UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | X | |||||||

| Filed by a Party other than the Registrant | ||||||||

Check the appropriate box:

| Preliminary Proxy Statement | ||||||||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||||||

| X | Definitive Proxy Statement | |||||||

| Definitive Additional Materials | ||||||||

| Soliciting Material Under Rule 14a-12 | ||||||||

| ALBEMARLE CORPORATION | ||||||||||||||

(Name of registrant as specified in its charter) | ||||||||||||||

| N/A | ||||||||||||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||||||||||||

Payment of Filing Fee (Check the appropriate box):

| X | No Fee Required | |||||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||||||||

| (1) Title of each class of securities to which transaction applies: | ||||||||

| (2) Aggregate number of securities to which transaction applies: | ||||||||

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||||||

| (4) Proposed maximum aggregate value of transaction: | ||||||||

| (5) Total Paid Fee | ||||||||

| Fee Paid Previously with preliminary materials | ||||||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: | ||||||||

(1) Amount Previously Paid: | ||||||||

(2) Form, Schedule or Registration Statement No.: | ||||||||

(3) Filing Party: | ||||||||

(4) Date Filed: | ||||||||

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Albemarle Corporation 2021 Annual Meeting of Shareholders (the “Annual Meeting”) will be held at# Albemarle Corporation, 4250 Congress Street, Charlotte, North Carolina 28209, on Tuesday, May 4, 2021, at 7:00 a.m., Eastern Time, for the following purposes:

1.To consider and vote on a non-binding advisory resolution approving the compensation of our named executive officers;

2.To elect the nine nominees named in the accompanying Proxy Statement to the Board of Directors to serve for the ensuing year or until their successors are duly elected and qualified;

3.To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and

4.To conduct any other business which may properly come before the Annual Meeting or any adjournments or postponements thereof.

Only shareholders of record at the close of business on March 8, 2021, are entitled to receive notice of and vote at the Annual Meeting.

To ensure your vote is counted, you are requested to vote your shares promptly, regardless of whether you expect to attend the Annual Meeting. Voting by the Internet or telephone is fast and convenient, and your vote is immediately tabulated. In addition, by using the Internet or telephone, you help reduce our postage and proxy tabulation costs. You may also vote by completing, signing, dating, and returning by May 3, 2021 the proxy enclosed with paper copies of the materials in the postage-paid envelope provided.

This year, we are again electronically disseminating Annual Meeting materials to some of our shareholders, as permitted under the “Notice and Access” rules approved by the Securities and Exchange Commission. Shareholders to whom Notice and Access applies will receive a Notice of Internet Availability of Proxy Materials ("Notice") containing instructions on how to access Annual Meeting materials via the Internet. The Notice also provides instructions on how to obtain paper copies if preferred.

If you are present at the Annual Meeting, you may vote in person even if you already have voted your proxy by the Internet, telephone, or mail. Seating at the Annual Meeting will be on a first-come, first-served basis. Attendees at the Annual Meeting will be required to comply with public health guidelines of the Centers for Disease Control and Prevention and local public health officials, including wearing a face mask and staying at least 6 feet away from others.

By Order of the Board of Directors

Karen G. Narwold, Secretary

March 23, 2021

TABLE OF CONTENTS

i

PROXY STATEMENT SUMMARY

This summary provides an overview and highlights information contained elsewhere in this Proxy Statement ("Proxy Statement"). This summary does not contain all information that you should consider, and you should read the entire Proxy Statement carefully before voting. Throughout the Proxy Statement, “we,” “us,” “our,” “the Company,” and “Albemarle” refer to Albemarle Corporation, a Virginia corporation.

Annual Meeting

| Date and Time | Place# | ||||

Tuesday, May 4, 2021 | Albemarle Corporation | ||||

| 7:00 a.m., Eastern Time | 4250 Congress Street | ||||

| Charlotte, North Carolina 28209 | |||||

Voting Matters

The following table summarizes the proposals to be considered at the Annual Meeting and the Board’s voting recommendation with respect to each proposal.

| Voting Matter | Board Vote Recommendation | |||||||

| Proposal 1: | Advisory Vote to Approve the Compensation of our Named Executive Officers (Say-on-Pay) | FOR | ||||||

| Proposal 2: | Election of Directors | FOR each Nominee | ||||||

| Proposal 3: | Ratification of Appointment of Independent Registered Public Accounting Firm for Fiscal Year 2021 | FOR | ||||||

Our Business in 2020

| Lithium | Bromine Specialties | Catalysts | |||||||||

| Net Sales | $1,145M | $965M | $798M | ||||||||

| Adj. EBITDA* | $393M | $324M | $130M | ||||||||

| Adj. EBITDA Margin* | 34% | 34% | 16% | ||||||||

| Applications | Green Energy Storage, Glasses & Ceramics, Greases & Lubricants, Pharmaceutical Synthesis | Flame Retardants, Industrial Water Treatment, Completion Fluids for Oilfield, Plastic & Synthetic Rubber, C3Ag & Pharma Synthesis | Fluid Cracking Catalysts, Clean Fuels Technologies, Organometallics & Curatives | ||||||||

Our Strategy

| Grow Profitably | • Pursue profitable growth to align with customer demand • Build capabilities to accelerate lower capital intensity, higher return projects | |||||||

| Maximize Productivity | • Optimize earnings and cash flow generation across all of our businesses • Drive productivity through operational discipline | |||||||

| Invest with Discipline | • Focus investment capital on highest-return opportunities • Generate shareholder value through continual portfolio assessment; buy vs. build • Maintain Investment Grade credit rating and support our dividend | |||||||

| Advance Sustainability | • Enable our customers' sustainability ambitions • Continue to implement and improve ESG performance across all of our businesses | |||||||

___________________________________________________

# Attendees at the Annual Meeting will be required to comply with public health guidelines of the Centers for Disease Control and Prevention and local public health officials, including wearing a face mask and staying at least 6 feet away from others.

* Non-GAAP financial measure, reconciliations from US GAAP financial measures are available in Q4/FY2020 earnings release.

1

2020 Company Performance

•Our 3-year Total Shareholder Return for the 2018-2020 period placed us at the 78th percentile relative to our 2018 peer group

•Net sales of $3,129 million decreased 13% from 2019; Adjusted EBITDA* of $819 million decreased 21% from 2019; Adjusted EBITDA margin* of 26% in 2020 compared to 29% in 2019

•Cash flows from operations of $798.9 million increased 11% compared to 2019

•Achieved $80 million of sustainable cost savings in 2020, 60% above our initial target

•Our plants were able to operate without material impact from the COVID-19 pandemic; we established a cross-functional Global Response Team to monitor and report on the global situation and collaborate on protocols for operations and employee safety at all sites

•On April 20, 2020, J. Kent Masters, Jr. was elected Chairman, President and Chief Executive Officer following the announced retirement of Luther C. Kissam IV

•The U.S. Department of Energy (“DOE”) selected Albemarle as a critical partner for two lithium research projects over three years through a Battery Manufacturing Lab Call; Albemarle will work in conjunction with two DOE labs on the approved projects

•We increased our quarterly dividend for the 26th consecutive year, to $0.385 per share; as of February 2020, Albemarle was included in the S&P 500 Dividend Aristocrats Index

Governance Highlights

We believe good governance is integral to achieving long-term shareholder value. We are committed to governance policies and practices that best serve the interests of our Company and its shareholders. Our Board of Directors (the “Board of Directors” or the "Board") monitors developments in governance best practices to ensure it continues to meet its commitment to thoughtful and independent representation of shareholder interests, and other stakeholders. The following table summarizes certain corporate governance practices and certain facts about the nominees for our Board of Directors.

| Governance Practices | ||||||||

| Annual Election of all Directors | Regular Executive Sessions of Independent Directors | Robust Stock Ownership Guidelines (6x Salary for CEO) | ||||||

| Resignation Policy for Directors Not Receiving Majority Approval | Longstanding Commitment to Sustainability and Corporate Responsibility | Annual Board and Committee Evaluation Process led by Lead Independent Director | ||||||

| Directors Do Not Stand for Re-election in the Year in Which They Reach 72 Years of Age | Board and Committee Authority to Retain Independent Advisors | Policies Prohibiting Hedging, Short Sale, and Pledging Our Stock by Directors, Officers, and Employees | ||||||

| Compensation Recovery Policy (Clawback Policy) | Risk Oversight by Full Board and Committees | No Shareholder Rights Plan (Poison Pill) | ||||||

| Director Nominees: Key Facts | |||||||||||

| Less than 5 years average tenure | 8 of 9 are independent | 56% racial and gender diversity | 67% have C-suite experience | ||||||||

CEO Compensation

•Target Total Direct Compensation is below the median of our peer group

•Pay Mix: 86% of CEO compensation is based on incentive pay

•CEO pay shows a strong correlation between 3-year relative realizable pay and 3-year relative total shareholder return

___________________________________________________

* Non-GAAP financial measure, reconciliations from US GAAP financial measures are available in Q4/FY2020 earnings release.

2

COMPENSATION DISCUSSION AND ANALYSIS

The following pages describe Albemarle’s executive compensation program and the compensation decisions made by the Executive Compensation Committee (the “Committee”) for our Named Executive Officers ("NEOs") listed below.

| NEO | Title | ||||

| J. Kent Masters, Jr. | Chairman, President and Chief Executive Officer | ||||

| Scott A. Tozier | Executive Vice President, Chief Financial Officer | ||||

| Eric W. Norris | President, Lithium | ||||

| Netha N. Johnson, Jr. | President, Bromine Specialties | ||||

| Raphael G. Crawford | President, Catalysts | ||||

| Luther C. Kissam IV | Former Chairman, President and Chief Executive Officer | ||||

Mr. Masters replaced Mr. Kissam as the Company's Chairman, President and Chief Executive Officer effective April 20, 2020. Mr. Kissam retired from the Company effective July 1, 2020 and continues to serve on our Board through the Annual Meeting. Unless specifically identified as annualized, Mr. Masters' compensation for 2020 reflects his employment period from April 20 to December 31, 2020. As part of his new hire package, Mr. Masters was awarded a one-time equity grant of $3,500,000 consisting of restricted stock units. Future equity grants to Mr. Masters will align to the Company's compensation philosophy, as described in this Compensation Discussion & Analysis, that are 50% time-based and 50% performance-based.

In order to manage and incentivize a smooth transition to Mr. Masters, the Committee took the following compensation actions. For Mr. Kissam, the Committee, instead of an equity grant or base salary increase for 2020, approved 2020 annual incentive in an amount equal to the higher of target or actual achievement of the annual incentive performance criteria as if employed for the full performance year. In addition, to manage top leadership continuation, and retain key skills, knowledge, and experience during a time of leadership transition, the Committee approved one-time equity grants of restricted stock units in 2020 for Messrs. Tozier, Norris, Johnson, and Crawford.

EXECUTIVE SUMMARY

Compensation Program Highlights

•Chief Executive Officer ("CEO") compensation over a three-year period shows a strong correlation between realizable pay and total shareholder return relative to our Peer Group (as defined on page 7).

•Performance metrics(1) were aligned with our Peer Group and our Company goals.

◦Annual Goals: Adjusted EBITDA, Adjusted Cash Flow from Operations, and Stewardship

◦Long Term Goals: Total Shareholder Return (“TSR”) relative to our Peer Group ("rTSR") and Return on Invested Capital ("ROIC"), each measured over a 3-year performance period

•Focused Peer Group of similarly-sized companies.

___________________________________________________

(1) See pages 10-18 for a discussion of how Adjusted EBITDA, Adjusted Cash Flow from Operations, rTSR, and ROIC are defined and calculated.

3

Shareholder Alignment

In May 2020, the Company held our annual shareholder advisory vote to approve the compensation paid to our NEOs in 2019, which resulted in approximately 96% of the votes cast approving such compensation.

In the fall of 2020 we continued our annual engagement with our shareholders. This engagement gave us a basis for further evaluation of our practices in executive compensation and corporate governance. This initiative was led by a group of senior officers of the Company, acting on behalf and at the request of the Committee, by reaching out to shareholders holding 70% of our outstanding shares. For those shareholders who elected to engage with us (representing approximately 44% of our outstanding shares), we organized follow-up calls. This outreach reflects our commitment to understand and address key issues of importance to our shareholders. In line with the high support for our executive compensation program as expressed in the 2020 annual shareholder advisory vote to approve our NEO compensation, shareholders continued their support for our compensation program and the changes made over the past several years:

•2019: We introduced ROIC as a second metric for our long term incentive, to ensure alignment between our expected return on capital (as we entered a period of higher investments) and long term payout opportunities for our executives. We put a payout cap of 100% on rTSR payouts if, in absolute terms, TSR is negative.

•2017: We included a "double trigger" in our equity plan and award agreements, so that in the event of a Change in Control, equity would only vest following a termination of employment.

•2016: We changed our Peer Group from the Dow Jones Chemical Index to a smaller group of chemical companies that were similarly situated to, and sized as, Albemarle.

Pay for Performance: 2020 Compensation Outcomes

CEO Pay At-A-Glance: Realizable Pay Relative Degree of Alignment

We aim for our CEO’s total compensation to be reflective of pay opportunities at or around median levels among our Peer Group, while aligning payout opportunities with the Company's long-term performance. Realizable Pay Relative Degree of Alignment (“RPRDA”) is an important measure the Committee uses to assess whether realizable pay is commensurate with TSR achieved by shareholders relative to our Peer Group.

RPRDA compares the percentile ranks of a CEO’s three-year realizable pay and a company’s three-year TSR performance relative to the Peer Group. The RPRDA is equal to the difference between the combined performance rank minus the combined pay rank. Values for the RPRDA can measure between -100% and 100%. On that scale, the values can be interpreted as outlined below.

•A value of 100% represents a situation where the pay rank is the lowest, while the performance rank is the highest among the Peer Group.

•A value of 0% represents the situation where the pay rank and the performance rank among the Peer Group are perfectly aligned.

•A value of -100% represents a situation where the pay rank is the highest, while the performance rank is the lowest among the Peer Group.

4

Realizable pay captures the following elements of compensation for the three-year period:

•Base salary in the year it is earned;

•Annual incentive compensation paid for the year it is earned; and

•“In-the-money” value of outstanding equity awards granted during the period, calculated based on the stock price at year-end rather than the grant date fair market value. The use of an end-of-year stock price directly correlates the value of an executive’s equity with the return our shareholders receive from investing in our common stock over the same period;

◦Stock Options: calculated using intrinsic value (closing stock price less strike price);

◦Restricted Stock and Restricted Stock Units ("RSUs"): calculated using face value (closing stock price);

◦Performance Stock Units ("PSUs") for awards granted and earned during the period: calculated using dollar value based on actual performance; and

◦PSUs for awards granted and not earned (due to incomplete performance periods): calculated using face value at target performance.

The Company has used rTSR as one of its long-term performance measures since 2014. Since then we have consistently measured RPRDA. The following table shows the Company's percentile rank relative to our Peer Group for the three-year periods starting in 2014. No compensation data is included for the 2018-2020 period as such data cannot be obtained until after Peer Group company proxy statements are available for 2020.

The following table shows the CEO RPRDA for the three-year periods.

| 3-Year Period | Realizable Pay | Relative Total Shareholder Return | Realizable Pay Relative Degree of Alignment | ||||||||

| Percentile Ranking | Percentile Ranking | ||||||||||

| 2018-2020 | Not Available yet | 78% | Not Available Yet | ||||||||

| 2017-2019 | 16% | 26% | 10% | ||||||||

| 2016-2018 | 50% | 81% | 31% | ||||||||

| 2015-2017 | 88% | 100% | 12% | ||||||||

| 2014-2016 | 88% | 81% | (7)% | ||||||||

EXECUTIVE COMPENSATION PROGRAM IN DETAIL

Compensation principles

The Committee designs and oversees the Company’s compensation policies and approves compensation for our NEOs. Our overarching goal is to create executive compensation plans that incent and are aligned with the creation of sustained shareholder value. To accomplish this, our plans are designed to:

•Support our Business Strategy – We align our programs with business strategies focused on long-term growth and sustained shareholder value. Our plans provide incentives to our NEOs to overcome challenges and exceed our Company goals.

5

•Pay for Performance – A large portion of our executive pay is dependent upon the achievement of specific corporate, business unit and individual performance goals. We pay higher compensation when goals are exceeded and lower compensation when goals are not met.

•Pay Competitively – We set target compensation to be at or around the market median relative to the companies that make up our Peer Group.

•Discourage Excessive Risk-taking – Our compensation programs are balanced and designed to discourage excessive risk-taking.

Compensation principles are aligned with good governance practices and pay-for-performance

Below is a list of things that we do and don’t do in order to ensure that our program reflects good governance practices and pay for performance.

| What We Do | What We Don’t Do | |||||||

We require above-Peer Group median stock ownership for our NEOs | No excessive perquisites are provided to any NEO | |||||||

We have a clawback policy for the recovery of cash and non-cash compensation in the event of NEO misconduct which results in a financial restatement | No stock option re-pricing without shareholder approval or discounted stock options are permitted under our 2017 Incentive Plan | |||||||

We have an annual advisory vote on executive compensation ("Say-on-Pay") | No excise tax gross-ups for change in control payments are provided to any NEO | |||||||

| We require a double trigger for equity to vest following a Change in Control ("CIC") | No hedging or short selling of our shares is permitted by our Directors, officers, and employees | |||||||

The components of our executive compensation program

We provide our NEOs with the following components of compensation:

| Annual | Annual base salary and annual cash incentive opportunities | ||||

| Long-Term | Long-term incentive awards comprised of a combination of 50% PSUs, 25% RSUs, and 25% stock options | ||||

| Benefits | Various Health and welfare benefits, including health and life insurance, retirement benefits, and savings plan that are generally available to all our employees | ||||

| Post-Termination Benefits | Severance and change in control benefits | ||||

For each NEO, the Committee reviews and approves annually each component of compensation and the resulting total compensation. The Committee benchmarks the individual components of compensation and total compensation to our Peer Group. In setting the compensation for each NEO, the Committee also considers other factors, including the scope and complexity of his or her position, level of performance, skills and experience, and contribution to the overall success of the Company. As a result, we do not set compensation for our NEOs in a formulaic manner.

6

Our compensation program is designed to focus our NEOs on long-term success

We design our compensation programs to keep our NEOs focused on the long-term success of our Company by making a substantial portion of their compensation subject to the achievement of specific performance measures, requiring NEOs to hold a significant amount of Company stock during the term of their employment, and granting stock-based awards with multi-year earning and vesting periods.

The performance period covered by our PSU grants is three years, with the vesting of any award earned occurring in two equal tranches – the first tranche vests when the Committee determines the award has been earned and the second tranche vests on January 1 of the following year. PSUs issued in 2020 were based on rTSR as compared to our Peer Group and ROIC, each with equal weighting. The Committee chose these measures to provide a strong linkage between the rewards for our leaders and the returns experienced by our shareholders, and also because these measures were thought to be well-aligned with the longer three-year performance period and the higher level of investments in capital for that period.

RSUs also vest in two equal tranches – the first tranche at the third anniversary of the grant date and the second tranche at the fourth anniversary of the grant date.

Stock option grants vest and become exercisable at the third anniversary of the grant date.

Competitive Compensation – Peer Group

The Committee uses a group of peer companies to align executive compensation with comparable positions within that peer group. We use the following criteria for selecting peer companies that we include in our compensation peer group (our "Peer Group").

| Criteria for selecting peer companies | How we use the compensation Peer Group | |||||||

Companies with the same eight-digit GICS code as Albemarle | As an input in designing compensation plans, benefits and perquisites | |||||||

Comparable size based on revenue of approximately 0.4-2.5 times that of Albemarle | As an input in developing base salary ranges, annual incentive targets, and long-term awards | |||||||

Market capitalization of approximately 0.25-4.0 times that of Albemarle | To benchmark total direct compensation, including the pay mix | |||||||

We believe that using an industry-specific group of companies with similar revenue is appropriate because it provides us with the best comparisons for competitive compensation offered by publicly-held companies with similar business challenges and the type of leadership talent needed to achieve success over the long-term. We consider market value as an important factor for peer selection, but believe that market value should be balanced with sales (which are less volatile and a better predictor of compensation levels).

In setting base salaries, target total cash compensation, and target total direct compensation, the Committee generally focused on the median of the last reported data from our 2020 Peer Group. The Committee also referred to survey information from nationally recognized compensation surveys.

7

For 2020, we continued with 15 of the 16 companies that we used in our 2019 Peer Group. We removed Koppers Holdings Inc. because it no longer fit our revenue criteria and we added four other companies that fit our selection criteria (Axalta Coating Systems Ltd., Eastman Chemical Company, NewMarket Corporation, and Trinseo SA).

| 2020 Peer Group | |||||

| Ashland Global Holdings Inc. | Minerals Technologies Inc. | ||||

| Avient Corporation (f/k/a PolyOne Corporation) | Newmarket Corporation | ||||

| Axalta Coating Systems Ltd. | Olin Corporation | ||||

| Cabot Corporation | RPM International Inc. | ||||

| Celanese Corporation | The Chemours Company | ||||

| CF Industries Holdings, Inc. | The Mosaic Company | ||||

| Eastman Chemical Company | The Scotts Miracle-Gro Company | ||||

| FMC Corporation | Trinseo S.A. | ||||

| H.B. Fuller Company | W. R. Grace & Co. | ||||

| International Flavors & Fragrances Inc. | |||||

NEO Target and Actual Compensation

The Committee utilizes the Peer Group data and survey data as two of its tools in establishing target levels of compensation. However, the Committee does not rely exclusively on such data and does not employ a rigid or formulaic process to set compensation levels. In setting compensation levels, the Committee considers the following factors:

•The competitive data (Peer Group and other survey data), focusing on the median data as a starting point;

•Each NEO’s performance;

•Each NEO’s scope of responsibility and impact on the Company’s performance;

•Internal equity – NEO’s compensation relative to his or her peers, direct reports and supervisors;

•The recommendations of the Board’s independent executive compensation consultant, Pearl Meyer, with respect to the NEOs; and

•The CEO’s recommendations for his direct reports.

The Committee evaluates the performance of each NEO in light of our overall financial performance (as described in greater detail below). For 2020, as in past years, the Committee structured a compensation package for our NEOs comprised of base salary and benefits coupled with annual and long-term incentives, which we believed provided an appropriate mix of financial security, risk and reward.

2020 Base Salaries

Base salary provides our NEOs with a basic level of financial security and supports the Committee’s objectives in attracting and retaining top talent. Base salaries for our NEOs, other than the CEO, are recommended by our CEO and are reviewed and approved by the Committee. Base salary for our CEO is recommended and approved by the Committee. Salary changes went into effect on April 1, 2020. The Committee believes that each NEO’s salary was reasonable and appropriate.

8

Base salaries were reduced 20% from May 11, 2020 until October 1, 2020 as part of our austerity measures, with the Annual Incentive Plan ("AIP") to be based on the original base salaries without reduction.

| Executive Officer | 2019 Year-End Base Salary | 2020 Increase in Annualized Base Salary | 2020 Annualized Base Salary | ||||||||

| J. Kent Masters, Jr. | |||||||||||

| Chairman, President and Chief Executive Officer | N/A | N/A | $ | 1,000,000 | |||||||

| Scott A. Tozier | |||||||||||

| Executive Vice President, Chief Financial Officer | $ | 600,000 | $ | 15,000 | $ | 615,000 | |||||

| Eric W. Norris | |||||||||||

| President, Lithium | $ | 550,000 | $ | 13,750 | $ | 563,750 | |||||

| Netha N. Johnson, Jr. | |||||||||||

| President, Bromine Specialties | $ | 500,000 | $ | 40,000 | $ | 540,000 | |||||

| Raphael G. Crawford | |||||||||||

| President, Catalysts | $ | 490,000 | $ | 35,000 | $ | 525,000 | |||||

| Luther C. Kissam IV | |||||||||||

| Former Chairman, President and Chief Executive Officer | $ | 1,000,000 | $ | — | $ | 1,000,000 | |||||

Purpose and key features of the 2020 Annual Incentive Program (AIP)

The Committee designed the AIP to provide both an incentive to achieve, and a reward for achieving, our annual goals and objectives. Each year, the Committee and the Board approve the performance goals under the AIP. These performance goals are intended to ensure that our NEOs execute on short-term financial and strategic initiatives that drive our business strategy and long-term shareholder value.

For all NEOs, performance is based 85% on business performance and 15% on individual performance. For corporate roles (CEO, CFO and former CEO) business performance is defined as performance of the Corporation. For Global Business Unit ("GBU") Presidents, business performance is defined as a combination of GBU and Corporate performance, with a weighting of 59.5% and 25.5%, respectively. For 2020, the Committee established the business AIP metrics as shown in the table below, including for each metric its weighting and payout opportunities at threshold, target and superior performance levels.

9

Threshold performance on Adjusted EBITDA and Adjusted Cash Flow from Operations pays out 35% of the target level. Stewardship performance below target does not result in any payout. For performance at the superior level, payout doubles for all three metrics, compared to payout at target. We use linear interpolation to determine awards for performance between the identified points. Individual performance pays out between 0% and 30%.

Rationale behind the performance metrics

The Committee chose these performance metrics to align the AIP with our 2020 goals and objectives. The Committee chose the relative weights of the performance measures based on the desire to emphasize financial results while maintaining a focus on non-financial objectives.

The Committee chose Adjusted EBITDA and Adjusted Cash Flow from Operations as the 2020 AIP metrics because they were considered the key measures of financial performance in the Company’s 2020 annual operating plan. Adjusted EBITDA is a measure of our ability to generate earnings and Adjusted Cash Flow from Operations is a performance measure aligned with our objective of generating cash for debt reduction and growth.

•Adjusted EBITDA is defined as total Albemarle earnings before interest, tax, depreciation and amortization, as adjusted for non-recurring, non-operating, and special items.

•Adjusted Cash Flow from Operations is defined as cash from Operations as reported on our Statement of Cash Flows, adjusted for pension contributions, joint venture earnings distribution timing, non-recurring, or unusual items.

•The superior performance levels for both of these metrics were set by the Committee at levels that while believed to be realistic, were achievable only as the result of exceptional performance.

Stewardship metrics were included because they are critical to our license to operate and consistent with our values. Our stewardship metrics consist of three factors: occupational safety, process safety, and environmental responsibility. For each of the three stewardship metrics, we have set a target and superior performance level. Performance below target does not pay out. Occupational safety was measured as our OSHA recordable rate, which is calculated as the number of OSHA recordable injuries x 200,000 hours and divided by the actual total man-hours worked; process safety was measured by severity score; and environmental responsibility was measured by the number of level 2 environmental incidents.

Individual performance is included to emphasize the individual accountability for each of the executives for achieving specific goals. Performance goals typically include both leadership objectives and strategic business objectives.

The Committee may take into account extraordinary or infrequently occurring events, or significant corporate transactions in deciding to adjust the results used to determine whether the AIP objectives have been met. The Committee retains the right to exercise discretion in determining the final level of the awards paid, in order to ensure that the AIP remains consistent with its stated objectives. As described below in greater detail, the Committee exercised this discretion for the first time in over ten years in determining 2020 AIP payouts for the Catalysts GBU.

Individual performance was evaluated by comparing actual performance to the pre-established leadership business objectives and considering individual accomplishments not contemplated in the setting of the pre-established objectives. The Committee assessed the performance of the CEO, and the CEO presented his assessment of each other NEO to the Committee.

10

Performance against our 2020 AIP Metrics

For the NEOs four different plans apply based on their Corporate or GBU responsibility.

•The Corporate plan applies to Messrs. Masters, Tozier, and Kissam.

•The Lithium plan applies to Mr. Norris.

•The Bromine plan applies to Mr. Johnson.

•The Catalysts plan applies to Mr. Crawford.

The following tables summarize the threshold, target, and superior performance levels set by the Committee for 2020 and the actual results achieved in 2020 for the Adjusted EBITDA and Adjusted Cash Flow from Operations metrics, for each of the plans that apply to our NEOs.

Corporate

11

Lithium

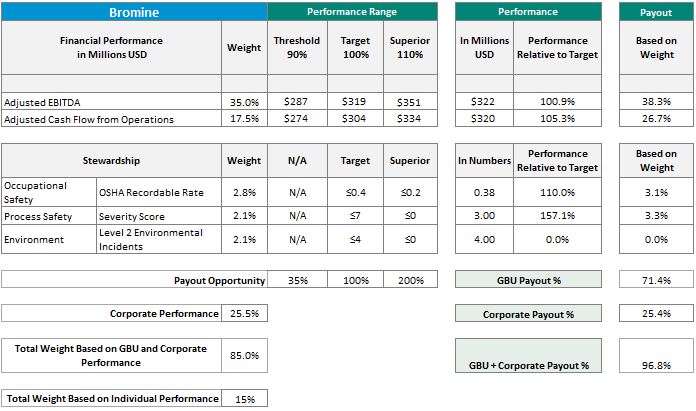

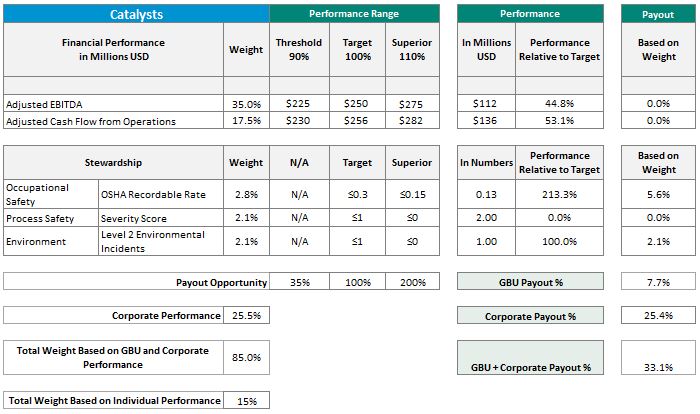

Bromine

12

Catalyst

The Committee approved AIP payouts based on performance targets and ranges set at the beginning of 2020 for all groups except Catalysts. For Catalysts, the Committee exercised its discretion and determined a payout for business performance at 70% was warranted (this only impacts one of our NEOs). The Committee based its discretion, which it exercised for the first time in over 10 years, on the extraordinary business challenges Catalysts faced in 2020 due to the effects of a combination of the COVID-19 pandemic, the significant decline in oil prices, and taking into account the broader Albemarle Company performance:

•Financials: Adjusted EBITDA at 91.8% of target, Adjusted Cash Flow from Operations at 111.2% of target; sustainable cost savings of $85.6 million against an original target of $50 million, with a 2021 run rate 25% above our goal of $125 million. Catalysts showed strong financial performance considering the decline in oil prices and the demand for oil in general. Catalysts also contributed $8 million of savings in 2020, with a 2021 run rate savings of $16.7 million.

•Shareholders: Albemarle's rTSR for 2020 was at the top of our Peer Group. For our two- and three-year rTSR, Albemarle performed at the 94th and 78th percentiles of our Peer Group, respectively. No interruption with dividends paid in 2020.

•Operations: All plants, including Catalysts, remained fully operational during 2020 without disruption. Over 2,000 employees transitioned successfully to working from home ("WFH").

•Employees: From the start of the COVID-19 pandemic we had a COVID-19 response team to guide employees and managers through the challenges posed by the pandemic. This included virtual support groups and the rapid mobilization of emotional, mental, physical, and financial support, including a global Employee Assistance Program. We experienced limited furloughs in terms of the total number of employees impacted and the duration (two locations for a total of approximately 37 employees were furloughed in August/September 2020, with employees being recalled either in November 2020 or January 2021).

13

•Customers: We had business continuity plans in place to serve our customers and had minimal disruptions. This included an agile logistics team, the ability to ship from multiple ports and freight lines, and multi-sourcing of raw materials and supplies.

•Communities: The Company, the Albemarle Foundation, and our JBC joint venture have contributed over $1 million to help those in need (donations of PPE globally, fighting hunger, relief for medical responders, research grants, and improving access to learning).

The Committee recognized this Company-wide performance, which made 2020 a successful year. Finally, the Committee also recognized that the efforts made by the Company and its employees were extraordinary and that a low bonus payout for employees working for the Catalysts business unit would not be commensurate with their contributions to the success of the organization.

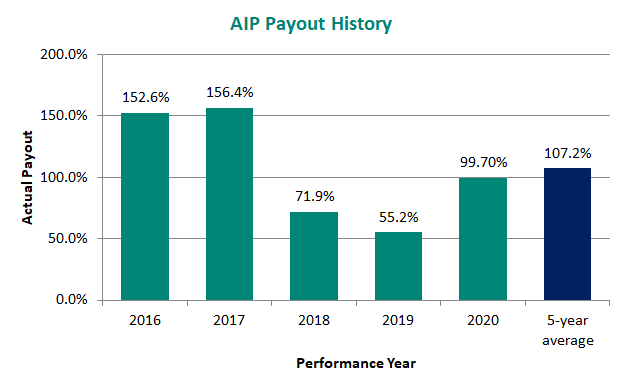

AIP Payout History

The following table illustrates the 2020 AIP payout for the Corporate plan against payout levels over the previous years. We believe the fluctuations in payout confirm the correlation of pay to performance at Albemarle.

Note: 2019 & 2020 AIP percentiles include additive 15% individual component

AIP earning opportunity for our NEOs

Under the AIP, each of our current NEOs can earn a bonus targeted at a certain percentage of their base salary. For 2020, our NEOs’ target bonus percentages were 125% (Messrs. Masters and Kissam), 80% (Mr. Tozier), and 75% (Messrs. Norris, Johnson, and Crawford) for achieving target performance levels for Company and individual performance combined.

Given Mr. Kissam's 2020 retirement and the need for his engagement and availability for the remainder of the year to ensure a smooth transition to the new CEO, the Committee approved a bonus payout for Mr. Kissam in an amount equal to the higher of target or the bonus amount that is determined based on actual achievement of the performance criteria as if employed for the full performance year, and with the individual component set at 15%.

14

Actual earnings for our NEOs under the 2020 AIP

The Committee reviewed the Company’s 2020 performance and determined that the potential awards for the NEOs were funded consistent with the plan metrics set during the first quarter of the year. After this determination was made, Mr. Masters engaged the Committee in a further discussion of the Company’s performance and of each NEO’s (with the exception of Mr. Kissam, who was guaranteed a 15% payout for his individual component) individual performance compared to their objectives. In light of the accomplishments by each NEO that were cited by Mr. Masters to the Committee, it was recommended by Mr. Masters and approved by the Committee that the individual performance-related payout for each NEO be set as follows: Mr. Tozier 20%, Mr. Norris 20%, Mr. Johnson 20%, and, Mr. Crawford 15%.

In the case of Mr. Masters, in early 2021 the Board assessed his performance against both quantitative metrics (Safety and Operations) and qualitative objectives (Lithium capital expansions, portfolio, people and Board), and determined that an individual performance payout of 20% was appropriate given performance against these measures.

When applied to and combined with the Company score, this yielded actual bonus payouts for each NEO shown in the table below. The eligible earnings column shows actual base salary for each executive for 2020 as if their base salaries were not reduced as part of the austerity measures. Mr. Kissam's eligible earnings were not prorated. As mentioned earlier, the Committee approved for Mr. Kissam a bonus payout equal to the higher of target or the bonus amount that is determined based on actual achievement of the performance criteria as if employed for the full performance year, and with the individual component set at 15%.

| 2020 AIP Payouts | |||||||||||||||||||||||||||||||||||

| Name | Eligible Earnings | X | Average Target Bonus % | = | Target Bonus Amount | X | Payout Based on (Company Performance + Individual Performance) | = | Actual Bonus Amount | ||||||||||||||||||||||||||

| J. Kent Masters, Jr. | $ | 694,442 | x | 125% | = | $ | 868,502 | x | 84.7% | + | 20% | = | 908,807 | ||||||||||||||||||||||

| Scott A. Tozier | $ | 611,270 | x | 80% | = | $ | 489,016 | x | 84.7% | + | 20% | = | 511,976 | ||||||||||||||||||||||

| Eric W. Norris | $ | 560,331 | x | 75% | = | $ | 420,248 | x | 92.1% | + | 20% | = | 471,255 | ||||||||||||||||||||||

| Netha N. Johnson, Jr. | $ | 530,055 | x | 75% | = | $ | 397,541 | x | 96.8% | + | 20% | = | 464,283 | ||||||||||||||||||||||

| Raphael G. Crawford | $ | 516,298 | x | 75% | = | $ | 387,223 | x | 70.0% | + | 15% | = | 329,140 | ||||||||||||||||||||||

| Luther C. Kissam IV | $ | 1,000,000 | x | 125% | = | $ | 1,250,000 | x | 85.0% | + | 15% | = | 1,250,000 | ||||||||||||||||||||||

Purpose and key features of the Long-Term Incentive Plan (LTIP)

We believe it is important to provide a long-term incentive opportunity to our NEOs who are charged with driving sustainable growth and long-term value creation for the Company, further aligning their interests with those of our shareholders. We do this through an annual LTIP grant which, in 2020, was comprised of PSUs, RSUs, and stock options, and which is designed to ensure an equity mix that is primarily performance-based and retentive in nature.

Our PSU grant performance measures are rTSR as compared to our Peer Group for the three-year performance period and ROIC, each with equal weighting. The rTSR performance metric emphasizes the linkage between our pay-for-performance philosophy and our shareholders' interests. The ROIC performance metric emphasizes our continued commitment to invest efficiently and generate long-term returns, and ensures alignment between our expected return on capital and long-term payout opportunities for our executives. Both measures are aligned with the longer three-year performance period.

15

Vesting

We employ longer vesting periods than our Peer Group median.

| Albemarle | Compensation Peer Group Median | |||||||

| PSUs | PSUs vest 50% after the award date, which is the date at which the Committee determines the earnings level for the award for the 3-year performance period. The remaining 50% vests at January 1 of the following year. | Earned PSU grants vest in full after 3 years. | ||||||

| RSUs | RSUs vest 50% after 3 years, with the remaining 50% vesting after 4 years. | RSUs cliff vest after 3 years. | ||||||

| Stock Options | Stock Options cliff vest after 3 years. | Stock options step-vest over a 3-year period. | ||||||

PSU results for the 2018-2020 performance period

Payouts under the 2018 PSU grants were earned based on the achievement of TSR performance relative to the 2018 Peer Group over a three-year measurement period. The original 2018 Peer Group included 17 companies. One company was acquired during the period and was therefore not included in the rTSR calculation. Our rTSR for the period placed us at the 78th percentile relative to the 2018 Peer Group.

The following table illustrates threshold, target and superior relative performance levels and the percentage of the target grant earned for each performance level. Results between threshold and target, and target and superior performance, are interpolated. The table also includes the relative performance result and the percentage of grants earned as determined by the Committee.

| 2018 PSU Grant Metrics | ||||||||||||||

| Threshold | Target | Superior | Actual Result | |||||||||||

| Percentile performance relative to the 2018 Peer Group | 25th | 50th | 75th | 78th | ||||||||||

| % of Grants Earned | 25 | % | 100 | % | 200 | % | 200 | % | ||||||

The following table shows the grants approved in February 2018 by the Committee for the NEOs and the grant values approved by the Committee in February 2021 after it determined the 2018-2020 relative performance results.

| 2018 PSU Grants | ||||||||||||||

| Number of Units | Number of Units | Number of Units | ||||||||||||

| at Threshold | at Target | at Superior | 2018 Earned PSUs | |||||||||||

| 25% | 100% | 200% | ||||||||||||

| J. Kent Masters, Jr. | — | — | — | — | ||||||||||

| Scott A. Tozier | 1,106 | 4,422 | 8,844 | 8,844 | ||||||||||

| Eric W. Norris | 632 | 2,528 | 5,056 | 5,056 | ||||||||||

| Netha N. Johnson, Jr. | — | — | — | — | ||||||||||

| Raphael G. Crawford | 790 | 3,158 | 6,316 | 6,316 | ||||||||||

| Luther C. Kissam, IV | 3,510 | 14,037 | 28,074 | 28,074 | ||||||||||

Note: Messrs. Masters and Johnson joined the Company after these grants were made. Mr. Kissam was originally granted 16,844 PSUs that were prorated as a result of his retirement.

16

2020 LTIP grants

In February 2020, the Committee approved a total grant value for the NEOs under the LTIP. The values granted to each NEO are set forth below, as well as the approximate percentage apportioned in the form of PSUs, RSUs, and Stock Options. Mr. Kissam did not receive a grant in 2020 given his planned retirement announced in early 2020. As part of his employment with the Company on April 20, 2020, Mr. Masters received 54,475 RSUs on May 8, 2020. The units vest on the earlier of April 19, 2023 or the date the Company appoints a new Chief Executive Officer.

| 2020 Grants | ||||||||||||||

| Value Granted | Stock Options | RSUs | PSUs | |||||||||||

| J. Kent Masters, Jr. | $ | 3,500,000 | — | % | 100 | % | — | % | ||||||

| Scott A. Tozier | $ | 1,100,000 | 25 | % | 25 | % | 50 | % | ||||||

| Eric W. Norris | $ | 1,100,000 | 25 | % | 25 | % | 50 | % | ||||||

| Netha N. Johnson, Jr. | $ | 1,100,000 | 25 | % | 25 | % | 50 | % | ||||||

| Raphael G. Crawford | $ | 1,100,000 | 25 | % | 25 | % | 50 | % | ||||||

| Luther C. Kissam, IV | $ | — | — | % | — | % | — | % | ||||||

The number of PSUs and RSUs granted were based on the stock closing price at the grant date. The number of stock options was determined using the Black Scholes value of the options.

PSU Grants

The performance-based PSU grants were based 50% on the Company's TSR relative to the 2020 Peer Group as measured over a three-year period and 50% based on the Company's ROIC performance as calculated for each calendar year during the three-year performance period and averaged over such period. The following table illustrates the number of units to be granted for performance at threshold, target and superior levels for the rTSR PSU grants and ROIC PSU grants.

| 2020 PSU Grants | |||||||||||||||||

| Number of Units at Threshold | Number of Units at Target | Number of Units at Superior | |||||||||||||||

| J. Kent Masters, Jr. | — | — | — | ||||||||||||||

| Scott A. Tozier | 3,360 | 6,720 | 13,440 | ||||||||||||||

| Eric W. Norris | 3,360 | 6,720 | 13,440 | ||||||||||||||

| Netha N. Johnson, Jr. | 3,360 | 6,720 | 13,440 | ||||||||||||||

| Raphael G. Crawford | 3,360 | 6,720 | 13,440 | ||||||||||||||

| Luther C. Kissam, IV | — | — | — | ||||||||||||||

The following table illustrates threshold, target and superior relative performance levels for the rTSR PSUs and the performance of the target grant earned for each performance level. Results between threshold and target, and target and superior performance will be interpolated.

| 2020 rTSR PSU Grants | |||||||||||

| Threshold | Target | Superior | |||||||||

| Percentile performance relative to the 2020 Peer Group | 25th | 50th | 75th | ||||||||

| % of Grants Earned | 50 | % | 100 | % | 200 | % | |||||

17

The 2020 ROIC PSU grant is measured against ROIC performance levels set by the Committee. ROIC is calculated for each calendar year during the three-year performance period and averaged over such period, and is determined using the following formula:

| Annual ROIC | = | Net Income + (Interest Income and Interest Expense, net of tax) | ||||||

| (Prior Year End Total Capital + Current Year End Total Capital)/2 | ||||||||

The following table illustrates the percentage of the target ROIC grant earned for each performance level. Results between threshold and target, and target and superior performance will be interpolated.

| 2020 ROIC PSU Grants | |||||||||||

| Threshold | Target | Superior | |||||||||

| % of Grants Earned | 50 | % | 100 | % | 200 | % | |||||

Performance and payout opportunities reflect the dual character of both rTSR and ROIC PSU grants:

•The grants are performance-based to ensure payout opportunities are aligned with shareholder interests.

•The grants are also competitive in nature and as such reflect performance and payout opportunities aligned with the Peer Group and the broader market in which we compete for talent.

Half of any shares earned will vest in early 2023 at the time the Committee evaluates the three-year performance for both rTSR and ROIC. The other half of shares earned will vest on January 1, 2024.

RSU Grants

In February 2020, the Committee approved RSU awards to our NEOs, as follows. Mr. Masters' RSUs were approved at the time of his employment in April.

| 2020 Restricted Stock Units | |||||

| J. Kent Masters, Jr. | 54,475 | ||||

| Scott A. Tozier | 3,360 | ||||

| Eric W. Norris | 3,360 | ||||

| Netha N. Johnson, Jr. | 3,360 | ||||

| Raphael G. Crawford | 3,360 | ||||

| Luther C. Kissam, IV | — | ||||

Half of the RSUs will vest on each of the third and fourth anniversaries of the grant date in 2023 and 2024. Mr. Masters' 2020 RSUs will vest on the earlier of the third anniversary of his employment (April 19, 2023) or the date the Company appoints a new Chief Executive Officer.

18

In addition to the annual grants, the Committee also approved retention RSU awards to our NEOs, as follows:

| 2020 Retention Grants | ||||||||

| Value Granted | RSUs | |||||||

| J. Kent Masters, Jr. | — | |||||||

| Scott A. Tozier | $ | 1,000,000 | 12,218 | |||||

| Eric W. Norris | $ | 250,000 | 3,055 | |||||

| Netha N. Johnson, Jr. | $ | 750,000 | 9,164 | |||||

| Raphael G. Crawford | $ | 750,000 | 9,164 | |||||

| Luther C. Kissam, IV | — | |||||||

These awards will vest on the third anniversary of the grant date in 2023.

Stock Option Grants

In February 2020, the Committee approved a grant of stock options to our NEOs, as follows:

| 2020 Stock Options | |||||

| J. Kent Masters, Jr. | — | ||||

| Scott A. Tozier | 12,421 | ||||

| Eric W. Norris | 12,421 | ||||

| Netha N. Johnson, Jr. | 12,421 | ||||

| Raphael G. Crawford | 12,421 | ||||

| Luther C. Kissam IV | — | ||||

The options vest and become exercisable on the third anniversary of the grant date in 2023, and expire ten years from the date of the grant.

Other benefits the Company provides to NEOs

The Company provides NEOs with the same benefits provided to other Albemarle employees, including:

•Health and dental insurance (Company pays a portion of costs);

•Basic life insurance;

•Long-term disability insurance;

•Participation in the Albemarle Corporation Savings Plan (the “Savings Plan”), including Company matching and defined contribution pension contributions;

•Participation in the Executive Deferred Compensation Plan;

•Participation in the Albemarle Corporation Pension Plan, defined below, for those executives hired prior to 2004 (Mr. Kissam is the only NEO that meets this qualification); and

•Matching charitable contributions.

19

Executive Deferred Compensation Plan (“EDCP”)

We maintain a deferred compensation plan that covers executives, including the NEOs, who are limited in how much they can contribute to tax-qualified deferred compensation plans (such as our Savings Plan). We maintain this plan in order to be competitive and because we want to encourage executives to save for their retirement. A participant in the EDCP may defer up to 50% of base salary and/or up to 100% of cash incentive awards (net of FICA and Medicare taxes due). We also provide for employer contributions in the EDCP to provide executives with the same proportional benefits as are provided to all other employees, but which cannot be provided under our tax-qualified plan because of statutory limitations that apply under that plan. The EDCP also provides for a supplemental benefit of 5% of compensation in excess of amounts that may be recognized under the tax-qualified Savings Plan and of the cash incentive bonus award paid during the year.

Effective as of January 1, 2013, all our NEOs, regardless of hire date, participate in the same tax-qualified Savings Plan and EDCP. This defined contribution plan design provides all participating employees the opportunity to receive a Company contribution of 11% of their base and bonus earnings for the calendar year if they contribute at least 9% of their base and bonus earnings to the Savings Plan. Such Company contributions go into the tax-qualified Savings Plan up to the compensation and benefit limitations under the Internal Revenue Code (the "Code"), and after that are credited to an EDCP account.

Defined Benefit Plan

We previously maintained a traditional tax-qualified defined benefit pension plan ("Pension Plan"), which was fully frozen as of December 31, 2014. In 2004, we implemented a new defined contribution pension benefit in our tax-qualified Savings Plan for all non-represented employees hired on or after April 1, 2004, and limited participation in the "Pension Plan" to then-current participants. Mr. Kissam joined the Company prior to April 1, 2004, and, as such, participated in the Pension Plan. We also maintain a supplemental executive retirement plan (“SERP”) to provide participants with the difference between (i) the benefits they would actually accrue under the Pension Plan but for the maximum compensation and benefit limitations under the Code, and (ii) the benefits actually accrued under the Pension Plan, which are subject to the Code’s compensation and benefit limits. Certain provisions of the SERP also permitted the Committee to award key executives additional pension credits related to offset reduction in the Pension Plan plan as a mid-career hire. This provision was also limited to then-current participants in 2004 concurrent with the Pension Plan changes. The Company froze accruals in the Pension Plan and SERP effective December 31, 2014.

Perquisites

Our perquisites are intended to be limited in nature, and are focused in areas directly related to a business purpose, or in helping to foster the health, security and well-being of our senior executives for the benefit of the Company.

When an NEO is required to relocate geographically in order to join the Company, or is asked to relocate due to a change in their work location after joining the Company, we provide them with the same relocation package that is offered to management and senior professional employees. Certain relocation expenses are grossed-up for taxes, as is the competitive practice within our Peer Group, and, more broadly, in the general marketplace.

We also offer executive physical exams and limited reimbursement for financial planning. We do not provide tax gross-ups on such amounts to NEOs.

20

Post-termination payments

We believe that providing our executives, including our NEOs, with reasonable severance benefits aligns their interests with shareholders’ interests in the context of potential change in control transactions, and also believe that such benefits help facilitate our recruitment and retention of senior executive talent.

Consistent with this philosophy, we maintain a Severance Pay Plan (“SPP”) that provides severance payments to certain of our employees if we (a) terminate their employment without cause or request that they relocate and they elect not to do so after a change in control or (b) eliminate their position or have a change in our organizational structure with a similar effect absent a change in control. The SPP provides severance payments only in the absence of a change in control.

We entered into severance compensation agreements with each of our NEOs, providing for severance payments for a change in control-related termination. None of these severance compensation agreements include an excise tax gross-up.

The Committee periodically reviews our post-employment compensation arrangements taking best practices into consideration, and believes that these arrangements are generally consistent with arrangements currently being offered by our Peer Group. The Committee has determined that both the terms and payout levels are appropriate to accomplish our stated objectives. The Committee also considered the non-competition agreement that we would receive from the NEO in exchange for any post-employment termination benefits. Based on these considerations, the Committee believes that such arrangements are appropriate and reasonable.

For additional information with respect to change in control arrangements, please see “Agreements with Executive Officers and Other Potential Payments upon Termination or a Change in Control” beginning on page 38.

21

ADDITIONAL INFORMATION

We believe this additional information may assist you in better understanding our compensation practices and principles.

Role of the Committee and the CEO

The Committee, consisting entirely of independent Directors, is responsible for executive compensation. As part of the compensation-setting process each year, the Committee meets periodically with the CEO to review a list of corporate performance goals and receives comments from members of the Board of Directors. The CEO recommends to the Committee the compensation amounts for each of our NEOs, other than himself. The Committee has retained an independent compensation consultant, Pearl Meyer, to provide advice on best practices and market developments. The CEO, the Chief HR Officer, Human Resources staff members, and the Committee’s consultant attend Committee meetings and make recommendations regarding plan design and levels of compensation.

While the Committee will ask for advice and recommendations from management and Pearl Meyer, the Committee is responsible for executive compensation and as such:

•Sets NEO base salaries;

•Reviews financial and operational goals, performance measures, and strategic and operating plans for the Company;

•Establishes specific goals, objectives, and potential awards for the AIP and LTIP;

•Reviews annual and long-term performance against goals and objectives and approves payment of any incentive earned;

•Reviews contractual agreements and benefits, including supplemental retirement and any payments that may be earned upon termination, and makes changes as appropriate;

•Reviews incentive plan designs and makes changes as appropriate; and

•Reviews total compensation to ensure compensation earned by NEOs is fair and reasonable relative to corporate and individual performance.

Total compensation actions, annual and long-term performance goals and objectives, contractual agreements, and benefits are evaluated and determined by the Committee and discussed with the Board. The Albemarle Corporation 2017 Incentive Plan was approved by the Board and shareholders.

Role of Compensation Consultant

The Committee retained Pearl Meyer to provide independent advice to the Committee. Pearl Meyer gathers and analyzes data at the direction of the Committee, advises the Committee on compensation standards and trends, and assists in the development of policies and programs. The Committee directs, approves, and evaluates Pearl Meyer’s work in relation to all executive compensation matters. The Committee considers Pearl Meyer to be independent from our management pursuant to the U.S. Securities and Exchange Commission standards. Please see “Independence of the Executive Compensation Consultant” beginning on page 49.

The Committee regularly meets with Pearl Meyer without management present. Pearl Meyer participates in Committee meetings throughout the year, reviews materials in advance, consults with the Chairperson of the Committee, provides to the Committee data on market trends and compensation

22

design, assesses recommendations for base salary and annual incentive awards for our NEOs, and periodically meets with management. Pearl Meyer may provide consulting advice to management outside the scope of executive compensation with the approval of the Committee. In 2020, Pearl Meyer did not provide consulting advice to management outside the scope of executive compensation. The Committee does not delegate authority to Pearl Meyer.

Clawbacks

In 2017, the Company adopted a Compensation Recoupment and Forfeiture Policy under the 2017 Incentive Plan. In the event misconduct by any employee results in a financial restatement, as more specifically defined in the policy, the policy requires that our Chief Executive Officer and Chief Financial Officer reimburse the Company for (i) the gross amount of any bonus or other incentive-based or equity-based compensation received by such officer from the Company during the 12-month period following the date the document required to be restated was first publicly issued or filed (whichever occurs first) with the SEC and (ii) any profits realized from the sale of securities of the Company during such 12-month period. The policy further requires any employee who engaged in such misconduct to reimburse the Company the same amounts set forth in (i) and (ii) above applicable to that employee, and requires any such employee whose employment is terminated for cause to forfeit all unpaid cash-based incentive compensation under our incentive plan (whether or not accrued and/or payable at such time) and all unvested equity-based awards (whether or not earned at such time), in each case as of the date such employee is notified of termination of his or her employment for cause (as defined under the policy).

In addition, in 2018 we disclosed that based on an internal investigation, we voluntarily self-reported potential issues relating to the use of third party sales representatives in our Refining Solutions business to the U.S. Department of Justice (the "DOJ"), the SEC, and the Dutch Public Prosecutor (the "DPP") and that we intended to cooperate with the DOJ, the SEC, and the DPP in their review of these matters. Our Board of Directors determined, as a prudent governance measure while the investigation is pending, to condition payment of each of our named executive officers for fiscal year 2017 (the "2017 NEO’s") cash incentive bonus for the fiscal year 2017 (the “2017 cash incentive”) on each 2017 NEO executing a clawback agreement applicable to the 2017 cash incentive. Accordingly, in February 2018, the Company entered into a clawback agreement with each of our 2017 NEOs and other executives at that time. The clawback agreements supplement the Company’s existing policy described above and provide that each 2017 NEO's 2017 cash incentive is subject to clawback by the Company in the event that the Committee determines that, with respect to the Company’s internal investigation or the government’s review of these matters following such self-report, the NEO: (1) engaged in unlawful conduct or misconduct; (2) failed to cooperate in any related investigation; (3) violated the Company’s Code of Conduct or any other Company policy; or (4) failed to exercise appropriate supervision or oversight.

23

EXECUTIVE COMPENSATION COMMITTEE REPORT

The Executive Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis section of this Proxy Statement with management and, based on such review and discussion, recommended to the Board of Directors that it be included in this Proxy Statement.

EXECUTIVE COMPENSATION COMMITTEE | |||||

| Alejandro D. Wolff, Chair | |||||

| Diarmuid B. O'Connell | |||||

| Dean L. Seavers | |||||

| Holly A. Van Deursen | |||||

24

COMPENSATION OF EXECUTIVE OFFICERS

Total Compensation of Our Named Executive Officers

The following table presents information for the fiscal years ended December 31, 2020, 2019 and 2018 relating to total compensation of our CEO, CFO, the three other highest paid executive officers, and former CEO (the “NEOs”).

SUMMARY COMPENSATION TABLE

| Summary Compensation Table | |||||||||||||||||||||||||||||

| Name and Principal Position | Year(1) | Salary ($)(2) | Bonus ($)(3) | Stock Awards ($)(4)(5) | Option Awards ($)(4) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(6) | All Other Compensation ($)(7) | Total ($) | ||||||||||||||||||||

| J. Kent Masters, Jr. | 2020 | $ | 667,053 | $ | — | $ | 3,248,889 | $ | — | $ | 908,807 | $ | 114,620 | $ | 4,939,369 | ||||||||||||||

| Chairman, President and Chief Executive Officer | |||||||||||||||||||||||||||||

| Scott A. Tozier | 2020 | $ | 563,213 | $ | — | $ | 1,866,951 | $ | 275,001 | $ | 511,976 | $ | 96,006 | $ | 3,313,147 | ||||||||||||||

| Executive Vice President, Chief Financial Officer | 2019 | $ | 597,041 | $ | — | $ | 904,877 | $ | 275,022 | $ | 259,460 | $ | 117,789 | $ | 2,154,189 | ||||||||||||||

| 2018 | $ | 581,000 | $ | — | $ | 939,722 | $ | 262,533 | $ | 314,302 | $ | 112,817 | $ | 2,210,374 | |||||||||||||||

| Eric W. Norris | 2020 | $ | 516,279 | $ | — | $ | 1,158,743 | $ | 275,001 | $ | 471,255 | $ | 76,616 | $ | 2,497,894 | ||||||||||||||

| President, Lithium | |||||||||||||||||||||||||||||

| Netha N. Johnson, Jr. | 2020 | $ | 487,858 | $ | — | $ | 1,630,908 | $ | 275,001 | $ | 464,283 | $ | 98,756 | $ | 2,956,806 | ||||||||||||||

| President, Bromine Specialties | 2019 | $ | 493,836 | $ | 150,000 | $ | 658,147 | $ | 200,011 | $ | 558,520 | $ | 304,852 | $ | 2,365,366 | ||||||||||||||

| Raphael G. Crawford | 2020 | $ | 475,273 | $ | — | $ | 1,630,908 | $ | 275,001 | $ | 329,140 | $ | 88,933 | $ | 2,799,255 | ||||||||||||||

| President, Catalysts | 2019 | $ | 486,301 | $ | — | $ | 658,147 | $ | 200,011 | $ | 411,754 | $ | 112,248 | $ | 1,868,461 | ||||||||||||||

| Luther C. Kissam, IV | 2020 | $ | 542,268 | $ | — | $ | 131,204 | $ | — | $ | 1,250,000 | $ | 1,873,677 | $ | 31,325 | $ | 3,828,474 | ||||||||||||

| Former Chairman, President and Chief Executive Officer | 2019 | $ | 1,000,000 | $ | — | $ | 3,702,153 | $ | 1,125,026 | $ | 751,991 | $ | 1,697,660 | $ | 244,754 | $ | 8,521,584 | ||||||||||||

| 2018 | $ | 1,000,000 | $ | — | $ | 3,579,097 | $ | 1,000,009 | $ | 856,389 | $ | (411,490) | $ | 230,899 | $ | 6,254,904 | |||||||||||||

___________________________________________________

(1)No salary amounts or other compensation are reported for Messrs. Masters and Norris for 2019 or for Messrs. Masters, Norris, Johnson, and Crawford for 2018. Mr. Masters joined the company in 2020. Mr. Norris was not a named executive officer in 2018 or 2019. Mr. Johnson joined the company on July 31, 2018 and was not a named executive officer in 2018. Mr. Crawford was not a named executive officer in 2018.

(2)The amount shown in this column for Messrs. Masters and Kissam include $45,742 and $45,000, respectively, in fees earned or paid in cash to him for his service as a non-employee Director during portions of 2020. The NEOs each took a 20% reduction in base salary from May 11, 2020 until October 1, 2020 as part of Company austerity measures. Salary amounts include cash compensation earned by each NEO officer during the applicable fiscal year, as well as any amounts earned in the applicable fiscal year but contributed into the Savings Plan and/or deferred at the election of the NEO into the EDCP. For a discussion of the deferred compensation program and amounts deferred by the NEOs in fiscal year 2020, including earnings on amounts deferred, please see “Nonqualified Deferred Compensation” on page 37.

(3)Bonus amount includes a new-hire bonus of $150,000 for Mr. Johnson when he joined the Company.

(4)The amount represents the aggregate grant date fair value of stock or option awards recognized in the fiscal year in accordance with FASB ASC Topic 718. This amount does not reflect our accounting expense for these award(s) during the year and does not correspond to the actual cash value that will be recognized by the NEO when received. For more information on the assumptions for these awards, see Note 19 to our Consolidated Financial Statements filed on Form 10-K

25

for the year ended December 31, 2020. Information on individual equity awards granted to each of the NEOs in fiscal year 2020 is set forth in the section entitled “Grants of Plan-Based Awards” beginning on page 28.

(5)Amounts for fiscal year 2020 include two performance unit awards calculated at 100% of Target level. The rTSR performance unit awards are calculated assuming a fair value per share of $122.99 using the Monte Carlo valuation method. The ROIC performance unit awards are calculated assuming a fair value price per share of $75.80. The maximum payable for Superior level performance on our 2020 PSU awards is 200% of Target level. The aggregate grant date fair value of the rTSR performance unit awards at the Superior level of 200% for each of the NEOs is: Messrs. Masters and Kissam $0; Messrs. Tozier, Norris, Johnson, and Crawford $826,492 each. The aggregate grant date fair value of the ROIC performance unit awards at the Superior level of 200% for each of the NEOs is: Messrs. Masters and Kissam $0; Messrs. Tozier, Norris, Johnson, and Crawford $509,376 each. Amounts also include 2020 Restricted Stock Units assuming a fair value price per share of $59.64 with an aggregate grant date fair value for Mr. Masters of $3,248,889; Restricted Stock Units assuming a fair value per share of $75.80 with an aggregate grant date fair value for Messrs. Masters and Kissam $0 each; Messrs. Tozier, Norris, Johnson, and Crawford $254,688 each; and Restricted Stock Units assuming a fair value price per share of $77.29 with an aggregate grant date fair value for Messrs. Masters and Kissam $0 each; Mr. Tozier $944,329, Mr. Norris $236,121, Messrs Johnson and Crawford $708,286 each. Amount indicated is Mr. Kissam's non-employee Director grant of shares of Common Stock with a fair value per share of $76.06; he did not receive an equity grant in 2020 for his service as CEO. For further information on the non-employee Director grants, please see “Director Compensation” beginning on page 54.

(6)Includes the actuarial increases in the present values of the NEOs’ benefits under our pension plans determined using interest rate and mortality rate assumptions consistent with those used in our financial statements. Mr. Kissam had a gain of $1,873,677 in 2020. For a full description of the pension plan assumptions used by us for financial reporting purposes, see Note 15 to our Consolidated Financial Statements filed on Form 10-K for the year ended December 31, 2020.

(7)All other compensation amounts reported for 2020 include:

| All Other Compensation | |||||||||||||||||

| Name | Company Contribution to Albemarle 401K Plan | Company Contributions to Defined Retirement Benefit in Savings Plan | Company Contributions to Nonqualified Deferred Compensation Plan | Perquisites(a) | Total | ||||||||||||

| J. Kent Masters, Jr. | $ | 14,025 | $ | 14,250 | $ | 37,434 | $ | 48,911 | $ | 114,620 | |||||||

| Scott A. Tozier | $ | 14,025 | $ | 14,250 | $ | 50,681 | $ | 17,050 | $ | 96,006 | |||||||

| Eric W. Norris | $ | 14,025 | $ | 14,250 | $ | 31,291 | $ | 17,050 | $ | 76,616 | |||||||

| Netha N. Johnson, Jr. | $ | 14,025 | $ | 14,250 | $ | 34,789 | $ | 35,692 | $ | 98,756 | |||||||

| Raphael G. Crawford | $ | 14,025 | $ | 14,250 | $ | 46,938 | $ | 13,720 | $ | 88,933 | |||||||

| Luther C. Kissam IV | $ | 14,025 | $ | 14,250 | $ | — | $ | 3,050 | $ | 31,325 | |||||||

___________________________________________________

(a) Includes the following: personal financial consulting expenses in the amount of $14,000 paid by the Company on behalf of Messrs. Masters, Tozier, Norris, and Johnson; moving expenses in the amounts of $31,861 and $19,192 for Messrs. Masters and Johnson, respectively; executive wellness exams in the amount of $2,500 paid by the Company on behalf of Messrs. Masters, Tozier, Norris, Johnson, Crawford, and Kissam; annual credit card fees of $550 paid by the Company on behalf of Messrs. Masters, Tozier, Norris, Crawford and Kissam; and a corporate country club membership in the amount of $10,670 that Mr. Crawford and the Catalyst business use for customer meetings and events.

26

Compensation Risk Assessment

As part of its oversight of the Company’s executive compensation program, the Committee considers the impact of the Company’s executive compensation program and the incentives created by the compensation awards that it administers, on the Company’s risk profile. In addition, the Company reviews all employee compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk-taking, to determine whether they present a significant risk to the Company. At the Committee’s direction, our Chief Human Resources Officer and members of our Total Rewards team, together with our Vice President, Audit & Risk Management and members of our Internal Audit team, conducted a risk assessment of our compensation programs. This assessment included, but was not limited to, evaluation of each compensation program based on the following categories: (i) performance measures and period; (ii) funding; (iii) pay mix; (iv) goal setting and pay-for-performance alignment; and (v) controls and processes.

The Committee reviewed the findings of the assessment and concluded that our compensation programs are designed with the appropriate balance of risk and reward in relation to our overall business strategy and that the balance of compensation elements discourages excessive risk-taking. The Committee therefore determined that the risks arising from our compensation policies and practices for employees are not reasonably likely to have a material adverse effect on the Company. In its discussions, the Committee considered the attributes of our programs, including:

•The balance between annual and long-term performance opportunities;

•Alignment of our programs with business strategies focused on long-term growth and sustained shareholder value;

•Dependence upon the achievement of specific corporate and individual performance goals that are objectively determined with verifiable results;

•That corporate goals include both financial and stewardship metrics (safety and environment) and have pre-established threshold, target, and maximum award limits;

•The Executive Compensation Committee’s ability to consider non-financial and other qualitative performance factors in determining actual compensation payouts;

•Stock ownership guidelines that are reasonable and align executives’ interests with those of our shareholders; and

•Forfeiture and recoupment policy provisions for cash and equity awards.

27

Grants of Plan-Based Awards

The Albemarle Corporation 2017 Incentive Plan (the "Plan") serves as the core program for the performance-based compensation components of our NEOs' total compensation. This plan:

•Defines the incentive arrangements for eligible participants;

•Authorizes the granting of annual and long-term cash incentive awards, stock options, stock appreciation rights, performance shares, PSUs, restricted stock, RSUs, and other incentive awards, all of which may be made subject to the attainment of performance goals recommended by management and approved by the Committee;

•Provides for the enumeration of the business criteria on which performance goals are to be based; and

•Establishes the maximum share grants or awards (or, in the case of cash incentive awards, the maximum compensation) that can be paid to a participant under the Plan.

With the exception of significant promotions and new executive hires, grants generally are determined at the first meeting of the Committee each year following the availability of the financial results for the prior year. Awards to our NEOs were made on February 28, 2020, for the 2020 LTIP. These awards consisted of stock options, PSUs, and RSUs.

•The awards of PSUs vest 50% at the time the Committee determines the performance relative to the goals after the end of the three-year performance period, with the remaining 50% vesting on the following January 1.

•The 2020 stock options fully vest on the third anniversary of the grant date.

•The 2020 award of RSUs will vest 50% on the third anniversary of the grant date, while the remaining 50% will vest on the fourth anniversary of the grant date.