Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

JoEllen L. Legg, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: October 31

Date of reporting period: November 1, 2014 – October 31, 2015

1

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

October 31, 2015

ALPS | Alerian MLP Infrastructure Index Fund

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

ALPS | Kotak India Growth Fund

ALPS | Red Rocks Listed Private Equity Fund

ALPS | Sterling ETF Tactical Rotation Fund

ALPS | Westport Resources Hedged High Income Fund

ALPS | WMC Research Value Fund

Clough China Fund

RiverFront Global Allocation Series

An ALPS Advisors Solution

Table of Contents

CONTENTS

www.alpsfunds.com

Table of Contents

October 31, 2015 (Unaudited)

Examples. As a shareholder of the Funds, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2015 and held until October 31, 2015.

Actual Expenses. The first line under each class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period May 1, 2015 – October 31, 2015” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line under each class in the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other mutual funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or redemption fees. Therefore, the second line under each class in the following table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

1 | October 31, 2015

Table of Contents

Disclosure of Fund Expenses

October 31, 2015 (Unaudited)

| Beginning Account Value May 1, 2015 |

Ending Account Value October 31, 2015 |

Expense Ratio(a) |

Expenses Paid During Period May 1, 2015

- |

|||||||||||

|

|

||||||||||||||

| ALPS | Alerian MLP Infrastructure Index Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 761.10 | 1.25% | $ | 5.55 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,018.90 | 1.25% | $ | 6.36 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 763.40 | 1.85% | $ | 8.22 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.88 | 1.85% | $ | 9.40 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 763.20 | 0.85% | $ | 3.78 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.92 | 0.85% | $ | 4.33 | |||||||

|

|

||||||||||||||

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund(c) |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 841.20 | 1.45% | $ | 6.73 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,017.90 | 1.45% | $ | 7.38 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 837.90 | 2.05% | $ | 9.50 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,014.87 | 2.05% | $ | 10.41 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 843.20 | 1.15% | $ | 5.34 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | 1.15% | $ | 5.85 | |||||||

|

|

||||||||||||||

| ALPS | Kotak India Growth Fund(d) |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 989.00 | 1.92% | $ | 9.63 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.53 | 1.92% | $ | 9.75 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 986.30 | 2.60% | $ | 13.02 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,012.10 | 2.60% | $ | 13.19 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 990.70 | 1.60% | $ | 8.03 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,017.14 | 1.60% | $ | 8.13 | |||||||

|

|

||||||||||||||

| ALPS | Red Rocks Listed Private Equity Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 959.00 | 1.41% | $ | 6.96 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,018.10 | 1.41% | $ | 7.17 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 954.90 | 2.12% | $ | 10.45 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,014.52 | 2.12% | $ | 10.76 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 959.40 | 1.16% | $ | 5.73 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.36 | 1.16% | $ | 5.90 | |||||||

| Class R |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 958.40 | 1.61% | $ | 7.95 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,017.09 | 1.61% | $ | 8.19 | |||||||

|

|

||||||||||||||

| ALPS | Sterling ETF Tactical Rotation Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 954.00 | 1.55% | $ | 7.63 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,017.39 | 1.55% | $ | 7.88 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 950.80 | 2.15% | $ | 10.57 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,014.37 | 2.15% | $ | 10.92 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 956.10 | 1.15% | $ | 5.67 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | 1.15% | $ | 5.85 | |||||||

2 | October 31, 2015

Table of Contents

Disclosure of Fund Expenses

October 31, 2015 (Unaudited)

| Beginning Account Value May 1, 2015 |

Ending Account Value October 31, 2015 |

Expense Ratio(a) |

Expenses Paid During Period May 1, 2015

- |

|||||||||||

|

|

||||||||||||||

| ALPS | Westport Resources Hedged High Income Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 982.40 | 2.21% | $ | 11.04 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,014.06 | 2.21% | $ | 11.22 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 978.50 | 2.99% | $ | 14.91 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,010.13 | 2.99% | $ | 15.15 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 983.70 | 1.99% | $ | 9.95 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.17 | 1.99% | $ | 10.11 | |||||||

|

|

||||||||||||||

| ALPS | WMC Research Value Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 983.00 | 1.40% | $ | 7.00 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,018.15 | 1.40% | $ | 7.12 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 979.20 | 2.15% | $ | 10.73 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,014.37 | 2.15% | $ | 10.92 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 984.10 | 1.15% | $ | 5.75 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | 1.15% | $ | 5.85 | |||||||

|

|

||||||||||||||

| Clough China Fund |

||||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 791.10 | 1.95% | $ | 8.80 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.38 | 1.95% | $ | 9.91 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 788.10 | 2.70% | $ | 12.17 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,011.59 | 2.70% | $ | 13.69 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 794.30 | 1.70% | $ | 7.69 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,016.64 | 1.70% | $ | 8.64 | |||||||

|

|

||||||||||||||

| RiverFront Conservative Income Builder Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 983.40 | 1.15% | $ | 5.75 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | 1.15% | $ | 5.85 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 980.30 | 1.90% | $ | 9.48 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.63 | 1.90% | $ | 9.65 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 985.20 | 0.90% | $ | 4.50 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.67 | 0.90% | $ | 4.58 | |||||||

|

|

||||||||||||||

| RiverFront Dynamic Equity Income Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 959.70 | 1.15% | $ | 5.68 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | 1.15% | $ | 5.85 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 955.90 | 1.90% | $ | 9.37 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.63 | 1.90% | $ | 9.65 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 960.90 | 0.90% | $ | 4.45 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.67 | 0.90% | $ | 4.58 | |||||||

3 | October 31, 2015

Table of Contents

Disclosure of Fund Expenses

October 31, 2015 (Unaudited)

| Beginning Account Value May 1, 2015 |

Ending Account Value October 31, 2015 |

Expense Ratio(a) |

Expenses Paid During Period May 1, 2015

- |

|||||||||||

|

|

||||||||||||||

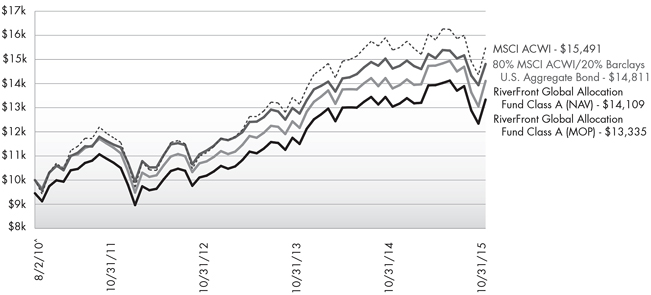

| RiverFront Global Allocation Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 950.90 | 1.15% | $ | 5.65 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | 1.15% | $ | 5.85 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 947.00 | 1.90% | $ | 9.32 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.63 | 1.90% | $ | 9.65 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 952.30 | 0.90% | $ | 4.43 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.67 | 0.90% | $ | 4.58 | |||||||

|

|

||||||||||||||

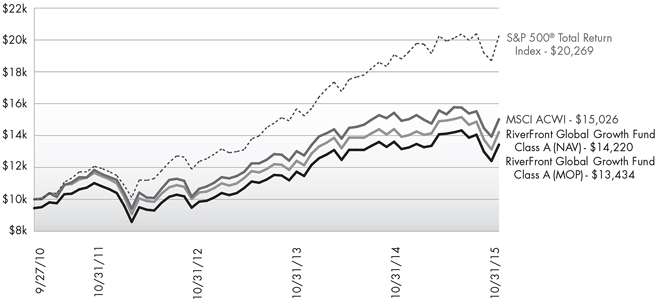

| RiverFront Global Growth Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 945.80 | 1.15% | $ | 5.64 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | 1.15% | $ | 5.85 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 942.10 | 1.90% | $ | 9.30 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.63 | 1.90% | $ | 9.65 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 946.70 | 0.90% | $ | 4.42 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.67 | 0.90% | $ | 4.58 | |||||||

| Class L |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 946.60 | 0.90% | $ | 4.42 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.67 | 0.90% | $ | 4.58 | |||||||

| Investor Class |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 945.50 | 1.15% | $ | 5.64 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | 1.15% | $ | 5.85 | |||||||

|

|

||||||||||||||

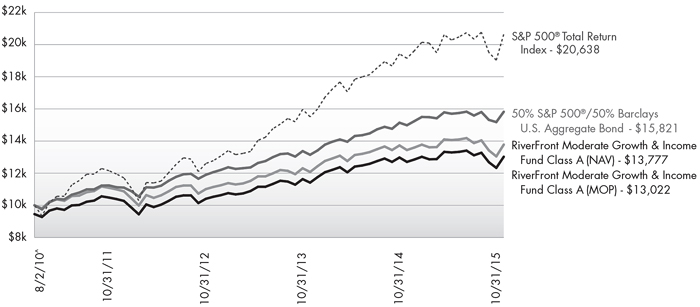

| RiverFront Moderate Growth & Income Fund |

|

|||||||||||||

| Class A |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 977.30 | 1.15% | $ | 5.73 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.41 | 1.15% | $ | 5.85 | |||||||

| Class C |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 972.80 | 1.90% | $ | 9.45 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,015.63 | 1.90% | $ | 9.65 | |||||||

| Class I |

||||||||||||||

| Actual |

$ | 1,000.00 | $ | 977.00 | 0.90% | $ | 4.48 | |||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,020.67 | 0.90% | $ | 4.58 | |||||||

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 365. |

| (c) | Includes expenses of the CoreCommodity Management Cayman Commodity Fund Ltd. (wholly-owned subsidiary), exclusive of the subsidiary’s management fee. |

| (d) | Includes expenses of the Kotak Mauritius Portfolio (wholly-owned subsidiary). |

4 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund

| October 31, 2015 (Unaudited) |

During the twelve-month period of November 1, 2014 to October 31, 2015 the Alerian MLP Infrastructure Index Fund’s (“Fund”) Class A shares delivered a net return of -27.23% at Net Asset Value. Class A delivered a net return of -31.24% at MOP, Class C was -27.85% with CDSC, and Class I was -26.95%. This compares to the Fund’s index, the Alerian MLP Infrastructure Index (“AMZI”), which fell -33.3% on a price-return and -29.1% on a total-return basis. The difference in performance for this period between the AMZI and the Fund is primarily attributable to the Fund’s operating expenses and the impact of the Fund’s C Corporation tax election.

During the period, the fund paid four distributions*:

| ● | $0.1820 on February 19, 2015 |

| ● | $0.1839 on May 20, 2015 |

| ● | $0.1860 on August 19, 2015 |

| ● | $0.1879 on October 30, 2015 |

These distributions represent 1.1%, 1.0%, 1.1%, and 1.0% increases respectively from their previous quarters. On an annual basis, the Fund increased its distribution by 4.3% when comparing the October 30, 2015 distribution versus the October 31, 2014 distribution of $0.1800.

The majority of master limited partnerships (MLPs) in the AMZI generated negative returns during the period. The top contributor to the AMZI during the period was Tesoro Logistics Partners LP (TLLP), which fell 0.4%. Bottom contributors included Targa Resource Partners (NGLS), NGL Energy Partners (NGL), and DCP Midstream (DPM).

During the period, Shell Midstream Partners (SHLX) was added to the AMZI and Williams Partners, Atlas Pipeline Partners, Regency Energy Partners, and Crestwood Midstream Partners were removed due to merger activity.

Weakness in the energy markets persisted, with crude oil prices falling over 60% from $80/barrel to roughly $46 by the end of October, with a brief stint of sub-$40/barrel prices in late August. During the period, MLP price performance exhibited strong correlations to falling energy prices. Historically however, MLPs have exhibited weak correlations to commodity prices over a longer time frame. Investor sentiment for the energy macro picture remains weak, particularly since North American crude production has not slowed enough to address global oversupply issues. Continued growth in US production through May 2015—despite prices peaking 11 months earlier—and the slowdown in China and Europe exacerbated the supply/demand imbalance during the period.

Infrastructure MLPs have not been immune. Estimates for capital spending, distribution growth, and cash flow have come down to reflect a moderated growth outlook. While we recognize these adjustments are necessary, we note they do not signal that infrastructure MLP distributions are no longer growing, nor do they signal that infrastructure MLP distributions are in jeopardy. Rather, distributions may not grow at similar rates as previous years in the near term. During the period, AMZI distribution growth totaled 7.6%. Of the 22 MLPs in the AMZI, 15 increased their distribution during the third calendar quarter of 2015 and the remaining 7 maintained their distribution.

Unlike the last commodity downturn during 2007-2008, access to capital is still available to MLPs. Not to mention, many MLPs can finance growth internally by maintaining higher distribution coverage. MLPs continue to announce organic projects backed by long-term binding commitments. These projects vary by product handled, including crude oil, natural gas, NGLs, refined products, and propane. They also vary by asset type, including pipelines, processing plants, and fractionation plants. While the near-term outlook for energy seems uncertain, the long-term fundamentals for energy infrastructure MLPs to support the domestic supply of energy resources remain intact. We continue to believe that MLPs represent a potentially compelling investment opportunity for investors seeking after-tax yield and access to real assets.

The views of the author and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed are those of the author only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither ALPS Advisors, Inc., Alerian, nor the Fund accept any liability for losses either direct or consequential caused by the use of this information.

Diversification cannot guarantee gain or prevent losses.

| * | At the time of the distribution the character was estimated to be 100% return of capital. Please reference the year-end tax forms for the final character. |

5 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund

| October 31, 2015 (Unaudited) |

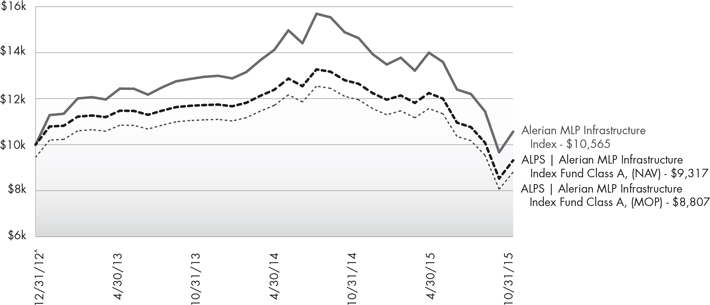

Performance of $10,000 Initial Investment (as of October 31, 2015)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of October 31, 2015)

|

6 Month |

1 Year | Since Inception^ | Total Expense Ratio* | What You Pay*,** | ||||||

| Class A (NAV) |

-23.89% | -27.23% | -2.46% | 2.22% | 1.25% | |||||

| Class A (MOP) |

-28.08% | -31.24% | -4.39% | |||||||

| Class C (NAV) |

-23.66% | -27.18% | -2.70% | 2.82% | 1.85% | |||||

| Class C (CDSC) |

-24.38% | -27.85% | -2.70% | |||||||

| Class I |

-23.68% | -26.95% | -2.22% | 1.81% | 0.85% | |||||

| Alerian MLP Infrastructure Index1 |

-24.53% | -29.05% | 1.96% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-866-759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account. If you invest $1 million or more, either as a lump sum or through the Fund’s accumulation or letter of intent programs, you can purchase Class A shares without an initial sales charge (load). A Contingent Deferred Sales Charge (“CDSC”) of 1.00% may apply to Class C shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million.

Performance less than 1 year is cumulative.

6 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund

| Performance Update |

October 31, 2015 (Unaudited) |

| 1 | Alerian MLP Infrastructure Index is comprised of midstream energy Master Limited Partnerships. The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund inception date of December 31, 2012. |

| * | Excludes deferred income tax expense of 4.49% for Class A, 4.27% for Class C, and 4.63% for Class I. |

| ** | What You Pay reflects the Advisor’s and Sub-Advisor’s decision to contractually limit expenses through February 29, 2016. Please see the prospectus for additional information. |

Investments in securities of MLPs involve risks that differ from an investment in common stock. MLPs are controlled by their general partners, which generally have conflicts of interest and limited fiduciary duties to the MLP, which may permit the general partner to favor its own interests over the MLPs. The benefit you are expected to derive from the Fund’s investment in MLPs depends largely on the MLPs being treated as partnerships for federal income tax purposes. As a partnership, an MLP has no federal income tax liability at the entity level. Therefore, treatment of one or more MLPs as a corporation for federal income tax purposes could affect the Fund’s ability to meet its investment objective and would reduce the amount of cash available to pay or distribute to you. Legislative, judicial, or administrative changes and differing interpretations, possibly on a retroactive basis, could negatively impact the value of an investment in MLPs and therefore the value of your investment in the Fund.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

This Fund is not suitable for all investors and is subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Not FDIC Insured – No Bank Guarantee – May Lose Value

7 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund

| October 31, 2015 |

| 8 | October 31, 2015 |

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund

| October 31, 2015 |

| ASSETS |

||||

| Investments, at value |

$ | 26,696,934 | ||

| Receivable for investments sold |

258,695 | |||

| Receivable for shares sold |

264,754 | |||

| Dividends receivable |

277,384 | |||

| Deferred tax asset(a) (Note 4) |

– | |||

| Income tax receivable |

6,904 | |||

| Prepaid expenses and other assets |

10,624 | |||

|

|

||||

| Total Assets |

27,515,295 | |||

|

|

||||

| LIABILITIES |

||||

| Franchise tax payable |

2,800 | |||

| Payable for shares redeemed |

39,160 | |||

| Payable due to custodian - overdraft |

252,058 | |||

| Investment advisory fees payable |

4,965 | |||

| Administration and transfer agency fees payable |

3,469 | |||

| Distribution and services fees payable |

17,318 | |||

| Trustees’ fees and expenses payable |

4 | |||

| Professional fees payable |

28,576 | |||

| Accrued expenses and other liabilities |

10,961 | |||

|

|

||||

| Total Liabilities |

359,311 | |||

|

|

||||

| NET ASSETS |

$ | 27,155,984 | ||

|

|

||||

| NET ASSETS CONSIST OF |

||||

| Paid-in capital |

$ | 35,019,545 | ||

| Accumulated net investment loss, net of deferred income taxes |

(651,915) | |||

| Accumulated net realized loss on investments, net of deferred income taxes |

(2,421,153) | |||

| Net unrealized depreciation on investments, net of deferred income taxes |

(4,790,493) | |||

|

|

||||

| NET ASSETS |

$ | 27,155,984 | ||

|

|

||||

| INVESTMENTS, AT COST |

$ | 31,484,363 | ||

|

|

||||

| PRICING OF SHARES |

||||

| Class A: |

||||

| Net Asset Value, offering and redemption price per share |

$ | 7.60 | ||

| Net Assets |

$ | 14,393,110 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

1,894,449 | |||

| Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) |

$ | 8.04 | ||

| Class C: |

||||

| Net Asset Value, offering and redemption price per share(b) |

$ | 7.54 | ||

| Net Assets |

$ | 8,290,640 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

1,100,131 | |||

| Class I: |

||||

| Net Asset Value, offering and redemption price per share |

$ | 7.66 | ||

| Net Assets |

$ | 4,472,234 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

583,877 | |||

| (a) | Any net deferred tax asset was fully offset by a 100% valuation allowance. |

| (b) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund’s Prospectus. |

See Notes to Financial Statements.

9 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund

| For the Year Ended October 31, 2015 |

| INVESTMENT INCOME |

||||

| Dividends |

$ | 150 | ||

| Distributions from master limited partnerships |

1,783,256 | |||

| Less return of capital distributions |

(1,783,256) | |||

|

|

||||

| Total Investment Income |

150 | |||

|

|

||||

| EXPENSES |

||||

| Investment advisory fees |

205,873 | |||

| Administrative fees |

30,998 | |||

| Transfer agency fees |

933 | |||

| Distribution and service fees |

||||

| Class A |

54,871 | |||

| Class C |

90,921 | |||

| Professional fees |

84,911 | |||

| Reports to shareholders and printing fees |

7,759 | |||

| State registration fees |

42,831 | |||

| SEC registration fees |

1,303 | |||

| Insurance fees |

287 | |||

| Franchise tax expenses |

2,385 | |||

| Custody fees |

14,125 | |||

| Trustees’ fees and expenses |

677 | |||

| Miscellaneous expenses |

16,727 | |||

|

|

||||

| Total Expenses |

554,601 | |||

|

|

||||

| Less fees waived/reimbursed by investment advisor (Note 8) |

||||

| Class A |

(74,023) | |||

| Class C |

(48,445) | |||

| Class I |

(34,034) | |||

|

|

||||

| Net Expenses |

398,099 | |||

|

|

||||

| Net Investment Loss, Before Income Taxes |

(397,949) | |||

| Income tax expense |

(60,756) | |||

| Income tax expense - Class A |

(15,096) | |||

| Income tax expense - Class C |

(15,409) | |||

|

|

||||

| Net Investment Loss, Net of Income Taxes |

(489,210) | |||

|

|

||||

| REALIZED AND UNREALIZED GAIN/(LOSS) |

||||

| Net realized loss on investments, before income taxes |

(2,029,855) | |||

| Income tax expense |

(22,374) | |||

|

|

||||

| Net Realized Loss on investments, Net of Income Taxes |

(2,052,229) | |||

|

|

||||

| Net change in unrealized depreciation on investment, before deferred income taxes |

(8,253,358) | |||

| Income tax benefit |

1,238,743 | |||

|

|

||||

| Net Change in Unrealized Depreciation on Investments |

(7,014,615) | |||

|

|

||||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS, NET OF INCOME TAXES |

(9,066,844) | |||

|

|

||||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | (9,556,054) | ||

|

|

||||

See Notes to Financial Statements.

10 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund

Statements of Changes in Net Assets

| For the Year | For the Fiscal | |||||||||||||

| Ended | Period Ended | For the Year | ||||||||||||

| October 31, | October 31, | Ended | ||||||||||||

| 2015 | 2014(a) | April 30, 2014 | ||||||||||||

|

|

||||||||||||||

| OPERATIONS |

||||||||||||||

| Net investment loss, net of income taxes |

$ | (489,210) | $ | (84,514) | $ | (70,565) | ||||||||

| Net realized gain/(loss) on investments, net of income taxes |

(2,052,229) | 3,372 | (40,286) | |||||||||||

| Net change in unrealized appreciation/(depreciation) on investments, net of deferred income taxes |

(7,014,615) | 902,714 | 918,233 | |||||||||||

|

|

||||||||||||||

| Net Increase/(Decrease) in Net Assets Resulting from Operations |

(9,556,054) | 821,572 | 807,382 | |||||||||||

|

|

||||||||||||||

| DISTRIBUTIONS |

||||||||||||||

| Distributions to shareholders from net investment income |

||||||||||||||

| Class A |

(4,150) | (26,390) | (137,326) | |||||||||||

| Class C |

(2,627) | (32,401) | (42,694) | |||||||||||

| Class I |

(1,614) | (36,117) | (47,927) | |||||||||||

| Distributions to shareholders from tax return of capital |

||||||||||||||

| Class A |

(1,160,636) | (422,657) | (120,029) | |||||||||||

| Class C |

(734,478) | (205,706) | (41,147) | |||||||||||

| Class I |

(451,330) | (200,052) | (74,680) | |||||||||||

|

|

||||||||||||||

| Net Decrease in Net Assets from Distributions |

(2,354,835) | (923,323) | (463,803) | |||||||||||

|

|

||||||||||||||

| BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) |

||||||||||||||

| Shares sold |

||||||||||||||

| Class A |

12,474,282 | 3,317,091 | 9,171,152 | |||||||||||

| Class C |

8,002,639 | 3,457,848 | 3,336,491 | |||||||||||

| Class I |

7,103,832 | 5,196,869 | 1,646,324 | |||||||||||

| Distributions reinvested |

||||||||||||||

| Class A |

1,105,212 | 427,003 | 240,424 | |||||||||||

| Class C |

721,890 | 178,058 | 58,350 | |||||||||||

| Class I |

448,126 | 219,273 | 118,124 | |||||||||||

| Shares redeemed |

||||||||||||||

| Class A |

(4,057,509) | (1,375,093) | (2,345,899) | |||||||||||

| Class C |

(3,615,264) | (245,100) | (621,954) | |||||||||||

| Class I |

(7,165,800) | (184,339) | (2,533,055) | |||||||||||

|

|

||||||||||||||

| Net Increase in Net Assets Derived from Beneficial Interest Transactions |

15,017,408 | 10,991,610 | 9,069,957 | |||||||||||

|

|

||||||||||||||

| Net increase in net assets |

3,106,519 | 10,889,859 | 9,413,536 | |||||||||||

| NET ASSETS |

||||||||||||||

| Beginning of year |

24,049,465 | 13,159,606 | 3,746,070 | |||||||||||

|

|

||||||||||||||

| End of year * |

$ | 27,155,984 | $ | 24,049,465 | $ | 13,159,606 | ||||||||

|

|

||||||||||||||

| *Including accumulated net investment loss, net of deferred income taxes, of: |

$ | (651,915) | $ | (162,705) | $ | (78,191) | ||||||||

| (a) | Effective May 1, 2014, the Board approved changing the fiscal year-end of the Funds from April 30 to October 31. |

See Notes to Financial Statements.

11 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund – Class A

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Period | ||||||||||

| For the Year | For the Fiscal | January 2, 2013 | ||||||||

| Ended | Period Ended | For the Year | (Commencement) | |||||||

| October 31, | October 31, | Ended | to | |||||||

| 2015 | 2014(a) | April 30, 2014 | April 30, 2013 | |||||||

|

| ||||||||||

| Net asset value, beginning of period |

$11.32 | $11.23 | $11.10 | $10.00 | ||||||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||||||||

| Net investment loss(b) |

(0.15) | (0.05) | (0.09) | (0.03) | ||||||

| Net realized and unrealized gain/(loss) |

(2.83) | 0.67 | 0.90 | 1.29 | ||||||

|

| ||||||||||

| Total from investment operations |

(2.98) | 0.62 | 0.81 | 1.26 | ||||||

|

| ||||||||||

| DISTRIBUTIONS: |

||||||||||

| From net investment income |

(0.00)(c) | (0.03) | (0.36) | – | ||||||

| From tax return of capital |

(0.74) | (0.50) | (0.32) | (0.16) | ||||||

|

| ||||||||||

| Total distributions |

(0.74) | (0.53) | (0.68) | (0.16) | ||||||

|

| ||||||||||

| Net increase/(decrease) in net asset value |

(3.72) | 0.09 | 0.13 | 1.10 | ||||||

|

| ||||||||||

| Net asset value, end of year |

$7.60 | $11.32 | $11.23 | $11.10 | ||||||

|

| ||||||||||

| TOTAL RETURN(d) |

(27.23)% | 5.61% | 7.59% | 12.68% | ||||||

| RATIOS/SUPPLEMENTAL DATA: |

||||||||||

| Net assets, end of year (000s) |

$14,393 | $10,619 | $8,223 | $928 | ||||||

| Ratio of expenses to average net assets before waivers, franchise tax expense and income tax expense/benefit |

1.77% | 2.20%(e) | 3.09% | 5.51%(e)(f) | ||||||

| Ratio of expense waivers to average net assets |

(0.53%) | (0.97%)(e) | (1.84%) | (4.26%)(e)(f) | ||||||

|

| ||||||||||

| Ratio of expenses to average net assets net of waivers before franchise tax expense and income tax expense/benefit |

1.24%(g) | 1.23%(e)(g) | 1.25% | 1.25%(e)(f) | ||||||

| Ratio of franchise tax expense and income tax expense/(benefit) to average net assets(h) |

(4.03%) | 4.49%(e) | 5.38% | 20.55%(e) | ||||||

|

| ||||||||||

| Ratio of total expenses to average net assets |

(2.79%) | 5.72%(e) | 6.63% | 21.80%(e) | ||||||

|

| ||||||||||

| Ratio of investment loss to average net assets before waivers, franchise tax expense and income tax expense/benefit |

(1.77%) | (2.20%)(e) | (3.09%) | (5.51%)(e)(f) | ||||||

| Ratio of expense waivers to average net assets |

(0.53%) | (0.97%)(e) | (1.84%) | (4.26%)(e)(f) | ||||||

|

| ||||||||||

| Ratio of investment loss to average net assets net of waivers before franchise tax expense and income tax expense/benefit |

(1.24%)(g) | (1.23%)(e)(g) | (1.25%) | (1.25%)(e)(f) | ||||||

| Ratio of franchise tax expense and income tax (expense)/benefit to average net assets(i) |

(0.34%) | 0.43%(e) | 0.43% | 0.40%(e) | ||||||

|

| ||||||||||

| Ratio of net investment loss to average net assets |

(1.58%) | (0.80%)(e) | (0.82%) | (0.85%)(e) | ||||||

|

| ||||||||||

| Portfolio turnover rate(j) |

52% | 7% | 63% | 3% | ||||||

|

| ||||||||||

See Notes to Financial Statements.

12 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund – Class A

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| (a) | Effective May 1, 2014, the Board approved changing the fiscal year-end of the Funds from April 30 to October 31. |

| (b) | Calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (e) | Annualized. |

| (f) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (g) | According to the Fund’s shareholder services plan with respect to the Fund’s Class A shares, any amount of such payment not paid during the Fund’s fiscal year for such service activities shall be reimbursed to the Fund as soon as practical after the end of the fiscal year. Fees were reimbursed to the Fund during the period ended October 31, 2015 and October 31, 2014, for the prior fiscal year in the amount of 0.01% and 0.02% (annualized) of average net assets of Class A shares respectively. |

| (h) | Adjustment for income tax expense/(benefit) for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

| (i) | Adjustment for income tax (expense)/benefit for the ratio calculation is derived from net investment loss only. |

| (j) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

13 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund – Class C

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Period | ||||||||||

| For the Year | For the Fiscal | January 2, 2013 | ||||||||

| Ended | Period Ended | For the Year | (Commencement) | |||||||

| October 31, | October 31, | Ended | to | |||||||

| 2015 | 2014(a) | April 30, 2014 | April 30, 2013 | |||||||

|

| ||||||||||

| Net asset value, beginning of period |

$11.23 | $11.17 | $11.09 | $10.00 | ||||||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||||||||

| Net investment loss(b) |

(0.22) | (0.07) | (0.13) | (0.05) | ||||||

| Net realized and unrealized gain/(loss) |

(2.73) | 0.66 | 0.89 | 1.30 | ||||||

|

| ||||||||||

| Total from investment operations |

(2.95) | 0.59 | 0.76 | 1.25 | ||||||

|

| ||||||||||

| DISTRIBUTIONS: |

||||||||||

| From net investment income |

(0.00)(c) | (0.08) | (0.35) | – | ||||||

| From tax return of capital |

(0.74) | (0.45) | (0.33) | (0.16) | ||||||

|

| ||||||||||

| Total distributions |

(0.74) | (0.53) | (0.68) | (0.16) | ||||||

|

| ||||||||||

| Net increase/(decrease) in net asset value |

(3.69) | 0.06 | 0.08 | 1.09 | ||||||

|

| ||||||||||

| Net asset value, end of year |

$7.54 | $11.23 | $11.17 | $11.09 | ||||||

|

| ||||||||||

| TOTAL RETURN(d) |

(27.18)% | 5.37% | 7.13% | 12.58% | ||||||

| RATIOS/SUPPLEMENTAL DATA: |

||||||||||

| Net assets, end of year (000s) |

$8,291 | $6,773 | $3,429 | $563 | ||||||

| Ratio of expenses to average net assets before waivers, franchise tax expense and income tax expense/benefit |

2.38% | 2.82%(e) | 3.71% | 7.01%(e)(f) | ||||||

| Ratio of expense waivers to average net assets |

(0.53%) | (0.97%)(e) | (1.86%) | (5.16%)(e)(f) | ||||||

|

| ||||||||||

| Ratio of expenses to average net assets net of waivers before franchise tax expense and income tax expense/benefit |

1.85% | 1.85%(e) | 1.85% | 1.85%(e)(f) | ||||||

| Ratio of franchise tax expense and income tax expense/(benefit) to average net assets(g) |

(4.09%) | 4.27%(e) | 5.16% | 20.55%(e) | ||||||

|

| ||||||||||

| Ratio of total expenses to average net assets |

(2.24%) | 6.12%(e) | 7.01% | 22.40%(e) | ||||||

|

| ||||||||||

| Ratio of investment loss to average net assets before waivers, franchise tax expense and income tax expense/benefit |

(2.38%) | (2.82%)(e) | (3.71%) | (7.01%)(e)(f) | ||||||

| Ratio of expense waivers to average net assets |

(0.53%) | (0.97%)(e) | (1.86%) | (5.16%)(e)(f) | ||||||

|

| ||||||||||

| Ratio of investment loss to average net assets net of waivers before franchise tax expense and income tax expense/benefit |

(1.85%) | (1.85%)(e) | (1.85%) | (1.85%)(e)(f) | ||||||

| Ratio of franchise tax expense and income tax (expense)/benefit to average net assets(h) |

(0.40%) | 0.65%(e) | 0.65% | 0.40%(e) | ||||||

|

| ||||||||||

| Ratio of net investment loss to average net assets |

(2.25%) | (1.20%)(e) | (1.20%) | (1.45%)(e) | ||||||

|

| ||||||||||

| Portfolio turnover rate(i) |

52% | 7% | 63% | 3% | ||||||

|

| ||||||||||

(a) Effective May 1, 2014, the Board approved changing the fiscal year-end of the Funds from April 30 to October 31.

(b) Calculated using the average shares method.

(c) Less than $0.005 per share.

(d) Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges.

(e) Annualized.

(f) Expense ratios before reductions for startup periods may not be representative of longer term operating periods.

(g) Adjustment for income tax expense/(benefit) for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses.

(h) Adjustment for income tax (expense)/benefit for the ratio calculation is derived from net investment loss only.

(i) Portfolio turnover rate for periods less than one full year have not been annualized.

See Notes to Financial Statements.

14 | October 31, 2015

Table of Contents

ALPS | Alerian MLP Infrastructure Index Fund – Class I

Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Period | ||||||||||

| For the Year | For the Fiscal | January 2, 2013 | ||||||||

| Ended | Period Ended | For the Year | (Commencement) | |||||||

| October 31, | October 31, | Ended | to | |||||||

| 2015 | 2014(a) | April 30, 2014 | April 30, 2013 | |||||||

|

| ||||||||||

| Net asset value, beginning of period |

$11.36 | $11.25 | $11.11 | $10.00 | ||||||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||||||||

| Net investment loss(b) |

(0.11) | (0.03) | (0.06) | (0.02) | ||||||

| Net realized and unrealized gain/(loss) |

(2.85) | 0.67 | 0.88 | 1.29 | ||||||

|

| ||||||||||

| Total from investment operations |

(2.96) | 0.64 | 0.82 | 1.27 | ||||||

|

| ||||||||||

| DISTRIBUTIONS: |

||||||||||

| From net investment income |

(0.00)(c) | (0.04) | (0.27) | – | ||||||

| From tax return of capital |

(0.74) | (0.49) | (0.41) | (0.16) | ||||||

|

| ||||||||||

| Total distributions |

(0.74) | (0.53) | (0.68) | (0.16) | ||||||

|

| ||||||||||

| Net increase/(decrease) in net asset value |

(3.70) | 0.11 | 0.14 | 1.11 | ||||||

|

| ||||||||||

| Net asset value, end of year |

$7.66 | $11.36 | $11.25 | $11.11 | ||||||

|

| ||||||||||

| TOTAL RETURN(d) |

(26.95)% | 5.78% | 7.68% | 12.78% | ||||||

| RATIOS/SUPPLEMENTAL DATA: |

||||||||||

| Net assets, end of year (000s) |

$4,472 | $6,658 | $1,507 | $2,256 | ||||||

| Ratio of expenses to average net assets before waivers, franchise tax expense and income tax expense/benefit |

1.38% | 1.81%(e) | 3.03% | 6.01%(e)(f) | ||||||

| Ratio of expense waivers to average net assets |

(0.53%) | (0.96%)(e) | (2.18%) | (5.16%)(e)(f) | ||||||

|

| ||||||||||

| Ratio of expenses to average net assets net of waivers before franchise tax expense and income tax expense/benefit |

0.85% | 0.85%(e) | 0.85% | 0.85%(e)(f) | ||||||

| Ratio of franchise tax expense and income tax expense/(benefit) to average net assets(g) |

(3.92%) | 4.63%(e) | 5.53% | 20.55%(e) | ||||||

|

| ||||||||||

| Ratio of total expenses to average net assets |

(3.07%) | 5.48%(e) | 6.38% | 21.40%(e) | ||||||

|

| ||||||||||

| Ratio of investment loss to average net assets before waivers, franchise tax expense and income tax expense/benefit |

(1.38%) | (1.81%)(e) | (3.03%) | (6.01%)(e)(f) | ||||||

| Ratio of expense waivers to average net assets |

(0.53%) | (0.96%)(e) | (2.18%) | (5.16%)(e)(f) | ||||||

|

| ||||||||||

| Ratio of investment loss to average net assets net of waivers before franchise tax expense and income tax expense/benefit |

(0.85%) | (0.85%)(e) | (0.85%) | (0.85%)(e)(f) | ||||||

| Ratio of franchise tax expense and income tax (expense)/benefit to average net assets(h) |

(0.23%) | 0.28%(e) | 0.29% | 0.40%(e) | ||||||

|

| ||||||||||

| Ratio of net investment loss to average net assets |

(1.08%) | (0.57%)(e) | (0.56%) | (0.45%)(e) | ||||||

|

| ||||||||||

| Portfolio turnover rate(i) |

52% | 7% | 63% | 3% | ||||||

|

| ||||||||||

| (a) Effective | May 1, 2014, the Board approved changing the fiscal year-end of the Funds from April 30 to October 31. |

(b) Calculated using the average shares method.

(c) Less than $0.005 per share.

(d) Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

(e) Annualized.

(f) Expense ratios before reductions for startup periods may not be representative of longer term operating periods.

(g) Adjustment for income tax expense/(benefit) estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses.

(h) Adjustment for income tax (expense)/benefit for the ratio calculation is derived from net investment loss only.

(i) Portfolio turnover rate for periods less than one full year have not been annualized.

See Notes to Financial Statements.

15 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| October 31, 2015 (Unaudited) |

| 16 | October 31, 2015 |

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Management Commentary |

October 31, 2015 (Unaudited) |

17 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| October 31, 2015 (Unaudited) |

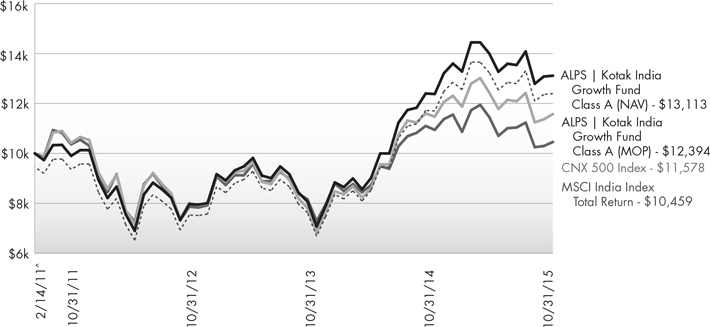

Performance of $10,000 Initial Investment (as of October 31, 2015)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of October 31, 2015)

| Since | Total | |||||||||||||

| 6 Month | 1 Year | 3 Year | 5 Year | Inception^ | Expense Ratio | What You Pay* | ||||||||

| Class A (NAV) |

-15.88% | -25.21% | -12.60% | -7.23% | -3.64% | 1.46% | 1.45% | |||||||

| Class A (MOP) |

-20.47% | -29.35% | -14.25% | -8.26% | -4.65% | |||||||||

| Class C (NAV) |

-16.21% | -25.67% | -13.14% | -7.82% | -4.20% | 2.07% | 2.05% | |||||||

| Class C (CDSC) |

-17.04% | -26.41% | -13.14% | -7.82% | -4.20% | |||||||||

| Class I |

-15.68% | -24.88% | -12.31% | -6.96% | -3.33% | 1.16% | 1.15% | |||||||

| TR/CC CRB Total Return Index1 |

-14.75% | -28.05% | -12.84% | -8.19% | -4.87% | |||||||||

|

Bloomberg Commodity TR Index1 |

-15.72% | -25.72% | -15.04% | -9.85% | -6.31% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-866-759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account. If you invest $1 million or more, either as a lump sum or through the Fund’s accumulation or letter of intent programs, you can purchase Class A shares without an initial sales charge (load). A Contingent Deferred Sales Charge (“CDSC”) of 1.00% may apply to Class C shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days.

Performance less than 1 year is cumulative.

18 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Performance Update |

October 31, 2015 (Unaudited) |

| 1 | Thomson Reuters/CC CRB Total Return Index and the Bloomberg Commodity TR Index (formerly the Dow Jones-UBS Commodity Index) are unmanaged indices used as a measurement of change in commodity market conditions based on the performance of a basket of different commodities. Each index is composed of a different basket of commodities, a different weighting of the commodities in the basket, and a different re-balancing schedule. The indices are not actively managed and do not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund Inception date of June 29, 2010. |

| * | What You Pay reflects the Advisor’s decision to contractually limit expenses through February 29, 2016. Please see the prospectus for additional information. |

Investments in securities of MLPs involve risks that differ from an investment in common stock. MLPs are controlled by their general partners, which generally have conflicts of interest and limited fiduciary duties to the MLP, which may permit the general partner to favor its own interests over the MLPs. The benefit you are expected to derive from the Fund’s investment in MLPs depends largely on the MLPs being treated as partnerships for federal income tax purposes. As a partnership, an MLP has no federal income tax liability at the entity level. Therefore, treatment of one or more MLPs as a corporation for federal income tax purposes could affect the Fund’s ability to meet its investment objective and would reduce the amount of cash available to pay or distribute to you. Legislative, judicial, or administrative changes and differing interpretations, possibly on a retroactive basis, could negatively impact the value of an investment in MLPs and therefore the value of your investment in the Fund.

Investing in commodity-related securities involves risk and considerations not present when investing in more conventional securities. The Fund may be more susceptible to high volatility of commodity markets.

Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

This Fund is not suitable for all investors, and is subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Not FDIC Insured – No Bank Guarantee – May Lose Value

19 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments | October 31, 2015 |

20 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments |

October 31, 2015 |

21 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments |

October 31, 2015 |

22 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments |

October 31, 2015 |

23 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments |

October 31, 2015 |

24 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments |

October 31, 2015 |

| SCHEDULE OF WRITTEN OPTIONS |

Expiration Date |

Exercise Price | Contracts | Value (Note 2) |

||||||||||

|

|

||||||||||||||

| Written Call Options |

||||||||||||||

| Sugar #11 Future |

1/16/16 | $ | 15.50 | (20) | $ | (10,080) | ||||||||

| Sugar (WRLD) Future: |

||||||||||||||

| 2/16/16 | 15.00 | (50) | (41,440) | |||||||||||

| 2/16/16 | 15.50 | (50) | (31,920) | |||||||||||

| WTI Crude Future: |

||||||||||||||

| 11/17/15 | 90.00 | (500) | (5,000) | |||||||||||

| 11/17/15 | 100.00 | (225) | (2,250) | |||||||||||

|

|

|

|||||||||||||

| TOTAL WRITTEN CALL OPTIONS |

||||||||||||||

| (Premiums received $802,326) |

(90,690) | |||||||||||||

|

|

|

|||||||||||||

| Written Put Options |

||||||||||||||

| Coffee ‘C’ Future |

1/23/16 | 115.00 | (30) | (36,562) | ||||||||||

| WTI Crude Future |

11/17/15 | 70.00 | (100) | (2,341,000) | ||||||||||

|

|

|

|||||||||||||

| TOTAL WRITTEN PUT OPTIONS |

||||||||||||||

| (Premiums received $339,723) |

(2,377,562) | |||||||||||||

|

|

|

|||||||||||||

| TOTAL WRITTEN OPTIONS |

||||||||||||||

| (Premiums received $1,142,049) |

$ | (2,468,252) | ||||||||||||

|

|

|

|||||||||||||

FUTURES CONTRACTS

| Description | Position | Contracts | Expiration Date |

Value (Note 2) |

Unrealized Appreciation |

|||||||||||

|

|

||||||||||||||||

| Brent Crude Future |

Long | 265 | 11/14/15 | $ | 13,133,400 | $ | 728,750 | |||||||||

| Coffee ‘C’ Future |

Long | 25 | 12/21/15 | 1,133,906 | 34,219 | |||||||||||

| Copper Future |

Short | (39) | 12/30/15 | (2,259,563) | 38,513 | |||||||||||

| LME Nickel Future |

Long | 10 | 12/15/15 | 602,729 | 2,583 | |||||||||||

|

|

|

|||||||||||||||

| $ | 12,610,472 | $ | 804,065 | |||||||||||||

|

|

|

|||||||||||||||

| Description | Position | Contracts | Expiration Date |

Value (Note 2) |

Unrealized Depreciation |

|||||||||||

|

|

||||||||||||||||

| Gold 100 Oz Future |

Long | 35 | 12/30/15 | $ | 3,994,900 | $ | (86,915) | |||||||||

| LME Zinc Future |

Long | 2 | 12/15/15 | 84,893 | (5,673) | |||||||||||

| Natural Gas Future |

Long | 15 | 11/26/15 | 348,150 | (4,800) | |||||||||||

| Platinum Future |

Long | 61 | 1/28/16 | 3,016,755 | (25,620) | |||||||||||

| Silver Future |

Long | 39 | 12/30/15 | 3,035,565 | (65,910) | |||||||||||

| Sugar #11 (World) |

Long | 140 | 3/01/16 | 2,276,736 | (18,816) | |||||||||||

| WTI Crude Futures |

Short | (244) | 11/20/15 | (11,367,960) | (827,160) | |||||||||||

|

|

|

|||||||||||||||

| $ | 1,389,039 | $ | (1,034,894) | |||||||||||||

|

|

|

|||||||||||||||

25 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments |

October 31, 2015 |

TOTAL RETURN SWAP CONTRACTS(a)

| Swap Counterparty | Reference Obligation | Notional Dollars | Floating Rate/Fixed Amount Paid by Fund |

Termination Date |

Unrealized Appreciation | |||||||||

|

|

||||||||||||||

| UBS |

CRB 3m Fwd TR Index* | $ 14,375,255 | USB3MTA + 40 bps** | 11/30/2015 | $ | 209,260 | ||||||||

| Citigroup |

CRB 3m Fwd TR Index* | 65,690,265 | USB3MTA + 27 bps** | 9/19/2016 | 956,253 | |||||||||

| Societe Generale |

CRB 3m Fwd TR Index* | 78,798,197 | USB3MTA + 35 bps** | 11/30/2015 | 1,147,065 | |||||||||

| Bank of America - Merrill Lynch |

CRB 3m Fwd TR Index* | 73,722,783 | USB3MTA + 35 bps** | 6/30/2016 | 1,073,182 | |||||||||

| Bank of America - Merrill Lynch |

LME Copper Future | 3,070,800 | n/a | 11/10/2015 | 8,100 | |||||||||

| Bank of America - Merrill Lynch |

ML eXtra Coffee GA6 | 2,780,847 | USB3MTA + 10 bps** | 6/30/2016 | 4,785 | |||||||||

| Bank of America - Merrill Lynch |

ML eXtra Silver GA6 | 465,253 | USB3MTA + 10 bps** | 6/30/2016 | 33,504 | |||||||||

|

|

|

|||||||||||||

| $ | 3,432,149 | |||||||||||||

|

|

|

|||||||||||||

| Swap Counterparty | Reference Obligation | Notional Dollars | Floating Rate/Fixed Amount Paid by Fund |

Termination Date |

Unrealized Appreciation | |||||||||

|

|

||||||||||||||

| Bank of America - Merrill Lynch |

MLCS Coffee J-F3 | $ (2,685,887 | ) | USB3MTA** | 6/30/2016 | $ | 3,218 | |||||||

| Bank of America - Merrill Lynch |

MLCS Copper J-F3 | (3,895,657 | ) | USB3MTA** | 6/30/2016 | 30,705 | ||||||||

| Bank of America - Merrill Lynch |

MLCS Aluminum J-F3 | (3,832,047 | ) | USB3MTA** | 6/30/2016 | 262,512 | ||||||||

|

|

|

|||||||||||||

| $ | 296,435 | |||||||||||||

|

|

|

|||||||||||||

| Total Appreciation | $ | 3,728,584 | ||||||||||||

|

|

|

|||||||||||||

| Swap Counterparty | Reference Obligation | Notional Dollars | Floating Rate/Fixed Amount Paid by Fund |

Termination Date |

Unrealized Depreciation | |||||||||

|

|

||||||||||||||

| Bank of America - Merrill Lynch |

ML Nickel | 612,600 | n/a | 12/24/2015 | $ | (9,375) | ||||||||

| Bank of America - Merrill Lynch |

ML Aluminum GA6 | 3,907,193 | USB3MTA + 10 bps** | 6/30/2016 | (270,815) | |||||||||

| Bank of America - Merrill Lynch |

ML eXtra Copper GA6 | 3,911,311 | USB3MTA + 10 bps** | 6/30/2016 | (28,306) | |||||||||

|

|

|

|||||||||||||

| $ | (308,496) | |||||||||||||

|

|

|

|||||||||||||

| Swap Counterparty | Reference Obligation | Notional Dollars | Floating Rate/Fixed Amount Paid by Fund |

Termination Date |

Unrealized Depreciation | |||||||||

|

|

||||||||||||||

| Bank of America - Merrill Lynch |

MLCS Silver J-F3 | $ (462,236 | ) | USB3MTA** | 06/30/2016 | $ | (33,292) | |||||||

|

|

|

|||||||||||||

| $ | (33,292) | |||||||||||||

|

|

|

|||||||||||||

| Total Depreciation | $ | (341,788) | ||||||||||||

|

|

|

|||||||||||||

| (a) | The Fund receives payments based on any positive return of the Reference Obligation less the rate paid by the Fund. The Fund makes payments on any negative return of such Reference Obligations plus the rate paid by the fund |

| * | CRB - Commodity Research Bureau |

| ** | United States Auction Results 3 Month Treasury Bill High Discount |

See Notes to Financial Statements.

26 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| October 31, 2015 |

| ASSETS |

||||

| Investments, at value |

$ | 392,482,047 | ||

| Cash |

111,046 | |||

| Foreign currency, at value (Cost $80,812) |

80,559 | |||

| Unrealized appreciation on total return swap contracts |

3,728,584 | |||

| Receivable for investments sold |

1,972,578 | |||

| Receivable for shares sold |

340,749 | |||

| Cash collateral pledged for written options (Note 3) |

298,349 | |||

| Deposit with broker for futures contracts (Note 3) |

137,486 | |||

| Cash collateral pledged for total return swap contracts (Note 3) |

159,198 | |||

| Deposit with broker for futures and options |

4,466,289 | |||

| Dividends and interest receivable |

933,754 | |||

| Prepaid expenses and other assets |

32,290 | |||

|

|

||||

| Total Assets |

404,742,929 | |||

|

|

||||

| LIABILITIES |

||||

| Written options, at value (premiums received $1,142,049) |

2,468,252 | |||

| Payable for variation margin on futures contracts |

3,058 | |||

| Payable due to broker for total return swap contracts |

31,852 | |||

| Payable for shares redeemed |

592,660 | |||

| Unrealized depreciation on total return swap contracts |

341,788 | |||

| Investment advisory fees payable |

264,451 | |||

| Administration and transfer agency fees payable |

57,974 | |||

| Distribution and services fees payable |

29,825 | |||

| Professional fees payable |

22,526 | |||

| Accrued expenses and other liabilities |

121,096 | |||

|

|

||||

| Total Liabilities |

3,933,482 | |||

|

|

||||

| NET ASSETS |

$ | 400,809,447 | ||

|

|

||||

| NET ASSETS CONSIST OF |

||||

| Paid-in capital |

$ | 460,840,912 | ||

| Accumulated net investment loss |

(1,662,022) | |||

| Accumulated net realized loss on investments, written options, futures contracts, total return swap contracts and foreign currency transactions |

(27,755,417) | |||

| Net unrealized depreciation on investments, written options, futures contracts, total return swap contracts and translation of assets and liabilities denominated in foreign currencies |

(30,614,026) | |||

|

|

||||

| NET ASSETS |

$ | 400,809,447 | ||

|

|

||||

| INVESTMENTS, AT COST |

$ | 424,919,876 | ||

|

|

||||

| PRICING OF SHARES |

||||

| Class A: |

||||

| Net Asset Value, offering and redemption price per share |

$ | 7.15 | ||

| Net Assets |

$ | 30,085,290 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

4,205,925 | |||

| Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) |

$ | 7.57 | ||

| Class C: |

||||

| Net Asset Value, offering and redemption price per share(a) |

$ | 6.98 | ||

| Net Assets |

$ | 8,334,922 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

1,193,810 | |||

| Class I: |

||||

| Net Asset Value, offering and redemption price per share |

$ | 7.15 | ||

| Net Assets |

$ | 362,389,235 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

50,715,990 | |||

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund’s Prospectus. |

See Notes to Financial Statements.

27 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

| For the Year Ended October 31, 2015 |

| INVESTMENT INCOME |

||||

| Dividends |

$ | 3,735,923 | ||

| Foreign taxes withheld on dividends |

(230,971) | |||

| Interest and other income, net of premium amortization and accretion of discount |

(1,799,534) | |||

|

|

||||

| Total Investment Income |

1,705,418 | |||

|

|

||||

| EXPENSES |

||||

| Investment advisory fees |

3,575,556 | |||

| Investment advisory fees - subsidiary |

668,490 | |||

| Administrative fees |

496,960 | |||

| Transfer agency fees |

97,107 | |||

| Distribution and service fees |

||||

| Class A |

140,662 | |||

| Class C |

94,219 | |||

| Professional fees |

73,093 | |||

| Networking fees |

||||

| Class I |

389,977 | |||

| Reports to shareholders and printing fees |

78,413 | |||

| State registration fees |

58,580 | |||

| SEC registration fees |

8,859 | |||

| Insurance fees |

5,618 | |||

| Custody fees |

60,439 | |||

| Trustees’ fees and expenses |

16,991 | |||

| Miscellaneous expenses |

26,107 | |||

|

|

||||

| Total Expenses |

5,791,071 | |||

|

|

||||

| Less fees waived/reimbursed by investment advisor (Note 8) |

||||

| Waiver of investment advisory fees - subsidiary |

(668,490) | |||

| Class A |

(6,800) | |||

| Class C |

(1,838) | |||

| Class I |

(86,129) | |||

|

|

||||

| Net Expenses |

5,027,814 | |||

|

|

||||

| Net Investment Loss |

(3,322,396) | |||

|

|

||||

| Net realized loss on investments |

(23,188,518) | |||

| Net realized gain on written options |

1,666,342 | |||

| Net realized loss on futures contracts |

(2,057,904) | |||

| Net realized loss on total return swap contracts |

(88,888,724) | |||

| Net realized gain on foreign currency transactions |

1,478 | |||

| Net change in unrealized depreciation on investments |

(16,223,361) | |||

| Net change in unrealized depreciation on written options |

(1,573,724) | |||

| Net change in unrealized appreciation on futures contracts |

926,594 | |||

| Net change in unrealized appreciation on total return swap contracts |

9,468,760 | |||

| Net change in unrealized depreciation on translation of assets and liabilities denominated in foreign currencies |

(43) | |||

|

|

||||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS |

(119,869,100) | |||

|

|

||||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | (123,191,496) | ||

|

|

||||

See Notes to Financial Statements.

28 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund

Consolidated Statements of Changes in Net Assets

| For the Year Ended October 31, 2015 |

For the Fiscal Period Ended October 31, 2014(a) |

For the Year Ended April 30, 2014 |

||||||||||

|

|

||||||||||||

| OPERATIONS |

||||||||||||

| Net investment loss |

$ | (3,322,396) | $ | (225,381) | $ | (1,332,666) | ||||||

| Net realized loss on investments, written options, futures contracts, total return swap contracts and foreign currency transactions |

(112,467,326) | (21,185,447) | (4,722,374) | |||||||||

| Net change in unrealized appreciation/(depreciation) on investments, written options, futures contracts, total return swap contracts and translation of assets and liabilities denominated in foreign currencies |

(7,401,774) | (36,830,011) | 20,918,827 | |||||||||

|

|

||||||||||||

| Net Increase/(Decrease) in Net Assets Resulting from Operations |

(123,191,496) | (58,240,840) | 14,863,787 | |||||||||

|

|

||||||||||||

| DISTRIBUTIONS |

||||||||||||

| Dividends to shareholders from net investment income |

||||||||||||

| Class I |

(1,912,471) | – | – | |||||||||

|

|

||||||||||||

| Net Decrease in Net Assets from Distributions |

(1,912,471) | – | – | |||||||||

|

|

||||||||||||

| BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) |

||||||||||||

| Shares sold |

||||||||||||

| Class A |

18,414,093 | 21,322,142 | 78,069,155 | |||||||||

| Class C |

4,099,809 | 3,307,759 | 5,689,512 | |||||||||

| Class I |

316,791,938 | 225,598,695 | 234,370,555 | |||||||||

| Dividends reinvested |

||||||||||||

| Class I |

1,791,360 | – | – | |||||||||

| Shares redeemed, net of redemption fees |

||||||||||||

| Class A |

(17,894,431) | (86,135,268) | (73,729,663) | |||||||||

| Class C |

(5,305,252) | (3,037,985) | (11,437,221) | |||||||||

| Class I |

(238,107,077) | (49,542,035) | (165,799,406) | |||||||||

|

|

||||||||||||

| Net Increase in Net Assets Derived from Beneficial Interest Transactions |

79,790,440 | 111,513,308 | 67,162,932 | |||||||||

|

|

||||||||||||

| Net increase/(decrease) in net assets |

(45,313,527) | 53,272,468 | 82,026,719 | |||||||||

| NET ASSETS |

||||||||||||

| Beginning of year |

446,122,974 | 392,850,506 | 310,823,787 | |||||||||

|

|

||||||||||||

| End of year * |

$ | 400,809,447 | $ | 446,122,974 | $ | 392,850,506 | ||||||

|

|

||||||||||||

| *Including accumulated net investment income/(loss) of: |

$ | (1,662,022) | $ | 1,837,073 | $ | 1,681,334 | ||||||

| (a) | Effective May 1, 2014, the Board approved changing the fiscal year-end of the Funds from April 30 to October 31. |

See Notes to Financial Statements.

29 | October 31, 2015

Table of Contents

ALPS | CoreCommodity Management

CompleteCommodities® Strategy Fund – Class A

Consolidated Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Year Ended October 31, 2015 |

For the Fiscal Period Ended October 31, 2014(a) |

For the Year Ended April 30, 2014 |

For the Year Ended April 30, 2013(b) |

For the Year Ended April 30, 2012 |

For the Period June 29, 2010 (Inception) to April 30, 2011 |

|||||||||

|

| ||||||||||||||

| Net asset value, beginning of period(c) |

$9.56 | $10.87 | $10.40 | $11.18 | $14.28 | $10.00 | ||||||||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||||||||||||

| Net investment income/(loss)(d) |

(0.09) | 0.00(e) | (0.06) | (0.03) | 0.04 | 0.12 | ||||||||

| Net realized and unrealized gain/(loss) |

(2.32) | (1.31) | 0.53 | (0.69) | (2.29) | 4.87 | ||||||||

|

| ||||||||||||||

| Total from investment operations |

(2.41) | (1.31) | 0.47 | (0.72) | (2.25) | 4.99 | ||||||||

|

| ||||||||||||||

| DISTRIBUTIONS: |

||||||||||||||

| From net investment income |

– | – | – | – | (0.83) | (0.71) | ||||||||

| From net realized gains |

– | – | – | – | (0.02) | – | ||||||||

| Tax return of capital |

– | – | – | (0.06) | – | – | ||||||||

|

| ||||||||||||||

| Total distributions |

– | – | – | (0.06) | (0.85) | (0.71) | ||||||||

|

| ||||||||||||||

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) |

0.00(e) | 0.00(e) | 0.00(e) | 0.00(e) | 0.00(e) | 0.00(e) | ||||||||

|

| ||||||||||||||

| Net increase/(decrease) in net asset value |

(2.41) | (1.31) | 0.47 | (0.78) | (3.10) | 4.28 | ||||||||

|

| ||||||||||||||