UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08104

Touchstone Funds Group Trust

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: September 30

Date of reporting period: September 30, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| September 30, 2015 |

| Annual Report |

| Touchstone Funds Group Trust |

| Touchstone Arbitrage Fund |

| Touchstone Emerging Markets Equity Fund |

| Touchstone Global Real Estate Fund |

| Touchstone Merger Arbitrage Fund |

| Touchstone Mid Cap Fund |

| Touchstone Mid Cap Value Fund |

| Touchstone Premium Yield Equity Fund |

| Touchstone Sands Capital Select Growth Fund |

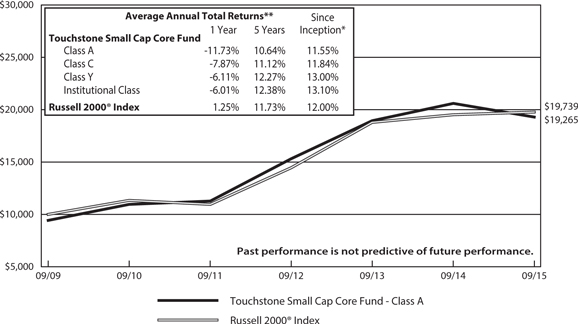

| Touchstone Small Cap Core Fund |

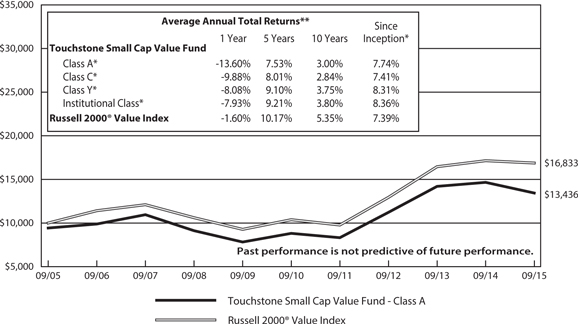

| Touchstone Small Cap Value Fund |

| Touchstone Total Return Bond Fund |

| Touchstone Ultra Short Duration Fixed Income Fund |

Table of Contents

This report identifies the Funds' investments on September 30, 2015. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

| 2 |

Dear Fellow Shareholder:

We are pleased to provide you with the Touchstone Funds Group Trust Annual Report. Inside you will find key financial information, as well as manager commentaries, for the 12 months ended September 30, 2015.

During the fiscal year, the U.S. economy maintained its positive trajectory despite weakness in other major economies around the world. Europe, Japan and China all faced economic challenges, prompting central bank action to loosen monetary conditions and spur economic growth. The accommodative monetary policy, however, was not enough to allay investor concerns of a global economic slowdown. Facing the effects of lower global demand, crude oil and commodity prices declined sharply, weighing on emerging market economies, which are often more reliant on commodity production.

The financial markets reflected the heightened uncertainty surrounding the world’s economic prospects. Equities experienced an increase in volatility, particularly late in the period when macroeconomic concerns became more acute. Domestic equity markets weathered this volatility better than their international counterparts, perhaps an indication of more solid economic footing in the U.S. Emerging market equities were especially challenged during the period, hurt by the sell-off in commodity prices.

The bond markets reflected the heightened uncertainty surrounding the world’s growth prospects. Investors shunned riskier bonds in favor of higher credit quality securities. U.S. Treasuries outperformed Investment Grade Corporate Bonds, while high yield issues were affected in part by weak commodity prices. Interest rates experienced considerable volatility, but ended the period lower to continue their recent decline.

The recent market volatility only reinforces our belief that successful investing requires a long-term approach. Short-term performance can often obscure the value of sound asset allocation and a disciplined approach. Your financial professional can help steer you through the fluctuations of the market by identifying a risk-return profile that will help you meet your financial goals.

We greatly appreciate the opportunity to be part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Funds Group Trust

| 3 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Arbitrage Fund

Sub-Advised by Longfellow Investment Management Co.

Investment Philosophy

The Touchstone Arbitrage Fund seeks to achieve positive absolute returns regardless of market conditions over the long term by investing primarily in securities of companies that are involved in publicly announced mergers, takeovers, tender offers, debt restructurings, minority purchases, leveraged buyouts, spin-offs, liquidations and other corporate reorganizations.

Fund Performance

The Touchstone Arbitrage Fund (Class A Shares) outperformed its benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, for the 12-month period ended September 30, 2015. The Fund’s total return was 0.77 percent (excluding the maximum sales charge) while the benchmark’s total return was 0.02 percent.

Market Environment

Volatility in the equity markets was unpredictable over the last 12 months, as represented by the significant fluctuations in the CBOE Volatility Index (VIX) during the period. Historically, spikes in volatility have typically created trading opportunities in merger arbitrage as spreads have temporarily widened, facilitating potentially attractive entry points.

During the period, the equity markets’ response to announced mergers and acquisitions (M&A) was generally positive, which served as a wake-up call to many companies. While historically it is common for a target company’s stock to rise on the announcement of a merger, recently the stock of the acquiring company has increased on the announcement of an acquisition, which is uncharacteristic. Interestingly, as strategic M&A activity has risen substantially, the amount of leveraged buyouts, or deals by financial sponsors, has drifted lower.

The Information Technology and Health Care sectors saw particularly high levels of announced M&A activity during the period. For example, five of the largest managed care providers may consolidate to three primary providers, primarily in response to the Affordable Care Act. Additionally, the semiconductor industry experienced significant consolidation among its largest companies. Although deal volume in these sectors was significant, many of these mergers were accompanied by regulatory risks and substantially long time horizons until close.

Key drivers of the strong M&A environment during 2014 were the favorable financing environment, competitive peer pressure, impatient shareholders and the resurgence of activist investors seeking to optimize growth by capturing potential synergies. While 2014 marked one of the busiest years for M&A activity in recent history, activity through the third quarter of 2015 is already ahead of last year.

Portfolio Review

The spike in volatility that emerged in October 2014 provided merger arbitrage investors a reason to exit their positions. This allowed the Fund to redeploy idle capital into deals at widespread levels during the period, which contributed to Fund performance.

Several holdings contributed to Fund performance during the period. A failed Dutch tender offer in early 2014 from Outerwall Inc., the operator of RedBox DVD kiosks, contributed positively to Fund performance. Outerwall’s stock price rebounded during the period, which allowed the Fund to sell its position at an attractive return. Another positive development regarding a broken deal from 2014 was the merger between Ainsworth Lumber Corp. and Norbord Inc., which created North America’s largest particle board manufacturer. The deal closed in the first quarter of 2015.

| 4 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

The deal between Covidien PLC and Medtronic PLC contributed to Fund performance as the spread tightened significantly from its widest levels in mid-October 2014. Investors grew skeptical of Covidien’s commitment because of the deal’s tax-inversion benefits and many investors exited the position as a result. Medtronic successfully acquired Covidien in January 2015.

Liberty Interactive Corp. spun-off of Liberty Ventures Group in October 2014. Liberty Interactive subsequently changed its ticker symbol from LINTA to QVCA in order to showcase its flagship asset, QVC Group. We believe this move may position Liberty Interactive to acquire the portion of the Home Shopping Network (HSN Inc.) that it does not already own. The Fund’s position in Liberty Interactive contributed to performance.

An ordinary investment in BallyTechnologies Inc., which was acquired by Scientific Games Corp., also contributed to Fund performance. Opportunistic trading, based on the Fund’s entry point, produced an enhanced return on an otherwise unremarkable merger transaction.

The multiple-bidder situation that emerged surrounding the eventual acquisition of Salix Pharmaceuticals Inc. by Valeant Pharmaceuticals International Inc. also contributed to Fund returns during the period.

In January, American Realty Capital Healthcare Trust was successfully acquired by Ventas Inc. in a cash and stock merger, which benefited the Fund.

The Fund’s position in Allergan PLC, acquired in March 2015 by Actavis PLC, contributed to Fund performance during the first quarter of 2015. The highly contested deal was initially exposed to potential regulatory risks as the combined company would have both product and geographic overlaps and operations in several countries. In aggregate, these risks kept the deal spread wide, thus providing an attractive return.

An otherwise unremarkable merger between Dresser-Rand Group Inc. and Siemens AG contributed to performance. A monthly “ticking fee” was triggered when the deal took longer than expected. Beginning in March, this fee was payable on the first of each month and continued through the deal’s consummation on June 30.

Talisman Energy Inc. was successfully acquired by Repsol SA during the second quarter of 2015 which contributed to performance.

In the wake of the failed merger between Time Warner Cable Inc. and Comcast Corp., the DIRECTV and AT&T Inc. merger came under fire. Investors feared that the DIRECTV deal could meet the same Federal Communications Commission (FCC) scrutiny as Time Warner, thus the spread widened accordingly. As the fears subsided, the deal’s spread gradually tightened into the end of the second quarter of 2015. This spread tightening contributed positively to overall performance. The deal ultimately closed in the summer of 2015.

The successful completion of WEC Energy Group Inc.’s acquisition of Integrys Energy Group Inc. also contributed to Fund performance. The merger required a litany of state public utility commission approvals as well as Hart-Scott-Rodino, FCC, Federal Energy Regulatory Commission approvals and SEC review of the proxy and votes from both shareholder groups. This gauntlet of approvals increased volatility in the merger’s spread, allowing an opportunistic addition to the Fund’s position.

The protracted acquisition of Hudson City Bancorp Inc. by M&T Bank Corp. – which was also the Fund’s oldest merger holding – finally earned approval from the U.S. Federal Reserve Board (Fed) on September 30, 2015. M&T Bank Corp. has nearly all of the necessary approvals in place and is expected to close in early November. The spread tightened significantly on the news. As it was the largest position in the portfolio, it similarly became the Fund’s largest positive contributor to return.

| 5 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

CVS Health Corp. successfully acquired Omnicare Inc. in August 2015. There were narrow overlaps in the companies’ operations, which gave way to procedural caution on the antitrust front. This regulatory uncertainty offered a relatively wide deal spread, which was advantageous to Fund performance.

Pfizer Inc. acquired Hospira Inc. in September 2015, and numerous international regulatory approvals were required to complete the merger. As each approval was granted, the spread tightened and the deal moved closer to completion. In particular, there were some product overlaps in injectable medicines that were specifically scrutinized by the FTC. However, the merger was granted without required divestitures and the deal contributed positively to Fund performance.

Dealertrack Technologies Inc., a provider of software to automotive dealerships, was acquired by Cox Automotive Inc. during the third quarter. The Department of Justice determined that the merger would require Cox to divest its inventory management solution system in order for the deal to proceed. The merger’s relatively wide spread due to the regulatory concerns benefited Fund returns.

Tokio Marine Holdings Inc. continued its process of acquiring HCC Insurance Holdings Inc. in an all-cash merger. The deal spread has steadily tightened as the deal meets regulatory milestones. With each regulatory approval granted, the deal has moved one step closer to completion. Several approvals were granted during the third quarter of 2015 and, consequently, the spread tightened meaningfully and contributed positively to returns.

Several holdings negatively impacted performance during the period. The Fund experienced two broken deals over the 12-month period. The first occurred in the fourth quarter of 2014. The combination of pharmaceutical firms Shire PLC and AbbVie Inc. was billed as a watershed event, with the tax inversion benefits serving as an extra benefit. AbbVie’s management team had reiterated the strategic merits of a merger with Shire and, while acknowledging the tax savings by reincorporating in Ireland, they affirmed that the tax savings were not the main motivation behind the deal. However, drastic and unilateral action by the U.S. Treasury in mid-October made the economics of an inversion less attractive. Only days after the U.S.Treasury’s action, AbbVie’s management team advised shareholders to vote against the deal, effectively terminating the acquisition. The second broken deal occurred during the second quarter of 2015. Applied Materials Inc.’s pending acquisition of Tokyo Electron Ltd. was terminated more than a year and a half after the deal was first announced. The management teams agreed to significant divestures to meet regulator demands. However, the companies voluntarily terminated the merger when it was clear that regulators felt the combined entity could still inhibit future microchip technology innovation.

A pair trade of NorthStar Realty Finance Corp. with Vanguard REIT ETF detracted from Fund performance. NorthStar was a significant hedge fund holding and, as hedge fund performance faltered, client redemptions followed and managers were forced to liquidate holdings to meet redemption requests. However, NorthStar is planning a spin-off of its European properties, which remains on schedule for the fourth quarter of 2015.

An investment in Carbonite Inc. a cloud-based computer backup storage provider, also detracted from Fund performance. A significant holder of Carbonite stock, j2 Global Inc., made an unsolicited proposal to acquire the entire company. After the two companies began negotiations, j2 Global amended its proposal to acquire only the enterprise business from Carbonite, excluding the retail application service. Carbonite was unwilling to separate its business. With negotiations stalled, j2 Global cancelled its tender offer.

The utility merger between Pepco Holdings Inc. and Exelon Corp. also detracted from performance. While Maryland regulators narrowly approved the merger, regulators in Washington, D.C. had to approve it as well. Significant public outcry against the merger urged the D.C. Commission to reject the deal. Additionally, the

| 6 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

D.C. Attorney General publicly opposed the merger, as did about half of the D.C. Council and more than half of the city’s neighborhood commissions. With the substantial regulatory approval risk, the Fund exited the position.

A pending spin-off by Fiat Chrysler Automobiles NV of its flagship brand, Ferrari, also detracted from Fund performance, as investors reacted negatively to Fiat’s announced delay for the spin-off. We continue to believe in the thesis underlying this position and the Fund continues to hold the investment. The issues at Volkswagen over claims that it installed software that obstructed diesel emission test devices caused a sell-off across the auto sector near the end of the third quarter of 2015.

Outlook

We believe the rationale for M&A activity continues to remain compelling, as interest rates remain low and organic growth has been difficult. Further, corporate cash continues to be broadly deployed into financial engineering rather than research and development, which will likely leave management teams with few options for growth outside of M&A. Deal spreads in merger situations have widened somewhat from the historically tight range that investors experienced throughout 2014. Spreads appear to have settled in the mid-single digits on an annualized basis. The market is now differentiating between deals that appear riskier and those that are more straightforward. Deals with a greater amount of perceived risk are being assigned a wider spread than transactions with fewer hurdles. This is in contrast to much of 2014 when spreads did not necessarily compensate investors appropriately for the amount of risk being assumed.

Short-term interest rates remain near zero and the Fed has steadfastly defended its data-dependent position. While historically low short-term interest rates will continue to act as a headwind to the merger arbitrage strategy, we continue to believe that the strategy offers an attractive risk-reward profile and serves as a valuable diversification tool. Historically, there has been a strong positive correlation between short-term interest rates and merger arbitrage spreads. When rates eventually rise, deal spreads should be favorably impacted. We believe the idiosyncratic nature of each of the positions in the portfolio, along with the various strategies employed, combines to create a Fund with a low overall correlation to the broad equity and fixed income indexes. We maintain our belief that the robust M&A cycle will continue to present the Fund with attractive risk-adjusted opportunities going forward.

We believe the risks going forward include a general slowdown in M&A activity, which would potentially make it difficult to diversify the Fund across an adequate number of deals. Similarly, interest rates remaining at historically low levels could act as a double-edged sword — on one hand, spreads on merger deals would remain tighter than in an environment of high rates yet, on the other hand, low interest rates could foster an environment of easy financing which helps facilitate deal-making.

| 7 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

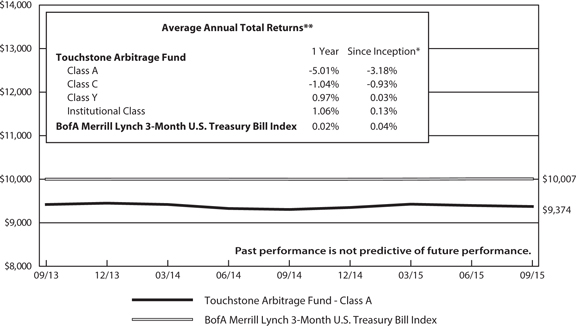

Comparison of the Change in Value of

a $10,000 Investment in the

Touchstone Arbitrage Fund - Class A* and the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of the Fund was September 30, 2013. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net assets value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note To Chart

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged index of Treasury securities maturing in 90 days that assumes reinvestment of all income.

| 8 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Emerging Markets Equity Fund

Sub-Advised by AGF Investments America, Inc.

Investment Philosophy

The Touchstone Emerging Markets Equity Fund seeks capital appreciation by primarily investing in equity securities of companies located in emerging markets. It seeks to invest in businesses believed to be mispriced by the market and that are expected to generate positive and sustainable earnings growth.

Fund Performance

The Touchstone Emerging Markets Equity Fund (Class A Shares) underperformed its benchmark, the MSCI Emerging Markets Index, for the 12-month period ended September 30, 2015. The Fund’s total return was -21.18 percent (excluding the maximum sales charge) while the total return of the benchmark was -19.28 percent.

Market Environment

Emerging Markets closed lower for the one-year period. Asia was the best performing region within Emerging Markets, while Latin America lagged the most. The U.S. Federal Reserve Board (Fed) announced the end of its quantitative easing program in October 2014 and later removed the word “patience” in its message on monetary policy. This was significant, as investors believed it could be an indicator that the Fed was preparing the market for future interest rate hikes. Subsequently, anticipation of an interest rate hike dominated markets. However, at the Federal Open Market Committee (FOMC) meeting in September, the Fed left short-term interest rates unchanged, but indicated that an increase would likely occur this year, which further added to the uncertainty in the market.

The European Central Bank greatly expanded its asset purchase program during the period. This expansion started in March 2015 and is expected to run until at least September 2016, as inflation expectations have fallen significantly in a slowing growth environment. This provided support to equities in the first four months of the calendar year; however, equities declined during May and June as the crisis in Greece intensified. Greece subsequently received its third bailout package, which provided some temporary relief to European equity markets.

Chinese equities were volatile and fell sharply during the last four months of the period, although they outperformed emerging market equities as a whole. During the 12-month period, China’s A-shares entered bear market territory and China’s H-shares sold off, as margin investors aggressively sold shares. In particular, those investors were concerned that the government would suppress margin trading, that equity valuations were overvalued and that initial public offerings (IPOs) would lock up funds. Further, the People’s Bank of China (PBoC) unexpectedly devalued the country’s currency in August, which sparked a global sell-off in equities. In an effort to ease tensions in financial markets and bolster economic growth, the PBoC announced a number of consecutive interest rate cuts and also lowered the amount of reserves banks are required to hold.

In Latin America, Brazil was one of the worst performing markets as the country faced significant headwinds. During August, data reports showed Brazil’s unemployment had climbed notably from the same time last year and its manufacturing activity had contracted. In September, Standard & Poor’s downgraded Brazil’s credit rating to junk with a negative outlook, which put further pressure on the country’s equities. Following the downgrade, Brazil’s finance minister proposed a new round of spending cuts and the re-introduction of a levy on banking transactions in an effort to boost government revenues.

In India, the Reserve Bank of India lowered its policy rates in September amid slowing inflation, which was the fourth interest rate cut in the 12-month period.

| 9 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

Portfolio Review

Security selection detracted from performance relative to the benchmark, while sector allocation and country allocation contributed. From a country perspective, security selection in China, Thailand and South Korea detracted from performance, while security selection in Taiwan, Mexico and India contributed positively to returns. In terms of sector allocation, the Fund’s underweight to the Information Technology sector and overweight to the Energy sector detracted. This was partly offset by an overweight to the Consumer Staples sector, which contributed to returns. Country and sector positioning were a residual of security selection.

During the period, the Fund’s weighting to Brazil was reduced, as there was concern that a deteriorating macro-economic environment could impact its companies’ ability to drive earnings growth. At the end of the period, the Fund’s largest overweight positions were to India and Mexico. In terms of sectors, the Fund’s largest overweight positions were to Consumer Discretionary, Consumer Staples and Health Care.

Among the top detractors from performance during the period was Localiza Rent a Car SA (Industrials sector), an auto rental and fleet management company in Latin America. The company came under pressure in the second half of the period amid a broader slide in Brazilian equities. Further, a new competitor entered the market and investors were concerned about a tougher competitive landscape, which also weighed on its performance. However, we believe that Localiza’s strong market share should position the company to better withstand a competitive market environment going forward.

Weichai Power Co. Ltd. (Industrials sector), a China-based manufacturer of diesel engines, also detracted from performance. The company underperformed as a result of China’s economic slowdown and its weak demand for heavy-duty trucks (HDT), which more than offset growth in demand for the company’s logistics activities. Consequently, the company’s HDT sales volumes remained weak, with those sales down in China during the first six months of the year. Nevertheless, we anticipate HDT demand will recover in the near term on the back of planned government projects in railways and logistics.

One of the largest contributors to performance during the period was SABMiller PLC (Consumer Staples sector), a multinational brewing and beverage company headquartered in the United Kingdom (UK). Toward the end of the period, SABMiller’s shares rallied after brewer Anheuser-Busch InBev SA indicated it intended to make an offer for the company. This transaction would unite two of the world’s largest beer makers. Further, we believe SABMiller’s strong market position in a number of high-growth consumption markets should continue to drive the company’s top-line growth.

Eclat Textile Corp. (Consumer Discretionary sector), a Taiwan-based manufacturer of fabrics and garments, was also a top contributor to performance due to better than expected results during the period. In particular, Eclat’s margins continued to expand during the period, which was well received by investors. The stock further benefited as visibility for the company’s Under Armour brand, underpinned by a strong endorsement line-up, increased globally. Additionally, Eclat is expected to open new factories in the near term, which we believe should increase utilization and further expand margins and asset turns. We also believe the company’s expanding margins, as well as its differentiated manufacturing technology in the weaving and dying process, should continue to benefit the stock.

Outlook

Over the long term, we believe countries that implement reform measures should benefit from higher potential growth rates and financial market outperformance. Countries like India and Mexico are examples of countries that have proposed and implemented a number of reforms, which we believe should benefit their economies and financial markets over the long term. Food prices fell during the quarter and oil-importing countries received a tailwind in the form of lower oil prices, which we believe should also keep inflation from rising materially.

| 10 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

Even though China also implemented a number of reform measures to boost growth, we found it difficult to find securities in China and Hong Kong that meet the Fund’s criteria.

Some of the potential risks we see to emerging market equities are the timing of a U.S. interest rate increase as well as continued strength in the U.S. dollar. We believe we have constructed the Fund to help curtail these risks. For example, we have limited its portfolio’s exposure to those countries with large current account deficits, such as South Africa and Brazil, as these currencies tend to be more adversely affected by rising U.S. interest rates. Deflation is also a risk that we will continue to monitor closely.

In seeking to capture attractive opportunities and help mitigate the potential risks when investing in Emerging Markets, we believe that active management remains key to adding value. We are long-term, bottom-up investors and, as a result, have positioned the Fund to benefit from exposure to the long-term secular trend of Emerging Market domestic demand from both consumers and enterprises.

| 11 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of

a $10,000 Investment in the

Touchstone Emerging Markets Equity Fund - Class A* and the

MSCI Emerging Markets Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of the Fund was September 30, 2009. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net assets value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note To Chart

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

| 12 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Global Real Estate Fund

Sub-Advised by Forum Securities Limited

Investment Philosophy

The Fund seeks income and capital appreciation by investing primarily in common stocks and other equity securities of U.S. and foreign real estate companies without regard to market capitalization.

Fund Performance

The Touchstone Global Real Estate Fund (Class A Shares) underperformed its benchmark, the FTSE EPRA/NAREIT Developed Index, for the 12-month period ended September 30, 2015. The Fund’s total return was -0.50 percent (excluding the maximum sales charge) while the benchmark’s total return was 3.58 percent.

Market Environment

It was an eventful 12 months. News stories included an Ebola scare, Russia’s annexation of Crimea, the boom then bust of Chinese A-shares, China’s largest devaluation of the yuan since 1994, acceleration of stimulus programs in Japan and the eurozone, interest rate cuts in Canada, Norway, Australia and Sweden and endless discussion of interest rate hikes in the United States. In addition, oil prices plunged and the U.S. dollar rallied. All of this combined to create increased market volatility.

Overall, real estate securities fared among the better-performing asset classes during the period. Regionally, European real estate performed best, followed by North American. Asia Pacific was the only developed region in negative territory. Emerging markets real estate was pulled down by underperformance in Latin America, the Middle East and parts of Southeast Asia.

Storage and Residential sector real estate investment trusts (REITs) were among the strongest subsectors over the past 12 months. Hotel and Diversified sector REITs were among those that declined the most.

Portfolio Review

The Fund’s positioning was driven by evaluation of relative yield and fundamental factors.

Country exposure detracted from performance. The Fund had overweight exposures to Australia, Canada, Latin America and Singapore, all of which underperformed the benchmark. Moreover, the Fund was underweight in the U.S., which outperformed the benchmark. Security selection contributed to performance. In particular security selection in Asia was strong, especially in Japan, Hong Kong and Singapore.

From a subsector perspective, positioning in Diversified, Health Care, Hotel and Specialty REITs contributed to performance, while positioning in Industrial, Residential and Retail REITs detracted from performance.

Among the largest contributors to performance in the past 12 months were AVIV REIT Inc. in the U.S. (acquired at premium valuation; merged with Omega Healthcare Investors Inc. as of April 1, 2015), Premier Investment Corp. REIT in Japan and Prosperity REIT in Hong Kong. Lack of ownership of U.S. hotels and ownership of hotel preferreds instead also contributed to performance. The largest detractors were Campus Crest Communities Inc. (which discontinued its dividend payment), OUTFRONT Media Inc. (formerly CBS Outdoor) and Dream Office REIT in Canada (formerly Dundee REIT; subject to negative market dynamics as a result of the decline in oil prices).

From a regional perspective the Fund had more exposure to Canada, Singapore and Australia than it did a year ago. As these markets declined, the Fund added positions in them in an effort to capture what were believed to be attractive dividend yield levels, undemanding valuation in terms of low price-to-earnings (P/E) ratios and discounted valuations on a net asset value (NAV) basis. The Fund is also overweight Continental Europe

| 13 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

and less under weight Japan relative to a year ago. The funding source for these geographical changes was predominantly from the U.S. and Hong Kong, where we decreased the Fund’s exposure during the year.

From a subsector standpoint we rotated the Fund’s holdings from Hotel to Office REITs; the Fund is now less exposed to Hotel and is overweight Office REITs, versus an underweight at the start of the year.

Outlook

The current environment, one of high macroeconomic and monetary policy uncertainty dominated by political decisions, could significantly impact market direction. While this environment has existed since 2008, we believe an inflection point may be near regarding the prolonged uncertainty surrounding when the U.S. Federal Reserve Board (Fed) will hike interest rates. The rest of the world meanwhile does not appear to be near to a turning point in monetary policy. However, economies and markets are highly intertwined and interdependent. Prevailing conditions may eventually shift from a world dominated by central bank interest rates to one driven by fundamentals and determined by market forces. Such a scenario seems unlikely to become reality anytime soon. If the European Central Bank and the Bank of Japan extend their quantitative easing programs (as speculated by market participants), we think a renewed rally in those markets seems likely. We believe the Fed’s procrastination on interest rate action should continue to bode well for the real estate market in the U.S., in particular if U.S. growth is sustained.

Recent market volatility has also created new opportunities. Investors appear to view REITs in Hong Kong, Singapore, Canada and Australia less favorably than, for example, those in the U.S or Europe. Hong Kong is trading at a significant discount to NAV, having priced in the potential negative impact of an interest rate hike in the U.S., as well as weaker economic conditions in mainland China. At a certain point this valuation gap may present an attractive investment opportunity. Likewise, the fundamentals in the real estate sector seem to be gradually improving and are supported by recent policies. Canada and Australia REITs have been hurt due to exposure to oil price weakness. We believe high comparative dividend yields and valuations at discounted levels with low double digit P/E multiples may produce capital appreciation in these markets over time.

While the effect of quantitative easing deployed in Europe and Japan over the past 12 months led to the out performance of these jurisdictions, significant equity market gains eroded during the recent market correction. If quantitative easing resurfaces in Europe and Japan, we look for their market’s higher-quality holdings with less-expensive valuations to again be in favor.

While the U.S market has corrected, we believe it remains relatively expensive. However, some sectors have suffered more than others. The sell-off in Hotel and Health Care subsectors may provide stock-specific opportunities worth exploring.

The Fund remains overweight the highest yielding jurisdictions: Canada, Singapore and Australia. A recovery in the price of oil could lead to a strong re-rating of REIT markets in Canada and Australia. The Fund also is overweight Continental Europe and Japanese REITs, where additional quantitative economic stimulus could lead to higher valuations. The largest underweight positions are in the U.K., based on valuation, and the U.S., due to the potential negative impact of an interest rate hike and the low overall level of dividend yield and high valuation. From a subsector perspective, the Fund is overweight Hotel and Specialty REITs and underweight Residential and Retail REITs.

We believe higher volatility may continue in the marketplace until greater clarity around the timing of a U.S. interest rate hike emerges. We perceive the greatest risks to the markets as follows: a) a premature hike by the Fed followed by economic stagnation: b) a global recession combined with deflationary pressures; and c) increased emerging market stress.

| 14 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

Policymakers seem committed to forestalling these scenarios by deploying all sorts of monetary tools to ensure at least some level of economic growth and positive inflation. Volatility always presents new opportunities for repositioning. We will respond to market movements with new ideas at the portfolio level.

Dividend paying investments may not experience the same price appreciation as non-dividend paying instruments, dividend-issuing companies may choose not to pay a dividend, or the dividend may be less than what is anticipated.

| 15 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

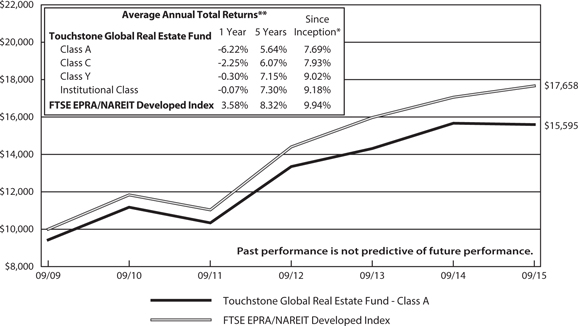

Comparison of the Change in Value of

a $10,000 Investment in the

Touchstone Global Real Estate Fund - Class A* and the FTSE EPRA/NAREIT Developed Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of the Fund was September 30, 2009. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net assets value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note To Chart

FTSE EPRA/NAREIT Developed Index measures the general trends in eligible real estate equities worldwide. Relevant real estate activities are defined as the ownership, disposure and development of income-producing real estate.

| 16 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Merger Arbitrage Fund

Sub-Advised by Longfellow Investment Management Co.

Investment Philosophy

The Touchstone Merger Arbitrage Fund seeks to achieve positive absolute returns regardless of market conditions over the long term by investing primarily in securities of companies that are involved in publicly announced mergers and other corporate reorganizations. Merger arbitrage is an investment strategy that seeks to capture the “arbitrage spread” represented by the difference between the market price of the securities of the company being purchased and the value that is offered for these securities by the acquiring company. The Fund selects securities based on proposed financing terms, the size of the transaction, anti-trust concerns, regulatory approvals and shareholder voting requirements.

Fund Performance

The Touchstone Merger Arbitrage Fund (Class A Shares) outperformed its benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, for the 12-month period ended September 30, 2015. The Fund’s total return was 0.92 percent (excluding the maximum sales charge) while the benchmark’s total return was 0.02 percent.

Market Environment

Volatility in the equity markets was unpredictable over the last 12 months, as represented by the notable fluctuations in the CBOE Volatility Index (VIX) during the period. Historically, spikes in volatility have typically created trading opportunities in merger arbitrage as spreads have temporarily widened, facilitating potentially attractive entry points.

During the period, the equity markets’ response to announced mergers and acquisitions (M&A) was generally positive, which served as a wake-up call to many companies. While historically it is common for a target company’s stock to rise on the announcement of a merger, recently the stock of the acquiring company increased on the announcement of an acquisition, which is uncharacteristic. Interestingly, as strategic M&A activity has risen substantially, the amount of leveraged buyouts, or deals by financial sponsors, has drifted lower.

The Information Technology and Health Care sectors saw particularly high levels of announced M&A activity during the period. For example, five of the largest managed care providers may consolidate to three primary providers, primarily in response to the Affordable Care Act. Additionally, the semiconductor industry experienced significant consolidation among its largest companies. Although deal volume in these sectors was significant, many of these mergers were accompanied by regulatory risks and substantially long time horizons until close.

The key drivers of the strong M&A environment during 2014 were the favorable financing environment, competitive peer pressure, impatient shareholders and the resurgence of activist investors seeking to optimize growth by capturing potential synergies. While 2014 marked one of the busiest years for M&A activity in recent history, activity through the third quarter of 2015 is already ahead of last year.

Portfolio Review

The spike in volatility that emerged in October 2014 provided merger arbitrage investors a reason to exit their positions. This allowed the Fund to redeploy idle capital into deals at widespread levels during the period, which contributed to Fund performance.

Several holdings contributed to Fund performance during the period. A failed Dutch tender offer in early 2014 from Outerwall Inc., the operator of RedBox DVD kiosks, contributed positively to Fund performance. Outerwall’s stock price rebounded during the period, which allowed the Fund to sell its position at an attractive return.

| 17 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

Another positive development regarding a broken deal from 2014 was the merger between Ainsworth Lumber Corp. and Norbord Inc., which created North America’s largest particleboard manufacturer. The deal closed in the first quarter of 2015.

The deal between Covidien PLC and Medtronic Inc. contributed to Fund performance as the spread tightened significantly from its widest levels in mid-October 2014. Investors grew skeptical of Covidien’s commitment because of the deal’s tax-inversion benefits and many investors exited the position as a result. Medtronic successfully acquired Covidien in January 2015.

Liberty Interactive Corp. spun-off of Liberty Ventures Group in October 2014. Liberty Interactive subsequently changed its ticker symbol from LINTA to QVCA in order to showcase its flagship asset, QVC Group. We believe this move may position Liberty Interactive to acquire the portion of the Home Shopping Network (HSN Inc.) that it does not already own. The Fund’s position in Liberty Interactive contributed to performance.

An ordinary investment in BallyTechnologies Inc., which was acquired by Scientific Games Corp., also contributed to Fund performance. Opportunistic trading, based on the Fund’s entry point, produced an enhanced return on an otherwise unremarkable merger transaction.

The multiple-bidder situation that emerged surrounding the eventual acquisition of Salix Pharmaceuticals Inc. by Valeant Pharmaceuticals International Inc. also contributed to Fund returns during the period.

In January, American Realty Capital Healthcare Trust was successfully acquired by Ventas Inc. in a cash and stock merger, which benefited the Fund.

The Fund’s position in Allergan PLC, acquired in March 2015 by Actavis PLC, contributed to Fund performance during the first quarter of 2015. The highly contested deal was initially exposed to potential regulatory risks as the combined company would have both product and geographic overlaps and operations in several countries. In aggregate, these risks kept the deal spread wide, thus providing an attractive return.

An otherwise unremarkable merger between Dresser-Rand Group Inc. and Siemens AG contributed to performance. A monthly “ticking fee” was triggered when the deal took longer than expected. Beginning in March, this fee was payable on the first of each month and continued through the deal’s consummation on June 30.

Talisman Energy Inc. was successfully acquired by Repsol SA during the second quarter of 2015 which contributed to performance.

In the wake of the failed merger between Time Warner Cable Inc. and Comcast Corp., the DIRECTV and AT&T Inc. merger came under fire. Investors feared that the DIRECTV deal could meet the same Federal Communications Commission (FCC) scrutiny as Time Warner, thus the spread widened accordingly. As the fears subsided, the deal’s spread gradually tightened into the end of the second quarter of 2015. This spread tightening contributed positively to overall performance. The deal ultimately closed in the summer of 2015.

The successful completion of WEC Energy Group Inc.’s acquisition of Integrys Energy Group Inc. also contributed to Fund performance. The merger required a litany of state public utility commission approvals as well as Hart-Scott-Rodino, FCC, Federal Energy Regulatory Commission approvals and SEC review of the proxy and votes from both shareholder groups.This gauntlet of approvals increased volatility in the merger’s spread, allowing an opportunistic addition to the Fund’s position.

The protracted acquisition of Hudson City Bancorp Inc. by M&T Bank Corp. – which was also the Fund’s oldest merger holding – finally earned approval from the U.S. Federal Reserve Board (Fed) on September 30, 2015. M&T Bank Corp. has nearly all of the necessary approvals in place and is expected to close in early

| 18 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

November. The spread tightened significantly on the news. As it was the largest position in the portfolio, it similarly became the Fund’s largest positive contributor to return.

CVS Health Corp. successfully acquired Omnicare Inc. in August 2015. There were narrow overlaps in the companies’ operations, which gave way to procedural caution on the antitrust front. This regulatory uncertainty offered a relatively wide deal spread, which was advantageous to Fund performance.

Pfizer Inc. acquired Hospira Inc. in September 2015, and numerous international regulatory approvals were required to complete the merger. As each approval was granted, the spread tightened and the deal moved closer to completion. In particular, there were some product overlaps in injectable medicines that were specifically scrutinized by the FTC. However, the merger was granted without required divestitures and the deal contributed positively to Fund performance.

DealertrackTechnologies Inc., a provider of software to automotive dealerships, was acquired by Cox Automotive Inc. during the third quarter. The Department of Justice determined that the merger would require Cox to divest its inventory management solution system in order for the deal to proceed. The merger’s relatively wide spread due to the regulatory concerns benefited Fund returns.

Tokio Marine Holdings Inc. continued its process of acquiring HCC Insurance Holdings Inc. in an all-cash merger. The deal spread has steadily tightened as the deal meets regulatory milestones. With each regulatory approval granted, the deal moved one step closer to completion. Several approvals were granted during the third quarter of 2015 and, consequently, the spread tightened meaningfully and contributed positively to returns.

Several holdings negatively impacted performance during the period. The Fund experienced two broken deals over the 12-month period. The first occurred in the fourth quarter of 2014.The combination of pharmaceutical firms Shire PLC and AbbVie Inc. was billed as a watershed event, with the tax inversion benefits serving as an extra benefit. AbbVie’s management team had reiterated the strategic merits of a merger with Shire and, while acknowledging the tax savings by reincorporating in Ireland, they affirmed that the tax savings were not the main motivation behind the deal. However, drastic and unilateral action by the U.S. Treasury in mid-October made the economics of an inversion less attractive. Only days after the U.S.Treasury’s action, AbbVie’s management team advised shareholders to vote against the deal, effectively terminating the acquisition. The second broken deal occurred during the second quarter of 2015. Applied Materials Inc.’s pending acquisition of Tokyo Electron Ltd. was terminated more than a year and a half after the deal was first announced. The management teams agreed to significant divestures to meet regulator demands. However, the companies voluntarily terminated the merger when it was clear that regulators felt the combined entity could still inhibit future microchip technology innovation.

A pair trade of NorthStar Realty Finance Corp. with Vanguard REIT ETF detracted from Fund performance. NorthStar was a large hedge fund holding and, as hedge fund performance faltered, client redemptions followed and managers were forced to liquidate holdings to meet redemption requests. However, NorthStar is planning a spin-off of its European properties, which remains on schedule for the fourth quarter of 2015.

An investment in Carbonite Inc., a cloud-based computer backup storage provider, also detracted from Fund performance. A significant holder of Carbonite stock, j2 Global Inc. made an unsolicited proposal to acquire the entire company. After the two companies began negotiations, j2 Global amended its proposal to acquire only the enterprise business from Carbonite, excluding the retail application service. Carbonite was unwilling to separate its business. With negotiations stalled, j2 Global cancelled its tender offer.

The utility merger between Pepco Holdings Inc. and Exelon Corp. also detracted from performance. While Maryland regulators narrowly approved the merger, regulators in Washington, D.C. had to approve it as well. Significant public outcry against the merger urged the D.C. Commission to reject the deal. Additionally, the

| 19 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

D.C. Attorney General publicly opposed the merger, as did about half of the D.C. Council and more than half of the city’s neighborhood commissions. With the substantial regulatory approval risk, the Fund exited the position.

A pending spin-off by Fiat Chrysler Automobiles NV of its flagship brand, Ferrari, also detracted from Fund performance, as investors reacted negatively to Fiat’s announced delay for the spin-off. We continue to believe in the thesis underlying this position and the Fund continues to hold the investment. The issues at Volkswagen over claims that it installed software that obstructed diesel emission test devices caused a sell-off across the auto sector near the end of the third quarter of 2015.

Outlook

We believe the rationale for M&A activity continues to remain compelling, as interest rates remain low and organic growth has been difficult. Further, corporate cash continues to be broadly deployed into financial engineering rather than research and development, which will likely leave management teams with few options for growth outside of M&A. Deal spreads in merger situations have widened somewhat from the historically tight range that investors experienced throughout 2014. Spreads appear to have settled in the mid-single digits on an annualized basis. The market is now differentiating between deals that appear riskier and those that are more straightforward. Deals with a greater amount of perceived risk are being assigned a wider spread than transactions with fewer hurdles. This is in contrast to much of 2014 when spreads did not necessarily compensate investors appropriately for the amount of risk being assumed.

Short-term interest rates remain near zero and the Fed has steadfastly defended its data-dependent position. While historically low short-term interest rates will continue to act as a headwind to the merger arbitrage strategy, we continue to believe that the strategy offers an attractive risk-reward profile and serves as a valuable diversification tool. Historically, there has been a strong positive correlation between short-term interest rates and merger arbitrage spreads. When rates eventually rise, deal spreads should be favorably impacted. We believe the idiosyncratic nature of each of the positions in the Fund’s portfolio, along with the various strategies employed, combine to create a Fund with a low overall correlation to the broad equity and fixed income indexes. We maintain our belief that the robust M&A cycle will continue to present the Fund with attractive risk-adjusted opportunities going forward.

We believe the risks going forward include a general slowdown in M&A activity, which would potentially make it difficult to diversify the Fund across an adequate number of deals. Similarly, interest rates remaining at historically low levels could act as a double-edged sword — on one hand, spreads on merger deals would remain tighter than in an environment of high rates yet, on the other hand, low interest rates could foster an environment of easy financing which helps facilitate deal-making.

| 20 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

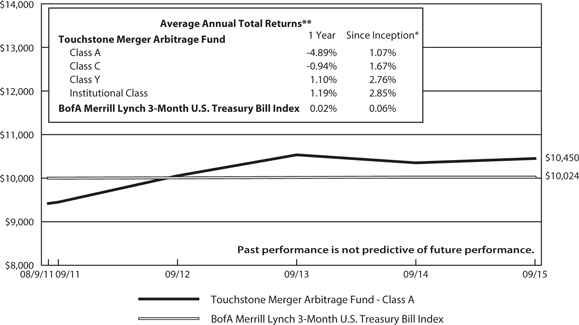

Comparison of the Change in Value of

a $10,000 Investment in the Touchstone Merger

Arbitrage Fund - Class A* and the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of the Fund was August 9, 2011. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net assets value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged index of Treasury securities maturing in 90 days that assumes reinvestment of all income.

| 21 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Mid Cap Fund

Sub-Advised by The London Company

Investment Philosophy

The Touchstone Mid Cap Fund seeks long-term capital growth by investing primarily in common stocks of mid-cap U.S.-listed companies. The Fund utilizes a bottom-up security selection process that screens potential investments against a proprietary quantitative model for return on capital, earnings-to-enterprise value ratio, and free cash flow yield. Its goal is to purchase financially stable companies that consistently generate high returns on unleveraged operating capital, are run by shareholder-oriented managements and are trading at a discount to their respective private market values.

Fund Performance

The Touchstone Mid Cap Fund (Class A Shares) underperformed its benchmark, the Russell Midcap® Index, for the 12-month period ended September 30, 2015. The Fund’s total return was -1.94 percent (excluding the maximum sales charge) while the benchmark’s total return was -0.25 percent.

Market Environment

For the one-year period, U.S. equities faced increased volatility and the long-awaited correction in the bull market finally arrived. At the center of the correction, all asset classes moved lower, as small-, mid- and large-cap stocks declined during the narrow window. Market volatility increased due to investors’ growing concerns about the potential for higher interest rates in the U.S., the rapid change in the price of oil and other commodities and slowing economic growth in China. Despite weaker investor sentiment, however, U.S. economic readings continued to reflect moderate but steady growth with low inflation.

The resiliency of growth and momentum stocks during the correction was in contrast to previous environments. During the period, small-cap stocks outperformed large-cap stocks, growth stocks outperformed value stocks, and defensive stocks outperformed cyclical stocks — all of which impacted relative market performance. However, the two biggest factors that impacted performance were quality and beta1. High quality stocks, which Standard & Poor’s defines as those with stability of earnings, outperformed low quality stocks, while low beta1 stocks outperformed high-quality stocks. Within the benchmark, the Health Care, Financials and Consumer Discretionary sectors benefited performance.

Portfolio Review

Within the Fund, sector allocation had a negative impact on relative performance, while stock selection contributed positively. At the sector level, the Fund’s underweight to Health Care and Financials and an overweight to Materials detracted from performance, which was partially offset by an overweight to the Consumer Staples and Consumer Discretionary sectors. Stock selection within the Consumer Discretionary, Materials and Industrials sectors also contributed to Fund performance but was offset by stock selection in the Health Care sector.

Among the individual stocks that contributed to Fund performance during the period were Cintas Corp. (Industrials sector), Vulcan Materials Co. (Materials sector), and CarMax Inc., Dollar Tree Stores Inc. and Tempur Sealy International Inc. (all three from the Consumer Discretionary sector). Cintas, a provider of specialized services to all business types, outperformed as the company consistently met or slightly exceeded expectations during the period. In June, the company announced that it would sell its Shred-it document business and in August announced that it would use substantially all of those proceeds in an expanded share repurchase program, which further benefited the stock. Vulcan Materials is a provider of construction aggregates and aggregates-based construction materials. The company posted positive operating results and positive growth in its end markets, plus stronger than expected pricing power and lower variable costs. Vulcan Materials also benefited from the prospect of a

| 22 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

long-term highway bill in the near term. CarMax, a used-car retailer, rallied in late 2014 after the company reported stronger than expected results. The company also benefited from same-store sales that exceeded expectations and strong traffic gains. Further, we believe CarMax is positioned well for future store growth going forward. Dollar Tree Stores, a chain of discount variety stores, rallied following the announcement that shareholders of Family Dollar Stores Inc. approved a merger with Dollar Tree. We believe the merger will create significant room for margin expansion at Family Dollar Stores going forward. Further, Dollar Tree has a history of consistent topline growth and margin improvement, which we also expect to benefit the stock. Bedding provider Tempur Sealy International outperformed for the year. In particular, performance was boosted by solid results, increased guidance from management and positive management changes. Further, the company’s strong product offering and successful advertising helped sales and earnings exceed expectations and encouraged management to raise its financial goals for the remainder of 2015. The company also appointed a new CFO and new CEO, both of whom were well received by investors.

Among the stocks that detracted from Fund performance were MBIA Inc. (Financials sector), NetApp Inc. (Information Technology sector), Deckers Outdoor Corp. (Consumer Discretionary sector), Tenet Healthcare Corp. (Health Care sector) and Atwood Oceanics Inc. (Energy sector). MBIA, a provider of financial guarantee insurance, was volatile during the year as investor concerns about Puerto Rico’s finances weighed on the stock. As a financial guarantor, MBIA has written insurance covering various municipal bonds issued by different government agencies in Puerto Rico. While the company’s exposure to Puerto Rico has been significant, we believe that the company has sufficient cash and claims-paying reserves to satisfy any potential payments. We also believe Puerto Rico and the various bondholder groups will work together on practical solutions going forward. NetApp is a provider of software, systems and services to manage and store data. The stock declined during the period due to product transitions and increased competition in the technology storage sector. The company named a new CEO as it deals with industry challenges. Going forward, we believe the company has a solid cash position and a willingness to return capital to shareholders, which we expect to benefit the stock. Deckers Outdoor, a footwear, apparel and accessories company, experienced profit taking during 2015, which followed the company’s strong rise in 2014. While the company’s earnings updates and management guidance confirmed its operating outlook, recent results have shown a decline in the company’s core UGG® brand, which renewed questions about the durability of that product line. Tenet Healthcare, a healthcare services company, declined due to the additional expense from recent acquisitions and to management maintaining its full-year outlook. However, longer term, we believe the company should benefit from additional bed capacity as implementation of the Affordable Care Act continues. Atwood Oceanics, an offshore gas and driller company, was pressured along with most of the Energy sector. The decline in energy prices and the associated reductions in the company’s capital spending also weighed on the stock. Further, weakening demand caused the company’s rig rental rates to decline and capacity utilization to run below long-term averages.

The Fund initiated new positions in Ball Corp. (Materials sector), VOYA Financial Inc. (Financials sector), H&R Block Inc. (Consumer Discretionary sector), Copart Inc. and Dover Corp. (both from the Industrials sector). Ball Corp. is a supplier of metal and plastic packaging to beverage and food industries. The company has a stable, high return-on-capital business with a management team driven by economic value added (EVA) and strong returns of capital to shareholders through dividends or share repurchases. VOYA Financial experienced improving return on equity and return on capital during the period, which was driven by its leadership position in its retirement, investment management and insurance solutions. The company’s balance sheet became stronger and management reduced risk in its investment portfolio by limiting its holdings of structured securities and raising its investment grade holdings. H&R Block, a tax preparer, generated returns significantly above the company’s cost of capital, and its large scale has allowed the company to produce solid margins. Copart is a provider of online vehicle auction and remarketing services. The company has a defensible business model with increasing competitive advantages and a sizable market share. Copart also has a large footprint, low transportation

| 23 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

costs, a large audience of buyers and high returns. Dover is a manufacturer of specialized industrial products and equipment. The company has a strong management team and high profitability, and also allocates its capital in a balanced fashion with roughly half of available funds going to growth initiatives via capital spending and acquisitions, and half going to dividends and share buybacks.

The Fund sold its positions in Atwood Oceanics Inc. (Energy sector), Reynolds American Inc. (Consumer Staples sector), Service Corporation International (Consumer Discretionary sector), ATK (prior to its split into Orbital ATK Inc. (Industrials sector) and Vista Outdoor Inc. (Consumer Discretionary sector) and Kinder Morgan Inc. (Energy sector). We trimmed positions in Cintas Corp. (Industrials sector) and Dollar Tree Stores Inc. (Consumer Discretionary sector) to fund transactions, but still have high conviction in both companies.

Outlook

While we do not attempt to forecast the future, we believe many of the headlines in today’s news will likely remain intact though year end. In particular, we expect global uncertainty and weakness in commodities, particularly in China, to remain large macro risks. The anticipation of an interest rate increase by the U.S. Federal Reserve Board and strength in the U.S. dollar could also shake up domestic equities further. In general, we expect the foreign slowdown to continue and believe stocks could be more volatile in the future.

While recent volatility has resulted in significant market declines, stocks are considered less expensive but not necessarily cheap. However, we are still finding high-conviction investment ideas, and the recent correction has increased the number of available opportunities. In addition, the strength of corporate balance sheets, high cash levels, below-average dividend payout ratios and low interest rates continued to provide flexibility for corporate management teams in terms of capital allocation and mergers and acquisitions (M&A) activity. In addition, the dispersion among the asset classes and sectors has been a welcome change from the past few years and we believe it should benefit the Fund’s stock selection going forward.

Our strategy focuses on stocks from a bottom-up standpoint. We seek companies with strong returns on capital and the flexibility to enhance shareholder value using the balance sheet. Low interest rates and relatively high equity risk premiums enable companies to increase shareholder value by adjusting the capital structure of the company. Separately, with elevated cash levels on corporate balance sheets and dividend payout ratios near historic lows, we expect investors to reward companies that wisely deploy capital including higher dividends, share repurchases and M&A transactions. Going forward, we believe the Fund is positioned well for a slow growth environment that rewards strong capital allocation.

| 1 | Beta is a measure of the volatility of a portfolio relative to its benchmark. |

Dividend paying investments may not experience the same price appreciation as non-dividend paying instruments, dividend-issuing companies may choose not to pay a dividend, or the dividend may be less than what is anticipated.

| 24 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

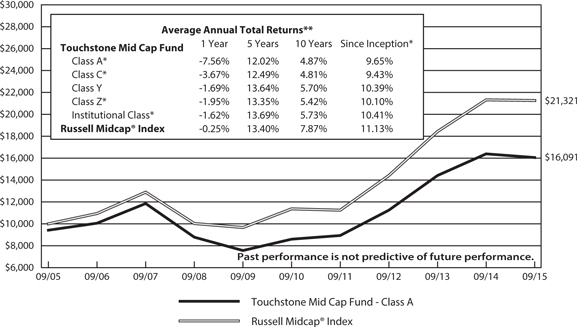

Comparison of the Change in Value of

a $10,000 Investment in the Touchstone

Mid Cap Fund - Class A* and the Russell Midcap® Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares, Class Z shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares, Class Z shares and Institutional Class shares was May 14, 2007, May 14, 2007, January 2, 2003, April 24, 2006 and January 27, 2012, respectively. Class A shares, Class C shares, Class Z shares and Institutional Class shares performance was calculated using the historical performance of Class Y shares for the periods prior to May 14, 2007, May 14, 2007, April 24, 2006 and January 27, 2012, respectively. The returns have been restated for sales loads and fees applicable to Class A, Class C, Class Z and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net assets value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares, Class Z shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000® Index.

The Frank Russell Company (FRC) is the source and owner of the Index data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

| 25 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Mid Cap Value Fund

Sub-Advised by LMCG Investments, LLC

Investment Philosophy

The Touchstone Mid Cap Value Fund seeks capital appreciation by investing primarily in common stocks of medium capitalization companies. The Fund seeks to identify companies believed to be selling at a discount to their inherent value.

Fund Performance

The Touchstone Mid Cap Value Fund (Class A Shares) outperformed its benchmark, the Russell Midcap® Value Index, for the 12-month period ended September 30, 2015. The Fund’s total return was -1.14 percent (excluding the maximum sales charge) while the benchmark’s total return was -2.07 percent.

Market Environment

The economy continued to improve in the U.S. throughout late 2014 and early 2015, as strong corporate earnings and an improving employment picture existed. However, during the second half of the period, volatility returned as slowing global growth, the U.S. Federal Reserve Board’s indecision and growing currency devaluation fears resulted in weak equity market returns. Investor questions and fears regarding China’s ultimate growth rate were magnified when the Chinese government decided to devalue the yuan after other attempts to boost the economy had not proven fruitful.

Portfolio Review

Both sector selection and security selection contributed to relative performance. The Fund’s strongest contributors to performance were reported in the Energy, Consumer Staples and Utilities sectors. Primary detractors were the Financials, Materials and Health Care sectors.

With oil prices falling 50 percent over the last 12 months, the Fund’s underweight combined with good stock selection in the Energy sector was a key contributor to performance. Favorable stock selection in the Utilities sector aided performance as AGL Resources Inc. appreciated on a proposed acquisition of the company by Southern Companies. The Fund’s overweight to the Consumer Staples sector, which historically has benefited during periods of market turmoil, helped performance. Supermarket chain Kroger Co. was a contributor, based on strong execution by management and the market’s rerating the stock higher.

Most of the Fund’s underperformance in the Materials sector was concentrated in Allegheny Technologies Inc. Allegheny declined on increased supply from China and falling demand from Energy companies. We continue to believe the stock of the company represents good value. FMC Corporation (Materials sector) detracted as inventory levels and the company’s 2016 outlook were questioned. The Fund’s underweight to the Health Care sector (particularly to the health care providers/services industry) detracted from performance, which was partially offset by good stock selection within the sector. The Fund’s ongoing underweight to real estate investment trusts (REITs) on a valuation basis hurt performance in the Financials sector. REITs outperformed in this low-interest-rate environment, while more asset-sensitive holdings, including some of the Fund’s bank names, underperformed.

There were no significant changes to the Fund’s positioning made during the year; however, the combination of the Russell reconstitution in the second quarter of 2015, with modest changes to the Fund’s portfolio, did impact some of the relative industry weights. We continue to populate the Fund with what we believe are compelling risk/reward opportunities across all of the industries in a diversified manner.

| 26 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

Outlook