Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission only

(as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to § 240.14a-12

| | |

| PLANTRONICS, INC. |

(Name of Registrant as Specified In Its Charter) |

| | | | | | | | |

Payment of Filing Fee (Check the appropriate box) |

þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 26, 2021

To our Stockholders:

Our Board of Directors is soliciting proxies for the 2021 Annual Meeting of Stockholders (the "Annual Meeting") of Plantronics, Inc. (the "Company"). This year, in light of the continued public health impact of the COVID-19 pandemic, we will hold our Annual Meeting in a virtual format, via live webcast at www.virtualshareholdermeeting.com/POLY2021. In addition, we may continue to hold our annual meetings using a virtual-only format in future years, even after the most severe impacts of the pandemic have subsided, as we believe that a virtual format is more environmentally-friendly, provides ease of accessibility, enhances communication, allows for greater stockholder participation, and decreases the costs of holding the annual meeting. We intend to hold our virtual annual meetings in a manner that affords stockholders the same general rights and opportunities to participate, to the greatest extent possible, as they would have at an in-person meeting. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. We ask that you please read it carefully.

Annual Meeting Date: July 26, 2021

Time: 10:00 am Pacific Daylight Time

Place: You will be able to participate in the Annual Meeting as well as vote and submit your questions and examine our stockholder list during the live webcast of the Annual Meeting by visiting www.virtualshareholdermeeting.com/POLY2021 and entering the 16-digit control number included on your notice of internet availability or proxy card.

Record Date: May 27, 2021

Purpose of the Meeting: At the Annual Meeting, stockholders will be asked to consider and act upon the following matters:

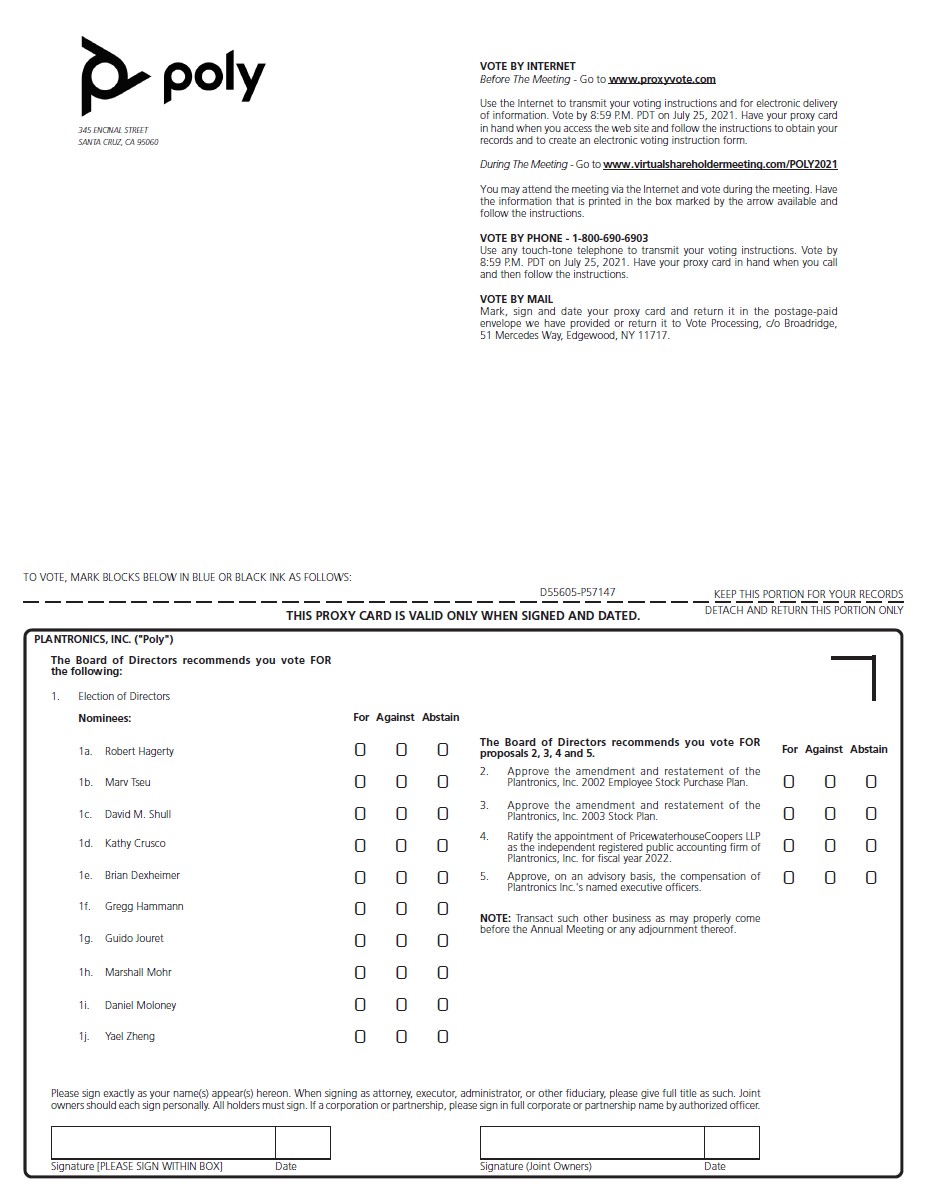

1. Elect ten (10) directors to serve until the next annual meeting or until their successors are duly elected and qualified.

2. Approve the amendment and restatement of the Plantronics, Inc. 2002 Employee Stock Purchase Plan.

3. Approve the amendment and restatement of the Plantronics, Inc. 2003 Stock Plan.

4. Ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Plantronics, Inc. for fiscal year 2022.

5. Approve, on an advisory basis, the compensation of Plantronics' named executive officers.

6. Transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

BY ORDER OF THE BOARD OF DIRECTORS

| | |

| /s/ Lisa Bodensteiner |

| Lisa Bodensteiner |

| Secretary |

| Santa Cruz, California |

| June 14, 2021 |

YOUR VOTE IS IMPORTANT TO US

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD JULY 26, 2021: THE NOTICE OF 2021 ANNUAL MEETING AND PROXY STATEMENT AND FISCAL YEAR 2021 ANNUAL REPORT ON FORM 10-K WILL BE AVAILABLE AT HTTP://INVESTOR.POLY.COM/DOCS.

TO ASSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, WE REQUEST YOU VOTE YOUR SHARES PROMPTLY. EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING VIRTUALLY, WE ENCOURAGE YOU TO VOTE PRIOR TO THE ANNUAL MEETING ON THE INTERNET AT WWW.PROXYVOTE.COM OR BY TELEPHONE 1-800-690-6903. ALTERNATIVELY, YOU MAY REQUEST A PAPER PROXY CARD, WHICH YOU MAY COMPLETE, SIGN AND RETURN BY MAIL.

TABLE OF CONTENTS

PROXY STATEMENT

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

The 2021 Annual Meeting of Stockholders (the "Annual Meeting") of Plantronics, Inc. will be held virtually at 10:00 a.m. PDT on Monday, July 26, 2021.

Our Board of Directors (our "Board") is soliciting proxies for the Annual Meeting. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully. Your vote is very important to us.

We have elected to provide access to our proxy materials via the Internet. Accordingly, on or about June 14, 2021, we will mail a Notice of Internet Availability of Proxy Materials (the "Notice of Internet Availability") to our stockholders of record as of the close of business on May 27, 2021. On the date of mailing of the Notice of Internet Availability, all of the proxy materials will be made available free of charge on the website referred to in the Notice of Internet Availability. The Notice of Internet Availability will provide instructions on how you may view the proxy materials for the Annual Meeting on the Internet and how you may request a paper copy or email of such materials.

Please follow the instructions provided below to attend the Annual Meeting.

We will pay the costs of soliciting proxies from stockholders. We have engaged The Proxy Advisory Group, LLC to assist with the solicitation of proxies and provide proxy-related advice and informational support. Fees for these services, plus customary disbursements, are not expected to exceed $25,000. We may also compensate brokerage firms and other persons representing beneficial owners of shares for their customary fees and expenses in forwarding the voting materials to beneficial owners. Our directors, officers and regular employees may solicit proxies on our behalf, without additional compensation, personally or by telephone.

We are incorporated in the State of Delaware under the name Plantronics, Inc. In March 2019, we announced our re-branding under which we began to market ourselves as "Poly" although currently we continue to retain "Plantronics, Inc." as our corporate name. On May 24, 2021, we changed our ticker symbol on the New York Stock Exchange ("NYSE") from "PLT" to "POLY." We will refer to ourselves as the "Company" throughout this Proxy Statement or "Plantronics," when appropriate. Our principal executive offices are located at 345 Encinal Street, Santa Cruz, California 95060. Our telephone numbers are (831) 420-3002 and (800) 544-4660. Our website is www.poly.com.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

AND THE ANNUAL MEETING

How do I attend and participate in the Annual Meeting online?

This year, to ensure the health and well-being of our employees, directors, stockholders and other stakeholders in light of the continuing impacts of COVID-19 and local health and safety guidelines, our Annual Meeting will be conducted in a virtual-only format over the internet via live webcast. There will not be a physical location for the Annual Meeting, and you will not be able to attend in person. In addition, we may continue to hold our annual meetings using a virtual-only format in future years, even after the pandemic. We believe the virtual format allows us to communicate effectively and efficiently with our stockholders while enhancing attendance and participation regardless of where a stockholder resides. Additionally, a virtual meeting will enable us to conduct the Annual Meeting with a reduced carbon footprint and less environmental impact than an in-person meeting.

Any stockholder (or their authorized representatives) can virtually attend the Annual Meeting live online at www.virtualshareholdermeeting.com/POLY2021. We intend to hold our virtual Annual Meetings in a manner that affords stockholders the same general rights and opportunities to participate, to the greatest extent possible, as they would have at an in-person meeting. Accordingly, stockholders may vote and submit questions while attending the meeting online. See below "How do I ask questions at the Annual Meeting?"

The Annual Meeting will be held live via the Internet on Monday, July 26, 2021 at 10:00 a.m. Pacific Time. We encourage you to access the webcast prior to the start time. Online check-in will begin at 9:45 a.m. Pacific Time and you should allow ample time for the check-in procedures.

Participation in and attendance at the Annual Meeting is limited to our stockholders of record as of the close of business on May 27, 2021 ("Record Date"), and other persons holding valid proxies for the Annual Meeting. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/POLY2021, you must enter the 16-digit control number included in the Notice or on the proxy card if you are a stockholder of record of shares of common stock (as defined below), or included with your voting instructions received from your broker, bank or other agent if you hold your shares of common stock in “street name” (as defined below). Further instructions on how to attend and participate online are available at www.virtualshareholdermeeting.com/POLY2021. If you encounter difficulties accessing the virtual meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/POLY2021. Technical support will be available starting at 9:45 a.m. Pacific Time and until the end of the Annual Meeting.

How do I ask questions at the Annual Meeting?

As part of the Annual Meeting, we will hold a question and answer session. Stockholders may submit questions during the Annual Meeting at www.virtualshareholdermeeting.com/POLY2021. If you wish to submit a question during the Annual Meeting, log into the virtual meeting website using your control number on your Notice of Internet Availability, type your question into the “Ask a Question” field and click “Submit.” Only questions that are pertinent to meeting matters will be answered during the Annual Meeting, subject to time constraints. Questions regarding personal matters or matters not relevant to the Annual Meeting will not be answered. If we receive substantially similar questions, we will group them together to avoid repetition. We will endeavor to answer as many questions related to the business of the Annual Meeting that comply with our Annual Meeting Rules of Conduct, which will be available at www.virtualshareholdermeeting.com/POLY2021. If there are questions pertinent to meeting matters that cannot be answered during the meeting due to time constraints, then we will post answers to a representative set of such questions at https://investor.poly.com/com. The questions and answers will be available as soon as practicable after the Annual Meeting. We ask that all stockholders provide their name and contact details when submitting questions through the virtual meeting platform, so that we may address any individual concerns or follow up matters directly.

We want to ensure that our stockholders are afforded the same rights and opportunities to participate as if they were attending an in-person meeting, so our Board, certain members of our executive leadership team and representatives of PricewaterhouseCoopers, LLP, our independent auditors, will all join the virtual Annual Meeting and be available for questions.

What if I need technical assistance during the Annual Meeting?

Beginning at approximately 9:45 a.m. Pacific Time on the date of the Annual Meeting, there will be a support team ready to assist stockholders with any technical difficulties they may have accessing or hearing the Annual Meeting. If you encounter any difficulties accessing the Annual Meeting while logging in or during the meeting time, you should call the support team listed on www.virtualshareholdermeeting.com/POLY2021.

Who can vote?

Our Board has set May 27, 2021 as the Record Date for the Annual Meeting. All stockholders of record who owned shares of our common stock at the close of business on the Record Date may attend and vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of common stock held on each of the matters to be voted. Stockholders may not cumulate their votes for the election of directors. At the close of business on the Record Date, there were 42,295,241 shares of our common stock outstanding.

How many votes are required to conduct business at the Annual Meeting?

The required quorum for the transaction of business at the Annual Meeting is the presence in person or by proxy of a majority of shares of common stock issued and outstanding on the Record Date. Shares voted "FOR," "AGAINST" or "ABSTAIN" and broker non-votes, if any, with respect to any proposal are treated as being present at the Annual Meeting for purposes of establishing a quorum.

How are abstentions and broker non-votes treated?

A broker non-vote occurs when a nominee holding shares for a beneficial owner is not permitted to vote on a particular proposal because such proposal is deemed non-routine, meaning that the nominee does not have discretionary voting power with respect to that item, and the nominee has not received instructions from the beneficial owner. Proposal Four, Ratification of Appointment of Independent Registered Public Accounting Firm, is the only routine matter for which nominees may have discretionary voting power. Broker non-votes are not treated as votes cast and therefore will have no effect on the outcome of the vote on any of the proposals included in this Proxy Statement.

How many votes are required to approve a proposal?

| | | | | | | | | | | |

| PROPOSALS | VOTING STANDARD | EFFECTS OF ABSTENTIONS AND BROKER NON-VOTES |

| 1 | To elect ten (10) directors to serve until the next annual meeting or until their successors are duly elected and qualified.

(Non-Discretionary) | Majority of votes cast | •Not counted as votes cast and therefore have no effect |

| 2 | To approve the amendment and restatement of the Plantronics, Inc. 2002 Employee Stock Purchase Plan.

(Non-Discretionary) | Majority of the shares present in person or represented by proxy | •Abstentions have the effect of a vote against the proposal •Broker non-votes have no effect |

| 3 | To approve the amendment and restatement of the Plantronics, Inc. 2003 Stock Plan.

(Non-Discretionary) | Majority of the shares present in person or represented by proxy | •Abstentions have the effect of a vote against the proposal •Broker non-votes have no effect |

| 4 | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for fiscal year 2022.

(Discretionary) | Majority of the shares present in person or represented by proxy | •Abstentions have the effect of a vote against the proposal

|

| 5 | To approve, on an advisory basis, the compensation of the Company's named executive officers.

(Non-Discretionary - Advisory/Non-Binding)* | Majority of the shares present in person or represented by proxy | •Abstentions have the effect of a vote against the proposal •Broker non-votes have no effect |

*The vote on Proposal Five is advisory and, therefore, not binding on us, the Board or the Leadership Development and Compensation Committee of the Board (the "LD&C Committee"). The Board and the LD&C Committee value the opinions of our stockholders and will take the vote of stockholders on Proposal Five into account in their evaluation of the design and philosophy of our executive compensation program.

How does the board recommend I vote on each of the proposals?

The Board recommends that you vote:

| | | | | | | | | | | |

| PROPOSALS | BOARD'S RECOMMENDATION | PAGE REFERENCE

(for more detail) |

| 1 | To elect ten (10) directors to serve until the next annual meeting or until their successors are duly elected and qualified. | FOR each nominee of the Board | 24-32 |

| 2 | To approve the amendment and restatement of the Plantronics, Inc. 2002 Employee Stock Purchase Plan. | FOR | 33-36 |

| 3 | To approve the amendment and restatement of the Plantronics, Inc. 2003 Stock Plan. | FOR | 37-48 |

| 4 | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for fiscal year 2022. | FOR | 49-50 |

| 5 | To approve, on an advisory basis, the compensation of the Company's named executive officers ("NEOs"). | FOR | 51 |

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Set forth below are certain distinctions between stockholders of record and those whose shares are owned beneficially or in "street name":

Stockholder of Record. If your shares are registered directly in your name with Computershare Trust Company, N.A., our transfer agent, then you are considered the stockholder of record with respect to those shares and the Notice of Internet Availability is being sent directly to you by us. As the stockholder of record, you may grant your voting proxy directly to the proxyholders nominated by the Board (the "Proxyholders") by voting over the Internet, by telephone, or by returning a completed proxy card. The Board has named David M. Shull, Charles Boynton and Lisa Bodensteiner as the Proxyholders for the Annual Meeting.

Beneficial Owner. Most of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. If your shares are held in a stock brokerage account or by a bank or other nominee, then you are considered the beneficial owner of shares held in "street name," and the Notice of Internet Availability is being forwarded to you by your broker, bank or nominee. The Notice of Internet Availability contains instructions on how to vote your shares and request a paper copy of the proxy materials. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote on matters at the Annual Meeting and are also invited to attend the Annual Meeting. Since you are not the stockholder of record, you may vote your shares online during the Annual Meeting only by using your 16-digit control number or by following instructions from your broker, bank or other nominee.

Can I vote my shares at the Annual Meeting if I have already voted or submitted a proxy for my shares?

You may attend the Annual Meeting virtually and vote at the meeting even if you have already voted or submitted a proxy. Please be aware that attendance at the Annual Meeting will not, by itself, revoke your proxy. If a bank, broker or other nominee holds your shares in "street name" and you wish to attend, and vote at, the virtual Annual Meeting, then you must follow the instructions from your broker, bank or other nominee.

If you choose to vote virtually at the Annual Meeting either as a stockholder of record or as a holder in "street name," then please have your control number accessible.

EVEN IF YOU CURRENTLY PLAN TO ATTEND AND VOTE AT THE ANNUAL MEETING, WE RECOMMEND YOU ALSO SUBMIT YOUR PROXY AS DESCRIBED BELOW SO THAT YOUR SHARES WILL BE VOTED ACCORDING TO YOUR INSTRUCTIONS IF YOU LATER DECIDE NOT TO ATTEND.

How can I vote?

Stockholder of Record. Registered stockholders may vote by one of the following methods:

| | | | | | | | | | | |

| INTERNET | PHONE | MAIL | ONLINE AT THE VIRTUAL ANNUAL MEETING |

| | | |

Go to:

www.proxyvote.com or follow the instructions on the Notice of Internet Availability. | Call toll-free:

1-800-690-6903 | Request a proxy card from us and cast your vote by completing, signing and dating the card where indicated and by thereafter timely mailing or otherwise returning the card in the enclosed, prepaid, pre-addressed envelope. | Attend the Annual Meeting virtually by logging into www.virtualshareholdermeeting.com/POLY2021. |

Please note that the Internet and telephone voting facilities for registered stockholders will close at 8:59 PM Pacific Daylight Time on July 25, 2021. If you are voting by paper proxy card, then it must be mailed in time to be received in time to be counted at the Annual Meeting.

Beneficial Owner. If your shares are held not in your name, but rather by a broker, bank or other nominee, then you must follow the instructions you receive from your broker, bank or other nominee in a timely manner to ensure your vote is cast. Please follow their instructions carefully. Also, please note that if the holder of record of your shares is a broker, bank or other nominee, and you wish to vote at the Annual Meeting, you must follow the instructions from your broker, bank or other nominee

Subject to instructions provided by your broker, bank or other nominee, as a beneficial owner you may typically vote by one of the following methods:

| | | | | | | | |

| MAIL | METHODS LISTED ON THE VOTING INSTRUCTION CARD | ONLINE AT THE VIRTUAL ANNUAL MEETING WITH A LEGAL PROXY FROM THE RECORD HOLDER |

|  or or  | |

| If you requested printed copies of the proxy materials to be mailed to you, you may vote by completing, signing, dating and timely returning your voting instruction card in the enclosed prepaid, pre-addressed envelope. | Refer to the materials provided by your bank, broker or other nominee, to determine whether you may vote by telephone or via the Internet, and timely follow such instructions. | Please follow the instructions from your bank, broker or other nominee. |

All shares entitled to vote and that are represented by properly and timely completed and delivered proxies that are not properly revoked before the Annual Meeting will be voted at the Annual Meeting, as instructed. If you are a stockholder of record and timely submit a properly signed and dated proxy but do not indicate how your shares should be voted on a matter, then the shares represented by your returned proxy will be voted as the Board recommends.

What happens if additional proposals are presented at the Annual Meeting?

Except for the proposals described in this Proxy Statement, we do not expect any other matters to be presented for a vote at the Annual Meeting. If you grant a proxy, the persons named as Proxyholders will have the discretion to vote your shares on additional matters, if any, properly presented for a vote at the Annual Meeting to the extent authorized by Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended (the "Securities Exchange Act"). Under our bylaws, the deadline has passed for notifying us of additional proposals to be presented at the Annual Meeting by stockholders.

Can I change my vote?

You may change your proxy instructions at any time prior to the vote at the Annual Meeting. For shares held directly in your name, you may change your vote by: (i) executing a new proxy bearing a later date (which automatically revokes the earlier proxy) and delivering it to the Corporate Secretary at our principal executive office located at 345 Encinal Street, Santa Cruz, California 95060 prior to the vote at the Annual Meeting; (ii) voting again on a later date via the Internet or by telephone (however, only your latest proxy timely submitted prior to the Annual Meeting will be counted); (iii) advising the Corporate Secretary that you revoke your proxy by providing notice at our principal executive office at the address stated above, in writing, before the vote at the Annual Meeting; or (iv) attending the virtual Annual Meeting and voting. For shares you hold beneficially, you may change your vote by following the instructions from your broker, bank or other nominee. Attendance at the virtual Annual Meeting, without casting a vote, will not cause your previously granted proxy to be revoked.

What happens if I do not cast a vote?

If you hold your shares in "street name" and you do not instruct your broker, bank or other nominee how to vote, your broker will have discretion to vote your shares only on Proposal Four, Ratification of Appointment of Independent Registered Public Accounting Firm. No other votes will be cast on your behalf. If you are a stockholder of record and fail to timely return your proxy or vote at the Annual Meeting, no votes will be cast on your behalf on any of the items of business at the Annual Meeting. If you are a stockholder of record and you return, in a timely manner, a properly executed proxy without indicating how you wish to vote, your shares will be voted in accordance with the Board’s recommendations.

How can I request materials or information referred to in these questions and answers?

You may contact us:

•By mail addressed to:

Poly

345 Encinal Street

Santa Cruz, California 95060

Attn: Investor Relations

•By calling (831) 420-3002 and asking for Investor Relations

•By emailing IR@poly.com

We encourage you to conserve natural resources and reduce printing and mailing costs by using electronic delivery of stockholder communications materials. If you have questions about electronic delivery, please call our Investor Relations office at the number above. To sign up for electronic delivery:

Stockholder of Record. If you are a stockholder of record (you hold Company shares in your own name through our transfer agent, Computershare Trust Company, N.A., or you have stock certificates), visit www.proxyvote.com to enroll.

Beneficial Owner. If you are a beneficial owner (your Company shares are held by a broker, bank or other nominee), visit www.proxyvote.com to learn more about your electronic delivery options and enroll.

What is "householding"?

We generally send a single Notice of Internet Availability and other stockholder communications to households at which two or more stockholders reside unless we receive contrary instructions. This process is called "householding." If your Notice of Internet Availability is being householded and you wish to receive separate copies, or, if you are receiving multiple copies and would like to receive a single copy, contact our Investor Relations office by mail, telephone or email, as described above. If you would like to opt out of this practice for future mailings, please contact us at Poly, 345 Encinal Street, Santa Cruz, California 95060, Attn: Investor Relations, or by phone at (831) 420-3002 and ask for Investor Relations.

What is the deadline for receipt of stockholder proposals for the 2022 Annual Meeting of Stockholders?

You may present proposals for action at a future stockholder meeting only if you comply with the requirements of the proxy rules established by the Securities and Exchange Commission (the "SEC") and our bylaws. For a stockholder proposal to be included in our Proxy Statement and form of proxy for our 2022 Annual Meeting of Stockholders (the "2022 Annual Meeting") under rules adopted under the Securities Exchange Act, we must receive the proposal no later than February 16, 2022.

Stockholders wishing to present business at an annual meeting may do so by filing with the Corporate Secretary a "Business Solicitation Statement," containing, among other things, certain information about the business the stockholder intends to bring before the annual meeting and the stockholder proposing such business. Stockholders wishing to nominate a director for election to the Board may do so by filing with the Corporate Secretary a "Nominee Solicitation Statement" containing, among other things, certain information about the nominee and the stockholder nominating such nominee.

For our 2022 Annual Meeting, the Business Solicitation Statement or the Nominee Solicitation Statement, as applicable, must be filed with our Corporate Secretary not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the one-year anniversary of the preceding year's annual meeting of stockholders. In the event that no annual meeting was held in the previous year, or if the date of the annual meeting is advanced by more than 30 days prior to or delayed by more than 60 days after the one-year anniversary of the date of the previous year's annual meeting, then, for notice by the stockholder to be timely, it must be received by the Corporate Secretary not later than the 10th day following the day on which a public announcement (as described in the bylaws) of the date of such meeting is first made by us.

Our bylaws contain additional details about requirements for the Business Solicitation Statement and the Nominee Solicitation Statement as well as certain procedural requirements for the proposal of business and the nomination of directors. You should also review our Corporate Governance Guidelines and our Director Candidates Nomination Policy which contain additional information about the nomination of directors. Our bylaws, Corporate Governance Guidelines and Director Candidates Nomination Policy are available on the Corporate Governance portal of the Investor Relations section of our website at http://investor.poly.com/govdocs (the "Governance Portal").

The Company's bylaws permit "proxy access" by which eligible stockholders may nominate director candidates for inclusion in our Proxy Statement and proxy card. Proxy access may be used by a stockholder or a group of up to 20 stockholders, owning at least 3% of the Company's outstanding common stock continuously for at least three years to nominate and include in the Company's proxy materials director nominees constituting up to the greater of two individuals or 20% of the Board, provided that the stockholders and the nominees satisfy the conditions, including, without limitation, the advance notice requirements, specified in the bylaws. The Company believes that certain safeguards as to ownership threshold and duration of ownership are important to assure that proxy access is not misused by those without significant economic interest in the Company or those driven by short term goals.

What is the date of our fiscal year end?

Our fiscal year ends on the Saturday closest to the last day of March. The year ended April 3, 2021 ("Fiscal Year 2021") had 53 weeks. The years ended March 28, 2020 ("Fiscal Year 2020") and March 30, 2019 ("Fiscal Year 2019") each had 52 weeks. Some of the information provided herein is stated as of the end of our Fiscal Year 2021 and some information is provided as of a more current date in accordance with applicable legal requirements.

Who should I contact if I have questions?

If you have any questions, or need assistance voting your shares, please contact the firm assisting us in the solicitation of proxies:

The Proxy Advisory Group, LLC

18 East 41st Street, Suite 2000

New York, New York 10017

1 (212) 616-2181

CORPORATE GOVERNANCE

Strong corporate governance is an integral part of our core values. Our Board is committed to good corporate governance practices and seeks to represent stockholders' best interest through the exercise of sound judgment. To achieve this, the Board has established corporate governance policies and procedures that provide the framework for the governance of the Board and the Company and are available on the Governance Portal. The Governance Portal includes the Corporate Governance Guidelines, Access to Board of Directors Policy, Director Candidates Nomination Policy, Bylaws, Board Committee Charters, Code of Conduct and the link to Report Accounting Issues for reporting issues regarding accounting, internal accounting controls, auditing and other business conduct. These policies are also available in print to any stockholder by making a written request addressed to Poly, 345 Encinal Street, Santa Cruz, California 95060, Attn: Investor Relations.

| | | | | | | | | | | | | | |

| CORPORATE GOVERNANCE HIGHLIGHTS |

|

| | | |

Board Composition & Independence

| Board & Committee Practices | Stockholder Rights | Key Board/Committee Oversight Areas | Compensation Governance |

| Committed to Board diversity; two female and two ethnically diverse directors | Annual board & committee self-evaluation process | Annual election of all directors | Long-term strategic plans and capital allocation | Clawback of Executive incentive-based compensation, including performance-based equity awards and cash incentive awards |

| 90% independent board* | Regular board refreshment | No poison pill | Enterprise risk management, including cybersecurity | Robust stock ownership guidelines for Executives and Directors |

| 100% independent committees | Regular focus on strategic planning | No preferred stock issued | Commitment to environmental, social and governance ("ESG") policies and practices | Anti-hedging, anti-short sale and anti-pledging policies applicable to all employees and directors |

| Separate CEO & independent Board chair | Active consideration of diversity in director recruiting/nomination process | Majority vote standard in uncontested elections with a director resignation policy | Environmental stewardship & sustainability | Double-trigger change-in-control benefits |

| Healthy mix of tenure | Annual review of CEO's performance | Stockholder proxy access rights | Diversity and inclusion, equity in business practices, and safe and secure workplaces | Annual say-on-pay stockholder advisory vote |

| Regular director executive sessions without the presence of management | Limits on director and CEO public company board service | No super-majority voting requirements | Human capital management | Pay-for-performance: •multiple financial metrics and rigorous performance goals •70% of NEO compensation is tied to performance-based stock unit awards • Cash bonus programs are tied to Company financial targets |

| Full access to management and employees | Strong Audit Committee with two financial experts | Regular stockholder outreach | Annual CEO review and management succession planning | No extraordinary or excessive perquisites or tax gross-ups; No change in control excise tax gross-up entitlements (including no “modified” gross-ups) |

| No classified or staggered Board | Comprehensive onboarding and continuing education program support | Stockholder rights to call special meetings | Political activities and contributions | Equity burn and dilution rates within stockholder expectations and below industry norms |

| Robust director nomination process | Process for stockholder communications with Board | Unqualified auditor opinion | Minimum 12-month vesting for all equity awards |

| | Single class of voting stock | Reasonable audit and non-audit auditor fee ratio | No option repricing, replacement or regranting, and no cash buyback or buyout, without stockholder approval |

| | | Governance Policies and Trainings, including Corporate Governance Guidelines, Code of Conduct and Insider Trading Policies | No share recycling permitted under Equity Plan |

*See "Corporate Governance - Director Independence" below for further discussion. | Independent compensation consultant |

Code of Conduct

We have a Code of Conduct (the "Code") that applies to all employees, our executive officers and our directors to ensure that our business is conducted in a consistently legal and ethical manner. The Code forms the foundation of a comprehensive process that includes compliance with corporate policies and procedures and a Company-wide focus on uncompromising integrity in every aspect of our operations. Our Code covers many topics, including no tolerance for discriminatory or harassing conduct, compliance with antitrust and competition law, avoiding conflicts of interest, protection of confidential information, and compliance with all laws and regulations applicable to the conduct of our business. Any modification or waiver of any provision of the Code for a director or executive officer must be approved in writing by the Board. If required under applicable law, modifications and waivers will be promptly disclosed to our stockholders by posting on our website.

Employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code. Our Audit Committee has adopted procedures to receive, retain, and treat complaints received regarding accounting, internal accounting controls, or auditing matters, and to allow for the confidential and anonymous submission by employees or others of concerns regarding questionable accounting or auditing matters. Information on how to submit any such communications can be found on the Governance Portal.

We also are committed to responsible manufacturing of our products and responsible sourcing of materials. We require our suppliers to share in this commitment and have established the Supplier Code of Conduct, which outlines our expectations of Poly suppliers in conducting business in a legal, ethical, and responsible manner.

For further information on our Code, our Supplier Code of Conduct and other related policies, see our Governance Portal.

Ethics Hotline Policy

Our Audit Committee has established a third-party hosted ethics hotline and website available to all employees, stockholders, and the general public for the anonymous submission of suspected legal, ethical or other violations, including accounting, internal controls, auditing matters and other business conduct at the Company. Our Code expressly provides for non-retaliation for good faith reporting. For further information see the Code or Report Accounting Issues link on the Governance Portal.

Related Person Transaction Procedures

We have related person transaction procedures which apply to any transaction or series of transactions in which the Company or a subsidiary is a participant, the amount involved exceeds $120,000, and a related person (as defined under Item 404(a) of Regulation S-K) has a direct or indirect material interest which is required to be disclosed under such Regulation. Transactions that fall within this definition are referred to the Audit Committee for approval, ratification, or other action. Based on its consideration of all of the relevant facts and circumstances, the Committee decides whether or not to approve a related party transaction and approves only those transactions that are in the best interests of the Company. In the course of its review and approval or ratification of such a transaction, the Audit Committee considers:

| | | | | | | | |

• | The nature of the related person’s interest in the transaction; |

• | The material terms of the transaction, including whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances; |

• | The significance of the transaction to the related person; |

• | The significance of the transaction to the Company; |

• | Whether the transaction would impair the judgment of a director or executive officer to act in the best interest of the Company; and |

• | Any other matters the Committee deems appropriate. |

Directors and Committee Members

The names of, and certain information about, the members of our Board and its committees as of May 27, 2021 are:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name of Director | | Board | | Audit | | Leadership Development & Compensation | | Nominating & Corporate Governance | | Strategy(1) | | Mergers and Acquisitions(2) |

Robert Hagerty(3) | | Chairman and Former Interim CEO | | | | | | Member | | Member | | Chair |

Marv Tseu(4) | | Vice Chairman / Former Lead Independent Director | | Member | | Member | | Member | | Member | | Member |

| David M. Shull | | Member | | | | | | | | | | |

| Kathy Crusco | | Member | | Member | | Member | | | | | | |

| Brian Dexheimer | | Member | | | | Member | | Chair | | Member | | Member |

| Gregg Hammann | | Member | | Member | | Chair | | | | | | Member |

Guido Jouret(5) | | Member | | | | | | Member | | Chair | | |

| Marshall Mohr | | Member | | Chair | | | | | | | | Member |

| Daniel Moloney | | Member | | | | | | | | | | |

Yael Zheng(6) | | Member | | | | | | | | Member | | |

(1)Effective May 11, 2021, the Board dissolved the Strategy Committee. Instead, the full Board will oversee strategic initiatives and progress towards goals.

(2)Effective May 11, 2021, the Board dissolved the Mergers & Acquisitions ("M&A") Committee, which instead will be formed on an ad hoc basis, as necessary.

(3)Effective September 8, 2020, Mr. Hagerty resigned as the Company's interim Chief Executive Officer ("Interim CEO") and retained his position as Chairman of the Board ("Chairman"). On such date, upon the recommendation of the Nominating and Corporate Governance Committee ("N&CG Committee"), the Board determined that Mr. Hagerty remained an independent Board member and approved the reinstatement of Mr. Hagerty as a member of the N&CG Committee and Strategy Committee and as Chair of the M&A Committee.

(4)Effective September 8, 2020, Mr. Tseu retained his position as Vice Chairman of the Board ("Vice Chairman") and resigned as the Board's lead independent director ("Lead Independent Director") upon the separation of CEO and Chair positions. Effective May 11, 2021, Mr. Tseu resigned as a member of the Audit Committee, LD&C Committee and the N&CG Committee.

(5)Effective September 9, 2020, Mr. Jouret was appointed as Chair of the Strategy Committee, which was dissolved on May 11, 2021.

(6)Effective November 12, 2020, Ms. Zheng was appointed to the Strategy Committee, which was dissolved on May 11, 2021.

Director Independence

In accordance with Corporate Governance Guidelines and our Director Candidates Nomination Policy (each of which is available on our Governance Portal), our Board has adopted a formal set of guidelines with respect to the determination of director independence, which conform to the independence requirements of the NYSE listing standards. In accordance with these guidelines, an independent director or nominee must be determined to have no material relationship with the Company other than as a director. These guidelines specify the criteria by which the independence of our directors will be determined, including strict guidelines for directors and their immediate family members with respect to past employment or affiliation with the Company or its independent registered public accounting firm. They also prohibit Audit, N&CG and LD&C Committee members from having any direct or indirect financial relationship with the Company. Directors may not be given personal loans or extensions of credit by the Company pursuant to SEC's requirements, and all directors are required to deal at arm’s length with the Company and its subsidiaries, and to disclose any circumstance that might be perceived as a conflict of interest.

In accordance with these guidelines, the Board undertook its annual review of director independence. During this review, the Board considered transactions and relationships between each director, or any member of his or her immediate family and the Company and its subsidiaries and affiliates in each of the most recent three completed fiscal years. The Board also considered whether there were any transactions or relationships between the Company and a director or any members of a director’s immediate family (or any entity of which a director or an immediate family member is an executive officer, general partner, or significant equity holder). In particular, the Board considered the relationship between Daniel Moloney and Siris

Capital Group, LLC ("Siris") and its wholly-owned subsidiary, Triangle Private Holdings II, LLC ("Triangle"). Siris acquired Polycom, Inc. ("Polycom") immediately prior to the Company's Acquisition of Polycom on July 2, 2018, Triangle was Polycom’s sole stockholder and, pursuant to the Company's Stock Purchase Agreement with Triangle, Triangle owned approximately 17.8% of Plantronics' issued and outstanding stock. However, Triangle sold all of its Plantronics stock in two block sales to a broker-dealer on August 27, 2020 and November 23, 2020. As a result of the first block sale, one of the directors previously appointed to Plantronics' Board resigned pursuant to the Stockholder Agreement with Triangle. The second director, Mr. Moloney entered into a waiver and acknowledgement on August 26, 2020, whereby the Board agreed to retain Mr. Moloney in his capacity as an individual director and not a representative of Triangle. In determining whether Mr. Moloney qualified as an independent director, the Board considered the fact that Triangle and Siris sold all of their holdings in the Company's stock as of November 23, 2020, and that Mr. Moloney has not received compensation from the Company (other than in his capacity as a member of the Board) or any of its affiliates, including Polycom, since July 2, 2018. Accordingly, after considering the independence rules of the NYSE, discussions with members of the Board, and consideration of other relevant facts and circumstances of Mr. Moloney's relationship to the Company, the N&CG Committee and the Board determined that Mr. Moloney has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company) and deemed that he would qualify as an independent director effective as of July 3, 2021.

As of result of this review, the Board has determined that, except for David M. Shull (who was appointed as CEO on September 8, 2020), none of our other director nominees standing for re-election has a material relationship with the Company (directly or indirectly through applicable relatives as a partner, stockholder, or officer of an organization that has a relationship with the Company), other than as a director of the Company. The Board has further determined that all of our current directors, other than Mr. Shull who is considered not to be independent because of his employment with the Company, are independent under the listing rules of the NYSE and the Company's Corporate Governance Guidelines and Director Candidates Nomination Policy.

Board Leadership Structure

Our Corporate Governance Guidelines require that the roles of Chairman and the CEO be separate. Historically, the Company has had different persons serving in these positions, except for a period of approximately seven months as noted below where Robert Hagerty, the Board's Chair, served as Interim CEO while the Board conducted a search for a new permanent CEO.

The Board’s current leadership structure is characterized by:

| | | | | |

• | A separate Chairman of the Board and CEO; |

• | A robust committee structure consisting entirely of independent directors with oversight of various types of risks; and |

• | An engaged and independent Board. |

The Chairman is, at all times, selected from our independent non-employee directors. Notwithstanding the foregoing, if at any time the CEO either resigns or is terminated as, or otherwise is not able to perform the function of, the Company's CEO for any reason, then the Board may appoint the Chairman or another Board member to act as an Interim CEO, and in such event, the offices of the Chairman and the CEO may be held by the same person until such times as a replacement CEO is appointed. In such event, the Board is required to appoint, as soon as reasonably practicable, a non-employee Director to serve as the Board's Lead Independent Director to perform the functions as described in the Company's Lead Independent Director Charter (located on the Governance Portal) for the period of time that the Chairman and CEO positions remain combined.

Since March 2018, Robert Hagerty has served as Chairman, and Marv Tseu has served as our Vice Chairman, after having previously served as Chairman since 1999. On February 10, 2020, Mr. Hagerty was appointed as the Company's Interim CEO and retained his position as Chairman thereby effectively combining the roles of CEO and Chairman on this interim basis. On that same date, the Board appointed Mr. Tseu to serve as the Company's Lead Independent Director. On September 8, 2020, the Company announced the appointment of Mr. Shull as CEO and the resignations of Mr. Hagerty as Interim CEO (thereby resuming the separation of CEO and Chair positions) and Mr. Tseu as Lead Independent Director. In his capacity as Chairman, Mr. Hagerty, in consultation with Mr. Tseu and other directors, approves the agenda for Board meetings and chairs all regular meetings of the Board, and may attend all committee meetings. Mr. Tseu manages the board agenda, presides at executive sessions of the directors, and oversees overall board strategy and execution.

The Board also believes that the Company’s corporate governance measures ensure that strong, independent directors continue to effectively oversee the Company’s management and key issues related to executive compensation, CEO evaluation and succession planning, strategy, risk, and integrity. The Corporate Governance Guidelines provide, in part, that:

| | | | | |

• | Independent directors comprise a substantial majority of the Board; |

• | Directors are elected annually by a majority vote in uncontested director elections; |

• | Only independent directors serve on the Audit, LD&C and N&CG Committees; |

• | The committee chairs establish their respective agendas; |

• | The Board and committees may retain their own advisors; |

• | The independent directors have complete access to management and employees; |

• | The independent directors meet in executive session without the CEO or other employees during each regular Board meeting; and |

• | The Board and each committee regularly conduct a self-evaluation to determine whether the Board and its committees function effectively. |

Another key responsibility of the Board is ensuring that an effective process is in place to provide continuity of leadership over time at all levels within the Company. Annually, the Board, either directly or through its LD&C Committee, conducts a review on succession planning. During this review, the Board may discuss a variety of topics, including future candidates for senior leadership positions, succession timing for those positions, and development plans for candidates believed to have the highest potential. The Board or any of the directors may identify, evaluate or nominate potential successors to the CEO and may similarly do so for other senior leadership positions. This process promotes continuity of leadership over the long-term and forms the basis on which we make ongoing leadership assignments.

Board and Committee Meetings and Attendance

The Board held four regular meetings and six special meetings during Fiscal Year 2021. The directors met seven times in executive session without the CEO present. During each member's tenure on the Board in the last fiscal year, each director attended 100% of the aggregate number of Board and applicable Committee meetings.

Our Board is responsible for providing oversight over the Company's business, including the strategic direction, as well as the management and financial and operational execution to best support the business for long-term success. To effectively support all of its responsibilities, the Board had five standing committees during Fiscal Year 2021: an Audit Committee, a LD&C Committee, a N&CG Committee, a Strategy Committee and an M&A Committee, each of which is described below. As noted above, effective May 11, 2021, the Board dissolved the Strategy Committee as well as the M&A Committee. The Board further determined that strategic initiatives and progress towards goals would be covered in the quarterly Board meetings with a deeper dive at least annually. The Board also determined that an M&A Committee would meet on an ad hoc basis, as needed, with initial members including Messrs. Jouret, Hagerty and Tseu. See the table in the section "Directors and Committee Members" above for a listing of the members and chairs of each committee.

Each of the Audit, N&CG and LD&C Committees has adopted a written charter that is available on the Governance Portal. This information is also available in print to any stockholder who makes a request to Poly, 345 Encinal Street, Santa Cruz, California 95060, Attn: Investor Relations.

| | | | | |

| AUDIT COMMITTEE |

| |

| Members: | Primary Functions and Additional Information |

ºMarshall Mohr (Chair)

ºKathy Crusco

ºGregg Hammann

ºMarv Tseu | º Oversees the accounting and financial reporting processes of the Company and audits of the consolidated financial statements, including overseeing the audit functions.

º Reviews the independence and performance of our independent registered public account firm and our internal auditors.

º Assists the Board in oversight and monitoring of legal and regulatory requirements, including, without limitation, cybersecurity, data privacy and security and business continuity matters.

º Oversees the Company's ethical compliance program; including oversight of the Company's Code of Conduct and Ethics Reporting and Non-Retaliation Policy, Insider Trading Policy, Conflicts of Interest Policy and CEO Delegation of Authority Policy.

º Report to the Board and provide to the Board such additional information and materials as it may deem necessary to make the Board aware of significant matters within its oversight role that require the attention of the Board.

º Prepares the report that is required to be included in this proxy statement attached as Appendix A. |

| Meetings in Fiscal Year 2021: 9 |

|

The Board of Directors has determined that all members of the Audit Committee are independent under the applicable rules and regulations of the NYSE and the SEC.

|

| The Board has determined that each of Mr. Mohr and Ms. Crusco is, and at all times during Fiscal Year 2021 was, an “audit committee financial expert” as defined by SEC rules. |

| | | | | |

| LEADERSHIP DEVELOPMENT AND COMPENSATION COMMITTEE |

| |

| Members: | Primary Functions and Additional Information |

ºGregg Hammann (Chair)

ºKathy Crusco

ºBrian Dexheimer

ºMarv Tseu | º Reviews with executive leadership the proper culture, leadership dynamics and performance goals for the CEO and her/his direct reports and Section 16 officers.

º Reviews culture development and evolution, including the Company's programs related to pay parity, diversity and inclusion, leadership development, strategic succession planning and talent management, review of employee recruitment, development and retention of the Company's employees.

º Evaluates and recommends for approval by the Board, as necessary, the Company's various compensation plans, policies and programs.

º Determines and approves salaries, incentives and other forms of compensation for directors, executive officers (including our CEO) and certain other highly compensated employees.

º Administers various incentive compensation and benefit plans.

º Oversees risk management in the design and implementation of our compensation plans.

º Reviews and discusses with management the proposed Compensation Discussion and Analysis disclosure and determines whether to recommend it to the Board for inclusion in our proxy statement.

º May form and delegate subcommittees when appropriate.

º Prepares the report that is required to be included in this Proxy Statement attached as Appendix B.

º See also, the section entitled "Executive Compensation" for additional information regarding our compensation policies and practices. |

| Meetings in Fiscal Year 2021: 4 |

The Board has determined that each member of the Leadership Development and Compensation Committee does, and did at all times during their respective tenures on the Leadership Development and Compensation Committee in Fiscal Year 2021, meet the requirements for independence of compensation committee members as defined by the NYSE listing standards and each member was also a non-employee director as defined under Rule 16b-3 of the Securities Exchange Act.

|

|

The LD&C Committee has delegated the authority, within guidelines it has established and as set forth in our Amended and Restated 2003 Stock Plan, to the Management Equity Committee to make equity grants to employees who are not senior executive officers. Each member of our Management Equity Committee, which consists of our CEO, our Executive Vice President and Chief Financial Officer, our Executive Vice President and Chief Human Resources Officer and our Executive Vice President, Chief Legal and Compliance Officer and Corporate Secretary, has the authority to grant restricted stock unit awards and stock options.

| | | | | |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

| |

| Members: | Primary Functions and Additional Information |

ºBrian Dexheimer (Chair)

ºRobert Hagerty*

ºGuido Jouret

ºMarv Tseu | º Assists the Board in identifying and interviewing potential additions or replacement members of the Board, to ensure that qualified director candidates with a diversity of gender, ethnicity, tenure, skills and experience are included by the Company or any search firm it engages in each pool of candidates from which Board nominees are chosen. º Assists the Board to evaluate governance risks and develops and recommends to the Board the appropriate governance guidelines for us, the Board and management. º Oversees the evaluation of the Board and management. º Recommends to the Board director nominees for each committee. º Oversees the orientation program for new directors and continuing education for directors. º Reviews the Company's policies, programs and initiatives for employee diversity and inclusion and provides guidance to the board on diversity matters. º Periodically reviews updates from the Company on significant ESG and other corporate social responsibility and sustainability initiatives, policies and practices and makes recommendations to the Board, as appropriate. |

Meetings in Fiscal Year 2021: 5

|

The Board has determined that each member of the N&CG Committee does, and did at all times during their respective tenures on the N&CG Committee in Fiscal Year 2021, meet the requirements for independence as defined by the NYSE listing standards and under the Securities Exchange Act.

|

*Effective September 8, 2020, following his resignation as Interim CEO, Mr. Hagerty rejoined the N&CG Committee.

Identification of Director Candidates; Stockholder Nominations and Recommendations; and Director Qualifications

Our N&CG Committee oversees the process for selecting director candidates, including identifying and evaluating individuals who the Committee believes are qualified to become Board members. Important criteria for Board membership include the following:

•Members of the Board should be individuals of high integrity and independence, and substantial accomplishments;

•Members of the Board should have demonstrated leadership ability, with broad experience, diverse perspectives, and the ability to exercise sound business judgment;

•The background core competencies, skills and experience of members of the Board should be in areas important to Poly's operations; and

•The composition of the Board should reflect the benefits of diversity as to gender, ethnic background, and experience.

Generally, it is the policy of the N&CG Committee to review the qualifications of and consider any director candidates who have been properly recommended or nominated by a stockholder on the same basis as candidates identified by management, individual members of the Board or, if the N&CG Committee determines, a search firm hired to identify candidates.

When evaluating a candidate, the N&CG Committee evaluates the current composition and size of the Board, the candidate's qualifications, the needs of the Board and its respective committees, and such other factors it may consider appropriate.

Following its identification of potential candidates, the N&CG Committee Chair, the Board Chair and other Board members, including our CEO, interview the prospective candidates and selects those for consideration who best suit the Board's current needs. The Board reviews such recommendations and determines submissions for election at the next annual stockholder meeting in which directors will be elected or any vacancies on the Board are filled. The Committee also focuses on overall Board-level succession planning at the director level, periodically reviews the appropriate size and composition of the Board and anticipates future vacancies and needs of the Board. In the event the N&CG Committee recommends an increase in the size of the Board or a vacancy occurs, the N&CG Committee considers qualified nominees from several sources, including current Board members and nominees recommended by stockholders and other persons.

The N&CG Committee may from time to time retain a director search firm to help the Committee identify qualified director nominees for consideration by the Committee. In 2021, the Committee retained Russell Reynolds, who recommended Ms. Zheng who joined our Board in October of 2021, and to help identify future Board candidates.

Board Refreshment

Our N&CG Committee regularly evaluates Board succession planning, including Board refreshment practices and leadership structure, to ensure that the Board and each of its standing committees include the right balance of tenured directors, who provide continuity and historical perspective, and new directors, who bring new ideas and fresh perspectives into the boardroom.

Over the past several years, we have added new independent Directors to infuse the Board with relevant experience that supports our changing business strategy and operating environment. The N&CG Committee's succession planning process is on-going and throughout the year, our N&CG Committee strives to maintain a continuous pipeline of highly qualified director candidates with particular attributes, experience and skills designed to enhance the Board’s effectiveness and to achieve the Company’s business objectives. Our commitment to board refreshment has been demonstrated through our Board's robust assessment and succession planning efforts as follows:

| | | | | |

| Independent Board Chair | Our Board Chair and Vice Chair are independent directors who bring strong, independent Board leadership and functioning. |

| Board Independence | 90%* of our Directors are independent to ensure the integration of good corporate governance practices. |

| Strong Board Diversity | Currently 30% of the board is comprised of gender or ethnically diverse Board members, demonstrating our commitment to building a diverse Board that reflects the whole breadth of our stakeholders: stockholders; customers; and employees. |

| Committee Rotation | Our Board also periodically rotates committee members to more closely align business, financial and governance expertise with committee oversight responsibilities. |

| Director Succession | Over the last several years, we have added new independent directors to infuse the Board with relevant experience and skills that support our evolving business strategy and operating environment. |

| Average Tenure | We have the right mix of tenure, with 4 out of our 9 independent directors joining us since 2018. The average tenure for our independent directors is ~ 10 years. |

| No Arbitrary Age or Term Limits | We do not impose arbitrary mandatory retirement age or term limits |

Balanced

Director Mix | The N&CG Committee annually utilizes a skills matrix to assess the capabilities of the current directors with the current needs of the Board. We believe our director nominees bring a balance of experience and fresh perspective to our boardroom, with a varied mix of strategic planning, industry background, and financial and operational expertise. |

*See "Corporate Governance - Director Independence" above for further discussion.

Board Diversity

In selecting candidates for recommendation to the Board, the N&CG Committee annually reviews the size and composition of the Board to ensure qualified director candidates with a broad diversity of professional experience, skills, backgrounds, tenure, gender, race, national origin and ethnicity are included by the Company or any search firm it engages in each pool of candidates from which the Board nominees are chosen to ensure that each director brings a different viewpoint and different skills to the Board. The Board and the N&CG Committee also believe that diversity is an important factor in reviewing and selecting qualified director candidates to serve on the Board and they, along with Poly's senior management, are committed to building a diverse, inclusive and collaborative culture and view diversity at the Board and senior management levels as an essential element in supporting the attainment of Poly's strategic objectives and its sustainable development. In considering candidates and nominees for the Board, the N&CG Committee considers the entirety of each candidate's credentials in the context of these standards and actively considers diversity in recruitment and nomination of directors, such as gender, race, ethnicity, sexual orientation, and national origin. The N&CG Committee also reviews the Company's policies, programs and initiatives for employee diversity and inclusion and provides guidance to the Board on diversity matters.

We believe our current Board composition strikes the right balance in terms of size, independence, expertise and average tenure as well as our ongoing efforts and the continued importance of diversity to the Board. For more information about our director nominees, see the section entitled "Proposal One - Election of Directors" below.

Director Commitments / No Over-boarding

Each director must ensure that other existing and anticipated future commitments do not materially interfere with her or his service to the Company. In accordance with our Corporate Governance Guidelines and our Nominating and Corporate Governance Committee Charter, the N&CG Committee considers the number of boards of directors of other public companies on which a candidate serves. Under these governance documents and to avoid "over-boarding" no director may serve on the boards of more than four additional public companies. If a director is also a named executive officer of a public company, including a chief executive officer, such director may not serve on more than two (2) public company boards, including our Board. Directors are required to advise the N&CG Committee of any invitations to join a board of any other public company prior to accepting another directorship. With respect to Audit Committee members, no member may concurrently serve on the audit committee of more than three public companies, unless our Board determines such simultaneous service and related time commitments will not impair her or his ability to effectively serve on the Audit Committee, she or he takes steps to address any related issues and we disclose that determination in our Proxy Statement. Upon the evaluation and recommendation of our N&CG Committee, our Board has determined that Ms. Crusco’s service on the audit committees of three other public companies would not impair her ability to effectively serve on our Audit Committee. Specifically, our Board believes that Ms. Crusco has satisfactory time to commit to our Audit Committee and Board responsibilities, and that the meetings of the other audit committees do not overlap with or interfere with her ability to be fully prepared and present at all of our Audit Committee meetings. Ms. Crusco attended 100% of Audit Committee and Board meetings during Fiscal Year 2021.

Proxy Access

The Company's amended and restated bylaws include "proxy access" by which eligible stockholders may nominate director candidates for inclusion in our Proxy Statement and form of proxy card. Proxy access may be used by a stockholder or a group of up to 20 stockholders, owning at least 3% of the Company's outstanding common stock continuously for at least three years to nominate and include in the Company's proxy materials director nominees constituting up to the greater of two individuals or 20% of the Board, provided that the stockholders and the nominees satisfy the conditions, including, without limitation, the advance notice requirements, specified in the bylaws. The Company believes that certain safeguards as to ownership threshold and duration of ownership are important to assure that proxy access is not misused by those without significant economic interest in the Company or those driven by short term goals.

Stockholders wishing to nominate persons for election to the Board can do so by timely filing a Nominee Solicitation Statement with our Corporate Secretary which, in accordance with our Director Candidates Nomination Policy and our bylaws, contains, among other things, certain information concerning the nominee and the stockholder nominating such nominee as set forth in our bylaws and otherwise complying with the bylaws. For a further description of the process and procedures concerning the submission of a Nominee Solicitation Statement, see "Questions and Answers About the Proxy Materials and the Annual Meeting - What is the Deadline for Receipt of Stockholder Proposals for the 2022 Annual Meeting of Stockholders" above. Additional information regarding our policies with respect to director nominations can be found in our bylaws, our Corporate Governance Guidelines and our Director Candidates Nomination Policy, all of which are posted on the Governance Portal.

Director Change in Primary Job Policy

The Board reviews the appropriateness of the continued service of directors who change their primary employment subsequent to their appointment or most recent election to the Board. If a director changes his or her primary job during his or her term of office, such director must submit a letter to the Board that (i) describes the circumstances surrounding the change; and (ii) contains an offer to resign from the Board. The Board then evaluates the circumstances surrounding the change and determines if the change will adversely affect the director's ability to perform his or her duties as a member of the Board. If so, the Board will accept the director's resignation.

Board and Committee Evaluations

Our N&CG Committee oversees the self-evaluation of the Board. In Fiscal Year 2021, we engaged outside counsel to conduct interviews with each director regarding, among other things, Board membership, structure, performance and areas for improvement. Following the interviews, the results were discussed with the Chair of the Board and presented to the full Board. While this formal self-evaluation is conducted on an annual basis, directors share perspectives, feedback and suggestions year-round.

Board Role in Risk Oversight

Our Board oversees an enterprise-wide approach to risk management, which is designed to support the achievement of long-term organizational performance and enhance stockholder value. Fundamentals of our risk management include understanding the risks we face, management's processes for managing the risks and determining our appropriate level of risk tolerance. Our management is responsible for day-to-day business risk management, including disaster and crisis management, business and financial risk, strategic risk, legal risk, corporate governance risk and compliance risk. The Board, as a whole and through its committees, has the ultimate oversight responsibility for the risk management process.

Each of the Board committees focuses on particular aspects of risk management.

The Audit Committee regularly discusses and evaluates policies concerning risk assessment and management, including our major financial, compliance, environmental, social and operational risks, including cybersecurity risks, and steps management takes to monitor and control such risks. The Audit Committee also oversees our independent registered public accounting firm and our annual audit, including reviewing our key financial risk areas with our independent auditors.

Additionally, our Head of Internal Audit, whose appointment and performance is reviewed and evaluated by the Audit Committee and who has direct reporting obligations to the Audit Committee, is responsible for leading the formal risk assessment and management process within the Company. The Internal Auditors, through consultation with the Company’s senior management, periodically assess the major risks facing the Company and work with those executives responsible for managing each specific risk. The Head of Internal Audit periodically reviews with the Audit Committee the major risks facing the Company and the steps management has taken to monitor and mitigate those risks. The Internal Auditor’s risk management report, which is provided in advance of the meeting, is reviewed with the entire Board by either the Chair of the Audit Committee or the Head of Internal Audit.

In its design of our overall compensation policies, programs and philosophy, the LD&C Committee assists the Board to manage incentives for short and long-term performance and performs an annual review of the Company’s compensation policies and practices for its employees, including pay equity, diversity and inclusion.

The N&CG Committee assists the Board to fulfill its oversight responsibilities concerning risks associated with corporate governance and Board organization, membership, structure, and succession planning for directors. This Committee reviews our corporate governance structures and recommends compliance and corporate governance principles and practices to the Board. The N&CG Committee also provides oversight of ESG activities as further described below in "Board Oversight of Environmental, Social and Governance Matters."

The M&A Committee is no longer a standing committee and will continue to meet on an ad hoc basis to advise management during various stages of mergers, acquisitions and divestitures, including early discussions and assessments as well as post-acquisition integration or post-divestiture separation activities. The M&A Committee has authority to approve management actions with regard to any potential merger, acquisition or divestiture transaction that involves $25 million or more.

Management's Role in Risk Management and Mitigation

Company's Management:

| | | | | | | | |

| • | Provides consultation to the Auditor when he or she assesses the major risks facing the Company; |

| • | Manages and mitigates risks (e.g., new cross-functional Environmental Social and Governance and Inclusion Diversity Education and Awareness committees were formed to advance diversity, social justice, equality and equity in our workplaces, and workplace safety and sustainability business practices globally); and |

| • | Reports, as needed, to the full Board on how a particular risk is being managed and mitigated, including risk identified by our Enterprise Risk Assessment. |

The Board believes that its oversight of risks, primarily through delegation to the Audit Committee, but also through delegation to other committees to oversee specific risks within their areas of responsibility and expertise, and the sharing of information with the full Board, is appropriate for a diversified technology company. The chair of each committee that oversees risk provides a summary of the matters discussed with the committee to the full Board following each committee meeting. The minutes of each committee meeting are also available to all Board members.

Board Oversight of Environmental, Social and Governance Matters

In addition to upholding high ethical standards in the ways we conduct business through our Code, we also recognize that our Company has opportunities to bring about positive environmental, social and governance impacts. Our Board is actively engaged in the oversight of Company ESG risks, policies and practices primarily through its N&CG Committee.

We are committed to creating the right kind of long-term impact in the world, not just because it matters to our employees, our customers and our investors, but because it is part of who we are as a company. We know we are part of a larger global community and make decisions as good stewards of the earth, its resources, and its people.

Fiscal Year 2020 was an important year for the Company as we developed our new Corporate and Social Responsibility ("CSR") Strategy that focused on ESG issues that we believe will positively impact our stakeholders and wider society and drive value for our business. We enhanced our CSR/ESG strategies in Fiscal Year 2021 focusing on three key priorities: delivering low carbon solutions; keeping people safe and secure; and being a destination employer. These three pillars are underpinned by strong governance and supported by our deeply-ingrained culture, values and behaviors.