EXHIBIT 99.2

Colliers International Group Inc. Second Quarter 2018 Financial Results July 31, 2018

Forward - Looking Statements This presentation includes or may include forward - looking statements. Forward - looking statements include the Company’s financial performance outlook and statements regarding goals, beliefs, strategies, objectives, plans or current expectations. These sta tem ents involve known and unknown risks, uncertainties and other factors which may cause the actual results to be materially different from a ny future results, performance or achievements contemplated in the forward - looking statements. Such factors include: economic conditions, especiall y as they relate to commercial and consumer credit conditions and business spending; commercial real estate property values, vacancy ra tes and general conditions of financial liquidity for real estate transactions; the effects of changes in foreign exchange rates in r ela tion to the US dollar on Canadian dollar, Australian dollar, UK pound sterling and Euro denominated revenues and expenses; competition in markets s erv ed by the Company; labor shortages or increases in commission, wage and benefit costs; disruptions or security failures in information tec hnology systems; and political conditions or events, including elections, referenda, changes to international trade and immigration p oli cies and any outbreak or escalation of terrorism or hostilities. Additional factors and explanatory information are identified in the Company’s Annual Information Form for the year ended Dec emb er 31, 2017 under the heading “Risk Factors” (which factors are adopted herein and a copy of which can be obtained at www.sedar.com) an d other periodic filings with Canadian and US securities regulators. Forward looking statements contained in this presentation are ma de as of the date hereof and are subject to change. All forward - looking statements in this press release are qualified by these cautionary stateme nts. Except as required by applicable law, Colliers undertakes no obligation to publicly update or revise any forward - looking statement, whethe r as a result of new information, future events or otherwise. Non - GAAP measures This presentation makes reference to the non - GAAP measures Adjusted EBITDA and Adjusted EPS. Please refer to Appendix for reconciliations to GAAP measures. 2

3 Second Quarter 2018 Results • Strong second quarter results • Quarterly revenues up 14% (11% in local currencies) with internal growth of 5% • Adjusted EPS of $0.95, up 23% from the prior year quarter • Issued € 210 million of senior unsecured notes, with a ten - year term and fixed interest rate of 2.23% • Total of six acquisitions completed so far this year, three acquisitions in the second quarter (Utah, Winnipeg, Pittsburgh) • In July 2018, Colliers completed strategic investment in Harrison Street Real Estate Capital LLC (“Harrison Street”), acquisition of Sadolin & Albæk (Denmark) and divestiture of Finnish residential property management operations • 2018 results reflect the adoption of new US GAAP revenue recognition standard; immaterial impact to earnings. 2017 results have been restated for the impact of adoption.

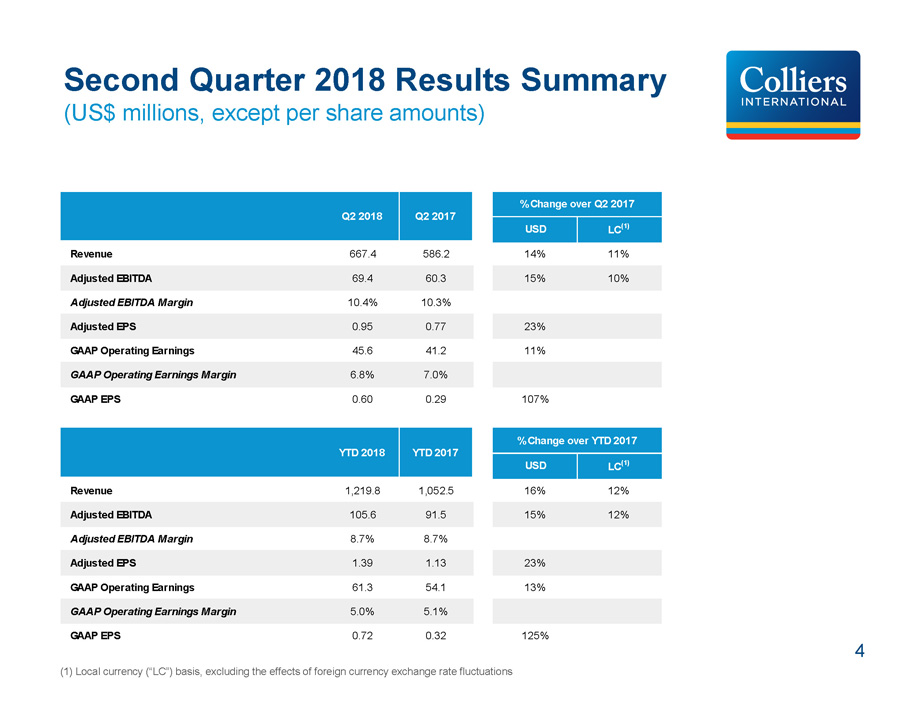

4 Second Quarter 2018 Results Summary (US$ millions, except per share amounts) (1) Local currency (“LC”) basis, excluding the effects of foreign currency exchange rate fluctuations USD LC (1) Revenue 667.4 586.2 14% 11% Adjusted EBITDA 69.4 60.3 15% 10% Adjusted EBITDA Margin 10.4% 10.3% Adjusted EPS 0.95 0.77 23% GAAP Operating Earnings 45.6 41.2 11% GAAP Operating Earnings Margin 6.8% 7.0% GAAP EPS 0.60 0.29 107% USD LC (1) Revenue 1,219.8 1,052.5 16% 12% Adjusted EBITDA 105.6 91.5 15% 12% Adjusted EBITDA Margin 8.7% 8.7% Adjusted EPS 1.39 1.13 23% GAAP Operating Earnings 61.3 54.1 13% GAAP Operating Earnings Margin 5.0% 5.1% GAAP EPS 0.72 0.32 125% Q2 2018 Q2 2017 % Change over Q2 2017 YTD 2018 YTD 2017 % Change over YTD 2017

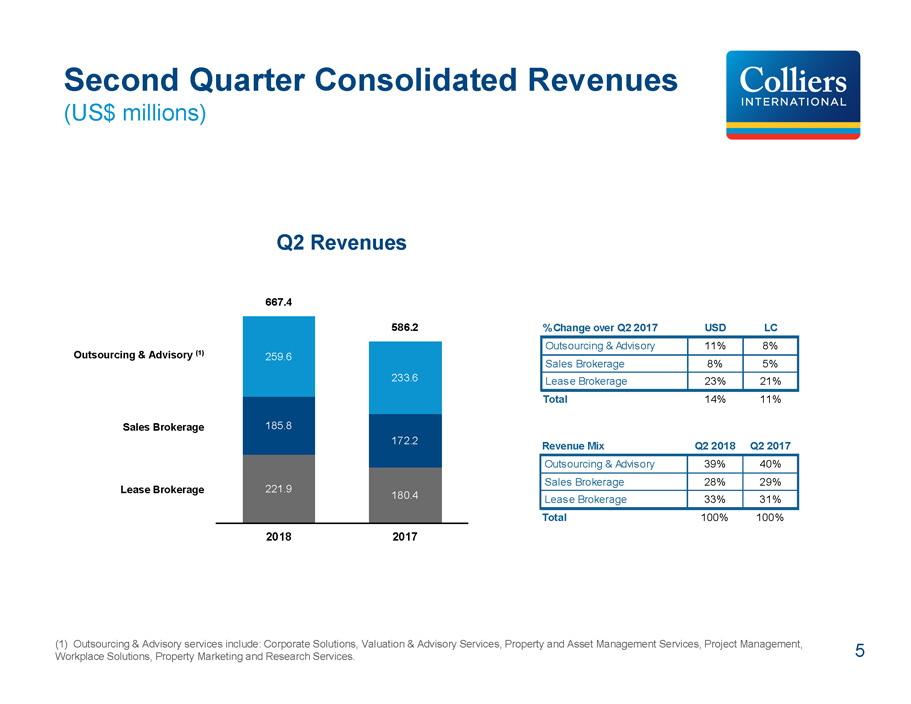

5 Second Quarter Consolidated Revenues (US$ millions) (1) Outsourcing & Advisory services include: Corporate Solutions, Valuation & Advisory Services, Property and Asset Manageme nt Services, Project Management, Workplace Solutions, Property Marketing and Research Services. 221.9 180.4 185.8 172.2 259.6 233.6 667.4 586.2 2018 2017 Q2 Revenues Outsourcing & Advisory (1) Sales Brokerage Lease Brokerage % Change over Q2 2017 USD LC Outsourcing & Advisory 11% 8% Sales Brokerage 8% 5% Lease Brokerage 23% 21% Total 14% 11% Revenue Mix Q2 2018 Q2 2017 Outsourcing & Advisory 39% 40% Sales Brokerage 28% 29% Lease Brokerage 33% 31% Total 100% 100%

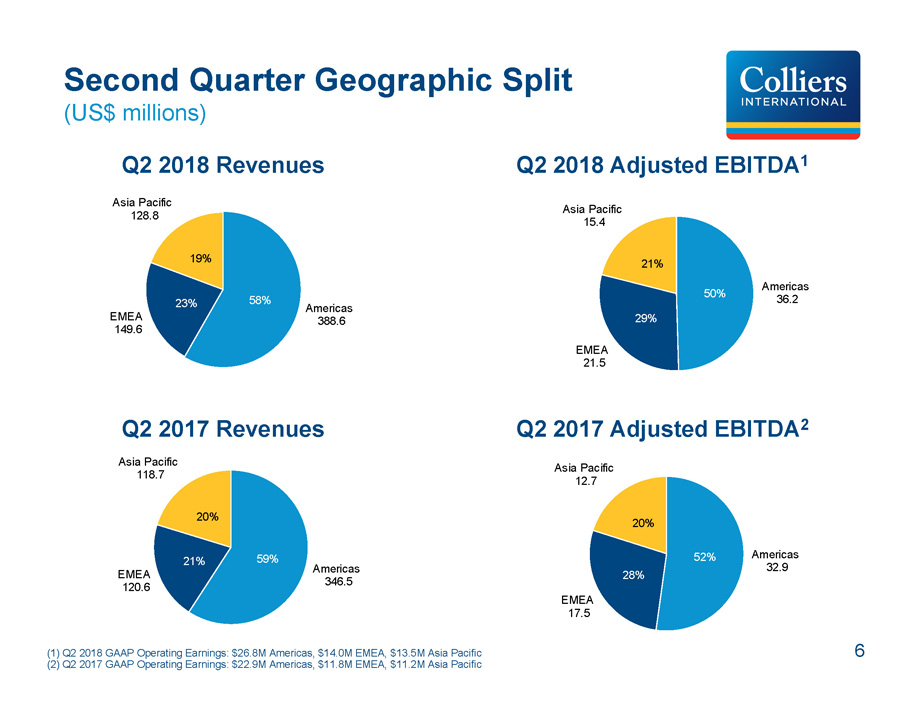

6 (1) Q2 2018 GAAP Operating Earnings: $26.8M Americas, $14.0M EMEA, $13.5M Asia Pacific (2) Q2 2017 GAAP Operating Earnings: $22.9M Americas, $11.8M EMEA, $11.2M Asia Pacific Q2 2018 Revenues Q2 2018 Adjusted EBITDA 1 Second Quarter Geographic Split (US$ millions) 58% 23% 19% Americas 388.6 EMEA 149.6 Asia Pacific 128.8 Q2 2017 Revenues Americas 346.5 EMEA 120.6 Asia Pacific 118.7 59% 21% 20% Q2 2017 Adjusted EBITDA 2 Americas 36.2 EMEA 21.5 Asia Pacific 15.4 50% 29% 21% 52% 28% 20% Americas 32.9 EMEA 17.5 Asia Pacific 12.7

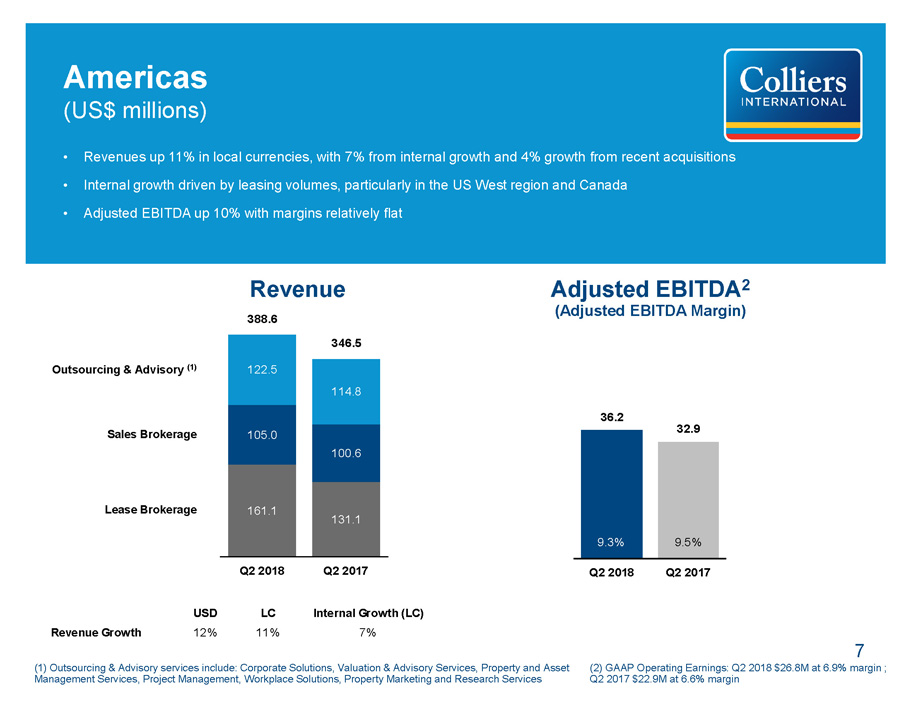

7 (1) Outsourcing & Advisory services include: Corporate Solutions, Valuation & Advisory Services, Property and Asset Management Services, Project Management, Workplace Solutions, Property Marketing and Research Services Revenue Americas (US$ millions) Adjusted EBITDA 2 (Adjusted EBITDA Margin) • Revenues up 11% in local currencies, with 7% from internal growth and 4% growth from recent acquisitions • Internal growth driven by leasing volumes, particularly in the US West region and Canada • Adjusted EBITDA up 10% with margins relatively flat Outsourcing & Advisory (1) Sales Brokerage Lease Brokerage USD LC Internal Growth (LC) Revenue Growth 12% 11% 7% (2) GAAP Operating Earnings: Q2 2018 $26.8M at 6.9% margin ; Q2 2017 $22.9M at 6.6% margin 161.1 131.1 105.0 100.6 122.5 114.8 388.6 346.5 Q2 2018 Q2 2017 36.2 32.9 9.3% 9.5% Q2 2018 Q2 2017

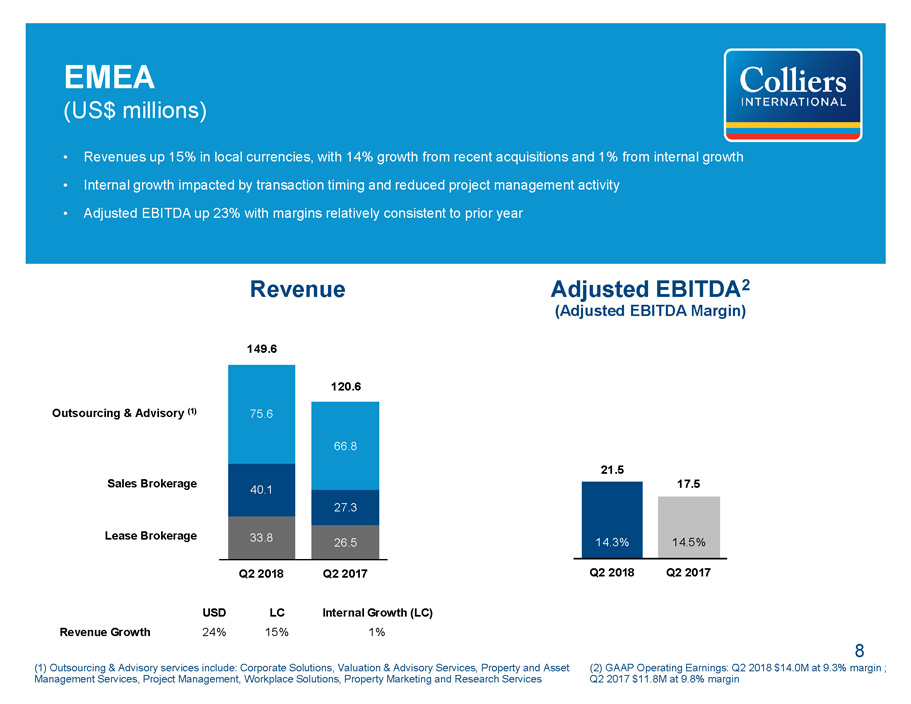

8 (1) Outsourcing & Advisory services include: Corporate Solutions, Valuation & Advisory Services, Property and Asset Management Services, Project Management, Workplace Solutions, Property Marketing and Research Services Revenue EMEA (US$ millions) Adjusted EBITDA 2 (Adjusted EBITDA Margin) • Revenues up 15% in local currencies, with 14% growth from recent acquisitions and 1% from internal growth • Internal growth impacted by transaction timing and reduced project management activity • Adjusted EBITDA up 23% with margins relatively consistent to prior year Outsourcing & Advisory (1) Sales Brokerage Lease Brokerage USD LC Internal Growth (LC) Revenue Growth 24% 15% 1% (2) GAAP Operating Earnings: Q2 2018 $14.0M at 9.3% margin ; Q2 2017 $11.8M at 9.8% margin 33.8 26.5 40.1 27.3 75.6 66.8 149.6 120.6 Q2 2018 Q2 2017 21.5 17.5 14.3% 14.5% Q2 2018 Q2 2017

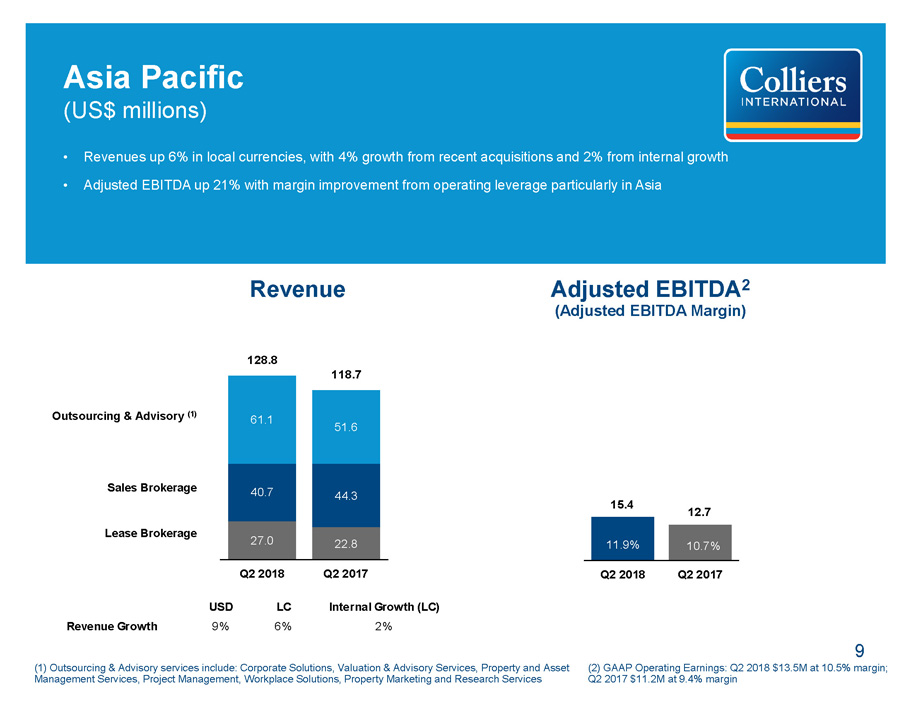

9 (1) Outsourcing & Advisory services include: Corporate Solutions, Valuation & Advisory Services, Property and Asset Management Services, Project Management, Workplace Solutions, Property Marketing and Research Services Revenue Asia Pacific (US$ millions) Adjusted EBITDA 2 (Adjusted EBITDA Margin) • Revenues up 6% in local currencies, with 4% growth from recent acquisitions and 2% from internal growth • Adjusted EBITDA up 21% with margin improvement from operating leverage particularly in Asia Outsourcing & Advisory (1) Sales Brokerage Lease Brokerage (2) GAAP Operating Earnings: Q2 2018 $13.5M at 10.5% margin; Q2 2017 $11.2M at 9.4% margin 27.0 22.8 40.7 44.3 61.1 51.6 128.8 118.7 Q2 2018 Q2 2017 15.4 12.7 11.9% 10.7% Q2 2018 Q2 2017 USD LC Internal Growth (LC) Revenue Growth 9% 6% 2%

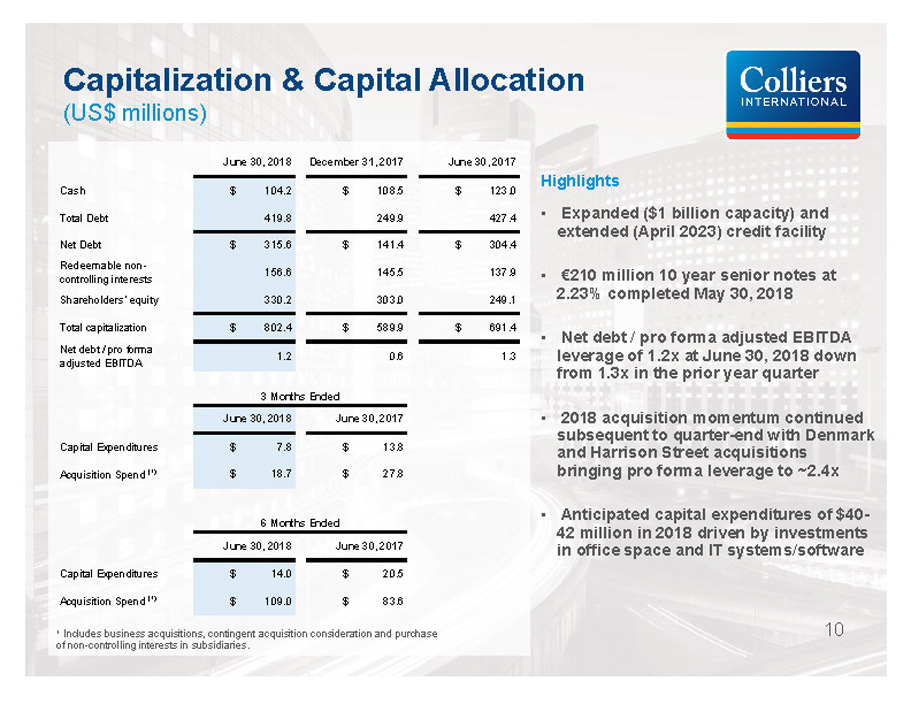

10 1 Includes business acquisitions, contingent acquisition consideration and purchase of non - controlling interests in subsidiaries. Capitalization & Capital Allocation (US$ millions) Highlights • Expanded ($1 billion capacity) and extended (April 2023) credit facility • € 210 million 10 year senior notes at 2.23% completed May 30, 2018 • Net debt / pro forma adjusted EBITDA leverage of 1.2x at June 30, 2018 down from 1.3x in the prior year quarter • 2018 acquisition momentum continued subsequent to quarter - end with Denmark and Harrison Street acquisitions bringing pro forma leverage to ~2.4x • Anticipated capital expenditures of $40 - 42 million in 2018 driven by investments in office space and IT systems/software Cash $ 104.2 $ 108.5 $ 123.0 Total Debt 419.8 249.9 427.4 Net Debt $ 315.6 $ 141.4 $ 304.4 Redeemable non- controlling interests 156.6 145.5 137.9 Shareholders' equity 330.2 303.0 249.1 Total capitalization $ 802.4 $ 589.9 $ 691.4 Net debt / pro forma adjusted EBITDA 1.2 0.6 1.3 Capital Expenditures $ 7.8 $ 13.8 Acquisition Spend (1) $ 18.7 $ 27.8 Capital Expenditures $ 14.0 $ 20.5 Acquisition Spend (1) $ 109.0 $ 83.6 6 Months Ended June 30, 2018 June 30, 2017 June 30, 2018 December 31, 2017 June 30, 2017 3 Months Ended June 30, 2018 June 30, 2017

11 Looking Ahead 2018 Existing Business Outlook • Predicated on stable market conditions, including modest economic growth and increases to interest rates • Low to mid single - digit percentage internal revenue growth on full year basis plus mid single - digit revenue growth due to acquisitions • Adjusted EBITDA margin improvement of 20 - 30 bps Harrison Street Outlook • Expect revenues of $50 - 55 million for balance of 2018 • Expect adjusted EBITDA margin of 35 - 40% • 25% non - controlling interest share of earnings • Expect significant intangible asset amortization, which will impact GAAP earnings measures Consolidated Outlook • Consolidated income tax rate of 30 - 32% (including benefit of lower corporate tax rates under US Tax Reform) • Mid teen to 20% adjusted EPS growth on full year basis

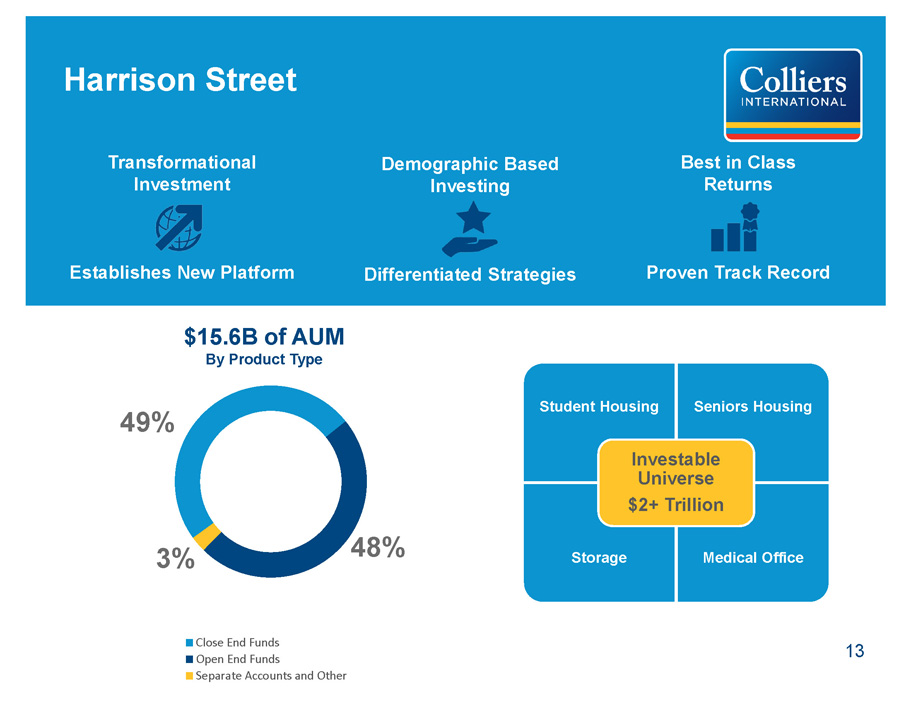

Harrison Street Investment Management

49% 48% 3% Close End Funds Open End Funds Separate Accounts and Other $15.6B of AUM By Product Type Harrison Street Demographic Based Investing Differentiated Strategies Transformational Investment Establishes New Platform Student Housing Seniors Housing Storage Medical Office Investable Universe $2+ Trillion 13 Best in Class Returns Proven Track Record

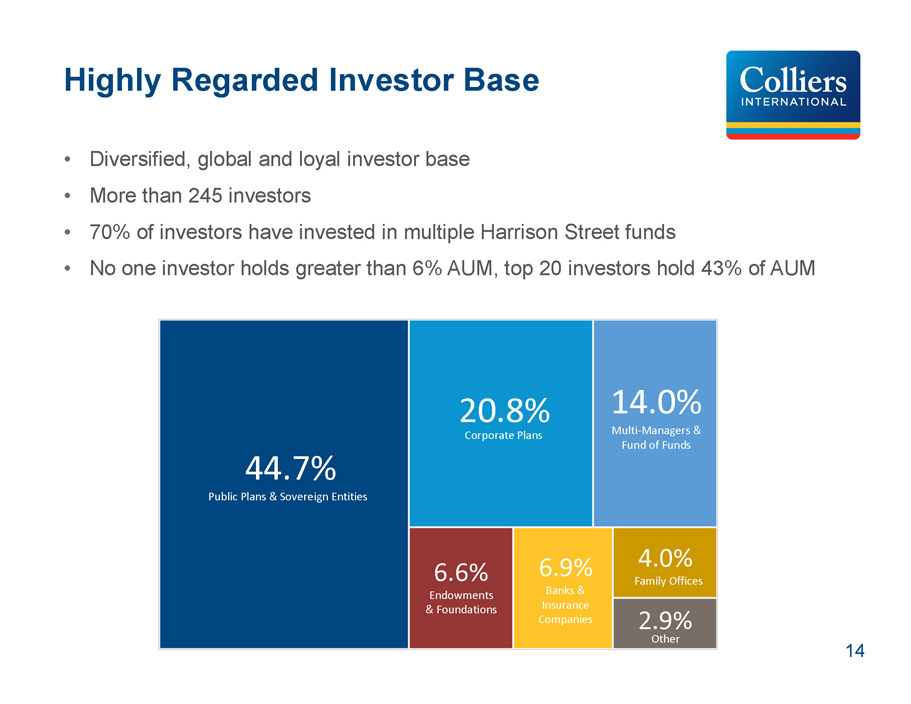

14 Highly Regarded Investor Base • Diversified, global and loyal investor base • More than 245 investors • 70% of investors have invested in multiple Harrison Street funds • No one investor holds greater than 6% AUM, top 20 investors hold 43% of AUM Public Plans & Sovereign Entities 44.7% Corporate Plans 20.8% Multi - Managers & Fund of Funds 14.0% Endowments & Foundations 6.6% Banks & Insurance Companies 6.9% Family Offices 4.0% Other 2.9%

Investment Management Platform Stable Recurring Revenues 15 15%+ of Colliers EBITDA • Harrison Street and existing investment management business • Recurring revenue streams • $115 - $130 million • EBITDA margins of 35 - 40% • ~15% of Colliers annualized EBITDA • Strong growth potential • Positive industry dynamics • Leverage track records, culture and client focus to grow • Capitalize on Colliers’ global brand, platform and relationships $20+ Billion in AUM Positive industry dynamics Leverage platform & capabilities

Appendix Reconciliation of non - GAAP measures

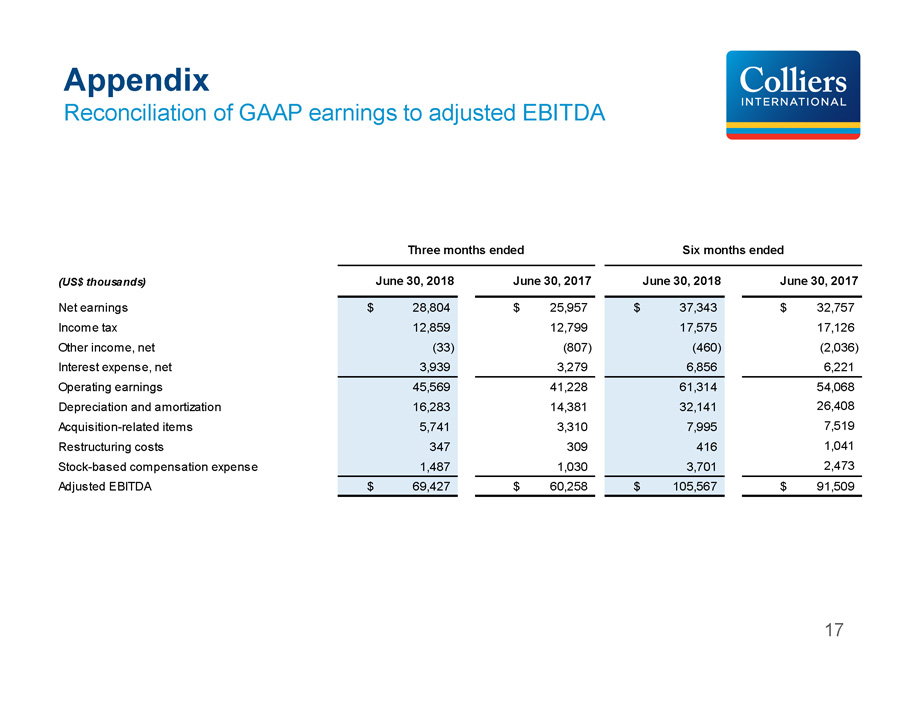

17 Appendix Reconciliation of GAAP earnings to adjusted EBITDA (US$ thousands) Net earnings $ 28,804 $ 25,957 $ 37,343 $ 32,757 Income tax 12,859 12,799 17,575 17,126 Other income, net (33) (807) (460) (2,036) Interest expense, net 3,939 3,279 6,856 6,221 Operating earnings 45,569 41,228 61,314 54,068 Depreciation and amortization 16,283 14,381 32,141 26,408 Acquisition-related items 5,741 3,310 7,995 7,519 Restructuring costs 347 309 416 1,041 Stock-based compensation expense 1,487 1,030 3,701 2,473 Adjusted EBITDA $ 69,427 $ 60,258 $ 105,567 $ 91,509 Three months ended Six months ended June 30, 2018 June 30, 2017 June 30, 2018 June 30, 2017

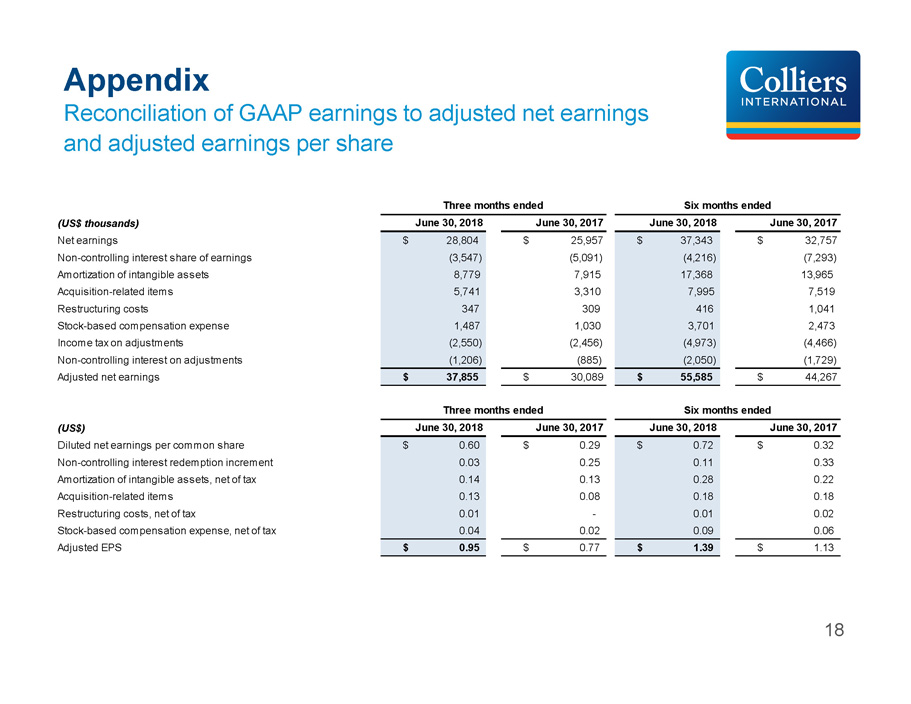

18 Appendix Reconciliation of GAAP earnings to adjusted net earnings and adjusted earnings per share (US$ thousands) Net earnings $ 28,804 $ 25,957 $ 37,343 $ 32,757 Non-controlling interest share of earnings (3,547) (5,091) (4,216) (7,293) Amortization of intangible assets 8,779 7,915 17,368 13,965 Acquisition-related items 5,741 3,310 7,995 7,519 Restructuring costs 347 309 416 1,041 Stock-based compensation expense 1,487 1,030 3,701 2,473 Income tax on adjustments (2,550) (2,456) (4,973) (4,466) Non-controlling interest on adjustments (1,206) (885) (2,050) (1,729) Adjusted net earnings $ 37,855 $ 30,089 $ 55,585 $ 44,267 (US$) Diluted net earnings per common share $ 0.60 $ 0.29 $ 0.72 $ 0.32 Non-controlling interest redemption increment 0.03 0.25 0.11 0.33 Amortization of intangible assets, net of tax 0.14 0.13 0.28 0.22 Acquisition-related items 0.13 0.08 0.18 0.18 Restructuring costs, net of tax 0.01 - 0.01 0.02 Stock-based compensation expense, net of tax 0.04 0.02 0.09 0.06 Adjusted EPS $ 0.95 $ 0.77 $ 1.39 $ 1.13 Three months ended Six months ended June 30, 2018 June 30, 2017 June 30, 2018 June 30, 2017 Three months ended Six months ended June 30, 2018 June 30, 2017 June 30, 2018 June 30, 2017