UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(exact name of Registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

David T. Buhler, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2013 - October 31, 2013

Item 1. Reports to Stockholders.

|

| ||

|

| ||

|

| ||

| Table of Contents October 31, 2013 |

| Disclosure of Fund Expenses | 1 | |||||||

| ALPS | Alerian MLP Infrastructure Index Fund | ||||||||

| 5 | ||||||||

| 6 | ||||||||

| 8 | ||||||||

| 9 | ||||||||

| 10 | ||||||||

| 11 | ||||||||

| 12 | ||||||||

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||||||||

| 15 | ||||||||

| 17 | ||||||||

| 19 | ||||||||

| 25 | ||||||||

| 26 | ||||||||

| 27 | ||||||||

| 28 | ||||||||

| ALPS | Kotak India Growth Fund | ||||||||

| 31 | ||||||||

| 34 | ||||||||

| 36 | ||||||||

| 38 | ||||||||

| 39 | ||||||||

| 40 | ||||||||

| 41 | ||||||||

| ALPS | Red Rocks Listed Private Equity Fund | ||||||||

| 44 | ||||||||

| 45 | ||||||||

| 47 | ||||||||

| 49 | ||||||||

| 50 | ||||||||

| 51 | ||||||||

| 52 | ||||||||

| ALPS | WMC Disciplined Value Fund | ||||||||

| 56 | ||||||||

| 57 | ||||||||

| 59 | ||||||||

| 62 | ||||||||

| 63 | ||||||||

| 64 | ||||||||

| 65 | ||||||||

| Clough China Fund | ||||||||

| 68 | ||||||||

| 70 | ||||||||

| 72 | ||||||||

| 75 | ||||||||

| 76 | ||||||||

| 77 | ||||||||

| 78 | ||||||||

| RiverFront Global Allocation Series | ||||||||

| 81 | ||||||||

| 83 | ||||||||

| 93 | ||||||||

| 103 | ||||||||

| 105 | ||||||||

| 106 | ||||||||

| 111 | ||||||||

| Notes to Financial Statements | 128 | |||||||

| Additional Information | 153 | |||||||

| October 31, 2013 (Unaudited) | ||

As a shareholder of the Funds, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2013 and held until October 31, 2013.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees, or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| 1 | October 31, 2013 |

| Disclosure of Fund Expenses | ||

| October 31, 2013 (Unaudited) | ||

| Beginning Account Value May 1, 2013 |

Ending Account Value October 31, 2013 |

Expense Ratio(a) |

Expense Paid During Period May 1, 2013 - October 31, 2013(b) | |||||

| ALPS | Alerian MLP Infrastructure Index Fund | ||||||||

| Class A | ||||||||

| Actual |

$ 1,000.00 | $ 1,032.40 | 1.25% | $ 6.40 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,018.90 | 1.25% | $ 6.36 | ||||

| Class C | ||||||||

| Actual |

$ 1,000.00 | $ 1,029.70 | 1.85% | $ 9.46 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,015.88 | 1.85% | $ 9.40 | ||||

| Class I | ||||||||

| Actual |

$ 1,000.00 | $ 1,033.30 | 0.85% | $ 4.36 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,020.92 | 0.85% | $ 4.33 | ||||

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund(c) | ||||||||

| Class A | ||||||||

| Actual |

$ 1,000.00 | $ 974.00 | 1.45% | $ 7.21 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,017.90 | 1.45% | $ 7.38 | ||||

| Class C | ||||||||

| Actual |

$ 1,000.00 | $ 970.90 | 2.05% | $ 10.18 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,014.87 | 2.05% | $ 10.41 | ||||

| Class I | ||||||||

| Actual |

$ 1,000.00 | $ 974.90 | 1.15% | $ 5.72 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,019.41 | 1.15% | $ 5.85 | ||||

| ALPS | Kotak India Growth Fund(d) | ||||||||

| Class A | ||||||||

| Actual |

$ 1,000.00 | $ 932.40 | 2.00% | $ 9.74 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,015.12 | 2.00% | $ 10.16 | ||||

| Class C | ||||||||

| Actual |

$ 1,000.00 | $ 929.30 | 2.60% | $ 12.64 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,012.10 | 2.60% | $ 13.19 | ||||

| Class I | ||||||||

| Actual |

$ 1,000.00 | $ 933.00 | 1.60% | $ 7.80 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,017.14 | 1.60% | $ 8.13 | ||||

| ALPS | Red Rocks Listed Private Equity Fund | ||||||||

| Class A | ||||||||

| Actual |

$ 1,000.00 | $ 1,137.20 | 1.65% | $ 8.89 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,016.89 | 1.65% | $ 8.39 | ||||

| Class C | ||||||||

| Actual |

$ 1,000.00 | $ 1,133.40 | 2.25% | $ 12.10 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,013.86 | 2.25% | $ 11.42 | ||||

| Class I | ||||||||

| Actual |

$ 1,000.00 | $ 1,139.80 | 1.25% | $ 6.74 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,018.90 | 1.25% | $ 6.36 | ||||

| Class R | ||||||||

| Actual |

$ 1,000.00 | $ 1,136.80 | 1.75% | $ 9.43 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,016.38 | 1.75% | $ 8.89 | ||||

| 2 | October 31, 2013 |

| Disclosure of Fund Expenses | ||

| October 31, 2013 (Unaudited) | ||

| Beginning Account Value May 1, 2013 |

Ending Account Value October 31, 2013 |

Expense Ratio(a) |

Expense Paid During Period May 1, 2013 - October 31, 2013(b) | |||||

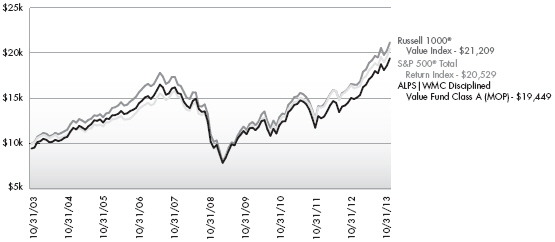

| ALPS | WMC Disciplined Value Fund |

||||||||

| Class A |

||||||||

| Actual |

$ 1,000.00 | $ 1,114.90 | 1.40% | $ 7.46 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,018.15 | 1.40% | $ 7.12 | ||||

| Class C |

||||||||

| Actual |

$ 1,000.00 | $ 1,111.80 | 2.15% | $ 11.44 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,014.37 | 2.15% | $ 10.92 | ||||

| Class I |

||||||||

| Actual |

$ 1,000.00 | $ 1,116.80 | 1.15% | $ 6.14 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,019.41 | 1.15% | $ 5.85 | ||||

| Clough China Fund | ||||||||

| Class A |

||||||||

| Actual |

$ 1,000.00 | $ 1,043.80 | 1.95% | $ 10.05 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,015.38 | 1.95% | $ 9.91 | ||||

| Class C |

||||||||

| Actual |

$ 1,000.00 | $ 1,040.10 | 2.70% | $ 13.88 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,011.59 | 2.70% | $ 13.69 | ||||

| Class I |

||||||||

| Actual |

$ 1,000.00 | $ 1,045.80 | 1.70% | $ 8.77 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,016.64 | 1.70% | $ 8.64 | ||||

| RiverFront Conservative Income Builder Fund | ||||||||

| Class A |

||||||||

| Actual |

$ 1,000.00 | $ 1,031.60 | 1.15% | $ 5.89 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,019.41 | 1.15% | $ 5.85 | ||||

| Class C |

||||||||

| Actual |

$ 1,000.00 | $ 1,027.00 | 1.90% | $ 9.71 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,015.63 | 1.90% | $ 9.65 | ||||

| Class I |

||||||||

| Actual |

$ 1,000.00 | $ 1,031.90 | 0.90% | $ 4.61 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,020.67 | 0.90% | $ 4.58 | ||||

| RiverFront Dynamic Equity Income Fund | ||||||||

| Class A |

||||||||

| Actual |

$ 1,000.00 | $ 1,063.30 | 1.15% | $ 5.98 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,019.41 | 1.15% | $ 5.85 | ||||

| Class C |

||||||||

| Actual |

$ 1,000.00 | $ 1,060.50 | 1.90% | $ 9.87 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,015.63 | 1.90% | $ 9.65 | ||||

| Class I |

||||||||

| Actual |

$ 1,000.00 | $ 1,066.00 | 0.90% | $ 4.69 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,020.67 | 0.90% | $ 4.58 | ||||

| RiverFront Global Allocation Fund | ||||||||

| Class A |

||||||||

| Actual |

$ 1,000.00 | $ 1,081.30 | 1.15% | $ 6.03 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,019.41 | 1.15% | $ 5.85 | ||||

| Class C |

||||||||

| Actual |

$ 1,000.00 | $ 1,077.70 | 1.90% | $ 9.95 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,015.63 | 1.90% | $ 9.65 | ||||

| Class I |

||||||||

| Actual |

$ 1,000.00 | $ 1,082.80 | 0.90% | $ 4.72 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,020.67 | 0.90% | $ 4.58 | ||||

| 3 | October 31, 2013 |

| Disclosure of Fund Expenses | ||

| October 31, 2013 (Unaudited) | ||

| Beginning Account Value May 1, 2013 |

Ending Account Value October 31, 2013 |

Expense Ratio(a) |

Expense Paid During Period May 1, 2013 - October 31, 2013(b) | |||||

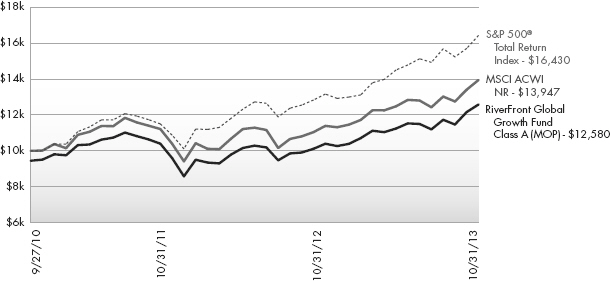

| RiverFront Global Growth Fund | ||||||||

| Class A | ||||||||

| Actual |

$ 1,000.00 | $ 1,091.30 | 1.15% | $ 6.06 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,019.41 | 1.15% | $ 5.85 | ||||

| Class C | ||||||||

| Actual |

$ 1,000.00 | $ 1,088.10 | 1.90% | $ 10.00 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,015.63 | 1.90% | $ 9.65 | ||||

| Class I | ||||||||

| Actual |

$ 1,000.00 | $ 1,093.20 | 0.90% | $ 4.75 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,020.67 | 0.90% | $ 4.58 | ||||

| Class L | ||||||||

| Actual |

$ 1,000.00 | $ 1,093.30 | 0.90% | $ 4.75 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,020.67 | 0.90% | $ 4.58 | ||||

| Investor Class | ||||||||

| Actual |

$ 1,000.00 | $ 1,091.80 | 1.15% | $ 6.06 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,019.41 | 1.15% | $ 5.85 | ||||

| RiverFront Moderate Growth & Income Fund | ||||||||

| Class A | ||||||||

| Actual |

$ 1,000.00 | $ 1,046.20 | 1.15% | $ 5.93 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,019.41 | 1.15% | $ 5.85 | ||||

| Class C | ||||||||

| Actual |

$ 1,000.00 | $ 1,042.30 | 1.90% | $ 9.78 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,015.63 | 1.90% | $ 9.65 | ||||

| Class I | ||||||||

| Actual |

$ 1,000.00 | $ 1,047.20 | 0.90% | $ 4.64 | ||||

| Hypothetical (5% return before expenses) |

$ 1,000.00 | $ 1,020.67 | 0.90% | $ 4.58 | ||||

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 365. |

| (c) | Includes expenses of the CoreCommodity Management Cayman Commodity Fund Ltd. (wholly-owned subsidiary), exclusive of the subsidiary’s management fee. |

| (d) | Includes expenses of the Kotak Mauritius Portfolio (wholly-owned subsidiary), exclusive of subsidiary’s management fee. |

| 4 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund

| ||

| October 31, 2013 (Unaudited) | ||

Performance

During the six month period of May 1, 2013 to October 31, 2013, the Alerian MLP Infrastructure Index Fund’s Class A Shares delivered a net return of 3.24% at Net Asset Value (Class A delivered a net return of -2.47% at MOP1 , Class C was 1.97% with CDSC, and Class I was 3.33%).

Performance of the Fund’s MLP holdings during this period was impacted both by the Federal Reserve’s May announcement to taper its bond buying program as well as uncertainty in the months following as to when tapering would actually begin. Expectations for rising rates disproportionately impacted income-oriented equities such as MLPs, REITs and utilities during this period. However, the distribution growth element of the Fund’s MLP holdings as well as investors becoming more comfortable with valuations mitigated most of the impact. To that point, the Fund’s two distributions during this period—payable May 14, 2013 and August 14, 2013—represented a 1.4% and 1.8% increase from the previous quarter.

In 2013, MLPs announced and put into service several infrastructure assets addressing takeaway needs from various areas experiencing dramatic production growth. In the Marcellus Shale in the Northeast, natural gas pipelines were expanded, connecting lines were built to larger trunklines, and a handful of pipelines transporting natural gas liquids are either under construction or being proposed. In the Bakken Shale in North Dakota, MLPs are at the forefront of the crude-by-rail trend, constructing loading and unloading terminals along major rail lines. Moving crude via rail has allowed producers the flexibility to ship Bakken crude to favorably priced markets across the US including California, the Midwest, and the Gulf Coast.

Further down south in Mont Belvieu, Texas, many MLPs continue to build out fractionation plants and expand pipelines that carry natural gas liquids to petrochemical plants along the Gulf Coast. In addition, MLPs have emerged as the leading operators of liquefied petroleum gas (LPG) export facilities along the Gulf Coast. The oversupply of natural gas liquids domestically plus an increased demand for propane and butane in emerging countries overseas has created favorable opportunities for MLPs to expand and built out additional export docks and ancillary facilities.

We believe an energy revolution is taking place in the United States through directional drilling and hydraulic fracturing, and recoverable oil and gas reserves are at levels not seen in decades. Industry executives and analysts estimate that the US will be net energy independent sometime in the next 10 years. The MLP-owned energy infrastructure assets, including pipelines, storage tanks, and processing plants, are the means by which the reserves and production in supply basins make their way to demand centers.

With toll-road business models anchored by inflation-indexed tariff increases and billions of dollars of infrastructure opportunities over the next few decades, MLPs continue, in our view, to represent a compelling investment opportunity for investors seeking after-tax yield.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. Alerian does not accept any liability for losses either direct or consequential caused by the use of this information.

| 1 | Maximum Offering Price (MOP) includes sales charge. |

| 5 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund

| ||

| October 31, 2013 (Unaudited) | ||

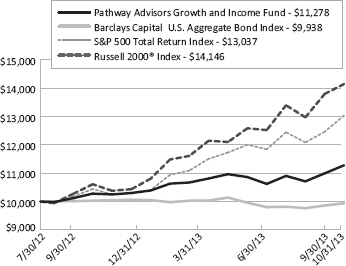

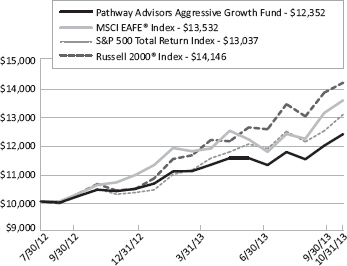

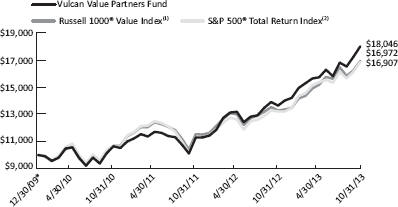

Performance of $10,000 Initial Investment (as of October 31, 2013)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of October 31, 2013)

| Since Inception ^ | Total Expense Ratio * | What You Pay ** | ||||

| Class A (NAV)1 |

16.33% | 1.49% | 1.25% | |||

| Class A (MOP)2 |

9.96% | |||||

| Class C (NAV)1 |

15.92% | 2.09% | 1.85% | |||

| Class C (CDSC)2 |

14.92% | |||||

| Class I |

16.54% | 1.09% | 0.85% | |||

| Alerian MLP Infrastructure Index3 |

27.54% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million. Performance shown does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data please call 1-866-759-5679.

Investments in securities of MLPs involve risks that differ from an investment in common stock. MLPs are controlled by their general partners, which generally have conflicts of interest and limited fiduciary duties to the MLP, which may permit the general partner to favor its own interests over the MLPs. The benefit you are expected to derive from the Fund’s investment in MLPs depends largely on the MLPs being treated as partnerships for federal income tax purposes. As a partnership, an MLP has no federal income tax liability at the entity level. Therefore, treatment of one or more MLPs as a corporation for federal income tax purposes could affect the Fund’s ability to meet its investment objective and would reduce the amount of cash available to pay or distribute to you. Legislative, judicial, or administrative changes and differing interpretations, possibly on a retroactive basis, could negatively impact the value of an investment in MLPs and therefore the value of your investment in the Fund.

| 6 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund

| ||

| Performance Update |

October 31, 2013 (Unaudited) | |

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | Alerian MLP Infrastructure Index is comprised of 25 midstream energy Master Limited Partnerships. The index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund inception date of December 31, 2012. The Fund commenced operations on January 2, 2013. |

| * | Excludes current and deferred income tax expense. |

| ** | What You Pay reflects the Advisor’s and Sub-Advisor’s decision to contractually limit expenses through August 31, 2014. Please see the prospectus for additional information. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

This Fund is not suitable for all investors and is subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Mutual funds are not insured or guaranteed by the FDIC or by any other government agency or government sponsored agency of the federal government or any state, not deposits, obligations or guaranteed by any bank or its affiliates and are subject to investment risks, including possible loss of the principal amount invested.

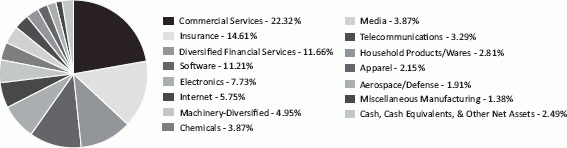

| Top Ten Long Holdings (as a % of Net Assets) †

|

|

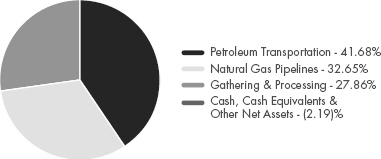

Industry Sector Allocation (as a % of Net Assets)

| ||||||

| Enterprise Products Partners LP |

9.98 | % |

| |||||

| Kinder Morgan Energy Partners LP |

9.31 | % | ||||||

| Magellan Midstream Partners LP |

7.70 | % | ||||||

| MarkWest Energy Partners LP |

7.24 | % | ||||||

| Energy Transfer Partners LP |

7.11 | % | ||||||

| Plains All American Pipeline LP |

6.92 | % | ||||||

| ONEOK Partners LP |

4.87 | % | ||||||

| Williams Partners LP |

4.82 | % | ||||||

| Buckeye Partners LP |

4.60 | % | ||||||

| Enbridge Energy Partners LP |

4.33 | % | ||||||

| Top Ten Holdings |

66.88 | % | ||||||

|

† Holdings are subject to change. Table presents indicative values only. |

|

|||||||

| 7 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund

| ||

| October 31, 2013 (Unaudited) | ||

| 8 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund | ||

| October 31, 2013 (Unaudited) | ||

| ASSETS |

||||

| Investments, at value |

$ | 11,911,475 | ||

| Dividends receivable |

82,133 | |||

| Receivable due from advisor |

15,803 | |||

| Prepaid offering costs |

11,397 | |||

| Prepaid expenses and other assets |

32,004 | |||

|

|

||||

| Total Assets |

12,052,812 | |||

|

|

||||

| LIABILITIES |

||||

| Payable for investments purchased |

445,941 | |||

| Deferred tax liability |

373,238 | |||

| Current tax payable |

10,182 | |||

| Administration and transfer agency fees payable |

1,206 | |||

| Distribution and services fees payable |

4,250 | |||

| Trustees’ fees and expenses payable |

85 | |||

| Legal fees payable |

63 | |||

| Audit and tax fees payable |

954 | |||

| Accrued expenses and other liabilities |

7,501 | |||

|

|

||||

| Total Liabilities |

843,420 | |||

|

|

||||

| NET ASSETS |

$ | 11,209,392 | ||

|

|

||||

| NET ASSETS CONSIST OF |

||||

| Paid-in capital |

$ | 10,558,970 | ||

| Accumulated net investment loss, net of deferred income taxes |

(31,390) | |||

| Accumulated net realized loss on investments, net of deferred income taxes |

(26,713) | |||

| Net unrealized appreciation on investments, net of deferred income taxes |

708,525 | |||

|

|

||||

| NET ASSETS |

$ | 11,209,392 | ||

|

|

||||

| INVESTMENTS, AT COST |

$ | 10,797,151 | ||

|

|

||||

| PRICING OF SHARES |

||||

| Class A: |

||||

| Net Asset Value, offering and redemption price per share(a) |

$ | 11.12 | ||

| Net Assets |

$ | 6,994,470 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

629,049 | |||

| Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) |

$ | 11.77 | ||

| Class C: |

||||

| Net Asset Value, offering and redemption price per share(a) |

$ | 11.08 | ||

| Net Assets |

$ | 1,650,844 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

149,001 | |||

| Class I: |

||||

| Net Asset Value, offering and redemption price per share |

$ | 11.14 | ||

| Net Assets |

$ | 2,564,078 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

230,206 | |||

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund’s Prospectus. |

| See Notes to Financial Statements. |

| 9 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund | ||

| For the Six Months Ended October 31, 2013 (Unaudited) | ||

| INVESTMENT INCOME |

||||

| Distributions from master limited partnerships |

181,312 | |||

| Less return of capital distributions |

(181,312) | |||

|

|

||||

| Total Investment Income |

– | |||

|

|

||||

| EXPENSES |

||||

| Investment advisory fees |

22,245 | |||

| Administrative and transfer agency fees |

4,129 | |||

| Distribution and service fees |

||||

| Class A |

6,417 | |||

| Class C |

3,950 | |||

| Legal fees |

16 | |||

| Audit and tax fees |

23,462 | |||

| Reports to shareholders and printing fees |

706 | |||

| State registration fees |

4,294 | |||

| SEC registration fees |

690 | |||

| Custody fees |

6,270 | |||

| Trustees’ fees and expenses |

122 | |||

| Offering costs |

34,620 | |||

| Miscellaneous expenses |

4,612 | |||

|

|

||||

| Total Expenses |

111,533 | |||

| Less fees waived/reimbursed by investment advisor (Note 7) |

||||

| Class A |

(34,955) | |||

| Class C |

(9,835) | |||

| Class I |

(29,365) | |||

|

|

||||

| Net Expenses |

37,378 | |||

|

|

||||

| Net Investment Loss, Before Deferred Income Taxes |

(37,378) | |||

| Deferred income tax benefit |

13,614 | |||

|

|

||||

| Net Investment Loss, Net of Deferred Income Taxes |

(23,764) | |||

|

|

||||

| REALIZED AND UNREALIZED GAIN/(LOSS) |

||||

| Net realized loss on investments, before deferred income taxes |

(10,884) | |||

| Current income tax expense |

(10,182) | |||

| Deferred income tax benefit |

14,146 | |||

|

|

||||

| Net Realized Loss on investments, Net of Deferred Income Taxes |

(6,920) | |||

|

|

||||

| Net change in unrealized appreciation on investment, before deferred income taxes |

480,401 | |||

| Deferred income tax expense |

(175,051) | |||

|

|

||||

| Net Change in Unrealized Appreciation on Investments |

305,350 | |||

|

|

||||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS, NET OF DEFERRED INCOME TAXES |

298,430 | |||

|

|

||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 274,666 | ||

|

|

||||

| See Notes to Financial Statements. |

| 10 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund | ||

| For the Six MonthsEnded October 31, 2013 (Unaudited) |

For the Period January 2, 2013 (Commencement) to April 30, 2013 |

|||||||

|

|

||||||||

| OPERATIONS |

||||||||

| Net investment loss, net of deferred income taxes |

(23,764) | (7,626) | ||||||

| Net realized loss on investments, net of deferred income taxes |

(6,920) | (764) | ||||||

| Net change in unrealized appreciation on investments, net of deferred income taxes |

305,350 | 403,175 | ||||||

|

|

||||||||

| Net Increase in Net Assets Resulting from Operations |

274,666 | 394,785 | ||||||

|

|

||||||||

| DISTRIBUTIONS |

||||||||

| Dividends to shareholders from net realized gains |

||||||||

| Class A |

(5,165) | – | ||||||

| Class C |

(2,812) | – | ||||||

| Class I |

(11,052) | – | ||||||

| Dividends to shareholders from tax return of capital |

||||||||

| Class A |

(26,670) | (8,653) | ||||||

| Class C |

(14,520) | (8,137) | ||||||

| Class I |

(57,063) | (32,548) | ||||||

|

|

||||||||

| Net Decrease in Net Assets from Distributions |

(117,282) | (49,338) | ||||||

|

|

||||||||

| BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) |

||||||||

| Shares sold |

||||||||

| Class A |

6,409,506 | 851,295 | ||||||

| Class C |

1,050,687 | 500,010 | ||||||

| Class I |

230,232 | 2,000,010 | ||||||

| Dividends reinvested |

||||||||

| Class A |

27,042 | 8,653 | ||||||

| Class C |

17,181 | 8,137 | ||||||

| Class I |

68,115 | 32,548 | ||||||

| Shares redeemed |

||||||||

| Class A |

(496,825) | (10) | ||||||

| Class C |

– | (10) | ||||||

| Class I |

– | (10) | ||||||

|

|

||||||||

| Net Increase in Net Assets Derived from Beneficial Interest Transactions |

7,305,938 | 3,400,623 | ||||||

|

|

||||||||

| Net increase in net assets |

7,463,322 | 3,746,070 | ||||||

| NET ASSETS |

||||||||

| Beginning of period |

3,746,070 | – | ||||||

|

|

||||||||

| End of period * |

$ | 11,209,392 | $ | 3,746,070 | ||||

|

|

||||||||

| *Including accumulated net investment loss, net of Deferred Income Taxes, of: |

$ | (31,390) | $ | (7,626) | ||||

| See Notes to Financial Statements. |

| 11 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund – Class A | ||

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Six Months Ended October 31,

2013 |

For the Period January 2, 2013 April 30, 2013 | |||

|

| ||||

| Net asset value, beginning of period |

$11.10 | $10.00 | ||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||

| Net investment loss(a) |

(0.05) | (0.03) | ||

| Net realized and unrealized gain |

0.40 | 1.29 | ||

|

| ||||

| Total from investment operations |

0.35 | 1.26 | ||

|

| ||||

| DISTRIBUTIONS: |

||||

| From net realized gains |

(0.05) | – | ||

| From tax return of capital |

(0.28) | (0.16) | ||

|

| ||||

| Total distributions |

(0.33) | (0.16) | ||

|

| ||||

| Net increase in net asset value |

0.02 | 1.10 | ||

|

| ||||

| Net asset value, end of period |

$11.12 | $11.10 | ||

|

| ||||

| TOTAL RETURN(b) |

3.24% | 12.68% | ||

| RATIOS/SUPPLEMENTAL DATA: |

||||

| Net assets, end of period (000s) |

$6,994 | $928 | ||

| Ratio of expenses to average net assets before waivers and income tax expense |

3.43%(c)(d) | 5.51%(c)(d) | ||

| Ratio of expense waivers to average net assets |

(2.18%)(c)(d) | (4.26%)(c)(d) | ||

|

| ||||

| Ratio of expenses to average net assets net of waivers and before income tax expense |

1.25%(c)(d) | 1.25%(c)(d) | ||

| Ratio of deferred income tax expense to average net assets(e) |

4.96%(c) | 20.55%(c) | ||

|

| ||||

| Ratio of total expenses to average net assets |

6.21%(c) | 21.80%(c) | ||

|

| ||||

| Ratio of investment loss to average net assets before waivers and income tax expense |

(3.43%)(c)(d) | (5.51%)(c)(d) | ||

| Ratio of expense waivers to average net assets |

(2.18%)(c)(d) | (4.26%)(c)(d) | ||

|

| ||||

| Ratio of investment loss to average net assets net of waivers and before income tax expense |

(1.25%)(c)(d) | (1.25%)(c)(d) | ||

| Ratio of deferred income tax benefit to average net assets(f) |

0.42%(c) | 0.40%(c) | ||

|

| ||||

| Ratio of net investment loss to average net assets |

(0.83%)(c) | (0.85%)(c) | ||

|

| ||||

| Portfolio turnover rate(g) |

7% | 3% | ||

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (c) | Annualized. |

| (d) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Deferred income tax expense estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

| (f) | Deferred income tax benefit for the ratio calculation is derived from net investment loss only. |

| (g) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| See Notes to Financial Statements. |

| 12 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund – Class C | ||

| Financial Highlights |

||

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Six Months Ended |

For the Period January 2, 2013 (Commencement) to April 30, 2013 | |||

|

| ||||

| Net asset value, beginning of period |

$11.09 | $10.00 | ||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||

| Net investment loss(a) |

(0.08) | (0.05) | ||

| Net realized and unrealized gain |

0.40 | 1.30 | ||

|

| ||||

| Total from investment operations |

0.32 | 1.25 | ||

|

| ||||

| DISTRIBUTIONS: |

||||

| From net realized gains |

(0.05) | – | ||

| From tax return of capital |

(0.28) | (0.16) | ||

|

| ||||

| Total distributions |

(0.33) | (0.16) | ||

|

| ||||

| Net increase/(decrease) in net asset value |

(0.01) | 1.09 | ||

|

| ||||

| Net asset value, end of period |

$11.08 | $11.09 | ||

|

| ||||

| TOTAL RETURN(b) |

2.97% | 12.58% | ||

| RATIOS/SUPPLEMENTAL DATA: |

||||

| Net assets, end of period (000s) |

$1,651 | $563 | ||

| Ratio of expenses to average net assets before waivers and income tax expense |

4.34%(c)(d) | 7.01%(c)(d) | ||

| Ratio of expense waivers to average net assets |

(2.49%)(c)(d) | (5.16%)(c)(d) | ||

|

| ||||

| Ratio of expenses to average net assets net of waivers and before income tax expense |

1.85%(c)(d) | 1.85%(c)(d) | ||

| Ratio of deferred income tax expense to average net assets(e) |

4.96%(c) | 20.55%(c) | ||

|

| ||||

| Ratio of total expenses to average net assets |

6.81%(c) | 22.40%(c) | ||

|

| ||||

| Ratio of investment loss to average net assets before waivers and income tax expense |

(4.34%)(c)(d) | (7.01%)(c)(d) | ||

| Ratio of expense waivers to average net assets |

(2.49%)(c)(d) | (5.16%)(c)(d) | ||

|

| ||||

| Ratio of investment loss to average net assets net of waivers and before income tax expense |

(1.85%)(c)(d) | (1.85%)(c)(d) | ||

| Ratio of deferred income tax benefit to average net assets(f) |

0.42%(c) | 0.40%(c) | ||

|

| ||||

| Ratio of net investment loss to average net assets |

(1.43%)(c) | (1.45%)(c) | ||

|

| ||||

| Portfolio turnover rate(g) |

7% | 3% | ||

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (c) | Annualized. |

| (d) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Deferred income tax expense estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

| (f) | Deferred income tax benefit for the ratio calculation is derived from net investment loss only. |

| (g) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| See Notes to Financial Statements. |

| 13 | October 31, 2013 |

| ALPS | Alerian MLP Infrastructure Index Fund – Class I | ||

| Financial Highlights |

||

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Six Months Ended October 31, 2013 (Unaudited) |

For the Period January 2, 2013 (Commencement) to April 30, 2013 | |||

|

| ||||

| Net asset value, beginning of period |

$11.11 | $10.00 | ||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||

| Net investment loss(a) |

(0.02) | (0.02) | ||

| Net realized and unrealized gain |

0.38 | 1.29 | ||

|

| ||||

| Total from investment operations |

0.36 | 1.27 | ||

|

| ||||

| DISTRIBUTIONS: |

||||

| From net realized gains |

(0.05) | – | ||

| From tax return of capital |

(0.28) | (0.16) | ||

|

| ||||

| Total distributions |

(0.33) | (0.16) | ||

|

| ||||

| Net increase in net asset value |

0.03 | 1.11 | ||

|

| ||||

| Net asset value, end of period |

$11.14 | $11.11 | ||

|

| ||||

| TOTAL RETURN(b) |

3.33% | 12.78% | ||

| RATIOS/SUPPLEMENTAL DATA: |

||||

| Net assets, end of period (000s) |

$2,564 | $2,256 | ||

| Ratio of expenses to average net assets before waivers and income tax expense |

3.34%(c)(d) | 6.01%(c)(d) | ||

| Ratio of expense waivers to average net assets |

(2.49%)(c)(d) | (5.16%)(c)(d) | ||

|

| ||||

| Ratio of expenses to average net assets net of waivers and before income tax expense |

0.85%(c)(d) | 0.85%(c)(d) | ||

| Ratio of deferred income tax expense to average net assets(e) |

4.96%(c) | 20.55%(c) | ||

|

| ||||

| Ratio of total expenses to average net assets |

5.81%(c) | 21.40%(c) | ||

|

| ||||

| Ratio of investment loss to average net assets before waivers and income tax expense |

(3.34%)(c)(d) | (6.01%)(c)(d) | ||

| Ratio of expense waivers to average net assets |

(2.49%)(c)(d) | (5.16%)(c)(d) | ||

|

| ||||

| Ratio of investment loss to average net assets net of waivers and before income tax expense |

(0.85%)(c)(d) | (0.85%)(c)(d) | ||

| Ratio of deferred income tax benefit to average net assets(f) |

0.42%(c) | 0.40%(c) | ||

|

| ||||

| Ratio of net investment loss to average net assets |

(0.43%)(c) | (0.45%)(c) | ||

|

| ||||

| Portfolio turnover rate(g) |

7% | 3% | ||

| (a) | Calculated using the average shares method. |

| (b) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (c) | Annualized. |

| (d) | Expense ratios before reductions for startup periods may not be representative of longer term operating periods. |

| (e) | Deferred income tax expense estimate for the ratio calculation is derived from the net investment loss, and realized and unrealized gains/losses. |

| (f) | Deferred income tax benefit for the ratio calculation is derived from net investment loss only. |

| (g) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| See Notes to Financial Statements. |

| 14 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| October 31, 2013 (Unaudited) | ||

| 15 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| Management Commentary |

October 31, 2013 (Unaudited) | |

| 16 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| October 31, 2013 (Unaudited) | ||

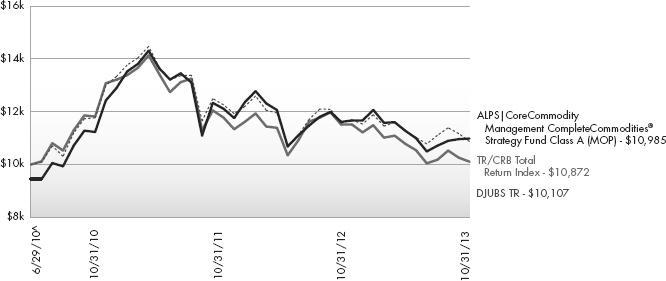

Performance of $10,000 Initial Investment (as of October 31, 2013)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of October 31, 2013)

| 1 Year | 3 Years | Since Inception ^ | Total Expense Ratio | What You Pay * | ||||||

| Class A (NAV)1 |

-5.42% | -0.89% | 4.61% | 1.55% | 1.46% | |||||

| Class A (MOP)2 |

-10.66% | -2.72% | 2.85% | |||||||

| Class C (NAV)1 |

-6.02% | -1.54% | 4.02% | 2.15% | 2.06% | |||||

|

Class C (CDSC)2 |

-6.95% | -1.54% | 4.02% | |||||||

|

Class I |

-5.17% | -0.65% | 4.91% | 1.17% | 1.16% | |||||

|

TR/CRB Total Return Index3 |

-6.02% | -2.52% | 2.53% | |||||||

|

DJUBS Commodity TR3 |

-12.22% | -5.19% | 0.32% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call 1-866-759-5679.

| 17 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| Performance Update |

October 31, 2013 (Unaudited) | |

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | Thomson Reuters / CRB Index and the Dow Jones-UBS Commodity Index are unmanaged indices used as a measurement of change in commodity market conditions based on the performance of a basket of different commodities. The indices are not actively managed and do not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund inception date of June 29, 2010. |

| * | What You Pay reflects the Sub-Advisor’s decision to contractually limit expenses through August 31, 2014. Please see the prospectus for additional information. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Mutual funds are not insured or guaranteed by the FDIC or by any other government agency or government sponsored agency of the federal government or any state, not deposits, obligations or guaranteed by any bank or its affiliates and are subject to investment risks, including possible loss of the principal amount invested.

This Fund is not suitable for all investors, and is subject to investment risks, including possible loss of the principal amount invested.

Investing in commodity-related securities involves risk and considerations not present when investing in more conventional securities. The Fund may be more susceptible to high volatility of commodity markets.

Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment.

| 18 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

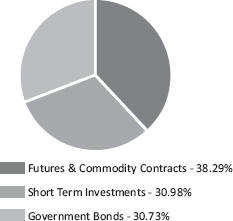

| October 31, 2013 (Unaudited) | ||

| 19 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| Consolidated Statement of Investments |

October 31, 2013 (Unaudited) | |

| 20 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| Consolidated Statement of Investments |

October 31, 2013 (Unaudited) | |

| 21 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| Consolidated Statement of Investments |

October 31, 2013 (Unaudited) | |

| 22 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| Consolidated Statement of Investments |

October 31, 2013 (Unaudited) | |

| SCHEDULE OF WRITTEN OPTIONS |

Expiration Date |

Exercise Price | Contracts | Value | ||||||

| Written Call Options |

||||||||||

| Gold 100 Oz. Future: |

||||||||||

| 12/28/13 | $ 1,285.00 | (20) | $ (100,800) | |||||||

| 12/28/13 | 1,290.00 | (5) | (23,350) | |||||||

| Market Vectors® Gold Miners ETF |

11/16/13 | 27.00 | (300) | (6,600) | ||||||

|

| ||||||||||

| TOTAL WRITTEN CALL OPTIONS |

||||||||||

| (Premiums received $ 147,071) |

(130,750) | |||||||||

|

| ||||||||||

| Written Put Options |

||||||||||

| Market Vectors® Gold Miners ETF |

1/18/14 | 25.00 | (100) | (19,000) | ||||||

| Monsanto Co. |

1/18/14 | 110.00 | (50) | (36,750) | ||||||

| Phillips 66 |

1/18/14 | 65.00 | (100) | (36,500) | ||||||

|

| ||||||||||

| TOTAL WRITTEN PUT OPTIONS |

||||||||||

| (Premiums received $ 81,002) |

(92,250) | |||||||||

|

| ||||||||||

| TOTAL WRITTEN OPTIONS |

||||||||||

| (Premiums received $ 228,073) |

$ (223,000) | |||||||||

|

| ||||||||||

| FUTURES CONTRACTS |

||||||||||||||||||

| Description | Position | Contracts | Expiration Date |

Value (Note 2) |

Unrealized Appreciation |

|||||||||||||

| Brent Crude Future |

Long | 150 | 11/15/13 | $ 16,326,000 | $ 235,890 | |||||||||||||

| WTI Crude Future |

Short | (170) | 11/20/13 | (16,384,600) | 1,141,890 | |||||||||||||

|

|

|

|

|

|||||||||||||||

| $ (58,600) | $ 1,377,780 | |||||||||||||||||

|

|

|

|

|

|||||||||||||||

| Description |

Position | Contracts | |

Expiration Date |

|

|

Value (Note 2) |

|

|

Unrealized Depreciation |

| |||||||

| E-mini S&P 500® Future |

Short | (215) | 12/23/13 | $ (18,823,250) | $ (504,072) | |||||||||||||

| Gold 100 Oz. Future |

Long | 35 | 12/30/13 | 4,632,950 | (15,034) | |||||||||||||

| S&P 500® Index Future |

Short | (54) | 12/20/13 | (23,638,500) | (472,598) | |||||||||||||

|

|

|

|

|

|||||||||||||||

| $ (37,828,800) | $ (991,704) | |||||||||||||||||

|

|

|

|

|

|||||||||||||||

| See Notes to Financial Statements. |

| 23 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| Consolidated Statement of Investments |

October 31, 2013 (Unaudited) | |

| TOTAL RETURN SWAP CONTRACTS(a) | ||||||||||||||||

| Swap Counterparty | Reference Obligation | Notional Dollars |

Rate Paid by the Fund |

Termination Date |

Unrealized Appreciation |

|||||||||||

| Bank of America - Merrill Lynch |

ML eXtra Silver GA6 | $ | 706,507 | 0.10% | 6/30/14 | $ | 5,483 | |||||||||

| Bank of America - Merrill Lynch |

ML Index Robusta | (5,434,669) | 0.00% | 6/30/14 | 476,736 | |||||||||||

| Bank of America - Merrill Lynch |

MLCS Coffee J-F3 | (3,012,014) | 0.10% | 6/30/14 | 213,834 | |||||||||||

| Bank of America - Merrill Lynch |

MLCS Copper J-F3 | (5,548,322) | 0.10% | 6/30/14 | 39,721 | |||||||||||

| Bank of America - Merrill Lynch |

MLCX Aluminum J-F3 | (4,937,153) | 0.10% | 6/30/14 | 3,937 | |||||||||||

|

|

|

|||||||||||||||

| $ | 739,712 | |||||||||||||||

|

|

|

|||||||||||||||

| Swap Counterparty | Reference Obligation | Notional Dollars |

Rate Paid by the Fund |

Termination Date |

Unrealized Depreciation |

|||||||||||

| Bank of America - Merrill Lynch |

CRB 3 Month Forward Total Return Index | $ | 75,939,666 | 0.48% | 6/30/14 | $ | (1,512,006) | |||||||||

| Bank of America - Merrill Lynch |

ML Aluminum GA6 | 4,983,625 | 0.10% | 6/30/14 | (10,633) | |||||||||||

| Bank of America - Merrill Lynch |

ML eXtra Coffee ER | 5,359,839 | 0.30% | 6/30/14 | (378,629) | |||||||||||

| Bank of America - Merrill Lynch |

ML eXtra Coffee GA6 | 3,042,705 | 0.10% | 6/30/14 | (207,321) | |||||||||||

| Bank of America - Merrill Lynch |

ML eXtra Copper GA6 | 5,584,775 | 0.10% | 6/30/14 | (55,198) | |||||||||||

| Bank of America - Merrill Lynch |

MLCS Silver J-F3 | (704,397) | 0.10% | 6/30/14 | (5,243) | |||||||||||

| Societe Generale |

CRB 3 Month Forward Total Return Index | 76,279,090 | 0.35% | 11/29/13 | (1,495,675) | |||||||||||

| UBS |

CRB 3 Month Forward Total Return Index | 77,317,181 | 0.40% | 11/29/13 | (1,538,484) | |||||||||||

|

|

|

|||||||||||||||

| $ | (5,203,188) | |||||||||||||||

|

|

|

|||||||||||||||

| (a) | The Fund receives monthly payments based on any positive monthly return of the Reference Obligation. The Fund makes payments on any negative monthly return of such Reference Obligation. |

| See Notes to Financial Statements. |

| 24 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| October 31, 2013 (Unaudited) | ||

| ASSETS |

||||

| Investments, at value |

$ | 363,681,490 | ||

| Cash |

3,421,340 | |||

| Foreign currency, at value (Cost $4,775) |

4,775 | |||

| Unrealized appreciation on total return swap contracts |

739,712 | |||

| Receivable for shares sold |

2,566,194 | |||

| Receivable for variation margin |

386,076 | |||

| Deposit with broker for written options |

1,010,475 | |||

| Deposit with broker for futures contracts |

210,632 | |||

| Dividends and interest receivable |

919,597 | |||

| Prepaid expenses and other assets |

41,342 | |||

|

|

||||

| Total Assets |

372,981,633 | |||

|

|

||||

| LIABILITIES |

||||

| Written options, at value (premiums received $228,073) |

223,000 | |||

| Payable due to broker for total return swap contracts |

82,014 | |||

| Payable for shares redeemed |

234,050 | |||

| Unrealized depreciation on total return swap contracts |

5,203,188 | |||

| Investment advisory fees payable |

246,282 | |||

| Administration and transfer agency fees payable |

51,159 | |||

| Distribution and services fees payable |

119,329 | |||

| Trustees’ fees and expenses payable |

3,871 | |||

| Legal fees payable |

333 | |||

| Audit and tax fees payable |

25,269 | |||

| Accrued expenses and other liabilities |

58,176 | |||

|

|

||||

| Total Liabilities |

6,246,671 | |||

|

|

||||

| NET ASSETS |

$ | 366,734,962 | ||

|

|

||||

| NET ASSETS CONSIST OF |

||||

| Paid-in capital |

$ | 388,091,113 | ||

| Accumulated net investment loss |

(140,632 | ) | ||

| Accumulated net realized loss on investments, written options, futures contracts, total return swap contracts and foreign currency transactions |

(13,880,458 | ) | ||

| Net unrealized depreciation on investments, futures contracts, total return swap contracts and translation of assets and liabilities denominated in foreign currencies |

(7,335,061 | ) | ||

|

|

||||

| NET ASSETS |

$ | 366,734,962 | ||

|

|

||||

| INVESTMENTS, AT COST |

$ | 366,946,335 | ||

|

|

||||

| PRICING OF SHARES |

||||

| Class A: |

||||

| Net Asset Value, offering and redemption price per share(a) |

$ | 10.13 | ||

| Net Assets |

$ | 97,908,111 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

9,665,166 | |||

| Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) |

$ | 10.72 | ||

| Class C: |

||||

| Net Asset Value, offering and redemption price per share(a) |

$ | 10.01 | ||

| Net Assets |

$ | 18,763,352 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

1,874,317 | |||

| Class I: |

||||

| Net Asset Value, offering and redemption price per share |

$ | 10.11 | ||

| Net Assets |

$ | 250,063,499 | ||

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) |

24,729,561 | |||

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund’s Prospectus. |

| See Notes to Financial Statements. |

| 25 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| For the Six Months Ended October 31, 2013 (Unaudited) | ||

| INVESTMENT INCOME |

||||

| Dividends |

$ | 2,047,851 | ||

| Foreign taxes withheld on dividends |

(178,898) | |||

| Interest and other income |

68,255 | |||

|

|

||||

| Total Investment Income |

1,937,208 | |||

|

|

||||

| EXPENSES |

||||

| Investment advisory fees |

1,361,858 | |||

| Administrative and transfer agency fees |

259,477 | |||

| Distribution and service fees |

||||

| Class A |

200,479 | |||

| Class C |

95,631 | |||

| Legal fees |

8,224 | |||

| Audit and tax fees |

19,910 | |||

| Networking fees |

||||

| Class I |

63,640 | |||

| Reports to shareholders and printing fees |

34,123 | |||

| State registration fees |

31,087 | |||

| SEC registration fees |

2,838 | |||

| Insurance fees |

3,430 | |||

| Custody fees |

26,063 | |||

| Trustees’ fees and expenses |

6,866 | |||

| Miscellaneous expenses |

9,082 | |||

|

|

||||

| Total Expense |

2,122,708 | |||

| Less fees waived/reimbursed by investment advisor (Note 7) |

||||

| Class A |

(25,824) | |||

| Class C |

(4,843) | |||

| Class I |

(13,110) | |||

|

|

||||

| Net Expenses |

2,078,931 | |||

|

|

||||

| Net Investment Loss |

(141,723) | |||

|

|

||||

| Net realized loss on investments |

(296,166) | |||

| Net realized gain on written options |

264,753 | |||

| Net realized loss on futures contracts |

(4,095,750) | |||

| Net realized loss on total return swap contracts |

(4,209,889) | |||

| Net realized gain on foreign currency transactions |

242 | |||

| Net change in unrealized depreciation on investments |

(2,895,084) | |||

| Net change in unrealized appreciation on written options |

5,073 | |||

| Net change in unrealized appreciation on futures contracts |

2,301,003 | |||

| Net change in unrealized appreciation on total return swap contracts |

553,946 | |||

| Net change in unrealized appreciation on translation of assets and liabilities denominated in foreign currencies |

1,068 | |||

|

|

||||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS |

(8,370,804) | |||

|

|

||||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | (8,512,527) | ||

|

|

||||

| See Notes to Financial Statements. |

| 26 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund | ||

| For the Six Months Ended October 31, 2013 (Unaudited) |

For the Year Ended April 30, 2013 |

|||||||

| OPERATIONS |

||||||||

| Net investment loss |

$ | (141,723) | $ | (498,594) | ||||

| Net realized loss on investments, written options, futures contracts, total return swap contracts and foreign currency transactions |

(8,336,810) | (9,335,982) | ||||||

| Net change in unrealized depreciation on investments, written options, futures contracts, total return swap contracts and translation of assets and liabilities denominated in foreign currencies |

(33,994) | (4,642,501) | ||||||

|

|

||||||||

| Net Decrease in Net Assets Resulting from Operations |

(8,512,527) | (14,477,077) | ||||||

|

|

||||||||

| DISTRIBUTIONS |

||||||||

| Dividends to shareholders from tax return of capital |

||||||||

| Class A |

– | (532,988) | ||||||

| Class C |

– | (84,918) | ||||||

| Class I |

– | (699,604) | ||||||

|

|

||||||||

| Net Decrease in Net Assets from Distributions |

– | (1,317,510) | ||||||

|

|

||||||||

| BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) |

||||||||

| Shares sold |

||||||||

| Class A |

38,528,509 | 90,054,418 | ||||||

| Class C |

3,413,591 | 8,548,230 | ||||||

| Class I |

106,242,093 | 157,098,320 | ||||||

| Dividends reinvested |

||||||||

| Class A |

– | 395,824 | ||||||

| Class C |

– | 51,810 | ||||||

| Class I |

– | 542,393 | ||||||

| Shares redeemed |

||||||||

| Class A |

(41,655,776) | (66,182,451) | ||||||

| Class C |

(3,504,105) | (5,831,034) | ||||||

| Class I |

(38,600,610) | (45,457,181) | ||||||

|

|

||||||||

| Net Increase in Net Assets Derived from Beneficial Interest Transactions |

64,423,702 | 139,220,329 | ||||||

|

|

||||||||

| Net increase in net assets |

55,911,175 | 123,425,742 | ||||||

| NET ASSETS |

||||||||

| Beginning of period |

310,823,787 | 187,398,045 | ||||||

|

|

||||||||

| End of period * |

$ | 366,734,962 | $ | 310,823,787 | ||||

|

|

||||||||

| * Including accumulated net investment income/(loss) of: |

$ | (140,632) | $ | 1,091 | ||||

| See Notes to Financial Statements. |

| 27 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund – Class A | ||

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Six Months Ended |

For the Year Ended April 30, 2013 (a)(b) |

For the Year Ended April 30, 2012 (a) |

For the Period June 29, 2010 (Inception) to April 30, 2011 (a) | |||||

| Net asset value, beginning of period |

$10.40 | $11.18 | $14.28 | $10.00 | ||||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||||||

| Net investment income/ |

(0.01) | (0.03) | 0.04 | 0.12 | ||||

| Net realized and unrealized gain/(loss) |

(0.26) | (0.69) | (2.29) | 4.87 | ||||

|

| ||||||||

| Total from investment operations |

(0.27) | (0.72) | (2.25) | 4.99 | ||||

|

| ||||||||

| DISTRIBUTIONS: |

||||||||

| From net investment income |

– | – | (0.83) | (0.71) | ||||

| From net realized gains |

– | – | (0.02) | – | ||||

| Tax return of capital |

– | (0.06) | – | – | ||||

|

| ||||||||

| Total distributions |

– | (0.06) | (0.85) | (0.71) | ||||

|

| ||||||||

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) |

0.00(d) | 0.00(d) | 0.00(d) | 0.00(d) | ||||

|

| ||||||||

| Net increase/(decrease) in net asset value |

(0.27) | (0.78) | (3.10) | 4.28 | ||||

|

| ||||||||

| Net asset value, end of period |

$10.13 | $10.40 | $11.18 | $14.28 | ||||

|

| ||||||||

| TOTAL RETURN(e) |

(2.60)% | (6.44)% | (15.77)% | 51.41% | ||||

| RATIOS/SUPPLEMENTAL DATA: |

||||||||

| Net assets, end of period (000s) |

$97,908 | $104,234 | $85,805 | $37,060 | ||||

| Ratio of expenses to average net assets excluding fee waivers and reimbursements |

1.50%(f) | 1.50% | 1.64% | 2.59%(f) | ||||

| Ratio of expenses to average net assets including fee waivers and reimbursements |

1.45%(f) | 1.40%(g) | 1.45% | 1.45%(f) | ||||

| Ratio of net investment income/(loss) to average net assets |

(0.23)%(f) | (0.30)% | 0.36% | 1.08%(f) | ||||

| Portfolio turnover rate(h) |

5% | 117% | 264% | 59% | ||||

|

| ||||||||

| (a) | Per share amounts and ratios to average net assets include income and expenses of the CoreCommodity Management Cayman Commodity Fund Ltd. (wholly-owned subsidiary). |

| (b) | Prior to April 30, 2013 the ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund was known as the Jefferies Asset Management Commodity Strategy Allocation Fund. |

| (c) | Calculated using the average shares method. |

| (d) | Less than $0.005 per share. |

| (e) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (f) | Annualized. |

| (g) | According to the Fund’s shareholder services plan with respect to the Fund’s Class A shares, any amount of such payment not paid during the Fund’s fiscal year for such service activities shall be reimbursed to the Fund as soon as practicable after the end of the fiscal year. Fees were reimbursed to the Fund during the year ended April 30, 2013, for the prior fiscal year in the amount of 0.05% of average net assets of Class A shares. |

| (h) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| See Notes to Financial Statements. |

| 28 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund – Class C | ||

| Consolidated Financial Highlights |

||

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Six Months Ended |

For the Year Ended April 30, 2013 (a)(b) |

For the Year Ended April 30, 2012 (a) |

For the Period June 29, 2010 (Inception) to April 30, 2011 (a) | |||||

| Net asset value, beginning of period |

$10.31 | $11.15 | $14.19 | $10.00 | ||||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||||||

| Net investment income/ |

(0.04) | (0.10) | (0.05) | 0.08 | ||||

| Net realized and unrealized gain/(loss) |

(0.26) | (0.69) | (2.26) | 4.87 | ||||

|

| ||||||||

| Total from investment operations |

(0.30) | (0.79) | (2.31) | 4.95 | ||||

|

| ||||||||

| DISTRIBUTIONS: |

||||||||

| From net investment income |

– | – | (0.71) | (0.76) | ||||

| From net realized gains |

– | – | (0.02) | – | ||||

| Tax return of capital |

– | (0.05) | – | – | ||||

|

| ||||||||

| Total distributions |

– | (0.05) | (0.73) | (0.76) | ||||

|

| ||||||||

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) |

0.00(d) | 0.00(d) | 0.00(d) | 0.00(d) | ||||

|

| ||||||||

| Net increase/(decrease) in net asset value |

(0.30) | (0.84) | (3.04) | 4.19 | ||||

|

| ||||||||

| Net asset value, end of period |

$10.01 | $10.31 | $11.15 | $14.19 | ||||

|

| ||||||||

| TOTAL RETURN(e) |

(2.91)% | (7.10)% | (16.26)% | 50.90% | ||||

| RATIOS/SUPPLEMENTAL DATA: |

||||||||

| Net assets, end of period (000s) |

$18,763 | $19,444 | $18,095 | $7,352 | ||||

| Ratio of expenses to average net assets excluding fee waivers and reimbursements |

2.10%(f) | 2.14% | 2.24% | 4.00%(f) | ||||

| Ratio of expenses to average net assets including fee waivers and reimbursements |

2.05%(f) | 2.05% | 2.05% | 2.05%(f) | ||||

| Ratio of net investment income/(loss) to average net assets |

(0.81)%(f) | (0.92)% | (0.42)% | 0.72%(f) | ||||

| Portfolio turnover rate(g) |

5% | 117% | 264% | 59% | ||||

|

| ||||||||

| (a) | Per share amounts and ratios to average net assets include income and expenses of the CoreCommodity Management Cayman Commodity Fund Ltd. (wholly-owned subsidiary). |

| (b) | Prior to April 30, 2013 the ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund was known as the Jefferies Asset Management Commodity Strategy Allocation Fund. |

| (c) | Calculated using the average shares method. |

| (d) | Less than $0.005 per share. |

| (e) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (f) | Annualized. |

| (g) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| See Notes to Financial Statements. |

| 29 | October 31, 2013 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund – Class I | ||

| Consolidated Financial Highlights |

||

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| For the Six Months Ended |

For the Year Ended April 30, 2013 (a)(b) |

For the Year Ended April 30, 2012 (a) |

For the Period June 29, 2010 (Inception) to April 30, 2011 (a) | |||||

| Net asset value, beginning of period |

$10.37 | $11.12 | $14.25 | $10.00 | ||||

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

||||||||

| Net investment income/(loss)(c) |

0.00(d) | (0.00)(d) | 0.10 | 0.13 | ||||

| Net realized and unrealized gain/(loss) |

(0.26) | (0.69) | (2.32) | 4.89 | ||||

|

| ||||||||

| Total from investment operations |

(0.26) | (0.69) | (2.22) | 5.02 | ||||

|

| ||||||||

| DISTRIBUTIONS: |

||||||||

| From net investment income |

– | – | (0.89) | (0.77) | ||||

| From net realized gains |

– | – | (0.02) | – | ||||

| Tax return of capital |

– | (0.06) | – | – | ||||

|

| ||||||||

| Total distributions |

– | (0.06) | (0.91) | (0.77) | ||||

|

| ||||||||

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) |

0.00(d) | 0.00(d) | 0.00(d) | 0.00(d) | ||||

|

| ||||||||

| Net increase/(decrease) in net asset value |

(0.26) | (0.75) | (3.13) | 4.25 | ||||

|

| ||||||||

| Net asset value, end of period |

$10.11 | $10.37 | $11.12 | $14.25 | ||||

|

| ||||||||

| TOTAL RETURN(e) |

(2.51)% | (6.16)% | (15.53)% | 51.74% | ||||

| RATIOS/SUPPLEMENTAL DATA: |

||||||||

| Net assets, end of period (000s) |

$250,063 | $187,146 | $83,497 | $73,630 | ||||

| Ratio of expenses to average net assets excluding fee waivers and reimbursement |

1.16%(f) | 1.17% | 1.33% | 2.04%(f) | ||||

| Ratio of expenses to average net assets including fee waivers and reimbursements |

1.15%(f) | 1.15% | 1.15% | 1.15%(f) | ||||

| Ratio of net investment income/(loss) to average net assets |

0.05%(f) | (0.02)% | 0.82% | 1.19%(f) | ||||

| Portfolio turnover rate(g) |

5% | 117% | 264% | 59% | ||||

|

| ||||||||

| (a) | Per share amounts and ratios to average net assets include income and expenses of the CoreCommodity Management Cayman Commodity Fund Ltd. (wholly-owned subsidiary). |

| (b) | Prior to April 30, 2013 the ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund was known as the Jefferies Asset Management Commodity Strategy Allocation Fund. |

| (c) | Calculated using the average shares method. |

| (d) | Less than $0.005 and ($0.005) per share. |

| (e) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (f) | Annualized. |

| (g) | Portfolio turnover rate for periods less than one full year have not been annualized. |

| See Notes to Financial Statements. |

| 30 | October 31, 2013 |

| October 31, 2013 (Unaudited) | ||

| 31 | October 31, 2013 |

| ALPS | Kotak India Growth Fund | ||

| Management Commentary |

October 31, 2013 (Unaudited) | |

| 32 | October 31, 2013 |

| ALPS | Kotak India Growth Fund | ||

| Management Commentary |

October 31, 2013 (Unaudited) | |

| 33 | October 31, 2013 |

| ALPS | Kotak India Growth Fund | ||

| October 31, 2013 (Unaudited) | ||

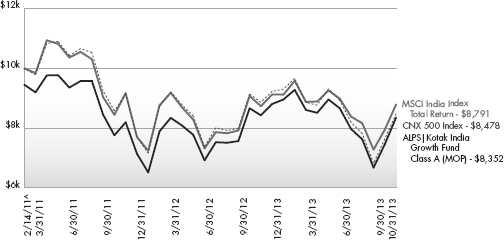

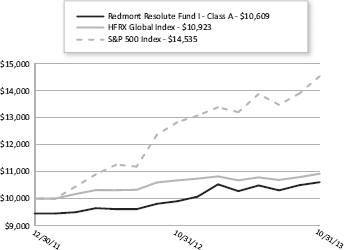

Performance of $10,000 Initial Investment (as of October 31, 2013)

Comparison of change in value of a $10,000 investment (includes maximum sales charges of 5.50%)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of October 31, 2013)

| 1 Year | Since Inception ^ | Total Expense Ratio | What You Pay * | |||||

| Class A (NAV)1 |

-0.90% | -4.46% | 8.01% | 2.00% | ||||

| Class A (MOP)2 |

-6.36% | -6.43% | ||||||

| Class C (NAV)1 |

-1.48% | -5.06% | 8.61% | 2.60% | ||||

| Class C (CDSC)2 |

-2.46% | -5.06% | ||||||

| Class I |

-0.56% | -4.14% | 7.61% | 1.60% | ||||

| CNX 500 Index3 |

4.37% | -5.90% | ||||||

|

MSCI India Index Total Return4 |

0.66% | -4.65% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million. Performance shown does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data please call 1-866-759-5679.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested. Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the funds original investment.

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 34 | October 31, 2013 |

| ALPS | Kotak India Growth Fund | ||

| Performance Update |

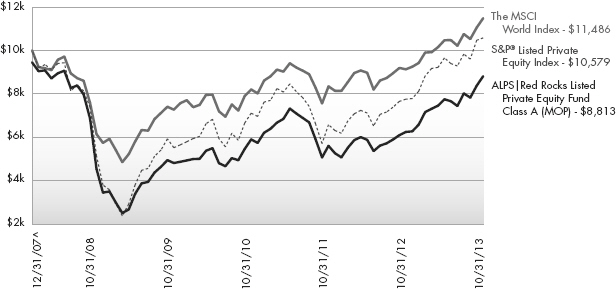

October 31, 2013 (Unaudited) | |