UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

(Mark One)

|

(X) ANNUAL REPORT PURSUANT TO SECTION 13 OR

|

|

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2013

|

|

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR

|

|

15(d) OF THE SECURITIES ACT OF 1934

|

|

For the transition period from ________to__________

|

Commission file number 0-22904

PARKERVISION, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Florida

|

59-2971472

|

|

|

(State of Incorporation)

|

(I.R.S. Employer ID No.)

|

7915 Baymeadows Way, Suite 400

Jacksonville, Florida 32256

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (904) 732-6100

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, $.01 par value

|

The NASDAQ Stock Market

|

|

|

Common Stock Rights

|

The NASDAQ Stock Market

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ( ) No (X)

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act. Yes ( ) No (X)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes (X) No( )

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes (X) No ( )

1

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. (X )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act. (Check one):

|

Large accelerated filer ( )

|

Accelerated filer (X)

|

|

Non-accelerated filer ( )

|

Smaller reporting company ( )

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act). Yes ( ) No (X)

As of June 28, 2013, the aggregate market value of the registrant’s common stock, $.01 par value, held by non-affiliates of the registrant was approximately $390,664,229 (based upon $4.55 share closing price on that date, as reported by NASDAQ).

As of March 13, 2014, 96,290,722 shares of the Issuer's Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement to be filed with the Commission pursuant to Regulation 14A in connection with the registrant’s 2014 Annual Meeting of Shareholders, to be filed not later than 120 days after the end of the fiscal year covered by this report, are incorporated by reference into Part III (Items 10, 11, 12, 13, and 14) of this report.

2

TABLE OF CONTENTS

|

3

|

|

|

INTRODUCTORY NOTE

|

4

|

|

PART I

|

|

|

Item 1. Business

|

4

|

|

Item 1A. Risk Factors

|

9

|

|

Item 1B. Unresolved Staff Comments

|

12

|

|

Item 2. Properties

|

13

|

|

Item 3. Legal Proceedings

|

13

|

|

Item 4. Mine Safety Disclosures

|

13

|

|

PART II

|

|

|

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

13

|

|

Item 6. Selected Financial Data

|

15

|

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

16

|

|

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

|

21

|

|

Item 8. Financial Statements and Supplementary Data

|

22

|

|

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

48

|

|

Item 9A. Controls and Procedures

|

48

|

|

Item 9B. Other Information

|

49

|

|

PART III

|

|

|

Item 10. Directors, Executive Officers and Corporate Governance

|

50

|

|

Item 11. Executive Compensation

|

50

|

|

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

50

|

|

Item 13. Certain Relationships and Related Transactions and Director Independence

|

50

|

|

Item 14. Principal Accountant Fees and Services

|

50

|

|

PART IV

|

|

|

Item 15. Exhibits and Financial Statement Schedule

|

51

|

|

SIGNATURES

|

55

|

|

SCHEDULE

|

56

|

|

EXHIBIT INDEX

|

57

|

3

INTRODUCTORY NOTE

Unless the context otherwise requires, in this Annual Report on Form 10-K (“Annual Report”) “we”, “us”, “our” and the “Company” mean ParkerVision, Inc.

Forward-Looking Statements

We believe that it is important to communicate our future expectations to our shareholders and to the public. This Annual Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, in particular, statements about our future plans, objectives, and expectations under the headings “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” When used in this Annual Report and in future filings by the Company with the Securities and Exchange Commission (“SEC”), the words or phrases “will likely result”, “management expects”, “we expect”, “will continue”, “is anticipated”, “estimated” or similar expressions are intended to identify such “forward-looking statements.” Readers are cautioned not to place undue reliance on such forward-looking statements, each of which speaks only as of the date made. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results and those presently anticipated or projected, including the risks and uncertainties set forth in this Annual Report under the heading “Item 1A. Risk Factors” and in our other periodic reports. Examples of such risks and uncertainties include general economic and business conditions, competition, unexpected changes in technologies and technological advances, the timely development and commercial acceptance of new products and technologies, reliance on key business and sales relationships, reliance on our intellectual property, the outcome of litigation and the ability to obtain adequate financing in the future. We have no obligation to publicly release the results of any revisions which may be made to any forward-looking statements to reflect anticipated events or circumstances occurring after the date of such statements.

PART I

Item 1. Business.

We were incorporated under the laws of the state of Florida on August 22, 1989. We are in the business of innovating fundamental wireless technologies. We design, develop and market our proprietary radio frequency (“RF”) technologies and products for use in semiconductor circuits for wireless communication products.

Based on the manner in which our management views and evaluates our operations, we have determined that our business currently operates under a single segment. Refer to our financial statements in Item 8 to this Annual Report for financial data including our revenues from external customers, net losses from operations, and total assets.

Recent Developments

Patent Infringement Litigation against Qualcomm

In October 2013, a jury in the United States District Court of the Middle District of Florida awarded us $172.7 million in damages for direct and indirect infringement of eleven claims of four of our patents by Qualcomm Incorporated (“Qualcomm”). The jury also found that all eleven claims of the four patents were valid. We have a district court hearing scheduled for May 1, 2014 regarding a number of outstanding motions in this case including our motions for an injunction and/or ongoing royalties for Qualcomm’s continued use of our patented technology. Following the hearing, we expect to receive a ruling from the district court on these outstanding motions, although there is no date certain for that ruling. Upon receipt of a final district court decision, either party will have 30 days to appeal the decision to the federal appellate court. Qualcomm has indicated that it plans to appeal. Refer to “Legal Proceedings” in Note 11 to our financial statements included in Item 8 for a complete discussion of the proceedings in this matter.

4

Engagement of 3LP Advisors LLC

In February 2014, we entered into a licensing services agreement with 3LP Advisors LLC (“3LP”) for the management of our licensing operations. The engagement is exclusive for the first 12 months and the exclusive period may be extended by written agreement. Kevin Rivette, 3LP’s co-founder and managing partner, and at least two additional professionals, including one legal professional, will devote substantially all of their professional time to our patent licensing operations. Additional 3LP partners, licensing professionals, analysts and support staff will also contribute to 3LP’s efforts. Under the terms of the agreement, 3LP will bear the costs and expenses of its staff and related overhead. We will provide an internal team to support 3LP’s efforts and will bear direct out of pocket costs of the licensing operations, such as third-party reports and services and outside legal services, as needed. We will pay 3LP success fees calculated as a percentage of net proceeds received by us for licensing or licensing-related activities or direct or indirect sales of any of our patent assets. We will also pay 3LP a monthly retainer during the first 12 months of the term of the agreement. Any retainer paid by us following the first six-month period under the agreement shall be offset against success fees earned by 3LP.

General Development of Business

Our business has been primarily focused on the development, marketing and legal defense of our RF technologies for mobile and other wireless applications. Our technologies represent among other things, unique, proprietary methods for processing RF waveforms in wireless applications. Our technologies apply to both transmit and receive functions of transmitters, receivers, and transceivers as well as other related RF communications functions. A portion of our transmit technology is marketed as Direct2Power™, or d2p™, and enables the transformation of a baseband data signal to an RF carrier waveform, at the desired power output level, in a single unified operation. A portion of our receiver technology is marketed as Direct2Data™, or d2d™, and enables the direct conversion of an RF carrier to a baseband data signal. We have developed these and a number of additional innovations which are protected by the intellectual property we have secured in various patent families for RF and related functions in RF-based communications.

We have a three-part growth strategy for commercializing our innovations that includes intellectual property licensing and/or product ventures, intellectual property enforcement, and product and component development, manufacturing and sales. We have actively launched a licensing/product venture campaign to explore licensing and joint product development opportunities with wireless communications companies that make, use or sell chipsets and/or products that incorporate RF. We believe there are a number of communications companies that can benefit from the use of the RF technologies we have developed, whether through a license or, in certain cases, a joint product venture that would include licensing rights.

From time to time we may be involved in litigation against others in order to protect or defend our intellectual property rights. Since 2011, we have been involved in patent infringement litigation against Qualcomm for their unauthorized use of our receiver technology. Refer to “Legal Proceedings” in Note 11 to our financial statements included in Item 8 for a complete discussion of the proceedings in this matter.

Our product development and marketing efforts are focused on our RF technologies in mobile wireless and other RF communications industries. We have developed and are actively marketing a number of RF components products to industries that do not use highly integrated semiconductors, such as infrastructure, industrial and military applications. These component products include I/Q demodulators and modulators based on our patented innovations, as well as certain other complimentary components. In addition, we are working with VIA-Telecom, Inc. (“VIA”) a CDMA baseband provider, on the continued development and marketing of RF integrated circuits that function with their baseband products for mobile handset customers.

5

Since 2005, we have generated no royalty or product revenue from our RF technologies. Our ability to generate revenues sufficient to offset costs is subject to securing new product and licensing customers for our technologies, successfully supporting our customers in completing their product designs, and/or successfully protecting and defending our intellectual property.

We believe the investments we make in new technology innovations and obtaining intellectual property rights on those innovations are critical business processes and, as such, we have and will continue to devote substantial resources to research and development for this purpose. We protect our intellectual property rights by securing patent protection and, where necessary, defending those patents against infringement by others.

In order to utilize RF technology in a mobile handset or certain other wireless application, RF chipsets must interface with the baseband processor that generates the data to be transmitted and/or received. The development of the interface between the baseband processor and RF chipsets requires a cooperative effort with the baseband provider. Our technology is capable of being incorporated for any of the mobile handset standards, as well as numerous other applications such as WiFi, Bluetooth, Zigbee, Z-Wave, and GPS. Our RF chipsets are currently designed to interface with VIA baseband processors. VIA is a global supplier of baseband processors used in a wide range of CDMA-enabled mobile devices that designs and supplies chipsets and related reference designs to original equipment manufacturers (“OEMs”) and original design manufacturers for incorporation into mobile devices.

Since 2009, we have worked with VIA on the joint development of reference platforms that incorporate our products and VIA baseband processors without the exchange of intellectual property rights. We also worked with VIA to co-develop a sample 3G mobile handset which verified our technology in a working implementation and tested our technology’s performance. The results of these efforts were utilized to market our product to VIA’s customers. During 2010, we modified our circuit layout and packaging to meet the specific design requirements of one of VIA’s customers. The testing of our product in this design was completed in early 2011. Despite the successful test results, this design did not result in an order from the prospective customer; however we were able to utilize the test results in marketing our solution to other VIA customers.

Since mid-year 2011, we have been working with VIA and a mutual OEM customer to design and test a handset solution incorporating our RF chipsets. In late 2012, the mutual customer requested commitments on the part of both ourselves and VIA to ensure adequate support of our products and the related interface between our products in order for our RF chipset to be considered for incorporation into one or more of the OEM’s products. In March 2013, we entered into a formal development agreement with VIA whereby we will compensate VIA for the resources required for their development and ongoing support and maintenance of the custom interfaces between our products. We continue to work with VIA towards securing design wins with this OEM customer. We are also exploring additional product opportunities for our interfaced products.

ITT Corporation (“ITT”) has been a licensee of our d2p technology since 2007; however, since 2011, we have not been actively engaged in product development or other activities with ITT, and we do not currently have plans to initiate any new development efforts for ITT-related projects, unless those projects are funded directly by ITT or its customers. In the event ITT incorporates our technology into their products in the future, we will receive a per unit royalty from them for any such products sold under the terms of our agreement with them.

6

Products and Services

We anticipate our future business will include both licensing of our intellectual property and the sale of integrated circuits and stand-alone components based on our technology for incorporation into wireless devices designed by our customers. In addition, from time to time, we offer engineering consulting and design services to our customers, for a negotiated fee, to assist them in developing prototypes and/or products incorporating our technologies. By pursuing both licensing and product opportunities, we believe our technologies can be deployed in multiple markets that incorporate RF transmitters, receivers, and/or transceivers, including mobile handsets, tablets, data cards, femtocells, machine-to-machine, RF identification and infrastructure, among others.

Competitive Position

We operate in a highly competitive industry against companies with substantially greater financial, technical, and sales and marketing resources. Our technologies face competition from incumbent providers of transceivers, such as Broadcom, Fujitsu, Intel, MediaTek, NVidia, Qualcomm, ST-Ericsson, and others, as well as incumbent providers of power amplifiers, including companies such as Anadigics, RF Microdevices, and Skyworks, among others. Each of our competitors, however, also has the potential of becoming a licensing or product customer for our technologies. Competition in our industry is generally based on price and technological performance.

To date, we are unaware of any competing or emerging RF technologies that provide all the simultaneous benefits that our technology enables. Our unique technologies process the RF carriers in a more optimal manner than traditional technologies, thereby allowing the creation of handsets and other products that have extended battery life, lower operating temperatures, more easily incorporate multiple air interface standards and frequencies in smaller form factors, and reduce manufacturing costs. Our technologies provide such attractive benefits, in part, because of their unique circuit architectures which enable highly accurate transmission and reception of RF carriers that use less power than traditional architectures and components, thereby extending battery life, reducing heat and enabling certain size, cost, performance, and packaging advantages.

Hurdles to the adoption of our technologies include entrenchment of, and therefore familiarity with, existing technologies, the disruptive nature of our technology, and our lack of tenure in the markets we are targeting. We believe we can gain adoption, and therefore compete, based on the advantages enabled by our unique circuit architectures, as supported by a solid and defensible patent portfolio. Our circuit architectures are capable of being compliant with all current mobile phone and numerous other wireless industry standards and can be configured to accept all standard baseband data interfaces with the cooperation of the baseband processor OEMs. In addition, we believe that one or more of our technology’s abilities to provide improved power efficiencies, highly accurate RF carrier waveforms, reduced cost, smaller form factors and better manufacturing yields, provides a solution to existing problems in applications for 3G and 4G standards and beyond that the mobile wireless industry is seeking to solve, as well as in other applications where we believe our technologies can provide an attractive solution.

Production and Supply

The integrated circuits which incorporate our RF technologies are produced through fabrication relationships with IBM Microelectronics (“IBM”) using a Silicon Germanium process and Taiwan Semiconductor Manufacturing Company Limited (“TSMC”) using a CMOS semiconductor process. We believe IBM and TSMC have sufficient capacity to meet our foreseeable needs. In addition, our integrated circuits have been and can be produced using different materials and processes, if necessary, to satisfy capacity requirements and/or customer preferences. In instances where our customer licenses our intellectual property, the production capacity risk shifts to that customer.

7

Patents and Trademarks

We consider our intellectual property, including patents, patent applications, trademarks, and trade secrets to be significant to our competitive positioning. We have a program to file applications for and obtain patents, copyrights, and trademarks in the United States and in selected foreign countries where we believe filing for such protection is appropriate to establish and maintain our proprietary rights in our technology and products. As of December 31, 2013, we had 168 U.S. and 73 foreign patents related to our RF technologies. In addition, we have approximately 39 U.S. and foreign patent applications pending. We estimate the economic lives of our patents to be fifteen to twenty years and our current portfolio of issued patents have expirations ranging from 2018 to 2031.

From time to time, we obtain licenses from others for standard industry circuit designs that are integrated into our own integrated circuits as supporting components that are peripheral to our core technologies. We believe there are multiple sources for these types of standard circuits and we estimate the economic lives of the licenses to be two to five years based on estimated technological obsolescence.

Research and Development

For the years ended December 31, 2013, 2012, and 2011 we spent approximately $10.4 million, $8.4 million, and $8.4 million, respectively, on Company-sponsored research and development activities. Our research and development efforts have been, and are expected to continue to be, devoted to the development and advancement of RF technologies, including the development of prototype integrated circuits for proof of concept purposes, the development of production-ready silicon samples and reference designs for specific customer applications, and the creation of test programs for quality control testing of our chipsets.

Employees

As of December 31, 2013, we had 48 full-time and 2 part-time employees, of which 32 are employed in engineering research and development, 6 in sales and marketing, and 12 in executive management, finance and administration. Our employees are not represented by a labor union. We consider our employee relations satisfactory.

Available Information and Access to Reports

We file annual reports on Forms 10-K, quarterly reports on Forms 10-Q, proxy statements and other reports, including any amendments thereto, electronically with the SEC. The SEC maintains an Internet site (http://www.sec.gov) where these reports may be obtained at no charge. Copies of these reports may also be obtained from the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the SEC Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. We also make copies of these reports available, free of charge through our website (http://www.parkervision.com) via the link “SEC filings” as soon as practicable after filing or furnishing such materials with the SEC. We also will provide copies of the annual report on Form 10-K and the quarterly reports on Forms 10-Q filed during the current fiscal year, including any amendments thereto, upon written request to us at ParkerVision, Inc., Investor Relations, 7915 Baymeadows Way, Suite 400, Jacksonville, Florida, 32256. These reports will be provided at no charge. Exhibits to these reports may be obtained at a cost of $.25 per page plus $5.00 postage and handling.

8

Item 1A. Risk Factors.

In addition to other risks and uncertainties described in this Annual Report, the following risk factors should be carefully considered in evaluating our business because such factors may have a significant impact on our business, operating results, liquidity and financial condition. As a result of the risk factors set forth below, actual results could differ materially from those projected in any forward-looking statements.

We have had a history of losses which may ultimately compromise our ability to implement our business plan and continue in operation.

We have had losses in each year since our inception in 1989, and continue to have an accumulated deficit which, at December 31, 2013, was approximately $290.0 million. The net loss for 2013 was approximately $27.9 million. To date, our technologies and products have not produced revenues sufficient to cover operating, research and development and overhead costs. We will continue to make expenditures on marketing, research and development, pursuit of patent protection for and defense of our intellectual property, and operational costs for fulfillment of any contracts that we achieve for the sale of our products or technologies. We expect that our revenues in 2014 will not bring the Company to profitability and our current capital resources may not be sufficient to sustain our operations through 2015. If we are not able to generate sufficient revenues or obtain sufficient capital resources, we will not be able to implement our business plan and investors will suffer a loss in their investment. This may also result in a change in our business strategies.

We expect to need additional capital in the future. Failure to raise such additional capital may prevent us from implementing our business plan as currently formulated.

Because we have had net losses and, to date, have not generated positive cash flow from operations, we have funded our operating losses from the sale of equity securities from time to time. We anticipate that our business plan will continue to require significant expenditures for research and development, patent protection, sales and marketing, and general operations. Furthermore, we expect that the implementation of significant cost reduction measures in order to reduce our cash needs would jeopardize our operations and future growth plans. Our current capital resources include cash and available for sale securities of $17.2 million at December 31, 2013 and $11.9 million in net proceeds from our March 2014 sale of equity securities. These capital resources are sufficient to meet our working capital needs for 2014, but may not be sufficient to sustain our operations on a longer-term basis and we may require additional capital to fund our operations. Financing, if any, may be in the form of debt or additional sales of equity securities, including common or preferred stock. The incurrence of debt or the sale of preferred stock may result in the imposition of operational limitations and other covenants and payment obligations, any of which may be burdensome to us. The sale of equity securities, including common or preferred stock, may result in dilution to the current shareholders’ ownership. The long-term continuation of our business plan is dependent upon the generation of sufficient revenues from the sale or license of our products or technologies, additional funding, reducing expenses or a combination of the foregoing. The failure to generate sufficient revenues, raise capital or reduce expenses will have a material adverse effect on our ability to achieve our long-term business objectives.

Our industry is subject to rapid technological changes which if we are unable to match or surpass, will result in a loss of competitive advantage and market opportunity.

Because of the rapid technological development that regularly occurs in the microelectronics industry, we must continually devote substantial resources to developing and improving our technology and introducing new product offerings. For example, in fiscal years 2013 and 2012, we spent approximately $10.4 million and $8.4 million, respectively, on research and development and, we expect to continue to spend a significant amount in this area in the future. These efforts and expenditures are necessary to establish market share and, ultimately, to generate revenues. If another company offers better products or technologies, a competitive position or market window opportunity may be lost, and therefore our revenues or revenue potential may be adversely affected.

9

If our technologies and/or products are not commercially accepted, our developmental investment will be lost and our ability to do business will be impaired.

There can be no assurance that our research and development will produce commercially viable technologies and products, or that our technologies and products will be established in the market as improvements over current competitive offerings. If our existing or new technologies and products are not commercially accepted, the funds expended will not be recoverable, and our competitive and financial position will be adversely affected. In addition, perception of our business prospects will be impaired with an adverse impact on our ability to do business and to attract capital and employees.

Our business is highly reliant on our business relationships with baseband suppliers for support of the interface of their product to our technology and the support of our sales and marketing efforts to their customers, the failure of which will have an adverse impact on our business.

The successful commercialization of our products will be impacted, in part, by factors outside of our control including the success and timing of product development and sales support activities of the suppliers of baseband processors with which our products interface. Delays in or failure of a baseband supplier’s product development or sales support activities will hinder the commercialization of our products which will have an adverse impact on our ability to generate revenues and recover development expenses.

We rely, in large part, on key business and sales relationships for the successful commercialization of our products, which if not developed or maintained, will have an adverse impact on achieving market awareness and acceptance and will result in a loss of business opportunity.

To achieve a wide market awareness and acceptance of our products and technologies, as part of our business strategy, we will attempt to enter into a variety of business relationships with other companies which will incorporate our technologies into their products and/or market products based on our technologies. The successful commercialization of our products and technologies will depend in part on our ability to meet obligations under contracts with respect to the products and related development requirements. The failure of these business relationships will limit the commercialization of our products and technologies which will have an adverse impact on our business development and our ability to generate revenues and recover development expenses.

If our patents and intellectual property rights do not provide us with the anticipated market protections, our competitive position, business, and prospects will be impaired.

We rely on our intellectual property rights, including patents and patent applications, to provide competitive advantage and protect us from theft of our intellectual property. We believe that our patents are for entirely new technologies and that our patents are valid, enforceable and valuable. Third parties may make claims of invalidity with respect to our patents and such claims could give rise to material costs for defense and divert resources away from our other activities. If our patents are shown not to be as broad as currently believed, or are otherwise challenged such that some or all of the protection is lost, we will suffer adverse effects from the loss of competitive advantage and our ability to offer unique products and technologies. As a result, there would be an adverse impact on our financial condition and business prospects.

10

Our litigation can be time-consuming, costly and we cannot anticipate the results.

Since 2011, we have spent a significant amount of our financial and management resources to pursue our patent infringement litigation against Qualcomm Incorporated. We believe this litigation, and others that we may in the future determine to pursue, could continue to consume management and financial resources for long periods of time. There can be no assurance that our current or future litigation matters will ultimately result in a favorable outcome for us. In addition, even if we obtain favorable interim rulings or verdicts in particular litigation matters, they may not be predictive of the ultimate resolution of the matter. Unfavorable outcomes could result in exhaustion of our financial resources and could otherwise encumber our ability to pursue licensing and/or product opportunities for our technologies which would have a material adverse impact on our financial condition and business prospects.

We are subject to outside influences beyond our control, including new legislation that could adversely affect our licensing and enforcement activities and have an adverse impact on the execution of our business plan.

Our licensing and enforcement activities are subject to numerous risks from outside influences, including new legislation, regulations and rules related to obtaining or enforcing patents. For instance, the U.S. recently enacted sweeping changes to the United States patent system including changes that transition the United States from a “first-to-invent” to a “first to file” system and that alter the processes for challenging issued patents. To the extent that we are unable to secure patent protection for our future technologies and/or our current patents are challenged such that some or all of our protection is lost, we will suffer adverse effects to our ability to offer unique products and technologies. As a result, there would be an adverse impact on our financial position and our ability to execute our business plan.

We are highly dependent on Mr. Jeffrey Parker as our chief executive officer and Mr. David Sorrells as our chief technology officer. If either of their services were lost, it would have an adverse impact on the execution of our business plan.

Because of Mr. Parker’s leadership position in the company and the respect he has garnered in both the industry in which we operate and the investment community, the loss of his services might be seen as an impediment to the execution of our business plan. Because of Mr. Sorrells’ technical expertise, the loss of his services could have an adverse impact on our research, technical support, and enforcement activities and impede the execution of our business plan. If either Mr. Parker or Mr. Sorrells were no longer available to the company, investors might experience an adverse impact on their investment. We currently have employment agreements with and maintain key-employee life insurance for our benefit for both Mr. Parker and Mr. Sorrells.

If we are unable to attract or retain key executives and other highly skilled employees, we will not be able to execute our current business plans.

Our business is very specialized, and therefore it is dependent on having skilled and specialized key executives and other employees to conduct our research, development and customer support activities. The inability to obtain or retain these key executives and other specialized employees would have an adverse impact on the research, development and technical customer support activities that our products require. These activities are instrumental to the successful execution of our business plan.

Our outstanding options, warrants, and restricted share units may affect the market price and liquidity of the common stock.

At December 31, 2013, we had 93,208,471 shares of common stock outstanding and had 10,771,111 options, warrants, and restricted share units (“RSU”) outstanding for the purchase and/or issuance of shares of common stock. Of these outstanding equity instruments, 6,739,574 were exercisable as of December 31, 2013. The majority of the underlying common stock of these securities is registered for sale to the holder or for public resale by the holder. The amount of common stock available for the sales may have an adverse impact on our ability to raise capital and may affect the price and liquidity of the common stock in the public market. In addition, the issuance of these shares of common stock will have a dilutive effect on current shareholders’ ownership.

11

We may not be able to deliver shares of common stock upon exercise of our public warrants if such issuance has not been registered or qualified or deemed exempt under the securities laws of the state of residence of the holder of the warrant.

On November 3, 2010 and March 30, 2011, we sold warrants to the public in offerings registered under shelf registration statements. The issuance of common stock upon exercise of these warrants must qualify for exemption from registration under the securities laws of the state of residence of the warrant holder. The qualification for exemption from registration may differ in different states. As a result, a warrant may be held by a holder in a state where an exemption is not available for such exercise and we may be precluded from issuing such shares. If our common stock continues to be listed on the NASDAQ Capital Market or another national securities exchange, an exemption from registration in every state for the issuance of common stock upon exercise of these warrants would be available. However, we cannot assure you that our common stock will continue to be so listed. As a result, these warrants may be deprived of any value, the market for these warrants may be limited and the holders of these warrants may not be able to obtain shares of common stock upon exercise of the warrants if the common stock issuable upon such exercise is not qualified or otherwise exempt from qualification in the jurisdictions in which the holders of the warrants reside.

Provisions in our certificate of incorporation and by-laws could have effects that conflict with the interest of shareholders.

Some provisions in our certificate of incorporation and by-laws could make it more difficult for a third party to acquire control of us. For example, our board of directors is divided into three classes with directors having staggered terms of office, our board of directors has the ability to issue preferred stock without shareholder approval, and there are advance notification provisions for director nominations and submissions of proposals from shareholders to a vote by all the shareholders under the by-laws. Florida law also has anti-takeover provisions in its corporate statute.

We have a shareholder protection rights plan that may delay or discourage someone from making an offer to purchase the company without prior consultation with the board of directors and management which may conflict with the interests of some of the shareholders.

On November 17, 2005, the board of directors adopted a shareholder protection rights plan which called for the issuance, on November 29, 2005, as a dividend, of rights to acquire fractional shares of preferred stock. The rights are attached to the shares of common stock and transfer with them. In the future the rights may become exchangeable for shares of preferred stock with various provisions that may discourage a takeover bid. Additionally, the rights have what are known as “flip-in” and “flip-over” provisions that could make any acquisition of the company more costly. The principal objective of the plan is to cause someone interested in acquiring the company to negotiate with the board of directors rather than launch an unsolicited bid. This plan may limit, prevent, or discourage a takeover offer that some shareholders may find more advantageous than a negotiated transaction. A negotiated transaction may not be in the best interests of the shareholders.

Item 1B. Unresolved Staff Comments.

Not applicable.

12

Item 2. Properties.

Our headquarters are located in a 14,000 square foot leased facility in Jacksonville, Florida. We have an additional 12,500 square foot leased facility in Lake Mary, Florida primarily for engineering design activities. Our facilities consist of general office space with laboratory facilities for circuit board layout and testing. We believe our properties are in good condition and suitable for the conduct of our business. Refer to “Lease Commitments” in Note 11 to our financial statements included in Item 8 for information regarding our outstanding lease obligations.

Item 3. Legal Proceedings.

Refer to “Legal Proceedings” in Note 11 to our financial statements included in Item 8 for a discussion of current legal proceedings.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock is traded on NASDAQ under the symbol “PRKR.” Listed below is the range of the high and low sale prices of the common stock for the last two fiscal years, as reported by NASDAQ.

|

2013

|

2012

|

|||||||||||||||

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

Quarter ended March 31

|

$ | 4.39 | $ | 1.83 | $ | 1.23 | $ | 0.74 | ||||||||

|

Quarter ended June 30

|

4.71 | 3.50 | 2.42 | 0.91 | ||||||||||||

|

Quarter ended September 30

|

4.92 | 2.94 | 3.25 | 1.80 | ||||||||||||

|

Quarter ended December 31

|

7.78 | 2.16 | 2.45 | 1.48 | ||||||||||||

Holders

As of February 24, 2014, we had 123 holders of record and we believe there are approximately 5,600 beneficial holders of our common stock.

Dividends

To date, we have not paid any dividends on our common stock. The payment of dividends in the future is at the discretion of the board of directors and will depend upon our ability to generate earnings, our capital requirements and financial condition, and other relevant factors. We do not intend to declare any dividends in the foreseeable future, but instead intend to retain all earnings, if any, for use in the business.

Sales of Unregistered Securities

On November 21, 2013, we issued an aggregate of 150,000 RSUs to two consultants as payment for services. These RSUs vest over a six month period beginning December 31, 2013. Upon thirty days’ notice, the consulting agreements may be terminated and any unvested portion of the RSUs will be cancelled. As of December 31, 2013, an aggregate of 16,666 RSUs have vested and a total of $75,830 has been recognized in share-based compensation expense.

13

On November 21, 2013, we also issued an aggregate of 750,000 RSUs to these same consultants as performance incentives. These RSUs vest only upon achievement of certain market conditions, as measured based on the closing price of our common stock during a period ending on the earlier of (i) December 31, 2015 or (ii) thirty days following termination of the related consulting agreements. As of December 31, 2013, no portion of the RSU has vested and we have recognized no compensation expense related to these awards.

The RSUs were issued pursuant to the exemption from registration provided by Section 4(2) of the Securities Act of 1933, as amended, as the vendor is a sophisticated investor, with such knowledge and experience in financial and business matters that it is capable of evaluating the merits and risks of the investment. Refer to Note 8 included in Item 8 for a complete discussion of the valuation and terms of these RSUs.

Issuer Repurchase of Equity Securities

None.

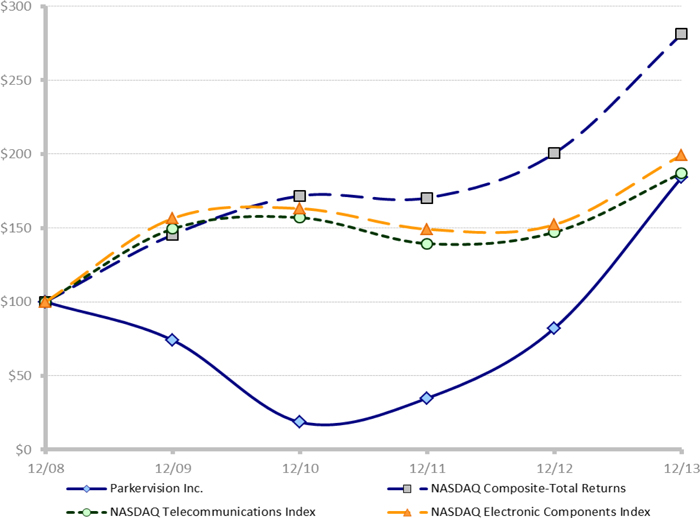

Performance Graph

The following graph shows a five-year comparison of cumulative total shareholder returns for our company, the NASDAQ U.S. Stock Market Index, the NASDAQ Electronic Components Index and the NASDAQ Telecommunications Index for the five years ending December 31, 2013. The total shareholder returns assumes the investment on December 31, 2008 of $100 in our common stock, the NASDAQ U.S. Stock Market Index, the NASDAQ Electronic Components Index, and the NASDAQ Telecommunications Index at the beginning of the period, with immediate reinvestment of all dividends.

The data points for the performance graph are as follows:

|

12/31/08

|

12/31/09

|

12/31/10

|

12/31/11

|

12/31/12

|

12/31/13

|

|||||||||||||||||||

|

ParkerVision, Inc.

|

$ | 100.00 | $ | 74.09 | $ | 18.62 | $ | 34.82 | $ | 82.19 | $ | 184.21 | ||||||||||||

|

NASDAQ Composite

|

$ | 100.00 | $ | 145.36 | $ | 171.74 | $ | 170.38 | $ | 200.61 | $ | 281.17 | ||||||||||||

|

NASDAQ Telecommunications

|

$ | 100.00 | $ | 149.35 | $ | 156.99 | $ | 139.44 | $ | 147.08 | $ | 187.21 | ||||||||||||

|

NASDAQ Electronic Components

|

$ | 100.00 | $ | 156.43 | $ | 163.12 | $ | 149.18 | $ | 152.27 | $ | 199.40 | ||||||||||||

14

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

|

*

|

100 invested on 12/31/08 in stock & index-including reinvestment of dividends.

|

|

|

Fiscal year ending December 31

|

Item 6. Selected Financial Data.

The following table sets forth our financial data as of the dates and for the periods indicated. The data has been derived from our audited financial statements. The selected financial data should be read in conjunction with our financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

15

| For the years ended December 31, | ||||||||||||||||||||

|

(in thousands, except per share amounts)

|

2013

|

2012

|

2011

|

2010

|

2009

|

|||||||||||||||

|

Statement of Operations Data:

|

||||||||||||||||||||

|

Revenues, net

|

$ | 0 | $ | 0 | $ | 0 | $ | 64 | $ | 64 | ||||||||||

|

Gross margin

|

0 | 0 | 0 | 17 | 10 | |||||||||||||||

|

Operating expenses

|

27,949 | 20,383 | 14,676 | 15,146 | 21,559 | |||||||||||||||

|

Net loss from continuing operations

|

(27,872 | ) | (20,322 | ) | (14,573 | ) | (15,028 | ) | (21,530 | ) | ||||||||||

|

Basic and diluted net loss per common share

from continuing operations |

(0.31 | ) | (0.27 | ) | (0.24 | ) | (0.35 | ) | (0.65 | ) | ||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Total assets

|

$ | 26,595 | $ | 18,720 | $ | 15,842 | $ | 17,596 | $ | 25,545 | ||||||||||

|

Long term obligations

|

22 | 58 | 138 | 55 | 155 | |||||||||||||||

|

Shareholders’ equity

|

24,046 | 16,520 | 14,341 | 16,592 | 23,883 | |||||||||||||||

|

Working capital

|

15,206 | 7,175 | 4,658 | 6,134 | 12,577 | |||||||||||||||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Executive Overview

We are in the business of innovating fundamental wireless technologies. We design, develop and market our proprietary RF technologies and products for use in semiconductor circuits for wireless communication products.

We have a three-part growth strategy that includes intellectual property licensing and/or product ventures, intellectual property enforcement, and product and component development, manufacturing and sales. We have actively launched a licensing/product venture campaign to explore licensing and joint product development opportunities with wireless communications companies that make, use or sell chipsets and/or products that incorporate RF. We have engaged the intellectual property firm of 3LP to assist in managing our licensing operations. We believe there are a number of wireless communications companies that can benefit from the use of the RF technologies we have developed, whether through a license or, in certain cases, a joint product venture that would include licensing rights.

From time to time we may be involved in litigation against others in order to protect or defend our intellectual property rights. Since 2011, we have been involved in patent infringement litigation against Qualcomm for their unauthorized use of our receiver technology. In October 2013, a jury found that Qualcomm was infringing four of our receiver patents and awarded us $172.7 million in past damages. We have a district court hearing scheduled for May 1, 2014 regarding the outstanding motions in this case including our request for an injunction against Qualcomm and/or ongoing royalties for Qualcomm’s continued infringement of our patents. Following the hearing, we expect to receive a ruling from the district court on the outstanding motions although there is no date certain for the court’s ruling. The law firm of McKool Smith is representing us in this litigation on a partial contingency basis. Refer to “Legal Proceedings” in Note 11 to our financial statements included in Item 8 for a complete discussion of the proceedings in this matter.

Our product development and marketing efforts are focused on our RF technologies in mobile and other communications industries that use RF. We have developed and are actively marketing a number of RF components products to industries that do not use highly integrated semiconductors, such as infrastructure, industrial and military applications. In addition, we are working with VIA on the continued development and marketing of RF integrated circuits that function with their baseband products for mobile handset customers.

16

Since 2005, we have generated no product or royalty revenue from our wireless technologies. We have made significant investments in developing and protecting our technologies and products, the returns on which are dependent upon the generation of future revenues for realization.

Liquidity and Capital Resources

At December 31, 2013, we had working capital of approximately $15.2 million, an increase of approximately $8.0 million from working capital of $7.2 million at December 31, 2012. This increase is a result of approximately $27.3 million in proceeds from our March 2013 and August 2013 sales of equity securities as well as approximately $1.1 million in proceeds from the exercise of options and warrants, offset by the use of approximately $18.9 million in cash for operating activities and the investment of approximately $0.7 million in patents and other long-lived assets in 2013. Proceeds from the sale of equity securities are invested in available for sale securities and our use of cash is funded from the sale of these securities. At December 31, 2013, we were not subject to any significant commitments to make additional capital expenditures and we have no significant long-term debt obligations.

For the year ended December 31, 2012, we used cash of approximately $14.7 million for operations and invested approximately $1.2 million in patents and other long-lived assets. This use of cash was offset by approximately $18.9 million in proceeds from the sale of equity securities and the exercise of options and warrants in 2012. The increase in our use of cash for operating activities from 2012 to 2013 was primarily the result of our increased operating expenses pertaining to our patent infringement litigation against Qualcomm.

Our future business plans call for continued investment in sales, marketing, customer support and product development for our technologies and products, as well as investment in continued protection of our intellectual property including prosecution of new patents and defense of existing patents. Our ability to generate revenues sufficient to offset costs is subject to our ability to secure new product and licensing customers for our technologies, successfully support our customers in completing their product designs and/or, our ability to successfully protect our intellectual property.

Revenue generated from technology licenses and/or the sale of RF chipsets or component products in 2014 may not be sufficient to cover our operational expenses, and we expect that our continued losses and use of cash will be funded from available working capital. In addition, we expect that available working capital will be used for initial production start-up costs, including test programs and production tooling, and for litigation expenses to defend our intellectual property. In March 2014, we generated net proceeds of approximately $11.9 million from the sale of equity securities. Our current capital resources are sufficient to support our liquidity requirements through 2014 and beyond.

The long-term continuation of our business plan is dependent upon the generation of sufficient revenues from our technologies and/or products to offset expenses. In the event that we do not generate sufficient revenues, we will be required to obtain additional funding through public or private financing and/or reduce operating costs. Failure to generate sufficient revenues, raise additional capital through debt or equity financings, and/or reduce operating costs could have a material adverse effect on our ability to meet our long-term liquidity needs and achieve our intended long-term business objectives.

17

Results of Operations for Each of the Years Ended December 31, 2013, 2012, and 2011

Revenues and Gross Margins

We had no product or royalty revenues for the years ended December 31, 2013, 2012, or 2011. Damages awarded as a result of patent infringement litigation are not recognized until we have a final court adjudication or executed settlement agreement, the amounts are fixed and determinable, and the collectability is reasonably assured.

Research and Development Expenses

Research and development expenses consist primarily of engineering and related management and support personnel costs; fees for outside engineering design services which we use from time to time to supplement our internal resources; amortization and depreciation expense related to our patents and other assets used in product development; prototype production and materials costs, which represent the fabrication and packaging costs for prototype integrated circuits, as well as the cost of supporting components for prototype board development; software licensing and support costs, which represent the annual licensing and support maintenance for engineering design and other software tools; and rent and other overhead costs for our engineering design facility. Personnel costs include share-based compensation which represents the grant date fair value of equity-based awards to our employees which is attributed to expense over the service period of the award.

Research and development costs increased approximately $2.0 million, or 23.2% from 2012 to 2013. This increase is primarily the result of an increase in employee share based compensation of approximately $829,000, an increase in outside professional fees of approximately $739,000, and an increase in personnel and related costs of approximately $479,000. The increase in share-based compensation expense is the result of long-term incentive equity awards granted to engineering executives and employees in July 2012 as well as restricted stock awards granted to employees as incentive compensation in 2013. The increase in outside professional fees is the result of an increase in fees for outside design services, including the VIA development arrangement, as well as an increase in legal fees related to maintenance of our patent portfolio. The increase in personnel and related costs is the result of an increase in personnel in early 2013 as well as an increase in performance bonuses to key engineering executives.

Research and development costs remained relatively unchanged from 2011 to 2012. Personnel and related costs increased by approximately $360,000 from 2011 to 2012 as a result of an increase in personnel during mid-2011 as well as an increase in incentive compensation to key personnel in 2012. This increase was offset by a decrease in outside engineering design services of approximately $330,000 as a result of the status and timing of various outsourced projects.

The markets for our products and technologies are characterized by rapidly changing technology, evolving industry standards and frequent new product introductions. Our ability to successfully develop and introduce, on a timely basis, new and enhanced products and technologies will be a significant factor in our ability to grow and remain competitive. We are committed to continue investing in our technology and product development and therefore we anticipate that we will use a substantial portion of our working capital for research and development activities in 2014.

Marketing and Selling Expenses

Marketing and selling expenses consist primarily of personnel costs, including share-based compensation and travel costs, and outside professional fees which consist of various consulting and other professional fees related to sales and marketing activities.

18

Marketing and selling expenses increased by approximately $0.1 million, or 7.1%, from 2012 to 2013. This increase is primarily due to an increase in share based compensation of approximately $120,000 as a result of long-term incentive equity awards granted to executives and employees in July 2012 and restricted stock awards granted to employees as incentive compensation in 2013.

Marketing and selling expenses increased by approximately $0.2 million, or 13.0%, from 2011 to 2012. This increase is primarily due to an increase in outside professional fees of approximately $135,000 as a result of outsourced support for a potential customer in Asia and an increase in certain public relations activities.

We anticipate that marketing and selling expenses will increase in 2014 as we expand our product marketing activities and our technology licensing efforts.

General and Administrative Expenses

General and administrative expenses consist primarily of executive, director, finance and administrative personnel costs, including share-based compensation, and costs incurred for insurance, shareholder relations and outside professional services, including litigation fees.

Our general and administrative expenses increased by approximately $5.5 million, or 53.3%, from 2012 to 2013. This increase was due primarily to increases in litigation fees and expenses of approximately $3,400,000 and an increase in share-based compensation expense of approximately $2,430,000, partially offset by a decrease in various consulting fees of approximately $490,000.

Our general and administrative expenses increased by approximately $5.5 million, or 114.4%, from 2011 to 2012. This increase was due primarily to increases in litigation fees and expenses of approximately $2,360,000, an increase in share-based compensation expense of approximately $1,970,000, and an increase in various consulting fees of approximately $525,000.

This increase in litigation fees and expenses in both 2012 and 2013 was the result of our patent infringement litigation against Qualcomm. The increases represent costs for experts and other third-party services, as well as increases in legal fees incurred as the case progressed towards trial which commenced in October 2013. Our litigation team is working on a partial contingency basis, and as a result, their fees have been reduced in exchange for a contingent fee in the event an award is received.

The increase in share-based compensation expense in both 2012 and 2013 is primarily related to the expense attribution of long-term equity incentive awards granted to executives, other administrative employees, and non-employee directors in July 2012, and the expense recognized upon vesting of performance based RSUs granted to a third-party in 2011. In addition, share-based compensation expense in 2013 included the value of a stock based performance bonus awarded to our CEO in lieu of a cash bonus of $390,000.

The increase in consulting fees from 2011 to 2012 was the result of one-time increases in various intellectual property strategy, investor relations, and financial advisory fees incurred in 2012. These increases were not sustained in 2013 and, as a result, we experienced a $490,000 decrease in consulting fees from 2012 to 2013.

Although we anticipate a decrease in legal fees and expenses in 2014 related to our current Qualcomm litigation, the initiation of additional litigation, by us or by other parties against us, could offset these anticipated decreases. Future litigation costs, if any, may be financed by a third party in return for a contingent fee on related litigation awards; however we currently have no such arrangements in place.

19

Loss and Loss per Common Share

Our net loss increased approximately $7.6 million, or $0.04 per common share, from 2012 to 2013. This increase was the result of a $7.6 million increase in operating expenses, which includes a $3.4 million increase in litigation fees and expenses and a $3.4 million increase in overall share-based compensation expense. The increase in the loss per common share is a result of the increased net loss, offset by a 17% increase in weighted average shares outstanding for the period.

Our net loss increased approximately $5.7 million, or $0.03 per common share, from 2011 to 2012. This increase was a result of the $5.7 million increase in operating expenses, which includes a $2.4 million increase in litigation fees and expenses and a $2.1 million increase in overall share-based compensation expense. The increase in the loss per common share is a result of the increased net loss, offset by a 27% increase in weighted average shares outstanding for the period.

Critical Accounting Policies

We believe that the following are the critical accounting policies affecting the preparation of our financial statements:

Intangible Assets

Patents, copyrights and other intangible assets are amortized using the straight-line method over their estimated period of benefit. We estimate the economic lives of our patents and copyrights to be fifteen to twenty years. We estimate the economic lives of other intangible assets, including licenses, based on estimated technological obsolescence, to be two to five years, which is generally shorter than the contractual lives. Periodically, we evaluate the recoverability of our intangible assets and take into account events or circumstances that may warrant revised estimates of useful lives or that may indicate impairment exists (“Triggering Event”). Based on our cumulative net losses and negative cash flows from operations to date, we assess our working capital needs on an annual basis. This annual assessment of our working capital is considered to be a Triggering Event for purposes of evaluating the recoverability of our intangible assets. As a result of our evaluation at December 31, 2013, we determined that no impairment exists with regard to our intangible assets.

Accounting for Share-Based Compensation

We calculate the fair value of share-based equity awards to employees, including restricted stock, stock options and restricted stock units, on the date of grant and recognize the calculated fair value, net of estimated forfeitures, as compensation expense over the requisite service periods of the related awards. The fair value of share-based awards is determined using various valuation models which require the use of highly subjective assumptions and estimates including (i) how long employees will retain their stock options before exercising them, (ii) the volatility of our common stock price over the expected life of the equity award, and (iii) the rate at which equity awards will ultimately be forfeited by the recipients. Changes in these subjective assumptions can materially affect the estimate of fair value of share-based compensation and consequently, the related amount recognized as expense in the statements of comprehensive loss.

20

Income Taxes

The provision for income taxes is based on loss before taxes as reported in the accompanying statements of comprehensive loss. Deferred tax assets and liabilities are recognized for the expected future tax consequences of events that have been included in the financial statements or tax returns. Deferred tax assets and liabilities are determined based on differences between the financial statement carrying amounts and the tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Valuation allowances are established to reduce deferred tax assets when, based on available objective evidence, it is more likely than not that the benefit of such assets will not be realized. Our deferred tax assets exclude unrecognized tax benefits which do not meet a more-likely-than-not threshold for financial statement recognition for tax positions taken or expected to be taken in a tax return.

Off-Balance Sheet Transactions, Arrangements and Other Relationships

As of December 31, 2013, we have outstanding warrants to purchase 1,849,517 shares of common stock that were issued in connection with the sale of equity securities in various private placement transactions in 2009, 2010, and 2011. These warrants have exercise prices ranging from $0.54 to $1.88 per share with a weighted average exercise price of $0.70 and a weighted average remaining contractual life of approximately 1.8 years. The estimated aggregate fair value of these warrants at their date of issuance of $663,100 is included in shareholders’ equity in our balance sheets. Refer to “Non-Plan Options and Warrants” in Note 8 to our financial statements included in Item 8 for information regarding the outstanding warrants.

Our contractual obligations and commercial commitments at December 31, 2013 were as follows (see “Lease Commitments” in Note 11 to the financial statements included in Item 8):

|

Payments due by period

|

||||||||||||||||||||

|

Contractual Obligations:

|

Total

|

1 year or less

|

2 – 3 years

|

4 – 5 years

|

After 5 years

|

|||||||||||||||

|

Capital leases

|

$ | 37,500 | $ | 30,000 | $ | 7,500 | $ | 0 | $ | 0 | ||||||||||

|

Operating leases

|

966,800 | 362,200 | 497,800 | 106,800 | 0 | |||||||||||||||

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Our cash equivalents, which are primarily highly liquid money market instruments, and our available for sale securities, which are mutual funds invested primarily in short-term municipal securities, are subject to market risk, including interest rate risk. Market risk is the risk of loss arising from adverse changes in market and economic conditions and is directly influenced by the volatility and liquidity in the markets in which the related underlying assets are traded. We are averse to principal loss and seek to ensure the safety and preservation of our funds by investing in market instruments with limited market risk. Accordingly, we do not believe there is any material market risk exposure with respect to our market instruments.

21

Item 8. Financial Statements and Supplementary Data.

|

Index to Financial Statements

|

||

|

Page

|

||

|

REPORT OF INDEPENDENT REGISTERED CERTIFIED PUBLIC

|

||

|

ACCOUNTING FIRM

|

23

|

|

|

FINANCIAL STATEMENTS:

|

||

|

Balance Sheets - December 31, 2013 and 2012

|

24

|

|

|

Statements of Comprehensive Loss - for the years ended

|

||

|

December 31, 2013, 2012 and 2011

|

25

|

|

|

Statements of Shareholders’ Equity - for the years ended

|

||

|

December 31, 2013, 2012 and 2011

|

26

|

|

|

Statements of Cash Flows - for the years ended

|

||

|

December 31, 2013, 2012 and 2011

|

28

|

|

|

Notes to Financial Statements - December 31, 2013, 2012 and 2011

|

29

|

|

|

FINANCIAL STATEMENT SCHEDULE:

|

||

|

Schedule II – Valuation and Qualifying Accounts

|

56

|

|

|

Schedules other than those listed have been omitted since they are

|

||

|

either not required, not applicable or the information is otherwise

|

||

|

included.

|

22

Report of Independent Registered Certified Public Accounting Firm

To the Board of Directors and

Shareholders of ParkerVision, Inc.

In our opinion, the financial statements listed in the accompanying index present fairly, in all material respects, the financial position of ParkerVision, Inc. at December 31, 2013 and December 31, 2012, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2013 in conformity with accounting principles generally accepted in the United States of America. In addition, in our opinion, the financial statement schedule listed in the accompanying index presents fairly, in all material respects, the information set forth therein when read in conjunction with the related financial statements. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2013, based on criteria established in Internal Control - Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company's management is responsible for these financial statements and financial statement schedule, for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in Management's Report on Internal Control Over Financial Reporting appearing under Item 9A. Our responsibility is to express opinions on these financial statements, on the financial statement schedule, and on the Company's internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

/s/ PricewaterhouseCoopers LLP

Jacksonville, Florida

March 17, 2014

23

PARKERVISION, INC.

BALANCE SHEETS

DECEMBER 31, 2013 AND 2012

|

2013

|

2012

|

|||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash and cash equivalents

|

$ | 222,697 | $ | 298,227 | ||||

|

Available for sale securities

|

16,957,489 | 8,041,904 | ||||||

|

Prepaid expenses and other

|

551,961 | 977,310 | ||||||

|

Total current assets

|

17,732,147 | 9,317,441 | ||||||

|

PROPERTY AND EQUIPMENT, net

|

307,385 | 403,446 | ||||||

|

INTANGIBLE ASSETS, net

|

8,552,432 | 8,978,101 | ||||||

|

OTHER ASSETS, net

|

2,576 | 20,866 | ||||||

|

Total assets

|

$ | 26,594,540 | $ | 18,719,854 | ||||

|

CURRENT LIABILITIES:

|

||||||||

|

Accounts payable

|

$ | 1,246,470 | $ | 827,209 | ||||

|

Accrued expenses:

|

||||||||

|

Salaries and wages

|

325,313 | 295,194 | ||||||

|

Professional fees

|

631,871 | 902,411 | ||||||

|

Other accrued expenses

|

289,031 | 42,231 | ||||||

|

Deferred rent, current portion

|

33,894 | 75,144 | ||||||

|

Total current liabilities

|

2,526,579 | 2,142,189 | ||||||

|

LONG TERM LIABILITIES

|

||||||||

|

Capital lease, net of current portion

|

7,290 | 33,915 | ||||||

|

Deferred rent, net of current portion

|

14,379 | 23,763 | ||||||

|

Total long term liabilities

|

21,669 | 57,678 | ||||||

|

Total liabilities

|

2,548,248 | 2,199,867 | ||||||

|

COMMITMENTS AND CONTINGENCIES

|

||||||||

|

SHAREHOLDERS' EQUITY:

|

||||||||

|

Common stock, $.01 par value, 150,000,000 shares authorized, 93,208,471 and 82,903,609 issued and

outstanding at December 31, 2013 and 2012, respectively |

932,085 | 829,036 | ||||||

|

Accumulated other comprehensive loss

|

(8,215 | ) | (20 | ) | ||||

|

Warrants outstanding

|

663,100 | 1,081,050 | ||||||

|

Additional paid-in capital

|

312,470,030 | 276,748,336 | ||||||

|

Accumulated deficit

|

(290,010,708 | ) | (262,138,415 | ) | ||||

|

Total shareholders' equity

|

24,046,292 | 16,519,987 | ||||||

|

Total liabilities and shareholders' equity

|

$ | 26,594,540 | $ | 18,719,854 | ||||

The accompanying notes are an integral part of these financial statements.

24

PARKERVISION, INC.

STATEMENTS OF COMPREHENSIVE LOSS

FOR THE YEARS ENDED DECEMBER 31, 2013, 2012 AND 2011

|

2013

|

2012

|

2011

|

||||||||||

|

Revenue

|

$ | 0 | $ | 0 | $ | 0 | ||||||

|

Cost of sales

|

0 | 0 | 0 | |||||||||