Class A Shares - EABSX Class C Shares - ECBSX Class I Shares - EIBSX

Class A Shares - EITAX Class C Shares - EITCX Class I Shares - ETIIX

Prospectus Dated

June 1, 2022

as revised July 1, 2022

The Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Prospectus contains important information about the Funds and the

services available to shareholders. Please save it for reference.

Table of Contents

Fund Summaries | 3 |

TABS Short-Term Municipal Bond Fund | 3 |

TABS Intermediate-Term Municipal Bond Fund | 8 |

Important Information Regarding Fund Shares | 13 |

Investment Objectives & Principal Policies and Risks | 14 |

Management and Organization | 20 |

Valuing Shares | 21 |

Purchasing Shares | 22 |

Sales Charges | 26 |

Redeeming Shares | 28 |

Shareholder Account Features | 29 |

Potential Conflicts of Interest | 31 |

Additional Tax Information | 33 |

Financial Highlights | 35 |

TABS Short-Term Municipal Bond Fund | 35 |

TABS Intermediate-Term Municipal Bond Fund | 37 |

Appendix A – Financial Intermediary Sales Charge Variations | 39 |

Parametric TABS Municipal Bond Funds2Prospectus dated June 1, 2022 as revised July 1, 2022

Fund Summaries

Parametric TABS Short-Term Municipal Bond Fund

The Fund's investment objective is to seek after-tax total return.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. Investors may also pay commissions or other fees to their financial intermediary, which are not reflected below.

| Class A | Class C | Class I |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | |||

Maximum Deferred Sales Charge (Load) (as a percentage of the lower of net asset value at purchase or redemption) |

| Class A | Class C | Class I |

Management Fees(1) | |||

Distribution and Service (12b-1) Fees | |||

Other Expenses | |||

Total Annual Fund Operating Expenses |

(1)

| Expenses with Redemption | Expenses without Redemption | ||||||

1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |

Class A shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class C shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class I shares | $ | $ | $ | $ | $ | $ | $ | $ |

Parametric TABS Municipal Bond Funds3Prospectus dated June 1, 2022 as revised July 1, 2022

With respect to its investment in municipal obligations, the Fund invests primarily in general obligation or revenue bonds. The Fund currently targets an average portfolio duration of approximately 2 - 4.5 years and an average weighted portfolio maturity of approximately 3 - 6 years, but may invest in securities of any maturity or duration, and may in the future alter its maturity or duration target range. The Fund may use various techniques to shorten or lengthen its dollar-weighted average portfolio duration, including the acquisition of municipal obligations at a premium or discount. The portfolio managers generally will seek to enhance after-tax total return by actively engaging in relative value trading within the portfolio to take advantage of price opportunities in the markets for municipal obligations and use relative value analysis to assist them in making decisions to purchase or sell investments. With respect to 20% of its net assets, the Fund may invest in municipal obligations that are not exempt from regular federal income tax, direct obligations of the U.S. Treasury and/or obligations of U.S. Government agencies, instrumentalities and government-sponsored enterprises. The Fund may hold cash and may invest in cash equivalents and money market instruments.

The sub-adviser’s process for selecting municipal obligations for purchase and sale generally includes consideration of the creditworthiness of the issuer or person obligated to repay the obligation. In evaluating creditworthiness, the sub-adviser considers ratings assigned by rating agencies and generally performs additional credit and investment analysis. The portfolio managers may also trade securities to minimize taxable capital gains to shareholders. The portfolio managers may sell a security when its credit quality declines, when the remaining maturity of a fixed-income security reaches a certain point or to pursue more attractive investment options. The portfolio managers may also consider financially material environmental, social and governance (“ESG”) factors in evaluating an issuer. These considerations may be taken into account alongside other factors in the investment selection process.

Market Risk. The value of investments held by the Fund may increase or decrease in response to social, economic, political, financial, public health crises or other disruptive events (whether real, expected or perceived) in the U.S. and global markets and include such events as war, natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest. These events may negatively impact broad segments of businesses and populations and may exacerbate pre-existing risks to the Fund. The frequency and magnitude of resulting changes in the value of the Fund’s investments cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Monetary and/or fiscal actions taken by U.S. or foreign governments to stimulate or stabilize the global economy may not be effective and could lead to high market volatility. No active trading market may exist for certain investments held by the Fund, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets.

Municipal Obligations Risk. The amount of public information available about municipal obligations is generally less than for corporate equities or bonds, meaning that the investment performance of municipal obligations may be more dependent on the analytical abilities of the investment adviser and sub-adviser than stock or corporate bond investments. The secondary market for municipal obligations also tends to be less well-developed and less liquid than many other securities markets, which may limit the Fund’s ability to sell its municipal obligations at attractive prices. The differences between the price at which an obligation can be purchased and the price at which it can be sold may widen during periods of market distress. Less liquid obligations can become more difficult to value and be subject to erratic price movements. The increased presence of non-traditional participants (such as proprietary trading desks of investment banks and hedge funds) or the absence of traditional participants (such as individuals, insurance companies, banks and life insurance

Parametric TABS Municipal Bond Funds4Prospectus dated June 1, 2022 as revised July 1, 2022

companies) in the municipal markets may lead to greater volatility in the markets because non-traditional participants may trade more frequently or in greater volume.

Interest Rate Risk. In general, the value of income securities will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income security matures. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. The Fund may own individual investments that have longer durations than the Fund's target average portfolio duration. In a rising interest rate environment, the duration of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. Certain instruments held by the Fund pay an interest rate based on the London Interbank Offered Rate (“LIBOR”), which is the average offered rate for various maturities of short-term loans between certain major international banks. LIBOR is used throughout global banking and financial industries to determine interest rates for a variety of financial instruments (such as debt instruments and derivatives) and borrowing arrangements. The ICE Benchmark Administration Limited, the administrator of LIBOR, ceased publishing certain LIBOR settings on December 31, 2021, and is expected to cease publishing the remaining LIBOR settings on June 30, 2023. Although the transition process away from LIBOR has become increasingly well defined, the impact on certain debt securities, derivatives and other financial instruments that utilize LIBOR remains uncertain. The phase-out of LIBOR may result in, among other things, increased volatility or illiquidity in markets for instruments based on LIBOR and changes in the value of such instruments.

Credit Risk. Investments in municipal obligations and other debt obligations (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect net asset value. Municipal obligations may be insured as to principal and interest payments. If the claims-paying ability or other rating of the insurer is downgraded by a rating agency, the value of such obligations may be negatively affected.

Risks of Principal Only Investments. Principal only investments entitle the Fund to receive the stated value of such investment when held to maturity. The values of principal only investments are subject to greater fluctuation in response to changes in market interest rates than obligations that pay interest currently. The Fund will accrue income on these investments and distribute that income each year. The Fund may be required to sell other investments to obtain cash needed for such income distributions.

U.S. Government Securities Risk. Although certain U.S. Government-sponsored agencies (such as the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association) may be chartered or sponsored by acts of Congress, their securities are neither issued nor guaranteed by the U.S. Treasury. U.S. Treasury securities generally have a lower return than other obligations because of their higher credit quality and market liquidity.

Tax Risk. Income from tax-exempt municipal obligations could be declared taxable because of changes in tax laws, adverse interpretations by the relevant taxing authority or the non-compliant conduct of the issuer of an obligation.

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of which could have a negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

Money Market Instrument Risk. Money market instruments may be adversely affected by market and economic events, such as a sharp rise in prevailing short-term interest rates; adverse developments in the banking industry, which issues or guarantees many money market instruments; adverse economic, political or other developments affecting issuers of money market instruments; changes in the credit quality of issuers; and default by a counterparty.

Parametric TABS Municipal Bond Funds5Prospectus dated June 1, 2022 as revised July 1, 2022

Tax-Sensitive Investing Risk. The Fund may hold a security in order to achieve more favorable tax-treatment or sell a security in order to create tax losses. The Fund’s utilization of various tax-management techniques may be curtailed or eliminated by tax legislation, regulation or interpretations. The Fund may not be able to minimize taxable distributions to shareholders and a portion of the Fund’s distributions may be taxable.

Lower Rated Investments Risk. Investments rated below investment grade and comparable unrated investments (sometimes referred to as “junk”) have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments typically are subject to greater price volatility and illiquidity than higher rated investments.

Portfolio Turnover Risk. The annual portfolio turnover rate of the Fund may exceed 100%. A mutual fund with a high turnover rate (100% or more) may generate more capital gains and may involve greater expenses (which may reduce return) than a fund with a lower rate. Capital gains distributions will be made to shareholders if offsetting capital loss carry forwards do not exist.

Risks Associated with Active Management. The success of the Fund’s investment strategy depends on portfolio management’s successful application of analytical skills and investment judgment. Active management involves subjective decisions.

General Fund Investing Risks.

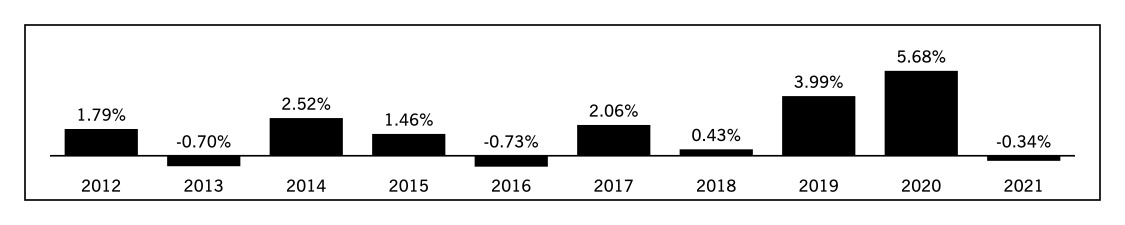

The returns in the bar chart reflect the effects of expense reductions. Absent these reductions, performance for certain periods would have been lower. Effective February 17, 2015, the Fund changed its name, objective and 80% Policy and may not have achieved the performance results shown for the period prior to February 17, 2015 under its current investment objective and strategy.

Parametric TABS Municipal Bond Funds6Prospectus dated June 1, 2022 as revised July 1, 2022

Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

Year Total Return | - | - | - |

For the ten years ended December 31, 2021, the

| One Year | Five Years | Ten Years |

Class A Return Before Taxes | - | ||

Class A Return After Taxes on Distributions | - | ||

Class A Return After Taxes on Distributions and Sale of Class A Shares | - | ||

Class C Return Before Taxes | - | ||

Class I Return Before Taxes | - | ||

Bloomberg Municipal Managed Money 1-7 Year Bond Index | - | ||

Bloomberg 5 Year Municipal Bond Index |

Management

Investment Adviser. Eaton Vance Management (“Eaton Vance”).

Investment Sub-Adviser. Parametric Portfolio Associates LLC (“Parametric”).

Portfolio Managers

The portfolio managers of the Fund are part of Parametric’s Tax-Advantaged Bond Strategies (“TABS”) division.

Brian C. Barney, Managing Director, Institutional Portfolio Management of Parametric, has managed the Fund since June 2010.

Devin J. Cooch, Director, Portfolio Management of Parametric, has managed the Fund since July 2013.

Alison Wagner, Portfolio Management of Parametric, has managed the Fund since June 1, 2022.

For important information about purchase and sale of shares, taxes and financial intermediary compensation, please turn to “Important Information Regarding Fund Shares” on page 13 of this Prospectus.

Parametric TABS Municipal Bond Funds7Prospectus dated June 1, 2022 as revised July 1, 2022

Parametric TABS Intermediate-Term Municipal Bond Fund

The Fund's investment objective is to seek after-tax total return.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. Investors may also pay commissions or other fees to their financial intermediary, which are not reflected below.

| Class A | Class C | Class I |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | |||

Maximum Deferred Sales Charge (Load) (as a percentage of the lower of net asset value at purchase or redemption) |

| Class A | Class C | Class I |

Management Fees(1) | |||

Distribution and Service (12b-1) Fees | |||

Other Expenses | |||

Total Annual Fund Operating Expenses | |||

Expense Reimbursement (2) | ( | ( | ( |

Total Annual Fund Operating Expenses After Expense Reimbursement |

(1)

(2)

| Expenses with Redemption | Expenses without Redemption | ||||||

1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |

Class A shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class C shares | $ | $ | $ | $ | $ | $ | $ | $ |

Class I shares | $ | $ | $ | $ | $ | $ | $ | $ |

Parametric TABS Municipal Bond Funds8Prospectus dated June 1, 2022 as revised July 1, 2022

With respect to its investment in municipal obligations, the Fund invests primarily in general obligation or revenue bonds. The Fund currently targets an average portfolio duration of approximately 5 - 7 years and an average weighted portfolio maturity of approximately 5 - 13 years, but may invest in securities of any maturity or duration, and may in the future alter its maturity or duration target range. The Fund may use various techniques to shorten or lengthen its dollar weighted average portfolio duration, including the acquisition of municipal obligations at a premium or discount. The portfolio managers generally will seek to enhance after-tax total return by actively engaging in relative value trading within the portfolio to take advantage of price opportunities in the markets for municipal obligations and use relative value analysis to assist them in making decisions to purchase or sell investments. With respect to 20% of its net assets, the Fund may invest in municipal obligations that are not exempt from regular federal income tax, direct obligations of the U.S. Treasury and/or obligations of U.S. Government agencies, instrumentalities and government-sponsored enterprises. The Fund may hold cash and may invest in cash equivalents and money market instruments.

The sub-adviser’s process for selecting municipal obligations for purchase and sale generally includes consideration of the creditworthiness of the issuer or person obligated to repay the obligation. In evaluating creditworthiness, the sub-adviser considers ratings assigned by rating agencies and generally performs additional credit and investment analysis. The portfolio managers may also trade securities to minimize taxable capital gains to shareholders. The portfolio managers may sell a security when its credit quality declines, when the remaining maturity of a fixed-income security reaches a certain point or to pursue more attractive investment options. The portfolio managers may also consider financially material environmental, social and governance (“ESG”) factors in evaluating an issuer. These considerations may be taken into account alongside other factors in the investment selection process.

Market Risk. The value of investments held by the Fund may increase or decrease in response to social, economic, political, financial, public health crises or other disruptive events (whether real, expected or perceived) in the U.S. and global markets and include such events as war, natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest. These events may negatively impact broad segments of businesses and populations and may exacerbate pre-existing risks to the Fund. The frequency and magnitude of resulting changes in the value of the Fund’s investments cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Monetary and/or fiscal actions taken by U.S. or foreign governments to stimulate or stabilize the global economy may not be effective and could lead to high market volatility. No active trading market may exist for certain investments held by the Fund, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets.

Parametric TABS Municipal Bond Funds9Prospectus dated June 1, 2022 as revised July 1, 2022

Municipal Obligations Risk. The amount of public information available about municipal obligations is generally less than for corporate equities or bonds, meaning that the investment performance of municipal obligations may be more dependent on the analytical abilities of the investment adviser and sub-adviser than stock or corporate bond investments. The secondary market for municipal obligations also tends to be less well-developed and less liquid than many other securities markets, which may limit the Fund’s ability to sell its municipal obligations at attractive prices. The differences between the price at which an obligation can be purchased and the price at which it can be sold may widen during periods of market distress. Less liquid obligations can become more difficult to value and be subject to erratic price movements. The increased presence of non-traditional participants (such as proprietary trading desks of investment banks and hedge funds) or the absence of traditional participants (such as individuals, insurance companies, banks and life insurance companies) in the municipal markets may lead to greater volatility in the markets because non-traditional participants may trade more frequently or in greater volume.

Interest Rate Risk. In general, the value of income securities will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income security matures. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. The Fund may own individual investments that have longer durations than the Fund's target average portfolio duration. In a rising interest rate environment, the duration of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. Certain instruments held by the Fund pay an interest rate based on the London Interbank Offered Rate (“LIBOR”), which is the average offered rate for various maturities of short-term loans between certain major international banks. LIBOR is used throughout global banking and financial industries to determine interest rates for a variety of financial instruments (such as debt instruments and derivatives) and borrowing arrangements. The ICE Benchmark Administration Limited, the administrator of LIBOR, ceased publishing certain LIBOR settings on December 31, 2021, and is expected to cease publishing the remaining LIBOR settings on June 30, 2023. Although the transition process away from LIBOR has become increasingly well defined, the impact on certain debt securities, derivatives and other financial instruments that utilize LIBOR remains uncertain. The phase-out of LIBOR may result in, among other things, increased volatility or illiquidity in markets for instruments based on LIBOR and changes in the value of such instruments.

Credit Risk. Investments in municipal obligations and other debt obligations (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect net asset value. Municipal obligations may be insured as to principal and interest payments. If the claims-paying ability or other rating of the insurer is downgraded by a rating agency, the value of such obligations may be negatively affected.

Risks of Principal Only Investments. Principal only investments entitle the Fund to receive the stated value of such investment when held to maturity. The values of principal only investments are subject to greater fluctuation in response to changes in market interest rates than obligations that pay interest currently. The Fund will accrue income on these investments and distribute that income each year. The Fund may be required to sell other investments to obtain cash needed for such income distributions.

U.S. Government Securities Risk. Although certain U.S. Government-sponsored agencies (such as the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association) may be chartered or sponsored by acts of Congress, their securities are neither issued nor guaranteed by the U.S. Treasury. U.S. Treasury securities generally have a lower return than other obligations because of their higher credit quality and market liquidity.

Tax Risk. Income from tax-exempt municipal obligations could be declared taxable because of changes in tax laws, adverse interpretations by the relevant taxing authority or the non-compliant conduct of the issuer of an obligation.

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of

Parametric TABS Municipal Bond Funds10Prospectus dated June 1, 2022 as revised July 1, 2022

which could have a negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

Money Market Instrument Risk. Money market instruments may be adversely affected by market and economic events, such as a sharp rise in prevailing short-term interest rates; adverse developments in the banking industry, which issues or guarantees many money market instruments; adverse economic, political or other developments affecting issuers of money market instruments; changes in the credit quality of issuers; and default by a counterparty.

Tax-Sensitive Investing Risk. The Fund may hold a security in order to achieve more favorable tax-treatment or sell a security in order to create tax losses. The Fund’s utilization of various tax-management techniques may be curtailed or eliminated by tax legislation, regulation or interpretations. The Fund may not be able to minimize taxable distributions to shareholders and a portion of the Fund’s distributions may be taxable.

Lower Rated Investments Risk. Investments rated below investment grade and comparable unrated investments (sometimes referred to as “junk”) have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments typically are subject to greater price volatility and illiquidity than higher rated investments.

Portfolio Turnover Risk. The annual portfolio turnover rate of the Fund may exceed 100%. A mutual fund with a high turnover rate (100% or more) may generate more capital gains and may involve greater expenses (which may reduce return) than a fund with a lower rate. Capital gains distributions will be made to shareholders if offsetting capital loss carry forwards do not exist.

Risks Associated with Active Management. The success of the Fund’s investment strategy depends on portfolio management’s successful application of analytical skills and investment judgment. Active management involves subjective decisions.

General Fund Investing Risks.

Parametric TABS Municipal Bond Funds11Prospectus dated June 1, 2022 as revised July 1, 2022

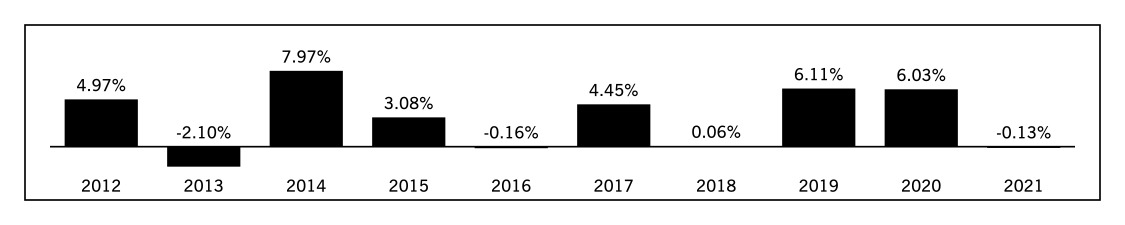

Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

Year Total Return | - | - | - |

For the ten years ended December 31, 2021, the

| One Year | Five Years | Ten Years |

Class A Return Before Taxes | - | ||

Class A Return After Taxes on Distributions | - | ||

Class A Return After Taxes on Distributions and Sale of Class A Shares | - | ||

Class C Return Before Taxes | - | ||

Class I Return Before Taxes | |||

Bloomberg Municipal Managed Money Intermediate (1-17 Year) Bond Index | |||

Bloomberg 7 Year Municipal Bond Index |

Management

Investment Adviser. Eaton Vance Management (“Eaton Vance”).

Investment Sub-Adviser. Parametric Portfolio Associates LLC (“Parametric”).

Portfolio Managers

The portfolio managers of the Fund are part of Parametric’s Tax-Advantaged Bond Strategies (“TABS”) division.

Brian C. Barney, Managing Director, Institutional Portfolio Management of Parametric, has managed the Fund since June 2010.

Devin J. Cooch, Director, Portfolio Management of Parametric, has managed the Fund since November 2021.

Alison Wagner, Portfolio Management of Parametric, has managed the Fund since June 1, 2022.

For important information about purchase and sale of shares, taxes and financial intermediary compensation, please turn to “Important Information Regarding Fund Shares” on page 13 of this Prospectus.

Parametric TABS Municipal Bond Funds12Prospectus dated June 1, 2022 as revised July 1, 2022

Important Information Regarding Fund Shares

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange Fund shares on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange Fund shares either through your financial intermediary or (except for purchases of Class C shares by accounts with no specified financial intermediary) directly from a Fund either by writing to the Fund, P.O. Box 9653, Providence, RI 02940-9653, or by calling 1-800-260-0761. The minimum initial purchase or exchange into a Fund is $1,000 for each Class (with the exception of Class I) and $1,000,000 for Class I (waived in certain circumstances). There is no minimum for subsequent investments.

Tax Information

Each Fund’s distributions are expected to primarily be exempt from regular federal income tax. However, the Fund may also distribute taxable income to the extent that it invests in taxable municipal obligations or other obligations which generate taxable income. Distributions of any net realized gains are expected to be taxable.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase a Fund’s shares through a broker-dealer or other financial intermediary (such as a bank) (collectively, “financial intermediaries”), the Fund, its principal underwriter and its affiliates may pay the financial intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend a Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

Parametric TABS Municipal Bond Funds13Prospectus dated June 1, 2022 as revised July 1, 2022

Investment Objectives & Principal Policies and Risks

The investment objective and principal investment policies and risks of each Fund are described in its Fund Summary. Set forth below is additional information about such policies and risks, as well as information about other types of investments and practices in which each Fund may engage from time to time, unless otherwise noted. References to the Fund below are to each Fund. See also “Strategies and Risks” in the Statement of Additional Information (“SAI”).

Definitions. As used herein, the following terms have the indicated meaning: “1940 Act” means the Investment Company Act of 1940, as amended; “1933 Act” means the Securities Act of 1933, as amended; “Code” means the Internal Revenue Code of 1986, as amended; “ERISA” means the Employee Retirement Income Security Act of 1974, as amended; and “investment adviser” means the Fund’s investment adviser but if the Fund is sub-advised, it refers to the sub-adviser(s) providing day-to-day management with respect to the investments or strategies discussed.

Municipal Obligations. Municipal obligations include bonds, notes, floating-rate notes and commercial paper issued by a municipality, a group of municipalities or participants in qualified issues of municipal debt for a wide variety of both public and private purposes. Revenue bonds are payable only from the revenues derived from a particular facility or class of facilities or, in some cases, from the proceeds of a special excise tax or other specific revenue source such as payments from the user of the facility being financed. Municipal obligations also include municipal lease obligations and certificates of participations in municipal leases. A municipal lease obligation is a bond that is secured by lease payments made by the party, typically a state or municipality, leasing the facilities (e.g., schools or office buildings) that were financed by the bond. Such lease payments may be subject to annual appropriation or may be made only from revenues associated with the facility financed. In other cases, the leasing state or municipality is obligated to appropriate funds from its general tax revenues to make lease payments as long as it utilizes the leased property. A certificate of participation (also referred to as a “participation”) in a municipal lease is an instrument evidencing a pro rata share in a specific pledged revenue stream, usually lease payments by the issuer that are typically subject to annual appropriation. The certificate generally entitles the holder to receive a share, or participation, in the payments from a particular project.

Certain municipal obligations may be purchased on a “when-issued” basis, which means that payment and delivery occur on a future settlement date. The price and yield of such securities are generally fixed on the date of commitment to purchase.

The Fund may invest in zero coupon bonds, which do not make cash interest payments during a portion or all of the life of the bond. Instead, such bonds are sold at a deep discount to face value, and the interest consists of the gradual appreciation in price as the bond approaches maturity. Zero coupon bonds can be an attractive financing method for issuers with near-term cash-flow problems or seeking to preserve liquidity. Principal only investments entitle the Fund to receive the stated value of such investment when held to maturity.

Certain municipal obligations are issued with interest rates that adjust periodically. Such municipal floating-rate debt obligations are generally indexed to LIBOR, the Securities Industry and Financial Markets Association index, the Consumer Price Index or other indices. Municipal floating-rate debt obligations include, but are not limited to, municipal floating-rate notes, floating-rate notes issued by tender option bond trusts, auction rate preferred securities, synthetic floating-rate securities (e.g., a fixed-rate instrument that is subject to a swap agreement converting a fixed rate to a floating rate) and other municipal instruments with floating interest rates (such as variable rate demand preferred shares and variable rate term preferred shares).

The interest on tax-exempt municipal obligations is (in the opinion of the issuer’s counsel) exempt from regular federal income and state or local taxes, as applicable. Income from certain types of municipal obligations generally may be subject to the federal alternative minimum tax (the “AMT”) for individuals. Investors subject to AMT should consult their tax advisors.

Issuers of general obligation bonds include states, counties, cities, towns and regional districts. The proceeds of these obligations are used to fund a wide range of public projects, including the construction or improvement of schools, highways and roads, water and sewer systems and a variety of other public purposes. The basic security of general obligation bonds is the issuer’s pledge of its faith, credit, and taxing power for the payment of principal and interest. The taxes that can be levied for the payment of debt service may be limited or unlimited as to rate and amount. General obligation bonds issued by municipalities can be adversely affected by economic downturns and the resulting decline in tax revenues, pension funding risk, other post-employment benefit risk, budget imbalances, taxing ability risk, lack of political willpower and federal funding risk, among others. Revenue bonds can be adversely affected by the negative economic viability of the facility or revenue source. Industrial development bonds are normally secured by the revenues from the project and not by state or local government tax payments. They are subject to a wide variety of risks, many of which relate to the nature of the specific project. Generally, industrial development bonds are sensitive to the risk of a slowdown in the economy. Many municipal obligations provide the issuer the option to “call,” or redeem, its securities. As

Parametric TABS Municipal Bond Funds14Prospectus dated June 1, 2022 as revised July 1, 2022

such, the effective maturity of a municipal obligation may be reduced as the result of such call provisions and, if an investment is called in a declining interest rate environment, the proceeds from the called bond may have to be reinvested at a lower interest rate.

The values of zero coupon bonds and principal only investments are subject to greater fluctuation in response to changes in market interest rates than municipal obligations that pay interest currently. The Fund is required to distribute to shareholders income imputed to any zero coupon bonds or principal only investments even though such income may not be received by the Fund as distributable cash. Such distributions could reduce the Fund’s reserve position and require it to sell securities and incur a gain or loss at a time it may not otherwise want to in order to provide the cash necessary for these distributions.

Interest Rate Risk. In general, the value of income securities will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Generally, securities with longer durations or maturities are more sensitive to changes in interest rates than securities with shorter durations or maturities, causing them to be more volatile. Conversely, fixed-income securities with shorter durations or maturities will be less volatile but may provide lower returns than fixed-income securities with longer durations or maturities. In a rising interest rate environment, the duration of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. The Fund may own individual investments that have longer durations than the Fund's target average portfolio duration. Certain factors, such as the presence of call features, may cause a particular fixed-income security, or the Fund as a whole, to exhibit less sensitivity to changes in interest rates. Certain of the Fund’s investments may also be valued, in part, by reference to the relative relationship between interest rates on tax-exempt securities and taxable securities, respectively. When the market for tax-exempt securities underperforms (or outperforms) the market for taxable securities, the value of these investments may be negatively affected (or positively affected). Certain countries and regulatory bodies may use negative interest rates as a monetary policy tool to encourage economic growth during periods of deflation. In a negative interest rate environment, debt instruments may trade at negative yields, which means the purchaser of the instrument may receive at maturity less than the total amount invested.

LIBOR. The London Interbank Offered Rate or LIBOR is the average offered rate for various maturities of short-term loans between major international banks who are members of the British Bankers Association. It is used throughout global banking and financial industries to determine interest rates for a variety of financial instruments (such as debt instruments and derivatives) and borrowing arrangements. In July 2017, the Financial Conduct Authority (the “FCA”), the United Kingdom financial regulatory body, announced a desire to phase out the use of LIBOR. The ICE Benchmark Administration Limited, the administrator of LIBOR, ceased publishing certain LIBOR settings on December 31, 2021, and is expected to cease publishing the remaining LIBOR settings on June 30, 2023. Many market participants are in the process of transitioning to the use of alternative reference or benchmark rates.

Although the transition process away from LIBOR has become increasingly well-defined, the impact on certain debt securities, derivatives and other financial instruments that utilize LIBOR remains uncertain. The transition process may involve, among other things, increased volatility or illiquidity in markets for instruments that currently rely on LIBOR. The transition may also result in a change in (i) the value of certain instruments held by the Fund, (ii) the cost of temporary borrowing for the Fund, or (iii) the effectiveness of related Fund transactions such as hedges, as applicable.

Various financial industry groups are planning for the transition away from LIBOR, but there are obstacles to converting certain longer term securities and transactions to a new benchmark. In June 2017, the Alternative Reference Rates Committee, a group of large U.S. banks working with the Federal Reserve, announced its selection of a new Secured Overnight Financing Rate (“SOFR”), which is intended to be a broad measure of secured overnight U.S. Treasury repo rates, as an appropriate replacement for LIBOR. Bank working groups and regulators in other countries have suggested other alternatives for their markets, including the Sterling Overnight Interbank Average Rate (“SONIA”) in England. Both SOFR and SONIA, as well as certain other proposed replacement rates, are materially different from LIBOR, and changes in the applicable spread for financial instruments transitioning away from LIBOR need to be made to accommodate the differences. Liquid markets for newly-issued instruments that use an alternative reference rate are still developing. Consequently, there may be challenges for a Fund to enter into hedging transactions against instruments tied to alternative reference rates until a market for such hedging transactions develops.

Additionally, while some existing LIBOR-based instruments may contemplate a scenario where LIBOR is no longer available by providing for an alternative or “fallback” rate-setting methodology, there may be significant uncertainty regarding the effectiveness of any such alternative methodologies to replicate LIBOR. Not all existing LIBOR-based instruments have such fallback provisions, and many that do, do not contemplate the permanent cessation of LIBOR. While it is expected that market participants will amend legacy financial instruments referencing LIBOR to include fallback provisions to alternative reference rates, there remains uncertainty regarding the willingness and ability of parties to add or amend such fallback provisions in legacy instruments maturing after the end of 2021, particularly with respect to legacy

Parametric TABS Municipal Bond Funds15Prospectus dated June 1, 2022 as revised July 1, 2022

cash products. Although there are ongoing efforts among certain government entities and other organizations to address these uncertainties, the ultimate effectiveness of such efforts is not yet known.

Any effects of the transition away from LIBOR and the adoption of alternative reference rates, as well as other unforeseen effects, could result in losses to the Fund, and such effects may occur prior to the discontinuation of the remaining LIBOR settings in 2023. Furthermore, the risks associated with the discontinuation of LIBOR and transition to replacement rates may be exacerbated if an orderly transition to an alternative reference rate is not completed in a timely manner.

U.S. Treasury and Government Securities. U.S. Treasury securities (“Treasury Securities”) include U.S. Treasury obligations that differ in their interest rates, maturities and times of issuance. U.S. Government agency securities (“Agency Securities”) include obligations issued or guaranteed by U.S. Government agencies or instrumentalities and government-sponsored enterprises. Agency Securities may be guaranteed by the U.S. Government or they may be backed by the right of the issuer to borrow from the U.S. Treasury, the discretionary authority of the U.S. Government to purchase the obligations, or the credit of the agency, instrumentality or enterprise.

Government-sponsored enterprises, such as the Federal Home Loan Mortgage Corporation (“Freddie Mac”), the Federal National Mortgage Association (“Fannie Mae”), the Federal Home Loan Banks (“FHLBs”), the Private Export Funding Corporation (“PEFCO”), the Federal Deposit Insurance Corporation (“FDIC”), the Federal Farm Credit Banks (“FFCB”) and the Tennessee Valley Authority (“TVA”), although chartered or sponsored by Congress, are not funded by congressional appropriations and the debt and mortgage-backed securities issued by them are neither guaranteed nor issued by the U.S. Government. Treasury Securities and Agency Securities also include any security or agreement collateralized or otherwise secured by Treasury Securities or Agency Securities, respectively.

Because of their high credit quality and market liquidity, U.S. Treasury and Agency Securities generally provide a lower current return than obligations of other issuers. While the U.S. Government has provided financial support to Fannie Mae and Freddie Mac in the past, there can be no assurance that it will support these or other government-sponsored enterprises in the future.

Build America Bonds. Build America Bonds are taxable municipal obligations issued pursuant to the American Recovery and Reimbursement Act of 2009 (the “Act”) or other legislation providing for the issuance of taxable municipal debt on which the issuer receives federal support. The Act authorized state and local governments to issue taxable bonds on which, assuming certain specified conditions were satisfied, issuers could either (i) receive reimbursement from the U.S. Treasury with respect to its interest payments on the bonds (“direct pay” Build America Bonds) or (ii) provide tax credits to investors in the bonds (“tax credit” Build America Bonds). Unlike most other municipal obligations, interest received on Build America Bonds is subject to federal income tax and may be subject to state income tax. Under the terms of the Act, issuers of direct pay Build America Bonds are entitled to receive reimbursement from the U.S. Treasury currently equal to 35% (or 45% in the case of Recovery Zone Economic Development Bonds) of the interest paid. Holders of tax credit Build America Bonds can receive a federal tax credit currently equal to 35% of the coupon interest received. The Fund may invest in “principal only” strips of tax credit Build America Bonds, which entitle the holder to receive par value of such bonds if held to maturity. The Fund does not expect to receive (or, if received, pass through to shareholders) tax credits as a result of its investments. The federal interest subsidy or tax credit continues for the life of the bonds.

Pursuant to the Act, the issuance of Build America Bonds ceased on December 31, 2010. As a result, the availability of such bonds is limited, which may adversely affect their liquidity.

Credit Risk. Investments in debt instruments are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In the event of bankruptcy of the issuer of a debt instrument, the Fund could experience delays or limitations with respect to its ability to realize the benefits of any collateral securing the instrument. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect net asset value. Municipal obligations may be insured as to principal and interest payments. If the claims-paying ability or other rating of the insurer is downgraded by a rating agency, the value of such obligations may be negatively affected.

In evaluating the quality of a particular instrument, the investment adviser (or sub-adviser, if applicable) may take into consideration, among other things, a credit rating assigned by a credit rating agency, the issuer’s financial resources and operating history, its sensitivity to economic conditions and trends, the ability of its management, its debt maturity schedules and borrowing requirements, and relative values based on anticipated cash flow, interest and asset coverage, and earnings prospects. Credit rating agencies are private services that provide ratings of the credit quality of certain

Parametric TABS Municipal Bond Funds16Prospectus dated June 1, 2022 as revised July 1, 2022

investments. Credit ratings issued by rating agencies are based on a number of factors including, but not limited to, the issuer’s financial condition and the rating agency’s credit analysis, if applicable, at the time of rating. As such, the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The ratings assigned are not absolute standards of credit quality and do not evaluate market risks or necessarily reflect the issuer’s current financial condition or the volatility or liquidity of the security.

For purposes of determining compliance with the Fund’s credit quality restrictions, if any, the Fund’s investment adviser (or sub-adviser, if applicable) relies primarily on the ratings assigned by credit rating agencies but may, in the case of unrated instruments, perform its own credit and investment analysis to determine an instrument’s credit quality. A credit rating may have a modifier (such as plus, minus or a numerical modifier) to denote its relative status within the rating. The presence of a modifier does not change the security credit rating (for example, BBB- and Baa3 are within the investment grade rating) for purposes of the Fund’s investment limitations. If an instrument is rated differently by two or more rating agencies, the highest rating will be used for any Fund rating restrictions.

Duration. Duration measures the time-weighted expected cash flows of a fixed-income security, while maturity refers to the amount of time until a fixed-income security matures. Duration differs from maturity in that it considers a security’s coupon payments in addition to the amount of time until the security matures. As the value of a security changes over time, so will its duration. Various techniques may be used to shorten or lengthen Fund duration.

Lower Rated Investments. Investments in obligations rated below investment grade and comparable unrated securities (sometimes referred to as “junk”) generally entail greater economic, credit and liquidity risks than investment grade securities. Lower rated investments have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments generally are subject to greater price volatility and illiquidity than higher rated investments.

Because of the greater number of investment considerations involved in investing in investments that receive lower ratings, investing in lower rated investments depends more on the investment adviser’s judgment and analytical abilities than may be the case for investing in investments with higher ratings. While the investment adviser will attempt to reduce the risks of investing in lower rated or unrated securities through, among other things, active portfolio management, credit analysis and attention to current developments and trends in the economy and the financial markets, there can be no assurance that the investment adviser will be successful in doing so.

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker, or legal restrictions impair the Fund’s ability to sell particular investments or close derivative positions at an advantageous market price. Trading opportunities are also more limited for securities and other instruments that are not widely held or are traded in less developed markets. These factors may make it more difficult to sell or buy a security at a favorable price or time. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or abandon an investment opportunity, any of which could have a negative effect on the Fund’s performance. It also may be more difficult to value less liquid investments. These effects may be exacerbated during times of financial or political stress. Increased Fund redemption activity also may increase liquidity risk due to the need of the Fund to sell portfolio investments and may negatively impact Fund performance.

The Fund will not acquire any illiquid investment if, immediately after the acquisition, the Fund will have invested more than 15% of its net assets in illiquid investments. Illiquid investments mean any investments that the Fund’s investment adviser and/or sub-adviser, as applicable, reasonably expect cannot be sold or disposed of in seven calendar days or less under then-current market conditions without the sale or disposition significantly changing the market value of the investment.

Restricted Securities. Securities held by the Fund may be legally restricted as to resale (such as those issued in private placements), including commercial paper issued pursuant to Section 4(a)(2) of the 1933 Act, securities eligible for resale pursuant to Rule 144A thereunder, and securities of U.S. and non-U.S. issuers initially offered and sold outside the United States pursuant to Regulation S thereunder. Restricted securities may not be listed on an exchange and may have no active trading market. The Fund may incur additional expense when disposing of restricted securities, including all or a portion of the cost to register the securities. The Fund also may acquire securities through private placements under which it may agree to contractual restrictions on the resale of such securities that are in addition to applicable legal restrictions. In addition, if the investment adviser and/or sub-adviser, if applicable, receives non-public information about the issuer, the Fund may as a result be unable to sell the securities.

Parametric TABS Municipal Bond Funds17Prospectus dated June 1, 2022 as revised July 1, 2022

Restricted securities may be difficult to value properly and may involve greater risks than securities that are not subject to restrictions on resale. It may be difficult to sell restricted securities at a price representing fair value until such time as the securities may be sold publicly. Under adverse market or economic conditions or in the event of adverse changes in the financial condition of the issuer, the Fund could find it more difficult to sell such securities when the investment adviser and/or sub-adviser, if applicable, believes it advisable to do so or may be able to sell such securities only at prices lower than if such securities were more widely held. Holdings of restricted securities may increase the level of Fund illiquidity if eligible buyers become uninterested in purchasing them. Restricted securities may involve a high degree of business and financial risk, which may result in substantial losses.

Forward Commitments and When-Issued Securities. The Fund may purchase securities on a “forward commitment” or “when-issued” basis (meaning securities are purchased or sold with payment and delivery taking place in the future). In such a transaction, the Fund is securing what is considered to be an advantageous price and yield at the time of entering into the transaction.

The yield on a comparable security when the transaction is consummated may vary from the yield on the security at the time that the forward commitment or when-issued transaction was made. From the time of entering into the transaction until delivery and payment is made at a later date, the securities that are the subject of the transaction are subject to market fluctuations. In forward commitment or when-issued transactions, if the seller or buyer, as the case may be, fails to consummate the transaction, the counterparty may miss the opportunity of obtaining a price or yield considered to be advantageous. Forward commitment or when-issued transactions may be expected to occur a month or more before delivery is due. No payment or delivery is made, however, until payment is received or delivery is made from the other party to the transaction. These transactions may create leverage in the Fund.

Securities Lending. The Fund may lend its portfolio securities to broker-dealers and other institutional borrowers. During the existence of a loan, the Fund will continue to receive the equivalent of the interest paid by the issuer on the securities loaned, or all or a portion of the interest on investment of the collateral, if any. The Fund may pay lending fees to such borrowers. Loans will only be made to firms that have been approved by the investment adviser, and the investment adviser or the securities lending agent will periodically monitor the financial condition of such firms while such loans are outstanding. Securities loans will only be made when the investment adviser believes that the expected returns, net of expenses, justify the attendant risks. Securities loans currently are required to be secured continuously by collateral in cash, cash equivalents (such as money market instruments) or other liquid securities held by the custodian and maintained in an amount at least equal to the market value of the securities loaned. The Fund may engage in securities lending to generate income. Upon return of the loaned securities, the Fund would be required to return the related collateral to the borrower and may be required to liquidate portfolio securities in order to do so. The Fund may lend up to one-third of the value of its total assets or such other amount as may be permitted by law.

As with other extensions of credit, there are risks of delay in recovery or even loss of rights in the securities loaned if the borrower of the securities fails financially. To the extent that the portfolio securities acquired with such collateral have decreased in value, it may result in the Fund realizing a loss at a time when it would not otherwise do so. As such, securities lending may introduce leverage into the Fund. The Fund also may incur losses if the returns on securities that it acquires with cash collateral are less than the applicable rebate rates paid to borrowers and related administrative costs.

Borrowing. The Fund is permitted to borrow for temporary purposes (such as to satisfy redemption requests, to remain fully invested in anticipation of expected cash inflows and to settle transactions). Any borrowings by the Fund are subject to the requirements of the 1940 Act. Borrowings are also subject to the terms of any credit agreement between the Fund and lender(s). Fund borrowings may be equal to as much as 331/3% of the value of the Fund’s total assets (including such borrowings) less the Fund’s liabilities (other than borrowings). The Fund will not purchase additional investments while outstanding borrowings exceed 5% of the value of its total assets.

In addition, the Fund will be required to maintain a specified level of asset coverage with respect to all borrowings and may be required to sell some of its holdings to reduce debt and restore coverage at times when it may not be advantageous to do so. The rights of the lender to receive payments of interest and repayments of principal of any borrowings made by the Fund under a credit facility are senior to the rights of holders of shares with respect to the payment of dividends or upon liquidation. In the event of a default under a credit arrangement, the lenders may have the right to cause a liquidation of the collateral (i.e., sell Fund assets) and, if any such default is not cured, the lenders may be able to control the liquidation as well.

Cash and Money Market Instruments; Temporary Defensive Positions. The Fund may invest in cash or money market instruments, including high quality short-term instruments or an affiliated investment company that invests in such instruments. During unusual market conditions, including for temporary defensive purposes, the Fund may invest up to 100% of its assets in cash or money market instruments, which may be inconsistent with its investment objective(s) and other policies, and as such, the Fund may not achieve its investment objective(s) during this period.

Parametric TABS Municipal Bond Funds18Prospectus dated June 1, 2022 as revised July 1, 2022

Money market instruments may be adversely affected by market and economic events, such as a sharp rise in prevailing short-term interest rates; adverse developments in the banking industry, which issues or guarantees many money market instruments; adverse economic, political or other developments affecting issuers of money market instruments; changes in the credit quality of issuers; and default by a counterparty.

Converting to Hub and Spoke Structure. Each Fund may invest all of its investable assets in an open-end management investment company (“portfolio”) with substantially the same investment objective, policies and restrictions as the Fund. Any such portfolio would be advised by the Fund’s investment adviser (or an affiliate) and the Fund would not pay directly any advisory fee with respect to the assets so invested. The Fund may initiate investments in a portfolio at any time without shareholder approval.

Cybersecurity Risk. With the increased use of technologies by Fund service providers to conduct business, such as the Internet, the Fund is susceptible to operational, information security and related risks. The Fund relies on communications technology, systems, and networks to engage with clients, employees, accounts, shareholders, and service providers, and a cyber incident may inhibit the Fund’s ability to use these technologies. In general, cyber incidents can result from deliberate attacks or unintentional events. Cyber attacks include, but are not limited to, gaining unauthorized access to digital systems (e.g., through “hacking” or malicious software coding) for purposes of misappropriating assets or sensitive information, corrupting data, or causing operational disruption. Cyber attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites. A denial-of-service attack is an effort to make network services unavailable to intended users, which could cause shareholders to lose access to their electronic accounts, potentially indefinitely. Employees and service providers also may not be able to access electronic systems to perform critical duties for the Fund, such as trading and NAV calculation, during a denial-of-service attack. There is also the possibility for systems failures due to malfunctions, user error and misconduct by employees and agents, natural disasters, or other foreseeable and unforeseeable events.

Because technology is consistently changing, new ways to carry out cyber attacks are always developing. Therefore, there is a chance that some risks have not been identified or prepared for, or that an attack may not be detected, which puts limitations on the Fund's ability to plan for or respond to a cyber attack. Like other funds and business enterprises, the Fund and its service providers have experienced, and will continue to experience, cyber incidents consistently. In addition to deliberate cyber attacks, unintentional cyber incidents can occur, such as the inadvertent release of confidential information by the Fund or its service providers.

The Fund uses third party service providers who are also heavily dependent on computers and technology for their operations. Cybersecurity failures by or breaches of the Fund’s investment adviser or administrator and other service providers (including, but not limited to, the custodian or transfer agent), and the issuers of securities in which the Fund invests, may disrupt and otherwise adversely affect their business operations. This may result in financial losses to the Fund, impede Fund trading, interfere with the Fund’s ability to calculate its NAV, limit a shareholder’s ability to purchase or redeem shares of the Fund or cause violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs, litigation costs, or additional compliance costs. While many of the Fund’s service providers have established business continuity plans and risk management systems intended to identify and mitigate cyber attacks, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified. The Fund cannot control the cybersecurity plans and systems put in place by service providers to the Fund and issuers in which the Fund invests. The Fund and its shareholders could be negatively impacted as a result.

Research Process. The Fund’s portfolio management utilizes information provided by, and the expertise of, the research staff of the investment adviser and/or certain of its affiliates in making investment decisions. As part of the research process, portfolio management may consider financially material environmental, social and governance (“ESG”) factors. Such factors, alongside other relevant factors, may be taken into account in the Fund’s securities selection process.

Geopolitical Risk. The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in a Fund’s portfolio may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, health emergencies (such as epidemics and pandemics), terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, health emergencies, social and political discord, war or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. Other financial, economic and other global market and social developments or disruptions may result in similar adverse circumstances, and it is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects (which may last for extended periods).

Parametric TABS Municipal Bond Funds19Prospectus dated June 1, 2022 as revised July 1, 2022

Such global events may negatively impact broad segments of businesses and populations, cause a significant negative impact on the performance of the Fund’s investments, adversely affect and increase the volatility of the Fund’s share price, and/or exacerbate pre-existing political, social and economic risks to the Fund. The Fund’s operations may be interrupted and any such event(s) could have a significant adverse impact on the value and risk profile of the Fund’s portfolio. There is a risk that you may lose money by investing in the Fund.

Recent Market Conditions. An outbreak of respiratory disease caused by a novel coronavirus was first detected in China in late 2019 and subsequently spread internationally. This coronavirus has resulted in closing borders, enhanced health screenings, changes to healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general concern and uncertainty. The impact of this coronavirus has resulted in a substantial economic downturn, which may continue for an extended period of time. Health crises caused by outbreaks of disease, such as the coronavirus outbreak, may exacerbate other pre-existing political, social and economic risks and disrupt normal market conditions and operations. The impact of this outbreak has negatively affected the worldwide economy, as well as the economies of individual countries and industries, and could continue to affect the market in significant and unforeseen ways. Other epidemics and pandemics that may arise in the future may have similar effects. For example, a global pandemic or other widespread health crisis could cause substantial market volatility and exchange trading suspensions and closures. In addition, the increasing interconnectedness of markets around the world may result in many markets being affected by events or conditions in a single country or region or events affecting a single or small number of issuers. The coronavirus outbreak and public and private sector responses thereto have led to large portions of the populations of many countries working from home for indefinite periods of time, temporary or permanent layoffs, disruptions in supply chains, and lack of availability of certain goods. The impact of such responses could adversely affect the information technology and operational systems upon which the Fund and the Fund’s service providers rely, and could otherwise disrupt the ability of the employees of the Fund’s service providers to perform critical tasks relating to the Fund. Any such impact could adversely affect the Fund’s performance, or the performance of the securities in which the Fund invests and may lead to losses on your investment in the Fund.

General. The Fund's 80% Policy only may be changed with shareholder approval. Unless otherwise stated, the Fund's investment objective and certain other policies may be changed without shareholder approval. The Fund might not use all of the strategies and techniques or invest in all of the types of securities described in this Prospectus or the SAI. While at times the Fund may use alternative investment strategies in an effort to limit its losses, it may choose not to do so.

The Fund’s annual operating expenses are expressed as a percentage of the Fund’s average daily net assets and may change as Fund assets increase and decrease over time. Purchase and redemption activities by Fund shareholders may impact the management of the Fund and its ability to achieve its investment objective. In addition, the redemption by one or more large shareholders or groups of shareholders of their holdings in the Fund could have an adverse impact on the remaining shareholders in the Fund. Mutual funds, investment advisers, other market participants and many securities markets are subject to rules and regulations and the jurisdiction of one or more regulators. Changes to applicable rules and regulations or to widely accepted market conventions or standards could have an adverse effect on securities markets and market participants, as well as on the Fund’s ability to execute its investment strategy. With the increased use of technologies by Fund service providers, such as the Internet, to conduct business, the Fund is susceptible to operational, information security and related risks. See “Additional Information about Investment Strategies and Risks” in the Fund’s SAI.

Management and Organization

Management. Each Fund’s investment adviser is Eaton Vance Management (“Eaton Vance”). Eaton Vance has offices at Two International Place, Boston, MA 02110. EV LLC (“EV”) serves as trustee of Eaton Vance. Eaton Vance and its predecessor organizations have been managing assets since 1924 and managing mutual funds since 1931. Prior to March 1, 2021, Eaton Vance was a wholly owned subsidiary of Eaton Vance Corp. (“EVC”).

On March 1, 2021, Morgan Stanley acquired EVC (the “Transaction”), and each became an indirect, wholly-owned subsidiary of Morgan Stanley. In connection with the Transaction, each Fund entered into a new investment advisory and administrative agreement with its investment adviser and each Fund's investment adviser entered into a new investment sub-advisory agreement with its sub-adviser. Each such agreement was approved by Fund shareholders prior to the consummation of the Transaction and was effective upon its closing. Effective March 1, 2021, any fee reduction agreement previously applicable to a Fund was incorporated into its new investment advisory agreement with its investment adviser and new investment sub-advisory agreement with its sub-adviser, as applicable.

Morgan Stanley (NYSE: MS), whose principal offices are at 1585 Broadway, New York, New York 10036, is a preeminent global financial services firm engaged in securities trading and brokerage activities, as well as providing investment banking, research and analysis, financing and financial advisory services. As of March 31, 2022, Morgan Stanley’s asset management operations had aggregate assets under management of approximately $1.4 trillion.

Parametric TABS Municipal Bond Funds20Prospectus dated June 1, 2022 as revised July 1, 2022

Effective March 1, 2021, any fee reduction agreement previously applicable to a Fund was incorporated into its new investment advisory and administrative agreement with Eaton Vance and/or its new investment sub-advisory agreement with Parametric, as applicable.

Pursuant to investment sub-advisory agreements, Eaton Vance has delegated the investment management of each Fund to Parametric Portfolio Associates LLC (“Parametric”). Parametric’s principal offices are at 800 Fifth Avenue, Suite 2800, Seattle, WA 98104. Eaton Vance pays Parametric a portion of the advisory fee for sub-advisory services provided to each Fund. On March 1, 2021, upon the closing of the Transaction, Parametric became an indirect wholly owned subsidiary of Morgan Stanley. Prior to March 1, 2021, Parametric was an indirect wholly owned subsidiary of EVC.

Each Fund’s semiannual report covering the fiscal period ended July 31 will provide information regarding the basis for the Trustees’ approval of each Fund’s investment advisory and administrative agreements and sub-advisory agreements.