UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File Number 0-23702

STEVEN MADDEN, LTD.

(Exact name of registrant as specified in its charter)

Delaware | 13-3588231 | |

(State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

incorporation or organization) | ||

52-16 Barnett Avenue, Long Island City, New York 11104

(Address of principal executive offices) (Zip Code)

(718) 446-1800

(Registrant's Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered |

Common Stock, par value $.0001 per share | The NASDAQ Stock Market LLC |

Preferred Stock Purchase Rights | The NASDAQ Stock Market LLC |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act.

Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o |

Non-accelerated filer o (do not check if smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

The aggregate market value of the common equity held by non-affiliates of the registrant (assuming for these purposes, but without conceding, that all executive officers and directors are “affiliates” of the registrant) as of June 30, 2015, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $2,378,693,217 (based on the closing sale price of the registrant's common stock on that date as reported on The NASDAQ Global Select Market).

The number of outstanding shares of the registrant's common stock as of February 25, 2016 was 61,798,245 shares.

DOCUMENTS INCORPORATED BY REFERENCE:

PART III INCORPORATES CERTAIN INFORMATION BY REFERENCE FROM THE REGISTRANT'S DEFINITIVE PROXY STATEMENT FOR THE REGISTRANT'S 2016 ANNUAL MEETING OF STOCKHOLDERS.

TABLE OF CONTENTS

PART I | |

ITEM 4 MINE SAFETY DISCLOSURES | |

PART II | |

ITEM 5 MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER | |

ITEM 7 MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION | |

ITEM 9 CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON | |

PART III | |

ITEM 12 SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND | |

ITEM 13 CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND | |

PART IV | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” (as that term is defined in the federal securities laws), which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with regard to future revenue, projected 2016 results, earnings, spending, margins, cash flow, customer orders, expected timing of shipment of products, inventory levels, future growth or success in specific countries, categories or market sectors, continued or expected distribution to specific retailers, liquidity, capital resources and market risk, strategies and objectives and other future events. More generally, forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or simply state future results, performance or achievements, and can be identified by the use of forward looking language such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “plan,” “project,” “will be,” “will continue,” “will result,” “could,” “may,” “might,” or any variations of such words with similar meanings. Factors that may affect our results include, but are not limited to, the risks and uncertainties discussed in Item 1A of this Annual Report on Form 10-K.

Any such forward-looking statements are subject to risks and uncertainties, many of which are beyond our control, which may influence the accuracy of the statements and the projections upon which the statements are based and could cause our actual results to differ materially from those projected in forward-looking statements. As such, we strongly caution you that these forward-looking statements are not guarantees of future performance or events. Our actual results, performance and achievements could differ materially from those expressed or implied in these forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether from new information, future events or otherwise.

PART I

ITEM 1 BUSINESS

($ in thousands, except share and per share data)

Overview

Steven Madden, Ltd. and its subsidiaries (collectively, the “Company”, "we", "our", "us", as applicable) design, source, market and sell fashion-forward name brand and private label footwear for women, men and children and name brand and private label fashion handbags and accessories and license some of our trademarks for use in connection with the manufacture, marketing and sale of various products of our licensees. Our products are marketed through our retail stores and our e-commerce websites, as well as better department stores, major department stores, mid-tier department stores, specialty stores, luxury retailers, value priced retailers, national chains, mass merchants and catalog retailers throughout the United States, Canada, Mexico and South Africa. In addition, we have special distribution arrangements for the marketing of our products in Asia, Australia, Europe, India, the Middle East, South and Central America and New Zealand. We offer a broad range of updated styles designed to establish or complement and capitalize on market trends. We have established a reputation for design creativity and our ability to offer quality products in popular styles at affordable prices, delivered in an efficient manner and time frame.

Steven Madden, Ltd. was incorporated as a New York corporation on July 9, 1990, reincorporated under the same name in Delaware in November 1998 and completed our initial public offering in December 1993. Shares of Steven Madden, Ltd. common stock, $0.0001 par value per share, currently trade on the NASDAQ Global Select Market under the symbol “SHOO”. Our principal executive offices are located at 52-16 Barnett Avenue, Long Island City, NY 11104. Our telephone number is (718) 446-1800 and our website address is http://www.stevemadden.com.

We file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports and information with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). These reports, any amendments to such reports, and our proxy statements for our stockholders' meetings are available free of charge, on the "Investor Relations" section of our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. We will provide paper copies of such filings free of charge upon request. The public may read and copy any materials filed by us with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information regarding the operation of the SEC's Public Reference Room is available by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding us, which is available at http://www.sec.gov.

We have a Code of Ethics for our Chief Executive Officer and our senior financial officers, as well as a Code of Business Conduct and Ethics specific to directors of the Company and a Code of Business Conduct and Ethics that is applicable to all of

1

our employees, each of which are attached as exhibits to the 2014 Annual Report on Form 10-K filed with the SEC on February 26, 2015 and posted on our website, http://www.stevemadden.com. We will provide paper copies of these codes free of charge upon request. We intend to disclose on our website any amendments to, or waivers of, these codes that would otherwise be reportable on a current report on Form 8-K. Such disclosure would be posted within four business days following the date of the amendment or waiver.

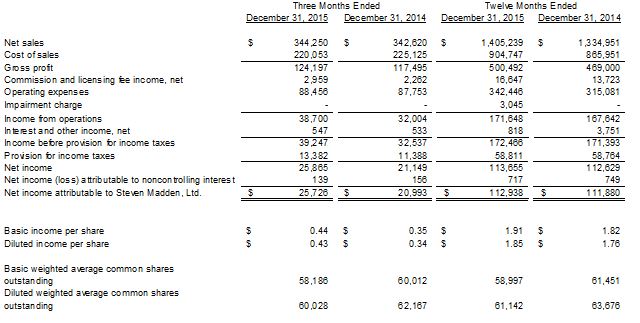

Net sales for 2015 increased 5% to $1,405,239 from $1,334,951 in 2014. Net income attributable to Steven Madden, Ltd. increased 1% to $112,938 in 2015 compared to $111,880 in 2014. Diluted earnings per share in 2015 increased to $1.85 per share on 61,142,000 diluted weighted average shares outstanding compared to $1.76 per share on 63,676,000 diluted weighted average shares outstanding in the prior year.

Product Distribution Segments

Our business is comprised of five distinct segments: Wholesale Footwear, Wholesale Accessories, Retail, First Cost and Licensing.

Our Wholesale Footwear segment is comprised of the following brands: Steve Madden Women's®, Madden Girl®, Steve Madden Men's®, Madden®, Dolce Vita®, DV by Dolce Vita®, Mad Love®, Steven by Steve Madden®, Report®, Report Signature®, Superga® (under license), Betsey Johnson®, Steve Madden Kids®, FREEBIRD by Steven®, Stevies®, B Brian Atwood®, Blondo® and includes our International business and certain private label footwear business. Our Wholesale Accessories segment includes Big Buddha®, Betseyville®, Betsey Johnson®, Steve Madden®, Steven by Steve Madden®, Madden Girl®, Cejon®, B Brian Atwood® and Luv Betsey® accessories brands and includes our International business and certain private label accessories business. These trademarks are registered trademarks owned by us or licensed to us by third parties. Steven Madden Retail, Inc., our wholly-owned retail subsidiary, operates Steve Madden, Steven and Superga retail stores along with one multi-branded SHOO by Steve Madden store offering a variety of the Company's brands, domestically and internationally, as well as Steve Madden, Superga, Betsey Johnson and Dolce Vita e-commerce websites. The First Cost segment represents activities of a subsidiary that earns commissions for serving as a buying agent for footwear products under private labels for many of the country's large mass-market merchandisers, shoe chains and other value priced retailers. Our Licensing segment is engaged in the licensing of the Steve Madden®, Steven by Steve Madden®, and Madden Girl® trademarks for use in connection with the manufacture, marketing and sale of outerwear, hosiery, activewear, sleepwear, jewelry, watches, hair accessories, umbrellas, bedding, luggage, and men’s leather accessories. In addition, we license our Betsey Johnson®, Betseyville®, and Dolce Vita® trademarks for use in connection with the manufacture, marketing and sale of women's and children’s apparel, hosiery, swimwear, outerwear, sleepwear, activewear, jewelry, watches, bedding, luggage, stationary, umbrellas, and household goods.

Wholesale Footwear Segment

Steve Madden Women's. We design, source and market our Steve Madden brand to department stores, specialty stores, luxury retailers, value priced retailers, national chains, mass merchants, online retailers and catalog retailers throughout the United States. The Steve Madden brand has become a leading life-style brand in the fashion conscious marketplace. Steve Madden Women's offers fashion forward footwear designed to appeal to customers (primarily women ages 16 to 35) seeking exciting, new footwear designs at affordable prices. New products for Steve Madden Women's are test marketed at Company-owned retail stores. Typically, within a few days, we can determine if the test product appeals to our customers. This enables us to use our flexible sourcing model to rapidly respond to changing trends and customer preferences, which we believe is essential for success in the fashion industry.

Madden Girl. We design, source and market a full collection of directional young women's shoes under the Madden Girl® brand. Madden Girl is geared for young women ages 16 to 23, and is an “opening price point” brand currently sold at major department stores, mid-tier retailers and specialty stores.

Steve Madden Men's. We design, source, and market a life style collection of men's footwear for the fashion forward man, ages 18 to 45 years old, under the Steve Madden® brand. Retail channels include major department stores, mid-tier department stores, better specialty stores, online retailers and independent shoe stores throughout the United States. Price points for Steve Madden Men's products range from $70 to $150 at retail.

Madden. The Madden® brand is a streetwear focused collection of footwear geared to meet the trend directions of the 13 to 21 year old fashion consumer. Madden products range from $45 to $85 and are sold to national specialty stores, better department stores, mid-tier department stores, online retailers and independent specialty stores.

2

Steven. We design, source and market women's fashion footwear under the Steven® trademark through major department and better footwear specialty stores throughout the United States as well as in our retail stores. Priced a tier above the Steve Madden brand, Steven products are designed to appeal principally to fashion conscious women, ages 25 to 45, who shop at department stores and footwear boutiques.

Stevies and Steve Madden Kids. Our Stevies and Steve Madden Kids brands are designed, sourced and marketed to appeal to young girls, ages six to 12, and are sold at department stores, specialty stores, online retailers and independent boutiques throughout the United States.

Betsey Johnson. On October 5, 2010, the Company acquired the Betsey Johnson® trademark and substantially all other intellectual property of Betsey Johnson LLC. Products branded under the Betsey Johnson shoe brand are distributed through department stores and online retailers.

Superga. On February 9, 2011, the Company entered into a license agreement with Basic Properties America Inc. and BasicNet S.p.A., for the use of the Superga® trademark in connection with the marketing and sale of footwear. Founded in Italy in 1911, Superga is recognized for its fashion sneakers in a wide range of colors, fabrics and prints for women, men and children.

FREEBIRD by Steven. We design, source, and market a full collection of handcrafted, Goodyear welted boots. The designs are inspired by vintage Americana and created using time-honored craftsmanship. The FREEBIRD by Steven® collection conveys a unique fashion life style that transcends multiple generations. FREEBIRD by Steven products are currently sold, at retail prices ranging from $195 to $450 at major department stores, mid-tier retailers, and specialty boutiques.

Report. The Report and Report Signature brands were acquired in our May 2011 acquisition of Topline Corporation ("Topline"). We design, manufacture, market and sell our Report branded products to major department stores, mid-tier department stores and independently-owned boutiques throughout the United States.

Mad Love. Formed in April 2011 as a joint venture with the Company, the Mad Love® brand is an exclusive beach-to-the-street life style brand created to appeal to women with a young attitude and active life style and marketed to Target.

Dolce Vita. In August 2014, the Company acquired the Dolce Vita® and DV® brands and other intellectual property assets in the acquisition of Dolce Vita Holdings, Inc. The Dolce Vita brand is a contemporary women's footwear brand with price points ranging from $120 to $350. The DV brand, which is designed for younger fashion conscious women, has price points ranging from $60 to $200. Both brands are distributed through department stores and online retailers.

Brian Atwood. In March 2014, the Company acquired the Brian Atwood® designer brand and the B Brian Atwood® contemporary brand from Brian Atwood IP Company LLC. Founded in 2011, Brian Atwood is known for luxury shoes manufactured in Italy.

Blondo. In January 2015, the Company acquired the intellectual property and related assets of Blondo, a fashion-oriented footwear brand specializing in waterproof leather boots. Founded over 100 years ago, Blondo products are sold to wholesale customers, including better department stores and specialty boutiques in both the United States and Canada.

International Division. The International division, utilizing the brands discussed above, markets products to better department stores, major department stores, mid-tier department stores, specialty stores, luxury retailers, value priced retailers, national chains, mass merchants and catalog retailers throughout Canada, Mexico and South Africa. In addition the International division works through special distribution arrangements for the marketing and sales of our products in Asia, Australia, Europe, India, the Middle East, South and Central America and New Zealand.

Private label business. We design, source and market private label footwear primarily to mid-tier chains and mass market merchants. In addition, we design, source and market footwear for third party brands, such as Material Girl® and Candies®.

Wholesale Accessories Segment

Our Wholesale Accessories segment designs, sources and markets name brands (including our Steve Madden®, Steven by Steve Madden®, Madden Girl®, Betsey Johnson®, Betseyville®, Big Buddha®, B Brian Atwood® and Luv Betsey® brands) and private label fashion handbags and accessories to department stores, mass merchants, value priced retailers, online retailers and specialty stores throughout the United States, Canada and Mexico. In addition, we market and sell cold weather accessories,

3

fashion scarves, wraps and other trend accessories primarily under our Cejon® and Steve Madden® brand names and private labels to department stores and specialty stores.

Retail Segment

As of December 31, 2015, we owned and operated 169 retail stores including 123 Steve Madden full price stores, 40 Steve Madden outlet stores, one Steven store, one Superga store, one SHOO by Steve Madden store offering a variety of the Company's brands and four e-commerce websites (Steve Madden, Superga, Betsey Johnson and Dolce Vita). In 2015, we opened seven new full price stores, eight new outlet stores and closed six stores, including five full price stores in the United States and one full price store in Mexico. Steve Madden stores are located in major shopping malls and in urban street locations across the United States, Canada, Mexico and South Africa. Comparative store sales (sales of those stores, including the e-commerce websites, that were open for all of 2015 and 2014) increased 11.2% in fiscal year 2015 from the prior year. The Company excludes new locations from the comparable store base for the first year of operations. Stores that are closed for renovations are removed from the comparable store base.

We anticipate that the Retail segment can enhance the Company's overall sales and profitability while increasing recognition for our brands. Additionally, our retail stores enable us to evaluate the appeal of new products and designs to our customers and respond accordingly, which, in turn, strengthens the product development efforts of our two Wholesale segments. We expect to open 17 to 20 new retail stores in 2016.

First Cost Segment

The First Cost segment earns commissions for serving as a buying agent for footwear products under private labels for many of the large mass-market merchandisers, shoe chains and other mid-tier retailers. As a buying agent, we utilize our expertise and our relationships with shoe manufacturers to facilitate the production of private label shoes to customer specifications. We believe that by operating in the private label, mass merchandising market provides us additional non-branded sales opportunities and leverages our overall sourcing and design capabilities. Currently, our First Cost segment earns commissions serving as a buying agent for the procurement of women's, men's and children's footwear for large retailers, including, Kohl's, K-Mart and Payless. In addition, by leveraging the strength of our Steve Madden brands and product designs, we have been able to partially recover our design, product and development costs from our suppliers.

Licensing Segment

We license our Steve Madden®, Steven by Steve Madden® and Madden Girl® trademarks for use in connection with the manufacture, marketing and sale of outerwear, hosiery, activewear, sleepwear, jewelry, watches, hair accessories, umbrellas, bedding, luggage, and men’s leather accessories. In addition, the Company licenses the Betsey Johnson®, Betseyville® and Dolce Vita® trademarks for use in connection with the manufacture, marketing and sale of women's and children’s apparel, hosiery, swimwear, outerwear, sleepwear, activewear, jewelry, watches, bedding, luggage, stationary, umbrellas, and household goods. Most of our license agreements require the licensee to pay us a royalty based on actual net sales, a minimum royalty in the event that specified net sales targets are not achieved and a percentage of sales for advertising the brand.

See Note P to our Consolidated Financial Statements included in this Annual Report on Form 10-K for additional information relating to our five operating segments.

Product Design and Development

We have established a reputation for our creative designs, marketing and trendy products at affordable price points. Our future success will substantially depend on our ability to continue to anticipate and react swiftly to changing consumer demands. To meet this objective, we have developed what we believe is an unparalleled design process that allows us to recognize and respond quickly to changing consumer demands. Our design team strives to create designs that fit our image, reflect current or anticipated trends and can be manufactured in a timely and cost-effective manner. Most new Steve Madden products are tested in select Steve Madden retail stores. Based on these tests, among other things, management selects the Steve Madden products that are then offered for wholesale and retail distribution nationwide. We believe that our design and testing processes and flexible sourcing models provide the Steve Madden brands with a significant competitive advantage allowing us to mitigate the risk of incurring costs associated with the production and distribution of less desirable designs.

4

Product Sourcing and Distribution

We source each of our product lines separately based on the individual design, style and quality specifications of the products in such product lines. We do not own or operate manufacturing facilities; rather, we use agents and our own sourcing office to source our products from independently-owned manufacturers in China, Mexico, India, Brazil, Indonesia, Vietnam and Italy. We have established relationships with a number of manufacturers and agents in each of these countries. We have not entered into any long-term manufacturing or supply contracts. We believe that a sufficient number of alternative sources exist for the manufacture of our products.

We continually monitor the availability of the principal raw materials used in our footwear, which are currently available from a number of sources in various parts of the world. We track inventory flow on a regular basis, monitor sell-through data and incorporate input on product demand from wholesale customers. We use retailers' feedback to adjust the production of products on a timely basis, which helps reduce the close out of slow-moving products.

The manufacturers of our products are required to meet our quality, human rights, safety and other standard requirements. We are committed to the safety and well-being of the workers throughout our supply chain.

Our products are manufactured overseas and a majority of our products filling domestic orders are shipped via ocean freight carriers to ports in California, New Jersey and Texas with the greatest reliance on the California ports. To a lesser extent we rely on air and ground freight carriers for the shipping of products. Once our products arrive in the U.S., we distribute them mainly from four third-party distribution centers, two located in California, one located in Texas and one located in New Jersey and through two Company-operated distribution centers located in New Jersey and Canada. By utilizing distribution facilities specializing in distribution fulfillment to effect distribution to certain wholesale accounts, Steve Madden retail stores and Internet customers, we believe that our customers are served more promptly and efficiently. For our international markets, products for our businesses in Canada and Mexico are shipped to ports in the respective countries, and products for our overseas distributors are shipped to freight forwarders in China where the distributor arranges for subsequent shipment.

Customers

Our wholesale customers consist principally of better department stores, major department stores, mid-tier department stores, national chains, mass merchants, value priced retailers, specialty stores, online retailers and catalog retailers. These customers include, Target, Macy's, Nordstrom, Ross, DSW, Payless, TJ Maxx, Walmart, Kohl's and Burlington Coat Factory. For the year ended December 31, 2015, Target, Inc. represented 12.2% of net sales and 16.7% of total accounts receivable. The Company did not have any other customers who accounted for more than 10% of total net sales or 10% of total accounts receivable.

Distribution Channels

United States, Canada, Mexico and South Africa

We sell our products principally through department stores, specialty stores, online retailers, luxury retailers, national chains and mass merchants and in our Company-owned retail stores in the United States, Canada, Mexico and South Africa and our e-commerce websites. For the year ended December 31, 2015, our Retail segment and our two Wholesale segments generated net sales of approximately $240,312 and $1,164,927, or 17% and 83% of our total net sales, respectively. Each of these distribution channels is described below.

Steve Madden, Steve Madden Outlet, Steven and Superga Retail Stores. As of December 31, 2015, we operated 123 Steve Madden full price stores, 40 Steve Madden outlet stores, one Steven store, one Superga store and four e-commerce websites (Steve Madden, Superga, Betsey Johnson and Dolce Vita). We believe that our retail stores will continue to enhance overall sales, profitability, and our ability to react swiftly to changing consumer trends. Our stores also serve as a marketing tool that allows us to strengthen brand recognition and to showcase selected items from our full line of branded and licensed products. Furthermore, our retail stores provide us with venues through which to test and introduce new products, designs and merchandising strategies. Specifically, we often test new designs at our Steve Madden retail stores before scheduling them for mass production and wholesale distribution. In addition to these test marketing benefits, we have been able to leverage sales information gathered at Steve Madden retail stores to assist our wholesale customers in order placement and inventory management.

A typical Steve Madden store is approximately 1,500 to 2,000 square feet and is located in a mall or street location that we expect will attract the highest concentration of our core demographic, style-conscious customer base. The Steven and Superga

5

stores, which are generally the same size as our Steve Madden stores, have a more sophisticated design and format styled to appeal to a more mature target audience. The typical outlet store is approximately 2,000 to 2,500 square feet and is located within outlet malls throughout the United States. In addition to carefully analyzing mall demographics and locations, we set profitability guidelines for each potential store site. Specifically, we target well trafficked sites at which the demographics fit our consumer profile and seek new locations where the projected fixed annual rent expense stays within our guidelines. By setting these guidelines, we seek to identify stores that will contribute to our overall profitability both in the near and longer terms.

Department Stores. We currently sell to over 2,500 doors of 17 department stores throughout the United States, Canada and Mexico. Our major accounts include Macy's, Nordstrom, Dillard's, Belk and Lord & Taylor.

We provide merchandising support to our department store customers including, in-store fixtures and signage, supervision of displays and merchandising of our various product lines. Our wholesale merchandising effort includes the creation of in-store concept shops in which to showcase a broader collection of our branded products. These in-store concept shops create an environment that is consistent with our image and are designed to enable the retailer to display and sell a greater volume of our products per square foot of retail space. In addition, these in-store concept shops encourage longer term commitment by the retailer to our products and enhance consumer brand awareness.

In addition to merchandising support, our key account executives maintain weekly communications with their respective accounts to guide them in placing orders and to assist them in managing inventory, assortment and retail sales. We leverage our sell-through data gathered at our retail stores to assist department stores in allocating their open-to-buy dollars to the most popular styles in the product line and phasing out styles with weaker sell-throughs, which, in turn, reduces markdown exposure at season's end.

National chains and mass merchants. We currently sell to national chains and mass merchants throughout the United States, Canada and Mexico. Our major accounts include Target, Walmart, Kohl's, J.C. Penney and Sears.

Specialty Stores/Catalog Sales. We currently sell to specialty store locations throughout the United States, Canada and Mexico. Our major specialty store accounts include DSW, Famous Footwear and Journeys. We offer our specialty store accounts the same merchandising, sell-through and inventory tracking support offered to our department store accounts. Sales of our products are also made through various catalogs, such as Bloomingdale's and Victoria's Secret.

Internet Sales. We operate four Internet e-commerce website stores (Steve Madden, Superga, Betsey Johnson and Dolce Vita) where customers can purchase numerous styles of our Steve Madden Women's, Steven, Madden Men's, FREEBIRD by Steven, Superga, Betsey Johnson and Dolce Vita, as well as selected styles of Madden Girl, footwear and accessory products. We also sell to online retailers throughout the United States and Canada. Our major accounts include Zappos and Amazon.

International

Our products are available in many countries and territories worldwide via retail selling and distribution agreements. Under the terms of these agreements, the distributors and retailers purchase product from the Company and are generally required to open a minimum number of stores each year and to pay a fee for each pair of footwear purchased and an additional sales royalty as a percentage of sales or a predetermined amount per unit of sale. Most of the distributors are required to purchase a minimum number of products within specified periods. The agreements currently in place expire on various dates through February 14, 2031 and include automatic renewals at the distributors' option provided certain conditions are met. These agreements are exclusive in their specific territories, which include Asia, Australia, Europe, India, the Middle East, South and Central America and New Zealand.

Competition

The fashion industry is highly competitive. We compete with specialty shoe and accessory companies as well as companies with diversified footwear product lines, such as Nine West, Jessica Simpson, Guess, Ugg and Aldo. Our competitors may have greater financial and other resources than we do. We believe effective advertising and marketing, favorable brand image, fashionable styling, high quality, value and fast manufacturing turnaround are the most important competitive factors and intend to continue to employ these elements in our business. However, we cannot be certain that we will be able to compete successfully against our current and future competitors, or that competitive pressures will not have a material adverse effect on our business, financial condition and results of operations.

6

Marketing and Sales

We have focused on creating an integrated brand building program to establish Steve Madden as a leading designer of fashion footwear for style-conscious young women and men. Principal marketing activities include product placements in life style and fashion magazines, personal appearances by our founder and Creative and Design Chief, Steve Madden, and in-store promotions. We continue to promote our e-commerce websites where customers can purchase Steve Madden Women's, Steven, Madden Men's, FREEBIRD by Steven, Superga, Betsey Johnson and Dolce Vita, as well as selected styles of Madden Girl, footwear and accessory products, as well as view exclusive content, participate in contests and “live chat” with customer service representatives. We also connect with our customers through social media forums including Twitter, Facebook and Instagram.

Management Information Systems (MIS) Operations

Sophisticated information systems are essential to our ability to maintain our competitive position and to support continued growth. Our wholesale information system is an Enterprise Resource Planning (“ERP”) system. This integrated system supports our wholesale business in the areas of finance and accounting, manufacturing-sourcing, purchase order management, customer order management and inventory control. We completed the implementation of this new ERP system for our wholesale business in 2014. During 2015, we completed the implementation of such ERP system in three of our acquired businesses and are currently in the process of implementing the ERP system for one of our U.S.-based wholesale businesses and its Asia first-cost and sourcing operation as well as our Mexico business. In 2014 we completed the implementation of a new warehouse management system that is utilized by our third-party logistics providers. During 2015 we implemented this warehouse management system in a company-owned warehouse. This warehouse management system interfaces with our ERP system. We have a new business-to-consumer e-commerce software platform that we are currently in the process of implementing as to businesses acquired. We are also currently implementing a point of sale system for our retail stores that is integrated with a retail inventory management/store replenishment system. Complimenting all of these systems are ancillary systems and third-party information processing services including, among others, supply chain, business intelligence/data warehouse, Electronic Data Interchange, credit card processing and payroll. We undertake updates of all of these information management systems on a periodic basis in order to ensure that our functionality is continuously improved.

Intellectual Property

Trademarks

We consider our trademarks to be among our most valuable assets and have registered many of our marks in the United States and 94 other countries and in numerous International Classes. From time to time we adopt new trademarks and new logos and/or stylized versions of our trademarks in connection with the marketing of new product lines. We believe that these trademarks have significant value and are important for purposes of identifying the Company, the marketing of our products and the products of our licensees, distinguishing them from the products of others. What follows is a list of the trademarks we believe are most significant to our business:

Steve Madden® | Report® |

Steven by Steve Madden® | Report Signature® |

Steven® | R Design® |

Madden Girl® | Brian Atwood® |

Stevies® | B Brian Atwood® |

Big Buddha® | Dolce Vita® |

Betseyville® | DV BY DOLCE VITA® |

Betsey Johnson® | DV® |

LUV BETSEY plus Kiss Design® | Wild Pair® |

LUV BETSEY by Betsey Johnson Design® | MadLove® |

Blondo® | |

7

We act aggressively to register trademarks and we monitor their use in order to protect them against infringement. There can be no assurance, however, that we will be able to effectively obtain rights to our marks throughout all of the world. Moreover, no assurance can be given that others will not assert rights in, or ownership of, our marks and other proprietary rights or that we will be able to resolve any such conflicts successfully. Our failure to adequately protect our trademarks from unlawful and improper appropriation may have a material adverse effect on our business, financial condition, results of operations and liquidity.

Trademark Licensing

Our strategy for the continued growth of the Company's business includes expanding the Company's presence beyond footwear and accessories through the selective licensing of our brands. As of December 31, 2015, we license our Steve Madden®, Steven by Steve Madden®, and Madden Girl® trademarks for use in connection with the manufacture, marketing and sale of outerwear, hosiery, activewear, sleepwear, jewelry, watches, hair accessories, umbrellas, bedding, luggage, and men’s leather accessories. In addition, the Company licenses the Betsey Johnson®, Betseyville®, and Dolce Vita® trademarks for use in connection with the manufacture, marketing and sale of women's and children’s apparel, hosiery, swimwear, outerwear, sleepwear, activewear, jewelry, watches, bedding, luggage, stationary, umbrellas, and household goods. Most of our license agreements require the licensee to pay us a royalty based on actual net sales, a minimum royalty in the event that specified net sales targets are not achieved and a percentage of sales for advertising the brand.

In addition to the licensing of our trademarks, we also license the trademarks of third parties for use in connection with certain of our product lines. Through a license agreement with Basic Properties America Inc. and BasicNet S.p.A we have the right to use the Superga® trademark in connection with the marketing and sale of footwear through December 31, 2022. This licensing agreement requires us to make royalty and advertising payments to the licensor equal to a percentage of our net sales or a minimum royalty and advertising payment in the event that specified net sales targets are not achieved. See Notes A and O to our Consolidated Financial Statements included in this Annual Report on Form 10-K for additional disclosure regarding these licensing arrangements.

Employees

On February 1, 2016, we employed approximately 3,578 employees, of whom approximately 2,260 work on a full-time basis and approximately 1,318 work on a part-time basis. Most of our part-time employees work in the Retail segment. Approximately 2,437 of our employees are located in the United States, approximately 696 employees are located in Hong Kong and China, approximately 331 employees are located in Canada and approximately 114 employees are located in Mexico. None of our employees are represented by a union. Our management considers relations with our employees to be good. The Company has never experienced a material interruption of its operations due to a labor dispute.

Seasonality

Historically, some of our businesses, including our Retail segment, have experienced holiday retail seasonality. In addition to seasonal fluctuations, our operating results fluctuate from quarter to quarter as a result of the timing of holidays, weather, the timing of larger shipments of footwear, market acceptance of our products, product mix, pricing and presentation of the products offered and sold, the hiring and training of additional personnel, inventory write downs for obsolescence, the cost of materials, the product mix among our wholesale, retail and licensing businesses, the incurrence of other operating costs and factors beyond our control, such as general economic conditions and actions of competitors.

Backlog

We had unfilled wholesale customer orders of approximately $295,000 and $312,000, as of February 1, 2016 and 2015, respectively. Our backlog at a particular time is affected by a number of factors, including seasonality, timing of market weeks and wholesale customer purchases of our core products through our open stock program. Accordingly, a comparison of backlog from period to period may not be indicative of eventual shipments.

8

ITEM 1A RISK FACTORS

You should carefully consider the risks and uncertainties we describe below and the other information in this Annual Report on Form 10-K before deciding to invest in, sell or retain shares of our common stock. These are not the only risks and uncertainties that we face. Other sections of this report may discuss factors that could adversely affect our business. The retail industry is highly competitive and subject to rapid change. There may be additional risks and uncertainties that we do not currently know about or that we currently believe are immaterial, or that we have not predicted, which may also harm our business or adversely affect us. If any of these risks or uncertainties actually occurs, our business, financial condition, results of operations and liquidity could be materially harmed.

Risks Related to the Industry in Which the Company Operates

Constantly Changing Fashion Trends and Consumer Demands. Our success depends in significant part upon our ability to anticipate and respond to product and fashion trends as well as to anticipate, gauge and react to changing consumer demands in a timely manner. There can be no assurance that our products will correspond to the changes in taste and demand or that we will be able to successfully market products that respond to such trends. If we misjudge the market for our products, we may be faced with significant excess inventories for some products and missed opportunities as to others. In addition, misjudgments in merchandise selection could adversely affect our image with our customers resulting in lower sales and increased markdown allowances for customers which could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Intense Fashion Industry Competition. The fashion footwear and accessories industry is highly competitive and barriers to entry are low. Our competitors include specialty companies as well as companies with diversified product lines. The recent market growth in the sales of fashion footwear and accessories has encouraged the entry of many new competitors and increased competition from established companies. Many of these competitors, including Nine West, Guess, Jessica Simpson, Ugg and Aldo, may have significantly greater financial and other resources than we do and there can be no assurance that we will be able to compete successfully with other fashion footwear and accessories companies. Increased competition could result in pricing pressures, increased marketing expenditures and loss of market share, and could have a material adverse effect on our business, financial condition, results of operations and liquidity. We believe effective advertising and marketing, favorable branding of the Steve Madden® and our other trademarks, fashionable styling, high quality and value are the most important competitive factors and we plan to continue to focus on these elements as we develop new products and businesses. Our inability to effectively advertise and market our products and respond to customer preferences could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Cyclical Nature of the Fashion Industry. The overall fashion industry is cyclical, and purchasing tends to decline during recessionary periods when disposable income is low. Likewise, purchases of contemporary shoes and accessories tends to decline during recessionary periods and also may decline at other times. There can be no assurance that we will be able to grow or even maintain our current level of revenues and earnings, or remain profitable in the future. Continuing slow growth in the international, national or regional economies and uncertainties regarding future economic prospects, among other things, could affect consumer spending habits. The volatility and disruption of global economic and financial market conditions that began in 2008 has caused lingering declines in consumer confidence and spending in the United States and internationally. A further deterioration or a continued weakness of economic and financial market conditions for an extended period of time could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Consolidation Among Retailers. In recent years, the retail industry has experienced consolidation and other ownership changes. In the future, retailers in the United States and in foreign markets may further consolidate, undergo restructurings or reorganizations, or realign their affiliations, any of which could decrease the number of stores that carry our products or increase the ownership concentration within the retail industry. While such changes in the retail industry to date have not had a material adverse effect on our business or financial condition, results of operations and liquidity, there can be no assurance as to the future effect of any such changes.

Economic Uncertainty and Political Risks. Our opportunities for long-term growth and profitability are accompanied by significant challenges and risks, particularly in the near term. Specifically, our business is dependent on consumer demand for our products. We believe that declining consumer confidence accompanied with the tightening of credit standards, higher energy and food prices and unemployment rates and a decrease in consumers' disposable income has negatively impacted the level of consumer spending for discretionary items during the years ended December 31, 2015, 2014 and 2013. During the three year period ended December 31, 2015, we achieved revenue growth in both our Wholesale and Retail segments but we cannot assume that this growth will be sustained. A continued weak economic environment could have a negative effect on the Company's sales

9

and results of operations during the year ending December 31, 2016 and thereafter. In addition, the unstable political conditions in the Middle East and some other parts of the world, including potential or actual international conflicts, or the continuation or escalation of terrorism, could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Risks Related to Our Business

Dependence on Key Personnel. The growth and success of our Company since its inception more than a quarter century ago is attributable, to a significant degree, to the talents, skills and efforts of our founder and Creative and Design Chief, Steven Madden. An extended or permanent loss of the services of Mr. Madden could severely disrupt our business and have a material adverse effect on the Company. Our senior executives have substantial experience and expertise in our business and industry and have made significant contributions to our growth and success as well. Competition for executive talent in the apparel, footwear and accessories industries is intense. While our employment agreements with Mr. Madden and most of our senior executives include a non-compete provision in the event of the termination of employment, the non-compete periods are of limited duration. While we believe we have depth within our senior management team, if we lose the services of our Creative and Design Chief or any of our senior executives, and especially if any of these individuals joins a competitor or forms a competing company, our business and financial performance could be seriously harmed. A loss of the skills, industry knowledge, contacts and expertise of our Creative and Design Chief or any of our senior executives could cause a setback to our operating plan and strategy.

Dependence Upon Significant Customers. Our customers consist principally of better department stores, major department stores, mid-tier department stores, specialty stores, luxury retailers, value priced retailers, national chains, mass merchants and catalog retailers. Certain of our department store customers, including some under common ownership, account for significant portions of our wholesale business. We generally enter into a number of purchase order commitments with our customers for each of our lines every season and do not enter into long-term agreements with any of our customers. Therefore, a decision by a significant customer, whether motivated by competitive conditions, financial difficulties or otherwise, to decrease the amount of merchandise purchased from us or to change its manner of doing business could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Risks Associated with Extending Credit to Customers. We sell our products primarily to retail stores across the United States and extend credit based on an evaluation of each customer's financial condition, usually without collateral. Various retailers, including some of our customers, have experienced financial difficulties as a result of the financial crisis that began in 2008, which has increased the risk of extending credit to such retailers. However, our losses due to bad debts have been limited. Pursuant to the terms of our collection agency agreement, our factor, Rosenthal & Rosenthal, Inc., currently assumes the credit risk related to approximately 80% of our trade accounts receivable. In addition, we have letters of credit for approximately 5% of our trade accounts receivable. Still, if any of our customers experiences a shortage of liquidity, the risk that the customer's outstanding payables to us would not be paid could cause us to curtail business with the customer or require us to assume more credit risk relating to the customer's account payable.

Risks Associated with Expansion of Retail Business. Our continued growth depends to a significant degree on whether we are successful in further developing and marketing our brands, and creating new brands, product categories and businesses that are appealing to our customers. The operation of company-owned Steve Madden, Steven and Superga stores and outlets is a significant part of our growth strategy. During the year ended December 31, 2015, we opened seven new full price stores, eight new outlet stores and closed six stores, including five full price stores in the United States and one full price store in Mexico. We have plans to open 17 to 20 new retail stores in 2016. Our future expansion plan includes the opening of stores in new geographic markets as well as strengthening existing markets. New markets have in the past presented, and will continue to present, competitive and merchandising challenges that are different from those faced by us in our existing markets. There can be no assurance that we will be able to open new stores, and if opened, that such new stores will be able to achieve sales and profitability levels consistent with management's expectations. Our retail expansion is dependent on the performance of our wholesale and retail operations, generally, as well as on a number of other factors, including our ability to:

• | locate and obtain favorable store sites; |

• | negotiate favorable lease terms; |

• | hire, train and retain competent store personnel; |

• | anticipate the preferences of our retail customers in new geographic areas; |

• | successfully integrate new stores into our existing operations. |

Past comparable store sales results may not be indicative of future results and there can be no assurance that our comparable store sales results will increase or even be maintained in the future.

10

Management of Growth. The size of our business continues to grow organically and as a result of business acquisitions. In order to gain from our acquisitions, we must be effective in integrating the businesses acquired into our overall operations. Further, the expansion of our operations has increased and will continue to increase the demand on our managerial, operational and administrative resources. In recent years, we have invested significant resources in, among other things, our management information systems and hiring and training of new personnel. However, in order to manage currently anticipated levels of future demand, we may be required to, among other things, expand our distribution facilities, establish relationships with new manufacturers to produce our product, and continue to expand and improve our financial, management and operating systems. We may experience difficulty integrating acquired businesses into our operations and may not achieve anticipated synergies from such integration. There can be no assurance that we will be able to manage future growth effectively and a failure to do so could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Disruptions to Product Delivery Systems and Associated Inventory Management Issues. A majority of our products for U.S. distribution are shipped to us via ocean freight carriers to ports in California, New Jersey and Texas with the greatest reliance on California ports. The trend-focused nature of the fashion industry and the rapid changes in customer preferences leave us vulnerable to risk of inventory obsolescence. Our reliance upon ocean freight transportation for the delivery of our inventory exposes us to various inherent risks, including port workers’ union disputes and associated strikes, work slow-downs and work stoppages, severe weather conditions, natural disasters and terrorism, any of which could result in delivery delays and inefficiencies, increase our costs and disrupt our business. Any severe and prolonged disruption to ocean freight transportation could force us to use alternate and more expensive transportation systems, such as the California port workers' dispute in 2014, which caused us to re-route our merchandise by air transit. Efficient and timely inventory deliveries and proper inventory management are important factors in our operations. Inventory shortages can adversely affect the timing of shipments to customers and diminish sales and brand loyalty. Conversely, excess inventories can result in lower gross margins due to the excessive discounts and markdowns that may be necessary to reduce high inventory levels. Severe and extended delays in the delivery of our inventory or our inability to effectively manage our inventory could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Disruption of Information Technology Systems and Websites. We are heavily dependent upon our information technology systems to record and process transactions and manage and operate all aspects of our business ranging from product design and testing, production, forecasting, ordering, transportation, sales and distribution, invoicing and accounts receivable management, quick response replenishment, point of sale support and financial management reporting functions. In addition, we have e-commerce and other Internet websites. Given the nature of our business and the significant number of transactions that we engage in on an annual basis, it is essential that we maintain constant operation of our information technology systems and websites and that these systems and our websites operate effectively. We depend on our in-house information technology employees and outside vendors including “cloud” service providers to maintain and periodically update and/or upgrade these systems and our websites to support the growth of our business. Despite our preventative efforts, our information technology systems and websites may be vulnerable from time to time to damage or interruption from events such as difficulties in replacing or integrating new systems, computer viruses, security breaches and power outages. Cybersecurity attacks are becoming increasingly sophisticated and run the gamut from malicious software to electronic security breaches to corruption of data and beyond. We are continually evaluating, improving and upgrading our information technology systems and websites in an effort to address these concerns. Any such problems or interruptions could result in loss of valuable business data, our customers' or employees' personal information, disruption of our operations and other adverse impact to our business and require significant expenditures by us to remediate any such failure, problem or breach. In addition, we must comply with increasingly complex regulatory standards enacted to protect business and personal data and an inability to maintain compliance with these regulatory standards could subject us to legal risks and penalties.

We maintain $25 million of network-security insurance coverage, above a $250,000 deductible. This coverage and certain other insurance coverage may reduce our exposure to electronic data theft and sabotage.

Breach of Customer Privacy. A routine part of our business includes the gathering, processing and retention of sensitive and confidential information pertaining to our customers, employees and others. While we believe that our information security and information technology systems and websites allow for the secure storage and transmission of private information regarding our customers and others, including credit card information and personal identification information, we may not have the resources or technical sophistication to anticipate or prevent rapidly-evolving types of cyber attacks. As a result, our facilities and information technology systems, as well as those of our third party service providers, may be vulnerable to cyber attacks and breaches, acts of vandalism and software viruses. Any actual or threatened cyber attack may cause us to incur costs, including costs related to the hiring of additional computer experts, engaging third party cyber security consultants and upgrading our information security technologies. We also may be vulnerable to data and security breaches by us or by persons with whom we have commercial relationships resulting from misplaced or lost data, programming or human error, or other similar events. Any compromise or

11

breach of our information technology systems that results in the misappropriation, loss or other unauthorized disclosure of a customer's or other person’s confidential or proprietary information, whether by the Company or a third party service provider, could result in a loss of confidence and severely damage our reputation and relationship with our customers and others who entrust us with sensitive information, violate applicable privacy and other laws and adversely affect our business, as well as expose the Company to the risk of litigation and significant potential liability.

Foreign Sourcing and Manufacturing. Virtually all of our products are purchased through arrangements with a number of foreign manufacturers, primarily from China, Mexico, India, Brazil, Indonesia, Italy and Vietnam. During 2015, approximately 90% of our total purchases were from China. Risks inherent in foreign operations including work stoppages, transportation delays and interruptions, social unrest and political upheaval and changes in economic conditions, can result in the disruption of trade from the countries in which our manufacturers or suppliers are located, the imposition of additional regulations relating to imports, the imposition of additional duties, taxes and other charges on imports, significant fluctuations of the value of the dollar against foreign currencies, or restrictions on the transfer of funds, any of which could have a material adverse effect on our business, financial condition, results of operations and liquidity. While we believe that we manage our exposure to the risk that any such economic or political condition will materially affect our ability to purchase products because we are aware of the availability of a variety of materials and alternative sources, we cannot be certain that we will be able to identify such alternative materials and/or sources without delay or without greater cost to us. Our inability to identify and secure alternative sources of supply in this situation could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Impact of Custom Duties and Other Import Regulations. Virtually all of our products are imported and subject to United States custom duties. The United States and the countries in which our products are produced or sold, from time to time, impose new quotas, duties, tariffs or other restrictions on imports or exports, may adversely adjust prevailing quotas, duties or tariff levels, or impose sanctions in the form of additional duties to remedy perceived illegal actions, any of which could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Manufacturers' Inability to Produce Our Goods in a Timely Manner or Meet Quality Standards. As is common in the footwear and accessories industries, we contract with foreign manufactures who produce virtually all of our products to our specifications. We do not own or operate any manufacturing facilities; therefore, we are dependent upon third parties for the manufacture of all of our products. The inability of a manufacturer to ship orders of our products in a timely manner or to meet our quality standards could cause us to miss the delivery date requirements of our customers for those items, which, in turn, could result in cancellation of orders, refusal to accept deliveries, a reduction in purchase prices and, ultimately, termination of a customer relationship, any of which could have a material adverse effect on our business, financial condition, results of operations and liquidity.

SEC rules relating to “conflict minerals” require the Company to incur additional expenses and could adversely affect our business. The SEC has promulgated final rules mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act requiring the disclosure of the use of tantalum, tin, tungsten and gold, known as “conflict minerals,” included in products either manufactured by public companies or as to which public companies have contracted for the manufacture. These rules, adopted in an effort to prevent inadvertent support of armed conflict in the Democratic Republic of Congo and certain adjoining countries (collectively, the “DRC”), require companies to investigate their supply chains to determine whether these minerals are present in their products and, if so, from where the minerals originated. The rules also require disclosure and annual reporting as to whether or not conflict minerals, if used in the manufacture of the products offered, originated from the DRC. Compliance with these rules could adversely affect the sourcing, supply and pricing of materials used in our products. We currently require our manufacturers to comply with policies addressing legal and ethical concerns relating to labor, employment, political and social matters including restrictions on the use of conflict minerals. Violation of these policies by our manufacturers could harm our reputation, disrupt our supply chain and/or increase our cost of goods sold. Additionally, violation of any of these policies by our manufacturers could cause us to face disqualification as a supplier for our customers and suffer reputational challenges. Due to the complexity of our supply chain, compliance with the rules requires significant efforts from a cross-operational team and diverts our management and personnel and results in potential costs of additional staff. Any of the foregoing could adversely affect our sales, net earnings, business and financial condition and results of operations.

Difficulty in Locating Replacement Manufacturers. Although we enter into a number of purchase order commitments each season specifying a time frame for delivery, method of payment, design and quality specifications and other standard industry provisions, we do not have long-term contracts with any manufacturer. As a consequence, any of these manufacturing relationships may be terminated, by either party, at any time. In addition, we may seek replacement manufacturers for various reasons, including a significant increase in the prices we are required to pay to existing manufacturers of our goods. Although we believe that other facilities are available for the manufacture of our products, there can be no assurance that such facilities would be available to us

12

on an immediate basis, if at all, or be able to meet our quality standards and delivery requirements, or that the costs charged to us by such manufacturers would not be significantly greater than those presently paid.

Manufacturers' Failure to Use Acceptable Labor Practices. and Comply with Local Laws and Other Standards. Our products are manufactured by numerous independent manufacturers outside of the United States. We also have license agreements that permit our licensees to manufacture or contract to manufacture products using our trademarks. We impose, and require that our licensees impose, on these manufacturers environmental, health, and safety standards for the benefit of their labor force. In addition, we require these manufacturers to comply with applicable standards for product safety. However, we do not control our independent manufacturers or licensing partners or their labor, product safety and other business practices and, from time to time, our independent manufacturers may not comply with such standards or applicable local law or our licensees may not require their manufacturers to comply with such standards or applicable local law. The violation of such standards and laws by one of the independent manufacturers with whom we contract or by one of our licensing partners, or the divergence of a manufacturer's or a licensing partner's labor practices from those generally accepted as ethical in the United States, could harm our reputation, result in a product recall or require us to curtail our relationship with and locate a replacement for such manufacturer, which, as noted in the immediately preceding risk factor, could be challenging. Any of these events could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Seasonal and Quarterly Fluctuations. Our results of operations may fluctuate from quarter to quarter and are affected by a variety of factors, including:

• | the timing of holidays; |

• | weather conditions; |

• | the timing of larger shipments of footwear; |

• | market acceptance of our products; |

• | the mix, pricing and presentation of the products offered and sold; |

• | the hiring and training of additional personnel; |

• | inventory write downs for obsolescence; |

• | the cost of materials; |

• | the product mix between wholesale, retail and licensing businesses; |

• | the incurrence of other operating costs; and |

• | factors beyond our control, such as general economic conditions and actions of competitors. |

In addition, we expect that our sales and operating results may be significantly impacted by the opening of new retail stores and the introduction of new products. Accordingly, the results of operations in any quarter will not necessarily be indicative of the results that may be achieved for a full fiscal year or any future quarter.

Extreme or unseasonable weather conditions in locations in which we or our customers and suppliers are located could adversely affect our business. Our corporate headquarters and principal operational locations, including retail, distribution and warehousing facilities, may be subject to natural disasters and other severe weather and geological events that could disrupt our operations. The occurrence of such natural events may result in sudden disruptions in business conditions of the local economies affected, as well as of the regional and global economies, and may result in decreased demand for our products and disruptions in our management functions, sales channels and manufacturing and distribution networks, which could have a material adverse effect on our business, financial condition and results of operations. Extreme weather events and changes in weather patterns can also influence customer trends and shopping habits. Extended periods of unseasonably warm temperatures during the winter season or cool weather during the summer season may diminish demand for our seasonal merchandise. Heavy snowfall, hurricanes or other severe weather events in the areas in which our retail stores and the retail stores of our wholesale customers are located may decrease customer traffic in those stores and reduce our sales and profitability. If severe weather events force closure of or disrupt operations at the distribution centers we use for our merchandise, we could incur higher costs and experience longer lead times to distribute our products to our retail stores, wholesale customers or e-commerce customers. If prolonged, such extreme or unseasonable weather conditions could adversely affect our business, financial condition and results of operations.

Inadequate Trademark Protections. We believe that our trademarks and other proprietary rights are of major significance to our success and our competitive position and consider some of our trademarks, such as Steve Madden, to be integral to our business and among our most valuable assets. Accordingly, we devote substantial resources to the establishment and protection of our trademarks on a worldwide basis. Nevertheless, there can be no assurance that the actions taken by us to establish and protect our trademarks and other proprietary rights will be adequate to prevent imitation of our products by others or to prevent others from seeking to block sales of our products on the basis that our products violate the trademarks and proprietary rights of others. Moreover, no assurance can be given that others will not assert rights in, or ownership of, trademarks and other proprietary

13

rights of ours or that we will be able to successfully resolve such conflicts. In addition, the laws of certain foreign countries may not protect proprietary rights to the same extent as do the laws of the United States. Our failure to establish and then protect such proprietary rights from unlawful and improper utilization could have a material adverse effect on our business, financial condition, results of operations and liquidity.

Litigation and Other Legal Proceedings. We are involved in various claims, litigations and other legal and regulatory proceedings and governmental investigations that arise from time to time in the ordinary course of our business. Due to the inherent uncertainties of litigation and such other proceedings and investigations, we cannot predict with accuracy the ultimate outcome of any such matters. An unfavorable outcome could have an adverse impact on our business, financial condition and results of operations and the amount of insurance coverage we maintain to address such matters may be inadequate to cover these or other claims. In addition, any significant litigation, investigation or proceeding, regardless of its merits, could divert financial and management resources that would otherwise be used to benefit our operations. See Item 3 “Legal Proceedings,” below for additional information regarding certain of the matters in which we are involved.

Declines in Our Stock Price Due to Inaccurate Predictions. The trading price of our common stock periodically may rise or fall based on the accuracy of predictions of our future performance. As one of our primary objectives, we strive to maximize the long-term strength, growth and profitability of our Company, rather than to achieve an earnings target in any particular fiscal quarter. We believe that this longer-term goal is in the best interests of the Company and our stockholders, but recognize that it may be helpful to our stockholders and potential investors for us to provide guidance as to our quarterly and annual forecast of net sales and earnings. While we endeavor to provide meaningful and considered guidance at the time it is provided and generally expect to provide updates to our guidance when we report our results each fiscal quarter, actual results may differ from our predictions as the guidance is based on assumptions and expectations that may or may not come to pass and, as such, we assume no responsibility to update any of our forward-looking statements at such times or otherwise. If and when we announce actual results that differ from those that have been predicted by us, the market price of our common stock could be adversely affected. Investors who rely on these predictions in making investment decisions with respect to our common stock do so at their own risk. We take no responsibility for any losses suffered as a result of such changes in the price of our common stock.

In addition, at any given time outside securities analysts may follow our financial results and issue reports that discuss our historical financial results and the analysts' predictions of our future performance, which our stockholders and potential investors may choose to rely on in making investment decisions. These analysts' predictions are based upon their own opinions and are often different from our own forecasts. Our stock price could decline if our results are below the estimates or expectations of these outside analysts.

Exposure to Foreign Currency Fluctuations. We make all of our purchases in U.S. dollars. However, we source substantially all of our products overseas and, as such, the cost of these products may be affected by changes in the value of the relevant currencies. Changes in currency exchange rates may also affect the relative prices at which we and our foreign competitors sell products in the same market. There can be no assurance that foreign currency fluctuations will not have a material adverse effect on our business, financial condition, results of operations and liquidity.

ITEM 1B UNRESOLVED STAFF COMMENTS

None.

ITEM 2 PROPERTIES

We lease space for our headquarters, our retail stores, showrooms and office facilities in various locations in the United States, as well as overseas. We own one improved real property parcel in Long Island City, New York. We believe that our existing facilities are in good operating condition and are adequate for our present level of operations. The following table sets forth information with respect to our key properties:

14

Location | Leased/Owned | Primary Use | Approximate Area Square Feet | |

Dongguan, Guangdong Province, China | Leased | Offices and sample production | 180,000 | |

Long Island City, NY | Leased | Executive offices | 90,000 | |

Bayonne, NJ | Leased | Warehouse | 80,000 | |

Bellevue, WA | Leased | Offices, Topline | 41,500 | |

Montreal, Canada | Leased | Offices, warehouse | 35,000 | |

New York, NY | Leased | Offices and showroom, Accessories | 30,000 | |

New York, NY | Leased | Showroom | 14,000 | |

Putian City, Guangdong Province, China | Leased | Offices | 13,800 | |

New York, NY | Leased | Offices, Cejon | 12,400 | |

Seattle, Washington | Leased | Offices and showroom, Dolce Vita | 10,537 | |

Long Island City, NY | Leased | Storage | 7,200 | |

Los Angeles, CA | Leased | Showroom, Steven | 4,600 | |

Guangdong Province, China | Leased | Offices | 4,500 | |

Kwai Chung, Hong Kong | Leased | Offices | 3,800 | |

Mexico City, Mexico | Leased | Offices, SM Mexico | 3,520 | |

Long Island City, NY | Owned | Other | 2,200 | |

New York, NY | Leased | Apartments | 1,800 | |

Los Angeles, CA | Leased | Showroom, Accessories | 1,400 | |

New York, NY | Leased | Office | 850 | |

Dallas, Texas | Leased | Showroom | 800 | |

All of our retail stores are leased pursuant to leases that, under their original terms, extend for an average of ten years. Many of the leases contain rent escalation clauses to compensate for increases in operating costs and real estate taxes over the base year. The current terms of our retail store leases expire as follows: