Forward-Looking Statements This presentation contains “forward-looking” statements within the meaning of the federal securities laws. The forward-looking statements include statements concerning our outlook for the future, as well as other statements of beliefs, future plans and strategies or anticipated events, and similar expressions concerning matters that are not historical facts. Our forward-looking information and statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in, or implied by, the statements. These risks and uncertainties include the availability and prices of live hogs, feed ingredients (including corn), raw materials, fuel and supplies, food safety, livestock disease, live hog production costs, product pricing, the competitive environment and related market conditions, risks associated with our indebtedness, including cost increases due to rising interest rates or changes in debt ratings or outlook, hedging risk, adverse weather conditions, operating efficiencies, changes in foreign currency exchange rates, access to capital, the cost of compliance with and changes to regulations and laws, including changes in accounting standards, tax laws, environmental laws, agricultural laws and occupational, health and safety laws, adverse results from on-going litigation, actions of domestic and foreign governments, labor relations issues, credit exposure to large customers, the ability to make effective acquisitions and successfully integrate newly acquired businesses into existing operations, our ability to effectively restructure portions of our operations and achieve cost savings from such restructurings and other risks and uncertainties described under "Item 1A. Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended April 29, 2012. Readers are cautioned not to place undue reliance on forward-looking statements because actual results may differ materially from those expressed in, or implied by, the statements. Any forward-looking statement that we make speaks only as of the date of such statement, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. 2

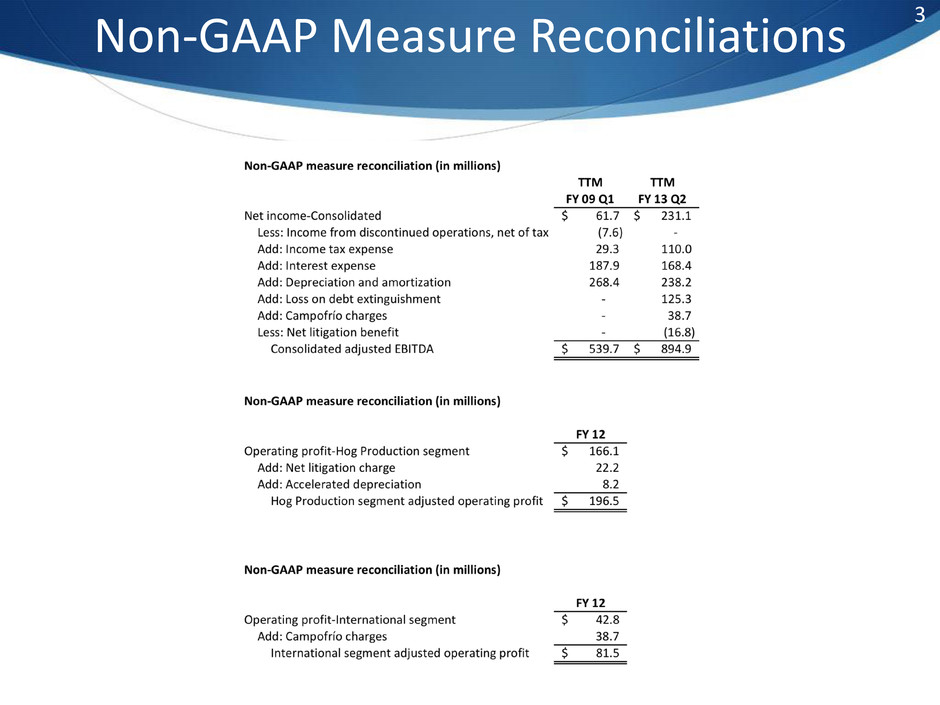

3 Non-GAAP Measure Reconciliations

Leading Positions In Food Industry

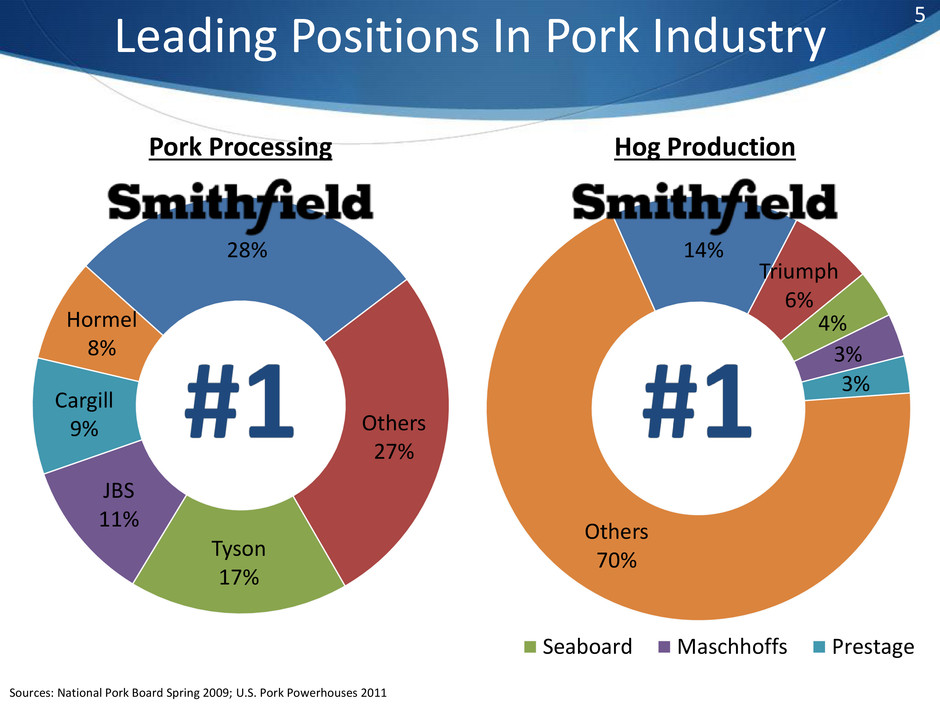

Leading Positions In Pork Industry 14% Triumph 6% 4% 3% 3% Others 70% Hog Production Seaboard Maschhoffs Prestage 28% Others 27% Tyson 17% JBS 11% Cargill 9% Hormel 8% Pork Processing Sources: National Pork Board Spring 2009; U.S. Pork Powerhouses 2011 5

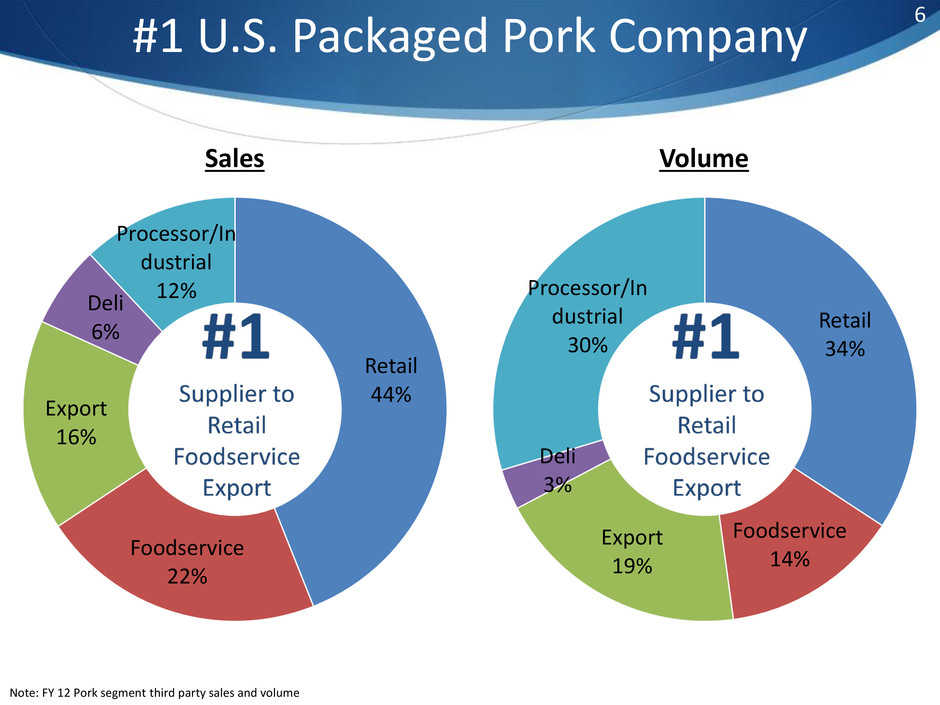

Retail 34% Foodservice 14% Export 19% Deli 3% Processor/In dustrial 30% Volume #1 U.S. Packaged Pork Company Retail 44% Foodservice 22% Export 16% Deli 6% Processor/In dustrial 12% Sales Note: FY 12 Pork segment third party sales and volume 6

7 Market leader with top three position in ten key product categories 45% 36% 22% 20% 17% 16% 14% 13% 9% 8% Specialty Ham Cuts Smoked Hams Marinated Pork Bacon BBQ Meats Dinner Sausage Dry Sausage Portable Lunches Meatballs Service Deli Smithfield Market Share #1 #1 #2 #1 #3 #2 #2 #2 #2 #2 Source: Information Resources, Inc. (IRI) 13 weeks ending 11/04/12 and Nielsen Perishables Group 13 weeks ending 10/27/12 Smithfield Core Brands

Delivering Higher Quality & More Consistent Earnings

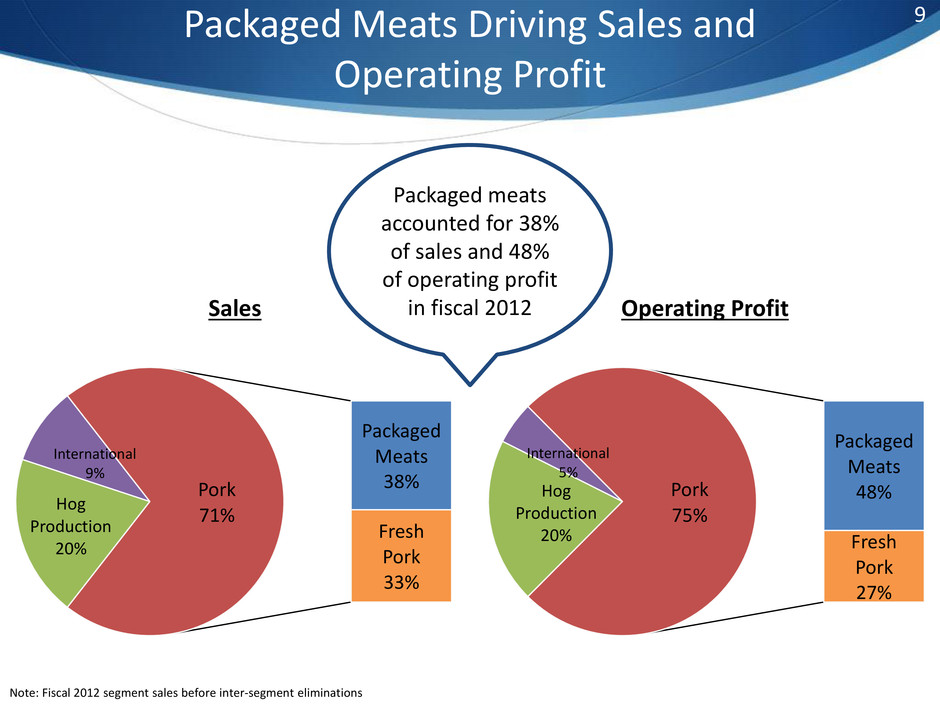

Hog Production 20% International 9% Packaged Meats 38% Fresh Pork 33% Pork 71% Sales Packaged Meats Driving Sales and Operating Profit Note: Fiscal 2012 segment sales before inter-segment eliminations 9 Hog Production 20% International 5% Packaged Meats 48% Fresh Pork 27% Pork 75% Operating Profit Packaged meats accounted for 38% of sales and 48% of operating profit in fiscal 2012

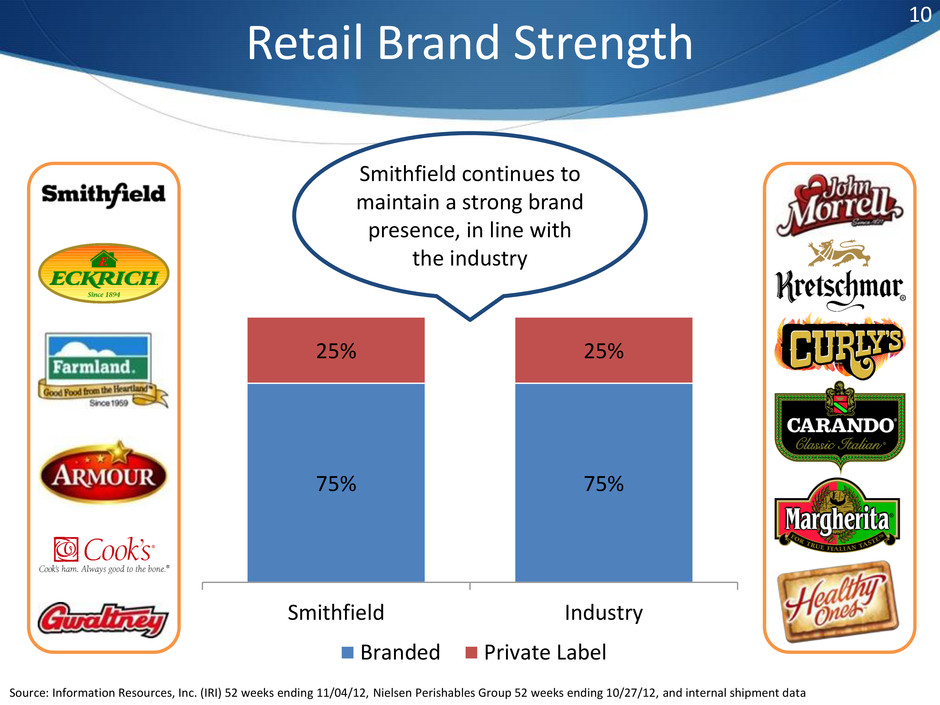

10 Retail Brand Strength 75% 75% 25% 25% Smithfield Industry Branded Private Label Smithfield continues to maintain a strong brand presence, in line with the industry Source: Information Resources, Inc. (IRI) 52 weeks ending 11/04/12, Nielsen Perishables Group 52 weeks ending 10/27/12, and internal shipment data

Executing Strategy For Growth • Consistent increases in consumer marketing spending • Restructured Pork Group is platform for growth • Driving consumer relevant product innovation • Leveraging consolidated brand portfolio Focus on 12 core brands Building strong innovation pipeline Investing in advertising to activate brands Coordinated sales & marketing team Growing share & distribution 11

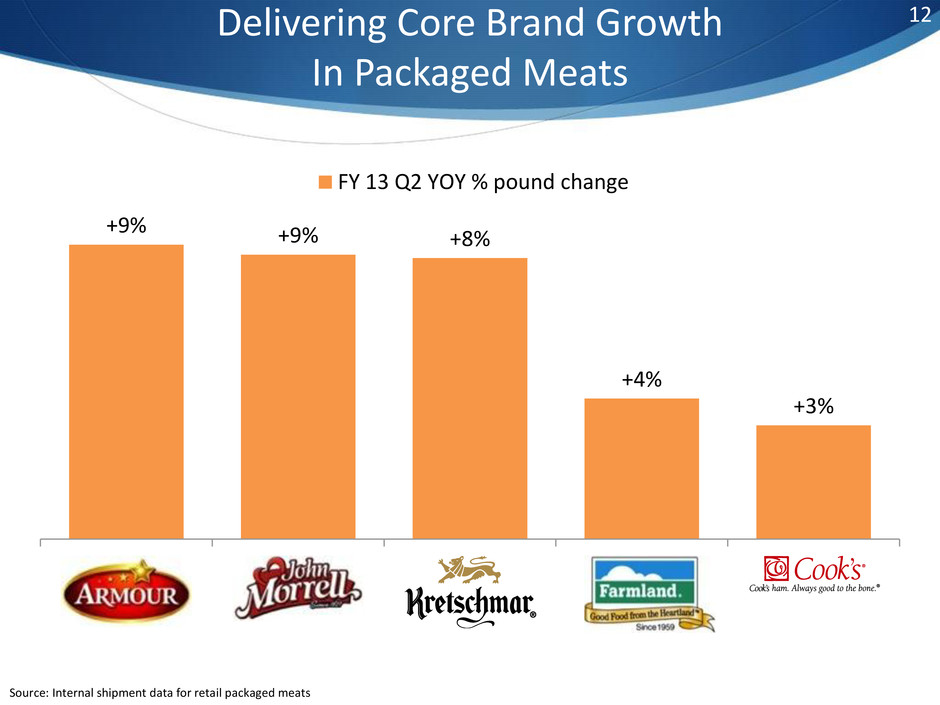

12 Delivering Core Brand Growth In Packaged Meats +9% +9% +8% +4% +3% Armour John Morrell Kretschmar Farmland Cook's FY 13 Q2 YOY % pound change Source: Internal shipment data for retail packaged meats

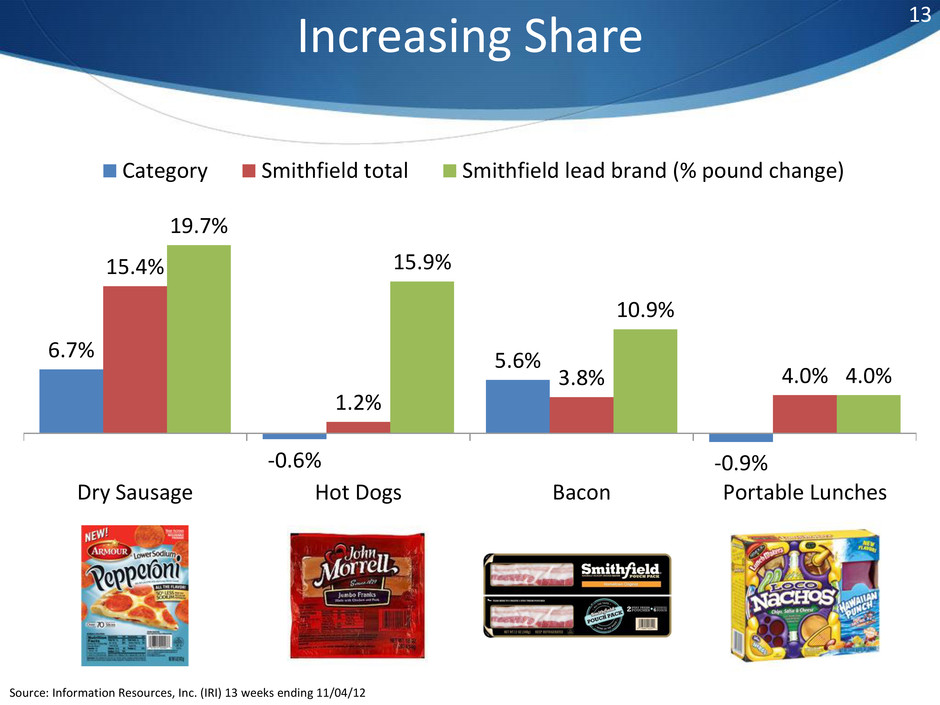

Increasing Share 6.7% -0.6% 5.6% -0.9% 15.4% 1.2% 3.8% 4.0% 19.7% 15.9% 10.9% 4.0% Dry Sausage Hot Dogs Bacon Portable Lunches Category Smithfield total Smithfield lead brand (% pound change) 13 Source: Information Resources, Inc. (IRI) 13 weeks ending 11/04/12

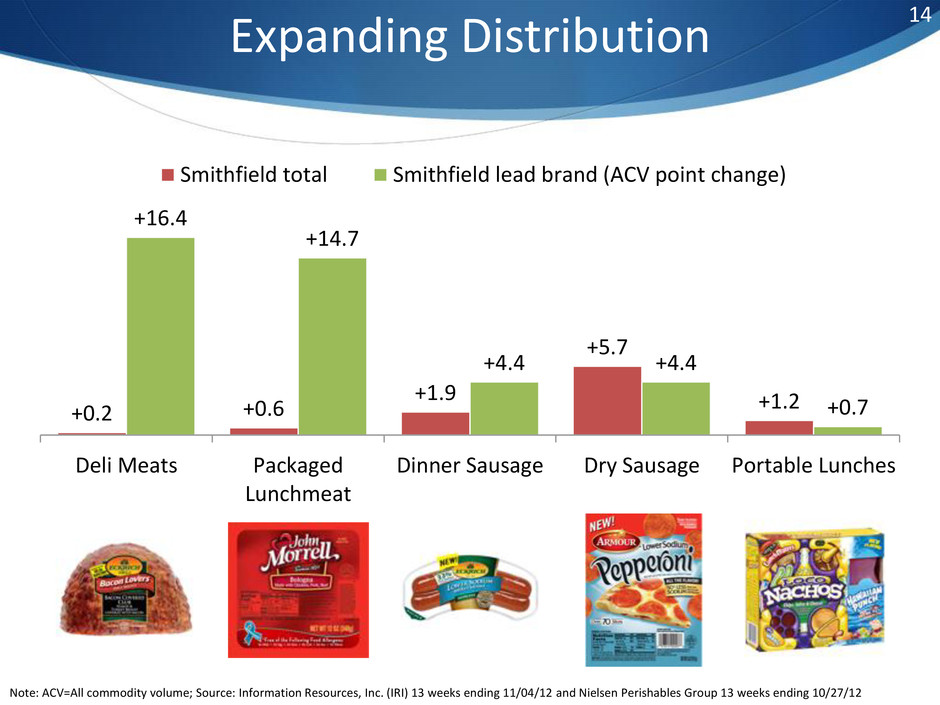

Expanding Distribution 14 +0.2 +0.6 +1.9 +5.7 +1.2 +16.4 +14.7 +4.4 +4.4 +0.7 Deli Meats Packaged Lunchmeat Dinner Sausage Dry Sausage Portable Lunches Smithfield total Smithfield lead brand (ACV point change) Note: ACV=All commodity volume; Source: Information Resources, Inc. (IRI) 13 weeks ending 11/04/12 and Nielsen Perishables Group 13 weeks ending 10/27/12

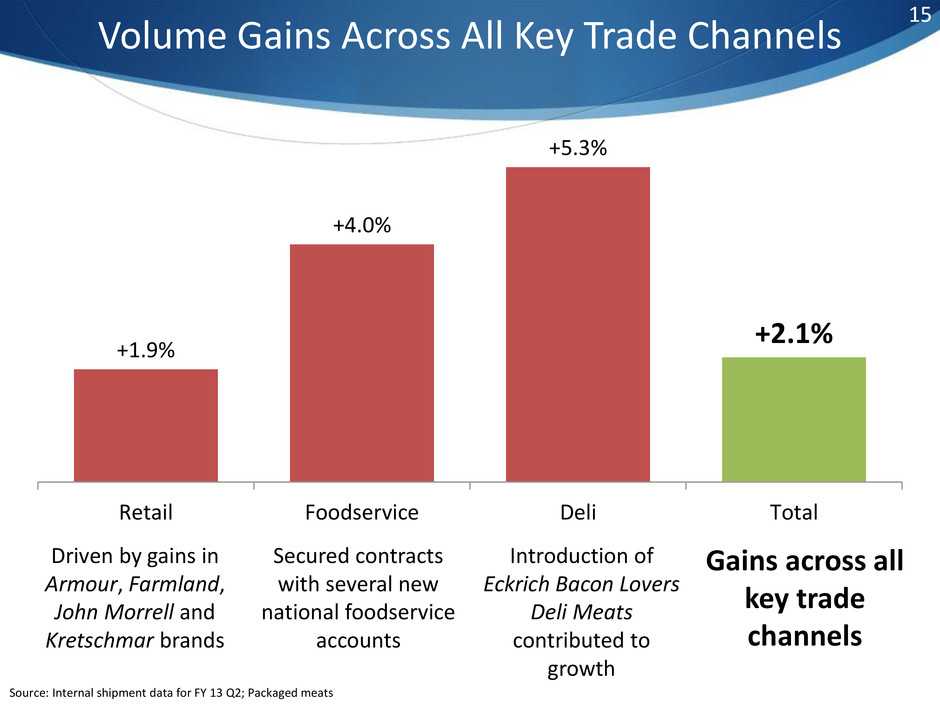

15 Volume Gains Across All Key Trade Channels +1.9% +4.0% +5.3% +2.1% Retail Foodservice Deli Total Driven by gains in Armour, Farmland, John Morrell and Kretschmar brands Secured contracts with several new national foodservice accounts Introduction of Eckrich Bacon Lovers Deli Meats contributed to growth Gains across all key trade channels Source: Internal shipment data for FY 13 Q2; Packaged meats

Building a Strong Innovation Pipeline

Innovation Platforms Packaging Packaging differentiation highlighting quality and convenience Packaging technology establishing new features and benefits Health and Wellness Meeting consumer demand for better-for-you foods Lower in sodium, lean protein, natural ingredients Convenience Providing consumers convenient time-saving solutions Delivering quality and taste in ready-to-heat/ready-to-eat formats Taste The most important consumer driver in any food category Bringing new taste experiences to consumers Pork Consumer Solutions Bringing flavor, value, and convenience to the fresh pork category 17

• Leveraging packaging technology (cook-in-bag, re-sealable packaging, etc.) to deliver enhanced quality and convenience Platform • Consumers are seeking products that allow for ease of storage, preparation, and clean up as part of their time-constrained lifestyles Consumer Insight Re-sealable Re-sealable, gas-flushed, shingle packaging delivers Deli quality and freshness in a ready-to-go format Cook-in-Bag Self-venting cook-in-the-bag technology increases the convenience of meal preparation, enhances the end result, and reduces clean-up messiness and time Portion Pack Perforated portion packs provide consumers Smithfield bacon in two easy peel pouches, maintaining product freshness and reducing waste Innovations Packaging Platform 18

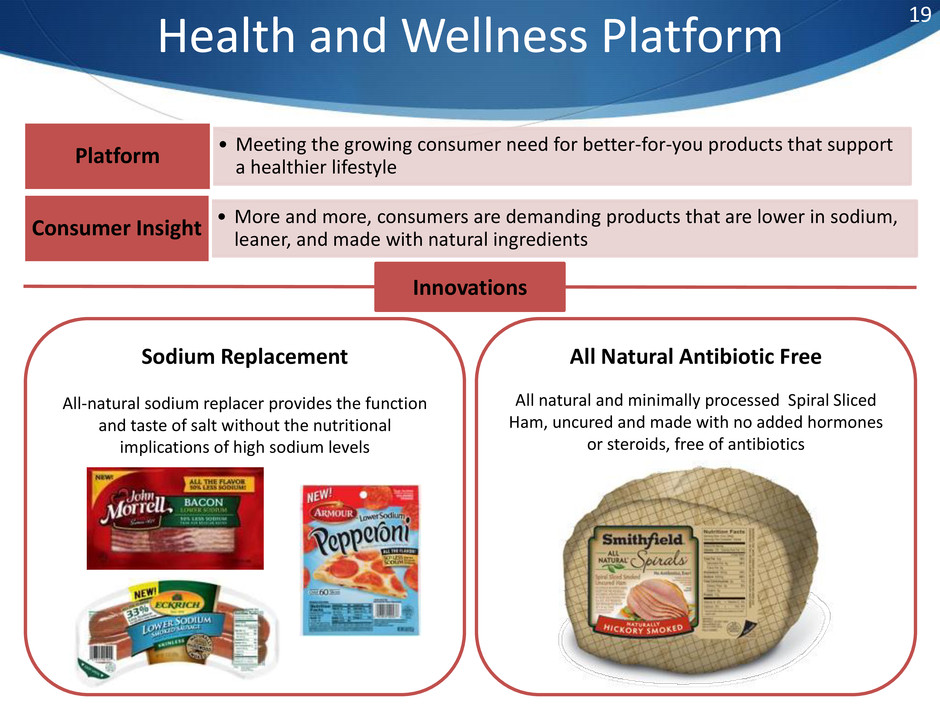

• Meeting the growing consumer need for better-for-you products that support a healthier lifestyle Platform • More and more, consumers are demanding products that are lower in sodium, leaner, and made with natural ingredients Consumer Insight Innovations Health and Wellness Platform All Natural Antibiotic Free All natural and minimally processed Spiral Sliced Ham, uncured and made with no added hormones or steroids, free of antibiotics Sodium Replacement All-natural sodium replacer provides the function and taste of salt without the nutritional implications of high sodium levels 19

• Providing convenient solutions to consumers who lack time but demand delicious, high-quality foods Platform • Consumers are seeking ready-to-heat and ready-to-eat food solutions to fit their time-starved lifestyles Consumer Insight Innovations Convenience Platform Versatility Convenient solutions for customizing the meal via a pre- cooked, heat-and-eat format Ready-to-Heat/ Ready-to-Eat Right-sized portions in a variety of cuts, pre-cooked and ready to heat and eat in minutes Grab and Go Convenient on-the-go packaging provides meal and snack solutions any time, any place 20

•Delighting consumers with on-trend new taste experiences, leveraging mega trends like bacon, bold flavors, and ethnic flavors Platform •Consumers are gravitating to new taste experiences and twists on old favorites Consumer Insight Innovations Taste Platform Bold Flavors Bold and spicy taste combined with the smoky deliciousness of smoked sausage New Flavor Twists Sweet and indulgent flavors like Pecan Praline and Caramel Apple for new and unique tastes for holiday or any day meals Bacon Flavor Trend Real bacon combined with quality deli meat for a totally new taste experience 21

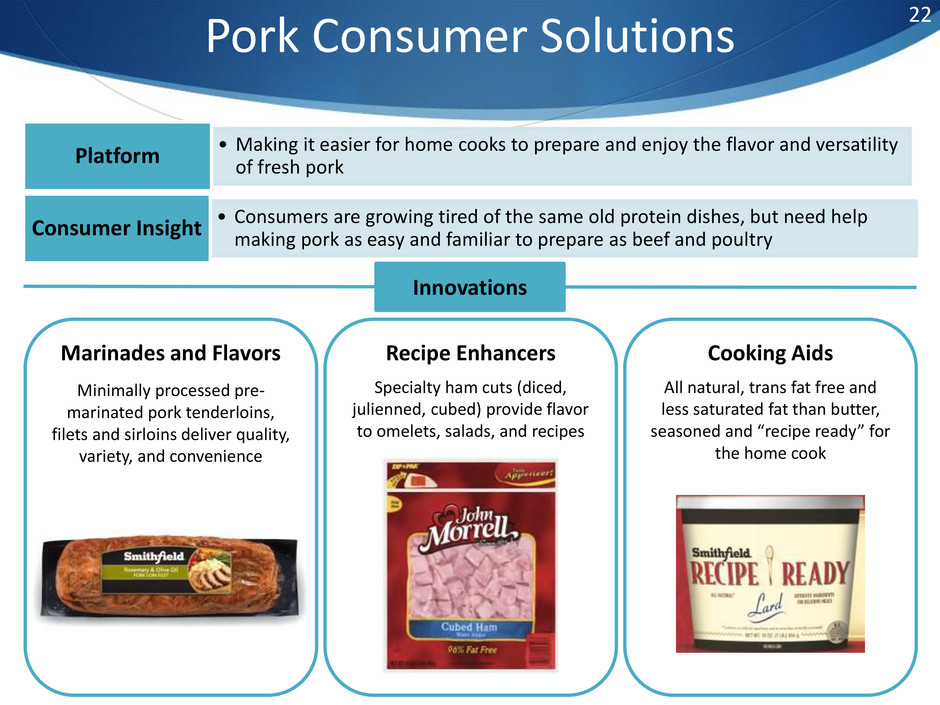

• Making it easier for home cooks to prepare and enjoy the flavor and versatility of fresh pork Platform • Consumers are growing tired of the same old protein dishes, but need help making pork as easy and familiar to prepare as beef and poultry Consumer Insight Innovations Pork Consumer Solutions Cooking Aids All natural, trans fat free and less saturated fat than butter, seasoned and “recipe ready” for the home cook Marinades and Flavors Minimally processed pre- marinated pork tenderloins, filets and sirloins deliver quality, variety, and convenience Recipe Enhancers Specialty ham cuts (diced, julienned, cubed) provide flavor to omelets, salads, and recipes 22

Returning Cash to Shareholders While Maintaining Conservative Balance Sheet

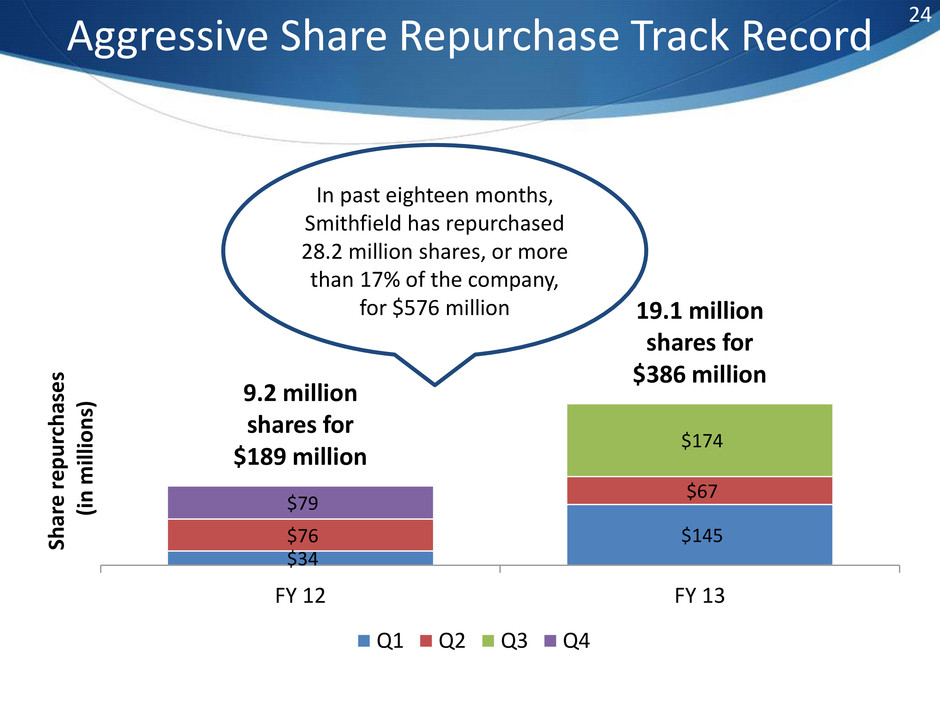

24 Aggressive Share Repurchase Track Record $34 $145 $76 $67 $174 $79 9.2 million shares for $189 million 19.1 million shares for $386 million FY 12 FY 13 Sh ar e r e p u rc h as e s (i n milli o n s) Q1 Q2 Q3 Q4 In past eighteen months, Smithfield has repurchased 28.2 million shares, or more than 17% of the company, for $576 million

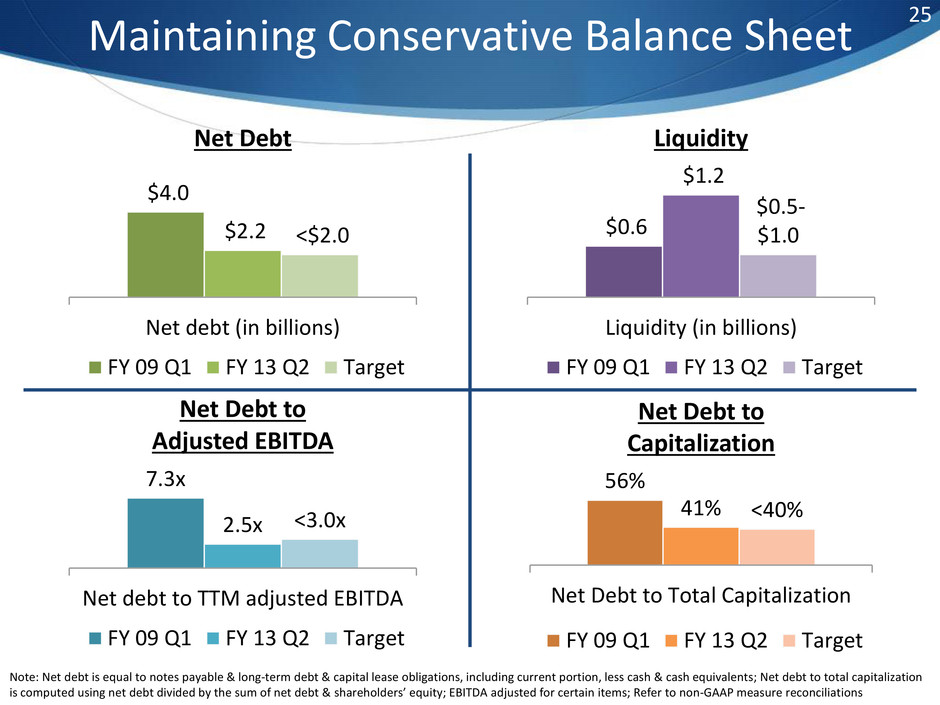

Maintaining Conservative Balance Sheet $4.0 $2.2 <$2.0 Net debt (in billions) Net Debt FY 09 Q1 FY 13 Q2 Target 7.3x 2.5x <3.0x Net debt to TTM adjusted EBITDA Net Debt to Adjusted EBITDA FY 09 Q1 FY 13 Q2 Target 56% 41% <40% Net Debt to Total Capitalization Net Debt to Capitalization FY 09 Q1 FY 13 Q2 Target $0.6 $1.2 $0.5- $1.0 Liquidity (in billions) Liquidity FY 09 Q1 FY 13 Q2 Target Note: Net debt is equal to notes payable & long-term debt & capital lease obligations, including current portion, less cash & cash equivalents; Net debt to total capitalization is computed using net debt divided by the sum of net debt & shareholders’ equity; EBITDA adjusted for certain items; Refer to non-GAAP measure reconciliations 25

Continued Positive Outlook

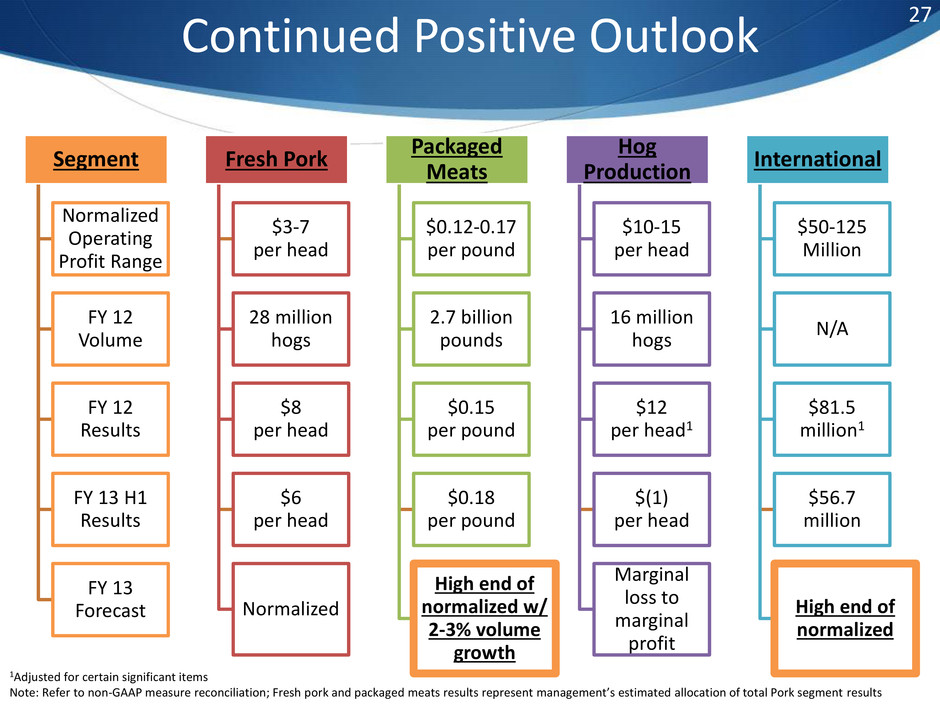

Continued Positive Outlook Segment Normalized Operating Profit Range FY 12 Volume FY 12 Results FY 13 H1 Results FY 13 Forecast Fresh Pork $3-7 per head 28 million hogs $8 per head $6 per head Normalized Packaged Meats $0.12-0.17 per pound 2.7 billion pounds $0.15 per pound $0.18 per pound High end of normalized w/ 2-3% volume growth Hog Production $10-15 per head 16 million hogs $12 per head1 $(1) per head Marginal loss to marginal profit International $50-125 Million N/A $81.5 million1 $56.7 million High end of normalized 1Adjusted for certain significant items Note: Refer to non-GAAP measure reconciliation; Fresh pork and packaged meats results represent management’s estimated allocation of total Pork segment results 27

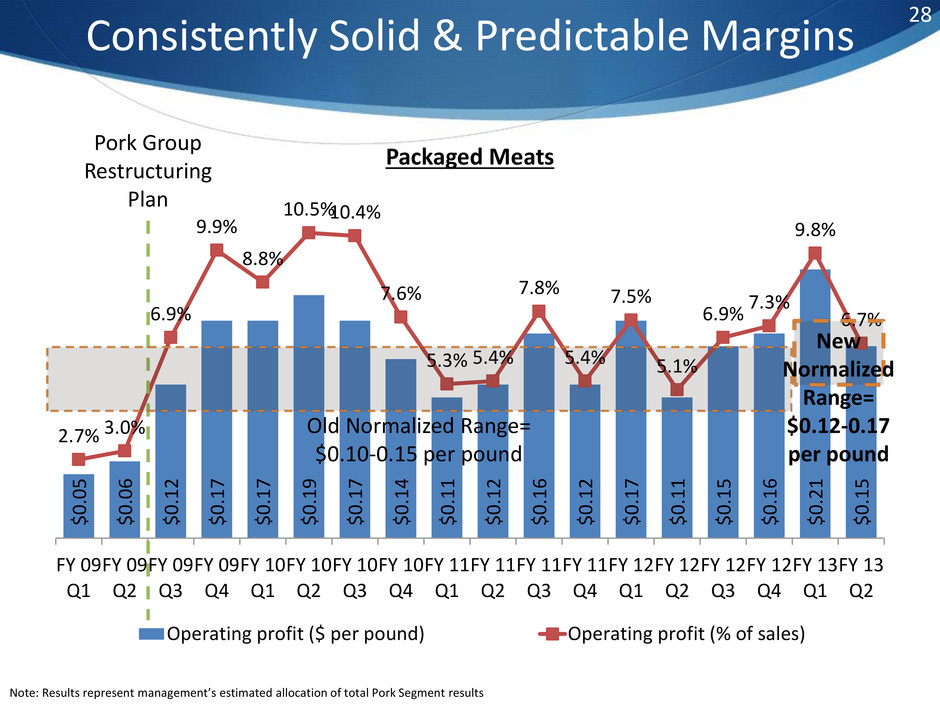

$ 0 .0 5 $ 0 .0 6 $ 0 .1 2 $ 0 .1 7 $ 0 .1 7 $ 0 .1 9 $ 0 .1 7 $ 0 .1 4 $ 0 .1 1 $ 0 .1 2 $ 0 .1 6 $ 0 .1 2 $ 0 .1 7 $ 0 .1 1 $ 0 .1 5 $ 0 .1 6 $ 0 .2 1 $ 0 .1 5 2.7% 3.0% 6.9% 9.9% 8.8% 10.5% 10.4% 7.6% 5.3% 5.4% 7.8% 5.4% 7.5% 5.1% 6.9% 7.3% 9.8% 6.7% FY 09 Q1 FY 09 Q2 FY 09 Q3 FY 09 Q4 FY 10 Q1 FY 10 Q2 FY 10 Q3 FY 10 Q4 FY 11 Q1 FY 11 Q2 FY 11 Q3 FY 11 Q4 FY 12 Q1 FY 12 Q2 FY 12 Q3 FY 12 Q4 FY 13 Q1 FY 13 Q2 Packaged Meats Operating profit ($ per pound) Operating profit (% of sales) Consistently Solid & Predictable Margins Note: Results represent management’s estimated allocation of total Pork Segment results Old Normalized Range= $0.10-0.15 per pound Pork Group Restructuring Plan 28 New Normalized Range= $0.12-0.17 per pound

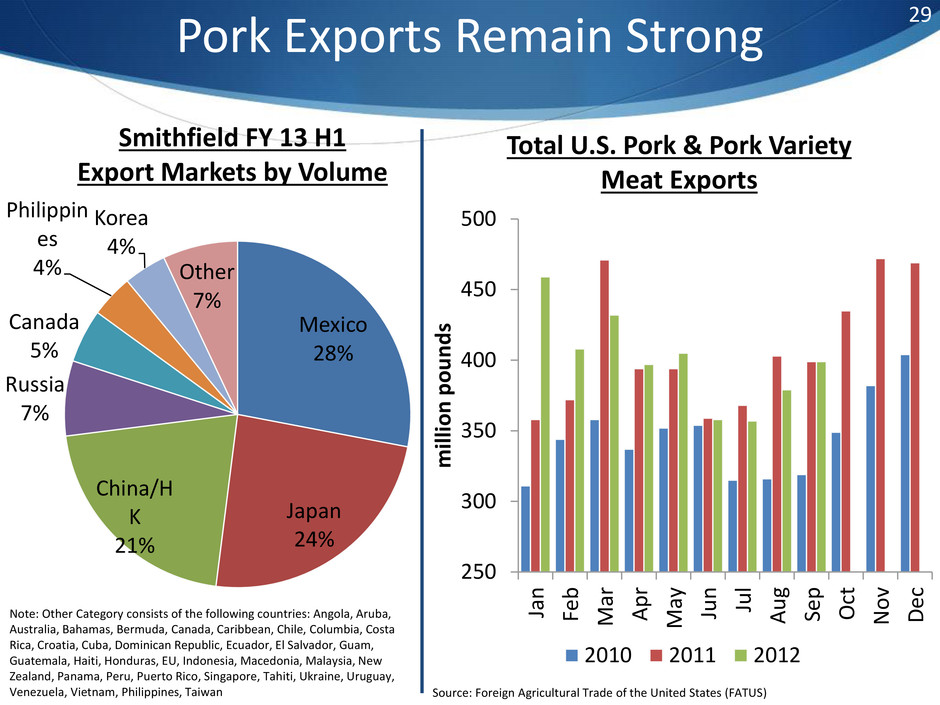

250 300 350 400 450 500 Ja n Fe b Ma r Ap r Ma y Ju n Ju l Au g Se p Oc t No v De c milli o n p o u n d s Total U.S. Pork & Pork Variety Meat Exports 2010 2011 2012 Source: Foreign Agricultural Trade of the United States (FATUS) Pork Exports Remain Strong 29 Mexico 28% Japan 24% China/H K 21% Russia 7% Canada 5% Philippin es 4% Korea 4% Other 7% Smithfield FY 13 H1 Export Markets by Volume Note: Other Category consists of the following countries: Angola, Aruba, Australia, Bahamas, Bermuda, Canada, Caribbean, Chile, Columbia, Costa Rica, Croatia, Cuba, Dominican Republic, Ecuador, El Salvador, Guam, Guatemala, Haiti, Honduras, EU, Indonesia, Macedonia, Malaysia, New Zealand, Panama, Peru, Puerto Rico, Singapore, Tahiti, Ukraine, Uruguay, Venezuela, Vietnam, Philippines, Taiwan

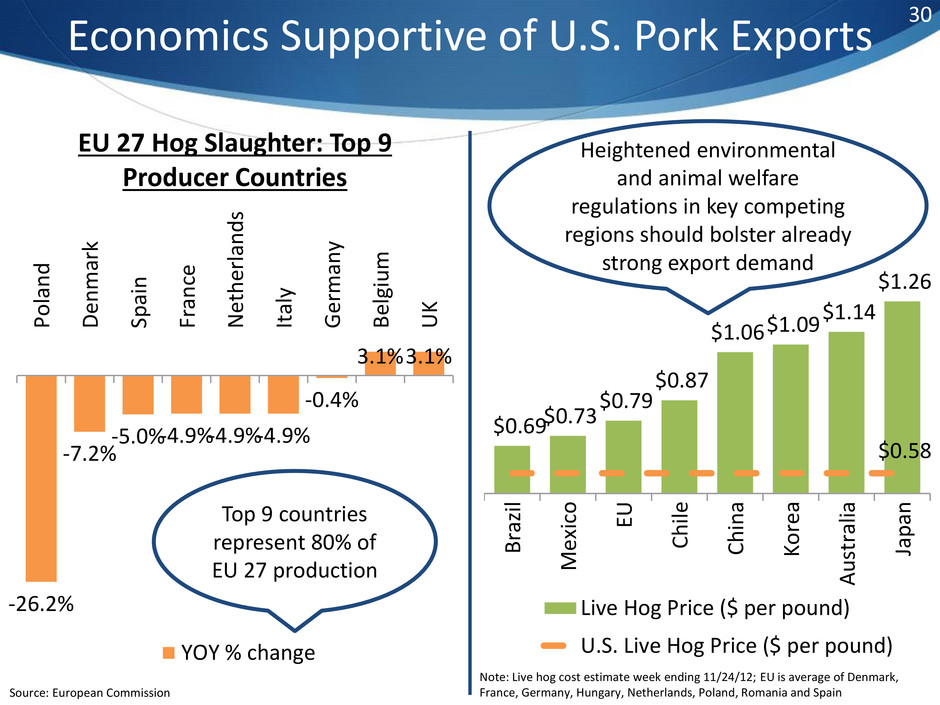

$0.69 $0.73 $0.79 $0.87 $1.06 $1.09 $1.14 $1.26 $0.58 Braz il Mexic o EU Chil e Chin a Kore a Au st ra lia Japa n Live Hog Price ($ per pound) U.S. Live Hog Price ($ per pound) 30 Economics Supportive of U.S. Pork Exports Note: Live hog cost estimate week ending 11/24/12; EU is average of Denmark, France, Germany, Hungary, Netherlands, Poland, Romania and Spain Heightened environmental and animal welfare regulations in key competing regions should bolster already strong export demand -26.2% -7.2% -5.0% -4.9% -4.9% -4.9% -0.4% 3.1% 3.1% Polan d Den m ar k Sp ai n Franc e N et h erla n d s Ital y Ger m an y Bel gi u m U K EU 27 Hog Slaughter: Top 9 Producer Countries YOY % change Top 9 countries represent 80% of EU 27 production Source: European Commission

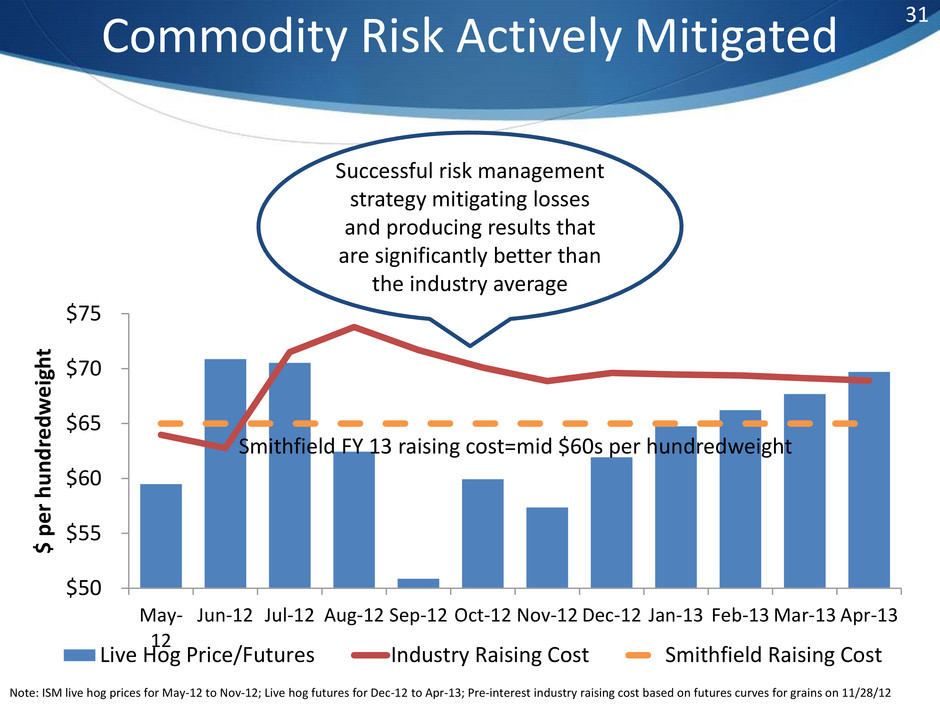

31 Commodity Risk Actively Mitigated Note: ISM live hog prices for May-12 to Nov-12; Live hog futures for Dec-12 to Apr-13; Pre-interest industry raising cost based on futures curves for grains on 11/28/12 $50 $55 $60 $65 $70 $75 May- 12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 $ p e r h u n d re d w e ig h t Live Hog Price/Futures Industry Raising Cost Smithfield Raising Cost Successful risk management strategy mitigating losses and producing results that are significantly better than the industry average Smithfield FY 13 raising cost=mid $60s per hundredweight

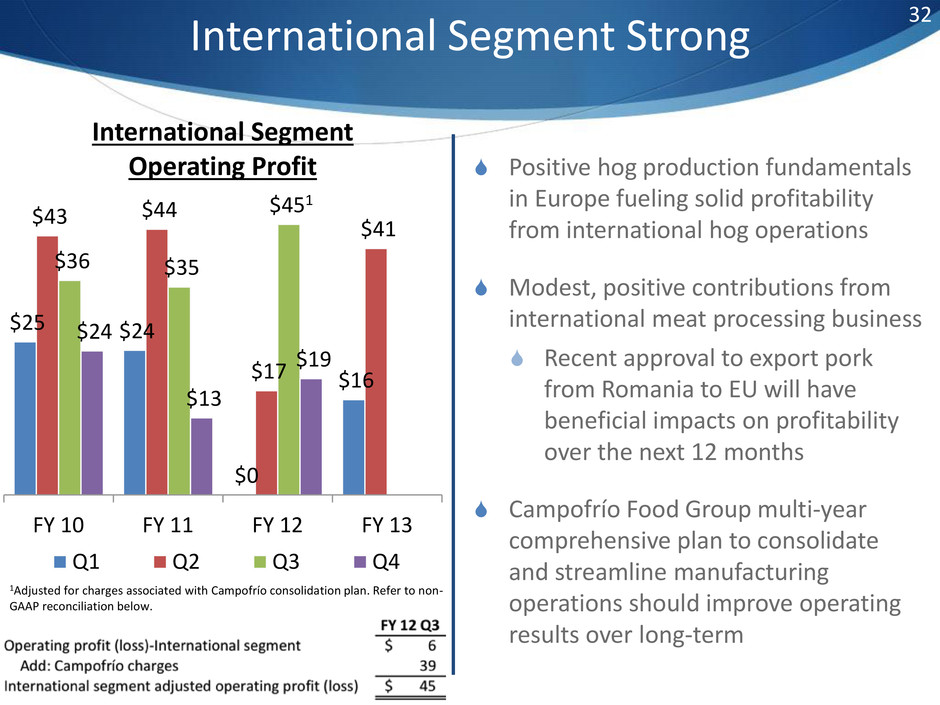

International Segment Strong Positive hog production fundamentals in Europe fueling solid profitability from international hog operations Modest, positive contributions from international meat processing business Recent approval to export pork from Romania to EU will have beneficial impacts on profitability over the next 12 months Campofrío Food Group multi-year comprehensive plan to consolidate and streamline manufacturing operations should improve operating results over long-term $25 $24 $0 $16 $43 $44 $17 $41 $36 $35 $451 $24 $13 $19 FY 10 FY 11 FY 12 FY 13 International Segment Operating Profit Q1 Q2 Q3 Q4 32 1Adjusted for charges associated with Campofrío consolidation plan. Refer to non- GAAP reconciliation below.