UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

|

Investment Company Act file number |

811-07123 | |||||

|

|

| |||||

|

|

Advantage Funds, Inc. |

| ||||

|

|

(Exact name of Registrant as specified in charter) |

| ||||

|

|

|

| ||||

|

|

c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Address of principal executive offices) (Zip code) |

| ||||

|

|

|

| ||||

|

|

Bennett A. MacDougall, Esq. 200 Park Avenue New York, New York 10166 |

| ||||

|

|

(Name and address of agent for service) |

| ||||

|

| ||||||

|

Registrant's telephone number, including area code: |

(212) 922-6400 | |||||

|

|

| |||||

|

Date of fiscal year end:

|

10/31 |

| ||||

|

Date of reporting period: |

10/31/18

|

| ||||

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

Dreyfus Global Dynamic Bond Income Fund

Dreyfus Global Multi-Asset Income Fund

Dreyfus Global Real Return Fund

Dreyfus Total Emerging Markets Fund

Dynamic Total Return Fund

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Global Real Return Fund

|

|

ANNUAL REPORT October 31, 2018 |

|

|

|

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

|

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

|

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

|

With Those of Other Funds |

|

|

in Affiliated Issuers |

|

|

Currency Exchange Contracts |

|

|

Public Accounting Firm |

|

FOR MORE INFORMATION

Back Cover

|

|

The Fund |

A LETTER FROM THE PRESIDENT OF DREYFUS

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Global Real Return Fund, covering the 12-month period from November 1, 2017 through October 31, 2018. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Markets began the reporting period on solid footing as major global economies experienced above-trend growth across the board. In the United States, the Federal Reserve continued to move away from its accommodative monetary policy while other major central banks also began to consider monetary tightening. In the equity markets, both U.S. and non-U.S. markets enjoyed an upward trend, though investor concerns about volatility and inflation later began to weigh on returns. Interest rates rose across the curve, putting pressure on bond prices.

Later in the reporting period, global growth trends began to diverge. While a strong economic performance continued to bolster U.S. equity markets, slower growth and political concerns pressured markets in the Eurozone. Emerging markets also came under pressure as weakness in their currencies added to investors’ uneasiness. Fixed income markets continued to struggle as interest rates rose; the yield on the benchmark 10-year Treasury bond surged late in the reporting period, but growing investor concerns about global growth helped keep it from rising further.

Despite continuing doubts regarding trade, U.S. inflationary pressures, and global growth, we are optimistic that the U.S. economy will remain strong in the near term. However, we will stay attentive to signs that signal potential changes on the horizon. As always, we encourage you to discuss the risks and opportunities of today’s investment environment with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Renee Laroche-Morris

President

The Dreyfus Corporation

November 15, 2018

2

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from November 1, 2017 through October 31, 2018, as provided by portfolio managers Suzanne Hutchins (Lead) and Aron Pataki, of Newton Investment Management (North America) Limited, Sub-Investment Adviser

Market and Fund Performance Overview

For the 12-month period ended October 31, 2018, Dreyfus Global Real Return Fund’s Class A shares produced a total return of -0.05%, Class C shares returned -0.86%, Class I shares returned 0.11%, and Class Y shares returned 0.24%.1 In comparison, the fund’s benchmark, the FTSE One-Month U.S. Treasury Bill Index, and the fund’s performance baseline benchmark, the USD 1-Month LIBOR Index, produced total returns of 1.62% and 1.81%, respectively, for the same period.2,3

Some global stock and bond indices rose modestly over the reporting period, despite an environment of slowing growth, a strong dollar, trade tensions, and geopolitical issues. The fund lagged its benchmark largely due to its more cautious stance, in keeping with the team’s views on the risks associated with the market backdrop.

On July 31, 2018, the Citi One-Month U.S. Treasury Bill Index was renamed FTSE One-Month U.S. Treasury Bill Index.

The Fund’s Investment Approach

The fund seeks total return (consisting of capital appreciation and income). To pursue its goal, the fund uses an actively managed multi-asset strategy to produce absolute or real returns with less volatility than major equity markets over a complete market cycle, typically a period of five years. Rather than managing to track a benchmark index, the fund seeks to provide returns that are largely independent of market moves.

The fund allocates its investments among global equities, bonds and cash, and, generally to a lesser extent, other asset classes, including real estate, commodities, currencies, and alternative or non-traditional asset classes and strategies, primarily those accessed through derivative instruments.

The fund’s portfolio managers combine a top-down approach, emphasizing economic trends and current investment themes on a global basis, with bottom-up security selection, based on fundamental research, to allocate the fund’s investments among and within asset classes. In choosing investments, the portfolio managers consider key trends in global economic variables, such as gross domestic product, inflation and interest rates; investment themes, such as changing demographics, the impact of new technologies, and the globalization of industries and brands; relative valuations of equity securities, bonds, and cash; long-term trends in currency movements; and company fundamentals.

Volatility Returned to Global Markets

The reporting period proved to be something of a roller coaster ride for global equity markets. Although the period started strong, as the S&P 500 registered robust gains from November 2017 through January 2018, February 2018 marked the return of volatility to markets. Worries prompted by stronger-than-expected inflation data and subsequently higher bond yields caused a sell-off across most asset classes. Towards the middle of the

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

reporting period, equity markets recouped some of their earlier losses, as investors chose to focus on a positive outlook for economic growth.

As risk assets regained their poise, more cautious moods prevailed, spurred by slowing economic growth in non-U.S. developed markets. Volatility soon resurfaced, notably in emerging markets, which had previously been major beneficiaries of monetary policy largesse. The U.S. market continued to outperform on a relative basis, enjoying strong gains that were largely attributable to robust corporate earnings. The reporting period closed with risk assets resuming broad-based declines as a result of several factors weighing upon stock markets, such as Brexit uncertainties, geopolitical issues and trade tensions.

Stabilizing Layer Dampened Fund Performance

The portfolio’s stabilizing layer detracted from performance over the reporting period, as risk assets ground higher and the protective insurance was a cost. The derivative protection through short equity futures has been progressively reduced in favor of indirect hedges and diversified into a range of different equity indices. Gold was the other noteworthy detractor, as it struggled in an environment of rising real interest rates. We continue to maintain a small exposure within the stabilizing layer of the portfolio, based on the attraction of holding a real asset that cannot be manipulated by central banks and that also serves as a hedge against monetary-policy error. Within the return-seeking core, some weakness was seen from the portfolio’s emerging-market debt holdings, as sentiment toward this asset class succumbed to a range of macroeconomic and political factors which were exacerbated by the U.S. dollar’s appreciation and the rise in U.S. interest rates.

The main driver of returns over the reporting period was the return-seeking core, particularly its equities. The fund’s technology holdings were the top contributors, led by Cisco Systems, which continued to deliver strong results. CA Technologies also featured within the top contributors, benefiting from being the subject of a takeover bid from Broadcom, the latter attracted by the computer company’s recurring revenues. We subsequently sold the position, as the price approached the offer level. Publishing company Wolters Kluwer was another positive contributor, rebounding in the latter half of the period after having exerted a drag on stock selection earlier in 2018. Finally, energy company Royal Dutch Shell delivered gains as the oil price climbed, reflecting a tightening between supply and demand, coupled with a relatively constructive outcome to June’s Organization of the Petroleum Exporting Countries (OPEC) meeting.

A More Cautious Investment Posture

Our relatively cautious outlook remains broadly unchanged, and the recent volatility we have seen in markets makes an even stronger case for prioritizing capital preservation. We believe we may be past peak momentum in the U.S. economy, where the positive effects of last year’s tax cuts are set to wane, while higher interest rates take their toll upon demand in areas such as housing. We believe hopes of a synchronized global upturn, advanced at the start of 2018, are likely to remain unfulfilled, with Europe showing clear signs of deceleration and strains now visible in the Chinese economy. Nevertheless, the Federal Reserve continues to employ a hawkish tone, meaning a reversal of monetary tightening is some way off. Despite recent declines, aggregate valuations of the major risk asset classes remain stretched, and we therefore await better opportunities to meaningfully increase the portfolio’s commitment to return-seeking assets. We think the probability of a disinflationary/deflationary outcome has

4

increased in the rest of the world, which is problematic for equity markets. As risk assets start to come under pressure, we are likely to see increased demand for safe-haven government bonds, hence our recent decision to marginally increase the strategy’s duration in recent quarters.

Within the return-seeking core, the gross equity weighting fell by approximately 12% over the reporting period. However, on a net basis, it ended the period higher, as we progressively reduced the level of protection employed through equity-index futures with the aim of enabling the portfolio to benefit more fully from stock selection into year-end. The aim of the fund’s equity protection is to cushion the portfolio against a likely sell-off in risk assets, and this is coupled with indirect hedges in the form of a substantial cash position. We also continue to have significant exposure to government bonds within our stabilizing layer, primarily in the U.S. and Australasia.

November 15, 2018

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Return figures provided reflect the absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement in effect through March 1, 2019, at which time it may be extended, modified, or terminated. Had these expenses not been absorbed, the fund’s returns would have been lower. Past performance is no guarantee of future results.

2 Source: FactSet — The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds of a sizable amount from other banks in the London market. LIBOR is the most widely used “benchmark” or reference rate for short-term interest rates. Investors cannot invest directly in any index.

3 Source: Lipper, Inc. — The FTSE One-Month U.S. Treasury Bill Index consists of the last one-month Treasury bill month-end rates. The FTSE One-Month U.S. Treasury Bill Index measures return equivalents of yield averages. The instruments are not marked to market. Investors cannot invest directly in any index.

Please note: the position in any security highlighted with italicized typeface was sold during the reporting period.

Equities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Bonds are subject generally to interest-rate, credit, liquidity, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

The fund’s performance will be influenced by political, social, and economic factors affecting investments in foreign companies. Special risks associated with such companies include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability, and differing auditing and legal standards.

Because the fund seeks to provide exposure to alternative or non-traditional (i.e., satellite) asset categories or investment strategies, the fund’s performance will be linked to the performance of these highly volatile asset categories and strategies. Accordingly, investors should consider purchasing shares of the fund only as part of an overall diversified portfolio and should be willing to assume the risks of potentially significant fluctuations in the value of fund shares.

The fund may, but is not required to, use derivative instruments, such as options, futures, options on futures, forward contracts, and other credit derivatives. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

5

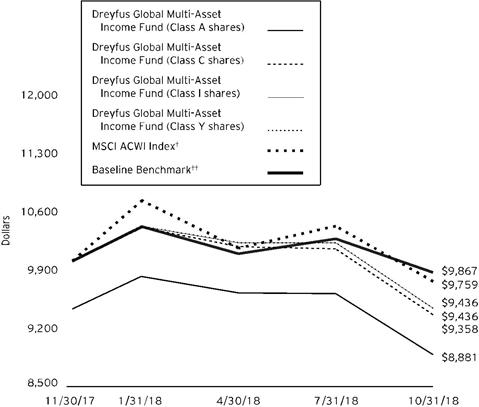

FUND PERFORMANCE (Unaudited)

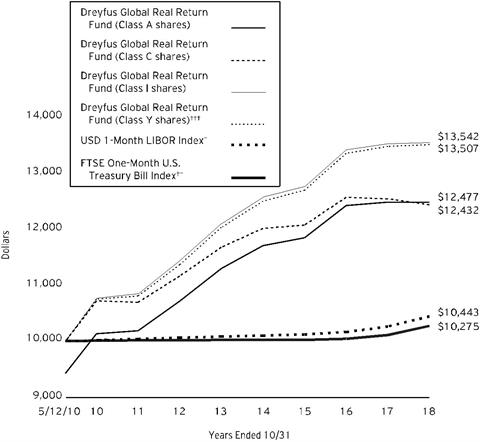

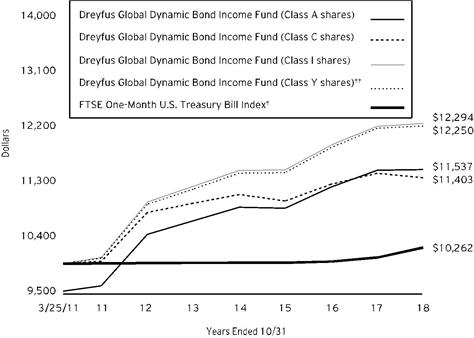

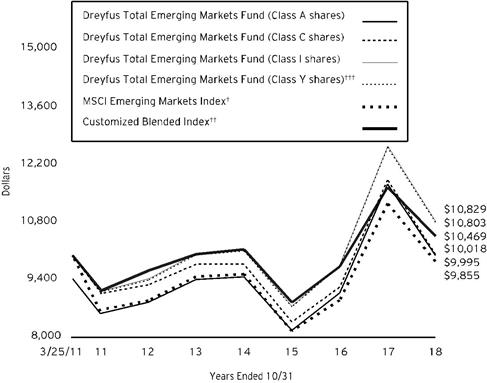

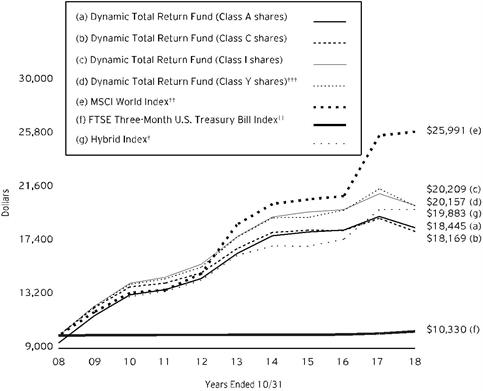

Comparison of change in value of $10,000 investment in Dreyfus Global Real Return Fund Class A shares, Class C shares, Class I shares and Class Y shares and the FTSE One-Month U.S. Treasury Bill Index and USD 1-Month LIBOR

† Source: FactSet

†† Source: Lipper Inc.

††† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales charges for Class A shares.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus Global Real Return Fund on 5/12/10 (inception date) to a $10,000 investment made in the FTSE One-Month U.S. Treasury Bill Index and USD 1-Month LIBOR on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The FTSE One-Month U.S. Treasury Bill Index consists of the last one-month Treasury bill month-end rates. The FTSE One-Month U.S. Treasury Bill Index measures returns equivalent of yield averages. The instruments are not marked to market. The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds of a sizable amount from other banks in the London market. LIBOR is the most widely used "benchmark" or reference rate for short-term interest rates. Unlike a mutual fund, the indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

|

Average Annual Total Returns as of 10/31/18 | ||||

|

|

Inception |

1 Year |

5 Years |

From |

|

Class A shares |

||||

|

with maximum sales charge (5.75%) |

5/12/10 |

-5.81% |

0.81% |

2.65% |

|

without sales charge |

5/12/10 |

-0.05% |

2.01% |

3.37% |

|

Class C shares |

||||

|

with applicable redemption charge† |

5/12/10 |

-1.85% |

1.26% |

2.60% |

|

without redemption |

5/12/10 |

-0.86% |

1.26% |

2.60% |

|

Class I shares |

5/12/10 |

0.11% |

2.27% |

3.65% |

|

Class Y shares |

7/1/13 |

0.24% |

2.34% |

3.61%†† |

|

USD 1-Month LIBOR Index |

4/30/10 |

1.81% |

0.70% |

0.51%††† |

|

FTSE One-Month U.S. Treasury |

4/30/10 |

1.62% |

0.50% |

0.32%††† |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales charges for Class A shares.

††† For comparative purposes, the value of each Index as of 4/30/10 is used as the beginning value on 5/12/10.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to Dreyfus.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Global Real Return Fund from May 1, 2018 to October 31, 2018. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

|

Expenses and Value of a $1,000 Investment | ||||||||

|

assuming actual returns for the six months ended October 31, 2018 | ||||||||

|

Class A |

Class C |

Class I |

Class Y | |||||

|

Expenses paid per $1,000† |

|

$5.70 |

$9.51 |

$4.54 |

$4.04 | |||

|

Ending value (after expenses) |

|

$1,000.00 |

$995.70 |

$1,000.70 |

$1,001.40 | |||

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

|

Expenses and Value of a $1,000 Investment | ||||||||

|

assuming a hypothetical 5% annualized return for the six months ended October 31, 2018 | ||||||||

|

Class A |

Class C |

Class I |

Class Y | |||||

|

Expenses paid per $1,000† |

$5.75 |

$9.60 |

$4.58 |

$4.08 | ||||

|

Ending value (after expenses) |

$1,019.51 |

$1,015.68 |

$1,020.67 |

$1,021.17 | ||||

† Expenses are equal to the fund’s annualized expense ratio of 1.13% for Class A, 1.89% for Class C, .90% for Class I and .80% for Class Y, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

8

STATEMENT OF INVESTMENTS

October 31, 2018

|

Description |

Coupon |

Maturity |

Principal |

a |

Value ($) |

||||

|

Bonds and Notes - 39.8% |

|||||||||

|

Australia - 5.3% |

|||||||||

|

Australia Government Bond, |

AUD |

3.00 |

3/21/2047 |

46,252,000 |

32,043,327 |

||||

|

Australia Government Bond, |

AUD |

3.25 |

6/21/2039 |

15,146,000 |

11,106,336 |

||||

|

Australian Government, |

AUD |

3.75 |

4/21/2037 |

29,956,000 |

23,598,548 |

||||

|

New South Wales Treasury, |

AUD |

3.52 |

11/20/2025 |

6,226,300 |

6,435,249 |

||||

|

Treasury Corp. of Victoria, |

AUD |

4.25 |

12/20/2032 |

6,399,000 |

5,062,062 |

||||

|

Treasury Corp. of Victoria, |

AUD |

5.50 |

11/17/2026 |

4,023,000 |

3,406,640 |

||||

|

81,652,162 |

|||||||||

|

Brazil - 1.3% |

|||||||||

|

Brazilian Government, |

4.88 |

1/22/2021 |

15,737,000 |

16,020,266 |

|||||

|

Brazilian Government, |

5.00 |

1/27/2045 |

4,599,000 |

3,854,537 |

|||||

|

19,874,803 |

|||||||||

|

Canada - 1.7% |

|||||||||

|

Canada Housing Trust No 1, |

CAD |

2.35 |

6/15/2027 |

37,015,000 |

b |

27,034,207 |

|||

|

Cayman Islands - .2% |

|||||||||

|

Dwr Cymru Financing, |

GBP |

1.86 |

3/31/2048 |

195,638 |

c |

421,676 |

|||

|

Sable International Finance, |

6.88 |

8/1/2022 |

2,029,000 |

b |

2,122,841 |

||||

|

2,544,517 |

|||||||||

|

Ecuador - .1% |

|||||||||

|

Ecuadorian Government, |

8.88 |

10/23/2027 |

2,435,000 |

2,149,496 |

|||||

|

Germany - 1.2% |

|||||||||

|

Bundesrepublik Deutschland Bundesanleihe, |

EUR |

0.25 |

8/15/2028 |

16,282,703 |

18,209,729 |

||||

|

India - .1% |

|||||||||

|

National Highways Authority of India, |

INR |

7.30 |

5/18/2022 |

120,000,000 |

1,522,159 |

||||

|

Indonesia - .1% |

|||||||||

|

Indonesian Government, |

IDR |

8.25 |

5/15/2036 |

15,462,000,000 |

955,791 |

||||

9

STATEMENT OF INVESTMENTS (continued)

|

Description |

Coupon |

Maturity |

Principal |

a |

Value ($) |

||||

|

Bonds and Notes - 39.8% (continued) |

|||||||||

|

Italy - .3% |

|||||||||

|

Italian Government, |

EUR |

0.35 |

6/15/2020 |

485,000 |

543,282 |

||||

|

Nexi Capital, |

EUR |

4.13 |

11/1/2023 |

2,970,000 |

3,378,089 |

||||

|

3,921,371 |

|||||||||

|

Japan - .2% |

|||||||||

|

SoftBank Group Corp, |

6.00 |

12/31/2049 |

2,935,000 |

2,579,146 |

|||||

|

Jersey - .1% |

|||||||||

|

CPUK Finance, |

GBP |

4.25 |

2/28/2047 |

1,795,000 |

2,311,678 |

||||

|

Mexico - .9% |

|||||||||

|

Mexican Government, |

MXN |

7.50 |

6/3/2027 |

76,956,600 |

3,488,785 |

||||

|

Mexican Government, |

MXN |

7.75 |

5/29/2031 |

77,244,000 |

3,469,986 |

||||

|

Mexican Government, |

MXN |

8.00 |

11/7/2047 |

14,557,300 |

643,513 |

||||

|

Mexican Government, |

MXN |

10.00 |

12/5/2024 |

116,860,600 |

6,101,149 |

||||

|

13,703,433 |

|||||||||

|

Netherlands - .5% |

|||||||||

|

InterXion Holding, |

EUR |

4.75 |

6/15/2025 |

2,702,000 |

3,198,139 |

||||

|

Petrobras Global Finance, |

7.38 |

1/17/2027 |

648,000 |

673,823 |

|||||

|

Telefonica Europe, |

EUR |

3.00 |

12/4/2023 |

1,300,000 |

1,415,344 |

||||

|

Teva Pharmaceuticals, |

2.20 |

7/21/2021 |

3,348,000 |

3,127,995 |

|||||

|

8,415,301 |

|||||||||

|

New Zealand - 2.0% |

|||||||||

|

New Zealand Government, |

NZD |

2.54 |

9/20/2040 |

5,000,000 |

3,865,396 |

||||

|

New Zealand Government, |

NZD |

4.50 |

4/15/2027 |

24,372,000 |

18,477,573 |

||||

|

New Zealand Government, |

NZD |

2.75 |

4/15/2037 |

13,529,000 |

8,708,522 |

||||

|

31,051,491 |

|||||||||

|

United Kingdom - 1.4% |

|||||||||

|

Anglian Water Services Financing, |

GBP |

3.67 |

7/30/2024 |

151,000 |

389,071 |

||||

|

British Telecommunications, |

GBP |

3.50 |

4/25/2025 |

533,000 |

1,424,033 |

||||

|

High Speed Rail Finance 1, |

GBP |

1.57 |

11/1/2038 |

309,419 |

c |

530,478 |

|||

10

|

Description |

Coupon |

Maturity |

Principal |

a |

Value ($) |

||||

|

Bonds and Notes - 39.8% (continued) |

|||||||||

|

United Kingdom - 1.4% (continued) |

|||||||||

|

Network Rail Infrastructure Finance, |

GBP |

1.75 |

11/22/2027 |

1,197,826 |

c |

2,030,804 |

|||

|

Scotland Gas Networks, |

GBP |

2.13 |

10/21/2022 |

300,000 |

635,167 |

||||

|

TESCO, |

GBP |

3.32 |

11/5/2025 |

3,960,000 |

9,980,726 |

||||

|

TESCO, |

GBP |

6.13 |

2/24/2022 |

147,000 |

212,336 |

||||

|

Tesco Property Finance 3, |

GBP |

5.74 |

4/13/2040 |

2,743,703 |

4,143,726 |

||||

|

Thames Water Kemble Finance, |

GBP |

7.75 |

4/1/2019 |

922,000 |

1,207,053 |

||||

|

Vodafone Group, |

GBP |

4.88 |

10/3/2078 |

1,169,000 |

1,462,501 |

||||

|

22,015,895 |

|||||||||

|

United States - 24.4% |

|||||||||

|

CCO Holdings, |

5.50 |

5/1/2026 |

2,727,000 |

b |

2,662,234 |

||||

|

CEMEX Finance, |

6.00 |

4/1/2024 |

5,760,000 |

5,761,440 |

|||||

|

Chesapeake Energy, |

7.00 |

10/1/2024 |

1,412,000 |

1,381,995 |

|||||

|

Netflix, |

EUR |

4.63 |

5/15/2029 |

1,769,000 |

2,013,426 |

||||

|

Post Holdings, |

5.50 |

3/1/2025 |

3,029,000 |

b |

2,940,023 |

||||

|

Refinitiv US Holdings, |

EUR |

6.88 |

11/15/2026 |

1,182,000 |

1,334,776 |

||||

|

Reynolds Group, |

5.75 |

10/15/2020 |

4,435,606 |

4,441,151 |

|||||

|

Spectrum Brands, |

6.63 |

11/15/2022 |

3,458,000 |

3,540,127 |

|||||

|

Sprint, |

7.13 |

6/15/2024 |

3,548,000 |

3,636,700 |

|||||

|

Sprint Capital, |

8.75 |

3/15/2032 |

5,395,000 |

5,881,089 |

|||||

|

T-Mobile USA, |

6.00 |

3/1/2023 |

2,563,000 |

2,627,331 |

|||||

|

T-Mobile USA, |

6.00 |

4/15/2024 |

3,236,000 |

3,324,990 |

|||||

|

U.S. Treasury Notes |

2.25 |

11/15/2027 |

203,247,600 |

189,151,267 |

|||||

|

U.S. Treasury Notes |

2.75 |

9/30/2020 |

148,205,200 |

147,886,790 |

|||||

|

376,583,339 |

|||||||||

|

Total Bonds and Notes |

614,524,518 |

||||||||

11

STATEMENT OF INVESTMENTS (continued)

|

Description |

Shares |

Value ($) |

|||||||

|

Common Stocks - 43.1% |

|||||||||

|

Australia - 1.0% |

|||||||||

|

Dexus |

1,576,362 |

d |

11,415,542 |

||||||

|

Newcrest Mining |

231,132 |

3,394,310 |

|||||||

|

OceanaGold |

354,357 |

1,020,178 |

|||||||

|

15,830,030 |

|||||||||

|

Canada - 1.9% |

|||||||||

|

Agnico-Eagle Mines |

28,516 |

1,007,250 |

|||||||

|

Alamos Gold |

198,666 |

793,789 |

|||||||

|

Eldorado Gold |

536,382 |

e |

358,552 |

||||||

|

Intact Financial |

161,573 |

12,765,550 |

|||||||

|

Kinross Gold |

143,262 |

e |

372,180 |

||||||

|

New Gold |

505,377 |

e |

403,088 |

||||||

|

Suncor Energy |

276,929 |

9,289,517 |

|||||||

|

Wheaton Precious Metals |

253,651 |

4,169,553 |

|||||||

|

29,159,479 |

|||||||||

|

Denmark - 1.1% |

|||||||||

|

Orsted |

258,091 |

b |

16,397,387 |

||||||

|

France - 2.0% |

|||||||||

|

Thales |

63,443 |

8,099,881 |

|||||||

|

Total |

165,864 |

9,734,422 |

|||||||

|

Vivendi |

521,961 |

12,611,294 |

|||||||

|

30,445,597 |

|||||||||

|

Germany - 4.1% |

|||||||||

|

Bayer |

103,541 |

7,949,480 |

|||||||

|

Deutsche Wohnen-BR |

330,083 |

15,115,191 |

|||||||

|

Infineon Technologies |

406,632 |

8,151,815 |

|||||||

|

LEG Immobilien |

137,137 |

15,012,750 |

|||||||

|

SAP |

95,119 |

10,193,914 |

|||||||

|

Telefonica Deutschland Holding |

1,637,213 |

6,368,044 |

|||||||

|

62,791,194 |

|||||||||

|

Guernsey - .3% |

|||||||||

|

Amedeo Air Four Plus |

3,691,487 |

5,024,978 |

|||||||

|

Hong Kong - 2.7% |

|||||||||

|

AIA Group |

3,508,800 |

26,688,007 |

|||||||

|

Link REIT |

1,597,500 |

14,139,641 |

|||||||

|

40,827,648 |

|||||||||

|

India - .4% |

|||||||||

|

ITC |

1,596,638 |

e |

6,035,292 |

||||||

|

Ireland - 3.1% |

|||||||||

|

Accenture |

110,642 |

17,439,392 |

|||||||

|

AIB Group |

718,979 |

3,476,506 |

|||||||

|

CRH |

325,199 |

9,753,997 |

|||||||

|

Linde |

65,400 |

10,821,738 |

|||||||

12

|

Description |

Shares |

Value ($) |

|||||||

|

Common Stocks - 43.1% (continued) |

|||||||||

|

Ireland - 3.1% (continued) |

|||||||||

|

Smurfit Kappa Group |

200,368 |

6,569,545 |

|||||||

|

48,061,178 |

|||||||||

|

Japan - .9% |

|||||||||

|

Suzuki Motor |

282,200 |

14,079,890 |

|||||||

|

Jersey - .0% |

|||||||||

|

Randgold Resources |

7,772 |

611,244 |

|||||||

|

Mexico - .4% |

|||||||||

|

Fresnillo |

99,012 |

1,073,519 |

|||||||

|

Wal-Mart de Mexico |

2,148,400 |

5,493,355 |

|||||||

|

6,566,874 |

|||||||||

|

Netherlands - 2.2% |

|||||||||

|

Royal Dutch Shell, Cl. B |

525,431 |

17,107,862 |

|||||||

|

Wolters Kluwer |

308,211 |

17,500,091 |

|||||||

|

34,607,953 |

|||||||||

|

South Africa - .0% |

|||||||||

|

Gold Fields |

201,714 |

532,493 |

|||||||

|

South Korea - 1.8% |

|||||||||

|

Macquarie Korea Infrastructure Fund |

1,467,077 |

11,667,050 |

|||||||

|

Samsung SDI |

77,894 |

16,027,671 |

|||||||

|

27,694,721 |

|||||||||

|

Switzerland - 4.9% |

|||||||||

|

ABB |

618,676 |

12,437,241 |

|||||||

|

Ferguson |

193,617 |

13,064,040 |

|||||||

|

Novartis |

349,369 |

30,509,064 |

|||||||

|

Roche Holding |

42,839 |

10,394,804 |

|||||||

|

Zurich Insurance Group |

30,425 |

e |

9,440,560 |

||||||

|

75,845,709 |

|||||||||

|

Taiwan - .9% |

|||||||||

|

Taiwan Semiconductor Manufacturing, ADR |

347,252 |

13,230,301 |

|||||||

|

United Kingdom - 5.7% |

|||||||||

|

Associated British Foods |

301,926 |

9,206,280 |

|||||||

|

BAE Systems |

1,995,922 |

13,407,249 |

|||||||

|

Cobham |

4,501,868 |

e |

6,191,994 |

||||||

|

Diageo |

334,491 |

11,569,093 |

|||||||

|

Informa |

1,211,285 |

11,038,781 |

|||||||

|

Prudential |

531,906 |

10,670,034 |

|||||||

|

RELX |

670,216 |

e |

13,261,829 |

||||||

|

Unilever |

248,916 |

13,401,077 |

|||||||

|

88,746,337 |

|||||||||

|

United States - 9.7% |

|||||||||

|

Abbott Laboratories |

118,638 |

8,178,904 |

|||||||

|

Alacer Gold |

831,193 |

e |

1,357,488 |

||||||

13

STATEMENT OF INVESTMENTS (continued)

|

Description |

Shares |

Value ($) |

|||||||

|

Common Stocks - 43.1% (continued) |

|||||||||

|

United States - 9.7% (continued) |

|||||||||

|

Albemarle |

114,130 |

11,323,979 |

|||||||

|

Applied Materials |

254,829 |

8,378,778 |

|||||||

|

Cisco Systems |

664,057 |

30,380,608 |

|||||||

|

Citigroup |

109,055 |

7,138,740 |

|||||||

|

CMS Energy |

271,738 |

13,456,466 |

|||||||

|

Ecolab |

51,769 |

7,928,422 |

|||||||

|

Eversource Energy |

264,729 |

16,746,757 |

|||||||

|

General Electric |

686,380 |

6,932,438 |

|||||||

|

Maxim Integrated Products |

108,446 |

5,424,469 |

|||||||

|

Microsoft |

125,528 |

13,407,646 |

|||||||

|

Newmont Mining |

16,261 |

502,790 |

|||||||

|

PepsiCo |

90,981 |

10,224,445 |

|||||||

|

Schlumberger |

167,774 |

8,608,484 |

|||||||

|

149,990,414 |

|||||||||

|

Total Common Stocks |

666,478,719 |

||||||||

|

Description /Number of Contracts |

Exercise |

Expiration Date |

Notional Amount ($) |

a |

|||||

|

Options Purchased - .0% |

|||||||||

|

Call Options - .0% |

|||||||||

|

Euro Stoxx 50 |

EUR |

3,400 |

11/16/2018 |

33,456,000 |

24,269 |

||||

|

S&P 500 Index |

3,000 |

1/18/2019 |

93,300,000 |

161,720 |

|||||

|

Total Options Purchased |

185,989 |

||||||||

|

Preferred Dividend |

Shares |

||||||||

|

Preferred Stocks - 1.2% |

|||||||||

|

Germany - .7% |

|||||||||

|

Volkswagen |

2.70 |

67,535 |

11,374,305 |

||||||

|

South Korea - .5% |

|||||||||

|

Samsung Electronics |

3.29 |

238,243 |

7,507,517 |

||||||

|

Total Preferred Stocks |

18,881,822 |

||||||||

|

Exchange-Traded Funds - 1.3% |

|||||||||

|

United States - 1.3% |

|||||||||

|

Invesco DB Gold Fund |

509,414 |

e,f |

19,464,709 |

||||||

14

|

Description |

Yield at |

Maturity Date |

Principal Amount ($) |

Value ($) |

|||||

|

Short-Term Investments - 9.3% |

|||||||||

|

U.S. Government Securities |

|||||||||

|

U.S. Treasury Bills |

2.43 |

4/4/2019 |

145,816,700 |

g |

144,332,124 |

||||

|

Description |

7-Day |

Shares |

|||||||

|

Investment Companies - 3.8% |

|||||||||

|

Registered Investment Companies - 3.8% |

|||||||||

|

Dreyfus Institutional Preferred Government Plus Money Market Fund |

2.21 |

59,322,564 |

h |

59,322,564 |

|||||

|

Total Investments (cost $1,464,184,359) |

98.5% |

1,523,190,445 |

|||||||

|

Cash and Receivables (Net) |

1.5% |

22,988,051 |

|||||||

|

Net Assets |

100.0% |

1,546,178,496 |

|||||||

ADR—American Depository Receipt

BR—Bearer Certificate

ETF—Exchange-Traded Fund

GDR—Global Depository Receipt

AUD—Australian Dollar

CAD—Canadian Dollar

CHF—Swiss Franc

EUR—Euro

GBP—British Pound

HKD—Hong Kong Dollar

IDR—Indonesian Rupiah

INR—Indian Rupee

JPY—Japanese Yen

KRW—South Korean Won

MXN—Mexican Peso

NZD—New Zealand Dollar

a Amount stated in U.S. Dollars unless otherwise noted above.

b Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2018, these securities were valued at $51,156,692 or 3.31% of net assets.

c Principal amount for accrual purposes is periodically adjusted based on changes in the Consumer Price Index.

d Investment in real estate investment trust.

e Non-income producing security.

f Investment in non-controlled affiliates (cost $21,569,887).

g Security is a discount security. Income is recognized through the accretion of discount.

h Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

15

STATEMENT OF INVESTMENTS (continued)

|

Portfolio Summary (Unaudited) † |

Value (%) |

|

U.S. Government Securities |

31.1 |

|

Foreign/Governmental |

12.7 |

|

Registered Investment Companies |

5.1 |

|

Health Care |

3.9 |

|

Real Estate |

3.9 |

|

Insurance |

3.9 |

|

Utilities |

3.2 |

|

Technology Hardware & Equipment |

3.1 |

|

Telecommunication Services |

3.0 |

|

Energy |

3.0 |

|

Media |

2.8 |

|

Semiconductors & Semiconductor Equipment |

2.3 |

|

Information Technology |

2.2 |

|

Aerospace & Defense |

1.8 |

|

Commercial & Professional Services |

1.7 |

|

Automobiles & Components |

1.6 |

|

Food Products |

1.4 |

|

Chemicals |

1.4 |

|

Beverage Products |

1.4 |

|

Industrials |

1.3 |

|

Consumer Staples |

1.1 |

|

Financials |

1.1 |

|

Metals & Mining |

1.0 |

|

Building Materials |

1.0 |

|

Consumer Discretionary |

1.0 |

|

Banks |

.7 |

|

Forest Products & Other |

.4 |

|

Agriculture |

.4 |

|

Retailing |

.4 |

|

Materials |

.3 |

|

Transportation |

.2 |

|

Internet Software & Services |

.1 |

|

Options Purchased |

.0 |

|

98.5 |

† Based on net assets.

See notes to financial statements.

16

STATEMENT OF INVESTMENTS IN AFFILIATED ISSUERS

|

Registered Investment Company |

Value |

Purchases($) |

Sales($) |

Value |

Net |

Dividends/ |

|

Dreyfus Institutional Preferred Government Plus Money Market Fund |

74,279,655 |

1,232,266,296 |

1,247,223,387 |

59,322,564 |

3.8 |

1,072,324 |

See notes to financial statements.

In addition, an affiliated company is a company in which the fund has ownership of at least 5% of the voting securities. Investments in affiliated companies during the period ended October 31, 2018 were as follows:

|

Affiliated |

Value |

Purchases($) |

Sales($) |

Net Realized |

|

Invesco DB |

20,585,420 |

- |

- |

- |

|

Affiliated |

Change in Net Unrealized Appreciation |

Value |

Net |

Dividends/ |

|

Invesco DB |

(1,120,711) |

19,464,709 |

1.3 |

- |

See notes to financial statements.

17

STATEMENT OF FUTURES

October 31, 2018

|

Description |

Number of |

Expiration |

Notional |

Value ($) |

Unrealized Appreciation ($) |

|

|

Futures Short |

||||||

|

DJ Euro Stoxx 50 |

284 |

12/18 |

10,719,097a |

10,274,223 |

444,874 |

|

|

E-mini Russell 2000 |

192 |

12/18 |

16,031,979 |

14,514,240 |

1,517,739 |

|

|

FTSE 100 |

257 |

12/18 |

23,831,702a |

23,359,450 |

472,252 |

|

|

Standard & Poor's 500 |

13 |

12/18 |

9,412,149 |

8,811,075 |

601,074 |

|

|

Standard & Poor's 500 E-mini |

361 |

12/18 |

50,807,458 |

48,935,355 |

1,872,103 |

|

|

Gross Unrealized Appreciation |

4,908,042 |

|||||

a Notional amounts in foreign currency have been converted to USD using relevant foreign exchange rates.

See notes to financial statements.

18

STATEMENT OF OPTIONS WRITTEN

October 31, 2018

|

Description/ Contracts |

Exercise Price |

Expiration Date |

Notional Amount |

Value ($) |

||

|

Call Options: |

||||||

|

S&P 500 Index |

3,150 |

1/18/19 |

97,965,000 |

(24,103) |

||

|

Total Options Written (premiums received $248,489) |

(24,103) |

|||||

See notes to financial statements.

19

STATEMENT OF FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS October 31, 2018

|

Counterparty/ Purchased |

Purchased Currency |

Currency |

Sold |

Settlement Date |

Unrealized Appreciation (Depreciation)($) |

|

CIBC World Markets Corp. |

|||||

|

Canadian Dollar |

229,082 |

United States Dollar |

175,316 |

11/14/18 |

(1,260) |

|

British Pound |

302,055 |

United States Dollar |

401,399 |

1/16/19 |

(13,695) |

|

Citigroup |

|||||

|

United States Dollar |

627,870 |

Canadian Dollar |

826,472 |

11/14/18 |

(82) |

|

United States Dollar |

1,227,376 |

British Pound |

945,204 |

1/16/19 |

14,157 |

|

Australian Dollar |

645,919 |

United States Dollar |

459,763 |

12/13/18 |

(2,140) |

|

United States Dollar |

5,516,000 |

Australian Dollar |

7,840,367 |

12/13/18 |

(38,781) |

|

United States Dollar |

41,931,546 |

Hong Kong Dollar |

328,758,000 |

11/14/18 |

(13,980) |

|

Canadian Dollar |

1,177,060 |

United States Dollar |

907,715 |

11/14/18 |

(13,387) |

|

United States Dollar |

117,008 |

Euro |

100,008 |

1/16/19 |

2,907 |

|

United States Dollar |

76,893,098 |

Canadian Dollar |

100,369,083 |

11/14/18 |

632,885 |

|

J.P. Morgan Securities |

|||||

|

Canadian Dollar |

816,773 |

United States Dollar |

627,443 |

11/14/18 |

(6,861) |

|

Euro |

107,444 |

United States Dollar |

122,970 |

1/16/19 |

(385) |

|

Australian Dollar |

977,451 |

United States Dollar |

697,851 |

12/13/18 |

(5,342) |

|

United States Dollar |

1,518,147 |

Canadian Dollar |

1,943,573 |

11/14/18 |

41,425 |

|

British Pound |

5,841,000 |

United States Dollar |

7,648,665 |

1/16/19 |

(151,434) |

|

British Pound |

39,835 |

United States Dollar |

50,812 |

11/1/18 |

107 |

|

Australian Dollar |

324,462 |

United States Dollar |

230,604 |

12/13/18 |

(728) |

|

United States Dollar |

10,847 |

Canadian Dollar |

14,247 |

11/1/18 |

25 |

|

United States Dollar |

135,883 |

Euro |

119,614 |

11/1/18 |

392 |

|

Swiss Franc |

1,546,624 |

United States Dollar |

1,565,809 |

11/14/18 |

(28,253) |

|

United States Dollar |

62,374,037 |

Swiss Franc |

61,579,143 |

11/14/18 |

1,155,948 |

|

RBS Securities |

|||||

|

Australian Dollar |

451,439 |

United States Dollar |

321,554 |

12/13/18 |

(1,716) |

20

|

Counterparty/ Purchased |

Purchased Currency |

Currency |

Sold |

Settlement Date |

Unrealized Appreciation (Depreciation)($) |

|

RBS Securities (continued) | |||||

|

United States Dollar |

30,448,449 |

New Zealand Dollar |

45,146,268 |

11/14/18 |

983,757 |

|

United States Dollar |

191,903,693 |

Euro |

165,788,892 |

1/16/19 |

2,751,837 |

|

State Street Bank and Trust Company |

|||||

|

Australian Dollar |

3,452,635 |

United States Dollar |

2,460,737 |

12/13/18 |

(14,598) |

|

United States Dollar |

132,843,858 |

Australian Dollar |

184,573,520 |

12/13/18 |

2,076,322 |

|

United States Dollar |

3,214,595 |

Canadian Dollar |

4,217,164 |

11/14/18 |

10,403 |

|

Mexican Peso |

121,126,000 |

United States Dollar |

6,062,392 |

11/5/18 |

(104,933) |

|

Canadian Dollar |

812,955 |

United States Dollar |

624,020 |

11/14/18 |

(6,338) |

|

United States Dollar |

1,993,179 |

Hong Kong Dollar |

15,605,710 |

11/14/18 |

2,080 |

|

Hong Kong Dollar |

951,394 |

United States Dollar |

121,630 |

11/14/18 |

(244) |

|

United States Dollar |

31,485,006 |

South Korean Won |

35,181,188,605 |

11/14/18 |

600,745 |

|

New Zealand Dollar |

734,394 |

United States Dollar |

480,174 |

11/14/18 |

(872) |

|

British Pound |

448,465 |

United States Dollar |

578,741 |

1/16/19 |

(3,113) |

|

United States Dollar |

147,160,355 |

British Pound |

112,134,033 |

1/16/19 |

3,230,413 |

|

Swiss Franc |

2,957,416 |

United States Dollar |

2,992,710 |

11/14/18 |

(52,634) |

|

Euro |

4,613,126 |

United States Dollar |

5,322,060 |

1/16/19 |

(58,852) |

|

United States Dollar |

20,183,444 |

Euro |

17,331,010 |

1/16/19 |

410,149 |

|

United States Dollar |

2,329,205 |

Swiss Franc |

2,260,429 |

11/14/18 |

82,029 |

|

UBS Securities |

|||||

|

Swiss Franc |

3,013,954 |

United States Dollar |

3,064,370 |

11/14/18 |

(68,087) |

|

British Pound |

1,372,091 |

United States Dollar |

1,808,042 |

1/16/19 |

(46,891) |

|

United States Dollar |

652,966 |

British Pound |

506,290 |

1/16/19 |

3,116 |

|

Euro |

1,074,576 |

United States Dollar |

1,243,611 |

1/16/19 |

(17,606) |

|

United States Dollar |

2,654,619 |

Euro |

2,305,421 |

1/16/19 |

24,318 |

|

Canadian Dollar |

204,738 |

United States Dollar |

155,845 |

11/14/18 |

(285) |

21

STATEMENT OF FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS (continued)

|

Counterparty/ Purchased |

Purchased Currency |

Currency |

Sold |

Settlement Date |

Unrealized Appreciation (Depreciation)($) |

|

UBS Securities (continued) | |||||

|

United States Dollar |

2,036,182 |

Canadian Dollar |

2,647,874 |

11/14/18 |

24,333 |

|

Australian Dollar |

2,073,003 |

United States Dollar |

1,480,503 |

12/13/18 |

(11,812) |

|

United States Dollar |

15,131 |

Euro |

13,364 |

11/1/18 |

(7) |

|

Gross Unrealized Appreciation |

12,047,348 | ||||

|

Gross Unrealized Depreciation |

(664,316) | ||||

See notes to financial statements.

22

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

Cost |

|

Value |

|

|

Assets ($): |

|

|

|

| ||

|

Investments in securities—See Statement of Investments: |

|

|

| |||

|

Unaffiliated issuers |

1,383,291,908 |

|

1,444,403,172 |

| ||

|

Affiliated issuers |

|

80,892,451 |

|

78,787,273 |

| |

|

Cash |

|

|

|

|

414,253 |

|

|

Cash denominated in foreign currency |

|

|

115,291 |

|

115,531 |

|

|

Unrealized appreciation on forward foreign |

|

12,047,348 |

| |||

|

Receivable for shares of Common Stock subscribed |

|

9,200,884 |

| |||

|

Dividends and interest receivable |

|

8,228,390 |

| |||

|

Receivable for investment securities sold |

|

7,094,458 |

| |||

|

Cash collateral held by broker—Note 4 |

|

4,313,281 |

| |||

|

Prepaid expenses |

|

|

|

|

37,779 |

|

|

|

|

|

|

|

1,564,642,369 |

|

|

Liabilities ($): |

|

|

|

| ||

|

Due to The Dreyfus Corporation and affiliates—Note 3(c) |

|

|

|

1,132,385 |

| |

|

Payable for investment securities purchased |

|

13,045,192 |

| |||

|

Payable for shares of Common Stock redeemed |

|

2,593,518 |

| |||

|

Payable for futures variation margin—Note 4 |

|

754,609 |

| |||

|

Unrealized depreciation on forward foreign |

|

664,316 |

| |||

|

Unrealized depreciation on foreign currency transactions |

|

39,902 |

| |||

|

Outstanding options written, at value |

|

24,103 |

| |||

|

Directors fees and expenses payable |

|

15,972 |

| |||

|

Accrued expenses |

|

|

|

|

193,876 |

|

|

|

|

|

|

|

18,463,873 |

|

|

Net Assets ($) |

|

|

1,546,178,496 |

| ||

|

Composition of Net Assets ($): |

|

|

|

| ||

|

Paid-in capital |

|

|

|

|

1,586,765,377 |

|

|

Total distributable earnings (loss) |

|

|

|

|

(40,586,881) |

|

|

Net Assets ($) |

|

|

1,546,178,496 |

| ||

|

Net Asset Value Per Share |

Class A |

Class C |

Class I |

Class Y |

|

|

Net Assets ($) |

26,380,156 |

27,738,981 |

688,369,194 |

803,690,165 |

|

|

Shares Outstanding |

1,842,642 |

2,000,036 |

47,920,551 |

55,861,840 |

|

|

Net Asset Value Per Share ($) |

14.32 |

13.87 |

14.36 |

14.39 |

|

|

See notes to financial statements. |

23

STATEMENT OF OPERATIONS

Year Ended October 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Income ($): |

|

|

|

| ||

|

Income: |

|

|

|

| ||

|

Dividends (net of $1,545,628 foreign taxes withheld at source): |

| |||||

|

Unaffiliated issuers |

|

|

21,883,416 |

| ||

|

Affiliated issuers |

|

|

1,072,324 |

| ||

|

Interest (net of $82,580 foreign taxes withheld at source) |

|

|

19,017,296 |

| ||

|

Total Income |

|

|

41,973,036 |

| ||

|

Expenses: |

|

|

|

| ||

|

Management fee—Note 3(a) |

|

|

11,598,223 |

| ||

|

Shareholder servicing costs—Note 3(c) |

|

|

924,210 |

| ||

|

Distribution fees—Note 3(b) |

|

|

227,648 |

| ||

|

Custodian fees—Note 3(c) |

|

|

197,328 |

| ||

|

Directors’ fees and expenses—Note 3(d) |

|

|

123,574 |

| ||

|

Professional fees |

|

|

122,376 |

| ||

|

Registration fees |

|

|

105,501 |

| ||

|

Prospectus and shareholders’ reports |

|

|

80,385 |

| ||

|

Loan commitment fees—Note 2 |

|

|

25,332 |

| ||

|

Miscellaneous |

|

|

82,015 |

| ||

|

Total Expenses |

|

|

13,486,592 |

| ||

|

Less—reduction in expenses due to undertaking—Note 3(a) |

|

|

(42,349) |

| ||

|

Less—reduction in fees due to earnings credits—Note 3(c) |

|

|

(10,822) |

| ||

|

Net Expenses |

|

|

13,433,421 |

| ||

|

Investment Income—Net |

|

|

28,539,615 |

| ||

|

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

|

| ||||

|

Net realized gain (loss) on investments and foreign currency transactions |

19,717,526 |

| ||||

|

Net realized gain (loss) on options transactions |

4,983,673 |

| ||||

|

Net realized gain (loss) on futures |

(30,468,374) |

| ||||

|

Net realized gain (loss) on forward foreign currency exchange contracts |

27,318,509 |

| ||||

|

Net Realized Gain (Loss) |

|

|

21,551,334 |

| ||

|

Net unrealized appreciation (depreciation) on investments |

|

|

(63,979,805) |

| ||

|

Net unrealized appreciation (depreciation) on options transactions |

(1,047,396) |

| ||||

|

Net unrealized appreciation (depreciation) on futures |

|

|

17,654,645 |

| ||

|

Net unrealized appreciation (depreciation) on |

|

|

(1,634,962) |

| ||

|

Net Unrealized Appreciation (Depreciation) |

|

|

(49,007,518) |

| ||

|

Net Realized and Unrealized Gain (Loss) on Investments |

|

|

(27,456,184) |

| ||

|

Net Increase in Net Assets Resulting from Operations |

|

1,083,431 |

| |||

|

See notes to financial statements. |

||||||

24

STATEMENT OF CHANGES IN NET ASSETS

|

|

|

|

|

Year Ended October 31, | |||||

|

|

|

|

|

2018 |

|

2017 |

a | ||

|

Operations ($): |

|

|

|

|

|

|

|

| |

|

Investment income—net |

|

|

28,539,615 |

|

|

|

22,698,537 |

| |

|

Net realized gain (loss) on investments |

|

21,551,334 |

|

|

|

(102,805,726) |

| ||

|

Net unrealized appreciation (depreciation) |

|

(49,007,518) |

|

|

|

91,835,518 |

| ||

|

Net Increase (Decrease) in Net Assets |

1,083,431 |

|

|

|

11,728,329 |

| |||

|

Distributions ($): |

| ||||||||

|

Distributions to shareholders: |

|

|

|

|

|

|

|

| |

|

Class A |

|

|

(160,339) |

|

|

|

(4,042,893) |

| |

|

Class C |

|

|

- |

|

|

|

(793,954) |

| |

|

Class I |

|

|

(6,085,615) |

|

|

|

(15,224,045) |

| |

|

Class Y |

|

|

(7,357,475) |

|

|

|

(21,341,116) |

| |

|

Total Distributions |

|

|

(13,603,429) |

|

|

|

(41,402,008) |

| |

|

Capital Stock Transactions ($): |

| ||||||||

|

Net proceeds from shares sold: |

|

|

|

|

|

|

|

| |

|

Class A |

|

|

9,949,354 |

|

|

|

46,710,000 |

| |

|

Class C |

|

|

5,779,933 |

|

|

|

10,975,522 |

| |

|

Class I |

|

|

294,435,285 |

|

|

|

627,749,307 |

| |

|

Class Y |

|

|

163,135,257 |

|

|

|

258,887,594 |

| |

|

Distributions reinvested: |

|

|

|

|

|

|

|

| |

|

Class A |

|

|

156,257 |

|

|

|

3,988,624 |

| |

|

Class C |

|

|

- |

|

|

|

792,979 |

| |

|

Class I |

|

|

5,903,112 |

|

|

|

14,782,332 |

| |

|

Class Y |

|

|

3,854,558 |

|

|

|

10,697,251 |

| |

|

Cost of shares redeemed: |

|

|

|

|

|

|

|

| |

|

Class A |

|

|

(24,352,906) |

|

|

|

(160,619,601) |

| |

|

Class C |

|

|

(12,015,519) |

|

|

|

(12,483,540) |

| |

|

Class I |

|

|

(307,725,100) |

|

|

|

(441,168,901) |

| |

|

Class Y |

|

|

(147,251,356) |

|

|

|

(174,731,954) |

| |

|

Increase (Decrease) in Net Assets |

(8,131,125) |

|

|

|

185,579,613 |

| |||

|

Total Increase (Decrease) in Net Assets |

(20,651,123) |

|

|

|

155,905,934 |

| |||

|

Net Assets ($): |

| ||||||||

|

Beginning of Period |

|

|

1,566,829,619 |

|

|

|

1,410,923,685 |

| |

|

End of Period |

|

|

1,546,178,496 |

|

|

|

1,566,829,619 |

| |

25

STATEMENT OF CHANGES IN NET ASSETS (continued)

|

|

|

|

|

Year Ended October 31, | |||||

|

|

|

|

|

2018 |

|

2017 |

a | ||

|

Capital Share Transactions (Shares): |

| ||||||||

|

Class Ab,c |

|

|

|

|

|

|

|

| |

|

Shares sold |

|

|

691,964 |

|

|

|

3,299,172 |

| |

|

Shares issued for distributions reinvested |

|

|

10,889 |

|

|

|

287,158 |

| |

|

Shares redeemed |

|

|

(1,709,260) |

|

|

|

(11,443,331) |

| |

|

Net Increase (Decrease) in Shares Outstanding |

(1,006,407) |

|

|

|

(7,857,001) |

| |||

|

Class Cb,c |

|

|

|

|

|

|

|

| |

|

Shares sold |

|

|

415,213 |

|

|

|

789,435 |

| |

|

Shares issued for distributions reinvested |

|

|

- |

|

|

|

58,393 |

| |

|

Shares redeemed |

|

|

(862,746) |

|

|

|

(901,640) |

| |

|

Net Increase (Decrease) in Shares Outstanding |

(447,533) |

|

|

|

(53,812) |

| |||

|

Class Ic |

|

|

|

|

|

|

|

| |

|

Shares sold |

|

|

20,426,413 |

|

|

|

43,906,268 |

| |

|

Shares issued for distributions reinvested |

|

|

410,794 |

|

|

|

1,061,187 |

| |

|

Shares redeemed |

|

|

(21,397,769) |

|

|

|

(30,962,659) |

| |

|

Net Increase (Decrease) in Shares Outstanding |

(560,562) |

|

|

|

14,004,796 |

| |||

|

Class Yc |

|

|

|

|

|

|

|

| |

|

Shares sold |

|

|

11,301,935 |

|

|

|

18,211,714 |

| |

|

Shares issued for distributions reinvested |

|

|

268,050 |

|

|

|

767,929 |

| |

|

Shares redeemed |

|

|

(10,234,190) |

|

|

|

(12,290,862) |

| |

|

Net Increase (Decrease) in Shares Outstanding |

1,335,795 |

|

|

|

6,688,781 |

| |||

|

a Distributions to shareholders include only distributions from net investment income. Distributions in excess of investment income—net was $17,991,058 in 2017 and is no longer presented as a result of the adoption of SEC’s Disclosure Update and Simplification Rule. |

|||||||||

|

b During the period ended October 31, 2018, 307 Class C shares representing $4,204 were automatically converted to 298 Class A shares. |

|||||||||

|

c During the period ended October 31, 2018, 21,357 Class A shares representing $306,692 were exchanged for 21,283 Class Y shares, 381,014 Class Y shares representing $5,512,575 were exchanged for 381,466 Class I shares and during the period ended October 31, 2017, 79,620 Class A shares representing $1,101,947 were exchanged for 79,391 Class I shares, 355 Class C shares representing $4,844 were exchanged for 346 Class I shares and 479,116 Class Y shares representing $6,867,173 were exchanged for 479,484 Class I shares. |

|||||||||

|

|

|||||||||

26

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

|

Year Ended October 31, | ||||||

|

Class A Shares |

2018 |

2017 |

2016 |

2015 |

2014 | |

|

Per Share Data ($): |

||||||

|

Net asset value, beginning of period |

14.39 |

14.72 |

14.61 |

15.11 |

14.75 | |

|

Investment Operations: |

||||||

|

Investment income—neta |

.22 |

.15 |

.17 |

.17 |

.36 | |

|

Net realized and unrealized |

(.23) |

(.09) |

.51 |

.01b |

.17 | |

|

Total from Investment Operations |

(.01) |

.06 |

.68 |

.18 |

.53 | |

|

Distributions: |

||||||

|

Dividends from |

(.06) |

(.39) |

(.57) |

(.68) |

(.04) | |

|

Dividends from net realized |

- |

- |

- |

- |

(.13) | |

|

Total Distributions |

(.06) |

(.39) |

(.57) |

(.68) |

(.17) | |

|

Net asset value, end of period |

14.32 |

14.39 |

14.72 |

14.61 |

15.11 | |

|

Total Return (%)c |

(.05) |

.47 |

4.87 |

1.22 |

3.63 | |

|

Ratios/Supplemental Data (%): |

||||||

|

Ratio of total expenses |

1.13 |

1.17 |

1.16 |

1.15 |

1.20 | |

|

Ratio of net expenses to |

1.13 |

1.15 |

1.15 |

1.15 |

1.15 | |

|

Ratio of net investment income |

1.55 |

1.09 |

1.15 |

1.16 |

2.38 | |

|

Portfolio Turnover Rate |

85.64 |

79.00 |

57.17 |

68.92 |

47.01 | |

|

Net Assets, end of period ($ x 1,000) |

26,380 |

41,008 |

157,624 |

49,672 |

56,501 | |

a Based on average shares outstanding.

b In addition to net realized and unrealized losses on investments, this amount includes an increase in net asset value per share resulting from the timing of issuances and redemptions of shares in relation to fluctuating market values for the portfolio investments.

c Exclusive of sales charge.

See notes to financial statements.

27

FINANCIAL HIGHLIGHTS (continued)

|

Year Ended October 31, | ||||||

|

Class C Shares |

2018 |

2017 |

2016 |

2015 |

2014 | |

|

Per Share Data ($): |

||||||

|

Net asset value, beginning of period |

13.99 |

14.34 |

14.26 |

14.79 |

14.51 | |

|

Investment Operations: |

||||||

|

Investment income—neta |

.11 |

.08 |

.06 |

.06 |

.21 | |

|

Net realized and unrealized |

(.23) |

(.12) |

.50 |

.02b |

.20 | |

|

Total from Investment Operations |

(.12) |

(.04) |

.56 |

.08 |

.41 | |

|

Distributions: |

||||||

|

Dividends from |

- |

(.31) |

(.48) |

(.61) |

- | |

|

Dividends from net realized |

- |

- |

- |

- |

(.13) | |

|

Total Distributions |

- |

(.31) |

(.48) |

(.61) |

(.13) | |

|

Net asset value, end of period |

13.87 |

13.99 |

14.34 |

14.26 |

14.79 | |

|

Total Return (%)c |

(.86) |

(.23) |

4.12 |

.49 |

2.87 | |

|

Ratios/Supplemental Data (%): |

||||||

|

Ratio of total expenses |

1.90 |

1.92 |

1.90 |

1.91 |

1.96 | |

|

Ratio of net expenses |

1.89 |

1.90 |

1.90 |

1.90 |

1.90 | |

|

Ratio of net investment income |

.82 |

.58 |

.44 |

.39 |

1.41 | |

|

Portfolio Turnover Rate |

85.64 |

79.00 |

57.17 |

68.92 |

47.01 | |

|

Net Assets, end of period ($ x 1,000) |

27,739 |

34,240 |

35,861 |

16,470 |

11,969 | |

a Based on average shares outstanding.

b In addition to net realized and unrealized losses on investments, this amount includes an increase in net asset value per share resulting from the timing of issuances and redemptions of shares in relation to fluctuating market values for the portfolio investments.

c Exclusive of sales charge.

See notes to financial statements.

28

|

Year Ended October 31, | ||||||

|

Class I Shares |

2018 |

2017 |

2016 |

2015 |

2014 | |

|

Per Share Data ($): |

||||||

|

Net asset value, beginning of period |

14.47 |

14.78 |

14.68 |

15.18 |

14.81 | |

|

Investment Operations: |

||||||

|

Investment income—neta |

.26 |

.23 |

.20 |

.21 |

.38 | |

|

Net realized and unrealized |

(.24) |

(.13) |

.52 |

.01b |

.19 | |

|

Total from Investment Operations |

.02 |

.10 |

.72 |

.22 |

.57 | |

|

Distributions: |

||||||

|

Dividends from |

(.13) |

(.41) |

(.62) |

(.72) |

(.07) | |

|

Dividends from net realized |

- |

- |

- |

- |

(.13) | |

|

Total Distributions |

(.13) |

(.41) |

(.62) |

(.72) |

(.20) | |

|

Net asset value, end of period |

14.36 |

14.47 |

14.78 |

14.68 |

15.18 | |

|

Total Return (%) |

.11 |

.82 |

5.16 |

1.49 |

3.89 | |

|

Ratios/Supplemental Data (%): |

||||||

|

Ratio of total expenses |

.90 |

.90 |

.88 |

.86 |

.90 | |

|

Ratio of net expenses |

.90 |

.90 |

.88 |

.86 |

.90 | |

|

Ratio of net investment income |

1.81 |

1.61 |

1.36 |

1.40 |

2.51 | |

|

Portfolio Turnover Rate |

85.64 |

79.00 |

57.17 |

68.92 |

47.01 | |

|

Net Assets, end of period ($ x 1,000) |

688,369 |

701,598 |

509,712 |

104,057 |

74,438 | |

a Based on average shares outstanding.

b In addition to net realized and unrealized losses on investments, this amount includes an increase in net asset value per share resulting from the timing of issuances and redemptions of shares in relation to fluctuating market values for the portfolio investments.

See notes to financial statements.

29

FINANCIAL HIGHLIGHTS (continued)

|

Year Ended October 31, | ||||||

|

Class Y Shares |

2018 |