UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08104

Touchstone Funds Group Trust

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: September 30

Date of reporting period: September 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

September 30, 2012

Annual Report

Touchstone Funds Group Trust

Touchstone Emerging Markets Equity Fund

Touchstone Focused Equity Fund

Touchstone Global Equity Fund

Touchstone Global Real Estate Fund

Touchstone International Fixed Income Fund

Touchstone Large Cap Relative Value Fund

Touchstone Market Neutral Equity Fund

Touchstone Merger Arbitrage Fund

Touchstone Mid Cap Fund

Touchstone Mid Cap Value Fund

Touchstone Premium Yield Equity Fund

Touchstone Sands Capital Select Growth Fund

Touchstone Short Duration Fixed Income Fund

Touchstone Small Cap Core Fund

Touchstone Small Cap Value Fund

Touchstone Total Return Bond Fund

Touchstone Ultra Short Duration Fixed Income Fund

Table of Contents

| Page | |

| Letter from the President | 3 |

| Management's Discussion of Fund Performance (Unaudited) | 4 - 57 |

| Tabular Presentation of Portfolios of Investments (Unaudited) | 58 - 62 |

| Portfolio Investments: | |

| Touchstone Emerging Markets Equity Fund | 63 |

| Touchstone Focused Equity Fund | 66 |

| Touchstone Global Equity Fund | 68 |

| Touchstone Global Real Estate Fund | 70 |

| Touchstone International Fixed Income Fund | 72 |

| Touchstone Large Cap Relative Value Fund | 76 |

| Touchstone Market Neutral Equity Fund | 78 |

| Touchstone Merger Arbitrage Fund | 82 |

| Touchstone Mid Cap Fund | 86 |

| Touchstone Mid Cap Value Fund | 87 |

| Touchstone Premium Yield Equity Fund | 89 |

| Touchstone Sands Capital Select Growth Fund | 90 |

| Touchstone Short Duration Fixed Income Fund | 91 |

| Touchstone Small Cap Core Fund | 98 |

| Touchstone Small Cap Value Fund | 99 |

| Touchstone Total Return Bond Fund | 101 |

| Touchstone Ultra Short Duration Fixed Income Fund | 106 |

| Statements of Assets and Liabilities | 116 - 123 |

| Statements of Operations | 124 - 127 |

| Statement of Changes in Net Assets | 128 - 135 |

| Statements of Changes in Net Assets - Capital Stock Activity | 136 - 147 |

| Financial Highlights | 148 - 186 |

| Notes to Financial Statements | 187 - 210 |

| Report of Independent Registered Public Accounting Firm | 211 |

| Other Items (Unaudited) | 212 - 218 |

| Management of the Trust (Unaudited) | 219 - 222 |

| Privacy Protection Policy | 223 |

| 2 |

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Funds Group Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the 12 months ended September 30, 2012.

The U.S. equity markets had a strong year, outperforming the bond market. From an investment style and market capitalization perspective, U.S. value equities slightly outperformed their growth counterparts, with small cap leading the way, followed closely by large cap. The U.S. equity markets outperformed both the developed and emerging international markets for the year. High yield bonds outperformed Treasuries and the overall bond market.

Global economic concerns continued to be in the forefront over the past year. An acceleration of the European debt crisis led the European Central Bank (ECB) to take more proactive measures to strengthen the currency bloc. Concerns over China’s ability to maintain a strong growth rate became greater during the year. U.S. economic growth waned and led to additional stimulus action by the Federal Reserve (Fed). Despite all the economic uncertainty, global capital markets generated strong performance. In the U.S., the S&P 500 Index gained significantly on strong earnings growth. International equities generated positive results over the period. Non-U.S. developed markets have been constrained by the ongoing pressures of dealing with unsustainable fiscal liabilities. Emerging markets also had positive gains over the past year as they continue to enjoy relatively high economic growth. The combination of continued Fed action and a flight to the perceived safety of U.S. Treasuries pushed interest rates to all-time lows and was a strong tailwind for bond investors.

There is much uncertainty going forward. The U.S. is faced with overcoming a large fiscal cliff of tax increases and spending cuts which risks weakening the U.S. economic recovery. Traditional income investors have benefited from strong bond returns but the low yields now available from fixed income may continue to influence investors to seek yield from other areas, including equities. U.S. and international equities are facing a slow growth environment that will create challenges in the year ahead.

Touchstone Investments helps investors achieve their financial goals by providing access to a distinctive selection of institutional asset managers who are known and respected for proficiency in their specific area of expertise. Recognizing that the mastery of all investment disciplines is beyond the scope of any one firm, the use of sub-advisors allows Touchstone to offer an array of strategically focused mutual funds across styles and asset classes. Touchstone employs a rigorous due-diligence process in sub-advisor selection and performs robust oversight and monitoring of its current sub-advisors.

When we examine where the financial markets may be headed in the year to come, we continue to believe that diversification is essential to balancing risk and return. We recommend that you continue to work with your financial professional on a sound asset allocation strategy to help keep your financial goals on course.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Funds Group Trust

| 3 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Emerging Markets Equity Fund

Sub-Advised by AGF Investments America, Inc.

Investment Philosophy

The Touchstone Emerging Markets Equity Fund seeks capital appreciation by primarily investing in equity securities of companies in emerging markets. It seeks to invest in businesses believed to be mispriced by the market and that are expected to generate positive and sustainable earnings growth.

Fund Performance

The Touchstone Emerging Markets Equity Fund (Class A Shares) slightly underperformed its benchmark, the MSCI Emerging Markets Index for the 12-month period ended September 30, 2012. The Fund’s total return was 16.71 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 16.93 percent.

Market Environment

Emerging markets were volatile but ended the period on a high note, as developments in Europe’s sovereign fiscal predicament swayed equity markets. European governments provided liquidity to prevent further escalation of the funding crisis, lifting markets. This short-term liquidity held off a decline, but an escalation of issues in Greece and Spain threw more uncertainty into the mix, leading to questions surrounding the long-term credibility of the European Union (EU). Most recently, substantial policy measures and long-term plans for stability helped markets, particularly the European Central Bank’s (ECB) Outright Monetary Transactions (OMTs) and the U.S. Federal Reserve’s third round of Quantitative Easing (QE3). Growth among developed markets remained constrained but the U.S. continued its modest recovery, particularly its housing industry.

In the Europe, Middle East and Africa (EMEA) regions, returns were mixed, although the stock markets in the larger economies of South Africa, Turkey and Russia posted double-digit returns. South African economic growth recovered after declining in the first quarter of 2012, with manufacturing production also declining as strikes affected the sector. Most recently, a series of labor-related issues have impacted mining firms and caused output disruptions. Turkish policymakers kept the benchmark repurchase rate stable throughout the 12-month period, as inflation continued to remain a concern. However, on a positive note, both consumer and producer price inflation have come down recently, and unemployment has also declined. The Fund had no exposure to Russia.

The smaller regional economies of Thailand and the Philippines led gains in Asia. China exhibited resilience after making cuts to its benchmark lending and deposit rates, with its manufacturing sector activity remaining relatively stable. Retail sales growth continues to remain strong, although it is slowing. Thailand recovered faster than expected from the disastrous flooding to post strong gains. In Taiwan, growth projections were revised downward due to weaker international trade. India’s growth slowed during the period, although the government has recently moved to implement a series of pro-investment policies as well as infrastructure spending to spur domestic growth. Economic growth in South Korea has trended downward during the past 12 months, but unemployment has remained at multi-year lows.

For the period, Latin America gained, with Mexico and Peru’s markets rising significantly. Brazil’s market was largely flat, as it saw a slowdown in economic growth. However, the government put into place broad economic reforms to stimulate growth, and successively cut the benchmark SELIC rate (Brazil’s central bank’s overnight rate) to record lows as well. Peru and Mexico maintained most of their growth momentum, with Mexico posting solid growth despite slowing demand from the United States. Inflationary pressures in the region have remained

| 4 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

minimal, which is conducive for growth or further easing. Peru saw declining consumer prices, and the country’s central bank kept its reference rate at 4.25 percent, as the labor market remains relatively healthy with declining unemployment.

Portfolio Review

For the period, the Financials, Consumer Discretionary and Energy sectors contributed to Fund performance, while the Industrials sector detracted from performance. Exposure to the Financials sector contributed significantly toward returns, although an underweight to the sector slightly detracted. Thai bank KasiKornbank Public Company Ltd. showed rising net interest and non-interest income. Corporate tax reductions for 2012 also helped results improve, resulting in rising earnings on a per-share basis. Non-performing loan ratios as well as their related coverage ratios have improved. China Overseas Land & Investment Ltd. contributed to performance after revising its sales target for 2012 substantially upward, with further landbank acquisitions likely ahead. Mexican Grupo Financiero Banorte S.A. de C.V. contributed to performance, as net income rose strongly, partially assisted by the bank’s merger with Ixe Grupo Financiero S.A. de C.V. The Wharf (Holdings) Ltd. also contributed to the Fund’s performance. Wharf’s earnings rose as it continued to expand its operations into China. The firm looks to increase its portfolio of investment properties, and has already met its annual sales target in China. Credicorp Ltd. continued to show solid growth, growing its loan book and its retail business.

Improving wages for South African consumers and an increase in gross margins helped drive earnings higher for Woolworths Holdings Ltd. Operating margins increased, allowing profits before tax and total dividends to increase as well. The Foschini Group Ltd. also benefited from the improving consumer environment in South Africa. Retail turnover and earnings-per-share rose in double digits, resulting in an increase to dividends per share as well. The largest bicycle manufacturer in the world by revenue, Giant Manufacturing Company Ltd. contributed to performance. Sales continue to be regionally well-diversified with its global sales network of over 10,000 shops. In Brazil, Lojas Renner S.A. and Lojas Americanas S.A. contributed positively to performance, after each saw increases to same store sales, generating solid net income.

Security selection contributed to the Fund’s performance in the Energy sector. Thai company PTT Exploration & Production PCL showed that net income increased. The company benefited from a reduced corporate tax rate, and acquired Cove Energy PLC. PTT Exploration & Production beat out Shell PLC to control Cove’s share of a substantial gas discovery. Steel pipe manufacturer for the oil and gas industry, Tenaris S.A., saw growing demand for piping in more complex applications, with lower material costs and improved efficiency. Thai Oil PCL saw strong domestic demand. Demand for bitumen rose due to flood reconstruction activity, and refinery utilization remained high. No exposure to OGX Petroleo e Gas Participacoes S.A. also contributed to performance.

Security selection in the Industrials sector detracted from Fund performance. Turkish glass manufacturer Trakya Cam Sanayii AS was affected by rising costs that included higher natural gas pricing. However, we believe growing structural demand for automobile glass and construction activity, as well as the company’s regional expansion, look positive for the long term. In China, softer manufacturing activity resulted in poor performance for Weichai Power Company Ltd., which affected sales of heavy-duty trucks. However, the company continues to be an industry-leader, and we believe is likely to benefit from improvements in economic growth. Indian power plant equipment manufacturer Bharat Heavy Electricals Ltd. was affected by slowing economic growth in India, as well as a depreciating rupee and competitive pressures. South Africa’s economic slowdown and delays in the government’s infrastructure program negatively affected Aveng Ltd.’s businesses, although its mining and manufacturing operations improved.

For the twelve-month period from a regional perspective, the Fund’s exposure to Brazil, Argentina, Mexico and Peru contributed in Latin America. In Asia, holdings in India and South Korea detracted from performance,

| 5 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

while exposure to Taiwan and Thailand contributed. China/Hong Kong contributed to performance somewhat. In the EMEA region, exposure to South Africa contributed, while Turkey detracted.

During the twelve-month period, the Fund’s position in Consorcio ARA S.A.B. de C.V., the fourth largest homebuilder in Mexico, was removed from the Fund’s portfolio. As the demand for housing, particularly in the lower income segment is expected to continue to grow, Consorcio’s track record of managing growth and maintaining a healthy balance sheet since the mid-1990s, positioned the company well to benefit from this secular trend. Despite generally rising affordability in the population, the recent growth in mortgage lending among lending institutions has been lower than expected, creating challenges for the company’s top line growth. With rising costs adding pressure to existing earnings margins, rising inventory levels, and a substantial deterioration in its working capital ratio through the addition of leverage, the company faced increasing headwinds to future incremental growth which would raise the company’s overall cost of capital, thus eroding the cash flow return on investment (CFROI) track record that is emphasized in the Fund’s process. The Fund also exited the position in Infosys Ltd., due to weakening fundamentals and earnings visibility, as well as rising pricing pressure.

Outlook

Global economies have decelerated, with developed markets in Europe showing severe levels of unemployment. The U.S. labor market is another cause for concern, although economic growth has been more resilient. In light of these conditions, as well as rising costs, emerging markets have seen earnings significantly revised downward. Consequently, emerging market policymakers have focused on cultivating domestic growth, either through government spending or expansionary monetary policy to boost domestic investment. In particular, we believe China retains significant potential to spur growth, with healthy balance sheets and minor inflationary risks, once leadership changes hands. Although earnings have come under pressure in emerging markets and profit margins have declined in some sectors, we believe long-term, emerging markets remain structurally sound.

While the short-term credibility of the euro has been positively addressed by the ECB’s OMT plans, long-term viability of the European Union continues to remain a concern and could easily disrupt financial markets if political issues arise. On a more optimistic note though, politicians and policymakers are working toward increased fiscal and political integration, which we believe would help reduce sovereign yields and improve global liquidity.

The U.S. elections and fiscal cliff will also pose some uncertainty going forward, and changes in Europe and the U.S. will impact emerging market growth. While developed markets work out their structural issues, emerging markets are experiencing faster improvements in demographics, rising incomes and healthier government finances. We believe these factors will most likely play out positively for long-term investors in these regions. Given their history as key sources of growth, current capacity and future propensity for growth, emerging markets will likely continue to do well.

We seek to identify companies that have created substantial economic value-add in the past and are believed to have the potential to continue doing so going forward. While security selection is key, uneven regional growth will play a role in determining which companies will benefit most, especially as policymakers take action to either preserve or enhance growth. We believe that companies with the ability to create value in light of these regional differences should be in the best position to reward the Fund’s shareholders over the long term.

| 6 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

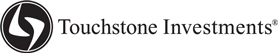

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Emerging Markets Equity Fund - Class A* and the MSCI Emerging Markets Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The Fund commenced operations on September 30, 2009. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges, if applicable. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance.

| 7 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Focused Equity Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Focused Equity Fund seeks capital appreciation by investing in equity securities of companies of any size.

Fund Performance

The Touchstone Focused Equity Fund (Class A Shares) underperformed its benchmark, the Russell 3000® Index for the 12-month period ended September 30, 2012. The Fund’s total return was 26.46 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 30.20 percent.

The Fund underperformed its benchmark over the past 12 months as the market was driven by a small subset of large capitalization, high quality companies that paid a significant dividend. The Fund had an underweight in those types of businesses as we did not find valuations to be attractive within our process.

Market Environment

For the one year ending September 30, 2012, investor optimism increased as the U.S. and European Central Bank (ECB) took action to support their economies. The positive move in the market was broadly based with the Consumer Discretionary, Telecommunication Services, and Financials sectors providing the leadership. The Utilities, Consumer Staples, and Energy sectors underperformed the Index.

Portfolio Review

Sectors that outperformed their respective peers included Industrials, Financials, Materials, Consumer Staples and Consumer Discretionary. Underperforming sectors included Information Technology, Health Care, Telecommunication Services, and Energy. The performance in each sector was driven by stock selection.

Stocks adding the most to performance were Allstate Corp. (Financials sector), Universal Forest Products Inc. (Industrials sector),Time Warner Cable Inc. (Consumer Discretionary sector), Oshkosh Corporation Inc. (Industrials sector) and Cemex S.A.B. de C.V. (Materials sector). This outperformance was driven by a combination of strong fundamentals and attractive valuation. Stocks detracting from performance included WellPoint Inc. (Health Care sector), Nokia and Hewlett-Packard Co. (Information Technology sector), Alliant Techsystems Inc. (Industrials sector) and North American Energy Partners Inc. (Energy sector).

During the past 12 months, the Fund’s weight in the Consumer Discretionary, Consumer Staples and Energy sectors increased. The Fund’s cash position also increased to almost 5% of fund assets. The Fund’s weight in the Information Technology, Financials and Materials sectors was reduced. The Fund’s weight in international companies has dramatically decreased.

In general, as the market moved higher over the past 12 months, more opportunities in businesses that have been able to consistently earn high returns on capital that also enjoy higher barriers to entry were found. Those types of businesses have increased from about 10% of Fund holdings to nearly 40% over the past 12 months.

Outlook

Markets do not largely go up after issues are solved. Rather, they rise as issues begin to improve. By the time issues are solved it is generally too late to invest heavily in equities as the market has already climbed the “wall of worry.” There is still more climbing to do with worries over third quarter of 2012 earnings, China, Europe and the U.S. fiscal cliff. Notably, earnings estimates for the domestically-oriented companies are, on balance, increasing which means the drag is global in nature on the earnings front. Importantly, at this juncture credit

| 8 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

conditions have improved since late last year in the U.S. and global PMIs (Purchasing Manager Indices) are moving upward. Moreover, Europe was priced nearly at replacement cost in mid-2012 and European markets are improving as Mario Draghi, President of the ECB pledged to use the full force of the ECB’s balance sheet to suppress European bond yields; and the U.S. markets are priced for the most likely scenario of a 1.5% drag with regard to the “fiscal cliff,” which implies that a reasonable real Gross Domestic Product (GDP) forecast for 2013 is approximately 2%. With China, there are signs that the economy may have bottomed out based on infrastructure investments, new housing starts, real retail sales, manufacturing PMI, and construction machinery sales. The point is, things are either moving in the right direction, or the market is priced for a “most likely” scenario in the case of the U.S. fiscal cliff situation.

That said, we continue to believe that fair value for the U.S. market is north of current prices as the S&P 500 is not yet priced for long-term Earnings per Share (EPS) growth of 7%, which is the trend-line since the late 1920s. Beyond this, credit cycles drive things in the shorter-term to a point where inflation stops the bull-market-we are not there yet. Typically, markets hit the bottom based on fears of deflation and reach the top based on expectations of higher inflation. Inflation rising through 4% resulted in material corrections in equity prices in 1968, 1973, 1987, 2000 and 2007. The “wall of worry” is climbed as inflation expectations go from 0 to approximately 4%. This must be kept in the context of what drives things longer term, which is demographics (i.e. labor force growth), and productivity, which drives economic growth which in turn drives revenues for companies.

As a result of our view that the market is still not at fair value and the belief that we still have some deeper value opportunities that have not reached their full potential, the Fund is still tilted toward a scenario where we believe it should outperform as the “value” style does well. However, we added several higher return on capital type businesses during the last two quarters. At this juncture, 100% of the Fund is in businesses that we believe have a barrier to entry. In addition, the weighted average return on capital of the businesses in the Fund is the highest it has ever been at well north of our calculation of the cost of capital.

| 9 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

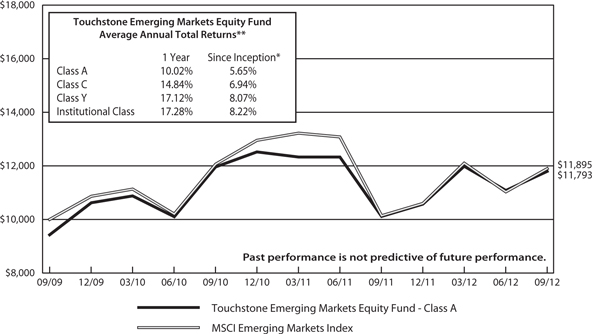

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Focused Equity Fund - Class A* and the Russell 3000® Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The Fund commenced operations on December 31, 2009. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges, if applicable. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance.

| 10 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Global Equity Fund

Sub-Advised by Bedlam Asset Management plc

Investment Philosophy

The Touchstone Global Equity Fund seeks capital appreciation by primarily investing in U.S. and foreign equity securities including those of emerging market countries regardless of market capitalization, sector or country with reasonable sector limitations.

Fund Performance

The Touchstone Global Equity Fund (Class A Shares) underperformed its benchmark, the MSCI All Country World Index for the 12-month period ended September 30, 2012. The Fund’s total return was 17.17 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 20.98 percent.

Market Environment

Strong gains in the equity markets were driven by the massive, unlimited, monetary stimulus packages by central banks globally. These were provoked by a deteriorating macroeconomic backdrop, with Gross Domestic Product (GDP) growth slowing and several major countries returning to recession in the second and third quarters of the year. Moreover, the eurozone crisis rumbled on, plaguing credit markets in Spain and Italy, and sent Greece into a spiral of contraction. The Federal Reserve’s (the Fed) third Quantitative Easing (QE3) program was the most aggressive yet. In contrast to QE1 and QE2, this time it is unlimited in size, open ended in nature, and has an overriding objective of reducing unemployment to a lower level. In addition to “Operation Twist,” the Fed will start buying $40 billion per month of Mortgage-Backed Securities (MBS) until the U.S. job market substantially improves. The aim is to drive down long-term rates, thereby increasing the value of homes, stocks and other financial assets. The hope is that it will push households and businesses into spending, investing and hiring.

Portfolio Review

For the 12-month period, gains were spread across all but two sectors, with two of the largest relative overweight sectors, Consumer Staples and Health Care, providing the largest contributions to performance. In the case of Consumer Staples, several stocks were sold as valuations hit their target prices. Sara Lee Corp. was broken up into its constituent parts, DE Masterblenders 1753 NV and Hillshire Brands Co. and, as we believed their value was unlocked; both of these stocks were sold. Cott Corp. saw a boost to margins from easing input costs and bounced upward from its November lows. Henkel AG & Co. performed well as management raised its revenue and growth targets for household products and adhesives. Estimates were revised up and the Fund took some profits as the stock progressed towards the target price. Treasury Wine Estates Ltd. was sold after rising when it was spun out of Foster Group Ltd. in 2011.

The Fund’s Health Care sector holdings performed well for a variety of reasons. Celgene Corp. benefited from positive trial results for its psoriasis drug, Aprimelast, and buoyant sales growth for its main product in the market, Revlimid. Pfizer Inc. was the best performer, benefiting from the disposal of its nutrition business and ongoing restructuring actions. The sector gains came in spite of a disappointment for Bristol Myers Squibb Co., which fell on the announcement that it had suspended the trial of a Hepatitis-C drug. Unlike Consumer Staples companies, we believe Health Care companies generally remain undervalued.

The Fund’s bias leans towards “undervalued growth” and, although it had a negligible weight in the Financials sector during the year, it was unable to keep pace with its benchmark, as it was more heavily weighted towards financial and cyclical sectors, which benefited from the aggressive quantitative easing.

| 11 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

The main detractors to Fund performance were in the Energy and Financials sectors. The Fund remains positioned with a bias towards natural gas over oil in the Energy sector, due to the large discount at which this commodity trades versus its history, and versus oil. While this meant that U.S. gas stocks, Ultra Gas Inc. and Southwestern Energy Co., came under pressure as gas prices neared all-time lows, they benefited from a sharp correction, which we expect to continue as supply becomes increasingly constrained by reduced drilling. The Fund continued to avoid mainstream Financials stocks, as deleveraging continued in the developed world and interest margins remained compressed by the abysmal central bank funding rates. The two Financials stocks held in the period had mixed results. F&C Asset Management PLC saw some gains as its institutional funds performed well, but was sold when it became clear that a large proportion of its assets under management were likely to disappear after lock-up periods ended. SBI Holdings Ltd., the Japanese retail brokerage, continued to suffer from low trading volumes and market volatility, which we believe should eventually reverse and provide a welcome boost. At the stock level, two of the top three contributors to performance were gold miners, Yamana Gold Inc. and Fresnillo PLC. After a precipitous fall in the gold price in December of 2011, the stocks rebounded strongly, nearing all-time highs, and some subsequent profit-taking made sense.

Outlook

Given the continued backdrop of low growth and rising inflationary pressures, we believe the ability of companies to gain market share and pass on cost inflation will remain crucial in sustaining profitability. As such, the quality of company management is imperative. The Fund’s investment strategy will remain focused on undervalued companies that have sustainable franchises and identifiable earnings catalysts that can drive earnings growth without excessive debt. While we believe equity markets will remain highly volatile, we believe the basic tenets of investing remain unchanged – valuations still matter.

If, as we expect, Quantitative Easing doesn’t stimulate global growth, then the preferred commodities will be precious metals and those where we believe supply is being constrained (agriculture and U.S. natural gas). We believe the likely fallout from continued large commodity price swings will need to be closely monitored; for example, consider the grain market. We believe the huge price spikes will force bread and meat prices upwards in 2013. This will more than likely compress disposable income, most notably in emerging countries such as China. Increasing cost inflation is happening at the same time as growth is slowing across many big emerging market economies (e.g. Brazil, China and India). Not surprisingly, the Fund continues to find cheaper and often better managed exposure to emerging markets through companies listed in developed markets. Consequently, the Fund’s portfolio has just an 8 percent exposure to emerging markets based on where companies are listed, but 36 percent when evaluated on where companies generate their profits.

| 12 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Global Equity Fund - Class A* and the MSCI All Country World Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The Fund commenced operations on September 30, 2009. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges, if applicable. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance.

| 13 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Global Real Estate Fund

Sub-Advised by Cornerstone Real Estate Advisers LLC

Investment Philosophy

The Touchstone Global Real Estate Fund seeks capital appreciation by primarily investing in common stocks and other equity securities of U.S. and foreign real estate companies. Fund management utilizes a core research approach that combines top-down macroeconomic, capital and property market analysis with bottom-up understanding of local real estate and operational capacity to evaluate both property sectors and individual companies.

Fund Performance

The Touchstone Global Real Estate Fund (Class A Shares) slightly underperformed its benchmark, the FTSE EPRA/NAREIT Developed Total Return Index, for the 12-month period ended September 30, 2012. The Fund returned 29.15 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 29.65 percent.

Market Environment

Global equity markets were volatile during the period as market sentiment shifted continuously on macroeconomic fundamentals, the sovereign debt crisis in Europe, and the timing of central bank actions globally. Ultimately, global equity markets ended up strongly on the back of continued central bank actions to provide liquidity.

Global real estate securities were able to display their unique characteristic as dividend payers with a growth component during the period. In an upward trending market supported by improved macroeconomic outlook and global central bank actions, the sector was able to keep up with other global equity indices. Economic growth can be reflected in rising rents while increased liquidity/lower interest rates serve to reduce funding cost for this capital intensive business, which is favorable. These factors may contribute to yield compression and higher valuations. On the other hand, in a downward trending market, the sector may exhibit defensive characteristics due to its dividends.

Within the global real estate securities benchmark (“Index”), Asia was the strongest region followed by North America. Within Asia, Hong Kong and Singapore were strong performers. In North America, both the U.S. and Canada had strong returns. As expected, Europe significantly underperformed as no European country outperformed the Index.

Portfolio Review

For the period, the Fund benefited from a strong overall contribution from Singapore as well as stock selection in the U.S., Japan, and the U.K.

The Fund consistently held an overweight position in Singapore based on its market maturity as well as the solid fundamentals and healthy dividends offered by the country’s property stocks. During the period, Singapore significantly outperformed the Index. In terms of stock selection in Singapore, Fortune REIT stands out as the top contributor. Fortune REIT is a Hong Kong retail company with dual listing in both Hong Kong and Singapore, with shopping centers largely located in residential neighborhoods catering to daily necessities. We invested in this out-of-index holding due to its yields, stable business, and potential for yield accretion from asset enhancements. In the U.S., an overweight position in Extra Space Storage, Inc. contributed substantially as the stock benefited from solid earnings and guidance. Japan’s contribution came mainly from an overweight position in the developers as the sector rallied due to reflation hopes on the back of the Bank of Japan’s introduction of an inflation target. The Fund’s relative weight in the two largest Japanese Real Estate Investment Trusts (JREITs), Japan Real Estate Investment (overweight) and Nippon Building Fund, Inc. (underweight) also contributed positively to performance. In the U.K., Derwent London PLC and Great Portland Estates PLC were among

| 14 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

the top performers. These two companies focus on the London West End office market, which is probably one of the strongest global real estate markets as there is healthy demand for space and for investment property with limited new supply due to development constraints. Both companies profited from the attractive characteristics of this underlying market. With their development pipelines they offer high quality space to tenants and investors in a constrained market. We also believe these companies have strong management teams and solid balance sheets, thus adding to our conviction.

Some detractors to performance were overall decisions in Hong Kong/China, stock selection in Germany, and an allocation decision in the Netherlands. In Hong Kong/China, performance was impacted by an unforeseen corporate governance event at Sun Hung Kai Properties in Hong Kong earlier in the period and an underweight position in the lower quality Hong Kong developers, which rallied later in the period. However, an overweight position in the high quality China Overseas Land & Investment Ltd. contributed significantly to performance, erasing a good portion of the stock selection struggles in Hong Kong/China. Negative performance in Germany was driven primarily by one stock, alstria Office REIT. This name worked well when it was initially made an investment in the fourth quarter of 2011 as a good defensive play in a negative, sentiment-driven market. Alstria was negatively impacted by profit taking following strong 2011 performance as well as an equity deal to finance the acquisition of a German office portfolio. As for the Netherlands, the Fund was overweight the country partly due to a quality bias in the region but it underperformed the Index significantly, which detracted from performance.

During the fiscal year, we shifted the Fund’s portfolio allocations proactively based on our macro fundamental views as well as valuation levels. Earlier in the period, we became comfortable with the improving global macro fundamental outlook as well as limited downside from global central bank backstop and shifted the Fund to a pro-cyclical tilt favoring Asia. As the period progressed, the global macro outlook began to deteriorate, particularly in the U.S. and China, and there were ongoing concerns about Europe and the effectiveness of global monetary easing. While recognizing the global central banks’ willingness to provide liquidity and support the economy, the Fund’s portfolio was gradually “de-risked.”

Outlook

Despite the recent weakness in the global economic outlook, we believe the coming year has the potential for slow but steady growth. Central banks around the globe have acted to provide necessary liquidity to support the global economy, which should slowly work its way into the system. An improving U.S. housing market could also be a catalyst into 2013. This environment is conducive for continued steady demand for commercial real estate. Modest economic growth rate should keep financing costs low for quite some time. These factors combined with limited new supply in most global real estate markets should lead to solid cash flow growth and provide valuation support for global real estate securities companies.

We believe the positive catalysts present in the markets should support equity valuations in the medium term, but we continue to closely monitor a number of significant risks ranging from slowing global growth, U.S. fiscal challenges, deterioration in the European sovereign debt issues, a hard landing in China, and instability in the Middle East, any one of which could impact equity markets in the near term.

The Fund has taken a marginal defensive characteristic to weather the short-term volatility. We believe the Fund is still positioned to capture the positive medium term catalysts seen in real estate fundamentals.

| 15 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Global Real Estate Fund - Class A* and the FTSE EPRA/NAREIT Developed Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The Fund commenced operations on September 30, 2009. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges, if applicable. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance.

| 16 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone International Fixed Income Fund

Sub-Advised by GAM International Management Ltd.

Investment Philosophy

The Touchstone International Fixed Income Fund seeks total return by investing primarily in fixed income securities of issuers located outside the United States. Fund management selects foreign country and currency compositions based on an evaluation of various macroeconomic factors including relative interest rates, exchange rates, monetary and fiscal policies, economic growth, employment, trade and current account balances. Management invests core holdings in developed market government bonds and currencies with tactical allocations to alpha-generating sectors: investment grade corporate bonds, emerging market bonds, high yield bonds and convertible bonds. Currencies are actively managed in order to manage risk and enhance returns.

Fund Performance

The Touchstone International Fixed Income Fund (Class A Shares) outperformed its benchmark, the Citigroup World Government Bond Index ex-U.S. for the year ended September 30, 2012. The Fund’s total return was 6.24 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 3.46 percent.

Market Environment

Over the past twelve months the market entered a period of heightened volatility as a result of significant changes in economic sentiment. Risk assets had a very strong start to the New Year, including lower-grade credit and convertibles, which benefited from strong risk appetite. This appetite spread to sovereign names that had near-pariah status last year, notably Ireland and Italy.

Within the global bond markets the major features during the first quarter of 2012 were weakness of U.S. Treasuries, a strong recovery in Italian debt prices and continuing excess returns from credit. Inflation-protected bonds performed well as hopes for economic recovery and high energy prices drove demand. Economic developments during the second quarter continued the pattern of mixed data with a moderate negative bias. Uncertainties over the outlook for the eurozone currency bloc continue to undermine sentiment amongst households and businesses. Up until the end of the second quarter there was a flight to quality from a ‘risk-off’ backdrop. The third quarter was again shaped by politics from both sides of the Atlantic. In July, core government bonds rallied through the month as concerns mounted over the level of yields in Spain and Italy. However, European Central Bank (ECB) President Mario Draghi’s unexpectedly firm commitment to do “whatever it takes to preserve the euro,” together with better U.S. economic data, led to a reversal in performance. This statement continued to boost peripheral European debt in August. Conversely, France, Austria and the Netherlands posted the worst returns among the region’s sovereign markets. Promises of further Quantitative Easing (QE3) measures from the Federal Reserve (the Fed) and an extension of the low interest rate policy saw risk assets rally strongly during September, including corporate and high-yield debt. This boosted currencies like the Euro at the expense of the U.S. dollar, as well as helped peripheral bonds for most of the third quarter. The Fund held overweight positions in the Mexican Peso, Korean Won, Sterling and some Scandinavian countries during the period.

Portfolio Review

The key drivers of the Fund’s outperformance versus the benchmark during this period were the spread contraction and Forex Index overlay, each factor contributing handsomely. In addition, the overweight, long maturity to Italy, the allocation to Convertible bonds and allocations to Latin American Emerging Market currencies out of the Yen contributed to performance as well. The recovery in Norwegian export credit insurer Eksportfinans ASA’s bonds, which were junked following the decision by the companies’ owners to put the organization into run-off, also contributed to the positive performance. Factors that also contributed to the Fund’s performance,

| 17 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

in addition to the safe haven block (U.S., U.K. and Germany), were the underweights to France, Italy and Spain, although a higher duration in safe haven currencies would have helped. The continuation of the European debt crisis led to a strengthening of the U.S. Dollar (USD), which created a headwind for the Fund. It was positioned for stronger global economic growth that was beneficial in the first and third quarters of 2012, but led to weaker results in the second quarter, which detracted from Fund performance for the period.

Outlook

We believe the range of possible outcomes for the European Union (EU) and the Euro, for Iran and Israel, for China economic growth and U.S. politics/fiscal outcomes remains as diverse as ever. The European Central Bank’s new Outright Monetary Transactions (OMT) program can provide a floor for the performance of the up-until-now distressed bonds, and their rally has already begun. The optimism that the ECB sovereign support program initially created has come increasingly into question, as Spain dithers over whether to request a formal program and the fiscally responsible northern European countries seek to impose increased conditionality to avoid inflationary monetary financing. While we accept that pragmatism rather than strict adherence to legal obligations has become a hallmark of official policy actions in many countries since the global financial crisis broke, we remain concerned that markets are not fully discounting the significant tail risks which Europe presents.

Investment grade credit appears, at best, fairly valued, while many parts of the market formerly known as high yield now seem to be merely junk bonds with a modest spread. We remain deeply skeptical of the current fashion for emerging market corporate issuance. Looking forward we expect bond yields to re-converge – higher yields in core and lower yields in periphery – creating what we believe to be relative value opportunities. Further, we believe the spotlight will switch away from Europe, for once, onto the U.S. elections that will take place in November of 2012.

| 18 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

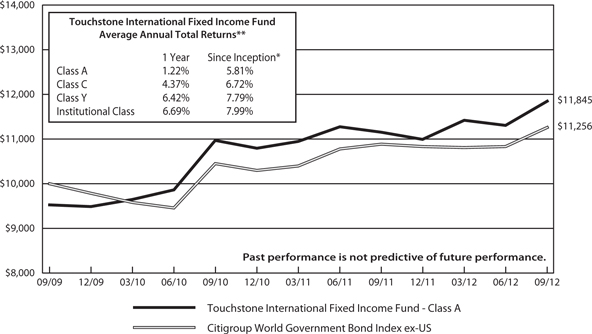

Comparison of the Change in Value of a $10,000 Investment in the Touchstone International Fixed Income Fund - Class A* and the Citigroup World Government Bond Index ex-US

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The Fund commenced operations on September 30, 2009. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges, if applicable. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance.

| 19 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Large Cap Relative Value Fund

Sub-Advised by EARNEST Partners LLC

Investment Philosophy

TheTouchstone Large Cap Relative Value Fund seeks capital appreciation by investing in stocks of large capitalization companies. The Fund seeks to identify stocks based on their financial characteristics and current environment including valuation measures, market trends, operating trends, growth measures and profitability measures.

Fund Performance

The Touchstone Large Cap Relative Value Fund (Class A Shares) underperformed its benchmark, the Russell 1000® Value Index for the 12-month period ended September 30, 2012. The Fund’s total return was 24.28 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 30.92 percent.

Market Environment

Despite ongoing volatility, global equity markets posted strong returns for the 12-month period ending September 30, 2012. The first half of the year was a reversal from what had been experienced for the previous 12 months. Overall sentiment was positive again as economic indicators in the U.S. came in better than expected, U.S. unemployment fell to 8.2 percent and the European Union (EU) formulated additional plans to help at-risk nations avoid default and provided liquidity to the region. In Europe, coordinated efforts to provide liquidity support to the global financial system by making it easier to exchange currencies was announced. The European Central Bank (ECB) also announced that it would lend over €500 billion to financial institutions in the region, further reducing liquidity risk for the eurozone banks and, in March, Greece moved forward with a debt restructuring that paved the way for additional international aid. The restructuring provided some immediate relief as the country continued the task of bringing its budget back into balance.

Then, as we reached the mid-point of the period, the progress in Europe was short-lived. Continued political disagreements, along with the Greek government’s inability to elect a government in early May, raised the likelihood that rescue efforts would not be enough and Greece might ultimately leave the eurozone, which led to a significant decline in global equity markets. A second election in mid-June, though, seated a pro-Euro government, easing those concerns for the time being. However, investor worries shifted to the impact these events would have on Spain and Italy. In response to the escalation of the crisis in Europe, EU member nations proposed a $125 billion aid package to Spain, and the ECB moved to accept a wider range of collateral to aid in bank funding. In late June, officials at the EU Summit agreed to allow bailouts to come directly from the jointly funded European Stability Mechanism (ESM) and that the aid would be subordinate to existing bond holders – which resulted in an immediate reduction in yield on both Spanish and Italian debt. Towards the end of the period market performance again turned positive as moderating fears regarding the European debt crisis and continued monetary support within the U.S. and Europe took hold. The ECB made clear that it would take whatever steps necessary to keep the Euro intact. The ECB’s new framework for buying sovereign debt of member nations gained traction once Germany provided its support. German chancellor Angela Merkel, with further affirmation by the German constitutional court, approved the plan at the end of the period.

In the U.S., the economy continued to post sluggish growth, but the housing market has been a relative bright spot with improving sales of new and existing homes, and prices beginning to show year-over-year increases after years of decline. The unemployment rate remains near 8 percent. The Federal Reserve (the Fed) announced plans for another round of Quantitative Easing (QE3) consisting of monthly purchases of $40 billion in Mortgage-Backed Securities (MBS), without a definitive termination date, in order to keep mortgage and other borrowing rates low. The Fed also pledged to keep its target fed funds rate at current levels until mid-2015,

| 20 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

an extension from the previous target of 2014. Despite pricing pressures, the U.S. inflation rate, as measured by the Consumer Price Index (CPI), remains a low 1.7 percent, below the long-term average and well within the Fed’s comfort zone.

Portfolio Review

The market was volatile for the period as investors balanced negative data (the European Financial Crisis, slower growth in the Emerging Markets, and a still-weak employment environment in the U.S.) with more positive data (Chinese government stimulus activity, strengthening U.S. housing, and the Federal Reserve’s additional Quantitative Easing, QE3). Because of the fluctuating investor sentiment throughout the year, consistent trends have been elusive.Two notable exceptions included the Energy sector (Oil and Gas Refineries) andTelecommunication Services (Wireless). Information Technology was one of the weakest sectors for the year.

The Fund’s overweight positions in the Information Technology and Energy sectors, and its underweight positions in one of the strongest performing industries, Wireless (Telecommunication Services sector), detracted from the relative performance of the Fund. Stock selection in the Energy sector also detracted from relative performance. The Fund was underweight Telecommunication Services, which traded higher as investors sought dividends and bid shares up to historically high valuations. The group is now trading both above the broader market and its historical average, while earnings growth is slowing given the mature, highly penetrated nature of the U.S. wireless market. Oil and Gas Refineries are similarly trading above their historical average due to short-term pricing issues. Because U.S. crude is trading at a discount to global crude, U.S. refineries are able to produce diesel fuel at a relatively lower cost than their global competitors, and then export that refined product overseas and sell it at the higher price. We believe these mispricings are temporary in nature, and current valuations do not reflect the likely fall-off in earnings over time.

Absolute returns in the Fund benefited from strong stock performance in a number of sectors. Consumer Discretionary holding Comcast Corp., one of the leading cable providers in the U.S., continued to post strong quarterly earnings despite the seasonality of its business. The company reiterated its commitment to return cash to shareholders and we believe investors continued to get comfortable with the value of the cable network and the possible threat of Over-The-Top (OTT) video disintermediation. We continue to see benefits of investing in the company as we believe its high speed broadband deployments continue to give it a competitive advantage overTelecommunication Services companies. Although the market continues to worry about the impact of OTT on the video business, we believe this high-margin business should continue to be a growth driver, even as OTT video gains traction. In addition, Comcast continues to come up with innovative products such as cloud based navigation, DVR enhancements, and second screen experiences. Comcast trades at an attractive valuation and continues to return cash to shareholders aggressively. Materials sector holding, Freeport McMoRan Copper & Gold Inc. also contributed to Fund performance. It is the world’s largest publicly traded producer of copper and a significant producer of gold and molybdenum. It has a geographically diverse portfolio of long-lived, low cost mines in North and South America, Africa, and Asia. We believe copper’s wide variety of industrial and commercial uses that include building construction and power generation and transmission should drive growth going forward, particularly in developing geographies. Shares rose over the year on higher copper prices related to a supply/demand imbalance. New supply remains constrained due to declining ore grades at existing mines and the time and capital needed to develop world-class greenfield mines.

| 21 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

During the year, a position in Boston Properties was initiated. It is regarded as the best in class operator in the office industry, with a bulk of property in the New York, Boston and Washington, DC markets. Boston Properties’ properties are at the top end of the quality spectrum and are located in the high demand markets where quality tenants are based. The Fund exited its position in Yum!Brands Inc. (Consumer Discretionary), an operator of quick service restaurants around the globe. Its brands include KFC, Pizza Hut, and Taco Bell. We saw the opportunity for Yum!Brands to expand in international markets such as China, and the market has recognized that growth. As the market is now giving Yum!Brands credit for sustained store growth and its longer-term opportunities in emerging markets, it was decided to exit the stock.

Outlook

As a bottom-up, fundamental manager, market and economic forecasts are not an integral part of our investment process. We continue to focus on owning fundamentally sound companies that are well capitalized and well positioned to take market share from weaker competitors. These higher quality companies have outperformed historically, and we believe will outperform over the longer term. Our investment philosophy is focused on the long term. The Fund is diversified across sectors and industries with relative over- and underweights reflective of where we believe we are finding the best opportunities.

| 22 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

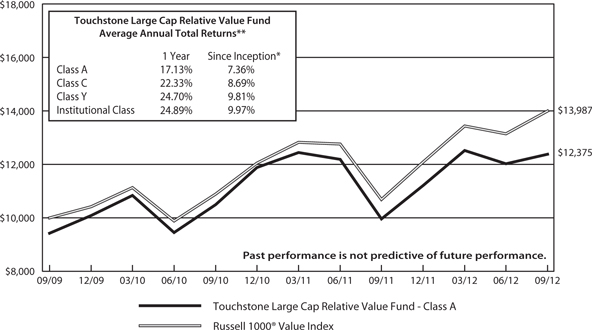

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Large Cap Relative Value Fund - Class A* and the Russell 1000® Value Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The Fund commenced operations on September 30, 2009. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges, if applicable. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance.

| 23 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Market Neutral Equity Fund

Sub-Advised by Aronson Johnson Ortiz

Investment Philosophy

The Touchstone Market Neutral Equity Fund seeks to achieve long-term capital appreciation and to provide positive returns regardless of the direction of the stock markets by investing long in equity securities believed to be undervalued, and taking short positions in securities believed to be overvalued.

Fund Performance

The Touchstone Market Neutral Equity Fund (Class A Shares) underperformed its benchmark, the Citigroup 3-Month Treasury Bill Index, for the 12-month period ended September 30, 2012. The Fund’s total return was -4.85 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 0.05 percent.

Market Environment

A respectable month of September capped off a solid trailing 12 months in the broad U.S. equity market. Value indices managed a slight edge over growth, and stocks of small capitalization companies outperformed those of large capitalization companies.

Portfolio Review

The Touchstone Market Neutral Equity Fund is always sector-neutral long versus short, with only limited industry bets, driven solely by the Fund’s bottom-up stock selection. Since our stock-picking is, in turn, guided by our multi-factor valuation model, we look to the measures underlying our model to explain what worked during the period.

Long holdings within the Energy sector were the largest contributors to performance, followed by positions in the Materials and Services sectors. Names like Tesoro Corp. and Valero Energy Corp. had a significantly positive impact on performance. We were challenged most by the Funds’ holdings in the Technology sector, particularly among short positions in the Software industry like NetSuite, Inc., SuccessFactors, and The Ultimate Software Group, Inc. In aggregate, our stock picking efforts were rewarded across all three broad pillars of attractiveness we use to evaluate stocks — value, management, and momentum — although our evaluation of management as represented by return on assets and earnings quality detracted from performance.

There were no significant changes in the Fund’s positioning. The Fund remained sector-neutral long versus short and invests solely in U.S. equities. Since individual positions are limited to 1.2% of the Fund, no individual stock change is considered significant.

Outlook

We remain firm in our conviction that results can be achieved through a consistent, systematic approach that focuses on low-priced companies with strong management and earnings power. Outperformance will continue to require patience and discipline — two virtues that are part of our investment process. As such, we do not allow the economic outlook — ours or anyone else’s — to shift our portfolio construction and structure. The Fund remains fully invested, well diversified, and sector-neutral, long versus short.

| 24 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Market Neutral Equity Fund - Class A* and the Citigroup 3-Month Treasury Bill Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The Fund commenced operations on September 30, 2009. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges, if applicable. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance.

| 25 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Merger Arbitrage Fund

Sub-Advised by Longfellow Investment Management Co.

Investment Philosophy

The Touchstone Merger Arbitrage Fund seeks to achieve positive absolute returns regardless of market conditions over the long term by investing primarily in securities of companies that are involved in publicly announced mergers and other corporate reorganizations. Merger arbitrage is an investment strategy that seeks to capture the “arbitrage spread” represented by the difference between the market price of the securities of the company that is being purchased and the value that is offered for these securities by the acquiring company. The Fund emphasizes risk management via a thorough understanding of proposed financing terms, the size of the transaction, anti-trust concerns, regulatory approvals, and shareholder voting requirements. The Fund also limits assets under management in an effort to meaningfully invest in the entire market-capitalization spectrum, with an emphasis on small- and mid-sized deals.

Fund Performance

The Touchstone Merger Arbitrage Fund (Class A Shares) outperformed its benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, for the 12-month period ended September 30, 2012. The Fund’s total return was 6.35 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 0.07 percent.

Market Environment

The market events during the past 12 months can be summed up in one word: unpredictable. The uncertainty has been driven by many factors: global economic problems, Euro debt crisis, the pending U.S. Presidential election, the fiscal “cliff ” and worldwide austerity packages are the obvious culprits. The S&P 500 Index rallied in the third quarter and returned 30% for the trailing twelve months. On the fixed income side, after much speculation, the Federal Reserve (the Fed) announced a new policy of Quantitative Easing (QE3) in mid-September 2012, which underscored its commitment to maintaining low interest rates until mid 2015 and emphasized its willingness to accept higher inflation in order to ensure job growth was on a sustainable path. We believe the program to buy Agency Mortgage Pass-through securities monthly will continue to pressure yield spreads tighter.

As for merger arbitrage, it continued on a steadier path than other markets. Headlines continued to paint a picture of declining global merger activity, primarily due to the decline in European transactions. The Fed’s effort to encourage investors to take more risk has proven successful in narrowing spreads across all asset classes, with merger arbitrage no exception.

Portfolio Review

During the period, the Fund has grown significantly. Despite the rapid increase in assets, we did not experience any significant challenges in putting the money to work. During this period, the Fund invested primarily in tender and merger related deals (70-80%) with a fixed income complement of about 10%. Cash fluctuated between 0 - 30%, with the average over the last two quarters approximately 12%. Health Care, Industrials, Information Technology, and Financials were prominently held sectors, with 90% of the deals invested in the U.S. The Fund’s non-U.S. deal holdings were primarily located in Canada.

The Fund continued to experience a high completion rate over the past year. The Fund invested in over 150 definitive merger arbitrage transactions with only one unsuccessful completion. This was partly a function of buyers taking more time to structure deals, as well as sellers being careful to ensure that agreements were solid, in addition to rigorous screening and analysis on our part. The number of successful deals positively impacted

| 26 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

performance as the Fund was able to experience small gains on many deals. In addition, the Fund had a handful of proposals which became definitive, contributing positively to returns.

Some notable transactions included Great Wolf Resorts and Dollar Thrifty Automotive Group. Great Wolf Resorts was more successful than originally planned as another bidder emerged and started a bidding war which ended with the final price over 50 percent greater than the initial price. Hertz Global Holdings, Inc., which had been in discussions for over two years with Dollar Thrifty Automotive Group, eventually came to terms, but at a much higher offer price. The Fund opportunistically participated in the Medco Health Solutions, Inc. merger with Express Scripts Holding Company towards the end of the transaction after the deal spread had widened significantly. The Fund also successfully exited the NYSE Euronext, Inc. transaction with Deutsche Boerse AG prior to the deal being terminated.

The Fund’s investment in Pep Boys was a detractor during the Fund’s fiscal year. Gores Group, a private equity buyer, decided to exercise its right to pay a termination fee and break the transaction after Pep Boys reported significantly lower than expected earnings for the quarter. This transaction was the only broken deal during the period.

Outlook

Much of the global decline in merger arbitrage deal activity was due to the reduction in European transactions. Any improved confidence overseas could translate into more activity both in overseas and cross-border deal making. Additionally, we continue to expect that merger & acquisition activity will be dominated by middle market deals, particularly deals under $1 billion in market capitalization.

The global economic problems, the fiscal cliff scenarios facing the U.S., and the Euro debt crisis could escalate into a larger market crisis which, while not expected, could reduce deal flow and opportunities going forward. In addition, the strategy has enjoyed an unusually high completion rate. Any increase in deal failures, combined with narrowing arbitrage spreads, would present a challenge moving forward. With risk appetite increasing during the past 12 months, merger arbitrage annualized returns have compressed. Merger arbitrage spreads are not immune to this pressure and have now declined.

Technical indicators remain healthy for the merger arbitrage environment, albeit with lower expected annualized returns. The Fund continues to be well diversified by position size with a modest allocation to non-deal sectors. We will continue to be focused on announced transactions with a signed definitive merger agreement. With continued steady deal flow and high completion rates, we believe that the Fund represents an attractive alternative and a good diversification vehicle.

| 27 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

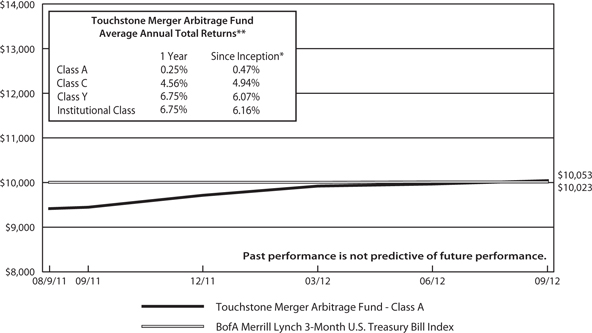

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Merger Arbitrage Fund - Class A* and the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

| * | The chart above represents performance for Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in loads and fees paid by shareholders in the different classes. The Fund commenced operations on August 9, 2011. |

| ** | The average annual total returns shown above are adjusted for maximum applicable sales charges, if applicable. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not predictive of future performance.

| 28 |

Management's Discussion of Fund Performance (Unaudited)

Touchstone Mid Cap Fund

Sub-Advised by The London Company

Investment Philosophy

The Touchstone Mid Cap Fund seeks long-term capital growth by investing primarily in common stocks of mid-cap U.S. companies. The Fund utilizes a bottom-up security selection process that screens potential investments against a proprietary quantitative model for return on capital, earnings to value ratio, free cash flow and return on equity. Its goal is to purchase generally profitable, financially stable companies that consistently generate high returns on unleveraged operating capital, are run by shareholder-oriented managements, and are trading at a discount to their private market value.

Fund Performance

Effective December 14, 2011, The London Company was named sub-advisor to the Touchstone Mid Cap Fund.

The Touchstone Mid Cap Fund (Class A Shares) underperformed its benchmark, the Russell Midcap® Index for the 12-month period ended September 30, 2012. The Fund’s total return was 25.95 percent, (calculated excluding the maximum sales charge) while the total return of the benchmark was 28.03 percent.

Market Environment

Equity markets reacted favorably to the Federal Reserve’s efforts to double-down on keeping short-term interest rates low and unchanged during the last year. Its “Operation Twist” program sold short-term U.S. Treasuries to purchase longer maturities, and its third round of Quantitative Easing (QE3) furthered efforts to keep interest rates at historically low levels. Both actions contributed to positive returns in equities.

Portfolio Review

Generally more economically sensitive stocks performed best over the past 12 months while defensive stocks lagged. This presented a headwind due to the Fund’s defensive nature.

For the 12-month period, the Fund added value through positive stock selection within the Energy, Health Care, Information Technology and Financials sectors. However, these gains were negated due primarily to an overweight in the Consumer Staples sector. An underweight in the Health Care sector, along with stock selection in the Consumer Staples and Materials sectors, also detracted from performance.

The Fund’s top performing stocks during the period included Consumer Discretionary companies, Cabela’s, Inc. and Whirlpool Corporation. Outdoor equipment retailer Cabela’s Inc. saw strong yearly results with better same-store sales comparisons and excellent cost control. Merchandise margins have continued to increase as a function of increasing Cabela’s branded merchandise and the company is benefiting from continued strong gun sales. Appliance maker Whirlpool Corporation rallied following strong earnings growth with significant margin improvement due to higher pricing and some improvement in the housing market. Additional top performers included Financials companies, Eaton Vance Corp. and M&T Bank Corp. Investment manager Eaton Vance Corp. benefited from a rising equity market which contributed to growth in assets under management. Commercial banker M&T Bank Corp. has a consistent track record in the banking industry with an attractive return on equity and very conservative and shareholder friendly management team. Also a top performer was Industrials company, Cintas Corporation, supplier of specialized services to businesses, which experienced increasing sales and profitability throughout the period, resulting in a higher share price.

The largest detractors from Fund performance over the past 12 months included Consumer Staples companies, Staples, Inc., Smithfield Foods, and Nu Skin Enterprises. Office supplier Staples, Inc. experienced weak performance as spending on office supply goods lessened and investors worried about an abundance of retail locations in

| 29 |

Management's Discussion of Fund Performance (Unaudited) (Continued)

the U.S. Global food retailer Smithfield Foods experienced poor performance due to swings in commodity prices and high margin costs. Nu Skin Enterprises, maker of anti-aging products, traded into weaker territory after a report questioning the company’s operations in China was circulated. We believe the report’s allegations are without merit as the company recently announced expansion plans in China. An additional detractor to performance was Consumer Discretionary company, CarMax, Inc. The used car retailer witnessed poor performance due to declining auto sales during the period.

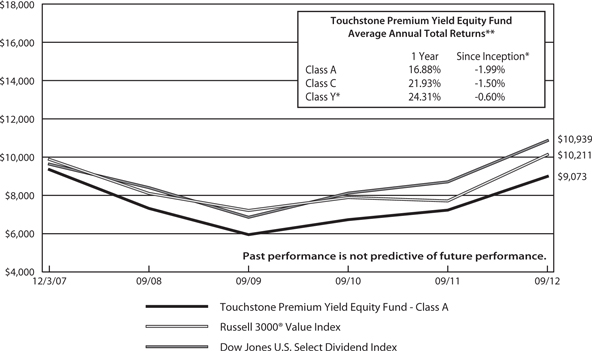

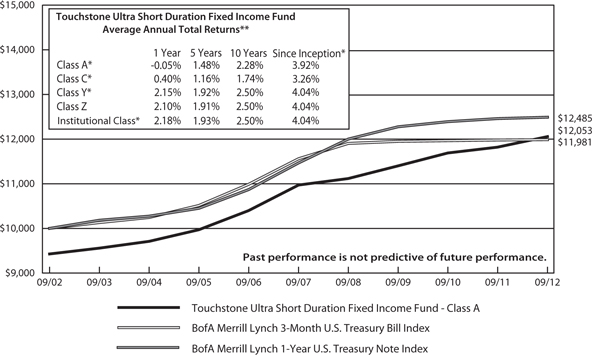

Outlook