DEF 14A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| |

o | Preliminary Proxy Statement |

|

| |

o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| |

ý | Definitive Proxy Statement |

|

| |

o | Definitive Additional Materials |

|

| |

o | Soliciting Material Pursuant to § 240.14a-12

|

MIDDLEBURG FINANCIAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

| |

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

| o Fee paid previously with preliminary materials: |

| o Check box if any part of the fee is offset as provided in Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

MIDDLEBURG FINANCIAL CORPORATION

Dear Shareholder:

You are cordially invited to attend the 2016 Annual Meeting of Shareholders of Middleburg Financial Corporation (the “Company”) to be held on Wednesday, May 4, 2016, at 10:00 a.m. at the Middleburg Community Center, 300 West Washington Street, Middleburg, Virginia.

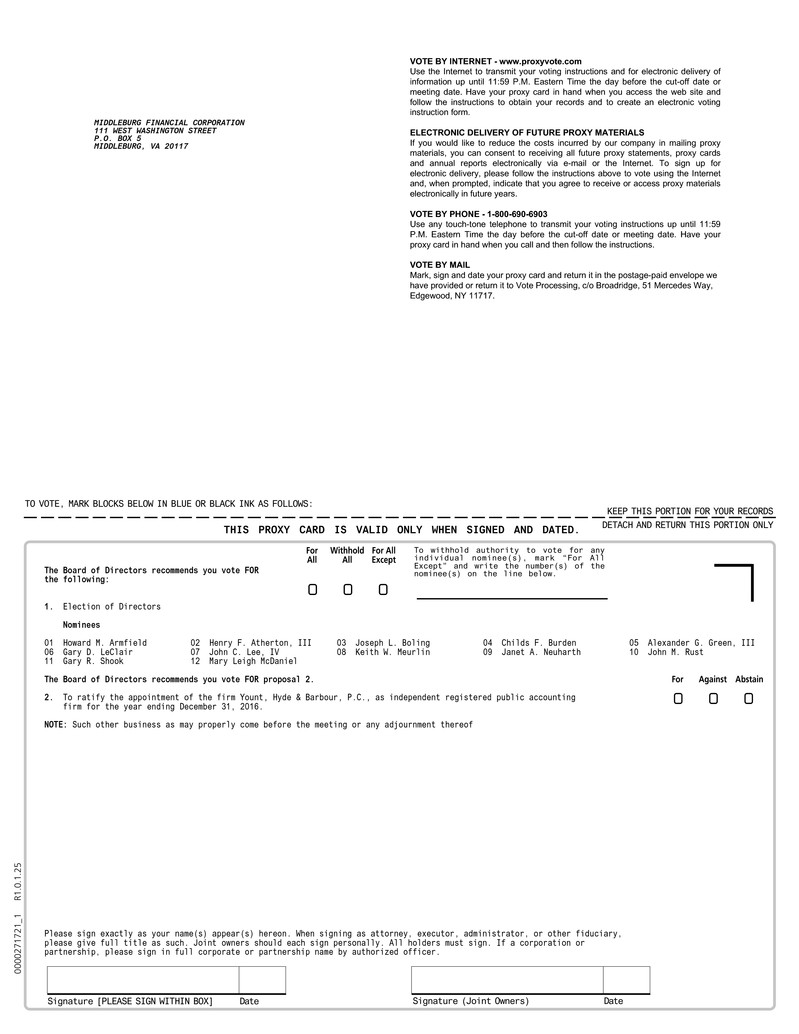

At the Annual Meeting, you will be asked to elect 12 directors for terms of one year each and to ratify the appointment of Yount, Hyde & Barbour, P.C., to serve as our independent auditors for the year ending December 31, 2016. Enclosed with this letter are a formal notice of the Annual Meeting, a Proxy Statement and a form of proxy.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted. Please complete, sign, date and return the enclosed proxy card promptly using the enclosed postage-paid envelope. The enclosed proxy card, when returned properly executed, will be voted in the manner directed in the proxy statement. You may also vote by phone or Internet by following the instructions on the enclosed proxy card.

We hope you will participate in the Annual Meeting, either in person or by proxy.

Sincerely,

Gary R. Shook

Chief Executive Officer and President

Middleburg, Virginia

April 4, 2016

MIDDLEBURG FINANCIAL CORPORATION

111 West Washington Street

Middleburg, Virginia 20117

___________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

___________________

The Annual Meeting of Shareholders (the “Annual Meeting”) of Middleburg Financial Corporation (the “Company”) will be held on Wednesday, May 4, 2016, at 10:00 a.m. at the Middleburg Community Center, 300 West Washington Street, Middleburg, Virginia, for the following purposes:

1.To elect 12 directors to serve for terms of one year each expiring at the 2017 Annual Meeting of Shareholders;

| |

2. | To ratify the appointment of Yount, Hyde & Barbour, P.C., as our independent registered public accounting firm for the year ending December 31, 2016, and |

3.To act upon such other matters as may properly come before the Annual Meeting.

Only holders of shares of Common Stock of record at the close of business on March 18, 2016, the record date fixed by the Board of Directors of the Company, are entitled to notice of, and to vote at, the Annual Meeting.

By Order of the Board of Directors

Jeffrey H. Culver

Senior Executive Vice President,

Chief Operating Officer and Corporate Secretary

April 4, 2016

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 4, 2016.

The proxy statement and the Company’s 2015 annual report on Form 10-K are available at https://materials.proxyvote.com/596094.

MIDDLEBURG FINANCIAL CORPORATION

111 West Washington Street

Middleburg, Virginia 20117

PROXY STATEMENT

This Proxy Statement is furnished to holders of the common stock, par value $2.50 per share (“Common Stock”), of Middleburg Financial Corporation (the “Company”), in connection with the solicitation of proxies by the Board of Directors of the Company to be used at the 2016 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Wednesday, May 4, at 10:00 a.m. at the Middleburg Community Center, 300 West Washington Street, Middleburg, Virginia, and any duly reconvened meeting after adjournment thereof.

Any shareholder who executes a proxy has the power to revoke it at any time by written notice to the Secretary of the Company, by executing a proxy dated as of a later date, or by voting in person at the Annual Meeting. If your shares are held by a bank or brokerage firm please follow the instructions delivered with the notice from your bank or broker or contact them for instructions on how to change or revoke your vote. It is expected that this Proxy Statement and the enclosed proxy card will be mailed on or about April 4, 2016, to all shareholders entitled to vote at the Annual Meeting.

The cost of soliciting proxies for the Annual Meeting will be borne by the Company. The Company does not intend to solicit proxies otherwise than by use of the mail, but certain officers and regular employees of the Company or its subsidiaries, without additional compensation, may use their personal efforts, by telephone or otherwise, to obtain proxies. The Company may also reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses in forwarding proxy materials to the beneficial owners of shares of Common Stock.

On March 18, 2016, the record date for determining those shareholders entitled to notice of and to vote at the Annual Meeting, there were 7,107,518 shares of Common Stock issued and outstanding. Each outstanding share of Common Stock is entitled to one vote on all matters to be acted upon at the Annual Meeting. A majority of the shares of Common Stock entitled to vote, represented in person or by proxy, constitutes a quorum for the transaction of business at the Annual Meeting.

A shareholder may abstain or (only with respect to the election of directors) withhold his or her vote (collectively, “Abstentions”) with respect to each item submitted for shareholder approval. Abstentions will be counted for purposes of determining the existence of a quorum. Abstentions will not be counted as voting in favor of or against the relevant item.

A broker who holds shares in “street name” has the authority to vote on certain items when it has not received instructions from the beneficial owner. Except for certain items for which brokers are prohibited from exercising their discretion, a broker is entitled to vote on matters presented to shareholders without instructions from the beneficial owner. “Broker shares” that are voted on at least one matter will be counted for purposes of determining the existence of a quorum for the transaction of business at the Annual Meeting. Where brokers do not have or do not exercise such discretion, the inability or failure to vote is referred to as a “broker nonvote.” Under the circumstances where the broker is not permitted to, or does not, exercise its discretion, assuming proper disclosure to the Company of such inability to vote, broker nonvotes will not be counted as voting in favor of or against the particular matter. A broker is prohibited from voting on the election of directors without instructions from the beneficial owner; therefore, there may be broker nonvotes on Proposals One. A broker may vote on the ratification of the independent public accountants; therefore, no broker nonvotes are expected to exist in connection with Proposal Two. Abstentions and broker nonvotes will not count as votes cast and will have no effect on the outcome of any of the matters at the meeting.

The Board of Directors is not aware of any matters other than those described in this Proxy Statement that may be presented for action at the Annual Meeting. However, if other matters do properly come before the Annual Meeting, the persons named in the enclosed proxy card possess discretionary authority to vote in accordance with their best judgment with respect to such other matters.

PROPOSAL ONE

ELECTION OF DIRECTORS

General

Twelve directors will be elected at the Annual Meeting. The individuals listed below are nominated by the Board of Directors for election at the Annual Meeting. The election of each nominee for director requires the affirmative vote of the holders of a plurality of the shares of Common Stock cast in the election of directors. If the proxy is executed in such manner as not to withhold authority for the election of any or all of the nominees for directors, then the persons named in the proxy will vote the shares represented by the proxy for the election of the 12 nominees named below. If the proxy indicates that the shareholder wishes to withhold a vote from one or more nominees for director, such instructions will be followed by the persons named in the proxy.

Each nominee has consented to being named in this Proxy Statement and has agreed to serve if elected. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve. If at the time of the Annual Meeting any nominee is unable or unwilling to serve as a director, then votes will be cast pursuant to the enclosed proxy for such substitute nominee as may be nominated by the Board of Directors. There are no current arrangements between any nominee and any other person pursuant to which a nominee was selected. No family relationships exist among any of the directors or between any of the directors and executive officers of the Company.

The following biographical information discloses each nominee’s age, business experience and other directorships held during the past five years. It also includes the experiences, qualifications, attributes and skills that caused the nominating committee and the Board of Directors to determine that the individual should serve as a director for the Company, and the year that each individual was first elected to the Board of Directors of the Company or previously to the Board of Directors of Middleburg Bank (the “Bank”), the predecessor to and now a wholly owned subsidiary of the Company. Unless otherwise specified, each nominee has held his or her current position for at least five years.

Nominees for Election for Terms Expiring in 2017

Howard M. Armfield, 73, has been a director since 1984.

Mr. Armfield is the retired President of Armfield, Harrison & Thomas, Inc., an independent insurance broker based in Leesburg, Virginia. Mr. Armfield holds a bachelor of arts degree from Duke University. A significant factor in Mr. Armfield’s contribution to the Board is his knowledge and experience in chairing the audit committee for the Company as he also holds a Certified Public Accountant (CPA) designation. Mr. Armfield brings extensive experience in executive management, corporate governance and risk management.

Henry F. Atherton, III, 71, has been a director since 2004.

Mr. Atherton owns and operates a cattle and hay farm in Fauquier County, Virginia. Previously, Mr. Atherton served as a member and as Chairman of the Fauquier County Planning Commission and also served as a member and Chairman of the Fauquier County Board of Supervisors. Mr. Atherton has demonstrated his civic mindedness and commitment by serving many community and civic organizations. He currently serves on the Board of the Land Trust of Virginia. He is a former trustee of the Virginia Outdoors Foundation and has served on the Agricultural and Forestall District Advisory Committee, the Agricultural Development Advisory Committee and the Virginia Association of Counties - Agricultural and Environmental Steering Committee. Mr. Atherton holds a bachelor of arts degree from Harvard University and a J.D. degree from Columbus School of Law, Catholic University. Mr. Atherton has also served in the U.S. Army. Overall, Mr. Atherton brings to our Board an understanding of our Company’s business, proven leadership skills and knowledge of the important role of agribusiness and community leadership in our local economy.

Joseph L. Boling, 71, has been a director since 1993.

Mr. Boling has been Chairman of the Board since May 2010. From 2008 to May 2010, Mr. Boling was Chairman and Chief Executive Officer of the Company and Chairman of the Bank. From 1997 to 2008, he was the Chairman and Chief Executive Officer of the Company and the Bank. From 1993 to 1997, he was President and Chief Executive Officer of the Company and the Bank. Mr. Boling brings extensive experience in banking and executive management to our Board. In addition, his activities as a civic and business leader in the markets where we operate provide insight on the factors that impact both our Company and our communities. Mr. Boling is president of the Windy Hill Foundation, is a former member of the Loudoun County Economic Development Commission, Chairman of the James Madison University Foundation, past Chairman of the Virginia Bankers Association, on the Founding Board of the Piedmont Community Foundation, member and past Chairman of the CEO Cabinet in Loudoun County and a Rotarian. Mr. Boling holds a bachelor of arts degree in history from North Carolina Wesleyan and did his graduate work at the University of Virginia in finance. Moreover, Mr. Boling’s experience with day to day leadership and intimate knowledge of our business and operations provide the Board with company-specific expertise.

Childs F. Burden, 65, has been a director since 1997.

Since 1978, Mr. Burden has been a partner with a Washington, D.C. investment firm. In addition, he is committed to volunteer service for historic preservation and serves on many preservation associated boards. Mr. Burden holds a bachelor of arts degree from the University of Virginia and is a Chartered Financial Analyst (CFA). He brings to our Board extensive knowledge of investments and financial services, having many years of experience in such fields.

Alexander G. Green, III, 67, has been a director since 2008.

Mr. Green is the recently retired President and Chief Executive Officer of Armfield, Harrison & Thomas, Inc., an independent insurance agency in Leesburg, Virginia. Earlier in his career he worked for First and Merchants National Bank as Assistant Vice President of Regional Commercial and Mortgage Lending. Mr. Green has served on other bank boards and multiple insurance agency councils and advisory boards. Mr. Green has also been very active in community groups such as the Leesburg Airport Commission, Loudoun County Planning Commission, Loudoun County Industrial Development Advisory Commission and the Loudoun Advisory Board of George Washington University. Mr. Green holds both his bachelor of science in finance and his master in business administration degrees from Virginia Polytechnic Institute and State University. As the former principal executive officer of a successful company, Mr. Green provides the Board with valuable insight and guidance on the issues of corporate strategy, commercial and mortgage lending, business community growth and risk management.

Gary D. LeClair, 60, has been a director since 2008.

Prior to 2008, Mr. LeClair had served as a Director of the Company from 2001 to 2006. Mr. LeClair also serves as a Director of Middleburg Investment Group and its subsidiary, Middleburg Trust Company. Mr. LeClair is the founder of the law firm of LeClairRyan, a Professional Corporation, resident in its Richmond, Virginia, office. Mr. LeClair holds a bachelor of business administration degree in accounting from the College of William and Mary and a J.D. Degree from Georgetown University School of Law. Mr. LeClair’s extensive experience in the various aspects of the law, including dispute resolution, employee relations and contract negotiations, combined with his focus on the capital needs of a growing company and his extensive skills at managing risk and directing corporate strategy, provide our Board with an invaluable resource as it manages the current environment and looks to its future.

John C. Lee, IV, 58, has been a director since November 2006.

Mr. Lee founded Lee Technologies in 1983. Schneider Electric, a global specialist in energy management acquired Lee Technologies in 2011. Mr. Lee maintained a senior leadership position with Schneider Electric until his departure in December 2014. Mr. Lee serves on various corporate Boards including Canara (Columbia Capital), Primary Integration (Rotunda Capital), RedPeg Marketing and Aegis Mobile. Mr. Lee also serves on various non-profit Boards including the Wolf Trap Foundation for the Performing Arts, Virginia Polytechnic Institute and State University Board of Visitors, Cal Ripken Sr. Foundation, Loyola University Maryland Board of Trustees, Northern Virginia Technology Council and The Economic Club of Washington, D.C. Previous Boards served include Randolph-Macon College and Virginia Foundation for Independent Colleges (VFIC). Mr. Lee holds a bachelor of arts in economics and business administration from Randolph-Macon College, and resides with his family in Middleburg, Virginia, and Washington, D.C. Mr. Lee’s entrepreneurial and professional experience, together with his dedicated and wide-ranging philanthropic involvement as a business leader, provide our Board with valuable insight in matters of corporate strategy and planning.

Mary Leigh McDaniel, 62, has been a director since 2014.

Mary Leigh McDaniel joined the Board of Directors in January 2014. Ms. McDaniel is a partner in the public accounting firm of Updegrove, Combs & McDaniel, PLC, a full service accounting firm that has been providing tax, accounting and financial consulting services throughout the Northern Virginia area for over 37 years. Ms. McDaniel was appointed by Governor Timothy M. Kaine to serve on the Vint Hill Economic Development Authority, serves on the PATH Foundation Board, and serves on the JV Board with LifePoint Hospitals. She has served on the Land Trust of Virginia, Chair of the Fauquier County Chamber of Commerce and was the recipient of their Business Person of the Year Award. Additionally, she is a member of the Warrenton Garden Club. She was elected to the Fauquier County Board of Supervisors effective January 1, 2016. Ms. McDaniel graduated Magna Cum Laude from James Madison University with a Bachelor of Business Administration in Accounting and Finance, is designated a Certified Public Accountant by the Virginia State Board of Accountancy, and holds the specialty designation of Personal Financial Specialist from the American Institute of CPAs. She has been designated as a “Super CPA” by Virginia Business Magazine for several years. Ms. McDaniel, as a highly successful executive with deep experience in accounting who is also very committed to our communities, is a valuable addition to our Board.

Keith W. Meurlin, 66, has been a director since 2005.

Mr. Meurlin retired as Vice President and Airport Manager of Washington Dulles International Airport in 2005 after 28 years of service. Mr. Meurlin is also a retired Major General in the United States Air Force Reserve and was called back to active duty in 2005. His final assignment was to establish for the Secretary of Defense the office to manage the care and benefits for wounded warriors from all services. Mr. Meurlin has been actively involved in our communities by serving on the Board of Directors for

both the Reston Chamber of Commerce as well as the Loudoun Chamber of Commerce, past Regional Chairman of the United Way of the National Capital Area, past Chairman of the Heart Association of Northern Virginia and recently was a member of the Loudoun Economic Development Commission, serving as Chairman of the Transportation and Infrastructure Committee. He currently is the President of the Washington Airports Task Force, a public/private enterprise supporting the growth of aviation services and economic development for the Washington, D.C. region. Mr. Meurlin also serves as a Board Member of the Dulles South Alliance, an organization focused on the long term planning and development of the Dulles south region and President of the Dulles Foreign Trade Zone. Mr. Meurlin holds a bachelor of arts degree in political science from the University of Vermont and a master of science in systems management from the University of Southern California.

Janet A. Neuharth, 60, has been a director since 2006.

Ms. Neuharth is the Founder and President of Paper Chase Farms, Inc., an equestrian company based in Middleburg, Virginia. She is an active participant in Paper Chase Farms’ subsidiaries, serving as Director of Marketing for the retail area and Editorial Director of the publishing division. Ms. Neuharth is also the Chair and CEO of The Freedom Forum, a nonpartisan foundation based in Washington, D.C. that champions the First Amendment as a cornerstone of democracy. Ms. Neuharth is the former Chair of the National Council at Vanderbilt University School of Law and currently serves on the boards of the Library of Virginia Foundation, the Middleburg Forum, the Newseum, and the Newseum Institute. Ms. Neuharth holds a bachelor of arts degree in Political Science and English from the University of Florida and a J.D. Degree from Vanderbilt University School of Law. Ms. Neuharth’s leadership skills in consensus-building, risk management and executive management and her legal acumen add an important dimension and provide a valuable resource for our Board.

John M. Rust, 65, has been a director since 2009.

Mr. Rust is Senior Managing Director of Dominick and Dominick, a division of Wunderlich Securities, Inc. Dominick and Dominick is a full service securities firm founded in 1870 and based in New York City. Mr. Rust’s family’s long standing community leadership in Loudoun County provides the Company with valuable insights as to the specific needs of our community. Mr. Rust served on the Board of the Piedmont Community Foundation for nine years. In addition, Mr. Rust serves as a Trustee of the Rust Foundation. Mr. Rust holds a bachelor of science degree in finance from Lehigh University. Mr. Rust’s extensive experience in the various aspects of investment management, his focus on the capital needs of a growing company and his extensive skills at managing risk and directing corporate strategy provide our Board with an invaluable resource as it manages the current economic environment.

Gary R. Shook, 55, has been a director since 2007.

Mr. Shook has served as Chief Executive Officer and President of the Company since May 2010, and as President and Chief Executive Officer of the Bank since August 2008. From 2007 to 2008, he served as President of the Company and the Bank. From 2005 to 2007, Mr. Shook served as Executive Vice President, Investment Services and Fauquier Community Executive with the Company. Mr. Shook serves as a Director and Chairman of the Board of Middleburg Investment Group and Middleburg Trust Company. From 1995 to 2005, he was Senior Vice President, Fauquier Bankshares, Inc. Mr. Shook has served as a Director of the Loudoun County Chamber of Commerce, Vice Chairman of the Fauquier Chamber of Commerce, Chairman of the Bluemont Concert Series, President of the Rotary Club of Warrenton, and Senior Warden and Vestryman of St. James’ Episcopal Church. He has served as a Director and is a past Chairman of the Virginia Bankers Association. He is a member of the Government Relations Administrative Committee of the American Bankers Association. He is a Trustee and member of the Executive Committee of the Virginia Foundation for Independent Colleges and a Director of Shrine Mont, The Cathedral Shrine of the Transfiguration and Conference Center. He is also a member of the CEO Cabinet of Loudoun County and a member of the Loudoun Laurels Committee. Mr. Shook holds a bachelor of arts degree from the University of Virginia. Mr. Shook’s experience with Middleburg Financial Corporation and his extensive understanding of the financial services industry provide the Board with an invaluable resource for assessing and managing risks and planning for corporate strategy.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE NOMINEES SET FORTH ABOVE.

Executive Officers Who Are Not Directors

John Mason L. Antrim, 65

Mr. Antrim has served in numerous capacities at Middleburg Trust Company since its inception in 1993. Currently, he is the Chief Operating Officer. In addition to his duties as COO, he is a member of the Board of Directors of Middleburg Trust Company and Middleburg Investment Group. He also serves on the Trust Committee of the Virginia Bankers Association. Mr. Antrim holds a bachelor of arts degree in history from the University of Virginia.

Jeffery H. Culver, 47

Mr. Culver was appointed Senior Executive Vice President and Chief Operating Officer of the Company and the Bank in 2013. From 2008 to 2012, Mr. Culver served as Executive Vice President and Chief Operating Officer of the Company and the Bank. Mr. Culver has also served as Corporate Secretary since November 2008. From May 2007 until December 2008, he served as Senior Vice President, Credit Administration and Strategic Planning. From 2003 to 2007, Mr. Culver was Senior Vice President, Credit Administration. Mr. Culver holds a bachelor of arts degree from Ursinus College and master of arts degree in economics from American University.

David L. Hartley, 52

Mr. Hartley has served as President and Chief Executive Officer of Middleburg Investment Group since January of 2011 and also serves as Secretary on its Board of Directors. Mr. Hartley was named President and Chief Executive Officer of Middleburg Trust Company, a subsidiary of Middleburg Investment Group, in December 2015. Prior to that, Mr. Hartley served as Senior Vice President of Middleburg Trust Company. He has served on the Middleburg Trust Company Investment Committee since its founding in 2001. He is currently a member of the Government Relations Committee of the Virginia Bankers Association. Mr. Hartley holds a Certified Trust and Financial Advisor designation and a bachelor of arts degree from Randolph-Macon College. Mr. Hartley has 25 years of investment experience.

Kathryn L. Kearns, 68

Ms. Kearns joined Middleburg Bank in 2010 as Senior Vice President, Community Executive for Leesburg and Loudoun County. In 2011, she was promoted to regional commercial lending manager for Northern Virginia and in July 2012 was promoted to Chief Credit Officer. Ms. Kearns has 37 years of financial services experience including commercial, construction lending, mortgages, mortgage operations and SBA lending. Ms. Kearns attended Hagerstown Junior College and the National Commercial Lending School at the University of Oklahoma.

Mark Andrew McLean, 62

Mr. McLean has served as Executive Vice President of Middleburg Bank, since May 2012. In November 2013, he was appointed Chief Lending Officer. From February 2010 to 2012, Mr. McLean served as Senior Vice President of Middleburg Bank. Mr. McLean holds a bachelor of science degree from the University of Virginia, a mini master of business administration degree from the University of Richmond and has 31 years of commercial banking experience.

Rajesh Mehra, 55

Mr. Mehra joined the Company on November 2, 2009, as Executive Vice President, Chief Financial Officer and Treasurer. Prior to joining the Company, he was Executive Vice President and Chief Financial Officer for Fidelity Co-Operative Bank in Leominster, Massachusetts. Mr. Mehra has also served as the President of Chelsea Advisory Services, LLC, a consulting firm specializing in banking and capital markets in McLean, Virginia. From 2005 to 2007 he was Senior Vice President and Chief Financial Officer for Urban Trust Bank in Bethesda, Maryland. Earlier in his career, he worked at Fannie Mae and PricewaterhouseCoopers in Washington, D.C., and Credit Suisse and JP Morgan in New York. Mr. Mehra earned a bachelors degree in engineering from the Indian Institute of Technology and holds masters of science and business administration degree from the University of Massachusetts.

Suzanne K. Withers, 65

Ms. Withers is Executive Vice President, Human Resources and has served the Company since 2004. From 2002 to 2004, she was a human resource independent contractor. Prior to 2002, she was employed with ALCATEL in Chantilly, Virginia, as Vice President, Human Resources and Freddie Mac in McLean, Virginia as Director, Human Resources. Ms. Withers holds a bachelor of science degree in sociology with a minor in psychology from Iowa State University and a master of education in personnel, guidance and counseling from Clemson University.

SECURITY OWNERSHIP

Security Ownership of Management

The following table sets forth, as of March 18, 2016, certain information with respect to beneficial ownership of shares of Common Stock by each of the members of the Board of Directors, by each of the executive officers named in the “Summary Compensation Table” (the “named executive officers”) and by all current directors and executive officers as a group. Beneficial ownership includes shares, if any, held in the name of the spouse, minor children or other relatives of a director living in such person’s home, as well as shares, if any, held in the name of another person under an arrangement whereby the director or executive officer can vest title in his or herself at once or at some future time.

|

| | | | | | | | | | |

Name | | Common Stock that May Be Acquired Within 60 days of March 18, 2016 | | Shares of Common Stock Beneficially Owned as of March 18, 2016 (1) | | | | Percent of Class (%) (2) |

Howard M. Armfield | | — |

| | 50,345 |

| | (3) (4) | | * |

Henry F. Atherton, III | | — |

| | 3,000 |

| | (4) | | * |

Joseph L. Boling | | — |

| | 5,526 |

| | (4) | | * |

Childs F. Burden | | — |

| | 24,920 |

| | (4) (8) | | * |

Jeffery H. Culver | | 5,073 |

| | 43,532 |

| | (4) | | * |

Alexander G. Green, III | | — |

| | 8,735 |

| | (4) | | * |

David L. Hartley | | — |

| | 17,548 |

| | (4) | | * |

Gary D. LeClair | | — |

| | 10,899 |

| | (4) (5) | | * |

John C. Lee, IV | | — |

| | 36,256 |

| | (4) | | * |

Mary Leigh McDaniel | | — |

| | 3,705 |

| | (4) | | * |

Mark. A. McLean | | — |

| | 6,750 |

| | (4) | | * |

Rajesh Mehra | | 5,000 |

| | 18,500 |

| | (4) | | * |

Keith W. Meurlin | | — |

| | 3,704 |

| | (4) | | * |

Janet A. Neuharth | | — |

| | 3,624 |

| | (4) (6) | | * |

John M. Rust | | — |

| | 14,324 |

| | (4) (7) | | * |

Gary R. Shook | | — |

| | 51,923 |

| | (4) | | * |

Current directors and executive officers as a group (19 persons) | | 18,735 |

| | 361,500 |

| | | | 5.09% |

* Percentage of ownership is less than one percent of the outstanding shares of Common Stock.

| |

(1) | Does not include shares of Common Stock that could be acquired through the exercise of stock options within 60 days of March 18, 2016. |

| |

(2) | Based on 7,107,518 shares outstanding as of March 18, 2016. |

| |

(3) | Includes 23,190 shares held in revocable trusts in which Mr. and Mrs. Armfield are trustees. |

| |

(4) | Includes shares of unvested restricted stock with voting and dividend rights as follows: 400 shares to each director; Mr. Culver 32,650 shares; Mr. Hartley 13,750 shares; Mr. McLean 6,750 shares; Mr. Mehra 17,500 shares; and Mr. Shook 40,400 shares. |

| |

(5) | Includes 9,199 shares owned jointly with Mr. LeClair’s wife. |

| |

(6) | Includes 1,012 shares held in trusts for Ms. Neuharth’s children. |

| |

(7) | Includes 12,424 shares held in a trust in which Mr. Rust is trustee. |

| |

(8) | Includes 8,000 shares held in a trust in which Mr. Burden is trustee. |

Security Ownership of Certain Beneficial Owners

The following table sets forth, as of March 18, 2016, certain information with respect to the beneficial ownership of shares of Common Stock by each person who owns, to the Company’s knowledge, more than 5% of the outstanding shares of Common Stock.

|

| | | | |

Name and Address | | Amount and Nature of Beneficial Ownership | | Percent of Class (1) |

David L. Sokol (2) | | 2,103,008 | | 29.59% |

P.O. Box 2080 | | | | |

Wilson, WY 83014 | | | | |

| | | | |

Wellington Management Group, LLP (3) | | 499,909 | | 7.03% |

280 Congress Street | | | | |

Boston, MA 02210 | | | | |

| |

(1) | Based on 7,107,518 shares outstanding as of March 18, 2016. |

| |

(2) | According to the most current information available to the Company as of March 18, 2016, David L. Sokol, through certain investment accounts, reported that he has sole voting and dispositive power over 2,103,008 shares of our Common Stock. |

| |

(3) | According to Schedule 13G filed with the SEC on February 11, 2016, Wellington Management Group, LLP reported that it has shared voting power and shared dispositive power over 499,909 shares. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s directors and executive officers, and any persons who own more than 10% of the outstanding shares of Common Stock, to file with the Securities and Exchange Commission (the “SEC”) reports of ownership and changes in ownership of Common Stock. Directors and executive officers are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports that they file. Based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required to be filed, the Company believes that, during 2015, all directors, executive officers and beneficial owners of more than 10% of the Company’s Common Stock have filed with the SEC on a timely basis all reports required to be filed under Section 16(a), except as follows: Mr. LeClair- four late reports reporting four transactions; Mr. Mehra-one late report reporting one transaction; Mr. Shook-one late report reporting one transaction; Mr. Culver-one late report reporting one transaction; Mr. Hartley-one late report reporting one transaction.

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

General

The business and affairs of the Company are managed under the direction of the Board of Directors in accordance with the Virginia Stock Corporation Act and the Company’s Articles of Incorporation and Bylaws, as amended. Members of the Board are kept informed of the Company’s business through discussions with the Chief Executive Officer and President and other officers, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees.

Independence of the Directors

The Board of Directors has determined that the following 10 individuals of its total 12 members are independent as defined by the listing standards of the NASDAQ Stock Market (“NASDAQ”): Ms. McDaniel and Ms. Neuharth and Messrs. Armfield, Atherton, Burden, Green, LeClair, Lee, Meurlin and Rust. In reaching this conclusion, the Board of Directors considered that the Company and its subsidiary Bank conduct business with companies of which certain members of the Board of Directors or members of their immediate families are or were directors or officers.

In addition to the transactions disclosed under "Certain Relationships and Related Transactions," the Board of Directors considered the following relationship between the Company and certain of its directors to determine whether such director was independent under NASDAQ's listing standards:

| |

• | The Bank procures certain legal and advisory services from LeClairRyan, a legal firm in Richmond, Virginia. Gary LeClair is one of the founders of this law firm. |

Leadership Structure

In 2010, we changed our senior leadership structure as it relates to Board and Company leadership. Joseph L. Boling, who had served as Chief Executive Officer and Chairman of the Board of Directors since 1997, retired from his position as Chief Executive Officer of the Company but remains as Chairman of the Board. The Company appointed Gary R. Shook as Chief Executive Officer in addition to his duties as President and Director of the Company. This change reflected the implementation of our plan of leadership and management succession as well as the retention of key talent at the Board level. Mr. Boling continues to serve as Board Chairman in recognition of his long service, industry expertise, and intimate knowledge of our Company, our customers,

and our shareholders. This separation of Board Chairman and CEO roles is also commonly utilized by other public companies in the United States, and we believe this leadership structure is highly effective for the Company.

In addition to Mr. Boling and Mr. Shook, our Board currently is comprised of 10 independent directors. Our corporate governance guidelines require the election, by the independent directors, of an independent Lead Director to serve during any period when there is no independent Chairman of the Board. Howard M. Armfield is the elected independent Lead Director. The Board has five standing committees-Audit, Compensation, Investment, Nominating, and Governance. Each of the Board committees is comprised solely of independent directors, with each of the committees having a separate chair. Our corporate governance guidelines provide that our non-management directors will meet in executive session from time to time and that our independent Lead Director will preside at these sessions. Our independent directors meet periodically outside of regularly scheduled Board meetings. In addition, our independent Lead Director chairs meetings in the absence of our Chairman.

Risk Oversight

Under the Company’s Corporate Governance Guidelines, the Board is charged with providing oversight of the Company’s risk management processes. The Audit Committee is primarily responsible for overseeing the risk management function at the Company on behalf of the Board. In carrying out its responsibilities, the Audit Committee works closely with the Company’s Senior Vice President of Risk Management and other members of the Company’s enterprise risk management team. The Audit Committee meets regularly with the Senior Vice President of Risk Management and other members of management and receives an overview of findings from various risk management initiatives including internal audits, Sarbanes-Oxley and compliance reports. The Audit Committee also receives updates between meetings from the Senior Vice President of Risk Management, the Chief Executive Officer, the Chief Financial Officer and other members of management relating to risk oversight matters. The Audit Committee provides minutes of all meetings, including actions taken, to the full Board on a quarterly basis. The Board also receives a report from our Senior Vice President of Risk Management on a quarterly basis.

We believe that our directors provide effective oversight of the risk management function, especially through the work of the Audit Committee and the communication between the full Board and David Stalnaker, Senior Vice President of Risk Management.

In addition to the Audit Committee, the other committees of the Board consider the risks within their areas of responsibility. For example, the Compensation Committee considers the risks that may be implicated by our executive compensation programs. For a discussion of the Compensation Committee’s review of the Company’s executive officer compensation plans, employee incentive compensation plans and the risks associated with these plans, see “Compensation Policy and Practices Review” included in this Proxy Statement.

Code of Ethics

The Board of Directors has approved a Code of Business Conduct and Ethics for directors, officers and all employees of the Company and its subsidiaries, including the Chief Executive Officer, Chief Financial Officer and other principal financial and accounting officers. The Code addresses such topics as protection and proper use of Company assets, compliance with applicable laws and regulations, accuracy and preservation of records, accounting and financial reporting and conflicts of interest. The Code of Ethics is available at www.middleburgbank.com, and requests for a copy of the Company’s Code of Ethics may be sent to ir@middleburgbank.com.

Board and Committee Meeting Attendance

There were 13 meetings of the Board of Directors in 2015. Each incumbent director attended at least 75% of the aggregate number of meetings of the Board of Directors and meetings of committees of which the director was a member in 2015.

Committees of the Board

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibility to the shareholders relating to the integrity of the Company’s financial statements, compliance with legal and regulatory requirements and the qualifications, independence and the performance of the internal audit function. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of both the Company’s Risk Management Officer and the independent auditor engaged for the purpose of preparing and issuing an audit report and performing other audit, review or attestation services for the Company. The Board of Directors has adopted a written charter for the Audit Committee. In addition, the Audit Committee is primarily responsible for overseeing the Company’s risk management. Requests for a copy of the Company’s Audit Committee Charter may be sent to ir@middleburgbank.com, and it is also available on the Company’s website at www.middleburgbank.com.

Members of the Audit Committee are Ms. Neuharth and Ms. McDaniel and Messrs. Armfield, Atherton and LeClair, all of whom the Board in its business judgment determined are independent as defined by NASDAQ listing standards and SEC regulations.

The Board of Directors also determined that all of the members of the Audit Committee have sufficient knowledge in financial and auditing matters to serve on the Audit Committee and that Mr. Armfield qualifies as a financial expert as defined by SEC regulations.

The Audit Committee met five times in 2015. For additional information regarding the Audit Committee, refer to “Audit Information - Audit Committee Report” included in this Proxy Statement.

Compensation Committee

The Compensation Committee reviews the CEO’s performance, including the results of CEO performance review questionnaires completed by all individual outside directors, sets CEO compensation, and reviews and sets guidelines for compensation of the other executive officers. In carrying out its responsibilities, the Compensation Committee annually reviews the recommendations made by the Chairman for the compensation of the CEO as well as recommendations made by the CEO for the compensation of other executive officers, and thereby establishes the compensation of the Company’s executive officers. The Compensation Committee may annually approve, with assistance from an independent consultant, the issuance of stock grants and other compensation related matters.

The members of the Compensation Committee are Messrs. Armfield, Burden, Green, Lee and Rust. The Board of Directors in its business judgment has determined that all members are independent as defined by the NASDAQ listing standards and SEC regulations. The Compensation Committee met four times in 2015. For additional information regarding the Compensation Committee, see “Executive Compensation” included in this Proxy Statement. The Board of Directors has adopted a written charter for the Compensation Committee. Requests for a copy of the Company’s Compensation Committee Charter may be sent to ir@middleburgbank.com, and it is also available on the Company’s website at www.middleburgbank.com.

Governance Committee

The Governance Committee consists of Messrs. Armfield, Boling, Burden, Green, Lee and Shook. The Governance Committee is called, as necessary, to consider any matters that arise between regularly scheduled Board of Directors’ meetings that require a quorum of the Board members, but when the Company’s full Board of Directors is unable to meet. The Governance Committee met once in 2015.

Investment Committee

The Investment Committee consists of Messrs. Boling, Burden, Meurlin, Rust and Shook. The Investment Committee meets with management to review the Company’s investment strategy. The Investment Committee met four times in 2015.

Nominating Committee

The Nominating Committee consists of Ms. Neuharth and Messrs. Armfield, Atherton, Green, Lee and Meurlin. The Board of Directors in its business judgment has determined that all members are independent as defined by NASDAQ’s listing standards. This Committee nominates the individuals proposed for election as directors in accordance with the Company’s Articles of Incorporation and Bylaws. The Nominating Committee does not have a charter and met one time in 2015.

In identifying potential nominees, the Nominating Committee takes into account such factors as it deems appropriate, including the current composition of the Board, the range of talents, experiences and skills that would best complement those that are already represented on the Board, the balance of management and independent directors and the need for specialized expertise. The Nominating Committee considers candidates for Board membership suggested by Board members and by management. The Nominating Committee will also consider candidates suggested informally by a shareholder of the Company.

The Nominating Committee considers, at a minimum, the following factors in recommending to the Board of Directors potential new directors, or the continued service of existing directors:

•The ability of the prospective nominee to represent the interests of the shareholders of the Company;

•The prospective nominee’s standards of integrity, commitment and independence of thought and judgment;

| |

• | The prospective nominee’s ability to dedicate sufficient time, energy and attention to the diligent performance of his or her duties, including the prospective nominee’s service on other public company boards; |

| |

• | The extent to which the prospective nominee contributes to the diversity of talent, skill and expertise appropriate for the Board of Directors; and |

•The prospective nominee’s involvement within the communities the Company serves.

Shareholders entitled to vote for the election of directors may submit candidates for formal consideration by the Nominating Committee in connection with an annual meeting if the Company receives timely written notice, in proper form, for each such recommended director nominee. If the notice is not timely and in proper form, the nominee will not be considered by the Company. To be timely for the 2017 Annual Meeting, the notice must be received within the time frame set forth in “Proposals for 2017

Annual Meeting of Shareholders” included in this Proxy Statement. To be in proper form, the notice must include each nominee’s written consent to be named as a nominee and to serve, if elected, and information about the shareholder making the nomination and the person nominated for election. These requirements are more fully described in Section 2.5 of the Company’s Bylaws, a copy of which will be provided, without charge, to any shareholder upon written request to the Secretary of the Company, whose address is Middleburg Financial Corporation, 111 West Washington Street, Middleburg, Virginia, 20117.

Under the current process for selecting new Board candidates, the Chairman, the Nominating Committee or other Board members identify the need to add a new Board member with specific qualifications or to fill a vacancy on the Board. The Chairman of the Nominating Committee will initiate a search, seeking input from Board members and executive management, hiring a search firm, if necessary, and considering any candidates suggested informally or recommended by shareholders. An initial slate of candidates that will satisfy criteria and otherwise qualify for membership on the Board may be presented to the Nominating Committee. A determination is made as to whether the Nominating Committee members or Board members have relationships with preferred candidates and can initiate contacts. The Chairman and at least one member of the Nominating Committee interview prospective candidates. The Nominating Committee meets to conduct additional interviews of prospective candidates, if necessary, and to consider and recommend final candidates for approval by the full Board of Directors.

Annual Meeting Attendance

The Company encourages members of the Board of Directors to attend the Annual Meeting of Shareholders. All twelve members of the Board of Directors attended the 2015 annual meeting.

Communications with Directors

Any director may be contacted by writing to c/o Middleburg Financial Corporation, 111 West Washington Street, Middleburg, Virginia, 20117. Communications to the non-management directors as a group may be sent to the same address, c/o the Secretary of the Company. The Company promptly forwards, without screening, all such correspondence to the indicated directors.

Director Compensation

As compensation for his or her service to the Company, each member of the Board of Directors, other than the Board Chairman, receives a fee of $1,000 for each meeting of the Board, $500 for each Audit and Compensation Committee meeting and $400 for other board committee meetings attended. In addition, each member of the Board of Directors receives a stock retainer of 400 shares per year, with a one-year vesting period. The Chairman of the Audit Committee receives an annual retainer of $4,000, and the Chairman of the Compensation Committees receives an annual retainer of $3,000.

Joseph L. Boling serves as Chairman of the Board of the Company and receives a stipend of $45,250. In addition, Mr. Boling received a grant of 400 restricted shares of stock during 2015. The grant has a one-year vesting period on the same terms as other Directors.

The following table shows the compensation earned by each of the nonemployee directors during 2015:

|

| | | | | | | | | | | | | | | |

Name | | Fees Earned or Paid in Cash | | Stock Awards(1) | | All Other Compensation | | Total |

Howard M. Armfield | | $ | 22,300 |

| | $ | 7,400 |

| | — |

| | $ | 29,700 |

|

Henry F. Atherton, III | | $ | 24,500 |

| | $ | 7,400 |

| | — |

| | $ | 31,900 |

|

Joseph L. Boling | | $ | 45,250 |

| | $ | 7,400 |

| | — |

| | $ | 52,650 |

|

Childs F. Burden | | $ | 29,400 |

| | $ | 7,400 |

| | — |

| | $ | 36,800 |

|

Alexander G. Green, III | | $ | 16,200 |

| | $ | 7,400 |

| | — |

| | $ | 23,600 |

|

Gary D. LeClair (2) | | $ | 18,500 |

| | $ | 7,400 |

| | — |

| | $ | 25,900 |

|

John C. Lee, IV | | $ | 16,800 |

| | $ | 7,400 |

| | — |

| | $ | 24,200 |

|

Mary Leigh McDaniel (3) | | $ | 17,300 |

| | $ | 7,400 |

| | — |

| | $ | 24,700 |

|

Keith W. Meurlin | | $ | 21,400 |

| | $ | 7,400 |

| | — |

| | $ | 28,800 |

|

Janet A. Neuharth | | $ | 23,500 |

| | $ | 7,400 |

| | — |

| | $ | 30,900 |

|

John M. Rust | | $ | 17,600 |

| | $ | 7,400 |

| | — |

| | $ | 25,000 |

|

| |

(1) | This amount reflects the grant date fair value ($18.50 per share) computed in accordance with FASB ASC topic 718 for 400 shares of restricted stock granted to each member of the Board on May 6, 2015. For information on the model and assumptions used to calculate the Company’s share-based compensation expense, see Note 8 to the audited consolidated financial statements in our 2015 Form 10-K. |

| |

(2) | Fees earned or paid in cash includes $3,000 paid by Middleburg Trust Company for service on the subsidiary Board of Directors. |

| |

(3) | Fees earned or paid in cash includes $1,800 paid by Middleburg Bank for service on the Bank's regional advisory board. |

Compensation Policy and Practices Review

On an annual basis the Company reviews its compensation policies and practices to identify any risks arising from these policies or practices that are reasonably likely to have a material adverse effect on the Company. This review covers executive officers as well as all employees. While we do not believe such risks are reasonably likely to have a material adverse effect, we believe it is in the best interest of effective communication to our shareholders to explain the process and results of our review.

During 2015, the Compensation Committee conducted a review of its compensation policies and practices, incorporating guidelines on sound compensation principles established by the Federal Reserve and jointly supported by the FDIC and the OCC. The Committee reviewed an extensive report prepared by the Company’s Risk Management Officer and utilized the assistance of the Company’s independent compensation advisor. We reviewed each plan’s stated objective and purpose, categories of participants, the manner in which accountability is assigned for the administration of each plan, performance measures used and the process for determining and verifying results, and the range of potential payouts. In addition, our advisor reviewed the competitiveness and mix of compensation elements comprising our total executive compensation package.

As a result of our review, we find that the Company’s compensation policies, plans and practices do not encourage unnecessary or unreasonable risk-taking and do not give rise to risks that are reasonably likely to have a material adverse effect on the Company.

EXECUTIVE COMPENSATION

Compensation Committee Report

The Compensation Committee has reviewed the Compensation Discussion and Analysis included in this Proxy Statement and discussed it with the Company’s management. Based on this review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference into the Company's Annual Report on Form 10-K for the year ended December 31, 2015.

Compensation Committee

Childs F. Burden, Chairman

Howard M. Armfield

John C. Lee, IV

Alexander G. Green III

John M. Rust

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is a current or former officer or employee of the Company or any of our subsidiaries. In addition, there are no Compensation Committee interlocks with other entities with respect to any such member.

Update On Advisory Vote On Executive Compensation

In 2010, Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act"). Among the provisions of the Act is the opportunity for our shareholders to vote their approval, on a non-binding basis, of the compensation of our executives that we describe in our Proxy Statement, including the Compensation Discussion & Analysis (“CD&A").

As discussed in this Proxy Statement, our Compensation Committee, comprised of independent directors, is accountable for establishing our compensation philosophy, determining the key elements that comprise the overall compensation program, approving plans, monitoring performance, and determining pay actions including salary adjustments, incentive awards, and equity grants. The Committee uses the services of an independent compensation consultant that receives direction from and reports directly to the Committee. The Committee meets throughout the year with its advisor and, periodically, without executive management present.

In 2014, our shareholders voted their approval of the compensation of our executives as described in the Compensation Discussion & Analysis section and accompanying tables in the Proxy Statement for the 2014 Annual Meeting of Shareholders. Of note is that over 97% of all votes cast were for approval. The Compensation Committee appreciates this very strong show of shareholder support for our compensation philosophy, plans and practices and strives to continue its work consistent with this support.

In 2011, our shareholders voted on the frequency with which their advisory vote should be held in the future. Options available to shareholders were to conduct voting annually, every two years, or every three years. Consistent with shareholder voting in 2011, we will follow a three-year cycle. Shareholders will be asked to vote again in 2017 to approve the compensation of our executives and to determine the frequency of future votes on executive compensation.

Although this vote is advisory in nature and not binding on the Compensation Committee, we will review results carefully and take shareholder suggestions into account when making decisions concerning compensation philosophy, plans, and practices.

Compensation Discussion and Analysis

General

The Compensation Committee (the “Committee”) of the Board of Directors, composed of five independent directors of the Company, is responsible for the development, oversight and implementation of the Company’s compensation program for executive officers, including the executive officers named in the "Summary Compensation Table". The Committee consists entirely of non-employee, independent members of our Board of Directors and operates under a written charter approved by the Board of Directors.

The Company’s executive compensation program is designed to provide levels of compensation that are reflective of both the individual’s and the Company’s performance in achieving its goals and objectives. The Compensation Committee seeks to provide a mix of annual and long-term compensation that will align the short-term and long-term interests of the Company’s executive officers with those of its shareholders.

During 2015, the Committee engaged Matthews, Young - Management Consulting to act as consultant and independent advisor to the Committee. This advisor has provided ongoing assistance to the Committee since late 2008. The consultant assisted the Committee in reviewing compensation strategy, reviewing and recommending changes to our peer group, selecting and reviewing compensation and performance data for a peer group of comparable, community financial institutions, conducting assessments of compensation policy, plans, and practices to address reporting requirements and Federal Reserve joint guidelines on effective incentive compensation, assisting with long term incentive grant determinations, assisting with risk assessment of compensation, and providing periodic updates on regulatory and reporting requirement changes related to compensation. In the capacity as advisor to the Compensation Committee, the consultant worked directly for the Committee and periodically met with Committee members without the presence of Company management.

In retaining the consultant as the Committee’s advisor, the Committee reviewed the factors described in the Dodd-Frank Act in evaluating the consultant’s independence status. These factors, and the Committee’s review, are as follows:

| |

• | Review of services provided to the Company, determining that all consulting services were provided directly to the Committee or with the Committee’s advance review and approval; |

| |

• | Review and determination that the consultant’s total fees for services to the Company were not a material percentage of Matthews, Young’s total consulting revenues; |

| |

• | Discussion of the policies and procedures employed by Matthews, Young to prevent conflicts of interest; |

| |

• | Determination that the consultant has no business or personal relationship with any member of the Committee; |

| |

• | Determination that the consultant owns no common stock in the Company; and |

| |

• | Determination that the consultant has no business or personal relationship with any member of executive management. |

In carrying out its responsibilities and objectives, the Compensation Committee annually reviews the Chief Executive Officer’s performance and compensation, with input from the Chairman. The Committee also reviews and approves recommendations made by the Chief Executive Officer for the compensation of the CFO, COO and other executive officers and thereby establishes the compensation of these executive officers. The Chairman, Chief Executive Officer, and the members of the Compensation Committee are provided peer group and competitive market compensation data for consideration and review when determining executive compensation levels. Additionally, the Committee may confer independently with its consultant prior to accepting management recommendations.

In 2015, the Compensation Committee established executive base salaries, determined annual cash bonuses/incentives, made grants of long-term incentives in the form of restricted stock, determined vesting status of outstanding stock grants, and conducted an annual risk assessment of compensation.

Additional information on the Compensation Committee’s processes and procedures for the consideration and determination of executive and director compensation are included under the caption “Corporate Governance and the Board of Directors - Committees of the Board - Compensation Committee.”

Objectives of Our Compensation Program

The primary objective of our executive compensation program is to attract and retain highly skilled and motivated executive officers who will manage the Company in a manner to promote our growth and profitability and advance the interests of our shareholders. Additional objectives of our executive compensation program are the following:

| |

• | Support our business strategy and business plan with clearly communicated expectations for executive officers related to our common goals. |

| |

• | Align executive pay with shareholders’ interests. |

| |

• | Recognize individual initiative and achievements. |

The Compensation Committee will continue to be guided by the following key principles:

| |

• | Balancing Shareholder and Executive Interests |

We balance our goal of using compensation as a key tool in attracting and retaining highly skilled and motivated executives with our commitment to using compensation to support our business strategy, align executive pay with shareholder interests, and recognize initiative and performance.

| |

• | Competitiveness and Reasonableness |

We target compensation to be competitive with our peer organizations while reflecting the skill set, track record, and performance of our executives. We evaluate our actual compensation levels to ensure reasonableness (comparable pay for comparable performance, benchmarking against financial institutions of similar size, complexity, and geographic location).

| |

• | Balancing Pay-for-Performance with Safety and Soundness |

A significant portion of executive pay is tied to annual and long-term performance of the Company as well as individual job performance. Annual cash incentives and equity grants are truly at-risk and are only earned through performance. However, we carefully monitor and assess our incentive plans to ensure that they do not encourage unnecessary risk-taking. Also, we include objectives related to asset and credit quality to emphasize the importance of operating the Company in a safe and sound manner.

| |

• | Executive Investment in the Company |

We link the interests of our key executives to the Company and our shareholders through two vehicles: employment agreements that spell out the Company’s expectations; and the use of equity compensation that encourages executives to think like shareholders because a material part of their pay depends on creating durable value for our shareholders.

Executive Compensation Philosophy

Our executive compensation philosophy strives to provide the opportunity for our executives to earn compensation that is competitive with market and peer levels and rewarded for results that are supportive of shareholder interests. Our program consists of annual cash compensation (base salaries and annual cash bonus and incentives), and long-term incentives (typically in the form of stock-based awards). We strive to maintain competitive compensation levels reflective of performance and provided in a mix of compensation that effectively balances cash and equity, and balances short and long-term rewards for operating and strategic results. We target executive salaries at the 50th percentile of comparable organizations and set individual salaries to reflect job performance and track record. We establish annual target incentive levels in-line with prevailing practice among comparable organizations, with the intent that annual cash compensation for targeted performance is competitive with the 50th percentile of comparable organizations. Job and operating performance that falls short of performance targets is designed to earn conservative cash compensation; and similarly, job and operating performance that exceeds performance targets is designed to pay above the market average. We manage the long-term incentive element of executive compensation so as to provide competitive equity awards. When making equity grants, we evaluate our run rate (total grants as a percent of common shares outstanding) in light of peer and competitive market practices so that the dilutive impact on our shareholders is in line with prevailing market practice.

We expect a reasonable and competitive portion of an executive officer’s total compensation to be at risk, tied both to our annual and long-term performance as well as to the creation of shareholder value. In particular, we believe that short-term annual cash incentive compensation should be tied directly to both corporate performance and individual performance for the fiscal year that support the Company’s long term success and creation of shareholder value. Performance measures also include the achievement of identified goals as they pertain to the areas of our operations for which the executive officer is personally responsible and accountable. In coordination with our annual cash incentive plan, we believe that the value of long-term incentive compensation should be tied directly to future service, long-term corporate performance and an increase in shareholder value.

We differentiate compensation among executive officers based on the philosophy that total compensation should increase with an executive officer’s position and responsibility and that a greater percentage of total compensation should be tied to corporate and individual performance, and therefore at risk, as position and responsibility increase. Thus, executive officers with greater roles and responsibilities associated with achieving our performance targets should bear a greater proportion of the risk that those goals are not achieved and should receive a greater proportion of the reward if our performance targets are met or surpassed. In addition, as an executive officer’s position and responsibility increases, the use of long-term incentive compensation should increase where our executive officers have the greatest influence on our strategic performance over time.

We currently have no executive stock ownership guidelines, but do monitor the overall level of executive stock ownership as well as the level of outstanding and unvested or unearned stock grants and unexercised stock options. In addition, we maintain an

incentive claw back policy which requires executive officers to repay incentive payments and awards, whether in cash or stock, if based on materially inaccurate financial statements or any other materially inaccurate performance metric criteria.

Basis for Executive Pay Levels

The Compensation Committee generally meets at least quarterly to review our executive compensation program and its elements. At meetings, it also reviews peer group data provided by our executive compensation consultant.

In determining the compensation of our executive officers, the Committee evaluates total overall compensation, including benefits, as well as the mix of salary, cash bonuses and incentives, and equity incentives, using a number of factors including the following:

| |

• | Our financial and operating performance, measured by attainment of specific strategic objectives and operating results. |

| |

• | The Chief Executive Officer’s review of the duties, responsibilities and performance of each executive officer. These include the achievement of identified goals for the year as they pertain to the areas of our operations for which the executive is personally responsible and accountable. |

| |

• | Historical cash and equity compensation levels. |

| |

• | Comparative industry market data to assess compensation competitiveness. |

With respect to comparative industry data, the Compensation Committee reviews executive salaries and evaluates compensation structures and the financial performance of comparable companies in a designated peer group established by the Compensation Committee, with assistance from its executive compensation consultant. The peer group used for comparison purposes focuses principally on public companies in the banking industry in surrounding states that are similar to us in size and complexity, considering multiple factors including size of balance sheet, workforce, branch network, business structure, market areas served, and market capitalization.

In 2015, the Compensation Committee worked with its independent consultant to review the existing peer group against which to compare the Company. The criteria used in selecting and evaluating the suitability of peer organizations focused on SEC reporting community banking institutions of comparable size and located in Virginia and surrounding states. During 2015, Valley Financial Corporation was removed due to being acquired by another institution. Xenith Bankshares was added in 2015. The independent consultant compiled compensation data from proxy statements of the peer group and from market survey data contained in published surveys. The Compensation Committee used both sources of information when considering 2015 levels of base salary and total compensation for executive officers.

Members of our peer group include:

|

| |

Access National Corp - Reston, VA | Monarch Financial Holdings - Chesapeake, VA |

American National Bankshares, - Danville, VA | NewBridge Bancorp - Lexington, NC |

BNC Bancorp - High Point, NC | Old Point Financial Corp - Hampton, VA |

C&F Financial Corp - West Point, VA | Park Sterling Corp - Charlotte, NC |

Cardinal Financial Corp - McLean, VA | Peoples Bancorp of North Carolina - Newton, NC |

Community Bankers Trust - Richmond, VA | Porter Bancorp - Louisville, KY |

Eagle Bancorp - Bethesda, MD | SY Bancorp - Louisville, KY |

Eagle Financial Services - Berryville, VA | Shore Bancshares - Easton, MD |

Eastern Virginia Bankshares - Tappahannock, VA | Tri-County Financial Corp - Waldorf, MD |

Fauquier Bankshares - Warrenton, VA | Xenith Bankshares - Richmond, VA |

First South Bancorp - Washington, NC | WashingtonFirst Bancshares - Washington, DC |

Components of Executive Compensation

The elements of our 2015 executive compensation program included base annual salary, short-term incentive compensation under our Management Incentive Plan, and long-term incentives using stock-based awards under our 2006 Equity Compensation Plan.

We provide certain retirement benefits through supplemental executive retirement plans, our 401(k) savings plan, and our Money Purchase Pension Plan. We also provide health and welfare benefits that include participation in our health, dental and vision plans and various insurance plans, including disability and life insurance.

Each of the three principal components of executive compensation is designed to reward and provide incentives to executive officers consistent with our overall policies and principles on executive compensation. These components and the rationale and methodology for each are described below. Specific information on the amounts and types of compensation earned by the named executive officers during 2015 can be found in the "Summary Compensation Table" and other tables and narrative disclosures following this discussion.

Base Salary

Our base salary philosophy is to provide reasonable current income to our named executive officers in amounts that will attract and retain individuals with a broad, proven track record of performance.

The Compensation Committee establishes annual salary ranges for each executive officer. In establishing these ranges, the Compensation Committee balances the need to offer salaries that are competitive with peer companies with the need to maintain careful control of salary and benefits expense. The Compensation Committee reviews peer group data prepared by an independent consulting firm. Based upon the review of the peer group data provided and the Committee’s assessment of the CEO’s performance and track record, including a review of CEO performance review questionnaires prepared by each outside director, the Committee determines an appropriate salary level for the CEO. Based upon the review of peer group salary data and his performance assessments, the CEO of the Company recommends base salaries for the COO, the CFO, the President of Middleburg Investment Group and the Chief Lending Officer, and reports salary changes for other executives to the Compensation Committee for review.

In reviewing the CEO’s compensation recommendations for 2015, the Compensation Committee considered our financial performance, achievements in implementing our long-term strategy, and the personal observations of the Chief Executive Officer with respect to individual executive’s performance. The CEO recommended to the Compensation Committee increases in base salaries of other executives after considering each individual’s performance and the peer group salary and compensation data. No particular weight was given to any particular aspects of the performance of the executive officers.

Mr. Shook, Mr. Culver, Mr. Mehra and Mr. Hartley are compensated pursuant to employment agreements, which are described under “Annual Compensation of Executive Officers”. Mr. Shook, Mr. Culver, Mr. Mehra and Mr. Hartley are eligible for base salary increases, bonuses and incentives as the Compensation Committee may determine.

In making a salary determination for the CEO for 2015, the Compensation Committee evaluated the performance of the CEO based on our financial performance, achievements in implementing the Bank’s long-term strategy, and the independent review of the performance of the CEO by the members of the Board of Directors. As with executive officers, the Compensation Committee also considered a salary range evaluation of an independent consulting firm. In 2015, the Compensation Committee adjusted the base salaries of the named executive officers in light of their performance and also took into consideration the salary levels of our peer group.

The annual base salaries for our named executive officers for 2015 and the percentage change from 2014 are as follows:

|

| | | | | | |

Name and Position | | 2015 Annual Salary | | Percent Change from 2014 |

Gary R. Shook, President and Chief Executive Officer | | $ | 390,615 |

| | 3.23% |

Jeffrey H. Culver, SEVP, Chief Operating Officer | | $ | 279,010 |

| | 5.12% |

Rajesh Mehra, EVP, Chief Financial Officer | | $ | 224,223 |

| | 2.23% |

David L. Hartley, President, Middleburg Investment Group | | $ | 218,135 |

| | 3.67% |

Mark A. McLean, EVP, Chief Lending Officer | | $ | 197,708 |

| | 3.33% |

Annual Incentives

In 2015, the Compensation Committee approved performance metrics under our Management Incentive Plan (MIP), which sets the target level of executive cash incentives as a percentage of base salary, as further described below, at December 31, 2015. Each of the named executive officers participates in the Management Incentive Plan.

Executive officers currently have the opportunity to earn an annual incentive award up to a predetermined percentage of total compensation based on achievement of the Company's operating or consolidated performance goals. In addition to promoting the achievement of corporate performance goals, the incentive awards are designed to align the interests of executive management with those of shareholders in managing a profitable and sound institution.