EXPLANATORY STATEMENT

As previously reported in our filings with the Securities and Exchange Commission (the “SEC”), we have undertaken strategic reviews of our global portfolio and have announced plans to divest certain of our subsidiaries as part of a strategic shift. This strategic shift will have a significant effect on our operations and financial results. Accordingly, as of September 30, 2018, we will account for all of the divestitures that are currently part of this strategic shift as discontinued operations for all periods presented, including in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2018 filed with the SEC on November 8, 2018 and in our Current Report on Form 8-K filed with the SEC on November 13, 2018 (including this Exhibit 99.1 and Exhibit 99.2 thereto, the “Form 8-K”), in which we recast the financial information contained in our Annual Report on Form 10-K for the year ended December 31, 2017 (the “2017 Form 10-K”) to present the operations and financial position of these entities as discontinued operations. Unless otherwise indicated, the information in this Form 8-K, including our segment information, relates only to our continuing operations. We also announced on November 8, 2018 that we are considering various strategic options with respect to the portion of our business operated through our online education program division known as Walden University (“Walden”). Because Walden does not meet the criteria to be classified as held for sale or a discontinued operation, it continues to be included in our continuing operations.

The information included in this Form 8-K is presented in connection with the reporting changes described above and does not otherwise amend or restate our audited consolidated financial statements that were included in the 2017 Form 10-K. Unaffected items and unaffected portions of our 2017 Form 10-K have not been repeated in, and are not amended or modified by, this Form 8-K. This Form 8-K does not reflect events occurring after we filed the 2017 Form 10-K, and does not modify or update the disclosures therein in any way, other than to reflect the presentation of certain business units as discontinued operations as described above. Therefore, this Form 8-K should be read in conjunction with our other filings made with the SEC, including, and subsequent to, the date of the 2017 Form 10-K.

FORWARD LOOKING STATEMENTS

This Form 8-K contains “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or similar expressions that concern our strategy, plans or intentions. All statements we make relating to estimated and projected earnings, costs, expenditures, cash flows, growth rates, financial results and all statements we make relating to our planned divestitures, the expected proceeds generated therefrom and the expected reduction in revenue resulting therefrom, are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. All of these forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those we expected. We derive most of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, including, without limitation, in conjunction with the forward-looking statements included in this Form 8-K, are disclosed in “Item 1—Business, Item 1A—Risk Factors” of our 2017 Form 10-K, as updated in Part II, Item 1A of our Form 10-Q for the quarter ended March 31, 2018 and in Part II, Item 1A of our Form 10-Q for the quarter ended September 30, 2018. Some of the factors that we believe could affect our results include:

· the risks associated with conducting our global operations, including complex business, foreign currency, political, legal, regulatory, tax and economic risks;

· our ability to effectively manage the growth of our business, implement a common operating model and platform, and increase our operating leverage;

· the development and expansion of our global education network and programs and the effect of new technology applications in the educational services industry;

· our ability to successfully complete planned divestitures and make strategic acquisitions, and to successfully integrate and operate acquired businesses;

· the effect of existing international and U.S. laws and regulations governing our business or changes to those laws and regulations or in their application to our business;

· changes in the political, economic and business climate in the international or the U.S. markets where we operate;

· risks of downturns in general economic conditions and in the educational services and education technology industries, that could, among other things, impair our goodwill and intangible assets;

· possible increased competition from other educational service providers;

· market acceptance of new service offerings by us or our competitors and our ability to predict and respond to changes in the markets for our educational services;

· the effect on our business and results of operations from fluctuations in the value of foreign currencies;

· our ability to attract and retain key personnel;

· the fluctuations in revenues due to seasonality;

· our ability to generate anticipated savings from our Excellence in Process (“EiP”) program, our shared services organizations (“SSOs”) and reductions in overhead costs after our planned divestitures;

· our ability to maintain proper and effective internal controls or remediate any of our current material weaknesses necessary to produce accurate financial statements on a timely basis;

· our focus on a specific public benefit purpose and producing a positive effect for society may negatively influence our financial performance;

· the future trading prices of our Class A common stock and the impact of any securities analysts’ reports on these prices; and

· our ability to maintain and, subsequently, increase tuition rates and student enrollments in our institutions.

We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this Form 8-K may not in fact occur. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

ITEM 6. SELECTED FINANCIAL DATA

Set forth below are selected consolidated financial data of Laureate Education, Inc., at the dates and for the periods indicated. The selected historical statements of operations data and statements of cash flows data for the fiscal years ended December 31, 2017, 2016 and 2015 and balance sheet data as of December 31, 2017 and 2016 have been derived from our audited consolidated financial statements included elsewhere in this Form 8-K. The selected historical statements of operations data and statements of cash flows data for the fiscal years ended December 31, 2014 and 2013 and balance sheet data as of December 31, 2015, 2014 and 2013, as recast for discontinued operations, are unaudited and have been derived from our accounting records. Our historical results are not necessarily indicative of our future results. The data should be read in conjunction with the consolidated financial statements, related notes, and other financial information included therein.

The selected historical consolidated financial data should be read in conjunction with “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this Form 8-K.

|

|

|

Fiscal Year Ended December 31, |

| |||||||||||||

|

(Dollar amounts in thousands) |

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

| |||||

|

|

|

|

|

|

|

|

|

(unaudited) |

|

(unaudited) |

| |||||

|

Consolidated Statements of Operations: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Revenues |

|

$ |

3,385,876 |

|

$ |

3,301,864 |

|

$ |

3,399,774 |

|

$ |

3,510,209 |

|

$ |

3,118,049 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Direct costs |

|

2,821,291 |

|

2,788,691 |

|

2,946,016 |

|

2,985,338 |

|

2,671,962 |

| |||||

|

General and administrative expenses |

|

315,471 |

|

222,496 |

|

194,686 |

|

151,215 |

|

141,197 |

| |||||

|

Loss on impairment of assets |

|

7,121 |

|

— |

|

— |

|

48,421 |

|

29,200 |

| |||||

|

Operating income |

|

241,993 |

|

290,677 |

|

259,072 |

|

325,235 |

|

275,690 |

| |||||

|

Interest income |

|

11,865 |

|

14,414 |

|

9,474 |

|

17,215 |

|

18,081 |

| |||||

|

Interest expense |

|

(334,901 |

) |

(390,391 |

) |

(367,284 |

) |

(358,805 |

) |

(328,535 |

) | |||||

|

Loss on debt extinguishment |

|

(8,392 |

) |

(17,363 |

) |

(1,263 |

) |

(22,853 |

) |

(1,361 |

) | |||||

|

Gain (loss) on derivatives |

|

28,656 |

|

(6,084 |

) |

(2,607 |

) |

(3,101 |

) |

6,631 |

| |||||

|

Other (expense) income, net |

|

(1,892 |

) |

457 |

|

(423 |

) |

(476 |

) |

(617 |

) | |||||

|

Foreign currency exchange gain (loss), net |

|

2,539 |

|

77,299 |

|

(128,299 |

) |

(107,703 |

) |

6,640 |

| |||||

|

(Loss) gain on sale of subsidiaries, net(1) |

|

(10,490 |

) |

398,081 |

|

— |

|

(13 |

) |

5,906 |

| |||||

|

(Loss) income from continuing operations before income taxes and equity in net income (loss) of affiliates |

|

(70,622 |

) |

367,090 |

|

(231,330 |

) |

(150,501 |

) |

(17,565 |

) | |||||

|

Income tax benefit (expense) |

|

91,308 |

|

(34,440 |

) |

(95,364 |

) |

55,245 |

|

(68,186 |

) | |||||

|

Equity in net income (loss) of affiliates, net of tax |

|

152 |

|

90 |

|

2,495 |

|

158 |

|

(905 |

) | |||||

|

Income (loss) from continuing operations |

|

20,838 |

|

332,740 |

|

(324,199 |

) |

(95,098 |

) |

(86,656 |

) | |||||

|

Income (loss) from discontinued operations, net of tax of $24,495, $30,561, $22,366, $16,185, and $23,060, respectively |

|

72,926 |

|

33,446 |

|

8,354 |

|

(67,355 |

) |

(2,770 |

) | |||||

|

Gain on sales of discontinued operations, net of tax of $0, $0, $0, $0 and $1,864, respectively |

|

— |

|

— |

|

— |

|

— |

|

4,350 |

| |||||

|

Net income (loss) |

|

93,764 |

|

366,186 |

|

(315,845 |

) |

(162,453 |

) |

(85,076 |

) | |||||

|

Net (income) loss attributable to noncontrolling interests |

|

(2,299 |

) |

5,661 |

|

(403 |

) |

4,162 |

|

15,398 |

| |||||

|

Net income (loss) attributable to Laureate Education, Inc. |

|

$ |

91,465 |

|

$ |

371,847 |

|

$ |

(316,248 |

) |

$ |

(158,291 |

) |

$ |

(69,678 |

) |

(1) In 2016, represented a gain of approximately $249.4 million resulting from the Swiss institutions sale that closed on June 14, 2016 and a gain of approximately $148.7 million, subject to certain adjustments, resulting from the French institutions sale that closed on July 20, 2016. In 2017, primarily represents a final purchase price settlement related to the sale of the Swiss institutions.

|

|

|

Fiscal Year Ended December 31, |

| |||||||||||||

|

(Dollar amounts in thousands) |

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

| |||||

|

|

|

|

|

|

|

|

|

(unaudited) |

|

(unaudited) |

| |||||

|

Consolidated Statements of Cash Flows: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Net cash provided by operating activities |

|

$ |

130,756 |

|

$ |

184,570 |

|

$ |

170,486 |

|

$ |

269,156 |

|

$ |

277,202 |

|

|

Net cash (used in) provided by investing activities |

|

(324,530 |

) |

269,234 |

|

(173,642 |

) |

(489,181 |

) |

(899,083 |

) | |||||

|

Net cash provided by (used in) financing activities |

|

222,795 |

|

(445,722 |

) |

34,424 |

|

172,586 |

|

756,663 |

| |||||

|

Business acquisitions, net of cash acquired |

|

(835 |

) |

— |

|

(6,705 |

) |

(287,945 |

) |

(177,550 |

) | |||||

|

|

|

Fiscal Year Ended December 31, |

| |||||||||||||

|

(Dollar amounts in thousands) |

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

| |||||

|

|

|

|

|

|

|

|

|

(unaudited) |

|

(unaudited) |

| |||||

|

Segment Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

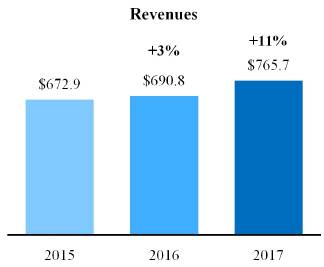

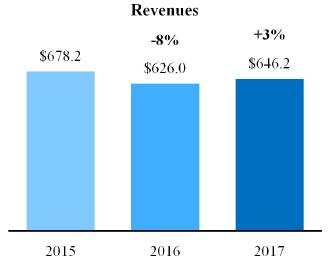

Brazil |

|

$ |

765,746 |

|

$ |

690,804 |

|

$ |

672,917 |

|

$ |

713,623 |

|

$ |

569,018 |

|

|

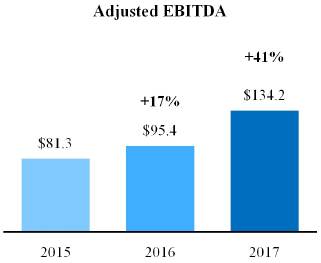

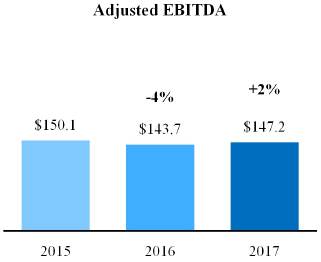

Mexico |

|

646,154 |

|

626,011 |

|

678,193 |

|

741,755 |

|

701,871 |

| |||||

|

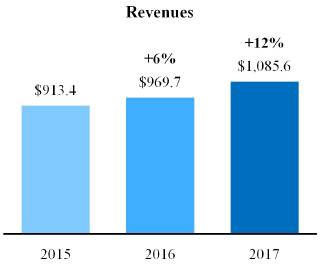

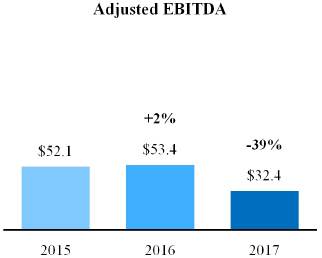

Andean |

|

1,085,640 |

|

969,717 |

|

913,388 |

|

931,104 |

|

911,538 |

| |||||

|

Rest of World |

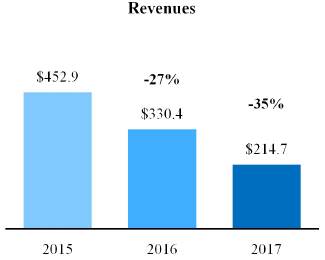

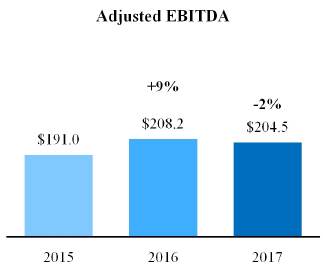

|

214,720 |

|

330,423 |

|

452,937 |

|

457,056 |

|

278,434 |

| |||||

|

Online & Partnerships |

|

690,374 |

|

704,976 |

|

707,998 |

|

683,084 |

|

664,573 |

| |||||

|

Corporate |

|

(16,758 |

) |

(20,067 |

) |

(25,659 |

) |

(16,413 |

) |

(7,385 |

) | |||||

|

Total revenues |

|

$ |

3,385,876 |

|

$ |

3,301,864 |

|

$ |

3,399,774 |

|

$ |

3,510,209 |

|

$ |

3,118,049 |

|

|

Other Data: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Total enrollments (rounded to the nearest hundred): |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Brazil |

|

271,200 |

|

259,000 |

|

257,200 |

|

255,600 |

|

156,800 |

| |||||

|

Mexico |

|

214,200 |

|

213,800 |

|

205,000 |

|

195,000 |

|

184,300 |

| |||||

|

Andean |

|

299,100 |

|

286,600 |

|

270,700 |

|

242,700 |

|

212,900 |

| |||||

|

Rest of World |

|

17,200 |

|

15,400 |

|

28,700 |

|

28,400 |

|

20,000 |

| |||||

|

Online & Partnerships |

|

63,500 |

|

68,300 |

|

72,400 |

|

68,300 |

|

67,000 |

| |||||

|

Total |

|

865,200 |

|

843,100 |

|

834,000 |

|

790,000 |

|

641,000 |

| |||||

|

New enrollments (rounded to the nearest hundred): |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Brazil |

|

149,900 |

|

134,500 |

|

142,300 |

|

105,000 |

|

83,700 |

| |||||

|

Mexico |

|

107,300 |

|

108,400 |

|

101,000 |

|

97,000 |

|

93,000 |

| |||||

|

Andean |

|

116,600 |

|

117,200 |

|

112,500 |

|

108,600 |

|

101,200 |

| |||||

|

Rest of World |

|

12,000 |

|

14,100 |

|

19,400 |

|

22,000 |

|

4,900 |

| |||||

|

Online & Partnerships |

|

35,000 |

|

39,300 |

|

39,500 |

|

37,300 |

|

35,600 |

| |||||

|

Total |

|

420,800 |

|

413,500 |

|

414,700 |

|

369,900 |

|

318,400 |

| |||||

|

|

|

As of December 31, |

| |||||||||||||

|

(Dollar amounts in thousands) |

|

2017 |

|

2016 |

|

2015 |

|

2014 |

|

2013 |

| |||||

|

|

|

|

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

| |||||

|

Consolidated Balance Sheets: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Cash and cash equivalents |

|

$ |

320,567 |

|

$ |

295,785 |

|

$ |

279,226 |

|

$ |

308,023 |

|

$ |

407,335 |

|

|

Restricted cash and investments |

|

212,215 |

|

178,552 |

|

151,294 |

|

135,074 |

|

345,788 |

| |||||

|

Net working capital (deficit) (including cash and cash equivalents) |

|

(85,895 |

) |

(324,431 |

) |

(491,084 |

) |

(589,744 |

) |

(267,861 |

) | |||||

|

Property and equipment, net |

|

1,380,417 |

|

1,361,465 |

|

1,453,742 |

|

1,600,696 |

|

1,785,758 |

| |||||

|

Goodwill |

|

1,828,365 |

|

1,786,554 |

|

1,951,444 |

|

2,296,551 |

|

2,103,332 |

| |||||

|

Tradenames |

|

1,167,302 |

|

1,153,348 |

|

1,199,943 |

|

1,294,885 |

|

1,339,572 |

| |||||

|

Other intangible assets, net |

|

35,779 |

|

46,035 |

|

50,158 |

|

86,959 |

|

17,184 |

| |||||

|

Total assets |

|

7,391,285 |

|

7,062,534 |

|

7,403,168 |

|

8,315,018 |

|

8,325,612 |

| |||||

|

Total debt, including due to shareholders of acquired companies |

|

3,167,051 |

|

3,635,261 |

|

4,264,200 |

|

4,397,270 |

|

4,090,568 |

| |||||

|

Deferred compensation |

|

14,470 |

|

14,128 |

|

32,343 |

|

115,575 |

|

188,394 |

| |||||

|

Total liabilities, excluding debt, due to shareholders of acquired companies and derivative instruments |

|

2,209,107 |

|

2,393,080 |

|

2,711,783 |

|

2,793,066 |

|

2,629,894 |

| |||||

|

Convertible redeemable preferred stock |

|

400,276 |

|

332,957 |

|

— |

|

— |

|

— |

| |||||

|

Redeemable noncontrolling interests and equity |

|

13,721 |

|

23,876 |

|

51,746 |

|

43,876 |

|

42,165 |

| |||||

|

Total Laureate Education, Inc. stockholders’ equity |

|

1,575,164 |

|

632,210 |

|

324,759 |

|

1,017,068 |

|

1,465,755 |

| |||||

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion of our results of operations and financial condition with the ‘‘Selected Financial Data’’ and the audited historical consolidated financial statements and related notes included elsewhere in this Form 8-K. This discussion contains forward-looking statements and involves numerous risks and uncertainties, including, but not limited to, those described in the “Item 1A. Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the 2017 Form 10-K), as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q or our current reports on Form 8-K. Actual results may differ materially from those contained in any forward-looking statements. See “Forward-Looking Statements.”

Introduction

This Management’s Discussion and Analysis of Financial Condition and Results of Operations (the ‘‘MD&A’’) is provided to assist readers of the financial statements in understanding the results of operations, financial condition and cash flows of Laureate Education, Inc. This MD&A should be read in conjunction with the consolidated financial statements and related notes included elsewhere in this Form 8-K. The consolidated financial statements included elsewhere in this Form 8-K are presented in U.S. dollars (USD) rounded to the nearest thousand, with the amounts in MD&A rounded to the nearest tenth of a million. Therefore, discrepancies in the tables between totals and the sums of the amounts listed may occur due to such rounding. Our MD&A is presented in the following sections:

· Overview;

· Results of Operations;

· Liquidity and Capital Resources;

· Contractual Obligations;

· Off-Balance Sheet Arrangements;

· Critical Accounting Policies and Estimates; and

· Recently Issued Accounting Standards.

Overview

Our Business

We are an international network of degree-granting higher education institutions with approximately 865,200 students enrolled at our 39 institutions in 10 countries on more than 150 campuses included in our continuing operations as of December 31, 2017, which we collectively refer to as the Laureate International Universities network. We believe the global higher education market presents an attractive long-term opportunity, primarily because of the large and growing imbalance between the supply and demand for quality higher education around the world. Advanced education opportunities drive higher earnings potential, and we believe the projected growth in the middle-class population worldwide and limited government resources dedicated to higher education create substantial opportunities for high-quality private institutions to meet this growing and unmet demand. Our outcomes-driven strategy is focused on enabling students to prosper and thrive in the dynamic and evolving knowledge economy.

As of December 31, 2017, our international network of 39 institutions comprised 30 institutions we owned or controlled, and an additional 9 institutions that we managed or with which we had other relationships. We have six operating segments as described below. We group our institutions by geography in: 1) Brazil; 2) Mexico; 3) Andean (formerly Andean & Iberian); 4) Central America & U.S. Campuses; and 5) Rest of World (formerly EMEAA) for reporting purposes. Our sixth segment, Online & Partnerships, includes fully online institutions that operate globally.

Discontinued Operations

As reported in our 2017 Form 10-K, in 2017 the Company announced the divestiture of certain subsidiaries in our Rest of World and Central America & U.S. Campuses segments. On August 9, 2018, the Company announced that it plans to divest additional subsidiaries located in Europe, Asia and Central America. After completing all of the announced divestitures, the Company’s remaining principal markets will be Brazil, Chile, Mexico and Peru, along with the Online and Partnerships segment and the institutions in Australia and New Zealand. The markets to be divested (the Discontinued Operations) include the institutions in Portugal and Spain, which are part of the Andean segment, all remaining institutions in the Central America & U.S. Campuses segment, and all remaining institutions in the Rest of World segment except for Australia, New Zealand and the managed institutions in the Kingdom of Saudi Arabia and China. The divestitures represent a strategic shift that will have a major effect on the Company’s operations and financial results. Accordingly, in accordance with Accounting Standard Codification (ASC) 205-20, ‘‘Discontinued Operations,’’ the results of the divestitures that are part of the strategic shift are presented as discontinued operations in our consolidated financial statements included elsewhere in our Form 8-K for all periods. Since our entire Central America & U.S. Campuses operating segment is included in Discontinued Operations, it no longer meets the criteria for a reportable segment under ASC 280, “Segment Reporting.” In addition, the portions of the Andean and Rest of World reportable segments that are included in Discontinued Operations have also been excluded from the segment information for all periods presented. Unless indicated otherwise, the information in the MD&A relates to continuing operations.

As discussed in Note 25, Subsequent Events, in our consolidated financial statements included elsewhere in this Form 8-K, the Company has begun entering into sale agreements for these entities and closing of the sale transactions began in the first quarter of 2018.

Our Segments

As previously disclosed in our Quarterly Report on Form 10-Q for the period ended September 30, 2017, effective August 1, 2017, we changed our operating segments in order to realign our segments according to how our chief operating decision maker allocates resources and assesses performance. The change includes the creation of three operating segments (Brazil, Mexico and Andean & Iberian) from the previous Latin America (LatAm) segment. Our institutions in Spain and Portugal (Iberian) have moved from the Europe, Middle East, Africa and Asia Pacific (EMEAA) segment and combined with our institutions in Chile and Peru to form the Andean & Iberian segment. In addition, our institutions in Central America, which were previously part of the LatAm segment, have combined with our campus-based institutions in the United States, which were previously part of the GPS segment, to form the Central America & U.S. Campuses segment. The Online & Partnerships segment consists of the online institutions that were previously part of the GPS segment. We have renamed our Andean & Iberian segment as Andean and our EMEAA segment as Rest of World. This change has been reflected in the segment information for the year ended December 31, 2017. As required, the segment information presented for comparative purposes for the years ended December 31, 2016 and 2015 has also been revised to reflect this change. As discussed above, the Central America and U.S. Campuses segment no longer meets the criteria for a reportable segment and, therefore, it is excluded from the segments information for all periods presented.

Our campus-based segments generate revenues by providing an education that emphasizes professional-oriented fields of study with undergraduate and graduate degrees in a wide range of disciplines. Our educational offerings are increasingly utilizing online and hybrid (a combination of online and in-classroom) courses and programs to deliver their curriculum. Many of our largest campus-based operations are in developing markets which are experiencing a growing demand for higher education based on favorable demographics and increasing secondary completion rates, driving increases in participation rates and resulting in continued growth in the number of higher education students. Traditional higher education students (defined as 18-24 year olds) have historically been served by public universities, which have limited capacity and are often underfunded, resulting in an inability to meet the growing student demand and employer requirements. This supply and demand imbalance has created a market opportunity for private sector participants. Most students finance their own education. However, there are some government-sponsored student financing programs which are discussed below. These campus-based segments include Brazil, Mexico, Andean, Central America & U.S. Campuses and Rest of World. Specifics related to each of these campus-based segments and our Online & Partnerships segment are discussed below:

· In Brazil, approximately 75% of post-secondary students are enrolled in private higher education institutions. While the federal government defines the national curricular guidelines, institutions are licensed to operate by city. Laureate owns 13

institutions in eight states throughout Brazil, with a particularly strong presence in the competitive São Paulo market. Many students finance their own education while others rely on the government-sponsored programs such as Prouni and FIES.

· Public universities in Mexico enroll approximately two-thirds of students attending post-secondary education. However, many public institutions are faced with capacity constraints or the quality of the education is considered low. Laureate owns two institutions and is present throughout the country with a footprint of over 40 campuses. Each institution in Mexico has a national license. Students in our Mexican institutions typically finance their own education.

· The Andean segment includes institutions in Chile, Peru, Portugal and Spain. In Chile, private universities enroll approximately 80% of post-secondary students. In Peru, the public sector plays a significant role but private universities are increasingly providing the capacity to meet growing demand. In Spain and Portugal, the high demand for post-secondary education places capacity constraints on the public sector, pushing students to turn to the private sector for high-quality education. Chile has government-sponsored student financing programs, while in the other countries students generally finance their own education. The institutions in Portugal and Spain are included in Discontinued Operations.

· The Central America & U.S. Campuses segment includes institutions in Costa Rica, Honduras, Panama and the United States. Students in Central America typically finance their own education while students in the United States finance their education in a variety of ways, including Title IV programs. The entire Central America & U.S. Campuses segment is included in Discontinued Operations.

· The Rest of World segment includes institutions in the European countries of Cyprus, Germany, Italy and Turkey, as well as locations in the Middle East, Africa and Asia Pacific consisting of campus-based institutions with operations in Australia, China, India, Malaysia, Morocco, New Zealand, South Africa and Thailand. Additionally, Rest of World manages eight licensed institutions in the Kingdom of Saudi Arabia and manages one additional institution in China through a joint venture arrangement. The institutions in the Rest of World segment are included in Discontinued Operations, except for Australia, New Zealand and the managed institutions in the Kingdom of Saudi Arabia and China.

· The Online & Partnerships segment includes fully online institutions operating globally that offer professionally-oriented degree programs in the United States through Walden University (Walden), a U.S.-based accredited institution, and through the University of Liverpool and the University of Roehampton in the United Kingdom. These online institutions primarily serve working adults with undergraduate and graduate degree program offerings. Students in the United States finance their education in a variety of ways, including Title IV programs.

Corporate is a non-operating business unit whose purpose is to support operations. Its departments are responsible for establishing operational policies and internal control standards; implementing strategic initiatives; and monitoring compliance with policies and controls throughout our operations. Our Corporate segment is an internal source of capital and provides financial, human resource, information technology, insurance, legal and tax compliance services. The Corporate segment also contains the eliminations of intersegment revenues and expenses.

The following information for our reportable segments is presented as of December 31, 2017:

|

|

|

Countries |

|

Institutions |

|

Enrollment |

|

2017 YTD |

|

% Contribution |

| |

|

Brazil |

|

1 |

|

13 |

|

271,200 |

|

$ |

765.7 |

|

23 |

% |

|

Mexico |

|

1 |

|

2 |

|

214,200 |

|

646.2 |

|

19 |

% | |

|

Andean |

|

2 |

|

9 |

|

299,100 |

|

1,085.6 |

|

32 |

% | |

|

Rest of World (2) |

|

4 |

|

12 |

|

17,200 |

|

214.7 |

|

6 |

% | |

|

Online & Partnerships (3) |

|

2 |

|

3 |

|

63,500 |

|

690.4 |

|

20 |

% | |

|

Total (1) |

|

10 |

|

39 |

|

865,200 |

|

$ |

3,385.9 |

|

100 |

% |

(1) The elimination of intersegment revenues and amounts related to Corporate, which total $16.8 million, is not separately presented.

(2) Includes eight licensed institutions in the Kingdom of Saudi Arabia that are managed under a contract that expires in 2019.

(3) In December 2017, we stopped accepting new enrollments at the University of Roehampton, an institution in our Online & Partnerships segment.

Challenges

Our international operations are subject to complex business, economic, legal, regulatory, political, tax and foreign currency risks, which may be difficult to adequately address. The majority of our operations are outside the United States. As a result, we face risks that are inherent in international operations, including: fluctuations in exchange rates, possible currency devaluations, inflation and hyper-inflation; price controls and foreign currency exchange restrictions; potential economic and political instability in the countries in which we operate; expropriation of assets by local governments; key political elections and changes in government policies; multiple and possibly overlapping and conflicting tax laws; and compliance with a wide variety of foreign laws. There are also risks associated with our announcement of the divestiture of certain operations. See ‘‘Risk Factors-Risks Relating to Our Business-Our divestiture activities and the planned strategic shift in our business may disrupt our ongoing business, involve increased expenses and present risks not contemplated at the time of the transactions,” in our Quarterly Report on Form 10-Q for the period ended September 30, 2018. We plan to grow our continuing operations organically by: 1) adding new programs and course offerings; 2) expanding target student demographics; and 3) increasing capacity at existing and new campus locations. Our success in growing our business will depend on the ability to anticipate and effectively manage these and other risks related to operating in various countries.

Regulatory Environment and Other Matters

Our business is subject to regulation by various agencies based on the requirements of local jurisdictions. These agencies continue to review and update regulations as they deem necessary. We cannot predict the form of the rules that ultimately may be adopted in the future or what effects they might have on our business, financial condition, results of operations and cash flows. We will continue to develop and implement necessary changes that enable us to comply with such regulations. See ‘‘Risk Factors—Risks Relating to Our Business—Our institutions are subject to uncertain and varying laws and regulations, and any changes to these laws or regulations or their application to us may materially adversely affect our business, financial condition and results of operations, Risk Factors—Risks Relating to Our Business—Political and regulatory developments in Turkey may materially adversely affect us, “Risk Factors—Risks Relating to Our Business—Political and regulatory developments in Chile have materially adversely affected us and may continue to affect us, Risk Factors—Risks Relating to Our Business—Our ability to control our institutions may be materially adversely affected by changes in laws affecting higher education in certain countries in which we operate, Risk Factors-Risks Relating to Our Highly Regulated Industry in the United States,” in the 2017 Form 10-K, as revised or supplemented by our subsequent Quarterly Reports on Form 10-Q or our current reports on Form 8-K, and ‘‘Item 1—Business—Industry Regulation’’ in the 2017 Form 10-K for a detailed discussion of our different regulatory environments and Note 20, Legal and Regulatory Matters, in our consolidated financial statements included elsewhere in this Form 8-K.

Evaluation of Strategic Alternatives for Walden University

We are continuing to pursue our previously announced strategy of simplifying and focusing our business, including our announced plan to divest our campus-based assets in the U.S., Europe, Asia and Central America, and the creation of two scaled enterprises - one campus-based business primarily focused on emerging markets in Latin America, and one fully online platform in the U.S. We are currently evaluating the strategic fit of having these two scaled, but different, business units together in one organization. Accordingly, we are considering various strategic options for Walden University (Walden) with the goal of continuing to provide the best possible experience for Walden students, as well as ensuring the best position for Walden, for us and for our key stakeholders. To that end, we have had exploratory discussions with third parties regarding possible alternative transactions involving Walden. We are very proud of the quality and strength of Walden and we are very committed to maintaining that quality. Our conclusion following these discussions may be to decide to retain Walden within Laureate. At this time there is no assurance that we will engage in any transaction, or of the timing of any transaction, or that any proposed transaction, if it were to be announced, would be successfully consummated. Because Walden does not meet the criteria to be classified as held for sale or a discontinued operation, its results are reported within continuing operations for all periods presented.

Key Business Metrics

Enrollment

Enrollment is our lead revenue indicator and represents our most important non-financial metric. We define ‘‘enrollment’’ as the number of students registered in a course on the last day of the enrollment reporting period. New enrollments provide an indication of future revenue trends. Total enrollment is a function of continuing student enrollments, new student enrollments and enrollments from acquisitions, offset by graduations, attrition and enrollment decreases due to dispositions. Attrition is defined as a student leaving the institution before completion of the program. To minimize attrition, we have implemented programs that involve assisting students in remedial education, mentoring, counseling and student financing.

Each of our institutions has an enrollment cycle that varies by geographic region and academic program. During each academic year, each institution has a “Primary Intake” period in which the majority of the enrollment occurs. Most institutions also have one or more smaller “Secondary Intake” periods. The first calendar quarter generally coincides with the Primary Intakes for our institutions in Brazil, the Andean Region, Australia, New Zealand and Saudi Arabia. The third calendar quarter generally coincides with the Primary Intakes for our institutions in Mexico and the Online & Partnerships segment.

The following chart shows our enrollment cycles at our continuing operations. Shaded areas in the chart represent periods when classes are generally in session and revenues are recognized. Areas that are not shaded represent summer breaks during which revenues are not typically recognized. The large circles indicate the Primary Intake start dates of our institutions, and the small circles represent Secondary Intake start dates.

Pricing

We continually monitor market conditions and carefully adjust our tuition rates to meet local demand levels. We proactively seek the best price and content combinations to ensure that we remain competitive in all the markets in which we operate.

Principal Components of Income Statement

Revenues

The majority of our revenue is derived from tuition and educational services agreements with students, and thus, is recognized over time on a weekly straight-line basis over each academic session. The amount of tuition generated in a given period depends on the price per credit hour and the total credit hours or price per program taken by the enrolled student population. Deferred revenue and student deposits on our consolidated balance sheets consist of tuition paid prior to the start of academic sessions and unearned tuition amounts recorded as accounts receivable after an academic session begins. The price per credit hour varies by program, by market and by degree level. Additionally, varying levels of discounts and scholarships are offered depending on market-specific dynamics and individual achievements of our students. Revenues are recognized net of scholarships, other discounts, refunds, waivers and the fair value of any guarantees made by Laureate related to student financing programs. In addition to tuition revenues, we generate other revenues from student fees, dormitory/residency fees, and other education-related services. These other revenues are less material to our overall financial results and have a tendency to trend with tuition revenues. The main drivers of changes in revenues between periods are student enrollment and price.

Direct Costs

Our direct costs include labor and operating costs associated with the delivery of services to our students, including the cost of wages, payroll taxes, and benefits for institution employees, depreciation and amortization, rent, utilities, bad debt expenses and marketing and promotional costs to grow future enrollments. In general, a significant portion of our direct costs tend to be variable in nature and trend with enrollment, and management continues to monitor and improve the efficiency of instructional delivery. Conversely, as campuses expand, direct costs may grow faster than enrollment growth as infrastructure investments are made in anticipation of future enrollment growth.

General and Administrative Expenses

Our general and administrative expenses primarily consist of costs associated with corporate departments, including executive management, finance, legal, business development and other departments that do not provide direct operational services.

Factors Affecting Comparability

Acquisitions

Our past experiences provide us with the expertise to further our mission of providing high-quality, accessible and affordable higher education to students by expanding into new markets, primarily through acquisitions. Acquisitions affect the comparability of our financial statements from period to period. Acquisitions completed during one period impact comparability to a prior period in which we did not own the acquired entity. Therefore, changes related to such entities are considered “incremental impact of acquisitions” for the first 12 months of our ownership. We made two acquisitions in 2015, no acquisitions in 2016 and only one small acquisition in 2017 that had essentially no impact on the comparability of the periods presented.

Dispositions

Certain strategic initiatives may include the sale of institutions such as the 2016 sales of our Swiss and French institutions, which are included in Continuing Operations for all periods presented. In June 2016, we completed the sale of our Swiss and associated institutions for total net proceeds of approximately $339 million, and in July 2016 we completed the sale of our French institutions for total net proceeds of approximately $207 million. Such dispositions affect the comparability of our financial statements from period to period. Dispositions completed during one period impact comparability to a prior period in which we owned the divested entity. Therefore, changes related to such entities are considered “incremental impact of dispositions” for the first 12 months subsequent to the disposition.

Foreign Exchange

The majority of our institutions are located outside the United States. These institutions enter into transactions in currencies other than USD and keep their local financial records in a functional currency other than the USD. We monitor the impact of foreign currency movements and the correlation between the local currency and the USD. Our revenues and expenses are generally denominated in local currency. The USD is our reporting currency and our subsidiaries operate in various other functional currencies, including: Australian Dollar, Brazilian Real, Chilean Peso, Euro, Mexican Peso, New Zealand Dollar, Peruvian Nuevo Sol, Polish Złoty, and Saudi Riyal. The principal foreign exchange exposure is the risk related to the translation of revenues and expenses incurred in each country from the local currency into USD. The impact of changing foreign currency exchange rates increased consolidated revenues by approximately $83 million for the year ended December 31, 2017 and reduced consolidated revenues by approximately $150 million and $620 million for the years ended December 31, 2016 and 2015, respectively, as compared to the comparable preceding period. For the years ended December 31, 2017, 2016, and 2015, the impact of changing foreign currency exchange rates reduced consolidated Adjusted EBITDA by approximately $5 million, $2 million and $129 million, respectively, as compared to the comparable preceding period. We experienced a proportionally greater negative impact related to the years ended December 31, 2015 and the first half of 2016, which resulted from the significant weakening against the USD experienced by most currencies where we have significant operations. See ‘‘Risk Factors—Risks Relating to Our Business—Our reported revenues and earnings may be negatively affected by the strengthening of the U.S. dollar and currency exchange rates.’’ In order to provide a framework for assessing how our business performed excluding the effects of foreign currency fluctuations, we present organic constant currency in our segment results, which is calculated using the change from prior-year average foreign exchange rates to current-year average foreign exchange rates, as applied to local-currency operating results for the current year.

Seasonality

Most of the institutions in our network have a summer break during which classes are generally not in session and minimal revenues are recognized. In addition to the timing of summer breaks, holidays such as Easter also have an impact on our academic calendar. Operating expenses, however, do not fully correlate to the enrollment and revenue cycles, as the institutions continue to incur expenses during summer breaks. Given the geographic diversity of our institutions and differences in timing of summer breaks, our second and fourth quarters are stronger revenue quarters as the majority of our institutions are in session for most of these respective quarters. Our first and third fiscal quarters are weaker revenue quarters because the majority of our institutions have summer breaks for some portion of one of these two quarters. Due to this seasonality, revenues and profits in any one quarter are not necessarily indicative of results in subsequent quarters and may not be correlated to new enrollment in any one quarter.

Income Tax Expense

Our consolidated income tax provision is derived based on the combined impact of federal, state and foreign income taxes. Laureate has operations in multiple countries, many of which have statutory tax rates lower than the United States. Generally, lower tax rates in these foreign jurisdictions, along with Laureate’s intent and ability to indefinitely reinvest foreign earnings outside of the United States, results in an effective tax rate lower than the statutory rate in the United States. Further, discrete items can arise in the course of our operations that can further impact the Company’s effective tax rate for the period. Our tax rate fluctuates from period to period due to changes in the mix of earnings between our tax-paying entities, our tax-exempt entities and our loss-making entities for which it is not more likely than not that a tax benefit will be realized on the loss. The pre-tax result from our profitable entities in continuing operations for the years ended December 31, 2017 and 2016 was $522.8 million and $536.7 million, respectively.

Results of the Discontinued Operations

The results of operations of the Discontinued Operations for the years ended December 31, 2017, 2016 and 2015 were as follows:

|

|

|

For the year ended December 31, |

| |||||||

|

|

|

2017 |

|

2016 |

|

2015 |

| |||

|

Revenues |

|

$ |

992.1 |

|

$ |

942.3 |

|

$ |

891.9 |

|

|

Depreciation and amortization |

|

60.4 |

|

65.1 |

|

72.9 |

| |||

|

Share-based compensation expense |

|

2.9 |

|

3.0 |

|

3.2 |

| |||

|

Other direct costs |

|

780.5 |

|

758.6 |

|

737.9 |

| |||

|

Loss on impairment of assets |

|

33.5 |

|

23.5 |

|

— |

| |||

|

Operating income |

|

114.8 |

|

92.2 |

|

77.9 |

| |||

|

Other non-operating expense |

|

(17.4 |

) |

(28.2 |

) |

(47.2 |

) | |||

|

Pretax income of discontinued operations |

|

97.4 |

|

64.0 |

|

30.7 |

| |||

|

Income tax expense |

|

(24.5 |

) |

(30.6 |

) |

(22.4 |

) | |||

|

Income from discontinued operations, net of tax |

|

72.9 |

|

33.4 |

|

8.4 |

| |||

The following table provides enrollment of the Discontinued Operations as of December 31, 2017, 2016 and 2015:

|

|

|

2017 |

|

2016 |

|

2015 |

|

|

Enrollment |

|

202,800 |

|

200,100 |

|

187,000 |

|

Results of Operations

The following discussion of the results of our operations is organized as follows:

· Summary Comparison of Consolidated Results;

· Non-GAAP Financial Measure; and

· Segment Results.

Summary Comparison of Consolidated Results

Discussion of Significant Items Affecting the Consolidated Results for the Years Ended December 31, 2017, 2016 and 2015

Year Ended December 31, 2017

During the second quarter of 2017, the Company completed refinancing transactions that resulted in repayment of the previous senior credit facility and the redemption of the 9.250% Senior Notes due 2019 (the Senior Notes due 2019) (other than $250.0 million in aggregate principal amount of the Senior Notes due 2019 that the Company exchanged on April 21, 2017 for substantially identical but non-redeemable notes issued under a new indenture (the Exchanged Notes)). As a result of the refinancing transactions, during the quarter ended June 30, 2017, we recorded approximately $22.8 million in General and administrative expenses related to new third-party costs. We also recorded a Loss on debt extinguishment of $8.4 million as a result of the refinancing transactions combined with the repayment of notes in the first quarter related to the note exchange transaction, as discussed in Note 10, Debt in our consolidated financial statements included elsewhere in this Form 8-K.

On August 11, 2017, the remaining Senior Notes due 2019 were exchanged for a total of 18.7 million shares of the Company’s Class A common stock and the Senior Notes due 2019 were canceled.

In November 2017, we completed the sale of property and equipment at Ad Portas, a for-profit real estate subsidiary in our Andean segment, to UDLA Ecuador a licensed institution in Ecuador that was formerly consolidated into Laureate. We recognized an operating gain on the sale of this property and equipment of approximately $20.3 million.

In December 2017, we reached a final purchase price settlement agreement with the buyer of our Swiss hospitality management schools in 2016 and made a payment of approximately $9.3 million. The total settlement amount was approximately $10.3 million, which we recognized as (Loss) gain on sales of subsidiaries, net, in the Consolidated Statement of Operations for the year ended December 31, 2017, as it represented an adjustment of the sale purchase price. This loss is included in other non-operating income in the table below.

Impairment

Upon completion of our impairment testing for 2017, we recorded a total impairment loss of $40.6 million. Of the impairment charges recorded in 2017, $33.5 million relates to the discontinued operations described in Note 3, Discontinued Operations, in our consolidated financial statements included elsewhere in the Form 8-K, which under ASC 360-10 are required to be recorded at the lower of their carrying values or their estimated ‘fair values less costs to sell.’ Two subsidiaries in our Central America & U.S. Campuses that met the held-for-sale criteria during the fourth quarter of 2017 recorded impairment of approximately $17.4 million. Several subsidiaries in one country within our Rest of World segment that are classified as held-for-sale at December 31, 2017 recorded impairment of approximately $16.1 million. Since the estimated fair values of these disposal groups were less than their carrying values by more than the carrying value of the long-lived assets, we recorded an impairment on the long-lived assets and wrote the remaining Tradenames and Property and equipment, net down to a carrying value of $0. These impairment charges are included in income from discontinued operations in the table below.

The remaining $7.1 million of the impairment charges recorded in 2017 related to impairments of certain Property and equipment, net as well as impairments of Deferred costs and Other intangible assets, which were not associated with the assets held for sale and therefore are included in the results of our continuing operations. These included the impairment of a lease intangible, certain modular buildings and online course development costs.

Year Ended December 31, 2016

On June 14, 2016, we sold the operations of Glion in Switzerland and the United Kingdom, and the operations of Les Roches in Switzerland and the United States, as well as Haute école spécialisée Les Roches-Gruyère SA (LRG) in Switzerland, Les Roches Jin Jiang in China, Royal Academy of Culinary Arts (RACA) in Jordan and Les Roches Marbella in Spain, which resulted in a gain on sale of approximately $249.4 million. This gain is included in continuing operations within other non-operating income in the table below.

On July 20, 2016, we sold the operations of École Supérieure du Commerce Extérieur (ESCE), Institut Français de Gestion (IFG), European Business School (EBS), École Centrale d’Electronique (ECE), and Centre d’Études Politiques et de la Communication (CEPC), which resulted in a gain on sale of approximately $148.7 million. This gain is included in continuing operations within other non-operating income in the table below.

Impairment

Upon completion of our impairment testing for 2016, we recorded a total impairment loss of $23.5 million in our Rest of World segment. We recorded a goodwill impairment charge of $4.2 million related to our institutions in Germany and $19.3 million at Monash South Africa (MSA). The weakness of the South African Rand and challenging economic conditions have resulted in a change to our capital allocation strategy for this business, resulting in an impairment charge in the fourth quarter of 2016. We determined the fair value of the reporting units using an income approach based primarily on discounted cash flow projections. This impairment loss is included in income from discontinued operations in the table below.

Year Ended December 31, 2015

On March 5, 2015, we completed the sale of our interest in HSM Group Management Focus Europe Global S.L. (HSM). We recognized a net gain of $2.0 million in equity in net income (loss) of affiliates, net of tax, for the year ended December 31, 2015.

During the quarter ended June 30, 2015, we reassessed our position regarding certain ongoing Spanish tax audits and, as a result of recent adverse decisions from the Spanish Supreme Court and Spanish National Court on cases for taxpayers with similar facts, it was determined that we could no longer support a more-likely-than-not position and therefore recorded a provision of $42.1 million relating to these tax audits.

During the fourth quarter of 2015, we approved a plan of restructuring, which primarily included workforce reductions in order to reduce operating costs in response to overcapacity at certain locations. We incurred employee termination costs of $15.5 million resulting from a reduction in force at certain locations. Of the total employee termination costs, $11.2 million was incurred at our continuing operations, including $3.3 million in our Brazil segment, $0.1 million in our Mexico segment, $2.8 million in our Andean segment, $3.2 million in our Rest of World segment, $1.5 million in our Online & Partnerships segment and $0.3 million incurred at Corporate. The remaining $4.3 million was incurred at our discontinued operations and included in income from discontinued operations in the table below.

Comparison of Consolidated Results for the Years Ended December 31, 2017, 2016 and 2015

|

|

|

|

|

|

|

|

|

% Change |

| |||||

|

|

|

|

|

|

|

|

|

Better/(Worse) |

| |||||

|

(in millions) |

|

2017 |

|

2016 |

|

2015 |

|

2017 vs. 2016 |

|

2016 vs. 2015 |

| |||

|

Revenues |

|

$ |

3,385.9 |

|

$ |

3,301.9 |

|

$ |

3,399.8 |

|

3 |

% |

(3 |

)% |

|

Direct costs |

|

2,821.3 |

|

2,788.7 |

|

2,946.0 |

|

(1 |

)% |

5 |

% | |||

|

General and administrative expenses |

|

315.5 |

|

222.5 |

|

194.7 |

|

(42 |

)% |

(14 |

)% | |||

|

Loss on impairment of assets |

|

7.1 |

|

— |

|

— |

|

nm |

|

nm |

| |||

|

Operating income |

|

242.0 |

|

290.7 |

|

259.1 |

|

(17 |

)% |

12 |

% | |||

|

Interest expense, net of interest income |

|

(323.0 |

) |

(376.0 |

) |

(357.8 |

) |

14 |

% |

(5 |

)% | |||

|

Other non-operating income (expense) |

|

10.4 |

|

452.4 |

|

(132.6 |

) |

(98 |

)% |

nm |

| |||

|

(Loss) income from continuing operations before income taxes and equity in net income of affiliates |

|

(70.6 |

) |

367.1 |

|

(231.3 |

) |

(119 |

)% |

nm |

| |||

|

Income tax benefit (expense) |

|

91.3 |

|

(34.4 |

) |

(95.4 |

) |

nm |

|

64 |

% | |||

|

Equity in net income of affiliates, net of tax |

|

0.2 |

|

0.1 |

|

2.5 |

|

100 |

% |

(96 |

)% | |||

|

Income (loss) from continuing operations |

|

20.8 |

|

332.7 |

|

(324.2 |

) |

(94 |

)% |

nm |

| |||

|

Income from discontinued operations, net of tax |

|

72.9 |

|

33.4 |

|

8.4 |

|

118 |

% |

nm |

| |||

|

Net income (loss) |

|

93.8 |

|

366.2 |

|

(315.8 |

) |

(74 |

)% |

nm |

| |||

|

Net (income) loss attributable to noncontrolling interests |

|

(2.3 |

) |

5.7 |

|

(0.4 |

) |

140 |

% |

nm |

| |||

|

Net income (loss) attributable to Laureate Education, Inc. |

|

$ |

91.5 |

|

$ |

371.8 |

|

$ |

(316.2 |

) |

(75 |

)% |

nm |

|

nm - percentage changes not meaningful

For further details on certain discrete items discussed below, see “Discussion of Significant Items Affecting the Consolidated Results.”

Comparison of Consolidated Results for the Year Ended December 31, 2017 to the Year Ended December 31, 2016

Revenues increased by $84.0 million to $3,385.9 million for the year ended December 31, 2017 from $3,301.9 million for the year ended December 31, 2016. This revenue increase was driven by higher average total enrollment at a majority of our institutions, which increased revenues by $41.5 million; the effect of changes in tuition rates and enrollments in programs at varying price points (“product mix”), pricing and timing, which increased revenues by $98.5 million; the effect of a net change in foreign currency exchange rates, which increased revenues by $82.6 million; and other Corporate and Eliminations changes, which accounted for an increase in revenues of $3.3 million. These increases in revenues were partially offset by the incremental impact of dispositions, which decreased revenues by $141.9 million.

Direct costs and general and administrative expenses combined increased by $125.6 million to $3,136.8 million for 2017 from $3,011.2 million for 2016. The direct costs increase was due to overall higher enrollments and expanded operations which increased costs by $69.1 million compared to 2016. The effect of a net change in foreign currency exchange rates increased costs by $83.3 million for 2017 compared to 2016. For 2017, share-based compensation expense and EiP implementation expense also increased direct costs by $72.0 million. Other Corporate and Eliminations expenses accounted for an increase in costs of $61.5 million in 2017, which included an expense of $22.8 million related to the portion of the refinancing transactions that was deemed to be a debt modification.

Offsetting these direct cost increases was the incremental impact of dispositions, which decreased costs by $118.3 million for 2017 compared to 2016. Acquisition-related contingent liabilities for taxes other-than-income tax, net of changes in recorded indemnification assets, decreased direct costs by $2.8 million in 2017 and increased direct costs by $18.9 million in 2016, decreasing expenses by $21.7 million in 2017 compared to 2016. An operating gain on the sale of an asset group at Ad Portas decreased direct costs by $20.3 million in 2017.

Operating income decreased by $48.7 million to $242.0 million for 2017 from $290.7 million for 2016. The decrease in operating income was primarily the result of higher 2017 operating expenses at Corporate combined with an increase in impairment loss of $7.1 million, partially offset by increased operating income at our Andean segment.

Interest expense, net of interest income decreased by $53.0 million to $323.0 million for 2017 from $376.0 million for 2016. The decrease in interest expense was primarily attributable to lower average debt balances and lower interest rates during 2017 resulting from the 2017 debt refinancing transactions.

Other non-operating income decreased by $442.0 million to $10.4 million for 2017 from $452.4 million for 2016. This decrease was primarily attributable to the gain on the sale of our Swiss and French subsidiaries in 2016 for a change of $408.6 million, a decrease in gain on foreign currency exchange of $74.8 million, primarily due to a redesignation of certain intercompany loans from temporary to permanent in the first quarter of 2017, and a change in other non-operating expense of $2.3 million in 2017 compared to 2016. These decreases were partially offset by a gain on derivative instruments in 2017 compared to a loss in 2016 for a change of $34.7 million and a decrease in loss on debt extinguishment of $9.0 million.

Income tax benefit (expense) changed by $125.7 million to a benefit of $91.3 million for 2017 from expense of $34.4 million for 2016. This decrease in expense was primarily due to the effects of the U.S. tax reform legislation, including an $82.4 million benefit for the remeasurement of deferred tax assets/liabilities due to the decrease in the U.S. federal tax rate from 35% to 21% beginning in 2018, and a $53.4 million benefit for valuation allowance release on the deferred tax assets other than net operating losses that, when realized, will become indefinite-lived net operating losses. Also, management’s decision to redesignate certain intercompany loans from temporary to permanent caused a discrete benefit of approximately $30 million during 2017. Changes in the mix of pre-tax book income attributable to taxable and non-taxable entities in various taxing jurisdictions also contributed to the overall change.

Income from discontinued operations, net of tax increased by $39.5 million to $72.9 million for 2017 from $33.4 million for 2016.

Net (income) loss attributable to noncontrolling interests increased by $8.0 million to net income of $2.3 million for 2017 from a net loss of $5.7 million for 2016. The increase in net income attributable to noncontrolling interests primarily related to less net loss at Monash and CIU, combined with increased net income related to HIEU and a change from net loss to net income at INTI and Pearl. In 2017, the noncontrolling interest holders of Pearl exercised their put option, which required Laureate to purchase an additional 35% equity interest in Pearl. These increases were partially offset by St. Augustine, for which we had noncontrolling interest net income in 2016 but no noncontrolling interest net income in 2017 following our 2016 acquisition of the remaining 20% noncontrolling interest.

Comparison of Consolidated Results for the Year Ended December 31, 2016 to the Year Ended December 31, 2015

Revenues decreased by $97.9 million to $3,301.9 million for the year ended December 31, 2016 from $3,399.8 million for the year ended December 31, 2015. This revenue decrease was driven by the effect of a net change in foreign currency exchange rates, which decreased revenues by $149.5 million and the incremental impact of dispositions, which reduced revenue by $129.2 million. Partially offsetting this decrease in revenues was the overall increased average total enrollment at a majority of our institutions, which increased revenues by $50.6 million; and the effect of product mix, pricing and timing, which increased revenues by $124.6 million. Other Corporate and Elimination changes accounted for an increase in revenues of $5.6 million.

Direct costs and general and administrative expenses combined decreased by $129.5 million to $3,011.2 million for 2016 from$3,140.7 million for 2015. The decrease in direct costs was due to the effect of a net change in foreign currency exchange rates, which decreased costs by $157.3 million for 2016 compared to 2015; the incremental impact of dispositions, which decreased costs by $122.1 million for 2016 compared to 2015; and employee termination costs, which increased direct costs by $11.2 million in 2015.

Offsetting these direct cost decreases was the effect of overall higher enrollments and expanded operations, which increased costs by $123.6 million. Acquisition-related contingent liabilities for taxes other than income tax, net of changes in recorded indemnification assets increased direct costs by $18.9 million in 2016 and increased direct costs by $5.6 million in 2015,

increasing expenses by $13.3 million in 2016 compared to 2015. Other Corporate and Eliminations expenses accounted for an increase in costs of $24.2 million in 2016 compared to 2015.

Operating income increased by $31.6 million to $290.7 million for 2016 from $259.1 million for 2015. The increase in operating income was related to increased operating income in our Rest of World, Online & Partnerships, Brazil and Andean segments. The increase in operating income was partially offset by increased Corporate expenses.

Interest expense, net of interest income increased by $18.2 million to $376.0 million for 2016 from $357.8 million for 2015. The increase in interest expense was primarily attributable to higher interest rates on our outstanding balances, partially offset by lower average balances outstanding during 2016.

Other non-operating income (expense) increased by $585.0 million to income of $452.4 million for 2016 from expense of $132.6 million for 2015. This increase was primarily attributable to a gain on sales of subsidiaries in 2016 of $398.1 million, a gain on foreign currency exchange in 2016 compared to a loss in 2015 for a change of $205.6 million and a change in other non-operating income (expense) of $0.9 million in 2016 compared to 2015. This increase was offset by an increase in the loss on debt extinguishment of $16.1 million combined with an increased loss on derivative instruments in 2016 compared to 2015 of $3.5 million.

Income tax expense decreased by $61.0 million to $34.4 million in 2016 from $95.4 million in 2015. This year-over-year decrease in expense was the result of recognizing a contingent liability in 2015 of $42.1 million related to the Spanish tax audits. In addition, in 2016 we had a benefit of $7.9 million related to the deferred taxes included within the accounting for the sale of the hospitality management schools and a release of contingent liabilities related to Peru and Brazil of $21.8 million and $12.5 million, respectively. There was also a change in the mix of pre-tax book income attributable to taxable and tax-exempt entities, partially offsetting the decreases above. Of the total 2016 pre-tax book income, $83.1 million related to the non-taxable gain on the sale of the hospitality management schools, resulting in a decrease to the overall effective tax rate for 2016.

Equity in net income of affiliates, net of tax decreased by $2.4 million to $0.1 million in 2016 from $2.5 million in 2015. We recognized a net gain on the sale of HSM for $2.0 million in 2015. Other equity-method investments resulted in a change of $0.4 million for 2016 compared to 2015.

Income from discontinued operations, net of tax increased by $25.0 million to $33.4 million for 2016 from $8.4 million for 2015.

Net loss (income) attributable to noncontrolling interests increased by $6.1 million to net loss of $5.7 million for 2016 from net income of $0.4 million for 2015. The increase in net loss attributable to noncontrolling interests primarily related to a higher net loss at Monash, combined with net losses at Obeikan and INTI and less net income from St. Augustine. We acquired the remaining 20% noncontrolling interest of St. Augustine in 2016. These losses were offset by increased net income related to HIEU and the closure of NHU in August 2015, which had losses in 2015.

Non-GAAP Financial Measure

We define Adjusted EBITDA as income (loss) from continuing operations, before equity in net (income) loss of affiliates, net of tax, income tax expense (benefit), loss (gain) on sale of subsidiaries, net, foreign currency exchange (gain) loss, net, other (income) expense, net, loss (gain) on derivatives, loss on debt extinguishment, interest expense and interest income, plus depreciation and amortization, share-based compensation expense, loss on impairment of assets and expenses related to implementation of our EiP initiative. When we review Adjusted EBITDA on a segment basis, we exclude inter-segment revenues and expenses that eliminate in consolidation. Adjusted EBITDA is used in addition to and in conjunction with results presented in accordance with GAAP and should not be relied upon to the exclusion of GAAP financial measures.

Adjusted EBITDA is a key measure used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, the exclusion of certain expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Additionally, Adjusted EBITDA is a key financial measure used by the compensation committee of our board of directors and our Chief Executive Officer in connection with the payment of incentive compensation

to our executive officers and other members of our management team. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

The following table presents Adjusted EBITDA and reconciles net income (loss) to Adjusted EBITDA for the years ended December 31, 2017, 2016 and 2015:

|

|

|

|

|

|

|

|

|

% Change |

| |||||

|

|

|

|

|

|

|

|

|

Better/(Worse) |

| |||||

|

(in millions) |

|

2017 |

|

2016 |

|

2015 |

|

2017 vs. 2016 |

|

2016 vs. 2015 |

| |||

|

Income (loss) from continuing operations |

|

$ |

20.8 |

|

$ |

332.7 |

|

$ |

(324.2 |

) |

(94 |

)% |

nm |

|

|

Plus: |

|

|

|

|

|

|

|

|

|

|

| |||

|

Equity in net income of affiliates, net of tax |

|

(0.2 |

) |

(0.1 |

) |

(2.5 |

) |

100 |

% |

(96 |

)% | |||

|

Income tax (benefit) expense |

|

(91.3 |

) |

34.4 |

|

95.4 |

|

nm |

|

64 |

% | |||

|

(Loss) income from continuing operations before income taxes and equity in net income of affiliates |

|

(70.6 |

) |

367.1 |

|

(231.3 |

) |

(119 |

)% |

nm |

| |||

|

Plus: |

|

|