Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8194

FINANCIAL INVESTORS TRUST

(exact name of Registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

JoEllen L. Legg, Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2010 - October 31, 2010

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

Table of Contents

|

October 31, 2010

|

Table of Contents

| ALPS | GNI Long-Short Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

1 | October 31, 2010

Table of Contents

| ALPS | GNI Long-Short Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

| * | The National Bureau of Economic Research and The Globe and Mail, “Slow U.S. recovery follows the Great Recession,” Sept. 20, 2010. |

| ** | Financial Times, “US stocks post best September since 1939,” Oct. 1, 2010. |

2 | October 31, 2010

Table of Contents

| ALPS | GNI Long-Short Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

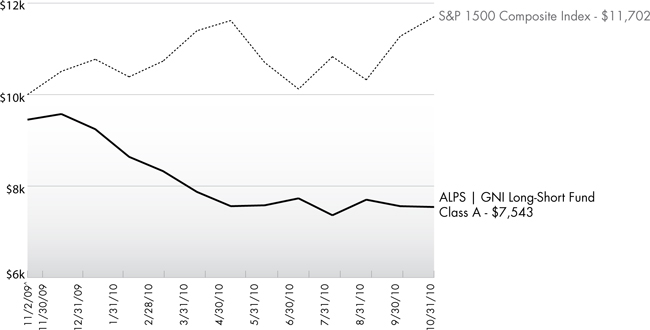

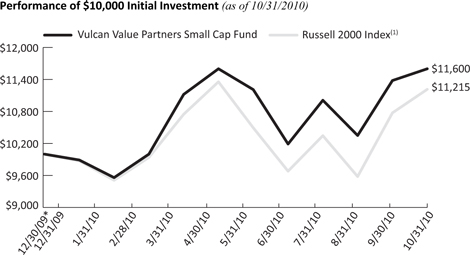

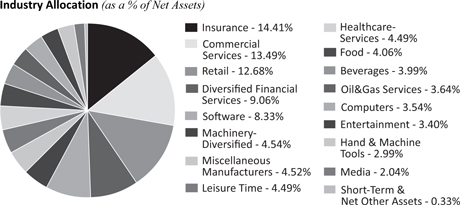

Performance of $10,000 Initial Investment (as of October 31, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3 | October 31, 2010

Table of Contents

| ALPS | GNI Long-Short Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

Cumulative Return (as of October 31, 2010)

| 6 month | Since Inception^ | Gross Expense Ratio | Net Expense Ratio* | |||||

| Class A (NAV)1 |

-0.25% | -20.20% | 26.75% | 3.13% | ||||

| Class A (MOP)2 |

-5.79% | -24.57% | ||||||

| Class I |

0.00% | -19.80% | 2.96% | 2.83% | ||||

| S&P 1500 Composite Index3 |

0.72% | 17.03% |

| Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 90 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data please call (866) 759-5679.

Subject to investment risks, including possible loss of the principal amount invested. Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the funds original investment.

1 Net Asset Value (NAV) is the share price without sales charges. 2 Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%. 3 S&P Composite 1500: an equity benchmark that combines three leading indices, the S&P 500®, the S&P MidCap 400 and the S&P SmallCap 600 to cover approximately 90% of the U.S. market capitalization. It is designed for investors seeking to replicate the performance of the U.S. equity market or benchmark against a representative universe of tradable stocks. You cannot invest directly in the index. ^ Fund inception date of 11/02/09. * ALPS Advisors, Inc. (the “Adviser”) has given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of distribution and service (12b-1) fees, shareholder service fees, acquired fund fees and expenses, short-sale dividend expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses, to 2.00% of the Fund’s average daily net assets. This agreement is in effect through August 31, 2011 and is reevaluated on an annual basis. Without this agreement, expenses could be higher.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund enters into a short sale by selling a security it has borrowed. If the market price of a security increases after the Fund borrows the security, the Fund will suffer a potentially unlimited loss when it replaces the borrowed security at the higher price. Short sales also involve transaction and other costs that will reduce potential Fund gains and increase potential Fund losses. Please refer to the prospectus for complete information regarding all risks associated with the fund.

The Fund is less than a year old and has limited operating history. This fund is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment. |

4 | October 31, 2010

Table of Contents

| ALPS | GNI Long-Short Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

As a shareholder of the Fund, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2010 and held until October 31, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on May 1, 2010 and held until October 31, 2010.

| Beginning Account Value 5/1/10 |

Ending Account Value 10/31/10 |

Expense Ratio(a) | Expense Paid During Period(b) 5/1/10-10/31/10 |

|||||||||||||

| Class A |

||||||||||||||||

| Actual |

$1,000.00 | $998.70 | 3.12% | $15.72 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,009.48 | 3.12% | $15.80 | ||||||||||||

| Class I |

||||||||||||||||

| Actual |

$1,000.00 | $1,001.20 | 2.98% | $15.03 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,010.18 | 2.98% | $15.10 | ||||||||||||

| (a) | The Fund’s expense ratios have been based on the Fund’s most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

5 | October 31, 2010

Table of Contents

| ALPS | GNI Long-Short Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

6 | October 31, 2010

Table of Contents

| ALPS | GNI Long-Short Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

7 | October 31, 2010

Table of Contents

| ALPS | Red Rocks Listed Private Equity Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

8 | October 31, 2010

Table of Contents

| ALPS | Red Rocks Listed Private Equity Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

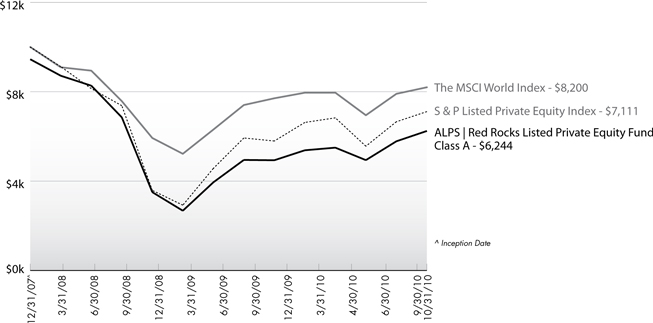

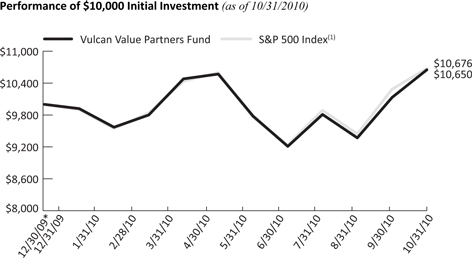

Performance of $10,000 Initial Investment (as of October 31, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

Source: Morningstar

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9 | October 31, 2010

Table of Contents

| ALPS | Red Rocks Listed Private Equity Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

| Average Annual Total Returns (as of October 31, 2010) | ||||||||||

| 6 Month Cummulative Returns |

1 Year | Since Inception^ | Gross Expense Ratio |

Net Expense Ratio* | ||||||

| Class A (NAV)1 |

7.35% | 22.60% | -15.30% | 1.86% | 1.65% | |||||

| Class A (MOP)2 |

1.46% | 15.93% | -16.97% | |||||||

| Class C (NAV)1 |

6.44% | 21.11% | -16.08% | 2.46% | 2.40% | |||||

|

Class C (CDSC)2 |

5.44% | 20.11% | -16.08% | |||||||

| Class I |

7.32% | 22.97% | -15.06% | 1.62% | 1.40% | |||||

| Class R |

6.77% | 21.93% | -15.80% | 2.42% | 1.90% | |||||

| MSCI World Index3 |

3.05% | 12.74% | -6.76% | |||||||

| S&P LPE Index4 |

4.11% | 28.81% | -11.34% | |||||||

|

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 90 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (866) 759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. CDSC performance for Class C shares includes a 1% contingent deferred sales charge (CDSC) on C shares redeemed within 12 months of purchase. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account.

Performance shown for Class C shares prior to June 30, 2010 reflects the historical performance of the Fund’s Class A shares, calculated using the fees and expenses of Class C shares.

1 Net Asset Value (NAV) is the share price without sales charges. The performance data shown does not reflect the decution of the sales load or the redemption fee or CDSC, and that, if reflected, the load or fee would reduce the performance quoted. 2 Maximum Offering Price (MOP) includes sales charges. Returns include effects of the Fund’s maximum sales charge of 5.50% for ALPS/Red Rocks Listed Private Equity Fund - A Shares. 3 MSCI World Index: Morgan Stanley Capital International’s market capitalization weighted index is composed of companies representative of the market structure of 22 developed market countries in North America, Europe and the Asia/Pacific Region. You cannot invest directly in the index. 4 S&P Listed Private Equity Index: The S&P Listed Private Equity Index is comprised of 30 leading listed private equity companies that meet size, liquidity, exposure, and activity requirements. The index is designed to provide tradable exposure to the leading publicly listed companies in the private equity space. ^ Fund inception date of 12/31/2007. The Fund began trading on 1/2/2008. * Effective through August 31, 2011, the Adviser and the Red Rocks Capital LLC (the “Sub-Adviser”) have given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of distribution and service (12b-1) fees, shareholder service fees (C shares only), acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses, to 1.25% of the Fund’s average daily net assets. This agreement is reevaluated on an annual basis. Without this agreement expenses could be higher.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Listed Private Equity Companies are subject to various risks depending on their underlying investments, which could include, but are not limited to, additional liquidity risk, industry risk, non-U.S. security risk, currency risk, credit risk, managed portfolio risk and derivatives risk (derivatives risk is the risk that the value of the Listed Private Equity Companies’ derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment).

There are inherent risks in investing in private equity companies, which encompass financial institutions or vehicles whose principal business is to invest in and lend capital to privately held companies. Generally, little public information exists for private and thinly traded companies, and there is a risk that investors may not be able to make a fully informed investment decision.

Listed Private Equity Companies may have relatively concentrated investment portfolios, consisting of a relatively small number of holdings. A consequence of this limited number of investments is that the aggregate returns realized may be adversely impacted by the poor performance of a small number of investments, or even a single investment, particularly if a company experiences the need to write down the value of an investment.

Certain of the Fund’s investments may be exposed to liquidity risk due to low trading volume, lack of a market maker or legal restrictions limiting the ability of the Fund to sell particular securities at an advantageous price and/or time. As a result, these securities may be more difficult to value. Foreign investing involves special risks, such as currency fluctuations and political uncertainty. The Fund invests in derivatives and is subject to the risk that the value of those derivative investments will fall because of pricing difficulties or lack of correlation with the underlying investment. | ||||||||||

10 | October 31, 2010

Table of Contents

| ALPS | Red Rocks Listed Private Equity Fund | ||||||

| As a shareholder of the Fund, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2010 and held until October 31, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees, or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on May 1, 2010 and held until October 31, 2010. |

| Beginning Account Value 5/1/10 |

Ending Account Value 10/31/10 |

Expense Ratio(a) | Expense Paid During Period(b) 5/1/10- 10/31/10 |

|||||||||||||

| Class A |

||||||||||||||||

| Actual |

$1,000.00 | $1,073.50 | 1.50% | $7.84 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,017.64 | 1.50% | $7.63 | ||||||||||||

| Class C(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,064.40 | 2.25% | $7.76 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,017.68 | 2.25% | $11.42 | ||||||||||||

| Class I |

||||||||||||||||

| Actual |

$1,000.00 | $1,073.20 | 1.25% | $6.53 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,018.90 | 1.25% | $6.36 | ||||||||||||

| Class R |

||||||||||||||||

| Actual |

$1,000.00 | $1,067.70 | 1.75% | $9.12 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,016.38 | 1.75% | $8.89 | ||||||||||||

| (a) | The Fund’s expense ratios have been based on the Fund’s most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

| (c) | Class C shares commenced operations on July 2, 2010. |

11 | October 31, 2010

Table of Contents

| ALPS | Red Rocks Listed Private Equity Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

12 | October 31, 2010

Table of Contents

| ALPS | Red Rocks Listed Private Equity Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

13 | October 31, 2010

Table of Contents

| ALPS | WMC Value Intersection Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

14 | October 31, 2010

Table of Contents

| ALPS | WMC Value Intersection Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

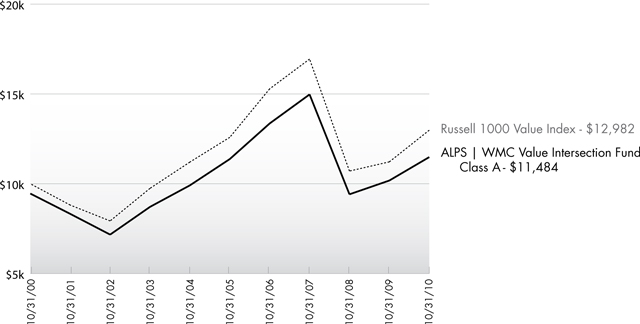

Performance of $10,000 Initial Investment (as of October 31, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

Source: Morningstar

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15 | October 31, 2010

Table of Contents

| ALPS | WMC Value Intersection Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

| Average Annual Total Returns (as of October 31, 2010) |

| 6 Month Cummulative Returns |

1 Year | 5 Year | 10 Year | Gross Expense Ratio |

Net Expense Ratio^ | |||||||

| Class A (NAV)1 |

-1.21% | 12.80% | 0.19% | 1.96% |

1.71% |

1.41% | ||||||

| Class A (MOP)2 |

-6.62% | 6.64% | -0.93% | 1.39% | ||||||||

|

Class C (NAV)1 |

-1.47% | 12.08% | -0.54% | 1.22% | 2.46% | 2.16% | ||||||

|

Class C (CDSC)2 |

-2.46% | 11.08% | -0.54% | 1.22% | ||||||||

| Class I |

-1.07% | 13.13% | 0.38% | 2.11% | 1.50% | 1.16% | ||||||

| Russell 1000 Value Index3 |

-1.75% | 15.71% | 0.62% | 2.64% | ||||||||

|

S&P 500 Index4 |

0.74% | 16.52% | 1.73% | -0.02% |

| Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (866) 759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. CDSC performance for Class C shares includes a 1% CDSC on C shares redeemed within 12 months of purchase. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account.

Performance shown for Class C shares prior to June 30, 2010 reflects the historical performance of the Fund’s Class A shares, calculated using the fees and expenses of Class C shares.

The performance shown for the ALPS | WMC Value Intersection Fund (the “Fund”) for periods prior to August 29, 2009, reflects the performance of the Activa Mutual Funds Trust – Activa Value Fund (as result of a prior reorganization of Activa Mutual Funds Trust – Activa Value Fund into the Fund).

1 Net Asset Value (NAV) is the share price without sales charges. 2 Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%. 3 The Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. You cannot invest directly in the index. 4 The S&P 500 Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. You cannot invest directly in the index. ^ The Adviser has given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of distribution and service (12b-1) fees, shareholder service fees, brokerage expenses, interest expenses, taxes and extraordinary expenses, to 1.15% of the Fund’s average daily net assets. This agreement is in effect through August 31, 2011.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Mutual funds, annuities and other investments are not insured or guaranteed by the FDIC or by any other government agency or government sponsored agency of the federal government or any state, not deposits, obligations or guaranteed by any bank or its affiliates and are subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund’s top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested. Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment. |

16 | October 31, 2010

Table of Contents

| ALPS | WMC Value Intersection Fund | ||||||

| As a shareholder of the Fund, you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2010 and held until October 31, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on May 1, 2010 and held until October 31, 2010. |

| Beginning Account Value 5/1/10 |

Ending Account Value 10/31/10 |

Expense Ratio(a) | Expense Paid During Period(b) 5/1/10-10/31/10 |

|||||||||||||

| Class A |

||||||||||||||||

| Actual |

$1,000.00 | $987.90 | 1.40% | $7.01 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,018.15 | 1.40% | $7.12 | ||||||||||||

| Class C(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,145.30 | 2.15% | $7.71 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,009.52 | 2.15% | $10.89 | ||||||||||||

| Class I |

||||||||||||||||

| Actual |

$1,000.00 | $989.30 | 1.15% | $5.77 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,019.41 | 1.15% | $5.85 | ||||||||||||

| (a) The Fund’s expense ratios have been based on the Fund’s most recent fiscal half-year expenses. (b) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. (c) Class C shares commenced operations on July 2, 2010. |

17 | October 31, 2010

Table of Contents

| ALPS | WMC Value Intersection Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

18 | October 31, 2010

Table of Contents

| ALPS | WMC Value Intersection Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

19 | October 31, 2010

Table of Contents

| ALPS | WMC Value Intersection Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

20 | October 31, 2010

Table of Contents

| Clough China Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

21 | October 31, 2010

Table of Contents

| Clough China Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

| 1 | Sources: National Bureau of Statistics of China (“NBS”), BNP Paribas, Morgan Stanley 07/15/2010. |

| 2 | Source: NBS prices from 12/31/09 to 03/31/10 |

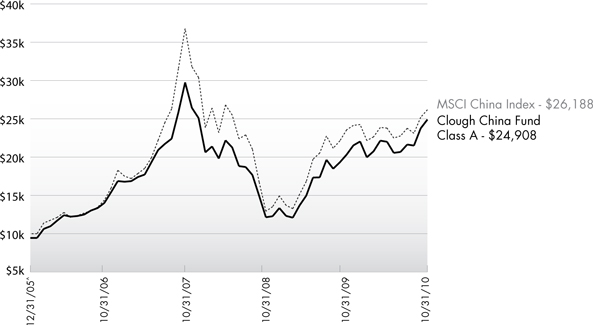

Performance of $10,000 Initial Investment (as of October 31, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

22 | October 31, 2010

Table of Contents

| Clough China Fund | ||||||

| Management Commentary | October 31, 2010 (Unaudited) |

| Average Annual Total Returns (as of October 31, 2010) |

| 6 Month Cummulative Returns |

1 Year | 3 Year | Since Inception^ |

Gross Expense Ratio |

Net Expense Ratio* | |||||||

|

Class A (NAV)1 |

13.13% | 22.38% | -5.79% | 22.16% | 2.25% | 1.86% | ||||||

| Class A (MOP)2 |

6.91% | 15.67% | -7.55% | 20.75% | ||||||||

|

Class C (NAV)1 |

12.70% | 21.39% | -6.51% | 21.27% | 3.19% | 2.71% | ||||||

| Class C (CDSC)2 |

11.70% | 20.39% | -6.51% | 21.27% | ||||||||

| Class I3 |

13.42% | 22.97% | -5.30% | 22.83% | 1.87% | 1.41% | ||||||

| MSCI China Index4 |

10.07% | 11.11% | -10.71% | 22.02% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 90 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (877)256-8445.

The performance shown for the Clough China Fund for periods prior to January 15, 2010, reflects the performance of the Old Mutual China Fund, a series of Old Mutual Funds I (as a result of a prior reorganization of the Old Mutual China Fund into the Clough China Fund).

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | Prior to close of business on January 15, 2010, Class I was known as Institutional Class of the Predecessor Fund. |

| 4 | The Morgan Stanley Capital International (“MSCI”) China Index is constructed according to the MSCI Global Investable Market Index (GIMI) family. The MSCI China Index is part of the MSCI Emerging Markets Index. An investor may not invest directly in the index. |

| ^ | Predecessor Fund Inception date of 12/30/05. |

| * | The Adviser contractually has agreed to limit the operating expenses of the Fund (excluding underlying fund fees and expenses, interest, taxes, brokerage costs and commissions, dividend and interest expense on short sales, litigation, indemnification and extraordinary expenses as determined under generally accepted accounting principles) to an annual rate of 1.40% for Class I shares through December 31, 2010, 1.70% for Class A shares through December 31, 2009 and 1.85% for Class A shares from January 1, 2010 through December 31, 2010, and 2.70% for Class C shares through December 31, 2010. |

Effective January 1, 2011, the Adviser has given a contractual agreement to limit the operating expenses of the Fund (excluding underlying fund fees and expenses, interest, taxes, brokerage costs and commissions, dividend and interest expense on short sales, litigation, indemnification and extraordinary expenses as determined under generally accepted accounting principles) to an annual rate of 2.75% for Class I shares, 3.00% for Class A shares, and 3.75% for Class C shares through December 31, 2018. ALPS Advisors will consider further reductions to these limits on an annual basis. Without this agreement, expenses would be higher.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is ubject to investment risks, including possible loss of the principal amount invested. Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund’s original investment.

Investing in China, Hong Kong and Taiwan involves risk and considerations not present when investing in more established securities markets. The Fund may be more susceptible to the economic, market, political and local risks of these regions than a fund that is more geographically diversified.

This Fund is not suitable for all investors.

23 | October 31, 2010

Table of Contents

| Clough China Fund | ||||||

|

As a shareholder of the Fund you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2010 and held until October 31, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on May 1, 2010 and held until October 31, 2010. |

| Beginning Account Value 5/1/10 |

Ending Account Value 10/31/10 |

Expense Ratio(a) | Expense Paid During Period(b) 5/1/10- 10/31/10 |

|||||||||||||

| Class A |

||||||||||||||||

| Actual |

$1,000.00 | $1,131.80 | 1.85% | $9.94 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,015.88 | 1.85% | $9.40 | ||||||||||||

| Class C |

||||||||||||||||

| Actual |

$1,000.00 | $1,127.40 | 2.70% | $14.48 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,011.59 | 2.70% | $13.69 | ||||||||||||

| Class I |

||||||||||||||||

| Actual |

$1,000.00 | $1,134.70 | 1.40% | $7.53 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,018.15 | 1.40% | $7.12 | ||||||||||||

| (a) The Fund’s expense ratios have been based on the Fund’s most recent fiscal half-year expenses. (b) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

24 | October 31, 2010

Table of Contents

| Clough China Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

25 | October 31, 2010

Table of Contents

| Clough China Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

26 | October 31, 2010

Table of Contents

| Clough China Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

27 | October 31, 2010

Table of Contents

| Jefferies Asset Management Commodity Strategy Allocation Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

| ^ | If successive-month futures contracts are trading at prices higher than the current month, the market is said to be in “contango” |

| ^^ | A unit that is equal to 1/100th of 1% |

28 | October 31, 2010

Table of Contents

| Jefferies Asset Management Commodity Strategy Allocation Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

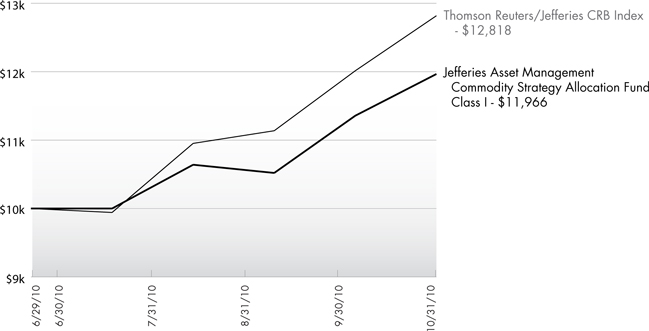

Performance of $10,000 Initial Investment (as of October 31, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Cumulative Return (as of October 31, 2010)

| 1 month | 3 month | Since Inception^ |

Gross Expense Ratio |

Net Expense Ratio* | ||||||

| Class A (NAV)1 |

5.27% | 12.19% | 19.37% | 1.60% | 1.45% | |||||

| Class A (MOP)2 |

-0.52% | 6.01% | 12.82% | |||||||

| Class C (NAV)1 |

5.17% | 12.41% | 19.49% | 2.20% | 2.05% | |||||

| Class C (CDSC)2 |

4.17% | 11.41% | 18.49% | |||||||

| Class I |

5.36% | 12.46% | 19.66% | 1.30% | 1.15% | |||||

| Thomson Reuters/Jefferies CRB Index3 |

6.69% | 17.04% | 28.18% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the redemption fee or the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (866) 759-5679.

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | Thomson Reuters/Jefferies CRB Index measures the performance of certain commodity futures contracts. An investor may not invest directly in the index. |

| ^ | Fund inception date of 6/29/10. |

| * | Effective through August 31, 2011, the Sub-Adviser has given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expense, taxes and extraordinary expenses to 1.05% of the average daily net assets for Class A and Class C shares, and to 1.15% of the average daily net assets for Class I shares. Without this agreement expenses could be higher. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund is less than a year old and has limited operating history. This Fund is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

Investing in Commodity-Related securities involves risk and considerations not present when investing in more conventional securities. The Fund may be more susceptible to high volatility of commodity markets.

29 | October 31, 2010

Table of Contents

| Jefferies Asset Management Commodity Strategy Allocation Fund | ||||||

As a shareholder of the Fund you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on June 29, 2010 and held until October 31, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on June 29, 2010 and held until October 31, 2010.

| Beginning Account Value 6/29/10 |

Ending Account Value 10/31/10 |

Expense Ratio(a) |

Expense Paid 10/31/10 |

|||||||||||||

| Class A(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,193.70 | 1.45% | $5.40 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,012.06 | 1.45% | $7.35 | ||||||||||||

| Class C(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,194.90 | 2.05% | $7.64 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,010.02 | 2.05% | $10.39 | ||||||||||||

| Class I(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,196.60 | 1.15% | $4.29 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,013.08 | 1.15% | $5.84 | ||||||||||||

| (a) | The Fund’s expense ratios have been based on the Fund’s inception date of June 29, 2010 through October 31, 2010. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

| (c) | Shares commenced operations on June 29, 2010. |

30 | October 31, 2010

Table of Contents

| Jefferies Asset Management Commodity Strategy Allocation Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

31 | October 31, 2010

Table of Contents

| Jefferies Asset Management Commodity Strategy Allocation Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

32 | October 31, 2010

Table of Contents

| Jefferies Asset Management Commodity Strategy Allocation Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

33 | October 31, 2010

Table of Contents

| Jefferies Asset Management Commodity Strategy Allocation Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

| Total Return Swap Contracts(a) | ||||||||||||||||||||

| Swap Counterparty | Reference Obligation |

Notional Amount | Rate Paid by the Fund |

Termination Date | Unrealized Appreciation |

|||||||||||||||

| Bank of America Merrill Lynch |

|

CRB 3 Month Forward Total Return Index |

|

$ | 8,064,097 | 0.48 | % | 06/30/11 | $ | 327,912 | ||||||||||

| (a) | The Fund receives monthly payments based on any positive monthly return of the Reference Obligation. The Fund makes payments on any negative monthly return of such Reference Obligation. |

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third party definitions and are unaudited. The definitions are industry terms and do not reflect the legal status of any of the investments or the companies in which the Fund has invested.

34 | October 31, 2010

Table of Contents

| RiverFront Long-Term Growth & Income Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

| ^ | The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq |

| ^^ | A unit that is equal to 1/100th of 1% |

| * | Forward P/E multiples are a measure of the price-to-earnings ratio (P/E) using forecasted earnings |

35 | October 31, 2010

Table of Contents

| RiverFront Long-Term Growth & Income Fund | ||||||

| Management Commentary | October 31, 2010 (Unaudited) |

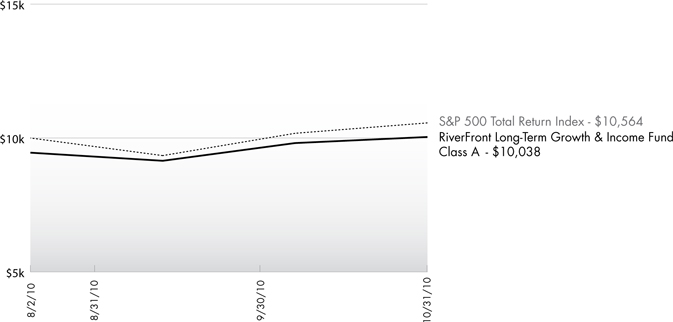

Performance of $10,000 Initial Investment (as of October 31, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Cumulative Return (as of October 31, 2010) |

| 1 month | Since Inception^ | Gross Expense Ratio |

Net Expense Ratio* | |||||

| Class A (NAV)1 |

2.31% | 6.20% | 2.01% | 1.51% | ||||

| Class A (MOP)2 |

-3.28% | 0.38% | ||||||

| Class C (NAV)1 |

2.32% | 6.00% | 2.76% | 2.26% | ||||

| Class C (CDSC)2 |

1.32% | 5.00% | ||||||

| Class I |

2.41% | 6.20% | 1.76% | 1.26% | ||||

| S&P 500 Total Return Index3 |

3.81% | 5.64% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (866) 759-5679.

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | S&P 500 Total Return Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. An investor may not invest directly in the index. |

| ^ | Fund inception date of 8/2/10. |

| * | Effective through August 31, 2011, the Adviser and the Sub-Adviser have given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expense, taxes and extraordinary expenses to 1.05% of the average daily net assets for Class A, Class C and Class I shares. Without this agreement expenses could be higher. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund is less than a year old and has limited operating history. This Fund is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

36 | October 31, 2010

Table of Contents

| RiverFront Long-Term Growth & Income Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

As a shareholder of the Fund you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on August 2, 2010 and held until October 31, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on August 2, 2010 and held until October 31, 2010.

| Beginning Account Value 8/2/10 |

Ending Account Value 10/31/10 |

Expense Ratio(a) | Expense Paid During Period(b) 8/2/10- 10/31/10 |

|||||||||||||

| Class A(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,062.00 | 1.30% | $3.30 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,009.12 | 1.30% | $6.58 | ||||||||||||

| Class C(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,060.00 | 2.05% | $5.21 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,007.27 | 2.05% | $10.37 | ||||||||||||

| Class I(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,062.00 | 1.05% | $2.67 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,009.74 | 1.05% | $5.32 | ||||||||||||

| (a) | The Fund’s expense ratios have been based on the Fund’s inception date of August 2, 2010 through October 31, 2010. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

| (c) | Shares commenced operations on August 2, 2010. |

37 | October 31, 2010

Table of Contents

| RiverFront Long-Term Growth & Income Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

38 | October 31, 2010

Table of Contents

| RiverFront Long-Term Growth & Income Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

39 | October 31, 2010

Table of Contents

| RiverFront Long-Term Growth & Income Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

Common Abbreviations:

E-TRACS - Exchange Traded Access Securities

ETF - Exchange Traded Fund

ETN - Exchange Traded Note

LLC - Limited Liability Company

Ltd. - Limited

MLP - Master Limited Partnership

MSCI - Morgan Stanley Capital International

REIT - Real Estate Investment Trust

S&P - Standard & Poor’s

SPDR - Standard & Poor’s Depositary Receipt

VIX - Market Volatility Index

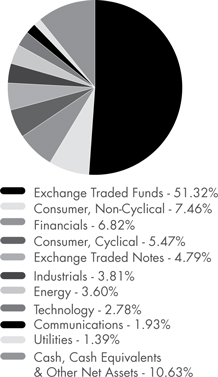

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third party definitions and are unaudited. The definitions are industry terms and do not reflect the legal status of any of the investments or the companies in which the Fund has invested.

See Notes to Financial Statements.

40 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

| ^ | The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq |

| ^^ | A unit that is equal to 1/100th of 1% |

| * | Forward P/E multiples are a measure of the price-to-earnings ratio (P/E) using forecasted earnings |

41 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

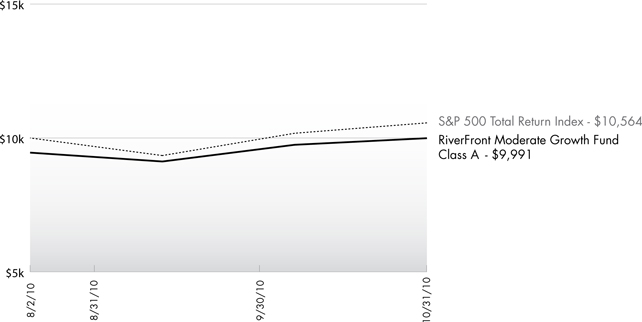

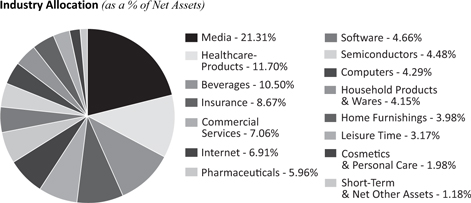

Performance of $10,000 Initial Investment (as of October 31, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Cumulative Return (as of October 31, 2010)

| 1 month | Since Inception^ | Gross Expense Ratio |

Net Expense Ratio* | |||||

| Class A (NAV)1 |

2.52% | 5.70% | 2.01% | 1.51% | ||||

| Class A (MOP)2 |

-3.12% | -0.09% | ||||||

| Class C (NAV)1 |

2.43% | 5.50% | 2.76% | 2.26% | ||||

| Class C (CDSC)2 |

1.52% | 4.60% | ||||||

| Class I |

2.42% | 5.70% | 1.76% | 1.26% | ||||

| S&P 500 Total Return Index3 |

3.81% | 5.64% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (866) 759-5679.

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | S&P 500 Total Return Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. An investor may not invest directly in the index. |

| ^ | Fund inception date of 8/2/10. |

| * | Effective through August 31, 2011, the Adviser and the Sub-Adviser have given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expense, taxes and extraordinary expenses to 1.05% of the average daily net assets for Class A, Class C and Class I shares. Without this agreement expenses could be higher. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund is less than a year old and has limited operating history. This Fund is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

42 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

As a shareholder of the Fund you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on August 2, 2010 and held until October 31, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on August 2, 2010 and held until October 31, 2010.

| Beginning Account Value 8/2/10 |

Ending Account Value 10/31/10 |

Expense Ratio(a) |

Expense Paid 10/31/10 |

|||||||||||||

| Class A(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,057.00 | 1.30% | $3.30 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,009.12 | 1.30% | $6.58 | ||||||||||||

| Class C(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,055.00 | 2.05% | $5.19 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,007.27 | 2.05% | $10.37 | ||||||||||||

| Class I(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,057.00 | 1.05% | $2.66 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,009.74 | 1.05% | $5.32 | ||||||||||||

| (a) | The Fund’s expense ratios have been based on the Fund’s inception date of August 2, 2010 through October 31, 2010. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

| (c) | Shares commenced operations on August 2, 2010. |

43 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

44 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

45 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

46 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

Common Abbreviations:

E-TRACS - Exchange Traded Access Securities

ETF - Exchange Traded Fund

ETN - Exchange Traded Note

Ltd. - Limited

MLP - Master Limited Partnership

MSCI - Morgan Stanley Capital International

REIT - Real Estate Investment Trust

S&P - Standard & Poor’s

SPDR - Standard & Poor’s Depositary Receipt

VIX - Market Volatility Index

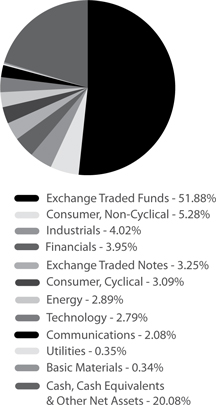

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are based on third party definitions and are unaudited. The definitions are industry terms and do not reflect the legal status of any of the investments or the companies in which the Fund has invested.

See Notes to Financial Statements.

47 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth & Income Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

| ^ | The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq |

| ^^ | A unit that is equal to 1/100th of 1% |

| * | Forward P/E multiples are a measure of the price-to-earnings ratio (P/E) using forecasted earnings |

48 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth & Income Fund | ||||||

|

Management Commentary |

October 31, 2010 (Unaudited) | |||||

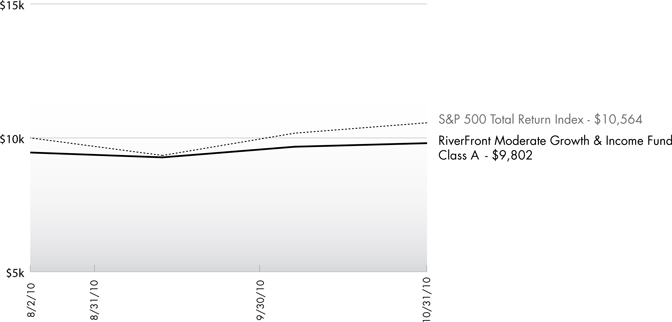

Performance of $10,000 Initial Investment (as of October 31, 2010)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Cumulative Return (as of October 31, 2010)

| 1 month | Since Inception^ | Gross Expense Ratio |

Net Expense Ratio* | |||||

| Class A (NAV)1 |

1.37% | 3.70% | 2.01% | 1.51% | ||||

| Class A (MOP)2 |

-4.25% | -1.98% | ||||||

| Class C (NAV)1 |

1.37% | 3.60% | 2.76% | 2.26% | ||||

| Class C (CDSC)2 |

0.37% | 2.60% | ||||||

| Class I |

1.47% | 3.80% | 1.76% | 1.26% | ||||

| S&P 500 Total Return Index3 |

3.81% | 5.64% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. The Fund imposes a maximum Contingent Deferred Sales Charge (“CDSC”) of 1.00% to shares redeemed within the first 12 months after a purchase in excess of $1 million. Performance data does not reflect the CDSC, which if reflected would reduce the performance quoted. For the most current month-end performance data, please call (866) 759-5679.

| 1 | Net Asset Value (NAV) is the share price without sales charges. |

| 2 | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Fund’s maximum sales charge of 5.50%; Class C returns include the 1.00% CDSC. |

| 3 | S&P 500 Total Return Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. An investor may not invest directly in the index. |

| ^ | Fund inception date of 8/2/10. |

| * | Effective through August 31, 2011, the Adviser and the Sub-Adviser have given a contractual agreement to the Fund to limit the amount of the Fund’s total annual expenses, exclusive of distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expense, taxes and extraordinary expenses to 1.05% of the average daily net assets for Class A, Class C and Class I shares. Without this agreement expenses could be higher. |

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund is less than a year old and has limited operating history. This Fund is not suitable for all investors. Subject to investment risks, including possible loss of the principal amount invested.

49 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth & Income Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

As a shareholder of the Fund you will incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on August 2, 2010 and held until October 31, 2010.

Actual Expenses. The first line of the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table on the next page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as sales charges, redemption fees or exchange fees. Therefore, the second line of the table on the next page is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The examples are based on an investment of $1,000 invested on August 2, 2010 and held until October 31, 2010.

| Beginning Account Value 8/2/10 |

Ending Account Value 10/31/10 |

Expense Ratio(a) | Expense Paid 10/31/10 |

|||||||||||||

| Class A(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,037.00 | 1.30% | $3.27 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,009.12 | 1.30% | $6.58 | ||||||||||||

| Class C(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,036.00 | 2.05% | $5.15 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,007.27 | 2.05% | $10.37 | ||||||||||||

| Class I(c) |

||||||||||||||||

| Actual |

$1,000.00 | $1,038.00 | 1.05% | $2.64 | ||||||||||||

| Hypothetical (5% return before expenses) |

$1,000.00 | $1,009.74 | 1.05% | $5.32 | ||||||||||||

| (a) | The Fund’s expense ratios have been based on the Fund’s inception date of August 2, 2010 through October 31, 2010. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365. |

| (c) | Shares commenced operations on August 2, 2010. |

50 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth & Income Fund | ||||||

|

|

October 31, 2010 (Unaudited) | |||||

51 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth & Income Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

52 | October 31, 2010

Table of Contents

| RiverFront Moderate Growth & Income Fund | ||||||

|

Statement of Investments |

October 31, 2010 (Unaudited) | |||||

53 | October 31, 2010

Table of Contents

| Statements of Assets and Liabilities | ||||||

|

October 31, 2010 (Unaudited) | ||||||

| ALPS | GNI Long-Short Fund |

ALPS | Red Rocks Listed Private Equity Fund |

ALPS | WMC Value Intersection Fund (a) |

Clough China Fund |

|||||||||||||

| ASSETS |

||||||||||||||||

| Investments, at value |

$ | 9,579,717 | $ | 136,556,425 | $ | 57,045,278 | $ 93,817,621 | |||||||||

| Cash |

333,150 | – | – | – | ||||||||||||

| Foreign currency, at value |

– | 234,924 | – | 59,731 | ||||||||||||

| Receivable for investments sold |

477,213 | 447,067 | 1,253,033 | 1,063,096 | ||||||||||||

| Receivable for shares sold |

– | 338,883 | 62,332 | 475,268 | ||||||||||||

| Dividends and interest receivable |

650 | 68,189 | 57,389 | 14,537 | ||||||||||||

| Deposits with brokers for securities sold short |

331,013 | – | – | – | ||||||||||||

| Prepaid expenses and other assets |

22,630 | 37,721 | 27,804 | 18,498 | ||||||||||||

| Total Assets |

10,744,373 | 137,683,209 | 58,445,836 | 95,448,751 | ||||||||||||

| LIABILITIES |

||||||||||||||||

| Payable for investments purchased |

– | 883,514 | 841,606 | 2,905,697 | ||||||||||||

| Payable for shares redeemed |

– | 60,435 | 8,479 | 142,363 | ||||||||||||

| Securities sold short |

2,362,992 | – | – | – | ||||||||||||

| Dividends payable–short sales |

450 | – | – | – | ||||||||||||

| Written options |

102,600 | – | – | – | ||||||||||||

| Investment advisory fees payable |

6,478 | 63,830 | 14,352 | 82,004 | ||||||||||||

| Administration and transfer agency fees payable |

1,483 | 19,368 | 9,449 | 21,128 | ||||||||||||

| Distribution and services fees payable |

9 | 26,979 | 9,003 | 19,637 | ||||||||||||

| Directors’ fees and expenses payable |

864 | 6,784 | 5,044 | 4,661 | ||||||||||||

| Audit fees payable |

10,993 | 20,276 | 10,321 | 12,505 | ||||||||||||

| Legal fees payable |