false--03-31Q220200000914025PLANTRONICS INC /CA/P11MP6MP3M0

0000914025

2019-04-01

2019-09-30

0000914025

2019-10-30

0000914025

2019-03-31

0000914025

2019-09-30

0000914025

2019-07-01

2019-09-30

0000914025

2018-07-01

2018-09-30

0000914025

us-gaap:ProductMember

2019-04-01

2019-09-30

0000914025

2018-04-01

2018-09-30

0000914025

us-gaap:ServiceMember

2019-04-01

2019-09-30

0000914025

us-gaap:ServiceMember

2019-07-01

2019-09-30

0000914025

us-gaap:ServiceMember

2018-07-01

2018-09-30

0000914025

us-gaap:ProductMember

2019-07-01

2019-09-30

0000914025

us-gaap:ServiceMember

2018-04-01

2018-09-30

0000914025

us-gaap:ProductMember

2018-04-01

2018-09-30

0000914025

us-gaap:ProductMember

2018-07-01

2018-09-30

0000914025

2018-03-31

0000914025

2018-09-30

0000914025

us-gaap:RetainedEarningsMember

2018-09-30

0000914025

us-gaap:RetainedEarningsMember

2018-06-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2018-07-01

2018-09-30

0000914025

us-gaap:CommonStockMember

2018-07-01

2018-09-30

0000914025

us-gaap:CommonStockMember

2018-09-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-07-01

2018-09-30

0000914025

us-gaap:CommonStockMember

2018-06-30

0000914025

us-gaap:TreasuryStockMember

2018-07-01

2018-09-30

0000914025

us-gaap:RetainedEarningsMember

2018-07-01

2018-09-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-06-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2018-06-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-09-30

0000914025

2018-06-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2018-09-30

0000914025

us-gaap:TreasuryStockMember

2018-09-30

0000914025

us-gaap:TreasuryStockMember

2018-06-30

0000914025

us-gaap:CommonStockMember

2019-07-01

2019-09-30

0000914025

us-gaap:RetainedEarningsMember

2019-09-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-06-30

0000914025

2019-06-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2019-09-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2019-07-01

2019-09-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-09-30

0000914025

us-gaap:TreasuryStockMember

2019-07-01

2019-09-30

0000914025

us-gaap:TreasuryStockMember

2019-06-30

0000914025

us-gaap:CommonStockMember

2019-09-30

0000914025

us-gaap:CommonStockMember

2019-06-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2019-06-30

0000914025

us-gaap:RetainedEarningsMember

2019-06-30

0000914025

us-gaap:TreasuryStockMember

2019-09-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-07-01

2019-09-30

0000914025

us-gaap:RetainedEarningsMember

2019-07-01

2019-09-30

0000914025

us-gaap:CommonStockMember

2019-04-01

2019-09-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2019-04-01

2019-09-30

0000914025

us-gaap:CommonStockMember

2019-03-31

0000914025

2019-04-01

0000914025

us-gaap:AdditionalPaidInCapitalMember

2019-03-31

0000914025

us-gaap:TreasuryStockMember

2019-03-31

0000914025

us-gaap:RetainedEarningsMember

2019-04-01

2019-09-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-04-01

2019-09-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-03-31

0000914025

us-gaap:RetainedEarningsMember

2019-03-31

0000914025

us-gaap:RetainedEarningsMember

2019-04-01

0000914025

us-gaap:TreasuryStockMember

2019-04-01

2019-09-30

0000914025

us-gaap:AdditionalPaidInCapitalMember

2018-04-01

2018-09-30

0000914025

us-gaap:CommonStockMember

2018-04-01

2018-09-30

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-04-01

0000914025

2018-04-01

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-04-01

2018-09-30

0000914025

us-gaap:RetainedEarningsMember

2018-03-31

0000914025

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2018-03-31

0000914025

us-gaap:CommonStockMember

2018-03-31

0000914025

us-gaap:AdditionalPaidInCapitalMember

2018-03-31

0000914025

us-gaap:RetainedEarningsMember

2018-04-01

2018-09-30

0000914025

us-gaap:RetainedEarningsMember

2018-04-01

0000914025

us-gaap:TreasuryStockMember

2018-03-31

0000914025

us-gaap:TreasuryStockMember

2018-04-01

2018-09-30

0000914025

us-gaap:OtherAssetsMember

2019-04-01

0000914025

plt:OtherLongTermLiabilitiesMember

2019-04-01

0000914025

us-gaap:AccruedLiabilitiesMember

2019-04-01

0000914025

plt:PolycomMember

2018-07-02

0000914025

plt:PolycomMember

2019-04-01

2019-09-30

0000914025

plt:PolycomMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

plt:DeferredRevenueAdjustmentMember

2019-04-01

2019-09-30

0000914025

plt:PolycomMember

plt:AmortizationexpenseofpurchaseintangibleassetsMember

2019-04-01

2019-09-30

0000914025

plt:TriangleMember

2018-07-02

0000914025

plt:PolycomMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

us-gaap:TrademarksAndTradeNamesMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-04-01

2019-09-30

0000914025

plt:PolycomMember

us-gaap:CustomerRelationshipsMember

2019-04-01

2019-09-30

0000914025

plt:PolycomMember

us-gaap:OrderOrProductionBacklogMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

us-gaap:CustomerRelationshipsMember

2018-07-02

2018-07-02

0000914025

plt:PolycomMember

us-gaap:TrademarksAndTradeNamesMember

2019-04-01

2019-09-30

0000914025

plt:PolycomMember

us-gaap:OrderOrProductionBacklogMember

2019-04-01

2019-09-30

0000914025

plt:PolycomMember

us-gaap:InProcessResearchAndDevelopmentMember

2018-07-02

2018-07-02

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2019-09-30

0000914025

us-gaap:CashMember

2019-03-31

0000914025

us-gaap:FairValueInputsLevel1Member

plt:MutualFundsMember

2019-03-31

0000914025

us-gaap:FairValueInputsLevel1Member

plt:MutualFundsMember

2019-09-30

0000914025

us-gaap:CashMember

2019-09-30

0000914025

us-gaap:ShortTermInvestmentsMember

plt:MutualFundsMember

2019-09-30

0000914025

us-gaap:OtherNoncurrentLiabilitiesMember

2019-03-31

0000914025

us-gaap:OtherNoncurrentLiabilitiesMember

2019-09-30

0000914025

plt:ProvisionForPromotionsRebatesAndOtherMember

2019-09-30

0000914025

plt:ProvisionForDoubtfulAccountsAndSalesAllowancesMember

2019-09-30

0000914025

plt:ProvisionForPromotionsRebatesAndOtherMember

2019-03-31

0000914025

plt:ProvisionForDoubtfulAccountsAndSalesAllowancesMember

2019-03-31

0000914025

us-gaap:InProcessResearchAndDevelopmentMember

2019-09-30

0000914025

us-gaap:TradeNamesMember

2019-03-31

0000914025

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-03-31

0000914025

us-gaap:InProcessResearchAndDevelopmentMember

2019-03-31

0000914025

us-gaap:InProcessResearchAndDevelopmentMember

2019-09-30

0000914025

us-gaap:CustomerRelationshipsMember

2019-03-31

0000914025

us-gaap:CustomerRelationshipsMember

2019-09-30

0000914025

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-09-30

0000914025

us-gaap:TradeNamesMember

2019-09-30

0000914025

us-gaap:TechnologyBasedIntangibleAssetsMember

2019-04-01

2019-09-30

0000914025

us-gaap:CustomerRelationshipsMember

2019-04-01

2019-09-30

0000914025

us-gaap:TrademarksAndTradeNamesMember

2019-04-01

2019-09-30

0000914025

plt:GNNetcomInc.vs.PlantronicsInc.Member

plt:PunitiveSanctionsMember

2016-07-01

2016-07-31

0000914025

plt:GNNetcomInc.vs.PlantronicsInc.Member

plt:PunitiveSanctionsMember

2017-11-01

2017-11-30

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-12-29

2019-06-29

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-04-01

2019-09-30

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2015-05-31

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-07-02

0000914025

us-gaap:SecuredDebtMember

2018-07-02

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2015-05-01

2015-05-31

0000914025

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-04-01

2019-09-30

0000914025

us-gaap:SecuredDebtMember

us-gaap:LondonInterbankOfferedRateLIBORMember

2019-04-01

2019-09-30

0000914025

srt:ScenarioForecastMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2021-04-04

2021-04-04

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-09-30

0000914025

srt:MinimumMember

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2015-05-01

2015-05-31

0000914025

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-04-01

2019-09-30

0000914025

us-gaap:SecuredDebtMember

plt:FederalFundsRateMember

2019-04-01

2019-09-30

0000914025

srt:ScenarioForecastMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-07-01

2020-03-28

0000914025

srt:MaximumMember

plt:SeniorNotes5.50PercentMember

us-gaap:SeniorNotesMember

2015-05-01

2015-05-31

0000914025

srt:ScenarioForecastMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2020-03-29

2021-04-03

0000914025

2018-07-02

2018-07-02

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-07-02

2018-07-02

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-07-01

2019-09-30

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-04-01

2018-12-31

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:SeniorNotesMember

2019-03-31

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:LineOfCreditMember

2019-09-30

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:FairValueInputsLevel2Member

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:LineOfCreditMember

2019-03-31

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:LineOfCreditMember

2019-03-31

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:FairValueInputsLevel2Member

us-gaap:EstimateOfFairValueFairValueDisclosureMember

us-gaap:SeniorNotesMember

2019-09-30

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:FairValueInputsLevel2Member

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:SeniorNotesMember

2019-03-31

0000914025

us-gaap:RevolvingCreditFacilityMember

us-gaap:FairValueInputsLevel2Member

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:LineOfCreditMember

2019-09-30

0000914025

plt:SeniorNotes5.50PercentMember

us-gaap:FairValueInputsLevel2Member

us-gaap:CarryingReportedAmountFairValueDisclosureMember

us-gaap:SeniorNotesMember

2019-09-30

0000914025

us-gaap:FacilityClosingMember

plt:FiscalYear2019RestructuringPlansMember

2019-04-01

2019-09-30

0000914025

us-gaap:EmployeeSeveranceMember

2019-09-30

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2020RestructuringPlansMember

2019-09-30

0000914025

us-gaap:FacilityClosingMember

2019-04-01

2019-09-30

0000914025

us-gaap:OtherRestructuringMember

2019-04-01

2019-09-30

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2019RestructuringPlansMember

2019-09-30

0000914025

plt:FiscalYear2019RestructuringPlansMember

2019-09-30

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2019RestructuringPlansMember

2019-04-01

2019-09-30

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2020RestructuringPlansMember

2019-04-01

2019-09-30

0000914025

us-gaap:OtherRestructuringMember

2019-03-31

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

us-gaap:FacilityClosingMember

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

us-gaap:FacilityClosingMember

plt:FiscalYear2020RestructuringPlansMember

2019-04-01

2019-09-30

0000914025

us-gaap:FacilityClosingMember

plt:FiscalYear2019RestructuringPlansMember

2019-09-30

0000914025

us-gaap:EmployeeSeveranceMember

2019-04-01

2019-09-30

0000914025

us-gaap:FacilityClosingMember

plt:FiscalYear2020RestructuringPlansMember

2019-09-30

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2019RestructuringPlansMember

2019-09-30

0000914025

us-gaap:OtherRestructuringMember

2019-09-30

0000914025

plt:FiscalYear2020RestructuringPlansMember

2019-04-01

2019-09-30

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2019RestructuringPlansMember

2019-04-01

2019-09-30

0000914025

us-gaap:EmployeeSeveranceMember

2019-03-31

0000914025

us-gaap:OtherRestructuringMember

plt:FiscalYear2020RestructuringPlansMember

2019-09-30

0000914025

plt:FiscalYear2019RestructuringPlansMember

2019-04-01

2019-09-30

0000914025

plt:FiscalYear2020RestructuringPlansMember

2019-09-30

0000914025

plt:FiscalYear2019RestructuringPlansMember

2019-03-31

0000914025

us-gaap:FacilityClosingMember

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

us-gaap:FacilityClosingMember

2019-09-30

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2020RestructuringPlansMember

2019-03-31

0000914025

us-gaap:EmployeeSeveranceMember

plt:FiscalYear2020RestructuringPlansMember

2019-04-01

2019-09-30

0000914025

us-gaap:FacilityClosingMember

2019-03-31

0000914025

us-gaap:OperatingExpenseMember

2019-04-01

2019-09-30

0000914025

us-gaap:ResearchAndDevelopmentExpenseMember

2019-07-01

2019-09-30

0000914025

plt:SellingGeneralAndAdministrativeMember

2019-07-01

2019-09-30

0000914025

us-gaap:ResearchAndDevelopmentExpenseMember

2018-07-01

2018-09-30

0000914025

us-gaap:OperatingExpenseMember

2018-04-01

2018-09-30

0000914025

us-gaap:CostOfSalesMember

2018-04-01

2018-09-30

0000914025

us-gaap:CostOfSalesMember

2019-07-01

2019-09-30

0000914025

us-gaap:ResearchAndDevelopmentExpenseMember

2019-04-01

2019-09-30

0000914025

plt:SellingGeneralAndAdministrativeMember

2018-07-01

2018-09-30

0000914025

us-gaap:OperatingExpenseMember

2019-07-01

2019-09-30

0000914025

us-gaap:OperatingExpenseMember

2018-07-01

2018-09-30

0000914025

us-gaap:ResearchAndDevelopmentExpenseMember

2018-04-01

2018-09-30

0000914025

plt:SellingGeneralAndAdministrativeMember

2018-04-01

2018-09-30

0000914025

us-gaap:CostOfSalesMember

2019-04-01

2019-09-30

0000914025

us-gaap:CostOfSalesMember

2018-07-01

2018-09-30

0000914025

plt:SellingGeneralAndAdministrativeMember

2019-04-01

2019-09-30

0000914025

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2019-04-01

2019-09-30

0000914025

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2019-04-01

2019-09-30

0000914025

2018-11-28

0000914025

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-03-31

0000914025

us-gaap:AccumulatedTranslationAdjustmentMember

2019-09-30

0000914025

us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember

2019-09-30

0000914025

us-gaap:AccumulatedTranslationAdjustmentMember

2019-03-31

0000914025

plt:ForeignCurrencySwapContractMember

2019-09-30

0000914025

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

2018-07-01

2018-09-30

0000914025

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

2019-04-01

2019-09-30

0000914025

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

2018-04-01

2018-09-30

0000914025

us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember

2019-07-01

2019-09-30

0000914025

us-gaap:InterestRateSwapMember

2018-07-30

2018-07-30

0000914025

us-gaap:InterestRateSwapMember

2018-07-30

0000914025

plt:ForeignCurrencySwapContractMember

2019-03-31

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:InterestRateSwapMember

2019-09-30

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:NondesignatedMember

2019-03-31

0000914025

us-gaap:OtherCurrentAssetsMember

us-gaap:NondesignatedMember

2019-03-31

0000914025

us-gaap:OtherCurrentAssetsMember

2019-03-31

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:InterestRateSwapMember

2019-03-31

0000914025

us-gaap:OtherCurrentAssetsMember

2019-09-30

0000914025

us-gaap:OtherLiabilitiesMember

2019-03-31

0000914025

us-gaap:OtherCurrentAssetsMember

us-gaap:NondesignatedMember

2019-09-30

0000914025

us-gaap:OtherCurrentAssetsMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-03-31

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-09-30

0000914025

us-gaap:OtherLiabilitiesMember

2019-09-30

0000914025

us-gaap:OtherLiabilitiesMember

us-gaap:NondesignatedMember

2019-09-30

0000914025

us-gaap:OtherCurrentAssetsMember

us-gaap:CashFlowHedgingMember

us-gaap:DesignatedAsHedgingInstrumentMember

2019-03-31

0000914025

us-gaap:ForeignExchangeForwardMember

2019-09-30

0000914025

us-gaap:ForeignExchangeOptionMember

2019-03-31

0000914025

us-gaap:ForeignExchangeOptionMember

2019-09-30

0000914025

us-gaap:ForeignExchangeForwardMember

2019-03-31

0000914025

plt:ForeignExchangeForwardEuroMember

2019-04-01

2019-09-30

0000914025

plt:ForeignExchangeForwardAudMember

2019-04-01

2019-09-30

0000914025

plt:ForeignExchangeForwardEuroMember

2019-09-30

0000914025

plt:ForeignExchangeForwardGbpMember

2019-09-30

0000914025

plt:ForeignExchangeForwardGbpMember

2019-04-01

2019-09-30

0000914025

plt:ForeignExchangeForwardAudMember

2019-09-30

0000914025

us-gaap:NondesignatedMember

2019-04-01

2019-09-30

0000914025

us-gaap:NondesignatedMember

2018-04-01

2018-09-30

0000914025

us-gaap:NondesignatedMember

2019-07-01

2019-09-30

0000914025

us-gaap:NondesignatedMember

2018-07-01

2018-09-30

0000914025

srt:MinimumMember

us-gaap:OptionMember

us-gaap:CashFlowHedgingMember

2019-04-01

2019-09-30

0000914025

srt:MaximumMember

us-gaap:OptionMember

us-gaap:CashFlowHedgingMember

2019-04-01

2019-09-30

0000914025

us-gaap:ForwardContractsMember

us-gaap:CashFlowHedgingMember

2019-04-01

2019-09-30

0000914025

plt:IngramMicroMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2018-04-01

2019-03-31

0000914025

plt:IngramMicroMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-04-01

2019-09-30

0000914025

plt:DHDistributorsMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2018-04-01

2019-03-31

0000914025

plt:ScanSourceMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2018-04-01

2018-09-30

0000914025

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2018-09-30

0000914025

srt:MaximumMember

2019-04-01

2019-09-30

0000914025

plt:ScanSourceMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2018-04-01

2019-03-31

0000914025

plt:ScanSourceMember

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-04-01

2019-09-30

0000914025

srt:MinimumMember

2019-04-01

2019-09-30

0000914025

plt:IngramMicroMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-04-01

2019-09-30

0000914025

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-09-30

0000914025

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-09-30

0000914025

plt:SynnexCorp.Member

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-04-01

2019-09-30

0000914025

plt:ScanSourceMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-04-01

2019-09-30

0000914025

plt:IngramMicroMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-07-01

2019-09-30

0000914025

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2019-03-31

0000914025

plt:ScanSourceMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2018-07-01

2018-09-30

0000914025

plt:ScanSourceMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-07-01

2019-09-30

0000914025

plt:EnterpriseHeadsetMember

2019-07-01

2019-09-30

0000914025

plt:ConsumerHeadsetMember

2018-04-01

2018-09-30

0000914025

plt:VideoMember

2018-04-01

2018-09-30

0000914025

plt:VideoMember

2018-07-01

2018-09-30

0000914025

plt:VideoMember

2019-04-01

2019-09-30

0000914025

plt:VoiceMember

2018-07-01

2018-09-30

0000914025

plt:EnterpriseHeadsetMember

2018-07-01

2018-09-30

0000914025

plt:EnterpriseHeadsetMember

2019-04-01

2019-09-30

0000914025

plt:VideoMember

2019-07-01

2019-09-30

0000914025

plt:ConsumerHeadsetMember

2019-04-01

2019-09-30

0000914025

plt:ConsumerHeadsetMember

2018-07-01

2018-09-30

0000914025

plt:VoiceMember

2019-04-01

2019-09-30

0000914025

plt:VoiceMember

2018-04-01

2018-09-30

0000914025

plt:EnterpriseHeadsetMember

2018-04-01

2018-09-30

0000914025

plt:VoiceMember

2019-07-01

2019-09-30

0000914025

plt:ConsumerHeadsetMember

2019-07-01

2019-09-30

0000914025

srt:AsiaPacificMember

2018-07-01

2018-09-30

0000914025

plt:AmericasexcludingUnitedStatesMember

2018-04-01

2018-09-30

0000914025

us-gaap:EMEAMember

2018-07-01

2018-09-30

0000914025

plt:AmericasexcludingUnitedStatesMember

2019-07-01

2019-09-30

0000914025

srt:AsiaPacificMember

2018-04-01

2018-09-30

0000914025

plt:AmericasexcludingUnitedStatesMember

2018-07-01

2018-09-30

0000914025

srt:AsiaPacificMember

2019-07-01

2019-09-30

0000914025

country:US

2019-07-01

2019-09-30

0000914025

country:US

2019-04-01

2019-09-30

0000914025

us-gaap:EMEAMember

2019-07-01

2019-09-30

0000914025

us-gaap:EMEAMember

2019-04-01

2019-09-30

0000914025

plt:AmericasexcludingUnitedStatesMember

2019-04-01

2019-09-30

0000914025

plt:AllCountriesExceptUnitedStatesMember

2018-07-01

2018-09-30

0000914025

plt:AllCountriesExceptUnitedStatesMember

2019-04-01

2019-09-30

0000914025

plt:AllCountriesExceptUnitedStatesMember

2018-04-01

2018-09-30

0000914025

us-gaap:EMEAMember

2018-04-01

2018-09-30

0000914025

plt:AllCountriesExceptUnitedStatesMember

2019-07-01

2019-09-30

0000914025

country:US

2018-07-01

2018-09-30

0000914025

srt:AsiaPacificMember

2019-04-01

2019-09-30

0000914025

country:US

2018-04-01

2018-09-30

0000914025

us-gaap:SubsequentEventMember

2019-11-05

xbrli:shares

iso4217:USD

xbrli:pure

iso4217:USD

xbrli:shares

iso4217:EUR

iso4217:MXN

iso4217:GBP

iso4217:AUD

plt:Customer

plt:financial_institution

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 28, 2019

or

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________to _________

Commission File Number: 001-12696

Plantronics, Inc.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 77-0207692 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

345 Encinal Street

Santa Cruz, California 95060

(Address of principal executive offices)

(Zip Code)

(831) 426-5858

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act

|

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.01 par value | PLT | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 30, 2019, 39,915,781 shares of the registrant's common stock were outstanding.

Plantronics, Inc.

FORM 10-Q

TABLE OF CONTENTS

|

| |

PART I. FINANCIAL INFORMATION | Page No. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART II. OTHER INFORMATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Plantronics®, Poly®, Simply Smarter Communications® , and the propeller design are trademarks or registered trademarks of Plantronics, Inc. All other trademarks are the property of their respective owners.

DECT™ is a trademark of ETSI registered for the benefit of its members in France and other jurisdictions.

The Bluetooth name and the Bluetooth® trademarks are owned by Bluetooth SIG, Inc. and are used by Plantronics, Inc. under license. All other trademarks are the property of their respective owners.

Part I -- FINANCIAL INFORMATION

Management’s Discussion and Analysis of Financial Condition and Results of Operations

CERTAIN FORWARD-LOOKING INFORMATION:

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 ("Securities Act") and Section 21E of the Securities Exchange Act of 1934 ("Exchange Act"). Forward-looking statements may generally be identified by the use of such words as "anticipate," "believe," “could,” "expect," "intend," “may,” "plan," "potential," "shall," "will," “would,” or variations of such words and similar expressions, or the negative of these terms. Specific forward-looking statements contained within this Form 10-Q include, but are not limited to, statements regarding (i) our expectations of the impact of the acquisition of Polycom as it relates to our strategic vision and additional market and strategic partnership opportunities for our combined hardware and services offerings, (ii) our beliefs regarding the key factors of our customers' purchasing decisions, drivers for customers' solutions adoption, and the ability of our solutions to provide our users with the versatility and convenience they desire, and our positioning in the markets we target, (iii) our beliefs regarding the UC&C market, market dynamics and opportunities, and customer and partner behavior as well as our position in the market, (iv) our belief that the increased adoption of certain technologies and our open architecture approach has and will continue to increase demand for our solutions, (v) our expectations for our Consumer Headset business; (vi) our expectations to reduce channel inventory which will have a material impact on our third quarter and full fiscal year results, (vii) our expectations for new and next generation product and services offerings, (viii) our expectations concerning macroeconomic factors and their potential impact on future business, (ix) the potential impact to our results of operations from tax rulings and interpretations, (x) potential fluctuations in our cash provided by operating activities, (xi) our anticipated range of capital expenditures for the remainder of Fiscal Year 2020 and the sufficiency of our cash, cash equivalents, and cash from operations to sustain future operations and discretionary cash requirements, (xii) our expectations regarding liquidity, capital resources and results of operations along with our intentions concerning the repayment of our debt obligations and our ability to draw funds on our credit facility as needed, (xiii) our expectations regarding consigned inventory and other off balance sheet obligations, (xiv) our expenses and expenditures, including research, development and engineering as well selling, general and administrative, (xv) our future tax rate and payments related to unrecognized tax benefits, (xvi) our ability to pay future stockholder dividends or repurchase stock, (xvii) our beliefs concerning interest rates and foreign currency exchange rates, our exposure to changes in each, and the benefits and risks of our hedging activities, (xviii) our expectations regarding pending and potential future litigation, and other matters discussed in this Quarterly Report on Form 10-Q that are not purely historical data. Such forward-looking statements are based on current expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking statements. Factors that could cause actual results and events to differ materially from such forward-looking statements are included, but not limited to, those discussed in this Quarterly Report on Form 10-Q; in Part I, "Item 1A. Risk Factors" of our Annual Report on Form 10-K for the fiscal year ended March 31, 2019, filed with the Securities and Exchange Commission (“SEC”) on May 17, 2019; and other documents we have filed with the SEC. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

OVERVIEW

We are a leading global designer, manufacturer, and marketer of integrated communications and collaboration solutions that span headsets, open SIP desktop phones, audio and video conferencing, cloud management and analytics software solutions, and services. Our major product categories are Enterprise Headsets, which includes corded and cordless communication headsets; Consumer Headsets, which includes Bluetooth and corded products for mobile device applications, personal computer and gaming; and Voice and Video solutions, which includes open SIP desktop phones, conference room phones, and video endpoints, including cameras, speakers and microphones. All of our solutions are designed to work in a wide range of Unified Communications & Collaboration ("UC&C"), Unified Communication as a Service ("UCaaS"), and Video as a Service ("VaaS") environments. Our RealPresence collaboration solutions range from infrastructure to endpoints and allow people to connect and collaborate globally, naturally, and seamlessly. In addition, we offer comprehensive support services including support for our solutions and hardware devices, as well as professional, hosted, and managed services. There are significant synergies across our communication categories, and we continue to operate under a single operating segment.

We sell our Enterprise products through a high-touch sales team and a well-developed global network of distributors and channel partners including value-added resellers, integrators, direct marketing resellers, service providers, and resellers. We sell our Consumer products through both traditional and online consumer electronics retailers, consumer product retailers, office supply distributors, wireless carriers, catalog and mail order companies, and mass merchants. We have well-established distribution channels in the Americas, Europe, Middle East, Africa, and Asia Pacific where use of our products is widespread.

Our consolidated financial results as of September 30, 2019, include the six-month financial results of Polycom whereas our consolidated financial results as of September 30, 2018, include the financial results of Polycom, Inc. from July 2, 2018, the date of we acquired Polycom (the "Acquisition").

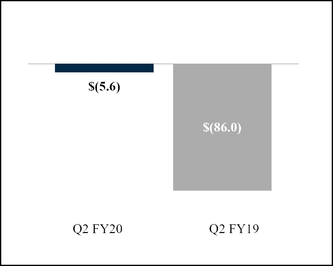

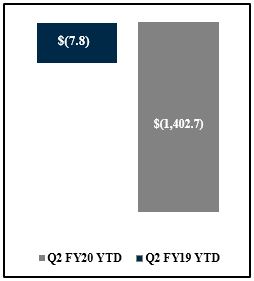

Total Net Revenues (in millions) Operating Income (Loss) (in millions)

Compared to the second quarter of Fiscal Year 2019 total net revenues decreased (4.4)% to $461.7 million; the decrease in total net revenues was primarily driven by a decline in Voice product revenues as well as declines in our Enterprise and Consumer headset product revenues. We continued to see a decline in our net revenues primarily due the Microsoft Skype to Teams transition, macroeconomic conditions, such as China trade tensions, and a softening Gaming market.

As a result of purchase accounting, a total of $8.5 million of deferred revenue that otherwise would have been recognized in the second quarter of Fiscal Year 2020 was excluded from second quarter revenue of $461.7 million; the amount of deferred revenue excluded from the second quarter of Fiscal Year 2019 was $36.6 million.

We reported an operating loss of $5.6 million for the second quarter of Fiscal Year 2020 and an operating loss of $86.0 million for the second quarter of Fiscal Year 2019. The improvement in our results from operations is primarily due to a non-recurring purchase accounting adjustment for inventory in the second quarter of Fiscal Year 2019, decreased amount of deferred revenue excluded due to purchase accounting, reduced funding of our variable compensation plans, decreased integration related costs, and cost savings recognized from restructuring activities taken in prior periods.

Our strategic initiatives are primarily focused on driving long-term growth through our end-to-end portfolio of audio and video endpoints, including headsets, desktop phones, conference room phones, and video collaboration solutions. The acquisition of Polycom has positioned us as a global leader in communications and collaboration endpoints, allowed us to target the faster-growing market categories, such as the Huddle Room for video collaboration, is allowing us to capture additional opportunities through data analytics and insight services across a broad range of communications endpoints, and better positions us with our channel partners, customers and strategic alliance partners to pursue comprehensive solutions to communications challenges in the marketplace, each of which we believe will drive long-term revenue growth.

Within the Enterprise market, we anticipate the key driver of growth over the next few years will be the continued adoption of UC&C solutions. We believe enterprises are increasing their adoption of UC&C systems to reduce costs, improve collaboration, and migrate to more capable and flexible technology. We expect the growth of UC&C solutions will increase overall headset, video endpoint and voice product adoption in enterprise environments.

Revenues from our Consumer Headsets are seasonal and typically strongest in our third fiscal quarter, which includes the holiday shopping season. Other factors that directly impact performance in the product category include product life cycles (including the introduction and pace of adoption of new technology), market acceptance of new product introductions, consumer preferences and the competitive retail environment, changes in consumer confidence and other macroeconomic factors. In addition, the timing or non-recurrence of retailer product placements can cause volatility in quarter-to-quarter results.

The Acquisition is also allowing us to reevaluate our business to determine which aspects remain consistent with our enterprise-focused strategic initiatives and to realize manufacturing and supply chain efficiencies. This review led to our announcement in the first quarter of Fiscal Year 2020 that we had begun considering strategic alternatives for our Consumer Headset products. Those efforts are ongoing and the timing, structure, or financial impact of any potential transaction has not yet been determined.

Additionally, our consolidation efforts have led to material integration-related cost and expense savings. The majority of these savings are being realized in our operations group where efficiencies in our manufacturing operations and supply chain have helped to reduce our time to market. Simultaneously, we have begun to announce and release a number of new and refreshed product offerings in support of our end-to-end strategic initiatives. As a result of these dynamics combined with the net revenue declines discussed above, the inventory levels of our raw materials and finished products on hand has increased. In addition, our channel inventory has increased, and we would like to see those channel inventory levels come down going forward. Consequently, we intend to reduce channel inventory by approximately $65 million to more closely align with our global manufacturing lead-time improvements, expectations for the macroeconomic environment, and product transitions. This action will be accomplished by reducing sales to our channel partners and will have a material impact on our third quarter and full year results.

We remain cautious about the macroeconomic environment, based on uncertainty around trade and fiscal policy in the U.S. and internationally and broader economic uncertainty in many parts of Europe and Asia Pacific, which makes it difficult for us to gauge the economic impacts on our future business. We furthermore intend to continue monitoring our expenditures, including opportunities to streamline our workforce, tools and processes, prioritize expenditures that further our strategic long-term growth opportunities, and go to market under a unified Poly brand.

RESULTS OF OPERATIONS

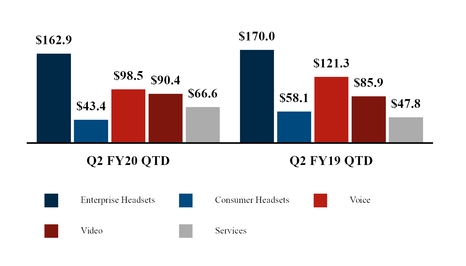

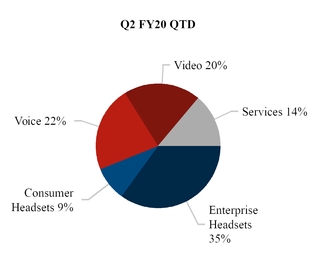

The following graphs display net revenues by product category for the three and six months ended September 30, 2019 and 2018:

Net Revenues (in millions)

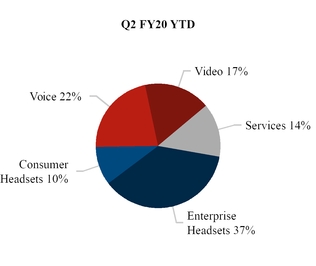

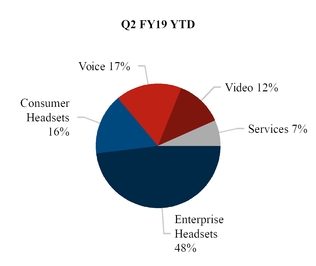

Revenue by Product Category (percent)

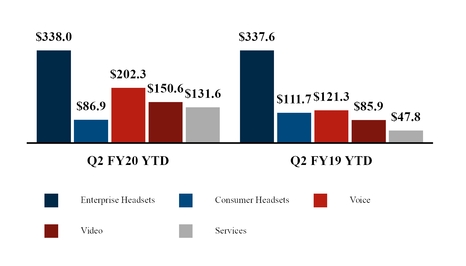

Net Revenues* (in millions)

Revenue by Product Category* (percent)

* Year to date net revenues for Voice, Video, and Services in FY19 include only three months activity as the Acquisition closed on July 2, 2018.

Total net revenues decreased in the three months ended September 30, 2019 compared to the prior year period primarily due to declines in Voice product revenues as well as declines in our Enterprise and Consumer headset product revenues. These decreases were partially offset by an increase in Service revenue attributable to a decline in deferred revenue excluded due to purchase accounting. Video product revenues increased compared to the prior year period.

Total net revenues increased in the six months ended September 30, 2019 compared to the prior year period primarily due to the Acquisition. This increase was partially offset by declines in our Consumer headset product revenues which largely were driven by our Gaming and Mono product lines.

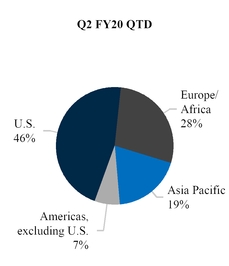

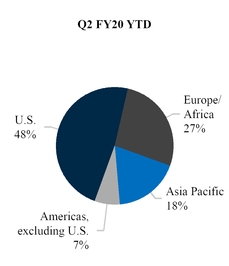

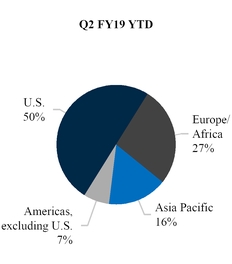

Geographic Information (in millions) Revenue by Region (percent)

Geographic Information (in millions) Revenue by Region (percent)

Compared to the same prior year period, U.S. net revenues for the three months ended September 30, 2019 decreased primarily due to declines in non-UC&C Enterprise headset product revenues as well as a decline in Voice and Consumer product revenues. These decreases were partially offset by an increase in Service revenue attributable to a decline in the amount of deferred revenue excluded due to purchase accounting. Video product revenues increased compared to the prior year period.

Compared to the same prior year period, U.S. net revenues for the six months ended September 30, 2019 increased primarily due to Voice, Video, and Service product categories introduced as a result of the Acquisition. This increase was partially offset by declines in our Consumer headset product revenues which largely were driven by our Gaming and Mono product lines, as well as continued declines in our non-UC&C Enterprise headset product revenues. These declines were partially offset by growth in UC&C revenues.

International net revenues for the three months ended September 30, 2019 decreased from the same prior year period primarily due to declines in Voice product revenues as well as declines in our Consumer headset product revenues. These declines were partially offset by an increase in Service revenue attributable to a decline in the amount of deferred revenue excluded due to purchase accounting.

International net revenues for the six months ended September 30, 2019 increased from the same prior year period primarily due to the Acquisition as well as growth in our Enterprise Headsets category driven by UC&C product sales. These increases were partially offset by declines in our Consumer headset product revenues which largely were driven by our Mono and Gaming product lines.

During the three months ended September 30, 2019, changes in foreign exchange rates negatively impacted net revenues by $3.8 million, net of the effects of hedging, compared to an immaterial impact in the prior year period.

During the six months ended September 30, 2019, changes in foreign exchange rates negatively impacted net revenues by $7.7 million, net of the effects of hedging, compared to an immaterial impact in the prior year period.

COST OF REVENUES AND GROSS PROFIT

Cost of revenues consists primarily of direct and contract manufacturing costs, warranty, freight, depreciation, duties, charges for excess and obsolete inventory, royalties, and overhead expenses.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Six Months Ended | | |

| | September 30, | | Increase | | September 30, | | Increase |

(in thousands, except percentages) | | 2019 | | 2018 | | (Decrease) | | 2019 | | 2018 | | (Decrease) |

Total net revenues | | $ | 461,709 |

| | $ | 483,069 |

| | $ | (21,360 | ) | | (4.4 | )% | | $ | 909,476 |

| | $ | 704,378 |

| | $ | 205,098 |

| | 29.1 | % |

Cost of revenues | | 255,638 |

| | 330,440 |

| | (74,802 | ) | | (22.6 | )% | | 490,759 |

| | 441,906 |

| | 48,853 |

| | 11.1 | % |

Gross profit | | $ | 206,071 |

| | $ | 152,629 |

| | $ | 53,442 |

| | 35.0 | % | | $ | 418,717 |

| | $ | 262,472 |

| | $ | 156,245 |

| | 59.5 | % |

Gross profit % | | 44.6 | % | | 31.6 | % | |

|

| | | | 46.0 | % | | 37.3 | % | | | | |

Compared to the same prior year period, gross profit as a percentage of net revenues increased in the three and six months ended September 30, 2019, primarily due to a non-recurring inventory fair value adjustment in the prior year and a decrease in deferred revenue fair value adjustment when compared to prior year, both of which resulted from the Acquisition. In addition, we had material cost reductions as a result of our in-sourcing of certain products.

There are significant variances in gross profit percentages between our higher and lower margin products, including Voice, Video, and Service products acquired through the Acquisition; therefore, small variations in product mix, which can be difficult to predict, can have a significant impact on gross profit as a percentage of net revenues. Gross profit percentages also may vary based on other factors, including distribution channels and return rates.

OPERATING EXPENSES

Operating expenses consists primarily of research, development and engineering; selling, general and administrative; gain, net of litigation settlements and restructuring and other related charges, all of which are summarized in the table below for the three and six months ended September 30, 2019 and 2018:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Six Months Ended | | | |

| | September 30, | | Increase | | September 30, | | Increase | |

(in thousands, except percentages) | | 2019 | | 2018 | | (Decrease) | | 2019 | | 2018 | | (Decrease) | |

Research, development, and engineering | | $ | 57,415 |

| | $ | 57,047 |

| | $ | 368 |

| | 1 | % | | $ | 116,939 |

| | $ | 80,748 |

| | $ | 36,191 |

| | 45 | % | |

Selling, general and administrative | | 148,419 |

| | 174,297 |

| | (25,878 | ) | | (15 | )% | | 312,027 |

| | 238,500 |

| | 73,527 |

| | 31 | % | |

Gain, net of litigation settlements | | — |

| | — |

| | — |

| | — | % | | (1,162 | ) | | (30 | ) | | (1,132 | ) | | (3,773 | )% | |

Restructuring and other related charges | | 5,847 |

| | 7,261 |

| | (1,414 | ) | | (20 | )% | | 25,372 |

| | 8,581 |

| | 16,791 |

| | 196 | % | |

Total Operating Expenses | | $ | 211,681 |

| | $ | 238,605 |

| | $ | (26,924 | ) | | (11 | )% | | $ | 453,176 |

| | $ | 327,799 |

| | $ | 125,377 |

| | 38 | % | |

% of net revenues | | 45.8 | % | | 49.4 | % | |

| | | | 49.8 | % | | 46.5 | % | | | | | |

Our Research, development, and engineering expenses were flat in the three months ended September 30, 2019 when compared to the prior year period and increased in the six months ended September 30, 2019 primarily due to the inclusion of Polycom operating expenses after the Acquisition.

Our Selling, general and administrative expenses decreased during the three months ended September 30, 2019 when compared to the prior year period primarily due to lower compensation expense, driven by reduced funding of our variable compensation plans, cost reductions from our restructuring actions initiated in prior periods, and Acquisition related costs that did not recur in the current period. Selling, general and administrative expenses increased in the six months ended September 30, 2019 primarily due to the inclusion of Polycom operating expenses after the Acquisition.

Compared to the prior year period, Restructuring and other related charges increased in the six months ended September 30, 2019, primarily due to restructuring actions initiated during the period to streamline the global workforce and achieve planned synergies. For more information regarding restructuring activities, see Note 10, Restructuring and Other Related Charges, of the accompanying notes to condensed consolidated financial statements.

INTEREST EXPENSE

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Six Months Ended | | | | |

| | September 30, | | Increase | | September 30, | | Increase |

(in thousands, except percentages) | | 2019 |

| 2018 | | (Decrease) | | 2019 | | 2018 | | (Decrease) |

Interest expense | | $ | (23,797 | ) | | $ | (23,893 | ) | | $ | 96 |

| | 0.4 | % | | $ | (47,729 | ) | | $ | (31,220 | ) | | $ | (16,509 | ) | | 52.9 | % |

% of net revenues | | (5.2 | )% | | (4.9 | )% | | | | | | (5.2 | )% | | (4.4 | )% | | | | |

Interest expense was flat for the three months ended September 30, 2019 and increased for the six months ended September 30, 2019 primarily due to interest incurred on our Credit Facility Agreement entered into in connection with the Acquisition. See Note 9, Debt, of the accompanying notes to condensed consolidated financial statements.

OTHER NON-OPERATING INCOME, NET

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Six Months Ended | | | | | |

| | September 30, | | Increase | | September 30, | | Increase | |

(in thousands, except percentages) | | 2019 | | 2018 | | (Decrease) | | 2019 | | 2018 | | (Decrease) | |

Other non-operating income, net | | $ | (625 | ) | | $ | 1,610 |

| | $ | (2,235 | ) | | (138.8 | )% | | $ | (292 | ) | | $ | 3,606 |

| | $ | (3,898 | ) | | (108.1 | )% | |

% of net revenues | | (0.1 | )% | | 0.3 | % | | | | | | — | % | | 0.5 | % | | | | | |

Other non-operating income, net for the three months ended September 30, 2019 decreased primarily due to immaterial net foreign currency losses compared to immaterial net foreign currency gains in the prior period.

Other non-operating income, net for the six months ended September 30, 2019 decreased primarily due to lower interest income as our investment portfolios were liquidated during the First Quarter of Fiscal Year 2019 to facilitate the Acquisition and lower net foreign currency gains compared to the prior period.

INCOME TAX EXPENSE (BENEFIT)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | | Six Months Ended | | | | | |

| | September 30, | | Increase | | September 30, | | Increase | |

(in thousands except percentages) | | 2019 |

| 2018 | | (Decrease) | | 2019 | | 2018 | | (Decrease) | |

Loss before income taxes | | $ | (30,032 | ) | | $ | (108,259 | ) | | $ | 78,227 |

| | (72.3 | )% | | $ | (82,480 | ) | | $ | (92,941 | ) | | $ | 10,461 |

| | (11.3 | )% | |

Income tax benefit | | (4,122 | ) | | (21,550 | ) | | 17,428 |

| | (80.9 | )% | | (11,699 | ) | | (20,703 | ) | | 9,004 |

| | (43.5 | )% | |

Net loss | | $ | (25,910 | ) | | $ | (86,709 | ) | | $ | 60,799 |

| | (70.1 | )% | | $ | (70,781 | ) | | $ | (72,238 | ) | | $ | 1,457 |

| | (2.0 | )% | |

Effective tax rate | | (13.7 | )% | | (19.9 | )% | |

|

| |

| | (14.2 | )% | | (22.3 | )% | | | | | |

The Company and its subsidiaries are subject to taxation in the U.S. and in various foreign and state jurisdictions. Our income tax expense or benefit is determined using an estimate of our annual effective tax rate and adjusted for discrete items that are taken into account in the relevant period. The effective tax rates for the three months ended September 30, 2019 and 2018 were (13.7)% and (19.9)%, respectively. The effective tax rates for the six months ended September 30, 2019 and 2018 were (14.2)% and (22.3)%, respectively.

The annual effective tax rates as of September 30, 2019 and 2018 varied from the statutory tax rate of 21%, primarily due to our jurisdictional mix of income, state taxes, U.S. taxation of foreign earnings, and R&D credits. The reduction in our annual effective tax rate for the three and six months ended September 30, 2019 relative to prior year is primarily due to an unfavorable shift in jurisdictional losses and higher state taxes as a proportion of losses partially offset by incremental benefit for R&D credits.

During the six months ended September 30, 2019, we recognized a discrete $11.6 million tax benefit related to an intra-entity transfer of an intangible asset that will have a deferred future benefit, for which we established a deferred tax asset.

On June 7, 2019, a Ninth Circuit panel reversed the United States Tax Court’s holding in Altera Corp. v. Commissioner and upheld the portion of the Treasury regulations issued under IRC Section 482 requiring related-party participants in a cost sharing arrangement to share stock-based compensation costs. At this time, the taxpayer is protesting the decision in en banc rehearing in the US Court of Appeals Ninth Circuit. We have considered the issue and have recorded a $8.6 million discrete tax charge resulting from the cost sharing of prior stock-based compensation, partially offset by a reduction to the 2017 Tax Cuts and Jobs Act toll charge accrued in prior periods. We will continue to monitor developments related to the case and the potential impact on its consolidated financial statements.

FINANCIAL CONDITION

|

| | |

Operating Cash Flow (in millions) | Investing Cash Flow (in millions) | Financing Cash Flow (in millions) |

| | |

We use cash provided by operating activities as our primary source of liquidity. We expect that cash provided by operating activities will fluctuate in future periods as a result of a number of factors, including fluctuations in our revenues, the timing of compensation-related payments such as our annual bonus/variable compensation plan, integration costs related to the Acquisition, interest payments on our long-term debt, product shipments during the quarter, accounts receivable collections, inventory and supply chain management, and the timing and amount of tax and other payments.

Operating Activities

Compared to the same period last year, net cash provided by operating activities during the six months ended September 30, 2019 decreased primarily due to increased inventory resulting from new product introductions and in-sourcing of manufacturing, cash paid for interest payments on long-term debt, and cash paid for restructuring and integration activities. The decrease was partially offset by higher cash collections from customers as a result of increased revenue when compared to the six months ended September 30, 2018.

Investing Activities

Net cash used for investing activities during the six months ended September 30, 2019 was primarily used for the purchase of personal property, plant and equipment and partially offset by proceeds from the sale of real property.

We estimate total capital expenditures for Fiscal Year 2020 will be approximately $30 million to $40 million. We expect capital expenditures for the remainder of Fiscal Year 2020 to consist primarily of new information technology investments, capital investment in our manufacturing capabilities, including tooling for new products, and facilities upgrades.

Financing Activities

Net cash used for financing activities during the six months ended September 30, 2019, primarily was used for early repayment of long-term debt, dividend payments on our common stock, and taxes paid on behalf of employees related to net share settlements of vested employee equity awards. The uses of cash were partially offset by proceeds from issuance of common stock from our Employee Stock Purchase Plan ("ESPP").

Liquidity and Capital Resources

Our primary sources of liquidity as of September 30, 2019, consisted of cash, cash equivalents, and short-term investments, cash we expect to generate from operations, and a $100 million revolving credit facility. At September 30, 2019, we had working capital of $224.1 million, including $200.8 million of cash, cash equivalents, and short-term investments, compared with working capital of $252.9 million, including $215.8 million of cash, cash equivalents, and short-term investments at March 31, 2019. The decrease in working capital at September 30, 2019 compared to March 31, 2019 resulted from the net decrease in cash and cash equivalents, which were reduced by integration-related payments and the early repayment of long-term debt in the second quarter of Fiscal Year 2020, and a net increase in accounts payable due to payment timing.

Our cash and cash equivalents as of September 30, 2019 consisted of bank deposits with third party financial institutions. We monitor bank balances in our operating accounts and adjust the balances as appropriate. Cash balances are held throughout the world, including substantial amounts held outside of the U.S. As of September 30, 2019, of our $200.8 million of cash, cash equivalents, and short-term investments, $71.8 million was held domestically while $129.0 million was held by foreign subsidiaries, and approximately 64% was based in USD-denominated instruments. Our remaining investments were composed of Mutual Funds.

During Fiscal Year 2019, in connection with the Acquisition, we entered into a Credit Agreement with Wells Fargo Bank, National Association, as administrative agent, and the lenders party thereto (the “Credit Agreement”). The Credit Agreement replaced our prior revolving credit facility in its entirety. The Credit Agreement provides for (i) a revolving credit facility with an initial maximum aggregate amount available of $100 million that matures in July 2023 and (ii) a $1.275 billion term loan facility that matures in July 2025. On July 2, 2018, the Company borrowed the full amount available under the term loan facility of $1.245 billion, net of approximately $30 million of discounts and issuance costs. Borrowings under the Credit Agreement bear interest due on a monthly basis at a variable rate equal to (i) LIBOR plus a specified margin, or (ii) the base rate (which is the highest of (a) the prime rate publicly announced from time to time by Wells Fargo Bank, National Association, (b) the federal funds rate plus 0.50% or (c) the sum of 1% plus one-month LIBOR) plus a specified margin. In the second quarter of Fiscal Year 2020, we prepaid $25 million of our outstanding principal on the term loan facility. See Note 9, Debt, in the accompanying notes to the condensed consolidated financial statements.

On July 30, 2018, we entered into a 4-year amortizing interest rate swap agreement with Bank of America, NA. The swap has an initial notional amount of $831 million and matures on July 31, 2022. The purpose of this swap is to hedge against changes in cash flows (interest payments) attributable to fluctuations in the contractually specified LIBOR interest rate associated with our credit facility agreement. The swap involves the receipt of floating-rate amounts for fixed interest rate payments over the life of the agreement. We have designated this interest rate swap as a cash flow hedge. The derivative is valued based on prevailing LIBOR rate curves on the date of measurement. We also evaluate counterparty credit risk when we calculate the fair value of the swap. For additional details, see Note 14, Derivatives, of the accompanying notes to condensed consolidated financial statements.

During Fiscal Year 2016, we obtained $488.4 million from debt financing, net of issuance costs. The debt matures on May 31, 2023 and bears interest at a rate of 5.50% per annum, payable semi-annually on May 15 and November 15 of each year. See Note 9, Debt, in the accompanying notes to the condensed consolidated financial statements.

From time to time, our Board of Directors ("Board") authorizes programs under which we may repurchase shares of our common stock in the open market or through privately negotiated transactions, including accelerated stock repurchase agreements. On November 28, 2018, the Board approved a 1 million share repurchase program expanding our capacity to repurchase shares to approximately 1.7 million shares. During the first half of Fiscal Year 2020, we did not repurchase any shares of our common stock. As of September 30, 2019, there remained 1,369,014 shares authorized for repurchase under the existing stock repurchase program. See Note 12, Common Stock Repurchases, in the accompanying notes to the condensed consolidated financial statements.

Our liquidity, capital resources, and results of operations in any period could be affected by repurchases of our common stock, the payment of cash dividends, the exercise of outstanding stock options, restricted stock grants under stock plans, and the issuance of common stock under our ESPP. The debt we assumed for the Acquisition negatively affected our liquidity and leverage ratios. To reduce our debt leverage ratios, we expect to prioritize the repayment of the debt under the Credit Agreement.

Additionally, the Acquisition impacted our cash conversion cycle due to Polycom's use of third-party partner financing and early payment discounts to drive down cash collection cycles.

We also receive cash from the exercise of outstanding stock options under our stock plan and the issuance of shares under our ESPP. However, the resulting increase in the number of outstanding shares from these equity grants and issuances could affect our earnings per share. We cannot predict the timing or amount of proceeds from the sale or exercise of these securities or whether they will be exercised, forfeited, canceled, or expire.

On November 5, 2019, we announced that the Audit Committee of our Board declared a cash dividend of $0.15 per share, payable on December 10, 2019 to stockholders of record at the close of business on November 20, 2019.

We believe that our current cash and cash equivalents, cash provided by operations, and the availability of additional funds under the Credit Agreement will be sufficient to fund operations for at least the next 12 months; however, any projections of future financial needs and sources of working capital are subject to uncertainty. Readers are cautioned to review the risks, uncertainties, and assumptions set forth in this Quarterly Report on Form 10-Q, including the section entitled "Certain Forward-Looking Information" and the risk factors set forth in our Annual Report on Form 10-K for the fiscal year ended March 31, 2019, filed with the SEC on May 17, 2019, and other periodic filings with the SEC, any of which could affect our estimates for future financial needs and sources of working capital.

OFF BALANCE SHEET ARRANGEMENTS AND CONTRACTUAL OBLIGATIONS

We have not entered into any transactions with unconsolidated entities whereby we have financial guarantees, subordinated retained interests, derivative instruments, or other contingent arrangements that expose us to material continuing risks, contingent liabilities, or any other obligation under a variable interest in an unconsolidated entity that provides us with financing and liquidity support, market risk, or credit risk support.

A substantial portion of the raw materials, components, and subassemblies used in our products are provided by our suppliers on a consignment basis. These consigned inventories are not recorded on our consolidated balance sheet until we take title to the raw materials, components, and subassemblies, which occurs when they are consumed in the production process. Prior to consumption in the production process, our suppliers bear the risk of loss and retain title to the consigned inventory. The terms of the agreements allow us to return parts in excess of maximum order quantities to the suppliers at the supplier’s expense. Returns for other reasons are negotiated with the suppliers on a case-by-case basis and to date have been immaterial. If our suppliers were to discontinue financing consigned inventory, it would require us to make cash outlays and we could incur expenses which, if material, could negatively affect our business and financial results. As of September 30, 2019, and March 31, 2019, we had off-balance sheet consigned inventories of $52.3 million and $47.1 million, respectively.

Unconditional Purchase Obligations

We use several contract manufacturers to manufacture raw materials, components, and subassemblies for our products. We provide these contract manufacturers with demand information that typically covers periods up to 13 weeks, and they use this information to acquire components and build products. We also obtain individual components for our products from a wide variety of individual suppliers. Consistent with industry practice, we acquire components through a combination of purchase orders, supplier contracts, and open orders based on projected demand information. As of September 30, 2019, we had outstanding off-balance sheet third-party manufacturing, component purchase, and other general and administrative commitments of $341.5 million, including the off-balance sheet consigned inventories of $52.3 million discussed above, which we expect to consume in the normal course of business.

Except as described above, there have been no material changes in our contractual obligations as described in our Annual Report on Form 10-K for the fiscal year ended March 31, 2019.

CRITICAL ACCOUNTING ESTIMATES

For a complete description of what we believe to be the critical accounting estimates used in the preparation of our condensed consolidated financial statements, refer to our Annual Report on Form 10-K for the fiscal year ended March 31, 2019, filed with the SEC on May 17, 2019. There have been no changes to our critical accounting estimates during the six months ended September 30, 2019.

Recent Accounting Pronouncements

For more information regarding the Recent Accounting Pronouncements that may impact us, see Note 2, Recent Accounting Pronouncements, of the accompanying notes to the condensed consolidated financial statements.

Financial Statements (Unaudited)

PLANTRONICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited) |

| | | | | | | |

| September 30,

2019 | | March 31,

2019 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 186,442 |

| | $ | 202,509 |

|

Short-term investments | 14,378 |

| | 13,332 |

|

Accounts receivable, net | 337,077 |

| | 337,671 |

|

Inventory, net | 228,363 |

| | 177,146 |

|

Other current assets | 55,160 |

| | 50,488 |

|

Total current assets | 821,420 |

| | 781,146 |

|

Property, plant, and equipment, net | 186,638 |

| | 204,826 |

|

Goodwill | 1,279,897 |

| | 1,278,380 |

|

Purchased intangibles, net | 734,355 |

| | 825,675 |

|

Deferred tax assets | 20,728 |

| | 5,567 |

|

Other assets | 68,976 |

| | 20,941 |

|

Total assets | $ | 3,112,014 |

| | $ | 3,116,535 |

|

| | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | |

|

Current liabilities: | |

| | |

|

Accounts payable | $ | 169,701 |

| | $ | 129,514 |

|

Accrued liabilities | 427,647 |

| | 398,715 |

|

Total current liabilities | 597,348 |

| | 528,229 |

|

Long term debt, net of issuance costs | 1,619,015 |

| | 1,640,801 |

|

Long-term income taxes payable | 92,831 |

| | 83,121 |

|

Other long-term liabilities | 143,713 |

| | 142,697 |

|

Total liabilities | 2,452,907 |

| | 2,394,848 |

|

Commitments and contingencies (Note 8) |

|

| |

|

|

Stockholders' equity: | |

| | |

|

Common stock | 890 |

| | 884 |

|

Additional paid-in capital | 1,465,978 |

| | 1,431,607 |

|

Accumulated other comprehensive loss | (5,351 | ) | | (475 | ) |

Retained earnings | 60,545 |

| | 143,344 |

|

Total stockholders' equity before treasury stock | 1,522,062 |

| | 1,575,360 |

|

Less: Treasury stock, at cost | (862,955 | ) | | (853,673 | ) |

Total stockholders' equity | 659,107 |

| | 721,687 |

|

Total liabilities and stockholders' equity | $ | 3,112,014 |

| | $ | 3,116,535 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended

September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

Net revenues | | | | | | | |

Net product revenues | $ | 395,137 |

| | $ | 435,262 |

| | $ | 777,882 |

| | $ | 656,571 |

|

Net service revenues | 66,572 |

| | 47,807 |

| | 131,594 |

| | 47,807 |

|

Total net revenues | 461,709 |

| | 483,069 |

| | 909,476 |

| | 704,378 |

|

Cost of revenues | | | | | | | |

Cost of product revenues | 229,323 |

| | 305,477 |

| | 437,939 |

| | 416,943 |

|

Cost of service revenues | 26,315 |

| | 24,963 |

| | 52,820 |

| | 24,963 |

|

Total cost of revenues | 255,638 |

| | 330,440 |

| | 490,759 |

| | 441,906 |

|

Gross profit | 206,071 |

| | 152,629 |

| | 418,717 |

| | 262,472 |

|

Operating expenses: | | | | | | | |

Research, development, and engineering | 57,415 |

| | 57,047 |

| | 116,939 |

| | 80,748 |

|

Selling, general, and administrative | 148,419 |

| | 174,297 |

| | 312,027 |

| | 238,500 |

|

Gain, net from litigation settlements | — |

| | — |

| | (1,162 | ) | | (30 | ) |

Restructuring and other related charges | 5,847 |

| | 7,261 |

| | 25,372 |

| | 8,581 |

|

Total operating expenses | 211,681 |

| | 238,605 |

| | 453,176 |

| | 327,799 |

|

Operating loss | (5,610 | ) | | (85,976 | ) | | (34,459 | ) | | (65,327 | ) |

Interest expense | (23,797 | ) | | (23,893 | ) | | (47,729 | ) | | (31,220 | ) |

Other non-operating income, net | (625 | ) | | 1,610 |

| | (292 | ) | | 3,606 |

|

Loss before income taxes | (30,032 | ) | | (108,259 | ) | | (82,480 | ) | | (92,941 | ) |

Income tax benefit | (4,122 | ) | | (21,550 | ) | | (11,699 | ) | | (20,703 | ) |

Net loss | $ | (25,910 | ) | | $ | (86,709 | ) | | $ | (70,781 | ) | | $ | (72,238 | ) |

| | | | | | | |

Loss per common share: | | | | | | | |

Basic | $ | (0.65 | ) | | $ | (2.21 | ) | | $ | (1.80 | ) | | $ | (2.01 | ) |

Diluted | $ | (0.65 | ) | | $ | (2.21 | ) | | $ | (1.80 | ) | | $ | (2.01 | ) |

| | | | | | | |

Shares used in computing loss per common share: | | | | | | | |

Basic | 39,584 |

| | 39,281 |

| | 39,411 |

| | 35,938 |

|

Diluted | 39,584 |

| | 39,281 |

| | 39,411 |

| | 35,938 |

|

| | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Six Months Ended

September 30, |

| 2019 | | 2018 | | 2019 | | 2018 |

Net loss | $ | (25,910 | ) | | $ | (86,709 | ) | | $ | (70,781 | ) | | $ | (72,238 | ) |

Other comprehensive income (loss): | | | | | | | |

Foreign currency translation adjustments | — |

| | (1,815 | ) | | (219 | ) | | (1,815 | ) |

Unrealized gains (losses) on cash flow hedges: | | | | | | | |

Unrealized cash flow hedge gains (losses) arising during the period | 2,369 |

| | 813 |

| | (4,335 | ) | | 4,769 |

|

Net (gains) losses reclassified into income for revenue hedges | (1,568 | ) | | (900 | ) | | (2,927 | ) | | (1,149 | ) |

Net (gains) losses reclassified into income for cost of revenue hedges | (62 | ) | | — |

| | (166 | ) | | (79 | ) |

Net (gains) losses reclassified into income for interest rate swaps | 945 |

| | 977 |

| | 1,597 |

| | 977 |

|

Net unrealized gains (losses) on cash flow hedges | 1,684 |

| | 890 |

| | (5,831 | ) | | 4,518 |

|