Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

|

| |

(Mark One) | |

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2018 |

| OR |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ______________ to ______________ |

Commission file number 1-12626

EASTMAN CHEMICAL COMPANY

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 62-1539359 |

(State or other jurisdiction of | (I.R.S. employer |

incorporation or organization) | identification no.) |

| |

200 South Wilcox Drive | |

Kingsport, Tennessee | 37662 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (423) 229-2000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

1.50% Notes Due 2023 | | New York Stock Exchange |

1.875% Notes Due 2026 | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

|

| | |

| Yes | No |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | [X] | |

| Yes | No |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. | | [X] |

| Yes | No |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | [X] | |

| Yes | No |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | [X] | |

| Yes | No |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | [X] | |

| | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of "large accelerated filer," "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. Large accelerated filer [X] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [ ] Emerging growth company [ ] | | |

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ] | | |

| Yes | No |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | | [X] |

The aggregate market value (based upon the $99.96 closing price on the New York Stock Exchange on June 29, 2018) of the 139,171,775 shares of common equity held by non-affiliates as of December 31, 2018 was $13,911,610,629 using beneficial ownership rules adopted pursuant to Section 13 of the Securities Exchange Act of 1934 to exclude common stock that may be deemed beneficially owned as of December 31, 2018 by Eastman Chemical Company's directors and executive officers and charitable foundation, some of whom might not be held to be affiliates upon judicial determination. A total of 139,777,332 shares of common stock of the registrant were outstanding at December 31, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement for the 2019 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission, are incorporated by reference in Part III, Items 10 to 14 of this Annual Report on Form 10-K (this "Annual Report") as indicated herein.

FORWARD-LOOKING STATEMENTS

Certain statements made or incorporated by reference in this Annual Report on Form 10-K (this "Annual Report") are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act (Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities and Exchange Act of 1934, as amended). Forward-looking statements are all statements, other than statements of historical fact, that may be made by Eastman Chemical Company ("Eastman" or the "Company") from time to time. In some cases, you can identify forward-looking statements by terminology such as "anticipates", "believes", "estimates", "expects", "intends", "may", "plans", "projects", "will", "would", and similar expressions or expressions of the negative of these terms. Forward-looking statements may relate to, among other things, such matters as planned and expected capacity increases and utilization; anticipated capital spending; expected depreciation and amortization; environmental matters; exposure to, and effects of hedging of, raw material and energy prices and costs; foreign currencies and interest rates; disruption or interruption of operations and of raw material or energy supply; global and regional economic, political, and business conditions; competition; growth opportunities; supply and demand, volume, price, cost, margin and sales; pending and future legal proceedings; earnings, cash flow, dividends, stock repurchases and other expected financial results, events, and conditions; expectations, strategies, and plans for individual assets and products, businesses, and operating segments, as well as for the whole of Eastman; cash requirements and uses of available cash; financing plans and activities; pension expenses and funding; credit ratings; anticipated and other future restructuring, acquisition, divestiture, and consolidation activities; cost reduction and control efforts and targets; the timing and costs of, and benefits from, the integration of, and expected business and financial performance of, acquired businesses; strategic and technology and product innovation initiatives and development, production, commercialization and acceptance of new products, services and technologies and related costs; asset, business, and product portfolio changes; and expected tax rates and net interest costs.

Forward-looking statements are based upon certain underlying assumptions as of the date such statements were made. Such assumptions are based upon internal estimates and other analyses of current market conditions and trends, management expectations, plans, and strategies, economic conditions, and other factors. Forward-looking statements and the assumptions underlying them are necessarily subject to risks and uncertainties inherent in projecting future conditions and results. Actual results could differ materially from expectations expressed in the forward-looking statements if one or more of the underlying assumptions and expectations proves to be inaccurate or is unrealized. The most significant known factors, risks, and uncertainties that could cause actual results to differ materially from those in the forward-looking statements are identified and discussed under "Management's Discussion and Analysis of Financial Condition and Results of Operations - Risk Factors" in Part II, Item 7 of this Annual Report. Other factors, risks or uncertainties of which management is not aware, or presently deems immaterial, could also cause actual results to differ materially from those in the forward-looking statements.

The Company cautions you not to place undue reliance on forward-looking statements, which speak only as of the date such statements are made. Except as may be required by law, the Company undertakes no obligation to update or alter these forward-looking statements, whether as a result of new information, future events, or otherwise. Investors are advised, however, to consult any further public Company disclosures (such as filings with the Securities and Exchange Commission or in Company press releases) on related subjects.

TABLE OF CONTENTS

PART II

PART III

PART IV

SIGNATURES

PART I

|

| |

| Page |

| |

| |

| |

| |

| |

| |

Chemical Intermediates Segment | |

| |

| |

Eastman Chemical Company ("Eastman" or the "Company") is a global advanced materials and specialty additives company that produces a broad range of products found in items people use every day. Eastman began business in 1920 for the purpose of producing chemicals for Eastman Kodak Company's photographic business and became a public company, incorporated in Delaware, on December 31, 1993. Eastman has 48 manufacturing facilities and equity interests in three manufacturing joint ventures in 14 countries that supply products to customers throughout the world. The Company's headquarters and largest manufacturing facility are located in Kingsport, Tennessee. With a robust portfolio of specialty businesses, Eastman works with customers to deliver innovative products and solutions while maintaining a commitment to safety and sustainability. Eastman's businesses are managed and reported in four operating segments: Additives & Functional Products, Advanced Materials, Chemical Intermediates, and Fibers. See "Business Segments".

In the first years as a stand-alone company, Eastman was diversified between commodity and more specialty chemical businesses. Beginning in 2004, the Company refocused its strategy and changed its businesses and portfolio of products, first by the divestiture and discontinuance of under-performing assets and commodity businesses and initiatives (including divestiture in 2004 of resins, inks, and monomers product lines, divestiture in 2006 of the polyethylene business, and divestiture from 2007 to 2010 of the polyethylene terephthalate assets and business). The Company then pursued growth through the development and acquisition of more specialty businesses and product lines by inorganic acquisition and integration (including the acquisition of Solutia, Inc. ("Solutia"), a global leader in performance materials and specialty chemicals, in 2012, and Taminco Corporation, a global specialty chemical company, in 2014) and organic development and commercialization of new and enhanced technologies and products.

Eastman currently uses an innovation-driven growth model which consists of leveraging world class scalable technology platforms, delivering differentiated application development capabilities, and relentlessly engaging the market. The Company's world class technology platforms form the foundation of sustainable growth by differentiated products through significant scale advantages in research and development ("R&D") and advantaged global market access. Differentiated application development converts market complexity into opportunities for growth and accelerates innovation by enabling a deeper understanding of the value of Eastman's products and how they perform within customers' and end-user products. Key areas of application development include thermoplastic conversion, functional films, coatings formulations, rubber additive formulations, adhesives formulations, nonwovens and textiles, and animal nutrition. The Company engages the market by working directly with customers and downstream users, targeting attractive niche markets, and leveraging disruptive macro trends such as health and wellness, natural resource efficiency, an increasing middle class in emerging economies, and feeding a growing population. Management believes that these elements of the Company's innovation-driven growth model, combined with disciplined portfolio management and balanced capital deployment, will result in consistent, sustainable earnings growth and strong cash flow.

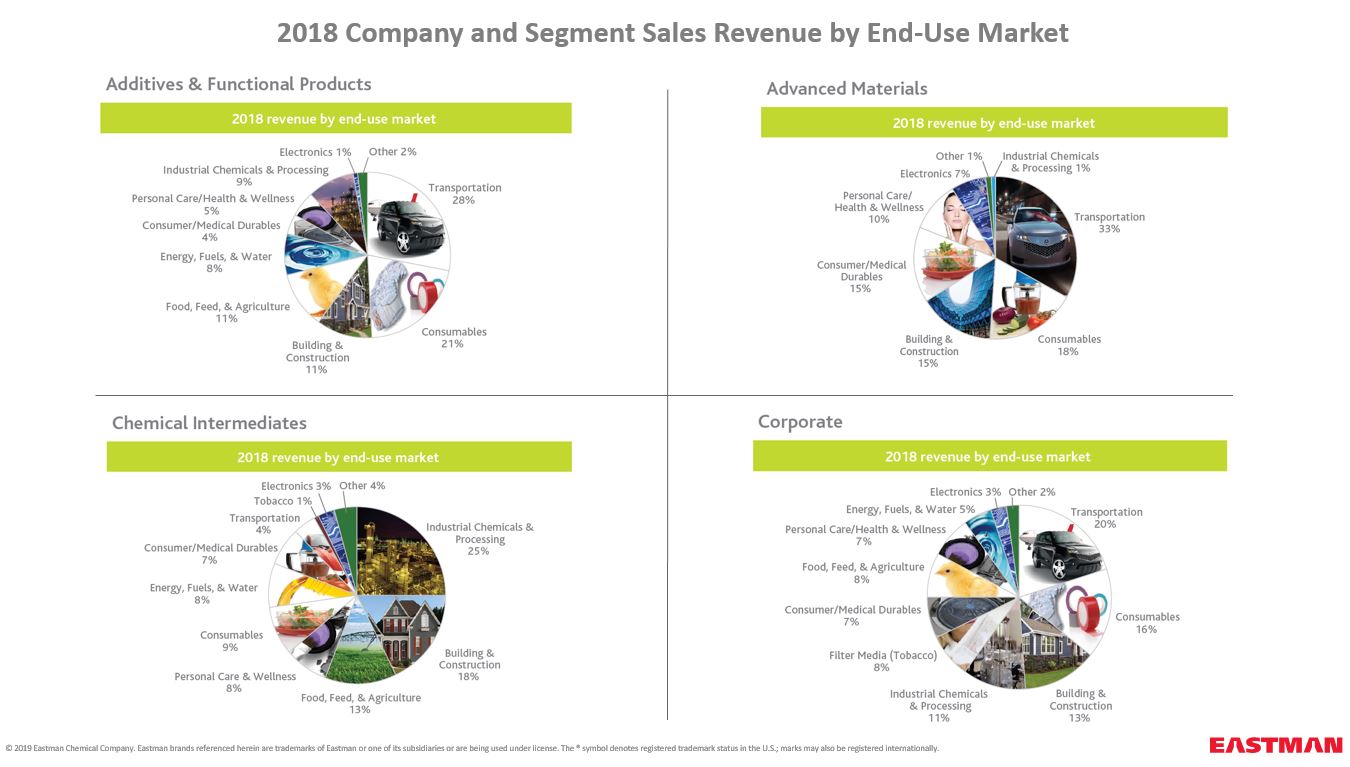

In 2018, the Company reported sales revenue of $10.2 billion, earnings before interest and taxes ("EBIT") of $1.6 billion, and net earnings attributable to Eastman of $1.1 billion. Diluted earnings per share attributable to Eastman were $7.56. Cash provided by operating activities was $1.5 billion. Excluding non-core and unusual items, adjusted EBIT was $1.6 billion and adjusted diluted earnings per share attributable to Eastman were $8.20. See "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Part II, Item 7 of this Annual Report on Form 10-K (this "Annual Report") for reconciliation of accounting principles generally accepted in the United States ("GAAP") to non-GAAP measures, description of excluded items, and related information. For Company sales revenue by end-market, see Exhibit 99.01 "2018 Company and Segment Revenue by End-Use Market" of this Annual Report. Approximately 60 percent of 2018 sales revenue was generated from outside the United States and Canada region. For additional information regarding sales by customer location and by segment, see Note 19, "Segment Information", to the Company's Consolidated Financial Statements in Part II, Item 8, and "Management's Discussion and Analysis of Financial Condition and Results of Operations - Summary by Operating Segment", "Sales by Customer Location", and "Risk Factors" in Part II, Item 7 of this Annual Report.

BUSINESS STRATEGY

Eastman's objective is to be an outperforming specialty chemical company with consistent, sustainable earnings growth and strong cash flow. Integral to the Company's strategy for growth is leveraging its heritage of expertise and innovation within its cellulose and acetyl, olefins, polyester, and alkylamine chemistries. For each of these "streams", the Company has developed and acquired a combination of assets and technologies that combine scale and integration across multiple manufacturing units and sites as a competitive advantage. Management uses an innovation-driven growth model which consists of leveraging world class scalable technology platforms, delivering differentiated application development, and relentlessly engaging the market. The Company sells differentiated products into diverse markets and geographic regions and engages the market by working directly with customers and downstream users to meet their needs in existing and new niche markets. Management believes that this innovation-driven growth model will result in consistent financial results by leveraging the Company's proven technology capabilities to improve product mix, increasing emphasis on specialty businesses, and sustaining and expanding leadership in attractive niche markets. A consistent increase in earnings is expected to continue to result from both organic growth initiatives and strategic inorganic initiatives.

Innovation

Management is pursuing specific opportunities to leverage Eastman's innovation-driven growth model for continued near-term and long-term greater than end-market growth by both sustaining the Company's leadership in existing markets and expanding into new markets, including the following examples of recent innovation:

| |

• | Tetrashield™ performance polyester resins based on proprietary monomer technology. These polyester resins provide a combination of improved performance and sustainability, particularly for the automotive coatings, industrial, and food packaging markets. |

| |

• | Impera™ high performance resins for tires. When used as additives in tire compound formulations, Impera™ resins enable tire manufacturers to improve the safety and handling of tires, balance tire performance and fuel economy needs, and achieve superior levels of tack for tire construction. |

| |

• | Aerafin™ polymer, developed from proprietary olefin technology. These olefin polymers enable improved processing time and other benefits including low odor, improved adhesion, exceptional peel performance, and thermal stability for adhesive applications within the hygiene market. |

| |

• | Care chemicals alkylamine derivatives including water treatment solutions with state-of-the-art technology enabling the efficient removal of dirt particles at a low dosage for demanding industrial and municipal applications. |

| |

• | Treva™, a cellulose-based engineering bioplastic that offers high performance, sustainability, and design flexibility in applications that require complex and intricate designs and high safety requirements such as eyeglass frames, wearable electronics, lenses, and cosmetics. |

| |

• | Naia™, a yarn for the apparel market developed from Eastman's proprietary cellulose ester technology. |

| |

• | Avra™, a family of fibers for the performance apparel market developed from a combination of Eastman proprietary spinning technology and polymer chemistry enabling unique fiber capabilities of size, shape, comfort, and performance. |

| |

• | Vestera™, a new wood pulp-based alternative for the nonwoven industry used in personal hygiene applications. |

| |

• | Recently introduced 72" version of automotive paint protection film marketed under established trademarks. |

Sustainability

Eastman is committed to making a positive impact on the markets, customers, communities and employees that it serves. An important element of this commitment is offering the Company’s stakeholders a dedicated approach to sustainable innovation. Management approaches sustainability as a source of competitive strength by focusing its innovation strategy on opportunities where disruptive macro trends align with the Company's differentiated technology platforms and applications development capabilities to develop innovative products that enable customers' development and sales of sustainable products. Eastman's sustainability-related growth initiatives include targeted products utilizing technology that enhances end-use product durability, material usage, recyclability, and health and safety impact characteristics to reduce unnecessary waste, pollution, and greenhouse gas emissions. Examples of Eastman's leading position in providing sustainable solutions within identified disruptive macro trends include:

| |

• | Health and wellness: Tritan™ copolyester, Tetrashield™ performance polyester resins, and Vestera™ cellulosic fiber; |

| |

• | Natural resource efficiency: Saflex™ Q series advanced acoustic interlayers, Impera™ high performance resins for tires, and Treva™ proprietary engineering bioplastic; |

| |

• | Emerging middle class: Saflex™ and head-up display ("HUD") acoustic interlayers, Regalite™ hydrocarbon resins, Naia™ cellulosic yarn, and Avra™ performance fibers; and |

| |

• | Feeding a growing population: Eastman organic acids, Enhanz™ feed additive, and Banguard™ crop protection. |

The Company leverages core competencies in polyesters, cellulose esters, thermoplastic processing, textile capability, and in-house application expertise for use in a wide range of applications to provide solutions to markets which are in search of new and improved products.

FINANCIAL STRATEGY

In its management of the Company's businesses and growth initiatives, management is committed to maintaining a strong financial position with appropriate financial flexibility and liquidity. Management believes maintaining a financial profile that supports an investment grade credit rating is important to its long-term strategic and financial flexibility. The Company employs a disciplined and balanced approach to capital allocation and deployment of cash. The priorities for uses of available cash include payment of the quarterly dividend, repayment of debt, funding targeted growth opportunities, and repurchasing shares. Management expects that the combination of continued strong cash flow generation, a strong balance sheet, and sufficient liquidity will continue to provide flexibility to pursue growth initiatives.

The Company's products and operations are managed and reported in four operating segments: Additives & Functional Products ("AFP"), Advanced Materials ("AM"), Chemical Intermediates ("CI"), and Fibers. This organizational structure is based on the management of the strategies, operating models, and sales channels that the various businesses employ and supports the Company's strategy of continued transformation towards a specialty portfolio of products. For segment sales revenue and earnings and segment product lines revenues, see Note 19, "Segment Information", to the Company's Consolidated Financial Statements in Part II, Item 8 and "Management's Discussion and Analysis of Financial Condition and Results of Operations - Summary by Operating Segment" in Part II, Item 7 of this Annual Report. For identification of manufacturing facilities by segment, see Item 2, "Properties" of this Annual Report.

ADDITIVES & FUNCTIONAL PRODUCTS SEGMENT

Overview

In the AFP segment, the Company manufactures chemicals for products in the transportation, consumables, building and construction, animal nutrition, crop protection, energy, personal and home care, and other markets. Key technology platforms in this segment are cellulose esters, polyester polymers, insoluble sulfur, hydrocarbon resins, alkylamine derivatives, and propylene derivatives.

The AFP segment's sales growth is typically above annual industrial production growth due to innovation and enhanced commercial execution with sales to a robust set of end-markets. The segment is focused on producing high-value additives that provide critical functionality but which comprise a small percentage of total customer product cost. The segment principally competes on the unique performance characteristics of its products and through leveraging its strong customer base and long-standing customer relationships to promote substantial recurring business and product development. A critical element of the AFP segment's success is its close formulation collaboration with customers through advantaged application development capability.

Principal Products

|

| | | | |

Product | Description | Principal Competitors | Key Raw Materials | End-Use Applications |

Coatings and Inks Additives |

Polymers cellulosics Tetrashield™ polyesters polyolefins

Additives and Solvents Texanol™ Optifilm™ ketones esters glycol ethers oxo alcohols

| specialty coalescents, specialty solvents, and commodity solvents paint additives and specialty polymers | BASF SE DowDuPont Inc. Oxea Celanese Corporation Alternative Technologies

| wood pulp propane propylene

| building and construction (architectural coatings) transportation (OEM) and refinish coatings durable goods (wood, industrial coatings and applications) consumables (graphic arts, inks, and packaging)

|

Adhesives Resins |

Piccotac™ Regalite™ Eastotac™ Eastoflex™ Aerafin™ | hydrocarbon resins and rosin resins mainly for hot-melt and pressure sensitive adhesives

| Exxon Mobil Corporation Kolon Industries, Inc. Evonik Industries | C9 resin oil piperylene gum rosin propylene

| consumables (resins used in hygiene and packaging adhesives) building and construction (resins for construction adhesives and interior flooring)

|

Tire Additives |

Crystex™ | insoluble sulfur rubber additive

| Oriental Carbon & Chemicals Limited Shikoku Chemicals Corporation

| sulfur naphthenic process oil | transportation (tire manufacturing) other rubber products (such as hoses, belts, seals, and footwear) |

Santoflex™ | antidegradant rubber additive | Jiangsu Sinorgchem Technology Co., Ltd. Kumho Petrochemical Co., Ltd. Lanxess AG

| nitrobenzene aniline methyl isobutyl ketone

| transportation (tire manufacturing) other rubber products (such as hoses, belts, seals, and footwear)

|

Impera™

| performance resins | Cray Valley Hydrocarbon Specialty Chemicals Exxon Mobil Corporation Kolon Industries, Inc.

| alpha methylstyrene piperylene styrene

| transportation (tire manufacturing)

|

|

| | | | |

Product | Description |

Principal Competitors |

Key Raw Materials |

End-Use Applications |

Care Chemicals |

Alkylamine derivatives Organic acids and derivatives Cellulose esters

| amine derivative-based building blocks for production of flocculants intermediates for surfactants | BASF SE DowDuPont Inc. Huntsman Corporation

| alkylamines ammonia alcohols ethylene oxide

| water treatment personal and home care pharmaceuticals

|

Specialty Fluids |

Therminol™ Turbo oils Skydrol™ SkyKleen™

| heat transfer and aviation fluids

| DowDuPont Inc. Exxon Mobil Corporation

| benzene phosphorous neo-polyol esters

| industrial chemicals and processing (heat transfer fluids for chemical processes) renewable energy commercial aviation

|

Animal Nutrition |

Organic acids and derivatives Choline chloride Enhanz™ | organic acid-based solutions | BASF SE Perstorp Luxi Chemical Group Feicheng Acid Chemicals | formic acid ethylene oxide propane heavy fuel oil | gut health solutions preservation industrial applications

|

Crop Protection |

Alkylamine derivatives Banguard™

| metam-based soil fumigants thiram and ziram-based fungicides plant growth regulator

| DowDuPont Inc. Argo-Kanesho Co., Ltd. Bayer BASF SE | alkylamines CS2 caustic soda

| agriculture crop protection

|

See Exhibit 99.01 for AFP segment revenue by end-use market.

Strategy

Management applies the innovation-driven growth model in the AFP segment by leveraging proprietary technologies for the continued development of innovative product offerings and focusing growth efforts on further expanding end-markets such as transportation, building and construction, consumables, industrial applications, animal nutrition, care chemicals, crop protection, and energy. Management believes that the ability to leverage the AFP segment's research, differentiated application development, and production capabilities across multiple markets uniquely positions it to meet evolving needs to improve the quality and performance of its customers' products. For example, tire performance labeling regulations in various parts of the world and competitive pressure favoring performance over cost are causing tire manufacturers to simultaneously improve conflicting tire attributes. Eastman's tire additives technology helps tire manufacturers overcome common compromises often observed between wet grip and rolling resistance. In order to address identified market needs, the Company is also developing new technologies such as polyester resins for coatings, sustainable solvents, and cellulose esters and hydrocarbon resins for tires.

Eastman's global manufacturing presence is a key element of the AFP segment's growth strategy. For example, the segment expects to capitalize on industrial growth in Asia from its manufacturing capacity expansion in Kuantan, Malaysia and cellulose ester products sourced from the Company's low-cost cellulose and acetyl manufacturing stream in North America.

In 2018, the AFP segment:

| |

• | advanced growth and innovation of Crystex™ insoluble sulfur rubber additives through mechanical completion of an expansion of the manufacturing facility in Kuantan, Malaysia in second quarter 2018 resulting in commercial sales beginning in first quarter 2019. This expansion is expected to allow the Company to capitalize on recent enhancements of technology by improving the Company's cost position and facilitating the introduction of new products into the tire markets; and |

| |

• | advanced growth of specialty ketones for low volatile organic compound ("VOC") coatings and other markets as a result of a capacity expansion at the Kingsport, Tennessee manufacturing facility which became fully operational in second quarter 2018. |

The AFP segment is pursuing specific opportunities to leverage Eastman's innovation-driven growth model to create greater than end-market growth by both sustaining the Company's leadership in existing markets and expanding into new markets. Examples of recent product innovation within the AFP segment include Tetrashield™ performance polyester resins based on proprietary monomer technology, Impera™ high performance resins for tires, Aerafin™ polymer, developed from proprietary olefin technology, and care chemicals alkylamine derivatives including state-of-the-art water treatment solutions.

ADVANCED MATERIALS SEGMENT

Overview

In the AM segment, the Company produces and markets polymers, films, and plastics with differentiated performance properties for value-added end-uses in transportation, consumables, building and construction, durable goods, and health and wellness markets. Key technology platforms for this segment include cellulose esters, copolyesters, and polyvinyl butyral ("PVB") and polyester films.

Eastman's technical, application development, and market development capabilities enable the AM segment to modify its polymers, films, and plastics to control and customize their final properties for development of new applications with enhanced functionality. For example, Tritan™ copolyesters are a leading solution for food contact applications due to their performance and processing attributes and Bisphenol A ("BPA") free properties. The Saflex™ Q Series product line is a leading acoustic solution for architectural and automotive applications. The Company also maintains a leading solar control technology position in the window film market through the use of high performance sputter coatings which enhance solar heat rejection while maintaining superior optical properties. The segment principally competes on differentiated technology and application development capabilities. Management believes the AM segment's competitive advantages also include long-term customer relationships, vertical integration and scale in manufacturing, and leading market positions.

Principal Products

|

| | | | |

Product | Description | Principal Competitors | Key Raw Materials | End-Use Applications |

| | | | |

Specialty Plastics |

Tritan™ copolyester Eastar™ copolyesters Spectar™ copolyester Embrace™ copolyester Visualize™ Eastman Aspira™ family of resins Treva™

| copolyesters cellulose esters | Covestro Trinseo Evonik Industries AG Saudi Basic Industries Corporation Mitsubishi Chemical Corporation S.K. Chemical Industries Sichuan Push Acetati Company Limited Daicel Chemical Industries Ltd | paraxylene ethylene glycol cellulose purified terephthalic acid

| consumables (consumer packaging, cosmetics packaging, in-store fixtures and displays) durable goods (consumer housewares and appliances) health and wellness (medical) electronics (displays)

|

Advanced Interlayers |

Saflex™ Saflex™ Q Series Saflex™ ST

| PVB sheet specialty PVB intermediates

| Sekisui Chemical Co., Ltd. Kuraray Co., Ltd Kingboard (Fo Gang) Specialty Resins Limited Chang Chun Petrochemical Co., Ltd

| polyvinyl alcohol vinyl acetate monomer butyraldehyde 2-ethyl hexanol ethanol triethylene gylcol | transportation (automotive safety glass, automotive acoustic glass, and HUD) building and construction (PVB for architectural interlayers)

|

Performance Films |

LLumar™ Flexvue™ SunTek™ V-KOOL™ Gila™

| window film and protective film products for aftermarket applied films

| 3M Company Saint-Gobain S.A. Beijing Kangde Xin Composite Material Co., Ltd "KDX"

| polyethylene terephthalate film

| transportation (automotive after- market window film and paint protection film) building and construction (residential and commercial window films) health and wellness (medical)

|

See Exhibit 99.01 for AM segment revenue by end-use market.

Strategy

Management applies the innovation-driven growth model in the AM segment by leveraging innovation and technology platforms into new and multi-generational products and applications, accelerating AM segment growth, and leveraging its manufacturing capacity. The segment continues to expand its portfolio of higher margin products in attractive end-markets. Through Eastman's advantaged asset position and expertise in applications development, management believes that the AM segment is well positioned for future growth. The advanced interlayers product lines, including PVB and HUD sheet interlayer products, leverage Eastman's global presence to supply industry leading innovations to automotive and architectural end-markets by collaborating with global and large regional customers. In the automotive end-market, the performance films product line has industry leading technologies, recognized brands, and what management believes is one of the largest distribution and dealer networks which, when combined, position Eastman for further growth, particularly in leading automotive markets such as North America and Asia. The segment's product portfolio is aligned with underlying energy efficiency trends in both automotive and architectural markets. Additionally, increased demand for BPA-free products has created new opportunities for various copolyester applications.

The AM segment expects to continue to improve product mix from increased sales of premium products, including Tritan™ copolyester, Visualize™ material, Saflex™ Q acoustic series, Saflex™ HUD interlayer products, LLumar™, V-KOOL™, and SunTek™ window and protective films.

In 2018, the AM segment:

| |

• | continued the growth of Tritan™ copolyester in the durable goods and health and wellness markets, supported by completion of an additional 60,000 metric ton expansion of Tritan™ copolyester capacity at the Kingsport, Tennessee manufacturing facility which became fully operational in second quarter 2018; |

| |

• | advanced growth and innovation of Saflex™ acoustic interlayers used in the transportation and building and construction markets, enabled by construction of a manufacturing facility for PVB resin at the Kuantan, Malaysia site which became fully operational in first quarter 2018; |

| |

• | advanced growth in the Chinese market supported by the conversion of manufacturing capacity at the Suzhou, China site from non-acoustic to acoustic interlayer production which was mechanically completed in fourth quarter 2018 and is expected to produce material qualified for commercial sales in 2019; and |

| |

• | strengthened growth in automotive window and paint protection films in North America and China through improved sales channel, marketing, and commercial execution strategies and capabilities. |

The AM segment is pursuing specific opportunities to leverage Eastman's innovation-driven growth model to create greater than end-market growth by both sustaining the Company's leadership in existing markets and expanding into new markets. An example of recent product innovation within the AM segment is Treva™, a cellulose-based engineering bioplastic.

CHEMICAL INTERMEDIATES SEGMENT

Overview

The CI segment leverages large scale and vertical integration from the cellulose and acetyl, olefins, and alkylamines streams to support the Company's specialty operating segments with advantaged cost positions. The CI segment sells excess intermediates beyond the Company's internal specialty needs into markets such as industrial chemicals and processing, building and construction, health and wellness, and agrochemicals. Key technology platforms include acetyls, oxos, plasticizers, polyesters, and alkylamines.

The CI segment product lines benefit from competitive cost positions primarily resulting from the use of and access to lower cost raw materials, and the Company's scale, technology, and operational excellence. Examples include coal used in the production of cellulose and acetyl stream product lines, feedstocks used in the production of olefin derivative product lines such as oxo alcohols and plasticizers, and ammonia and methanol used to manufacture methylamines. The CI segment also provides superior reliability to customers through its backward integration into readily available raw materials, such as propane, ethane, coal, and propylene. In addition to a competitive cost position, the plasticizers business expects to continue to benefit from the growth in relative use of non-phthalate rather than phthalate plasticizers in the United States, Canada, and Europe.

Several CI segment product lines are affected by cyclicality, most notably olefin and acetyl-based products. See "Eastman Chemical Company General Information - Manufacturing Streams". This cyclicality is caused by periods of supply and demand imbalance, when either incremental capacity additions are not offset by corresponding increases in demand, or when demand exceeds existing supply. While management continues to take steps to reduce the impact of the trough of these cycles, future results are expected to occasionally fluctuate due to both general economic conditions and industry supply and demand.

Principal Products

|

| | | | |

Product | Description | Principal Competitors | Key Raw Materials | End-Use Applications |

| | | | |

Intermediates |

Oxo alcohols and derivatives Acetic acid and derivatives Acetic anhydride Ethylene Glycol ethers Esters

| Olefin derivatives, acetyl derivatives, ethylene, commodity solvents

| Lyondell Bassell, BASF SE DowDuPont Inc. Oxea BP plc Celanese Corporation Lonza Ineos Group Holdings S.A. Indorama Ventures Public Company Limited

| propane ethane propylene coal natural gas paraxylene metaxylene

| industrial chemicals and processing building and construction (paint and coating applications, construction chemicals, building materials) pharmaceuticals and agriculture health and wellness packaging

|

Plasticizers |

Eastman 168™ DOP Benzoflex™ TXIB™ Effusion™

| primary non- phthalate and phthalate plasticizers and a range of niche non- phthalate plasticizers

| BASF SE Exxon Mobil Corporation LG Chem, Ltd. Emerald Performance Materials

| propane propylene paraxylene

| building and construction (non-phthalate plasticizers used in interior surfaces) consumables (food packaging, packaging adhesives, and glove applications) health and wellness (medical devices)

|

Functional Amines |

Alkylamines

| methylamines and salts higher amines and solvents

| BASF SE Chemours U.S. Amines Oxea

| methanol ammonia acetone ethanol butanol

| agrochemicals energy consumables water treatment animal nutrition industrial intermediates |

See Exhibit 99.01 for CI segment revenue by end-use market.

Strategy

To maintain and enhance its status as a low-cost producer and optimize earnings, the CI segment continuously focuses on cost control, operational efficiency, and capacity utilization. This includes focusing on products used internally by other operating segments, thereby supporting growth in specialty product lines throughout the Company. Through the CI segment, the Company has leveraged the advantage of its highly integrated manufacturing facilities. For example, the Kingsport, Tennessee manufacturing facility allows for the production of acetic anhydride and other acetyl derivatives from coal rather than natural gas or other petroleum feedstocks. At the Longview, Texas manufacturing site, Eastman uses its proprietary oxo technology in one of the world's largest single-site, oxo butyraldehyde manufacturing facilities to produce a wide range of alcohols and other derivative products utilizing local propane and ethane supplies and purchased propylene. The Pace, Florida manufacturing facility, which uses ammonia and methanol feedstocks, is the largest methylamine production site in the world. These integrated facilities, combined with large scale production processes and a continuous focus on additional process improvements, allow the CI segment product lines to remain cost competitive and, for some products, cost-advantaged as compared to competitors.

The Company reduced operating rates of the olefin cracking units at the Longview, Texas manufacturing facility to reduce the amount of excess ethylene produced and sold at lower spot prices in the merchant ethylene market over the second half of 2018. The Company took further action through completion of modifications to the site's olefin cracking units, which will allow for the introduction of refinery-grade propylene ("RGP") into the feedstock mix while also reducing the amount of other purchased feedstocks in 2019. This feedstock shift is expected to result in a significant decrease in ethylene production and excess ethylene sales, while maintaining historical levels of propylene production. Consequently, the RGP project provides the flexibility to largely remove the Company from participation in the merchant ethylene market, while retaining a cost-advantaged integrated propylene position to support specialty derivatives throughout the Company.

FIBERS SEGMENT

Overview

In the Fibers segment, Eastman manufactures and sells Estron™ acetate tow and Estrobond™ triacetin plasticizers for use in filtration media, primarily cigarette filters; Estron™ natural (undyed), Chromspun™ solution-dyed acetate yarns, Naia™ cellulosic fibers and yarn for use in apparel, home furnishings, and industrial fabrics; nonwovens for use in filtration and friction media, used primarily in transportation, industrial, and agricultural markets; and cellulose acetate flake and acetyl raw materials for other acetate fiber producers. Eastman is one of the world's two largest suppliers of acetate tow and has been a market leader in the manufacture and sale of acetate tow since it began production in the early 1950s. The Company is the world's largest producer of acetate yarn and has been in this business for over 85 years.

The largest 10 Fibers segment customers accounted for approximately 70 percent of the segment's 2018 sales revenue, and include multinational as well as regional cigarette producers, fabric manufacturers, and other acetate fiber producers.

The Company's long history and experience in fibers markets are reflected in the Fibers segment's operating expertise, both within the Company and in support of its customers' processes. The Fibers segment's knowledge of the industry and of customers' processes allows it to assist its customers in maximizing their processing efficiencies, promoting repeat sales, and developing mutually beneficial, long-term customer relationships.

The Company's fully integrated fibers manufacturing process employs unique technology that allows it to use a broad range of high-purity wood pulps for which the Company has dependable sources of supply.

Contributing to profitability in the Fibers segment is the limited number of competitors and significant barriers to entry. These barriers include, but are not limited to, high capital costs for integrated manufacturing facilities.

The Fibers segment's competitive strengths include a reputation for high-quality products, technical expertise, large scale vertically-integrated processes, reliability of supply, balanced internally produced acetate flake supply for Fibers products, a reputation for customer service excellence, and a customer base characterized by strategic long-term customer and end-user relationships. The Company continues to capitalize and build on these strengths to further improve the strategic position of its Fibers segment. In response to challenging acetate tow market conditions, including additional industry capacity and lower capacity utilization rates, the Company has taken actions expected to stabilize segment earnings including, establishing long-term acetate tow customer agreements, pursuing growth in textile and nonwoven applications, and repurposing manufacturing capacity from acetate tow to new products.

Principal Products

|

| | | | |

Product | Description | Principal Competitors | Key Raw Materials | End-Use Applications |

| | | | |

Acetate Tow |

Estron™ | cellulose acetate tow | Celanese Corporation Rhodia Acetow Daicel Corporation Mitsubishi Rayon Co. Ltd. | wood pulp methanol high sulfur coal | filtration media (primarily cigarette filters) |

Acetyl Chemical Products |

Estrobond™ | triacetin cellulose acetate flake acetic acid acetic anhydride

| Jiangsu Ruijia Chemistry Co., Ltd. Polynt SpA Daicel Corporation Celanese Corporation Rhodia Acetow | wood pulp methanol high sulfur coal | filtration media (primarily cigarette filters)

|

Acetate Yarn |

Estron™ Chromspun™ Naia™

| natural (undyed) acetate yarn solution dyed acetate yarn | UAB Dirbtinis Pluostas Industrias del Acetato de Celulosa S.A. Mitsubishi Rayon Co. Ltd. Lenzing AG ENKA International GmbH & Co.KG | wood pulp methanol high sulfur coal | consumables (apparel, home furnishings, and industrial fabrics) health and wellness (medical tape) |

Nonwovens |

Nonwovens Vestera™ Celluosic Fiber

| wetlaid nonwoven media specialty and engineered papers cellulose acetate fiber | Hollingsworth and Vose Company Lydall, Inc. BorgWarner Inc. Lenzing AG | natural and synthetic fibers inorganic and metallic additives resins | filtration and friction media for transportation industrial agriculture and mining aerospace markets personal hygiene consumables |

Strategy

Management applies the innovation-driven growth model in the Fibers segment by leveraging its strong customer relationships and industry knowledge to maintain a leading industry position in the global market. The segment benefits from a state-of-the-art, world class, acetate flake production facility at the Kingsport, Tennessee site, which is supplied from Eastman's vertically integrated coal gasification facility and is the largest and most integrated acetate tow site in the world. Eastman's global acetate tow capacity is approximately 150,000 metric tons, not including the Company's participation in an acetate tow joint venture manufacturing facility in China. The Company supplies 100 percent of the acetate flake raw material to the China manufacturing joint venture from the Company's manufacturing facility in Kingsport, Tennessee, which the Company recognizes in sales revenue. The Company recognizes earnings in the joint venture through its equity investment, reported in "Other (income) charges, net" in the Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings in Part II, Item 8 of this Annual Report. The Company’s focus on innovation has resulted in repurposing some of its acetate tow manufacturing capacity to textiles and nonwovens, resulting in increased capacity utilization and lower acetate tow costs.

As a result of challenging market conditions for acetate tow, the Company closed its Workington, UK acetate tow manufacturing facility in 2015. Following an increase in acetate flake capacity at the Kingsport, Tennessee site in 2015, the Fibers segment could supply all its acetate tow and yarn spinning capacity from this low-cost flake asset. In order to fully utilize the increased capacity and reduce fixed costs, in June 2016, the Company sold its 50 percent interest in Primester, which manufactures cellulose acetate at the Company's Kingsport, Tennessee site. In 2018, the Company repurposed some of its acetate tow manufacturing capacity for production of new products.

The Company makes use of its capabilities in fibers technology to maintain a strong focus on incremental product and process improvements, with the goals of meeting customers' evolving needs and further improving the segment's manufacturing process efficiencies.

The Fibers segment R&D efforts focus on serving existing customers, leveraging proprietary cellulose ester and spinning technology for differentiated application development in new markets, optimizing asset productivity, and working with suppliers to reduce costs. For acetate tow, these efforts are assisting customers in the effective use of the segment's products and customers' product development efforts. Beyond acetate tow, management is applying the innovation-driven growth model to leverage its fibers technology and expertise to focus on innovative growth in the textiles and nonwovens markets. Examples of recent product innovation within the Fibers segment include Naia™, a yarn for the apparel market developed from Eastman's proprietary cellulose ester technology, Avra™, a family of performance fibers for the apparel, home furnishings and industrial fabrics markets developed from a combination of Eastman proprietary spinning technology and polymer chemistry enabling unique fiber capabilities of size, shape, comfort, and performance, and Vestera™, a new wood pulp-based alternative for the nonwoven industry used in personal hygiene applications.

|

|

EASTMAN CHEMICAL COMPANY GENERAL INFORMATION |

Seasonality and Cyclicality

Eastman's earnings are typically higher in second and third quarters, and cash flows from operations are typically highest in the second half of the year due to seasonal demand based on general economic activity in the Company's key markets as described in "Business Segments". Results in the AM segment are typically weaker in fourth quarter due to seasonal downturns in key markets.

The coatings and inks additives product line of the AFP segment and the intermediates product line of the CI segment are impacted by the cyclicality of key end products and markets, while other operating segments and product lines are more sensitive to global economic conditions. Supply and demand dynamics determine profitability at different stages of business cycles and global economic conditions affect the length of each cycle.

Despite sensitivity to global economic conditions, the product portfolios of each operating segment are expected to continue to provide an overall stable foundation for earnings growth.

Sales, Marketing, and Distribution

Eastman markets and sells products primarily through a global marketing and sales organization which has a presence in the United States and approximately 30 other countries selling into more than 100 countries around the world. The Company focuses its market engagement on attractive niche markets, leveraging disruptive macro trends, and market activation throughout the value chain with both customers and downstream users. Eastman's strategy is to target industries and markets where the Company can leverage its application development expertise to develop product offerings to provide differentiated value that address current and future customer and market needs. The Company's strategic marketing approach and capabilities leverage the Company's insights about trends, markets, and customers to drive development of specialty products. Through a highly skilled and specialized sales force that is capable of providing differentiated product solutions, Eastman strives to be the preferred supplier in the Company's targeted markets.

The Company's products are also marketed through indirect channels, which include dealers and contract representatives. Sales outside the United States tend to be made more frequently through dealers and contract representatives than sales in the United States. The combination of direct and indirect sales channels, including sales online through its Customer Center website, allows Eastman to reliably serve customers throughout the world.

The Company's products are shipped to customers and to downstream users directly from Eastman manufacturing plants and distribution centers worldwide.

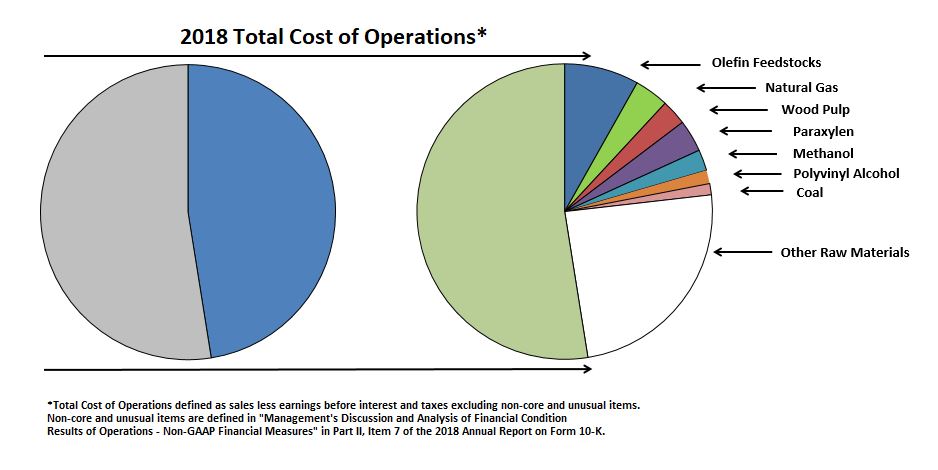

Sources and Availability of Raw Materials and Energy

Eastman purchases approximately 75 percent of its key raw materials and energy through different contract mechanisms, generally of one to three years in initial duration with renewal or cancellation options for each party. Most of these agreements do not require the Company to purchase materials or energy if its operations are reduced or idle. The cost of raw materials and energy is generally based on market price at the time of purchase, and Eastman uses derivative financial instruments for certain key raw materials to mitigate the impact of market price fluctuations. Key raw materials include propane, propylene, paraxylene, methanol, cellulose, fatty alcohol, polyvinyl alcohol, and a wide variety of precursors for specialty organic chemicals. Key purchased energy sources include natural gas, coal, and electricity. The Company has multiple suppliers for most key raw materials and energy and uses quality management principles, such as the establishment of long-term relationships with suppliers and ongoing performance assessments and benchmarking, as part of its supplier selection process. When appropriate, the Company purchases raw materials from a single source supplier to maximize quality and cost improvements, and has contingency plans to minimize the potential impact of any supply disruptions from single source suppliers.

While temporary shortages of raw materials and energy may occasionally occur, these items are generally sufficiently available to cover current and projected requirements. However, their continuous availability and cost are subject to unscheduled plant interruptions occurring during periods of high demand, domestic and world market conditions, changes in government regulation, natural disasters, war or other outbreak of hostilities or terrorism or other political factors, or breakdown or degradation of transportation infrastructure. Eastman's operations or products have in the past, and may in the future, be adversely affected by these factors. See "Management's Discussion and Analysis of Financial Condition and Results of Operations - Risk Factors" in Part II, Item 7 of this Annual Report. The Company's raw material and energy costs as a percent of total cost of operations were approximately 50 percent in 2018. For additional information about raw materials, see Exhibit 99.02 "Product and Raw Material Information" of this Annual Report.

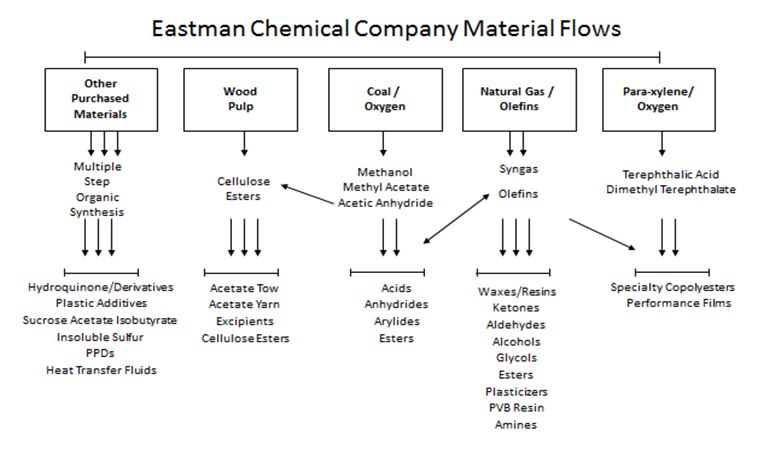

Manufacturing Streams

Integral to Eastman's strategy for growth is leveraging its heritage of expertise and innovation in cellulose and acetyl, olefins, polyester, and alkylamine chemistries in key markets, including transportation, building and construction, consumables, filtration media, and agriculture. For each of these chemistries, Eastman has developed and acquired a combination of assets and technologies that are operated within four manufacturing "streams", combining scale and integration across multiple manufacturing units and sites as a competitive advantage.

| |

• | In the cellulose and acetyl stream, the Company begins with coal which is gasified with oxygen in its coal gasification facility. The resulting synthesis gas is converted into acetic acid and acetic anhydride. Cellulose derivative manufacturing at the Company begins with natural polymers, sourced from managed forests, which, when combined with acetyl and olefin chemicals, provide differentiated product lines. The major end-markets for products from the cellulose and acetyl stream include coatings, displays, thermoplastics, and filtration media. |

| |

• | In the olefins stream, the Company begins primarily with propane and ethane, which are "cracked" (the process whereby hydrocarbon molecules are broken down and rearranged) into ethylene and propylene in three cracking units at its site in Longview, Texas. As a result of recent modifications, these units also offer flexibility to use RGP as a diversified feedstock to minimize the impact of olefins spread volatility. The Company purchases some additional propylene to supplement cracking unit production. Propylene derivative products are used in a variety of items such as paints and coatings, automotive safety glass, and non-phthalate plasticizers. Ethylene derivative products are converted for end-uses in the food industry, health and beauty products, detergents, and automotive products. |

| |

• | In the polyester stream, the Company begins with paraxylene and glycol feedstocks, converting them through a series of intermediate materials to ultimately produce copolyesters. Eastman can add specialty monomers to copolyesters to provide clear, tough, chemically resistant product characteristics. As a result, the Company's copolyesters effectively compete with materials such as polycarbonate and acrylic. |

| |

• | In the alkylamines stream, the Company begins with ammonia and alcohol feedstocks to produce methylamines and higher alkylamines, which can then be further converted into alkylamine derivatives. The Company's alkylamines products are primarily used in agriculture, water treatment, consumables, animal nutrition, and oil and gas end-markets. |

The Company leverages its expertise and innovation in cellulose and acetyl, olefins, polyester, and alkylamine chemistries and technologies, to meet demand and create new uses and opportunities for the Company's products in key markets. Through integration and optimization across these streams, the Company is able to create unique and differentiated products that have a performance advantage over competitive materials.

Employees

Eastman employs approximately 14,500 people worldwide. Approximately 10 percent of the total worldwide labor force is represented by collective labor agreements, mostly outside the United States.

Customers

Eastman has an extensive customer base and, while it is not dependent on any one customer, loss of certain top customers could adversely affect the Company until such business is replaced. The top 100 customers accounted for approximately 55 percent of the Company's 2018 sales revenue. No single customer accounted for 10 percent or more of the Company's consolidated sales revenue during 2018.

Intellectual Property and Trademarks

While Eastman's intellectual property portfolio is an important Company asset which it expands and vigorously protects globally through a combination of patents, trademarks, copyrights, and trade secrets, neither its business as a whole nor any particular operating segment is materially dependent upon any one particular patent, trademark, copyright, or trade secret. As a producer of a broad range of advanced materials, specialty additives, chemicals, and fibers, Eastman owns over 700 active United States patents and more than 1,600 active foreign patents, expiring at various times over several years, and owns over 5,400 active worldwide trademark applications and registrations. Eastman continues to actively protect its intellectual property. As the laws of many countries do not protect intellectual property to the same extent as the laws of the United States, Eastman cannot ensure that it will be able to adequately protect its intellectual property assets outside the United States. See "Management's Discussion and Analysis of Financial Condition and Results of Operations - Risk Factors" in Part II, Item 7 of this Annual Report.

The Company pursues opportunities to license proprietary technology to third parties where it has determined competitive impact to its businesses will be minimal. These arrangements typically are structured to require payments at significant project milestones such as signing, completion of design, and start-up.

Research and Development

Management applies its innovation-driven growth model to leverage the Company's world class scalable technology platforms that provide a competitive advantage and the foundation for sustainable earnings growth. The Company's R&D strategy for sustainable growth through innovation includes multi-generational product development for specialty products, faster and more differentiated product development by leveraging global application development capabilities, and the creation of value through integration of multiple technology platforms. The Company leverages core competencies in polyesters, cellulose esters, thermoplastic processing, textile capability, and in-house application expertise for use in a wide range of applications to provide solutions to markets which are in search of new and improved products. This strategy has been accelerated by enhancements of global differentiated application development capabilities that position Eastman as a strategic element of customers’ success within attractive niche markets. See examples of recent product innovations in "Corporate Overview - Business Strategy - Innovation".

Eastman manages certain growth initiatives and costs at the corporate level, including certain R&D costs not allocated to any one operating segment. The Company uses a stage-gating process, which is a disciplined decision-making framework for evaluating targeted opportunities, with a number of projects at various stages of development. As projects meet milestones, additional amounts are spent on those projects. The Company continues to explore and invest in R&D initiatives such as high-performance materials and advanced cellulosics that are aligned with opportunities created by disruptive macro trends. See discussion of macro trends in "Corporate Overview - Business Strategy - Sustainability".

Environmental

The Company is subject to significant and complex laws, regulations, and legal requirements relating to the use, storage, handling, generation, transportation, emission, discharge, disposal, and remediation of, and exposure to, hazardous and non-hazardous substances and wastes in all of the countries in which it does business. These health, safety, and environmental considerations are a priority in the Company's planning for all existing and new products and processes. The Health, Safety, Environmental and Security Committee of Eastman's Board of Directors oversees the Company's policies and practices concerning health, safety, and the environment and its processes for complying with related laws and regulations, and monitors related matters.

The Company's policy is to operate its plants and facilities in compliance with all applicable laws and regulations such that it protects the environment and the health and safety of its employees and the public. The Company intends to continue to make expenditures for environmental protection and improvements in a timely manner consistent with its policies and with available technology. In some cases, applicable environmental regulations such as those adopted under the Clean Air Act, Resource Conservation and Recovery Act, Comprehensive Environmental Response, Compensation, and Liability Act, and related actions of regulatory agencies determine the timing and amount of environmental costs incurred by the Company. Likewise, any new legislation or regulations related to greenhouse gas emissions and energy, or the repeal of such legislation or regulations, could impact the timing and amount of environmental costs incurred by the Company.

The Company accrues environmental costs when it is probable that the Company has incurred a liability at a contaminated site and the amount can be reasonably estimated. In some instances, the amount cannot be reasonably estimated due to insufficient information, particularly as to the nature and timing of future expenditures. In these cases, the liability is monitored until such time that sufficient information exists. With respect to a contaminated site, the amount accrued reflects liabilities expected to be paid out within approximately 30 years and the Company's assumptions about remediation requirements at the contaminated site, the nature of the remedy, the outcome of discussions with regulatory agencies and other potentially responsible parties at multi-party sites, and the number and financial viability of other potentially responsible parties. Changes in the estimates on which the accruals are based, unanticipated government enforcement action, or changes in health, safety, environmental, and chemical control regulations, and testing requirements could result in higher or lower costs.

Eastman's cash expenditures related to environmental protection and improvement were $274 million, $257 million, and $267 million, in 2018, 2017, and 2016, respectively, and include operating costs associated with environmental protection equipment and facilities, engineering costs, and construction costs. These cash expenditures include environmental capital expenditures of approximately $44 million, $38 million, and $45 million in 2018, 2017, and 2016, respectively.

The Company does not currently expect near term environmental capital expenditures arising from requirements of environmental laws and regulations to materially impact the Company's planned level of annual capital expenditures for environmental control facilities. Other matters concerning health, safety, and the environment are discussed in "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Part II, Item 7 and in Note 1, "Significant Accounting Policies"; Note 12, "Environmental Matters and Asset Retirement Obligations"; and Note 21, "Reserve Rollforwards" to the Company's consolidated financial statements in Part II, Item 8 of this Annual Report.

Backlog

As of December 31, 2018, Eastman's backlog of firm sales orders represented less than 10 percent of the Company's total consolidated revenue for the year. These orders are primarily short-term, and all orders are expected to be filled in the following year. The Company manages its inventory levels to control the backlog of products depending on customers' needs. In areas where the Company is the single source of supply, or competitive forces or customers' needs dictate, the Company may carry additional inventory to meet customer requirements.

Available Information - Securities and Exchange Commission ("SEC") Filings

Eastman makes available free of charge, in the "Investors - SEC Information" section of its Internet website (www.eastman.com), its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after electronically filing such material with, or furnishing it to, the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

For identification and discussion of the most significant risks applicable to the Company and its business, see "Management's Discussion and Analysis of Financial Condition and Results of Operations - Risk Factors" in Part II, Item 7 of this Annual Report.

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS |

None.

|

|

EXECUTIVE OFFICERS OF THE COMPANY |

Certain information about Eastman's executive officers is provided below:

Mark J. Costa, age 52, is Chief Executive Officer and Chair of the Eastman Chemical Company Board of Directors. Mr. Costa joined the Company in June 2006 as Senior Vice President, Corporate Strategy and Marketing; was appointed Executive Vice President, Polymers Business Group Head and Chief Marketing Officer in August 2008; was appointed Executive Vice President, Specialty Polymers, Coatings and Adhesives, and Chief Marketing Officer in May 2009; and became President and a member of the Board of Directors of the Company in May 2013. Prior to joining Eastman, Mr. Costa was a senior partner with Monitor Group ("Monitor"). He joined Monitor, a global management consulting firm, in 1988, and his experience included corporate and business unit strategies, asset portfolio strategies, innovation and marketing, and channel strategies across a wide range of industries. Mr. Costa was appointed Chief Executive Officer in January 2014 and was named Board Chair effective July 2014.

Curtis E. Espeland, age 54, is Executive Vice President and Chief Financial Officer. Mr. Espeland joined Eastman in 1996, and has served in various financial management positions of increasing responsibility, including Director of Internal Auditing; Director of Finance, Asia Pacific; Director of Corporate Planning and Forecasting; Vice President and Controller; Vice President, Finance, Eastman Division; Vice President, Finance, Polymers; and Senior Vice President and Chief Financial Officer from 2008 until December 2013. He served as the Company's Chief Accounting Officer from December 2002 to 2008. Prior to joining Eastman, Mr. Espeland was an audit and business advisory manager with Arthur Andersen LLP in the United States, Eastern Europe, and Australia. Mr. Espeland was appointed to his current position effective January 2014.

Brad A. Lich, age 51, is Executive Vice President and Chief Commercial Officer, with responsibility for the AM and Fibers segments, outside-U.S. regional business leadership, and the marketing, sales, pricing, and procurement organizations. Mr. Lich joined Eastman in 2001 as Director of Global Product Management and Marketing for the Coatings business. Other positions of increasing responsibility followed, including General Manager of Emerging Markets of the former Coatings, Adhesives, Specialty Polymers, and Inks ("CASPI") segment. In 2006, Mr. Lich became Vice President of Global Marketing with direct responsibility for company-wide global marketing functions. In 2008, Mr. Lich was appointed Vice President and General Manager of the CASPI segment, and in 2012 was appointed Vice President and General Manager of the AFP segment. In January 2014, Mr. Lich was appointed Executive Vice President, with responsibility for the AFP and AM segments and the marketing, sales, and pricing organizations. In March 2016, Mr. Lich assumed executive responsibility for outside-U.S. regional business leadership. Mr. Lich was appointed to his current position effective July 2016.

Lucian Boldea, age 47, is Executive Vice President with responsibility for the AFP and CI segments. Mr. Boldea joined Eastman in 1997 as a chemist. During his career at Eastman, he has held various positions in R&D, licensing, business management, and corporate growth platforms leadership. These positions included Technology Director for the former Performance Chemicals and Intermediates ("PCI") segment and Director of Corporate Growth Platforms. In 2015, he was appointed Group Vice President and General Manager of the AFP segment and became Senior Vice President of AFP in July 2016. Mr. Boldea was appointed to his current position effective January 2019.

Mark K. Cox, age 53, is Senior Vice President and Chief Manufacturing, Supply Chain, and Engineering Officer. Mr. Cox joined Eastman in 1986 and has served in a variety of management positions, including leadership roles within the business management, manufacturing, and technology areas. Additionally, he has held responsibility for Eastman's Corporate Six Sigma program. In August 2008, Mr. Cox was appointed Vice President, Chemicals and Fibers Technology. Beginning in May 2009, Mr. Cox served as Vice President, Chemicals, Fibers, and Performance Polymers Technology. He was appointed Vice President, Worldwide Engineering and Construction in August 2010, appointed Senior Vice President and Chief Manufacturing and Engineering Officer effective January 2014, and to his current position effective March 2016.

Stephen G. Crawford, age 54, is Senior Vice President and Chief Technology Officer, with executive responsibility for corporate innovation. Mr. Crawford joined Eastman in 1984. Since then, he has held several leadership positions of increasing responsibility in both the manufacturing and technology organizations. From 2007 until January 2014 he served as Vice President of Global R&D in the AM and AFP segments, and was appointed to his current position effective January 2014.

David A. Golden, age 53, is Senior Vice President, Chief Legal & Sustainability Officer and Corporate Secretary. Mr. Golden has overall responsibility for Eastman's Legal, Corporate Health, Safety, Environment, Security, Product Safety and Regulatory Affairs, Sustainability, Government Relations, Community Affairs, and Public Policy and Communication functions. He also has overall responsibility for Eastman's Global Business Conduct and International Trade Compliance programs. Prior to this position, he was Vice President, Associate General Counsel, and Corporate Secretary with overall responsibility for Eastman's Legal Department. Mr. Golden joined Eastman in 1995 as an attorney and has held positions of increasing responsibility, including serving as the Director of Internal Audit from October 2005 to October 2007 and Vice President and Assistant General Counsel responsible for the Company's commercial and international law groups from 2007 to 2010. Mr. Golden was appointed Senior Vice President, Chief Legal Officer, and Corporate Secretary in January 2013 and to his current position including executive leadership of the Company's sustainability efforts in March 2016. Prior to joining Eastman, he worked as an attorney in the Atlanta office of the law firm of Hunton & Williams.

Perry Stuckey III, age 59, is Senior Vice President, Chief Human Resources Officer. Mr. Stuckey joined Eastman in 2011 as Vice President, Global Human Resources, and was responsible for Eastman's human resources strategy and services worldwide. Mr. Stuckey's work experience includes a variety of global human resource management positions in manufacturing, industrial automation, and bio-technology companies, including Hill-Rom Company, Rockwell Automation, and Monsanto Company. Mr. Stuckey was appointed to his current position in January 2013.

Damon C. Warmack, age 61, is Senior Vice President, Corporate Development. Mr. Warmack joined Eastman in 1980, working in a series of sales and product management positions. He was located in Taiwan, Hong Kong, Shanghai, and Singapore with a range of assignments including the establishment of Eastman's commercial presence in China, joint venture development and management, and serving as Vice President and Managing Director, Asia Pacific. In addition, he served as Vice President and General Manager of Resins, Inks, and Monomers, leading the restructure and divestiture of this business. Mr. Warmack then served as Vice President and General Manager of the former CASPI segment and then of the former PCI segment. More recently, he had responsibility for corporate development and strategic planning, playing a lead role in the Company's business portfolio transformation through acquisitions and divestitures, and became Senior Vice President of Corporate Development and CI in July 2016. As previously announced, Mr. Warmack is retiring mid-year 2019 and was appointed to his current position effective January 2019 until his retirement.

Scott V. King, age 50, is Vice President, Corporate Controller and Chief Accounting Officer. Since joining Eastman in 1999 as Manager, Corporate Consolidations and External Reporting, Mr. King has held various positions of increasing responsibility in the financial organization. He was first appointed Corporate Controller in August 2007 and has served as Chief Accounting Officer since September 2008. Prior to joining Eastman, Mr. King was an audit and business advisory manager with PricewaterhouseCoopers LLP.

At December 31, 2018, Eastman owned or operated 48 manufacturing facilities and had equity interests in three manufacturing joint ventures in a total of 14 countries. Utilization of these sites may vary with product mix and economic, seasonal, and other business conditions; however, none of the principal plants are substantially idle. The Company's plants, including approved expansions, generally have sufficient capacity for existing needs and expected near-term growth. These plants are generally well maintained, in good operating condition, and suitable and adequate for their use. Unless otherwise indicated, all properties are owned. Corporate headquarters are in Kingsport, Tennessee. The Company's regional headquarters are in Shanghai, China; Miami, Florida; Rotterdam, the Netherlands; Singapore; and Zug, Switzerland.

The locations and general character of the Company's manufacturing facilities are:

|

| | | | |

| Segment using manufacturing location |

Location | Additives & Functional Products | Advanced Materials | Chemical Intermediates | Fibers |

| | | | |

USA | | | | |

Alvin, Texas (1) | x | | | |

Anniston, Alabama | x | | | |

Axton, Virginia | | x | | |

Canoga Park, California (2) | | x | | |

Cartersville, Georgia (1) | x | | | |

Chestertown, Maryland | | | x | |

Columbia, South Carolina (1) | | x | | |

Franklin, Virginia (1) | x | | | |

Jefferson, Pennsylvania | x | | | |

Kingsport, Tennessee | x | x | x | x |

Lemoyne, Alabama (1) | x | | | |

Linden, New Jersey | x | | | |

Longview, Texas | x | x | x | |

Martinsville, Virginia (3) | | x | | |

Monongahela, Pennsylvania | x | | | |

Pace, Florida | x | | x | |

Sauget, Illinois | x | | | |

Springfield, Massachusetts | | x | | |

St. Gabriel, Louisiana | x | | x | |

Sun Prairie, Wisconsin | | x | | |

Texas City, Texas | | | x | |

Trenton, Michigan | | x | | |

Watertown, New York | | | | x |

Europe | | | | |

Antwerp, Belgium (1) | x | x | | |

Ghent, Belgium (3) | x | x | x | |

Kohtla-Järve, Estonia | x | | x | |

Oulu, Finland (2) | x | | | |

Dresden, Germany | | x | | |

Leuna, Germany | x | | x | |

Nienburg, Germany | x | | | |

Middelburg, the Netherlands | x | | | |

Newport, Wales | x | x | | |

| |

(1) | Eastman is a guest under an operating agreement with a third party that operates its manufacturing facilities at the site. |

| |

(2) | Eastman leases from a third party and operates the site. |

| |

(3) | Eastman has more than one manufacturing facility at this location. |

|

| | | | |

| Segment using manufacturing location |