio 10 Index (+25.87%), the Lipper Micro-Cap Stock Funds Index (+20.62%), the Russell 2000 Index (+25.52%), and the Russell Microcap Index (+22.43%).

The table below presents our December quarter, six-month, one-year, five-year, 10-year, 15-year, and inception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of December 31, 2019

| Annualized | |||||||||||||||||||||||||||||||||||

| Quarter | 6 Months | 1 Year | 5 Years | 10 Years | 15 Years | Since Inception (7/31/97) | |||||||||||||||||||||||||||||

| Ultra-Small Company Market Fund |

7.34% | 3.84% | 15.34% | 3.67% | 10.05 | % | 5.34 | % | 9.67 | % | |||||||||||||||||||||||||

| CRSP Cap-Based Portfolio 10 Index |

12.55% | 8.59% | 25.87% | 5.29% | 10.33 | % | 7.31 | % | 10.23 | % | |||||||||||||||||||||||||

| Russell 2000 Index |

9.94% | 7.30% | 25.52% | 8.23% | 11.83 | % | 7.92 | % | 7.83 | % | |||||||||||||||||||||||||

| Russell Microcap Index |

13.45% | 7.26% | 22.43% | 6.57% | 11.26 | % | 6.16 | % | N/A | ||||||||||||||||||||||||||

| Lipper Micro-Cap Stock Funds Index |

8.07% | 4.31% | 20.62% | 6.74% | 10.88 | % | 6.80 | % | 7.77 | % | |||||||||||||||||||||||||

Performance figures quoted in the table above represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The CRSP Cap-Based Portfolio 10 Index is an unmanaged index of 643 of the smallest publicly traded U.S. stocks with dividends reinvested, as reported by the Center for Research on Security Prices. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Russell Microcap Index is an unmanaged, market value weighted index that measures performance of 1,000 of the smallest securities in the Russell 2000 Index. The Lipper Micro-Cap Stock Funds Index is an index of micro-cap funds compiled by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

| 22 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Market Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Growth of a $10,000 Investment

from Inception July 31, 1997 to December 31, 2019

| * | The Russell Microcap Index began on 6/30/2000, and the line graph for the Index begins at the same value as the Fund on that date. |

Detailed Explanation of Quarterly Performance

During the quarter, the Fund held about 20% of its assets, on average, in stocks outside of CRSP 10, including stocks that appreciated into CRSP 9. These larger stocks underperformed the benchmark and hurt the Fund’s relative results. The Fund’s sidestepping strategies, which eliminated exposure to stocks with high probability of a steep price decline, major financial distress or bankruptcy, helped performance against the benchmark.

The Fund’s stock selection effect was negative, with holdings in the Health Care and Communication Services sectors detracting most from relative returns.

The table below presents index performance numbers for stocks in the different CRSP deciles during various time periods.

| Annualized | ||||||||||||||||||||||||

| CRSP Decile1 |

Quarter | 6 Months | 1 Year | 5 Years | 10 Years | 94 Years | ||||||||||||||||||

| 1 (ultra-large) | 9.73% | 11.38% | 31.05% | 12.28% | 13.56% | 9.52% | ||||||||||||||||||

| 2 | 7.01% | 7.23% | 31.55% | 10.04% | 13.69% | 10.62% | ||||||||||||||||||

| 3 | 8.42% | 6.24% | 28.39% | 10.12% | 13.73% | 11.07% | ||||||||||||||||||

| 4 | 7.43% | 5.20% | 31.01% | 8.65% | 12.68% | 10.88% | ||||||||||||||||||

| 5 | 7.92% | 4.41% | 22.86% | 6.26% | 11.57% | 11.31% | ||||||||||||||||||

| 6 | 10.16% | 6.62% | 24.32% | 7.02% | 12.04% | 11.29% | ||||||||||||||||||

| 7 | 11.36% | 7.81% | 29.47% | 10.40% | 13.89% | 11.59% | ||||||||||||||||||

| 8 | 14.36% | 8.63% | 21.95% | 6.62% | 11.67% | 11.38% | ||||||||||||||||||

| 9 | 14.56% | 7.98% | 22.04% | 7.76% | 11.81% | 11.43% | ||||||||||||||||||

| 10 (ultra-small) | 12.55% | 8.59% | 25.87% | 5.29% | 10.33% | 13.07% | ||||||||||||||||||

| 1 | Performance figures are as of the period ended December 31, 2019. The CRSP Cap-Based Portfolio Indexes are unmanaged indexes of publicly traded U.S. stocks with dividends reinvested, grouped by market capitalization, as reported by the Center for Research in Security Prices. Past performance is no guarantee of future results. |

| bridgeway.com | 23 |

| Ultra-Small Company Market Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Detailed Explanation of Calendar Year Performance

The Fund held about 19% of its assets, on average, in stocks outside of CRSP 10, including stocks that appreciated into CRSP 9. These larger stocks underperformed the benchmark during the year, which hurt relative results. However, the Fund’s sidestepping strategies, which eliminated exposure to stocks with high probability of a steep price decline, major financial distress or bankruptcy, helped performance against the benchmark.

The Fund’s stock selection effect was negative, with holdings in the Health Care and Industrials sectors detracting most from relative performance.

Top Ten Holdings as of December 31, 2019

| Rank | Description | Industry | % of Net Assets |

|||||

| 1 | Pacific Biosciences of California, Inc. | Health Care | 0.7% | |||||

| 2 | Jounce Therapeutics, Inc. | Health Care | 0.6% | |||||

| 3 | Constellation Pharmaceuticals, Inc. | Health Care | 0.6% | |||||

| 4 | CEL-SCI Corp. | Health Care | 0.5% | |||||

| 5 | Stratus Properties, Inc. | Real Estate | 0.5% | |||||

| 6 | Eiger BioPharmaceuticals, Inc. | Health Care | 0.5% | |||||

| 7 | Utah Medical Products, Inc. | Health Care | 0.5% | |||||

| 8 | Calithera Biosciences, Inc. | Health Care | 0.5% | |||||

| 9 | Pfenex, Inc. | Health Care | 0.5% | |||||

| 10 | Overseas Shipholding Group, Inc., Class A | Energy | 0.5% | |||||

| Total | 5.4% | |||||||

Industry Sector Representation as of December 31, 2019

| % of Net Assets | % of CRSP 10 Index | Difference | |||||||||||||

| Communication Services |

4.5 | % | 4.1 | % | 0.4% | ||||||||||

| Consumer Discretionary |

12.3 | % | 11.0 | % | 1.3% | ||||||||||

| Consumer Staples |

1.3 | % | 2.0 | % | -0.7% | ||||||||||

| Energy |

9.8 | % | 9.0 | % | 0.8% | ||||||||||

| Financials |

21.1 | % | 21.6 | % | -0.5% | ||||||||||

| Health Care |

27.0 | % | 29.7 | % | -2.7% | ||||||||||

| Industrials |

10.0 | % | 10.0 | % | 0.0% | ||||||||||

| Information Technology |

8.8 | % | 8.5 | % | 0.3% | ||||||||||

| Materials |

2.9 | % | 2.6 | % | 0.3% | ||||||||||

| Real Estate |

1.7 | % | 1.0 | % | 0.7% | ||||||||||

| Utilities |

0.6 | % | 0.5 | % | 0.1% | ||||||||||

| Cash & Other Assets |

0.0 | % | 0.0 | % | 0.0% | ||||||||||

| Total |

100.0 | % | 100.0 | % | |||||||||||

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2019, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

The Fund is subject to very high, above market risk (volatility) and is not an appropriate investment for short-term investors. Investments in ultra-small companies generally carry greater risk than is customarily associated with larger companies and

| 24 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Market Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

even “small companies” for various reasons, such as narrower markets (fewer investors), limited financial resources and greater trading difficulty.

Conclusion

Thank you for your continued investment in Ultra-Small Company Market Fund. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

The Investment Management Team

| bridgeway.com | 25 |

| Ultra-Small Company Market Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

26 |

Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Market Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

bridgeway.com |

27 |

| Ultra-Small Company Market Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

28 |

Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Market Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

bridgeway.com |

29 |

| Ultra-Small Company Market Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

30 |

Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Market Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

bridgeway.com |

31 |

| Ultra-Small Company Market Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

32 |

Semi-Annual Report | December 31, 2019 (Unaudited) |

| Ultra-Small Company Market Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

bridgeway.com |

33 |

| Small-Cap Growth Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) | ||

December 31, 2019

Dear Fellow Small-Cap Growth Fund Shareholder,

For the quarter ended December 31, 2019, our Fund returned +11.03%, slightly underperforming our primary market benchmark, the Russell 2000 Growth Index (+11.39%), but outperforming our peer benchmark, the Lipper Small-Cap Growth Funds Index (+8.40%). It was a strong quarter on an absolute basis, but a mixed one on a relative basis.

For the calendar year, our Fund returned +15.10%, lagging both the Russell 2000 Growth Index (+28.48%) and the Lipper Small-Cap Growth Funds Index (+30.31%). The Fund lags our benchmarks across the longer five-year, 10-year, 15-year, and inception-to-date periods as well.

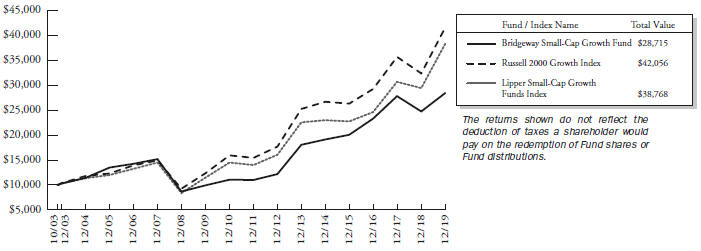

The table below presents our December quarter, six-month, one-year, five-year, 10-year, 15-year, and inception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of December 31, 2019

| Annualized | |||||||||||||||||||||||||||||||||||

| Quarter | 6 Months | 1 Year | 5 Years | 10 Years | 15 Years | Since Inception (10/31/03) | |||||||||||||||||||||||||||||

| Small-Cap Growth Fund |

11.03% | 4.53% | 15.10% | 8.29% | 11.22 | % | 6.32 | % | 6.74 | % | |||||||||||||||||||||||||

| Russell 2000 Growth Index |

11.39% | 6.75% | 28.48% | 9.34% | 13.01 | % | 8.81 | % | 9.29 | % | |||||||||||||||||||||||||

| Lipper Small-Cap Growth Funds Index |

8.40% | 4.17% | 30.31% | 10.81% | 12.89 | % | 8.51 | % | 8.75 | % | |||||||||||||||||||||||||

Performance figures quoted in the table above represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Russell 2000 Growth Index is an unmanaged index that consists of stocks in the Russell 2000 Index with higher price-to-book ratios and higher forecasted growth values with dividends reinvested. The Lipper Small-Cap Growth Funds Index is an index of small-company, growth-oriented funds compiled by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

| 34 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Small-Cap Growth Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Growth of a $10,000 Investment

from Inception October 31, 2003 to December 31, 2019

Detailed Explanation of Quarterly Performance

The Fund’s company financial health and price momentum models lagged the benchmark during the quarter, which weighed on relative results. This negative impact was partly offset by outperformance from the Fund’s value metrics models. The Fund’s greater-than-benchmark exposure to core stocks (as measured by multiple valuation metrics) detracted from relative results. In contrast, the Fund’s tilt toward smaller stocks in the small-cap growth universe improved relative performance.

From a sector perspective, the Fund’s allocation effect was negative. An underweighting in the Health Care sector and an overweighting in the Real Estate sector detracted the most from relative results. However, the Fund’s stock selection effect was positive, largely driven by the performance of holdings in the Materials and Consumer Discretionary sectors.

Detailed Explanation of Calendar Year Performance

All three of the Fund’s model categories underperformed the benchmark during the year. The Fund’s greater-than-benchmark exposure to core stocks (as measured by multiple valuation metrics) also detracted from relative returns, as did its tilt toward smaller stocks in the small-cap growth universe.

From a sector perspective, the Fund’s allocation effect was negative. Overweightings in the Energy and Materials sectors and an underweighting in the Real Estate sector detracted the most from relative results. The Fund’s stock selection effect was significantly negative, with holdings in the Health Care and Information Technology sectors weighing most heavily on relative performance.

| bridgeway.com | 35 |

| Small-Cap Growth Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Top Ten Holdings as of December 31, 2019

| Rank | Description | Industry | % of Net Assets |

|||||||

| 1 | Crocs, Inc. | Consumer Discretionary | 1.6% | |||||||

| 2 | TTEC Holdings, Inc. | Information Technology | 1.6% | |||||||

| 3 | ACI Worldwide, Inc. | Information Technology | 1.6% | |||||||

| 4 | AMN Healthcare Services, Inc. | Health Care | 1.6% | |||||||

| 5 | Forterra, Inc. | Materials | 1.5% | |||||||

| 6 | OSI Systems, Inc. | Information Technology | 1.5% | |||||||

| 7 | Cimpress PLC | Industrials | 1.5% | |||||||

| 8 | Hanger, Inc. | Health Care | 1.5% | |||||||

| 9 | R1 RCM, Inc. | Health Care | 1.5% | |||||||

| 10 | Castlight Health, Inc., Class B | Health Care | 1.5% | |||||||

| Total | 15.4% | |||||||||

Industry Sector Representation as of December 31, 2019

| % of Net Assets | % of Russell 2000 Growth Index |

Difference | |||||||||||||

| Communication Services |

4.7 | % | 2.4 | % | 2.3% | ||||||||||

| Consumer Discretionary |

14.9 | % | 12.0 | % | 2.9% | ||||||||||

| Consumer Staples |

2.8 | % | 3.3 | % | -0.6% | ||||||||||

| Energy |

0.8 | % | 0.6 | % | 0.2% | ||||||||||

| Financials |

7.3 | % | 5.8 | % | 1.5% | ||||||||||

| Health Care |

27.9 | % | 30.5 | % | -2.6% | ||||||||||

| Industrials |

16.0 | % | 18.9 | % | -2.9% | ||||||||||

| Information Technology |

15.0 | % | 17.3 | % | -2.3% | ||||||||||

| Materials |

2.7 | % | 3.1 | % | -0.4% | ||||||||||

| Real Estate |

7.7 | % | 4.6 | % | 3.1% | ||||||||||

| Utilities |

0.8 | % | 1.5 | % | -0.7% | ||||||||||

| Liabilities in Excess of Other Assets |

-0.6 | % | 0.0 | % | -0.6% | ||||||||||

| Total |

100.0 | % | 100.0 | % | |||||||||||

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2019, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly impact short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in small companies generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

| 36 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Small-Cap Growth Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Conclusion

Thank you for your continued investment in Small-Cap Growth Fund. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

The Investment Management Team

| bridgeway.com | 37 |

| Small-Cap Growth Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

38 |

Semi-Annual Report | December 31, 2019 (Unaudited) |

| Small-Cap Growth Fund |

| |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | ||

| Showing percentage of net assets as of December 31, 2019 |

|

bridgeway.com |

39 |

| Small-Cap Value Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) | ||

December 31, 2019

Dear Fellow Small-Cap Value Fund Shareholder,

For the quarter ended December 31, 2019, our Fund returned +6.47%, underperforming our primary market benchmark, the Russell 2000 Value Index (+8.49%), and our peer benchmark, the Lipper Small-Cap Value Funds Index (+8.01%). It was a positive quarter on an absolute basis, but a poor one on a relative basis.

For the calendar year, our Fund returned +14.98%, trailing both the Russell 2000 Value Index (+22.39%) and the Lipper Small-Cap Value Funds Index (+21.81%). We lag our primary market and peer benchmarks in the longer five-year, 10-year, 15-year, and inception-to-date periods as well.

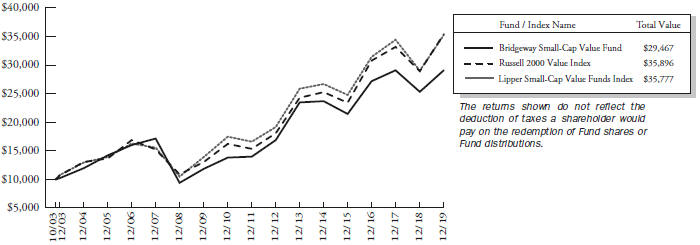

The table below presents our December quarter, six-month, one-year, five-year, 10-year, 15-year, and inception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of December 31, 2019

| Annualized | |||||||||||||||||||||||||||||||||||

| Quarter | 6 Months | 1 Year | 5 Years | 10 Years | 15 Years | Since Inception (10/31/03) | |||||||||||||||||||||||||||||

| Small-Cap Value Fund |

6.47% | 8.10% | 14.98% | 4.22% | 9.45 | % | 6.14 | % | 6.91 | % | |||||||||||||||||||||||||

| Russell 2000 Value Index |

8.49% | 7.87% | 22.39% | 6.99% | 10.56 | % | 6.92 | % | 8.23 | % | |||||||||||||||||||||||||

| Lipper Small-Cap Value Funds Index |

8.01% | 7.39% | 21.81% | 5.81% | 9.84 | % | 6.96 | % | 8.21 | % | |||||||||||||||||||||||||

Performance figures quoted in the table above represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The Russell 2000 Value Index is an unmanaged index that consists of stocks in the Russell 2000 Index with lower price-to-book ratios and lower forecasted growth values with dividends reinvested. The Lipper Small-Cap Value Funds Index is an index of small-company, value-oriented funds compiled by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

| 40 | Semi-Annual Report | December 31, 2019 (Unaudited) |

| Small-Cap Value Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Growth of a $10,000 Investment

from Inception October 31, 2003 to December 31, 2019

Detailed Explanation of Quarterly Performance

All three of the Fund’s model categories underperformed the benchmark during the quarter and detracted from relative results. This underperformance was partly offset by the Fund’s tilt toward smaller stocks in the small-cap value universe, which improved relative results. The impact of the Fund’s tilt toward deeper value stocks across multiple valuation metrics was mixed during the quarter.

From a sector perspective, the Fund’s allocation effect was positive, with underweightings in the Utilities and Communication Services sectors adding the most to relative results. The Fund’s stock selection effect was significantly negative, however, with holdings in the Health Care and Financials sectors detracting the most from relative performance.

Detailed Explanation of Calendar Year Performance

For the calendar year, the Fund’s core value metrics models and diversifying price momentum model lagged the benchmark and detracted from relative results. However, the Fund’s company financial health models outperformed the benchmark and offset some of that negative impact. The Fund’s tilt toward deeper value stocks across multiple valuation metrics also weighed on relative performance during the 12-month period, as did its tilt toward smaller stocks in the small-cap value universe.

From a sector perspective, the Fund’s allocation effect was negative. Underweightings in the Information Technology and Real Estate sectors, along with an overweighting in the Health Care sector, particularly hurt relative results. The Fund’s stock selection effect also was negative, primarily due to poor performance from holdings in the Financials, Energy, and Materials sectors.

| bridgeway.com | 41 |

| Small-Cap Value Fund |

| |

| MANAGER’S COMMENTARY (Unaudited) (continued) | ||

Top Ten Holdings as of December 31, 2019

| Rank | Description | Industry | % of Net Assets |

|||||

| 1 | TherapeuticsMD, Inc. | Health Care | 1.7% | |||||

| 2 | Piper Sandler Cos. | Financials | 1.6% | |||||

| 3 | Gladstone Commercial Corp. | Real Estate | 1.6% | |||||

| 4 | Hibbett Sports, Inc. | Consumer Discretionary | 1.5% | |||||

| 5 | OFG Bancorp | Financials | 1.5% | |||||

| 6 | Standard Motor Products, Inc. | Consumer Discretionary | 1.5% | |||||

| 7 | TTM Technologies, Inc. | Information Technology | 1.5% | |||||

| 8 | Brady Corp., Class A | Industrials | 1.5% | |||||

| 9 | National Western Life Group, Inc., Class A | Financials | 1.5% | |||||

| 10 | Aircastle, Ltd. | Industrials | 1.5% | |||||

| Total | 15.4% | |||||||

Industry Sector Representation as of December 31, 2019

| % of Net Assets | % of Russell 2000 Value Index |

Difference | |||||||||||||

| Communication Services |

0.0 | % | 2.2 | % | -2.2% | ||||||||||

| Consumer Discretionary |

13.4 | % | 9.7 | % | 3.7% | ||||||||||

| Consumer Staples |

2.6 | % | 2.7 | % | -0.1% | ||||||||||

| Energy |

5.0 | % | 5.8 | % | -0.8% | ||||||||||

| Financials |

31.3 | % | 30.2 | % | 1.1% | ||||||||||

| Health Care |

5.3 | % | 5.4 | % | -0.1% | ||||||||||

| Industrials |

12.9 | % | 12.7 | % | 0.2% | ||||||||||

| Information Technology |

9.1 | % | 9.6 | % | -0.5% | ||||||||||

| Materials |

4.2 | % | 4.7 | % | -0.5% | ||||||||||

| Real Estate |

14.0 | % | 11.1 | % | 2.9% | ||||||||||

| Utilities |

2.2 | % | 5.9 | % | -3.7% | ||||||||||

| Cash & Other Assets |

0.0 | % | 0.0 | % | 0.0% | ||||||||||

| Total |

100.0 | % | 100.0 | % | |||||||||||