UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Karen Gilomen, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2016 – April 30, 2017

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

|

PAGE

|

|

|

Manager Commentary

|

|

|

Aspen Managed Futures Strategy Fund

|

1

|

|

Aspen Portfolio Strategy Fund

|

5

|

|

Performance Update

|

|

|

Aspen Managed Futures Strategy Fund

|

3

|

|

Aspen Portfolio Strategy Fund

|

7

|

|

Consolidated Disclosure of Fund Expenses

|

9

|

|

Consolidated Schedule of Investments

|

|

|

Aspen Managed Futures Strategy Fund

|

10

|

|

Aspen Portfolio Strategy Fund

|

12

|

|

Consolidated Statements of Assets & Liabilities

|

14

|

|

Consolidated Statements of Operations

|

16

|

|

Consolidated Statements of Changes in Net Assets

|

|

|

Aspen Managed Futures Strategy Fund

|

17

|

|

Aspen Portfolio Strategy Fund

|

18

|

|

Consolidated Financial Highlights

|

|

|

Aspen Managed Futures Strategy Fund

|

19

|

|

Aspen Portfolio Strategy Fund

|

21

|

|

Notes to Consolidated Financial Statements

|

23

|

|

Report of Independent Registered Public Accounting Firm

|

34

|

|

Disclosure Regarding Approval of Fund Advisory Agreements

|

35

|

|

Additional Information

|

38

|

|

Trustees and Officers

|

39

|

|

Privacy Policy

|

44

|

|

Aspen Managed Futures Strategy Fund

|

Manager Commentary

|

|

April 30, 2017 (Unaudited)

|

May 15, 2017

Performance Results

For the twelve‐month period ending April 30, 2017, the Class I shares of the Aspen Managed Futures Strategy Fund (the “Fund”) posted a return of ‐7.33%. Per its mandate, the Fund maintained tight correlation(1) to the Aspen Managed Futures Beta Index (“Aspen MFBI” or the “Index”)(2). The Index uses a combination of trend and counter‐trend algorithms to determine exposures to 23 futures markets. In following the Index, the Fund can take long or short positions in each of the eligible markets. A long position in a futures market may post gains (losses) if the price of the futures contract rises (falls), whereas a short position may post gains (losses) if the price of the futures contract falls (rises).

The BTOP50 Index(3), a managed futures benchmark, returned ‐6.7% over the same period. It is important to note that there are substantive differences between the Fund and this index in terms of construction. There were no significant changes to the Fund strategy during this period.

Explanation of Fund Performance

The Fund returned ‐2.45% in May. A surprise rate cut by the Reserve Bank of Australia was a factor in the monthly loss. The cut drove down the Australian dollar (“AUD”), causing losses in long AUD positions in the Index’s trend and counter‐trend exposure.

The month of June provided a gain of +3.18% for the Fund. The majority of that return happened on a single day: June 24, the day of the initial market reaction to the surprise results of the UK’s “Brexit” vote to leave European Union. The Aspen MFBI’s futures positioning around Brexit(4) arose from the crosswinds of pre‐Brexit market moves. Because the vote was a rare, point‐in‐time volatility‐inducing event that everyone could see coming in advance, volatility naturally spiked in advance over the weeks preceding the vote—which led to an increase trend and decrease in counter‐trend exposures in the Index. Risk assets, particularly European issues, declined—which led to net short risk exposures in the Trend model. However, concerns notwithstanding, at no point prior to the actual vote tally did markets predict a greater than 50% probability of a UK “Leave” vote; in particular, over the course of the actual week of the vote, the market’s movements reflected increasing confidence that the “Remain” side would win. This resulted in Index positioning that, while risk‐off overall, was not fully strongly short risk assets, but was decidedly long fixed income. In aggregate, that positioning enabled the Fund to capture a gain of about +2% on June 24. Remarkably, it took only about a week for global equity markets, including those in the UK itself, to recover their Brexit losses. Typically a “V‐bottom”(5) bounce of that nature is problematic for a trend‐following model like the one followed by the Fund, but in this case the Fund was actually able to profit during the market rebound as well as the initial market drop. The primary reason for this was the fact that the Fund’s long fixed income positions continued to post profits, as the post‐Brexit rebound was apparently at least partly driven by speculation of further easing, which benefitted sovereign bonds as well as equity markets.

After the wildness of Brexit, the markets settled into a quieter mode for the next several months. A trendless, low‐volatility backdrop created difficult conditions for the Index’s trend exposures, but it benefitted the Index’s counter‐trend exposures. Trend attribution(6) was negative and counter‐trend attribution was positive in each of the next four months—a pattern that previously had not occurred for more than two consecutive months. Because the Index is always primarily trend‐following, this pattern led to losses for the Fund in all four months (July: ‐0.50%, August: ‐0.70%, September: ‐1.01%, October: ‐1.93%). However, the boost provided by the counter‐trend sub‐model kept the losses over the entire period relatively modest—i.e., the losses over the entire four‐month period were only about 100 basis points(7) greater than the gains in June alone.

At the end of October, heading toward the U.S. presidential election, the most notable development in the Fund was the adoption of net short fixed income futures positioning for the first time all year, in response to rising global interest rates. Per its mandate, the Index does not “tilt” to the long side in fixed income, and as a consequence it is able to turn short faster than most trend‐following programs. This enabled the Fund to return +3.0% in November, when most trend following Commodity Trading Advisors (“CTA”) posted negative returns in the wake of the rising‐rate backdrop that followed the surprise election of Donald Trump to the US presidency.

The calendar year ended with a quiet 0.19% gain in December, with continued gains from “Trump rally” Trend positioning offset by a give‐back of a portion of the year’s Counter‐Trend profits.

2017 began with a series of eerily low‐volatility months in the markets, which typically creates a difficult, range‐bound backdrop for trend following. January (‐1.01%) and February (‐0.11%) exemplified this type of backdrop, with typically minor losses stemming from commodity, currency, and fixed income trends, partially offset by gains in (entirely long) equity trends and risk‐on Counter‐Trend exposure.

Currency trend trading became particularly problematic in March, when currency positioning experienced a classic “V‐bottom” bounce—a pattern where trend systems post losses in the initial leg down, turn short, and then post losses on the subsequent bounce back up. The initial decline in foreign exchange (“FX”) values was caused by a sudden increase in the markets’ expectations that the Federal Reserve would raise interest rates in their March meeting. Index trend positioning turned short after the FX decline. The Fed did indeed raise rates, but the markets were unimpressed with the hawkishness of the announcement; FX rates jumped up again in the aftermath of the announcement, causing losses for the short currency trend positions. These V‐bottom losses were a major contributor to the Fund’s ‐3.31% return in March.

|

Annual Report | April 30, 2017

|

1

|

|

Aspen Managed Futures Strategy Fund

|

Manager Commentary

|

|

April 30, 2017 (Unaudited)

|

Counter‐Trend reversals contributed the majority of the Fund’s ‐2.7% return in April. A prime factor was the euro relief rally following the first round of the French presidential election, when the possibility of an extreme right/extreme left runoff was eliminated. Strength in the US dollar relative to high‐yielding commodity currencies also produced losses in the Counter‐Trend model. Trend following fared little better in the ongoing low‐vol environment in April, but Trend losses were muted because trend positioning was limited in notional size and mixed in direction due to market choppiness the prior several months.

Outlook

As noted above, volatility in the financial markets is very abnormally low, both in trailing terms across asset class complexes and in prospective terms (e.g., the VIX Index(8) is near all‐time lows as of this writing). Low‐vol, range‐bound markets are historically difficult for trend‐following, though the magnitude of the losses for the Fund early in 2017 was exacerbated by a few unusual events, particularly in currency markets. Many market commentators have begun to notice that volatility levels seem inexplicably depressed, perhaps unreasonably so given geopolitical and economic risks. Moreover, there are some early indications that we may be seeing the beginnings of the (undoubtedly slow and uneven) unwind of one of the primary causes of the unusually low‐vol environment that has prevailed since the end of the Great Financial Crisis—i.e., extraordinary levels of central bank accommodationism. For example, the Federal Reserve has begun raising rates, the Bank of Japan has changed its focus from the short‐term to the long‐term end of the rate curve, and the European Central Bank (“ECB”) has begun issuing somewhat less dovish‐sounding commentary.

While the artificially imposed low‐vol environment has reduced the immediate profit potential for trend followers, it likely simultaneously increases the importance of the latent crisis mitigation potential for trend strategies. However, with rising rates in the U.S., a change from short‐term rate reduction to long‐term rate stabilization in Japan, and less dovish ECB commentary in Europe, there are signs that the slow, uneven unwind of the extraordinary post‐GFC central bank and government accommodationism may be underway. Hopefully a successful unshackling of the markets’ customary risk monitoring capabilities will occur without major incident, which in turn would increase the likelihood that trend following systems would be able to generate a reasonable profit even in the absence of a crisis. In the meantime, trend following remains an operative mitigation tool in the event that hidden risks prove too large for the financial system to handle.

Sincerely,

Bryan R. Fisher

William Ware Bush

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-855-845-9444.

The views of Aspen Partners, Ltd. and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writers’ current views. The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Aspen Partners Ltd. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Aspen Managed Futures Strategy Fund is distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

Diversification does not eliminate the risk of experiencing investment losses.

|

(1)

|

Correlation - a statistical measure of how two securities or portfolios move in relation to each other.

|

|

(2)

|

Aspen Managed Futures Beta Index (Aspen MFBI) is constructed using a quantitative, rules-based model designed to replicate the trend following and counter-trend exposure of futures markets by allocating assets to liquid futures contracts of certain financial and commodities futures markets. The Index therefore seeks to reflect the performance of strategies and exposures common to a broad universe of futures markets, i.e., managed futures beta. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index.

|

|

(3)

|

Barclay BTOP50 Index is an index of the largest investable CTA programs as measured by assets under management. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor may not invest directly into the Index.

|

|

(4)

|

Brexit is an abbreviation for "British exit," which refers to the June 23, 2016, referendum whereby British citizens voted to exit the European Union. The referendum roiled global markets, including currencies, causing the British pound to fall to its lowest level in decades.

|

|

(5)

|

V-bottom - a chart formation caused by a sharp extended decline followed by a sudden upward movement.

|

|

(6)

|

Attribution - The portion of overall returns attributable to a given subset of the fund portfolio.

|

|

(7)

|

Basis point is a common unit of measure fir interest rates and other percentages in finance. One basis point is equal to 1/100th of 1% or 0.01%(.0001).

|

|

(8)

|

VIX Index - the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options.

|

2

|

Aspen Managed Futures Strategy Fund

|

Performance Update

|

|

April 30, 2017 (Unaudited)

|

Cumulative Total Return Performance as of April 30, 2017

|

|

|

Expense Ratios

|

|||||

|

Aspen Managed Futures Strategy Fund

|

Calendar

Year-to-Date

|

1 Year

|

3 Year

|

5 Year

|

Since

Inception*

|

Total

|

Net(1)

|

|

Aspen Managed Futures Strategy Fund ‐

Class A (NAV)(2)

|

‐6.88%

|

‐6.97%

|

0.18%

|

0.42%

|

‐1.55%

|

1.61%

|

1.61%

|

|

Aspen Managed Futures Strategy Fund ‐

Class A (MOP)(3)

|

‐12.03%

|

‐12.05%

|

‐1.68%

|

‐0.71%

|

‐2.51%

|

1.61%

|

1.61%

|

|

Aspen Managed Futures Strategy Fund ‐

Class I

|

‐6.99%

|

‐7.33%

|

0.28%

|

0.63%

|

‐1.31%

|

1.23%

|

1.23%

|

|

SG CTA Index(4)

|

‐0.04%

|

‐4.58%

|

4.54%

|

1.79%

|

0.81%

|

||

|

Aspen Managed Futures Beta Index(5)

|

‐6.28%

|

‐5.63%

|

2.16%

|

2.53%

|

0.64%

|

||

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-845-9444.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Subject to investment risks, including possible loss of the principal amount invested. Returns for periods greater than 1 year are annualized.

|

*

|

Fund Inception date of August 2, 2011.

|

|

(1)

|

Aspen Partners, Ltd. (the “Adviser”) has agreed to waive and/or reimburse fees or expenses in order to limit total annual Fund operating expenses after fee waiver/expense reimbursements (excluding distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.55% of the Funds’ average daily net assets. This agreement (the “Expense Agreement”) is in effect through August 31, 2017. The Adviser will be permitted to recover, on a class-by-class basis, expenses it has borne through the Expense Agreement to the extent that the Funds’ expenses in later periods fall below the expense cap in effect at the time of waiver or reimbursement. Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date of the waiver or reimbursement. The Expense Agreement may not be terminated or modified prior to August 31, 2017 except with the approval of the Funds’ Board of Trustees

|

|

(2)

|

Net Asset Value (NAV) is the share price without sales charges.

|

|

(3)

|

Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Funds’ maximum sales charge of 5.50%.

|

|

(4)

|

The SG CTA Index (formerly, the Newedge CTA Index) provides the market with a reliable daily performance benchmark of major commodity trading advisors (CTAs). The SG CTA Index calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. Selection of the pool of qualified CTAs used in construction of the Index will be conducted annually, with re-balancing on January 1st of each year. A committee of industry professionals has been established to monitor the methodology of the index on a regular basis. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index.

|

|

(5)

|

Aspen Managed Futures Beta Index – The Managed Futures Beta Index is constructed using a quantitative, rules-based model designed to replicate the trend-following and counter-trend exposure of futures markets by allocating assets to liquid futures contracts of certain financial and commodities futures markets. The Index therefore seeks to reflect the performance of strategies and exposures common to a broad universe of futures markets, i.e., managed futures beta. The index is not actively managed and does not reflect any deductions for fees, expense or taxes. An investor may not invest directly in an index.

|

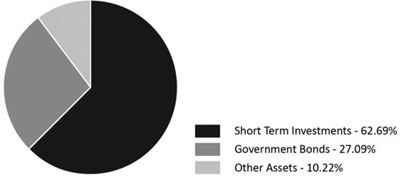

Portfolio Composition as of April 30, 2017

As a percentage of Net Assets^

|

^

|

Holdings subject to change, and may not reflect the current or future position of the portfolio.

|

|

Annual Report | April 30, 2017

|

3

|

|

Aspen Managed Futures Strategy Fund

|

Performance Update

|

April 30, 2017 (Unaudited)

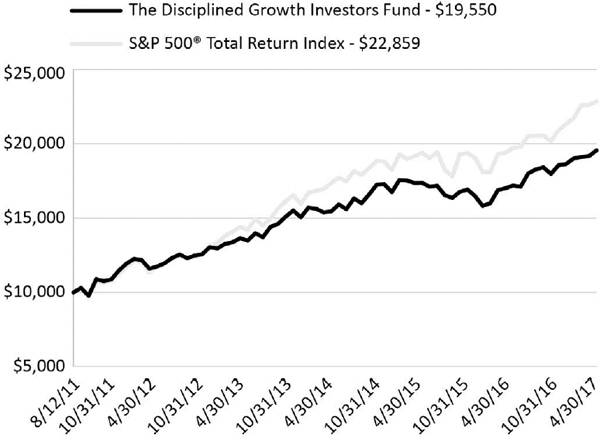

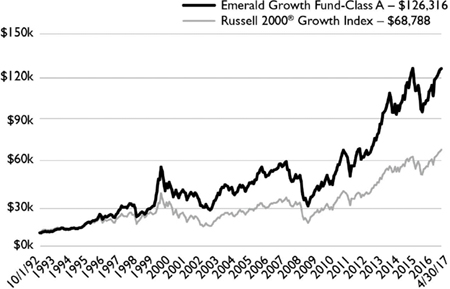

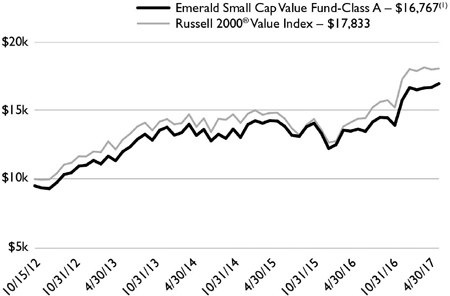

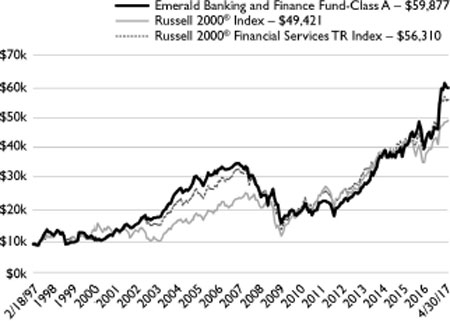

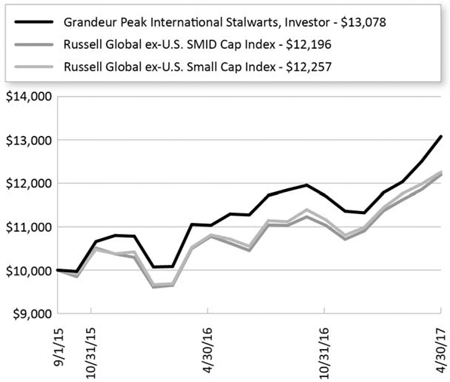

Performance of $10,000 Initial Investment (as of April 30, 2017)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

4

|

Aspen Portfolio Strategy Fund

|

Manager Commentary

|

April 30, 2017 (Unaudited)

May 15, 2017

Performance Results

The Aspen Portfolio Strategy Fund (the “Fund”) launched on December 29, 2016. Performance for the first four months of 2017 for the Fund’s Class I shares was ‐1.77%. Per its mandate, the Fund traded the Aspen Portfolio Strategy, which combines full exposure to US large‐cap equities (the “Equity Strategy”) with full exposure to Aspen’s proprietary diversified trend following program (the “Futures Strategy”). To capture the Equity Strategy, the Fund can employ a variety of vehicles, including exchange‐traded funds and futures contracts. To capture the Futures Strategy, the Fund can take long or short positions in each eligible futures market. A long position in a futures market may post gains (losses) if the price of the futures contract rises (falls), whereas a short position may post gains (losses) if the price of the futures contract falls (rises).

The S&P 500 Index(1), a US large‐cap equity benchmark, returned +7.16%. See the following section for a description of the sources of the return differential between the Fund and the S&P 500.

Explanation of Fund Performance

Though the Fund launched in late December, the asset base was insufficient to start trading the Aspen Portfolio Strategy Fund until the third trading day of January. As a consequence, the Fund was unable to participate in the markets on the first two trading days in January, which were positive return days for the markets. Thus the losses for the Fund in January (‐2.25% return) were partly due to those missed days at the beginning of the month.

Beyond that, the Futures Strategy experienced losses that often accompany a very low‐volatility backdrop like what was experienced in the opening months of 2017. January and February exemplified this type of backdrop, with typically minor losses stemming from commodity, currency, and fixed income trends, partially offset by gains in (entirely long) equity trends. A strong month for the Equity Strategy enabled the Fund to post a +3.37% return in February.

After the first day of March, the US equity markets hit a lull that continued through the end of the reporting period. In the Futures Strategy, currency trend trading became particularly problematic in March, when currency positioning experienced a classic “V‐bottom”(2) bounce—a pattern where trend systems post losses in the initial leg down, turn short, and then post losses on the subsequent bounce back up. The initial decline in FX values was caused by a sudden increase in the markets’ expectations that the Federal Reserve would raise interest rates in their March meeting. Index trend positioning turned short after the FX decline. The Fed did indeed raise rates, but the markets were unimpressed with the hawkishness of the announcement; FX rates jumped up again in the aftermath of the announcement, causing losses for the short currency trend positions. These V‐bottom losses were a major contributor to the Fund’s ‐2.54% return in March.

Trend following continued to fare poorly in the ongoing low‐vol environment in April, but Trend losses were muted because trend positioning was limited in notional size and mixed in direction due to market choppiness the prior several months. Mildly positive Equity Strategy returns resulted in small losses overall, with the Fund returning ‐0.24% for the month of April.

Outlook

As noted above, volatility in the financial markets is very abnormally low, both in trailing terms across asset class complexes and in prospective terms (e.g., the VIX Index(3) is near all‐time lows as of this writing). Low‐vol, range‐bound markets are historically difficult for trend‐following, though the magnitude of the losses for the Fund early in 2017 was exacerbated by a few unusual events, particularly in currency markets. Conversely, such low‐vol backdrops are generally accretive to equity investing, as was the case for the Fund’s Equity Strategy through April. This is one of the reasons why the combination of equities and trend following, as captured in the Aspen Portfolio Strategy Fund, tends to smooth out the skewness of both equity‐ and trend‐based investing.

Many market commentators have begun to notice that volatility levels seem inexplicably depressed, perhaps unreasonably so given geopolitical and economic risks. Moreover, there are some early indications that we may be seeing the beginnings of the (undoubtedly slow and uneven) unwind of one of the primary causes of the unusually low‐vol environment that has prevailed since the end of the Great Financial Crisis (“GFC”)—i.e., extraordinary levels of central bank accommodationism. For example, the Federal Reserve has begun raising rates, the Bank of Japan has changed its focus from the short‐term to the long‐term end of the rate curve, and the ECB has begun issuing somewhat less dovish‐sounding commentary.

|

Annual Report | April 30, 2017

|

5

|

|

Aspen Portfolio Strategy Fund

|

Manager Commentary

|

April 30, 2017 (Unaudited)

While the artificially imposed low‐vol environment has reduced the immediate profit potential for trend following—while simultaneously helping to produce excellent post‐crisis returns for equities—it likely simultaneously increases the importance of the latent crisis mitigation potential for trend strategies. However, with rising rates in the U.S., a change from short‐term rate reduction to long‐term rate stabilization in Japan, and less dovish ECB commentary in Europe, there are signs that the slow, uneven unwind of the extraordinary post‐GFC central bank and government accommodationism may be underway. Hopefully a successful unshackling of the markets’ customary risk monitoring capabilities will occur without major incident, which in turn would increase the likelihood that trend following systems would be able to generate a reasonable profit even in the absence of a crisis—the “Goldilocks”(4) scenario for an equity‐plus‐trend program like the Aspen Portfolio Strategy Fund. In the meantime, trend following remains an operative mitigation tool in the event that hidden risks prove too large for the financial system to handle, so that holding a sizable allocation to trend following can potentially enable lower‐risk holding of equity investments.

Sincerely,

Bryan R. Fisher

William Ware Bush

Bryan R. Fisher

William Ware Bush

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-855-845-9444.

The views of Aspen Partners, Ltd. and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writers’ current views. The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Aspen Partners Ltd. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Aspen Portfolio Strategy Funds are distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors.

The Fund may not achieve its objectives. The Fund is new with limited operating history.

Diversification does not eliminate the risk of experiencing investment losses.

|

(1)

|

The The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index

|

|

(2)

|

V-bottom - a chart formation caused by a sharp extended decline followed by a sudden upward movement.

|

|

(3)

|

VIX Index - the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options.

|

|

(4)

|

A scenario where markets are exhibiting neither highly elevated volatility (which on average tends to be problematic for equity investing) or extremely low volatility (which on average tends to be problematic for trend following). The name refers to Goldilocks finding the middle ground between too hot/big/hard and too cold/small/soft in the story The Three Bears.

|

6

|

Aspen Portfolio Strategy Fund

|

Performance Update

|

April 30, 2017 (Unaudited)

Cumulative Total Return Performance as of April 30, 2017

|

Expense Ratios

|

||||

|

Aspen Portfolio Strategy Fund

|

Calendar

Year-to-Date

|

Since

Inception*

|

Gross

|

Net(1)

|

|

Aspen Portfolio Strategy Fund ‐ Class A (NAV)(2)

|

‐1.89%

|

‐2.20%

|

2.12%

|

1.95%

|

|

Aspen Portfolio Strategy Fund ‐ Class A (MOP)(3)

|

‐7.28%

|

‐7.60%

|

2.12%

|

1.95%

|

|

Aspen Portfolio Strategy Fund ‐ Class I

|

‐1.77%

|

‐2.08%

|

1.72%

|

1.55%

|

|

S&P 500 Total Return Index

|

7.16%

|

6.64%

|

||

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-845-9444.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods greater than 1 year are annualized.

|

*

|

Fund Inception date of December 28, 2016.

|

|

(1)

|

Aspen Partners, Ltd. (the “Adviser”) has agreed to waive and/or reimburse fees or expenses in order to limit total annual Fund operating expenses after fee waiver/expense reimbursements (excluding distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.55% of the Funds’ average daily net assets. This agreement (the “Expense Agreement”) is in effect through August 31, 2018. The Adviser will be permitted to recover, on a class-by-class basis, expenses it has borne through the Expense Agreement to the extent that the Funds’ expenses in later periods fall below the expense cap in effect at the time of waiver or reimbursement. Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date of the waiver or reimbursement. The Expense Agreement may not be terminated or modified prior to August 31, 2018 except with the approval of the Funds’ Board of Trustees

|

|

(2)

|

Net Asset Value (NAV) is the share price without sales charges.

|

|

(3)

|

Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Funds’ maximum sales charge of 5.50%.

|

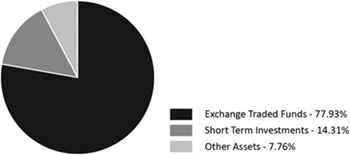

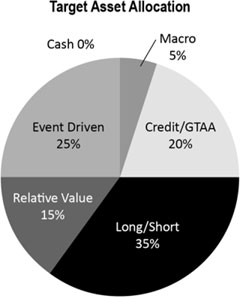

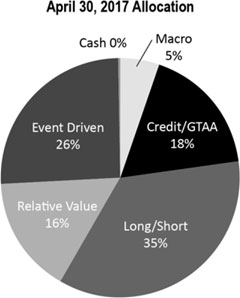

Portfolio Composition as of April 30, 2017

As a percentage of Net Assets^

|

^

|

Holdings subject to change, and may not reflect the current or future position of the portfolio.

|

|

Annual Report | April 30, 2017

|

7

|

|

Aspen Portfolio Strategy Fund

|

Performance Update

|

April 30, 2017 (Unaudited)

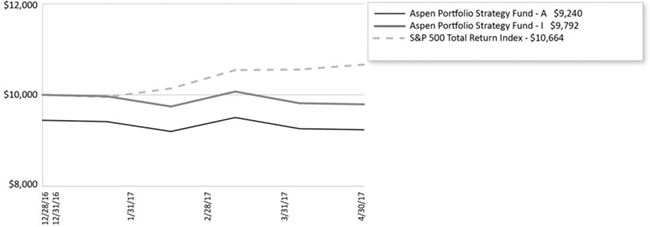

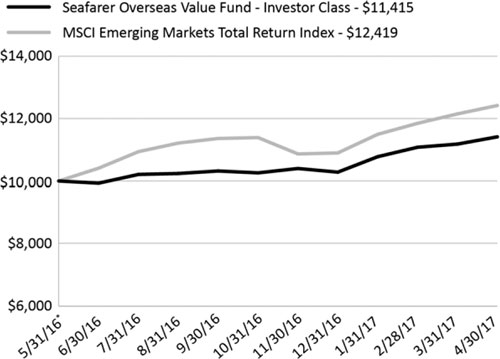

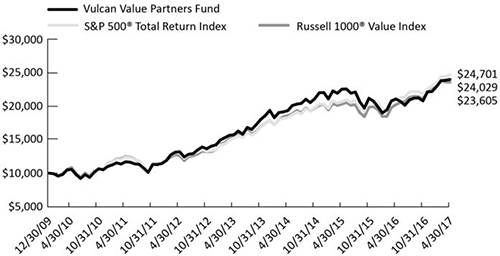

Performance of $10,000 Initial Investment (as of April 30, 2017)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

8

|

Aspen Funds

|

Consolidated Disclosure of Fund Expenses

|

April 30, 2017 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b‐1) fees; shareholder servicing fees; and other fund operating expenses. This example is intended to help you understand your ongoing costs (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six‐month period of November 1, 2016 through April 30, 2017.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as applicable sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

Beginning

Account Value

11/1/16

|

Ending

Account Value

4/30/17

|

Expense Ratio(a)

|

Expenses Paid

During period

11/1/16 - 4/30/17(b)

|

|

|

Aspen Managed Futures Strategy Fund

|

||||

|

Class A

|

||||

|

Actual

|

$1,000.00

|

$961.90

|

0.97%

|

$4.72

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,019.98

|

0.97%

|

$4.86

|

|

Class I

|

||||

|

Actual

|

$1,000.00

|

$959.80

|

1.33%

|

$6.46

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,018.20

|

1.33%

|

$6.66

|

|

Aspen Portfolio Strategy Fund

|

||||

|

Class A

|

||||

|

Actual(c)

|

$1,000.00

|

$978.00

|

1.95%

|

$6.50

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,015.12

|

1.95%

|

$9.74

|

|

Class I

|

||||

|

Actual(c)

|

$1,000.00

|

$979.20

|

1.55%

|

$5.17

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,017.11

|

1.55%

|

$7.75

|

|

(a)

|

The Fund's expense ratios have been based on the Fund's most recent fiscal half-year expenses.

|

|

(b)

|

Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181)/365 (to reflect the half-year period).

|

|

(c)

|

The Aspen Portfolio Strategy Fund's commencement date is December 29, 2016. Actual expenses on this Fund is equal to the Fund's annualized expense ratio multiplied by the average account value of the period, multiplied by the number of days since the Fund launched (123), divided by 365.

|

|

Annual Report | April 30, 2017

|

9

|

|

Aspen Managed Futures Strategy Fund

|

Consolidated Schedule of Investments

|

April 30, 2017

|

Principal

Amount/ Shares

|

Value

(Note 2)

|

|||||||

|

GOVERNMENT BONDS (27.09%)

|

||||||||

|

U.S. TREASURY NOTES (27.09%)

|

||||||||

|

0.625%, 05/31/2017

|

$

|

90,000

|

$

|

89,994

|

||||

|

0.625%, 06/30/2017

|

7,000,000

|

6,998,768

|

||||||

|

0.625%, 07/31/2017

|

14,823,000

|

14,813,528

|

||||||

|

0.625%, 08/31/2017

|

5,045,000

|

5,040,369

|

||||||

|

1.000%, 09/15/2017

|

5,000,000

|

5,000,975

|

||||||

|

0.625%, 09/30/2017

|

6,050,000

|

6,041,730

|

||||||

|

0.750%, 10/31/2017

|

5,229,000

|

5,222,872

|

||||||

|

0.625%, 11/30/2017

|

8,314,000

|

8,293,705

|

||||||

|

0.750%, 12/31/2017

|

3,075,000

|

3,068,933

|

||||||

|

TOTAL GOVERNMENT BONDS (Cost $54,618,306)

|

54,570,874

|

|||||||

|

SHORT TERM INVESTMENTS (62.69%)

|

||||||||

|

MONEY MARKET FUND (1.41%)

|

||||||||

|

Dreyfus Treasury & Agency Cash Management Fund ‐ Institutional Shares, 7‐day yield, 0.626%

|

2,835,019

|

2,835,019

|

||||||

|

U.S. TREASURY BILLS (61.28%)

|

||||||||

|

0.492%, 05/25/2017(a)

|

10,500,000

|

10,495,380

|

||||||

|

0.429%, 06/22/2017(a)

|

13,350,000

|

13,336,677

|

||||||

|

0.402%, 07/20/2017(a)

|

10,000,000

|

9,983,140

|

||||||

|

0.557%, 08/17/2017(a)

|

14,000,000

|

13,966,764

|

||||||

|

0.528%, 09/14/2017(a)

|

11,200,000

|

11,163,981

|

||||||

|

0.631%, 10/12/2017(a)

|

9,400,000

|

9,360,445

|

||||||

|

0.507%, 11/09/2017(a)

|

10,000,000

|

9,950,130

|

||||||

|

0.670%, 12/07/2017(a)

|

13,400,000

|

13,323,124

|

||||||

|

0.770%, 01/04/2018(a)

|

10,600,000

|

10,529,902

|

||||||

|

0.578%, 02/01/2018(a)

|

10,400,000

|

10,323,560

|

||||||

|

0.898%, 03/29/2018(a)

|

5,400,000

|

5,350,261

|

||||||

|

1.004%, 04/26/2018(a)

|

5,700,000

|

5,640,503

|

||||||

|

123,423,867

|

||||||||

|

TOTAL SHORT TERM INVESTMENTS (Cost $126,359,127)

|

126,258,886

|

|||||||

|

TOTAL INVESTMENTS (89.78%) (Cost $180,977,433)

|

$

|

180,829,760

|

||||||

|

Other Assets In Excess Of Liabilities (10.22%)

|

20,578,397

|

(b)

|

||||||

|

NET ASSETS (100.00%)

|

$

|

201,408,157

|

||||||

| (a) |

Rate shown represents the bond equivalent yield to maturity at date of purchase.

|

| (b) |

Includes cash which is being held as collateral for futures contracts.

|

See Notes to Consolidated Financial Statements.

10

|

Aspen Managed Futures Strategy Fund

|

Consolidated Schedule of Investments

|

April 30, 2017

FUTURES CONTRACTS

At April 30, 2017, the Fund had the following outstanding futures contracts:

|

Description

|

Position

|

Contracts

|

Expiration Date

|

Underlying Face

Amount at Value

|

Unrealized

Appreciation

|

|||||||||

|

Commodity Contracts

|

||||||||||||||

|

Copper Future(a)

|

Long

|

48

|

07/27/2017

|

$

|

3,129,000

|

$

|

8,244

|

|||||||

|

Silver Future(a)

|

Short

|

33

|

07/27/2017

|

(2,848,230

|

)

|

28,038

|

||||||||

|

Soybean Future(a)

|

Short

|

191

|

07/14/2017

|

(9,132,187

|

)

|

1,681

|

||||||||

|

Equity Contracts

|

||||||||||||||

|

Euro STOXX 50 Index Future

|

Long

|

415

|

06/16/2017

|

15,858,252

|

565,210

|

|||||||||

|

S&P®500 E‐Mini Future

|

Long

|

133

|

06/16/2017

|

15,830,325

|

27,860

|

|||||||||

|

Foreign Currency Contracts

|

||||||||||||||

|

Canadian Dollar Currency Future

|

Short

|

472

|

06/20/2017

|

(34,550,400

|

)

|

468,400

|

||||||||

|

Interest Rate Contracts

|

||||||||||||||

|

Canadian 10 Year Bond Future

|

Long

|

109

|

06/21/2017

|

11,143,943

|

21,599

|

|||||||||

|

Long Gilt Future

|

Long

|

67

|

06/28/2017

|

11,131,073

|

20,035

|

|||||||||

|

$

|

10,561,776

|

$

|

1,141,067

|

|||||||||||

|

Description

|

Position

|

Contracts

|

Expiration Date

|

Underlying Face

Amount at Value

|

Unrealized

Depreciation

|

|||||||||

|

Commodity Contracts

|

||||||||||||||

|

Corn Future(a)

|

Long

|

163

|

07/14/2017

|

$

|

2,986,975

|

$

|

(2,641

|

)

|

||||||

|

Gold 100 Oz Future(a)

|

Long

|

48

|

06/28/2017

|

6,087,840

|

(5,196

|

)

|

||||||||

|

NY Harbor ULSD Future(a)

|

Long

|

45

|

05/31/2017

|

2,848,608

|

(65,351

|

)

|

||||||||

|

Sugar No. 11 (World) Future(a)

|

Short

|

336

|

06/30/2017

|

(6,070,042

|

)

|

(212,033

|

)

|

|||||||

|

WTI Crude Future(a)

|

Long

|

61

|

05/22/2017

|

3,009,130

|

(255,788

|

)

|

||||||||

|

Equity Contracts

|

||||||||||||||

|

FTSE 100 Index Future

|

Long

|

58

|

06/16/2017

|

5,382,466

|

(97,423

|

)

|

||||||||

|

Nikkei 225 Index Future

|

Short

|

54

|

06/08/2017

|

(5,193,450

|

)

|

(192,507

|

)

|

|||||||

|

Foreign Currency Contracts

|

||||||||||||||

|

Australian Dollar Currency Future

|

Long

|

294

|

06/19/2017

|

21,979,440

|

(284,479

|

)

|

||||||||

|

Euro FX Currency Future

|

Short

|

245

|

06/19/2017

|

(33,445,563

|

)

|

(848,333

|

)

|

|||||||

|

Japanese Yen Currency Future

|

Long

|

206

|

06/19/2017

|

23,159,550

|

(348,109

|

)

|

||||||||

|

New Zealand Dollar Currency Future

|

Long

|

654

|

06/19/2017

|

44,877,480

|

(539,836

|

)

|

||||||||

|

Swiss Franc Currency Future

|

Short

|

360

|

06/19/2017

|

(45,396,000

|

)

|

(719,266

|

)

|

|||||||

|

Interest Rate Contracts

|

||||||||||||||

|

Euro‐Bund Future

|

Short

|

124

|

06/08/2017

|

(21,852,148

|

)

|

(70,476

|

)

|

|||||||

|

U.S. 10 Year Treasury Note Future

|

Short

|

88

|

06/21/2017

|

(11,063,254

|

)

|

(15,261

|

)

|

|||||||

|

$

|

(12,688,968

|

)

|

$

|

(3,656,699

|

)

|

|||||||||

Common Abbreviations:

FTSE - Financial Times and the London Stock Exchange

S&P - Standard and Poor's

ULSD - Ultra Low Sulfur Diesel

| (a) |

Owned by an entity that is owned by the Fund and is consolidated as described in Note 1 of the Notes to the Consolidated Financial Statements.

|

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

See Notes to Consolidated Financial Statements.

|

Annual Report | April 30, 2017

|

11

|

|

Aspen Portfolio Strategy Fund

|

Consolidated Schedule of Investments

|

April 30, 2017

|

Shares

|

Value

(Note 2)

|

|||||||

|

EXCHANGE TRADED FUNDS (77.93%)

|

||||||||

|

SPDR® S&P 500® ETF Trust

|

141,781

|

$

|

33,755,794

|

|||||

|

TOTAL EXCHANGE TRADED FUNDS (Cost $33,131,361)

|

33,755,794

|

|||||||

|

SHORT TERM INVESTMENTS (14.31%)

|

||||||||

|

MONEY MARKET FUND (14.31%)

|

||||||||

|

Dreyfus Treasury & Agency Cash Management Fund ‐ Institutional Shares, 7‐day yield, 0.626%

|

6,199,164

|

6,199,164

|

||||||

|

TOTAL SHORT TERM INVESTMENTS (Cost $6,199,164)

|

6,199,164

|

|||||||

|

TOTAL INVESTMENTS (92.24%) (Cost $39,330,525)

|

$

|

39,954,958

|

||||||

|

Other Assets In Excess Of Liabilities (7.76%)

|

3,363,365

|

(a)

|

||||||

|

NET ASSETS (100.00%)

|

$

|

43,318,323

|

||||||

| (a) |

Includes cash which is being held as collateral for futures contracts.

|

See Notes to Consolidated Financial Statements.

12

12

|

Aspen Portfolio Strategy Fund

|

Consolidated Schedule of Investments

|

April 30, 2017

FUTURES CONTRACTS

At April 30, 2017, the Fund had the following outstanding futures contracts:

|

Description

|

Position

|

Contracts

|

Expiration Date

|

Underlying Face

Amount at Value

|

Unrealized

Appreciation

|

|||||||||

|

Commodity Contracts

|

||||||||||||||

|

Copper Future(a)

|

Long

|

11

|

07/27/2017

|

$

|

717,063

|

$

|

3,265

|

|||||||

|

Gold 100 Oz Future(a)

|

Long

|

12

|

06/28/2017

|

1,521,960

|

3,251

|

|||||||||

|

Silver Future(a)

|

Short

|

8

|

07/27/2017

|

(690,480

|

)

|

8,294

|

||||||||

|

Soybean Future(a)

|

Short

|

44

|

07/14/2017

|

(2,103,750

|

)

|

18,537

|

||||||||

|

Equity Contracts

|

||||||||||||||

|

Euro STOXX 50 Index Future

|

Long

|

97

|

06/16/2017

|

3,706,627

|

127,555

|

|||||||||

|

Foreign Currency Contracts

|

||||||||||||||

|

Canadian Dollar Currency Future

|

Short

|

111

|

06/20/2017

|

(8,125,200

|

)

|

132,841

|

||||||||

|

Euro FX Currency Future

|

Long

|

20

|

06/19/2017

|

2,730,250

|

5,195

|

|||||||||

|

Interest Rate Contracts

|

||||||||||||||

|

Canadian 10 Year Bond Future

|

Long

|

25

|

06/21/2017

|

2,555,950

|

8,336

|

|||||||||

|

Long Gilt Future

|

Long

|

16

|

06/28/2017

|

2,658,167

|

5,563

|

|||||||||

|

$

|

2,970,587

|

$

|

312,837

|

|||||||||||

|

Description

|

Position

|

Contracts

|

Expiration Date

|

Underlying Face

Amount at Value

|

Unrealized

Depreciation

|

|||||||||

|

Commodity Contracts

|

||||||||||||||

|

Corn Future(a)

|

Long

|

38

|

07/14/2017

|

$

|

696,350

|

$

|

(13,916

|

)

|

||||||

|

NY Harbor ULSD Future(a)

|

Long

|

11

|

05/31/2017

|

696,326

|

(16,529

|

)

|

||||||||

|

Sugar No. 11 (World) Future(a)

|

Short

|

79

|

06/30/2017

|

(1,427,182

|

)

|

(22,513

|

)

|

|||||||

|

WTI Crude Future(a)

|

Long

|

15

|

05/22/2017

|

739,950

|

(66,029

|

)

|

||||||||

|

Equity Contracts

|

||||||||||||||

|

FTSE 100 Index Future

|

Long

|

14

|

06/16/2017

|

1,299,216

|

(25,598

|

)

|

||||||||

|

Nikkei 225 Index Future

|

Short

|

13

|

06/08/2017

|

(1,250,275

|

)

|

(41,315

|

)

|

|||||||

|

S&P®500 E‐Mini Future

|

Long

|

117

|

06/16/2017

|

13,925,925

|

(1,393

|

)

|

||||||||

|

Foreign Currency Contracts

|

||||||||||||||

|

Australian Dollar Currency Future

|

Short

|

73

|

06/19/2017

|

(5,457,480

|

)

|

(10,161

|

)

|

|||||||

|

Japanese Yen Currency Future

|

Long

|

48

|

06/19/2017

|

5,396,400

|

(72,582

|

)

|

||||||||

|

Interest Rate Contracts

|

||||||||||||||

|

Euro‐Bund Future

|

Short

|

29

|

06/08/2017

|

(5,110,583

|

)

|

(17,083

|

)

|

|||||||

|

U.S. 10 Year Treasury Note Future

|

Short

|

21

|

06/21/2017

|

(2,640,095

|

)

|

(6,943

|

)

|

|||||||

|

$

|

6,868,552

|

$

|

(294,062

|

)

|

||||||||||

Common Abbreviations:

FTSE - Financial Times and the London Stock Exchange

S&P - Standard and Poor's

ULSD - Ultra Low Sulfur Diesel

| (a) |

Owned by an entity that is owned by the Fund and is consolidated as described in Note 1 of the Notes to the Consolidated Financial Statements.

|

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

See Notes to Consolidated Financial Statements.

|

Annual Report | April 30, 2017

|

13

|

|

Aspen Funds

|

Consolidated Statements of Assets & Liabilities

|

April 30, 2017

|

Aspen

Managed Futures

Strategy Fund

|

Aspen Portfolio

Strategy Fund

|

|||||||

|

ASSETS:

|

||||||||

|

Investments, at value

|

$

|

180,829,760

|

$

|

39,954,958

|

||||

|

Cash

|

5,642,466

|

–

|

||||||

|

Foreign currency, at value(Cost $– and $101,401) (Note 3)

|

–

|

103,225

|

||||||

|

Deposit with broker for futures contracts (Note 3)

|

18,616,052

|

3,377,009

|

||||||

|

Receivable for investments sold

|

5,090,875

|

–

|

||||||

|

Receivable for shares sold

|

236,554

|

75,506

|

||||||

|

Interest receivable

|

85,087

|

4,508

|

||||||

|

Offering costs (Note 2)

|

–

|

48,385

|

||||||

|

Prepaid and other assets

|

13,733

|

3,751

|

||||||

|

Total assets

|

210,514,527

|

43,567,342

|

||||||

|

LIABILITIES:

|

||||||||

|

Foreign cash due to broker for futures contracts (Cost $2,768,312 and $–) (Note 3)

|

2,706,311

|

–

|

||||||

|

Payable to advisor

|

129,829

|

6,141

|

||||||

|

Payable for investments purchased

|

5,643,380

|

–

|

||||||

|

Variation margin payable

|

264,177

|

90,558

|

||||||

|

Payable for shares redeemed

|

213,719

|

105,618

|

||||||

|

Payable for administration fees

|

22,290

|

11,652

|

||||||

|

Payable for distribution and service fees

|

||||||||

|

Class A

|

4,420

|

2,182

|

||||||

|

Payable for transfer agency fees

|

7,886

|

3,128

|

||||||

|

Delegated transfer agent equivalent services fees

|

||||||||

|

Class A

|

230

|

–

|

||||||

|

Class I

|

30,001

|

2,573

|

||||||

|

Payable for trustee fees and expenses

|

890

|

258

|

||||||

|

Payable for professional fees

|

29,162

|

23,204

|

||||||

|

Payable for chief compliance officer fees

|

3,123

|

605

|

||||||

|

Payable for principal financial officer fees

|

406

|

11

|

||||||

|

Payable for licensing fees

|

43,276

|

–

|

||||||

|

Accrued expenses and other liabilities

|

7,270

|

3,089

|

||||||

|

Total liabilities

|

9,106,370

|

249,019

|

||||||

|

NET ASSETS

|

$

|

201,408,157

|

$

|

43,318,323

|

||||

|

NET ASSETS CONSIST OF:

|

||||||||

|

Paid‐in capital (Note 5)

|

$

|

229,634,590

|

$

|

43,488,585

|

||||

|

Accumulated net investment income/(loss)

|

(592,781

|

)

|

62,516

|

|||||

|

Accumulated net realized loss

|

(25,035,605

|

)

|

(878,395

|

)

|

||||

|

Net unrealized appreciation/(depreciation)

|

(2,598,047

|

)

|

645,617

|

|||||

|

NET ASSETS

|

$

|

201,408,157

|

$

|

43,318,323

|

||||

|

INVESTMENTS, AT COST

|

$

|

180,977,433

|

$

|

39,330,525

|

||||

See Notes to Consolidated Financial Statements.

14

14

|

Aspen Funds

|

Consolidated Statements of Assets & Liabilities

|

April 30, 2017

|

PRICING OF SHARES:

|

||||||||

|

Class A:

|

||||||||

|

Net Asset Value, offering and redemption price per share

|

$

|

8.12

|

$

|

24.45

|

||||

|

Net Assets

|

$

|

6,330,770

|

$

|

2,196,398

|

||||

|

Shares of beneficial interest outstanding

|

779,627

|

89,845

|

||||||

|

Maximum offering price per share (NAV/0.9450), based on maximum sales charge of 5.50% of the offering price

|

$

|

8.59

|

$

|

25.87

|

||||

|

Class I:

|

||||||||

|

Net Asset Value, offering and redemption price per share

|

$

|

8.25

|

$

|

24.48

|

||||

|

Net Assets

|

$

|

195,077,386

|

$

|

41,121,925

|

||||

|

Shares of beneficial interest outstanding

|

23,636,548

|

1,679,893

|

||||||

See Notes to Consolidated Financial Statements.

|

Annual Report | April 30, 2017

|

15

|

|

Aspen Funds

|

Consolidated Statements of Operations

|

For the Year or Period Ended April 30, 2017

|

Aspen

Managed Futures

Strategy Fund

|

Aspen Portfolio

Strategy Fund(a)

|

|||||||

|

INVESTMENT INCOME:

|

||||||||

|

Interest

|

$

|

1,237,418

|

$

|

–

|

||||

|

Dividends

|

5,983

|

159,526

|

||||||

|

Total investment income

|

1,243,401

|

159,526

|

||||||

|

EXPENSES:

|

||||||||

|

Investment advisory fees (Note 6)

|

1,871,444

|

102,326

|

||||||

|

Investment advisory fees ‐ subsidiary (Note 6)

|

169,945

|

2,784

|

||||||

|

Administrative fees

|

236,234

|

31,446

|

||||||

|

Distribution and service fees

|

||||||||

|

Class A

|

21,562

|

3,874

|

||||||

|

Transfer agency fees

|

73,351

|

10,315

|

||||||

|

Delegated transfer agent equivalent services fees

|

||||||||

|

Class A

|

1,747

|

–

|

||||||

|

Class I

|

180,348

|

4,830

|

||||||

|

Professional fees

|

49,069

|

23,459

|

||||||

|

Offering costs

|

–

|

31,494

|

||||||

|

Custodian fees

|

11,871

|

3,838

|

||||||

|

Trustee fees and expenses

|

17,983

|

12,885

|

||||||

|

Principal financial officer fees

|

4,861

|

139

|

||||||

|

Chief compliance officer fees

|

36,388

|

1,755

|

||||||

|

Licensing fees

|

623,814

|

–

|

||||||

|

Other

|

44,532

|

5,972

|

||||||

|

Total expenses before waiver/reimbursement

|

3,343,149

|

235,117

|

||||||

|

Waiver of investment advisory fees

|

–

|

(69,902

|

)

|

|||||

|

Waiver of investment advisory fees ‐ subsidiary (Note 6)

|

(169,945

|

)

|

(2,784

|

)

|

||||

|

Total net expenses

|

3,173,204

|

162,431

|

||||||

|

NET INVESTMENT LOSS

|

(1,929,803

|

)

|

(2,905

|

)

|

||||

|

Net realized gain/(loss) on investments

|

5,768

|

(218

|

)

|

|||||

|

Net realized loss on futures contracts

|

(7,984,165

|

)

|

(1,515,500

|

)

|

||||

|

Net realized gain on foreign currency transactions

|

316,994

|

1,071

|

||||||

|

Total net realized loss

|

(7,661,403

|

)

|

(1,514,647

|

)

|

||||

|

Net change in unrealized appreciation/(depreciation) of investments

|

(242,460

|

)

|

624,433

|

|||||

|

Net change in unrealized appreciation/(depreciation) on futures contracts

|

(7,635,549

|

)

|

18,775

|

|||||

|

Net change in unrealized appreciation on translation of assets and liabilities denominated in foreign currency transactions

|

105,959

|

2,409

|

||||||

|

Net change in unrealized appreciation/(depreciation)

|

(7,772,050

|

)

|

645,617

|

|||||

|

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS

|

(15,433,453

|

)

|

(869,030

|

)

|

||||

|

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

(17,363,256

|

)

|

$

|

(871,935

|

)

|

||

| (a) |

The Aspen Portfolio Strategy Fund is for the period from December 29, 2016 (commencement of operations) to April 30, 2017.

|

See Notes to Consolidated Financial Statements.

16

16

|

Aspen Managed Futures Strategy Fund

|

Consolidated Statements

of Changes in Net Assets |

|

For the

Year Ended

April 30, 2017

|

For the

Year Ended

April 30, 2016

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment loss

|

$

|

(1,929,803

|

)

|

$

|

(2,786,624

|

)

|

||

|

Net realized loss

|

(7,661,403

|

)

|

(22,047,854

|

)

|

||||

|

Net change in unrealized appreciation/(depreciation)

|

(7,772,050

|

)

|

9,897,802

|

|||||

|

Net decrease in net assets resulting from operations

|

(17,363,256

|

)

|

(14,936,676

|

)

|

||||

|

DISTRIBUTIONS TO SHAREHOLDERS (Note 4):

|

||||||||

|

From net investment income

|

||||||||

|

Class A

|

(87,401

|

)

|

(290,384

|

)

|

||||

|

Class I

|

(2,130,729

|

)

|

(4,854,577

|

)

|

||||

|

From net realized gains on investments

|

||||||||

|

Class A

|

–

|

(1,080,184

|

)

|

|||||

|

Class I

|

–

|

(15,329,525

|

)

|

|||||

|

Net decrease in net assets from distributions

|

(2,218,130

|

)

|

(21,554,670

|

)

|

||||

|

SHARE TRANSACTIONS (Note 5):

|

||||||||

|

Class A

|

||||||||

|

Proceeds from sales of shares

|

5,709,455

|

17,757,620

|

||||||

|

Distributions reinvested

|

77,296

|

1,314,015

|

||||||

|

Cost of shares redeemed

|

(18,518,215

|

)

|

(20,727,211

|

)

|

||||

|

Redemption fees

|

2,337

|

5,100

|

||||||

|

Class I

|

||||||||

|

Proceeds from sales of shares

|

67,326,891

|

83,806,547

|

||||||

|

Distributions reinvested

|

1,277,264

|

16,756,950

|

||||||

|

Cost of shares redeemed

|

(119,175,878

|

)

|

(44,568,213

|

)

|

||||

|

Redemption fees

|

9,991

|

2,041

|

||||||

|

Net increase/(decrease) from share transactions

|

(63,290,859

|

)

|

54,346,849

|

|||||

|

Net increase/(decrease) in net assets

|

(82,872,245

|

)

|

17,855,503

|

|||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

284,280,402

|

266,424,899

|

||||||

|

End of period*

|

$

|

201,408,157

|

$

|

284,280,402

|

||||

|

*Includes accumulated net investment income/(loss) of:

|

$

|

(592,781

|

)

|

$

|

2,217,954

|

|||

|

Other Information:

|

||||||||

|

SHARE TRANSACTIONS:

|

||||||||

|

Class A

|

||||||||

|

Sold

|

657,148

|

1,836,531

|

||||||

|

Distributions reinvested

|

8,695

|

146,490

|

||||||

|

Redeemed

|

(2,116,176

|

)

|

(2,134,823

|

)

|

||||

|

Net decrease in shares outstanding

|

(1,450,333

|

)

|

(151,802

|

)

|

||||

|

Class I

|

||||||||

|

Sold

|

7,602,448

|

8,468,843

|

||||||

|

Distributions reinvested

|

141,447

|

1,837,385

|

||||||

|

Redeemed

|

(13,558,549

|

)

|

(4,699,475

|

)

|

||||

|

Net increase/(decrease) in shares outstanding

|

(5,814,654

|

)

|

5,606,753

|

|||||

See Notes to Consolidated Financial Statements.

|

Annual Report | April 30, 2017

|

17

|

|

Aspen Portfolio Strategy Fund

|

Consolidated Statements

of Changes in Net Assets |

|

For the

Period Ended

April 30, 2017(a)

|

||||

|

OPERATIONS:

|

||||

|

Net investment loss

|

$

|

(2,905

|

)

|

|

|

Net realized loss

|

(1,514,647

|

)

|

||

|

Net change in unrealized appreciation

|

645,617

|

|||

|

Net decrease in net assets resulting from operations

|

(871,935

|

)

|

||

|

SHARE TRANSACTIONS (Note 5):

|

||||

|

Class A

|

||||

|

Proceeds from sales of shares

|

4,346,888

|

|||

|

Cost of shares redeemed

|

(2,024,348

|

)

|

||

|

Class I

|

||||

|

Proceeds from sales of shares

|

42,535,105

|

|||

|

Cost of shares redeemed

|

(669,987

|

)

|

||

|

Redemption fees

|

2,600

|

|||

|

Net increase from share transactions

|

44,190,258

|

|||

|

Net increase in net assets

|

43,318,323

|

|||

|

NET ASSETS:

|

||||

|

Beginning of period

|

–

|

|||

|

End of period*

|

$

|

43,318,323

|

||

|

*Includes accumulated net investment income of:

|

$

|

62,516

|

||

|

Other Information:

|

||||

|

SHARE TRANSACTIONS:

|

||||

|

Class A

|

||||

|

Sold

|

173,467

|

|||

|

Redeemed

|

(83,622

|

)

|

||

|

Net increase in shares outstanding

|

89,845

|

|||

|

Class I

|

||||

|

Sold

|

1,707,193

|

|||

|

Redeemed

|

(27,300

|

)

|

||

|

Net increase in shares outstanding

|

1,679,893

|

|||

| (a) |

The Aspen Portfolio Strategy Fund is for the period from December 29, 2016 (commencement of operations) to April 30, 2017.

|

See Notes to Consolidated Financial Statements.

18

|

Aspen Managed Futures Strategy Fund – Class A

|

Consolidated Financial Highlights

|

For a share outstanding throughout the periods presented.

|

For the

Year Ended

April 30,

2017(a)

|

For the

Year Ended

April 30,

2016(a)

|

For the

Year Ended

April 30,

2015(a)

|

For the

Year Ended

April 30,

2014(a)

|

For the

Year Ended

April 30,

2013(a)

|

||||||||||||||||

|

NET ASSET VALUE, BEGINNING OF PERIOD

|

$

|

8.83

|

$

|

10.01

|

$

|

8.97

|

$

|

9.29

|

$

|

8.95

|

||||||||||

|

INCOME/(LOSS) FROM OPERATIONS:

|

||||||||||||||||||||

|

Net investment loss(b)

|

(0.04

|