Use these links to rapidly review the document

TABLE OF CONTENTS

Index to Consolidated Financial Statements

As filed with the Securities and Exchange Commission on December 15, 2016

Registration No. 333-207243

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 4

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Laureate Education, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

8200 (Primary Standard Industrial Classification Code Number) |

52-1492296 (I.R.S. Employer Identification No.) |

650 S. Exeter Street

Baltimore, Maryland 21202

(410) 843-6100

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Robert W. Zentz, Esq.

Senior Vice President, Secretary and General Counsel

Laureate Education, Inc.

650 S. Exeter Street

Baltimore, Maryland 21202

(410) 843-6100

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

| With copies to: | ||

Robert W. Smith, Jr., Esq. Michael J. Stein, Esq. DLA Piper LLP (US) 6225 Smith Avenue Baltimore, MD 21209 (410) 580-3000 |

Joseph H. Kaufman, Esq. David W. Azarkh, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017 (212) 455-2000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Class A common stock, par value $0.001 per share |

$100,000,000 | $10,070(3) | ||

|

||||

- (1)

- Includes

additional shares of Class A common stock that the underwriters have the option to purchase.

- (2)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act.

- (3)

- Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated December 15, 2016

PROSPECTUS

Shares

Class A Common Stock

Laureate Education, Inc. is offering shares of its Class A common stock. This is our initial public offering and no public market currently exists for our shares of Class A common stock. We anticipate that the initial public offering price will be between $ and $ per share.

Following this offering, we will have two classes of outstanding common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock will be identical, except with respect to voting and conversion. Each share of Class A common stock will be entitled to one vote per share. Each share of Class B common stock will be entitled to ten votes per share and will be convertible at any time into one share of Class A common stock. Outstanding shares of Class B common stock will represent approximately % of the voting power of our outstanding capital stock following this offering. After completion of this offering, Wengen Alberta, Limited Partnership, an Alberta limited partnership ("Wengen"), our controlling stockholder, will continue to control a majority of the voting power of our outstanding common stock. As a result, we are a "controlled company" within the meaning of the Nasdaq Global Select Market ("Nasdaq") corporate governance standards. See "Security Ownership of Certain Beneficial Owners and Management." In October 2015, we redomiciled in Delaware as a public benefit corporation as a demonstration of our long-term commitment to our mission to benefit our students and society.

We intend to apply for the listing of our Class A common stock on Nasdaq under the symbol "LAUR."

Investing in our Class A common stock involves risks. See "Risk Factors" beginning on page 27.

| |

Per Share |

Total | |||||

|---|---|---|---|---|---|---|---|

Initial public offering price |

$ | $ | |||||

Underwriting discounts and commissions(1) |

$ | $ | |||||

Proceeds, before expenses, to us |

$ | $ | |||||

- (1)

- We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See "Underwriting (Conflicts of Interest)."

We have granted the underwriters the right to purchase up to an additional shares of Class A common stock from us.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A common stock to purchasers on , 2017.

Joint Book-Running Managers

| Credit Suisse | Morgan Stanley | Barclays |

| J.P. Morgan | BMO Capital Markets | Citigroup | KKR | Goldman, Sachs & Co. |

Co-Managers

Baird |

Barrington Research |

Piper Jaffray |

Stifel |

William Blair |

Bradesco BBI |

BTG Pactual |

, 2017

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission (the "SEC"). Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the SEC. We are offering to sell, and seeking offers to buy, our Class A common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus.

Through and including , 2017 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside of the United States, neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

As used in this prospectus, unless otherwise stated or the context otherwise requires, references to "we," "us," "our," the "Company," "Laureate" and similar references refer collectively to Laureate Education, Inc. and its subsidiaries. Unless otherwise stated or the context requires, references to the Laureate International Universities network include Santa Fe University of Art and Design ("SFUAD"),

i

which is owned by Wengen. Laureate is affiliated with SFUAD, but does not own or control it and, accordingly, SFUAD is not included in the financial results of Laureate presented throughout this prospectus.

LAUREATE, LAUREATE INTERNATIONAL UNIVERSITIES and the leaf symbol are trademarks of Laureate Education, Inc. in the United States and other countries. This prospectus also includes other trademarks of Laureate and trademarks of other persons, which are properties of their respective owners.

We obtained the industry, market and competitive position data used throughout this prospectus from our own internal estimates and research as well as from industry publications and research, surveys and studies conducted by third parties. This prospectus also contains the results from studies by Millward Brown and Gallup, Inc. ("Gallup"). We commissioned the Millward Brown study as part of our periodic evaluation of employment rates and starting salary information for our graduates. In addition, we commissioned the Gallup survey to explore the relationship between the experiences of students at Walden University, our online university located in the United States, and long-term outcomes of those students based on the survey responses.

Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these publications, surveys and studies is reliable, we have not independently verified industry, market and competitive position data from third-party sources. While we believe our internal business research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source.

PRESENTATION OF FINANCIAL INFORMATION

In this prospectus we present certain data for the 12-month period ("LTM") ended September 30, 2016. This data has been derived by summing our historical results for the year ended December 31, 2015 and our historical results for the nine months ended September 30, 2016, then subtracting our historical results for the nine months ended September 30, 2015. Our results of operations for the nine months ended September 30, 2016 are not necessarily indicative of the results that may be expected for the full year.

On May 2, 2016, we announced a change to our operating segments in order to align our structure more geographically. Our institution in Italy, Nuova Accademia di Belle Arti Milano ("NABA"), including Domus Academy, moved from our GPS segment into our Europe segment. Media Design School ("MDS"), located in New Zealand, moved from our GPS segment into our AMEA segment. Our GPS segment now focuses on Laureate's fully online global operations and on its campus-based institutions in the United States. This change has been reflected in the financial statements for all periods presented.

On January 1, 2016, Laureate adopted Accounting Standards Update 2015-03, which simplified the presentation of debt issuance costs by requiring debt issuance costs to be presented as a deduction from debt. At adoption, the new guidance was applied retrospectively to all prior periods presented in this prospectus.

Our consolidated financial statements included in this prospectus are presented in U.S. dollars ($) rounded to the nearest thousand, with many amounts in this prospectus rounded to the nearest tenth of a million. Therefore, discrepancies in the tables between totals and the sums of the amounts listed may occur due to such rounding.

ii

Dear Prospective Investors,

As the founder of Laureate, it is my privilege to explain the company and its beliefs, as a way of educating potential new investors to determine if we are a compatible fit. This company was founded over 25 years ago and, while the offerings, strategies and even the name of the company have changed over the years, our core beliefs remain the same. Chief among them is our belief in the power of education to transform lives, and our view that the private sector can make a positive impact in a field that traditionally has been the province of the public sector. I have been accompanied on this journey by remarkable partners, friends and co-workers, and the success and longevity of this company is a credit to their passion, commitment and many sacrifices. Many of these contributors are still with us and some are gone, but I write this letter on behalf of them all, in a shared belief that Laureate is that rare company that will outlive its many founders and make lasting contributions to the world.

Seventeen years ago, we entered the field of international higher education with the acquisition of Universidad Europea de Madrid in Spain, and this became our testbed for innovation as we developed our ideas for new ways to manage universities and to improve outcomes for students. The company was built upon the idea that our main purpose was to prepare our students for success in their careers and lives. And we also believed that this was a much more valuable contribution if it could be done at scale. There are many barriers that inhibit participation in higher education and we committed ourselves to overcoming these barriers in order to expand access. This requires us to educate students at an affordable price, and in fact our tuition typically is far below the actual per-student cost to society of public institutions, which are heavily subsidized by government. Expanding access also requires us to accept more students compared to elite institutions, and to demonstrate that many of our students graduate and succeed in career and life.

From the very beginning, we wanted to create an international network of universities that would give our students a unique multicultural experience and better preparation for success in an increasingly globalized workforce. So we searched for other compatible acquisitions of, or partnerships with, universities in other countries, initially in Spanish-speaking markets but eventually across many languages and cultures. In the process, we forged the largest and most powerful network of universities of its kind, with over 70 institutions that today serve more than one million students. Many of these universities are owned or controlled by Laureate, but we also manage institutions that we do not own. In addition, we provide services under contract to governments and to prestigious public and non-profit universities, which demonstrates our quality and value. We believe that providing these types of services will become an increasingly important part of our business model.

Accountability for results has been a critical factor in our success, and to accomplish this we have brought together best practices from the fields of higher education and business management. As a company, we understand the needs of the private sector, which will ultimately employ most of our graduates. So we build deep linkages with employers to ensure that our curriculum reflects the latest requirements and that our students graduate with the skills to succeed. But we are not just a company. We are a company of educators. Our academic leaders ensure that we have great teachers in the classroom, teaching in effective ways and with the right curriculum, and with a human connection to each of our students. They ensure that we understand the needs and requirements of regulators in the many countries that we serve, helping achieve the goals of increasing participation while assuring quality. Their efforts allow us to deliver great, measurable outcomes for our students, the majority of whom are outside the United States.

We recognize the enormous importance that society places on education as a public good or even a civil right, and we respect the role that government plays in ensuring quality and access to education. As a leader in this field, we are required to operate with the highest integrity and the deepest commitment to social responsibility. This has always caused us to have a culture that combines the "head" of a business enterprise—scalable, efficient and accountable for measurable results—with the

iii

"heart" of a non-profit organization—dedicated to improving lives and benefitting society. We reconcile these two concepts by delivering measurable results for our students, recognizing that when our students succeed, countries prosper and societies benefit. This means that we have always asked our stockholders and employees to recognize our commitment to put the needs of our students first.

I believe that balancing the needs of our constituents has been instrumental to our success and longevity, allowing us to grow even in challenging economic times. For a long time, we didn't have an easy way to explain the idea of a for-profit company with such a deep commitment to benefitting society. So we took notice when in 2010 the first state in the U.S. passed legislation creating the concept of a Public Benefit Corporation, a new type of for-profit corporation with an expressed commitment to creating a material positive impact on society. We watched this concept carefully as it swept the nation, with 31 states and the District of Columbia now having passed legislation to allow for this new class of corporation, which commits itself to high standards of corporate purpose, accountability and transparency. This includes Delaware, the state that we have selected as our new domicile and which has the most up-to-date Public Benefit Corporation law. We believe that we are by far the largest company to become a Public Benefit Corporation and that, following our IPO, we likely will be the first publicly traded Public Benefit Corporation. In addition, while not required by Delaware law, we have chosen to have our social and environmental performance, accountability and transparency assessed against the proprietary criteria established by an independent non-profit organization. Based on this assessment, we have been designated as a "Certified B Corporation."

Which brings me to the topic of our initial public offering. Many of you may know that Laureate was previously a publicly traded company, from 1993 until we went private in 2007. So we understand the advantages and challenges associated with being public. We went private with the intention of accomplishing some very specific objectives and, having achieved these goals, we believe it is time for us to re-establish ourselves as a publicly traded company. Being public brings the highest level of transparency, and will enable us to more easily raise capital to support our mission which, at its core, is about expanding access to higher education through greater scale. We want to best ensure that we always have capital to grow and bring the benefits of our education programs to more students. We recognize that some investors in public companies are highly focused on short-term results, and we hope that it is very clear to them that this is not our approach. With the benefit of a long-term view, we will balance the needs of stockholders with the needs of students, employees and the communities in which we operate, and we believe that this approach will deliver the best results for our investors. We plan to seek out and engage with investors who see the benefit of this approach, and who want to be a part of an enduring, mission-driven company that we believe has strong prospects for long-term growth and the opportunity to help millions of people change their lives through education. We use the expression Here For Good to explain our commitment to thinking and acting for the long-term, and providing a significant benefit to society.

Looking ahead, I can't think of a more exciting time for our company. The world embraces the power and importance of education and is seeking new ideas and technologies to deliver better education to more people at an affordable cost. We believe we are uniquely positioned to meet this need through our unparalleled scale and resources, and our growing capacity to provide our intellectual property and services to other universities and governments.

Sincerely yours,

Douglas

L. Becker

Founder, Chairman and

Chief Executive Officer

iv

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider before making your investment decision. Before investing in our Class A common stock, you should carefully read this entire prospectus, including the information presented under the section entitled "Risk Factors" and the financial statements and notes thereto included elsewhere in this prospectus.

Our Mission

Laureate is an international community of universities that encourages learning without boundaries. Our purpose is to offer higher education with a unique multicultural perspective, and prepare our students for exciting careers and life-long achievement. We believe that when our students succeed, countries prosper and societies benefit.

Our Beliefs

We are a mission-driven company with a long-term perspective, committed to addressing the needs of our students and preparing them for their future endeavors. We are intensely focused on providing our students with the highest quality education resulting in strong employment opportunities. In addition to delivering superior outcomes for our students, we remain highly focused on delivering social returns to all of our constituents, especially the local communities we serve. Key decisions affecting each institution are made by local management and faculty, taking into account the needs of the students, prospective employers, surrounding communities and regulators. We believe our dedication to these constituencies has enabled our institutions to become trusted brands in their local markets, and has enabled Laureate to become a trusted name in global higher education.

Our Business

We are the largest global network of degree-granting higher education institutions, with more than one million students enrolled at our 72 institutions in 25 countries on more than 200 campuses, which we collectively refer to as the Laureate International Universities network. We participate in the global higher education market, which was estimated to account for revenues of approximately $1.5 trillion in 2015, according to GSV Advisors ("GSV"). We believe the global higher education market presents an attractive long-term opportunity, primarily because of the large and growing imbalance between the supply and demand for quality higher education around the world. Advanced education opportunities drive higher earnings potential, and we believe the projected growth in the middle class population worldwide and limited government resources dedicated to higher education create substantial opportunities for high-quality private institutions to meet this growing and unmet demand. Our outcomes-driven strategy is focused on enabling millions of students globally to prosper and thrive in the dynamic and evolving knowledge economy.

In 1999, we made our first investment in higher education and, since that time, we have developed into the global leader in higher education, based on the number of students, institutions and countries making up our network. Our global network of 72 institutions comprises 60 institutions we own or control, and an additional 12 institutions that we manage or with which we have other relationships. Our institutions are recognized for their high-quality academics. For example, we own and operate Universidad del Valle de México ("UVM Mexico"), the largest private university in Mexico, which in 2016 was ranked seventh among all public and private higher education institutions in the country by Guía Universitaria, an annual publication of Reader's Digest. Our track record for delivering high-quality outcomes to our students, while stressing affordability and accessibility, has been a key reason for our long record of success, including 16 consecutive years of enrollment growth. We have generated

1

compound annual growth rates ("CAGRs") in total enrollment and revenues of 10.4% and 9.0%, respectively, from 2009 through September 30, 2016. For the LTM ended September 30, 2016, we generated total revenues of $4,218.8 million, operating income of $336.8 million, net income of $311.6 million and Adjusted EBITDA of $708.3 million. For a reconciliation of Adjusted EBITDA to net income (loss), see "Prospectus Summary—Summary Historical Consolidated Financial and Other Data."

Since being taken private in August 2007, we have undertaken several initiatives to continually improve the quality of our programs and outcomes for our students, while expanding our scale and geographic presence, and strengthening our organization and management team. From 2007 to September 30, 2016, we have expanded into 11 new countries, added over 100 campuses worldwide and grown enrollment from approximately 300,000 to more than one million students with a combination of strong organic revenue growth of 9.3% (average annual revenue growth from 2007 to 2015 excluding acquisitions) and the successful integration of 41 strategic acquisitions. Key to this growth were expansions into Brazil, where we owned 13 institutions with a combined enrollment of approximately 260,000 students, and expansions into Asia, the Middle East and Africa, where we owned or controlled 21 institutions with a combined enrollment of approximately 86,000 students. Further, we have made significant capital investments and continue to make operational improvements in technology and human resources, including key management hires, and are developing scalable back-office operations to support the Laureate International Universities network, including implementing a vertically integrated information technology, finance, accounting and human resources organization that, among other things, are designed to enhance our analytical capabilities. Finally, over the past several years, we have invested heavily in technology-enabled solutions to enhance the student experience, increase penetration of our hybrid offerings and optimize efficiency throughout our network. We believe these investments have created an intellectual property advantage that has further differentiated our offerings from local market competitors.

The Laureate International Universities network enables us to educate our students locally, while connecting them to an international community with a global perspective. Our students can take advantage of shared curricula, optional international programs and services, including English language instruction, dual-degree and study abroad programs and other benefits offered by other institutions in our network. We believe that the benefits of the network translate into better career opportunities and higher earnings potential for our graduates.

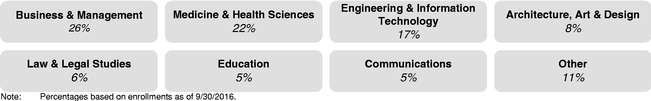

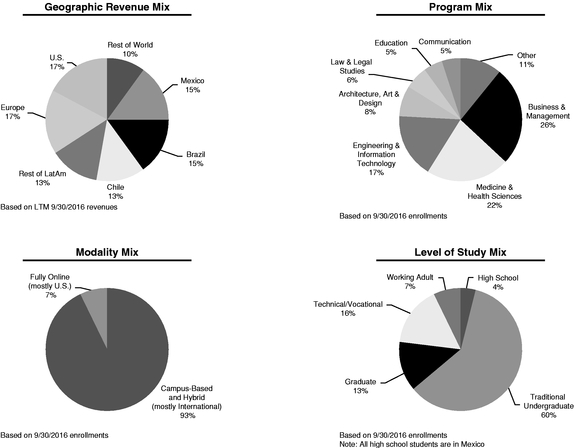

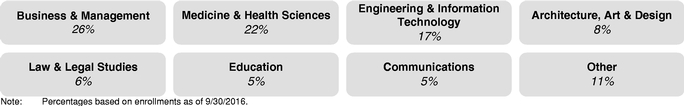

The institutions in the Laureate International Universities network offer a broad range of undergraduate and graduate degrees through campus-based, online and hybrid programs. Approximately 93% of our students attend traditional, campus-based institutions offering multi-year degrees, similar to leading private and public higher education institutions in the United States and Europe. In addition, approximately two thirds of our students are enrolled in programs of four or more years in duration. Our programs are designed with a distinct emphasis on applied, professional-oriented content for growing career fields and are focused on specific academic disciplines, or verticals, that we believe demonstrate strong employment opportunities and provide high earnings potential for our students, including:

Across these academic disciplines, we continually and proactively adapt our curriculum to the needs of the market, including emphasizing the core STEM (science, technology, engineering and

2

math) and business disciplines. We believe the STEM and business disciplines present attractive areas of study to students, especially in developing countries where there exists a strong and ongoing focus to develop and retain professionally trained individuals. Since 2009, we have more than doubled our enrollment of students pursuing degrees in Business & Management, Medicine & Health Sciences and Engineering & Information Technology, our three largest disciplines. We believe the work of our graduates in these disciplines creates a positive impact on the communities we serve and strengthens our institutions' reputations within their respective markets.

Across the world, we operate institutions that address regional, national and local supply and demand imbalances in higher education. As the global leader in higher education, we believe we are uniquely positioned to effectively deliver high-quality education across different brands and tuition levels in the markets in which we operate. In many developing markets, traditional higher education students (defined as 18-24 year olds) have historically been served by public universities, which have limited capacity and are often underfunded, resulting in an inability to meet growing student demands and employer requirements. Our institutions in these markets offer traditional higher education students a private education alternative, often with multiple brands and price points in each market, with innovative programs and strong career-driven outcomes. In many of these same markets, non-traditional students such as working adults and distance learners have limited options for pursuing higher education. Through targeted programs and multiple teaching modalities, we are able to serve the differentiated needs of this unique demographic. Our flexible approach across geographies allows Laureate to access a broader addressable market of students by efficiently tailoring institutions to meet the needs of a particular geography and student population.

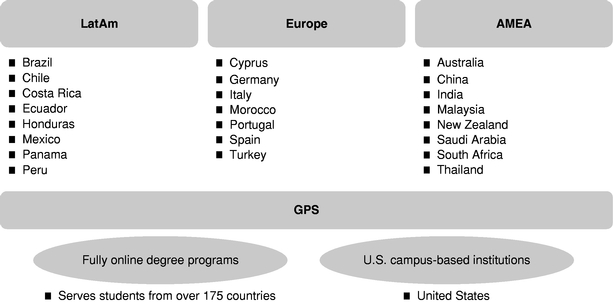

We have four reporting segments, which are summarized in the table below. We group our institutions by geography in Latin America ("LatAm"), Europe ("Europe") and Asia, Middle East and Africa ("AMEA") for reporting purposes. Our Global Products and Services segment ("GPS") includes our fully online universities and our campus-based institutions in the United States.

3

The following information for our operating segments is presented as of September 30, 2016, except where otherwise indicated, and reflects the operating segment change discussed in the section entitled "Presentation of Financial Information":

| |

LatAm | Europe | AMEA | GPS | Total | |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Countries |

8 | 7 | 8 | 2 | 25 | ||||||||||||

Institutions |

29 | 15 | 21 | 7 | 72 | ||||||||||||

Enrollments (rounded to nearest thousand) |

834,000 | 54,000 | 86,000 | 73,000 | 1,047,000 | ||||||||||||

LTM ended September 30, 2016 Revenues ($ in millions)‡ |

$ | 2,378.7 | $ | 496.9 | $ | 419.1 | $ | 939.9 | $ | 4,218.8 | |||||||

% Contribution to LTM ended September 30, 2016 Revenues‡ |

56 | % | 12 | % | 10 | % | 22 | % | 100 | % | |||||||

- ‡

- The elimination of inter-segment revenues and amounts related to Corporate, which total $15.7 million, is not separately presented.

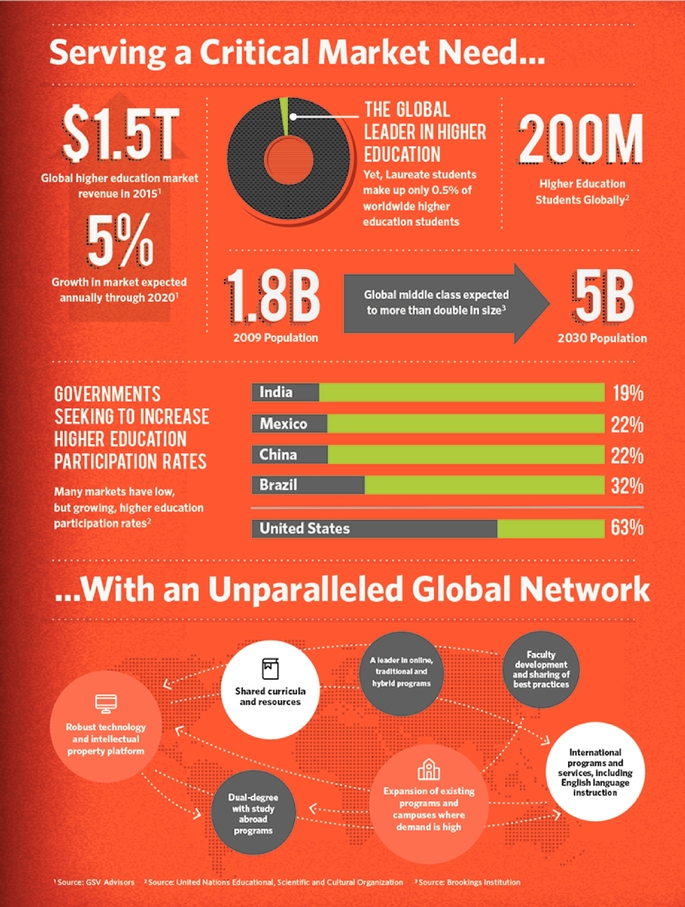

Our Industry

We are the leader in the global market for higher education, which is characterized by a significant imbalance between supply and demand, especially in developing economies. In many countries, demand for higher education is large and growing. GSV estimates that higher education institutions accounted for total revenues of approximately $1.5 trillion globally in 2015, with the higher education market expected to grow by approximately 5% per annum through 2020. Global growth in higher education is being fueled by several demographic and economic factors, including a growing middle class, global growth in services and technology-related industries and recognition of the significant personal and economic benefits gained by graduates of higher education institutions. At the same time, many governments have limited resources to devote to higher education, resulting in a diminished ability by the public sector to meet growing demand, and creating opportunities for private education providers to enter these markets and deliver high-quality education. As a result, the private sector plays a large and growing role in higher education globally. While the Laureate International Universities network is the largest global network of degree-granting higher education institutions in the world, our total enrollment of more than one million students represents only 0.5% of worldwide higher education students.

Large, Growing and Underpenetrated Population of Qualified Higher Education Students. According to the United Nations Educational, Scientific and Cultural Organization ("UNESCO"), 198.6 million students worldwide were enrolled in higher education institutions in 2013, nearly double the 99.7 million students enrolled in 2000, and approximately 90% of those students were enrolled at institutions outside of the United States as of 2013. In many countries, including throughout Latin America, Asia and other developing regions, there is growing demand for higher education based on favorable demographics, increasing secondary completion rates and increasing higher education participation rates, resulting in continued growth in higher education enrollments. While global participation rates have increased for traditional higher education students (defined as 18-24 year olds), the market for higher education is still significantly underpenetrated, particularly in developing countries. Given the low penetration rates, many governments in developing countries have a stated goal of increasing the number of students participating in higher education. For example, Mexico's participation rate increased from approximately 16% to approximately 22% from 2003 to 2013, and the Mexican government has set a goal of increasing the number of students enrolled in higher education by 17% over the next three years. Other developing countries with large addressable markets are similarly underpenetrated as evidenced by the following participation rates for 2013: Brazil (32%), China (22%) and India (19%), all of which are well below rates of developed countries such as the

4

United States and Spain, which in 2013 had participation rates of approximately 63% and approximately 60%, respectively.

Strong Economic Incentives for Higher Education. According to the Brookings Institution, approximately 1.8 billion people in the world composed the middle class in 2009, a number that is expected to more than double by 2030 to almost five billion people. We believe that members of this large and growing group seek advanced education opportunities for themselves and their children in recognition of the vast differential in earnings potential with and without higher education. According to data from the Organization for Economic Co-operation and Development ("OECD"), in certain European markets in which we operate, the earnings from employment for an adult completing higher education were approximately 60% higher than those of an adult with just an upper secondary education, while in the United States the differential was approximately 76%. This income gap is even more pronounced in many developing countries around the world, including a differential of approximately 160% in Chile and approximately 152% in Brazil. OECD statistics also show that overall employment rates are greater for individuals completing higher education than for those who have not completed upper secondary education. In addition, we believe as economies around the world are increasingly based on the services sector, they will require significant investment in human capital, advanced education and specialized training to produce knowledgeable professionals. We believe the cumulative impact of favorable demographic and socio-economic trends, coupled with the superior earnings potential of higher education graduates, will continue to expand the market for private higher education.

Increasing Role of the Private Sector in Higher Education. In many of our markets, the private sector plays a meaningful role in higher education, bridging supply and demand imbalances created by a lack of capacity at public universities. In addition to capacity limitations, we believe that limited public resources, and the corresponding policy reforms to make higher education systems less dependent on the financial and operational support of local governments, have resulted in increased enrollments in private institutions relative to public institutions.

According to the OECD, from 2003 to 2013, the number of students enrolled in private institutions grew from approximately 26% to approximately 31% of total enrollments within OECD countries. For example, Brazil and Chile rely heavily upon private institutions to deliver quality higher education to students, with approximately 71% (in 2012) and approximately 84% (in 2013), respectively, of higher education students in these countries enrolled in private institutions.

The decrease in government funding to public higher education institutions in recent years has served to spur the growth of private institutions, as tuitions have been increasingly funded by private sources. On average, OECD countries experienced a decrease in public funding from approximately 69% of total funding in 2000 to approximately 65% in 2012. For example, Mexico experienced a decrease in public funding as a percentage of total funding of approximately ten percentage points during the same period. We believe these trends have increased demand for competitive private institutions as public institutions are unable to meet the demand of students and families around the world, especially in developing markets.

Greater Accessibility to Higher Education through Online and Hybrid Offerings. Improving Internet broadband infrastructure and new instruction methodologies designed for the online medium have driven increased acceptance of the online modality globally. According to a survey conducted by the Babson Survey Research Group, approximately 71% of academic leaders rated online learning outcomes as the same or superior to classroom learning in 2014, up from approximately 57% in 2003. GSV estimates that the online higher education market will grow by a CAGR of approximately 25%, from $49 billion in 2012 to $149 billion in 2017. Additionally, new online and hybrid education offerings have enabled the cost-effective delivery of higher education, while improving overall affordability and accessibility for students. We believe that increasing student demand, coupled with

5

growing employer and regulatory acceptance of degrees obtained through online and hybrid modalities, will continue to drive significant growth in the online and hybrid higher education market globally.

Our Strengths and Competitive Advantages

We believe our key competitive strengths that will enable us to execute our growth strategy include the following:

First Mover and Leader in Global Higher Education. In 1999, we made our first investment in global higher education. Since that time, the Laureate International Universities network has grown to include 72 institutions in 25 countries that enroll more than one million students, of which approximately 95% are outside of the United States. Our growth has been the result of numerous organic initiatives, supplemented by successfully completing and integrating 41 acquisitions since August 2007, substantially all of which were completed through private negotiations and not as part of an auction process. Given our size and status as the first mover in many of our markets, we have been able to acquire many marquee assets, which we believe will help us maintain our market-leading position due to the considerable time and expense it would take a competitor to establish an integrated network of international universities of similar scale with the brands, intellectual property and accreditations that we possess.

Long-Standing and Reputable University Brands Delivering High Quality Education. We believe we have established a reputation for providing high-quality higher education around the world, and that our schools are among the most respected higher education brands in their local markets. Many of our institutions have over 40-year histories, with some institutions approaching 100 years. In addition to long-standing presences in their local communities, many of our institutions are ranked among the best in their respective countries. For example, the Barómetro de la Educación Superior has ranked Universidad Andrés Bello as a top university in Chile. Similarly, in Brazil, Universidade Anhembi Morumbi is ranked by Guia do Estudante as one of São Paulo's top universities, and in Europe, Universidad Europea de Madrid is the second largest private university in Spain and received four stars in the prestigious 2015 QS StarsTM international university rating.

Our strong brands are perpetuated by our student-centric focus and our mission to provide greater access to cost-effective, high-quality higher education, which allows more students to pursue their academic and career aspirations. We are committed to continually evaluating our institutions to ensure we are providing the highest quality education to our students. Our proprietary management tool, the Laureate Education Assessment Framework ("LEAF"), is used to evaluate institutional performance based on 44 unique criteria across five different categories: Employability, Learning Experience, Personal Experience, Access & Outreach and Academic Excellence. LEAF, in conjunction with additional external assessment methodologies, such as QS StarsTM, allows us to identify key areas for improvement in order to drive a culture of quality and continual innovation at our institutions. For example, more than 86% of students attending Laureate institutions in Brazil are enrolled in an institution with an IGC score (an indicator used by the Brazilian Ministry of Education to evaluate the quality of higher education institutions) that has improved since 2010. In addition, our Brazilian institutions' IGC scores have increased by approximately 16% on average from 2010 to 2014, placing three of our institutions in the top quintile, and nine (encompassing approximately 96% of our student enrollment in Brazil) in the top three quintiles of all private higher education institutions in the country.

Many of our institutions and programs have earned the highest accreditation available, which provides us with a strong competitive advantage in local markets. For example, we serve more than 200,000 students in the fields of medicine and health sciences on over 100 campuses throughout the Laureate International Universities network, including 22 medical schools and 19 dental schools. Medical school licenses are often the most difficult to obtain and are only granted to institutions that meet

6

rigorous standards. We believe the existence of medical schools at many of our institutions further validates the quality of our institutions and programs. Similarly, other institutions have received numerous specialized accreditations, including those for Ph.D. programs.

Superior Outcomes for Our Students. We offer high-quality undergraduate, graduate and specialized programs in a wide range of disciplines that generate strong interest from students and provide attractive employment prospects. We design our programs to prepare students to contribute productively in their chosen professions upon employment. Our curriculum development process includes employer surveys and ongoing research into business trends to determine the skills and knowledge base that will be required by those employers in the future. This information results in timely curriculum upgrades, which helps ensure that our graduates acquire the skills that will make them marketable to employers. In 2014, we commissioned a study by Millward Brown, a leading third-party market research organization, of graduates at Laureate institutions representing over 60% of total Laureate enrollments. Graduates at 12 of our 13 surveyed international institutions achieved, on average, equal or higher employment rates within 12 months of graduation as compared to graduates of other institutions in the same markets, and in all of our premium institutions surveyed, graduates achieved higher starting salaries as compared to graduates of other institutions in those same markets (salary premium to market benchmarks ranged from approximately 6% to approximately 118%).

Robust Technology and Intellectual Property Platform. By virtue of our 17 years of experience operating in a global environment, managing campus-based institutions across multiple disciplines and developing and administering online programs and curricula, we have developed an extensive collection of intellectual property. We believe this collection of intellectual property, which includes online capabilities, campus design and management, recruitment of transnational students, faculty training, curriculum design and quality assurance, among other proprietary solutions, provides our students a truly differentiated learning experience and creates a significant competitive advantage for our institutions over competitors.

A critical element of our intellectual property is a suite of proprietary technology solutions. Select examples include OneCampus, which connects students across our network with shared online courses and digital experiences, and Slingshot, an online career orientation tool that enables students to explore career paths through state-of-the-art interest assessment and rich content about hundreds of careers. Our commitment to investing in technology infrastructure, software and human capital ensures a high-quality educational experience for our students and faculty, while also providing us with the infrastructure to manage and scale our business.

Our intellectual property has been a key driver in developing partnerships with prestigious independent institutions and governments globally. For example, we have partnered with other traditional public and private higher education institutions as a provider of online services. We have operated this model for more than ten years with the University of Liverpool in the United Kingdom and, more recently, we have added new partnerships with the University of Roehampton in the United Kingdom and the University of Miami in the United States. Additionally, in 2013, the Kingdom of Saudi Arabia launched the College of Excellence program with a long-term goal of opening 100 new technical colleges, and sought private operators to manage the institutions on its behalf under an operating model in which the Kingdom of Saudi Arabia funds the capital requirements to build the institutions, and the private operator runs the academic operations under a contract model. As of September 30, 2016, we have been awarded contracts to operate eight of the 33 colleges for which contracts have been awarded to date, more than any other provider in the Kingdom of Saudi Arabia.

Scale and Diversification of Our Global Network. The Laureate International Universities network is diversified across 25 countries, 72 campus-based and online institutions and over 2,500 programs. Additionally, in many markets, we have multiple institutions serving different segments of the population, at different price points and with different academic offerings. Although the majority of our

7

institutions serve the premium segment of the market, we also have expanded our portfolio of offerings in many markets to include high-quality value and technical-vocational institutions. By serving multiple segments of the market, all with high-quality offerings, we are able to continue to expand our enrollments during varying economic cycles. We believe there is no other public or private organization that commands comparable global reach or scale.

Our global network allows our institutions to bring their distinctive identities together with our proprietary international content, managerial best practices and international programs. Through collaboration across the global network, we can efficiently share academic curricula and resources, create dual degree programs and student exchanges, develop our faculty and incorporate best practices throughout the organization. In addition, our wide-ranging network allows us to continue to scale our business by facilitating the expansion of existing programs and campuses, the launch of new programs, the opening of new campuses in areas of high demand and the strategic acquisition and integration of new institutions into our network. For example, the resources and support of our global network have had a demonstrated impact on our Medicine & Health Sciences expansion effort, which has resulted in enrollment growth from approximately 75,000 students in 2009 to more than 200,000 students as of September 30, 2016. Furthermore, the existing breadth of our network allows us to provide a high-quality educational experience to our students, while simultaneously accessing the broadest addressable market for our offerings.

In recognition of the benefits of our international scale, and in order to formalize our organizational focus on the opportunities presented by our established network, we created the Laureate Network Office ("LNO") in 2015. The LNO is an important resource that allows us, among other things, to better leverage our expertise in the online modality to increase the frequency and effectiveness of online and hybrid learning opportunities across the network.

8

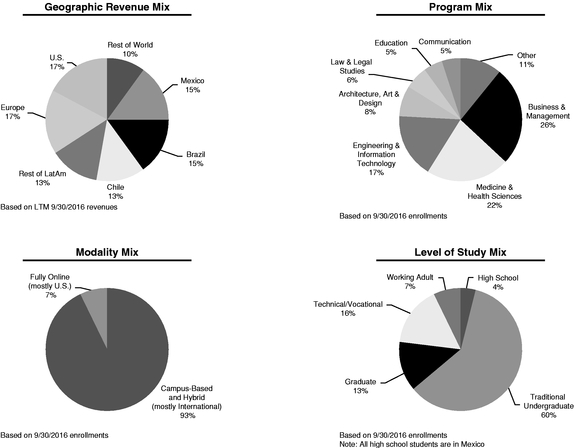

To further illustrate the breadth and diversity of our global network, the charts below show the mix of our geographic revenues, programs, modality and levels of study:

- •

- Strong and Consistent Growth. We have a proven track

record of delivering strong financial results through various economic cycles. From 2009 to 2015, our revenues and Adjusted EBITDA grew at a CAGR of 10.5% and 11.3%, respectively (13.5% and 14.8% on a

constant currency basis, respectively). From 2009 to 2015, our net loss increased at a CAGR of 13.2% to $315.8 million for the year ended December 31, 2015. During this same period, we

realized constant currency revenue growth of at least 10.3% every year. Adjusted for acquisitions, our average annual organic revenue growth over the same period was 7.6% (10.4% on a constant currency

basis). For a reconciliation of Adjusted EBITDA to net income (loss), see "—Summary Historical Consolidated Financial and Other Data."

- •

- Private Pay Model. Over 75% of our revenues for the year ended December 31, 2015 were generated from private pay sources. We believe students' and families' willingness to allocate personal resources to fund higher education at our institutions validates our strong value proposition.

Attractive Financial Model.

9

- •

- Revenue Visibility Enhanced by Program Length and Strong

Retention. The majority of the academic programs offered by our institutions last between three and five years, and approximately two

thirds of our students were enrolled in programs of at least four years or more in duration, as of September 30, 2016. The length of our programs provides us with a high degree of revenue

visibility, which historically has led to more predictable financial results. Given that our fall student intake is substantially completed by the end of September, we have visibility into

approximately 70% of the following year's revenues, assuming a constant foreign exchange environment and assuming retention and graduation rates in line with historical performance. We actively

monitor and manage student retention because of the impact it has on student outcomes and our financial results. The historical annual student retention rate, which we define as the proportion of

prior year students returning in the current year (excluding graduating students), of over 80% has not varied by more than three percentage points in any one year over the last five years. Given our

high degree of revenue visibility, we are able to make attractive capital investments and execute other strategic initiatives to help drive sustainable growth in our

business.

- •

- Attractive Return on Incremental Invested Capital ("ROIIC"). Our capital investments since inception have created significant scale and have also laid the foundation for continued strong organic growth. Given that we have already made foundational infrastructure investments in many of our core markets, we expect to recognize attractive returns on incremental invested capital deployed. As of December 31, 2015, our four-year ROIIC was 28.1%. For more information on ROIIC, see "Selected Historical Consolidated Financial and Other Data."

Proven Management Team. We have an experienced and talented senior management team, with strong international expertise from a wide variety of industry-leading global companies. Our executive officers have been with us an average of 13 years and have led our transformation into the largest global network of degree-granting higher education institutions in the world. Douglas L. Becker, our Chairman, Chief Executive Officer and founder, has led our Company since its inception in 1989 and has cultivated an entrepreneurial and collaborative management culture. This entrepreneurial leadership style has been complemented by an executive management team with broad global experience, enabling us to institute strong governance practices throughout our network. The strength of the management team has enabled the sharing of best practices, allowing us to capitalize on favorable market dynamics and leading to the successful integration of numerous institutions into the Laureate International Universities network. In addition, we have strong regional and local management teams with a deep understanding of the local markets, that are focused on meeting the needs of our students and communities, and maintaining key relationships with regulators and business leaders. Our management team has a proven track record of gaining the trust and respect of the many regulatory authorities that are critical to our business.

Our Growth Strategy

We intend to continue to focus on growing the Laureate International Universities network through the following key strategies:

Expand Programs, Demographics and Capacity. We will continue to focus on opportunities to expand our programs and the type of students that we serve, as well as our capacity in our markets to meet local demand. We also intend to continue to improve the performance of each of our institutions by adopting best practices that have been successful at other institutions in the Laureate International Universities network. We believe these initiatives will drive organic growth and provide an attractive return on capital. In particular, we intend to:

- •

- Add New Programs and Course Offerings. We will continue to develop new programs and course offerings to address the changing needs in the markets we serve by using shared curricula

10

- •

- Expand Target Student Demographics. In many of our

markets, we use sophisticated analytical techniques to identify opportunities to provide quality education to new or underserved student populations where market demand is not being met, such as

non-traditional students (e.g., working adults) who may value flexible scheduling options, as well as traditional students. Our ability to provide quality education to these underserved markets

has provided additional growth to the Laureate International Universities network and we intend to leverage our management capabilities and local

knowledge to further capitalize on these higher education opportunities in new and existing markets. As we expand in a particular country or region, we often develop tailored programs to address the

unmet needs of these markets.

- •

- Increase Capacity at Existing and New Campus Locations. We will continue to make demand-driven investments in additional capacity throughout the Laureate International Universities network by expanding existing campuses and opening new campuses, including in new cities. We employ a highly analytical process based on economic and demographic trends, and demand data for the local market to determine when and where to expand capacity. When opening a new campus or expanding existing facilities, we use best practices that we have developed over more than the past decade to cost-effectively expedite the opening and development of that location.

available through the network, and in consultation with leading local businesses. New programs and course offerings enable us to consistently provide a high-quality education that is desired by students and prospective employers. As we optimize our offerings to deliver courses in high-demand disciplines, we also believe we will be able to increase enrollment and improve utilization at institutions across our network.

We have successfully implemented these strategies at many of our institutions. For example, at UVM Mexico we grew total enrollments from approximately 37,000 students in 2002 to approximately 128,000 in 2015. This growth was the result of the introduction of new programs, including in the fields of health sciences, engineering and hospitality, the addition of 23 new campus locations (from 13 in 2002 to 36 in 2015), and the ability to serve new market segments such as working adults. While UVM Mexico has grown into the largest private institution in Mexico, our relentless focus on academic quality remains. In fact, UVM Mexico has improved from the 9th ranked institution in 2004 to the 7th ranked institution in 2016 according to Guía Universitaria.

Expand Penetration of Online and Hybrid Offerings. We intend to increase the number of our students who receive their education through fully online or hybrid programs to meet the growing demand of younger generations that continue to embrace technology. Over the past decade, the global population with Internet access has continued to grow, and Forrester Research, Inc. ("Forrester") estimates a total of 3.5 billion people will have Internet access by 2017, representing nearly half of the world's population. Additionally, in many of our markets, online education is becoming more accepted by regulators and education professionals as an effective means of providing quality higher education. As the quality and acceptance of online education increases globally, we plan to continue investing in both expanding our stand-alone online course offerings and enhancing our traditional campus-based course offerings via complementary online delivery, creating a hybrid delivery model. We believe our history of success with Walden University, a fully online institution in the United States, and our well-developed online program offerings will provide a considerable advantage over local competitors, enabling us to combine our strong local brands with our experience in delivering online education. Over the next five years, our goal is to increase the number of student credit hours taken online, which was approximately 11% as of the end of 2015, to approximately 25%. Some of our network institutions are already implementing online programs with significant progress being made. For example, at Universidad Europea de Madrid in Spain, approximately 20% of our students took at least one online course as of June 30, 2016. Our online initiative is designed to not only provide our students with access to the technology platforms and innovative programs they expect, but also to increase our

11

enrollment in a more capital efficient manner, leveraging current infrastructure and improving classroom utilization.

Expand Presence in AMEA. AMEA represents the largest higher education market opportunity in the world with more than 120 million students enrolled in higher education institutions in 2013, according to UNESCO. Despite the large number of students enrolled, participation rates in the region suggest significantly underpenetrated enrollment given the strong imbalance between the supply and demand for higher education.

In 2008, we entered the AMEA higher education market with our acquisition of an interest in INTI Education Group in Malaysia. In the last eight years, we have grown our AMEA footprint to include 21 institutions in eight countries, serving approximately 86,000 students, representing an enrollment CAGR of approximately 20% since entering the region in 2008. Recent expansion in the AMEA region includes eight Colleges of Excellence in the Kingdom of Saudi Arabia, and our first institution in Sub-Saharan Africa in 2013, Monash South Africa. In anticipation of continued growth, we have made significant investments in the region, including hiring an experienced regional management team and establishing the infrastructure to help facilitate growth and further expand our footprint in the region. We plan to continue to expand our presence in AMEA by prioritizing markets based on demographic, market and regulatory factors, while seeking attractive returns on capital.

Accelerate Partnership and Services Model Globally. As the global leader in higher education, we believe we are well-positioned to capitalize on additional opportunities in the form of partnership and service models that are designed to address the growing needs of traditional institutions and governments around the world.

Increasingly more complex services and operating capabilities are required by higher education institutions to address the needs of students effectively, and we believe our expertise and knowledge will allow us to leverage our intellectual property and technology to serve this market need. We have partnered with traditional public and private education institutions as a provider of online services and we believe there will be opportunities to expand that platform under similar relationships with other prestigious independent institutions in the future. Additionally, we are continually adding to our suite of solutions, and we believe many of these products and services will provide additional contractual and licensing opportunities for us in the future. For example, in recent years we have significantly advanced our digital teaching and learning efforts through proprietary technology-enabled solutions such as:

- •

- OneFolio, an online tool that connects Laureate faculty members, instructional

designers, and learning architects to valuable digital resources they can use to enhance the student learning experience.

- •

- Laureate Languages, which provides digital language learning solutions to our students and faculty in the areas of General English, Professional English and English for Academic Purposes, as well as teacher training and assessment.

Additionally, governments around the world are increasingly focused on increasing participation rates and often do not have an established or scalable public sector platform with the necessary expertise to accomplish that objective, and therefore are willing to fund private sector solutions. We believe our current partnership with the Kingdom of Saudi Arabia, where we were selected as their largest partner for the Colleges of Excellence program, is a demonstration of how our distinct portfolio of solutions differentiates us from other providers who participated in the selection process. We are in active discussion with other governments regarding similar partnerships, as well as other solutions that we can provide to existing and new partners, and we anticipate this could be a source of additional revenue for us in the future.

12

Increase Operating Efficiencies through Centralization and Standardization. In 2014, we launched Excellence in Process ("EiP") as an enterprise-wide initiative to optimize and standardize our processes to enable sustained growth and margin expansion. The program aims to enable vertical integration of procurement, information technology, finance, accounting and human resources, thus enabling us to fully leverage the growing size and scope of our local operations. Specifically, we have developed and begun to deploy regional shared services organizations ("SSOs") around the world, which will process most back-office and non-student facing transactions for the institutions in the Laureate International Universities network, such as accounting, finance and procurement. The implementation of EiP and regional SSOs are expected to generate significant cost savings throughout the network as we eliminate redundant processes and better leverage our global scale. In addition, centralized information technology, product development and content management will allow us to propagate best practices throughout the Laureate International Universities network and capitalize on efficiencies to help improve performance. We anticipate EiP will require an investment of approximately $180 million from 2015 to 2017, with the first significant investments already having been made in 2015. These investments have already begun to generate cost savings and, upon completion of the project, we expect these efficiencies to generate approximately $100 million in annual cost savings in 2019, while also enhancing our internal controls and the speed of integration of new acquisitions. We also believe these initiatives will enhance the student experience by improving the quality of our operations and by enabling additional reinvestment in facilities, faculty and course offerings.

Target Strategic Acquisitions. Since being taken private in August 2007, we have made 41 acquisitions with an aggregate purchase price of approximately $2.0 billion, including assumed debt. Substantially all of these acquisitions were completed through private negotiations and not as part of an auction process, which we believe demonstrates our standing as a partner of choice. We intend to continue to expand through the selective acquisition of institutions in new and existing markets. We employ a highly disciplined approach to acquisitions by focusing on key characteristics that make certain markets particularly attractive for private higher education, such as demographics, economic and social factors, the presence of a stable political environment and a regulatory climate that values private higher education. When we enter a new market or industry sector, we target institutions with well-regarded reputations and which are well-respected by regulators. We also invest time and resources to understand the managerial, financial and academic resources of the prospect and the resources we can bring to that institution. After an acquisition, we focus on organic growth and financial returns by applying best practices and integrating, both operationally and financially, the institution into the Laureate International Universities network, and we have a strong track record of success. For all the institutions we acquired between 1999 and December 31, 2010, we achieved average enrollment and revenue CAGRs of approximately 15% and approximately 19%, respectively, in the four full years following the first anniversary of the acquisition. Further, we achieved operating income CAGRs (adjusted for impairment charges) of approximately 40%, translating into a margin expansion of nearly six percentage points for the same period. Additionally, we bring programs and expertise to increase the quality and reputation of institutions after we acquire them, and assist them in earning new forms of licenses and accreditations. We believe our experienced management team, history of strong financial performance rooted in the successful integration of previous acquisitions, local contacts and cultural understanding makes us the leading choice for higher education institutions seeking to join an international educational network.

Our History

We were founded in 1989 as Sylvan Learning Systems, Inc., a provider of a broad array of supplemental and remedial educational services. In 1999, we made our first investment in global higher education with our acquisition of Universidad Europea de Madrid, and in 2001 we entered the market for online delivery of higher education services in the United States with our acquisition of Walden University. In 2003, we sold the principal operations that made up our then K-12 educational services

13

business and certain venture investments deemed not strategic to our higher education business, and in 2004 we changed our name to Laureate Education, Inc. Between the time we sold the K-12 educational services business in 2003 and August 2007, we acquired nine institutions for an aggregate purchase price of approximately $160 million, including assumed debt, and entered seven new countries.

In August 2007, we were acquired in a leveraged buyout by a consortium of investment funds and other investors affiliated with or managed by, among others, Douglas L. Becker, our Chairman and Chief Executive Officer and founder, Steven M. Taslitz, a director of the Company, Kohlberg Kravis Roberts & Co. L.P. (together with its affiliates, "KKR"), Point72 Asset Management, Bregal Investments, StepStone Group, Sterling Partners and Snow Phipps Group ("Snow Phipps" and, collectively, the "Wengen Investors"), for an aggregate total purchase price of $3.8 billion, including $1.7 billion of debt, all of which has been refinanced or replaced. See "Risk Factors—Risks Relating to Our Indebtedness—The fact that we have substantial debt could materially adversely affect our ability to raise additional capital to fund our operations and limit our ability to pursue our growth strategy or to react to changes in the economy or our industry." We believe that these investors have embraced our mission, commitment to academic quality and ongoing focus to provide a social benefit to the communities we serve.

Since being taken private in August 2007, we have undertaken several initiatives to continually improve the quality of our programs and outcomes for our students, while expanding our scale and geographic presence, and strengthening our organization and management team. Since August 2007, we have completed 41 acquisitions with an aggregate purchase price of approximately $2 billion, including assumed debt, and entered 11 new countries, and we now have a total institution count of 72.

In early 2013, International Finance Corporation ("IFC"), a member of the World Bank Group, the IFC Africa, Latin American and Caribbean Fund, LP and the Korea Investment Corporation (together with the IFC, the "IFC Investors") collectively invested $200 million in our common stock. IFC is a global development institution that helps developing countries achieve sustainable growth by financing investment in the private sector and providing advisory services to businesses and governments.

In December 2013, the board of directors of Wengen and Laureate authorized the combination of Laureate and Laureate Education Asia Limited ("Laureate Asia"). Laureate Asia was a subsidiary of Wengen that provided higher education programs and services to students through a network of licensed institutions located in Australia, China, India, Malaysia and Thailand. Wengen transferred 100% of the equity of Laureate Asia to Laureate. The transaction is accounted for as a transfer between entities under common control and, accordingly, the accounts of Laureate Asia are retrospectively included in the financial statements and notes thereto included elsewhere in this prospectus.

Public Benefit Corporation Status

In October 2015, we redomiciled in Delaware as a public benefit corporation as a demonstration of our long-term commitment to our mission to benefit our students and society. Public benefit corporations are a relatively new class of corporations that are intended to produce a public benefit and to operate in a responsible and sustainable manner. Under Delaware law, public benefit corporations are required to identify in their certificate of incorporation the public benefit or benefits they will promote and their directors have a duty to manage the affairs of the corporation in a manner that balances the pecuniary interests of the stockholders, the best interests of those materially affected by the corporation's conduct, and the specific public benefit or public benefits identified in the public benefit corporation's certificate of incorporation. Public benefit corporations organized in Delaware are also required to assess their benefit performance internally and to disclose publicly at least biennially a report detailing their success in meeting their benefit objectives.

14

We do not believe that an investment in the stock of a public benefit corporation differs materially from an investment in a corporation that is not designated as a public benefit corporation. We believe that our ongoing efforts to achieve our public benefit goals will not materially affect the financial interests of our stockholders. Holders of our Class A common stock will have voting, dividend and other economic rights that are the same as the rights of stockholders of a corporation that is not designated as a public benefit corporation. See "Risk Factors—Risks Relating to Investing in Our Class A Common Stock—As a public benefit corporation, our focus on a specific public benefit purpose and producing a positive effect for society may negatively influence our financial performance" and "Description of Capital Stock—Public Benefit Corporation Status."

Our public benefit, as provided in our certificate of incorporation, is: to produce a positive effect (or a reduction of negative effects) for society and persons by offering diverse education programs delivered online and on premises operated in the communities that we serve. By doing so, we believe that we provide greater access to cost-effective, high-quality higher education that enables more students to achieve their academic and career aspirations. Most of our operations are outside the United States, where there is a large and growing imbalance between the supply and demand for quality higher education. Our stated public benefit is firmly rooted in our company mission and our belief that when our students succeed, countries prosper and societies benefit. Becoming a public benefit corporation underscores our commitment to our purpose and our stakeholders, including students, regulators, employers, local communities and stockholders.

Certified B Corporation

In addition to becoming a public benefit corporation, although not required by Delaware law, we have elected to have our social and environmental performance, accountability and transparency assessed against the proprietary criteria established by an independent non-profit organization. As a result of this assessment, we have been designated as a "Certified B CorporationTM." See "Business—Certified B Corporation."

Recent Developments

Sale of Glion and Les Roches Hospitality Management Schools

On March 15, 2016, we signed an agreement with Eurazeo, a publicly traded French investment company, to sell Glion and Les Roches and associated institutions (the "Swiss Institution Sale") for a total transaction value of CHF 380 million (approximately $385 million at the signing date), subject to certain adjustments. The sale included the operations of Glion in Switzerland and the United Kingdom, with a total of approximately 1,800 students, and the operations of Les Roches in Switzerland and the United States, as well as LRG in Switzerland, Les Roches Jin Jiang in China, RACA in Jordan and Les Roches Marbella in Spain, with a combined total of approximately 3,000 students. The transaction closed on June 14, 2016 and we received total net proceeds of approximately $339 million. We are continuing to provide certain back-office services to Glion and Les Roches, and programs of those institutions will continue on various campuses in the Laureate International Universities network throughout the world.

Sale of Operations in France

On April 19, 2016, we signed an agreement with Apax Partners, a private equity firm, under which Apax Partners acquired LIUF SAS (the "French Institution Sale"), our French holding company ("LIUF"), for a total transaction value of EUR 201 million (approximately $228 million at the signing date), subject to certain adjustments. LIUF comprised our five institutions located in France with a total student population of approximately 7,500: École Supériure du Commerce Extérieur, Institut Français de Gestion, European Business School, École Centrale d'Electronique and Centre d'Études

15

Politiques et de la Communication. The transaction closed on July 20, 2016 and we received total net proceeds of approximately $207 million.