UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(exact name of Registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

David T. Buhler, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: October 31

Date of reporting period: October 31, 2013 – April 30, 2014

Item 1. Reports to Stockholders.

April 30, 2014

ALPS Real Asset Income Fund

ALPS | Westport Resources Hedged High Income Fund

An ALPS Advisors Solution

|

Table of Contents April 30, 2014 |

| 1 | ||||

| ALPS Real Asset Income Fund |

||||

| 2 | ||||

| 4 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| ALPS | Westport Resources Hedged High Income Fund |

||||

| 13 | ||||

| 14 | ||||

| 16 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 27 | ||||

| 37 | ||||

| April 30, 2014 (Unaudited) |

Examples. As a shareholder of the Funds, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on November 1, 2013 and held until April 30, 2014.

Actual Expenses. The first line under each class in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period November 1, 2013 – April 30, 2014” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line under each class in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other mutual funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or redemption fees. Therefore, the second line under each class in the table below is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning Account Value November 1, 2013 |

Ending Account Value April 30, 2014 |

Expense Ratio(a) |

Expenses Paid During Period November 1, 2013 - April 30, 2014(b) | |||||||||||||||||

| ALPS Real Asset Income Fund(c) |

|

|||||||||||||||||||

| Class A(d) |

||||||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,093.50 | 1.40 | % | $ | 6.10 | ||||||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,017.85 | 1.40 | % | $ | 7.00 | ||||||||||||

| Class C(d) |

||||||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,091.30 | 2.00 | % | $ | 8.71 | ||||||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,014.88 | 2.00 | % | $ | 9.99 | ||||||||||||

| Class I(d) |

||||||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,095.30 | 1.00 | % | $ | 4.36 | ||||||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,019.84 | 1.00 | % | $ | 5.01 | ||||||||||||

| ALPS | Westport Resources Hedged High Income Fund |

|

|||||||||||||||||||

| Class A(e) |

||||||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,027.20 | 2.39 | % | $ | 7.96 | ||||||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,012.94 | 2.39 | % | $ | 11.93 | ||||||||||||

| Class C(e) |

||||||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,024.10 | 2.99 | % | $ | 9.95 | ||||||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,009.97 | 2.99 | % | $ | 14.90 | ||||||||||||

| Class I(e) |

||||||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 1,027.60 | 1.99 | % | $ | 6.63 | ||||||||||||

| Hypothetical (5% return before expenses) |

$ | 1,000.00 | $ | 1,014.93 | 1.99 | % | $ | 9.94 | ||||||||||||

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), divided by 365. |

| (c) | Includes expenses of the ALPS Real Asset Income Fund (Cayman) Ltd. (wholly-owned subsidiary), exclusive of the subsidiary’s management fee. |

| (d) | ALPS Real Asset Income Fund commenced operations on November 30, 2013. For purposes of calculating the “Actual” figures, actual number of days from commencement of operations through April 30, 2014 were used (152 days). |

| (e) | ALPS | Westport Resources Hedged High Income Fund commenced operations on January 1, 2014. For purposes of calculating the “Actual” figures, actual number of days from commencement of operations through April 30, 2014 were used (120 days). |

1 | April 30, 2014

| ALPS Real Asset Income Fund |

||

| April 30, 2014 (Unaudited) |

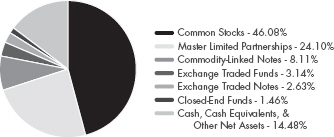

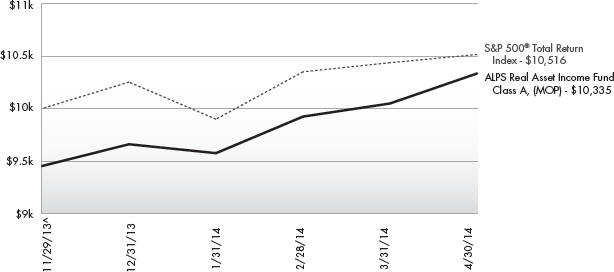

Performance of $10,000 Initial Investment (as of April 30, 2014)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of April 30, 2014)

| 3 Month1 | Since Inception ^ | Total Expense Ratio | What You Pay * | |||||

|

Class A (NAV) |

7.94% | 9.35% | ||||||

|

Class A (MOP) |

2.00% | 3.35% | 1.54% | 1.40% | ||||

| Class C (NAV) |

7.84% | 9.13% | ||||||

| Class C (CDSC) |

6.84% | 8.13% | 2.14% | 2.00% | ||||

| Class I |

8.02% | 9.53% | 1.14% | 1.00% | ||||

| S&P 500® Total Return Index2 |

6.23% | 5.16% |

Performance data quoted represents past performance. Past performance does not guarantee future results.

Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data

quoted. For the most current month-end performance data, please call

1-866-759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account. If you invest $1 million or more, either as a lump sum or through the Fund’s accumulation or letter of intent programs, you can purchase Class A shares without an initial sales charge (load). A Contingent Deferred Sales Charge (“CDSC”) of 1.00% may apply to Class C shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million.

| 1 | Performance less than 1 year is cumulative. |

| 2 | The S&P 500® Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund inception date of November 29, 2013. |

| * | What You Pay reflects the Advisor’s decision to contractually limit expenses through February 28, 2015. Please see the prospectus for additional information. |

2 | April 30, 2014

| ALPS Real Asset Income Fund |

||

| Performance Update |

April 30, 2014 (Unaudited) |

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Not FDIC Insured – No Bank Guarantee – May Lose Value

Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment.

3 | April 30, 2014

| ALPS Real Asset Income Fund |

||

| April 30, 2014 (Unaudited) |

4 | April 30, 2014

| ALPS Real Asset Income Fund |

||

| Consolidated Statement of Investments |

April 30, 2014 (Unaudited) |

5 | April 30, 2014

| ALPS Real Asset Income Fund |

||

| Consolidated Statement of Investments |

April 30, 2014 (Unaudited) |

6 | April 30, 2014

| ALPS Real Asset Income Fund |

||

| Consolidated Statement of Assets and Liabilities | April 30, 2014 (Unaudited) |

| ASSETS |

||||

| Investments, at value |

$ | 3,000,641 | ||

| Cash |

475 | |||

| Foreign currency, at value (Cost $4,988) |

5,003 | |||

| Receivable for investments sold |

83,637 | |||

| Deposit with broker for written options |

148,701 | |||

| Dividends receivable |

6,756 | |||

| Receivable due from advisor |

24,203 | |||

| Prepaid offering costs |

45,431 | |||

| Prepaid expenses and other assets |

4,061 | |||

|

|

||||

| Total Assets |

3,318,908 | |||

|

|

||||

| LIABILITIES |

||||

| Written options, at value (premiums received $112) |

27 | |||

| Administration and transfer agency fees payable |

13,745 | |||

| Distribution and services fees payable |

876 | |||

| Professional fees payable |

13,939 | |||

| Accrued expenses and other liabilities |

6,229 | |||

|

|

||||

| Total Liabilities |

34,816 | |||

|

|

||||

| NET ASSETS |

$ | 3,284,092 | ||

|

|

||||

| NET ASSETS CONSIST OF |

||||

| Paid-in capital |

$ | 3,036,486 | ||

| Accumulated net investment loss |

(14,772 | ) | ||

| Accumulated net realized gain on investments, written options, securities sold short and foreign currency transactions |

18,703 | |||

| Net unrealized appreciation on investments, written options and translation of assets and liabilities denominated in foreign currencies |

243,675 | |||

|

|

||||

| NET ASSETS |

$ | 3,284,092 | ||

|

|

||||

| INVESTMENTS, AT COST |

$ | 2,757,101 | ||

|

|

||||

| PRICING OF SHARES |

||||

| Class A: |

||||

| Net Asset Value, offering and redemption price per share(a) |

$ | 10.82 | ||

| Net Assets |

$ | 547,822 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

50,624 | |||

| Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) |

$ | 11.45 | ||

| Class C: |

||||

| Net Asset Value, offering and redemption price per share(a) |

$ | 10.82 | ||

| Net Assets |

$ | 545,437 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

50,431 | |||

| Class I: |

||||

| Net Asset Value, offering and redemption price per share |

$ | 10.82 | ||

| Net Assets |

$ | 2,190,833 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

202,459 | |||

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund’s Prospectus. |

See Notes to Financial Statements.

7 | April 30, 2014

| ALPS Real Asset Income Fund |

||

| For the Period Ended April 30, 2014 (Unaudited) |

| INVESTMENT INCOME |

||||

| Dividends |

$ | 38,518 | ||

| Foreign taxes withheld on dividends |

(1,816 | ) | ||

|

|

||||

| Total Investment Income |

36,702 | |||

|

|

||||

|

EXPENSES |

||||

| Investment advisory fees |

10,336 | |||

| Administrative and transfer agency fees |

64,873 | |||

| Distribution and service fees |

||||

| Class A |

862 | |||

| Class C |

2,150 | |||

| Professional fees |

14,558 | |||

| Networking fees |

||||

| Class I |

862 | |||

| Reports to shareholders and printing fees |

3,415 | |||

| State registration fees |

883 | |||

| SEC registration fees |

10 | |||

| Custody fees |

10,368 | |||

| Trustees’ fees and expenses |

2,842 | |||

| Offering costs |

28,905 | |||

| Miscellaneous expenses |

5,225 | |||

|

|

||||

| Total Expenses |

145,289 | |||

|

|

||||

| Less fees waived/reimbursed by investment advisor (Note 7) |

||||

| Class A |

(21,429 | ) | ||

| Class C |

(21,378 | ) | ||

| Class I |

(86,548 | ) | ||

|

|

||||

| Net Expenses |

15,934 | |||

|

|

||||

| Net Investment Income |

20,768 | |||

|

|

||||

| Net realized gain on investments |

19,664 | |||

| Net realized gain on written options |

825 | |||

| Net realized loss on securities sold short |

(1,754 | ) | ||

| Net realized loss on foreign currency transactions |

(32 | ) | ||

| Net change in unrealized appreciation on investments |

243,540 | |||

| Net change in unrealized appreciation on written options |

85 | |||

| Net change in unrealized appreciation on translation of assets and liabilities denominated in foreign currencies |

50 | |||

|

|

||||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS |

262,378 | |||

|

|

||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 283,146 | ||

|

|

||||

See Notes to Financial Statements.

8 | April 30, 2014

| ALPS Real Asset Income Fund |

||

| For the Period November 30, 2013 (Commencement) to April 30, 2014 (Unaudited) |

||||

|

|

||||

| OPERATIONS |

||||

| Net investment income |

$ | 20,768 | ||

| Net realized gain on investments, written options, securities sold short and foreign currency transactions |

18,703 | |||

| Net change in unrealized appreciation on investments, written options and translation of assets and liabilities denominated in foreign currencies |

243,675 | |||

|

|

||||

| Net Increase in Net Assets Resulting from Operations |

283,146 | |||

|

|

||||

|

DISTRIBUTIONS |

||||

| Dividends to shareholders from net investment income |

||||

| Class A |

(5,516 | ) | ||

| Class C |

(4,480 | ) | ||

| Class I |

(25,544 | ) | ||

|

|

||||

| Net Decrease in Net Assets from Distributions |

(35,540 | ) | ||

|

|

||||

|

BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) |

||||

| Shares sold |

||||

| Class A |

500,966 | |||

| Class C |

500,030 | |||

| Class I |

2,000,030 | |||

| Dividends reinvested |

||||

| Class A |

5,516 | |||

| Class C |

4,480 | |||

| Class I |

25,544 | |||

| Shares redeemed |

||||

| Class A |

(20 | ) | ||

| Class C |

(30 | ) | ||

| Class I |

(30 | ) | ||

|

|

||||

| Net Increase in Net Assets Derived from Beneficial Interest Transactions |

3,036,486 | |||

|

|

||||

| Net increase in net assets |

3,284,092 | |||

| NET ASSETS |

||||

| Beginning of period |

– | |||

|

|

||||

| End of period * |

$ | 3,284,092 | ||

|

|

||||

| *Including accumulated net investment loss of: |

$ | (14,772 | ) | |

See Notes to Financial Statements.

9 | April 30, 2014

| ALPS Real Asset Income Fund – Class A |

||

| Selected data for a share of beneficial interest outstanding throughout the period indicated: |

| For the Period November 30, 2013 (Commencement) to April 30, 2014 (Unaudited) | ||||||

| Net asset value, beginning of period |

$10.00 | |||||

| INCOME FROM INVESTMENT OPERATIONS: |

||||||

| Net investment income(a) |

0.06 | |||||

| Net realized and unrealized gain |

0.87 | |||||

| Total from investment operations |

0.93 | |||||

| DISTRIBUTIONS: |

||||||

| From net investment income |

(0.11) | |||||

| Total distributions |

(0.11) | |||||

| Net increase in net asset value |

0.82 | |||||

| Net asset value, end of period |

$10.82 | |||||

| TOTAL RETURN(b) |

9.35% | |||||

| RATIOS/SUPPLEMENTAL DATA: |

||||||

| Net assets, end of period (000s) |

$548 | |||||

| Ratio of expenses to average net assets excluding fee waivers and reimbursements |

11.34%(c)(d) | |||||

| Ratio of expenses to average net assets including fee waivers and reimbursements |

1.40%(c)(d) | |||||

| Ratio of net investment income to average net assets |

1.44%(c)(d) | |||||

| Portfolio turnover rate(e) |

8% | |||||

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (c) | Annualized. |

| (d) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

10 | April 30, 2014

| ALPS Real Asset Income Fund – Class C | ||

| Consolidated Financial Highlights |

||

| Selected data for a share of beneficial interest outstanding throughout the period indicated: | ||

| For the Period November 30, 2013 (Commencement) to April 30, 2014 (Unaudited) | ||

| Net asset value, beginning of period |

$10.00 | |

| INCOME FROM INVESTMENT OPERATIONS: |

||

| Net investment income(a) |

0.04 | |

| Net realized and unrealized gain |

0.87 | |

| Total from investment operations |

0.91 | |

| DISTRIBUTIONS: |

||

| From net investment income |

(0.09) | |

| Total distributions |

(0.09) | |

| Net increase in net asset value |

0.82 | |

| Net asset value, end of period |

$10.82 | |

| TOTAL RETURN(b) |

9.13% | |

| RATIOS/SUPPLEMENTAL DATA: |

||

| Net assets, end of period (000s) |

$545 | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements |

11.94%(c)(d) | |

| Ratio of expenses to average net assets including fee waivers and reimbursements |

2.00%(c)(d) | |

| Ratio of net investment income to average net assets |

0.84%(c)(d) | |

| Portfolio turnover rate(e) |

8% | |

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (c) | Annualized. |

| (d) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

11 | April 30, 2014

| ALPS Real Asset Income Fund – Class I | ||

| Consolidated Financial Highlights |

||

| Selected data for a share of beneficial interest outstanding throughout the period indicated: | ||

| For the Period November 30, 2013 (Commencement) to April 30, 2014 (Unaudited) |

||||

| Net asset value, beginning of period |

$10.00 | |||

| INCOME FROM INVESTMENT OPERATIONS: |

||||

| Net investment income(a) |

0.08 | |||

| Net realized and unrealized gain |

0.87 | |||

| Total from investment operations |

0.95 | |||

| DISTRIBUTIONS: |

||||

| From net investment income |

(0.13 | ) | ||

| Total distributions |

(0.13 | ) | ||

| Net increase in net asset value |

0.82 | |||

| Net asset value, end of period |

$10.82 | |||

| TOTAL RETURN(b) |

9.53% | |||

| RATIOS/SUPPLEMENTAL DATA: |

||||

| Net assets, end of period (000s) |

$2,191 | |||

| Ratio of expenses to average net assets excluding fee waivers and reimbursements |

11.04% | (c)(d) | ||

| Ratio of expenses to average net assets including fee waivers and reimbursements |

1.00% | (c)(d) | ||

| Ratio of net investment income to average net assets |

1.84% | (c)(d) | ||

| Portfolio turnover rate(e) |

8% | |||

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (c) | Annualized. |

| (d) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

12 | April 30, 2014

| April 30, 2014 (Unaudited) | ||

13 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

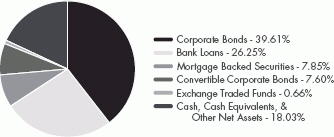

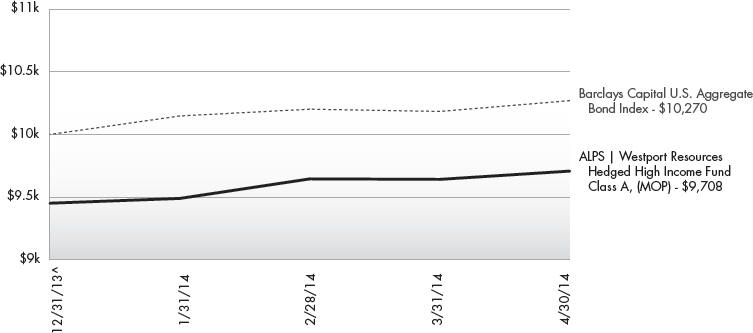

| April 30, 2014 (Unaudited) | ||

Performance of $10,000 Initial Investment (as of April 30, 2014)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of April 30, 2014)

| 3 Month1 | Since Inception ^ | Total Expense Ratio | What You Pay * | |||||

| Class A (NAV) |

2.21% | 2.72% | ||||||

| Class A (MOP) |

-3.38% | -2.92% | 2.45% | 2.39% | ||||

| Class C (NAV) |

2.10% | 2.41% | ||||||

| Class C (CDSC) |

1.10% | 1.41% | 3.05% | 2.99% | ||||

| Class I |

2.35% | 2.76% | 2.05% | 1.99% | ||||

| Barclays Capital U.S. Aggregate Bond Index2 |

1.21% | 2.70% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-866-759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account. If you invest $1 million or more, either as a lump sum or through the Fund’s accumulation or letter of intent programs, you can purchase Class A shares without an initial sales charge (load). A Contingent Deferred Sales Charge (“CDSC”) of 1.00% may apply to Class C shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million.

| 1 | Performance less than 1 year is cumulative. |

| 2 | The Barclays Capital U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in an index. |

14 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

| Performance Update |

April 30, 2014 (Unaudited) | |

| ^ | Fund inception date of December 31, 2013. |

| * | What You Pay reflects the Advisor’s decision to contractually limit expenses through August 31, 2015. Please see the prospectus for additional information. |

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Not FDIC Insured – No Bank Guarantee – May Lose Value

Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment.

All investments involve risks, including possible loss of principal. The risks associated with higher-yielding, lower-rated securities include higher risk of default and loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. In addition, interest rate movements will affect the fund’s share price and yield. Credit risk refers to the possibility the bond issuer will not be able to make principal and interest payments. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in the fund adjust to a rise in interest rates, the fund’s share price may decline. These and other risk considerations are discussed in the fund’s prospectus. The principal on mortgage or asset-backed securities normally may be prepaid at any time, which will reduce the yield and market value of those securities. US obligations are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US government. Investments in non-investment-grade debt securities (“high yield” or “junk” bonds) may be subject to greater market fluctuations and risk of default or loss of income and principal than securities in higher rating categories.

Senior-secured and second lien loans and bonds: Assets pledged as security for these loans and bonds would first be made available to senior lenders before other investors’ demands were met when settling a bankruptcy.

The Fund is not required to invest with any minimum number of sub-advisers, and does not have minimum or maximum limitations with respect to the allocations of the assets to any sub-adviser or investment option.

15 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

| April 30, 2014 (Unaudited) | ||

16 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

| Statement of Investments | April 30, 2014 (Unaudited) | |

17 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

| Statement of Investments | April 30, 2014 (Unaudited) | |

18 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

| Statement of Investments |

April 30, 2014 (Unaudited) | |

19 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

| Statement of Investments |

April 30, 2014 (Unaudited) | |

FUTURES CONTRACTS

| Description | Position | Contracts | Expiration Date |

Value (Note 2) |

Unrealized Appreciation |

|||||||||

| U.S. 5 Year Note Future |

Short | (16) | 7/01/14 | $ | (1,911,250 | ) | $ | 6,460 | ||||||

|

|

|

|||||||||||||

| $ | (1,911,250 | ) | $ | 6,460 | ||||||||||

|

|

|

|||||||||||||

| Description | Position | Contracts | Expiration Date |

Value (Note 2) |

Unrealized Depreciation |

|||||||||

| 10 Year USD Interest Rate Swap Future |

Short | (4) | 6/17/14 | $ | (402,938 | ) | $ | (2,604 | ) | |||||

| U.S. 10 Year Note Future |

Short | (3) | 6/20/14 | (373,266 | ) | (648 | ) | |||||||

| USD Interest Rate Swap 5 Year Primary Future |

Short | (3) | 6/17/14 | (305,297 | ) | (757 | ) | |||||||

|

|

|

|||||||||||||

| $ | (1,081,500 | ) | $ | (4,009 | ) | |||||||||

|

|

|

|||||||||||||

See Notes to Financial Statements.

20 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

| April 30, 2014 (Unaudited) | ||

| ASSETS |

||||

| Investments, at value |

$ | 17,716,818 | ||

| Cash |

3,608,599 | |||

| Receivable for investments sold |

2,543,339 | |||

| Receivable for shares sold |

516,787 | |||

| Receivable for variation margin |

6,460 | |||

| Interest receivable |

262,052 | |||

| Prepaid offering costs |

48,756 | |||

| Prepaid expenses and other assets |

6,373 | |||

|

|

||||

| Total Assets |

24,709,184 | |||

|

|

||||

| LIABILITIES |

||||

| Payable for investments purchased |

3,091,292 | |||

| Payable for variation margin |

4,009 | |||

| Payable due to broker for futures contracts |

10,982 | |||

| Investment advisory fees payable |

9,751 | |||

| Administration and transfer agency fees payable |

5,670 | |||

| Distribution and services fees payable |

2,708 | |||

| Trustees’ fees and expenses payable |

1,498 | |||

| Professional fees payable |

16,502 | |||

| Accrued expenses and other liabilities |

14,886 | |||

|

|

||||

| Total Liabilities |

3,157,298 | |||

|

|

||||

| NET ASSETS |

$ | 21,551,886 | ||

|

|

||||

| NET ASSETS CONSIST OF |

||||

| Paid-in capital |

$ | 21,268,093 | ||

| Accumulated net investment income |

2,845 | |||

| Accumulated net realized loss on investments and futures contracts |

(54,127 | ) | ||

| Net unrealized appreciation on investments and futures contracts |

335,075 | |||

|

|

||||

| NET ASSETS |

$ | 21,551,886 | ||

|

|

||||

| INVESTMENTS, AT COST |

$ | 17,384,194 | ||

|

|

||||

| PRICING OF SHARES |

||||

| Class A: |

||||

| Net Asset Value, offering and redemption price per share(a) |

$ | 10.18 | ||

| Net Assets |

$ | 3,599,853 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

353,785 | |||

| Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) |

$ | 10.77 | ||

| Class C: |

||||

| Net Asset Value, offering and redemption price per share(a) |

$ | 10.17 | ||

| Net Assets |

$ | 1,428,618 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

140,441 | |||

| Class I: |

||||

| Net Asset Value, offering and redemption price per share |

$ | 10.17 | ||

| Net Assets |

$ | 16,523,415 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

1,624,265 | |||

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund’s Prospectus. |

See Notes to Financial Statements.

21 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

| For the Period Ended April 30, 2014 (Unaudited) | ||

| INVESTMENT INCOME |

||||

| Interest and other income |

$ | 295,994 | ||

| Total Investment Income |

295,994 | |||

| EXPENSES |

||||

| Investment advisory fees |

130,177 | |||

| Administrative and transfer agency fees |

18,536 | |||

| Distribution and service fees |

||||

| Class A |

2,889 | |||

| Class C |

3,247 | |||

| Professional fees |

16,516 | |||

| Networking fees |

||||

| Class I |

4,344 | |||

| Reports to shareholders and printing fees |

2,775 | |||

| State registration fees |

1,693 | |||

| SEC registration fees |

46 | |||

| Custody fees |

9,616 | |||

| Trustees’ fees and expenses |

1,609 | |||

| Offering costs |

23,151 | |||

| Miscellaneous expenses |

3,265 | |||

| Total Expenses |

217,864 | |||

| Less fees waived/reimbursed by investment advisor (Note 7) |

||||

| Class A |

(13,323) | |||

| Class C |

(5,878) | |||

| Class I |

(85,250) | |||

| Net Expenses |

113,413 | |||

| Net Investment Income |

182,581 | |||

| Net realized loss on investments |

(49,659) | |||

| Net realized loss on futures contracts |

(4,468) | |||

| Net change in unrealized appreciation on investments |

332,624 | |||

| Net change in unrealized appreciation on futures contracts |

2,451 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS |

280,948 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 463,529 | ||

See Notes to Financial Statements.

22 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund | ||

| For the Period January 1, 2014 (Commencement) to April 30, 2014 (Unaudited) |

||||

| OPERATIONS |

||||

| Net investment income |

$ | 182,581 | ||

| Net realized loss on investments and futures contracts |

(54,127 | ) | ||

| Net change in unrealized appreciation on investments and futures contracts |

335,075 | |||

| Net Increase in Net Assets Resulting from Operations |

463,529 | |||

| DISTRIBUTIONS |

||||

| Dividends to shareholders from net investment income |

||||

| Class A |

(21,831 | ) | ||

| Class C |

(8,456 | ) | ||

| Class I |

(149,449 | ) | ||

| Net Decrease in Net Assets from Distributions |

(179,736 | ) | ||

| BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) |

||||

| Shares sold |

||||

| Class A |

3,555,566 | |||

| Class C |

1,470,040 | |||

| Class I |

16,640,704 | |||

| Dividends reinvested |

||||

| Class A |

4,231 | |||

| Class C |

1,140 | |||

| Class I |

18,142 | |||

| Shares redeemed |

||||

| Class A |

(40 | ) | ||

| Class C |

(58,040 | ) | ||

| Class I |

(363,650 | ) | ||

| Net Increase in Net Assets Derived from Beneficial Interest Transactions |

21,268,093 | |||

| Net increase in net assets |

21,551,886 | |||

| NET ASSETS |

||||

| Beginning of period |

– | |||

| End of period * |

$ | 21,551,886 | ||

| *Including accumulated net investment income of: |

$ | 2,845 | ||

See Notes to Financial Statements.

23 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund – Class A | ||

|

Selected data for a share of beneficial interest outstanding throughout the period indicated: | ||

| For the Period April 30, 2014 | ||

| Net asset value, beginning of period |

$10.00 | |

| INCOME FROM INVESTMENT OPERATIONS: |

||

| Net investment income(a) |

0.11 | |

| Net realized and unrealized gain |

0.16 | |

| Total from investment operations |

0.27 | |

| DISTRIBUTIONS: |

||

| From net investment income |

(0.09) | |

| Total distributions |

(0.09) | |

| Net increase in net asset value |

0.18 | |

| Net asset value, end of period |

$10.18 | |

| TOTAL RETURN(b) |

2.72% | |

| RATIOS/SUPPLEMENTAL DATA: |

||

| Net assets, end of period (000s) |

$3,600 | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements |

4.23%(c)(d) | |

| Ratio of expenses to average net assets including fee waivers and reimbursements |

2.39%(c)(d) | |

| Ratio of net investment income to average net assets |

3.23%(c)(d) | |

| Portfolio turnover rate(e) |

48% | |

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (c) | Annualized. |

| (d) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

24 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund – Class C | ||

| Financial Highlights Selected data for a share of beneficial interest outstanding throughout the period indicated: | ||

| For the Period January 1, 2014 (Commencement) to April 30, 2014 (Unaudited) | ||

| Net asset value, beginning of period |

$10.00 | |

| INCOME FROM INVESTMENT OPERATIONS: |

||

| Net investment income(a) |

0.09 | |

| Net realized and unrealized gain |

0.15 | |

| Total from investment operations |

0.24 | |

| DISTRIBUTIONS: |

||

| From net investment income |

(0.07) | |

| Total distributions |

(0.07) | |

| Net increase in net asset value |

0.17 | |

| Net asset value, end of period |

$10.17 | |

| TOTAL RETURN(b) |

2.41% | |

| RATIOS/SUPPLEMENTAL DATA: |

||

| Net assets, end of period (000s) |

$1,429 | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements |

4.80%(c)(d) | |

| Ratio of expenses to average net assets including fee waivers and reimbursements |

2.99%(c)(d) | |

| Ratio of net investment income to average net assets |

2.67%(c)(d) | |

| Portfolio turnover rate(e) |

48% | |

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (c) | Annualized. |

| (d) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

25 | April 30, 2014

| ALPS | Westport Resources Hedged High Income Fund – Class I | ||

| Financial Highlights Selected data for a share of beneficial interest outstanding throughout the period indicated: | ||

| For the Period January 1, 2014 (Commencement) to April 30, 2014 (Unaudited) | ||

| Net asset value, beginning of period |

$10.00 | |

| INCOME FROM INVESTMENT OPERATIONS: |

||

| Net investment income(a) |

0.11 | |

| Net realized and unrealized gain |

0.17 | |

| Total from investment operations |

0.28 | |

| DISTRIBUTIONS: |

||

| From net investment income |

(0.11) | |

| Total distributions |

(0.11) | |

| Net increase in net asset value |

0.17 | |

| Net asset value, end of period |

$10.17 | |

| TOTAL RETURN(b) |

2.76% | |

| RATIOS/SUPPLEMENTAL DATA: |

||

| Net assets, end of period (000s) |

$16,523 | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements |

3.95%(c)(d) | |

| Ratio of expenses to average net assets including fee waivers and reimbursements |

1.99%(c)(d) | |

| Ratio of net investment income to average net assets |

3.47%(c)(d) | |

| Portfolio turnover rate(e) |

48% | |

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (c) | Annualized. |

| (d) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

26 | April 30, 2014

| Notes to Financial Statements | ||

| April 30, 2014 (Unaudited) |

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). As of April 30, 2014, the Trust had 30 registered funds. This semi-annual report describes the following funds: ALPS Real Asset Income Fund and ALPS | Westport Resources Hedged High Income Fund (each, a “Fund” and collectively, the “Funds”). ALPS Real Asset Income Fund seeks to provide a high level of current income and long-term capital appreciation. The ALPS | Westport Resources Hedged High Income Fund seeks to provide high current income. The Fund’s secondary investment objective is to seek capital preservation, with the potential for capital appreciation.

The classes of each fund differ principally in the applicable distribution and shareholder service fees. Shareholders of each class also bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of the Fund and earn income and realized gains/losses from the Fund pro rata based on the average daily net assets of each class, without distinction between share classes. Dividends to shareholders are determined separately for each class based on income and expenses allocable to each class. Realized gain distributions to shareholders are allocated to each class pro rata based on the shares outstanding of each class on the date of distribution. Differences in per share dividend rates generally result from differences in separate class expenses, including distribution and shareholder service fees, if applicable.

Basis of Consolidation for the ALPS Real Asset Income Fund

ALPS Real Asset Income Fund (Cayman) Ltd. (the “Subsidiary”), a Cayman Islands exempted company, was incorporated on May 23, 2013 and is a wholly owned subsidiary of the ALPS Real Asset Income Fund (the “Real Asset Income Fund”). The Subsidiary acts as an investment vehicle for the Real Asset Income Fund in order to effect certain commodity-related investments on behalf of the Real Asset Income Fund. The Real Asset Income Fund is the sole shareholder of the Subsidiary pursuant to a subscription agreement dated as of November 25, 2013, and it is intended that the Real Asset Income Fund will remain the sole shareholder and will continue to wholly own and control the Subsidiary. Under the Articles of Association of the Subsidiary, shares issued by the Subsidiary confer upon a shareholder the right to vote at general meetings of the Subsidiary and certain rights in connection with any winding-up or repayment of capital, as well as the right to participate in the profits or assets of the Subsidiary. The Real Asset Income Fund may invest up to 25% of its total assets in shares of the Subsidiary. As a wholly owned subsidiary of the Real Assets Income Fund, the statement of investments the Subsidiary is included in the consolidated statement of investments of the Real Asset Income Fund. All investments held by the Subsidiary are disclosed in the accounts of the Real Asset Income Fund. As of April 30, 2014, net assets of the Real Asset Income Fund were $3,284,092, of which $610,907, or 18.60%, represented the Real Asset Income’s ownership of all issued shares and voting rights of the Subsidiary.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The following is a summary of significant accounting policies consistently followed by the Funds and subsidiaries, as applicable, in preparation of their financial statements.

Investment Valuation: The Funds generally value their securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Board of Trustees (the “Board”), which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more brokers–dealers that make a market in the security. Short–term debt obligations that will mature in 60 days or less are valued at amortized cost; unless it is determined that using this method would not reflect an investment’s fair value. Investments in non-exchange traded funds are fair valued at their respective net asset values.

Futures contracts that are listed or traded on a national securities exchange, commodities exchange, contract market or comparable over the counter market, and that are freely transferable, are valued at their closing settlement price on the exchange on which they are primarily traded or based upon the current settlement price for a like instrument acquired on the day on which the instrument is being valued. A settlement price may not be used if the market makes a limit move with respect to a particular commodity. Over-the-counter swap contracts for which market quotations are readily available are valued based on quotes received from independent pricing services or one or more dealers that make markets in such securities.

27 | April 30, 2014

| Notes to Financial Statements | ||

| April 30, 2014 (Unaudited) |

Equity securities that are primarily traded on foreign securities exchanges are valued at the closing values of such securities on their respective foreign exchanges, except when an event occurs subsequent to the close of the foreign exchange and the close of the NYSE that was likely to have changed such value. In such an event, the fair value of those securities is determined in good faith through consideration of other factors in accordance with procedures established by and under the general supervision of the Board. The Funds will use a fair valuation model provided by an independent pricing service, which is intended to reflect fair value when a security’s value or a meaningful portion of the Fund’s portfolio is believed to have been materially affected by an valuation event that has occurred between the close of the exchange or market on which the security is traded and the close of the regular trading day on the NYSE. The Funds’ valuation procedures set forth certain triggers which instruct when to use the fair valuation model.

Forward currency exchange contracts have a market value determined by the prevailing foreign currency exchange daily rates and current foreign currency exchange forward rates. The foreign currency exchange forward rates are calculated using an automated system that estimates rates on the basis of the current day foreign currency exchange rates and forward foreign currency exchange rates supplied by a pricing service. Foreign exchange rates and forward foreign currency exchange rates may generally be obtained at the close of the NYSE, normally 4:00 p.m. Eastern Time.

When such prices or quotations are not available, or when the Fair Value Committee appointed by the Board believes that they are unreliable, securities may be priced using fair value procedures approved by the Board.

Fair Value Measurements: The Funds disclose the classification of their fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of each Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – |

Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; | |

| Level 2 – |

Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and | |

| Level 3 – |

Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. | |

28 | April 30, 2014

| Notes to Financial Statements | ||

| April 30, 2014 (Unaudited) |

The following is a summary of each Fund’s investments/financial instruments in the fair value hierarchy as of April 30, 2014:

| Investments in Securities at Value | Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Total | ||||||||||||

|

|

||||||||||||||||

| ALPS Real Asset Income Fund |

| |||||||||||||||

| Closed-End Funds |

$ | 48,056 | $ | – | $ | – | $ | 48,056 | ||||||||

| Common Stocks(a) |

1,513,163 | – | – | 1,513,163 | ||||||||||||

| Exchange Traded Funds |

102,999 | – | – | 102,999 | ||||||||||||

| Exchange Traded Notes |

86,400 | – | – | 86,400 | ||||||||||||

| Master Limited Partnerships(a) |

791,461 | – | – | 791,461 | ||||||||||||

| Commodity-Linked Notes |

– | 266,264 | – | 266,264 | ||||||||||||

| Short Term Investments |

192,298 | – | – | 192,298 | ||||||||||||

|

|

||||||||||||||||

| Total |

$ | 2,734,377 | $ | 266,264 | $ | – | $ | 3,000,641 | ||||||||

|

|

||||||||||||||||

|

|

||||||||||||||||

| Other Financial Instruments |

||||||||||||||||

|

|

||||||||||||||||

| Liabilities |

||||||||||||||||

| Written Call Options |

$ | (27) | $ | – | $ | – | $ | (27) | ||||||||

|

|

||||||||||||||||

| Total |

$ | (27) | $ | – | $ | – | $ | (27) | ||||||||

|

|

||||||||||||||||

|

|

||||||||||||||||

| Investments in Securities at Value | Level 1 - Unadjusted Quoted Prices |

Level 2 - Other Significant Observable Inputs |

Level 3 - Significant Unobservable Inputs |

Total | ||||||||||||

|

|

||||||||||||||||

| ALPS | Westport Resources Hedged High Income Fund |

| |||||||||||||||

| Exchange Traded Funds |

$ | 142,390 | $ | – | $ | – | $ | 142,390 | ||||||||

| Bank Loans |

– | 5,657,164 | – | 5,657,164 | ||||||||||||

| Convertible Corporate Bonds(a) |

– | 1,637,188 | – | 1,637,188 | ||||||||||||

| Corporate Bonds(a) |

– | 8,536,973 | – | 8,536,973 | ||||||||||||

| Mortgage Backed Securities |

– | 1,693,112 | – | 1,693,112 | ||||||||||||

| Short Term Investments |

– | 49,991 | – | 49,991 | ||||||||||||

|

|

||||||||||||||||

| Total |

$ | 142,390 | $ | 17,574,428 | $ | – | $ | 17,716,818 | ||||||||

|

|

||||||||||||||||

|

|

||||||||||||||||

| Other Financial Instruments |

||||||||||||||||

|

|

||||||||||||||||

| Assets |

||||||||||||||||

| Futures Contracts |

$ | 6,460 | $ | – | $ | – | $ | 6,460 | ||||||||

| Liabilities |

||||||||||||||||

| Futures Contracts |

(4,009) | – | – | (4,009) | ||||||||||||

|

|

||||||||||||||||

| Total |

$ | 2,451 | $ | – | $ | – | $ | 2,451 | ||||||||

|

|

||||||||||||||||

|

|

||||||||||||||||

| (a) | For detailed descriptions of country, sector and/or industry, see the accompanying Statement of Investments. |

The Funds recognize transfers between levels as of the end of the period. For the period ended April 30, 2014, the Funds did not have any transfers between Level 1 and Level 2 securities. The Funds did not have any securities that used significant unobservable inputs (Level 3) in determining fair value.

Fund and Class Expenses: Some expenses of the Trust can be directly attributed to a Fund or a specific share class of a Fund. Expenses which cannot be directly attributed are apportioned among all Funds in the Trust based on average net assets of each share class within a Fund.

Federal Income Taxes: The Funds comply with the requirements under Subchapter M of the Internal Revenue Code of 1986 applicable to regulated investment companies and intend to distribute substantially all of their net taxable income and net capital gains, if any, each year. The Funds are not subject to income taxes to the extent such distributions are made.

As of and during the period ended April 30, 2014, the Funds did not have a liability for any unrecognized tax benefits. The Funds file U.S. federal, state, and local tax returns as required. The Funds’ tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return, but may extend to four years in certain jurisdictions. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Commodity-Linked Notes: The ALPS Real Asset Income Fund may invest in commodity-linked notes which are derivative instrument with characteristics of a debt security and of a commodity-linked derivative. A commodity-linked note typically provides for interest payments and a

29 | April 30, 2014

| Notes to Financial Statements |

||

| April 30, 2014 (Unaudited) |

principal payment at maturity linked to the price movement of the underlying commodity, commodity index or commodity futures or option contract. Commodity-linked notes may be principal protected, partially protected, or offer no principal protection. The value of these notes will rise and fall in response to changes in the underlying commodity or related index or investment. These notes are often leveraged, increasing the volatility of each note’s value relative to the change in the underlying linked index. Commodity index-linked investments may be more volatile and less liquid than the underlying index and their value may be affected by the performance of the commodities as well as other factors, including liquidity, quality, maturity and other economic variables. Commodity-linked notes are typically issued by a bank or other financial institution and are sometimes referred to as structured notes because the terms of the notes may be structured by the issuer and the purchaser of the notes to accommodate the specific investment requirements of the purchaser.

Investment Transactions and Investment Income: Investment transactions are accounted for on the date the investments are purchased or sold (trade date basis). Net realized gains and losses from investment transactions are reported on an identified cost basis. Interest income, which includes accretion of discounts and amortization of premiums, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to each Fund.

Foreign Securities: The Funds may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible reevaluation of currencies, the inability to repatriate foreign currency, less complete financial information about companies and possible future adverse political and economic developments.

Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. issuers.

Foreign Currency Translation: The books and records of the Funds are maintained in U.S. dollars. Investment valuations and other assets and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

Foreign Currency Spot Contracts: The Funds may enter into foreign currency spot contracts to facilitate transactions in foreign securities or to convert foreign currency receipts into U.S. dollars. A foreign currency spot contract is an agreement between two parties to buy and sell currencies at the current market rate, for settlement generally within two business days. The U.S. dollar value of the contracts is determined using current currency exchange rates supplied by a pricing service. The contract is marked-to-market daily for settlements beyond one day and any change in market value is recorded as an unrealized gain or loss. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value on the open and close date. Losses may arise from changes in the value of the foreign currency, or if the counterparties do not perform under the contract’s terms. The maximum potential loss from such contracts is the aggregate face value in U.S. dollars at the time the contract was opened.

Master Limited Partnerships: MLPs are publicly traded partnerships engaged in the transportation, storage and processing of minerals and natural resources. By confining their operations to these specific activities, their interests, or units, are able to trade on public securities exchanges exactly like the shares of a corporation, without entity level taxation. Of the seventy MLPs eligible for inclusion in the Index, approximately two-thirds trade on the NYSE and the rest trade on the NASDAQ. To qualify as a MLP and to not be taxed as a corporation, a partnership must receive at least 90% of its income from qualifying sources as set forth in Section 7704(d) of the Internal Revenue Code of 1986, as amended (the “Code”). These qualifying sources include natural resource based activities such as the processing, transportation and storage of mineral or natural resources. MLPs generally have two classes of owners, the general partner and limited partners. The general partner of an MLP is typically owned by a major energy company, an investment fund, the direct management of the MLP, or is an entity owned by one or more of such parties. The general partner may be structured as a private or publicly traded corporation or other entity. The general partner typically controls the operations and management of the MLP through an up to 2% equity interest in the MLP plus, in many cases, ownership of common units and subordinated units. Limited partners typically own the remainder of the partnership, through ownership of common units, and have a limited role in the partnership’s operations and management. MLPs are typically structured such that common units and general partner interests have first priority to receive quarterly cash distributions up to an established minimum amount (“minimum quarterly distributions” or “MQD”). Common and general partner interests also accrue arrearages in distributions to the extent the MQD is not paid. Once common and general partner interests have been paid, subordinated units receive distributions of up to the MQD; however, subordinated units do not accrue arrearages. Distributable cash in excess of the MQD is paid to both common and subordinated units and is distributed to both common and subordinated units generally on a pro rata basis. The general partner is also eligible to receive incentive distributions if the general partner operates the business in a manner which results in distributions paid per common unit surpassing specified target levels. As the general partner increases cash distributions to the limited partners, the general partner receives an increasingly higher percentage of the incremental cash distributions.

30 | April 30, 2014

| Notes to Financial Statements |

||

| April 30, 2014 (Unaudited) |

3. DERIVATIVE INSTRUMENTS

As a part of their investment strategy, ALPS Real Asset Income Fund and ALPS | Westport Resources Hedged High Income Fund are permitted to purchase investment securities and are also allowed to enter into various types of derivatives contracts. In doing so, the Funds will employ strategies in differing combinations to permit them to increase, decrease, or change the level or types of exposure to market factors. Central to those strategies are features inherent in derivatives that make them more attractive for this purpose than equity or debt securities; they require little or no initial cash investment, they can focus exposure on only certain selected risk factors, and they may not require the ultimate receipt or delivery of the underlying security (or securities) to the contract. This may allow the Funds to pursue their objectives more quickly and efficiently than if they were to make direct purchases or sales of securities capable of affecting a similar response to market factors.

Risk of Investing in Derivatives: The Funds’ use of derivatives can result in losses due to unanticipated changes in the market risk factors and the overall market. In instances where the Funds are using derivatives to decrease, or hedge, exposures to market risk factors for securities held by the Funds, there are also risks that those derivatives may not perform as expected resulting in losses for the combined or hedged positions.

Derivatives may have little or no initial cash investment relative to their market value exposure and therefore can produce significant gains or losses in excess of their cost. This use of embedded leverage allows a Fund to increase its market value exposure relative to its net assets and can substantially increase the volatility of the Funds’ performance.

Additional associated risks from investing in derivatives also exist and potentially could have significant effects on the valuation of the derivative and the Funds. Typically, the associated risks are not the risks that the Funds are attempting to increase or decrease exposure to, per their investment objectives, but are the additional risks from investing in derivatives.

Examples of these associated risks are liquidity risk, which is the risk that the Funds will not be able to sell or close out the derivative in a timely manner, and counterparty credit risk, which is the risk that the counterparty will not fulfill its obligation to the Funds. In addition, use of derivatives may increase or decrease exposure to the following risk factors:

Equity Risk: Equity risk relates to the change in value of equity securities as they relate to increases or decreases in the general market. Associated risks can be different for each type of derivative and are discussed by each derivative type in the notes that follow.

Commodity Risk: Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. Prices of various commodities may also be affected by factors, such as drought, floods, weather, livestock disease, embargoes, tariffs and other regulatory developments, which are unpredictable. The prices of commodities can also fluctuate widely due to supply and demand disruptions in major producing or consuming regions.

Foreign Currency Risk: Currency trading involves significant risks, including market risk, interest rate risk, country risk, counterparty credit risk and short sale risk. Market risk results from the price movement of foreign currency values in response to shifting market supply and demand. Interest rate risk arises whenever a country changes its stated interest rate target associated with its currency. Country risk arises because virtually every country has interfered with international transactions in its currency.

Interest Rate Risk: Interest rate risk is the risk that fixed income securities will decline in value because of changes in interest rates. As nominal interest rates rise, the value of fixed income securities held by the Fund are likely to decrease. Securities with longer durations tend to be more sensitive to changes in interest rates, and are usually more volatile than securities.

Futures: Certain Funds may invest in futures contracts in accordance with their investment objectives. Each Fund does so for a variety of reasons including for cash management, hedging or non-hedging purposes in an attempt to achieve investment returns consistent with the Fund’s investment objective. A futures contract provides for the future sale by one party and purchase by another party of a specified quantity of the security or other financial instrument at a specified price and time. A futures contract on an index is an agreement pursuant to which two parties agree to take or make delivery of an amount of cash equal to the difference between the value of the index at the close of the last trading day of the contract and the price at which the index contract was originally written. Futures transactions may result in losses in excess of the amount invested in the futures contract. There can be no guarantee that there will be a correlation between price movements in the hedging vehicle and in the portfolio securities being hedged. An incorrect correlation could result in a loss on both the hedged securities in a Fund and the hedging vehicle so that the portfolio return might have been greater had hedging not been attempted. There can be no assurance that a liquid market will exist at a time when a Fund seeks to close out a futures contract or a futures option position. Lack of a liquid market for any reason may prevent a Fund from liquidating an unfavorable position, and the Fund would remain obligated to meet margin requirements until the position is closed. In addition, a Fund could be exposed to risk if the counterparties to the contracts are unable to meet the terms of their contracts. With exchange traded futures, there is minimal counterparty credit risk to the Funds since futures are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default.

31 | April 30, 2014

| Notes to Financial Statements |

||

| April 30, 2014 (Unaudited) |

When a purchase or sale of a futures contract is made by a Fund, the Fund is required to deposit with its custodian (or broker, if legally permitted) a specified amount of liquid assets (“initial margin”). The margin required for a futures contract is set by the exchange on which the contract is traded and may be modified during the term of the contract. The initial margin is in the nature of a performance bond or good faith deposit on the futures contract that is returned to a Fund upon termination of the contract, assuming all contractual obligations have been satisfied. Each day a Fund may pay or receive cash, called “variation margin,” equal to the daily change in value of the futures contract. Such payments or receipts are recorded for financial statement purposes as unrealized gains or losses by a Fund. Variation margin does not represent a borrowing or loan by a Fund but is instead a settlement between a Fund and the broker of the amount one would owe the other if the futures contract expired. When the contract is closed, a Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. As of April 30, 2014, the ALPS | Westport Resources Hedged High Income Fund had futures contracts outstanding with a net unrealized appreciation of $2,451. The number of futures contracts held at April 30, 2014 is representative of futures contracts activity during the period ended April 30, 2014.

Option Contracts: Each Fund may enter into options transactions for hedging purposes and for non-hedging purposes such as seeking to enhance return. Each Fund may write covered put and call options on any stocks or stock indices, currencies traded on domestic and foreign securities exchanges, or futures contracts on stock indices, interest rates and currencies traded on domestic and, to the extent permitted by the CFTC, foreign exchanges. A call option on an asset written by a Fund obligates the Fund to sell the specified asset to the holder (purchaser) at a stated price (the exercise price) if the option is exercised before a specified date (the expiration date). A put option on an asset written by a Fund obligates the Fund to buy the specified asset from the purchaser at the exercise price if the option is exercised before the expiration date. Premiums received when writing options are recorded as liabilities and are subsequently adjusted to the current value of the options written. Premiums received from writing options that expire are treated as realized gains. Premiums received from writing options, which are either exercised or closed, are offset against the proceeds received or amount paid on the transaction to determine realized gains or losses.

The ALPS Real Asset Income Fund had the following transactions in written covered call/put options during the six months ended April 30, 2014:

| Number of Contracts | Premiums | |||||

|

|

||||||

| Options Outstanding, at the beginning of the period |

– | $ | – | |||

| Options written |

(31) | 2,059 | ||||

| Options closed |

13 | (845) | ||||

| Options exercised |

2 | (277) | ||||

| Options expired |

15 | (825) | ||||

|

|

||||||

| Options Outstanding, at April 30, 2014 |

(1) | $ | 112 | |||

|

|

||||||

Derivative Instruments: The following tables disclose the amounts related to each Fund’s use of derivative instruments.

The effect of derivative instruments on the Statement of Assets and Liabilities as of April 30, 2014:

| Risk Exposure | Asset Location | Fair Value | Liability Location | Fair Value | ||||||||

|

|

||||||||||||

| ALPS Real Asset Income Fund |

||||||||||||

| Equity Contracts (Written Options) |

N/A | N/A | Written options, at value | $ | 27 | |||||||

|

|

||||||||||||

| Total |

N/A | $ | 27 | |||||||||

|

|

||||||||||||

| ALPS | Westport Resources Hedged High Income Fund | ||||||||||||

| Futures Contracts* |

Receivable for variation margin | $ | 6,460 | Payable for variation margin |

$ | 4,009 | ||||||

|

|

||||||||||||

| Total |

$ | 6,460 | $ | 4,009 | ||||||||

|

|

||||||||||||

| * Risk Exposure to Fund | ||||||||||||

| Fixed Income Contracts | $ | 6,460 | $ | 4,009 | ||||||||

|

|

|

|||||||||||

| $ | 6,460 | $ | 4,009 | |||||||||

|

|

|

|||||||||||

32 | April 30, 2014

| Notes to Financial Statements |

||

| April 30, 2014 (Unaudited) |

The effect of derivative instruments on the Statement of Operations for the period ended April 30, 2014:

| Risk Exposure | Statement of Operations Location | Realized Gain/(Loss) Recognized in Income |

Change in Unrealized Gain/(Loss) on Derivatives Recognized in Income |

|||||||

| ALPS Real Asset Income Fund |

||||||||||

| Equity Contracts |

Net realized gain on written options/Net change in unrealized appreciation on written options |