Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 30, 2017

or

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________to _________

Commission File Number: 001-12696

Plantronics, Inc.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 77-0207692 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

345 Encinal Street

Santa Cruz, California 95060

(Address of principal executive offices)

(Zip Code)

(831) 426-5858

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | Emerging growth company o |

| | (Do not check if a smaller reporting company) | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of January 26, 2018, 33,075,564 shares of the registrant's common stock were outstanding.

Plantronics, Inc.

FORM 10-Q

TABLE OF CONTENTS

|

| |

PART I. FINANCIAL INFORMATION | Page No. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART II. OTHER INFORMATION | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Plantronics® and Simply Smarter Communications® are trademarks or registered trademarks of Plantronics, Inc.

DECT™ is a trademark of ETSI registered for the benefit of its members in France and other jurisdictions.

The Bluetooth name and the Bluetooth® trademarks are owned by Bluetooth SIG, Inc. and are used by Plantronics, Inc. under license. All other trademarks are the property of their respective owners.

Part I -- FINANCIAL INFORMATION

Management’s Discussion and Analysis of Financial Condition and Results of Operations

CERTAIN FORWARD-LOOKING INFORMATION:

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 ("Securities Act") and Section 21E of the Securities Exchange Act of 1934 ("Exchange Act"). Forward-looking statements may generally be identified by the use of such words as "anticipate," "believe," “could,” "expect," "intend," “may,” "plan," "potential," "shall," "will," “would,” or variations of such words and similar expressions, or the negative of these terms. Specific forward-looking statements contained within this Form 10-Q include, but are not limited to, statements regarding (i) our beliefs regarding the Enterprise market, market dynamics and customer behavior as well as our position in the market, (ii) our beliefs regarding the Consumer market, our new product introductions and the expected effect of such introductions, (iii) our belief that our "as-a-service" offerings will benefit our growth long-term but their contribution will not be material in the near term, (iv) our intention to provide customer data insight through software and service solutions, (v) the Unified Communications ("UC") market, including adoption of UC products, our position, and timing and growth expectations in this market, (vi) our plans regarding our "as a service" offerings including sales and marketing efforts, (vii) our intentions regarding investments in long-term growth opportunities and our core research and development efforts, in particular in the UC market, (viii) our intentions regarding the focus of our sales, marketing and customer services and support teams on UC, (ix) the future of UC technologies, including the transition of businesses to UC-supported systems and the effects on headset adoption and use, enterprises that adopt UC and our revenue opportunity and profit growth, (x) our expenses, including research, development and engineering expenses and selling, general and administrative expenses, (xi) fluctuations in our cash provided by operating activities as a result of various factors, including fluctuations in revenues and operating expenses, timing of product shipments, accounts receivable collections, inventory and supply chain management, and the timing and amount of taxes and other payments, (xii) our future tax rate and payments related to unrecognized tax benefits, (xiii) our anticipated range of capital expenditures for the remainder of Fiscal Year 2018 and the sufficiency of our cash, cash equivalents, and cash from operations to sustain future operations and discretionary cash requirements, (xiv) our ability to pay future stockholder dividends, (xv) our ability to draw funds on our credit facility as needed, (xvi) the sufficiency of our capital resources to fund operations, and other statements regarding our future operations, financial condition and prospects, and business strategies. Such forward-looking statements are based on current expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking statements. Factors that could cause actual results and events to differ materially from such forward-looking statements are included, but not limited to, those discussed in this Quarterly Report on Form 10-Q; in Part I, "Item 1A. Risk Factors" of our Annual Report on Form 10-K for the fiscal year ended March 31, 2017, filed with the Securities and Exchange Commission (“SEC”) on May 10, 2017; and other documents we have filed with the SEC. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

OVERVIEW

We are a leading designer, manufacturer, and marketer of lightweight communications headsets, telephone headset systems, other communication endpoints, and accessories for the worldwide business and consumer markets under the Plantronics brand. Our major product categories are Enterprise, which includes headsets optimized for Unified Communications (“UC”), other corded and cordless communication headsets, audio processors, and telephone systems; and Consumer, which includes Bluetooth and corded products for mobile device applications and personal computer gaming headsets. Until July 1, 2017, we also offered specialty products marketed for hearing impaired individuals under our Clarity brand, which was included in our Consumer product category.

We ship our products to approximately 80 countries through a network of distributors, retailers, resellers, wireless carriers, original equipment manufacturers, and telephony service providers. We have well-developed distribution channels in North America, Europe, and in some parts of the Asia Pacific region where use of our products is widespread.

|

| |

Net Revenues (in millions) | Operating Income (in millions) |

Compared to the third quarter of Fiscal Year 2017, net revenues decreased 2.7% to $226.5 million. The decrease in net revenues was driven by lower revenues within our Consumer product category, which declined 22.1%, or $16.7 million, from the year ago period. Of the declines in Consumer, approximately $8.0 million related to the divestiture of Clarity in the first quarter of Fiscal Year 2018. These declines were partially offset by higher revenues within our Enterprise product category, which grew 6.5%, or $10.3 million from the year ago period.

Operating income for the third quarter of Fiscal Year 2018 was $36.8 million and 16.2% of net revenue, compared to $31.9 million and 13.7% of net revenue in the prior year period. The divestiture of Clarity had a negligible impact on operating income for the third quarter of Fiscal Year 2018, and we expect the impact to be negligible for the full Fiscal Year 2018.

We reported a net loss of $49.5 million for the third quarter of Fiscal Year 2018, representing a decrease of 322.8% from the same quarter last year and driven by the impact of the Tax Cuts and Jobs Act ("the Act") that was signed into law on December 22, 2017, which resulted in a $76.4 million discrete charge for the quarter. For additional details regarding the impacts of the Act, refer to the income tax discussion in Results of Operations and Note 13, Income Taxes, in the accompanying footnotes to the condensed consolidated financial statements. In the year ago period net income was $22.2 million and 9.5% of revenues.

Our primary focus, long-term growth opportunities, strategic initiatives, and majority of our revenue and profits are in our Enterprise business. Within the Enterprise product category, we anticipate the key driver of long-term revenue growth and profit opportunity will continue to be UC audio solutions. We believe enterprises are increasing adoption of UC systems to reduce costs, improve collaboration, and migrate technology from obsolete legacy systems. We expect growth of UC will increase overall headset adoption in enterprise environments, and we believe most of the growth in our Enterprise product category over the next three years will come from headsets designed for UC. As such, UC remains the central focus of our sales, marketing, and support functions, and we will continue investing in key strategic alliances and integrations with major UC vendors.

Our Enterprise revenues increased in the third quarter of Fiscal Year 2018 when compared to the same prior year period, resulting from continued growth in UC product sales, which grew at a rate above our long-term growth expectations, partially offset by declines in sales of non-UC corded and cordless products.

Revenues from our Consumer products are seasonal and typically strongest in our third fiscal quarter, which includes the majority of the holiday shopping season. Additionally, other factors directly impact our Consumer product category performance, such as product life-cycles (including the introduction and pace of adoption of new technology), the market acceptance of new product introductions, consumer preferences and the competitive retail environment, changes in consumer confidence and other macroeconomic factors, and fluctuations in foreign currency rates relative to the U.S. Dollar ("USD"). In addition, the timing or non-recurrence of retailer placements can cause volatility in quarter-to-quarter results.

When compared to the same prior year period, the decline in Consumer revenues in the third quarter of Fiscal Year 2018 was primarily attributable to a decline in sales of our stereo Bluetooth products where new product introductions have not yet fully integrated into the market to replace revenues from certain older stereo products. Consumer product refreshes and launches typically take multiple quarters to fully integrate into the market, and it is difficult to predict at what point, if ever, these products will materially contribute to results or replace the sales of preceding models. We are currently refreshing our Consumer portfolio, having recently launched the BackBeat 300 and 500, refreshed BackBeat FIT Training and Boost editions, and RIG 800 series. Additionally, the divestiture of our Clarity line of business negatively impacted our Consumer results when compared to the same prior year period.

We continue to invest in new ideas and technology to create additional growth opportunities, such as Plantronics Manager Pro, our software-as-a-service ("SaaS") data insights offering introduced in Fiscal Year 2017, and Habitat Soundscaping, our intelligent acoustic management solution launched in July 2017. While we anticipate these investments will benefit our growth in the long term, their contribution will not be material in the near term.

We remain cautious about the macroeconomic environment, based primarily on uncertainty around trade and fiscal policy in the U.S. and broader economic uncertainty in many parts of Europe and Asia Pacific. We will continue to monitor our expenditures and prioritize those that further our strategic long-term growth opportunities, such as innovative product development. UC and SaaS are the central focus of our sales force, marketing group, and other customer service and support teams as we continue investing in key strategic alliances and integrations with major UC vendors, and work to expand the market opportunity for our SaaS offering.

RESULTS OF OPERATIONS

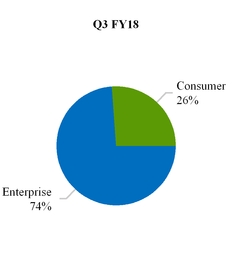

The following graphs display net revenues by product category for the three and nine months ended December 31, 2016 and 2017:

Net Revenues (in millions) Revenue by Product Category (percent)

Net revenues decreased in the three and nine months ended December 31, 2017 compared to the prior year periods due primarily to lower revenues within our Consumer product category, partially offset by increases in our Enterprise product revenues driven by UC revenues.

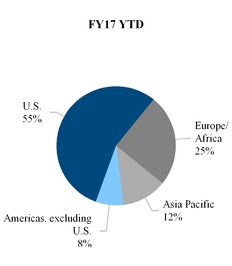

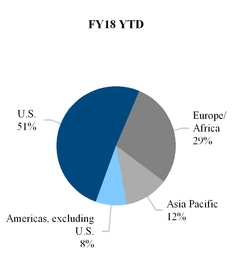

Geographic Information (in millions) Revenue by Region (percent)

Compared to the prior year periods, U.S. net revenues decreased in the three and nine months ended December 31, 2017 due primarily to a decline in Consumer product sales volumes, driven by a decline in sales of our stereo Bluetooth products and the divestiture of our Clarity business. These declines were partially offset by increases in Enterprise, resulting from continued growth in UC within both the Voyager and Blackwire product families.

International net revenues for the three and nine months ended December 31, 2017 increased from the same year ago periods due to growth in our Enterprise category, driven primarily by UC product sales. Changes in foreign exchange rates increased net revenues by $4.1 million, net of the effects of hedging, for the three months ended December 31, 2017, compared to an immaterial impact in the prior year period. During the nine months ended December 31, 2017, changes in foreign exchange rates positively impacted net revenues by $1.3 million, net of the effects of hedging, compared to an immaterial amount in the prior year period.

COST OF REVENUES AND GROSS PROFIT

Cost of revenues consists primarily of direct and contract manufacturing costs, warranty, freight, depreciation, duties, charges for excess and obsolete inventory, royalties, and overhead expenses.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

| | December 31, | | Increase | | December 31, | | Increase |

(in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

Net revenues | | $ | 232,933 |

| | $ | 226,534 |

| | $ | (6,399 | ) | | (2.7 | )% | | $ | 672,222 |

| | $ | 640,760 |

| | $ | (31,462 | ) | | (4.7 | )% |

Cost of revenues | | 122,753 |

| | 112,409 |

| | (10,344 | ) | | (8.4 | )% | | 338,523 |

| | 315,720 |

| | (22,803 | ) | | (6.7 | )% |

Gross profit | | $ | 110,180 |

| | $ | 114,125 |

| | $ | 3,945 |

| | 3.6 | % | | $ | 333,699 |

| | $ | 325,040 |

| | $ | (8,659 | ) | | (2.6 | )% |

Gross profit % | | 47.3 | % | | 50.4 | % | |

|

| | | | 49.6 | % | | 50.7 | % | | | | |

Compared to the same prior year periods, gross profit as a percentage of net revenues increased in the three and nine months ended December 31, 2017, due primarily to product cost reductions and a favorable product mix. Gross profit for the nine months ended December 31, 2017 was also negatively impacted by the loss recorded on the sale of our Clarity division and the write-off of an indirect tax asset in our Brazilian entity, both of which are discussed in detail in Note 8, Restructuring and other related charges (credits), in the accompanying footnotes to the condensed consolidated financial statements.

There are significant variances in gross profit percentages between our higher and lower margin products; therefore, small variations in product mix, which can be difficult to predict, can have a significant impact on gross profit as a percentage of net revenues. Gross profit percentages may also vary based on distribution channel, return rates, and other factors.

RESEARCH, DEVELOPMENT, AND ENGINEERING

Research, development, and engineering costs are expensed as incurred and consist primarily of compensation costs, outside services, including legal fees associated with protecting our intellectual property, expensed materials, travel expenses, depreciation, and overhead expenses.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

| | December 31, | | Increase | | December 31, | | Increase |

(in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

Research, development, and engineering | | $ | 21,393 |

| | $ | 21,257 |

| | $ | (136 | ) | | (0.6 | )% | | $ | 66,116 |

| | $ | 62,402 |

| | $ | (3,714 | ) | | (5.6 | )% |

% of net revenues | | 9.2 | % | | 9.4 | % | |

| | | | 9.8 | % | | 9.7 | % | | | | |

During the three and nine months ended December 31, 2017, research, development, and engineering expenses declined when compared to the prior year periods due primarily to lower compensation expenses, driven primarily by reduced funding of our variable compensation plans and cost reductions from our restructuring actions initiated in prior periods.

SELLING, GENERAL, AND ADMINISTRATIVE

Selling, general, and administrative expenses consist primarily of compensation costs, marketing costs, travel expenses, litigation and professional service fees, and overhead expenses.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

| | December 31, | | Increase | | December 31, | | Increase |

(in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

Selling, general, and administrative | | $ | 56,919 |

| | $ | 56,196 |

| | $ | (723 | ) | | (1.3 | )% | | $ | 169,581 |

| | $ | 170,125 |

| | $ | 544 |

| | 0.3 | % |

% of net revenues | | 24.4 | % |

| 24.8 | % | |

|

| | | | 25.2 | % |

| 26.6 | % | | | | |

Compared to the same year ago periods, selling, general, and administrative expenses were flat in the three and nine months ended December 31, 2017, with increases in legal fees related to our litigation with GN Netcom being offset by lower compensation expenses, driven primarily by reduced funding of our variable compensation plans, lower executive transition costs, cost savings from cost control initiatives and prior period restructuring actions. The litigation with GN Netcom was resolved in October 2017 in favor of the Company on all counts, as discussed further in Note 6, Commitments and Contingencies, in the accompanying footnotes to the condensed consolidated financial statements. As such, we expect legal fees to decrease in future quarters given there are currently no material outstanding legal matters.

(GAIN) LOSS, NET FROM LITIGATION SETTLEMENTS

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

| | December 31, | | Increase | | December 31, | | Increase |

(in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

(Gain) loss, net from litigation settlements | | $ | (103 | ) | | $ | (15 | ) | | $ | 88 |

| | (85.4 | )% | | $ | 4,287 |

| | $ | (295 | ) | | $ | (4,582 | ) | | (106.9 | )% |

% of net revenues | | — | % | | — | % | | | | | | 0.6 | % | | — | % | | | | |

We recognized immaterial gains from litigation in the three months ended December 31, 2016 and 2017. In the nine months ended December 31, 2017, we recognized immaterial gains compared to the prior year period when we recognized a $4.9 million charge related to discovery sanctions in the GN Netcom litigation.

RESTRUCTURING AND OTHER RELATED CHARGES (CREDITS)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

| | December 31, | | Increase | | December 31, | | Increase |

(in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

Restructuring and other related charges (credits) | | $ | 113 |

| | $ | (84 | ) | | $ | (197 | ) | | (174.3 | )% | | $ | (1,350 | ) | | $ | 2,438 |

| | $ | 3,788 |

| | (280.6 | )% |

% of net revenues | | — | % | | — | % | | | | | | (0.2 | )% | | 0.4 | % | | | | |

In the three months ended December 31, 2016 and 2017, we recognized immaterial adjustments resulting from changes to the estimates related to restructuring actions recorded in prior periods.

Compared to the prior year period, restructuring and other related charges (credits) increased in the nine months ended December 31, 2017, due to restructuring actions initiated during the first quarter of Fiscal Year 2018. In the prior year period we recorded a net reduction to expenses resulting from changes to the estimates related to our restructuring actions recorded in Fiscal Year 2016.

For more information regarding restructuring activities, refer to Note 8, Restructuring and other related charges (credits), of the accompanying notes to condensed consolidated financial statements.

INTEREST EXPENSE

Interest expense for the three and nine months ended December 31, 2016 and 2017 was $7.3 million and $21.9 million, respectively and relates primarily to our 5.50% Senior Notes.

OTHER NON-OPERATING INCOME AND (EXPENSE), NET |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Nine Months Ended | | |

| | December 31, | | Increase | | December 31, | | Increase |

(in thousands, except percentages) | | 2016 | | 2017 | | (Decrease) | | 2016 | | 2017 | | (Decrease) |

Other non-operating income and (expense), net

| | $ | 427 |

| | $ | 2,490 |

| | $ | 2,063 |

| | 483.1 | % | | $ | 4,119 |

| | $ | 5,230 |

| | $ | 1,111 |

| | 27.0 | % |

% of net revenues | | 0.2 | % | | 1.1 | % | | | | | | 0.6 | % | | 0.8 | % | | | | |

Other non-operating income and (expense), net for the three months ended December 31, 2017 increased primarily due to favorable changes in the Mexican Peso exchange rate and an increase in interest income from higher average yields on our investment portfolio.

Other non-operating income and (expense), net for the nine months ended December 31, 2017 increased primarily due to increases in interest income from higher average yields on our investment portfolio.

INCOME TAX EXPENSE

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | | Nine Months Ended | | | | |

| | December 31, | | Increase | | December 31, | | Increase |

(in thousands except percentages) | | 2016 |

| 2017 | | (Decrease) | | 2016 |

| 2017 | | (Decrease) |

Income before income taxes | | $ | 24,963 |

| | $ | 31,920 |

| | $ | 6,957 |

| | 27.9 | % | | $ | 77,317 |

| | $ | 73,696 |

| | $ | (3,621 | ) | | (4.7 | )% |

Income tax expense | | 2,742 |

| | 81,424 |

| | 78,682 |

| | 2,869.5 | % | | 14,235 |

| | 84,419 |

| | 70,184 |

| | 493.0 | % |

Net income | | $ | 22,221 |

| | $ | (49,504 | ) | | $ | (71,725 | ) | | (322.8 | )% | | $ | 63,082 |

| | $ | (10,723 | ) | | $ | (73,805 | ) | | (117.0 | )% |

Effective tax rate | | 11.0 | % | | 255.1 | % | |

|

| |

| | 18.4 | % | | 114.6 | % | | | | |

On December 22, 2017, the Tax Cuts and Jobs Act (H.R. 1) (the “Act”) was signed into law in the United States. The Act includes several changes to existing tax law, including, among other things, a permanent reduction in the corporate income tax rate from 35% to 21% and the move from a worldwide to a territorial tax system.

The move to a territorial tax system was accompanied by federal taxation of a one-time deemed repatriation of accumulated unremitted earnings (hereafter, the "toll charge"), which we will elect to pay over an eight-year period as permitted under the Act. We recorded a $69.3 million toll charge as part of income tax expense in the quarter ended December 31, 2017, representing a provisional estimate that will be finalized when we complete our review of data spanning a 30-year period. The provisional toll charge increased our effective tax rate by 217.2% and 94.1% for the three and nine months ended December 31, 2017, respectively.

As part of the Act, we also completed our remeasurement of deferred tax assets as of December 31, 2017 to the new future federal tax rate of 21.0%, thereby reducing our deferred tax assets by $2.1 million. The rate change resulted in an overall increase to our effective tax rate by 6.6% and 2.9% for the three and nine months ended December 31, 2017, respectively. In addition, prior to our third quarter of Fiscal Year 2018, we did not recognize a deferred tax liability related to unremitted foreign earnings because our plans did not require us to repatriate earnings from foreign operations to fund U.S. operations. We expect to fund payment of the toll charge by repatriating a portion of our foreign earnings and as such, have recorded a deferred tax liability of $5.0 million related to state income taxes and foreign withholding taxes that will become due as we repatriate our foreign earnings. This increased our effective tax rate by 15.6% and 6.8% for the three and nine months ended December 31, 2017, respectively. Finally, due to our fiscal year-end we are required to pro-rate the new and old tax rates during Fiscal Year 2018. The blended, annualized tax rate applied to Fiscal Year 2018 income is 31.56%. This reduction in the federal tax rate reduced our global tax rate by 2.3% and 1.0% for the three and nine months ended December 31, 2017, respectively.

The provisional estimate for the toll charge will be finalized when we complete our substantive review of unremitted foreign earnings through examination of statutory filings and tax returns of our foreign subsidiaries and fiscal branches that span a 30-year period. We must also analyze the impact of foreign exchange rates and inflation on the historical information to support foreign tax credits available to offset the toll charge. In addition, our estimate of the toll charge obligation may change due to legislative technical corrections, the IRS' promulgation of regulations to interpret the Act, and changes in accounting standards for income taxes or related interpretations in response to the Act. This review and finalization of the toll charge provisional estimate will be completed within a twelve month measurement period from the date of enactment.

We adopted the new stock-based compensation accounting guidance effective the beginning of Fiscal Year 2018. Excess tax benefits associated with employee equity plans were previously recorded in additional paid-in capital and the adoption of this guidance had an immaterial impact on our effective tax rate for the three months ended December 31, 2017, but resulted in a reduction to our effective tax rate by 2.6 percentage points for the nine months ended December 31, 2017. The amount of excess tax benefits or deficiencies will fluctuate from period-to-period based on the price of our stock, the volume of share-based instruments settled or vested, and the value assigned to employee equity awards under U.S. GAAP.

We recorded a correction to the geographic mix of income during the nine months ended December 31, 2017 related to Fiscal Year 2017, which reduced income in a high tax jurisdiction and increased income in a low tax jurisdiction. This correcting adjustment had no impact on the three months ended December 31, 2017, but resulted in a reduction to our effective tax rate by 3.5 percentage points for the nine months ended December 31, 2017 as compared to the prior year period. For additional details regarding this correction refer to Note 1, Basis of Presentation, in the accompanying footnotes to the condensed consolidated financial statements.

We are subject to taxation in various foreign and state jurisdictions, including the U.S. Our Fiscal Year 2016 federal income tax return is currently under examination by the Internal Revenue Service. Foreign income tax matters for material tax jurisdictions have been concluded for tax years prior to Fiscal Year 2012.

FINANCIAL CONDITION

|

| | |

Operating Cash Flow (in millions) | Investing Cash Flow (in millions) | Financing Cash Flow (in millions) |

Our primary source of liquidity is cash provided by operating activities and, on occasion, financing obtained from capital markets and other financing sources, such as our revolving credit line. We believe that internally generated cash flows are generally sufficient to support our business operations, capital expenditures, restructuring activities, principal and interest payment of debt, income tax payments and the payment of stockholder dividends, in addition to investments and share repurchases. We expect that cash provided by operating activities will fluctuate in future periods as a result of a number of factors, including fluctuations in our revenues and operating income, the timing of product shipments during the quarter, accounts receivable collections, inventory and supply chain management, and the timing and amount of tax, interest, annual bonus, and other payments.

Operating Activities

Compared to the same year ago period, net cash provided by operating activities during the nine months ended December 31, 2017 decreased primarily as a result of higher payouts in the first quarter of Fiscal Year 2018 related to Fiscal Year 2017 variable compensation than payouts during the prior year period for Fiscal Year 2016 variable compensation, due to better achievements against Corporate targets in Fiscal Year 2017.

Investing Activities

Compared to the same year ago period, we used more cash for investing activities during the nine months ended December 31, 2017 for increased investment purchases, net of proceeds received from the sale and maturity of securities in our portfolio. This increase was partially offset by lower capital expenditures.

We estimate total capital expenditures for Fiscal Year 2018 will be approximately $14.0 million to $17.0 million. We expect capital expenditures for the remainder of Fiscal Year 2018 to consist primarily of IT investments, capital investment in our manufacturing capabilities, including tooling for new products, and facilities upgrades.

Financing Activities

Net cash used for financing activities during the nine months ended December 31, 2017 increased from the prior year period resulting primarily from an increase in cash used for common stock repurchases due to a lower average stock price, partially offset by higher net proceeds from stock-based compensation plans.

On January 30, 2018, we announced that the Audit Committee of our Board ("the Audit Committee") had declared a cash dividend of $0.15 per share, payable on March 9, 2018 to stockholders of record at the close of business on February 20, 2018. We expect to continue paying a quarterly dividend of $0.15 per share; however, the actual declaration of dividends and the establishment of record and payment dates are subject to final determination by the Audit Committee each quarter after its review of our financial performance and financial position.

Liquidity and Capital Resources

At December 31, 2017, we had working capital of $619.4 million, including $499.1 million of cash, cash equivalents, and short-term investments, compared with working capital of $581.8 million, including $480.1 million of cash, cash equivalents, and short-term investments at March 31, 2017.

Our cash and cash equivalents as of December 31, 2017 consisted of bank deposits with third party financial institutions, US Treasury Bills, and Commercial Paper. We monitor bank balances in our operating accounts and adjust the balances as appropriate. Cash balances are held throughout the world, including substantial amounts held outside of the U.S. As of December 31, 2017, of our $499.1 million of cash, cash equivalents, and short-term investments, $17.8 million was held domestically while $481.2 million was held by foreign subsidiaries, approximately 90% of which was based in USD-denominated investments.

Prior to our third quarter of Fiscal Year 2018, we did not recognize a deferred tax liability related to unremitted foreign earnings because our plans did not require us to repatriate earnings from foreign operations to fund our U.S. operations. The Tax Cuts and Jobs Act (H.R. 1) (the "Act") was signed into law in the U.S. on December 22, 2017, which, among other things, introduced the move from a worldwide to a territorial tax system and imposed a one-time tax on a deemed repatriation of accumulated foreign earnings (hereafter, the "toll charge"). We recorded a $69.3 million toll charge as part of income tax expense in the quarter ended December 31, 2017, representing a provisional estimate of our obligation and which we will pay over an eight-year period as permitted under the Act. We expect to fund payment of the toll charge by repatriating a portion of our foreign earnings and as such, we recorded a deferred tax liability of $5 million related to state income taxes and foreign withholding taxes that will become due as we repatriate foreign earnings. For additional details, refer to Note 13, Income Taxes, in the accompanying footnotes to the condensed consolidated financial statements.

Our primary discretionary cash requirements have historically been for repurchases of our common stock and to fund stockholder dividends. As a result of the issuance of the 5.50% Senior Notes in May 2015, we are required to make interest payments of approximately $13.8 million each November and May through the life of the notes. Both the interest payments on the 5.50% Senior Notes and the payments for the toll charge described above will decrease our liquidity. We generate sufficient operating cash flow and have access to external funding under our revolving credit facility to provide for these payments. For additional details, refer to Note 7, Debt, and Note 13, Income Taxes, in the accompanying footnotes to the condensed consolidated financial statements.

Our short and long-term investments are intended to establish a high-quality portfolio that preserves principal and meets liquidity needs. As of December 31, 2017, our investments were composed of Mutual Funds, US Treasury Notes, Government Agency Securities, Commercial Paper, Corporate Bonds, and Certificates of Deposits ("CDs").

From time to time, depending on market conditions, our Board has authorized plans under which we may repurchase shares of our common stock in the open market or through privately negotiated transactions. During the nine months ended December 31, 2017, we repurchased 1,138,903 shares of our common stock in the open market as part of these publicly announced repurchase programs. The total cost of these repurchases was $52.9 million, with an average price of $46.46 per share. In addition, we withheld 210,416 shares with a total value of $11.2 million in satisfaction of employee tax withholding obligations upon the vesting of restricted stock granted under our stock plans.

As of December 31, 2017, there remained 730,932 shares authorized for repurchase under the stock repurchase program approved by the Board on July 27, 2017. For more information regarding our stock repurchase programs, refer to Note 10, Common Stock Repurchases, in the accompanying notes to the condensed consolidated financial statements.

In May 2011, we entered into a credit agreement with Wells Fargo Bank, National Association ("the Bank"), which was most recently amended in April 2017 (as amended, the "Credit Agreement"). The Credit Agreement provides for a $100.0 million unsecured revolving credit facility. Revolving loans under the Credit Agreement will bear interest, at our election, at (i) the Bank’s announced prime rate less 1.20% per annum or (ii) a daily one-month LIBOR rate plus 1.40% per annum. Principal, together with all accrued and unpaid interest, on the revolving loans is due and payable on May 9, 2020. We are also obligated to pay a commitment fee of 0.37% per annum on the average daily unused amount of the revolving line of credit, which fee shall be payable quarterly in arrears. We may prepay the loans and terminate the commitments under the Credit Agreement at any time, without premium or penalty, subject to the reimbursement of certain costs. During the third quarter of Fiscal Year 2018 we borrowed and repaid $8 million from our line of credit and as of December 31, 2017, we had no outstanding borrowings. The line of credit requires us to comply with the following two financial covenant ratios, in each case at each fiscal quarter end and determined on a rolling four-quarter basis:

| |

• | maximum ratio of funded debt to earnings before interest, taxes, depreciation and amortization ("EBITDA") of 3.25:1 (previously 3:1); and |

| |

• | minimum EBITDA coverage ratio, which is calculated as interest payments divided by EBITDA. |

In addition, we and our subsidiaries are required to maintain unrestricted cash, cash equivalents, and marketable securities plus availability under the Credit Agreement at the end of each fiscal quarter of at least $300.0 million. The Credit Agreement contains customary events of default that include, among other things, payment defaults, covenant defaults, cross-defaults with certain other indebtedness, bankruptcy and insolvency defaults, and judgment defaults. The occurrence of an event of default could result in the acceleration of the obligations under the Credit Agreement. As of December 31, 2017, we were in compliance with all ratios and covenants.

During Fiscal Year 2016, we obtained $488.4 million in aggregate principal amount, net of issuance costs, from the issuance of our 5.50% Senior Notes. The Notes mature on May 31, 2023, and bear interest at a rate of 5.50% per annum, payable semi-annually

on May 15 and November 15. A portion of the proceeds was used to repay all then-outstanding amounts under our revolving line of credit agreement with Wells Fargo Bank and the remaining proceeds were used primarily for share repurchases.

Our liquidity, capital resources, and results of operations in any period could be affected by repurchases of our common stock, the payment of cash dividends, the exercise of outstanding stock options, restricted stock grants under stock plans, and the issuance of common stock under our Employee Stock Purchase Plan ("ESPP"). We receive cash from the exercise of outstanding stock options under our stock plan and the issuance of shares under our ESPP. However, the resulting increase in the number of outstanding shares from these equity grants and issuances could affect our earnings per share. We cannot predict the timing or amount of proceeds from the sale or exercise of these securities or whether they will be exercised, forfeited, canceled, or will expire.

We believe that our current cash and cash equivalents, short-term investments, cash provided by operations, and the availability of additional funds under the Credit Agreement will be sufficient to fund operations for at least the next 12 months; however, any projections of future financial needs and sources of working capital are subject to uncertainty. Readers are cautioned to review the risks, uncertainties, and assumptions set forth in this Quarterly Report on Form 10-Q, including the section entitled "Certain Forward-Looking Information" and the risk factors set forth in our Annual Report on Form 10-K for the fiscal year ended March 31, 2017, filed with the SEC on May 10, 2017, and other periodic filings with the SEC, any of which could affect our estimates for future financial needs and sources of working capital.

OFF BALANCE SHEET ARRANGEMENTS AND CONTRACTUAL OBLIGATIONS

We have not entered into any transactions with unconsolidated entities giving rise to financial guarantees, subordinated retained interests, derivative instruments, or other contingent arrangements that expose us to material continuing risks, contingent liabilities, or any other obligation under a variable interest in an unconsolidated entity that provides us with financing and liquidity support, market risk, or credit risk support.

A substantial portion of the raw materials, components, and subassemblies used in our products are provided by our suppliers on a consignment basis. These consigned inventories are not recorded on our consolidated balance sheet until we take title to the raw materials, components, and subassemblies, which occurs when they are consumed in the production process. Prior to consumption in the production process, our suppliers bear the risk of loss and retain title to the consigned inventory. The terms of the agreements allow us to return parts in excess of maximum order quantities to the suppliers at the supplier’s expense. Returns for other reasons are negotiated with the suppliers on a case-by-case basis and to date have been immaterial. If our suppliers were to discontinue financing consigned inventory, it would require us to make cash outlays and we could incur expenses which, if material, could negatively affect our business and financial results. As of March 31, 2017 and December 31, 2017, we had off-balance sheet consigned inventories of $52.3 million and $56.1 million, respectively.

Unconditional Purchase Obligations

We utilize several contract manufacturers to procure raw materials, components, and subassemblies for our products. We provide these contract manufacturers with demand information that typically covers periods up to 13 weeks, and they use this information to acquire components and build products. We also obtain individual components for our products from a wide variety of individual suppliers. Consistent with industry practice, we acquire components through a combination of purchase orders, supplier contracts, and open orders based on projected demand information. As of December 31, 2017, we had outstanding off-balance sheet third-party manufacturing, component purchase, and other general and administrative commitments of $192.3 million, including off-balance sheet consigned inventories of $56.1 million as discussed above.

During the quarter ended December 31, 2017, our short and long-term tax obligations increased due to introduction of the Tax Cuts and Jobs Act (H.R. 1) (the “Act”), signed into law on December 22, 2017 and requiring the payment of a one-time deemed repatriation of accumulated unremitted earnings (the "toll charge"). As permitted under the Act, we have elected to pay the toll charge obligation over an 8-year period, as follows:

|

| | | | | | | | | | | | | | | |

(in millions) | Total | Less than 1 year | 1 - 3 years | 3 - 5 years | More than 5 years |

Toll charge | $ | 69.3 |

| $ | 5.5 |

| $ | 11.0 |

| $ | 11.2 |

| $ | 41.6 |

|

For additional details regarding the Act and the toll charge, refer to Note 13, Income Taxes, in the accompanying footnotes to the condensed consolidated financial statements.

Except as described above, there have been no material changes in our contractual obligations as described in our Annual Report on Form 10-K for the fiscal year ended March 31, 2017.

CRITICAL ACCOUNTING ESTIMATES

For a complete description of what we believe to be the critical accounting estimates used in the preparation of our condensed consolidated financial statements, refer to our Annual Report on Form 10-K for the fiscal year ended March 31, 2017, filed with the SEC on May 10, 2017.

During the quarter ended December 31, 2017, the Tax Cuts and Jobs Act (H.R. 1) (the “Act”) was signed into law in the United States. The Act includes several changes to existing tax law, including, among other things, a permanent reduction in the corporate income tax rate from 35% to 21% and the move from a worldwide to a territorial tax system. The move to a territorial tax system was accompanied by federal taxation of a one-time deemed repatriation of accumulated unremitted earnings (hereafter, the "toll charge"). The toll charge is a provisional estimate and is based on the application of certain tax rates to foreign unremitted cash and cash equivalents and permanently reinvested foreign assets. Our estimate of the toll charge obligation may change due to changes in interpretations of the Act, legislative action to address questions that arise because of the Tax Act, any changes in accounting standards for income taxes or related interpretations in response to the Tax Act, or any updates or changes to estimates we have utilized to calculate the transition impacts, including impacts from foreign exchange rates of foreign subsidiaries and the effects of inflation. We will finalize the estimate within a twelve-month period from the date of enactment of December 22, 2017.

In addition, prior to our third quarter of Fiscal Year 2018, we did not recognize a deferred tax liability related to unremitted foreign earnings because our plans did not require the Company to repatriate earnings from foreign operations to fund U.S. operations. We expect to fund payment of the toll charge by repatriating a portion of our foreign earnings and as such, have recorded a deferred tax liability related to state income taxes and foreign withholding taxes that will become due as the Company repatriates foreign earnings.

Refer to additional details surrounding impacts of the Act at Note 13, Income Taxes, in the accompanying footnotes to the condensed consolidated financial statements.

Other than the above item, there have been no changes to our critical accounting estimates during the nine months ended December 31, 2017.

Recent Accounting Pronouncements

For more information regarding the Recent Accounting Pronouncements that may impact us, refer to Note 2, Recent Accounting Pronouncements, of the accompanying notes to the condensed consolidated financial statements.

Financial Statements (Unaudited)

PLANTRONICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited) |

| | | | | | | |

| March 31,

2017 | | December 31,

2017 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 301,970 |

| | $ | 280,293 |

|

Short-term investments | 178,179 |

| | 218,773 |

|

Accounts receivable, net | 141,177 |

| | 143,919 |

|

Inventory, net | 55,456 |

| | 64,574 |

|

Other current assets | 22,195 |

| | 19,460 |

|

Total current assets | 698,977 |

| | 727,019 |

|

Long-term investments | 127,176 |

| | 118,870 |

|

Property, plant, and equipment, net | 150,307 |

| | 144,802 |

|

Goodwill and purchased intangibles, net | 15,577 |

| | 15,498 |

|

Deferred tax assets | 23,242 |

| | 14,783 |

|

Other assets | 1,880 |

| | 1,681 |

|

Total assets | $ | 1,017,159 |

| | $ | 1,022,653 |

|

| | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | |

|

Current liabilities: | |

| | |

|

Accounts payable | $ | 42,885 |

| | $ | 45,685 |

|

Accrued liabilities | 74,285 |

| | 61,906 |

|

Total current liabilities | 117,170 |

| | 107,591 |

|

Long term debt, net of issuance costs | 491,059 |

| | 492,146 |

|

Long-term income taxes payable | 11,729 |

| | 74,476 |

|

Other long-term liabilities | 15,045 |

| | 19,419 |

|

Total liabilities | $ | 635,003 |

| | $ | 693,632 |

|

Commitments and contingencies (Note 6) |

|

| |

|

|

Stockholders' equity: | |

| | |

|

Common stock | $ | 804 |

| | $ | 814 |

|

Additional paid-in capital | 818,777 |

| | 858,253 |

|

Accumulated other comprehensive income | 4,694 |

| | 1,905 |

|

Retained earnings | 319,931 |

| | 294,200 |

|

Total stockholders' equity before treasury stock | 1,144,206 |

| | 1,155,172 |

|

Less: Treasury stock, at cost | (762,050 | ) | | (826,151 | ) |

Total stockholders' equity | 382,156 |

| | 329,021 |

|

Total liabilities and stockholders' equity | $ | 1,017,159 |

| | $ | 1,022,653 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended

December 31, |

| 2016 | | 2017 | | 2016 | | 2017 |

Net revenues | $ | 232,933 |

| | $ | 226,534 |

| | $ | 672,222 |

| | $ | 640,760 |

|

Cost of revenues | 122,753 |

| | 112,409 |

| | 338,523 |

| | 315,720 |

|

Gross profit | 110,180 |

| | 114,125 |

| | 333,699 |

| | 325,040 |

|

Operating expenses: | | | | | | | |

Research, development, and engineering | 21,393 |

| | 21,257 |

| | 66,116 |

| | 62,402 |

|

Selling, general, and administrative | 56,919 |

| | 56,196 |

| | 169,581 |

| | 170,125 |

|

(Gain) loss, net from litigation settlements | (103 | ) | | (15 | ) | | 4,287 |

| | (295 | ) |

Restructuring and other related charges (credits) | 113 |

| | (84 | ) | | (1,350 | ) | | 2,438 |

|

Total operating expenses | 78,322 |

| | 77,354 |

| | 238,634 |

| | 234,670 |

|

Operating income | 31,858 |

| | 36,771 |

| | 95,065 |

| | 90,370 |

|

Interest expense | (7,322 | ) | | (7,341 | ) | | (21,867 | ) | | (21,904 | ) |

Other non-operating income and (expense), net | 427 |

| | 2,490 |

| | 4,119 |

| | 5,230 |

|

Income before income taxes | 24,963 |

| | 31,920 |

| | 77,317 |

| | 73,696 |

|

Income tax expense | 2,742 |

| | 81,424 |

| | 14,235 |

| | 84,419 |

|

Net income (loss) | $ | 22,221 |

| | $ | (49,504 | ) | | $ | 63,082 |

| | $ | (10,723 | ) |

| | | | | | | |

Earnings (Loss) per common share: | | | | | | | |

Basic | $ | 0.69 |

| | $ | (1.54 | ) | | $ | 1.96 |

| | $ | (0.33 | ) |

Diluted | $ | 0.68 |

| | $ | (1.54 | ) | | $ | 1.92 |

| | $ | (0.33 | ) |

| | | | | | | |

Shares used in computing earnings (loss) per common share: | | | | | | | |

Basic | 32,242 |

| | 32,075 |

| | 32,260 |

| | 32,384 |

|

Diluted | 32,826 |

| | 32,075 |

| | 32,895 |

| | 32,384 |

|

| | | | | | | |

Cash dividends declared per common share | $ | 0.15 |

| | $ | 0.15 |

| | $ | 0.45 |

| | $ | 0.45 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended

December 31, |

| 2016 | | 2017 | | 2016 | | 2017 |

Net income (loss) | $ | 22,221 |

| | $ | (49,504 | ) | | $ | 63,082 |

| | $ | (10,723 | ) |

Other comprehensive income (loss): | | | | | | | |

Foreign currency translation adjustments | 82 |

| | — |

| | (168 | ) | | 257 |

|

Unrealized gains (losses) on cash flow hedges: | | | | | | | |

Unrealized cash flow hedge gains (losses) arising during the period | 2,090 |

| | (446 | ) | | 2,394 |

| | (5,093 | ) |

Net (gains) losses reclassified into income for revenue hedges | (2,178 | ) | | 1,357 |

| | (3,163 | ) | | 2,506 |

|

Net (gains) losses reclassified into income for cost of revenue hedges | 756 |

| | (61 | ) | | 2,072 |

| | (193 | ) |

Net unrealized gains (losses) on cash flow hedges | 668 |

| | 850 |

| | 1,303 |

| | (2,780 | ) |

Unrealized gains (losses) on investments: | | | | | | | |

Unrealized holding gains (losses) during the period | (628 | ) | | (658 | ) | | (586 | ) | | (449 | ) |

| | | | | | | |

Aggregate income tax benefit (expense) of the above items | 156 |

| | 181 |

| | 130 |

| | 182 |

|

Other comprehensive income (loss) | 278 |

| | 373 |

| | 679 |

| | (2,790 | ) |

Comprehensive income (loss) | $ | 22,499 |

| | $ | (49,131 | ) | | $ | 63,761 |

| | $ | (13,513 | ) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited) |

| | | | | | | |

| Nine Months Ended |

| December 31, |

| 2016 | | 2017 |

CASH FLOWS FROM OPERATING ACTIVITIES | | | |

Net income (loss) | $ | 63,082 |

| | $ | (10,723 | ) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

Depreciation and amortization | 15,624 |

| | 15,894 |

|

Amortization of debt issuance costs | 1,087 |

| | 1,087 |

|

Stock-based compensation | 25,005 |

| | 26,047 |

|

Deferred income taxes | (753 | ) | | 10,490 |

|

Provision for excess and obsolete inventories | 1,292 |

| | 2,013 |

|

Restructuring and related charges (credits) | (1,350 | ) | | 2,438 |

|

Cash payments for restructuring charges | (3,793 | ) | | (2,911 | ) |

Other operating activities | 633 |

| | (645 | ) |

Changes in assets and liabilities: | | | |

|

Accounts receivable, net | (13,448 | ) | | (3,153 | ) |

Inventory, net | (5,990 | ) | | (9,577 | ) |

Current and other assets | (2,346 | ) | | (3,066 | ) |

Accounts payable | 3,626 |

| | 2,783 |

|

Accrued liabilities | 6,191 |

| | (15,695 | ) |

Income taxes | (1,141 | ) | | 66,387 |

|

Cash provided by operating activities | 87,719 |

| | 81,369 |

|

CASH FLOWS FROM INVESTING ACTIVITIES | | | |

|

Proceeds from sales of investments | 143,631 |

| | 54,411 |

|

Proceeds from maturities of investments | 97,253 |

| | 146,989 |

|

Purchase of investments | (247,491 | ) | | (232,840 | ) |

Capital expenditures | (19,603 | ) | | (9,403 | ) |

Cash used for investing activities | (26,210 | ) | | (40,843 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES | | | |

|

Repurchase of common stock | (34,236 | ) | | (52,915 | ) |

Employees' tax withheld and paid for restricted stock and restricted stock units | (9,444 | ) | | (11,186 | ) |

Proceeds from issuances under stock-based compensation plans | 6,516 |

| | 13,446 |

|

Proceeds from revolving line of credit | — |

| | 8,000 |

|

Repayments of revolving line of credit | — |

| | (8,000 | ) |

Payment of cash dividends | (14,947 | ) | | (15,008 | ) |

Other financing activity | 761 |

| | — |

|

Cash used for financing activities | (51,350 | ) | | (65,663 | ) |

Effect of exchange rate changes on cash and cash equivalents | (2,964 | ) | | 3,460 |

|

Net increase (decrease) in cash and cash equivalents | 7,195 |

| | (21,677 | ) |

Cash and cash equivalents at beginning of period | 235,266 |

| | 301,970 |

|

Cash and cash equivalents at end of period | $ | 242,461 |

| | $ | 280,293 |

|

SUPPLEMENTAL NON-CASH DISCLOSURES | | | |

Accounts payable for purchases of property, plant, and equipment | $ | 1,052 |

| | $ | 3,895 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

PLANTRONICS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. BASIS OF PRESENTATION

In the opinion of management, the accompanying unaudited condensed consolidated financial statements ("financial statements") of Plantronics, Inc. ("Plantronics" or "the Company") have been prepared on a basis materially consistent with the Company's March 31, 2017 audited consolidated financial statements and include all adjustments, consisting of normal recurring adjustments, necessary to fairly state the information set forth herein. Certain information and footnote disclosures normally included in financial statements prepared pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC") applicable to interim financial information and in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP") have been condensed or omitted pursuant to such rules and regulations. The financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2017, which was filed with the SEC on May 10, 2017. The results of operations for the interim period ended December 31, 2017 are not necessarily indicative of the results to be expected for the entire fiscal year or any future period.

The financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated.

The Company’s fiscal year ends on the Saturday closest to the last day of March. The Company’s current and prior fiscal years end on March 31, 2018 and April 1, 2017, respectively, and both consist of 52 weeks. The Company’s results of operations for the three and nine months ended December 30, 2017 and December 31, 2016 both contain 13 weeks. For purposes of presentation, the Company has indicated its accounting year as ending on March 31 and its interim quarterly periods as ending on the applicable calendar month end.

Certain immaterial reclassifications to our previously reported financial information have been made to conform to the current period presentation. In addition, refer to Note 2, Recent Accounting Pronouncements, for details regarding reclassifications made in our condensed consolidated statements of cash flows pursuant to the adoption of new share-based payment accounting guidance in the first quarter of Fiscal Year 2018.

Earnings per common share:

The Company has a share-based compensation plan under which employees, non-employee directors, and consultants may be granted share-based payment awards, including shares of restricted stock on which non-forfeitable dividends are paid on unvested shares. As such, shares of restricted stock are considered participating securities under the two-class method of calculating earnings per share. Historically, the two-class method of calculating earnings per share did not have a material impact on the Company's earnings per share calculation under the treasury stock method. Beginning in the second quarter of Fiscal Year 2018, the Company applied the two-class method of calculating earnings per share because the ratio of participating securities to the weighted average number of common shares outstanding has increased as compared to the historical average, and this dilution will continue if the Company continues to repurchase its common stock at current levels. During periods of net loss, no effect is given to participating securities since they do not share in the losses of the Company; therefore, the treasury stock method was used to calculate earnings per common share for the three and nine months ended December 31, 2017. For further details refer to Note 14, Computation of Earnings Per Common Share.

Immaterial Out-of-Period Correction:

During the first quarter of Fiscal Year 2018, the Company recognized an out-of-period correction to its Fiscal Year 2017 geographic mix of taxable income, which resulted in an overstatement of Fiscal Year 2017 income tax expense by $2.8 million. The Company's correction, recognized in the quarter ended June 30, 2017, resulted in a $2.8 million benefit to income tax expense. The Company assessed the materiality of this error and concluded it was not material to Fiscal Year 2017 and is not expected to be material to the full Fiscal Year 2018.

2. RECENT ACCOUNTING PRONOUNCEMENTS

Recently Issued Pronouncements

In May 2014, the Financial Accounting Standards Board ("FASB") issued guidance regarding revenue from contracts with customers. While the standard supersedes existing revenue recognition guidance, it closely aligns with current U.S. GAAP. Under the new standard, revenue will be recognized at the time control of a good or service is transferred to a customer for the amount of consideration received or to be received for that specific good or service. Entities may use a full retrospective approach or report the cumulative effect as of the date of adoption. In March 2016, the FASB issued additional guidance concerning "Principal versus Agent" considerations (reporting revenue gross versus net); in April 2016, the FASB issued additional guidance on identifying performance obligations and licensing; and in May 2016, the FASB issued additional guidance on collectability, non-cash consideration, presentation of sales tax, and transition. These updates are intended to improve the operability and understandability of the implementation guidance and have the same effective date and transition requirements as the greater "contracts with customers" standard. The Company will adopt the standard, as amended, in the first quarter of its fiscal year ending March 31, 2019, utilizing the modified retrospective method of adoption. The Company has completed its initial review of the impact of this guidance, and does not anticipate a material impact on its revenue recognition policies. The Company will continue to assess all potential impacts of the standard, and currently believes the most significantly impacted areas are the following:

| |

• | Software Revenue: The Company currently defers revenue for the value of software where vendor specific objective evidence ("VSOE") of fair value has not been established for undelivered items. Under Topic 606, revenue for such licenses will be recognized at the transfer of control, rather than ratably, as the VSOE requirement no longer applies and the value of the remaining services are not material in the context of the contract. At December 31, 2017, deferred revenue under Topic 605 for these licenses was $2.1 million. The Company expects the remaining balance of such deferred revenue will be eliminated as a cumulative effect adjustment of implementing Topic 606 in the first quarter of its fiscal year ending March 31, 2019. |

| |

• | Marketing Development Funds: The Company frequently provides marketing development funds to its channel partners. Under topic 605, our marketing development funds are recognized as a reduction of revenue at the later of when the related revenue is recognized or when the program is offered to the channel partner. Applying the criteria of Topic 606, these marketing development programs qualify as variable consideration, and are assigned as a reduction of the transaction price of the contract. This results in a timing difference such that all or some of the funds related to a program may be recognized in different periods than under Topic 605, depending on the circumstances. Based on analysis of prior periods, we anticipate that this timing difference impacts revenue by immaterial amounts in a given period. The full impact of the adjustment is still being analyzed by the Company. |

| |

• | Revenue Reserves: The Company establishes reserves for Discounts and Rebates and Sales Returns at the end of each fiscal period. These reserves are estimated based on current relevant and historical data, but there can be some variability associated with unforeseen changes in customer claim and return patterns. Under Topic 606, in cases where there is uncertainty around the variable consideration amount, a constraint, or an adjustment to ensure that a significant revenue reversal will not occur, on that consideration must be considered. Based on analysis of prior periods, we anticipate that impact of introducing this constraint will not materially impact revenue. The full impact of the adjustment is still being analyzed by the Company. |

In addition, the standard also requires new, expanded disclosures regarding revenue recognition. The Company will continue to monitor additional changes, modifications, clarifications or interpretations being undertaken by the FASB, which may impact its current conclusions.

In January 2016, the FASB issued guidance regarding the recognition and measurement of financial assets and liabilities. Changes to the current U.S. GAAP model primarily affect the accounting for equity investments, financial liabilities under the fair value option, and the presentation and disclosure requirements for financial instruments. In addition, the FASB clarified guidance related to the valuation allowance assessment when recognizing deferred tax assets resulting from unrealized losses on available-for-sale debt securities. The Company is required to adopt the standard in the first quarter of its fiscal year ending March 31, 2019, but may elect to adopt earlier as permitted under the standard. The Company is currently evaluating what impact, if any, the adoption of this standard will have on its consolidated financial statements and related disclosures.

In February 2016, the FASB issued guidance regarding both operating and financing leases, requiring lessees to recognize on their balance sheets "right-of-use assets" and corresponding lease liabilities, measured on a discounted basis over the lease term. Virtually all leases will be subject to this treatment except leases that meet the definition of a "short-term lease". For expense recognition, the dual model requiring leases to be classified as either operating or finance leases has been retained from the prior standard. Operating leases will result in straight-line expense while finance leases will result in a front-loaded expense pattern. Classification will use criteria very similar to those applied in current lease accounting, but without explicit bright lines. Extensive additional quantitative and qualitative disclosures, including significant judgments made by management, will be required to provide greater insight into the extent of expense recognized and expected to be recognized. The new lease guidance will essentially eliminate off-balance sheet financing. The guidance is effective for the Company's fiscal year ending March 31, 2020. The new standard must be adopted using a modified retrospective transition that provides for certain practical expedients and requires the new guidance to be applied at the beginning of the earliest comparative period presented. The Company expects adoption of this guidance will materially increase the assets and liabilities recorded on its condensed consolidated balance sheets, but is still evaluating the impact on its consolidated financial statements and related disclosures.

In June 2016, the FASB issued guidance regarding the measurement of credit losses on financial instruments, which changes the impairment model for most financial assets. The new model uses a forward-looking expected loss method, which will generally result in earlier recognition of allowances for losses. The guidance is effective for the Company's fiscal year ending March 31, 2021 with early adoption permitted beginning in the first quarter of Fiscal Year 2020. The Company is currently evaluating the impact the adoption of this standard will have on its consolidated financial statements and related disclosures.

In January 2017, the FASB issued guidance that revises the definition of a business, providing a more robust framework for determining when a set of assets and activities is deemed a business. The guidance is effective for the Company's fiscal year ending March 31, 2019, including interim periods within that year, and is not expected to have a material impact on the Company's consolidated financial statements or related disclosures.

In January 2017, the FASB issued guidance that simplifies the process required to test goodwill for impairment. The guidance is effective for the Company's fiscal year ending March 31, 2021, and is not expected to have a material impact on the Company's consolidated financial statements or related disclosures.

In March 2017, the FASB issued guidance related to the amortization of premiums on purchased callable debt securities. This guidance shortens the amortization period for certain callable debt securities purchased at a premium by requiring that the premium be amortized to the earliest call date instead of the maturity date. This guidance is effective for the Company's fiscal year ending March 31, 2020, including interim periods within that year. The Company expects the impact to be immaterial.

In May 2017, the FASB issued guidance that clarifies the scope of modification accounting with respect to changes to the terms or conditions of a share-based payment award. This guidance is effective for the Company's fiscal year ending March 31, 2019, including interim periods within that year. The Company is currently evaluating the impact the adoption of this standard will have on its consolidated financial statements and related disclosures, but expects the impact to be immaterial.

In August 2017, the FASB issued guidance that eliminates the requirement to separately measure and report hedge ineffectiveness and that generally requires, for qualifying hedges, the entire change in the fair value of a hedging instrument to be presented in the same income statement line as the hedged item. The guidance also modifies the accounting for components excluded from the assessment of hedge effectiveness, eases documentation and assessment requirements, and modifies certain disclosure requirements. The new standard must be adopted using a modified retrospective transition with a cumulative effect adjustment recorded to opening retained earnings as of the initial adoption date. This guidance is effective for the Company's fiscal year ending March 31, 2020, including interim periods within that year. The Company is currently evaluating the impact the adoption of this standard will have on its consolidated financial statements and related disclosures, but expects the impact to be immaterial.

Recently Adopted Pronouncement

Beginning Fiscal Year 2018, the Company adopted the FASB's new guidance, Improvements to Employee Share-Based Payment Accounting, which changes among other things, how the tax effects of share-based awards are recognized. This new guidance requires excess tax benefits and tax deficiencies to be recognized in the provision for income taxes as discrete items in the period when the awards vest or are settled, whereas previously such income tax effects were recorded as part of additional paid-in capital. The provision for income taxes for the three months ended December 31, 2017 included excess tax benefits that did not materially reduce the Company's effective tax rate. The provision for income taxes for the nine months ended December 31, 2017 included excess tax benefits of $1.9 million, which reduced the Company's effective tax rate by 2.6 percentage points. The recognized excess tax benefits resulted from share-based compensation awards that vested or settled in the first nine months of 2017. This guidance also eliminates the requirement to reclassify cash flows related to excess tax benefits from operating activities to financing activities on the consolidated statements of cash flows. The Company adopted this provision retrospectively by reclassifying $1.0 million of excess tax benefits from financing activities to operating activities in the condensed consolidated statement of cash flows for the nine months ended December 31, 2016. The Company also excluded the related tax benefits when applying the treasury stock method for computing diluted shares outstanding on a prospective basis as required by this guidance. In addition, the Company elected to continue its current practice of estimating expected forfeitures. The Company made no changes to its presentation of withholding taxes on the settlement of share-based payment awards, which were already presented as financing activities. The amount of excess tax benefits and deficiencies recognized in the provision for income taxes will fluctuate from period-to-period based on the price of the Company’s stock, the volume of share-based instruments settled or vested, and the value assigned to share-based instruments under U.S. GAAP. Refer to additional discussion in Note 13, Income Taxes.

3. CASH, CASH EQUIVALENTS, AND INVESTMENTS

The following tables summarize the Company’s cash and available-for-sale securities’ amortized cost, gross unrealized gains, gross unrealized losses, and fair value by significant investment category recorded as cash and cash equivalents, short-term, or long-term investments as of December 31, 2017 and March 31, 2017 (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

December 31, 2017 | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair

Value | | Cash & Cash Equivalents | | Short-term investments (due in 1 year or less) | | Long-term investments (due in 1 to 3 years) |

Cash | | $ | 272,063 |

| | $ | — |

| | $ | — |

| | $ | 272,063 |

| | $ | 272,063 |

| | $ | — |

| | $ | — |

|

Level 1: | | | | | | | | | | | | | | |

Mutual Funds | | 14,298 |

| | 399 |

| | (70 | ) | | 14,627 |

| | — |

| | 14,627 |

| | — |

|

US Treasury Notes | | 71,684 |

| | — |

| | (210 | ) | | 71,474 |

| | 4,998 |

| | 42,348 |

| | 24,128 |

|

Money Market Funds | | 239 |

| | — |

| | — |

| | 239 |

| | 239 |

| | — |

| | — |

|

Subtotal | | 86,221 |

| | 399 |

| | (280 | ) | | 86,340 |

| | 5,237 |

| | 56,975 |

| | 24,128 |

|

Level 2: | | | | | | | | | | | | | | |

Government Agency Securities | | 56,667 |

| | — |

| | (276 | ) | | 56,391 |

| | — |

| | 31,300 |

| | 25,091 |

|

Commercial Paper | | 32,944 |

| | — |

| | — |

| | 32,944 |

| | 2,993 |

| | 29,951 |

| | — |

|

Corporate Bonds | | 142,148 |

| | 45 |

| | (375 | ) | | 141,818 |

| | — |

| | 77,175 |

| | 64,643 |

|

Certificates of Deposits ("CDs") | | 28,383 |

| | — |

| | (3 | ) | | 28,380 |

| | — |

| | 23,372 |

| | 5,008 |

|

Subtotal | | 260,142 |

| | 45 |

| | (654 | ) | | 259,533 |

| | 2,993 |

| | 161,798 |

| | 94,742 |

|

| | | | | | | | | | | | | | |

Total cash, cash equivalents

and investments measured at fair value | | $ | 618,426 |

| | $ | 444 |

| | $ | (934 | ) | | $ | 617,936 |

| | $ | 280,293 |

| | $ | 218,773 |

| | $ | 118,870 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

March 31, 2017 | | Amortized

Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Fair

Value | | Cash & Cash Equivalents | | Short-term investments (due in 1 year or less) | | Long-term investments (due in 1 to 3 years) |

Cash | | $ | 295,877 |

| | $ | — |

| | $ | — |

| | $ | 295,877 |

| | $ | 295,877 |

| | $ | — |

| | $ | — |

|

Level 1: | | | | | | | | | | | | | | |

Mutual Funds | | 12,079 |

| | 352 |

| | (32 | ) | | 12,399 |

| | — |

| | 12,399 |

| | — |

|