UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant [X] Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

StoneX Group Inc.

(Name of Registrant as Specified in Its Charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount previously paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

STONEX GROUP INC.

230 Park Avenue

10th Floor

New York, New York 10169

January 21, 2022

Dear Shareholders:

You are cordially invited to attend the annual meeting of shareholders of StoneX Group Inc. to be held at the Hyatt Regency Orlando, 9801 International Drive, Orlando, Florida on Friday, March 4, 2022 at 10:00 a.m. (Eastern Standard Time). At the meeting, shareholders will be asked to vote on the election of nine Directors; the ratification of the appointment of KPMG LLP as the Company's independent registered public accounting firm for the Company's 2022 fiscal year; an advisory vote on executive compensation; the approval of the proposed 2022 Omnibus Incentive Compensation Plan, and to transact such other business as may properly come before the meeting.

Again this year we are using the "Notice and Access" method of providing proxy materials to you via the Internet. This process provides you with a convenient and quick way to access your proxy materials and vote your shares, while also conserving resources and reducing the costs of printing and mailing the proxy materials. On or about January 21, 2022, we will mail to our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and our 2021 Annual Report online and how to vote via the Internet. The Notice also contains instructions on how to receive a paper copy of the proxy materials and our 2021 Annual Report.

The Notice of Annual Meeting of Shareholders and the Proxy Statement that accompany this letter provide detailed information concerning the matters to be considered at the meeting.

Your vote is important. I urge you to vote as soon as possible, whether or not you plan to attend the annual meeting. Thank you for your continued support of StoneX Group Inc.

Sincerely,

John Radziwill

Chairman

Notice of Annual Meeting of Shareholders

Friday, March 4, 2022

10:00 a.m. Eastern Standard Time

TO THE SHAREHOLDERS OF STONEX GROUP INC.

The annual meeting of the shareholders of StoneX Group Inc., a Delaware corporation (the "Company" or “StoneX Group”), will be held on Friday, March 4, 2022, at 10:00 a.m. Eastern Standard Time, at the Hyatt Regency Orlando, 9801 International Drive, Orlando, Florida, for the following purposes:

1.To elect nine Directors;

2.To ratify the appointment of KPMG LLP as the Company's independent registered public accounting firm for the 2022 fiscal year;

3.To consider an advisory vote on executive compensation;

4.To approve the proposed 2022 Omnibus Incentive Compensation Plan; and

5.To transact such other business as may properly come before the meeting.

The Board of Directors has fixed the close of business on January 10, 2022 as the record date for the determination of shareholders entitled to notice of and to vote at the annual meeting.

Pursuant to the rules of the Securities and Exchange Commission, we have elected to provide access to our proxy materials over the Internet. Accordingly, we will mail, beginning on or about January 21, 2022, a Notice of Internet Availability of Proxy Materials to our shareholders of record and beneficial owners as of the record date. As of the date of mailing of the Notice of Internet Availability of Proxy Materials, all shareholders and beneficial owners will have the ability to access all of the Proxy Materials on a website referenced in the Notice of Internet Availability of Proxy Materials.

The Notice of Internet Availability of Proxy Materials also contains a toll-free telephone number, an e-mail address, and a website where shareholders can request a paper or e-mail copy of the Proxy Statement, our 2021 Annual Report, and a form of proxy relating to the Annual Meeting. These materials are available free of charge. The Notice also contains information on how to access and vote the form of proxy.

Even if you plan to attend the annual meeting, we request that you vote by one of the methods described in the proxy notification and thus ensure that your shares will be represented at the annual meeting if you are unable to attend.

If you fail to vote, the effect will be that your shares will not be counted for purposes of determining whether a quorum is present at the annual meeting. If you do attend the annual meeting and wish to vote in person, you may withdraw your proxy and vote in person.

January 21, 2022

New York, New York

By order of the Board of Directors,

SEAN M. O'CONNOR

Chief Executive Officer and President

TABLE OF CONTENTS

| PROXY STATEMENT | ||||||||

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | ||||||||

| PROPOSAL 1 - ELECTION OF DIRECTORS | ||||||||

| THE BOARD OF DIRECTORS AND ITS COMMITTEES | ||||||||

| BOARD DIVERSITY MATRIX | ||||||||

| BOARD MEMBER INDEPENDENCE | ||||||||

| EXECUTIVE COMPENSATION-COMPENSATION DISCUSSION AND ANALYSIS | ||||||||

| REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION | ||||||||

| DIRECTOR COMPENSATION | ||||||||

| PROPOSAL 2 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||||||||

| AUDIT COMMITTEE REPORT | ||||||||

| PROPOSAL 3 - ADVISORY VOTE ON EXECUTIVE COMPENSATION | ||||||||

| PROPOSAL 4 - APPROVAL OF THE 2022 OMNIBUS INCENTIVE COMPENSATION PLAN | ||||||||

| PROPOSAL 5 - OTHER MATTERS | ||||||||

| MANAGEMENT | ||||||||

| CODE OF ETHICS | ||||||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | ||||||||

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | ||||||||

| GENERAL INFORMATION | ||||||||

| EXHIBIT A STONEX GROUP INC. 2022 OMNIBUS INCENTIVE COMPENSATION PLAN | ||||||||

4

STONEX GROUP INC.

PROXY STATEMENT

2022 Annual Meeting of Shareholders

GENERAL

The proxy is solicited on behalf of the Board of Directors of StoneX Group Inc., a Delaware corporation (the "Company"), for use at the annual meeting of shareholders to be held on Friday, March 4, 2022, at 10:00 a.m. (Eastern Standard Time), or at any adjournment or postponement of the meeting, for the purposes set forth in this proxy statement and in the accompanying Notice of Annual Meeting. The annual meeting will be held at the Hyatt Regency Orlando at 9801 International Drive, Orlando, Florida. The Company intends to mail its Notice of Internet Availability of Proxy Materials and provide access to a website as referenced within its Notice of Internet Availability on or about January 21, 2022 to all shareholders entitled to vote at the annual meeting.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

When and where will the annual meeting take place?

The annual meeting will be held on March 4, 2022 at 10:00 a.m. (Eastern Standard Time), at the Hyatt Regency Orlando at 9801 International Drive, Orlando, Florida.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a paper copy of the proxy materials?

The "Notice and Access" rules of the Securities and Exchange Commission (the "SEC") permit us to furnish proxy materials, including this proxy statement and our Annual Report, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders will receive a Notice of Internet Availability of Proxy Materials (the "Notice") and will not receive printed copies of the proxy materials unless they request them. The Notice will be mailed beginning on or about January 21, 2022. The Notice includes instructions on how you may access and review all of our proxy materials via the Internet. The Notice also includes instructions on how you may vote your shares. If you would like to receive a paper or e-mail copy of our proxy materials, you should follow the instructions in the notice for requesting such materials. Any request to receive proxy materials by mail or e-mail will remain in effect until you revoke it.

Can I vote my shares by filling out and returning the Notice?

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote by Internet or how to request a paper proxy card.

Why did I receive this proxy statement?

You received this proxy statement because you held shares of the Company's common stock on January 10, 2022 (the "Record Date") and are entitled to vote at the annual meeting. The Board of Directors is soliciting your proxy to vote at the meeting.

What am I voting on?

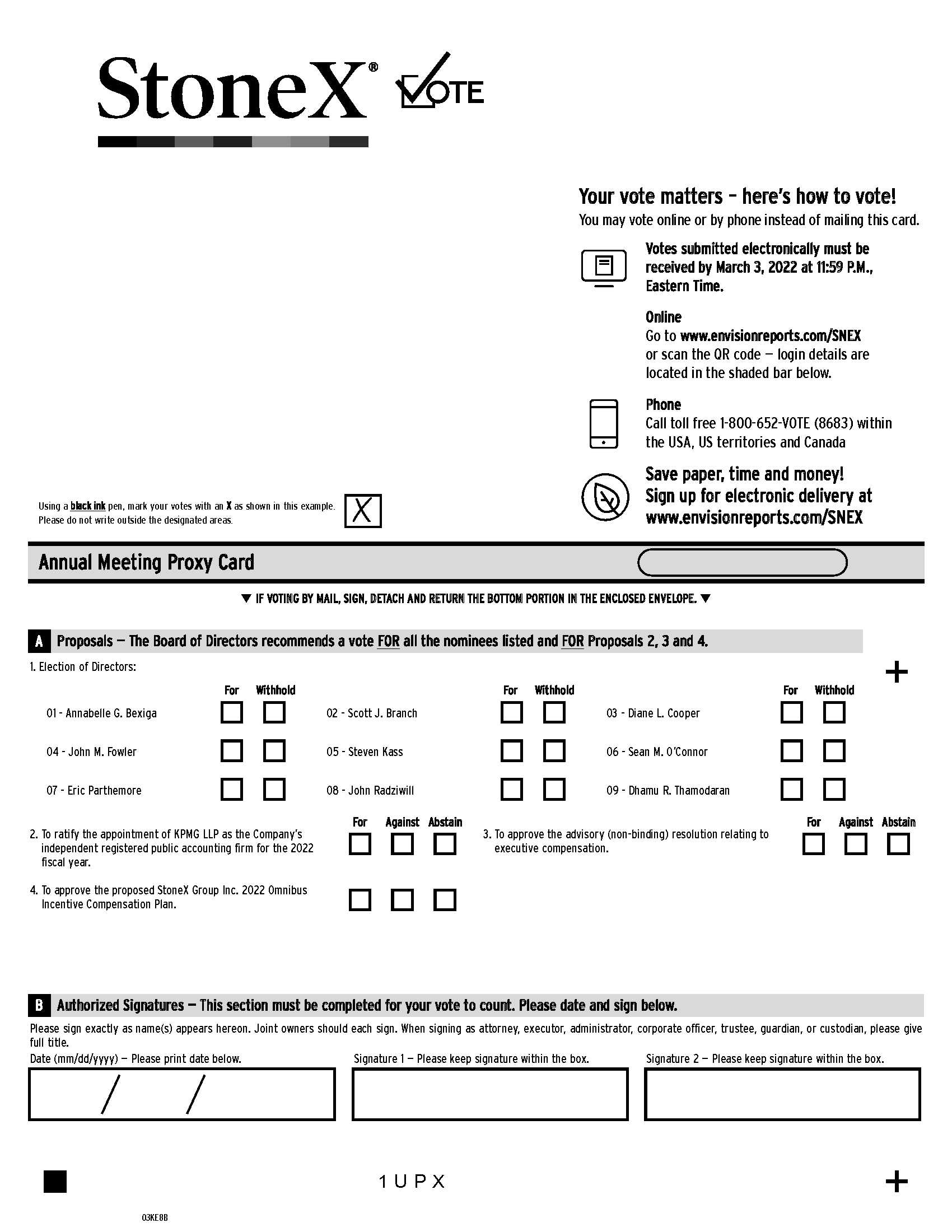

You are being asked to vote on four items:

1.The election of nine Directors (see page 8);

2.The ratification of the appointment of KPMG LLP ("KPMG") as the Company's independent registered public accounting firm for the 2022 fiscal year (see page 34);

3.An advisory vote on executive compensation (see page 36); and

4.The approval of the proposed StoneX Group Inc. 2022 Omnibus Incentive Compensation Plan (see page 36).

5

How do I vote?

Shareholders of Record

If you are a shareholder of record, there are four ways to vote:

•By toll free telephone at 1-800-652-8683.

•By internet at www.envisionreports.com/SNEX

•If you request printed copies of the proxy materials, you may vote by proxy by completing and returning your proxy card in the postage-paid envelope provided by the Company; or

•By voting at the meeting.

Street Name Holders

Shares which are held in a brokerage account in the name of the broker are said to be held in "street name."

If your shares are held in street name, you should follow the voting instructions provided by your broker. If you requested printed copies of the proxy materials, you may complete and return a voting instruction card to your broker, or, in many cases, your broker may also allow you to vote via the telephone or Internet. Check your notice from your broker for more information. If you hold your shares in street name and wish to vote at the meeting, you must obtain a legal proxy from your broker and bring that proxy to the meeting.

Regardless of how your shares are registered, if you request printed copies of the proxy materials, complete and properly sign the accompanying proxy card and return it to the address indicated, it will be voted as you direct.

What is the deadline for voting via Internet or telephone?

Internet and telephone voting is available through 11:59 p.m. (Eastern Standard Time) on Thursday, March 3, 2022 (the day before the annual meeting).

What are the voting recommendations of the Board of Directors?

The Board of Directors recommends that you vote in the following manner:

1.FOR each of the persons nominated by the Board of Directors to serve as Directors;

2.FOR the ratification of the appointment of KPMG as independent registered public accounting firm for the 2022 fiscal year;

3.FOR the approval of the compensation of the Company's named executive officers as disclosed in the Compensation Discussion and Analysis section and accompanying compensation tables contained in this Proxy Statement; and

4.FOR the approval of the proposed StoneX Group Inc. 2022 Omnibus Incentive Compensation Plan.

Unless you give contrary instructions in your proxy, the persons named as proxies will vote your shares in accordance with the recommendations of the Board of Directors.

Will any other matters be voted on?

We do not know of any other matters that will be brought before the shareholders for a vote at the annual meeting. If any other matter is properly brought before the meeting, your proxy would authorize the Chairman and the Chief Executive Officer of the Company to vote on such matters in their discretion.

Who is entitled to vote at the meeting?

Only shareholders of record at the close of business on the Record Date are entitled to receive notice of and to vote at the annual meeting. If you were a shareholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the annual meeting, or any postponement or adjournment of the meeting.

How many votes do I have?

You will have one vote for each share of the Company's common stock that you owned on the Record Date.

How many votes can be cast by all shareholders?

The Company had 20,090,054 outstanding shares of common stock on the Record Date. Each of these shares is entitled to one vote. There is no cumulative voting.

6

How many votes must be present to hold the meeting?

The holders of a majority of the Company's common stock outstanding on the Record Date must be present at the meeting in person or by proxy to fulfill the quorum requirement necessary to hold the meeting. This means at least 10,045,028 shares must be present in person or by proxy.

If you vote, your shares will be part of the quorum. Abstentions and broker non-votes will also be counted in determining the quorum. A broker non-vote occurs when a bank or broker holding shares in street name submits a proxy that states that the broker does not vote for some or all of the proposals because the broker has not received instructions from the beneficial owners on how to vote on the proposals and does not have discretionary authority to vote on non-routine matters in the absence of instructions. Only Proposal No. 2 is considered a routine matter and therefore, shares may be voted by brokers in their discretion.

We urge you to vote by proxy even if you plan to attend the meeting so that we will know as soon as possible that a quorum has been achieved.

What vote is required to approve each proposal?

For the election of Directors (Proposal No. 1), the affirmative vote of a plurality of the votes present in person or by proxy and entitled to vote at the meeting is required. A proxy that has properly withheld authority with respect to the election of one or more Directors will not be voted with respect to the Director or Directors indicated, although it will be counted for the purposes of determining whether there is a quorum.

For the ratification of the appointment of KPMG (Proposal No. 2), the affirmative vote of a majority of the shares represented in person or by proxy and entitled to vote at the meeting will be required for approval. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of a negative vote.

For the advisory vote on executive compensation (Proposal No. 3), the resolution will be approved if a majority of the shares represented in person or by proxy and entitled to vote at the meeting are cast in favor of the compensation. Because your vote is advisory, it will not be binding on the Board or the Company. However, the Board will review the voting results and take them into consideration when making future decisions regarding executive compensation. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of a negative vote.

For the approval of the proposed StoneX Group Inc. 2022 Omnibus Incentive Compensation Plan (Proposal No. 4), the affirmative vote of a majority of the shares represented in person or by proxy and entitled to vote at the meeting will be required for approval. An abstention with respect to this proposal will be counted for the purposes of determining the number of shares entitled to vote that are present in person or by proxy. Accordingly, an abstention will have the effect of a negative vote.

Can I change my vote?

Yes. If you are stockholder of record, you may change your vote at any time before your proxy is voted at the annual meeting. You can do this in one of three ways. First, you can send a written notice stating that you would like to revoke your proxy. Second, you can submit new proxy instructions either on a new proxy card, by telephone or via the Internet. Third, you can attend the meeting, and vote at that time. Your attendance alone will not revoke your proxy. If you have instructed a broker to vote your shares, you must follow directions received from your broker to change those instructions.

Who may attend the annual meeting?

Any person who was a shareholder of the Company on January 10, 2022 may attend the meeting. If you own shares in street name, you should ask your broker or bank for a legal proxy to bring with you to the meeting. If you do not receive the legal proxy in time, bring your most recent brokerage statement so that we can verify your ownership of our stock and admit you to the meeting. However, you will not be able to vote your shares at the meeting without a legal proxy.

What happens if I sign and return the proxy card but do not indicate how to vote on an issue?

If you return a signed proxy card without indicating your vote, your shares will be voted as follows:

•FOR each of the nominees for Director named in this proxy statement;

•FOR ratification of the appointment of KPMG as the independent registered public accounting firm for the Company for the 2022 fiscal year;

•FOR the approval of the compensation of the Company's named executive officers as disclosed in the Compensation Discussion and Analysis section and accompanying compensation tables contained in this Proxy Statement;

•FOR the approval of the proposed StoneX Group Inc. 2022 Omnibus Incentive Compensation Plan.

7

Who can help answer my questions?

If you are a StoneX Group Inc. shareholder, and would like additional copies, without charge, of this proxy statement or if you have questions about the annual meeting, including the procedures for voting your shares, you should contact:

David A. Bolte

Corporate Secretary

1251 NW Briarcliff Parkway, Suite 800

Kansas City, Missouri 64116

(515) 223-3797

PROPOSAL 1 - ELECTION OF DIRECTORS

The restated certificate of incorporation of the Company provides that the Company will have a Board of Directors consisting of nine members, and further provides that the number of Directors may be increased or decreased by resolution of the Board of Directors. Director Bruce W. Krehbiel has announced that he will retire from the Board immediately prior to the 2022 annual meeting of shareholders.

The Nominating & Governance Committee of the Company has nominated and the Board of Directors has approved the nominations of nine persons to serve as Directors until the 2023 annual meeting, or until each Director's successor is elected and qualified, or until the death or resignation of a Director. Each of the nominees has agreed to serve if elected.

The nominees are as follows:

| Name of Nominee | Age | Director Since | ||||||

| Annabelle G. Bexiga | 59 | 2020 | ||||||

| Scott J. Branch | 59 | 2002 | ||||||

| Diane L. Cooper | 62 | 2018 | ||||||

| John M. Fowler | 72 | 2005 | ||||||

| Steven Kass | 65 | 2018 | ||||||

| Sean M. O'Connor | 59 | 2002 | ||||||

| Eric Parthemore | 72 | 2009 | ||||||

| John Radziwill | 74 | 2002 | ||||||

| Dr. Dhamu R. Thamodaran | 66 | 2021 | ||||||

The background of each nominee for Director is as follows:

Annabelle G. Bexiga was elected as a director of the Company on February 27, 2020. She served as Chief Information Officer (CIO) of Global Commercial Insurance at American International Group until 2017. After holding leadership positions at J.P. Morgan & Co. and Deutsche Bank, she served as CIO at JPMorgan Invest, Bain Capital, and the Teachers Insurance and Annuity Association. Ms. Bexiga currently sits on the supervisory board of DWS Group GmbH of Frankfurt, Germany, where she serves on the remuneration committee. Ms. Bexiga also serves on the Board of Directors of Triton International Limited.

Ms. Bexiga brings to the Board, among other skills and qualifications, significant management experience and knowledge in the areas of finance and technology. Her previous positions also afford her a wealth of knowledge across a range of U.S. and global financial services institutions, and provides valuable insight as the Company expands its global network of services.

Scott J. Branch was elected to the Board of Directors of the Company in December 2002. Mr. Branch was appointed the President of the Company in May 2013 and served in that capacity until his retirement as President on October 1, 2015. He retired from employment by the Company on December 31, 2016. Prior to May 2013 he served as Chief Operating Officer of the Company following the merger with FCStone Group Inc. ("FCStone") in October 2009. He also served as President of the Company from 2002 until October 2009. Mr. Branch was General Manager of Standard Bank London, Ltd. from 1995 until 2002. During this period, he also served in other capacities for Standard Bank, including management of its banking and securities activities in the Eastern Mediterranean Region and management of its forfaiting and syndications group.

The Board believes that Mr. Branch's strong leadership skills, extensive financial experience, and knowledge of the Company, its products and services is valuable to the Board. In 2002, Mr. Branch made a significant equity investment in the

8

Company and since that time has been instrumental in guiding the Company's successful strategy and growth. In addition to his other skills and qualifications, Mr. Branch's previous service as President provides a valuable link between the management and operations of the Company and the Board of Directors, allowing the Board to perform its oversight role with the benefit of management's perspective on business and strategy.

Diane L. Cooper was elected as a director of the Company on September 7, 2018. She retired in 2016 after a 30 year career at General Electric, most recently serving as President and CEO of GE Capital’s Commercial Distribution Business from 2009 to 2016. Prior to that role, Ms. Cooper led the GE Capital Equipment Finance and Equipment Finance Services businesses, and served as President and CEO of Commercial Finance – Capital Solutions. Ms. Cooper also currently serves on the boards of the BMO Financial Corp. and Aqua Finance, Inc.

Ms. Cooper brings to the Board, among other skills and qualifications, significant management experience and knowledge in the areas of finance, business development, mergers and acquisitions, employee leadership, and developing and strengthening customer relationships. Her previous positions also afford her a wealth of experience in the operation and management of a public company in the financial services sector.

John M. Fowler was elected as a Director of the Company in 2005. Mr. Fowler, an attorney by training, has since 1998 been a private investor, financial consultant and adviser. From 1996 to 1998, Mr. Fowler was the Chief Financial Officer, Executive Vice President and Director of Moneygram Payment Systems, Inc. He also served as Chief Administrative Officer and Executive Vice President of then Travelers Group, Inc. (now Citigroup, Inc.) from 1986 to 1994. Mr. Fowler has served as General Counsel of the U.S. Department of Transportation, as a Director of Amtrak, as Chairman and Chief Executive Officer of Gulf Insurance Co., as a Director of Transatlantic Re (a reinsurance company), and as a Director of and Chairman of the Compensation Committee of Air Express International.

Mr. Fowler brings to the Board, among other skills and qualifications, significant management experience and knowledge in the areas of finance, accounting, legal and executive compensation. His previous positions also afford him a wealth of experience in the operation and management of a public company in the financial services sector, as well as substantial experience in regulatory affairs and governmental relations.

Steven Kass was elected as a Director of the Company at the 2018 annual meeting of shareholders. Mr. Kass is presently a consultant to professional service firms with a focus on leadership, organizational culture, business strategy, human capital and corporate governance. He spent 33 years with the accounting firm Rothstein Kass before his retirement as Chief Executive Officer in June 2014. During his tenure as CEO, Rothstein Kass grew organically to become the 20th largest accounting firm in the United States. After the acquisition by KPMG in June 2014 of certain assets of Rothstein Kass, Mr. Kass served as senior partner and global lead of the alternative investment globalization effort at KPMG, retiring from KPMG in September 2016. Mr. Kass was Chairman of the Audit Committee and a member of the Board of Directors of Sun Bancorp, Inc. from 2012 to 2014, and was a member of the Board of Directors of AGN International from 1998 to 2014, serving as Global Chairman of the Board from 2001-2003. Mr. Kass also currently serves on the board and as Audit Committee Chairman of Peapack-Gladstone Bank.

Mr. Kass brings to the Board, among other skills and qualifications, significant knowledge in the areas of finance, accounting, internal audit, risk management, corporate governance and Sarbanes-Oxley compliance. In addition, as CEO of Rothstein Kass during its sale to KPMG and subsequent integration, Mr. Kass is able to provide knowledge and insight into the successful integration of professional service organizations.

Sean M. O'Connor joined the Company in October 2002 as Chief Executive Officer and was appointed as President in October 2015. In December 2002, he was elected to the Board of Directors. From 1994 until 2002, Mr. O'Connor was Chief Executive Officer of Standard New York Securities, a division of Standard Bank. From 1999 until 2002, Mr. O'Connor also served as Executive Director of Standard Bank London, Ltd., a United Kingdom bank and subsidiary of the Standard Bank of South Africa.

The Board believes that Mr. O'Connor's strong leadership skills, extensive financial experience, and knowledge of the Company, its products and services is valuable to the Board. In 2002, Mr. O'Connor made a significant equity investment in the Company and since that time has led the Company and guided its successful strategy and growth. In addition to his other skills and qualifications, Mr. O'Connor's position as Chief Executive Officer and President serves as a valuable link between the management and vision of the Company and the Board of Directors, allowing the Board to perform its oversight role with the benefit of management's perspective on business, strategy and opportunities.

Eric Parthemore was elected as a Director of the Company on October 1, 2009, following the merger with FCStone. He had previously served as a Director of FCStone since 1996, as Vice Chairman of FCStone since January 2007, and as a member of its Board's Executive Committee. He served as the Secretary and Treasurer of FCStone until January 2007. Mr. Parthemore recently retired as the President and Chief Executive Officer of Heritage Cooperative, Inc. in West Mansfield, Ohio. He held that position since September 2009 and had served in the same capacity with its predecessor company since

9

1996. Mr. Parthemore was appointed in January 2004 to serve on the Ohio Agricultural Commodity Advisory Commission by the Secretary of Agriculture in the State of Ohio and served on this Commission until 2015. From 2009 to September 2017 Mr. Parthemore served on the National Grain Car Council of the Surface Transportation Board, an agency of the US Department of Transportation.

Mr. Parthemore brings to the Board, among other skills and qualifications, significant management experience and knowledge in the areas of risk management similar to a significant portion of the Company's existing customer base, and services sought by that customer base. In addition, as the former CEO of a large grain and supply cooperative involved in multiple mergers with similar organizations, Mr. Parthemore is able to provide knowledge, guidance and insight into successfully integrating the operations of multiple organizations at a time when the Company is also in the process of integrating multiple organizations.

John Radziwill was elected as a Director of the Company in 2002 and serves as Chairman of the Board. Mr. Radziwill is currently a Director of Oryx International Growth Fund Limited, Fifth Street Capital (BVI) and Netsurion LLC (formerly VendorSafe Technologies Inc.). In the past, he has also served as a Director of Goldcrown Group Limited, PingTone Communications, Inc., Baltimore Capital Plc, Lionheart Group, Inc., USA Micro Cap Value Co. Ltd, Acquisitor Plc and Acquisitor Holdings (Bermuda) Ltd. Mr. Radziwill is a member of the Bar of England and Wales.

Mr. Radziwill brings to the Board, among other skills and qualifications, significant management experience and knowledge in the areas of finance, accounting, and institutional investing, in particular in the small capitalization sector. In 2002, Mr. Radziwill, together with Mr. O'Connor and Mr. Branch, made a significant equity investment in the Company and, as an independent Director of the Company, has been closely involved in its development and growth. In addition, his background and current positions afford him the ability to bring an international perspective to the Board. This insight is increasingly valuable as the Company continues to expand its international operations.

Dr. Dhamu R. Thamodaran was elected as a director of the Company on October 1, 2021. He retired as Executive Vice President, Chief Strategy Officer & Chief Commodity Hedging Officer from Smithfield Foods, Inc. in December 2020, having served in this role since 2016. Dr. Thamodaran joined Smithfield Foods in 1995 as Director of Price Risk Management, and had related industry experience with John Morrell Food Group and Farmland Foods, which later became part of the Smithfield Foods family. Dr. Thamodaran earned his PhD in Economics from Iowa State University and his Master of Science degree in Agricultural Economics & Statistics from the Indian Agricultural Research Institute in New Delhi, India.

Dr. Thamodaran brings to the Board, among other skills and qualifications, significant risk management and strategy development experience and knowledge in the areas of global macroeconomics, global commodities research and analysis, agricultural markets, and the pork value chain. His risk management experience is similar to a significant portion of the Company's existing customer base, and he is familiar with the services sought by that customer base.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH NOMINEE.

THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Company's Board of Directors is responsible for establishing broad corporate policies and for overseeing the overall management of the Company. In addition to considering various matters which require its approval, the Board of Directors provides advice and counsel to, and ultimately monitors the performance of, the Company's senior management.

There are five standing committees of the Board of Directors - the Audit Committee, the Compensation Committee, the Nominating and Governance Committee, the Risk Committee and the Technology and Operations Committee. Committee assignments are re-evaluated annually and approved during the Board meeting that follows the annual meeting of shareholders. The Board of Directors has adopted charters for all of its standing Committees. Copies of these charters can be found on the Company's website at www.stonex.com.

During the fiscal year ended September 30, 2021, the Board of Directors held five meetings. Each Director attended at least 75% of the regular Board meetings and Board committee meetings of which he or she was a member in the fiscal year ended September 30, 2021.

The Company has adopted a formal policy regarding attendance by members of the Board of Directors at the Company's annual meeting of shareholders and at scheduled meetings of the Board of Directors. This policy is as follows:

10

Attendance of Directors at Meetings

The Board of Directors currently holds regularly scheduled meetings and calls for special meetings as necessary. Meetings of the Board may be held telephonically or virtually. Directors are expected to attend all Board meetings and meetings of the Committees of the Board on which they serve and to spend the time needed and meet as frequently as necessary to properly discharge their duties.

Directors are also expected to attend the annual meeting of shareholders. The Board believes that Director attendance at shareholder meetings is appropriate and can assist Directors in carrying out their duties. When Directors attend shareholder meetings, they are able to hear directly shareholder concerns regarding the Company. It is understood that special circumstances may occasionally prevent a Director from attending a meeting.

All of the Company's Directors serving at the time participated in the 2021 annual meeting of the shareholders on February 25, 2021, conducted virtually via live webcast due to the global COVID-19 pandemic.

Audit Committee

The Audit Committee meets at least quarterly with the Company's management and the independent registered public accounting firm to, among other things, review the results of the annual audit and quarterly reviews and discuss the financial statements, select and engage the independent registered public accounting firm, assess the adequacy of the Company's staff, management performance and procedures in connection with financial controls and receive and consider the independent registered public accounting firm's comments on the Company's internal controls. The members of the Audit Committee during the 2021 fiscal year were: Steven Kass (Chairman), Diane Cooper, Scott Branch and Annabelle Bexiga (prior to her appointment as Chairman of the Technology and Operations Committee in May 2021). The Audit Committee met five times during the 2021 fiscal year.

The Board has determined that at least one member of the Audit Committee who served during the Company's 2021 fiscal year, namely the Chairman of the Committee, Mr. Kass, was an "audit committee financial expert" within the meaning of Item 407(d)(5) of SEC Regulation S-K.

Compensation Committee

The Compensation Committee makes determinations concerning salaries and incentive compensation and otherwise determines compensation levels for the Company's executive officers and other key employees and performs such other functions regarding compensation as the Board may delegate. The members of the Compensation Committee during the 2021 fiscal year were: John M. Fowler (Chairman), Eric Parthemore, Bruce Krehbiel and Annabelle Bexiga. The Compensation Committee met four times during the 2021 fiscal year.

The Compensation Committee administers the Company's stock option or other equity-based plans, including the review and grant of stock options or restricted stock to all eligible employees under the Company's existing plans, including a requirement that all restricted stock and options awards shall be subject to a minimum vesting period of three years, with one-third of the award vesting on each of the first, second and third anniversaries of the award, and subject to the provisions as specified with greater particularity in the Company's Restricted Stock Plan and the Company's Stock Option Plan as currently applicable.

The Compensation Committee also administers the Company's stock option or other equity-based plans to ensure that there shall be no repricing of restricted stock or options once awarded, nor shall a buyout of underwater options be allowed.

Risk Committee

The Risk Committee meets at least quarterly to oversee the Company's risk management processes. This includes working with management to determine and assess the Company's philosophy and strategy towards risk management and mitigation. Management is responsible for the day-to-day management of risk under the direction of the Chief Risk Officer and the Risk department. Management and the Chief Risk Officer reports regularly to the Risk Committee on current and emerging risks and the Company's approach to avoiding and mitigating risk exposure. The Risk Committee reviews the Company's most significant risks and whether management, including the Risk department of the Company, is responding consistently within the Company's overall risk management and mitigation strategy. The members of the Risk Committee during the 2021 fiscal year were: Scott Branch (Chairman), Bruce Krehbiel and Diane Cooper. The Risk Committee met four times during the 2021 fiscal year.

Technology and Operations Committee

The Technology and Operations Committee meets at least quarterly to oversee the Company's technology and operations strategy, significant investments in support of such strategy, and risks arising from technology and operations,

11

including information security, fraud, vendor, data protection and privacy, business continuity and resilience and cybersecurity risks. This includes working with management to determine and assess the Company's philosophy and strategy towards technology and operations. Management is responsible for the day-to-day management of technology and operations under the direction of the Chief Operating Officer, Chief Information Officer, Chief Technology Officer and the IT department. Management and the COO, CIO and CTO report regularly to the Technology and Operations Committee on current and emerging strategies and trends and the Company's approach to technology and operations. The members of the Technology and Operations Committee during the 2021 fiscal year were: Annabelle Bexiga (Chairman), Diane Cooper and Steven Kass. The Technology and Operations Committee was formed in May 2021 and met one time during the 2021 fiscal year.

Nominating and Governance Committee

The Nominating and Governance Committee reviews and evaluates the effectiveness of the Company's executive development and succession planning processes, and also provides active leadership and oversight of these processes. Additionally, the Nominating and Governance Committee evaluates and recommends nominees for membership on the Company's Board of Directors and its committees and develops and recommends to the Board a set of effective corporate governance policies and procedures.

The members of the Nominating and Governance Committee during the 2021 fiscal year were: Eric Parthemore (Chairman), John M. Fowler and Steven Kass. The Committee met five times during the 2021 fiscal year.

In September 2005, the Board of Directors adopted a formal policy concerning shareholder recommendations for candidates as nominees to the Board of Directors. The policy has been incorporated into the charter of the Nominating & Governance Committee which is posted on the Company's website. The policy is as follows:

The Nominating and Governance Committee is charged with recommending to the entire board a slate of Director nominees for election at each annual meeting of the shareholders. Candidates for Director nominees are selected for their character, judgment and business experience.

The Committee will consider recommendations from the Company's shareholders when establishing the slate of Director nominees to be submitted to the entire Board. Such recommendations will be evaluated by the Committee using the same process and criteria that are used for recommendations received from Directors and executive officers. The Committee will consider issues of diversity, experience, skills, familiarity with ethical and corporate governance issues which the Company faces in the current environment, and other relevant factors. The Committee will make these determinations in the context of the perceived needs of the Company at the time.

Procedures by which Shareholders may Recommend Nominees for Director

For a shareholder to recommend a Director nominee to the Committee, the shareholder should send the recommendation to the Chairman of the Nominating and Governance Committee, c/o Corporate Secretary, StoneX Group Inc., 1251 NW Briarcliff Parkway, Suite 800, Kansas City, Missouri 64116. The recommendation should include (a) the name, address and telephone number of the potential nominee; (b) a statement regarding the potential nominee's background, experience, expertise and qualifications; (c) a signed statement from the potential nominee confirming his or her willingness and ability to serve as a Director and abide by the corporate governance policies of the Company (including its Code of Ethics) and his or her availability for a personal interview with the Committee; and (d) evidence establishing that the person making the recommendation is a shareholder of the Company.

Recommendations which comply with the foregoing procedures and which are received by the Corporate Secretary before September 1 in any year will be forwarded to the Chairman of the Nominating and Governance Committee for review and consideration by the Committee for inclusion in the slate of Director nominees to be recommended to the entire Board for presentation at the annual meeting of shareholders in the following year. In evaluating Director nominees, the Nominating and Governance Committee considers the following factors:

•the appropriate size of the Company's Board of Directors;

•the needs of the Company with respect to the particular talents and experience of its Directors;

•the knowledge, skills and experience of nominees, including experience in commodities and securities markets, business, finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board;

•familiarity with national and international business matters;

•experience with accounting rules and practices; and

•the desire to balance the considerable benefit of continuity with the periodic injection of the fresh and diverse perspectives provided by new members.

12

The Nominating and Governance Committee's goal is to assemble a Board of Directors that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience.

Other than the foregoing, there are no stated minimum criteria for Director nominees, although the Nominating and Governance Committee may also consider such other factors as it may deem are in the best interests of the Company and its shareholders. The Nominating and Governance Committee also believes that it is appropriate for certain key members of the Company's management to serve as Directors.

The Nominating and Governance Committee identifies nominees by first evaluating the current members of the Board of Directors who are willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company's business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the Nominating and Governance Committee or the Board decides not to re-nominate a member for re-election, the Nominating and Governance Committee identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the Nominating and Governance Committee and Board of Directors are polled for suggestions as to individuals meeting the criteria of the Nominating and Governance Committee. Research may also be performed to identify qualified individuals.

In consideration of the growth of the Company and the expanded international scope of the Company, the Company strives to increase the diversity on the Board of Directors.

Shareholder Communications with Non-Management Members of the Board

The Company has adopted a formal process for shareholder communications with the independent members of the Board. The policy, which is available on the Company's website, www.stonex.com, is as follows:

Interested parties are invited to communicate with the non-management members of the Board by sending correspondence to the non-management members of the Board of Directors, c/o Corporate Secretary, StoneX Group Inc., 1251 NW Briarcliff Parkway, Suite 800, Kansas City, Missouri 64116 or via e-mail to board@stonex.com.

The Corporate Secretary will review all such correspondence and forward to the non-management members of the Board a summary of all such correspondence received during the prior month and copies of all such correspondence that deals with the functions of the Board or committees thereof or that otherwise is determined to require attention of the non-management Directors. Non-management Directors may at any time review the log of all correspondence received by the Company that is addressed to the non-management members of the Board and request copies of any such correspondence. Concerns relating to accounting, internal controls or auditing matters will immediately be brought to the attention of the Chairman of the Audit Committee.

Board Leadership

A substantial majority of the members of the Board of Directors are independent Directors (eight of nine of the Directors to be voted upon at the 2022 Annual Shareholders' Meeting). The five Board committees - Audit, Nominating and Governance, Compensation, Risk, and Technology and Operations - are comprised solely of and chaired by independent Directors; and at each regularly scheduled Board meeting, the non-management Directors meet in executive session without management Directors. The position of Chairman of the Board is separated from Chief Executive Officer, and the Chairman of the Board position is held by an independent Director. The Board believes that this structure is in the best interests of the Company and its stockholders, as it allows the Chief Executive Officer to focus on day-to-day business operations, while allowing the Chairman of the Board to lead the Board of Directors in its fundamental role of review and oversight of management.

Board's Role of Risk Oversight

The Risk Committee meets at least quarterly to oversee the Company's risk management processes. This includes working with management to determine and assess the Company's philosophy and strategy towards risk management and mitigation. Management is responsible for the day-to-day management of risk under the direction of the Chief Risk Officer and the Risk department. Management and the Chief Risk Officer reports regularly to the Risk Committee on current and emerging risks and the Company's approach to avoiding and mitigating risk exposure. The Risk Committee reviews the Company's most significant risks and whether management, including the Risk department of the Company, is responding consistently within the Company's overall risk management and mitigation strategy.

The Compensation Committee of the Board monitors the compensation programs of the Company, including reviewing the relationship between the Company's risk management policies and practices and compensation arrangements. Credit losses and trading losses are considered in the calculation of variable compensation of executives and Company revenue

13

producers, and negative balances in one period are carried forward to succeeding periods in the calculation of bonuses for revenue producers. The Company periodically changes or adapts its compensation policies to address the specific risk profile of each business unit.

The Audit Committee of the Board oversees the Internal Audit department of the Company, including that department's review of the business continuity, disaster recovery, data privacy and cybersecurity efforts of the Company and its subsidiaries.

The Nominating and Governance Committee of the Board monitors the compliance programs of the Company and its subsidiaries, including periodic telephonic meetings with the chief compliance officers of the Company's primary operating segments and senior anti-money laundering officers.

The Technology and Operations Committee monitors the Company's information technology department and risks arising from technology and operations, including information security, fraud, vendor, data protection and privacy, business continuity and resilience and cybersecurity risks. This includes working with management to determine and assess the Company's philosophy and strategy towards technology and operations.

Board and Committee Evaluation

The Nominating and Governance Committee annually reviews and evaluates the performance of the Board of Directors. The Committee surveys all Board members on multiple subject areas, and the survey results are used to evaluate the Board's contribution as a whole and its effectiveness with respect to particular subject areas. Particular attention is given to subject areas which the Committee or Board believes for any reason warrant further attention. The purpose of the review is to increase the effectiveness of the Board, and the results are reviewed with the full Board.

In addition, each committee conducts an annual self-evaluation through the use of a survey completed by the members of each committee. The committee self-evaluations review whether and how well each committee has performed the responsibilities in its charter, whether there are sufficient meetings covering the necessary topics, whether the meeting materials are effective, and other matters. As with the Board evaluation, particular attention is given to subject areas which the particular committee or Board believes for any reason warrant further attention.

Director Education

Continuing director education is provided in conjunction with regular Board meetings and focuses on topics necessary to enable the Board to effectively evaluate issues before the Board. The education takes the form of management and key staff presentations covering timely subjects and topics, along with in-depth reviews of key business units and geographic regions serviced by the Company and its subsidiaries.

Director Financial Interest in the Company

The Nominating and Governance Committee Charter establishes the responsibility of the Committee to administer and monitor a policy that Directors and the Chief Executive Officer shall at all times have a financial interest in Company stock by owning vested Company stock at least equal in value to three times the most recent year's Director's cash compensation (excluding Board or committee chairman fees) or the Chief Executive Officer's base salary, within five years of being appointed to the Board or as Chief Executive Officer, with such three times level to be maintained after the five year phase-in period.

All of our directors, with the exception of two of our most recently elected directors, have met or exceeded our stock ownership guideline, in many instances by a significant amount. Mr. O'Connor's stock ownership vastly exceeds the target set for the Chief Executive Officer.

Hedging Policy

The Company officers and directors are subject to the mandatory legal prohibition on selling short company shares. The Company also prohibits officers and directors from entering into transactions that would have the effect of causing those individuals to benefit from a decline in the price of the Company stock, such as the purchase of “put” options. While the Company prohibits such “hedging” transactions, it has not adopted a policy prohibiting its officers and directors from otherwise hedging or pledging their shares of Company stock as security for a loan.

Environmental, Social and Governance Matters

The Company recognizes that its business, and the manner in which it operates, creates impacts that reach beyond its client relationships and bottom line to affect its physical environment, society and the climate in which companies like it conduct business. In the Company's environmental, social and governance (ESG) approach, it strives to complement the

14

positive impacts generated by its business philosophy and practices while minimizing or offsetting the possible negative impacts. In past years, the Company has let its approach to ESG arise organically from its corporate culture which has been cultivated by the Board of Directors and management team. This organic, culture-driven approach has produced a number of initiatives and best practices of which the Company is very proud. This year the Company is making a more concerted effort to share its efforts, beginning with a new section in its Annual Report that expresses the Company's core vision and efforts. The Company is also developing a new section for its website that will provide a more thorough review of its ESG initiatives.

NASDAQ BOARD DIVERSITY MATRIX

Board Diversity Matrix (As of December 31, 2021) | ||||||||||||||

Total Number of Directors | 10 | |||||||||||||

Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

Part I: Gender Identity | ||||||||||||||

Directors | 2 | 8 | ||||||||||||

Part II: Demographic Background | ||||||||||||||

African American or Black | ||||||||||||||

Alaskan Native or Native American | ||||||||||||||

Asian | 1 | |||||||||||||

Hispanic or Latinx | 1 | |||||||||||||

Native Hawaiian or Pacific Islander | ||||||||||||||

White | 1 | 7 | ||||||||||||

Two or More Races or Ethnicities | ||||||||||||||

LGBTQ+ | ||||||||||||||

Did Not Disclose Demographic Background | ||||||||||||||

BOARD MEMBER INDEPENDENCE

The Board of Directors annually determines the independence of Directors based upon a review conducted by the Nominating & Governance Committee and the Board. No Director is considered independent if he or she is an executive officer or employee of the Company or has a relationship which, in the opinion of the Company's Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director.

The Board of Directors has determined that, in its judgment as of the date of this Proxy Statement, each of the Company's Directors, other than Sean O'Connor, is an independent Director within the meaning of Rule 5600 of the NASDAQ Stock Exchange ("NASDAQ Rule 5600"). Accordingly, all of the members of the Audit, Compensation, Risk, Nominating and Governance, and Technology and Operations Committees are independent within the meaning of NASDAQ Rule 5600.

EXECUTIVE COMPENSATION -

COMPENSATION DISCUSSION AND ANALYSIS

This section contains a discussion of the Company's executive compensation program, including the objectives of the program, the policies underlying the program, the types of compensation provided by the program, and how the Company determined the compensation paid to each named executive officer.

Background

The Company's Compensation Committee (the "Compensation Committee" or "Committee" throughout this section) has primary responsibility for the design and implementation of the Company's executive compensation program. The Committee directly determines the compensation for the Company's principal executive officers. The Committee receives recommendations from the Chief Executive Officer regarding the compensation of the Chief Financial Officer, certain executive officers of the Company and certain executive officers of major subsidiaries, and supervises and reviews the compensation for the Company's other executive officers. The salaries for those officers are currently determined by one or more of the Company's principal executive officers.

15

The Compensation Committee has considered the results of the most recent shareholder advisory vote on executive compensation required by Section 14A of the Exchange Act in determining the Company's compensation policies and decisions. In this regard, at the Company's 2021 annual meeting, the shareholders voted on a non-binding resolution to approve the compensation awarded by the Company to the Company's named executive officers ("say-on-pay") as described in the Compensation Discussion & Analysis ("CD&A"), tabular disclosures, and other narrative executive compensation disclosures in the proxy statement for the 2021 annual meeting. At the 2021 annual meeting, approximately 93.2% of the votes on the say-on-pay proposal were voted in favor of the proposal. Based upon these results, the Compensation Committee has concluded that the Company's shareholders generally support the principal elements of the compensation program adopted by the Compensation Committee. The Committee has relied in part on that conclusion in continuing the principal elements of the compensation program in 2021.

At the 2017 annual meeting, the shareholders voted on a non-binding resolution to determine whether the advisory shareholder vote on say-on-pay should occur every one, two or three years ("say-on-frequency"). Approximately 59% of the votes on the say-on-frequency proposal voted in favor of a vote every year. Based upon the results of the say-on-frequency vote, the Board has determined to hold the say-on-pay vote annually.

At the 2017 annual meeting, the shareholders also voted on the Company's 2017 Restricted Stock Plan. Approximately 93% of the votes on the Restricted Stock Plan proposal voted in favor of the Plan.

For the 2021 fiscal year, the five named executive officers were Sean M. O'Connor, who served as the Chief Executive Officer and President of the Company, William J. Dunaway, who served as the Chief Financial Officer of the Company, Glenn Stevens, who served as Head of Retail and Foreign Exchange, Philip Smith, who served as Chief Executive Officer of StoneX Financial Ltd, and Diego Rotsztain, who served as Chief Governance and Legal Officer.

The Company designed its executive compensation program to reflect its vital need to attract and retain executives with specific skills and experience in the various businesses operated by the Company. In this regard, the success of these businesses is directly dependent on the ability of the Company's executives to generate operating income with an appropriate level of risk. The Company competes with larger and better capitalized companies for individuals with the required skills and experience. As a result, the Company must have a compensation program that provides its executives with a competitive level of compensation relative to the compensation available from the Company's competitors.

The Company also designed its executive compensation program to reward executives based on their contributions to the Company's success. The Compensation Committee believes that a compensation program which relies heavily on performance-based compensation will both maximize the efforts of the Company's executives and align the interests of executives with those of shareholders. This form of compensation also allows the Company to compete for talented individuals since it is common in the financial services industry.

Objectives of the Company's Executive Compensation Program

The Company's executive compensation program is designed to meet three principal objectives:

•to provide competitive levels of compensation to attract and retain talented executives,

•to provide compensation which reflects the contribution made by each executive to the Company's success, and

•to encourage long-term service to the Company by awarding equity-based compensation that vests over more than one year.

Attract and Retain Talented Employees

The Company's success depends on the leadership of senior executives and the skills and experience of its other executives. In order to attract and retain highly capable individuals, the Company needs to ensure that the Company's compensation program provides competitive levels of compensation. Therefore, the Compensation Committee seeks to provide executives with compensation that is similar to the compensation paid by other financial services firms.

Provide Compensation Based on Performance

The Company believes that its continued success requires it to reward individuals based upon their contribution to the Company's success. Accordingly, a substantial portion of each executive's compensation is in the form of performance-based compensation, which can be based on both objective and subjective criteria.

Encourage Long-Term Service through Equity Awards

The Company seeks to encourage long-term service by making equity awards to the Company's executives. In the case of the principal executive officers, the Compensation Committee has elected to award a portion of the executive's bonus in the

16

form of restricted stock. In the case of other executives, the Compensation Committee offers the executives the right to receive a portion of their bonuses in the form of restricted stock.

What the Executive Compensation Program is Designed to Reward

By linking compensation opportunities to performance of the Company as a whole, the Company believes the Company's compensation program encourages and rewards:

•efforts by each executive to enhance firm-wide productivity and profitability, and

•entrepreneurial behavior by each executive to maximize long-term equity value in the interest of all shareholders

Performance Accomplishments

In addition to following a disciplined approach to growing the Company's business through acquisitions and organic growth initiatives during the year, the executive management team continued to focus its energies in 2021 on upgrading and more tightly integrating the Company’s offerings, platforms, marketing strategy and customer experience, in the belief that this is necessary to achieving its goal of becoming a truly best-in-class global financial franchise. Fiscal year 2021 accomplishments include, among other things, the following:

•Leading the Company’s international operations through the worldwide COVID-19 pandemic,

•Achieved record operating revenues of $1,673.1 million, an increase of 27.9% over the prior year,

•Achieved record net operating revenues of $1,150.0 million, an increase of 32.5% over the prior year,

•Achieved net income of $116.3 million,

•Shareholders’ equity grew to $904.0 million, an increase of 17.8% over the prior year,

•Achieved an ROE (return on equity) of 13.9%,

•Leading the Company's integration of the GAIN Capital Holdings, Inc. ("GAIN") organization, a global provider of trading services and solutions in spot foreign exchange, precious metals and CFDs.

Clawback Policy

In May 2021, the Board of Directors of the Company adopted a Clawback Policy which permits the Compensation Committee to approve the recoupment, repayment or forfeiture, as applicable, of any incentive-based compensation paid to any “officer” of the Company as defined under Rule 16a-1(f) under the Securities Exchange Act of 1934 (a “Covered Executive”), if the Compensation Committee determines that: (i) the amount of incentive-based compensation paid was based on the achievement of financial results that were subsequently the subject of a material accounting restatement that occurred within three years of such payment (except in the case of a restatement due to a change in accounting policy or simple error); (ii) the Covered Executive engaged in fraud, gross negligence or intentional misconduct; or (iii) the Covered Executive deliberately misled the market or the Company’s stockholders regarding the Company’s financial performance.

Elements of Compensation

The Company's executive compensation program provides for the following elements of compensation:

•base salary,

•bonus under an established bonus plan with objective criteria,

•a long-term performance incentive plan,

•discretionary bonus based on subjective criteria, and

•health insurance and similar benefits.

Base Salary

The Company pays each executive officer an annual base salary to provide the executive with a predictable level of income and enable the executive to meet living expenses and financial commitments. The Compensation Committee views base salary as a way to provide a non-performance-based element of compensation that is certain and predictable. The Compensation Committee believes the base salaries paid to the Company's executive officers in 2021 were modest compared to other financial service firms.

The annual base salary for Sean M. O'Connor in 2021 was $600,000. The annual base salary for William J. Dunaway in 2021 was $375,000. The annual base salary for Glenn Stevens in 2021 was $500,000. The annual base salaries for Philip Smith and Diego Rotsztain in 2021 were $400,000.

17

Executive Performance Plan

The Company adopted the current Executive Performance Plan (the “EPP”) in 2019 to provide bonuses to designated executives based upon objective criteria. The plan's structure has previously satisfied the requirements for performance-based compensation within the prior provisions of Section 162(m) of the Internal Revenue Code so that the compensation was deductible for federal income tax purposes. While the requirements for performance-based compensation for tax-deductibility purposes were eliminated under the Tax Cuts and Jobs Act of 2017, the Company and the Compensation Committee have continued to follow the structure and criteria as established within the EPP. The EPP permits awards to be paid in cash, restricted stock or a combination of both.

The Company utilized the EPP to reward the Company's six principal executive officers and three executive officers of wholly-owned subsidiaries for the 2021 fiscal year. Bonuses paid under the EPP are objective and are based on criteria established by the Company in advance. The Compensation Committee's goal is to utilize bonuses under the EPP as the Company's principal tool for encouraging executives to maximize productivity and profitability. Awards under the plan provide executives with an incentive to focus on aspects of the Company's performance that the Compensation Committee believes are key to the Company's success.

The Compensation Committee administers the EPP and has responsibility for designations of eligible participants and establishing specific “performance targets” for each participant in the plan. The performance targets may be based on one or more of the following business criteria, or on any combination of these criteria:

•increase in share price,

•adjusted return on equity ("ROE"),

•control of fixed costs,

•control of variable costs, and

•adjusted EBITDA growth.

For the 2021 fiscal year, adjusted return on equity was the only performance target established and used by the Compensation Committee.

With respect to adjusted ROE and adjusted EBITDA growth, the plan generally requires that adjustments be made to return on equity or EBITDA, as the case may be, when determining whether the applicable performance targets have been met, so as to eliminate, in whole or in part, in any manner specified by the Committee at the time the performance targets are established, the gain, loss, income and/or expense resulting from the following items:

•changes in accounting principles that become effective during the performance period,

•extraordinary, unusual or infrequently occurring events reported in the Company's public filings, excluding early extinguishment of debt, and

•the disposal of a business, in whole or in part.

The Committee may, however, provide at the time the performance targets are established that one or more of these adjustments will not be made as to a specific award or awards.

In addition, the Committee may determine at the time the goals are established that other adjustments will be made under the selected business criteria and applicable performance targets to take into account, in whole or in part, in any manner specified by the Committee, any one or more of the following:

•gain or loss from all or certain claims and/or litigation and insurance recoveries,

•the impact of impairment of tangible or intangible assets,

•restructuring activities reported in the Company's public filings, and

•the impact of investments or acquisitions.

Each of these adjustments may relate to the Company as a whole or any part of the Company's business or operations, as determined by the Committee when it establishes the performance targets. Finally, adjustments will be made as necessary to any performance target related to the Company's stock to reflect changes in corporate capitalization, such as stock splits and certain reorganizations.

Concurrently with the selection of performance targets, the Committee must establish an objective formula or standard for calculating the maximum bonus payable to each participating executive officer. Under the plan, the maximum bonus for each fiscal year may not exceed $8,500,000 for any executive.

Over a five-year period, the maximum per participant amounts are thus $42,500,000 for each executive. Notwithstanding this overall maximum, the Committee has sole discretion to determine, pursuant to its “negative discretion,”

18

whether to actually pay any of or the entire maximum permissible bonus or to defer payment or vesting of any bonus, subject in each case to the plan's terms and any other written commitment authorized by the Committee. The Committee may also exercise its negative discretion by establishing additional conditions and terms of payment of bonuses, including the achievement of other financial, strategic or individual goals, which may be objective or subjective, as it deems appropriate. Although the Committee may waive these additional conditions and terms, it may not waive the basic performance target as to the business criterion chosen for any particular period.

Bonuses will be paid in either cash or a combination of cash and restricted stock on a basis to be established by the Committee. The specific proportion of each bonus to be received in the form of restricted stock is subject to review by the Committee from time to time. The proportions utilized for the 2021 fiscal year were as follows:

•amounts from 0 - $200,000: 15%

•amounts from $200,000 - $400,000: 20%

•amounts from $400,000 - $600,000: 25%

•amounts above $600,000: 30%

In general, restricted stock is a grant of stock that is subject to forfeiture if specified vesting requirements are not satisfied. The current vesting requirements are set forth in the following paragraph.

If any portion of a bonus is payable in the form of restricted stock, then the restricted stock will be issued to the executive at a discount of 25% to the market value of the Company's common stock (determined as of the date that is 75 days following the end of the applicable performance period, or, if the Committee has not determined the bonus by this date, 15 days after the amount of the bonus is determined and certified by the Committee). These shares of restricted stock will vest at the rate of one-third per year on each of the first, second and third anniversaries of the grant date of the award, all as specified with greater particularity in an award agreement to be entered into in accordance with the Company's Restricted Stock Plan. In its discretion, the Committee may waive these provisions and elect to pay 100% of any bonus payable under the plan, regardless of amount, entirely in cash (for example, in the case of a participant who already holds a substantial number of shares). Likewise, in its discretion, the Committee may alter the vesting period or reduce the discount applicable to any restricted stock award.

In the event sufficient shares are not available pursuant to the Restricted Stock Plan, then the entire bonus will be payable in cash.

The performance plan may from time to time be amended, suspended or terminated, in whole or in part, by the Board of Directors or the Committee.

Application of Executive Performance Plan in 2021

For 2021, the Compensation Committee selected Sean M. O'Connor and William J. Dunaway to be participants in the Executive Performance Plan. Seven additional executives, including Glenn Stevens, Head of Retail and Foreign Exchange, Philip Smith, Chief Executive Officer of StoneX Financial Ltd, a subsidiary of the Company, and Diego Rotsztain, Chief Governance and Legal Officer, are also participants in the Executive Performance Plan. The potential bonuses for the participants were based on the adjusted ROE generated by the Company during the fiscal year. No bonus was to be earned under the Plan unless the adjusted ROE for fiscal year 2021 was at least 6.0%.

19

The potential bonus for Mr. O'Connor based on this performance target is set forth in the following table. The potential bonuses for Messrs. Dunaway, Stevens, Smith and Rotsztain were a pro-rata portion of these amounts, based upon targets established by the Compensation Committee.

Executive Performance Plan - Fiscal 2021 | |||||

| Performance Target | |||||

| Adjusted Return on Equity Target | Target Bonus | ||||

| Less than 6.0% | None | ||||

| 6% | $495,000 | ||||

| For every additional 10 basis points, add | $9,625 | ||||

| 8% | $687,500 | ||||

| For every additional 10 basis points, add | $15,125 | ||||

| 10% | $990,000 | ||||

| For every additional 10 basis points, add | $19,800 | ||||

| 12.5% | $1,485,000 | ||||

| For every additional 10 basis points, add | $22,000 | ||||

| 15% | $2,035,000 | ||||

| For every additional 10 basis points, add | $24,200 | ||||

| 17.5% | $2,640,000 | ||||

| For every additional 10 basis points, add | $26,400 | ||||

| 20% | $3,300,000 | ||||

| For every additional 10 basis points, add | $42,900(*) | ||||

| (*) subject to a maximum annual amount of $8,500,000 per EPP participant. | |||||

Bonuses Earned under Executive Performance Plan for 2021

Based upon the Company's results for 2021 and adjusting for amortization expense of intangible assets identified in the GAIN acquisition and the net loss on the internal merger of the operations of GAIN's U.K. subsidiaries, an adjusted ROE of 15.2% was used in calculating the amount of bonuses earned under the EPP. As such, the awards for the five named executive officers were as follows:

Bonuses Earned under 2021 Executive Performance Plan | ||||||||||||||||||||||||||

| Name | Nominal Amount (1) | Cash Amount (2) | Restricted Shares (3) | |||||||||||||||||||||||

| (#) | Value | |||||||||||||||||||||||||

| Sean O'Connor | $ | 2,083,400 | $ | 1,518,380 | 12,144 | $ | 753,414 | |||||||||||||||||||

| William Dunaway | $ | 1,041,700 | $ | 789,190 | 5,427 | $ | 336,691 | |||||||||||||||||||

| Glenn Stevens | $ | 1,171,913 | $ | 880,339 | 6,267 | $ | 388,805 | |||||||||||||||||||

| Diego Rotsztain | $ | 546,893 | $ | 440,169 | 2,294 | $ | 142,320 | |||||||||||||||||||

| Philip Smith | $ | 1,250,040 | $ | 935,028 | 6,771 | $ | 420,073 | |||||||||||||||||||

(1) This column sets forth the nominal amount of the bonus earned by each executive under the plan in 2021. Messrs. Stevens and Rotsztain started participating in the EPP on January 1, 2021 and, therefore, their bonuses represent 75% of the annual amount otherwise payable. A portion of this amount was paid in the form of a cash bonus and the balance was paid in the form of restricted stock valued at a discount of 25% to the market value of the Company's common stock on the date specified in the EPP.

20

(2) This column sets forth the cash amount earned by each executive under the plan in 2021. Messrs. Stevens and Rotsztain started participating in the EPP on January 1, 2021 and, therefore, their bonuses represent 75% of the annual amount otherwise payable. These amounts were paid in fiscal 2022.

(3) This column sets forth the number of shares of restricted stock awarded under performance-based grants to each executive and the value of the shares calculated in accordance with the Stock Compensation Topic of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC"). These shares vest ratably over a period of three years. These shares were granted on December 15, 2021, and had a fair market value of $62.04 per share on the date of grant.

Long-Term Performance Incentive Plan