|

|

DLA Piper LLP (US) |

|

|

|

|

|

JASON C. HARMON |

|

|

CONFIDENTIAL TREATMENT REQUESTED BY LAUREATE EDUCATION, INC UNDER 17 C.F.R §§ 200.80(b)(4) AND 200.83 |

December 23, 2015

via EDGAR

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E. — Mail Stop 3720

Washington, D.C. 20549

Attention: Larry Spirgel

|

Re: |

Laureate Education, Inc. |

|

|

Amendment No. 1 to Registration Statement on Form S-1 |

|

|

Filed November 20, 2015 |

|

|

File No. 333-207243 |

Ladies and Gentlemen:

This letter is provided on behalf of our client, Laureate Education, Inc. (the “Company”), in response to the comments provided by the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in the letter from Larry Spirgel dated November 30, 2015 with respect to the above-referenced amendment to the Registration Statement on Form S-1 (the “Registration Statement”) filed with the Commission on November 20, 2015. In response to the Staff’s comments, we are filing today via EDGAR, Amendment No. 2 to the Form S-1 (“Amendment No. 2”). An electronic version of Amendment No. 2 has been submitted concurrently with the Commission through its EDGAR system. The enclosed copy of Amendment No. 2 has been marked to reflect changes made to the Registration Statement.

For your convenience, your comments have been reproduced in bold below, together with the Company’s responses. Defined terms used herein shall have the meaning specified in the Registration Statement.

General

1. We note your response to comment 4 of our prior letter. Please revise your disclosure to summarize your basis for the statement in the prospectus.

Response:

The Company has revised the disclosure on pages 1 and 159 of Amendment No. 2 in response to the Staff’s comment.

2. We note your responses to comments 7 and 17 of our prior letter that the company believes current disclosure of the certification standards used by B Lab are sufficient. However, current disclosure merely discusses the categories considered by B Lab during the certification process. Please revise your disclosure to discuss the certification process and the standards used by B Lab in such assessment.

Response:

The Company has revised the disclosure on pages 283 and 284 of Amendment No. 2 in response to the Staff’s comment.

Prospectus Summary, page 9

3. We note your response to comment 13. Please revise this section to also disclose the net loss for each year Adjusted EBITDA has been presented.

Response:

The Company has revised the disclosure on pages 9 and 166 of Amendment No. 2 in response to the Staff’s comment.

Public Benefit Corporation Status, page 14

4. We note your disclosure on the top of page 15 regarding the public benefit you provide. Please expand this disclosure to specify how your programs differ from other public education companies.

Response:

The Company advises the Staff that Section 362 of the Delaware General Corporation Law requires that a public benefit corporation identify in its certificate of incorporation the specific public benefit to be promoted by the corporation. The Company’s certificate of incorporation provides that its specific public benefit purpose is “to produce a positive effect (or a reduction of negative effects) for society and persons by offering diverse education programs delivered online and on premises operated in the communities that we serve.” The Company has revised the disclosure on pages 15 and 284 of Amendment No. 2 to make the disclosure consistent with the language that appears in its certificate of incorporation.

The difference for a corporation that has elected to be treated as a public benefit corporation is that it is required to manage its business in a manner that balances the stockholders’ pecuniary interests, the best interests of those materially affected by the corporation’s conduct and the public benefit disclosed in the corporation’s certificate of incorporation, which in the Company’s case is producing a positive effect for society through its educational offerings. The disclosure on page 15 is focused on how the Company intends to produce the specific public benefit as

described in its certificate of incorporation. The Company does not have insight into how other education companies are operated or how their educational offerings differ from those offered by the Company, and as a result the Company respectfully advises the Staff that it does not have a proper basis for making a comparison as suggested by the Staff’s comment. Instead, the Company believes that a discussion of its specific public benefit and how it intends to produce such benefit is most relevant to potential investors, which is disclosed in the Registration Statement.

Critical Accounting Policies

Goodwill and Indefinite-lived Intangible Assets, page 148

5. We note your response to comment 22 and your revisions on pages 148-149. Please expand your disclosures to state, if true, that none of your reporting units with significant goodwill were at risk of failing step one of the goodwill impairment test as of September 30, 2015.

Response:

The Company has revised the disclosure on page 149 of Amendment No. 2 in response to the Staff’s comment.

Notes to Consolidated Financial Statements

Other Intangible Assets, page F-30

6. We note your response to comment 26. It is unclear to us how you can support using the relief-from-royalty methodology for “tradenames and accreditations,” which represents the combination of two distinct intangible assets. In this regard, please tell us: 1) how losing one or more accreditations would affect the value of the asset; 2) what adjustments, if any, were made to the royalty rate used to ensure that it matches the characteristics of the accreditations; and 3) how the resultant royalty rate reflects the expectations of market participants.

Response:

The Company has always considered “Tradenames and accreditations” to be a single asset for accounting purposes, and did so as a public company prior to its going private transaction (“LBO”) in 2007. The Company believes the asset is a single unit of account because the accreditations have little value on their own and are not transferable from one institution to another, but can add reputational value to the trade name of the accredited institution. However, the reputational value of the trade name is also impacted by other factors including, but not limited to, the quality of the Company’s faculty, its job placement results and the success of the Company’s alumni. These and other reputational qualities are created with the related investment made in the Company’s tradename/brand prior to obtaining accreditations.

Each of the Company’s universities has numerous accreditations associated with its tradenames, and there are differences by jurisdiction and institution in terms of the types and numbers of

accreditations. These accreditations vary from institutional level accreditations, which allow an institution to grant degrees without supervision, to program specific undergraduate and graduate accreditations such as business or medical school programs. For example, the Company’s LatAm segment has a total of 15 institutional accreditations, 1,073 undergraduate program level accreditations and 24 graduate program level accreditations as of October 2015. All of the accreditations are available to any institution that meets the requirements to be accredited and pays the nominal registration fee that the government entity requires. Accreditations provide no exclusivity to any of the Company’s institutions, and the numbers of accreditations that are issued in the jurisdictions where the Company has operations are not limited. Additionally, as in the United States, the reputations of similarly accredited institutions can differ dramatically in each of the countries where the Company operates. Thus, there is no reason that a market participant would place a significant value on an accreditation; any institution that was qualified to receive such an accreditation could obtain it through the payment of a small fee and incurrence of relatively small third-party costs.

If an accreditation were to be separately recognized as an intangible asset, the Company believes a market participant would apply a cost replacement method and would not ascribe a value higher than the actual cost to recreate an asset of similar utility. Once the university has established its reputation and built up a faculty and curriculum in a program, which are non-capitalizable activities, the incremental costs and level of effort required to obtain accreditations are nominal. Thus, the theoretical fair value of accreditation on its own is simply related to the time and fairly minimal cost of completing the accreditation process. The Company spends a nominal amount (less than $2.0 million annually) to both renew existing and obtain new accreditations throughout the world. As such, the loss of one or more accreditations would not have a material impact on the value of the “Tradenames and accreditations” asset.

In contrast, a trade name is exclusive and unique, and the right to use a trade name can have significant value as a result of long-term building of brand equity in the Company’s markets. The right to use a trade name is often and commonly valued using a relief from royalty approach. The Company’s valuation of the “Tradenames and accreditations” asset focused on the value of the trade name.

The trade name valuation implicitly includes in the inputs to the relief from royalty approach (i.e., revenue and profits) the reputational value of any accreditations held as well as a variety of other factors including political and economic considerations, the quality of the Company’s faculty, the view of for profit education in those communities and relative value versus competitors. The revenue projections included in the Company’s relief from royalty approach incorporates these factors, among others. As noted previously, the fact that the accreditation conveys reputational value does not imply that a market participant would place significant value on the accreditation itself. Instead, the reputational value of being accredited is impounded in the value of the trade name.

As noted above, the Company applies a relief-from-royalty method to value trade names. The two main drivers of value under this method are forecasted revenues and the royalty rate assigned. Due to the absence of market derived rates, the Company estimates a market participant royalty rate using a profit split method. Under this method, the projected economics

are split, with the trade name allocated a portion of the operating profit (i.e., EBIT on a steady state basis), based on the relative importance of the trade name to the institution. The portion of the operating profit allocated to the trade name is then used to derive the trade name’s fair value. Under this approach, the Company does not make any direct adjustments to the royalty rate used, as the steady state EBIT includes the impact of changes in the institutions’ economics, including impacts, if any, of accreditation status. Rather the derived royalty rate can be subsequently increased or decreased based on the future expected economic performance of the institution. Accordingly, operating profit is the primary driver of the royalty rate and the rate varies depending on those results. The Company believes the resultant royalty rate reflects the expectations of market participants as it would expect to pay a higher royalty rate for institutions that operate at higher operating margins.

The loss of accreditation would likely occur and result from the deterioration in the fundamentals of an institution’s business, including its reputation, how curriculum is delivered to students, the economic and political environment in that country and market acceptance of for-profit institutions. These factors are integral to the development of the Company’s long-range plan, which is a key component to the Company’s annual impairment test. In fact, a loss of an accreditation is likely a lagging indicator in assessing the value of the asset. Therefore, losing one or more accreditations in and of itself would not typically impact the value of the trade name asset as the trade name’s value would have already declined and would have been accounted for through any necessary impairment charges. However, losing an accreditation in conjunction with a diminished reputation or a changing political or regulatory environment may impact the value of the asset.

In further response to the Staff’s comment, to help clarify the Company’s accounting treatment, the Company proposes to delete “and accreditations” from the balance sheet caption and in the related footnotes in its amended S-1 filing and further disclose in a footnote that the Company does not believe accreditations have significant value on their own, due to the fact that they are neither exclusive nor scarce. The Company proposes to add the following disclosure to its accounting policy footnote on page F-31 in a subsequent amendment:

Accreditations are not considered a separate unit of account and their values are embedded in the cash flows generated by the institution, which are used to value its trade name. The Company does not believe accreditations have significant value on their own due to the fact that they are neither exclusive nor scarce, and the direct costs associated with obtaining accreditations are not material.

7. Further, please tell us how the royalty rates change when you assess the value of trade names in entities where no accreditations exist.

Response:

The Company does not make any direct adjustments to the royalty rate used when it assesses the value of trade names where no accreditations exist. Accreditations are not, by themselves, a driver of economics. For example, an unknown school (i.e., without a reputation) that receives

an accreditation to be a medical school is not assured of having students enroll in its programs, nor would an accreditation ensure the institution has profitable operations. Rather, an institution with a good reputation will be able to leverage accreditations and enroll students and have the potential to be a profitable program. Accreditations are not a differentiating factor for an institution. For example, an institution in the bottom quartile from a reputation standpoint is likely to have the same accreditation as one in the top quartile. Thus, as detailed in the Company’s response to comment number 6, the royalty rate is based on the overall economics of the institution using a profit split method, and is primarily driven by revenues and the EBIT margin at the institutions.

8. We note that in 2014, you recorded a total impairment loss for “tradenames and accreditations” in the aggregate amount of $47.7 million related to two Chilean institutions in your LatAm segment. With respect to these two institutions, please tell us how you considered the guidance in ASC 350-30-35-16 that requires you to evaluate the remaining useful life of an intangible asset that is not being amortized each reporting period to determine whether events and circumstances continue to support an indefinite useful life. Further, please tell us if “tradenames and accreditations” associated with UDLA Chile has been fully impaired as of September 30, 2015. If not please tell us how you considered this guidance in October of 2013 when you were notified by the National Accreditation Commission that UDLA Chile’s institutional accreditation would not be renewed and again in January of 2014 when you received a final determination that the related appeal was denied.

Response:

As detailed in response to comment number 6, the Company has concluded the value assigned to “Tradenames and accreditations” is the value of its institutions’ trade names. The Company notes that UDLA possessed no accreditations as of the LBO date in 2007. UDLA obtained institutional accreditation from the National Accreditation Commission in 2008 and various other accreditations of academic programs (“programmatic accreditations”) beginning in 2008.

With regard to the two Chilean institutions that recognized impairments in 2014, the Company continues to believe that these are indefinite useful life assets. While the value of the trade name has diminished, as the future performance is less than the expected performance assumptions included in the model used to initially recognize the intangible asset, due to a variety of factors, there are no legal, regulatory, contractual, competitive, economic or other factors that will limit the useful life of this asset. Effectively, these institutions’ rights to use the trade names have not changed. However, the Company has concluded a market participant might pay less to acquire such asset, based on reduced expectations for the future performance of these institutions.

UNAB and UDLA both continue to offer their full suite of educational programs and expect to do so indefinitely into the future. They also have not experienced a negative impact to any academic programs and/or their ability to grant degrees. Further, the Company believes that both institutions will contribute profits and cash flows to the Company over an indefinite life.

With regard to UDLA, the Company had approximately $21.1 million of trade names still recorded as of September 30, 2015. The loss of the institutional accreditation did not change the educational programs offered, impact any other programmatic accreditations, or UDLA’s ability to grant degrees.

However, when the Company was notified in October 2013 by the National Accreditation Commission that UDLA Chile’s institutional accreditation would not be renewed and again in January 2014 when the Company received a final determination that the related appeal was denied, the Company considered the guidance in ASC 350-30-35-16 in order to assess whether the facts continued to support an indefinite life. As noted above, the loss of this accreditation did not change the educational programs offered, impact any programmatic accreditations or impact UDLA’s ability to grant degrees. However the loss did impact the institution’s ability to enroll new students who wished to participate in the government sponsored student loan program (“CAE”).

After receiving the notification and the appeal results noted above, which occurred while the Company was finalizing its long-range plan and conducting its fourth quarter annual impairment test, the Company updated its long-range plan for UDLA. It should be noted that this long-range plan was updated for the loss of accreditation and other factors. These other factors include specifics relative to unfavorable changes in the political and economic environment in Chile, the reputation of UDLA’s faculty and curriculum, the view of for-profit education in Chile and relative value versus competitors.

It should be noted that the environment in Chile has evolved since the LBO in 2007 when UDLA was a highly profitable business without any accreditations. As noted previously, UDLA subsequently received national and programmatic accreditations while, concurrently, the economy and political environment in Chile deteriorated. These factors, along with the loss of the national accreditation, were considered in our fourth quarter annual impairment test, which was conducted at the time of the loss of accreditation.

As part of that process, the Company considered its history of operating UDLA profitably prior to participating in the CAE program beginning in 2010 and the Company’s belief that it would re-attain accreditation in the future, including assumptions about UDLA’s enrollments and attrition rates. It should be noted that the Company acquired UDLA in 2000 and operated the institution profitably from the time of acquisition through the date of the LBO in 2007 without participating in the CAE program or having any accreditations. Based on those considerations, the Company continues to believe that UDLA will operate indefinitely as a profitable institution. This supports the Company’s position that this asset continues to have an indefinite life and value. As noted above, the asset initially recorded for “Tradenames and accreditations” for UDLA as of the LBO date in 2007 did not include any value for the national accreditation that was lost in October 2013. Therefore, there was no value recorded or asset related to this accreditation to impair.

Revenue Recognition, page F-32

9. We note your response to comment number 27. It appears to us that on the day a

student withdraws from a course and you are required to return the Title IV funds, you should reassess your revenue recognition policy to determine whether collectability continues to be reasonably assured. If collectability is not reasonably assured, you should recognize revenue on a cash basis. Considering that your historical collection experience with students who become responsible for tuition and related fees due to withdrawal or loss of financial aid eligibility is low, please provide us with your SAB 99 materiality analysis and a detailed analysis of the qualitative factors you considered to explain why you believe that you should not restate prior year financial statements for the correction of this error.

Response:

The Company acknowledges errors with respect to the collectability of tuition from students who become responsible for payments due to withdrawal or loss of financial aid. The Company does not believe these errors for 2012, 2013 and 2014 to be material pursuant to the guidance outlined in SAB 99. The Company has provided the following SAB 99 analysis for the Staff’s consideration:

Analysis of Misstatements

To assess errors, management uses a quantitative benchmark for identifying items over which to perform additional quantitative and qualitative analysis. The primary financial statement users currently are the Company’s debt holders and private equity investors, who focus primarily on cash flows and Adjusted EBITDA (as defined in the MD&A included in the Registration Statement), a non-GAAP measure, to assess financial performance. The items over which the Company’s management performs these analyses are:

· Pre-tax Income: This is the benchmark of greatest significance to the investors in profit-oriented entities. However, as the Company is highly leveraged and has experienced losses, and often operates at close to a break-even level, its current investors focus primarily on Adjusted EBITDA and Revenues.

· Revenues: This is a more stable measure than pre-tax income and is a strong indicator of the scale of the Company and relative materiality.

· Adjusted EBITDA: The Company’s current financial statement users focus primarily on cash-based performance measures, including cash flows from operations and Adjusted EBITDA, which exclude expenditures such as depreciation and amortization, which are non-cash, as well as derivative gains/losses, interest expense and income taxes. Adjusted EBITDA is a factor in certain covenants in the Company’s credit agreement and is also regularly reported to the Board of Directors and the Audit Committee.

The Company currently uses a materiality benchmark of approximately $20 million, based on consideration of the above factors, as a guideline to assess materiality prior to performing further quantitative and qualitative analysis. This benchmark was in a similar range during 2012, 2013 and 2014.

Quantitative Analysis

The Company performed inquiries and sensitivity analyses on the aggregated misstatements identified related to revenue recognition of withdrawn students and deemed that the policy elections that the Company made, as described in its response submitted to the Staff in the Company’s previous response letter, does not result in a material adjustment. The Company has aggregated all these identified misstatements for both the Title IV program as per this comment and the CAE program, as discussed in comment 10.

Table 1 (below) summarizes the aggregate misstatements accumulated during the calendar years 2012, 2013 and 2014 and the current year-to-date period ended September 30, 2015 and their impacts to Income (Loss) from Continuing Operations, Income Tax Expense (Benefit) and Net Income (Loss) under the “rollover” method. Table 2 (below) summarizes the aggregate misstatements accumulated as of September 30, 2015 and their impacts to Income (Loss) from Continuing Operations, Income Tax Expense (Benefit) and Net Income (Loss) under the “iron curtain” method. Table 3 (below) summarizes the aggregate misstatements accumulated for the quarter ended September 30, 2015 and their impacts to Income (Loss) from Continuing Operations, Income Tax Expense (Benefit) and Net Income (Loss) under the “iron curtain” method. The Company intends to record immaterial out-of-period adjustments related to these errors during the fourth quarter of 2015. When recording the cumulative catch-up entry in the fourth quarter of 2015, the Company will reflect this revenue on a cash basis.

Aggregate Income Statement Analysis: The overall impacts of the misstatements to the Company’s prior period’s consolidated income statements are as follows:

Table 1-Rollover

[***]

[***] Confidential Treatment Requested by Laureate Education, Inc. under 17 C.F.R. §§ 200.80(b)(4) and 200.83.

Table 2- Iron Curtain YTD 2015

[***]

Table 3 — Iron Curtain Q3 2015

[***]

The Company notes that certain of the percentages shown for 2013 appear high because the Company operated at close to a break-even level for that year.

Table 4

Income statement impact of misstatement (Rollover)

[***]

[***] Confidential Treatment Requested by Laureate Education, Inc. under 17 C.F.R. §§ 200.80(b)(4) and 200.83.

Aggregate Balance Sheet Analysis (Iron Curtain): The overall impacts of the misstatements to the Company’s prior periods’ consolidated balance sheets are as follows:

Table 5

Balance Sheet impacts of misstatements

[***]

Aggregate Statement of Cash Flows Analysis: As none of the identified misstatements impacted the reported amounts of cash and cash equivalents, and all of the adjustments net to a zero impact on the cash provided by (used in) operating activities, with no impact to any of the other sections of the statement of cash flows, the Company concludes that there are no material misstatements affecting the Statement of Cash Flows for any period presented.

Qualitative Analysis

With regard to qualitative factors, the Company performs the following analysis:

1. Whether the misstatement masks a change in earnings or other trends.

[***] Confidential Treatment Requested by Laureate Education, Inc. under 17 C.F.R. §§ 200.80(b)(4) and 200.83.

2. Whether the misstatement hides a failure to meet analysts’ consensus expectations for the enterprise.

3. Whether the misstatement changes a loss into income or vice versa.

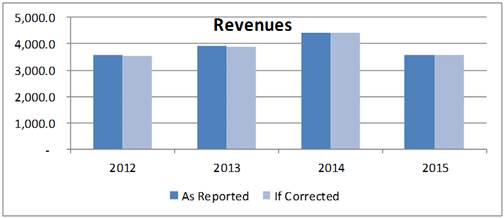

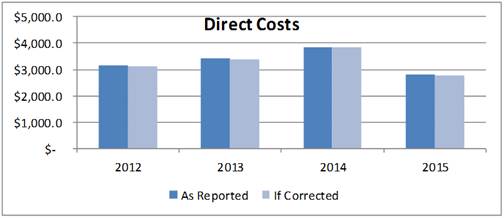

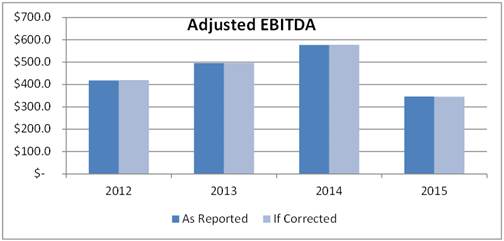

The misstatements do not result in a change in earnings or other trends nor do they change any measure from income to loss or vice versa in any period presented in the analysis. Further, with respect to all misstatements, each of Revenues, Operating Income (Loss), Income (Loss) from Continuing Operations, Income Tax Expense (Benefit), Net Income (Loss) and Adjusted EBITDA display a trend that is not significantly impacted nor distorted by the errors. The graphs below show these trends for Revenues, Direct Costs and Adjusted EBITDA.

4. Whether the misstatement concerns a segment or other portion of the registrant’s business that has been identified as playing a significant role in the registrant’s operations or profitability.

The Company considered the impact of the misstatements on a segment basis and the misstatements do not change any individual segment measure trend or relationship with the other segments. Both misstatements identified occurred within significant operating segments and the misstatements, both individually and in the aggregate, are not significant quantitatively.

5. Whether the misstatement affects the registrant’s compliance with regulatory requirements.

The misstatements do not result in the Company’s non-compliance with any of the United States Department of Education rules and regulations or rules and regulations of any similar governmental authority in other jurisdictions.

6. Whether the misstatement affects the registrant’s compliance with loan covenants or other contractual requirements.

Given the small amount of the misstatements discussed above, the Company concludes that such errors do not impact its compliance with its debt covenants. Furthermore, the Company’s credit facilities do not have a maintenance covenant which, if not met, would trigger a default. Rather, the facilities have incurrence-based covenants that limit the amount of debt the Company can borrow on a prospective basis. In other words, the Company would be restricted from incurring additional debt (subject to a number of baskets) or making an acquisition until it has met the leverage ratios contained in the credit facility. The misstatements do not impact any of the key ratios that would have resulted in a covenant violation. Lastly, the interest rates under the credit facilities could escalate based on the extent that the Company’s leverage ratios exceed the prescribed limits. The interest rate under the credit facilities for the years 2012 through 2014 would not have changed had the Company recorded all the unadjusted misstatements.

7. Whether the misstatement has the effect of increasing management’s compensation — for example, by satisfying requirements for the award of bonuses or other forms of incentive compensation.

The Company believes that due to the small size of the misstatements in each of the periods presented, no material impact to incentive compensation occurred as a result of the misstatements.

8. Whether the misstatement is intentional and involves concealment of an unlawful transaction?

The Company does not believe that any of the unadjusted misstatements were an intentional action taken or involved the concealment of an unlawful transaction.

Overall Conclusion

The Company considered all the quantitative and qualitative factors described above and believes that none of the identified unadjusted misstatements is material to the fair presentation of any of its previously issued financial statements. The Company has reviewed this analysis with its Audit Committee, which concurred with management’s conclusion.

10. We note your response to comment number 28. With respect to the CAE Program in Chile, it appears to us that on the day a student withdraws from a course, you should reassess your revenue recognition policy to determine whether collectability continues to be reasonably assured. If collectability is not reasonably assured, you should recognize revenue on a cash basis. Considering that your historical collection experience with students who become responsible for tuition and related fees due to withdrawal or loss of financial aid eligibility is low, please provide us with your SAB 99 materiality analysis and a detailed analysis of the qualitative factors you considered to explain why you believe that you should not restate prior year financial statements for the correction of this error.

Response:

The Company respectfully advises the Staff to review its response to comment 9, which provides the Company’s SAB 99 materiality analysis addressing the inappropriate revenue recognition in Chile.

11. Nevertheless, revise your revenue recognition accounting policy to disclose that because collectability is not reasonably assured after the student withdraws, you recognize revenue on a cash basis.

Response:

The Company has revised the disclosure on pages 152 and F-32 of Amendment No. 2 in response to the Staff’s comment.

Note 8. Goodwill and Other Intangible Assets, page F-64

12. We note your response to comment 34 and note that you provided us with key items from the company’s performance in 2013 prior to the loss of accreditation versus the outlook for 2014, 2015 and 2016, used to calculate the 2014 impairment loss recorded for UDLA Chile. However, we had asked you to provide us with the effect that the non-renewal actually had since the non-renewal, and is expected to have from this point on, on enrollment, student persistence, collectability of student receivables and your results of operations and related assets. Please reply accordingly. Further, considering the current status of the accreditation process, tell us if you continue to expect accreditation to occur in 2016 and if you have strong evidence from the National Accreditation Commission to support this assumption.

Response:

The Company advises the Staff that the table below summarizes the percentage change from the Company’s performance in 2013 prior to the loss of accreditation versus the actual performance through September 30, 2015 and its expectations of performance thereafter.

|

|

|

Actual |

|

Forecast |

| ||||||||||||

|

|

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

2019 |

|

2020 |

|

|

Total enrollments |

|

100.0 |

% |

(16.0 |

)% |

(25.9 |

)% |

(26.1 |

)% |

(21.3 |

)% |

(14.9 |

)% |

(8.4 |

)% |

(2.6 |

)% |

|

New enrollments |

|

100.0 |

% |

(42.7 |

)% |

(46.6 |

)% |

(39.3 |

)% |

(26.5 |

)% |

(22.5 |

)% |

(19.1 |

)% |

(17.0 |

)% |

|

Revenue |

|

100.0 |

% |

(25.2 |

)% |

(34.0 |

)% |

(32.5 |

)% |

(24.0 |

)% |

(14.9 |

)% |

(3.5 |

)% |

7.4 |

% |

|

Bad debt expense |

|

100.0 |

% |

(11.4 |

)% |

(27.1 |

)% |

(20.9 |

)% |

(8.4 |

)% |

1.6 |

% |

13.3 |

% |

24.7 |

% |

|

Bad debt expense % of Revenue |

|

4.5 |

% |

5.3 |

% |

5.0 |

% |

5.3 |

% |

5.4 |

% |

5.4 |

% |

5.3 |

% |

5.2 |

% |

|

Net income (loss) |

|

100.0 |

% |

(130.7 |

)% |

(151.3 |

)% |

(187.3 |

)% |

(151.2 |

)% |

(121.6 |

)% |

(89.4 |

)% |

(54.3 |

)% |

|

Total assets |

|

100.0 |

% |

(40.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

100.0 |

% |

(52.9 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Receivables, net |

|

100.0 |

% |

(24.2 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

It should be noted the loss of the national accreditation which affords the ability for students to participate in the CAE program only impacted new students at UDLA. Returning students remain eligible to participate in the CAE program; therefore, the most significant impact of the loss of the accreditation is a reduction to new enrollment rather than student persistence or attrition rates. Bad debt expense has also not been significantly impacted. Attrition rates of existing students have remained relatively consistent as those students remain eligible to participate in the CAE program. It should be noted bad debt expense is not high as a percentage of revenue in the Company’s business as students generally pay in advance and those who do not pay are denied the right to attend classes. This model did not change as a result of accreditation.

As of the date of this response, UDLA Chile has completed step 7 and is in the early stages of step 8 of the accreditation process described in the Company’s November 19, 2015 response to comment number 34 in the letter from Larry Spirgel dated October 29, 2015. UDLA has not received any communications from the National Accreditation Commission indicating that it will not be successful in this process, and continues to believe, based on all of the steps that it has taken to date, as well as the oral exit report it received from the External Peers Commission,

that it will ultimately be successful in re-attaining national accreditation in 2016.

* * * *

Thank you very much for your attention to this matter. We hope that our responses to your comments address the issues raised in your letter and would be happy to discuss with you any remaining questions or concerns you may have. Please contact me at (410) 580-4170 should you have any questions concerning this letter or require further information.

|

|

Sincerely, |

|

|

|

|

|

/s/ Jason C. Harmon, Esq. |

|

|

DLA Piper LLP (US) |

cc: Robert W. Zentz, Esq.

Thomas J. Plotz, Esq.

Laureate Education, Inc.

Robert W. Smith, Jr., Esq.

DLA Piper LLP (US)

Gary Horowitz, Esq.

Joseph H. Kaufman, Esq.

Simpson Thacher & Bartlett LLP