|

Selected Financial Data

|

2

|

|

|

|

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

3-25

|

|

|

|

|

Management's Annual Report on Internal Control Over Financial Reporting

|

26

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

27

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

28

|

|

|

|

|

Consolidated Balance Sheets as of December 28, 2013 and December 29, 2012

|

29-30

|

|

|

|

|

Consolidated Statements of Earnings and Comprehensive Income for the Years Ended December 28, 2013, December 29, 2012, and December 31, 2011

|

31

|

|

|

|

|

Consolidated Statements of Shareholders' Equity for the Years Ended December 28, 2013, December 29, 2012, and December 31, 2011

|

32-34

|

|

|

|

|

Consolidated Statements of Cash Flows for the Years Ended December 28, 2013, December 29, 2012, and December 31, 2011

|

35-36

|

|

|

|

|

Notes to Consolidated Financial Statements

|

37-60

|

|

|

|

|

Price Range of Common Stock and Dividends

|

61

|

|

|

|

|

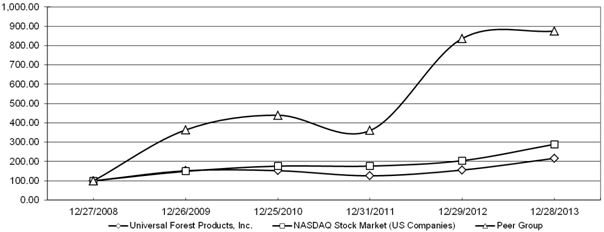

Stock Performance Graph

|

62

|

|

|

|

|

Directors and Executive Officers

|

63

|

|

|

|

|

Shareholder Information

|

64-65

|

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

|||||||||||||||

|

Consolidated Statement of Earnings Data

|

||||||||||||||||||||

|

Net sales

|

$

|

2,470,448

|

$

|

2,054,933

|

$

|

1,822,336

|

$

|

1,890,851

|

$

|

1,673,000

|

||||||||||

|

Gross profit

|

280,552

|

225,109

|

199,727

|

229,955

|

243,664

|

|||||||||||||||

|

Earnings before income taxes

|

70,258

|

41,064

|

8,787

|

27,111

|

38,583

|

|||||||||||||||

|

Net earnings attributable to controlling interest

|

43,082

|

23,934

|

4,549

|

17,411

|

24,272

|

|||||||||||||||

|

Diluted earnings per share

|

$

|

2.15

|

$

|

1.21

|

$

|

0.23

|

$

|

0.89

|

$

|

1.25

|

||||||||||

|

Dividends per share

|

$

|

0.410

|

$

|

0.400

|

$

|

0.400

|

$

|

0.400

|

$

|

0.260

|

||||||||||

|

|

||||||||||||||||||||

|

Consolidated Balance Sheet Data

|

||||||||||||||||||||

|

Working capital(1)

|

$

|

357,299

|

$

|

338,389

|

$

|

225,399

|

$

|

263,578

|

$

|

248,165

|

||||||||||

|

Total assets

|

916,987

|

860,540

|

764,007

|

789,396

|

776,868

|

|||||||||||||||

|

Total debt and capital lease obligations

|

84,700

|

95,790

|

52,470

|

55,291

|

53,854

|

|||||||||||||||

|

Shareholders' equity

|

649,734

|

607,525

|

582,599

|

581,176

|

568,946

|

|||||||||||||||

|

|

||||||||||||||||||||

|

Statistics

|

||||||||||||||||||||

|

Gross profit as a percentage of

|

||||||||||||||||||||

|

net sales

|

11.4

|

%

|

11.0

|

%

|

11.0

|

%

|

12.2

|

%

|

14.6

|

%

|

||||||||||

|

Net earnings attributable to controlling interest as a percentage of net sales

|

1.7

|

%

|

1.2

|

%

|

0.2

|

%

|

0.9

|

%

|

1.5

|

%

|

||||||||||

|

Return on beginning equity(2)

|

7.1

|

%

|

4.1

|

%

|

0.8

|

%

|

3.1

|

%

|

4.4

|

%

|

||||||||||

|

Current ratio

|

3.59

|

3.95

|

2.70

|

3.21

|

3.06

|

|||||||||||||||

|

Debt to equity ratio

|

0.13

|

0.16

|

0.09

|

0.10

|

0.09

|

|||||||||||||||

|

Book value per common share(3)

|

$

|

32.57

|

$

|

30.68

|

$

|

29.69

|

$

|

30.06

|

$

|

29.50

|

||||||||||

| (1) | Current assets less current liabilities. |

| (2) | Net earnings attributable to controlling interest divided by beginning shareholders’ equity. |

| (3) | Shareholders’ equity divided by common stock outstanding. |

|

·

|

Our sales increased 20% in 2013 due to a 12% increase in our selling prices due to the Lumber Market and an 8% increase in unit sales. See “Historical Lumber Prices”. Our unit sales increased in all five of our markets classifications, with our strongest growth occurring in our housing and construction markets (commercial construction and concrete forming, residential construction, and manufactured housing). Our unit sales to the retail building materials market reported an increase of approximately 1% and our industrial market increased by 8%, in part, due to recent acquisitions. |

| · | National housing starts increased approximately 21% in the period of December 2012 through November 2013 (our sales trail housing starts by about a month) compared to the same period of 2012, while our unit sales increased 12% in the residential construction market. Since the downturn in housing began, suppliers servicing this market were challenged with significant excess capacity. We have maintained our focus on profitability and cash flow by being selective in the business that we take. Consequently, our revenue growth may trail market growth from time to time. |

| · | Shipments of HUD code manufactured homes were up 9% in the period from January through November 2013, compared to the same period of 2012. In addition, through the first nine months of 2013 (the last period reported), modular home starts increased by 5%. These increases helped drive our 11% increase in unit sales to this market. |

| · | Our gross profit dollars increased by 25% comparing 2013 to 2012, which compares to our 8% increase in unit sales. Our profitability has improved primarily due to a combination of higher unit sales and improved operating leverage we have in the cost structure of our business and improvements in our sales mix whereby our sales of higher margin products have increased. In addition, pricing pressure on sales to the residential construction market has eased. These factors were offset by the higher level of lumber prices in 2013 relative to 2012. |

| · | We recorded loss contingencies of $1.6 million in 2013 and $2.3 million in 2012 related to anti-dumping duty assessments estimated on plywood and steel nails imported from China and Canadian anti-dumping duties. The Canadian government has imposed retroactive assessments for antidumping and countervailing duties tied to certain extruded aluminum products imported from China. We continue to work with the applicable government agencies to clarify the applicability of these rules to our products. |

| · | Higher unit sales and lumber prices have resulted in a year over year increase in our working capital. |

|

|

Random Lengths Composite

|

|||||||||||

|

|

Average $/MBF

|

|||||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

January

|

$

|

393

|

$

|

281

|

$

|

301

|

||||||

|

February

|

409

|

286

|

296

|

|||||||||

|

March

|

436

|

300

|

294

|

|||||||||

|

April

|

429

|

308

|

275

|

|||||||||

|

May

|

367

|

342

|

259

|

|||||||||

|

June

|

329

|

330

|

262

|

|||||||||

|

July

|

343

|

323

|

269

|

|||||||||

|

August

|

353

|

340

|

265

|

|||||||||

|

September

|

368

|

332

|

262

|

|||||||||

|

October

|

384

|

324

|

261

|

|||||||||

|

November

|

398

|

354

|

257

|

|||||||||

|

December

|

385

|

370

|

267

|

|||||||||

|

Annual average

|

$

|

383

|

$

|

324

|

$

|

272

|

||||||

|

Annual percentage change

|

18.2

|

%

|

19.1

|

%

|

||||||||

|

|

Random Lengths SYP

|

|||||||||||

|

|

Average $/MBF

|

|||||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

January

|

$

|

397

|

$

|

269

|

$

|

282

|

||||||

|

February

|

426

|

278

|

289

|

|||||||||

|

March

|

445

|

300

|

290

|

|||||||||

|

April

|

436

|

314

|

266

|

|||||||||

|

May

|

383

|

341

|

254

|

|||||||||

|

June

|

355

|

314

|

246

|

|||||||||

|

July

|

366

|

300

|

253

|

|||||||||

|

August

|

364

|

315

|

263

|

|||||||||

|

September

|

360

|

319

|

239

|

|||||||||

|

October

|

356

|

313

|

244

|

|||||||||

|

November

|

362

|

350

|

248

|

|||||||||

|

December

|

360

|

362

|

256

|

|||||||||

|

Annual average

|

$

|

384

|

$

|

315

|

$

|

261

|

||||||

|

Annual percentage change

|

21.9

|

%

|

20.7

|

%

|

||||||||

| Ÿ | Products with fixed selling prices. These products include value-added products such as decking and fencing sold to retail building materials customers, as well as trusses, wall panels and other components sold to the residential construction market, and most industrial packaging products. Prices for these products are generally fixed at the time of the sales quotation for a specified period of time or are based upon a specific quantity. In order to maintain margins and reduce any exposure to adverse trends in the price of component lumber products, we attempt to lock in costs with our suppliers for these sales commitments. Also, the time period and quantity limitations generally allow us to re-price our products for changes in lumber costs from our suppliers. |

| Ÿ | Products with selling prices indexed to the reported Lumber Market with a fixed dollar "adder" to cover conversion costs and profits. These products primarily include treated lumber, remanufactured lumber, and trusses sold to the manufactured housing industry. For these products, we estimate the customers' needs and we carry anticipated levels of inventory. Because lumber costs are incurred in advance of final sale prices, subsequent increases or decreases in the market price of lumber impact our gross margins. For these products, our margins are exposed to changes in the trend of lumber prices. As a result of the decline in the housing market and our sales to residential and commercial builders, a greater percentage of our sales fall into this general pricing category. Consequently, we believe our profitability may be impacted to a much greater extent to changes in the trend of lumber prices. |

| Ÿ | Products with significant inventory levels with low turnover rates, whose selling prices are indexed to the Lumber Market. In other words, the longer the period of time these products remain in inventory, the greater the exposure to changes in the price of lumber. This would include treated lumber, which comprises approximately 15% of our total sales. This exposure is less significant with remanufactured lumber, trusses sold to the manufactured housing market, and other similar products, due to the higher rate of inventory turnover. We attempt to mitigate the risk associated with treated lumber through vendor consignment inventory programs. (Please refer to the “Risk Factors” section of our annual report on form 10-K, filed with the United States Securities and Exchange Commission.) |

| Ÿ | Products with fixed selling prices sold under long-term supply arrangements, particularly those involving multi-family construction projects. We attempt to mitigate this risk through our purchasing practices by locking in costs. |

|

|

Period 1

|

Period 2

|

||||||

|

Lumber cost

|

$

|

300

|

$

|

400

|

||||

|

Conversion cost

|

50

|

50

|

||||||

|

= Product cost

|

350

|

450

|

||||||

|

Adder

|

50

|

50

|

||||||

|

= Sell price

|

$

|

400

|

$

|

500

|

||||

|

Gross margin

|

12.5

|

%

|

10.0

|

%

|

||||

|

|

Years Ended

|

|||||||||||

|

|

December 28, 2013

|

December 29, 2012

|

December 31, 2011

|

|||||||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||||||

|

Cost of goods sold

|

88.6

|

89.0

|

89.0

|

|||||||||

|

Gross profit

|

11.4

|

11.0

|

11.0

|

|||||||||

|

Selling, general, and administrative expenses

|

8.3

|

9.0

|

10.0

|

|||||||||

|

Loss contingency for anti-dumping duty assessments

|

0.1

|

0.1

|

-

|

|||||||||

|

Net loss (gain) on disposition of assets and other impairment and exit charges

|

-

|

(0.3

|

)

|

0.3

|

||||||||

|

Earnings from operations

|

3.0

|

2.2

|

0.7

|

|||||||||

|

Other expense, net

|

0.2

|

0.2

|

0.2

|

|||||||||

|

Earnings before income taxes

|

2.8

|

2.0

|

0.5

|

|||||||||

|

Income taxes

|

1.0

|

0.7

|

0.2

|

|||||||||

|

Net earnings

|

1.9

|

1.3

|

0.3

|

|||||||||

|

Less net earnings attributable to noncontrolling interest

|

(0.1

|

)

|

(0.1

|

)

|

(0.1

|

)

|

||||||

|

Net earnings attributable to controlling interest

|

1.7

|

%

|

1.2

|

%

|

0.2

|

%

|

||||||

| Ÿ | Diversifying our end market sales mix by increasing sales of specialty wood packaging to industrial users, increasing our penetration of the concrete forming market, increasing our sales of engineered wood components for custom home, multi-family, military and light commercial construction, and increasing our market share with independent retailers. |

| Ÿ | Expanding geographically in our core businesses, domestically and internationally. |

| Ÿ | Increasing sales of "value-added" products, which primarily consist of fencing, decking, lattice, and other specialty products sold to the retail building materials market, specialty wood packaging, engineered wood components, and "wood alternative" products. Engineered wood components include roof trusses, wall panels, and floor systems. Wood alternative products consist primarily of composite wood and plastics. Although we consider the treatment of dimensional lumber with certain chemical preservatives a value-added process, treated lumber is not presently included in the value-added sales totals. |

| Ÿ | Developing new products and expanding our product offering for existing customers. New product sales were $85 million in 2013 and $53 million in 2012. |

| Ÿ | Maximizing unit sales growth while achieving return on investment goals. |

|

|

Years Ended

|

|||||||||||||||||||

|

Market Classification

|

December 28,

2013

|

%

Change

|

December 29,

2012

|

%

Change

|

December 31,

2011

|

|||||||||||||||

|

Retail Building Materials

|

$

|

936,590

|

11.9

|

$

|

836,670

|

(0.3

|

) |

$

|

838,903

|

|||||||||||

|

Industrial

|

701,688

|

19.0

|

589,893

|

19.8

|

492,476

|

|||||||||||||||

|

|

||||||||||||||||||||

|

Manufactured Housing

|

388,697

|

23.8

|

314,095

|

28.4

|

244,663

|

|||||||||||||||

|

Residential Construction

|

340,296

|

33.2

|

255,544

|

25.9

|

202,970

|

|||||||||||||||

|

Commercial Construction and Concrete Forming

|

136,641

|

52.2

|

89,803

|

14.5

|

78,402

|

|||||||||||||||

|

Housing and Construction

|

865,634

|

659,442

|

526,035

|

|||||||||||||||||

|

Total Gross Sales

|

2,503,912

|

20.0

|

2,086,005

|

12.3

|

1,857,414

|

|||||||||||||||

|

Sales Allowances

|

(33,464

|

)

|

(31,072

|

)

|

(35,078

|

)

|

||||||||||||||

|

Total Net Sales

|

$

|

2,470,448

|

20.2

|

$

|

2,054,933

|

12.8

|

$

|

1,822,336

|

||||||||||||

|

% Change

|

||||||||||||

|

in Sales

|

in Selling Prices

|

in Units

|

||||||||||

|

2013 versus 2012

|

20

|

%

|

12

|

%

|

8

|

%

|

||||||

|

2012 versus 2011

|

12

|

%

|

8

|

%

|

4

|

%

|

||||||

|

2011 versus 2010

|

-3

|

%

|

-5

|

%

|

2

|

%

|

||||||

|

Value-Added

|

Commodity-Based

|

|||||||

|

2013

|

58.1

|

%

|

41.9

|

%

|

||||

|

2012

|

58.7

|

%

|

41.3

|

%

|

||||

|

2011

|

58.8

|

%

|

41.2

|

%

|

||||

| Ÿ | During the first half of 2012 we benefited from selling into a rising lumber market for much of the period. Conversely, during the first half of 2011 we were adversely impacted by selling into a falling market for most of that period. |

| Ÿ | In the first quarter of 2012 we experienced more favorable weather than we did in the first quarter of 2011, which was impacted by inclement weather in many areas of the country resulting in many lost production days. |

| Ÿ | We lost some market share with a major retail customer in 2012, primarily in product lines with lower gross margins. |

| Ÿ | The favorable factors above were offset to some extent by pricing pressure in each of our markets. |

| · | Current and projected earnings, cash flow and return on investment |

| · | Current and projected market demand |

| · | Market share |

| · | Competitive factors |

| · | Future growth opportunities |

| · | Personnel and management |

|

(in thousands)

|

Net Sales

|

|||||||||||||||||||

|

|

December 28,

2013

|

December 29,

2012

|

December 31,

2011

|

2013 vs

2012

|

2012 vs

2011

|

|||||||||||||||

|

Eastern and Western

|

$

|

1,987,751

|

$

|

1,635,178

|

$

|

1,486,058

|

21.6

|

%

|

10.0

|

%

|

||||||||||

|

Site-Built

|

272,114

|

222,824

|

183,120

|

22.1

|

21.7

|

|||||||||||||||

|

All Other

|

210,583

|

196,931

|

153,158

|

6.9

|

28.6

|

|||||||||||||||

|

Corporate

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||

|

Total

|

$

|

2,470,448

|

$

|

2,054,933

|

$

|

1,822,336

|

20.2

|

%

|

12.8

|

%

|

||||||||||

|

(in thousands)

|

Earnings from Operations

|

|||||||||||||||||||

|

|

December 28,

2013

|

December 29,

2012

|

December 31,

2011

|

2013 vs

2012

|

2012 vs

2011

|

|||||||||||||||

|

Eastern and Western

|

$

|

79,419

|

$

|

60,573

|

$

|

28,198

|

31.1

|

%

|

114.8

|

%

|

||||||||||

|

Site-Built

|

7,947

|

1,299

|

(6,349

|

)

|

511.8

|

120.5

|

||||||||||||||

|

All Other

|

(2,366

|

)

|

(11,316

|

)

|

(8,731

|

)

|

79.1

|

(29.6

|

)

|

|||||||||||

|

Corporate1

|

(10,732

|

)

|

(6,028

|

)

|

(1,107

|

)

|

(78.0

|

)

|

(444.5

|

)

|

||||||||||

|

Total

|

$

|

74,268

|

$

|

44,528

|

$

|

12,011

|

66.8

|

%

|

270.7

|

%

|

||||||||||

| · | An increase in commercial construction and concrete forming sales primarily due to new products introduced in our Gulf region and other market share gains. |

| · | An increase in manufactured housing sales due to an increase in industry production of HUD code homes. |

| · | Recently acquired businesses that serve the industrial market. |

| · | A slight increase in sales to retail customers due to market share gains. |

| · | A 19% increase in Industrial sales resulting from higher lumber prices and greater unit sales due to market share gains. |

| · | A 28% increase in Manufactured Housing sales due to higher lumber prices and an increase in industry production of HUD code homes. |

| · | A 15% increase in Commercial Construction and Concrete Forming sales primarily due to a significant increase in the sale of products used to make concrete forms. |

| · | Selling into a rising lumber market for much of the first half of 2012. Conversely, during the first half of 2011 we were adversely impacted by selling into a falling market for most of that period. |

| · | In the first quarter of 2012 we experienced more favorable weather than we did in the first quarter of 2011. Adverse weather conditions in many areas of the country resulted in lost production days during early 2011. |

| · | Earnings from operations were impacted in 2012 by a $6.9 million net gain on the sale of real estate. |

| · | An increase in sales to the manufactured housing market by our UFP Distribution operations, primarily due to an increase in industry production of HUD code homes and market share gains from adding new product lines. |

| · | An increase in sales to the industrial market by our Pinelli Universal partnership, which manufactures moulding and millwork products out of its plant in Durango, Durango Mexico. |

| · | An increase in sales by our Universal Consumer Products operations due to market share gains. |

| · | An increase in sales to the Manufactured Housing market by our UFP Distribution operations, primarily due to an increase in industry production of HUD code homes. |

| · | An increase in sales to the Retail Building Materials market by our Universal Consumer Products operations, due to market share gains in composite decking and vinyl fencing products. |

| · | An increase in sales to the Industrial market by our Universal Pinelli subsidiary, which manufactures molding and millwork products out of its plant in Durango, Mexico. |

|

|

Payments Due by Period

|

|||||||||||||||||||

|

Contractual Obligation

|

Less than

1 Year

|

1 – 3

Years

|

3 – 5

Years

|

After

5 Years

|

Total

|

|||||||||||||||

|

Long-term debt and capital lease obligations

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

84,700

|

$

|

84,700

|

||||||||||

|

Estimated interest on long-term debt

|

2,979

|

5,957

|

5,957

|

15,126

|

30,019

|

|||||||||||||||

|

Operating leases

|

4,235

|

4,475

|

1,448

|

-

|

10,158

|

|||||||||||||||

|

Capital project purchase obligations

|

4,152

|

-

|

-

|

-

|

4,152

|

|||||||||||||||

|

Total

|

$

|

11,366

|

$

|

10,432

|

$

|

7,405

|

$

|

99,826

|

$

|

129,029

|

||||||||||

|

|

December 28,

2013

|

December 29,

2012

|

December 31,

2011

|

|||||||||

|

Cash from operating activities

|

$

|

53,380

|

$

|

(5,721

|

)

|

$

|

11,515

|

|||||

|

Cash from investing activities

|

(43,625

|

)

|

(34,223

|

)

|

(32,990

|

)

|

||||||

|

Cash from financing activities

|

(18,419

|

)

|

36,695

|

(10,314

|

)

|

|||||||

|

Effect of exchange rate changes on cash

|

(62

|

)

|

244

|

(259

|

)

|

|||||||

|

Net change in cash and cash equivalents

|

(8,726

|

)

|

(3,005

|

)

|

(32,048

|

)

|

||||||

|

Cash and cash equivalents, beginning of year

|

7,647

|

10,652

|

42,700

|

|||||||||

|

Cash and cash equivalents (overdraft), end of year

|

$

|

(1,079

|

)

|

$

|

7,647

|

$

|

10,652

|

|||||

| Ÿ | General liability, automobile, and workers' compensation reserves are accrued based on third party actuarial valuations of the expected future liabilities. |

| Ÿ | Health benefits are self-insured by us up to our pre-determined stop loss limits. These reserves, including incurred but not reported claims, are based on internal computations. These computations consider our historical claims experience, independent statistics, and trends. |

| Ÿ | The environmental reserve is based on known remediation activities at certain wood preservation facilities and the potential for undetected environmental matters at other sites. The reserve for known activities is based on expected future costs and is computed by in-house experts responsible for managing our monitoring and remediation activities. |

| · | Achieve sales growth primarily through new product introduction, international business expansion, and gaining additional share, particularly of our industrial and concrete forming markets; |

| · | Increase our profitability through cost reductions, productivity improvements as volume improves, and a more favorable mix of higher margin value-added products; and |

| · | Earn a return on invested capital in excess of our weighted average cost of capital. |

| · | Increasing our market share of value-added and preservative-treated products, particularly with independent retail customers. |

| · | Developing new value-added products, such as our Eovations product line, and services for this market. |

| · | Adding new products or new markets through strategic business acquisitions or alliances. |

| · | Increasing our emphasis on product innovation and product differentiation in order to counter commoditization trends and influences. |

| · | End market demand. |

| · | Our ability to maintain market share and gross margins on products sold to our largest customers. We believe our level of service, geographic diversity, and quality of products provides an added value to our customers. However, if our customers are unwilling to pay for these advantages, our sales and gross margins may be reduced. Excess capacity exists for suppliers in each of our five markets. As a result, we may experience pricing pressure in the future. |

| · | Product mix. |

| · | Fluctuations in the relative level of the Lumber Market and the trend in the market place of lumber. (See "Impact of the Lumber Market on our Operating Results.") |

| · | Fuel and transportation costs. |

| · | Our ability to continue to achieve productivity improvements as our unit sales increase and planned cost reductions through our continuous improvement and other initiatives. |

| · | Operational improvements in our turn-key framing business. |

| · | Our growth in sales to the industrial market and, as industry conditions continue to improve, the residential construction market. Our sales to these markets require a higher ratio of SG&A costs due, in part, to product design requirements. |

| · | Sales of new products which may require higher development, marketing, and advertising costs. |

| · | Our incentive compensation program which is tied to pre-bonus earnings from operations and return on investment. |

| · | Our growth and success in achieving continuous improvement objectives and leveraging our fixed costs. |

|

Universal Forest Products, Inc.

|

|

February 26, 2014

|

|

/s/ Ernst & Young LLP

|

|

|

|

Grand Rapids, Michigan

|

|

February 26, 2014

|

|

/s/ Ernst & Young LLP

|

|

|

|

Grand Rapids, Michigan

|

|

February 26, 2014

|

|

|

December 28,

|

December 29,

|

||||||

|

|

2013

|

2012

|

||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash and cash equivalents

|

$

|

-

|

$

|

7,647

|

||||

|

Restricted cash

|

720

|

6,831

|

||||||

|

Accounts receivable, net

|

180,452

|

163,225

|

||||||

|

Inventories:

|

||||||||

|

Raw materials

|

161,226

|

136,201

|

||||||

|

Finished goods

|

126,079

|

106,979

|

||||||

|

Total inventories

|

287,305

|

243,180

|

||||||

|

Refundable income taxes

|

2,235

|

7,521

|

||||||

|

Deferred income taxes

|

6,866

|

9,212

|

||||||

|

Other current assets

|

18,820

|

15,557

|

||||||

|

TOTAL CURRENT ASSETS

|

496,398

|

453,173

|

||||||

|

|

||||||||

|

DEFERRED INCOME TAXES

|

1,365

|

1,759

|

||||||

|

OTHER ASSETS

|

12,087

|

14,583

|

||||||

|

GOODWILL

|

160,146

|

159,316

|

||||||

|

INDEFINITE-LIVED INTANGIBLE ASSETS

|

2,340

|

2,340

|

||||||

|

OTHER INTANGIBLE ASSETS, NET

|

7,241

|

8,101

|

||||||

|

PROPERTY, PLANT AND EQUIPMENT:

|

||||||||

|

Land and improvements

|

115,155

|

108,545

|

||||||

|

Building and improvements

|

173,641

|

165,307

|

||||||

|

Machinery and equipment

|

260,807

|

239,175

|

||||||

|

Furniture and fixtures

|

23,233

|

23,750

|

||||||

|

Construction in progress

|

5,866

|

6,818

|

||||||

|

PROPERTY, PLANT AND EQUIPMENT, GROSS

|

578,702

|

543,595

|

||||||

|

Less accumulated depreciation and amortization

|

(341,292

|

)

|

(322,327

|

)

|

||||

|

PROPERTY, PLANT AND EQUIPMENT, NET

|

237,410

|

221,268

|

||||||

|

TOTAL ASSETS

|

$

|

916,987

|

$

|

860,540

|

||||

|

December 28,

|

December 29,

|

|||||||

|

2013

|

2012

|

|||||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Cash overdraft

|

$ |

1,079

|

$ |

-

|

||||

|

Accounts payable

|

72,918

|

66,054

|

||||||

|

Accrued liabilities:

|

||||||||

|

Compensation and benefits

|

45,018

|

34,728

|

||||||

|

Other

|

20,084

|

14,002

|

||||||

|

TOTAL CURRENT LIABILITIES

|

139,099

|

114,784

|

||||||

|

|

||||||||

|

LONG-TERM DEBT

|

84,700

|

95,790

|

||||||

|

DEFERRED INCOME TAXES

|

26,788

|

24,930

|

||||||

|

OTHER LIABILITIES

|

16,666

|

17,511

|

||||||

|

TOTAL LIABILITIES

|

267,253

|

253,015

|

||||||

|

|

||||||||

|

SHAREHOLDERS' EQUITY:

|

||||||||

|

Controlling interest shareholders' equity:

|

||||||||

|

Preferred stock, no par value; shares authorized 1,000,000; issued and outstanding, none

|

$ | - | $ | - | ||||

|

Common stock, no par value; shares authorized 40,000,000; issued and outstanding, 19,948,270 and 19,799,606

|

|

19,948

|

|

19,800

|

||||

|

Additional paid-in capital

|

156,129

|

149,805

|

||||||

|

Retained earnings

|

461,812

|

426,887

|

||||||

|

Accumulated other comprehensive earnings

|

3,466

|

4,258

|

||||||

|

Employee stock notes receivable

|

(732

|

)

|

(982

|

)

|

||||

|

Total controlling interest shareholders' equity

|

640,623

|

599,768

|

||||||

|

Noncontrolling interest

|

9,111

|

7,757

|

||||||

|

TOTAL SHAREHOLDERS' EQUITY

|

649,734

|

607,525

|

||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$

|

916,987

|

$

|

860,540

|

||||

|

|

Year Ended

|

|||||||||||

|

|

December 28,

|

December 29,

|

December 31,

|

|||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

|

||||||||||||

|

NET SALES

|

$

|

2,470,448

|

$

|

2,054,933

|

$

|

1,822,336

|

||||||

|

|

||||||||||||

|

COST OF GOODS SOLD

|

2,189,896

|

1,829,824

|

1,622,609

|

|||||||||

|

|

||||||||||||

|

GROSS PROFIT

|

280,552

|

225,109

|

199,727

|

|||||||||

|

|

||||||||||||

|

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

|

204,390

|

184,919

|

181,363

|

|||||||||

|

ANTI-DUMPING DUTY ASSESSMENTS

|

1,526

|

2,328

|

-

|

|||||||||

|

NET LOSS (GAIN) ON DISPOSITION OF ASSETS, EARLY RETIREMENT AND OTHER IMPAIRMENT AND EXIT CHARGES

|

368

|

(6,666

|

)

|

6,353

|

||||||||

|

|

||||||||||||

|

EARNINGS FROM OPERATIONS

|

74,268

|

44,528

|

12,011

|

|||||||||

|

|

||||||||||||

|

INTEREST EXPENSE

|

4,851

|

4,053

|

3,732

|

|||||||||

|

INTEREST INCOME

|

(640

|

)

|

(510

|

)

|

(566

|

)

|

||||||

|

EQUITY IN EARNINGS OF INVESTEE

|

(201

|

)

|

(79

|

)

|

58

|

|||||||

|

|

4,010

|

3,464

|

3,224

|

|||||||||

|

|

||||||||||||

|

EARNINGS BEFORE INCOME TAXES

|

70,258

|

41,064

|

8,787

|

|||||||||

|

|

||||||||||||

|

INCOME TAXES

|

24,454

|

15,054

|

2,874

|

|||||||||

|

|

||||||||||||

|

NET EARNINGS

|

45,804

|

26,010

|

5,913

|

|||||||||

|

|

||||||||||||

|

LESS NET EARNINGS ATTRIBUTABLE TO NONCONTROLLING INTEREST

|

(2,722

|

)

|

(2,076

|

)

|

(1,364

|

)

|

||||||

|

|

||||||||||||

|

NET EARNINGS ATTRIBUTABLE TO CONTROLLING INTEREST

|

$

|

43,082

|

$

|

23,934

|

$

|

4,549

|

||||||

|

|

||||||||||||

|

EARNINGS PER SHARE - BASIC

|

$

|

2.16

|

$

|

1.21

|

$

|

0.23

|

||||||

|

|

||||||||||||

|

EARNINGS PER SHARE - DILUTED

|

$

|

2.15

|

$

|

1.21

|

$

|

0.23

|

||||||

|

|

||||||||||||

|

OTHER COMPRESHENSIVE INCOME:

|

||||||||||||

|

|

||||||||||||

|

FOREIGN CURRENCY TRANSLATION ADJUSTMENTS

|

(784

|

)

|

980

|

(1,067

|

)

|

|||||||

|

|

||||||||||||

|

COMPREHENSIVE INCOME

|

45,020

|

26,990

|

4,846

|

|||||||||

|

|

||||||||||||

|

LESS COMPREHENSIVE INCOME ATTRIBUTABLE TO NONCONTROLLING INTEREST

|

(2,730

|

)

|

(2,398

|

)

|

(862

|

)

|

||||||

|

|

||||||||||||

|

COMPREHENSIVE INCOME ATTRIBUTABLE TO CONTROLLING INTERST

|

$

|

42,290

|

$

|

24,592

|

$

|

3,984

|

||||||

|

|

Controlling Interest Shareholders' Equity

|

|||||||||||||||||||||||||||

|

|

Common Stock

|

Additional Paid-In Capital

|

Retained Earnings

|

Accumulated Other Comprehensive Earnings

|

Employees Stock Notes Receivable

|

Noncontrolling Interest

|

Total

|

|||||||||||||||||||||

|

Balance at December 25, 2010

|

$

|

19,333

|

$

|

138,573

|

$

|

414,108

|

$

|

4,165

|

$

|

(1,670

|

)

|

$

|

6,667

|

$

|

581,176

|

|||||||||||||

|

Net earnings

|

4,549

|

1,364

|

5,913

|

|||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

(565

|

)

|

(502

|

)

|

(1,067

|

)

|

||||||||||||||||||||||

|

Capital contribution from noncontrolling interest

|

80

|

80

|

||||||||||||||||||||||||||

|

Purchase of additional

|

||||||||||||||||||||||||||||

|

Current portion of long-term debt

|

(402

|

)

|

(402

|

)

|

||||||||||||||||||||||||

|

Distributions to noncontrolling interest

|

(1,413

|

)

|

(1,413

|

)

|

||||||||||||||||||||||||

|

Cash dividends - $0.400 per share

|

(7,818

|

)

|

(7,818

|

)

|

||||||||||||||||||||||||

|

Issuance of 137,029 shares under employee stock plans

|

137

|

2,834

|

2,971

|

|||||||||||||||||||||||||

|

Issuance of 150,376 shares under stock grant programs

|

150

|

8

|

9

|

167

|

||||||||||||||||||||||||

|

Issuance of 7,995 shares under deferred compensation plans

|

8

|

(8

|

)

|

-

|

||||||||||||||||||||||||

|

Tax benefits from non-qualified stock options exercised

|

684

|

684

|

||||||||||||||||||||||||||

|

Expense associated with share-based compensation arrangements

|

1,361

|

1,361

|

||||||||||||||||||||||||||

|

Accrued expense under deferred compensation plans

|

744

|

744

|

||||||||||||||||||||||||||

|

Note receivable adjustment

|

(4

|

)

|

(208

|

)

|

209

|

(3

|

)

|

|||||||||||||||||||||

|

Payments received on employee stock notes receivable

|

206

|

206

|

||||||||||||||||||||||||||

|

Balance at December 31, 2011

|

$

|

19,624

|

$

|

143,988

|

$

|

410,848

|

$

|

3,600

|

$

|

(1,255

|

)

|

$

|

5,794

|

$

|

582,599

|

|||||||||||||

|

Controlling Interest Shareholders' Equity

|

||||||||||||||||||||||||||||

|

Common Stock

|

Additional Paid-In Capital

|

Retained Earnings

|

Accumulated Other Comprehensive Earnings

|

Employees Stock Notes Receivable

|

Noncontrolling Interest

|

Total

|

||||||||||||||||||||||

|

Net earnings

|

23,934

|

2,076

|

26,010

|

|||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

658

|

322

|

980

|

|||||||||||||||||||||||||

|

Capital contribution from noncontrolling interest

|

436

|

436

|

||||||||||||||||||||||||||

|

Distributions to noncontrolling interest

|

(871

|

)

|

(871

|

)

|

||||||||||||||||||||||||

|

Cash dividends - $0.400 per share

|

(7,905

|

)

|

(7,905

|

)

|

||||||||||||||||||||||||

|

Issuance of 89,574 shares under employee stock plans

|

90

|

1,971

|

2,061

|

|||||||||||||||||||||||||

|

Issuance of 49,536 shares under stock grant programs

|

50

|

37

|

10

|

97

|

||||||||||||||||||||||||

|

Issuance of 37,437 shares under deferred compensation plans

|

37

|

(37

|

)

|

-

|

||||||||||||||||||||||||

|

Tax benefits from non-qualified stock options exercised

|

765

|

765

|

||||||||||||||||||||||||||

|

Expense associated with share-based compensation arrangements

|

1,270

|

1,270

|

||||||||||||||||||||||||||

|

Accrued expense under deferred compensation plans

|

1,836

|

1,836

|

||||||||||||||||||||||||||

|

Note receivable adjustment

|

(1

|

)

|

(25

|

)

|

27

|

1

|

||||||||||||||||||||||

|

Payments received on employee stock notes receivable

|

246

|

246

|

||||||||||||||||||||||||||

|

Balance at December 29, 2012

|

$

|

19,800

|

$

|

149,805

|

$

|

426,887

|

$

|

4,258

|

$

|

(982

|

)

|

$

|

7,757

|

$

|

607,525

|

|||||||||||||

|

Controlling Interest Shareholders' Equity

|

||||||||||||||||||||||||||||

|

Common Stock

|

Additional Paid-In Capital

|

Retained Earnings

|

Accumulated Other Comprehensive Earnings

|

Employees Stock Notes Receivable

|

Noncontrolling Interest

|

Total

|

||||||||||||||||||||||

|

Net earnings

|

43,082

|

2,722

|

45,804

|

|||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

(792

|

)

|

8

|

(784

|

)

|

|||||||||||||||||||||||

|

Capital contribution from noncontrolling interest

|

84

|

84

|

||||||||||||||||||||||||||

|

Distributions to noncontrolling interest

|

(1,460

|

)

|

(1,460

|

)

|

||||||||||||||||||||||||

|

Cash dividends - $0.410 per share

|

(8,166

|

)

|

(8,166

|

)

|

||||||||||||||||||||||||

|

Issuance of 76,492 shares under employee stock plans

|

76

|

2,068

|

2,144

|

|||||||||||||||||||||||||

|

Issuance of 30,808 shares under stock grant programs

|

31

|

20

|

9

|

60

|

||||||||||||||||||||||||

|

Issuance of 43,914 shares under deferred compensation plans

|

44

|

(44

|

)

|

-

|

||||||||||||||||||||||||

|

Tax benefits from non-qualified stock options exercised

|

290

|

290

|

||||||||||||||||||||||||||

|

Expense associated with share-based compensation arrangements

|

1,874

|

1,874

|

||||||||||||||||||||||||||

|

Accrued expense under deferred compensation plans

|

2,219

|

2,219

|

||||||||||||||||||||||||||

|

Note receivable adjustment

|

(3

|

)

|

(103

|

)

|

106

|

-

|

||||||||||||||||||||||

|

Payments received on employee stock notes receivable

|

144

|

144

|

||||||||||||||||||||||||||

|

Balance at December 28, 2013

|

$

|

19,948

|

$

|

156,129

|

$

|

461,812

|

$

|

3,466

|

$

|

(732

|

)

|

$

|

9,111

|

$

|

649,734

|

|||||||||||||

|

|

Year Ended

|

|||||||||||

|

|

December 28,

|

December 29,

|

December 31,

|

|||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||

|

Net earnings

|

$

|

45,804

|

$

|

26,010

|

$

|

5,913

|

||||||

|

Adjustments to reconcile net earnings attributable to controlling interest to net cash from operating activities:

|

||||||||||||

|

Depreciation

|

31,091

|

30,461

|

30,804

|

|||||||||

|

Amortization of intangibles

|

2,473

|

2,918

|

5,183

|

|||||||||

|

Expense associated with share-based compensation arrangements

|

1,874

|

1,270

|

1,361

|

|||||||||

|

Excess tax benefits from share-based compensation arrangements

|

(112

|

)

|

(75

|

)

|

(36

|

)

|

||||||

|

Expense associated with stock grant plans

|

58

|

97

|

167

|

|||||||||

|

Loss reserve on notes receivable

|

15

|

2,131

|

-

|

|||||||||

|

Deferred income taxes

|

4,453

|

2,526

|

(1,939

|

)

|

||||||||

|

Equity in earnings of investee

|

(201

|

)

|

(79

|

)

|

58

|

|||||||

|

Net (gain) loss on sale or impairment of property, plant and equipment

|

297

|

(6,890

|

)

|

2,490

|

||||||||

|

Changes in:

|

-

|

|||||||||||

|

Accounts receivable

|

(17,886

|

)

|

(32,274

|

)

|

(6,784

|

)

|

||||||

|

Inventories

|

(42,287

|

)

|

(45,529

|

)

|

(4,496

|

)

|

||||||

|

Accounts payable

|

6,756

|

16,281

|

(9,964

|

)

|

||||||||

|

Accrued liabilities and other

|

21,026

|

(2,568

|

)

|

(11,242

|

)

|

|||||||

|

NET CASH FROM OPERATING ACTIVITIES

|

53,361

|

(5,721

|

)

|

11,515

|

||||||||

|

|

||||||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||

|

Purchases of property, plant and equipment

|

(40,023

|

)

|

(30,344

|

)

|

(32,932

|

)

|

||||||

|

Proceeds from sale of property, plant and equipment

|

1,778

|

18,240

|

1,814

|

|||||||||

|

Acquisitions, net of cash received

|

(11,478

|

)

|

(16,974

|

)

|

-

|

|||||||

|

Purchase of patents & product technology

|

(143

|

)

|

(95

|

)

|

(175

|

)

|

||||||

|

Advances on notes receivable

|

(2,673

|

)

|

(1,183

|

)

|

(2,468

|

)

|

||||||

|

Collections on notes receivable

|

2,814

|

2,839

|

472

|

|||||||||

|

Cash restricted as to use

|

6,111

|

(6,178

|

)

|

10

|

||||||||

|

Other, net

|

11

|

(528

|

)

|

289

|

||||||||

|

NET CASH FROM INVESTING ACTIVITIES

|

(43,603

|

)

|

(34,223

|

)

|

(32,990

|

)

|

||||||

|

|

||||||||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||

|

Net borrowings (repayments) under revolving credit facilities

|

(11,090

|

)

|

11,090

|

(2,109

|

)

|

|||||||

|

Repayment of long-term debt

|

-

|

(42,774

|

)

|

(745

|

)

|

|||||||

|

Borrowings of long-term debt

|

-

|

75,000

|

-

|

|||||||||

|

Debt issuance costs

|

(46

|

)

|

(266

|

)

|

(946

|

)

|

||||||

|

Proceeds from issuance of common stock

|

2,144

|

2,061

|

2,971

|

|||||||||

|

Purchase of additional noncontrolling interest

|

-

|

-

|

(402

|

)

|

||||||||

|

Distributions to noncontrolling interest

|

(1,460

|

)

|

(871

|

)

|

(1,413

|

)

|

||||||

|

Capital contribution from noncontrolling interest

|

84

|

281

|

80

|

|||||||||

|

Dividends paid to shareholders

|

(8,166

|

)

|

(7,905

|

)

|

(7,818

|

)

|

||||||

|

Excess tax benefits from share-based compensation arrangements

|

112

|

75

|

36

|

|||||||||

|

Other, net

|

-

|

4

|

32

|

|||||||||

|

NET CASH FROM FINANCING ACTIVITIES

|

(18,422

|

)

|

36,695

|

(10,314

|

)

|

|||||||

|

|

||||||||||||

|

Effect of exchange rate changes on cash

|

(62

|

)

|

244

|

(259

|

)

|

|||||||

|

NET CHANGE IN CASH AND CASH EQUIVALENTS

|

(8,726

|

)

|

(3,005

|

)

|

(32,048

|

)

|

||||||

|

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR

|

7,647

|

10,652

|

42,700

|

|||||||||

|

|

||||||||||||

|

CASH AND CASH EQUIVALENTS (OVERDRAFT), END OF PERIOD

|

$

|

(1,079

|

)

|

$

|

7,647

|

$

|

10,652

|

|||||

|

|

Year Ended

|

|||||||||||

|

|

December 28,

|

December 29,

|

December 31,

|

|||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

SUPPLEMENTAL SCHEDULE OF CASH FLOW INFORMATION:

|

||||||||||||

|

Interest paid

|

$

|

4,883

|

$

|

3,982

|

$

|

3,654

|

||||||

|

Income taxes paid

|

14,427

|

16,751

|

6,163

|

|||||||||

|

|

||||||||||||

|

NON-CASH INVESTING ACTIVITIES

|

||||||||||||

|

Accounts receivable exchanged for notes receivable

|

$

|

1,635

|

-

|

-

|

||||||||

|

Notes receivable exchanged for property

|

$

|

3,900

|

-

|

-

|

||||||||

|

|

||||||||||||

|

NON-CASH FINANCING ACTIVITIES:

|

||||||||||||

|

Common stock issued under deferred compensation plans

|

$

|

1,800

|

1,310

|

246

|

||||||||

| A. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| Ÿ | Level 1 — Financial instruments with unadjusted, quoted prices listed on active market exchanges. |

| Ÿ | Level 2 — Financial instruments lacking unadjusted, quoted prices from active market exchanges, including over-the-counter traded financial instruments. Financial instrument values are determined using prices for recently traded financial instruments with similar underlying terms and direct or indirect observational inputs, such as interest rates and yield curves at commonly quoted intervals. |

| Ÿ | Level 3 — Financial instruments not actively traded on a market exchange and there is little, if any, market activity. Values are determined using significant unobservable inputs or valuation techniques. |

|

|

Additions

|

|||||||||||||||

|

|

Charged to

|

|||||||||||||||

|

|

Beginning

|

Costs and

|

Ending

|

|||||||||||||

|

|

Balance

|

Expenses

|

Deductions*

|

Balance

|

||||||||||||

|

Year Ended December 28, 2013:

|

||||||||||||||||

|

Allowance for possible losses on accounts receivable

|

$

|

2,550

|

$

|

17,114

|

$

|

(17,604

|

)

|

$

|

2,060

|

|||||||

|

Year Ended December 29, 2012:

|

||||||||||||||||

|

Allowance for possible losses on accounts receivable

|

$

|

2,053

|

$

|

16,687

|

$

|

(16,190

|

)

|

$

|

2,550

|

|||||||

|

|

||||||||||||||||

|

Year Ended December 31, 2011:

|

||||||||||||||||

|

Allowance for possible losses on accounts receivable

|

$

|

2,611

|

$

|

18,144

|

$

|

(18,702

|

)

|

$

|

2,053

|

|||||||

|

|

Beginning Balance

|

Additions

|

Deductions

|

Ending Balance

|

||||||||||||

|

Year Ended December 28, 2013: Allowance for possible losses on Notes receivable

|

$

|

3,226

|

$

|

887

|

$

|

(3,088

|

)

|

$

|

1,025

|

|||||||

|

Year Ended December 29, 2012: Allowance for possible losses on Notes receivable

|

$

|

-

|

$

|

3,226

|

$

|

-

|

$

|

3,226

|

||||||||

|

Land improvements

|

5 to 15 years

|

|

Buildings and improvements

|

15 to 31.5 years

|

|

Machinery, equipment and office furniture

|

3 to 10 years

|

|

|

2013

|

2012

|

||||||

|

Cost and Earnings in Excess of Billings

|

$

|

6,903

|

$

|

4,981

|

||||

|

Billings in Excess of Cost and Earnings

|

2,858

|

2,020

|

||||||

|

|

December 28, 2013

|

December 29, 2012

|

December 31, 2011

|

|||||||||

|

Numerator:

|

||||||||||||

|

Net earnings attributable to controlling interest

|

$

|

43,082

|

$

|

23,934

|

$

|

4,549

|

||||||

|

Adjustment for earnings allocated to non-vested restricted common stock

|

(412

|

)

|

(210

|

)

|

(38

|

)

|

||||||

|

Net earnings for calculating EPS

|

$

|

42,670

|

$

|

23,724

|

$

|

4,511

|

||||||

|

Denominator:

|

||||||||||||

|

Weighted average shares outstanding

|

19,952

|

19,800

|

19,572

|

|||||||||

|

Adjustment for non-vested restricted common stock

|

(191

|

)

|

(173

|

)

|

(165

|

)

|

||||||

|

Shares for calculating basic EPS

|

19,761

|

19,627

|

19,407

|

|||||||||

|

Effect of dilutive stock options

|

54

|

6

|

126

|

|||||||||

|

Shares for calculating diluted EPS

|

19,815

|

19,633

|

19,533

|

|||||||||

|

Net earnings per share:

|

||||||||||||

|

Basic

|

$

|

2.16

|

$

|

1.21

|

$

|

0.23

|

||||||

|

Diluted

|

$

|

2.15

|

$

|

1.21

|

$

|

0.23

|

||||||

| B | FAIR VALUE |

|

|

December 28, 2013

|

December 29, 2012

|

||||||||||||||||||||||

|

(in thousands)

|

Quoted

Prices in

Active

Markets

(Level 1)

|

Prices with

Other

Observable

Inputs

(Level 2)

|

Total

|

Quoted

Prices in

Active

Markets

(Level 1)

|

Prices with

Other

Observable

Inputs

(Level 2)

|

Total

|

||||||||||||||||||

|

Recurring:

|

||||||||||||||||||||||||

|

Money market funds

|

$

|

62

|

-

|

$

|

62

|

$

|

62

|

-

|

$

|

62

|

||||||||||||||

|

Mutual funds:

|

||||||||||||||||||||||||

|

Domestic stock funds

|

813

|

-

|

813

|

613

|

-

|

613

|

||||||||||||||||||

|

International stock funds

|

586

|

-

|

586

|

500

|

-

|

500

|

||||||||||||||||||

|

Target funds

|

176

|

-

|

176

|

145

|

-

|

145

|

||||||||||||||||||

|

Bond funds

|

139

|

-

|

139

|

140

|

-

|

140

|

||||||||||||||||||

|

Total mutual funds

|

1,776

|

-

|

1,776

|

1,398

|

-

|

1,398

|

||||||||||||||||||

|

Non-Recurring:

|

||||||||||||||||||||||||

|

Property, plant and equipment

|

-

|

-

|

-

|

-

|

$

|

1,600

|

$

|

1,600

|

||||||||||||||||

|

Assets at fair value

|

$

|

1,776

|

-

|

$

|

1,776

|

$

|

1,460

|

$

|

1,600

|

$

|

3,060

|

|||||||||||||

| C | BUSINESS COMBINATIONS |

|

Company Name

|

Acquisition Date

|

Purchase Price

|

Intangible Assets

|

Net Tangible Assets

|

Operating

Segment

|

Business Description

|

||||||

|

SE Panel and Lumber Supply, LLC (“SE Panel”)

|

November 8, 2013

|

$2,181 (asset purchase)

|

$

|

-

|

$

|

2,181

|

Eastern Division

|

A distributor of Olympic Panel overlay concrete forming panels and commodity lumber products to the concrete forming and construction industries. Facility is located in South Daytona, FL. SE Panel had annual sales of $5.4 million.

|

||||

|

Premier Laminating Services, Inc.

(“Premier Laminating”)

|

May 31, 2013

|

$696 (asset purchase)

|

$

|

250

|

$

|

446

|

Western Division

|

A business specialized in environmentally sustainable laminated wooden products. Facility is located in Perris, CA. Premier Laminating had annual sales of $6.2 million.

|

||||

|

Millry Mill Company, Inc. (“Millry”)

|

February 28, 2013

|

$2,323 (asset purchase)

|

$

|

50

|

$

|

2,273

|

Eastern Division

|

A highly specialized export mill that produces rough dimension boards and lumber. Facility is located in Millry, AL. Millry had annual sales of $4.7 million.

|

||||

|

Custom Caseworks, Inc. (“Custom Caseworks”)

|

December 31, 2012

|

$6,278 (asset purchase)

|

$

|

2,000

|

$

|

4,278

|

Western Division

|

A high-precision business-to-business manufacturer of engineered wood products in many commercial markets. Facility is located in Sauk Rapids, MN. Custom Caseworks had annual sales of $7 million.

|

||||

|

Nepa Pallet and Container Co., Inc. (“Nepa”)

|

November 5, 2012

|

$16,175

(asset purchase)

|

$

|

1,350

|

$

|

14,825

|

Western Division

|

Manufactures pallets, containers and bins for agricultural and industrial customers. Facilities are located in Snohomish, Yakima and Wenatchee, WA. NEPA had trailing twelve month sales of $25 million.

|

||||

|

MSR Forest Products, LLC

(“MSR”)

|

May 16, 2012

|

$3,208 (asset purchase)

|

$

|

1,164

|

$

|

2,044

|

Eastern Division

|

Supplies roof trusses and cut-to-size lumber to manufactured housing customers. Facilities are located in Haleyville, AL and Waycross, GA. MSR had annual sales of $10 million.

|

||||

|

|

Non-Compete

Agreements

|

Customer

Relationships

|

Goodwill

|

Goodwill - Tax Deductible

|

||||||||||||

|

Premier Laminating

|

$

|

250

|

-

|

-

|

-

|

|||||||||||

|

Millry

|

50

|

-

|

-

|

-

|

||||||||||||

|

Custom Caseworks

|

220

|

$

|

620

|

$

|

1,160

|

$

|

1,160

|

|||||||||

|

Nepa

|

330

|

-

|

1,020

|

1,020

|

||||||||||||

|

MSR

|

-

|

-

|

1,164

|

1,164

|

||||||||||||

|

|

||||||||||||||||

| D. | NET LOSS (GAIN) ON DISPOSITION OF ASSETS, EARLY RETIRMENT AND OTHER IMPAIRMENT AND EXIT CHARGES |

| E. | GOODWILL AND OTHER INTANGIBLE ASSETS |

|

|

Eastern and

Western

|

Site-Built

|

All

Other

|

Total

|

||||||||||||

|

Balance as of December 25, 2011

|

$

|

123,311

|

$

|

21,720

|

$

|

9,671

|

$

|

154,702

|

||||||||

|

Acquisitions

|

2,514

|

- | - |

2,514

|

||||||||||||

|

Other

|

2,100

|

- | - |

2,100

|

||||||||||||

|

Balance as of December 29, 2012

|

127,925

|

21,720

|

9,671

|

159,316

|

||||||||||||

|

Acquisitions

|

1,160

|

- |

-

|

1,160

|

||||||||||||

|

Other

|

(330

|

)

|

- | - |

(330

|

)

|

||||||||||

|

Balance as of December 28, 2013

|

$

|

128,755

|

$

|

21,720

|

$

|

9,671

|

$

|

160,146

|

||||||||

|

|

2013

|

2012

|

||||||||||||||

|

|

Assets

|

Accumulated

Amortization

|

Assets

|

Accumulated

Amortization

|

||||||||||||

|

Non-compete agreements

|

$

|

1,340

|

$

|

(514

|

)

|

$

|

3,730

|

$

|

(3,366

|

)

|

||||||

|

Customer relationships

|

9,480

|

(6,832

|

)

|

8,860

|

(5,465

|

)

|

||||||||||

|

Licensing agreements

|

4,589

|

(1,606

|

)

|

4,589

|

(1,147

|

)

|

||||||||||

|

Patents

|

3,393

|

(2,609

|

)

|

3,250

|

(2,350

|

)

|

||||||||||

|

Total

|

$

|

18,802

|

$

|

(11,561

|

)

|

$

|

20,429

|

$

|

(12,328

|

)

|

||||||

|

Non-compete agreements

|

5 to 10 years

|

|

Customer relationship

|

5 to 8 years

|

|

Licensing agreements

|