Exhibit 1

COLLIERS INTERNATIONAL GROUP INC.

ANNUAL INFORMATION FORM

For the year ended December 31, 2021

February 17, 2022

TABLE OF CONTENTS

|

Forward-looking statements |

2 |

|

Corporate structure |

3 |

|

General development of the business |

4 |

|

Dividends and dividend policy |

15 |

|

Capital structure |

15 |

|

Market for securities |

18 |

|

Escrowed securities and securities subject to contractual restriction on transfer |

18 |

|

Transfer agents and registrars |

18 |

|

Directors and executive officers |

19 |

|

Legal proceedings and regulatory actions |

26 |

|

Properties |

27 |

|

Reconciliation of non-GAAP financial measures |

27 |

|

Risk factors |

29 |

|

Interest of management and others in material transactions |

38 |

|

Material contracts |

39 |

|

Cease trade orders, bankruptcies, penalties or sanctions |

41 |

|

Conflicts of interest |

42 |

|

Independent registered public accounting firm |

42 |

|

Audit & Risk Committee |

42 |

|

Additional information |

44 |

| Exhibit “A” – Audit & Risk Committee Mandate |

FORWARD-LOOKING STATEMENTS

This Annual Information Form contains, and incorporates by reference, “forward looking statements” which reflect the current expectations, estimates, forecasts and projections of management regarding our future growth, results of operations, performance and business prospects and opportunities. Wherever possible, words such as “may,” “would,” “could,” “will,” “anticipate,” “believe,” “plan,” “expect,” “intend,” “estimate,” “aim,” “endeavour” and similar expressions have been used to identify these forward-looking statements. These statements reflect management’s current beliefs with respect to future events and are based on information currently available to management. Forward-looking statements involve significant known and unknown risks, uncertainties and assumptions. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, without limitation, those listed in the “Risk Factors” section of this Annual Information Form. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements could vary materially from those expressed or implied by the forward-looking statements contained in this Annual Information Form. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained, or incorporated by reference into, this Annual Information Form are based upon what management currently believes to be reasonable assumptions, we cannot assure readers that actual results, performance or achievements will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this Annual Information Form and we do not intend, and do not assume any obligation, to update or revise these forward-looking statements, except as otherwise required by law.

COLLIERS INTERNATIONAL GROUP INC.

ANNUAL INFORMATION FORM

February 17, 2022

All amounts referred to in this Annual Information Form (“AIF”) are in United States dollars unless otherwise indicated. All financial and statistical data in this AIF is presented as at December 31, 2021 unless otherwise indicated.

Corporate structure

Colliers International Group Inc. (“we,” “us,” “our,” “Colliers,” or the “Company”) was formed under the Business Corporations Act (Ontario) by Articles of Arrangement dated June 1, 2015. The predecessor to the Company, FirstService Corporation (“Old FSV”), was formed by Articles of Incorporation dated February 25, 1988. Old FSV amalgamated with Coloma Resources Limited pursuant to Articles of Amalgamation dated July 31, 1988, and the amalgamated corporation continued as Old FSV.

By Articles of Amendment dated April 2, 1990, Old FSV: (i) consolidated each of its Class A Subordinate Voting Shares on a 30 to 1 basis and changed the designation of that class of shares to “Subordinate Voting Shares”, each such share carrying one vote; and (ii) consolidated each of its Class B shares on a 30 to 1 basis and changed the designation of that class of shares to “Multiple Voting Shares”, each such share carrying 20 votes.

By Certificate of Amendment dated June 27, 2007, the first series of Preference Shares of Old FSV were created and designated as 7% cumulative preference shares, series 1 (the “Preferred Shares”), with each Preferred Share having a stated value of US$25.00 and carrying a fixed cumulative annual dividend of US$1.75 payable quarterly. All outstanding Preferred Shares were eliminated on May 3, 2013 by way of a partial redemption for cash of $39.2 million immediately followed by a mandatory conversion of all then remaining Preferred Shares into Subordinate Voting Shares, which resulted in the issuance of 2.89 million new Subordinate Voting Shares.

On June 1, 2015, Old FSV completed a plan of arrangement (the “Spin-off”) which separated Old FSV into two independent publicly traded companies – Colliers, a global leader in diversified professional real estate services and new FirstService Corporation (“FirstService”), the North American leader in residential property management and related services. The Spin-off was designed to enhance long-term value for shareholders by creating two independent and sustainable companies, each with the ability to pursue and achieve greater success by employing independent value creation strategies best suited to its core businesses and customers. Under the Spin-off, Old FSV shareholders received one Colliers share and one FirstService share of the same class as each Old FSV share previously held, Old FSV amalgamated with a wholly-owned subsidiary and changed its name to Colliers and FirstService adopted the name “FirstService Corporation”.

On April 16, 2021, after receiving approval from 95% of disinterested shareholders, the Company completed the previously announced transaction to settle the Management Services Agreement, including the LTIA, between Colliers, Jay S. Hennick and Jayset Management CIG Inc., a corporation controlled by Mr. Hennick. This transaction also established a timeline for the orderly elimination of Colliers’ dual class voting structure by no later than September 1, 2028.

Our Subordinate Voting Shares are publicly traded on both the Toronto Stock Exchange (“TSX”) (symbol: CIGI) and The NASDAQ Stock Market (“NASDAQ”) (symbol: CIGI). Our head and registered office is located at 1140 Bay Street, Suite 4000, Toronto, Ontario, M5S 2B4. Our fiscal year-end is December 31.

Intercorporate Relationships

We have the following principal subsidiaries which have total assets or revenues which exceed 10% of our total consolidated assets or revenues as at and for the year ended December 31, 2021:

|

Name of Subsidiary |

Percentage of Voting Securities Owned |

Jurisdiction of Incorporation, Continuance, Formation or Organization |

|

Colliers International EMEA Holdings Ltd. |

100% |

England & Wales |

|

Colliers International Financing Hungary PLC |

100% |

Hungary |

|

Colliers International Holdings (USA), Inc. |

100% |

Delaware |

|

Colliers International USA, LLC |

100% |

Delaware |

|

Colliers Investment Management Holdings, Inc. |

100% |

Delaware |

|

Colliers Macaulay Nicolls Inc. |

100% |

Ontario |

|

Colliers Macaulay Nicolls (Cyprus) Ltd. |

100% |

Cyprus |

|

Harrison Street Real Estate Capital, LLC |

75% |

Delaware |

|

Colliers Mortgage Holdings, LLC |

78% |

Delaware |

|

Colliers International Holdings Limited |

100% |

British Virgin Islands |

|

CI Holdings (USA), LLC |

100% |

Delaware |

|

Colliers International WA, LLC |

100% |

Delaware |

The above table does not include all of the subsidiaries of Colliers.

General development of the business

Our origins date back to 1972 when Jay S. Hennick, the Chairman & CEO of the Company, started a Toronto commercial swimming pool and recreational facility management business, which became the foundation of Old FSV. In 1993, we completed our initial public offering on the TSX, raising C$20 million. In 1995, our shares were listed on NASDAQ. In 1997, a second stock offering was completed in Canada and the United States raising US$20 million. In December 2004, a stock dividend was declared effectively achieving a 2-for-1 stock split for all outstanding Subordinate Voting Shares and Multiple Voting Shares (together, the “Common Shares”). In 2009, Old FSV issued US$77 million of convertible unsecured subordinate debentures, which were subsequently converted into 2.7 million Subordinate Voting Shares in 2014.

From 1994 to present, we completed numerous acquisitions and selected divestitures, developing, growing and focusing on the diversified professional real estate services provided by us today.

In 2004, we established a commercial real estate services division under the “Colliers International” brand with the acquisition of Colliers Macaulay Nicolls Inc. (“CMN”). Since that time, we have strengthened this business across markets and acquired numerous businesses within existing and new markets greatly expanding its geographic scope, services and talent. Today, Colliers is one of the world’s largest commercial real estate services providers offering a full range of commercial real estate services in the United States, Canada, Australia, the United Kingdom, Germany, China and several other countries in Asia, Europe and Latin America.

In 2015, we completed the Spin-off, creating two independent publicly traded companies: Colliers in commercial real estate services and FirstService in residential property management and related services. In connection with the Spin-off, Colliers entered into an Arrangement Agreement with, among others, FirstService dated March 11, 2015 (the “Arrangement Agreement”) and a Transitional Services and Separation Agreement with, among others, FirstService dated June 1, 2015 (the “Transitional Services and Separation Agreement”). The Arrangement Agreement set out the terms and conditions to the arrangement, including the plan of arrangement, which effected the Spin-off. The Transitional Services and Separation Agreement set out the mechanics for the separation of the businesses, including the division of assets and the assumption of liabilities and matters governing certain ongoing relationships between Colliers and FirstService, including reciprocal indemnities with respect to the assets and liabilities kept by Colliers or transferred to FirstService.

In September 2016, the Company acquired ICADE Asset Management and ICADE Conseil (“ICADE”), an asset management and investor advisory services platform in France. The acquisition established the Company’s Investment Management service line, with more than €2 billion of assets under management (“AUM") in Europe.

In July 2018, we acquired 75% of the ownership interests in Harrison Street Real Estate Capital, LLC (“Harrison Street”), a real estate investment firm dedicated to demographic-based investing with approximately $15.6 billion in AUM as of June 30, 2018. At closing, we paid $452 million, and up to an additional $100 million is expected to be paid in the first quarter of 2022 based on Harrison Street having achieved certain accelerated performance targets. The senior management team of Harrison Street holds the balance of the equity. Headquartered in Chicago, with an office in London, England, Harrison Street is a pioneer in demographic-based real estate investing.

In May 2020, we acquired a controlling interest in four subsidiaries of Dougherty Financial Group LLC – Dougherty Mortgage LLC, Dougherty & Company LLC, Dougherty Funding LLC and Dougherty Insurance Agency LLC (together “Dougherty”). Dougherty’s mortgage banking operations were rebranded as “Colliers Mortgage” which provides specialty debt financing through its relationships with US government agencies while all brokerage, investment banking, capital markets and public finance services are carried on through “Colliers Securities” which is licensed under the Securities and Exchange Commission and is a member of the Financial Industry Regulatory Authority (“FINRA”).

In July 2020, we acquired a controlling interest in Maser Consulting P.A. (“Maser”), a leading multi-disciplinary engineering design and consulting firm in the U.S. The operation was rebranded as “Colliers Engineering & Design” in the first half of 2021.

In January 2022, the Company announced its agreement to invest in Basalt Infrastructure, LLP (“Basalt”) a transatlantic infrastructure investment management firm with $8.5 billion in AUM. The expected acquisition adds highly differentiated investment products in the utility, transportation, energy/renewables and communications sectors. The transaction is subject to customary closing conditions and approvals and is expected to close in the second half of 2022.

Narrative description of Colliers

History

CMN traces its roots back to 1898 when Macaulay Nicolls was founded in Vancouver, Canada as a property management and insurance agency. Colliers originated in 1976 in Australia through the merger of three commercial property services firms. In 1984, Colliers joined forces with Macaulay Nicolls to form CMN. Over the years, Colliers continued to grow globally as other market leading commercial real estate service providers joined the group. In 2004, Old FSV acquired a controlling interest in CMN. At the time of the acquisition by Old FSV, CMN was generating approximately $250 million in annual revenue.

With the financial and strategic support of Old FSV and a deep and experienced senior management team, CMN accelerated its growth by adding company-owned operations, expanding into complementary service areas and growing into other geographic regions. By 2010, Old FSV had unified all operations globally under the “Colliers International” brand name with one mission and standardized business practices delivered consistently throughout all operations. Over the past 15 years, Colliers has been one of the fastest growing major, global diversified professional real estate services and investment management companies based on revenue growth. A summary of Colliers’ history and growth initiatives to date is as follows:

|

Year |

Event |

|

|

1898 |

Macaulay Nicolls founded in Vancouver, Canada |

|

|

1976 |

Colliers International Property Consultants incorporated in Australia |

|

|

1984 |

Colliers International launches global expansion into Canada and the US as CMN |

|

|

1986 |

Colliers International merges operations in Australia and Asia establishing operations in 20 markets in Asia Pacific |

|

|

1990 |

Colliers International expands into emerging markets including Central Europe and Latin America |

|

|

2004 |

Old FSV acquires a controlling interest in CMN with a long-term strategy to consolidate operations and create one global organization, under one brand with consistent business practices applied globally |

|

|

2006 |

Between 2006 and 2010, CMN begins to strengthen and grow its global platform by acquiring additional Colliers International branded operations. In total, 29 acquisitions are completed in 15 countries around the world |

|

|

2010 |

The US operations of Colliers combine with CMN and re-brand under as “Colliers International” in all markets Original network structure is disbanded and newly re-branded Colliers International, controlled by Old FSV, becomes one of the largest and most recognized brands in commercial real estate globally |

|

|

2012 |

Colliers acquires the Colliers International operations in the United Kingdom and Ireland and integrates them into its global platform |

|

|

2013 |

Colliers acquires the German Colliers International operations and integrates them into its global platform |

|

|

2014 |

Colliers International voted to the top five in Global Outsourcing 100 for the first time in its history Colliers expands to France and Belgium |

|

|

2015 |

Colliers International Group Inc. begins trading on the NASDAQ and TSX on June 2, 2015 |

|

|

2016 |

Colliers establishes its Investment Management service line with the acquisition of ICADE |

|

|

2017 |

Colliers acquires two of largest remaining non-owned Colliers International branded operations in the United States. Colliers acquires the Colliers International operations in Denmark and integrates them into its global platform |

|

|

2018 |

Colliers acquires a controlling interest in Harrison Street, a real estate investment management firm dedicated to demographic-based investing |

|

|

2019 |

Colliers acquires a controlling interest in Synergy Property Development Services, a leading project management services firm in India |

|

|

2020 |

Colliers acquires a controlling interest in Dougherty and establishes a U.S. debt finance and loan servicing platform Colliers acquires a controlling interest in Maser, a multi-discipline engineering design service firm in the U.S. |

|

2021 |

Colliers unveils new visual identity, including the removal of the word “International” to give more prominence to the “Colliers” wordmark Settlement of Long-Term Incentive Arrangement with the Company’s Chairman and CEO as approved by 95% of the Company’s disinterested shareholders. As part of the settlement, the Company established a timeline for the orderly elimination of Colliers’ dual class voting structure by no later than September 1, 2028 Colliers acquires Bergmann (“Bergmann”), a leading engineering, architecture and design services firm located in the US Northeast, Midwest and Mid-Atlantic regions Colliers enters into agreements to acquire controlling interests in Antirion, a real estate investment management firm in Italy, and our Colliers Italy affiliate. The transactions are expected to close by the end of first quarter of 2022 |

|

|

2022 |

Colliers enters into agreement to acquire controlling interest in Basalt, a transatlantic infrastructure investment management firm with a focus on utility, transportation, energy/renewables, and communication sectors in Europe and North America |

Service offerings

Recurring Services (45% of revenues)

Recurring services are comprised of our Outsourcing & Advisory and Investment Management segments. These services are typically higher-value-add professional real estate services with substantially all of the revenues contractual and recurring or repeat in nature.

Outsourcing & Advisory Services

Our Outsourcing & Advisory Services operations provide corporate and workplace solutions, property and facility management services, project management services, engineering and design services, appraisal and valuation services, loan servicing and research for commercial real estate clients. We partner with large corporations in managing their overall real estate portfolios and transactions to reduce costs, improve execution across multiple markets and increase operational efficiency. Professional staff combines proprietary technology with high level strategic planning, portfolio management, lease administration and facilities and project management. Outsourcing & Advisory Services has more than 6,900 professional staff globally.

Our Outsourcing & Advisory Services include:

|

• |

Corporate Solutions: We work as an extension of a client’s team to provide deep expertise and a comprehensive set of portfolio management, transaction management, project management, workplace solutions, strategic consulting, property and asset management as well as other corporate real estate services. Our Corporate Solutions clients are typically companies or public sector institutions with large, highly distributed, and diverse real estate portfolios. We typically enter into long-term, contractual relationships with these clients to ensure that real estate strategies are developed to support their overall business needs. This service line offers clients a fully integrated suite of services under the leadership and accountability of an account leader or team who are responsible for overall performance around the world. Many of our contracts contain fees that are tied to performance against client objectives (such as cost and footprint reduction, cycle-time improvement, and customer satisfaction) instead of fees based solely on transaction commissions. Our corporate solutions teams have a unified value proposition which is to deliver customized, accountable, and innovative real estate solutions that result in the best service experience and alignment with our client’s core business strategy. We have developed industry-leading technology through Colliers360 (which provides clients with user-friendly, fast and flexible dashboard and analytics technologies via a secure webpage) which allows us to measure performance and help our clients make efficient, well-informed decisions regarding their real estate portfolio. Colliers360 also includes leading edge business intelligence that populates data from various independent and client related sources. In 2020, we added the Workplace Expert tool to Colliers360 suite of technology apps that recommends clients different office environments and potential configurations tailored specific to their business needs. We also provide lease administration, transaction, project management and facilities management systems. |

|

• |

Property Management Services: Property Management provides oversight and management of the daily operations of a single property or portfolio of properties and provides on-going strategic advice on ways in which clients can maximize the value of their properties. Services include building operations and maintenance, facilities management, lease administration, property accounting and financial reporting, contract management and construction management. We ensure that we implement the owner’s specific property value enhancement objectives through maximization of opportunities to help clients ensure excellent tenant relations while maximizing property level cash flows. |

|

• |

Project Management Services: We provide project management services for a wide range of projects regardless of size. These services include bid document review, construction monitoring and delivery management, contract administration and integrated cost control, development management, facility and engineering functionality, milestone and performance monitoring, quality assurance, risk management and strategic project consulting. |

|

• |

Engineering and Design Services: We established our engineering and design service line with the acquisition of Maser in July 2020 and further enhanced this service offering with the acquisition of Bergmann in 2021. We offer private and public sector clients in the U.S. a full range of consulting and engineering design services for property & building, infrastructure, transportation, environmental and telecommunications end-markets through a dedicated team of more than 1,000 employees. Our professionals include licensed engineers, planners, surveyors, landscape architects and environmental scientists. |

|

• |

Valuation & Advisory Services: We provide clients with an opinion of a property’s value that complies with a client’s requirements and applicable professional standards and regulations to offer a nuanced understanding of the property and broader market trends. Our advisors leverage best-in-class technology to offer clients both speed and accuracy while maintaining a dedicated project leader and senior management oversight to ensure quality and accountability. Services include valuation and appraisal review and management, portfolio or single asset valuation, arbitration and consulting, highest and best use studies, tax appeals and litigation support. |

|

• |

Workplace Strategy: We provide a full suite of visioning, change management and strategic consulting services to occupiers to maximize the effectiveness of their workplace. These consulting services are designed to help clients turn their real estate into a competitive advantage to recruit and retain talent through the analysis and design of an optimal work environment. Over the course of 2020 and 2021, these services included advice on workplace optimization and strategy to address changes related to the COVID-19 pandemic. |

|

• |

Loan Servicing: We service loans originated under contractual arrangements associated with our debt finance operations. Our services include managing the administrative aspects of the loan, including collection of monthly payments, maintenance of records and management of escrow funds among others. Our loan servicing portfolio was approximately $11 billion as at December 31, 2021. |

|

• |

Property Marketing: We provide turnkey property marketing solutions for both commercial and high-end residential projects to generate demand and attract credit-worthy tenants and investors. We have made a significant investment in our property marketing strategies, increasing volumes of leads and reducing time-on-market. The majority of the leads we generate for our clients now come from online sources. By transforming the typical industry marketing mix, we can both reduce costs and decrease lease-up time. Our property marketing platform is impactful with both domestic and sophisticated international buyers. |

|

• |

Research Services: Our Research Services provide data-driven insights for owners and landlords into emerging trends and market activity, projections for lease rates, valuation estimations based on comparable transactions and mapping services. Research Services provide insights for occupiers and tenants into future lease rates, expansion potential, potential to sublease and mapping services. |

Our Outsourcing & Advisory Services revenues are derived from fees which are typically contractual, both fixed and performance based, and contract terms are often multi-year providing recurring or repeat revenues.

Investment Management

Our investment management operations were established in 2016 with the acquisition of ICADE, an asset management and investor advisory services platform in France, which was subsequently combined with existing asset advisory operations in the United Kingdom and Belgium and now operates as Colliers Global Investors. In 2018, the Company acquired a controlling interest in Harrison Street. In 2022, the Company expects to complete the acquisitions of Antirion and Basalt, described below. The Company’s strategy is to build, through acquisitions and internal growth, a full-service real estate and real asset investment management and asset advisory business that operates globally and is capable of serving the needs of clients, including institutional investors, sovereign wealth funds, public & corporate pension funds, endowments, insurance companies, foundations and family offices.

|

• |

Harrison Street: Harrison Street is a real estate investment management firm with a differentiated investment strategy focused on demographic-based investing with approximately $45.5 billion in AUM as of December 31, 2021. Specifically, these sectors include education, healthcare and storage as well as social and utility infrastructure in the United States, Europe and Canada. Harrison Street is a pioneer in demographic-based real estate investing, which we believe is a defensive strategy given consistent demand for underlying real estate and lower volatility in the value of real estate in these sectors. |

The education, healthcare and storage sectors represent an estimated investable universe of over $1.4 trillion, representing a significant opportunity for continuing institutional investment. These sectors benefit from strong demographic trends, attractive risk-adjusted returns relative to real estate in other classes, liquidity (measured in terms of resale volume), inflation protection (due to shorter term leases), limited supply and market fragmentation (resulting in pricing inefficiencies).

Since its inception in 2005, Harrison Street has established a series of disciplined and highly differentiated investment products across multiple risk/return strategies, originating and managing a series of open and closed-end real estate investment funds. Approximately 45% of Harrison Street’s AUM is held in closed end funds, 52% in open end funds and 3% in separate accounts.

Harrison Street generates contractual management fee revenue from each fund. This fee revenue is expected to be stable and recurring due to: (i) consistent fund financial performance at or exceeding industry benchmarks; (ii) the defensive nature of the real estate sectors being invested in by the funds; and (iii) management fees for closed-end funds based on committed or invested capital rather than marked-to-market asset value, providing for revenue stability throughout the life of the funds. Management contracts generally have a term for the life of each fund but are cancellable with notice by a vote by all or a super-majority of non-affiliated investors.

Harrison Street is headquartered in Chicago, with an office in London, UK, and has more than 200 employees. In 2021, Harrison Street was ranked 29th in the PERE Top 100 Private Real Estate Managers. Harrison Street also received four coveted PERE Awards, including ‘Alternatives Investor of the Year’ globally and in North America and was named as the “Best Place to Work in Money Management” by Pension & Investments for seven consecutive years from 2014-2020. Members of the senior management team hold a 25% redeemable non-controlling equity interest in Harrison Street, which is subject to an operating agreement.

|

• |

Colliers Global Investors (“CGI”): CGI, our investment management operation in Europe has AUM of approximately $5.5 billion as of December 31, 2021. CGI has operations in France, the United Kingdom and Belgium, and invests in core and core-plus real estate assets located throughout Europe. Asset classes include office, industrial, retail and hospitality. CGI’s AUM is held in separate accounts and closed end funds on behalf of its more than 100 clients. |

In October 2021, the Company announced the acquisition of a controlling interest in Milan-based Antirion, an Italian investment management firm. The Antirion acquisition is subject to customary closing conditions and approvals and is expected to be completed in the first half of 2022. Antirion has approximately $4 billion of AUM, held in closed and open-ended funds, with asset classes that are similar to CGI. Antirion will be rebranded and integrated with the CGI operations.

|

• |

Basalt: In January 2022, the Company announced the acquisition of a 75% equity interest in London and New York based Basalt. Basalt is a transatlantic infrastructure investment management firm with approximately $8.5 billion in AUM and is expected to generate approximately $65-75 million in annual management fee revenues once the acquisition is completed. The acquisition adds highly differentiated investment products in the utility, transportation, energy/renewables and communications sectors. The transaction is subject to customary closing conditions and approvals and is expected to be completed in the second half of 2022. |

Harrison Street, together with Colliers Global Investors, had AUM of approximately $51 billion as of December 31, 2021. Including Antirion and Basalt, AUM is expected to be approximately $63 billion.

Capital Markets and Leasing (55% of revenues)

We provide transaction brokerage services in sales and leasing for commercial clients as well as debt finance services related to the origination and sale of multifamily and commercial mortgage loans. Our commercial real estate advisors assist buyers and sellers in connection with the acquisition or disposition of real estate; assist landlords and tenants with lease opportunities; and assist borrowers and lenders with the placement of debt capital on commercial real estate assets. Our advisors typically perform their services for compensation based on commissions calculated on the value of a transaction. We have approximately 4,300 professional advisors globally. We execute transactions across a diverse client base, including corporations, financial institutions, governments and individuals.

We provide services for sales, leases, and mortgages in the following areas:

|

• |

Landlord Representation: Agency advisors work on behalf of property owners to search for and obtain tenants and other occupiers by strategically positioning and promoting the property through various campaigns and marketing channels. Our advisors look to secure the right tenants for clients’ properties, help owners avoid common pitfalls of the leasing process and otherwise support landlord ownership goals for their real estate assets. |

|

• |

Tenant Representation: Our brokerage advisors work on behalf of tenants to lease the right space in the right location and secure the most favorable terms. Our advisors help to turn a lease, often the second-greatest expenditure for a business after payroll, from a cost center into a competitive advantage that can elevate their brand, streamline their operations, attract leading talent and make a meaningful impact to their bottom line. |

|

• |

Capital Markets & Investment Services: Colliers’ Capital Markets & Investment Services advisors are professionals that work collaboratively to provide real estate expertise to our clients, acting in a consultancy capacity to help each client maximize investment returns, whether as a buyer, seller or borrower. Capital Markets & Investment Services advisors are organized into office, industrial, retail, multifamily, hospitality, healthcare and special purpose teams in order to drive thought leadership for each major asset class. Many team members also represent subspecialties in areas such as Affordable Housing, Data Centers, Student Housing, Seniors Housing, Land, Self-Storage and Transit Oriented Development. These investment teams are further organized in subsets to meet the needs of both our institutional and private capital clients, recognizing that these client groupings have different needs. These investment teams understand the intricacies of single asset and portfolio executions and, with the assistance of our advisors, are globally connected with active market participants. Integrally supporting these investment teams are national and/or regional groups of debt & equity financing advisors that help both our institutional and private capital clients with senior and subordinated debt strategies and placements with a global network of capital providers. Many of our financing advisors have experience helping our clients with preferred and common equity strategies and placements, including partnership capitalizations and recapitalizations. Our financing professionals are in the market continuously with these capital sources, providing our clients with significant market intelligence and leverage when evaluating their financing needs. Our Capital Markets & Investment Services teams work closely with each service line, including property management, project management, leasing, and valuations in order to serve the broader business needs of each client. |

|

• |

Debt Finance Services: With the acquisition of Colliers Mortgage in May 2020, we significantly strengthened our debt finance capabilities. We provide specialty debt financing for multifamily housing, healthcare and senior housing real estate through US Government Sponsored Agencies. This includes origination, underwriting, asset management and loan servicing for Fannie Mae, the Federal Housing Administration / U.S. Department of Housing and Urban Development (FHA/HUD) and the U.S. Department of Agriculture (USDA). Colliers Mortgage also provides commercial property lending to institutional investors as well as loan syndication. In 2021, the Company originated a total volume of $3.7 billion. |

|

• |

Mortgage Investment Banking: Colliers Securities provides brokerage, investment banking, capital markets services, public finance services and other real estate related activities. |

Our professional advisors work with all asset classes, including office, industrial, retail, multi-family, hospitality, health care and mixed-use properties. In 2021, we completed 54,000 sale and lease transactions for a total transaction value of $131 billion.

Focus on Environmental, Social and Governance (“ESG”)

In October 2021, the Company announced its ‘Elevate the Built Environment’ strategic framework designed to embed environment, social and governance (“ESG”) best practices across the organization. In addition, Colliers committed to setting a science-based target through the Science-Based Targets initiative’s (SBTi) Business Ambition for 1.5°C program as well as achieving Net Zero for the Company’s own operations by 2030. The company continues to develop remaining tactical plans and targets, which it expects to release over the course of the next two years.

Below is the Company’s framework to address material topics across three core areas identified through strong stakeholder engagement.

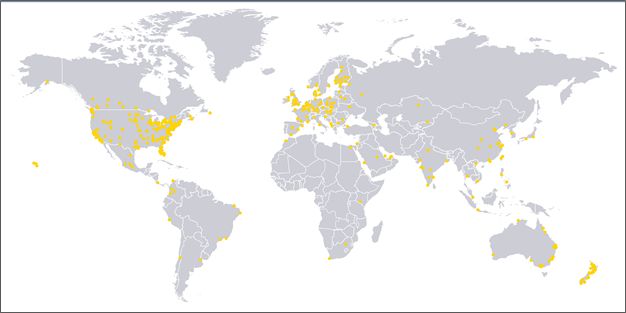

Geographic locations

We deliver services from 372 offices in 37 countries companywide (not including our affiliates). Operationally, we have organized our business and report our results through four segments. For the year ended December 31, 2021:

1. Americas represented 61% of our global revenues (48% generated in the United States, 11% in Canada and 1% in Latin America);

2. EMEA represented 16% of our global revenues, comprising operations in 19 countries;

3. Asia Pacific represented 17% of our revenues, comprising operations in 10 countries; and

4. Investment Management represented 6% of our revenues, comprising operations in 4 countries.

Below is a map reflecting the geographic location of our company-owned and affiliate offices:

Operating segments

| Revenues | ||||||||||||

|

by operating segment |

Year ended December 31 |

|||||||||||

|

(in thousands of US$) |

2021 |

2020 |

2019 |

|||||||||

|

Americas |

$ | 2,489,217 | $ | 1,626,372 | $ | 1,690,507 | ||||||

|

EMEA |

672,737 | 516,507 | 636,466 | |||||||||

|

Asia Pacific |

673,661 | 470,632 | 542,609 | |||||||||

|

Investment Management |

252,890 | 172,594 | 174,588 | |||||||||

|

Corporate |

624 | 752 | 1,641 | |||||||||

|

Total |

$ | 4,089,129 | $ | 2,786,857 | $ | 3,045,811 | ||||||

| Operating earnings | ||||||||||||||||||||||||

|

by operating segment |

Year ended December 31 |

|||||||||||||||||||||||

|

(in thousands of US$ and as a % of revenues) |

2021 |

2020 |

2019 |

|||||||||||||||||||||

|

Americas |

$ | 233,788 | 9.4 | % | $ | 121,371 | 7.5 | % | $ | 103,731 | 6.1 | % | ||||||||||||

|

EMEA |

59,606 | 8.9 | % | 8,336 | 1.6 | % | 48,510 | 7.6 | % | |||||||||||||||

|

Asia Pacific |

82,023 | 12.2 | % | 45,221 | 9.6 | % | 67,062 | 12.4 | % | |||||||||||||||

|

Investment Management |

63,659 | 25.2 | % | 40,738 | 23.6 | % | 35,048 | 20.1 | % | |||||||||||||||

|

Corporate |

(570,577 | ) | N/A | (51,088 | ) | N/A | (36,154 | ) | N/A | |||||||||||||||

|

Total |

$ | (131,501 | ) | (3.2 | )% | $ | 164,578 | 5.9 | % | $ | 218,197 | 7.2 | % | |||||||||||

| Adjusted EBITDA1 | ||||||||||||||||||||||||

|

by operating segment |

Year ended December 31 |

|||||||||||||||||||||||

|

(in thousands of US$ and as a % of revenues) |

2021 |

2020 |

2019 |

|||||||||||||||||||||

|

Americas |

$ | 296,133 | 11.9 | % | $ | 180,427 | 11.1 | % | $ | 151,347 | 9.0 | % | ||||||||||||

|

EMEA |

82,505 | 12.3 | % | 45,934 | 8.9 | % | 80,342 | 12.6 | % | |||||||||||||||

|

Asia Pacific |

95,238 | 14.1 | % | 66,292 | 14.1 | % | 76,209 | 14.0 | % | |||||||||||||||

|

Investment Management |

95,122 | 37.6 | % | 69,488 | 40.3 | % | 61,907 | 35.5 | % | |||||||||||||||

|

Corporate |

(24,660 | ) | N/A | (699 | ) | N/A | (10,329 | ) | N/A | |||||||||||||||

|

Total |

$ | 544,338 | 13.3 | % | $ | 361,442 | 13.0 | % | $ | 359,476 | 11.8 | % | ||||||||||||

Seasonality

The Company generates peak revenues and earnings in the month of December followed by a low in January and February as a result of the timing of closings on commercial real estate sales brokerage transactions. Revenues and earnings during the balance of the year are relatively even. These Capital Markets operations comprised 30% of our 2021 annual consolidated revenues. Variations can also be caused by business acquisitions or dispositions which alter the consolidated service mix.

Trademarks

Our trademarks are important for the advertising and brand awareness of our businesses. We take precautions to defend the value of our trademarks by maintaining legal registrations and by litigating against alleged infringements, if necessary.

In markets where Colliers does not operate company-owned operations, we operate through affiliates operating under the “Colliers International” and “Colliers” brands and trademarks. To ensure brand unity and service quality, all affiliates are subject to brand and performance guidelines that are monitored and enforced by Colliers. We currently have affiliates in 27 countries around the world who together generated approximately $585 million in revenue in 2021, which are excluded from the Company’s consolidated results. In 2021, our affiliates completed 15,000 sale and lease transactions for a total transaction value of $28 billion.

Employees

We currently have approximately 16,780 employees worldwide as follows:

|

Segment |

Professional staff |

Support & administrative staff |

Total employees |

|||||||||

|

Americas |

5,450 | 3,460 | 8,910 | |||||||||

|

EMEA |

2,410 | 1,000 | 3,410 | |||||||||

|

Asia Pacific |

3,330 | 910 | 4,240 | |||||||||

|

Investment Management |

150 | 70 | 220 | |||||||||

|

Total operations |

11,340 | 5,440 | 16,780 | |||||||||

Non-controlling interests

We own a majority interest in substantially all of our operations, while in many cases operating management of each subsidiary owns the remaining shares. This structure was designed to maintain control at Colliers while providing significant risks and rewards of equity ownership to management at the operating businesses. In almost all cases, we have the right to “call” management’s shares, usually payable at our option with any combination of Subordinate Voting Shares or cash. We may also be obligated to acquire certain of these non-controlling interests in the event of death, disability or cessation of employment or if the shares are “put” by the holder, subject to annual limitations on these puts imposed by the relevant shareholder agreements. These arrangements provide significant flexibility to us in connection with management succession planning and shareholder liquidity matters.

________________________

1 Adjusted EBITDA is a financial measure that is not calculated in accordance with GAAP. For a reconciliation of this and other non-GAAP financial measures, see “Reconciliation of non-GAAP financial measures” in this AIF.

Our growth strategy

We maintain a leadership position in the industry by offering a full complement of services to our wide range of customers on a global basis. Our key point of differentiation is the level of expertise and collaboration our professionals demonstrate, leading to higher levels of service for our clients. We have an established track record of expanding our business internally and through acquisitions. Our unique enterprising culture and global scale positions us well to further strengthen our market share in our core markets, expand into complementary services and increase our geographic footprint while continuing to pursue strategic acquisitions. We are focused on continuing to grow and add higher value-add and higher margin services. In 2021, the Company announced its new five-year Enterprise ’25 growth strategy, setting ambitious growth targets to 2025. Under the new plan, Colliers will strive to double our profitability and generate more than 65% of our Adjusted EBITDA from recurring revenue sources.

Dividends and dividend policy

Dividend policy

Following the completion of the Spin-off, our Board of Directors approved a revised dividend policy for the Company, which was a dividend of $0.08 per Common Share (being the Subordinate Voting Shares and Multiple Voting Shares) per annum, payable semi-annually. On May 31, 2016, the Board of Directors increased the semi-annual dividend from $0.04 to $0.05 per Common Share ($0.10 per annum). On December 7, 2021, the Board of Directors further increased the semi-annual dividend from $0.05 to $0.15 per Common Share ($0.30 per annum). These dividends are paid in cash after the end of the second and fourth quarters. All dividend payments are subject to the discretion of our Board of Directors. For the purposes of the Income Tax Act (Canada) and any similar provincial legislation, all dividends on the Common Shares will be eligible dividends unless indicated otherwise.

The terms of the Common Share dividend policy remain, among other things, at the discretion of our Board of Directors. Future dividends on the Common Shares, if any, will depend on the results of Colliers’ operations, cash requirements, financial condition, contractual restrictions, business opportunities, provisions of applicable law and other relevant factors. Under the terms of the Company’s debt agreements, the Company is not permitted to pay dividends, whether in cash or in specie, in the circumstances of an event of default thereunder occurring and continuing or an event of default occurring as a consequence thereof. See “Material contracts” below.

Dividend history

The aggregate cash dividends declared per Common Share in respect of the years ended December 31, 2021, 2020 and 2019 were $0.20, $0.10 and $0.10, respectively.

Capital structure

Share capital

The authorized capital of the Company consists of an unlimited number of preference shares (the “Preference Shares”), issuable in series, an unlimited number of Subordinate Voting Shares and an unlimited number of Multiple Voting Shares. As of February 17, 2022, there were 42,932,300 Subordinate Voting Shares and 1,325,694 Multiple Voting Shares issued and outstanding.

Common Shares

The Common Shares rank junior to the Preference Shares or series thereof ranking in priority with respect to the payment of dividends, return of capital and distribution of assets in the event of liquidation, dissolution or any distribution of the assets of Colliers for the purpose of winding-up its affairs. The holders of outstanding Common Shares are entitled to receive dividends and other distributions on a share-for-share basis (or, in the discretion of the directors, in a greater amount per Subordinate Voting Share than per Multiple Voting Share) out of the assets legally available therefor at such times and in such amounts as our Board of Directors may determine, but without preference or distinction between the Multiple Voting Shares and the Subordinate Voting Shares. The Subordinate Voting Shares carry one vote per share and the Multiple Voting Shares carry 20 votes per share. The holders of Subordinate Voting Shares and the holders of Multiple Voting Shares are entitled to receive notice of any meeting of shareholders and to attend and vote thereat as a single class on all matters to be voted on by the shareholders, except at meetings where the holders of shares of one class or of a particular series of shares are entitled to vote separately.

The rights, privileges, conditions and restrictions attaching to the Subordinate Voting Shares and the Multiple Voting Shares may be respectively modified if the amendment is authorized by at least two-thirds of the votes cast at a meeting of the holders of Subordinate Voting Shares and the holders of Multiple Voting Shares duly held for that purpose. However, if the holders of Subordinate Voting Shares, as a class, or the holders of Multiple Voting Shares, as a class, are to be affected in a manner different from the other classes of shares, such amendment must, in addition, be authorized by at least two-thirds of the votes cast at a meeting of the holders of the class of shares which is affected differently.

Each outstanding Multiple Voting Share is convertible at any time, at the option of the holder, into one Subordinate Voting Share. The Subordinate Voting Shares are not convertible into any other class of shares. No subdivision, consolidation, reclassification or other change of the Multiple Voting Shares or the Subordinate Voting Shares may be made without, concurrently, having the Multiple Voting Shares or Subordinate Voting Shares, as the case may be, subdivided, consolidated, reclassified or other change made under the same conditions. The Common Shares are not redeemable nor retractable but are able to be purchased for cancelation by Colliers in the open market, by private contract or otherwise. Upon the liquidation, dissolution or any distribution of the assets of Colliers for the purpose of winding-up its affairs, the holders of Common Shares are entitled to participate equally, on a share-for-share basis, in the remaining property and assets of Colliers available for distribution to such holders.

In accordance with the terms and conditions of a trust agreement entered into by Jay Hennick and Henset Capital Inc. (the “Multiple Voting Shareholder”) on April 16, 2021 (the “New Trust Agreement”) (see “Material Contracts” below), the Multiple Voting Shares will convert into Subordinate Voting Shares on a one-for-one basis and for no additional consideration or premium upon the earliest to occur of: (a) the date that the sum of the number of Multiple Voting Shares and Subordinate Voting Shares held by Mr. Hennick and the Multiple Voting Shareholder, together with their associates and affiliates, is less than 4,000,000 (subject to adjustment and including ownership of securities convertible into Subordinate Voting Shares); (b) 24 months after the termination of the New MSA (as defined below) as a result of Mr. Hennick’s death, disability, voluntary resignation or the occurrence of certain other specific events set out in the New MSA; and (c) September 1, 2028. Additionally, the New Trust Agreement provides that Mr. Hennick and the Multiple Voting Shareholder will not sell any Multiple Voting Shares at a price greater than the market price of the Subordinate Voting Shares on the date of the agreement to sell such shares unless through the facilities of the NASDAQ or TSX, pursuant to a take-over bid, or similar transaction, where there is a concurrent offer made to, or acquisition from, the holders of all of the Subordinate Voting Shares on terms that are at least as favorable to the holders of Subordinate Voting Shares as those made to the Multiple Voting Shareholders, pursuant to an issuer bid or pursuant to the granting of a permitted security interest.

Preference Shares

The Preference Shares are issuable, from time to time, in one or more series, as determined by our Board of Directors. Our Board of Directors will determine, before the issue of any series of Preference Shares, the designation, preferences, rights, restrictions, conditions, limitations, priorities as to payment of dividends and/or distribution on liquidation, dissolution or winding-up, or prohibitions attaching to such series. The Preference Shares, if issued, will rank prior to the Common Shares with respect to the payment of dividends and in the distribution of assets in the event of liquidation, dissolution or winding-up of Colliers or any other distribution of assets of Colliers among its shareholders for the purpose of winding-up its affairs, and may also be given such other preferences over the Common Shares as may be determined with respect to the respective series authorized and issued. Except as required by law, the Preference Shares will not carry voting rights.

Certain rights of holders of Subordinate Voting Shares

A summary of the rights attaching to the Subordinate Voting Shares in the event that a take-over bid is made for Multiple Voting Shares is set out in the section entitled “Certain Rights of Holders of Subordinate Voting Shares” contained in our Management Information Circular to be filed in connection with our upcoming meeting of shareholders (the “2022 Circular”), which shall be incorporated by reference herein and will be available on SEDAR at www.sedar.com. Reference should be made to our articles for the full text of these provisions.

Option Plan

Colliers has a stock option plan (the “Option Plan”) pursuant to which options to acquire Subordinate Voting Shares may be granted to directors, officers and full-time employees of Colliers or its subsidiaries (other than Jay S. Hennick). A summary of the terms of the Option Plan is set out in the section entitled “Executive Compensation – Incentive Award Plans of Colliers – Colliers Stock Option Plan” contained in the 2022 Circular, which is incorporated by reference herein and will be available on SEDAR at www.sedar.com. The maximum number of Subordinate Voting Shares subject to grants of options under the Option Plan is limited to 8,100,000, of which: (i) options exercisable for 2,357,375 Subordinate Voting Shares have been granted and are outstanding as at the date hereof; and (ii) options which were exercisable for 5,053,075 Subordinate Voting Shares have been exercised or expired as at the date hereof, leaving options yet to be granted which would be exercisable for 699,300 Subordinate Voting Shares.

Convertible Notes

On May 19, 2020, the Company issued $230 million aggregate principal of Convertible Senior Subordinated Notes (the “Convertible Notes”) at par value. The Convertible Notes will mature on June 1, 2025 and bear interest of 4.0% per annum, payable semi-annually in arrears on June 1 and December 1 of each year, beginning on December 1, 2020. The Convertible Notes are unsecured and subordinated to all of the Company’s existing and future secured indebtedness, and are treated as equity for financial leverage calculations under the Company’s Revolving Credit Facility (“Revolving Credit Facility”) and Senior Notes due 2028 and Senior Notes due 2031.

The Convertible Notes were issued pursuant to, and are governed by, the trust indenture (“Trust Indenture”) between the Company and Wells Fargo Bank, National Association as trustee (the “Trustee”). A copy of the Trust Indenture is available for review under Colliers’ SEDAR profile at www.sedar.com.

At the holder’s option, the Convertible Notes may be converted at any time prior to maturity into Subordinate Voting Shares based on an initial conversion rate of approximately 17.2507 Subordinate Voting Shares per $1,000 principal amount of Convertible Notes, which represents an initial conversion price of $57.97 per Subordinate Voting Share. Subsequent to the increase in Colliers’ semi-annual dividend announced on December 7, 2021, the conversion rate was adjusted to 17.2624 effective December 31, 2021.

The Company, at its option, may also redeem the Convertible Notes, in whole or in part, on or after June 1, 2023 at a redemption price equal to 100% of the principal amount of the Convertible Notes to be redeemed, plus accrued and unpaid interest, provided that the last reported trading price of the Subordinate Voting Shares for any 20 trading days in a consecutive 30 trading day period preceding the date of the notice of redemption is not less than 130% of the conversion price.

Subject to specified conditions, the Company may elect to repay some or all of the outstanding principal amount of the Convertible Notes, on maturity or redemption, through the issuance of Subordinate Voting Shares.

Market for securities

The outstanding Subordinate Voting Shares are listed for trading on the TSX and NASDAQ under the symbol “CIGI”. The Multiple Voting Shares are not listed and do not trade on any public market or quotation system.

The following table sets forth the reported high and low trading prices and the aggregate volume of trading of the Subordinate Voting Shares on NASDAQ (in United States dollars) and on the TSX (in Canadian dollars) for each month in 2021.

|

NASDAQ |

TSX |

|||||||||||||||||||||||

|

Month |

High Price (US$) |

Low Price (US$) |

Volume Traded |

High Price (C$) |

Low Price (C$) |

Volume Traded |

||||||||||||||||||

|

January 2021 |

94.74 | 84.02 | 917,408 | 120.72 | 106.70 | 1,077,901 | ||||||||||||||||||

|

February 2021 |

111.71 | 87.14 | 1,830,358 | 142.47 | 111.40 | 1,150,475 | ||||||||||||||||||

|

March 2021 |

109.97 | 98.23 | 1,767,215 | 138.71 | 123.48 | 1,151,179 | ||||||||||||||||||

|

April 2021 |

111.35 | 98.30 | 1,668,926 | 136.89 | 124.00 | 658,106 | ||||||||||||||||||

|

May 2021 |

120.30 | 104.98 | 1,627,624 | 148.63 | 126.83 | 1,659,272 | ||||||||||||||||||

|

June 2021 |

119.32 | 110.24 | 1,092,374 | 149.99 | 132.52 | 1,003,353 | ||||||||||||||||||

|

July 2021 |

132.15 | 107.62 | 1,129,179 | 164.29 | 134.74 | 728,522 | ||||||||||||||||||

|

August 2021 |

142.04 | 120.39 | 1,240,918 | 179.96 | 156.54 | 1,006,160 | ||||||||||||||||||

|

September 2021 |

143.38 | 123.83 | 1,984,305 | 179.88 | 158.75 | 1,612,103 | ||||||||||||||||||

|

October 2021 |

149.36 | 125.85 | 1,276,944 | 184.39 | 159.30 | 976,111 | ||||||||||||||||||

|

November 2021 |

150.64 | 134.22 | 1,225,614 | 186.76 | 172.00 | 1,058,351 | ||||||||||||||||||

|

December 2021 |

149.31 | 134.37 | 1,102,808 | 190.63 | 172.55 | 928,287 | ||||||||||||||||||

Escrowed securities and securities subject to contractual restriction on transfer

To the knowledge of Colliers, as of the date hereof, no securities of any class of securities of Colliers are held in escrow or subject to contractual restrictions on transfer or are anticipated to be held in escrow or subject to contractual restrictions on transfer.

Transfer agents and registrars

The transfer agent and registrar for the Subordinate Voting Shares is TSX Trust Company, 100 Adelaide Street West, Suite 301, Toronto, Ontario, M5H 4H1. The transfer agent and registrar for the Multiple Voting Shares is the Company at 1140 Bay Street, Suite 4000, Toronto, Ontario, M5S 2B4.

Directors and executive officers

Directors

Our Board of Directors is currently comprised of ten members. The following information is provided with respect to the directors of the Company as at February 17, 2022:

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Jay S. Hennick Ontario, Canada |

65 |

Chief Executive Officer & Director since May 30, 19884; Chairman since June 2015. |

Mr. Hennick is the Chairman and CEO of Colliers. Mr. Hennick is the founder and was the former CEO of FirstService Corporation from 1988 to 2015. In June 2015, Mr. Hennick became the Founder and Chairman of FirstService. In 1998, Mr. Hennick was awarded Canada's Entrepreneur of the Year, in 2001 he was named Canada's CEO of the Year by Canadian Business Magazine and in 2011, received an honorary Doctorate of Laws from York University and from the University of Ottawa in 2014. In 2018, Mr. Hennick was appointed a member of the Order of Canada and is also the 2019 International Horatio Alger Award recipient. Mr. Hennick served as past Chairman of the Board of Directors of the Sinai Health System and Mount Sinai Hospital, in Toronto. Mr. Hennick together with his wife Barbara established the Hennick Family Foundation to support important causes in healthcare, education and the arts including: the naming of Hennick Bridgepoint Hospital, the largest complex care and rehabilitation hospital in Canada; the naming of the Entry Arch at the World Holocaust Remembrance Centre in Israel; The Hennick Family Wellness Gallery at Mount Sinai Hospital in Toronto; The Hennick Centre for Business and Law, a joint program of the Osgoode Hall Law School and the Schulich School of Business at York University and The Jay Hennick JD-MBA Program at the University of Ottawa. Mr. Hennick holds a Bachelor of Arts degree from York University in Toronto and a Doctorate of Laws from the University of Ottawa. |

|

Peter F. Cohen1 Ontario, Canada |

69 |

Vice Chair of the board, Director since March 30, 19904; Chairman of the Old FSV board from May 2005 to May 2015 |

Mr. Cohen is a Chartered Professional Accountant and a former partner in an audit practice of a public accounting firm. Mr. Cohen is currently the President and Chief Executive Officer of a number of private companies including The Dawsco Group, Building Value Realty Group and BV Glazing Systems Inc. Mr. Cohen was a co-founder and Chairman and Chief Executive Officer of Centrefund Realty Corporation, a publicly-traded shopping center investment company until August 2000 when control of the company was sold. Mr. Cohen serves as the Chair of the Board of Directors of Sinai Health in Toronto, Ontario. |

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

John (Jack) P. Curtin, Jr.1,2 Ontario, Canada |

71 |

Director since February 10, 20154 |

Mr. Curtin is an Advisory Director in the Investment Banking Division of Goldman, Sachs & Co. in Toronto and New York. From July 2010 to December 2014, Mr. Curtin served as Chairman and Chief Executive of Goldman Sachs Canada Inc. From 2003 to July 2010, Mr. Curtin was Chairman of Goldman Sachs Canada Inc. From 1999 to 2003, Mr. Curtin was an Advisory Director of Goldman, Sachs & Co. in New York. From 1995 to 1999, Mr. Curtin was Chief Executive of Goldman Sachs Canada Inc. in Toronto. Prior to this assignment, Mr. Curtin was co-head of Global Money Markets and Chairman of Goldman Sachs Money Markets LP. Mr. Curtin moved to Money Markets in 1987 after serving as head of Fixed Income Syndicate/New Issues. Mr. Curtin joined the firm in 1976 in the Corporate Finance Department and was named partner in 1988 and managing director in 1996. Mr. Curtin is also a member of the Board of Directors of the Art Gallery of Ontario Foundation. He previously served as a Director of the Canada/United States Fulbright Foundation. Mr. Curtin is a former governor of the Toronto Stock Exchange, a former director of Brookfield Asset Management, Cadillac Fairview Corporation, Maxxcom Corporation and the Investment Dealers Association of Canada. Mr. Curtin served as a trustee of Lakefield College School as well as Royal St. George’s College. Mr. Curtin received an MBA from Harvard in 1976 and his BA from Williams College in 1972. |

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Christopher Galvin3 Illinois, USA |

71 |

Director since September 23, 2018 |

Christopher Galvin is the Co‐Founder of Harrison Street Real Estate Capital LLC. Additional roles include serving as either Chairman or Board Member of UniqueSoft LLC, VelociData, evolve24, Three Ocean Partners and MCR‐Aerodyne Inc. Mr. Galvin’s current outside activities include: Trustee and member of the Executive Committee of Northwestern University’s Board of Trustees; Executive Committee and member of Dean’s Advisory Board of the Kellogg School of Management at Northwestern; American Enterprise Institute Board; Legion D’Honneur; Advisory Board of Tsinghua University School of Management and Economics (Beijing); the American Society of Corporate Executives; the Board of the Chicago Council on Global Affairs; Advisory Committee on International Economic Policy of the US Department of State (ACIEP). Previously, Mr. Galvin has served in the following capacities: Chairman and CEO of Motorola Inc.; Chairman of NAVTEQ Inc.; Chairman of Cleversafe Inc.; Chairman of the U.S.‐China Business Council; member of the Bechtel Corporation’s Board of Counselors; member of Business Council (U.S.); director of the Rand Corporation; member of the U.S. Department of Defense Manufacturing Board; member of the U.S. Department of Defense Science Board; advisor to the City of Tianjin, China; advisor to the CEO of Hong Kong; Chair of the Rhodes Scholars selection committee for Illinois‐Michigan. |

|

P. Jane Gavan3 |

62 |

Director since April 8, 2020 |

Ms. P. Jane Gavan is the President, Asset Management of Dream Unlimited Corporation and has more than 30 years of experience in the real estate industry, having held increasingly senior positions since joining Dream. Ms. Gavan served as Chief Executive Officer of Dream Global Real Estate Investment Trust, a TSX listed real estate investment income trust (REIT) from its 2011 IPO until its sale to Blackstone in December 2019. Prior to joining Dream, Ms. Gavan served as legal counsel for numerous companies including those in the real estate industry. She began her career in private law practice with Blake, Cassels & Graydon, LLP, specializing in real estate and corporate finance. Ms. Gavan earned an Honours Bachelor of Commerce degree from Carleton University and a Bachelor of Law degree from York University’s Osgoode Hall. Ms. Gavan has served on the board of directors of the Women’s College Hospital Foundation and is on the Patron’s Council for Community Living Toronto. |

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Stephen J. Harper3 Alberta, Canada |

62 |

Director since September 15, 2016 |

Mr. Harper was elected the twenty-second Prime Minister of Canada in 2006 and served in such role until 2015, making him the longest serving Conservative Prime Minster since Sir John A. MacDonald, Canada’s first Prime Minister. Mr. Harper is Chairman of Harper & Associates Consulting, which is affiliated with Dentons, a leading global law firm, and acts as a strategic consultant to clients around the world, providing advice on matters relating to market access, the management of global geopolitical and economic risk and the maximization of value in global markets. Mr. Harper also serves as the Chair of the International Democrat Union and international Friends of Israel Initiative. Mr. Harper has received a bachelor and master’s degree in economics from the University of Calgary, was awarded an honorary doctorate of philosophy from Tel Aviv University in 2014 and received an honorary degree from the Jerusalem College of Technology. In recognition of his government service, Mr. Harper has been awarded the Ukrainian Order of Liberty, the Woodrow Wilson Award for Public Service, the B’nai B’rith International Presidential Gold Medallion for Humanitarianism and was named as the World Statesman of the Year in 2012 by the Appeal of Conscience Foundation. |

|

Katherine M. Lee1,2 Ontario, Canada |

58 |

Director since June 17, 2015 |

Ms. Lee is a seasoned executive in financial services and served as President & CEO of GE Capital Canada, a leading global provider of financial and fleet management solutions to mid-market companies operating in a broad range of economic sectors. Prior to this role, Ms. Lee served as CEO of GE Capital Real Estate in Canada from 2002 to 2010 building it to a full debt and equity operating company. Ms. Lee joined GE in 1994 where she held a number of positions including Director, Mergers & Acquisitions for GE Capital’s Pension Fund Advisory Services based in San Francisco, and Managing Director of GE Capital Real Estate Korea based in Seoul and Tokyo. Ms. Lee earned a Bachelor of Commerce from the University of Toronto. She is a Chartered Professional Accountant and Chartered Accountant. She is active in the community championing Women’s networks and Asian-Pacific Forums. |

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Poonam Puri3 |

49 |

Director since February 9, 2022 |

Ms. Puri is a tenured Professor of Law at Osgoode Hall Law School in Toronto, Ontario, and a corporate lawyer and Affiliated Scholar at Davies, Ward, Phillips & Vineberg, LLP, a leading Canadian law firm. Ms. Puri holds a Bachelor of Laws from the University of Toronto, a Master of Laws from Harvard University and has earned the Institute of Corporate Directors, Institute-Certified Director Designation (ICD.D). Ms. Puri has extensive experience as an expert in governance and as a director of organizations in the engineering, transportation, infrastructure and healthcare sectors, including as a past director of Arizona Mining, Cole Engineering and the Greater Toronto Airports Authority, and she previously served as the commission and director of the Ontario Securities Commission. Ms. Puri presently serves on the board of directors or trustees of the Canada Infrastructure Bank, Canadian Apartment Properties Real Estate Investment Trust, Augusta Gold and Holland Bloorview Kids Rehabilitation Hospital. Ms. Puri has been recognized as one of the top 25 most influential lawyers in Canada by Canadian Lawyer Magazine in 2017 and 2015 and is a former recipient of Canada’s Top 40 under 40 award and Canada’s Most Powerful Women: Top 100 Award. In 2021, Ms. Puri was awarded the Royal Society of Canada’s Yvan Allaire Medal for exemplary contributions to the governance of public and private institutions in Canada, in addition to the Law Society Medal and the David Walter Mundell Medal. |

|

Benjamin F. Stein2 New York, USA |

36 |

Director since September 14, 2017 |

Mr. Stein is a co-founder of The Spruce House Partnership, a New York-based investment partnership. Spruce House was founded in 2005 and has investments in public companies globally and seeks to invest alongside management teams that are focused on growing the value of their companies over the long term. Mr. Stein received his Bachelor of Arts in International Relations from the University of Pennsylvania in 2008. Mr. Stein also serves on the board of The Africa Center, a New York-based institution focused on African business, culture and policy. |

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

L. Frederick Sutherland1 Pennsylvania, USA |

69 |

Director since June 1, 2015 |

Mr. Sutherland was the Executive Vice President and Chief Financial Officer of Aramark Corporation, Philadelphia, PA, a provider of services, facilities management and uniform and career apparel, from 1997 to 2015. Prior to joining Aramark in 1980, Mr. Sutherland was Vice President, Corporate Banking, at Chase Manhattan Bank, New York, NY. Mr. Sutherland is a director of Consolidated Edison, Inc. and Sterling Check Corp. Mr. Sutherland is also a director and former Chair of the Board of WHYY, Philadelphia’s public broadcast affiliate, a trustee of Duke University, Board President of Episcopal Community Services, an anti-poverty agency, a Trustee of People’s Light, a professional non-profit theater, and a trustee of the National Constitution Center. Mr. Sutherland holds an MBA Degree in Finance from the Katz School of the University of Pittsburgh and a Bachelors in Physics and Mathematics from Duke University. |

Notes:

|

1. |

Member of Audit & Risk Committee |

|

2. |

Member of Executive Compensation Committee |

|

3. |

Member of Nominating and Corporate Governance Committee |

|

4. |

Member of the Old FSV board prior to the Spin-off; post Spin-off continued as a Colliers director |

Each director remains in office until the following annual shareholders’ meeting of the Company or until the election or appointment of their successor, unless they resign, their office becomes vacant or they become disqualified to act as a director. All directors stand for election or re-election annually.

Further background information regarding the directors of the Company will be set out in the 2022 Circular, the relevant sections of which are incorporated by reference herein and which will be available on SEDAR at www.sedar.com.

Executive officers

The following information is provided with respect to the executive officers of the Company as at February 17, 2022:

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Jay S. Hennick Ontario, Canada |

65 |

Chairman since June 1, 2015 and Chief Executive Officer since 19881 |

See description above under “Directors”. |

|

Christian Mayer Ontario, Canada |

49 |

Chief Financial Officer since 2020 1 |

Mr. Mayer served as Senior Vice President Finance & Treasurer of Colliers from 2015 to January 2020. Prior to the Spin-off, Mr. Mayer served as Vice President, Finance for Old FSV. Mr. Mayer joined Old FSV in 1999. Mr. Mayer is a Chartered Professional Accountant and began his career with the accounting firms Grant Thornton and PwC, both in Toronto. |

|

Elias Mulamoottil Ontario, Canada |

52 |

Co-Chief Investment Officer since 20211 |

Prior to the Spin-off, Mr. Mulamoottil served as Senior Vice President Strategy & Corporate Development for Old FSV since March 2011. Mr. Mulamoottil joined Old FSV in June 2007 as Vice President Strategy & Corporate Development. Prior to joining Old FSV, Mr. Mulamoottil was a partner at a Toronto based financial advisory and asset management firm, where he was responsible for the sourcing and executing of merger, acquisition, divestiture and financing transactions. Previously, Mr. Mulamoottil worked with one of Europe’s leading private equity firms, Terra Firma Capital Partners, in London, England executing and managing private equity investments. Mr. Mulamoottil is a Chartered Professional Accountant and began his career at the accounting firm Deloitte. Prior to being appointed as Co-Chief Investment Officer, Mr. Mulamoottil served as the Head, Strategic Investments of the Company. |

|

Zachary Michaud Ontario, Canada |

39 |

Co-Chief Investment Officer since 2021 |

Mr. Michaud joined Colliers in 2015. Prior to joining Colliers, Mr. Michaud was a senior investment professional at one of Canada’s leading private equity firms specializing in credit investing, distressed debt, operational turnarounds and activist investing. Previously, Mr. Michaud was an investment banker in Los Angeles and worked on the trading floor at two large bank owned investment dealers. Prior to being appointed as Co-Chief Investment Officer, Mr. Michaud served as the Vice President, Strategic Investments of the Company. |

|

Name and municipality of residence |

Age |

Present position and tenure |

Principal occupation during last five years |

|

Rebecca Finley Ontario, Canada |

46 |

Chief Brand and People Officer, since 2020 |

Ms. Finley is the Chief Brand & People Officer. In this role, Ms. Finley has responsibility for leading and providing global oversight for the Colliers marketing, brand, communication, and people strategies. She joined Colliers in 2018 as Senior Vice President, Brand & People. Ms. Finley has extensive leadership experience in branding, culture and business operations. Prior to Colliers, Ms. Finley served as Business Lead and Head of Technology, Telecommunications & Media at Facebook, led the Office of the CEO at Maple Leaf Foods, was a Management Consultant with the Boston Consulting Group, and worked as an Investment Banker with TD Securities. Ms. Finley holds an ICD.D from the Institute of Corporate Directors, an MBA from the Rotman School of Management and a Bachelor of Mathematics and Education from Queen’s University. |

|

Robert D. Hemming British Columbia, Canada |

54 |

Senior Vice President and Chief Accounting Officer since 2008 |

Prior to the Spin-off, Mr. Hemming served as Chief Financial Officer-Global for Colliers where he was responsible for Collier’s financial accounting, reporting, analysis and compliance functions. Prior to joining Colliers in August 2006, Mr. Hemming was the Corporate Controller–Western Canada for Bell Canada. Mr. Hemming is a Chartered Professional Accountant, Certified General Accountant and outside of real estate, has spent his career working in the mining, forestry and telecom industries. |

|

Matthew Hawkins Ontario, Canada |

39 |

Vice President, Legal Counsel and Corporate Secretary since 2016 |