UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

þ Preliminary Proxy Statement

o Confidential, for Use of the Commission only

(as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to § 240.14a-12

|

|

PLANTRONICS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

| | |

Payment of Filing Fee (Check the appropriate box) |

þ | | No fee required. |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

o | | Fee paid previously with preliminary materials. |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: |

| 2. | Form, Schedule or Registration Statement No.: |

| 3. | Filing Party: |

| 4. | Date Filed: |

PRELIMINARY PROXY MATERIALS - SUBJECT TO COMPLETION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON [l]

To our Stockholders:

Our Board of Directors is soliciting proxies for the 2020 Annual Meeting of Stockholders (the "Annual Meeting"), of Plantronics, Inc. (the "Company"). This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. We ask that you please read it carefully.

Annual Meeting Date: [l]

Time: [l]

Place: [l]

Record Date: [l]

Purpose of the Meeting:

1. Elect ten (10) directors to serve until the next annual meeting or until their successors are duly elected and qualified.

2. Approve the amendment and restatement of the Plantronics, Inc. 2002 Employee Stock Purchase Plan.

3. Approve the amendment and restatement of the Plantronics, Inc. 2003 Stock Plan.

4. Ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Plantronics, Inc. for fiscal year 2021.

5. Approve, on an advisory basis, the compensation of Plantronics' named executive officers.

6. Transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

YOUR VOTE IS IMPORTANT TO US

This year’s Annual Meeting will be a particularly important one, and YOUR vote is extremely important.

Please note that Guy Phillips (“Mr. Phillips”) has stated his intention to propose himself as a director nominee for election at the Annual Meeting. At the time he nominated himself, he held approximately 104 shares of stock and was in a short position. While we do not know whether Mr. Phillips will in fact nominate himself for election as a director at the Annual Meeting or solicit proxies, you may receive solicitation materials from Mr. Phillips seeking your proxy to vote for Mr. Phillips. Our Board of Directors unanimously recommends a vote "for" the election of each of the Board's nominees on the enclosed WHITE proxy card. Our Board of Directors urges you not to sign or return any [color] proxy card sent to you by Mr. Phillips, even as a protest vote. Even if you have previously signed a [color] proxy card sent to you by Mr. Phillips, you have every right to change your vote by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided or by voting via the Internet or telephone by following the instructions provided on the enclosed WHITE proxy card. Only your last-dated proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the accompanying Proxy Statement.

If you have any questions, or need assistance voting your shares, please contact the firm assisting us in the solicitation of proxies:

The Proxy Advisory Group, LLC

18 East 41st Street, Suite 2000

New York, New York 10017

1 (212) 616-2181

If you own shares in “street name” (that is, through a broker, bank or other nominee), we encourage you to provide voting instructions to your bank, broker or other nominee on your WHITE voting instruction form. Street name holders may also vote via telephone or the internet if their bank, broker or other nominee makes those methods available, in which case the bank, broker or other nominee will enclose the instructions on your WHITE voting instruction form along with this Proxy Statement.

BY ORDER OF THE BOARD OF DIRECTORS

|

|

/s/ Mary Huser |

Mary Huser |

Secretary |

Santa Cruz, California |

[l] |

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD [l]: THE NOTICE OF 2020 ANNUAL MEETING AND PROXY STATEMENT AND FISCAL YEAR 2020 ANNUAL REPORT ON FORM 10-K WILL BE AVAILABLE AT HTTP://INVESTOR.POLY.COM/DOCS.

TO ASSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, WE REQUEST YOU VOTE YOUR SHARES PROMPTLY. EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, WE ENCOURAGE YOU TO VOTE ON THE INTERNET AT WWW.PROXYVOTE.COM OR BY TELEPHONE 1-800-690-6903. ALTERNATIVELY, YOU MAY REQUEST A PAPER WHITE PROXY CARD, WHICH YOU MAY COMPLETE, SIGN AND RETURN BY MAIL.

TABLE OF CONTENTS

PRELIMINARY PROXY STATEMENT-SUBJECT TO COMPLETION

PROXY STATEMENT

FOR THE 2020 ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

The 2020 Annual Meeting of Stockholders (the "Annual Meeting") of Plantronics, Inc. will be held at [l] PDT on [l] at [l].

Our Board of Directors (our "Board") is soliciting proxies for the Annual Meeting. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully. Your vote is very important to us.

We have elected to provide access to our proxy materials via the Internet. Accordingly, on or about [l], we will mail a Notice of Internet Availability of Proxy Materials (the "Notice of Internet Availability") to our stockholders of record as of the close of business on [l]. On the date of mailing of the Notice of Internet Availability, all of the proxy materials will be made available free of charge on the website referred to in the Notice of Internet Availability. The Notice of Internet Availability will provide instructions on how you may view the proxy materials for the Annual Meeting on the Internet and how you may request a paper copy or email of such materials.

Please follow the instructions provided in the Notice of Internet Availability, or on the WHITE proxy card, if you plan to attend the Annual Meeting in person.

We are incorporated in the State of Delaware under the name Plantronics, Inc. In March 2019, we announced our re-branding under which we will market ourselves as "Poly" although we continue to retain "Plantronics, Inc." as our corporate name. We will refer to ourselves as the "Company" throughout this Proxy Statement or "Plantronics," when appropriate. Our principal executive offices are located at 345 Encinal Street, Santa Cruz, California 95060. Our telephone numbers are (831) 426-5858 and (800) 544-4660. Our website is www.poly.com.

Background to Proxy Solicitation

On March 6, 2020, Guy Phillips ("Mr. Phillips") delivered notice of an intent to nominate himself for election to our Board at the Annual Meeting. We do not know whether Mr. Phillips will in fact nominate himself for election as a director at the Annual Meeting or solicit proxies.

We believe that our ten nominees have the right experience, have a deep understanding of our Company and its markets, and are more capable than Mr. Phillips to lead our Company forward. We believe that Mr. Phillips as a nominee would not add additional skills or diversity to the Board as his stated skill sets are already well represented among our ten candidates.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

AND THE ANNUAL MEETING

Who can vote?

Our Board has set [l] as the record date for the Annual Meeting (the "Record Date"). All stockholders of record who owned shares of our common stock at the close of business on the Record Date may attend and vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of common stock held on each of the matters to be voted. Stockholders may not cumulate their votes for the election of directors. At the close of business on the Record Date, there were [l] shares of our common stock outstanding.

How many votes are required to conduct business at the Annual Meeting?

The required quorum for the transaction of business at the Annual Meeting is the presence in person or by proxy of a majority of shares of common stock issued and outstanding on the Record Date. Shares voted "FOR," "AGAINST" or "ABSTAIN" and broker non-votes, if any, with respect to any proposal are treated as being present at the Annual Meeting for purposes of establishing a quorum.

How are abstentions and broker non-votes treated?

Shares voted "ABSTAIN" are counted as present and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting.

Under our bylaws, abstentions, if any, and broker non-votes are not counted as “votes cast” in the election of directors and, therefore, they will have no effect on Proposal One, Election of Directors.

For Proposal Two, Approval of the Amendment and Restatement of the 2002 Employee Stock Purchase Plan, Proposal Three, Approval of the Amendment and Restatement of the 2003 Stock Plan, Proposal Four, Ratification of Appointment of Independent Registered Public Accounting Firm, and Proposal Five, Advisory Vote to Approve Named Executive Officer Compensation, respectively, an abstention is counted as a vote AGAINST the applicable proposal.

A broker non-vote occurs when a nominee holding shares for a beneficial owner is not permitted to vote on a particular proposal because such proposal is deemed non-routine, meaning that the nominee does not have discretionary voting power with respect to that item, and the nominee has not received instructions from the beneficial owner. Proposal Four, Ratification of Appointment of Independent Registered Public Accounting Firm, is the only routine matter for which nominees may have discretionary voting power. Broker non-votes are not treated as votes cast and therefore will have no effect on the outcome of the vote on any of the proposals included in this Proxy Statement.

However, if a nominee mails Mr. Phillips' proxy materials to the accounts of the underlying beneficial owners, then, notwithstanding the prior paragraph, such nominee will not be able to exercise its discretion to vote with respect to such accounts on any of the proposal at the Annual meeting.

How many votes are required to approve a proposal?

For Proposal One, Election of Directors, directors will be elected by a vote of a majority of the votes cast with respect to each nominee. In this context, a majority of the votes cast means that the number of votes “FOR” a nominee must exceed the number of votes cast “AGAINST” the nominee. However, our bylaws provide that directors will be elected by the vote of a plurality of the votes cast at any stockholder meeting where (1) our Corporate Secretary receives a notice of a stockholder’s intention to nominate a person or persons for election to the Board in compliance with our bylaws and (2) such nomination has not been withdrawn by such stockholder on or before the 14th day preceding the date that we first mail our notice of meeting for such stockholder meeting. Accordingly, it is possible that directors will be elected by plurality vote at the Annual Meeting. This means that the ten candidates receiving the most votes will be elected.

For Proposal Two, Approval of the Amendment and Restatement of the 2002 Employee Stock Purchase Plan, Proposal Three, Approval of the Amendment and Restatement of the 2003 Stock Plan, Proposal Four, Ratification of Appointment of Independent Registered Public Accounting Firm, and Proposal Five, Advisory Vote to Approve Named Executive Officer Compensation, respectively, approval by a majority of votes present in person or represented by proxy and entitled to vote is required.

The vote on Proposal Five is advisory and, therefore, not binding on us, the Board or the Leadership Development and Compensation Committee of the Board (the "LD&C Committee"). The Board and the LD&C Committee value the opinions of our stockholders and will take the vote of stockholders on Proposal Five into account in their evaluation of the design and philosophy of our executive compensation program.

How does the board recommend I vote on each of the proposals?

The Board recommends that you vote:

|

| | | |

PROPOSALS | BOARD'S RECOMMENDATION | PAGE REFERENCE (for more detail) |

1 | To elect ten (10) directors to serve until the next annual meeting or until their successors are duly elected and qualified. | FOR each nominee of the Board | 18-26 |

2 | To approve the amendment and restatement of the Plantronics, Inc. 2002 Employee Stock Purchase Plan. | FOR | 27-30 |

3 | To approve the amendment and restatement of the Plantronics, Inc. 2003 Stock Plan. | FOR | 31-38 |

4 | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for fiscal year 2021. | FOR | 39-40 |

5 | To approve, on an advisory basis, the compensation of the Company's named executive officers. | FOR | 41 |

Please note that Mr. Phillips has stated his intention to nominate himself as a director nominee for election at the Annual Meeting of Stockholders. While we do not know whether Mr. Phillips will in fact nominate himself for election as a director at the Annual Meeting, you may receive solicitation materials from Mr. Phillips seeking your proxy to vote for Mr. Phillip. THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE BOARD'S NOMINEES ON THE ENCLOSED WHITE PROXY CARD AND URGES YOU NOT TO SIGN OR RETURN OR VOTE ANY PROXY CARD THAT MAY BE SENT TO YOU BY MR. PHILLIPS.

If you have already voted using a proxy card sent to you by Mr. Phillips, you can subsequently revoke it by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided or by voting via the internet or by telephone by following the instructions provided on the enclosed WHITE proxy card. Only your last-dated proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the Proxy Statement.

Signing and returning any proxy card that Mr. Phillips sent to you, even to vote against a proposal or vote “withhold” with respect to Mr. Phillips, will cancel any previous vote you cast and may invalidate any votes you have cast for our Board’s nominees as only your latest dated proxy card or voting instruction form will be counted.

We are not responsible for the accuracy of any information provided by or relating to Mr. Phillips contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Mr. Phillips or any other statements that Mr. Phillips may otherwise make. Mr. Phillips chooses which of our stockholders will receive his proxy solicitation materials.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Set forth below are certain distinctions between stockholders of record and those whose shares are owned beneficially or in "street name":

Stockholder of Record. If your shares are registered directly in your name with Computershare Trust Company, N.A., our transfer agent, then you are considered the stockholder of record with respect to those shares and the Notice of Internet Availability is being sent directly to you by us. As the stockholder of record, you may grant your voting proxy directly to the proxyholders nominated by the Board and named in the WHITE proxy card distributed to you concurrently with this Proxy Statement (the "Proxyholders") or you may vote in person at the Annual Meeting. The Board has named Robert Hagerty, Charles Boynton and Mary Huser as the Proxyholders for the Annual Meeting.

Beneficial Owner. Most of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. If your shares are held in a stock brokerage account or by a bank or other nominee, then you are considered the beneficial owner of shares held in "street name," and the Notice of Internet Availability is being forwarded to you by your broker, bank or nominee. The Notice of Internet Availability contains instructions on how to vote your shares and request a paper copy of the proxy materials. As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote on matters at the Annual Meeting and are also invited to attend the Annual Meeting; however, you may not cast a vote at the Annual Meeting without signed authorization from your broker, bank or nominee in the form of a legal proxy.

Can I vote my shares in person at the Annual Meeting if I have already voted or submitted a proxy for my shares?

You may attend the Annual Meeting and vote in person even if you have already voted or submitted a proxy. Please be aware that attendance at the Annual Meeting will not, by itself, revoke your proxy. If a bank, broker or other nominee holds your shares in "street name" and you wish to attend the Annual Meeting and vote in person, you must obtain a legal proxy from that record holder of your shares giving you the right to vote your shares at the Annual Meeting.

If you choose to vote in person at the Annual Meeting either as a stockholder of record or as a holder in "street name", then please bring satisfactory proof of identification to the Corporate Secretary on the day of the Annual Meeting.

EVEN IF YOU CURRENTLY PLAN TO ATTEND AND VOTE AT THE ANNUAL MEETING, WE RECOMMEND YOU ALSO SUBMIT YOUR PROXY AS DESCRIBED BELOW SO THAT YOUR SHARES WILL BE VOTED ACCORDING TO YOUR INSTRUCTIONS IF YOU LATER DECIDE NOT TO ATTEND.

How can I vote?

Stockholder of Record. Registered stockholders may vote in person at the Annual Meeting or by one of the following methods:

|

| | | |

INTERNET | PHONE | MAIL | IN PERSON |

| | | |

Go to: www.proxyvote.com or follow the instructions on the Notice of Internet Availability. | Call toll-free: 1-800-690-6903 | Request a WHITE proxy card from us and cast your vote by completing, signing and dating the WHITE card where indicated and by thereafter timely mailing or otherwise returning the card in the enclosed, prepaid, pre-addressed envelope. | Attend the Annual Meeting in person. We will provide you with a ballot when you arrive. |

Please note that the Internet and telephone voting facilities for registered stockholders will close at 8:59 PM Pacific Daylight Time on [l]. If you are voting by WHITE proxy card, then it must be mailed in time to be received in time to be counted at the Annual Meeting.

Beneficial Owner. If your shares are held by a broker, bank or other nominee, you must follow the instructions you receive from your broker, bank or other nominee in a timely manner to ensure your vote is cast. Please follow their instructions carefully. Also, please note that if the holder of record of your shares is a broker, bank or other nominee, and you wish to vote at the Annual Meeting, you must request from them a signed authorization in the form of a legal proxy. To vote your shares at the Annual Meeting, you must present that legal proxy and satisfactory proof of identification to the Corporate Secretary.

Subject to instructions provided by your broker, bank or other nominee, as a beneficial owner you may typically vote by one of the following methods:

|

| | |

MAIL | METHODS LISTED ON THE VOTING INSTRUCTION CARD | IN PERSON WITH A LEGAL PROXY FROM THE RECORD HOLDER |

|  or or  | |

If you requested printed copies of the proxy materials to be mailed to you, you may vote by completing, signing, dating and timely returning your voting instruction card in the enclosed prepaid, pre-addressed envelope. | Refer to the materials provided by your bank, broker or other nominee, to determine whether you may vote by telephone or via the Internet, and timely follow such instructions. | Obtain signed authorization in the form of a legal proxy from your bank, broker or other nominee to cast your vote in person at the Annual Meeting. Please consult the materials provided by your bank, broker or other nominee to determine how to timely obtain a legal proxy. |

All shares entitled to vote and that are represented by properly and timely completed and delivered proxies that are not properly revoked before the Annual Meeting will be voted at the Annual Meeting, as instructed. If you are a stockholder of record and timely submit a properly signed and dated WHITE proxy but do not indicate how your shares should be voted on a matter, then the shares represented by your returned proxy will be voted as the Board recommends.

What should I do if I receive proxy materials from Mr. Phillips?

Our Board does NOT endorse Mr. Phillips for election as a director and urges you to vote using the WHITE proxy card. Our Board urges you NOT to vote any [color] proxy card sent to you by Mr. Phillips.

Voting to “withhold” with respect to Mr. Phillips on his [color] proxy card is not the same as voting for our Board’s nominees. This is because a vote to “withhold” with respect to Mr. Phillips on his [color] proxy card will revoke any previous proxy submitted by you. Do not return any [color] proxy card sent to you by Mr. Phillips, even as a protest vote.

If you have already voted using a [color] proxy card sent to you by Mr. Phillips, you have every right to change your vote. We urge you to revoke that proxy by voting in favor of our Board’s nominees by using the enclosed WHITE proxy card. Only the latest-dated and validly executed proxy that you submit will count. If you hold your shares in an account at a bank, broker, dealer or other nominee, follow the instructions provided by your nominee to change your vote.

What happens if additional proposals are presented at the Annual Meeting?

Except for the proposals described in this Proxy Statement, we do not expect any other matters to be presented for a vote at the Annual Meeting. If you grant a proxy, the persons named as Proxyholders will have the discretion to vote your shares on additional matters, if any, properly presented for a vote at the Annual Meeting to the extent authorized by Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended (the "Securities Exchange Act"). Under our bylaws, the deadline has passed for notifying us of additional proposals to be presented at the Annual Meeting by stockholders.

Can I change my vote?

You may change your proxy instructions at any time prior to the vote at the Annual Meeting. For shares held directly in your name, you may change your vote by (i) executing a new WHITE proxy bearing a later date (which automatically revokes the earlier proxy) and delivering it to the Corporate Secretary at our principal executive office located at 345 Encinal Street, Santa Cruz, California 95060 prior to the vote at the Annual Meeting; (ii) voting again on a later date via the Internet or by telephone (however, only your latest proxy timely submitted prior to the Annual Meeting will be counted); (iii) advising the Corporate Secretary that you revoke your proxy by providing notice at our principal executive office at the address stated above, in writing, before the vote at the Annual Meeting; or (iv) attending the Annual Meeting and voting in person. For shares you hold beneficially, you may change your vote by timely submitting new voting instructions to your broker, bank or other nominee. Attendance at the Annual Meeting, without casting a vote, will not cause your previously granted proxy to be revoked.

If you have already voted using a proxy card sent to you by Mr. Phillips, you can subsequently revoke it by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided or by voting via the internet or by telephone by following the instructions provided on the enclosed WHITE proxy card. Only your last-dated proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the Proxy Statement.

What happens if I do not cast a vote?

With respect to the proxy solicitation for the Annual Meeting, because of the potentially contested nature of this year’s solicitation, all of the proposals on the agenda, except the ratification of the appointment of our independent registered public accounting firm, will be considered non-routine matters, and accordingly, your broker will not have discretion to vote your shares on any proposal presented at the Annual Meeting unless you provide specific instructions to your broker as to how your shares are to be voted. If you hold your shares in "street name" and you do not instruct your broker, bank or other nominee how to vote, your broker will not have discretion to vote your shares. No other votes will be cast on your behalf. If you are a stockholder of record and fail to timely return your proxy or vote at the Annual Meeting, no votes will be cast on your behalf on any of the items of business at the Annual Meeting. If you are a stockholder of record and you return, in a timely manner, a properly executed WHITE proxy without indicating how you wish to vote, your shares will be voted in accordance with the Board’s recommendations.

How can I request materials or information referred to in these questions and answers?

You may contact us:

Plantronics, Inc.

345 Encinal Street

Santa Cruz, California 95060

Attn: Investor Relations

| |

• | By calling (831) 426-5858 and asking for Investor Relations |

We encourage you to conserve natural resources and reduce printing and mailing costs by using electronic delivery of stockholder communications materials. If you have questions about electronic delivery, please call our Investor Relations office at the number above. To sign up for electronic delivery:

Stockholder of Record. If you are a stockholder of record (you hold Company shares in your own name through our transfer agent, Computershare Trust Company, N.A., or you have stock certificates), visit www.proxyvote.com to enroll.

Beneficial Owner. If you are a beneficial owner (your Company shares are held by a broker, bank or other nominee), visit www.proxyvote.com to learn more about your electronic delivery options and enroll.

What is "householding"?

We generally send a single Notice of Internet Availability and other stockholder communications to households at which two or more stockholders reside unless we receive contrary instructions. This process is called "householding." If your Notice of Internet Availability is being householded and you wish to receive separate copies, or, if you are receiving multiple copies and would like to receive a single copy, contact our Investor Relations office by mail, telephone or email, as described above. If you would like to opt out of this practice for future mailings, please contact us at Plantronics, Inc., 345 Encinal Street, Santa Cruz, California 95060, Attn: Investor Relations, or by phone at (831) 426-5858 and ask for Investor Relations.

What is the deadline for receipt of stockholder proposals for the 2021 Annual Meeting of Stockholders?

You may present proposals for action at a future stockholder meeting only if you comply with the requirements of the proxy rules established by the Securities and Exchange Commission (the "SEC") and our bylaws. For a stockholder proposal to be included in our Proxy Statement and form of proxy for our 2021 Annual Meeting of Stockholders (the "2021 Annual Meeting") under rules adopted under the Securities Exchange Act of 1934, we must receive the proposal no later than [l].

Stockholders wishing to present business at an annual meeting may do so by filing with the Corporate Secretary a "Business Solicitation Statement," containing, among other things, certain information about the business the stockholder intends to bring before the annual meeting and the stockholder proposing such business. Stockholders wishing to nominate a director for election to the Board may do so by filing with the Corporate Secretary a "Nominee Solicitation Statement" containing, among other things, certain information about the nominee and the stockholder nominating such nominee.

For our 2021 Annual Meeting, the Business Solicitation Statement or the Nominee Solicitation Statement, as applicable, must be filed with our Corporate Secretary not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the one-year anniversary of the preceding year's annual meeting of stockholders. In the event that no annual meeting was held in the previous year, or if the date of the annual meeting is advanced by more than 30 days prior to or delayed by more than 60 days after the one-year anniversary of the date of the previous year's annual meeting, then, for notice by the stockholder to be timely, it must be received by the Corporate Secretary not later than the 10th day following the day on which a public announcement (as described in the bylaws) of the date of such meeting is first made by us.

Our bylaws contain additional details about requirements for the Business Solicitation Statement and the Nominee Solicitation Statement as well as certain procedural requirements for the proposal of business and the nomination of directors. You should also review our Corporate Governance Guidelines and our Director Candidates Nomination Policy which contain additional information about the nomination of directors. Our bylaws, Corporate Governance Guidelines and Director Candidates Nomination Policy are available on the Corporate Governance portal of the Investor Relations section of our website at http://investor.poly.com/govdocs (the "Governance Portal").

On December 13, 2019, the Company amended its bylaws to permit "proxy access" by which eligible stockholders may nominate director candidates for inclusion in our Proxy Statement and WHITE proxy card. Proxy access may be used by a stockholder or a group of up to 20 stockholders, owning at least 3% of the Company's outstanding common stock continuously for at least three years to nominate and include in the Company's proxy materials director nominees constituting up to the greater of two individuals or 20% of the Board, provided that the stockholders and the nominees satisfy the conditions, including, without limitation, the advance notice requirements, specified in the bylaws. The Company believes that certain safeguards as to ownership threshold and duration of ownership are important to assure that proxy access is not misused by those without significant economic interest in the Company or those driven by short term goals.

What is the date of our fiscal year end?

Our fiscal years end on the Saturday closest to March 31. Fiscal years 2020, 2019, and 2018 each had 52 weeks and ended on March 28, 2020, March 30, 2019 and March 31, 2018, respectively. For purposes of consistent presentation, we have indicated in this report that each fiscal year ended "March 31" of the given year, even though the actual fiscal year end was on a different date. Some of the information provided herein is stated as of the end of our fiscal year 2020 and some information is provided as of a more current date in accordance with applicable legal requirements.

How will proxies be solicited and who will pay the cost of that?

The solicitation of proxies is made on behalf of our Company and all the expenses of soliciting proxies from stockholders will be borne by our Company. In addition to the solicitation of proxies by use of the mail, directors, officers and regular employees of our Company may communicate with stockholders personally or by email, telephone, or otherwise for the purpose of soliciting such proxies. No additional compensation will be paid to any such persons for such solicitation, although we may reimburse them for reasonable out-of-pocket expenses incurred in connection with such solicitation. We will reimburse banks, brokers, dealers and other nominees for their reasonable out-of-pocket expenses in forwarding solicitation material to beneficial owners of shares held of record by such persons.

As a result of the proxy contest initiated by Mr. Phillips, we may incur additional costs in connection with the solicitation of proxies. We have engaged The Proxy Advisory Group, LLC to assist in the solicitation of proxies and provide related advice and informational support, for a service fee and the reimbursement of customary disbursements, which are not expected to exceed $50,000 in total. That firm expects that approximately 15 of its employees will assist in the solicitation. Our expenses related to the solicitation of proxies from stockholders this year may substantially exceed those normally spent for an annual meeting of stockholders. Such additional costs are expected to aggregate to approximately $[l]. These additional solicitation costs are expected to include: the fee payable to our proxy solicitor; fees of outside counsel to advise our Company in connection with a contested solicitation of proxies; increased mailing costs, such as the costs of additional mailings of solicitation material to stockholders, including printing costs, mailing costs and the reimbursement of reasonable expenses of banks, brokerage houses and other agents incurred in forwarding solicitation materials to beneficial owners of common stock; and the costs of retaining an independent inspector of election.

Who should I contact if I have questions?

If you have any questions, or need assistance voting your shares, please contact the firm assisting us in the solicitation of proxies:

The Proxy Advisory Group, LLC

18 East 41st Street, Suite 2000

New York, New York 10017

1 (212) 616-2181

CORPORATE GOVERNANCE

Strong corporate governance is an integral part of our core values. Our Board is committed to good corporate governance practices and seeks to represent stockholders' best interest through the exercise of sound judgment. To achieve this, the Board has established corporate governance policies and procedures which provide the framework for the governance of the Board and the Company and are available on the Governance Portal. The Governance Portal includes the Corporate Governance Guidelines, Access to Board of Directors Policy, Director Candidates Nomination Policy, Bylaws, Board Committee Charters, Code of Conduct and the link to Report Accounting Issues for reporting issues regarding accounting, internal accounting controls, auditing and other business conduct. These policies are also available in print to any stockholder by making a written request addressed to Plantronics, Inc., 345 Encinal Street, Santa Cruz, California 95060, Attn: Investor Relations.

|

| | |

Corporate Governance Highlights |

7 of 10 of our director nominees are independent | | Appointed Lead Independent Director and established the Lead Independent Charter |

100% independent Board committees | | Annual election of directors |

Regular director executive sessions without the presence of management | | Board oversees an enterprise-wide approach to risk oversight and management |

Annual review of CEO's performance | | Annual say-on-pay stockholder advisory vote |

Significant portion of Named Executive Officer compensation is tied to performance stock unit awards and cash bonus programs | | Double-trigger change-in-control benefits |

Annual Board performance evaluations | | Anti-hedging, anti-short sale and anti-pledging policies applicable to all employees and directors |

Succession planning for the CEO and key executive officers | | Clawback policy for performance-based incentive compensation payments made to executives |

Limits on director and CEO public company board service | | No guaranteed bonuses |

Majority vote standard in uncontested elections with a director resignation policy | | No tax gross ups to executives on any benefits or in relation to a change in control |

Independent compensation consultant | | Robust stock ownership guidelines for directors and executive officers |

Bylaws providing proxy access and rights to call special meeting | | Commitment to environmental, social and governance ("ESG") risks, policies and practices |

Code of Conduct

We have a Code of Conduct (the "Code") that applies to all employees, our executive officers, and directors. Any modification or waiver of any provision of the Code for a director or executive officer must be approved in writing by the Board. If required under applicable law, modifications and waivers will be promptly disclosed to our stockholders by posting on our website. For further information see the Governance Portal.

Ethics Hotline Policy

Our Audit Committee has established an ethics hotline and website available to all employees, stockholders, and the general public for the anonymous submission of suspected legal, ethical or other violations including accounting, internal controls, auditing matters and other business conduct at the Company. For further information see the Code or Report Accounting Issues link on the Governance Portal.

Directors and Committee Members

The names of, and certain information about, the members of our Board and its committees as of [l] are:

|

| | | | | | | | | | | | |

Name of Director | | Board | | Audit | | Leadership Development and Compensation | | Nominating and Corporate Governance | | Strategy | | Mergers and Acquisitions |

Robert Hagerty(1) | | Chairman and Interim Chief Executive Officer | | | | | |

| |

| |

|

Marv Tseu(2) | | Vice Chairman / Lead Independent Director | | Member | | Member | | Member | | Member | | Member |

Frank Baker | | Member | | | | | | | | | | |

Kathy Crusco(3) | | Member | | Member | | Member | | | | | | |

Brian Dexheimer | | Member | |

| | Member | | Chair | | Chair | | Member |

Gregg Hammann | | Member | | Member | | Chair | | | | | | Member |

John Hart | | Member | | | | Member | | Member | | Member | | |

Guido Jouret(4) | | Member | | | | | | Member | | Member | | |

Marshall Mohr | | Member | | Chair | | | | | | | | Member |

Daniel Moloney | | Member | | | | | | | | | | |

| |

(1) | Effective February 10, 2020, Mr. Hagerty was appointed as the Company's interim Chief Executive Officer ("Interim CEO") and retained his position as Chairman of the Board ("Chairman"). Upon the recommendation of the Nominating and Corporate Governance Committee ("NCG Committee"), the Board approved the resignation of Mr. Hagerty as a member of the NCG Committee and Strategy Committee and as Chair of the Mergers and Acquisitions Committee ("M&A Committee") as a result of his appointment as Interim CEO, until his successor is duly appointed or as otherwise determined by the Board. |

| |

(2) | Effective February 10, 2020, Mr. Tseu retained his position as Vice Chairman of the Board ("Vice Chairman") and was appointed as the Board's lead independent director ("Lead Independent Director"). |

| |

(3) | Effective October 1, 2019, Ms. Crusco was appointed to the LD&C Committee. |

| |

(4) | Effective October 1, 2019, Mr. Jouret was appointed to the NCG Committee. |

Director Independence

The Board has determined that, except for Robert Hagerty (who was appointed as our Interim CEO on February 10, 2020), Frank Baker and Daniel Moloney, none of our other directors holding office as of [l], has a material relationship with the Company (directly or indirectly through applicable relatives as a partner, stockholder, or officer of an organization that has a relationship with the Company), other than as a director of the Company. The Board has further determined that all of our current directors other than Messrs. Hagerty, Baker and Moloney are independent under the listing rules of the New York Stock Exchange ("NYSE").

In connection with our purchase of all of the issued and outstanding shares of capital stock of Polycom, Inc. ("Polycom") pursuant to a Stock Purchase Agreement ("Purchase Agreement") entered into with Polycom and Triangle Private Holdings II, LLC ("Triangle") on March 28, 2018, (the "Acquisition"), we issued 6,352,201 shares of our common stock and entered into a Stockholder Agreement ("Stockholder Agreement") with Triangle on July 2, 2018. Among the terms of the Stockholder Agreement, we were obligated to appoint two individuals selected by Triangle to our Board on July 2, 2018 and remain obligated to continue to nominate up to two individuals selected by Triangle for election to our Board and use commercially reasonable efforts to cause the election or appointment, as applicable, of each such individual to our Board based on Triangle's continuing ownership of our common stock and the overall size of the Board.

On February 10, 2020, the Board approved an amendment dated as of February 10, 2020 (the "Amendment") to the Stockholder Agreement. The Amendment provided that Triangle and its affiliates may purchase additional shares of the Company's common stock in open market transactions, including broker transactions or block trades, so long as immediately following any such purchase Triangle's percentage ownership interest in the Company does not exceed 19.99%. In addition, any shares so purchased will be deemed "Shares" under the Agreement and Triangle may request that the Company register such Shares under the Securities Act of 1933. The Amendment also provided that any such Shares purchased shall be subject to the "Lock-Up Restriction" until the two (2) year anniversary of the date of the Stockholder Agreement. To this end, on February 25, 2020, Triangle filed Amendment No.2 to Schedule 13D ("Amendment No. 2") in which Triangle disclosed that it had expended an aggregate of approximately $10,448,918 to acquire the 750,000 shares of the Company's common stock, all of which were acquired in open-market, broker transactions using cash on hand.

Messrs. Baker and Moloney were the individuals initially selected by Triangle and approved by our Board pursuant to the Stockholder Agreement and each has been selected by Triangle to serve an additional term with the approval and renomination by our Board. Mr. Baker is a co-founder and managing partner, and Mr. Moloney serves as an executive partner, of Siris Capital Group, LLC ("Siris"). Siris indirectly controls Triangle, and as of [l], Triangle controls approximately 17.8% of our outstanding common stock.

Pursuant to the Stockholder Agreement, Messrs. Baker and Moloney are bound by certain confidentiality obligations with respect to the sharing of information with others at Siris. Messrs. Baker and Moloney are permitted to disclose confidential company information to the partners, chief financial officer, general counsel and principals of Siris, subject to Siris and us entering into a mutually acceptable confidentiality agreement. In addition, Siris and its affiliates (including Messrs. Baker and Moloney) have the right to, and are not prohibited (contractual, fiduciary, or otherwise) from, directly or indirectly, engaging in any business, business activity or line of business, including those that are the same as us or compete against us. In addition, Messrs. Baker and Moloney are not obligated to present potential business opportunities to us unless such an opportunity arises solely as a result of their service as a director, officer, or employee of our Company. However, under the Purchase Agreement, if Triangle or its affiliates propose to enter into any non-disclosure agreement, indication of interest, letter of intent or similar agreement (other than with regard to the sale of a portfolio company) with certain of our competitors, then we may direct any conflicted member of our Board that was selected for appointment or nomination by Triangle to resign from our Board.

Based on the Board's review of their independence, including the business relationships between us and Siris as further described in "Certain Relationships and Related Transactions" (including the Acquisition), the Board has determined that Messrs. Baker and Moloney are not independent at this time.

Board Leadership Structure

Our Corporate Governance Guidelines require that the roles of Chairman and the CEO be separate. Historically, the Company has had different persons serving in these positions. The Chairman is, at all times, selected from our independent non-employee directors. Notwithstanding the foregoing, if at any time the CEO either resigns or is terminated, or otherwise is not able to perform the function, as the Company's CEO for any reason, then the Board may appoint the Chairman or another Board member to act as an Interim CEO, and in such event, the offices of the Chairman and the CEO may be held by the same person until such times as a replacement CEO is appointed. In such event, the Board is required to appoint, as soon as reasonably practicable, a non-employee Director to serve as the Board's Lead Independent Director to perform the functions as described in the Company's Lead Independent Director Charter (located on the Governance Portal) for the period of time that the Chairman and CEO positions remain combined.

Since March 2018, Robert Hagerty has served as Chairman and Marv Tseu has served as our Vice Chairman, after having previously served as Chairman since 1999. On February 7, 2020, the Company announced that the Board and Mr. Burton had reached a mutual decision to terminate Mr. Burton's role as the Company's President and CEO. On February 10, 2020, Mr. Hagerty was appointed as the Company's Interim CEO and retained his position as Chairman thereby effectively combining the roles of CEO and Chairman on this interim basis. On that same date, the Board appointed Mr. Tseu to serve as the Company's Lead Independent Director. In his capacity as Chairman, Mr. Hagerty, in consultation with Mr. Tseu and other directors, approves the agenda for Board meetings and chairs all regular meetings of the Board, and may attend all committee meetings. Mr. Tseu manages the board agenda, presides at executive sessions of the directors, and oversees overall board strategy and execution. The Board has determined that this structure of corporate governance, on an interim basis of a combined CEO and Chairman, and a separate Vice Chairman and Lead Independent Director, is appropriate for us at this time and believes it is considered a good governance practice by our stockholders. It allows the Interim CEO/Chairman to focus on the overall strategy and execution of our business and the Vice Chairman/Lead Independent Director to focus the Board on our governance, including management of the Board agenda and overseeing our strategy and execution. The Board periodically reviews its leadership structure and reserves the right to change accordingly. The Company intends to resume the separation of these roles upon the appointment of the next CEO.

A key responsibility of the Board is ensuring that an effective process is in place to provide continuity of leadership over time at all levels within the Company. Annually, the Board conducts a review on succession planning. During this review, the Board may discuss a variety of topics, including future candidates for senior leadership positions, succession timing for those positions, and development plans for candidates believed to have the highest potential. The Board or any of the directors may identify, evaluate or nominate potential successors to the CEO and may similarly do so for other senior leadership positions. This process promotes continuity of leadership over the long-term and forms the basis on which we make ongoing leadership assignments.

Board Meetings and Committees

The Board held 4 regular meetings and 7 special meetings during fiscal year 2020. The directors met 6. times in executive session without the CEO present. During each member's tenure on the Board in the last fiscal year, each director attended more than 75% of the aggregate number of Board and applicable Committee meetings during fiscal year 2020.

Our Board is responsible for providing oversight over the Company's business, including the strategic direction, as well as the management and financial and operational execution to best support the business for long-term success. To effectively support all of its responsibilities, the Board has five standing committees: an Audit Committee, a LD&C Committee, a NCG Committee, a Strategy Committee and a M&A Committee, each of which is described below. See the table in the section "Directors and Committee Members" above for a listing of the members and chairs of each committee. Each of the standing committees other than the M&A Committee has adopted a written charter that is available on the Governance Portal. This information is also available in print to any stockholder who makes a request to Plantronics, Inc., 345 Encinal Street, Santa Cruz, California 95060, Attn: Investor Relations.

|

| |

AUDIT COMMITTEE |

| |

Members: | Primary Functions and Additional Information |

ºMarshall Mohr (Chair) ºKathy Crusco ºGregg Hammann ºMarv Tseu | ºOversees the accounting and financial reporting processes of the Company and audits of the consolidated financial statements, including overseeing the audit functions.

ºReviews the independence and performance of our independent registered public account firm and our internal auditors.

ºAssists the Board in oversight and monitoring of legal and regulatory requirements.

ºOversees the Company's ethical compliance program; including oversight of the Company's Code of Conduct and Ethics Reporting and Non-Retaliation Policy, Insider Trading Policy and Conflicts of Interest Policy.

ºReport to the Board and provide to the Board such additional information and materials as it may deem necessary to make the Board aware of significant matters within its oversight role that require the attention of the Board.

ºPrepares the report that is required to be included in this proxy statement attached as Appendix A. |

Meetings in Fiscal Year 2020: 8 |

|

The Board of Directors has determined that all members of the Audit Committee are independent under the applicable rules and regulations of the NYSE and the SEC.

|

The Board has determined that each of Mr. Mohr and Ms. Crusco is, and at all times during Fiscal Year 2020 were, an “audit committee financial expert” as defined by SEC rules. |

|

| | |

| | LEADERSHIP DEVELOPMENT AND COMPENSATION COMMITTEE |

| | | |

| | Members: | Primary Functions and Additional Information |

| | ºGregg Hammann (Chair) ºKathy Crusco* ºBrian Dexheimer ºJohn Hart ºMarv Tseu | ºReviews with executive leadership the proper culture, leadership dynamics and performance goals for the CEO and their direct reports and Section 16 officers.

ºReviews culture development and evolution, including the Company's programs related to pay parity, diversity and inclusion, leadership development, strategic succession planning and talent management, review of employee recruitment, development and retention of the Company's employees.

ºEvaluates and recommends for approval by the Board, as necessary, the Company's various compensation plans, policies and programs.

ºDetermines and approves salaries, incentives and other forms of compensation for directors, executive officers (including our CEO) and certain other highly compensated employees.

ºAdministers various incentive compensation and benefit plans.

ºOversees risk management in the design and implementation of our compensation plans.

ºReviews and discusses with management the proposed Compensation Discussion and Analysis disclosure and determines whether to recommend it to the Board for inclusion in our proxy statement.

ºMay form and delegate subcommittees when appropriate.

ºPrepares the report that is required to be included in this Proxy Statement attached as Appendix B.

ºSee also, the section entitled "Executive Compensation" for additional information regarding our compensation policies and practices. |

| | Meetings in Fiscal Year 2020: 5

|

| | The Board has determined that each member of the Leadership Development and Compensation Committee does, and did at all times during their respective tenures on the Leadership Development and Compensation Committee in fiscal year 2020, meet the requirements for independence of compensation committee members as defined by the NYSE listing standards and each member was also a non-employee director as defined under Rule 16b-3 of the Securities Exchange Act.

|

| |

*Effective October 1, 2019, Ms. Crusco was appointed to the LD&C Committee.

The LD&C Committee has delegated the authority, within guidelines it has established and as set forth in our Amended and Restated 2003 Stock Plan, to the Management Equity Committee to make equity grants to employees who are not senior executive officers. Each member of our Management Equity Committee, which consists of our CEO, our Executive Vice President and Chief Financial Officer, our Executive Vice President and Chief Human Resources Officer and our Executive Vice President, Chief Legal and Compliance Officer and Corporate Secretary, has the authority to grant restricted stock unit awards and stock options.

|

| |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

| |

Members: | Primary Functions and Additional Information |

ºBrian Dexheimer (Chair) ºRobert Hagerty* ºJohn Hart ºGuido Jouret** ºMarv Tseu | ºAssists the Board in identifying and interviewing potential additions or replacement members of the Board.

ºAssists the Board to evaluate governance risks and develops and recommends to the Board the appropriate governance guidelines for us, the Board and management.

ºOversees the evaluation of the Board and management.

ºRecommends to the Board director nominees for each committee.

ºOversees the orientation program for new directors and continuing education for directors. |

Meetings in Fiscal Year 2020: 4

|

The Board has determined that each member of the NCG Committee does, and did at all times during their respective tenures on the NCG Committee in fiscal year 2020, meet the requirements for independence as defined by the NYSE listing standards and under the Securities Exchange Act.

|

*Effective March 9, 2020, following his appointment as Interim CEO, Mr. Hagerty resigned from the NCG Committee. From the date of his appointment on February 10, 2020 until his resignation from the NCG Committee, Mr. Hagerty did not attend any meetings.

**Effective October 1, 2019, Mr. Jouret was appointed to the NCG Committee.

Identification of Director Candidates; Stockholder Nominations and Recommendations; Proxy Access; Director Qualifications; and Board Diversity

Generally, it is the policy of the NCG Committee to review the qualifications of and consider any director candidates who have been properly recommended or nominated by a stockholder on the same basis as candidates identified by management, individual members of the Board or, if the NCG Committee determines, a search firm hired to identify candidates. When evaluating a candidate, the NCG Committee evaluates the current composition and size of the Board, the candidate's qualifications, the needs of the Board and its respective committees, and such other factors it may consider appropriate; however, the NCG Committee has not established any specific minimum qualifications that must be met by or specific qualities or skills that are necessary for one or more members of the Board to possess.

In selecting candidates for recommendation to the Board, the NCG Committee annually reviews the size of the Board to ensure qualified director candidates with a broad diversity of professional experience, skills, backgrounds, tenure, gender, race, national origin and ethnicity are included by the Company or any search firm it engages in each pool of candidates from which the Board nominees are chosen to ensure that each director brings a different viewpoint and different skills to the Board. The NCG Committee does not have a formal policy with respect to diversity; however, the Board and the NCG Committee believe that it is essential that the directors represent diverse viewpoints and demographics. In considering candidates for the Board, the NCG Committee considers the entirety of each candidate's credentials in the context of these standards. The NCG Committee also reviews the Company's policies, programs and initiatives for employee diversity and inclusion and provides guidance to the Board on diversity matters.

On December 13, 2019, the Company amended its bylaws to permit "proxy access" by which eligible stockholders may nominate director candidates for inclusion in our Proxy Statement and form of WHITE proxy card. Proxy access may be used by a stockholder or a group of up to 20 stockholders, owning at least 3% of the Company's outstanding common stock continuously for at least three years to nominate and include in the Company's proxy materials director nominees constituting up to the greater of two individuals or 20% of the Board, provided that the stockholders and the nominees satisfy the conditions, including, without limitation, the advance notice requirements, specified in the bylaws. The Company believes that certain safeguards as to ownership threshold and duration of ownership are important to assure that proxy access is not misused by those without significant economic interest in the Company or those driven by short term goals.

For more information, the full text of our bylaws, Corporate Governance Guidelines and Director Candidates Nomination Policy are available on the Governance Portal.

Stockholders wishing to nominate persons for election to the Board can do so by timely filing a Nominee Solicitation Statement with our Corporate Secretary which, in accordance with our Director Candidates Nomination Policy and our bylaws, contains, among other things, certain information concerning the nominee and the stockholder nominating such nominee as set forth in our

bylaws and otherwise complying with the bylaws. For a further description of the process and procedures concerning the submission of a Nominee Solicitation Statement, see "Questions and Answers About the Proxy Materials and the Annual Meeting - What is the Deadline for Receipt of Stockholder Proposals for the 2021 Annual Meeting of Stockholders" above. Additional information regarding our policies with respect to director nominations can be found in our bylaws, our Corporate Governance Guidelines and our Director Candidates Nomination Policy, all of which are posted on the Governance Portal.

Director Change in Primary Job Policy

The Board reviews the appropriateness of the continued service of directors who change their primary employment subsequent to their appointment or most recent election to the Board. If a director changes his or her primary job during his or her term of office, such director must submit a letter to the Board that (i) describes the circumstances surrounding the change; and (ii) contains an offer to resign from the Board. The Board then evaluates the circumstances surrounding the change and determines if the change will adversely affect the director's ability to perform his or her duties as a member of the Board. If so, the Board will accept the director's resignation.

Director Commitments

Each director must ensure other existing and anticipated future commitments do not materially interfere with her or his service to the Company. In any event, no director shall serve on the boards of more than four additional public companies. If a director is also a named executive officer of a public company, including a CEO, such director may not serve on more than two (2) public company boards, including the Company's board. Directors are required advise the NCG Committee of any invitations to join a board of any other public company prior to accepting another directorship. With respect to Audit Committee members, no member may concurrently serve on the audit committee of more than three public companies, unless our Board determines such simultaneous service and related time commitments will not impair her or his ability to effectively serve on the Audit Committee, she or he takes steps to address any related issues and we disclose that determination in our Proxy Statement.

Director Evaluations

Our NCG Committee oversees the self-evaluation of the Board. In fiscal year 2020, we engaged outside counsel to conduct interviews with each director regarding, among other things, Board membership, structure, performance and areas for improvement. Following the interviews, the results were discussed with the Chair of the Board and presented to the full Board.

|

| |

STRATEGY COMMITTEE |

| |

Members: | Primary Functions and Additional Information |

ºBrian Dexheimer (Chair) ºRobert Hagerty* ºJohn Hart ºGuido Jouret ºMarv Tseu | ºReviews and evaluates targeted areas of business development.

ºReviews and assesses material transactions and investments designed to implement our corporate strategy.

ºRecommends areas of improvement and provides feedback to management.

ºSupports the Board or management, as requested, in the development and/or refinement of specific aspects of the Company's strategic plan. |

Meetings in Fiscal Year 2020: 5 |

|

*Effective March 9, 2020, following his appointment as Interim CEO, Mr. Hagerty resigned from the Strategy Committee.

|

| |

MERGERS & ACQUISITIONS COMMITTEE |

| |

Members: | Primary Functions and Additional Information |

ºRobert Hagerty* ºBrian Dexheimer ºGregg Hammann ºMarshall Mohr ºMarv Tseu | ºAdvises management regarding mergers, acquisitions and divestitures, including post-acquisition integration and post-divestiture separation activities.

ºOversees and has authority to approve management actions with regard to any potential merger, acquisition or divestiture transactions that involve less than $5 million of consideration.

ºProvides input to the Board with regard to any potential merger, acquisition or divestiture transaction involving consideration of $5 million or more. |

|

Meetings in Fiscal Year 2020: 4 |

|

*Effective March 9, 2020, following his appointment as Interim CEO, Mr. Hagerty resigned from the M&A Committee, including his position as Chair. From the date of his appointment on February 10, 2020 until his resignation from the M&A Committee, Mr. Hagerty did not attend any meetings.

Board Role in Risk Oversight

Our Board oversees an enterprise-wide approach to risk management which is designed to support the achievement of long-term organizational performance and enhance stockholder value. Fundamentals of our risk management include understanding the risks we face, management's processes for managing the risks and determining our appropriate level of risk tolerance. Our management is responsible for day-to-day business risk management, including disaster and crisis management, business and financial risk, strategic risk, legal risk, corporate governance risk and compliance risk. The Board, as a whole and through its committees, has the ultimate oversight responsibility for the risk management process.

Each of the Board committees focuses on particular aspects of risk management. The Audit Committee regularly discusses and evaluates policies concerning risk assessment and management, including our major financial, compliance, environmental, social and operational risks, including cybersecurity and steps management takes to monitor and control such risks. The Audit Committee also oversees our independent registered public accounting firm and our annual audit, including reviewing our key financial risk areas with our independent auditors.

In its design of our overall compensation policies, programs and philosophy, the LD&C Committee assists the Board to manage incentives for short and long-term performance.

The NCG Committee assists the Board to fulfill its oversight responsibilities concerning risks associated with corporate governance and Board organization, membership, structure, and succession planning for directors. This Committee reviews our corporate governance structures and recommends compliance and corporate governance principles and practices to the Board.

The Strategy Committee examines our business strategy and provides guidance on balancing risks and potential rewards of our strategic choices.

The M&A Committee advises management during various stages of mergers, acquisitions and divestitures, including early discussions and assessments as well as post-acquisition integration or post-divestiture separation activities. The M&A Committee has authority to approve management actions with regard to any potential merger, acquisition or divestiture transaction that involves less than $5 million of consideration. Any merger, acquisition or divestiture transaction involving consideration of $5 million or more is reviewed by a quorum of the Board and is subject to its approval, in addition to any input from the M&A Committee and Strategy Committee, prior to completion.

Board Oversight of Environmental, Social and Governance Matters

In addition to upholding high ethical standards in the ways we conduct business through our Code, we also recognize that our Company has opportunities to bring about positive environmental, social and governance oversight. Our Board is actively engaged in the oversight of Company environmental, social and governance ("ESG") risks, policies and practices through its NCG Committee.

Below is a summary of the Company's commitment to enhancing our ESG practices. For more information, please refer to our website at https://www.poly.com/us/en/about/corporate-responsibility.

|

| |

Corporate Social Responsibility ("CSR") Highlights |

Environmental | ºOur range of Unified Communication products enable our customers to reduce their climate impact from travel, and support society’s transition to a low-carbon economy.

ºWe perform life-cycle assessments on new packaging structures to estimate the environmental impacts of our material choices, and our headset line distribution packaging contains an average of 29% to 35% post-consumer recycled material.

ºMany of our headsets are also Telecommunications Certification Organization certified, demonstrating that products have passed independent testing for low emissions, superior sound quality and high durability.

ºWe have take-back programs, offering a worldwide network through which to recycle, refurbish and reuse our products where possible, allowing us to divert from landfill and reducing our environmental impact. Our recycling network uses ISO 14001 certified facilities and offers a Certificate of Destruction upon request.

ºOur manufacturing facility in Tijuana, Mexico ("Plamex") is one of the largest capacity solar projects installed over a roof in Latin America - with 4,284 panels occupying a space the size of two soccer fields. With such a large-capacity system, it is able to generate close to 2 gigawatt hours of clean energy per year, and the solar roof provided 31.4% of Plamex’s energy use in 2019.

ºPoly's global headquarters, located in Santa Cruz, California was designed to meet the standards of California's voluntary Savings by Design program, featuring energy-efficient construction, solar and sun tubes. It also features and 870kW solar installation, which has generated an average of 780Mwh of clean energy per year. In total, our solar panels generated 728,000kW in 2019.

|

Supply Chain | ºAs affiliate members of the Responsible Business Alliance ("RBA"), the largest industry coalition dedicated to CSR in global supply chains, our Supplier Code of Conduct ("Supplier Code") is closely aligned with the RBA Code of Conduct.

ºWe are committed to responsible sourcing of materials using ethical business principles, the promotion and protection of human rights, and compliance with all applicable laws and regulations. We require all of our suppliers to share this commitment through acknowledgment of our newly refreshed Supplier Code, and with the understanding that any violations may jeopardize their business relationship with Poly.

ºWe work with suppliers to promote conflict-free sourcing of all parts and products supplied to us. We are members of the Responsible Mineral Initiative and are active participants in the working groups of Due Diligence Practices, and China Smelter or Refiner ("SOR") Engagement. In addition, we support and actively participate in the RMI’s Responsible Minerals Assurance Process - a program that audits SOR’s due diligence activities to provide information about the country of origin of minerals. We have also conducted further due diligence in accordance with the Organization for Economic Cooperation and Development ("OECD") Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High Risk Areas (OECD 2016) on those SORs known to - or, it is believed, may - source minerals from the DRC, adjoining countries, or countries considered to be possible smuggling routes of materials from the conflict area.

|

|

| |

Social | ºIn 2019, Poly rolled out an updated Code upon which all employees received training and were required to acknowledge.

ºAll new employees undergo onboarding training that covers the Code, anti-corruption, harassment prevention, and other compliance areas.

ºAt Plamex, we have achieved ‘Safe Organization Certification’, which is awarded to companies meeting all safety and hygiene statutory requirements.

ºIn our employee engagement scores, the most positive recurring theme from our employees is their appreciation of our flexible work environment. With over 10% of global employees working remotely, and with our leading technology enabling successful flexible working, we encourage our employees to work the way they love, in order to be their most productive by using our products and services.

ºIn July 2019, we introduced a global Employee Assistance Program ("EAP") with our partner, Beacon Health Options. The EAP is a professional, confidential, counseling service available to all employees and their household members.

ºWe focused on growing our Employee Resource Groups to celebrate our employees’ uniqueness and differences and launched three new groups: i) the Women’s Leadership Group; ii) the Accessibility and Inclusion Group; and iii) the Veterans Group.

ºAs part of our new Global Giving program, earlier this year, we held our first annual Global Giving Community Day in eight Poly offices around the world.

|

Access to Board of Directors Policy

Our Access to Board of Directors Policy outlines methods by which stockholders or any interested party may contact the Board, or any member of our Board, including the Chairman or Lead Independent Director who presides at executive sessions of the non-employee directors as a group. For further information, see the Governance Portal.

Directors' Attendance at Annual Meetings

We recognize attendance by our directors at annual stockholder meetings can provide investors with an opportunity to communicate with directors about issues affecting us. We encourage all of our directors to attend our annual meetings. If a director cannot attend in person, we encourage directors to attend telephonically. For the 2019 Annual Meeting of Stockholders, Mr. Burton (our former President, CEO and member of the Board) attended in person and all other directors then in office and nominated for re-election attended telephonically, except for Messrs. Baker, Hart and Mohr who were unable to attend.

Director Education

Our Corporate Governance Guidelines provide that our directors participate in continuing education programs on an "as needed" basis. The Board has a practice of receiving regular updates on corporate governance at Board meetings.

Additionally, the Board meets quarterly to review our business. Topics vary, but in general directors are updated on our financial plan, key performance indicators, corporate strategy, product portfolio, operations and manufacturing, sales and go to market strategy. During these discussions directors may be briefed on industry trends, market size and market share based on information gathered by and from third party industry analysts overlaid with our specific comparative data and competitor and product-specific data.

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

Our Board has nominated the following ten individuals for election to the Board at the Annual Meeting. All nominees are current directors. On April 9, 2020, pursuant to the Company's Amended and Restated Bylaws, due to the resignation of Mr. Burton, the Board approved a reduction in the size of our Board from eleven to ten Directors.

The following table provides certain information about each nominee for director as of March 28, 2020.

|

| | | | | | |

Name of Director | | Age | | Position(s) with the Company | | Director Since |

Robert Hagerty | | 68 | | Chairman and Interim Chief Executive Officer (Non-Independent Director) | | 2011 |

Marv Tseu | | 71 | | Vice Chairman & Lead Independent Director | | 1999 |

Frank Baker | | 47 | | Non-Independent Director | | 2018 |

Kathy Crusco | | 55 | | Independent Director | | 2018 |

Brian Dexheimer | | 57 | | Independent Director | | 2008 |

Gregg Hammann | | 57 | | Independent Director | | 2005 |

John Hart | | 74 | | Independent Director | | 2006 |

Guido Jouret | | 54 | | Independent Director | | 2018 |

Marshall Mohr | | 64 | | Independent Director | | 2005 |

Daniel Moloney | | 60 | | Non-Independent Director | | 2018 |

For purposes of election by our stockholders at the Annual Meeting, each of these nominees was nominated and recommended by the Board, including all the NCG Committee members. As discussed in "Director Independence" of the "Corporate Governance" section of this Proxy Statement, Messrs. Baker and Moloney were selected for nomination by Triangle pursuant to the terms of the Stockholder Agreement and approved by the NCG Committee and the Board. We believe that nominees selected by Triangle bring valuable experience and perspective to our Board and our right to pre-approve individuals selected by Triangle as nominees helps us to ensure their selection is consistent with the manner in which the NCG Committee identifies director candidates.

Unless otherwise instructed, the Proxyholders will vote the proxies they hold for each of the ten persons nominated by the Board. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present Board to fill such vacancy. In the event a nominee selected by Triangle is unable or declines to serve as a director at the time of the Annual Meeting, Triangle will select a new individual for nomination to our Board pursuant to the terms of the Stockholder Agreement and, subject to the approval by the NCG Committee and the Board, the proxies will be voted for such individual to fill such vacancy. We are not aware of any nominee who will be unable or will decline to serve as a director and all nominees have consented to act as a director. The term of office for each person elected will continue until the next annual meeting or until a successor has been elected and qualified.

Vote Required

For Proposal One, Election of Directors, directors will be elected by a vote of a majority of the votes cast with respect to each nominee. In this context, a majority of the votes cast means that the number of votes “FOR” a nominee must exceed the number of votes cast “AGAINST” the nominee. However, our bylaws provide that directors will be elected by the vote of a plurality of the votes cast at any stockholder meeting where (1) our Corporate Secretary receives a notice of a stockholder’s intention to nominate a person or persons for election to the Board in compliance with our bylaws and (2) such nomination has not been withdrawn by such stockholder on or before the 14th day preceding the date that we first mail our notice of meeting for such stockholder meeting. Accordingly, it is possible that directors will be elected by plurality vote at the Annual Meeting. This means that the 10 candidates receiving the most votes will be elected.

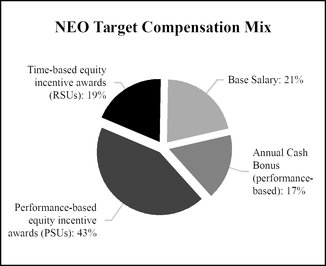

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" EACH OF THE NOMINEES LISTED ABOVE.