☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

☑ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

June 28, 2024

Dear Fellow Shareholders,

As a shareholder in our Company, you are an important partner in our continued success. We are pleased to invite you to attend our Annual Meeting of Shareholders on Wednesday, August 14, 2024. The meeting will be held virtually at 11:00 a.m. Eastern Time.

I am proud that we continued to build on the strong, consistent track record our business has delivered in fiscal year 2024. These results also represent an important validating moment for our organization. They reflect the success of the diligent work we have done to transform our organization over the past few years. Notably, we have reshaped our portfolio to create greater focus and prioritization supporting our commitment to establish leading positions in attractive categories; we enhanced our capabilities, including reshaping our marketing and sales functions to improve how we build brands consumers love; and we introduced our Transformation Office to formalize a collaborative approach to identifying and activating opportunities for value creation, operational efficiency, and cost savings to reinvest in the business.

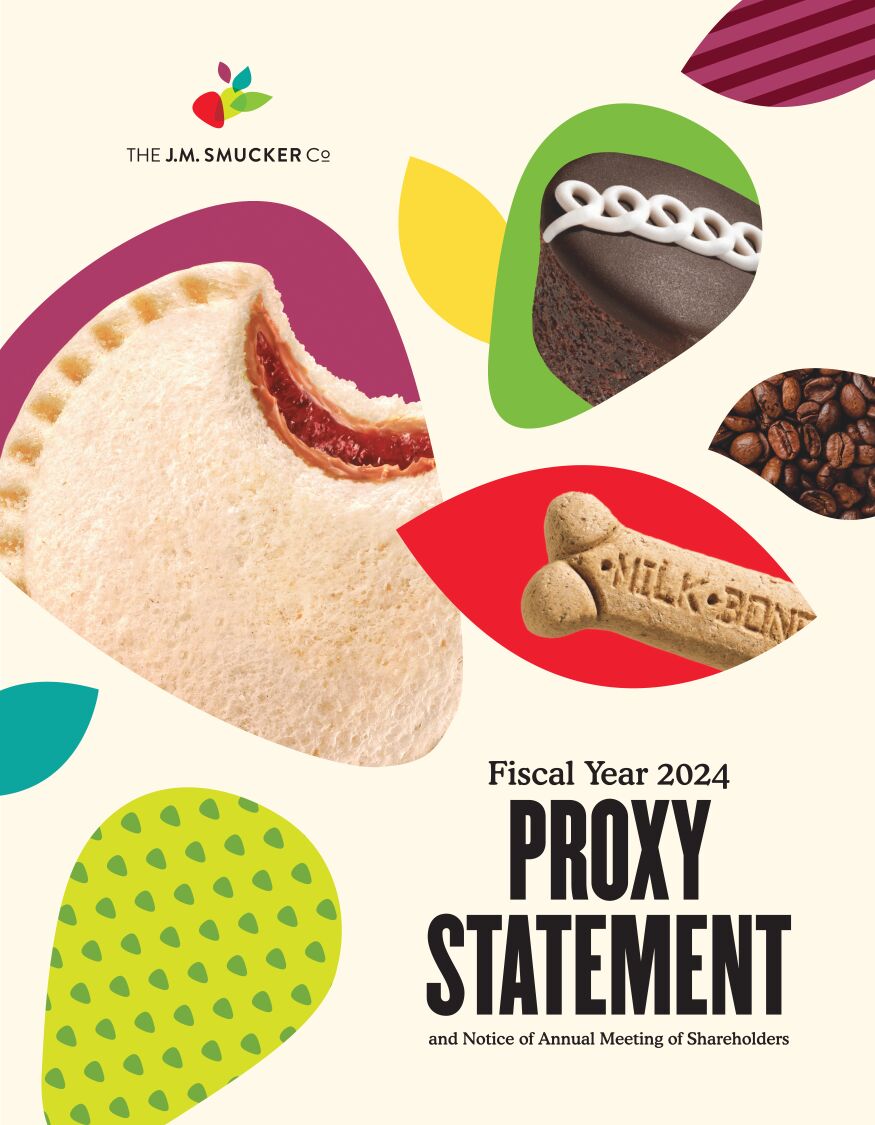

For the fiscal year, net sales were $8.2 billion. Additional highlights of our fiscal year 2024 performance include:

| • | Full-year comparable net sales increased 8 percent, with volume/mix growth across all of our U.S. Retail segments and our International and Away From Home businesses; |

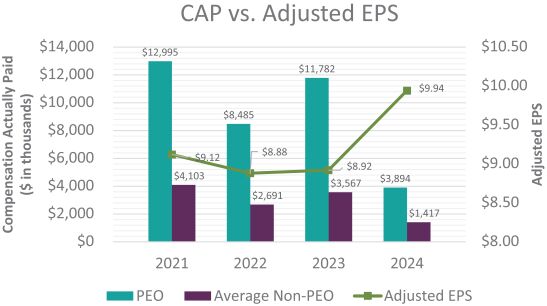

| • | Full-year adjusted earnings per share was $9.94*, reflecting a double-digit percentage increase versus the prior year; |

| • | On a full-year basis, free cash flow was $643 million*; and |

| • | Return of cash to shareholders through dividends was $438 million. |

In addition to delivering another fiscal year of strong financial results, we also took a transformational step supporting the long-term growth of our business with the acquisition of Hostess Brands.

The acquisition of Hostess Brands provides the Company with leadership in the highly attractive snacking market. In addition to the opportunity to serve as steward for the Hostess Brands portfolio, we are excited about the highly complementary capabilities of our businesses. The acquisition also increases confidence in delivering on our long-term financial goals by advancing our scale, profitability, and cash flow.

We are focused on continuing to build Hostess Brands into a snacking powerhouse by accelerating advertising of the brands; continuing to leverage the proven innovation engine; expanding distribution, including through our Away From Home channel; ensuring diligent revenue growth management; and driving enhanced presence in e-commerce.

With the addition of our Sweet Baked Snacks business, we further strengthen our leading portfolio and create new opportunities to serve consumers, support our ability to realize our financial aspirations, and ultimately create long-term shareholder value.

Continuing to Live our Purpose

We are inspired by our Purpose – “feeding connections that help us thrive – life tastes better together” and guided by our Thriving Together agenda, which allows us to sharpen our focus on the issues impacting the quality of life for people and pets, specifically around the need for Quality Food, Education, Equitable and Ethical Treatment, Community Resources, and a Healthier Planet.

With this foundation, we define success by our ability to grow our business and the positive impact we have on all those who count on it. And, with this standard in mind, I am pleased to share that fiscal year 2024 was a success for our organization and our partners. Here are a few highlights from this past year:

| • | We continued to support smallholder coffee farmers in key regions via partnerships with World Coffee Research, Hanns R. Neumann Stiftung (HRNS), TechnoServe, the U.S. Department of Agriculture (USDA), and Enveritas; |

| • | We expanded our partnership with Akron Children’s Hospital through its childhood literacy initiative with the launch of the Smucker’s Berry Good Reading Program; |

| • | As part of our corporate philanthropic commitments, we donated more than $1.5 million to key partners, including Feeding America, Greater Good – Rescue Bank, United Way, and American Red Cross, to address the needs of those in the communities where we live and work; |

| • | We celebrated our first-ever score of 100 on the Corporate Equality Index, a report published by the Human Rights Campaign which evaluates companies on equality and inclusion for LGBTQ+ employees; and |

| • | We stewarded resources and increased biodiversity through sustainable agriculture practices focused on soil health, conservation, reforestation, and pollinator health in partnership with National Fish and Wildlife Foundation, World Wildlife Fund, Reforest The Tropics and Pollinator Partnership, among others. |

In addition to these achievements, in reflection of our commitment to responsible business practices, we were recognized as one of the World’s Most Ethical Companies by Ethisphere and included in Newsweek’s listing of America’s Most Responsible Companies for the fifth year in a row.

Learn more about the progress we have made on these commitments by reviewing our public reporting including our 2023 Corporate Impact Report (inclusive of our disclosures based on the Sustainability Accounting Standards Board Food & Beverage standards and the recommendations set by the Task Force on Climate-related Financial Disclosures).

Recent Board Activity

During fiscal year 2024, we announced the election of Mercedes Abramo, Deputy Chief Commercial Officer for Cartier International SA, and Tarang Amin, Chairman and Chief Executive Officer of e.l.f. Beauty, Inc. to our Board of Directors. We are fortunate to have tremendous talent and diverse expertise across our Board to support the Company’s continued progress in executing our strategy. Mercedes and Tarang have been tremendous additions to our already strong Board, and I am excited to continue to work with all our directors to advance our organization in fiscal year 2025.

Fiscal Year 2025

To maintain progress on our strategy, it is important we continue to identify key priorities driving us forward. I have identified the following as our priorities for fiscal year 2025:

| • | First, deliver the core business, which includes a focus on growing volume, operating with excellence, and continuing to prioritize resources to our fastest growth opportunities; |

| • | Next, integrate and deliver on the acquired Hostess business, including the integration of systems and processes, achieving cost synergies and growth ambitions, and nurturing a unified culture as we expand our organization; |

| • | And third, achieve our transformation, cost discipline, and cash generation aspirations. |

With continued progress on our proven strategy, the sustained strength of our portfolio, and the continued ability of our employees to deliver with excellence, we are well positioned to realize success in fiscal year 2025 while continuing to support long-term shareholder value.

Thank you for your continued support of our Company.

Sincerely,

|

|

|||||||

|

Mark T. Smucker | Chair of the Board, President, and Chief Executive Officer

| ||||||||

| * | Please see Appendix A for a reconciliation of financial measures presented under generally accepted accounting principles in the United States (“GAAP”) to non-GAAP financial measures. |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON AUGUST 14, 2024

This Proxy Statement and the 2024 Annual Report are available at www.proxyvote.com |

NOTICE OF

2024 ANNUAL MEETING OF SHAREHOLDERS

After careful consideration, the Board of Directors (the “Board”) of The J. M. Smucker Company (the “Company,” “we,” “us,” or “our”) has decided to hold the 2024 Annual Meeting of Shareholders (the “Annual Meeting of Shareholders” or the “Annual Meeting”) exclusively online, via a live audio-only webcast, in order to continue to provide expanded access, improved communication, and cost savings for shareholders.

|

DATE AND TIME

|

|

Wednesday, August 14, 2024 | 11:00 a.m. Eastern Time

| ||

|

LIVE WEBCAST

|

|

www.virtualshareholdermeeting.com/SJM2024

| ||

The Annual Meeting of Shareholders of the Company will be held for the following purposes:

|

1

|

To elect as directors the ten nominees named in the Proxy Statement and recommended by the Board whose term of office will expire in 2025;

| |

|

2

|

To ratify the appointment of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm (the “Independent Auditors”) for the 2025 fiscal year;

| |

|

3

|

To approve, on a non-binding, advisory basis, the Company’s executive compensation as disclosed in these proxy materials; and

|

|

4

|

To consider and act upon any other matter that may properly come before the Annual Meeting.

|

Shareholders of record at the close of business on June 17, 2024, are entitled to vote at the Annual Meeting. All shareholders are invited to attend the virtual Annual Meeting.

Jeannette Knudsen | Chief Legal Officer and Secretary

Voting Methods:

|

VIA THE INTERNET

|

|

BY MAIL

|

| |||||||||

|

Visit www.proxyvote.com |

Complete, sign, date, and return | |||||||||||

| and follow instructions

|

the enclosed proxy card

|

|||||||||||

|

BY TELEPHONE

|

|

LIVE

|

| |||||||||

|

Call toll-free (U.S. or Canada) |

By attending the virtual Annual Meeting | |||||||||||

| 1-800-690-6903

|

and voting

|

|||||||||||

| TABLE OF CONTENTS |

| 67 | ||||

| 68 | ||||

| 69 | ||||

| 71 | ||||

| 72 | ||||

| Potential Payments to Executive Officers |

73 | |||

| 77 | ||||

| 78 | ||||

| 82 | ||||

| 83 | ||||

| 85 | ||||

| 86 | ||||

| 86 | ||||

| 86 | ||||

| 87 | ||||

| 88 | ||||

| 88 | ||||

| 88 | ||||

| APPENDIX A: RECONCILIATION OF ADJUSTED OPERATING INCOME, ADJUSTED EARNINGS PER SHARE, AND FREE CASH FLOW TO THE RELATED GAAP MEASURES |

A-1 | |||

PROXY SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. Please carefully read the entire Proxy Statement before voting.

2024 Annual Meeting of Shareholders

| DATE AND TIME |

| Wednesday, August 14, 2024 | 11:00 a.m. Eastern Time |

| LIVE WEBCAST |

|

www.virtualshareholdermeeting.com/SJM2024

|

||

| WHO CAN VOTE |

||

| Shareholders of record at the close of business on June 17, 2024 are entitled to vote at the virtual Annual Meeting.

| ||

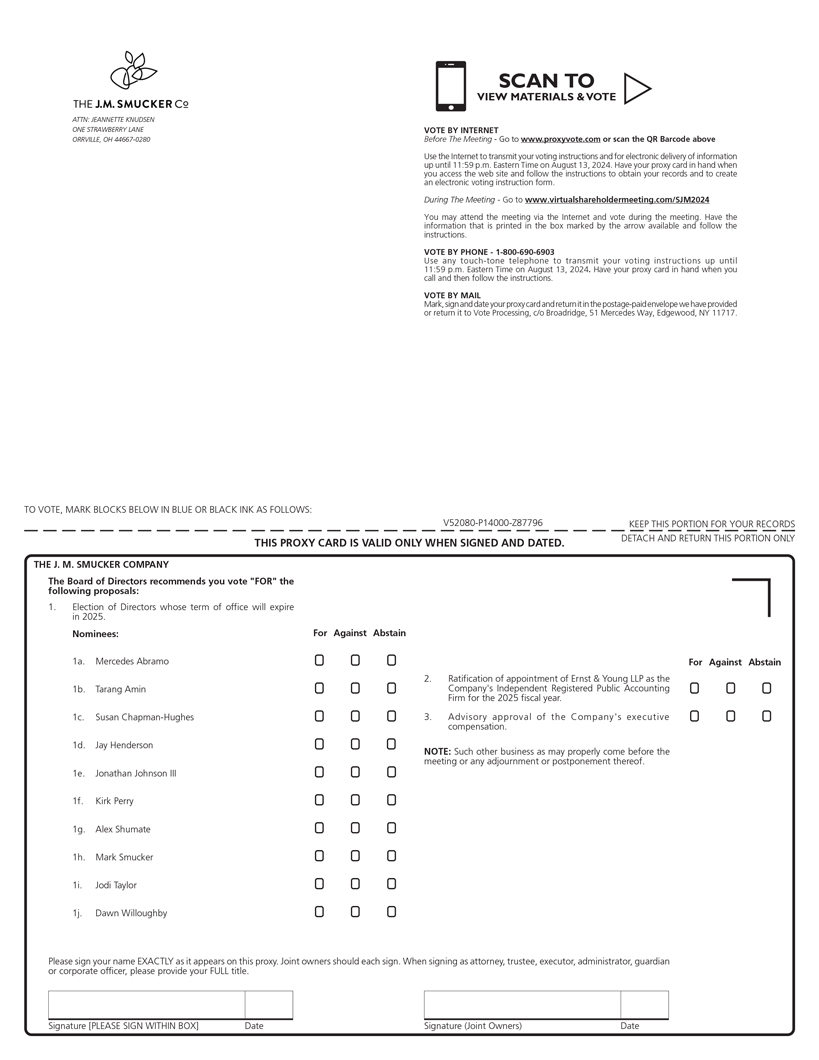

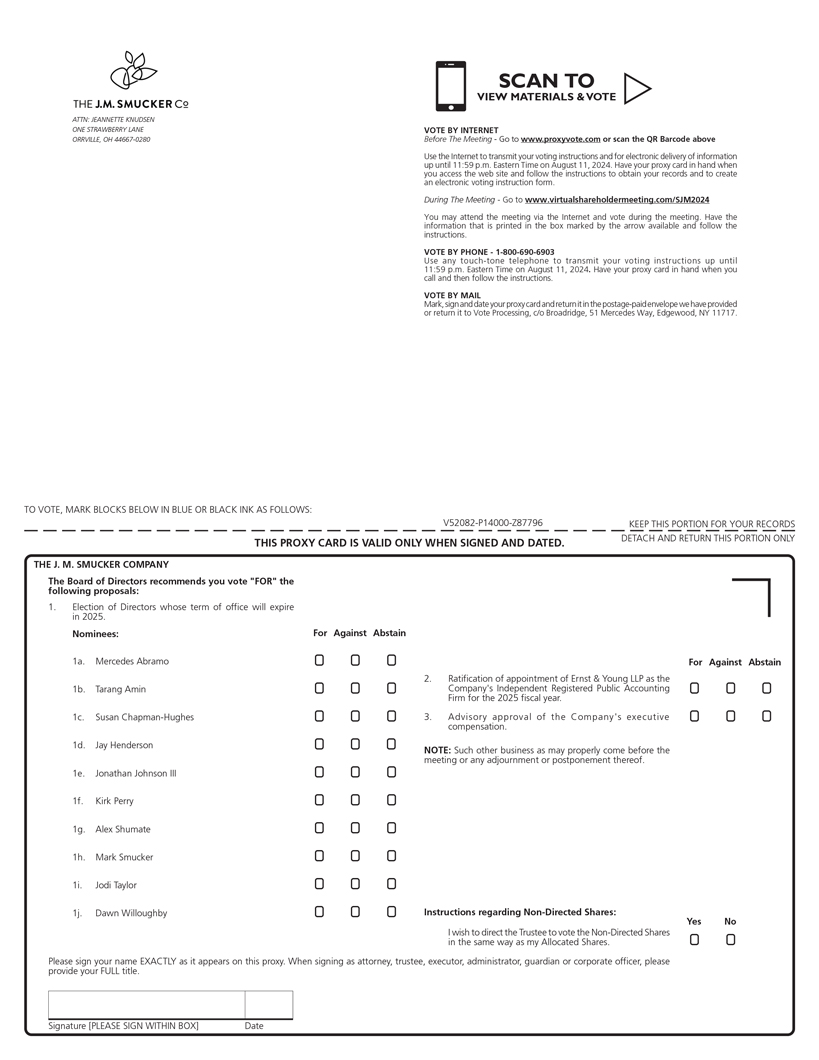

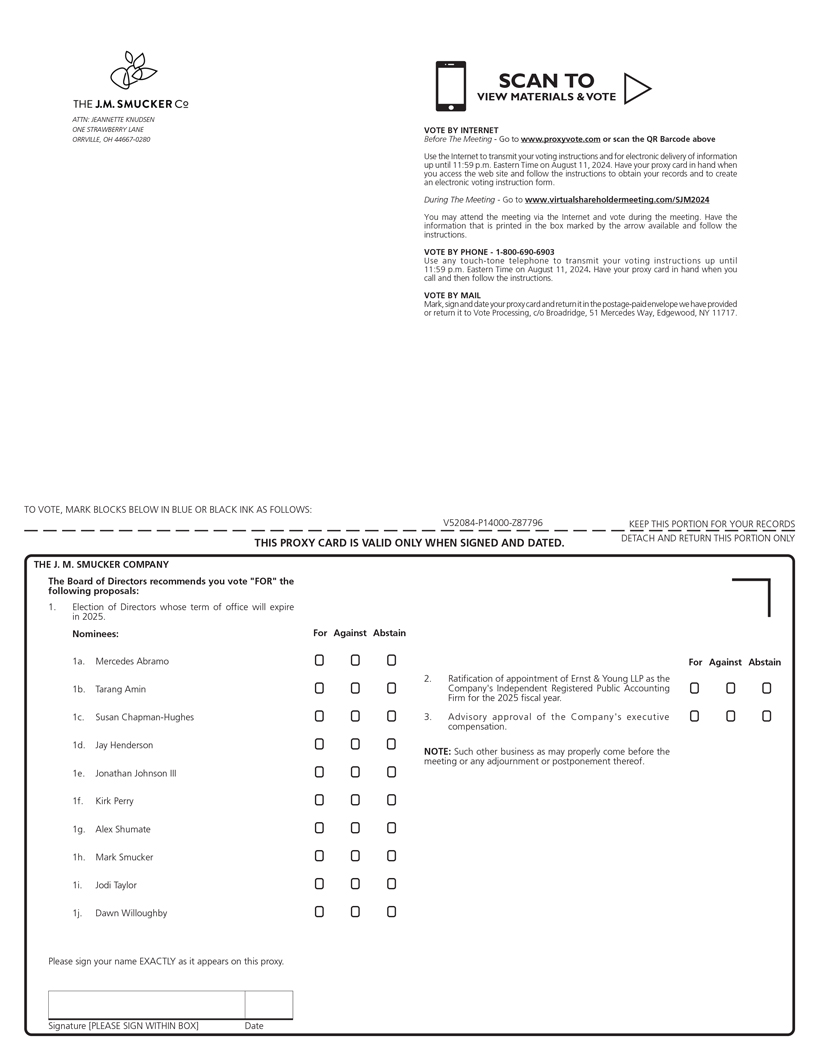

Voting Recommendations of the Board

| Proposal | Proposal Summary | Voting Recommendation | Page | |||

|

|

Election of the Board nominees named in this Proxy Statement with terms expiring at the 2025 Annual Meeting of Shareholders |

|

19 | |||

|

|

Ratification of appointment of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for the 2025 fiscal year |

|

38 | |||

|

|

Advisory approval of the Company’s executive compensation |

|

39 | |||

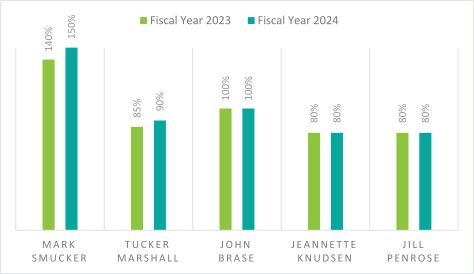

Fiscal Year 2024 Performance Highlights

| * | For a reconciliation of adjusted earnings per share and free cash flow, see Appendix A. For a description of how we calculate adjusted earnings per share and free cash flow, see Management’s Discussion and Analysis of Financial Condition and Results of Operations in our 2024 Annual Report on Form 10-K, which can be found on our website at investors.jmsmucker.com. Our fiscal year 2024 performance was one of the key factors in the compensation decisions for the fiscal year, as more specifically discussed in the Compensation Discussion and Analysis section of this Proxy Statement. |

| The J. M. Smucker Company |

|

2024 Proxy Statement | 1 |

PROXY SUMMARY

Director Nominees

The following table provides summary information about each of our director nominees.

|

Director Since

|

Professional Background

|

Board Committees

|

Other Public Company Boards

| |||||||||||

| Name

|

Age

|

AC*

|

CPC†

|

NGCR‡

| ||||||||||

|

Mercedes Abramo

|

54 |

2023 |

Deputy Chief Commercial Officer Cartier International SA |

|

||||||||||

| Tarang Amin

|

59 | 2023 | Chairman and Chief Executive Officer e.l.f. Beauty, Inc.

|

|

• e.l.f. Beauty, Inc. | |||||||||

| Susan Chapman-Hughes

|

55 | 2020 | Former Executive Vice President and General Manager, Global Head of Digital Capabilities, Transformation, and Operations, Global Commercial Services American Express Company

|

— |

|

— | • Toast, Inc. | |||||||

| Jay Henderson

|

68 | 2016 | Retired Vice Chairman, Client Service PricewaterhouseCoopers LLP

|

|

— | — | • Illinois Tool Works Inc. • Northern Trust Corporation | |||||||

| Jonathan Johnson III

|

58 | 2022 | Former Chief Executive Officer Overstock.com, Inc. (now known as Beyond, Inc.)

|

— |

|

— | ||||||||

| Kirk Perry

|

57 | 2017 | President and Chief Executive Officer Circana, Inc.

|

— | — |

|

||||||||

| Alex Shumate

|

74 | 2009 | Senior Partner and Ohio Strategic Relationship Partner Squire Patton Boggs (US) LLP

|

— | — |

|

||||||||

| Mark Smucker | 54 | 2009 | Chair of the Board, President, and Chief Executive Officer The J. M. Smucker Company

|

— | — | — | • Kimberly-Clark Corporation | |||||||

| Jodi Taylor

|

61 | 2020 | Retired Chief Financial and Administrative Officer The Container Store Group, Inc.

|

|

— | • Mister Car Wash, Inc. | ||||||||

| Dawn Willoughby

|

55 | 2017 | Former Executive Vice President and Chief Operating Officer The Clorox Company

|

— | — |

|

• International Flavors and Fragrances, Inc. • TE Connectivity Ltd. | |||||||

* Audit Committee † Compensation and People Committee ‡ Nominating, Governance, and Corporate Responsibility Committee

Chair

Chair

Financial Expert

Financial Expert

Independent Director

Independent Director

Lead Independent Director

Lead Independent Director

Member

Member

| 2 | The J. M. Smucker Company |

|

2024 Proxy Statement |

PROXY SUMMARY

ESG AND CORPORATE RESPONSIBILITY

|

We believe success is driving business growth while helping those associated with our Company thrive. And, for more than 125 years, we have done just that. Our philosophy of corporate responsibility builds on the wisdom of our founder, Jerome Monroe Smucker, a deeply principled and forward-thinking man. For our Company, being responsible means doing the right thing for our consumers, customers, employees, suppliers, communities, and shareholders. Our commitment to being a good corporate citizen allows us to positively impact the lives of our employees and business partners, as well as the communities and planet we all share. |

We are inspired by our Purpose, Feeding Connections That Help Us Thrive – Life Tastes Better Together. And we deliver on that Purpose through the guidance of our Thriving Together agenda, which is focused on:

|

Ensuring Access to Quality Food |

|

Supporting Access to Education |

|

Making Connections to Community Resources |

|

Promoting Equitable and Ethical Treatment for All |

|

Supporting a Healthier Planet |

Through this focused approach, we maximize our resources to make the most meaningful impact in the areas we are best equipped to support.

ESG Reporting

This year, we will issue our fourteenth public report on the progress we are making on our environmental, social, and governance (“ESG”) commitments through our Corporate Impact Report. As part of this report, we will share an overview of our ESG initiatives and metrics, using the Sustainability Accounting Standards Board (SASB) Food & Beverage – Processed Foods and Non-Alcoholic Beverages industry standards, as well as how our efforts support select United Nations Sustainable Development Goals. Additionally, the Corporate Impact Report will detail how we evaluate and manage climate-related risks and opportunities in alignment with the recommendations set by the Task Force on Climate-Related Financial Disclosures (TCFD). Lastly, in fiscal year 2024, we issued our latest Employer Information Report EEO-1.

ESG Oversight

Our ESG journey has evolved over time to become more comprehensive across our business. Our Vice President, ESG, Deputy General Counsel, and Assistant Secretary (“Vice President of ESG”) has the highest level of direct responsibility for ESG matters within the Company and is the executive sponsor of our Sustainability Steering Committee, which was established in 2006. The committee, which is chaired by our Director of Sustainability and is comprised of key leaders from various functional areas, leads our sustainability goalsetting efforts and monitoring of activities. Our Chief Legal Officer and Secretary (“Chief Legal Officer”) has the highest level of direct responsibility for governance, ethics, compliance, and enterprise risk management within the Company, and our Chief Financial Officer provides additional leadership and guidance for enterprise risk management.

We have continued to build and improve on our ESG efforts by expanding our ESG Governance Council, comprised of key leaders from various functional areas, which, together with certain members of our executive leadership team, is responsible for our evolving ESG strategy and efforts. Our Chief Legal Officer and our Vice President of ESG, along with members of their teams who are on the ESG Governance Council, report on such activities to our executive leadership team, the Board, and the committees of the Board, which in turn provide further direction on the prioritization of activities and resources. The Nominating, Governance, and Corporate Responsibility Committee (the “Nominating Committee”) assists the full Board and oversees our ESG program. In addition, and as noted below, the Compensation Committee holds our Chief Executive Officer responsible for achieving our ESG objectives and, beginning in fiscal year 2023, all of our employees at or above the Senior Director level, including all of our executive officers, had 10% of their short-term incentive compensation based on the achievement of ESG objectives.

| The J. M. Smucker Company |

|

2024 Proxy Statement | 3 |

PROXY SUMMARY

ESG Areas of Focus

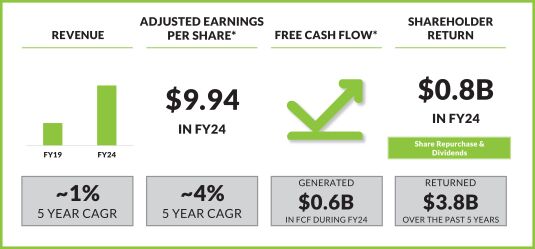

Our ESG areas of focus include (i) environmental impact, (ii) employee impact, (iii) community impact, (iv) consumer impact, (v) supply chain impact, and (vi) governance and ethics.

|

Environmental Impact

We are committed to improving the environmental footprint of our operations through a dedication to delivering a more sustainable approach to our operations and value chain focusing on climate action, natural resource stewardship, and responsible sourcing and packaging. We have:

| |

|

Employee Impact

We take proactive steps to ensure we meet our employees’ physical, emotional, and financial needs. Notably, we:

| |

| 4 | The J. M. Smucker Company |

|

2024 Proxy Statement |

PROXY SUMMARY

|

Community Impact

We are passionate about supporting the communities where we live and work. Through our many partnerships, we understand the needs and support required in our local communities and leverage these relationships to make the necessary connections to offer critical assistance to those in need. Notably, we:

| |

|

Consumer Impact

We make consumers’ lives better by delivering food people and pets love. We recognize the opportunity to serve consumers is earned, and we are committed to maintaining that trust with every product we produce. We realized this by:

| |

|

Supply Chain Impact

We are committed to ensuring the sustainability of our supply chain while supporting those connected to it by strategically investing in our suppliers’ ability to continuously deliver the quality ingredients used in our products. This supports livelihoods for our suppliers and their families, while ensuring we meet our expectation of ethical and responsible sourcing. This is realized by:

| |

| The J. M. Smucker Company |

|

2024 Proxy Statement | 5 |

PROXY SUMMARY

Governance and Ethics

We place a strong focus on our governance practices and continually evaluate them, taking into consideration evolving expectations and the perspectives of our shareholders. Our Board operates with transparency and integrity as it oversees corporate governance practices that align with the interests of our shareholders.

Board Makeup

We consider the skills and expertise of our directors, along with our Board makeup, to ensure we have the right individuals to fulfill the Board’s responsibilities of strategic oversight, succession planning, compliance oversight, ESG oversight, cybersecurity oversight, and risk management. We regularly consider new director candidates, and we utilize the assistance of an external search firm to identify new potential candidates. In developing our director criteria, we considered feedback from our Board and management, input from key external advisors, and interviews with our investors. We believe that it is important to maintain the continuity of our Board by retaining long-tenured directors, while also adding new directors who provide new insights and bring different expertise and experiences to the Board. Since 2020, we have nominated five new directors who have contributed strong expertise and insights in the areas of strategy, marketing, sales, finance, supply chain, digital technology, e-commerce, people management, operations, innovation, risk management, and ESG matters.

In fiscal year 2023, Mark Smucker assumed the role of Chair of the Board, succeeding Richard Smucker, who served as Executive Chairman since 2016. This continuity of leadership, combined with the Board members’ deep knowledge of our Company and its strategic vision, product categories, innovation platforms, risks, and opportunities, positions the Board to continue to oversee our strategy and continue our long history of generating attractive returns for our shareholders.

We will continue to consider the appropriate timing for director rotations to ensure we have the appropriate mix of skills based on our strategic goals and challenges and to ensure we maintain a diverse Board, because a strong, diverse Board provides differing perspectives that yield better decisions.

To facilitate our director succession planning, in August 2022, we rotated and appointed new Committee members and chairs for the Audit Committee, Compensation Committee, and Nominating Committee (collectively, the “Committees”). During fiscal year 2025, each independent director will sit on only one Committee. We are focused on orienting new Committee members appropriately for their roles, and we will continue to provide ongoing education sessions for all our directors.

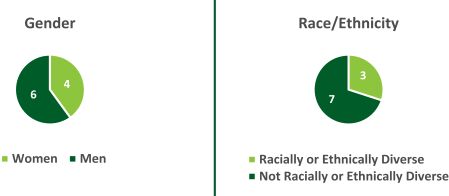

Following the annual meeting:

|

BOARD SIZE

|

| 10

directors

Since 2023

|

|

BOARD REFRESHMENT

|

| 5 new

directors

Since 2020

|

|

BOARD DIVERSITY

|

| 4 of 10

are women

3 of 10

are racially or ethnically diverse

|

|

BOARD INDEPENDENCE

|

| 9 of 10

are independent

|

| 6 | The J. M. Smucker Company |

|

2024 Proxy Statement |

PROXY SUMMARY

Finally, we consider the ratio between independent and non-independent directors and will have nine independent directors and one non-independent director if our current director nominees are elected. Since 2015, we have reduced the number of non-independent directors from five members to one member. The non-independent director is a Smucker family member, and we will also have two Smucker family members serving as non-voting Chairman Emeriti during fiscal year 2025. We believe that including Smucker family members strengthens our Board because of their deep knowledge of the Company, their commitment to the Company and our Basic Beliefs of Be Bold, Be Kind, Do the Right Thing, Play to Win, and Thrive Together (our “Basic Beliefs”), their passion for ensuring continued growth for the Company bearing their name, and their vested interest.

Risk Management

Our Company has always understood the importance of having strong compliance and enterprise risk management practices to protect our business and employees. In fact, Doing the Right Thing is one of our Basic Beliefs and is core to our culture. Over the past several years, we have taken a more formal approach to managing these two important areas and have expanded the compliance and enterprise risk functions to bring additional focus and visibility to our management and the Board. Our Vice President, Chief Ethics and Compliance Officer (“Chief Compliance Officer”) oversees this function. This independent function reports to the Chief Legal Officer and reports quarterly to our Board and the Audit Committee. We believe that our Chief Compliance Officer has the appropriate expertise and visibility within the organization to best develop and execute these programs, and she has developed strong relationships and trust with, as well as direct, independent access to, our Board and Audit Committee. Our Governance, Risk, and Compliance Committee, which is comprised of senior leaders from our officer leadership team, has completed its annual assessment of our enterprise risks, led by our enterprise risk team with input from leadership and numerous cross-functional teams. Leaders within our organization have been assigned responsibility for each key risk identified, and we have developed a system for monitoring and reporting these risks to the Board and its Committees. Each Committee is assigned responsibility for specific risks, which we have outlined in our Committee charters and which are further described in this Proxy Statement.

|

|

OUR KEY GOVERNANCE PRACTICES

|

|||||||||

|

|

|

|

|

To learn more, we invite you to read about our ESG efforts on our website at www.jmsmucker.com

|

| The J. M. Smucker Company |

|

2024 Proxy Statement | 7 |

PROXY SUMMARY

Our People and Culture

We believe our employees are our most important asset. Our founder, Jerome Monroe Smucker, established a culture that puts people at the core of everything we do. Preserving the essence of that culture and ensuring the well-being of our employees remains a critical business priority and responsibility of the Board. This commitment continues to be guided by our Basic Beliefs and Our Commitment to Each Other, which provide guidance on how to bring these important values to life each day. By achieving this, we retain the unique culture that differentiates our Company and enables all employees to reach their full potential. The Board’s role includes ensuring that we continue to implement these beliefs, which support the growth, safety, and well-being of our employees and are essential to driving a successful and sustainable business.

We Value Your Feedback

As we head further into fiscal year 2025, one of the Board’s key areas of focus is an increased level of direct engagement with our shareholders. We understand that an ongoing and open line of communication on all matters is critical to your investment in the Company, including our operational and financial strategy, compliance, risk management, and ESG programs. We encourage you to share your views with us.

If you would like to write to us, you may do so by addressing your correspondence to:

|

Corporate Secretary The J. M. Smucker Company One Strawberry Lane Orrville, Ohio 44667

|

You can also call our Shareholder Services number at 1-330-684-3838 |

| 8 | The J. M. Smucker Company |

|

2024 Proxy Statement |

|

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON AUGUST 14, 2024

|

CORPORATE GOVERNANCE

Corporate Governance Guidelines

Our Corporate Governance Guidelines (the “Guidelines”) are designed to formalize the Board’s role and to confirm its independence from management and its role of aligning management and Board interests with the interests of shareholders. The Guidelines provide in pertinent part that:

|

A majority of directors will be independent as required by the rules of the New York Stock Exchange (the “NYSE”) and the Securities and Exchange Commission (the “SEC”), and as further set forth in the Guidelines; |

|

All members of the Committees will be independent, and there will be at least three members on each of the Committees; |

|

All members of the Committees and the chairs of the Committees will be appointed by the Board on the recommendation of the Nominating Committee, and the Board intends to rotate the chairs of the Committees every five years; |

|

The independent directors will meet in executive session on a regular basis in conjunction with regularly scheduled meetings of the Board and the Committees, and such meetings will be chaired by a lead independent director (in such role, the “Lead Independent Director”), who will be selected by the independent directors with input from the Chair of the Board; |

|

The Lead Independent Director will coordinate the activities of the other independent directors and perform such other duties and responsibilities as the Board may determine, including those set forth below under the heading “Executive Sessions and Lead Independent Director;” |

|

The Board and each of the Committees will conduct an annual self-evaluation; |

|

All non-employee directors will own a minimum amount of the Company’s common shares as established in our Stock Ownership Guidelines for Directors and Officers, which currently require that non-employee directors own common shares with a value of no less than five times the annual cash retainer paid to each non-employee director and that each non-employee director should strive to attain this ownership threshold within five years of joining the Board; |

|

Each director will attend at least 75% of all regular and special meetings of the Board; |

|

Absent specific action by the Board, directors will not be eligible for nomination after reaching 75 years of age; |

|

Each director will advise the Chair of the Board and the Lead Independent Director in advance of accepting an invitation to serve on the board of another public company to allow for a review of any potential conflicts or other concerns; |

|

Each director will advise the Nominating Committee, and offer to resign, if his or her primary professional position or responsibility materially changes to provide the Board an opportunity to review the qualifications of the director; |

|

No director will serve concurrently on more than three public company boards, including that of the Company, without prior, unanimous consent of the Board; |

|

The Nominating Committee and the Board will consider a director’s length of tenure when reviewing Board composition and will seek to maintain an overall balance of experience and continuity, along with fresh perspectives. The Board does not have a director tenure limit but will consider the impact of a director’s tenure after he or she has served on the Board for more than 15 years; and |

|

|

|

|

| The J. M. Smucker Company |

|

2024 Proxy Statement | 9 |

CORPORATE GOVERNANCE

|

The Corporate Secretary will provide newly elected directors with materials and training in our director orientation program and will also provide such additional director training and orientation as appropriate and in accordance with our Board Education Policy. |

Shareholder Recommendations for Director Nominees

The Nominating Committee is responsible for identifying, evaluating, and recommending qualified candidates to the Board for nomination. The Nominating Committee considers all suggestions for membership on the Board, including nominations made by our shareholders, and all candidates are evaluated consistent with our policy of nondiscrimination. Shareholders’ nominations for directors must be made in writing and include the nominee’s written consent to the nomination and detailed background information sufficient for the Nominating Committee to evaluate the nominee’s qualifications. Nominations should be submitted to the Corporate Secretary, The J. M. Smucker Company, One Strawberry Lane, Orrville, Ohio 44667. The Corporate Secretary will then forward nominations to the Chair of the Nominating Committee. All recommendations must include qualifications that meet, at a minimum, the following criteria:

|

Director candidates must be committed to our culture and Basic Beliefs and will be individuals of integrity, intelligence, and strength of character having a balance of skills, knowledge, diversity, background, and experience beneficial to the Company; |

|

Independent director candidates must meet the independence requirements set forth below under the heading “Director Independence;” |

|

Independent director candidates must also maintain independence necessary for an unbiased evaluation of management performance; |

|

Director candidates must be able to effectively carry out responsibilities of oversight of our strategy, compliance, and risks; |

|

Director candidates should have either significant experience in a senior executive role with a major business organization or relevant experience from other professional backgrounds; |

|

Director candidates should have a working knowledge of ESG issues, risk oversight, and the changing role of boards; |

|

Director candidates should have a firm commitment to attend and participate in Board meetings and related Board activities; |

|

Director candidates should not have any affiliations or relationships with competitive businesses or organizations or other activities, in each case which could lead to a real or perceived conflict of interest; and |

|

Director candidates should not serve on more than three public company boards, including that of the Company, at any one time without prior, unanimous consent of the Board. |

Shareholder-Nominated Director Candidates

The Company’s Amended Regulations (the “Regulations”) provide a proxy access right to permit any shareholder or a group of up to 20 shareholders owning at least 3% of the Company’s outstanding common shares continuously for at least three years to nominate, and include in our Proxy Statement, director nominees constituting up to the greater of (i) two directors or (ii) 20% of the Board, subject to certain limitations and provided that shareholders and nominees satisfy the requirements specified in the Regulations. Requests to include shareholder-nominated candidates for director in our Proxy Statement and form of proxy related to our 2025 Annual Meeting of Shareholders must be submitted to and received by the Corporate Secretary, The J. M. Smucker Company, One Strawberry Lane, Orrville, Ohio 44667, no earlier than January 29, 2025 and no later than February 28, 2025.

| 10 | The J. M. Smucker Company |

|

2024 Proxy Statement |

|

|

|

|

CORPORATE GOVERNANCE

Board Diversity

We greatly value diversity and the varying perspectives and experiences that emerge from a diverse group of people, and the Board and the Nominating Committee believe the value of diversity extends to the boardroom and that diversity strengthens the composition of the Board. Therefore, the Board and the Nominating Committee seek to consider a diverse group of experiences, characteristics, attributes, skills, and cultural and other backgrounds in considering potential director candidates. To further this goal, the Nominating Committee recently amended its Charter to specify that the Nominating Committee is committed to seeking out qualified diverse candidates who meet the applicable search criteria, including women and minority candidates, to include in the pools from which nominees for the Board are considered, invited for interviews, and ultimately offered the opportunity to be appointed to the Board or stand for election to the Board. In the event a third-party search firm is engaged for a particular director search, the Nominating Committee would expect, and would plan to instruct, such firm to include individuals reflecting the aforementioned criteria in the initial pool or lists of potential director candidates submitted to the Nominating Committee for consideration. Diversity is important because a variety of viewpoints contribute to a more effective decision-making process.

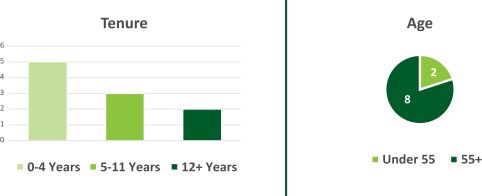

The Nominating Committee and the Board also consider the composition of the Board as a whole in evaluating whether a particular individual should serve on the Board, as the Board seeks to comprise itself of members who, collectively, possess a range of relevant skills, experience, and expertise. The below graphs summarize the tenure, age, gender, and racial or ethnic diversity breakdown of our director nominees:

|

|

|

|

| The J. M. Smucker Company |

|

2024 Proxy Statement | 11 |

CORPORATE GOVERNANCE

Experience, Qualifications, Attributes, Skills, and Diversity of Director Nominees

As mentioned above, in considering each director nominee and the composition of the Board as a whole, the Nominating Committee looks for a diverse group of experiences, characteristics, attributes, and skills that relate directly to our management and operations. Success in specific categories is a key factor in our overall operational success and creating shareholder value. The Nominating Committee believes that directors who possess some or all of the following experiences, characteristics, attributes, and skills are better able to provide oversight of our management and long-term and strategic objectives.

|

Adherence to the Company’s Basic Beliefs

|

We seek directors who understand, and are committed to, our Basic Beliefs. These Basic Beliefs are our values and principles that serve as guideposts for decisions at every level of the Company and cultivate a culture of commitment to each other and to our constituents.

| |

|

Leadership Experience |

We seek directors who have significant leadership experience, either in a senior executive role with a major business organization or relevant experience from other professional backgrounds. Strong leaders bring vision, strategic agility, diverse and global perspectives, and broad business insight to the Company. They also demonstrate a practical understanding of organizations, processes, strategy, risk management, compliance, and the methods to drive change and growth. People with experience in significant leadership positions possess strong abilities to motivate and manage others and to identify and develop leadership qualities in others.

| |

|

Independence |

We require that a majority of our directors satisfy the independence requirements of the NYSE and the SEC.

| |

|

Finance Experience

|

We believe that it is important for Directors to have an understanding of finance and financial reporting processes. Accurate financial reporting is critical to our success and reputation. We seek to have at least two independent Directors who qualify as “audit committee financial experts,” within the meaning of Regulation S-K promulgated by the SEC (“Regulation S-K”), particularly for service on the Audit Committee. We expect all of our directors to be financially knowledgeable.

| |

|

Public Company Board Experience |

We seek directors who have experience serving on the boards of other large, publicly traded companies. This experience prepares the directors to fulfil the Board’s responsibilities of overseeing our business and providing insight and guidance to management.

| |

|

Environmental, Social, and Governance Experience

|

We seek directors who have knowledge of and experience with ESG initiatives to help inform us on best practices and assist us in establishing goals and delivering against those goals.

| |

|

Operations Experience in Consumer Goods

|

We seek directors with relevant general management or operations experience in the consumer goods industry. We believe that it is important for directors to have experience in new and expanding businesses, customer segments, and geographies.

| |

|

People Management Experience

|

We seek directors with relevant people management experience, including matters such as inclusion, diversity, and equity, workplace environment, and talent development and retention.

| |

|

Diversity

|

We greatly value diversity and the varying perspectives and experiences that emerge from a diverse group of people. Because of this, we believe diversity in our Board is important, including diversity of experiences, characteristics, attributes, skills, and cultural and other backgrounds.

| |

|

Marketing, Digital, Innovation, or Public Relations Experience

|

As a manufacturer and marketer of branded food products, we seek directors who have a diverse range of marketing, digital, innovation, or public relations experience.

| |

|

Mergers and Acquisitions Experience

|

We have been, and believe we will continue to be, active in acquiring other companies that fit our strategy and, therefore, seek directors with relevant mergers and acquisitions experience, including experience in integrating businesses.

|

| 12 | The J. M. Smucker Company |

|

2024 Proxy Statement |

|

|

|

|

CORPORATE GOVERNANCE

The Board believes that all of the directors are highly qualified and have specific employment and leadership experiences, qualifications, and skills that qualify them for service on the Board. The specific experiences, qualifications, and skills that the Board considered in determining that each such person should serve as a director are included in their individual biographies and also summarized further in the following table:

| Director Qualifications and Experience |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| Knowledge, Skills, and Experience |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| Adherence to the Company’s Basic Beliefs |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Leadership Experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Independence |

● | ● | ● | ● | ● | ● | ● |

|

● | ● | ||||||||||||||||||||||||||||||||||||||||

| Finance Experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Public Company Board Experience |

|

● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Environmental, Social, and Governance Experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Operations Experience in Consumer Goods |

● | ● |

|

|

● | ● |

|

● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| People Management Experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Diversity |

● | ● | ● |

|

|

|

● |

|

● | ● | ||||||||||||||||||||||||||||||||||||||||

| Marketing, Digital, Innovation, or Public Relations Experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Mergers and Acquisition Experience |

|

● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Demographics |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| Race/Ethnicity |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| Black or African American |

|

|

● |

|

|

|

● |

|

|

| ||||||||||||||||||||||||||||||||||||||||

| American Indian or Alaska Native |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| Asian |

|

● |

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| White |

● |

|

|

● | ● | ● |

|

● | ● | ● | ||||||||||||||||||||||||||||||||||||||||

| Middle Eastern or North African |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| Native Hawaiian or Other Pacific Islander |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| Hispanic or Latino |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| Gender |

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

| Male |

|

● |

|

● | ● | ● | ● | ● |

|

| ||||||||||||||||||||||||||||||||||||||||

| Female |

● |

|

● |

|

|

|

|

|

● | ● | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

| The J. M. Smucker Company |

|

2024 Proxy Statement | 13 |

CORPORATE GOVERNANCE

Director Resignation Policy

In connection with the adoption of a majority voting standard for uncontested elections of directors, the Board adopted a director resignation policy to address the situation in which one or more incumbent directors fail to receive the required majority vote for re-election in an uncontested election. Under Ohio law, an incumbent director who is not re-elected would remain in office as a “holdover” director until his or her successor is elected. This director resignation policy provides that an incumbent director who is not re-elected with more “for” votes than “against” votes in an uncontested election will be expected to tender to the Board his or her resignation as a director promptly following the certification of the election results. The Nominating Committee would then consider each tendered resignation and recommend to the Board whether to accept or reject each such tendered resignation. The Board would act on each tendered resignation, taking into account its fiduciary duties to the Company and our shareholders and the Nominating Committee’s recommendation, within 90 days following the certification of the election results. The Nominating Committee, in making its recommendation, and the Board, in making its decision, may consider any factors or other information with respect to any tendered resignation that they consider appropriate, including, without limitation:

|

The stated reason for such director’s failure to receive the approval of a majority of votes cast; |

|

The percentage of votes cast against such director; and |

|

The performance of such director. |

Following the Nominating Committee’s recommendation and the Board’s decision, the Board will promptly and publicly disclose its decision whether to accept or reject each tendered resignation and, if applicable, the reasons for rejecting a tendered resignation. If a director’s tendered resignation is rejected, he or she would continue to serve until his or her successor is elected, or until his or her earlier resignation, removal from office, or death. If a director’s tendered resignation is accepted, then the Board would have the sole discretion to fill any resulting vacancy or decrease the number of directors, in each case pursuant to the provisions of and to the extent permitted by the Regulations. Any director who tenders his or her resignation pursuant to this policy would abstain from providing input or voting on the Nominating Committee’s recommendation or the Board’s action regarding whether to accept or reject the tendered resignation. While this description reflects the terms of the Board’s current director resignation policy, the Board retains the power to amend and administer the policy as the Board, in its sole discretion, determines is appropriate.

Director Independence

We require that a majority of our directors be “independent” as defined by the rules of the NYSE and the SEC. We may, in the future, amend the Guidelines to establish such additional criteria as the Board determines to be appropriate. The Board makes a determination as to the independence of each director on an annual basis. The Board has determined that the following nine non-employee directors are independent directors: Mercedes Abramo, Tarang Amin, Susan Chapman-Hughes, Jay Henderson, Jonathan Johnson III, Kirk Perry, Alex Shumate, Jodi Taylor, and Dawn Willoughby.

In general, “independent” means that a director has no material relationship with us or any of our subsidiaries. The existence of a material relationship is determined upon a review of all relevant facts and circumstances and, generally, is a relationship that might reasonably be expected to compromise the director’s ability to maintain his or her independence from our management.

The Board considers the issue of materiality from the standpoint of the persons or organizations with which the director has an affiliation, as well as from the standpoint of the director.

The following standards will be applied by the Board in determining whether individual directors qualify as “independent” under the rules of the NYSE and the SEC. To the extent that these standards are more stringent than the rules of the NYSE or the SEC, such standards will apply. References to the Company include our consolidated subsidiaries.

|

No director will be qualified as independent unless the Board affirmatively determines that the director has no material relationship with us, either directly or as a partner, shareholder, or officer of an organization that has a relationship with us. We will disclose these affirmative determinations on an annual basis. |

| 14 | The J. M. Smucker Company |

|

2024 Proxy Statement |

|

|

|

|

CORPORATE GOVERNANCE

|

No director who is a former employee of ours can be deemed independent until three years after the end of his or her employment relationship with us. |

|

No director whose immediate family member is a former executive officer of the Company can be deemed independent until three years after the end of such executive officer’s relationship with us. |

|

No director who receives, or whose immediate family member receives, more than $120,000 in direct compensation from the Company in any twelve-month period within the past three years, other than director and Committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), can be deemed independent. |

|

No director can be deemed independent if the director (i) is a current partner or employee of a firm that is our internal or external auditor; (ii) has an immediate family member who is a current partner of such a firm; (iii) has an immediate family member who is a current employee of such a firm and personally works on our audit; or (iv) was, or an immediate family member was, within the last three years, a partner or employee of such a firm and personally worked on our audit within that time. |

|

No director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of our present executive officers serve on that company’s compensation committee can be independent until three years after the end of such service or employment relationship. |

|

No director who is an executive officer or employee, or whose immediate family member is an executive officer, of a company (excluding charitable organizations) that makes payments to, or receives payments from, us for property or services in an amount which, in any single fiscal year, exceeds the greater of $1,000,000 or 2% of such other company’s consolidated gross revenues can be deemed independent until three years after falling below such threshold. |

|

No director can be deemed independent if we have made charitable contributions to any charitable organization in which such director serves as an executive officer if, within the preceding three years, contributions by us to such charitable organization in any single fiscal year of such charitable organization exceeded the greater of $1,000,000 or 2% of such charitable organization’s consolidated gross revenues. |

In its review and application of the criteria used to determine independence, the Board considered the fact that we do business with organizations directly or indirectly affiliated with Paul Dolan, who retired from the Board in August 2023, and Kirk Perry, and affirmatively determined that the amounts paid to the entities affiliated with these individuals do not meet the threshold which would create an issue under the standards for determining independence.

The value of advertising and promotional activities sponsored with the Cleveland Guardians organization, of which Paul Dolan is the Chairman and Chief Executive Officer, in the first quarter of fiscal year 2024 was approximately $0.3 million and does not exceed the greater of $1,000,000 or 2% of the consolidated gross revenues of the Cleveland Guardians.

The value of consumer data, analytics, and insights services provided to us by Circana, Inc. (“Circana”), of which Kirk Perry is the President and Chief Executive Officer, in fiscal year 2024 was approximately $11.0 million and does not exceed the greater of $1,000,000 or 2% of consolidated gross revenues of Circana.

Structure of the Board of Directors

Chair of the Board and Chief Executive Officer as Director

The Regulations provide that one person may hold both positions of Chair of the Board and Chief Executive Officer. Mark Smucker currently serves as both Chair of the Board and Chief Executive Officer. The Board believes that a current or former Chief Executive Officer is best situated to serve as Chair of the Board, because he is one of the directors most familiar with our business and industry. The Board also believes that having a current or former Chief Executive Officer serve as Chair of the Board provides an efficient and effective leadership model for us by fostering clear accountability, effective

|

|

|

|

| The J. M. Smucker Company |

|

2024 Proxy Statement | 15 |

CORPORATE GOVERNANCE

decision-making, and alignment of corporate strategy. The majority of our directors are independent, and the Board has a Lead Independent Director. The Board’s independent directors bring experience, oversight, and expertise from outside the Company and industry, while the Chair of the Board and Chief Executive Officer bring Company and industry-specific experience and expertise. One of the key responsibilities of the Board is to develop strategic direction and hold management accountable for the execution of its strategy once it is developed. The Board believes that its current management structure, together with independent directors having the duties described above and the Lead Independent Director having the duties described below, is in the best interests of shareholders because it strikes an appropriate balance for us; with a current or former Chief Executive Officer serving as Chair of the Board, there is unified leadership and a focus on strategic development and execution, while the independent directors help assure independent oversight of management.

Chairman Emeritus

Any member of the Smucker family who has previously served in the role of Chair of the Board may be appointed by the Board as a non-director Chairman Emeritus at such time as such individual ceases to be a member of the Board. The purpose of the Chairman Emeritus position is to permit the Company to continue to benefit from the participation and input of the Chairman Emeritus after such person has ceased to be a director and to permit the Chairman Emeritus to provide such participation and input to the Company and the Board. The term of a Chairman Emeritus will be one year from appointment, renewable annually by the Board, provided that the term of a Chairman Emeritus will not be renewed beyond the expiration of the term during which the Chairman Emeritus reaches the age of 80. Subject to any different determinations of the Board, a Chairman Emeritus:

|

Will receive notice of and may participate in Board meetings, but will generally not attend Board sessions that are limited to independent directors only; |

|

May be invited to attend and participate in Committee meetings as determined by the Board or the applicable Committee, but will generally not attend Committee sessions that are limited to independent directors only; |

|

Will not be entitled to vote and will not be counted for quorum purposes at Board or Committee meetings; |

|

To the extent requested by the Company or the Board and agreed to by the Chairman Emeritus, will act as an advisor to the Company, including (i) participating in Company communications, (ii) participating in Company meetings, (iii) serving as a spokesperson with external constituents, and (iv) serving as an advisor to the Chief Executive Officer; and |

|

Will provide such other advice and services and engage in such other activities as may be agreed between the Board and the Chairman Emeritus. |

A Chairman Emeritus will be entitled to reimbursement of expenses incurred in connection with service in the role of Chairman Emeritus and to indemnification and insurance in connection with such service. Any additional compensation or other perquisites will be as determined by the Board. A Chairman Emeritus will remain subject to Section 16 reporting requirements, the Company’s Code of Conduct (as defined below) and Insider Trading and Disclosure Policy (the “Insider Trading Policy”), and the confidentiality and similar obligations applicable to a director of the Company but will not be considered a director or officer of the Company under the Company’s Amended Articles of Incorporation (the “Articles”) or Regulations, under the Ohio General Corporation Law, or otherwise. Following the end of his or her final term, a Chairman Emeritus may retain the title of Chairman Emeritus as an honorific, without any rights, responsibilities, or obligations. However, at the request of the Chief Executive Officer and upon mutual agreement, a Chairman Emeritus may engage in activities to enhance and support the culture of the Company and its constituents. The Board appointed Richard Smucker and Timothy Smucker as Chairman Emeriti on August 16, 2023 and will appoint both of them for another one-year term upon the expiration of their current term.

Board’s Role in Risk Oversight

Risk is inherent in any business, and our management is responsible for the day-to-day management of risks that we face. The Board, on the other hand, has responsibility for the oversight of risk management. In that role, the Board has the responsibility to evaluate the risk management process to ensure its adequacy and that it is implemented properly by management.

| 16 | The J. M. Smucker Company |

|

2024 Proxy Statement |

|

|

|

|

CORPORATE GOVERNANCE

The Board believes that full and open communication between management and the Board is essential for effective risk management and oversight. The Board meets regularly with senior management, including executive officers, to discuss strategy and risks facing the Company, including new and potentially disruptive risks such as those posed by supply chain disruptions, product recalls, cybersecurity incidents, and relevant geopolitical incidents. Senior management attends the Board’s quarterly meetings, as well as Committee meetings, to address any questions or concerns raised by the Board on risk management and any other matters. The Chief Compliance Officer manages the Company’s compliance function and oversees the enterprise risk function; chairs the Governance, Risk, and Compliance Committee; attends Board and Audit Committee meetings; and provides periodic updates on risks and compliance issues facing the Company and the industry. The Governance, Risk, and Compliance Committee, along with members from various functions across the Company, meet periodically to review enterprise risk issues, including top risk activities and changes, emerging risks, risk mitigation activities, and program maturity. Each quarter, the Board receives presentations from senior management on business operations, financial results, and strategic, risk, and compliance issues. In addition, senior management holds regular strategic planning sessions to discuss strategies, key challenges, and risks and opportunities for the Company. Senior management then reviews the results of each strategic planning session with the Board.

The Committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to management of major financial risk exposures, including in the areas of financial reporting, internal controls, hedging strategies, and cybersecurity. Risk assessment reports are regularly provided by management, our internal auditors, and compliance professionals to the Audit Committee. In particular, the Audit Committee receives an update on cybersecurity and compliance matters at each regularly scheduled meeting and reports to the Board on key activities. The Board also receives an update on cybersecurity and compliance matters at least once a year. The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from the Company’s people management and compensation policies and programs, including overseeing the Company’s compensation-related risk assessment described further below in this Proxy Statement and developing stock ownership and clawback guidelines for our executive officers. The Nominating Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership, and structure, succession planning for directors and executive officers, and corporate governance, including monitoring corporate governance issues; overseeing the Company’s ESG processes, policies, commitments, and activities; developing director evaluations for the Board and the Committees; and reviewing potential conflicts of interest.

All Committees report back to the full Board at Board meetings as to the Committee’s activities and matters discussed and reviewed at the Committee’s meeting. In addition, the Board is encouraged to participate in internal and external director education courses, as described further in our Board Education Policy, to keep apprised of current issues, including areas of risk. External advisors also periodically present to the Board and the Committees on risks impacting the Company and the food industry.

Communications with the Board

Shareholders and others who wish to communicate with members of the Board as a group, with non-employee directors as a group, or with individual directors, may do so by writing to The J. M. Smucker Company, c/o Corporate Secretary, One Strawberry Lane, Orrville, Ohio 44667. The directors have requested that the Corporate Secretary act as their agent in processing any communications received. All communications that relate to matters within the scope of responsibilities of the Board and its Committees will be forwarded to the appropriate directors. Communications relating to matters within the responsibility of one of the Committees will be forwarded to the Chair of the appropriate Committee. Communications relating to ordinary business matters are not within the scope of the Board’s responsibility and will be forwarded to the appropriate executive officer at the Company. Solicitations, advertising materials, and frivolous or inappropriate communications will not be forwarded.

Commitment to Integrity: Our Code

Doing the Right Thing is one of our Basic Beliefs and is fundamental to our business. We emphasize that ethical conduct is vital to ensure successful, sustained business and business relationships. Our Commitment to Integrity: Our Code (the “Code of Conduct”) is an extension of our long-standing principles and values. It applies to our employees and directors. The Code

|

|

|

|

| The J. M. Smucker Company |

|

2024 Proxy Statement | 17 |

CORPORATE GOVERNANCE

of Conduct is a resource which guides daily conduct in the workplace, and employees are expected to reference it frequently. The Code of Conduct outlines our expectations across numerous areas and situations in which ethical choices might be necessary, such as creating a positive work environment; embracing inclusion, diversity, and equity; engaging with customers, suppliers, and competitors; handling confidential information and conflicts of interest; the exchange of gifts, meals, and entertainment; avoiding bribery and corruption and insider trading; our commitment to community, including ESG matters and philanthropic activities; and rules regarding food safety, advertising, and product labeling. Employees and directors are required to review and acknowledge the Code of Conduct on an annual basis and receive training at least once every three years. Additionally, employees receive annual compliance training on key topics throughout the year.

Any amendments to the Code of Conduct and any waivers of the Code of Conduct for or on behalf of any director, executive officer, or senior financial officer of the Company must be approved by the Board or by a Committee of the Board to which authority to issue such waivers has been delegated by the Board. Any amendments or waivers of the Code of Conduct will be promptly disclosed to the public, as required by applicable law, and will be disclosed on our website at www.jmsmucker.com. Waivers of the Code of Conduct for any other employee may be made only by an authorized officer of the Company. As of the date of this Proxy Statement, there have been no such waivers.

Procedures for Reporting Ethical, Accounting, Auditing, and Financial Related Issues

The Board has established procedures for employees to report violations of the Code of Conduct or complaints regarding accounting, auditing, and financial-related matters to their manager or supervisor, to the Chief Compliance Officer, the Chief Legal Officer, or directly to the Audit Committee. Reports to the Chief Compliance Officer or Chief Legal Officer may be made in writing, by telephone, in person, or may be submitted anonymously through the Company’s Integrity Portal, which is managed by an independent third-party service provider and is available 24 hours a day, seven days a week, in multiple languages, and can be accessed via phone or through the Internet at JMSIntegrity.com. Specifically, via phone in the U.S. and Canada, employees or concerned individuals can call toll-free 1-844-319-9352; in other countries, employees or concerned individuals can access the applicable country number at JMSIntegrity.com. We forbid retaliation, or threats of retaliation, against our employees who, in good faith, report violations of the Code of Conduct.

Availability of Corporate Governance Documents

Copies of the Articles, Regulations, Guidelines, Director Resignation Policy, Code of Conduct, Stock Ownership Guidelines, Audit Committee Charter, Compensation and People Committee Charter, and Nominating, Governance, and Corporate Responsibility Committee Charter are posted on our website at www.jmsmucker.com and are available free of charge to any shareholder submitting a written request to the Corporate Secretary, The J. M. Smucker Company, One Strawberry Lane, Orrville, Ohio 44667.

| 18 | The J. M. Smucker Company |

|

2024 Proxy Statement |

|

|

|

|

ELECTION OF DIRECTORS

(Proposal 1 on the proxy card)

The Board currently has 10 directors, all of whom will be up for election at the Annual Meeting of Shareholders to hold office for a term of one year. Unless instructed otherwise, the proxies intend to vote FOR the election of these nominees.

Each nominee has agreed to serve if elected. If any nominee declines, is unable to accept such nomination, or is unable to serve (an event which is not expected), the Board reserves the right, in its discretion, to substitute another person or nominee or to reduce the number of nominees. In this event, the proxy, with respect to such nominee or nominees, will be voted for such other person or persons as the Board may recommend.

The members of the Board, including those who are listed in this Proxy Statement as nominees for election, with information about each of them based on data furnished to us by these persons as of June 28, 2024, are as follows:

Nominees for Election as Directors Whose Proposed Terms Would Expire at the 2025 Annual Meeting

|

MERCEDES ABRAMO

Age: 54

Director Since: 2023

Committee: Audit

Favorite Product:

Café Bustelo

|

Professional Experience

Ms. Abramo has been the Deputy Chief Commercial Officer of Cartier International SA (“Cartier”), an international chain of jewelry boutiques since March 2023. Prior to her current role at Cartier, Ms. Abramo held several positions of increasing responsibility, including President and Chief Executive Officer of North America; Vice President, Retail, North America; Assistant Vice President, Retail, New York Region; and Director, Fifth Avenue Mansion, United States Flagship. Prior to joining Cartier, Ms. Abramo spent five years with Tiffany & Co. in various Director positions and six years with various luxury hotels in management roles. Ms. Abramo is a founding member of Chief, a private network designed specifically for women leaders to strengthen their experience in the C-suite and effect change from the top down.

Skills and Qualifications

The Board concluded that Ms. Abramo should serve as a director primarily due to her experience serving as a chief executive officer and her extensive experience in managing and overseeing retail, hospitality, and luxury goods. Specifically, Ms. Abramo brings significant leadership, finance, operating, and strategy experience through her positions with Cartier and Tiffany & Co. Ms. Abramo’s background enables her to provide valuable insights to the Board, particularly in strategy, operations, e-commerce, people management, marketing, supply chain, and in overseeing the Company’s finances and ESG areas.

|

|

|

|

|

| The J. M. Smucker Company |

|

2024 Proxy Statement | 19 |

ELECTION OF DIRECTORS

|

TARANG AMIN

Age: 59

Director Since: 2023

Committee: Compensation

Favorite Product:

Uncrustables

|

Professional Experience

Mr. Amin has been the Chairman and Chief Executive Officer of e.l.f. Beauty, Inc. (“e.l.f. Beauty”), a publicly traded cosmetics company since August 2015. He took the company public in 2016 in one of the most successful initial public offerings in the beauty industry. Mr. Amin also served as President, Chief Executive Officer, and Director of e.l.f. Beauty from February 2014 through July 2015. Prior to joining e.l.f. Beauty, he was President, Chief Executive Officer, and Director of Schiff Nutrition International (“Schiff Nutrition”), a publicly traded nutritional supplements company, from March 2011 through March 2013 and held various leadership roles at The Clorox Company (“Clorox”) and The Procter & Gamble Company (“P&G”). Mr. Amin has been a director of Pharmavite, LLC, a dietary supplements company, since January 2020 and served as a director of Angie’s BOOMCHICKAPOP, a natural and organic snack brand, from June 2014 through October 2017.

Skills and Qualifications

The Board concluded that Mr. Amin should serve as a director primarily due to his extensive leadership experience at consumer goods companies and his experience serving as a director of other companies. Specifically, he brings significant leadership, finance, operating, and strategy experience through his positions with e.l.f. Beauty, Schiff Nutrition, Clorox, and P&G. Mr. Amin’s background enables him to provide valuable insights to the Board, particularly in strategy, operations, e-commerce, people management, marketing, supply chain, corporate governance, and overseeing our executive compensation practices.

|

|

SUSAN CHAPMAN- HUGHES

Age: 55

Director Since: 2020

Committee: Compensation (Chair)

Favorite Product:

Smucker’s Hot Fudge Sauce

|

Professional Experience

Ms. Chapman-Hughes was the Executive Vice President and General Manager, Global Head of Digital Capabilities, Transformation, and Operations, Global Commercial Services of American Express Company, a financial services corporation, from February 2018 through February 2021. Prior to this role, Ms. Chapman-Hughes served in several Senior Vice President level positions since joining American Express Company in 2010. She is also a director, the chair of the compensation committee, and a member of the nominating and governance committee of Toast, Inc., a publicly traded cloud-based restaurant software company, since February 2021. In addition, Ms. Chapman-Hughes served as a director, the chair of the compensation committee, and a member of the nominating and governance committee of Potbelly Corporation, a publicly traded restaurant company, from May 2014 through June 2020.

Skills and Qualifications

The Board concluded that Ms. Chapman-Hughes should serve as a director primarily due to her significant experience in managing and overseeing businesses, as well as her strong corporate governance experience as a member of a public company board. Specifically, Ms. Chapman-Hughes brings leadership and operating skills through her former roles with American Express Company. Ms. Chapman-Hughes’s background enables her to provide valuable insights to the Board, particularly in sales, strategy, digital capabilities and technology, innovation, change management, and overseeing our executive compensation and ESG practices.

|

| 20 | The J. M. Smucker Company |

|

2024 Proxy Statement |

|

|

|

|

ELECTION OF DIRECTORS

|

JAY HENDERSON

Age: 68

Director Since: 2016

Committee: Audit

Favorite Product:

Uncrustables

|

Professional Experience

Mr. Henderson retired as Vice Chairman, Client Service at PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”) in June 2016, a position he held since 2007. He also served as PricewaterhouseCoopers’ Managing Partner of the Greater Chicago Market from 2003 through 2013. During his career at PricewaterhouseCoopers, Mr. Henderson gained significant experience working with the boards and audit committees of Fortune 500 companies and has managed major client relationships across multiple markets and industry sectors. He is the lead director, chair of the audit committee, and a member of the corporate governance, capital governance, human capital and compensation, business risk, and executive committees of Northern Trust Corporation, a publicly traded financial holding company, where he has served since July 2016, and a director, chair of the audit committee, and member of the finance and executive committees of Illinois Tool Works Inc., a publicly traded global multi-industrial manufacturer of specialized industrial equipment, consumables, and related service businesses, where he has served since August 2016. Mr. Henderson is also a member of the boards of several non-profit organizations.

Skills and Qualifications