Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☑ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |||

| THE J. M. SMUCKER COMPANY | ||||

| (Name of Registrant as Specified In Its Charter)

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

|

Payment of Filing Fee (Check the appropriate box): | ||||

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

|

(2) |

Aggregate number of securities to which transaction applies:

| |||

|

| ||||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

|

(4) |

Proposed maximum aggregate value of transaction:

| |||

|

| ||||

|

(5) |

Total fee paid: | |||

|

| ||||

|

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

|

(2) |

Form, Schedule or Registration Statement No.:

| |||

|

| ||||

|

(3) |

Filing Party:

| |||

|

| ||||

|

(4) |

Date Filed:

| |||

|

| ||||

Table of Contents

THE J. M. SMUCKER COMPANY

2019 Proxy Statement and

Notice of Annual Meeting of Shareholders

Table of Contents

THE J. M. SMUCKER COMPANY

June 28, 2019

Dear Shareholder:

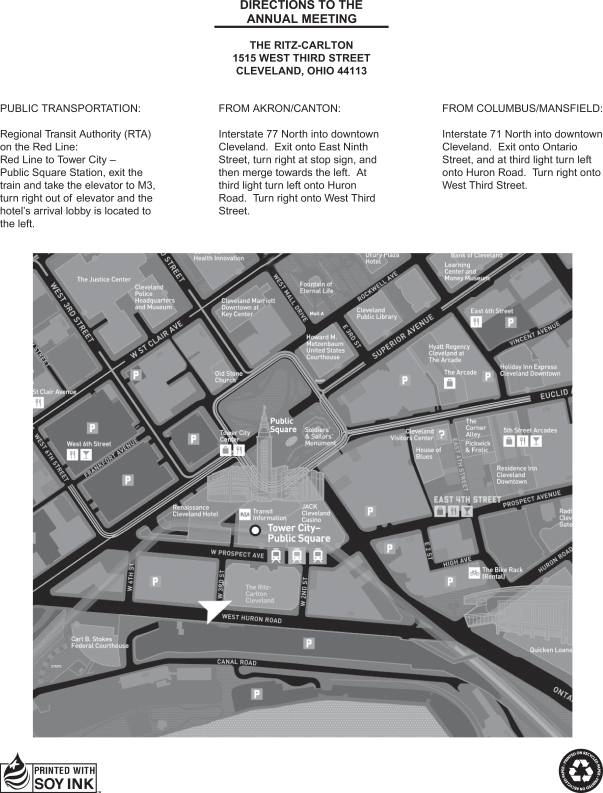

As a shareholder in our Company, you are a partner in our continued success. We are pleased to invite you to attend our Annual Meeting of Shareholders on Wednesday, August 14, 2019. The meeting will begin at 11:00 a.m. Eastern Time, at The Ritz-Carlton, 1515 West Third Street, Cleveland, Ohio 44113.

We are concluding a period of necessary and exciting transformation that has positioned us to deliver sustained growth. We achieved many important milestones toward this objective in the past year, including transforming our brand portfolio to better align with consumer preferences, launching a new innovation model, enhancing our efforts to deliver world-class marketing, making crucial investments to further our technology capabilities, and continuing to deliver against our established environmental sustainability goals. Following this tremendous evolution, we truly feel the best is yet to come.

Included with this letter is our Notice of the 2019 Annual Meeting of Shareholders and our proxy statement, which is first being mailed to our shareholders on or about June 28, 2019. Please review this material for information about the nominees named in the proxy statement for election as Directors and the Company’s appointed Independent Registered Public Accounting Firm. In addition, details regarding executive officer and Director compensation, corporate governance matters, and the business to be conducted at the annual meeting are also described.

Whether or not you plan to attend the annual meeting, please cast your vote, at your earliest convenience, as instructed in the Notice of Internet Availability of Proxy Materials or in the proxy card. Your vote is very important. Your vote before the annual meeting will ensure representation of your common shares at the annual meeting even if you are unable to attend.

We are eager to demonstrate we can build on the momentum we have created in fiscal year 2019 to continue delivering value on your investment and look forward to sharing more information about the Company’s performance and our plans at the annual meeting.

Sincerely,

|

|

Timothy P. Smucker |

|

Richard K. Smucker |

|

Mark T. Smucker |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON AUGUST 14, 2019

This proxy statement and the 2019 Annual Report are available at www.proxyvote.com

|

Table of Contents

| Notice of 2019 Annual Meeting of Shareholders |

||||

Wednesday, August 14, 2019

11:00 a.m. Eastern Time

The Ritz-Carlton

1515 West Third Street

Cleveland, Ohio 44113

The Annual Meeting of Shareholders of The J. M. Smucker Company (the “Company,” “we,” “us,” or “our”) will be held for the following purposes:

| 1. | To elect as Directors the twelve nominees named in the proxy statement and recommended by the Board of Directors (the “Board”) whose term of office will expire in 2020; |

| 2. | To ratify the appointment of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for the 2020 fiscal year; |

| 3. | To approve, on a non-binding, advisory basis, the Company’s executive compensation as disclosed in these proxy materials; and |

| 4. | To consider and act upon any other matter that may properly come before the annual meeting. |

Shareholders of record at the close of business on June 17, 2019 are entitled to vote at the annual meeting. You may cast your vote via the Internet, as instructed in the Notice of Internet Availability of Proxy Materials, or if you received your proxy materials by mail, you may also vote by mail or by telephone.

All shareholders are invited to attend the annual meeting. However, seating at the annual meeting will be on a first-come, first-served basis, and we cannot guarantee seating for all shareholders.

Jeannette L. Knudsen

Senior Vice President, General Counsel and Secretary

Table of Contents

THE J. M. SMUCKER COMPANY

| Page | ||||

| 1 | ||||

| 5 | ||||

| 5 | ||||

| 14 | ||||

| Board and Committee Meetings (includes 2019 Director Compensation Table) |

21 | |||

| 28 | ||||

| Service Fees Paid to the Independent Registered Public Accounting Firm |

29 | |||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| PROPOSAL 2 — RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

31 | |||

| PROPOSAL 3 — ADVISORY VOTE ON EXECUTIVE COMPENSATION (“SAY-ON-PAY”) |

32 | |||

| Executive Compensation (includes Compensation Discussion and Analysis) |

33 | |||

| 54 | ||||

| 54 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 58 | ||||

| 62 | ||||

| Potential Payments to Executive Officers Upon Termination or Change in Control |

64 | |||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 73 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 75 | ||||

| 75 | ||||

| 76 | ||||

| 76 | ||||

| A-1 | ||||

Table of Contents

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider. Please carefully read the entire proxy statement before voting.

2019 Annual Meeting of Shareholders

|

Date and Time |

Place |

Record Date | ||||||

|

Wednesday, August 14, 2019 11:00 a.m. Eastern Time

|

The Ritz-Carlton 1515 West Third Street Cleveland, Ohio 44113

|

Shareholders of record at the close of business on June 17, 2019 are entitled to vote at the annual meeting.

|

Voting Recommendations of the Board

| Proposal | Proposal Summary | FOR | AGAINST | Page | ||||

| 1 |

Election of the Board nominees named in this proxy statement with terms expiring at the 2020 annual meeting of shareholders

|

|

14 | |||||

| 2 |

Ratification of appointment of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for the 2020 fiscal year

|

|

31 | |||||

| 3 |

Advisory approval of the Company’s executive compensation

|

|

32 | |||||

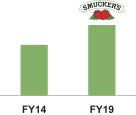

Performance Highlights

| REVENUE

|

ADJUSTED EARNINGS PER SHARE*

|

FREE CASH FLOW*

|

SHAREHOLDER RETURN

| |||||||||

|

|

$8.29

IN FY19

|

|

$383M

IN FY19

| |||||||||

|

Primarily Dividends

| ||||||||||||

| +7% 5 YEAR CAGR |

+6% 5 YEAR CAGR |

GENERATED $781M

IN FCF DURING FY19 |

RETURNED $2.6B

OVER THE PAST 5 YEARS | |||||||||

| * | For a reconciliation of adjusted earnings per share and free cash flow, see Appendix A. For a description of how we calculate adjusted earnings per share and free cash flow, see Management’s Discussion and Analysis of Financial Condition and Results of Operations in our 2019 Annual Report on Form 10-K, which can be found on our website at www.jmsmucker.com/investor-relations. |

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

1 |

Table of Contents

PROXY SUMMARY

Director Nominees

The following table provides summary information about each of our Director nominees.

| Board Committees | ||||||||||||||||||

| Name

|

Age

|

Director

|

Professional Background

|

AC

|

ECC

|

NGCR

|

Other Public Company Boards

| |||||||||||

|

Kathryn W. Dindo* |

|

70 |

|

|

1996 |

|

Retired Vice President and

|

F |

ALLETE, Inc. | |||||||||

|

Paul J. Dolan* |

|

60 |

|

|

2006 |

|

Chairman and CEO,

|

|

MSG Networks Inc. | |||||||||

|

Jay L. Henderson* |

|

63 |

|

|

2016 |

|

Retired Vice Chairman,

|

F |

Illinois Tools Works Inc. Northern Trust Corp. | |||||||||

|

Gary A. Oatey* |

|

70 |

|

|

2003 |

|

Executive Chairman,

|

|

||||||||||

|

Kirk L. Perry* |

|

52 |

|

|

2017 |

|

President, Brand Solutions, Google Inc.

|

|

e.l.f. Beauty, Inc. | |||||||||

|

Sandra Pianalto* |

|

64 |

|

|

2014 |

|

Retired President and CEO, Federal Reserve Bank of Cleveland

|

F |

Eaton Corporation plc Prudential Financial Inc. FirstEnergy Corp. | |||||||||

|

Nancy Lopez Russell* |

|

62 |

|

|

2006 |

|

Founder, Nancy Lopez Golf Company

|

|

||||||||||

|

Alex Shumate* |

|

69 |

|

|

2009 |

|

Managing Partner, North America,

|

|

CyrusOne Inc. | |||||||||

|

Mark T. Smucker |

|

49 |

|

|

2009 |

|

President and CEO,

|

|||||||||||

|

Richard K. Smucker |

|

71 |

|

|

1975 |

|

Executive Chairman,

|

|||||||||||

|

Timothy P. Smucker |

|

75 |

|

|

1973 |

|

Chairman Emeritus,

|

|||||||||||

|

Dawn C. Willoughby* |

|

50 |

|

|

2017 |

|

Former Executive

Vice President and Chief Operating Officer,

|

|

||||||||||

* Independent Director

Chair F Financial Expert

Chair F Financial Expert

Member

Member

AC = Audit Committee; ECC = Executive Compensation Committee; NGCR = Nominating, Governance, and Corporate Responsibility Committee

| 2 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

PROXY SUMMARY

Governance Highlights

Our Governance Philosophy

We place a strong focus on our governance practices and continually evaluate our practices, taking into consideration evolving expectations and the perspectives of our shareholders. We would like to share with you, our shareholders, our governance activities over this past year, along with some of our key governance practices and perspectives.

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

3 |

Table of Contents

PROXY SUMMARY

| 4 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

|

FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON AUGUST 14, 2019

|

Corporate Governance Guidelines

Our Corporate Governance Guidelines (the “Guidelines”) are designed to formalize the Board’s role and to confirm its independence from management and its role of aligning management and Board interests with the interests of shareholders. The Guidelines provide in pertinent part that:

|

a majority of Directors will be independent, as set forth under the rules of the New York Stock Exchange (the “NYSE”) and the Securities and Exchange Commission (the “SEC”), and as further set forth in the Guidelines; |

|

all members of the Committees will be independent, and there will be at least three members on each of the Committees; |

|

the independent Directors will meet in executive session on a regular basis in conjunction with regularly scheduled meetings of the Board and the Committees, and such meetings will be chaired by the Chair of each of the Committees for each Committee executive session and by the Chair of each of the Committees on a rotating term of two years for each Board executive session (in such role, the “Lead Independent Director”); |

|

the Lead Independent Director will coordinate the activities of the other independent Directors and perform such other duties and responsibilities as the Board may determine, including those set forth below under the heading “Executive Sessions and Lead Independent Director;” |

|

the Board and each of the Committees will conduct an annual self-evaluation; |

|

all non-employee Directors will own a minimum amount of the Company’s common shares as established in our Stock Ownership Guidelines for Directors and Officers, which currently require that non-employee Directors own common shares with a value of no less than five times the annual cash retainer paid to each non-employee Director and that each non-employee Director should strive to attain this ownership threshold within five years of joining the Board; |

|

each Director will attend at least 75% of all regular and special meetings of the Board; |

|

absent specific action by the Board, non-employee Directors will not be eligible for nomination after reaching 72 years of age; |

|

each Director will advise the Executive Chairman in advance of accepting an invitation to serve on the board of another public company; |

|

each Director will advise the Nominating Committee, and offer to resign, if his or her primary professional position or responsibility materially changes to provide the Board an opportunity to review the qualifications of the Director; |

|

no Director will serve concurrently on more than three public company boards, including the Company, without prior, unanimous consent of the Board; |

|

the Nominating Committee and the Board will consider a Director’s length of tenure when reviewing Board composition and will seek to maintain an overall balance of experience and continuity, along with fresh perspectives. The Board does not have a Director tenure limit but will consider the impact of a Director’s tenure after he or she has served on the Board for more than 15 years; and |

|

the Corporate Secretary will provide all newly-elected Directors with materials and training in our Director orientation program and will also provide such additional Director training and orientation as appropriate. |

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

5 |

Table of Contents

CORPORATE GOVERNANCE

The Guidelines are posted on our website at www.jmsmucker.com. A copy of the Guidelines is available free of charge to any shareholder who submits a written request to the Corporate Secretary, The J. M. Smucker Company, One Strawberry Lane, Orrville, Ohio 44667.

Shareholder Recommendations for Director Nominees

The Nominating Committee is responsible for identifying, evaluating, and recommending qualified candidates to the Board for nomination. The Nominating Committee considers all suggestions for membership on the Board, including nominations made by our shareholders. Shareholders’ nominations for Directors must be made in writing and include the nominee’s written consent to the nomination and detailed background information sufficient for the Nominating Committee to evaluate the nominee’s qualifications. Nominations should be submitted to the Corporate Secretary, The J. M. Smucker Company, One Strawberry Lane, Orrville, Ohio 44667. The Corporate Secretary will then forward nominations to the Chair of the Nominating Committee. All recommendations must include qualifications that meet, at a minimum, the following criteria:

|

Director candidates must be committed to our culture and our Basic Beliefs and will be individuals of integrity, intelligence, and strength of character having a balance of skills, knowledge, diversity, background, and experience beneficial to the Company; |

|

Non-employee Director candidates must meet the independence requirements set forth below under the heading “Director Independence”; |

|

Non-employee Director candidates must be able to effectively carry out responsibilities of oversight of our strategy; |

|

Director candidates should have either significant experience in a senior executive role with a major business organization or relevant experience from other professional backgrounds; |

|

Director candidates should have a working knowledge of corporate governance and corporate responsibility issues and the changing role of boards; |

|

Director candidates should have a firm commitment to attend and participate in Board meetings and related Board activities; |

|

Director candidates should not have any affiliations or relationships with competitive businesses, organizations, or other activities, which could lead to a real or perceived conflict of interest; and |

|

Director candidates should not serve on more than three public company boards, including the Company, at any one time without the prior consent of the directors. |

| 6 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

CORPORATE GOVERNANCE

Board Diversity

We greatly value diversity and the varying perspectives and experiences that emerge from a diverse group of people. Therefore, the Nominating Committee and the Board consider a diverse group of experiences, characteristics, attributes, and skills, including diversity in gender, ethnicity, race, age, and cultural and other backgrounds, in determining whether an individual is qualified to serve as a Director of the Company. While the Board does not maintain a formal policy regarding diversity, it does consider the diversity of the Board when evaluating Director nominees. Diversity is important because a variety of viewpoints contribute to a more effective decision-making process. The Nominating Committee and the Board also consider the composition of the Board as a whole in evaluating whether a particular individual should serve on the Board, as the Board seeks to comprise itself of members who, collectively, possess a range of relevant skills, experience, and expertise.

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

7 |

Table of Contents

CORPORATE GOVERNANCE

Experience, Qualifications, Attributes, Skills, and Diversity of Director Nominees

As mentioned above, in considering each Director nominee and the composition of the Board as a whole, the Nominating Committee looks for a diverse group of experiences, characteristics, attributes, and skills that relate directly to our management and operations. Success in specific categories is a key factor in our overall operational success and creating shareholder value. The Nominating Committee believes that Directors who possess some or all of the following experiences, characteristics, attributes, and skills are better able to provide oversight of our management and long-term and strategic objectives.

|

Adherence to the Company’s Basic Beliefs |

We seek Directors who have an understanding of, and are committed to, our Basic Beliefs. These Basic Beliefs are our values and principles that serve as guideposts for decisions at every level of the Company and cultivate a culture of commitment to each other and to our constituents. Further information regarding our Basic Beliefs can be found on our website at www.jmsmucker.com.

| |

|

Leadership and Operating Experience |

We seek Directors who have significant leadership and operating experience. Strong leaders bring vision, strategic agility, diverse and global perspectives, and broad business insight to the Company. They also demonstrate a practical understanding of organizations, processes, strategy, risk management, and the methods to drive change and growth. People with experience in significant leadership positions possess strong abilities to motivate and manage others and to identify and develop leadership qualities in others.

| |

|

Independence |

We require that a majority of our Directors satisfy the independence requirements of the NYSE and the SEC.

| |

|

Finance Experience |

We believe that it is important for Directors to have an understanding of finance and financial reporting processes. Accurate financial reporting is critical to our success and reputation. We seek to have at least two independent Directors who qualify as “audit committee financial experts,” within the meaning of Regulation S-K promulgated by the SEC (“Regulation S-K”), particularly for service on the Audit Committee. We expect all of our Directors to be financially knowledgeable.

| |

|

Public Company Board and Corporate Governance Experience |

We seek Directors who have experience serving on the boards of other large, publicly traded companies and who have knowledge with respect to public company board governance issues. This experience prepares the Directors to fulfill the Board’s responsibilities of overseeing our business and providing insight and guidance to management.

| |

|

Corporate Responsibility and Sustainability Experience |

We seek Directors who have knowledge of and experience with corporate responsibility and sustainability initiatives to help inform us on best practices and assist us in establishing goals and delivering against those goals.

| |

|

Operations Experience |

We seek Directors with relevant general management or operations experience in the consumer goods industry. In particular, we believe that it is important for Directors to have experience in new and expanding businesses, customer segments, and geographies.

| |

|

Knowledge of the Company |

We deem it important to have Directors who have in-depth knowledge of the Company and our industry, operations, business segments, products, compliance requirements, risks, strategy, and culture.

| |

|

Minority; Diversity |

We greatly value diversity and the varying perspectives and experiences that emerge from a diverse group of people. Because of this, we believe diversity in our Board is important, including, for example, with respect to their gender, ethnicity, race, age, and cultural and other backgrounds.

| |

|

Marketing or Public Relations Experience |

As a manufacturer and marketer of branded food products, we seek Directors who have a diverse range of marketing or public relations experience.

| |

|

Mergers and Acquisitions Experience |

We have been, and believe we will continue to be, active in acquiring other companies that fit our strategy and, therefore, seek Directors with relevant mergers and acquisitions experience.

|

| 8 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

CORPORATE GOVERNANCE

The Board believes that all of the Directors are highly qualified and have specific employment and leadership experiences, qualifications, and skills that qualify them for service on the Board. The specific experiences, qualifications, and skills that the Board considered in determining that each such person should serve as a Director are included in their individual biographies and also summarized further in the following table:

| Director Qualifications and Experience |

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||

| Adherence to the Company’s Basic Beliefs Understand and adhere to the Company’s Basic Beliefs |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Leadership and Operating Experience Significant leadership and operating experience |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

| Independence Satisfy the independence requirements of the NYSE and the SEC |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Finance Experience Possess the background, knowledge, and experience to provide the Company with valuable insight in overseeing the Company’s finances |

● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||

| Public Company Board and Corporate Governance Experience Experience serving on the boards of other large, publicly traded companies |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Corporate Responsibility and Sustainability Experience Knowledge of and experience with corporate responsibility and sustainability initiatives |

● | ● | ● | ● | ||||||||||||||||||||

| Operations Experience General management or distribution operations experience in the consumer goods industry |

● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||

| Knowledge of the Company Experience with the Company for a period in excess of ten years |

● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||

| Minority; Diversity Contribute to the Board in a way that enhances perspectives through diversity in gender, ethnicity, race, age, and cultural and other backgrounds |

● | ● | ● | ● | ● | ● | ● | |||||||||||||||||

| Marketing or Public Relations Experience Possess unique experience or insight into marketing or public relations matters |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Mergers and Acquisition Experience Possess experience or insight related to the mergers and acquisitions area |

● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

9 |

Table of Contents

CORPORATE GOVERNANCE

Director Resignation Policy

In connection with the adoption of a majority voting standard for uncontested elections of Directors, the Board adopted a Director resignation policy to address the situation in which one or more incumbent Directors fail to receive the required majority vote for re-election in an uncontested election. Under Ohio law, an incumbent Director who is not re-elected would remain in office as a “holdover” Director until his or her successor is elected. This Director resignation policy provides that an incumbent Director who is not re-elected with more “for” votes than “against” votes in an uncontested election will be expected to tender to the Board his or her resignation as a Director promptly following the certification of the election results. The Nominating Committee would then consider each tendered resignation and recommend to the Board whether to accept or reject each such tendered resignation. The Board would act on each tendered resignation, taking into account its fiduciary duties to the Company and our shareholders and the Nominating Committee’s recommendation, within 90 days following the certification of the election results. The Nominating Committee, in making its recommendation, and the Board in making its decision, may consider any factors or other information with respect to any tendered resignation that they consider appropriate, including, without limitation:

|

the stated reason for such Director’s failure to receive the approval of a majority of votes cast; |

|

the percentage of votes cast against such Director; and |

|

the performance of such Director. |

Following the Nominating Committee’s recommendation and the Board’s decision, the Board will promptly and publicly disclose its decision whether to accept or reject each tendered resignation and, if applicable, the reasons for rejecting a tendered resignation. If a Director’s tendered resignation is rejected, he or she would continue to serve until his or her successor is elected, or until his or her earlier resignation, removal from office, or death. If a Director’s tendered resignation is accepted, then the Board would have the sole discretion to fill any resulting vacancy or decrease the number of Directors, in each case pursuant to the provisions of and to the extent permitted by the Company’s Amended Regulations (the “Regulations”). Any Director who tenders his or her resignation pursuant to this policy would abstain from providing input or voting on the Nominating Committee’s recommendation or the Board’s action regarding whether to accept or reject the tendered resignation. While this description reflects the terms of the Board’s current Director resignation policy, the Board retains the power to amend and administer the policy as the Board, in its sole discretion, determines is appropriate. The Director resignation policy is posted on our website at www.jmsmucker.com and a copy will be provided free of charge to any shareholder submitting a written request to the Corporate Secretary, The J. M. Smucker Company, One Strawberry Lane, Orrville, Ohio 44667.

Director Independence

We require that a majority of our Directors be “independent” as defined by the rules of the NYSE and the SEC. We may, in the future, amend the Guidelines to establish such additional criteria as the Board determines to be appropriate. The Board makes a determination as to the independence of each Director on an annual basis. The Board has determined that the following nine non-employee Directors are independent Directors: Kathryn W. Dindo, Paul J. Dolan, Jay L. Henderson, Gary A. Oatey, Kirk L. Perry, Sandra Pianalto, Nancy Lopez Russell, Alex Shumate, and Dawn C. Willoughby.

In general, “independent” means that a Director has no material relationship with us or any of our subsidiaries. The existence of a material relationship is determined upon a review of all relevant facts and circumstances and, generally, is a relationship that might reasonably be expected to compromise the Director’s ability to maintain his or her independence from our management.

The Board considers the issue of materiality from the standpoint of the persons or organizations with which the Director has an affiliation, as well as from the standpoint of the Director.

| 10 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

CORPORATE GOVERNANCE

The following standards will be applied by the Board in determining whether individual Directors qualify as “independent” under the rules of the NYSE and the SEC. To the extent that these standards are more stringent than the rules of the NYSE or the SEC, such standards will apply. References to the Company include our consolidated subsidiaries.

|

No Director will be qualified as independent unless the Board affirmatively determines that the Director has no material relationship with us, either directly or as a partner, shareholder, or officer of an organization that has a relationship with us. We will disclose these affirmative determinations on an annual basis. |

|

No Director who is a former employee of ours can be deemed independent until three years after the end of his or her employment relationship with us. |

|

No Director whose immediate family member is a former executive officer of the Company can be deemed independent until three years after the end of such executive officer’s relationship with us. |

|

No Director who receives, or whose immediate family member receives, more than $120,000 in direct compensation from the Company in any twelve-month period within the past three years, other than Director and Committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), can be ‘independent’ until three years after he or she ceases to receive more than $120,000 in any twelve-month period in such compensation during such time period. |

|

No Director can be deemed independent if the Director (i) is a current partner or employee of a firm that is our internal or external auditor; (ii) has an immediate family member who is a current partner of such a firm; (iii) has an immediate family member who is a current employee of such a firm and personally works on our audit; or (iv) was, or an immediate family member was, within the last three years, a partner or employee of such a firm and personally worked on our audit within that time. |

|

No Director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of our present executive officers serve on that company’s compensation committee can be independent until three years after the end of such service or employment relationship. |

|

No Director who is an executive officer or employee, or whose immediate family member is an executive officer, of a company (excluding charitable organizations) that makes payments to, or receives payments from, us for property or services in an amount which, in any single fiscal year, exceeds the greater of $1,000,000 or 2% of such other company’s consolidated gross revenues can be deemed independent until three years after falling below such threshold. |

|

No Director can be independent if we have made charitable contributions to any charitable organization in which such Director serves as an executive officer if, within the preceding three years, contributions by us to such charitable organization in any single fiscal year of such charitable organization exceeded the greater of $1,000,000 or 2% of such charitable organization’s consolidated gross revenues. |

In its review and application of the criteria used to determine independence, the Board considered the fact that we do business with organizations directly or indirectly affiliated with Paul J. Dolan and Kirk L. Perry, and affirmatively determined that the amounts paid to the entities affiliated with these individuals do not meet the threshold which would create an issue under the standards for determining independence.

The value of advertising and promotional activities sponsored with the Cleveland Indians organization, of which Mr. Dolan is the Chairman and Chief Executive Officer, in fiscal year 2019 was approximately $371,000 and does not exceed the greater of $1,000,000 or 2% of the consolidated gross revenues of the Cleveland Indians.

The value of advertising services provided to us by Google Inc., of which Kirk L. Perry is the President, Brand Solutions, in fiscal year 2019 was approximately $12,257,000 and does not exceed the greater of $1,000,000 or 2% of the consolidated gross revenues of Google Inc.

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

11 |

Table of Contents

CORPORATE GOVERNANCE

Structure of the Board of Directors

Executive Chairman and Chief Executive Officer as Directors

The Regulations provide that one person may hold the positions of Executive Chairman and Chief Executive Officer. However, our Executive Chairman and Chief Executive Officer roles are currently held by different individuals. In addition, a majority of our Directors are independent, and, commencing in fiscal year 2020, the Board has a Lead Independent Director. Richard K. Smucker, our former Chief Executive Officer, currently serves as Executive Chairman. The Board believes that a current or former Chief Executive Officer is best situated to serve as Executive Chairman because he is one of the Directors most familiar with our business and industry. The Board also believes that having a current or former Chief Executive Officer serve as Executive Chairman provides an efficient and effective leadership model for us by fostering clear accountability, effective decision-making, and alignment of corporate strategy. The Board’s independent Directors bring experience, oversight, and expertise from outside the Company and industry, while the Executive Chairman and the Chief Executive Officer bring Company and industry-specific experience and expertise. One of the key responsibilities of the Board is to develop strategic direction and hold management accountable for the execution of its strategy once it is developed. The Board believes that its current management structure, together with independent Directors having the duties described above, is in the best interests of shareholders because it strikes an appropriate balance for us; with a current or former Chief Executive Officer serving as Executive Chairman, there is unified leadership and a focus on strategic development and execution, while the independent Directors help assure independent oversight of management.

Board’s Role in Risk Oversight

Risk is inherent in any business, and our management is responsible for the day-to-day management of risks that we face. The Board, on the other hand, has responsibility for the oversight of risk management. In that role, the Board has the responsibility to evaluate the risk management process to ensure its adequacy and that it is implemented properly by management.

The Board believes that full and open communication between management and the Board is essential for effective risk management and oversight. The Board meets regularly with senior management, including executive officers, to discuss strategy and risks facing the Company. Senior management attends the Board’s quarterly meetings, as well as certain Committee meetings, to address any questions or concerns raised by the Board on risk management and any other matters. The Company’s Senior Vice President, General Counsel and Secretary manages the Company’s compliance function and, along with the Vice Chair and Chief Financial Officer, the enterprise risk function, attends all Board meetings and Committee meetings that do not overlap, and provides periodic updates on risks and compliance issues facing the Company and the industry. Each quarter, the Board receives presentations from senior management on business operations, financial results, and strategic, risk, and compliance issues. In addition, senior management holds an annual strategic planning retreat, as well as periodic strategic planning sessions, to discuss strategies, key challenges, and risks and opportunities for the Company. Senior management then reviews the results of each strategic planning session with the Board.

The Committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to management of major financial risk exposures, including in the areas of financial reporting, internal controls, hedging strategies, cybersecurity, and reviewing potential conflicts of interest. Risk assessment reports are regularly provided by management and our internal auditors to the Audit Committee.

The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from the Company’s compensation policies and programs, including overseeing the Company’s compensation-related risk assessment described further below in this proxy statement and developing stock ownership and clawback guidelines for our executive officers. The Nominating Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for Directors and executive officers, and corporate governance, including the annual monitoring of corporate governance issues and developing Director self-evaluations.

| 12 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

CORPORATE GOVERNANCE

All Committees report back to the full Board at Board meetings as to the Committee’s activities and matters discussed and reviewed at the Committee’s meeting. In addition, the Board is encouraged to participate in internal and external Director education courses to keep apprised of current issues, including areas of risk.

Communications with the Board

Shareholders and other interested parties who wish to communicate with members of the Board as a group, with non-employee Directors as a group, or with individual Directors, may do so by writing to Board Members c/o Corporate Secretary, The J. M. Smucker Company, One Strawberry Lane, Orrville, Ohio 44667. The Directors have requested that the Corporate Secretary act as their agent in processing any communications received. All communications that relate to matters within the scope of responsibilities of the Board and its Committees will be forwarded to the appropriate Directors. Communications relating to matters within the responsibility of one of the Committees will be forwarded to the Chair of the appropriate Committee. Communications relating to ordinary business matters are not within the scope of the Board’s responsibility and will be forwarded to the appropriate executive officer at the Company. Solicitations, advertising materials, and frivolous or inappropriate communications will not be forwarded.

Code of Business Conduct and Ethics

Ethics is one of our Basic Beliefs and is fundamental to our business. We emphasize that ethical conduct is vital to ensure successful, sustained business and business relationships.

Our Code of Business Conduct and Ethics (the “Code of Conduct”) is an extension of our long-standing principles and values. It applies to our employees, officers, Directors, and contingent workers. The Code of Conduct is a resource which guides daily conduct in the workplace, and employees are expected to reference it frequently. The Code of Conduct outlines our expectations across numerous areas and situations in which ethical choices might be necessary, such as creating a positive work environment; engaging with customers, suppliers, and competitors; handling confidential information and conflicts of interest; the exchange of gifts, meals, and entertainment; avoiding bribery and corruption and insider trading; and rules regarding advertising and product labeling. Employees and Directors are required to review and acknowledge the Code of Conduct on an annual basis and receive training at least every three years. Additionally, employees receive annual compliance training on key topics throughout the year.

Any amendments of the Code of Conduct and any waivers of the Code of Conduct for or on behalf of any Director, executive officer, or senior financial officer of the Company must be approved by the Board or by a Committee of the Board to which authority to issue such waivers has been delegated by the Board. Any amendments or waivers of the Code of Conduct will be promptly disclosed to the public, as required by applicable law, and will be disclosed on our website at www.jmsmucker.com. Waivers of the Code of Conduct for any other employee may be made only by an authorized officer of the Company.

The Code of Conduct is posted on our website at www.jmsmucker.com and a copy will be provided free of charge to any shareholder submitting a written request to the Corporate Secretary, The J. M. Smucker Company, One Strawberry Lane, Orrville, Ohio 44667.

Procedures for Reporting Ethical, Accounting, Auditing and Financial Related Issues

The Board has established procedures for employees to report violations of the Code of Conduct or complaints regarding accounting, auditing, and financial-related matters to their manager or supervisor, to the General Counsel, or directly to the Audit Committee. Reports to the General Counsel may be made in writing, by telephone, in person, or may be submitted anonymously through the Smucker’s Voice Line, which is managed by an independent third-party service provider and is available 24 hours a day, 7 days a week, in multiple languages, and can be accessed via phone or through the Internet at www.jmsmucker.ethicspoint.com. Specifically, via phone in the U.S. and Canada, employees or concerned individuals can call toll-free 1-844-319-9352; in other countries, employees or concerned individuals can access the applicable country number at www.jmsmucker.ethicspoint.com. We forbid retaliation, or threats of retaliation, against our employees who, in good faith, report violations of the Code of Conduct.

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

13 |

Table of Contents

(Proposal 1 on the proxy card)

The Board currently has 13 Directors, but Elizabeth Valk Long will not be up for re-election when her current term expires on August 14, 2019. Effective on that date, the number of Directors will be set at 12 pursuant to the Regulations, and all remaining Directors will be up for election at this annual meeting to hold office for a term of one year. Unless instructed otherwise, the proxies intend to vote FOR the election of these 12 nominees.

After many years of distinguished service, Elizabeth Valk Long will be retiring from the Board on August 14, 2019, at the expiration of her current term. We appreciate Ms. Long’s years of service and thank her for her valuable guidance during her tenure with the Company.

Each nominee has agreed to serve if elected. If any nominee declines, is unable to accept such nomination, or is unable to serve (an event which is not expected), the Board reserves the right in its discretion to substitute another person or nominee or to reduce the number of nominees. In this event, the proxy, with respect to such nominee or nominees, will be voted for such other person or persons as the Board may recommend.

The members of the Board, including those who are listed in this proxy statement as nominees for election, with information about each of them based on data furnished to us by these persons as of June 28, 2019, are as follows:

Nominees for Election as Directors Whose Proposed Terms Would Expire at the 2020 Annual Meeting

|

KATHRYN W. DINDO

Age: 70

Director Since: 1996

Committee: Audit |

Professional Experience

Ms. Dindo commenced her career with FirstEnergy Corp., a utility holding company, in 1998, and retired as Vice President and Chief Risk Officer in 2007, a position she held since November 2001. Prior to that time, she was Vice President, Controller, and Chief Accounting Officer of Caliber System, Inc., formerly Roadway Services, Inc., a transportation services company. Ms. Dindo is a director and chairs the audit committees of both Bush Brothers & Company, a privately-owned food processing and manufacturing company, and ALLETE, Inc., a publicly traded energy service provider. Ms. Dindo is also a member of the boards of several non-profit organizations.

Skills and Qualifications

The Board concluded that Ms. Dindo should serve as a Director primarily due to her extensive experience in managing and overseeing businesses, her experience serving as a director of other private and public companies, and her significant knowledge of the Company, having served on the Board since 1996. Specifically, Ms. Dindo gained significant leadership, operating, finance, and risk management experience in her positions at FirstEnergy Corp. and Caliber System, Inc. Ms. Dindo is also a Certified Public Accountant and a former partner of Ernst & Young LLP. Together with her service on the boards and audit committees of Bush Brothers & Company and ALLETE, Inc., Ms. Dindo’s background enables her to provide valuable insights to the Board, particularly in overseeing the Company’s finances and risks.

|

| 14 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

ELECTION OF DIRECTORS

|

PAUL J. DOLAN

Age: 60

Director Since: 2006

Committee: Executive Compensation (Chair) |

Professional Experience

Mr. Dolan has been the Chairman and Chief Executive Officer of the Cleveland Indians, the Major League Baseball team operating in Cleveland, Ohio, since November 2010, after having served as President since January 2004 and as Vice President and General Counsel since February 2000. He is also a director of MSG Networks Inc., a publicly traded sports and entertainment media company, and Dix & Eaton, a privately-owned communications and public relations firm. Mr. Dolan served as a director of Cablevision Systems Corporation, a publicly traded telecommunications and media company, from May 2015 until its acquisition in September 2015. Mr. Dolan also served as Chairman and Chief Executive Officer of Fast Ball Sports Productions, a sports media company, from January 2006 through December 2012.

Skills and Qualifications

The Board concluded that Mr. Dolan should serve as a Director primarily due to his long experience in managing businesses, his experience serving on the boards of other companies and numerous non-profit organizations, and his significant knowledge of the evolving needs and preferences of consumers. Specifically, Mr. Dolan has gained significant leadership, operating, and marketing experience in his positions with the Cleveland Indians and Fast Ball Sports Productions. This background enables Mr. Dolan to provide valuable insights to the Board, particularly in setting corporate strategy and overseeing executive compensation practices.

|

|

JAY L. HENDERSON

Age: 63

Director Since: 2016

Committee: Audit (Chair) |

Professional Experience

Mr. Henderson retired as Vice Chairman, Client Service at PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”) in June 2016, a position he held since 2007. He also served as PricewaterhouseCoopers’ Managing Partner of the Greater Chicago Market from 2003 through 2013 and Managing Partner of the Cleveland Office from 1993 through 2002. During his career at PricewaterhouseCoopers, Mr. Henderson gained significant experience working with the boards and audit committees of Fortune 500 companies and has managed major client relationships across multiple markets and industry sectors. He is the lead director and a member of the corporate governance, audit, executive, and capital governance committees of Northern Trust Corporation, a publicly traded financial holding company, and a director and member of the audit and finance committees of Illinois Tool Works Inc., a publicly traded global multi-industrial manufacturer of specialized industrial equipment, consumables, and related service businesses. Mr. Henderson is also a member of the boards of several non-profit organizations.

Skills and Qualifications

The Board concluded that Mr. Henderson should serve as a Director primarily due to his extensive experience in managing and overseeing businesses, his experience working with the boards and audit committees of large public companies, and his experience serving as a director of public companies and non-profit organizations. Specifically, Mr. Henderson brings leadership and operating skills through his former roles with PricewaterhouseCoopers. He has also been a Certified Public Accountant since 1977. Mr. Henderson’s background enables him to provide valuable insights to the Board, particularly in overseeing the Company’s finances.

|

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

15 |

Table of Contents

ELECTION OF DIRECTORS

|

GARY A. OATEY

Age: 70

Director Since: 2003

Committee: Executive Compensation |

Professional Experience

Mr. Oatey has been the Executive Chairman of Oatey Co., a privately-owned manufacturer of plumbing products, since June 2012. Prior to that time, he served as Oatey Co.’s Chairman and Chief Executive Officer from January 1995 through June 2012. Mr. Oatey is a director, a member of the audit committee, and the chair of the compensation committee of Molded Fiber Glass Companies, a privately-owned composites manufacturing company. He also served as a director of Shiloh Industries, Inc., a publicly traded company that provides noise and vibration solutions to automotive, commercial vehicle, and other industrial markets, from August 2004 through February 2013.

Skills and Qualifications

The Board concluded that Mr. Oatey should serve as a Director primarily due to his extensive experience in managing businesses, his experience in serving as a director of other public and private companies, as well as several non-profits, and his significant knowledge of the Company, having served on the Board since 2003. As the Executive Chairman and former Chief Executive Officer of Oatey Co., Mr. Oatey has gained significant leadership, operating, and corporate governance experience. This background enables Mr. Oatey to provide valuable insights to the Board, particularly in setting corporate strategy and overseeing our governance and executive compensation practices.

|

|

KIRK L. PERRY

Age: 52

Director Since: 2017

Committee: Executive Compensation |

Professional Experience

Mr. Perry has been the President, Brand Solutions of Google Inc., a multinational technology company, since December 2013. Prior to his career at Google Inc., Mr. Perry spent twenty-three years with The Procter & Gamble Company, where he held several positions of increasing responsibility in marketing and general management roles, including President, Global Family Care from May 2011 to December 2013. Mr. Perry has served as a director of e.l.f. Beauty, Inc., a publicly traded cosmetics company, since September 2016, and he previously served as a director of the Hillerich & Bradsby Co. (Louisville Slugger), a privately-owned sporting goods manufacturer, from September 2013 to August 2016. He is also a member of the boards of several non-profit organizations.

Skills and Qualifications

The Board concluded that Mr. Perry should serve as a Director primarily due to his extensive operational experience in marketing and brand management and his experience serving as a director of other organizations. Specifically, Mr. Perry brings leadership and operating skills through his current and former roles with Google Inc. and The Procter & Gamble Company. Mr. Perry’s background enables him to provide valuable insights to the Board, particularly in marketing, operations, general management, consumer products, technology, and digital media.

|

| 16 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

ELECTION OF DIRECTORS

|

SANDRA PIANALTO

Age: 64

Director Since: 2014

Committee: Audit |

Professional Experience

Ms. Pianalto retired in May 2014 as President and Chief Executive Officer of the Federal Reserve Bank of Cleveland, a position she held since 2003. Prior to that time, she served as First Vice President and Chief Operating Officer, since 1993, Vice President and Secretary to the Board of Directors, since 1988, and Assistant Vice President of Public Affairs, since 1984. Prior to retiring, Ms. Pianalto also chaired the Federal Reserve’s Financial Services Policy Committee, which is a committee of senior Federal Reserve Bank officials responsible for overall direction of financial services and related support functions for the Federal Reserve Banks and for leadership in the evolving U.S. payment system. She is a director, the chair of the finance committee, and a member of the audit committee of Eaton Corporation plc, a publicly traded power management company. She is also a director and member of the audit and compensation committees of FirstEnergy Corp., a publicly traded utility holding company, and a director and member of the finance, corporate governance and business ethics, and corporate social responsibility oversight committees of Prudential Financial, Inc., a publicly traded financial services institution. Ms. Pianalto is also a member of the boards of several non-profit organizations. The Board unanimously approved Ms. Pianalto serving on four public company boards as required under the Guidelines.

Skills and Qualifications

The Board concluded that Ms. Pianalto should serve as a Director primarily due to her vast experience in monetary policy and financial services and her experience serving as a director of other public companies. Specifically, Ms. Pianalto brings leadership and operating skills through her former roles with the Federal Reserve Bank of Cleveland. As the President and Chief Executive Officer of the Federal Reserve Bank of Cleveland, she oversaw 950 employees in Cleveland, Cincinnati, and Pittsburgh who conducted economic research and supervised financial institutions. Ms. Pianalto’s background enables her to provide valuable insights to the Board, particularly in overseeing the Company’s finances.

|

|

NANCY LOPEZ RUSSELL

Age: 62

Director Since: 2006

Committee: Nominating |

Professional Experience

In 2000, Ms. Lopez Russell founded the Nancy Lopez Golf Company, which focuses on the design and manufacture of top-quality golf equipment and clothing for women. In 2015, she founded Nancy Lopez Golf Adventures, which provides golf instruction and golf travel adventures domestically and internationally. Ms. Lopez Russell is also an accomplished professional golfer, having won 48 career titles, including three majors, on the Ladies Professional Golf Association (“LPGA”) Tour. She is a member of the LPGA Hall of Fame and captained the 2005 U.S. Solheim Cup Team to victory. She also serves as a member of the Commissioner Advisory Board and the Foundation Board of the LPGA. In 2003, Ms. Lopez Russell was named to the Hispanic Business magazine’s list of 80 Elite Hispanic Women.

Skills and Qualifications

The Board concluded that Ms. Lopez Russell should serve as a Director primarily due to her leadership experience and her extensive knowledge regarding the evolving needs and preferences of consumers. As the founder of her own business, Ms. Lopez Russell has gained significant leadership, operating, and marketing experience. She is also active in several charitable causes. Ms. Lopez Russell’s blend of business expertise and philanthropic interests, together with her experience in dealing with the public and media as a renowned professional athlete, enables her to provide the Board with valuable perspectives on our management, strategy, and risks.

|

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

17 |

Table of Contents

ELECTION OF DIRECTORS

|

ALEX SHUMATE

Age: 69

Director Since: 2009

Committee: Nominating (Chair) |

Professional Experience

Mr. Shumate is the Managing Partner, North America of Squire Patton Boggs (US) LLP, where he has practiced law since February 1988. Mr. Shumate is also the chairman of the board, lead director, and a member of the governance and nominating committee of CyrusOne Inc., a publicly traded provider of data center consulting services, and a trustee on The Ohio State University Board of Trustees. From July 2005 to January 2013, he served as a director of Cincinnati Bell, Inc., a publicly traded provider of voice and data telecommunications products and services. He also served as a director of the Wm. Wrigley Jr. Company from 1998 until its acquisition in 2008, as well as Nationwide Financial Services, Inc. from 2002 until its acquisition in 2009.

Skills and Qualifications

The Board concluded that Mr. Shumate should serve as a Director primarily due to his significant legal background and his experience in managing a business and serving as a director of other public companies and as a trustee of several non-profit organizations. Mr. Shumate has practiced law for nearly 40 years and was named a Lawyer of the Year 2017 by Best Lawyers and an Ohio Super Lawyer by Law and Politics magazine. Together with his service as a director of other public companies, Mr. Shumate’s background allows him to provide valuable insights to the Board, particularly in regard to corporate governance and risk issues that we confront.

|

|

MARK T. SMUCKER

Age: 49

Director Since: 2009

Committee: None |

Professional Experience

Mr. Smucker has been our President and Chief Executive Officer since May 2016. Prior to that time, he served as President and President, Consumer and Natural Foods, from April 2015 through April 2016, President, U.S. Retail Coffee, from May 2011 through March 2015, President, Special Markets, from August 2008 through April 2011, Vice President, International, from July 2007 through July 2008, and Vice President, International and Managing Director, Canada, from May 2006 through June 2007. Mr. Smucker is the son of Timothy P. Smucker, who serves as a Director of the Company, and the nephew of Richard K. Smucker, who serves as a Director and executive officer of the Company.

Skills and Qualifications

The Board concluded that Mr. Smucker should serve as a Director largely due to his role as our President and Chief Executive Officer, his significant knowledge of the Company gained from more than 20 years of experience in various positions within the Company, and his experience serving as a director of the Grocery Manufacturers Association and a former director and member of the compensation committee of GS1 U.S. The Board believes that the perspectives that Mr. Smucker brings to the Board are particularly valuable in light of the significance of the coffee and consumer foods businesses to the Company. The Board also believes that continuing participation by qualified members of the Smucker family on the Board is an important part of our corporate culture that has contributed significantly to our long-term success.

|

| 18 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

ELECTION OF DIRECTORS

|

RICHARD K. SMUCKER

Age: 71

Director Since: 1975

Committee: None |

Professional Experience

Mr. Smucker has been our Executive Chairman since May 2016. He served as Chief Executive Officer from August 2011 through April 2016, Co-Chief Executive Officer from February 2001 through August 2011, Executive Chairman from August 2008 through August 2011, and President from August 1987 through April 2011. He was a director of The Sherwin-Williams Company, a publicly traded manufacturer of coatings and related products, from September 1991 through April 2016. Mr. Smucker also served as a director of the Cleveland Federal Reserve Bank from January 2010 through December 2015. Mr. Smucker is the brother of Timothy P. Smucker, who serves as a Director of the Company, and the uncle of Mark T. Smucker, who serves as a Director and executive officer of the Company.

Skills and Qualifications

The Board concluded that Mr. Smucker should serve as a Director largely due to his role as our Executive Chairman and former Chief Executive Officer, his intimate knowledge of the Company, his experience serving as a director of other private and public companies, and his financial knowledge and experience. The Board believes that Mr. Smucker’s extensive experience in and knowledge of our business gained as a result of his long-time service as a member of management is essential to the Board’s oversight of the Company and our business operations. The Board also believes that continuing participation by qualified members of the Smucker family on the Board is an important part of our corporate culture that has contributed significantly to our long-term success.

|

|

TIMOTHY P. SMUCKER

Age: 75

Director Since: 1973

Committee: None |

Professional Experience

Mr. Smucker has been our Chairman Emeritus since May 2016. He served as Chairman of the Board from August 1987 through April 2016 and as Co-Chief Executive Officer from February 2001 through August 2011. Mr. Smucker is the Chairman Emeritus of the GS1 Management Board, a leading global organization dedicated to the design and implementation of global standards and solutions to improve the efficiency and visibility of the supply and demand chains globally and across sectors. In addition, Mr. Smucker serves as a trustee on The Ohio State University Board of Trustees. Mr. Smucker is the brother of Richard K. Smucker and the father of Mark T. Smucker, both of whom serve as Directors and executive officers of the Company. The Board unanimously approved Mr. Smucker’s nomination as a Director although he has attained age 72 as required under the Guidelines.

Skills and Qualifications

The Board concluded that Mr. Smucker should serve as a Director largely due to his role as our Chairman Emeritus, his intimate knowledge of the Company, and his experience serving as a director of other private and public companies. The Board believes that Mr. Smucker’s extensive experience in and knowledge of our business gained as a result of his long-time service as a member of management is essential to the Board’s oversight of the Company and our business operations. The Board also believes that continuing participation by qualified members of the Smucker family on the Board is an important part of our corporate culture that has contributed significantly to our long-term success.

|

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

19 |

Table of Contents

ELECTION OF DIRECTORS

|

DAWN C. WILLOUGHBY

Age: 50

Director Since: 2017

Committee: Nominating |

Professional Experience

Ms. Willoughby was the Executive Vice President and Chief Operating Officer of The Clorox Company, a manufacturer and marketer of consumer and professional products, from September 2014 through January 2019. She also served as the company’s Senior Vice President and General Manager, Clorox Cleaning Division; Vice President and General Manager, Home Care Products; and Vice President and General Manager, Glad Products, along with several other positions since she was initially hired in 2001. Prior to her career at The Clorox Company, Ms. Willoughby spent nine years with The Procter & Gamble Company, where she held several positions in sales management. In May 2013, Ms. Willoughby was named one of the most influential women in the Bay Area by the San Francisco Business Times.

Skills and Qualifications

The Board concluded that Ms. Willoughby should serve as a Director primarily due to her extensive leadership experience at consumer goods companies and her experience serving as a director of several non-profit organizations. Specifically, Ms. Willoughby brings leadership and operating skills through her former roles with The Clorox Company and The Procter & Gamble Company, and insights regarding sustainability through her former role with The Clorox Company. Ms. Willoughby’s background enables her to provide valuable insights to the Board, particularly in management, strategy, sales, marketing, and sustainability.

|

|

The Board unanimously recommends a vote FOR each of the nominees named in this

|

| 20 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

Board Meetings

During fiscal year 2019, there were six meetings of the Board. All Directors are required to attend at least 75% of the total number of Board and Committee meetings for which they were eligible. During fiscal year 2019, all Directors attended at least 75% of the total number of Board and Committee meetings for which they were eligible. We have not adopted a formal policy requiring Directors to attend the annual meeting of shareholders. However, all Directors attended the 2018 annual meeting of shareholders.

The Board has a Nominating Committee, a Compensation Committee, and an Audit Committee. All Committees are comprised entirely of independent Directors in accordance with the NYSE listing standards. Each Committee operates under a written charter, which is posted on our website at www.jmsmucker.com. A copy of each charter will be provided free of charge to any shareholder submitting a written request to the Corporate Secretary, The J. M. Smucker Company, One Strawberry Lane, Orrville, Ohio 44667. Each Committee believes that its charter is an accurate and adequate statement of such Committee’s responsibilities, and each Committee reviews its charter on an annual basis to confirm that it continues to be an accurate and adequate statement of such responsibilities.

The table below shows current members of each of the Committees and the number of meetings held by each Committee in fiscal year 2019.

| Name

|

Audit Committee

|

Compensation Committee |

Nominating Committee | |||

| Kathryn W. Dindo |

|

|||||

| Paul J. Dolan |

|

|||||

| Jay L. Henderson |

|

|||||

| Elizabeth Valk Long |

|

|||||

| Gary A. Oatey |

|

| ||||

| Kirk L. Perry |

|

|||||

| Sandra Pianalto |

|

|||||

| Nancy Lopez Russell |

| |||||

| Alex Shumate |

| |||||

| Dawn C. Willoughby |

| |||||

| Number of Meetings |

12 |

4 |

3 | |||

|

|

||||||

Director Compensation

We use a combination of cash and stock-based compensation to attract, compensate, and retain non-employee Directors who serve on the Board. The Compensation Committee engages its outside compensation consultant, Semler Brossy Consulting Group (“Semler Brossy”), to perform an annual review of Director compensation in order to remain aware of current trends in Director compensation. At the Compensation Committee’s January 2019 meeting, Semler Brossy presented a competitive review of Director compensation (which is evaluated against the peer group set forth on page 40 of this proxy statement) and Director compensation trends. Based on this review, the Compensation Committee and the Board approved an increase in the compensation to be paid to our non-employee Directors, as set forth below, which became effective as of May 1, 2019. Employee Directors do not receive compensation for their services as Directors.

The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

21 |

Table of Contents

BOARD AND COMMITTEE MEETINGS

For fiscal year 2020, non-employee Directors will be eligible to receive the following compensation:

|

Type of Compensation

|

Amount

| |

| Annual Retainer |

$100,000 per year | |

| Additional Annual Retainer for Lead Independent Director |

$ 20,000 per year | |

| Additional Annual Retainer for Audit Committee Members |

$ 5,000 per year | |

| Additional Annual Retainer for Audit Committee Chair |

$ 15,000 per year | |

| Additional Annual Retainer for Compensation Committee Chair |

$ 15,000 per year | |

| Additional Annual Retainer for Nominating Committee Chair |

$ 15,000 per year | |

|

Annual Grant of Deferred Stock Units |

$150,000 in deferred stock units |

The annual grant of deferred stock units having a value of $150,000 is made in October of each year. The deferred stock units are awarded under The J. M. Smucker Company 2010 Equity and Incentive Compensation Plan (the “2010 Plan”), which was approved by our shareholders at our 2010 and 2015 annual meetings. The deferred stock units vest immediately upon grant and are entitled to dividends in an amount paid to all shareholders. These dividends are reinvested in additional deferred stock units.

During fiscal year 2020, non-employee Directors may elect to receive a portion of their annual retainer in the form of deferred stock units. Such amounts are deferred under the Nonemployee Director Deferred Compensation Plan, which was initially adopted by the Board on January 1, 2007 and amended and restated on January 1, 2014 (the “Nonemployee Director Deferred Compensation Plan”). All deferred stock units, together with dividends credited on those deferred stock units, will be paid out in the form of common shares upon termination of service as a non-employee Director (subject to a waiting period for deferred stock units granted in certain years).

For fiscal year 2019, non-employee Directors were eligible to receive the following compensation:

|

Type of Compensation

|

Amount

| |

| Annual Retainer |

$100,000 per year | |

| Additional Annual Retainer for Audit Committee Members |

$ 5,000 per year | |

| Additional Annual Retainer for Audit Committee Chair |

$ 15,000 per year | |

| Additional Annual Retainer for Compensation Committee Chair |

$ 15,000 per year | |

| Additional Annual Retainer for Nominating Committee Chair |

$ 12,500 per year | |

|

Annual Grant of Deferred Stock Units |

$ 135,000 in deferred stock units |

The annual grant of deferred stock units having a value of $135,000 was issued out of the 2010 Plan. The deferred stock units vested immediately upon grant and are entitled to dividends in an amount paid to all shareholders. These dividends are reinvested in additional deferred stock units.

During fiscal year 2019, non-employee Directors could have elected to receive a portion of their annual retainer in the form of deferred stock units. Such amounts were deferred under the Nonemployee Director Deferred Compensation Plan. All deferred stock units, together with dividends credited on those deferred stock units, will be paid out in the form of common shares upon termination of service as a non-employee Director (subject to a waiting period for deferred stock units granted in certain years).

| 22 | The J. M. Smucker Company

2019 Proxy Statement

2019 Proxy Statement |

Table of Contents

BOARD AND COMMITTEE MEETINGS

The following table reflects compensation earned by the non-employee Directors for fiscal year 2019:

2019 Director Compensation

|

Name (1)(2) |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) (3) |

Option Awards ($) (4) |

All Other Compensation ($) (5) (6) |

Total ($) | |||||

| Kathryn W. Dindo |

$105,000 |

$135,000 |

— |

$2,500 |

$242,500 | |||||

| Paul J. Dolan |

$115,000 |

$135,000 |

— |

— |

$250,000 | |||||

| Jay L. Henderson |

$120,000 |

$135,000 |

— |

— |

$255,000 | |||||

| Elizabeth Valk Long (7) |

$100,000 |

$135,000 |

— |

$2,500 |

$237,500 | |||||

| Gary A. Oatey |

$100,000 |

$135,000 |

— |

— |

$235,000 | |||||

| Kirk L. Perry |

$100,000 |

$135,000 |

— |

— |

$235,000 | |||||

| Sandra Pianalto |

$105,000 |

$135,000 |

— |

$2,500 |

$242,500 | |||||

| Nancy Lopez Russell |

$100,000 |

$135,000 |

— |

— |

$235,000 | |||||

| Alex Shumate |

$112,500 |

$135,000 |

— |

— |

$247,500 | |||||

| Timothy P. Smucker |

$100,000 |

$135,000 |

— |

$76,760 |

$311,760 | |||||

|

Dawn C. Willoughby |

$100,000 |

$135,000 |

— |

— |

$235,000 |

| (1) | Mark T. Smucker and Richard K. Smucker are not included in this table as they are employees of the Company and receive no compensation for their services as Directors. The compensation received by Mark T. Smucker and Richard K. Smucker as employees of the Company is shown in the “Summary Compensation Table” on page 54 of this proxy statement. |

| (2) | As of April 30, 2019, each non-employee Director had the aggregate number of deferred stock units and stock options shown in the following table. Deferred stock units include deferred meeting and retainer compensation and annual stock unit awards valued at a predetermined dollar amount, along with additional stock units credited as a result of the reinvestment of dividends. |

| Name |

Deferred Stock Units |

Stock Options | ||

|

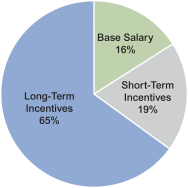

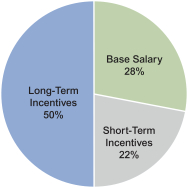

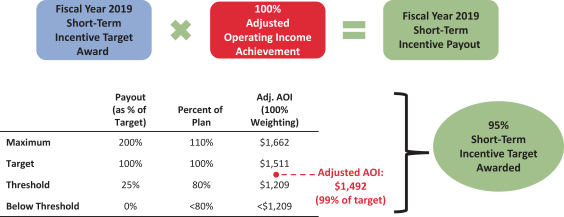

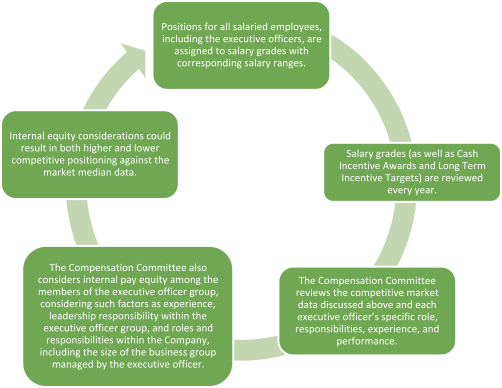

Kathryn W. Dindo |