UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One) | |

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2018 | |

OR | |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________ to ______________ | |

Commission file number 1-12626

EASTMAN CHEMICAL COMPANY

(Exact name of registrant as specified in its charter)

Delaware | 62-1539359 |

(State or other jurisdiction of | (I.R.S. employer |

incorporation or organization) | identification no.) |

200 South Wilcox Drive | |

Kingsport, Tennessee | 37662 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (423) 229-2000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | [X] | Accelerated filer | [ ] | |

Non-accelerated filer | [ ] | (Do not check if a smaller reporting company) | Smaller reporting company | [ ] |

Emerging growth company | [ ] | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

YES [ ] NO [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES [ ] NO [X]

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

Class | Number of Shares Outstanding at March 31, 2018 |

Common Stock, par value $0.01 per share | 142,635,082 |

--------------------------------------------------------------------------------------------------------------------------------

1

TABLE OF CONTENTS

ITEM | PAGE | |

PART I. FINANCIAL INFORMATION

PART II. OTHER INFORMATION

EXHIBIT INDEX

SIGNATURES

2

FORWARD-LOOKING STATEMENTS

Certain statements made or incorporated by reference in this Quarterly Report are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act (Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities and Exchange Act of 1934, as amended). Forward-looking statements are all statements, other than statements of historical fact, that may be made by Eastman Chemical Company ("Eastman" or the "Company") from time to time. In some cases, you can identify forward-looking statements by terminology such as "anticipates," "believes," "estimates," "expects," "intends," "may," "plans," "projects," "will," "would," and similar expressions or expressions of the negative of these terms. Forward-looking statements may relate to, among other things, such matters as planned and expected capacity increases and utilization; anticipated capital spending; expected depreciation and amortization; environmental matters; exposure to, and effects of hedging of, raw material and energy prices and costs; foreign currencies and interest rates; disruption or interruption of operations and of raw material or energy supply; global and regional economic, political, and business conditions; competition; growth opportunities; supply and demand, volume, price, cost, margin and sales; pending and future legal proceedings; earnings, cash flow, dividends, stock repurchases and other expected financial results, events, and conditions; expectations, strategies, and plans for individual assets and products, businesses, and operating segments, as well as for the whole of Eastman; cash requirements and uses of available cash; financing plans and activities; pension expenses and funding; credit ratings; anticipated and other future restructuring, acquisition, divestiture, and consolidation activities; cost reduction and control efforts and targets; the timing and costs of, and benefits from, the integration of, and expected business and financial performance of, acquired businesses; strategic and technology and product innovation initiatives and development, production, commercialization and acceptance of new products, services and technologies and related costs; asset, business, and product portfolio changes; and expected tax rates and net interest costs.

Forward-looking statements are based upon certain underlying assumptions as of the date such statements were made. Such assumptions are based upon internal estimates and other analyses of current market conditions and trends, management expectations, plans, and strategies, economic conditions, and other factors. Forward-looking statements and the assumptions underlying them are necessarily subject to risks and uncertainties inherent in projecting future conditions and results. Actual results could differ materially from expectations expressed in the forward-looking statements if one or more of the underlying assumptions and expectations proves to be inaccurate or is unrealized. The most significant known factors, risks, and uncertainties that could cause actual results to differ materially from those in the forward-looking statements are identified and discussed under "Management's Discussion and Analysis of Financial Condition and Results of Operations - Risk Factors" in Part I, Item 2 of this Quarterly Report. Other factors, risks or uncertainties of which management is not aware, or presently deems immaterial, could also cause actual results to differ materially from those in the forward-looking statements.

The Company cautions you not to place undue reliance on forward-looking statements, which speak only as of the date such statements are made. Except as may be required by law, the Company undertakes no obligation to update or alter these forward-looking statements, whether as a result of new information, future events, or otherwise. Investors are advised, however, to consult any further public Company disclosures (such as filings with the Securities and Exchange Commission or in Company press releases) on related subjects.

3

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

UNAUDITED CONSOLIDATED STATEMENTS OF EARNINGS,

COMPREHENSIVE INCOME AND RETAINED EARNINGS

First Quarter | |||||||

(Dollars in millions, except per share amounts) | 2018 | 2017 | |||||

Sales | $ | 2,607 | $ | 2,303 | |||

Cost of sales | 2,026 | 1,698 | |||||

Gross profit | 581 | 605 | |||||

Selling, general and administrative expenses | 190 | 179 | |||||

Research and development expenses | 56 | 57 | |||||

Asset impairments and restructuring charges, net | 2 | — | |||||

Other components of post-employment (benefit) cost, net | (30 | ) | (28 | ) | |||

Other (income) charges, net | (46 | ) | (4 | ) | |||

Earnings before interest and taxes | 409 | 401 | |||||

Net interest expense | 59 | 60 | |||||

Earnings before income taxes | 350 | 341 | |||||

Provision for income taxes | 60 | 62 | |||||

Net earnings | 290 | 279 | |||||

Less: Net earnings attributable to noncontrolling interest | — | 1 | |||||

Net earnings attributable to Eastman | $ | 290 | $ | 278 | |||

Basic earnings per share attributable to Eastman | $ | 2.03 | $ | 1.90 | |||

Diluted earnings per share attributable to Eastman | $ | 2.00 | $ | 1.89 | |||

Comprehensive Income | |||||||

Net earnings including noncontrolling interest | $ | 290 | $ | 279 | |||

Other comprehensive income (loss), net of tax: | |||||||

Change in cumulative translation adjustment | 27 | 7 | |||||

Defined benefit pension and other postretirement benefit plans: | |||||||

Amortization of unrecognized prior service credits included in net periodic (credit) cost | (7 | ) | (7 | ) | |||

Derivatives and hedging: | |||||||

Unrealized gain (loss) during period | (23 | ) | (21 | ) | |||

Reclassification adjustment for (gains) losses included in net income, net | — | (4 | ) | ||||

Total other comprehensive income (loss), net of tax | (3 | ) | (25 | ) | |||

Comprehensive income including noncontrolling interest | 287 | 254 | |||||

Less: Comprehensive income attributable to noncontrolling interest | — | 1 | |||||

Comprehensive income attributable to Eastman | $ | 287 | $ | 253 | |||

Retained Earnings | |||||||

Retained earnings at beginning of period | $ | 6,802 | $ | 5,721 | |||

Cumulative effect adjustment resulting from adoption of new accounting standards | 16 | — | |||||

Net earnings attributable to Eastman | 290 | 278 | |||||

Cash dividends declared | (82 | ) | (74 | ) | |||

Retained earnings at end of period | $ | 7,026 | $ | 5,925 | |||

The accompanying notes are an integral part of these consolidated financial statements.

4

UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

March 31, | December 31, | ||||||

(Dollars in millions, except per share amounts) | 2018 | 2017 | |||||

Assets | |||||||

Current assets | |||||||

Cash and cash equivalents | $ | 194 | $ | 191 | |||

Trade receivables, net of allowance for doubtful accounts | 1,430 | 1,026 | |||||

Miscellaneous receivables | 319 | 360 | |||||

Inventories | 1,476 | 1,509 | |||||

Other current assets | 64 | 57 | |||||

Total current assets | 3,483 | 3,143 | |||||

Properties | |||||||

Properties and equipment at cost | 12,520 | 12,370 | |||||

Less: Accumulated depreciation | 6,888 | 6,763 | |||||

Net properties | 5,632 | 5,607 | |||||

Goodwill | 4,540 | 4,527 | |||||

Intangible assets, net of accumulated amortization | 2,349 | 2,373 | |||||

Other noncurrent assets | 362 | 349 | |||||

Total assets | $ | 16,366 | $ | 15,999 | |||

Liabilities and Stockholders' Equity | |||||||

Current liabilities | |||||||

Payables and other current liabilities | $ | 1,440 | $ | 1,589 | |||

Borrowings due within one year | 589 | 393 | |||||

Total current liabilities | 2,029 | 1,982 | |||||

Long-term borrowings | 6,311 | 6,147 | |||||

Deferred income tax liabilities | 914 | 893 | |||||

Post-employment obligations | 951 | 963 | |||||

Other long-term liabilities | 541 | 534 | |||||

Total liabilities | 10,746 | 10,519 | |||||

Stockholders' equity | |||||||

Common stock ($0.01 par value – 350,000,000 shares authorized; shares issued – 219,032,630 and 218,369,992 for 2018 and 2017, respectively) | 2 | 2 | |||||

Additional paid-in capital | 2,004 | 1,983 | |||||

Retained earnings | 7,026 | 6,802 | |||||

Accumulated other comprehensive income (loss) | (212 | ) | (209 | ) | |||

8,820 | 8,578 | ||||||

Less: Treasury stock at cost (76,448,346 shares for 2018 and 75,454,111 shares for 2017) | 3,275 | 3,175 | |||||

Total Eastman stockholders' equity | 5,545 | 5,403 | |||||

Noncontrolling interest | 75 | 77 | |||||

Total equity | 5,620 | 5,480 | |||||

Total liabilities and stockholders' equity | $ | 16,366 | $ | 15,999 | |||

The accompanying notes are an integral part of these consolidated financial statements.

5

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS

First Three Months | |||||||

(Dollars in millions) | 2018 | 2017 | |||||

Operating activities | |||||||

Net earnings | $ | 290 | $ | 279 | |||

Adjustments to reconcile net earnings to net cash provided by operating activities: | |||||||

Depreciation and amortization | 152 | 145 | |||||

Gain from property insurance | (50 | ) | — | ||||

Provision for deferred income taxes | 11 | 31 | |||||

Changes in operating assets and liabilities, net of effect of acquisitions and divestitures: | |||||||

(Increase) decrease in trade receivables | (223 | ) | (149 | ) | |||

(Increase) decrease in inventories | (80 | ) | (82 | ) | |||

Increase (decrease) in trade payables | 8 | (26 | ) | ||||

Pension and other postretirement contributions (in excess of) less than expenses | (36 | ) | (36 | ) | |||

Variable compensation (in excess of) less than expenses | (77 | ) | (84 | ) | |||

Other items, net | (30 | ) | (26 | ) | |||

Net cash (used in) provided by operating activities | (35 | ) | 52 | ||||

Investing activities | |||||||

Additions to properties and equipment | (128 | ) | (133 | ) | |||

Proceeds from property insurance | 50 | — | |||||

Proceeds from sale of assets | — | 1 | |||||

Acquisitions, net of cash acquired | — | (4 | ) | ||||

Net cash used in investing activities | (78 | ) | (136 | ) | |||

Financing activities | |||||||

Net increase (decrease) in commercial paper and other borrowings | 199 | — | |||||

Proceeds from borrowings | 275 | 250 | |||||

Repayment of borrowings | (175 | ) | — | ||||

Dividends paid to stockholders | (80 | ) | (75 | ) | |||

Treasury stock purchases | (100 | ) | (75 | ) | |||

Proceeds from stock option exercises and other items, net | (3 | ) | 2 | ||||

Net cash provided by financing activities | 116 | 102 | |||||

Effect of exchange rate changes on cash and cash equivalents | — | (2 | ) | ||||

Net change in cash and cash equivalents | 3 | 16 | |||||

Cash and cash equivalents at beginning of period | 191 | 181 | |||||

Cash and cash equivalents at end of period | $ | 194 | $ | 197 | |||

The accompanying notes are an integral part of these consolidated financial statements.

6

Page | ||

Derivative and Non-Derivative Financial Instruments | ||

Environmental Matters and Asset Retirement Obligations | ||

7

1. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared by Eastman Chemical Company ("Eastman" or the "Company") in accordance and consistent with the accounting policies stated in the Company's 2017 Annual Report on Form 10-K, and should be read in conjunction with the consolidated financial statements in Part II, Item 8 of the Company's 2017 Annual Report on Form 10-K, with the exception of the items noted below. The December 31, 2017 financial position data included herein was derived from the audited consolidated financial statements included in the 2017 Annual Report on Form 10-K but does not include all disclosures required by accounting principles generally accepted in the United States ("GAAP").

In the opinion of management, the unaudited consolidated financial statements include all normal recurring adjustments necessary for fair statement of the interim financial information in conformity with GAAP. These statements contain some amounts that are based upon management estimates and judgments. Future actual results could differ from such current estimates. The unaudited consolidated financial statements include assets, liabilities, sales revenue, and expenses of all majority-owned subsidiaries and joint ventures in which a controlling interest is maintained. Eastman accounts for other joint ventures and investments where it exercises significant influence on the equity basis. Intercompany transactions and balances are eliminated in consolidation.

Certain prior period data has been reclassified in the consolidated financial statements and accompanying footnotes to conform to current period presentation. As of January 1, 2018:

• | Eastman's primary measure of operating performance for all periods presented is earnings before interest and taxes ("EBIT") on a consolidated and segment basis. Previously, the Company's primary measure of operating performance was operating earnings. |

• | As discussed below, the new accounting standard for the presentation of net periodic benefit costs requires the Company to present non-service cost components of net periodic benefit costs (interest cost, expected return on plan assets, curtailment gains or losses, amortization of prior service costs or credits, and mark-to-market gains or losses) separately from service cost. These non-service cost components were reclassified from "Cost of sales", "Selling, general and administrative expenses", and "Research and development expenses" line items and are now included in a new line item, "Other components of post-employment (benefit) cost, net" on the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings for all periods presented. This reclassification does not change prior period EBIT and accordingly management does not consider this change to have a material impact on the Company's financial statements and related disclosures. |

Recently Adopted Accounting Standards

Accounting Standards Update ("ASU") 2014-09 Revenue Recognition (Accounting Standards Codification "ASC" 606): On January 1, 2018, Eastman adopted this standard under the modified retrospective method, such that revenue for all periods prior to January 1, 2018 continue to be reported under the previous standard, which resulted in an increase to retained earnings of $53 million after tax for products shipped but not delivered as of December 31, 2017.

Under the new standard, the Company recognizes revenue when performance obligations of the sale are satisfied. The majority of the Company's terms of sale have a single performance obligation to transfer products. Accordingly, the Company recognizes revenue when control has been transferred to the customer, generally at the time of shipment of products. Under the previous revenue recognition accounting standard, the Company recognized revenue upon transfer of title and risk of loss, generally upon the delivery of goods.

Management does not expect that changes in its accounting required by this new standard will materially impact the Company's financial statements and related disclosures when comparing 2018 under the new revenue standard to previous years under the prior standard. However, the difference in timing of revenue recognition under the current and former accounting standards is expected to have some impact on seasonal revenue and EBIT trends during 2018 compared to previous years. For further information, see Note 18, "Revenue Recognition".

8

ASU 2016-01 Financial Instruments: On January 1, 2018, Eastman adopted this standard relating to the recognition and measurement of financial assets and financial liabilities. This standard requires equity investments (except equity method and consolidated investments) to be measured at fair value with changes in fair value recognized in net income. Management has concluded that changes in its accounting required by the new standard will not materially impact the Company's financial statements and related disclosures. In February 2018, the Financial Accounting Standards Board ("FASB") issued ASU 2018-03 as an update to the standard described above which is effective for the Company July 1, 2018. Management does not expect that changes in its accounting required by the update will materially impact the Company's financial statements and related disclosures.

ASU 2016-16 Income Taxes - Intra-Entity Transfers: On January 1, 2018, Eastman adopted this standard under the modified retrospective method resulting in a beginning retained earnings decrease of $39 million. Under this standard, the Company is required to recognize the income tax consequence of an intra-entity transfer of an asset other than inventory when the transfer occurs.

ASU 2017-05 Other Income - Gains and Losses from Derecognition of Nonfinancial Assets: On January 1, 2018, Eastman adopted this standard in conjunction with the revenue recognition standard mentioned above. This standard clarifies the scope of nonfinancial asset derecognition and the accounting for partial sales of nonfinancial assets. This adoption had no impact on the Company's financial statements and related disclosures in the current period.

ASU 2017-07 Compensation - Retirement Benefits: On January 1, 2018, Eastman adopted this standard retrospectively for income statement effects and prospectively for balance sheet effects. This standard is intended to improve the presentation of net periodic pension and postretirement benefit costs by requiring the reporting of the service cost component in the same line item or items as other compensation costs arising from services rendered by the pertinent employees during the period. The other components of net periodic benefit costs (interest cost, expected return on plan assets, curtailment gains or losses, amortization of prior service costs or credits, and mark-to-market gains or losses) are to be presented in the income statement separately from the service cost component and outside the subtotal of income from operations, if presented. Management has concluded that changes in its accounting required by this new standard will not materially impact the Company's financial statements and related disclosures.

ASU 2017-12 Derivatives and Hedging: On January 1, 2018, Eastman adopted this standard on a modified retrospective basis for income statement impacts and prospectively for presentation and disclosure resulting in a beginning retained earnings increase of $2 million related to the elimination of ineffectiveness recognized in "Accumulated other comprehensive income (loss)" ("AOCI") located in the Unaudited Consolidated Statements of Financial Position under the previous standard. This standard is intended to simplify the application of hedge accounting and improve the financial reporting of hedging relationships to better portray the economic results of an entity's risk management activities in the financial statements. Management has included the additional disclosures required by this standard in Note 6, "Derivative and Non-Derivative Financial Instruments".

Accounting Standards Issued But Not Adopted as of March 31, 2018

ASU 2016-02 Leases: In February 2016, the FASB issued a standard on lease accounting. The new standard establishes two types of leases for lessees: finance and operating. Both finance and operating leases will have associated right-of-use assets and liabilities initially measured at the present value of the lease payments. This standard is effective for annual reporting periods beginning after December 15, 2018, including interim periods within that reporting period and early adoption is permitted. The new standard is to be applied under a modified retrospective approach wherein practical expedients have been allowed that will not require reassessment of current leases at the effective date. In January 2018, the FASB issued an update to the new standard above in ASU 2018-01 that sets forth the requirement to assess land easements to determine if the arrangement should be accounted for as a lease. The effective date for this amended standard is the same as that of the lease standard stated above. Management is currently evaluating implementation options and impact on the Company's financial statements and related disclosures.

9

ASU 2016-13 Financial Instruments - Credit Losses: In June 2016, the FASB issued a standard relating to credit losses. The amendments require a financial asset (including trade receivables) to be presented at the net amount expected to be collected through the use of allowances for credit losses valuation account. The income statement will reflect the measurement of credit losses for newly recognized financial assets, as well as the expected increases or decreases of expected credit losses that have taken place during the period. This standard is effective for annual reporting periods beginning after December 15, 2019, including interim periods within that reporting period and early adoption is permitted, including adoption in an interim period, beginning after December 15, 2018. The new standard application is mixed among the various elements that include modified retrospective and prospective transition methods. Management does not expect that changes in its accounting required by the new standard will materially impact the Company's financial statements and related disclosures.

ASU 2017-04 Intangibles - Goodwill and Other: In January 2017, the FASB issued a standard as a part of its simplification initiative that bases the impairment of goodwill on any difference for which the carrying value is greater than the fair value of the reporting unit. This standard is effective for annual reporting periods, or interim period testing performed, beginning after December 15, 2019. Early adoption is permitted for interim or annual goodwill impairment testing performed after January 1, 2017. This standard is to be applied on a prospective basis for goodwill testing that occur after the effective date. Management does not expect that changes in its accounting required by the new standard will materially impact the Company's financial statements and related disclosures.

ASU 2018-02 Income Statement - Reporting Comprehensive Income: In February 2018, the FASB issued a standard that allows the reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the 2017 "Tax Cuts and Jobs Act" ("Tax Reform Act"). The amount of the reclassification is the difference between the historical corporate income tax rate and the newly enacted tax rate. This standard is effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted, including adoption in any interim period, for reporting periods for which financial statements have not yet been issued. The new standard is to be applied either in the period of adoption or retrospectively to each period (or periods) in which the effects of the change in the income tax rate in the Tax Reform Act is recognized. Management is currently evaluating implementation options and impact on the Company's financial statements and related disclosures.

2. | INVENTORIES |

March 31, | December 31, | ||||||

(Dollars in millions) | 2018 | 2017 | |||||

Finished goods | $ | 1,031 | $ | 1,114 | |||

Work in process | 241 | 213 | |||||

Raw materials and supplies | 504 | 470 | |||||

Total inventories at FIFO or average cost | 1,776 | 1,797 | |||||

Less: LIFO reserve | 300 | 288 | |||||

Total inventories | $ | 1,476 | $ | 1,509 | |||

Inventories valued on the last-in, first-out ("LIFO") method were approximately 55 percent and 60 percent of total inventories at March 31, 2018 and December 31, 2017, respectively.

10

3. | PAYABLES AND OTHER CURRENT LIABILITIES |

March 31, | December 31, | ||||||

(Dollars in millions) | 2018 | 2017 | |||||

Trade creditors | $ | 838 | $ | 842 | |||

Accrued payrolls, vacation, and variable-incentive compensation | 120 | 199 | |||||

Accrued taxes | 67 | 111 | |||||

Other | 415 | 437 | |||||

Total payables and other current liabilities | $ | 1,440 | $ | 1,589 | |||

"Other" consists primarily of accruals for post-employment obligations, dividends payable, interest payable, derivative hedging liabilities, the current portion of environmental liabilities, and miscellaneous accruals.

4. | INCOME TAXES |

First Quarter | |||||||||||||

(Dollars in millions) | 2018 | 2017 | |||||||||||

$ | % | $ | % | ||||||||||

Provision for income taxes and tax rate | $ | 60 | 17 | % | $ | 62 | 18 | % | |||||

The first quarter 2018 effective tax rate includes the impact of the U.S. corporate tax rate reduction resulting from the Tax Reform Act. The first quarter 2017 effective tax rate included adjustments to the tax provision to reflect planned amendments to and finalization of prior years' income tax returns.

As previously reported, the Company recognized an estimated net tax benefit for the year ended December 31, 2017, primarily resulting from the Tax Reform Act. The net tax benefit included a benefit from the one-time revaluation of deferred tax liabilities, partially offset by a one-time transition tax on deferred foreign income and changes in valuation of deferred tax assets. As of March 31, 2018, the Company continues to consider the accounting for the following impacts of the Tax Reform Act to be provisional and, accordingly, subject to adjustment in future periods: the transition tax on deferred foreign income (which consists of post-1986 accumulated earnings and profits of controlled foreign corporations and the determination of cash versus non-cash balances), the impact of the change in income tax rates on deferred tax assets and liabilities, and the evaluation of gross foreign tax credit carryforwards and related valuation allowances. In preparing the provisional estimates as of March 31, 2018, the Company has considered notices and revenue procedures issued by the Internal Revenue Service and authoritative accounting guidance.

Certain of the provisional amounts will be finalized in conjunction with the filing of the Company's U.S. federal income tax return for the year ended December 31, 2017 that will not be finalized until later in 2018. While historically differences between amounts reported in the Company's consolidated financial statements and the Company's U.S. federal income tax return have resulted in offsetting changes in estimates in current and deferred taxes for items which are timing related, the reduction of the U.S. tax rate will result in adjustments to the Company's income tax (benefit) provision when recognized. The Company also considers it likely that further technical guidance regarding certain aspects of the new provisions included in the Tax Reform Act, as well as clarity regarding state income tax conformity to current federal tax code, may be issued which could result in changes to the provisional amounts reported as of March 31, 2018 and related state income tax effects.

Additionally, the Company continues to consider the future impact of the Tax Reform Act for the fiscal year beginning January 1, 2018, including the new provisions known as the base erosion anti-abuse tax ("BEAT") and global intangible low-tax income ("GILTI") tax, as well as other provisions. Under U.S. GAAP, companies can make an accounting policy election to either treat taxes resulting from GILTI as a current-period expense when incurred or factor such amounts into the measurement of deferred taxes. The Company has not completed its analysis of the effects of the GILTI provisions and will further consider the accounting policy election within the measurement period as provided under Staff Accounting Bulletin No. 118, "Income Tax Accounting Implications of the Tax Cuts and Jobs Act".

11

5. | BORROWINGS |

March 31, | December 31, | ||||||

(Dollars in millions) | 2018 | 2017 | |||||

Borrowings consisted of: | |||||||

5.5% notes due November 2019 | $ | 250 | $ | 250 | |||

2.7% notes due January 2020 | 798 | 797 | |||||

4.5% notes due January 2021 (1) | 192 | 185 | |||||

3.6% notes due August 2022 (1) | 753 | 738 | |||||

1.50% notes due May 2023 (2) | 920 | 895 | |||||

7 1/4% debentures due January 2024 | 197 | 197 | |||||

7 5/8% debentures due June 2024 | 43 | 43 | |||||

3.8% notes due March 2025 | 689 | 690 | |||||

1.875% notes due November 2026 (2) | 609 | 592 | |||||

7.60% debentures due February 2027 | 195 | 195 | |||||

4.8% notes due September 2042 | 493 | 493 | |||||

4.65% notes due October 2044 | 871 | 871 | |||||

Commercial paper and short term borrowings | 588 | 389 | |||||

Credit facilities borrowings | 300 | 200 | |||||

Capital leases and other | 2 | 5 | |||||

Total borrowings | 6,900 | 6,540 | |||||

Borrowings due within one year | 589 | 393 | |||||

Long-term borrowings | $ | 6,311 | $ | 6,147 | |||

(1) | In January 2018, the Company entered into fixed-to-fixed cross-currency swaps with $180 million maturing 2021 and $320 million maturing 2022 and designated these swaps to hedge a portion of its net investment in a euro functional currency denominated subsidiary against foreign currency fluctuations. The hedged portion of the carrying value of the U.S. denominated 4.5% notes due January 2021 and 3.6% notes due August 2022 will fluctuate with changes in the euro exchange rate. During the three months ended March 31, 2018, pre-tax losses of $11 million were recognized in "Other comprehensive income (loss)" ("OCI") for revaluation of the hedged portion of these notes. |

(2) | The carrying value of the euro-denominated 1.50% notes due May 2023 and 1.875% notes due November 2026 will fluctuate with changes in the euro exchange rate. The carrying value of these euro-denominated borrowings have been designated as non-derivative net investment hedges of a portion of the Company's net investments in euro functional-currency denominated subsidiaries to offset foreign currency fluctuations. During the three months ended March 31, 2018, pre-tax losses of $42 million were recognized in OCI for revaluation of these notes. |

Credit Facilities and Commercial Paper Borrowings

In December 2016, the Company borrowed $300 million under a five-year term loan agreement ("2021 Term Loan"). As of March 31, 2018, the 2021 Term Loan agreement balance outstanding was $200 million with an interest rate of 2.90 percent. As of December 31, 2017, the 2021 Term Loan agreement balance outstanding was $200 million with an interest rate of 2.60 percent. Borrowings under the 2021 Term Loan agreement are subject to interest at varying spreads above quoted market rates.

The Company has access to a $1.25 billion revolving credit agreement (the "Credit Facility") expiring October 2021. Borrowings under the Credit Facility are subject to interest at varying spreads above quoted market rates and a commitment fee is paid on the total unused commitment. The Credit Facility provides available liquidity for general corporate purposes and supports commercial paper borrowings. Commercial paper borrowings are classified as short-term. At March 31, 2018 and December 31, 2017, the Company had no outstanding borrowings under the Credit Facility. At March 31, 2018, the Company's commercial paper borrowings were $452 million with a weighted average interest rate of 2.30 percent. At December 31, 2017, the Company's commercial paper borrowings were $280 million with a weighted average interest rate of 1.61 percent.

12

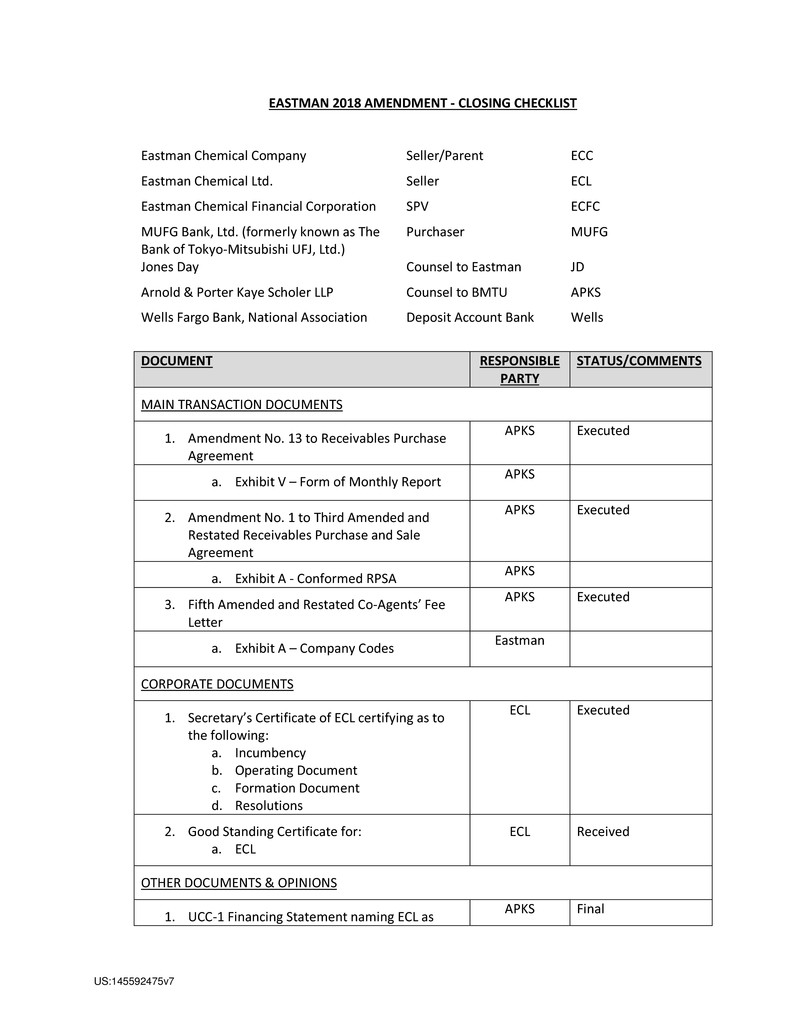

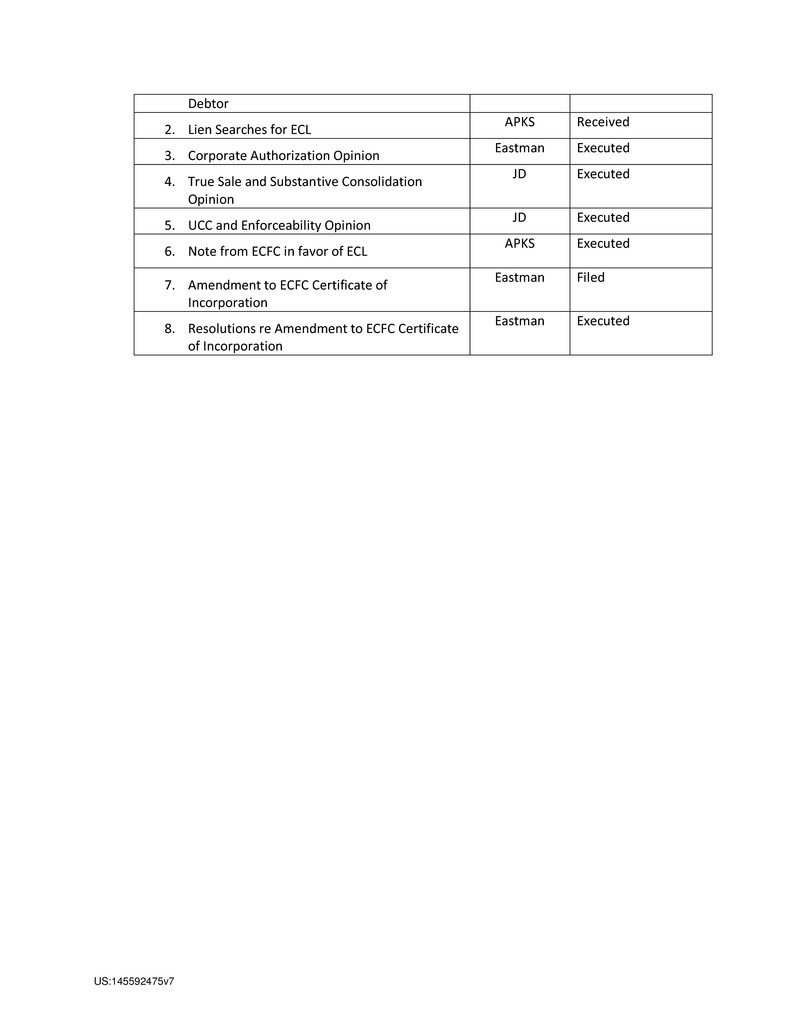

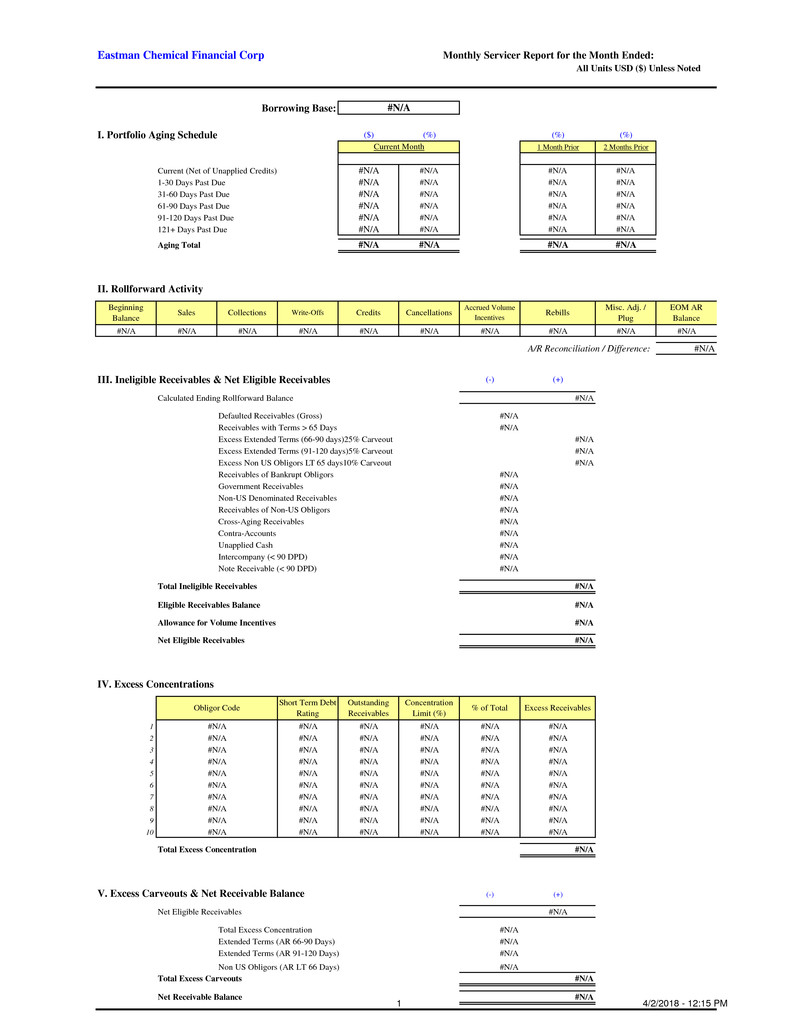

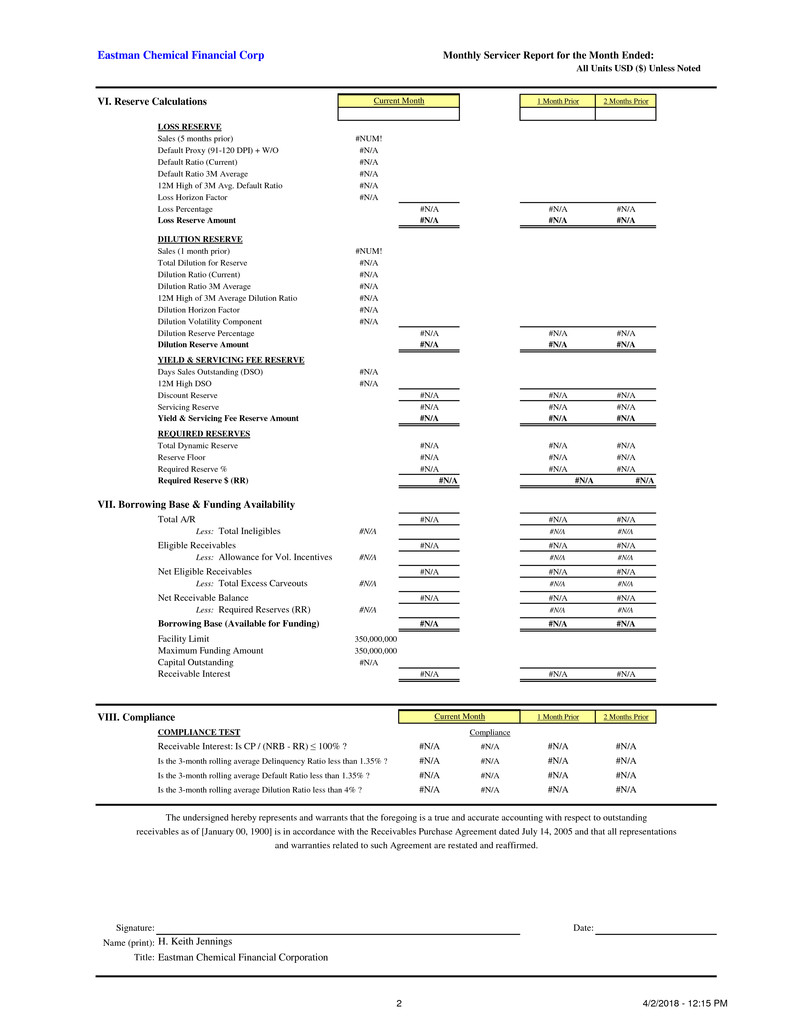

In April 2018, the Company amended its $250 million accounts receivable securitization agreement (the "A/R Facility") to extend the maturity to April 2020. Eastman Chemical Financial Corporation ("ECFC"), a subsidiary of the Company, has an agreement to sell interests in trade receivables under the A/R Facility to a third party purchaser. Third party creditors of ECFC have first priority claims on the assets of ECFC before those assets would be available to satisfy the Company's general obligations. Borrowings under the A/R Facility are subject to interest rates based on a spread over the lender's borrowing costs, and ECFC pays a fee to maintain availability of the A/R Facility. In first quarter 2018, $100 million available under the A/R Facility was borrowed and remained outstanding at March 31, 2018 with an interest rate of 2.69 percent. At December 31, 2017, the Company had no borrowings under the A/R Facility.

The Credit and A/R Facilities and other borrowing agreements contain customary covenants and events of default, some of which require the Company to maintain certain financial ratios that determine the amounts available and terms of borrowings. The Company was in compliance with all covenants at both March 31, 2018 and December 31, 2017.

The Company has access to borrowings of up to €150 million ($185 million) under a receivables facility based on the discounted value of selected customer accounts receivable. This facility expires December 2020 and renews for another one year period if not terminated with 90 days notice by either party. These arrangements include receivables in the United States, Belgium, and Finland, and are subject to various eligibility requirements. Borrowings under this facility are subject to interest at an agreed spread above EURIBOR for euro denominated drawings and the counterparty's cost of funds for drawings in any other currencies, plus administration and insurance fees and are classified as short-term. At March 31, 2018, the Company's amount of outstanding borrowings under this facility were $136 million with a weighted average interest rate of 1.32 percent. At December 31, 2017, the Company's amount of outstanding borrowings under this facility were $109 million with a weighted average interest rate of 1.31 percent.

Fair Value of Borrowings

Eastman has classified its total borrowings at March 31, 2018 and December 31, 2017 under the fair value hierarchy as defined in the accounting policies in Note 1, "Significant Accounting Policies", to the consolidated financial statements in Part II, Item 8 of the Company's 2017 Annual Report on Form 10-K. The fair value for fixed-rate debt securities is based on current market prices and is classified as Level 1. The fair value for the Company's other borrowings primarily under the Term Loan, commercial paper, A/R Facility, and a receivables facility equals the carrying value and is classified as Level 2. The Company had no borrowings classified as Level 3 as of March 31, 2018 and December 31, 2017.

Fair Value Measurements at March 31, 2018 | ||||||||||||||||

(Dollars in millions) | Recorded Amount March 31, 2018 | Total Fair Value | Quoted Prices in Active Markets for Identical Liabilities (Level 1) | Significant Other Observable Inputs (Level 2) | ||||||||||||

Total borrowings | $ | 6,900 | $ | 7,192 | $ | 6,303 | $ | 889 | ||||||||

Fair Value Measurements at December 31, 2017 | ||||||||||||||||

(Dollars in millions) | Recorded Amount December 31, 2017 | Total Fair Value | Quoted Prices in Active Markets for Identical Liabilities (Level 1) | Significant Other Observable Inputs (Level 2) | ||||||||||||

Total borrowings | $ | 6,540 | $ | 6,980 | $ | 6,386 | $ | 594 | ||||||||

13

6. | DERIVATIVE AND NON-DERIVATIVE FINANCIAL INSTRUMENTS |

Overview of Hedging Programs

Eastman is exposed to market risks, such as changes in foreign currency exchange rates, commodity prices, and interest rates. To mitigate these market risks and their effects on the cash flows of the underlying transactions and investments in foreign subsidiaries, the Company uses various derivative and non-derivative financial instruments, when appropriate, in accordance with the Company's hedging strategy and policies. Designation is performed on a specific exposure basis to support hedge accounting. The Company does not enter into derivative transactions for speculative purposes.

For further information on hedging programs, see Note 9, "Derivative and Non-Derivative Financial Instruments", to the consolidated financial statements in Part II, Item 8 of the Company's 2017 Annual Report on Form 10-K.

Cash Flow Hedges

Cash flow hedges are derivative instruments designated and used to hedge the exposure to variability in expected future cash flows that are attributable to a particular risk. The derivative instruments that are designated and qualify as a cash flow hedge are reported on the balance sheet at fair value and the changes in fair value of these hedging instruments are offset in part or in whole by corresponding changes in the anticipated cash flows of the underlying exposures being hedged. The net of the change in the hedge instrument and item being hedged for qualifying cash flow hedges is reported as a component of AOCI located in the Unaudited Consolidated Statements of Financial Position and reclassified into earnings in the same period or periods during which the hedged transaction affects earnings.

Fair Value Hedges

Fair value hedges are defined as derivative or non-derivative instruments designated as and used to hedge the exposure to changes in the fair value of an asset or a liability or an identified portion thereof that is attributable to a particular risk. The derivative instruments that are designated and qualify as fair value hedges are recorded on the balance sheet at fair value and the changes in fair value of these hedging instruments are offset in part or in whole by corresponding changes in the anticipated cash flows of the underlying exposures being hedged. The net of the change in the hedge instrument and item being hedged for qualifying fair value hedges is reclassified into earnings in the same period or periods during which the hedged transaction affects earnings.

Net Investment Hedges

Net investment hedges are defined as derivative or non-derivative instruments designated as and used to hedge the foreign currency exposure of the net investments in certain foreign operations. The net of the change in the hedge instrument and item being hedged for qualifying net investment hedges is reported as a component of the "Cumulative Translation Adjustment" ("CTA") within AOCI located in the Unaudited Consolidated Statements of Financial Position. Recognition in earnings of amounts previously recorded to CTA is limited to circumstances such as complete or substantially complete liquidation of the net investment in the hedged foreign operation.

For derivative cross-currency interest rate swap net investment hedges, gains and losses representing hedge components excluded from the assessment of effectiveness are recognized in CTA within AOCI and recognized in earnings through the periodic swap interest accruals. The foreign currency-denominated borrowings and cross-currency interest rate swaps designated as net investment hedges are included as part of "Long-term borrowings" within the Unaudited Consolidated Statements of Financial Position.

In January 2018, Eastman entered into fixed-to-fixed cross-currency swaps and designated these swaps to hedge a portion of its net investment in a euro functional currency denominated subsidiary against foreign currency fluctuations. These contracts involve the exchange of fixed U.S. dollars with fixed euro interest payments periodically over the life of the contracts and an exchange of the notional amounts at maturity. The fixed-to-fixed cross-currency swaps include €150 million ($180 million) maturing January 2021 and €266 million ($320 million) maturing August 2022.

14

Summary of Financial Position and Financial Performance of Hedging Instruments

The following table presents the notional amounts outstanding at March 31, 2018 and December 31, 2017 associated with Eastman's hedging programs.

Notional Outstanding | March 31, 2018 | December 31, 2017 | |||||

Derivatives designated as cash flow hedges: | |||||||

Foreign Exchange Forward and Option Contracts (in millions) | |||||||

EUR/USD (in EUR) | €498 | €525 | |||||

Commodity Forward and Collar Contracts | |||||||

Feedstock (in million barrels) | 7 | 7 | |||||

Energy (in million million british thermal units) | 20 | 23 | |||||

Derivatives designated as fair value hedges: | |||||||

Fixed-for-floating interest rate swaps (in millions) | $75 | $75 | |||||

Derivatives designated as net investment hedges: | |||||||

Cross-currency interest rate swaps (in millions) | |||||||

EUR/USD (in EUR) | €416 | — | |||||

Non-derivatives designated as net investment hedges: | |||||||

Foreign Currency Net Investment Hedges (in millions) | |||||||

EUR/USD (in EUR) | €1,241 | €1,240 | |||||

Fair Value Measurements

All the Company's derivative assets and liabilities are currently classified as Level 2. Level 2 fair value is based on estimates using standard pricing models. These standard pricing models use inputs that are derived from or corroborated by observable market data such as interest rate yield curves and currency spot and forward rates. The fair value of commodity contracts is derived using forward curves supplied by an industry recognized and unrelated third party. In addition, on an ongoing basis, the Company tests a subset of its valuations against valuations received from the transaction's counterparty to validate the accuracy of its standard pricing models. Counterparties to these derivative contracts are highly rated financial institutions which the Company believes carry minimal risk of nonperformance, and the Company diversifies its positions among such counterparties to reduce its exposure to counterparty risk and credit losses. The Company monitors the creditworthiness of its counterparties on an on-going basis. The Company did not recognize a credit loss during first quarter 2018 and 2017.

All the Company's derivative contracts are subject to master netting arrangements, or similar agreements, which provide for the option to settle contracts on a net basis when they settle on the same day and in the same currency. In addition, these arrangements provide for a net settlement of all contracts with a given counterparty in the event that the arrangement is terminated due to the occurrence of default or a termination event. The Company does not have any cash collateral due under such agreements.

The Company has elected to present derivative contracts on a gross basis within the Unaudited Consolidated Statements of Financial Position. The following table presents the financial assets and liabilities valued on a recurring and gross basis and includes where the financial assets and liabilities are located within the Unaudited Consolidated Statements of Financial Position as of March 31, 2018 and December 31, 2017.

15

The Financial Position and Fair Value Measurements of Hedging Instruments on a Gross Basis | ||||||||||

(Dollars in millions) | ||||||||||

Derivative Type | Statements of Financial Position Classification | March 31, 2018 Level 2 | December 31, 2017 Level 2 | |||||||

Derivatives designated as cash flow hedges: | ||||||||||

Commodity contracts | Other current assets | $ | 5 | $ | 9 | |||||

Commodity contracts | Other noncurrent assets | 2 | 4 | |||||||

Foreign exchange contracts | Other current assets | 15 | 23 | |||||||

Foreign exchange contracts | Other noncurrent assets | 1 | 2 | |||||||

Derivatives designated as fair value hedges: | ||||||||||

Fixed-for-floating interest rate swap | Other current assets | — | 1 | |||||||

Total Derivative Assets | $ | 23 | $ | 39 | ||||||

Derivatives designated as cash flow hedges: | ||||||||||

Commodity contracts | Payables and other current liabilities | $ | 31 | $ | 28 | |||||

Commodity contracts | Other long-term liabilities | 10 | 10 | |||||||

Foreign exchange contracts | Payables and other current liabilities | 10 | 6 | |||||||

Foreign exchange contracts | Other long-term liabilities | 9 | 4 | |||||||

Derivatives designated as fair value hedges: | ||||||||||

Fixed-for-floating interest rate swap | Long-term borrowings | 5 | 4 | |||||||

Derivatives designated as net investment hedges: | ||||||||||

Cross-currency interest rate swaps | Long-term borrowings | 22 | — | |||||||

Total Derivative Liabilities | $ | 87 | $ | 52 | ||||||

Total Net Derivative Liabilities | $ | 64 | $ | 13 | ||||||

In addition to the fair value associated with derivative instruments designated as cash flow hedges and fair value hedges noted in the table above, the Company had a carrying value of $1.5 billion associated with non-derivative instruments designated as foreign currency net investment hedges at both March 31, 2018 and December 31, 2017. The designated foreign currency-denominated borrowings are included in the "Long-term borrowings" line item of the Unaudited Consolidated Statements of Financial Position.

For additional fair value measurement information, see Note 1, "Significant Accounting Policies", and Note 9, "Derivative and Non-Derivative Financial Instruments", to the consolidated financial statements in Part II, Item 8 of the Company's 2017 Annual Report on Form 10-K.

16

As of March 31, 2018 and December 31, 2017, the following amounts were included on the Unaudited Consolidated Statements of Financial Position related to cumulative basis adjustments for fair value hedges.

(Dollars in millions) | Carrying amount of the hedged liabilities | Cumulative amount of fair value hedging loss adjustment included in the carrying amount of the hedged liability | ||||||||||||||

Line item in the Unaudited Consolidated Statements of Financial Position in which the hedged item is included | March 31, 2018 | December 31, 2017 | March 31, 2018 | December 31, 2017 | ||||||||||||

Long-term borrowings (1) | $ | (758 | ) | $ | (760 | ) | $ | 12 | $ | 10 | ||||||

(1) | At March 31, 2018 and December 31, 2017, the cumulative amount of fair value hedging loss adjustment remaining for hedged liabilities for which hedge accounting has been discontinued was $7 million and $6 million, respectively. |

The following table presents the effect of cash flow and net investment hedge accounting on OCI for first quarter 2018 and 2017:

(Dollars in millions) | Change in amount of after tax gain (loss) recognized in OCI on derivatives | Pre-tax amount of gain (loss) reclassified from OCI into earnings | ||||||||||||||

March 31, | March 31, | |||||||||||||||

Hedging Relationships | 2018 | 2017 | 2018 | 2017 | ||||||||||||

Derivatives in cash flow hedging relationships: | ||||||||||||||||

Commodity contracts | $ | (11 | ) | $ | (16 | ) | $ | (2 | ) | $ | (7 | ) | ||||

Foreign exchange contracts | (13 | ) | (10 | ) | 3 | 12 | ||||||||||

Forward starting interest rate and treasury lock swap contracts | 1 | 1 | (1 | ) | (1 | ) | ||||||||||

Non-derivatives in net investment hedging relationships (pre-tax): | ||||||||||||||||

Net investment hedges | (42 | ) | (18 | ) | — | — | ||||||||||

Derivatives in net investment hedging relationships (pre-tax): | ||||||||||||||||

Cross-currency interest rate swaps | (11 | ) | — | — | — | |||||||||||

Cross-currency interest rate swaps excluded component | (11 | ) | — | — | — | |||||||||||

17

The following table presents the effect of fair value and cash flow hedge accounting on the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings for first quarter 2018 and 2017.

Location and Amount of Gain or (Loss) Recognized in Earnings on Fair Value and Cash Flow Hedging Relationships | ||||||||||||||||||||||||

First Quarter | ||||||||||||||||||||||||

2018 | 2017 | |||||||||||||||||||||||

(Dollars in millions) | Sales | Cost of Sales | Net Interest Expense | Sales | Cost of Sales | Net Interest Expense | ||||||||||||||||||

Total amounts of income and expense line items presented in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings in which the effects of fair value or cash flow hedges are recognized | $ | 2,607 | $ | 2,026 | $ | 59 | $ | 2,303 | $ | 1,698 | $ | 60 | ||||||||||||

The effects of fair value and cash flow hedging: | ||||||||||||||||||||||||

Gain or (loss) on fair value hedging relationships in Subtopic 815-20: | ||||||||||||||||||||||||

Interest contracts (fixed-for-floating interest rate swaps): | ||||||||||||||||||||||||

Hedged items | — | (1 | ) | |||||||||||||||||||||

Derivatives designated as hedging instruments | — | 1 | ||||||||||||||||||||||

Gain or (loss) on cash flow hedging relationships in Subtopic 815-20: | ||||||||||||||||||||||||

Interest contracts (forward starting interest rate and treasury lock swap contracts): | ||||||||||||||||||||||||

Amount of loss reclassified from AOCI into earnings | (1 | ) | (1 | ) | ||||||||||||||||||||

Commodity Contracts: | ||||||||||||||||||||||||

Amount of loss reclassified from AOCI into earnings | (2 | ) | (7 | ) | ||||||||||||||||||||

Foreign Exchange Contracts: | ||||||||||||||||||||||||

Amount of gain reclassified from AOCI into earnings | 3 | 12 | ||||||||||||||||||||||

The Company enters into foreign exchange derivatives denominated in multiple currencies which are transacted and settled in the same quarter. These derivatives are not designated as hedges due to the short-term nature and the gains or losses on these derivatives are marked-to-market in line item "Other (income) charges, net" of the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings. The Company recognized net losses on these derivatives of $8 million and $6 million during first quarter 2018 and 2017, respectively.

Pre-tax monetized positions and mark-to-market gains and losses from raw materials and energy, currency, and certain interest rate hedges that were included in AOCI included net losses of $308 million and $214 million at March 31, 2018 and December 31, 2017, respectively. Losses in AOCI increased March 31, 2018 compared to December 31, 2017 primarily as a result of an increase in foreign currency exchange rates associated with the euro. If realized, approximately $27 million in pre-tax losses, as of March 31, 2018, would be reclassified into earnings during the next 12 months.

18

7. | RETIREMENT PLANS |

Defined Benefit Pension Plans and Other Postretirement Benefit Plans

Eastman maintains defined benefit pension plans that provide eligible employees with retirement benefits. In addition, Eastman provides life insurance for eligible retirees hired prior to January 1, 2007. Eastman provides a subsidy for pre-Medicare health care and dental benefits to eligible retirees hired prior to January 1, 2007 that will end on December 31, 2021. Company funding is also provided for eligible Medicare retirees hired prior to January 1, 2007 with a health reimbursement arrangement. Costs recognized for these benefits are estimated amounts, which may change as actual costs derived for the year are determined.

For additional information regarding retirement plans, see Note 10, "Retirement Plans", to the consolidated financial statements in Part II, Item 8 of the Company's 2017 Annual Report on Form 10-K.

Components of net periodic benefit (credit) cost were as follows:

First Quarter | |||||||||||||||||||||||

Pension Plans | Other Postretirement Benefit Plans | ||||||||||||||||||||||

2018 | 2017 | 2018 | 2017 | ||||||||||||||||||||

(Dollars in millions) | U.S. | Non-U.S. | U.S. | Non-U.S. | |||||||||||||||||||

Service cost | $ | 9 | $ | 4 | $ | 9 | $ | 3 | $ | — | $ | 1 | |||||||||||

Interest cost | 17 | 5 | 17 | 5 | 6 | 6 | |||||||||||||||||

Expected return on assets | (37 | ) | (9 | ) | (35 | ) | (8 | ) | (2 | ) | (2 | ) | |||||||||||

Amortization of: | |||||||||||||||||||||||

Prior service credit, net | — | — | (1 | ) | — | (10 | ) | (10 | ) | ||||||||||||||

Net periodic benefit (credit) cost | $ | (11 | ) | $ | — | $ | (10 | ) | $ | — | $ | (6 | ) | $ | (5 | ) | |||||||

On January 1, 2018, the Company adopted ASU 2017-07 resulting in non-service cost components of the net periodic pension and other postretirement benefit plans being presented in "Other components of post-employment (benefit) cost, net" line item of the Unaudited Consolidated Statement of Earnings, Comprehensive Income and Retained Earnings. See Note 1, "Significant Accounting Policies" for additional information.

8. | COMMITMENTS AND OFF BALANCE SHEET ARRANGEMENTS |

Purchase Obligations and Lease Commitments

The Company had various purchase obligations at March 31, 2018, totaling approximately $2.9 billion over a period of approximately 30 years for materials, supplies, and energy incident to the ordinary conduct of business. The Company also had various lease commitments for property and equipment under cancelable, noncancelable, and month-to-month operating leases totaling $254 million over a period of approximately 40 years. Of the total lease commitments, approximately 50 percent relate to real property, including office space, storage facilities, and land; approximately 40 percent relate to railcars; and approximately 10 percent relate to machinery and equipment, including computer and communications equipment and production equipment.

Guarantees

The Company has operating leases with terms that require the Company to guarantee a portion of the residual value of the leased assets upon termination of the lease as well as other guarantees. Disclosures about each group of similar guarantees are provided below.

19

Residual Value Guarantees

The Company has operating leases with terms that require the Company to guarantee a portion of the residual value of the leased assets upon termination of the lease. These residual value guarantees totaled $71 million at March 31, 2018 and consist primarily of leases for railcars that will expire beginning in third quarter 2018. Residual guarantee payments that become probable and estimable are recognized as rent expense over the remaining life of the applicable lease. Management's current expectation is that the likelihood of material residual guarantee payments is remote.

Other Guarantees

Guarantees and claims also arise during the ordinary course of business from relationships with customers, suppliers, joint venture partners, and other parties when the Company undertakes an obligation to guarantee the performance of others if specified triggering events occur. Non-performance under a contract could trigger an obligation of the Company. The Company's current other guarantees include guarantees relating to intellectual property, environmental matters, and other indemnifications and have arisen through the normal course of business. The ultimate effect on future financial results is not subject to reasonable estimation because considerable uncertainty exists as to the final outcome of these claims, if they were to occur. These other guarantees have terms up to 30 years with maximum potential future payments of approximately $35 million in the aggregate, with none of these guarantees being individually significant to the Company's operating results, financial position, or liquidity. Management's current expectation is that future payment or performance related to non-performance under other guarantees is remote.

Other Off Balance Sheet Arrangements

The Company has off balance sheet non-recourse factoring facilities with various commitment dates. These arrangements include customer specific receivables in the United States and Europe. The Company sells the receivables at face value which equals the carrying value and fair value, and thus no gain or loss is recognized. There is no continuing involvement with these receivables once sold and no credit loss exposure. The total amount of cumulative receivables sold in first quarter 2018 and 2017 were $39 million and $3 million, respectively.

9. | ENVIRONMENTAL MATTERS AND ASSET RETIREMENT OBLIGATIONS |

Certain Eastman manufacturing sites generate hazardous and nonhazardous wastes, the treatment, storage, transportation, and disposal of which are regulated by various governmental agencies. In connection with the cleanup of various hazardous waste sites, the Company, along with many other entities, has been designated a potentially responsible party ("PRP") by the U.S. Environmental Protection Agency under the Comprehensive Environmental Response, Compensation and Liability Act, which potentially subjects PRPs to joint and several liability for certain cleanup costs. In addition, the Company will incur costs for environmental remediation and closure and post-closure under the federal Resource Conservation and Recovery Act. Reserves for environmental contingencies have been established in accordance with Eastman's policies described in Note 1, "Significant Accounting Policies", to the consolidated financial statements in Part II, Item 8 of the Company's 2017 Annual Report on Form 10-K. Although the resolution of uncertainties related to these environmental matters may have a material adverse effect on the Company's consolidated results of operations in the period recognized, because of the availability of legal defenses, the Company's preliminary assessment of actions that may be required, and, if applicable, the expected sharing of costs, management does not believe that the Company's liability for these environmental matters, individually or in the aggregate, will be material to the Company's consolidated financial position, results of operations, or cash flows. The Company's total reserve for environmental loss contingencies was $302 million and $304 million at March 31, 2018 and December 31, 2017, respectively. The environmental reserve includes costs related to sites previously closed and impaired by Eastman and sites that have been divested by Eastman but for which the Company retains the environmental liability related to these sites of $7 million at both March 31, 2018 and December 31, 2017.

20

The Company's total environmental reserve that management believes to be probable and estimable for environmental contingencies, including remediation costs and asset retirement obligations, is included as part of "Payables and other current liabilities" and "Other long-term liabilities" in the Unaudited Consolidated Statements of Financial Position as follows:

(Dollars in millions) | March 31, 2018 | December 31, 2017 | |||||

Environmental contingent liabilities, current | $ | 25 | $ | 25 | |||

Environmental contingent liabilities, long-term | 277 | 279 | |||||

Total | $ | 302 | $ | 304 | |||

Environmental Remediation

Estimated future environmental expenditures for undiscounted remediation costs ranged from the best estimate or minimum of $278 million to the maximum of $478 million at March 31, 2018 and from the best estimate or minimum of $280 million to the maximum of $483 million at December 31, 2017. The best estimate or minimum estimated future environmental expenditures are considered to be probable and reasonably estimable and include the amounts recognized at both March 31, 2018 and December 31, 2017.

Reserves for environmental remediation include liabilities expected to be paid within approximately 30 years. The amounts charged to pre-tax earnings for environmental remediation and related charges are included within "Cost of sales" in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings. Changes in the reserves for environmental remediation liabilities during first three months 2018 are summarized below:

(Dollars in millions) | Environmental Remediation Liabilities | ||

Balance at December 31, 2017 | $ | 280 | |

Changes in estimates recognized in earnings and other | 1 | ||

Cash reductions | (3 | ) | |

Balance at March 31, 2018 | $ | 278 | |

Environmental Asset Retirement Obligations

An asset retirement obligation is an obligation for the retirement of a tangible long-lived asset that is incurred upon the acquisition, construction, development, or normal operation of that long-lived asset. The Company recognizes asset retirement obligations in the period in which they are incurred if a reasonable estimate of fair value can be made. The asset retirement obligations are discounted to expected present value and subsequently adjusted for changes in fair value. The associated estimated asset retirement costs are capitalized as part of the carrying value of the long-lived assets and depreciated over their useful life. Environmental asset retirement obligations consist primarily of closure and post-closure costs. For sites that have environmental asset retirement obligations, the best estimate recognized to date for these environmental asset retirement obligation costs was $24 million at both March 31, 2018 and December 31, 2017.

Non-Environmental Asset Retirement Obligations

The Company has contractual asset retirement obligations not associated with environmental liabilities. Eastman's non-environmental asset retirement obligations are primarily associated with the future closure of leased manufacturing assets at Pace, Florida and Oulu, Finland. These recognized non-environmental asset retirement obligations were $49 million at both March 31, 2018 and December 31, 2017.

21

10. | LEGAL MATTERS |

From time to time, Eastman and its operations are parties to, or targets of, lawsuits, claims, investigations and proceedings, including product liability, personal injury, asbestos, patent and intellectual property, commercial, contract, environmental, antitrust, health and safety, and employment matters, which are handled and defended in the ordinary course of business. While the Company is unable to predict the outcome of these matters, it does not believe, based upon currently available facts, that the ultimate resolution of any such pending matters will have a material adverse effect on its overall financial condition, results of operations, or cash flows.

11. | STOCKHOLDERS' EQUITY |

A reconciliation of the changes in stockholders' equity for first three months 2018 is provided below:

(Dollars in millions) | Common Stock at Par Value | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Treasury Stock at Cost | Total Eastman Stockholders' Equity | Noncontrolling Interest | Total Equity | |||||||||||||||||||||||

Balance at December 31, 2017 | $ | 2 | $ | 1,983 | $ | 6,802 | $ | (209 | ) | $ | (3,175 | ) | $ | 5,403 | $ | 77 | $ | 5,480 | |||||||||||||

Cumulative Effect of Adoption of New Accounting Standards (1) | — | — | 16 | — | — | 16 | — | 16 | |||||||||||||||||||||||

Net Earnings | — | — | 290 | — | — | 290 | — | 290 | |||||||||||||||||||||||

Cash Dividends Declared (2) ($0.56 per share) | — | — | (82 | ) | — | — | (82 | ) | — | (82 | ) | ||||||||||||||||||||

Other Comprehensive Income | — | — | — | (3 | ) | — | (3 | ) | — | (3 | ) | ||||||||||||||||||||

Share-Based Compensation Expense (3) | — | 24 | — | — | — | 24 | — | 24 | |||||||||||||||||||||||

Stock Option Exercises | — | 13 | — | — | — | 13 | — | 13 | |||||||||||||||||||||||

Other (4) | — | (16 | ) | — | — | — | (16 | ) | — | (16 | ) | ||||||||||||||||||||

Share Repurchases | — | — | — | — | (100 | ) | (100 | ) | — | (100 | ) | ||||||||||||||||||||

Distributions to Noncontrolling Interest | — | — | — | — | — | — | (2 | ) | (2 | ) | |||||||||||||||||||||

Balance at March 31, 2018 | $ | 2 | $ | 2,004 | $ | 7,026 | $ | (212 | ) | $ | (3,275 | ) | $ | 5,545 | $ | 75 | $ | 5,620 | |||||||||||||

(1) | On January 1, 2018, the Company adopted new accounting standards for revenue recognition, income taxes, and derivatives and hedging which resulted in adjustments to beginning retained earnings. See Note 1, "Significant Accounting Policies", for specific amounts related to each standard. |

(2) | Cash dividends declared includes cash dividends paid and dividends declared but unpaid. |

(3) | Share-based compensation expense is the fair value of share-based awards. |

(4) | Includes value of shares withheld for employees' taxes on vesting of share-based compensation awards. |

Accumulated Other Comprehensive Income (Loss), Net of Tax

(Dollars in millions) | Cumulative Translation Adjustment | Benefit Plans Unrecognized Prior Service Credits | Unrealized Gains (Losses) on Derivative Instruments | Unrealized Losses on Investments | Accumulated Other Comprehensive Income (Loss) | ||||||||||||||

Balance at December 31, 2016 | $ | (381 | ) | $ | 163 | $ | (62 | ) | $ | (1 | ) | $ | (281 | ) | |||||

Period change | 85 | (27 | ) | 14 | — | 72 | |||||||||||||

Balance at December 31, 2017 | (296 | ) | 136 | (48 | ) | (1 | ) | (209 | ) | ||||||||||

Period change | 27 | (7 | ) | (23 | ) | — | (3 | ) | |||||||||||

Balance at March 31, 2018 | $ | (269 | ) | $ | 129 | $ | (71 | ) | $ | (1 | ) | $ | (212 | ) | |||||

Amounts of other comprehensive income (loss) are presented net of applicable taxes. Eastman records deferred income taxes

on the CTA related to branch operations and income from other entities included in the Company's consolidated U.S. tax return. No deferred income taxes are provided on the CTA of other subsidiaries outside the United States, as the CTA is considered to be a component of indefinitely invested, unremitted earnings of these foreign subsidiaries.

22

Components of other comprehensive income recognized in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings are presented below, before tax and net of tax effects:

First Quarter | |||||||||||||||

2018 | 2017 | ||||||||||||||

(Dollars in millions) | Before Tax | Net of Tax | Before Tax | Net of Tax | |||||||||||

Other comprehensive income (loss) | |||||||||||||||

Change in cumulative translation adjustment | $ | 27 | $ | 27 | $ | 7 | $ | 7 | |||||||

Defined benefit pension and other postretirement benefit plans: | |||||||||||||||

Amortization of unrecognized prior service credits included in net periodic benefit costs | (10 | ) | (7 | ) | (11 | ) | (7 | ) | |||||||

Derivatives and hedging: | |||||||||||||||

Unrealized gain (loss) during period | (31 | ) | (23 | ) | (34 | ) | (21 | ) | |||||||

Reclassification adjustment for (gains) losses included in net income, net | — | — | (6 | ) | (4 | ) | |||||||||

Total other comprehensive income (loss) | $ | (14 | ) | $ | (3 | ) | $ | (44 | ) | $ | (25 | ) | |||

12. | EARNINGS AND DIVIDENDS PER SHARE |

The following table sets forth the computation of basic and diluted earnings per share ("EPS"):

First Quarter | |||||||

(In millions, except per share amounts) | 2018 | 2017 | |||||

Numerator | |||||||

Earnings attributable to Eastman, net of tax | $ | 290 | $ | 278 | |||

Denominator | |||||||

Weighted average shares used for basic EPS | 142.8 | 146.2 | |||||

Dilutive effect of stock options and other awards | 2.0 | 1.0 | |||||

Weighted average shares used for diluted EPS | 144.8 | 147.2 | |||||

(Calculated using whole dollars and shares) | |||||||

EPS | |||||||

Basic | $ | 2.03 | $ | 1.90 | |||

Diluted | $ | 2.00 | $ | 1.89 | |||

Stock options excluded from the first quarter 2018 and 2017 calculations of diluted earnings per share were 407,573 and 1,008,667, respectively, because the market value of option exercises for these awards were less than the cash proceeds that would be received from these exercises. First quarter 2018 and 2017 reflect the impact of share repurchases of 994,235 and 943,699, respectively.

The Company declared cash dividends of $0.56 and $0.51 per share in first quarter 2018 and 2017, respectively.

23

13. | ASSET IMPAIRMENTS AND RESTRUCTURING CHARGES, NET |

In first quarter 2018, the Company recognized restructuring charges of $2 million for corporate severance. There were no asset impairments and restructuring charges in first quarter 2017.

Changes in Reserves

The following table summarizes the changes in asset impairments and restructuring charges and gains, the non-cash reductions attributable to asset impairments, and the cash reductions in restructuring reserves for severance costs and site closure costs paid in first three months 2018 and full year 2017:

(Dollars in millions) | Balance at January 1, 2018 | Provision/ Adjustments | Non-cash Reductions/ Additions | Cash Reductions | Balance at March 31, 2018 | ||||||||||||||

Severance costs | $ | 19 | $ | 2 | $ | — | $ | (3 | ) | $ | 18 | ||||||||

Site closure and restructuring costs | 10 | — | — | — | 10 | ||||||||||||||

Total | $ | 29 | $ | 2 | $ | — | $ | (3 | ) | $ | 28 | ||||||||

(Dollars in millions) | Balance at January 1, 2017 | Provision/ Adjustments | Non-cash Reductions/ Additions | Cash Reductions | Balance at December 31, 2017 | ||||||||||||||

Non-cash charges | $ | — | $ | 1 | $ | (1 | ) | $ | — | $ | — | ||||||||

Severance costs | 42 | 6 | — | (29 | ) | 19 | |||||||||||||

Site closure and restructuring costs | 13 | 1 | 1 | (5 | ) | 10 | |||||||||||||

Total | $ | 55 | $ | 8 | $ | — | $ | (34 | ) | $ | 29 | ||||||||

Substantially all severance costs remaining are expected to be applied to the reserves within one year.

14. | SHARE-BASED COMPENSATION AWARDS |

The Company utilizes share-based awards under employee and non-employee director compensation programs. These share-based awards have included restricted and unrestricted stock, restricted stock units, stock options, and performance shares. In first quarter 2018 and 2017, $24 million and $14 million, respectively, of compensation expense before tax were recognized in "Selling, general and administrative expenses" in the Unaudited Consolidated Statements of Earnings, Comprehensive Income and Retained Earnings for all share-based awards of which $5 million and $3 million, respectively, related to stock options. The compensation expense is recognized over the substantive vesting period, which may be shorter time period than the stated vesting period for qualifying termination eligible employees as defined in the forms of award notice. For first quarter 2018 and 2017, $3 million and $2 million, respectively, of stock option compensation expense was recognized due to qualifying termination eligibility preceding the requisite service period. The impact on first quarter 2018 and 2017 net earnings of $18 million and $9 million, respectively, is net of deferred tax expense related to share-based award compensation for each period.

Stock Option Grants

In first quarter 2018 and 2017, the number of stock options granted under the 2017 and 2012 Omnibus Stock Compensation Plans, respectively, were approximately 620,000 and 746,000, respectively. Options have an exercise price equal to the closing price of the Company's stock on the date of grant. The term of options is 10 years with vesting periods that vary up to three years. Vesting usually occurs ratably over the vesting period or at the end of the vesting period. The Company utilizes the Black Scholes Merton option valuation model which relies on certain assumptions to estimate an option's fair value.

24

The assumptions used in the determination of fair value for stock options granted in first quarter 2018 and 2017 are provided in the table below:

First Quarter | ||||

Assumptions | 2018 | 2017 | ||

Expected volatility rate | 19.03% | 20.45% | ||

Expected dividend yield | 2.48% | 2.64% | ||

Average risk-free interest rate | 2.61% | 1.91% | ||

Expected term years | 5.1 | 5.1 | ||

The grant date exercise price and fair value of options granted during first quarter 2018 were $104.21 and $15.90, respectively, and first quarter 2017 were $80.25 and $11.79, respectively.

For options unvested at March 31, 2018, $8 million in compensation expense will be recognized over the next three years.

Other Share-Based Compensation Awards

In addition to stock option grants, the Company has awarded long-term performance share awards, restricted stock and restricted stock unit awards, and stock appreciation rights. The long-term performance share awards are based upon actual return on capital compared to a target return on capital and total stockholder return compared to a peer group ranking by total stockholder return over a three year performance period and pay out in unrestricted shares of common stock at the end of the performance period. The awards are valued using a Monte Carlo Simulation based model and vest pro-ratably over the three year performance period. The number of long-term performance share target awards during first quarter 2018 and 2017 for the 2018-2020 and 2017-2019 periods were approximately 310,000 and 360,000, respectively. The target shares awarded are assumed to be 100 percent. At the end of the three-year performance period, the actual number of shares awarded can range from zero percent to 250 percent of the target shares based on the award notice. The number of restricted stock unit awards, which pay out in unrestricted shares of common stock at the end of the vesting and performance (if any) period, during first quarter 2018 and 2017 were approximately 135,000 and 150,000, respectively. The fair value of a restricted stock unit award is equal to the closing stock price of the Company's stock on the award date and normally vests over a period of three years. In first quarter 2018 and 2017, $19 million and $11 million, respectively, was recognized as compensation expense before tax for these other share-based awards and was included in the total compensation expense noted above for all share-based awards. The unrecognized compensation expense before tax for these same type awards at March 31, 2018 was approximately $100 million and will be recognized primarily over a period of three years.

For additional information regarding share-based compensation plans and awards, see Note 17, "Share-Based Compensation Plans and Awards", to the consolidated financial statements in Part II, Item 8 of the Company's 2017 Annual Report on Form 10-K.

15. | OTHER (INCOME) CHARGES, NET |

First Quarter | |||||||

(Dollars in millions) | 2018 | 2017 | |||||