1 OMNI NEWCO, LLC AND SUBSIDIARIES Consolidated Financial Statements As of December 31, 2022 and for the Year Ended and Independent Auditor’s Report

2 OMNI NEWCO, LLC AND SUBSIDIARIES Table of Contents Page Independent Auditors Report 3-4 Consolidated Financial Statements Consolidated Balance Sheet as of December 31, 2022 5 Consolidated Statement of Operations and Comprehensive Income for the Year Ended December 31, 2022 6 Consolidated Statement of Members’ Equity for the Year Ended December 31, 2022 7 Consolidated Statement of Cash Flows for Year Ended December 31, 2022 8 Notes to Consolidated Financial Statements 9-25

3 INDEPENDENT AUDITOR'S REPORT The Board of Managers of Omni Newco, LLC Opinion We have audited the consolidated financial statements of Omni Newco, LLC and subsidiaries (the "Company"), which comprise the consolidated balance sheet as of December 31, 2022, and the related consolidated statements of operations and comprehensive income (loss), members’ equity and cash flows for the year then ended, and the related notes to the consolidated financial statements (collectively referred to as the "financial statements"). In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Emphasis of Matter – First time adoption of ASC 842. As disclosed in Note 2 and Note 8 to the financial statements, the Company adopted new accounting guidance related to ASC 842, Leases, applying retrospective application from the beginning of the adoption period through a cumulative-effect adjustment. Our opinion is not modified with respect to this matter. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued. Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material

4 misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. /s/Deloitte & Touche LLP Dallas, Texas September 16, 2023

OMNI NEWCO, LLC AND SUBSIDIARIES Consolidated Balance Sheet (in thousands) 5 December 31, 2022 ASSETS Current assets: Cash and cash equivalents $ 130,333 Accounts receivable: Billed, net 236,980 Unbilled 31,506 Prepaid expenses and other assets 34,290 Total current assets 433,109 Property and equipment, net 81,145 Operating lease right-of-use assets 210,480 Other assets Goodwill 531,385 Intangible assets, net 792,935 Other 14,820 Total other assets 1,339,140 Total assets $ 2,063,874 LIABILITIES AND MEMBERS’ EQUITY Current liabilities: Accounts payable $ 80,890 Accrued expenses 100,256 Current portion of long-term debt 16,563 Current portion of contingent consideration 71,395 Current portion of operating lease liabilities 42,499 Other 587 Total current liabilities 312,190 Long-term debt, less current portion 1,347,132 Operating lease liabilities, less current portion 189,023 Contingent consideration liability, less current portion 25,254 Deferred income taxes 25,554 Other long-term liabilities 2,862 Total liabilities 1,902,015 Commitments and contingencies (Note 9) Members’ equity 152,984 Accumulated other comprehensive loss (4,492) Retained earnings 13,367 Total members’ equity 161,859 Total liabilities and members’ equity $ 2,063,874 See accompanying notes to consolidated financial statements.

OMNI NEWCO, LLC AND SUBSIDIARIES Consolidated Statement of Operations and Comprehensive Income (in thousands) 6 Year Ended December 31, 2022 Operating revenue $ 1,872,269 Operating expenses: Purchased transportation costs 1,242,341 Selling, general and administrative 474,850 Change in fair value of contingent consideration (17,814) Depreciation and amortization 56,183 Total operating expenses 1,755,560 Income from operations 116,709 Other expense: Interest expense, net (102,208) Other income 4,517 Foreign exchange loss 2,638 Total other expense (95,053) Income before income taxes 21,656 Income tax expense (5,657) Net income $ 15,999 Other comprehensive income Foreign currency translation adjustment (4,387) Comprehensive income $ 11,612 See accompanying notes to consolidated financial statements.

OMNI NEWCO, LLC AND SUBSIDIARIES Consolidated Statement of Members’ Equity (in thousands) 7 Accumulated Other Comprehensive Loss Retained Earnings Members’ Equity Balance, January 1, 2022 $ (105) $ (2,632) $ 375,494 Issuance of member units - - 11,386 Member distributions - - (236,633) Net income - 15,999 15,999 Foreign currency translation loss (4,387) - (4,387) Balance, December 31, 2022 $ (4,492) $ 13,367 $ 161,859 See accompanying notes to consolidated financial statements.

OMNI NEWCO, LLC AND SUBSIDIARIES Consolidated Statement of Cash Flows (in thousands) 8 Year Ended December 31, 2022 Operating Activities Net income $ 15,999 Adjustments to reconcile net income to net cash used in operating activities: Depreciation and amortization 56,183 Amortization of deferred financing costs 6,996 Change in fair value of contingent consideration (17,849) Deferred income tax (1,018) Provision for bad debts 3,601 Non-cash compensation and other 801 Changes in operating assets and liabilities, net of effects of business acquisitions: Accounts receivable 148,140 Prepaid and other assets (11,171) Accounts payable (44,420) Accrued expenses and other liabilities (22,325) Net cash provided by operating activities 134,937 Investing activities Cash paid for acquisitions, net of cash acquired (132,559) Purchase of property and equipment (35,564) Net cash used in investing activities (168,123) Financing activities Proceeds from long-term debt 420,000 Repayments of long-term debt (10,565) Repayments of revolving line of credit (20,000) Repayments of finance lease obligations (3,204) Payment of debt issuance costs (13,404) Cash paid to settle contingent consideration (10,002) Cash received from member issuances 1,015 Purchase of member units (1,885) Member distributions (234,510) Net cash provided by financing activities 127,445 Effect of exchange rate changes on cash and cash equivalents (930) Net increase in cash and cash equivalents 93,329 Cash and cash equivalents - beginning of period 37,004 Cash and cash equivalents - end of period $ 130,333 Supplemental cash flow information Cash paid for interest $ 94,375 Cash paid for income taxes $ 8,613 Non-cash investing and financing activities Issuance of capital units in connection with acquisitions $ 9,709 Contingent consideration liability $ 32,700 Accrued distributions $ 7,444 Right-of-use assets – finance leases $ 13,841 Right-of-use assets – operating leases $ 176,818 Goodwill measurement period adjustment $ 1,506 See accompanying notes to consolidated financial statements.

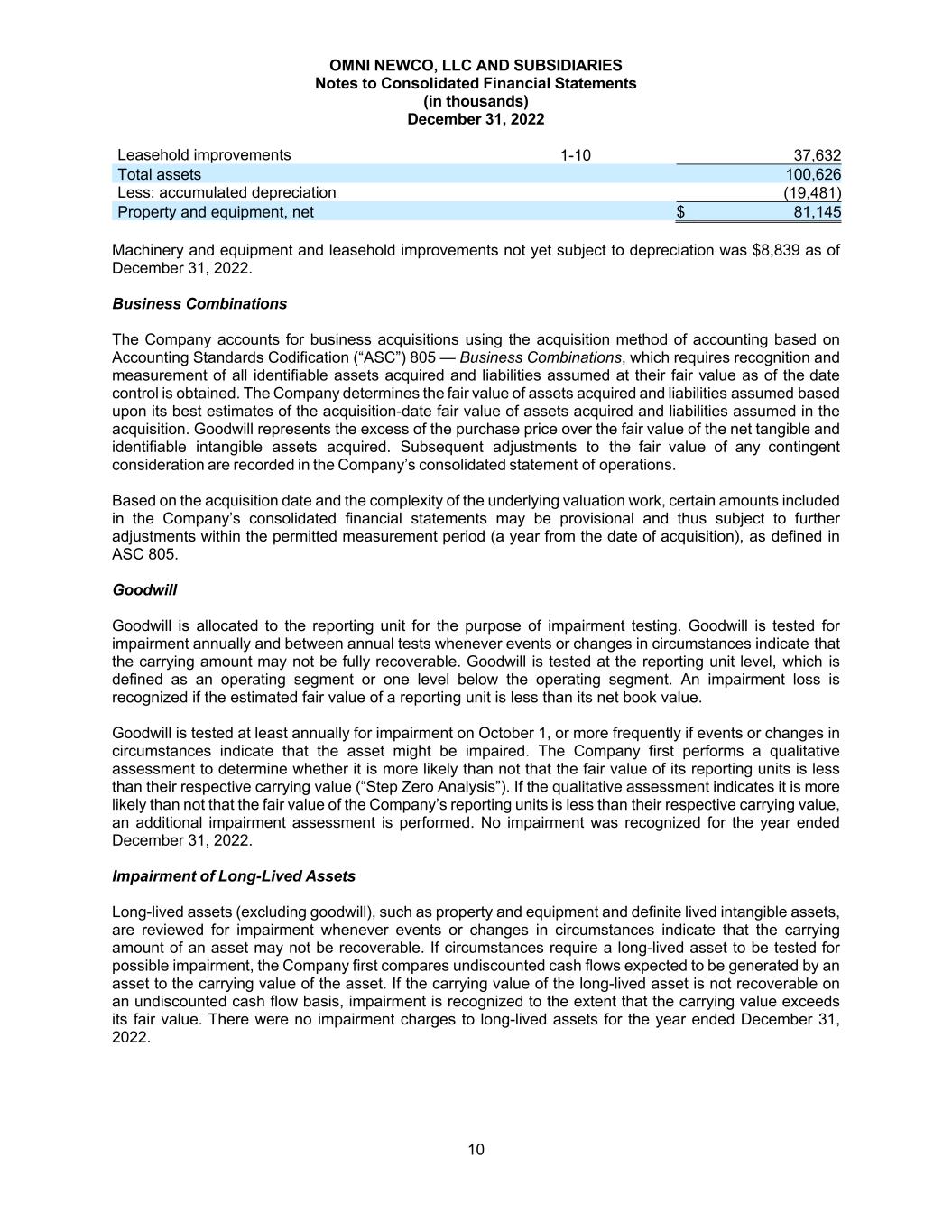

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 9 1. Nature of Operations Omni Newco, LLC (“Newco”), was formed as a Delaware limited liability company on December 21, 2020. Newco, through its wholly-owned subsidiary, Omni Parent, LLC (together “the Company,” “we,” or “our”) is engaged in the arrangement of air, ocean and ground transportation, with commercial carriers for its customers, both nationally and internationally. Additionally, the Company provides e-commerce fulfillment, warehousing and distribution and value-added services, such as testing and light assembly. 2. Summary of Significant Accounting Policies Basis of Presentation and Consolidation The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation. All dollar amounts in the notes are presented in thousands unless otherwise specified. Cash and Cash Equivalents The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. Accounts Receivable and Allowance for Doubtful Accounts Accounts receivable consist of billed and unbilled receivables for services performed for the Company’s customers. The Company performs credit evaluations of its customers and reviews accounts receivable on a monthly basis and determines if any accounts will potentially be uncollectible. The Company includes any such uncollectible amounts in its allowance for doubtful accounts. Based upon information available, management recorded an allowance for doubtful accounts of $6,091 as of December 31, 2022. Actual write- offs may occur and the resulting losses may exceed the allowance for doubtful accounts. Property and Equipment, Net Property and equipment are recorded at cost less accumulated depreciation and amortization. Property and equipment in connection with business combinations are recorded at fair value. Depreciation is computed on a straight-line basis over the estimated useful lives of the asset. Leasehold improvements are amortized over the shorter of the remaining lease term or economic life of the related assets. Depreciation and amortization expense for the year ended December 31, 2022 was $13,445. Expenditures for maintenance and repairs are charged to operations as incurred. Expenditures for betterment and major renewals are capitalized. The cost of assets sold or retired and the related amounts of accumulated depreciation and amortization are eliminated from the accounts in the year of disposal and the resulting gains and losses are included in operations. Property and equipment consist of the following: Estimated useful life in years December 31, 2022 Machinery and equipment 1-10 $ 28,496 Right-of-use asset – finance leases 1-7 18,809 Transportation equipment 1-5 1,387 Office furniture and fixtures 1-7 13,403 Land N/A 899

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 10 Leasehold improvements 1-10 37,632 Total assets 100,626 Less: accumulated depreciation (19,481) Property and equipment, net $ 81,145 Machinery and equipment and leasehold improvements not yet subject to depreciation was $8,839 as of December 31, 2022. Business Combinations The Company accounts for business acquisitions using the acquisition method of accounting based on Accounting Standards Codification (“ASC”) 805 — Business Combinations, which requires recognition and measurement of all identifiable assets acquired and liabilities assumed at their fair value as of the date control is obtained. The Company determines the fair value of assets acquired and liabilities assumed based upon its best estimates of the acquisition-date fair value of assets acquired and liabilities assumed in the acquisition. Goodwill represents the excess of the purchase price over the fair value of the net tangible and identifiable intangible assets acquired. Subsequent adjustments to the fair value of any contingent consideration are recorded in the Company’s consolidated statement of operations. Based on the acquisition date and the complexity of the underlying valuation work, certain amounts included in the Company’s consolidated financial statements may be provisional and thus subject to further adjustments within the permitted measurement period (a year from the date of acquisition), as defined in ASC 805. Goodwill Goodwill is allocated to the reporting unit for the purpose of impairment testing. Goodwill is tested for impairment annually and between annual tests whenever events or changes in circumstances indicate that the carrying amount may not be fully recoverable. Goodwill is tested at the reporting unit level, which is defined as an operating segment or one level below the operating segment. An impairment loss is recognized if the estimated fair value of a reporting unit is less than its net book value. Goodwill is tested at least annually for impairment on October 1, or more frequently if events or changes in circumstances indicate that the asset might be impaired. The Company first performs a qualitative assessment to determine whether it is more likely than not that the fair value of its reporting units is less than their respective carrying value (“Step Zero Analysis”). If the qualitative assessment indicates it is more likely than not that the fair value of the Company’s reporting units is less than their respective carrying value, an additional impairment assessment is performed. No impairment was recognized for the year ended December 31, 2022. Impairment of Long-Lived Assets Long-lived assets (excluding goodwill), such as property and equipment and definite lived intangible assets, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If circumstances require a long-lived asset to be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by an asset to the carrying value of the asset. If the carrying value of the long-lived asset is not recoverable on an undiscounted cash flow basis, impairment is recognized to the extent that the carrying value exceeds its fair value. There were no impairment charges to long-lived assets for the year ended December 31, 2022.

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 11 Leases The Company holds leases classified as both operating and finance. As of January 1, 2022, the Company adopted ASU 2016-02, Leases, which required the Company to recognize a right-of-use asset and a corresponding lease liability on its balance sheet for most leases classified as operating leases under previous guidance. The Company continues to record a right-of-use asset and corresponding lease liability for leases classified as finance leases under the previous guidance. This standard was adopted using the modified retrospective approach as of January 1, 2022 and comparative financial statements have not been presented as allowed per the guidance. As a result, for leases and subleases with terms greater than 12 months, the Company recorded the related right-of-use asset as the balance of the related lease liability, adjusted for any prepaid or accrued lease payments. The lease liability was recorded at the present value of the lease payments over the term. See further discussion in Note 8, Leases. Members’ Equity The Company allocates net income and losses to the Members in accordance with the Limited Liability Company agreement. Contributions and distribution are also made in accordance with the Limited Liability Company agreement. Revenue Freight Forwarding The Company contracts with commercial carriers to arrange for the shipment of cargo. A substantial portion of the Company’s freight forwarding business is conducted through non-committed space allocations with carriers. The Company arranges for, and in many cases provides, pick-up and delivery service between the carrier and the location of the shipper or recipient in addition to other ancillary services. The transaction price is based on the consideration specified in the customer’s contract. Revenue is recognized upon transfer of control of promised products or services to customers in an amount that reflects the consideration the Company expects to receive in exchange for those products or services. A performance obligation is created when a customer under a transportation contract submits a bill of lading for the transport of goods from origin to destination. These performance obligations are satisfied as the shipments move from origin to destination. Transportation revenue is recognized proportionally as a shipment moves from origin to destination and the related costs are recognized as incurred. Some of the customer contracts contain a promise to stand ready, as the Company is obligated to provide transportation services for the customer. For these contracts, the Company recognizes revenue on a straight-line basis over the term of the contract because the pattern of benefit to the customer, as well as the Company’s efforts to fulfill the contract, are generally distributed evenly throughout the period. Performance obligations are short-term, with transit periods ranging from several days to a few months. Customers are billed upon delivery of the freight on a monthly basis, and remit payment according to approved payment terms. The Company recognizes revenue on a net basis when the Company does not control the specific services. The Company has determined that in general each shipment transaction or service order constitutes a separate contract with the customer. However, when the Company provides multiple services to a customer, different contracts may be present for different services. The Company combines the contracts, which form a single performance obligation, and accounts for the contracts as a single contract when certain criteria are met. The Company evaluates whether amounts billed to customers should be reported as gross or net revenue. Generally, revenue is recorded on a gross basis when the Company is primarily responsible for fulfilling the promise to provide the services, when it assumes risk of loss, when it has discretion in setting the prices for the services to the customers, and when the Company has the ability to direct the use of the services provided by the third party.

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 12 Warehousing, Distribution and Value-Added Services The Company recognizes revenue for warehousing, distribution and value-added services as the performance obligation is satisfied in accordance with the contract, which ranges from a few months to a few years. The Company’s performance obligations are satisfied over time as customers simultaneously receive and consume the benefits of the Company’s services. The Company recorded an immaterial amount of deferred revenue included in other liabilities on the accompanying consolidated balance sheet. The contracts contain a single performance obligation, as the distinct services provided remain substantially the same over time. The transaction price is based on the consideration specified in the contract with the customer and contains fixed and variable consideration. In general, the fixed consideration component of a contract represents reimbursement for facility and equipment costs incurred to satisfy the performance obligation and is recognized on a straight-line basis over the term of the contract. The variable consideration component is comprised of cost reimbursement, per-unit pricing or time and materials pricing and is determined based on the costs, units or hours of services provided, respectively, and is recognized over time based on the level of activity. Revenues for freight forwarding was $1,685,869 for the year ended December 31, 2022. Revenues for warehousing, distribution and value-added services were $186,400 for the year ended December 31, 2022. Income Taxes The Company is a limited liability company. Under this method of organization, the members are taxed individually on their share of earnings. However, the Company has a wholly-owned U.S. corporation that is subject to federal income taxes which has been included in the accompanying consolidated financial statements. The Company accounts for income taxes pursuant to the asset and liability method which requires deferred income tax assets and liabilities to be computed annually for temporary differences between the financial statement and income tax bases of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Foreign income taxes are provided for the tax effects of transactions reported in the consolidated financial statements and consist of taxes currently due and deferred taxes, which relate primarily to the difference between the depreciation methods used for financial and income tax reporting. The Company follows guidance regarding accounting for uncertainty in income taxes. This guidance clarifies the accounting for income taxes by prescribing the minimum recognition threshold an income tax position is required to meet before being recognized in the consolidated financial statements and applies to all income tax positions. Each income tax position is assessed using a two-step process. A determination is first made as to whether it is more likely than not that the income tax position will be sustained, based upon technical merits, upon examination by the taxing authorities. If the income tax position is expected to meet the more likely than not criteria, the benefit recorded in the consolidated financial statements equals the largest amount that is greater than 50% likely to be realized upon its ultimate settlement. The Company records income tax related interest and penalties, if applicable, as a component of the provision for income tax expense. None of the Company’s income tax returns are currently under examination by taxing authorities. Fiscal years 2013 and later remain subject to examination by foreign tax authorities and years 2020 and later remain subject to examination by U.S. Federal and state taxing authorities. The Company believes that it has no uncertain tax positions for income taxes and believes there will be no significant changes in these positions during the next twelve months. Foreign Currency The Company operates in multiple countries in Asia, North America, and Europe. Foreign currency

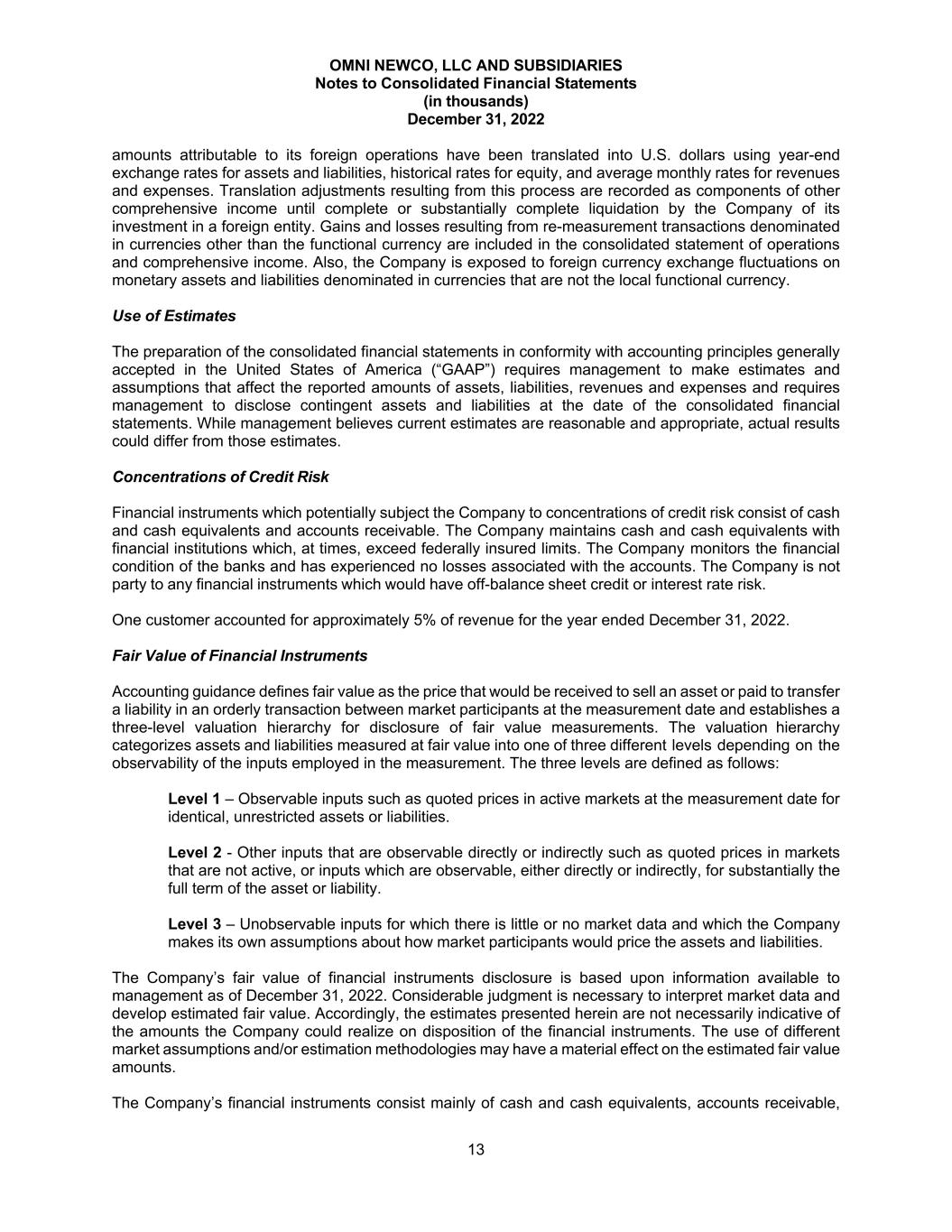

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 13 amounts attributable to its foreign operations have been translated into U.S. dollars using year-end exchange rates for assets and liabilities, historical rates for equity, and average monthly rates for revenues and expenses. Translation adjustments resulting from this process are recorded as components of other comprehensive income until complete or substantially complete liquidation by the Company of its investment in a foreign entity. Gains and losses resulting from re-measurement transactions denominated in currencies other than the functional currency are included in the consolidated statement of operations and comprehensive income. Also, the Company is exposed to foreign currency exchange fluctuations on monetary assets and liabilities denominated in currencies that are not the local functional currency. Use of Estimates The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and requires management to disclose contingent assets and liabilities at the date of the consolidated financial statements. While management believes current estimates are reasonable and appropriate, actual results could differ from those estimates. Concentrations of Credit Risk Financial instruments which potentially subject the Company to concentrations of credit risk consist of cash and cash equivalents and accounts receivable. The Company maintains cash and cash equivalents with financial institutions which, at times, exceed federally insured limits. The Company monitors the financial condition of the banks and has experienced no losses associated with the accounts. The Company is not party to any financial instruments which would have off-balance sheet credit or interest rate risk. One customer accounted for approximately 5% of revenue for the year ended December 31, 2022. Fair Value of Financial Instruments Accounting guidance defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date and establishes a three-level valuation hierarchy for disclosure of fair value measurements. The valuation hierarchy categorizes assets and liabilities measured at fair value into one of three different levels depending on the observability of the inputs employed in the measurement. The three levels are defined as follows: Level 1 – Observable inputs such as quoted prices in active markets at the measurement date for identical, unrestricted assets or liabilities. Level 2 - Other inputs that are observable directly or indirectly such as quoted prices in markets that are not active, or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability. Level 3 – Unobservable inputs for which there is little or no market data and which the Company makes its own assumptions about how market participants would price the assets and liabilities. The Company’s fair value of financial instruments disclosure is based upon information available to management as of December 31, 2022. Considerable judgment is necessary to interpret market data and develop estimated fair value. Accordingly, the estimates presented herein are not necessarily indicative of the amounts the Company could realize on disposition of the financial instruments. The use of different market assumptions and/or estimation methodologies may have a material effect on the estimated fair value amounts. The Company’s financial instruments consist mainly of cash and cash equivalents, accounts receivable,

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 14 accounts payable, contingent consideration and long-term debt. The carrying value for cash and cash equivalents, accounts receivable, and accounts payable approximates their fair value, principally due to the short-term maturities of these instruments. The carrying value for long-term debt approximates fair value because the interest rate is similar to other financial instruments with similar credit risks and terms. The Company follows accounting guidance for nonfinancial assets and liabilities measured at fair value on a non-recurring basis. As it relates to the Company, this applies to certain nonfinancial assets and liabilities acquired in business combinations and thereby measured at fair value. The Company has classified such fair value measurements as level 3 and determines fair value primarily by internal valuations. The Company’s only material financial instruments carried at fair value as of December 31, 2022, with changes in fair value flowing through current earnings, consist of contingent consideration liabilities recorded in conjunction with business combinations. In connection with 2021 acquisitions of Epic, Trinity, Millhouse and PLC, as well as the 2022 acquisitions of LiVe and AGW as defined in Note 3, the Company recorded a contingent consideration liability on each of the acquisition dates, which consists of a potential future payment to each of the sellers. The potential future payment for Epic, Millhouse and LiVe is based on adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”), as defined in the respective purchase and sale agreement. The potential future payment for Trinity, PLC and AGW is based on gross profit, as defined in the respective purchase and sale agreement. The fair value of the contingent consideration liability was determined using a Monte Carlo simulation model. The fair value is based on significant inputs not observable in the market and thus represents a level 3 measurement. The contingent consideration liabilities were measured subsequently at December 31, 2022 at fair value. The fair value adjustments associated with contingent consideration liabilities were included in total operating expenses on the consolidated statement of operations and comprehensive income for the year ended December 31, 2022. The following table summarizes the fair values of the contingent consideration liabilities for the acquisitions at each acquisition date (see Note 3) and at December 31, 2022. Epic Trinity Millhouse PLC LiVe AGW Total Estimated value at December 31, 2021 $ 11,000 $ 42,500 $ 24,000 $ 14,300 $ - $ - $ 91,800 Acquisition date estimated value - - - - 11,400 21,300 32,700 Payments of contingent consideration - (10,002) - - - - (10,002) Change in estimated value 288 (32,498) 914 9,497 5,850 (1,900) (17,849) Estimated value at December 31, 2022 $ 11,288 $ - $ 24,914 $ 23,797 $ 17,250 $ 19,400 $ 96,649 A reconciliation of the beginning and ending balances of recurring fair value measurements recognized in the accompanying balance sheet using significant unobservable (Level 3) inputs, is as follows: December 31, 2022 Balance at beginning of the period $ 91,800 Fair value recorded at acquisition 32,700 Fair value changes included in change in fair value of contingent consideration liability (17,849) Payments of contingent consideration (10,002) Balance at end of the period $ 96,649

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 15 Deferred Financing Costs Financing costs incurred related to debt issuance are deferred and amortized over the term of the related debt which approximates the effective interest rate method. When a debt is retired before its maturity, unamortized deferred financing costs are written off in the period the debt is extinguished. For the year ended December 31, 2022, amortization expense of $6,996 is recorded in interest expense on the consolidated statement of operations and comprehensive income. Investments Other Securities The Company accounts for its investments in equity securities in accordance with ASC Topic No. 321, Investments - Equity Securities (“ASC 321”) which requires the accounting for equity investments (other than those accounted for using the equity method of accounting) generally to be measured at fair value for equity securities with readily determinable fair values. For equity securities without a readily determinable fair value that are not accounted for by the equity method, the Company measures the equity security using cost, less impairment, if any, and plus or minus observable price changes arising from orderly transactions in the same or similar investment from the same issuer. Any unrealized gains or losses will be reported in current earnings. The Company has an investment in Evolve Supply Chain Solutions, LLC (“Evolve”) accounted for at cost less impairment, at $2,500 at December 31 2022, the Company owned a total of 882,352 Series A Preferred Units, or 15%, included in other noncurrent assets on the accompanying consolidated balance sheet. At any point in time, the Company has the ability to convert some or all its Series A Preferred Units into common units of Evolve based on the Series A Preferred Conversion Price, as defined in the Amended and Restated Limited Liability Company Agreement of Evolve Supply Chain Solutions, LLC. 3. Acquisitions On March 31, 2022, the Company through its wholly-owned subsidiary Omni Logistics, LLC acquired substantially all of the assets of LiVe Logistics Corporation (“LiVe”). LiVe was founded in 2016 and is headquartered in Vernon Hills, Illinois. LiVe is a third-party logistics company that provides assetlight transportation and logistics services, specializing in a variety of 3PL services, including full truckload, less- than-truckload, shared truckload, multi-stop deliveries, drop trailers, box trucks, sprinter vans, flatbeds, refrigerated, frozen, reefer, flatbeds, intermodal, rail, and warehousing to customers in the United States. On August 26, 2022, the Company purchased AG World Transport, Inc. and certain subsidiaries (collectively “AGW”) in a stock purchase acquisition. AGW was founded in 1996 and is headquartered in San Francisco, California, and has offices in the United States, Asia, and Europe. AGW is a global freight forwarder that leverages its expertise in air freight, ocean freight, road service, and logistics to craft customized, end-to-end supply chain solutions. The acquisition of AGW was to bolster Omni’s brokerage team and win additional business from existing customers through enhanced air freight capabilities. The business combinations described above were accounted for using the acquisition method of accounting and the purchase price was allocated to the net assets acquired at estimated fair value.

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 16 Total consideration for each acquisition is as follows: LiVe AGW Total Cash consideration $ 37,805 $ 108,664 $ 146,469 Working capital adjustment due from seller (250) (6,801) (7,051) Equity units 4,462 5,247 9,709 Contingent consideration 11,400 21,300 32,700 Total $ 53,417 $ 128,410 $ 181,827 Less: cash acquired (1,095) (12,815) (13,910) Total consideration $ 52,322 $ 115,595 $ 167,917 Management uses the Option-Pricing Method to estimate fair value of the capital units as of the acquisition date. The Option-Pricing Method requires valuation assumptions of expected term, risk-free interest rates (2.42% for LiVe and 3.27% for AGW), expected volatility (43.40% for LiVe and 51.50% for AGW), and expected dividend yield. The term of four years represents the period to an expected liquidity event. The estimated risk-free interest rate is based on the implied yield available on the transaction date of a U.S. Treasury note with a term equal to the expected term. Estimated volatility is based on historical volatility of publicly traded peer companies over a period equal to the expected term. The dividend yield of 0.0% assumes that dividends are accrued and paid continuously. Based upon the purchase price allocation, the following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of the respective acquisition: LiVe AGW Total Accounts receivable $ 7,864 $ 26,886 $ 34,750 Prepaid and other current assets 128 1,968 2,096 Right of use asset 75 9,446 9,521 Property and equipment 435 2,712 3,147 Other noncurrent assets - 652 652 Goodwill 7,156 37,137 44,293 Intangible assets – customer relationships 42,600 86,400 129,000 Intangible assets – trade names 1,000 2,000 3,000 Total assets $ 59,258 $ 167,201 $ 226,459 Accounts payable $ 5,642 $ 9,764 $ 15,406 Income tax payable - 5,610 5,610 Accrued expenses 1,219 4,127 5,346 Lease liabilities, current 69 1,698 1,767 Deferred income taxes, current - 17,147 17,147 Other current liabilities - 4,129 4,129 Lease liabilities, long-term - 375 375 Other long-term liabilities 6 8,756 8,762 Total liabilities $ 6,936 $ 51,606 $ 58,542 Net assets acquired $ 52,322 $ 115,595 $ 167,917 Goodwill represents the excess purchase price over the fair value of the assets net of liabilities acquired. Trained and assembled workforce which does not meet the separability criterion is included in goodwill. Goodwill is not deductible for tax purposes. Customer relationships have an estimated useful life of 15 years while trade names are amortized over 2

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 17 years. See Note 5 for further details. The Company incurred acquisition costs totaling approximately $3,937 that were expensed during 2022 and are included in selling, general and administrative expenses on the consolidated statement of operations and comprehensive income. In connection with the acquisitions, the Company borrowed under its First Lien Term Loan and Amended and Restated First Lien Term Loan. See Note 7 for further details. 4. Goodwill Reconciliation of goodwill as December 31, 2022 is as follows: December 31, 2022 Goodwill – beginning balance $ 485,586 Goodwill additions – business combinations (Note 3) 44,293 Measurement period adjustments 1,506 Goodwill – ending balance $ 531,385 5. Intangible Assets Intangible assets consist of the following as of December 31, 2022: Weighted Average Useful Life in Years Gross Carrying Amount Accumulated Amortization Net Carrying Amount Customer relationships 16.5 $ 766,081 $ (65,490) $ 700,591 Internally developed software 3.6 1,600 (437) 1,163 Trade names - finite-lived 1.2 9,500 (5,719) 3,781 Trade names - indefinite-lived 87,400 - 87,400 Total intangible assets $ 864,581 $ (71,646) $ 792,935 Amortization expense of $42,720 is included in the consolidated statement of operations and comprehensive income for the year ended December 31, 2022, within depreciation and amortization. Future amortization of intangible assets will be as follows: December 31, 2023 $ 46,315 2024 44,117 2025 43,325 2026 43,208 2027 43,005 Thereafter 485,565 $ 705,535

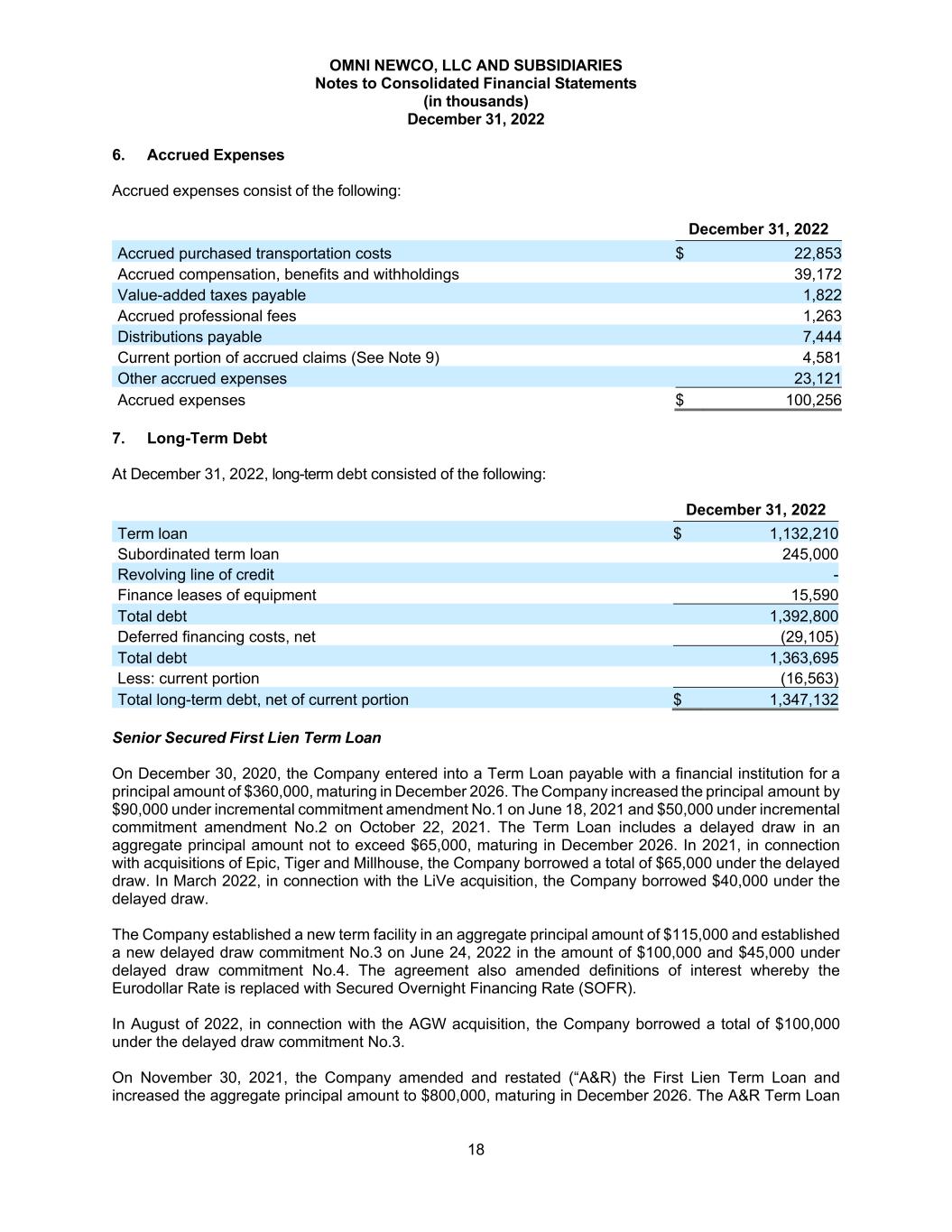

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 18 6. Accrued Expenses Accrued expenses consist of the following: December 31, 2022 Accrued purchased transportation costs $ 22,853 Accrued compensation, benefits and withholdings 39,172 Value-added taxes payable 1,822 Accrued professional fees 1,263 Distributions payable 7,444 Current portion of accrued claims (See Note 9) 4,581 Other accrued expenses 23,121 Accrued expenses $ 100,256 7. Long-Term Debt At December 31, 2022, long-term debt consisted of the following: December 31, 2022 Term loan $ 1,132,210 Subordinated term loan 245,000 Revolving line of credit - Finance leases of equipment 15,590 Total debt 1,392,800 Deferred financing costs, net (29,105) Total debt 1,363,695 Less: current portion (16,563) Total long-term debt, net of current portion $ 1,347,132 Senior Secured First Lien Term Loan On December 30, 2020, the Company entered into a Term Loan payable with a financial institution for a principal amount of $360,000, maturing in December 2026. The Company increased the principal amount by $90,000 under incremental commitment amendment No.1 on June 18, 2021 and $50,000 under incremental commitment amendment No.2 on October 22, 2021. The Term Loan includes a delayed draw in an aggregate principal amount not to exceed $65,000, maturing in December 2026. In 2021, in connection with acquisitions of Epic, Tiger and Millhouse, the Company borrowed a total of $65,000 under the delayed draw. In March 2022, in connection with the LiVe acquisition, the Company borrowed $40,000 under the delayed draw. The Company established a new term facility in an aggregate principal amount of $115,000 and established a new delayed draw commitment No.3 on June 24, 2022 in the amount of $100,000 and $45,000 under delayed draw commitment No.4. The agreement also amended definitions of interest whereby the Eurodollar Rate is replaced with Secured Overnight Financing Rate (SOFR). In August of 2022, in connection with the AGW acquisition, the Company borrowed a total of $100,000 under the delayed draw commitment No.3. On November 30, 2021, the Company amended and restated (“A&R) the First Lien Term Loan and increased the aggregate principal amount to $800,000, maturing in December 2026. The A&R Term Loan

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 19 includes delayed draw of an aggregate amount of $185,000. In connection with acquisition of PLC, the Company borrowed $90,000 under the delayed draw on December 29, 2021. The A&R Term Loan bears interest at a base rate per annum equal to the Eurodollar Rate plus the applicable margin or at a rate per annum equal to the Alternate Base Rate plus the applicable margin for Alternate Base Rate loans and secured by substantially all the assets of the Company. The June 2022 Amendment replaced Eurodollar Rate plus applicable margin with SOFR plus applicable margin. The interest rate on the outstanding borrowings was 9.73% at December 31, 2022. Principal payments equal to 0.25% of the aggregate principal amount are due quarterly commencing on June 30, 2021, with the remaining due upon maturity. Accrued interest is due quarterly. Revolving Line of Credit On December 30, 2020, the Company entered into Revolving Line of Credit with an aggregate principal amount not to exceed $40,000, maturing in December 2025. On November 30, 2021, the Company increased the Revolving Credit Commitment to an aggregate principal amount of $80,000 under the A&R First Lien Credit Agreement. The Revolving Line of Credit bears interest at a base rate per annum equal to the Eurodollar Rate (as replaced with SOFR) plus the applicable margin or at a rate per annum equal to the Alternate Base Rate plus the applicable margin for Alternate Base Rate loans and is unsecured. Principal is due at maturity and accrued interest is due quarterly. The Company shall pay a commitment fee at a rate per annual equal to 0.50% times the actual daily undrawn amount under the Revolving Line of Credit. The commitment fee is due quarterly and on the maturity date for the Revolving Line of Credit. There were no outstanding borrowings under the agreement at December 31, 2022. Secured Second Lien Subordinated Term Loan On December 30, 2020, the Company entered into a Subordinated Term Loan payable with a financial institution for a principal amount of $80,000, maturing in December 2027. On June 24, 2022, the Company obtained a new term facility in the aggregate principal amount of $135,000 and on June 30, 2022, the company entered into the Fifth Amendment to the Secured Second Lien Credit Agreement and funded $30,000 term facility. The Subordinated Term Loan bears interest at a base rate per annum equal to the Eurodollar Rate (as replaced with SOFR) plus the applicable margin or at a rate per annum equal to the Alternate Base Rate plus the applicable margin for Alternate Base Rate loans (10.0% at December 31, 2020) and secured by substantially all the assets of the Company. The Subordinated Term Loan is subordinate to the First Lien Term Loan. Principal is due at maturity and accrued interest is due quarterly. Future maturities of Company’s long-term debt as of December 31, 2022 are as follows: December 31, 2023 $ 11,455 2024 11,455 2025 11,455 2026 1,097,845 2027 245,000 Thereafter - $ 1,377,210 The credit agreements have affirmative and negative covenants as defined within each credit agreement and compliance with the consolidated net leverage ratio. At December 31, 2022, the Company was in compliance with all the terms of its credit facilities.

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 20 8. Leases As of January 1, 2022, the Company adopted ASU 2016-02, Leases, which required the Company to recognize a right-of-use asset and a corresponding lease liability on its balance sheet for most leases classified as operating leases under previous guidance. The Company adopted the standard using the modified retrospective approach as of January 1, 2022 and comparative financial statements have not been presented as allowed per the guidance. The Company elected several of the practical expedients permitted under the transition guidance within the new standard. Practical expedients selected allowed the Company to combine lease and non-lease components and to use hindsight in determining lease term. In addition, we have made a policy election to not apply the guidance of ASC 842 to leases with an initial term of 12 months or less as allowed by the standard. For these leases with an initial term of 12 months or less, the Company recognized the corresponding lease expense on a straight-line basis over the lease term. These practical expedients have been elected for all leases and subleases and will be applied on a go-forward basis. The Company determines if its contractual agreements contain a lease at Inception. A contract is or contains a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. An entity controls the use of the identified asset if both of the following are true: (1) the entity obtains the right to substantially all of the economic benefits from use of the identified asset and (2) the entity has the right to direct the use of the identified asset. For the year ended December 31, 2022, the Company leased facilities and equipment under operating and finance leases. The Company has entered into or assumed through acquisition several equipment finance leases for assets including forklifts, tractors and trailers with original lease terms between 2 and 9 years. These leases expire in various years through 2028 and certain leases may be renewed for periods varying from 1 to 3 years. The finance leased equipment is being amortized over the shorter of the lease term or useful life. This amortization is included in depreciation and amortization expense. The Company leases some of its facilities under noncancellable operating leases that expire in various years through 2032. Certain leases may be renewed for periods varying from 1 to 11 years. The Company also subleases certain facility leases to independent third parties; however, as the Company is not relieved of its primary obligation under these leases, these assets are included in the right-of-use lease assets and corresponding lease liabilities as of December 31, 2022. Sublease rental income was $488 for the year ended December 31, 2022. In 2023, the Company expects to receive aggregate future minimum rental payments under noncancellable subleases of approximately $136. Noncancellable subleases expire between 2020 and 2024. For leases and subleases with terms greater than 12 months, the Company recorded the related right-of- use asset as the balance of the related lease liability, adjusted for any prepaid or accrued lease payments. Unamortized initial direct costs and lease incentives were not significant as of December 31, 2021. The lease liability was recorded at the present value of the lease payments over the term. Many of the Company’s leases include rental escalation clauses, renewal options and/or termination options that were contemplated in the determination of lease payments when appropriate. As of December 31, 2021, the Company was not reasonably certain of exercising any renewal options. Further, as of December 31, 2021, it was reasonably certain that all termination options would not be exercised. As such, there were no adjustments made to its right-of-use lease assets or corresponding liabilities as a result. In addition, the Company does not have any leases with residual value guarantees or material restrictions or covenants as of December 31, 2022. The Company did not separate lease and nonlease components of contracts for purposes of determining the right-of use lease asset and corresponding liability. Additionally, variable lease and variable nonlease components were not contemplated in the calculation of the right-of-use asset and corresponding liability.

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 21 For facility leases, variable lease costs include the costs of common area maintenance, taxes, and insurance for which the Company pays its lessors an estimate that is adjusted to actual expense on a quarterly or annual basis depending on the underlying contract terms. For equipment leases, variable lease costs may include additional fees for using equipment in excess of estimated annual mileage thresholds. Leasehold improvements were also excluded from the calculation of the right-of-use asset and corresponding liability. Leasehold improvements are recorded as an asset at cost and are amortized over the shorter of the estimated useful life or the initial term of the lease. Year ended December 31, 2022 Lease cost Finance lease cost: Amortization of right of use asset $ 3,167 Interest on lease liabilities 627 Operating lease cost: 47,800 Short-term lease cost 10,690 Sublease income 488 Total lease cost $ 62,772 Future minimum lease payments under noncancelable operating and finance leases with remaining terms greater than one year as of December 31, 2022 were as follows: Finance Leases Operating Leases 2023 $ 5,908 $ 56,477 2024 4,408 51,856 2025 3,563 40,235 2026 2,774 32,844 2027 703 26,055 Thereafter 7 78,792 $ 17,363 $ 286,259 Following table summarizes the supplemental cash flow and additional information: Year ended December 31, 2022 Other information Cash paid for amount included in the measurement of lease liabilities: Operating cash flows from finance leases $ 627 Operating cash flows from operating leases 43,566 Financing cash flows from finance leases 3,204 Right of use asset obtained in exchange for new finance lease liabilities 13,841 Right of use asset obtained in exchange for new operating lease liabilities 176,818 Weighted-average remaining lease term – finance leases (in years) 3.7 Weighted-average remaining lease term – operating leases (in years) 5.4 Weighted-average discount rate – finance leases 6.1% Weighted-average discount rate – operating leases 6.1%

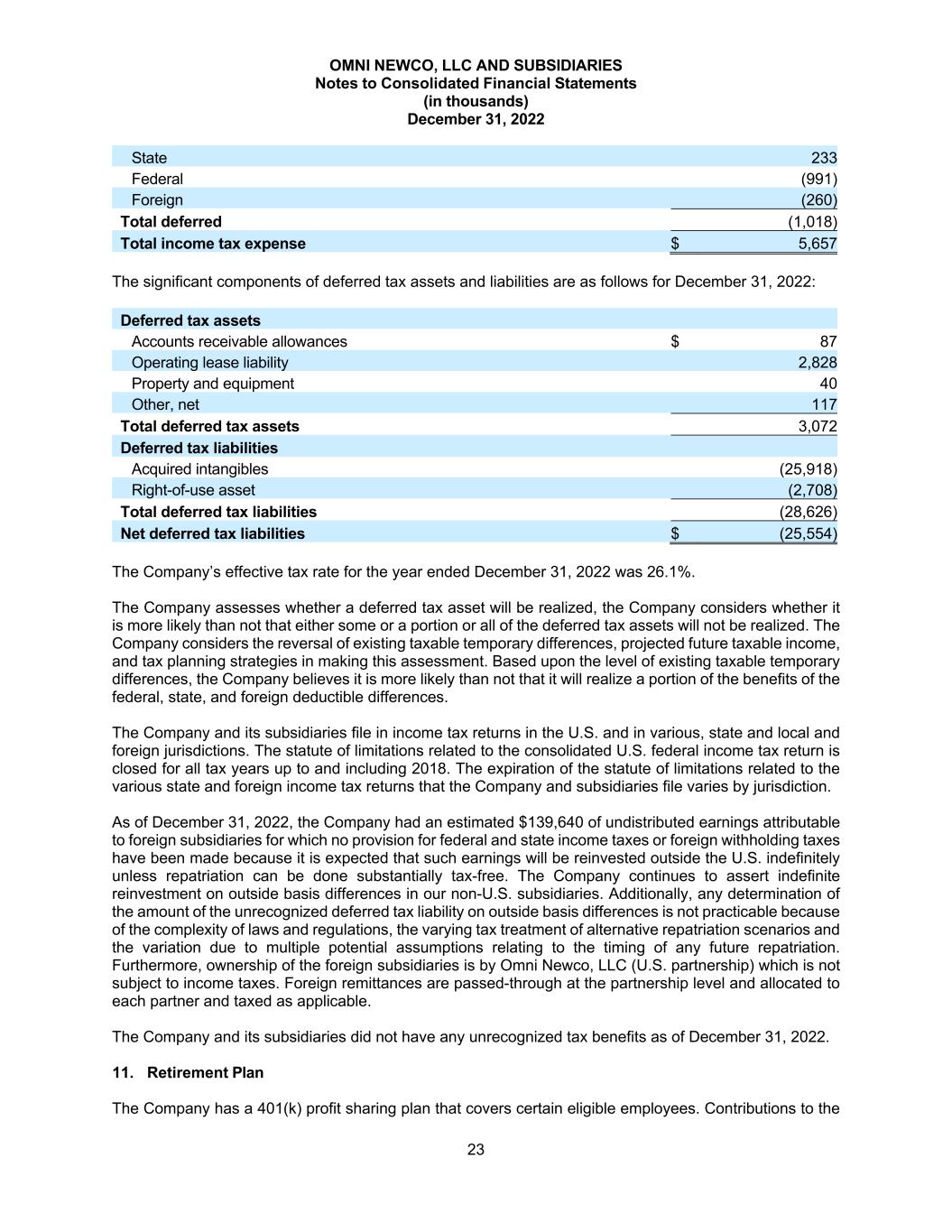

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 22 9. Commitments and Contingencies The Company is party to various legal claims and actions incidental to its business, including claims related to vehicle liability, workers’ compensation, and property damage. The Company accrues for the uninsured portion of contingent losses from these and other pending claims when it is both probable that a liability has been incurred and the amount of loss can be reasonably estimated. Based on the knowledge of the facts, the Company believes the resolution of claims and pending litigation, taking into account existing reserves, will not have a material adverse effect on our consolidated financial statements. Moreover, the results of complex legal proceedings are difficult to predict, and the Company’s view of these matters may change in the future as the litigation and related events unfold. From time-to-time, the Company is subject to various litigation and other claims in the normal course of business. The Company establishes liabilities in connection with legal actions that management deems to be probable and estimable. As of December 31, 2022, $4,581 are included in accrued expenses on the accompanying balance sheet for current portion of known claims. The non-current portion of known claims of $2,824 at December 31, 2022 are included in other long-term liabilities in the accompanying consolidated balance sheet. 10. Income Taxes The components of income before income taxes for the year ended December 31, 2022 are as follows: Domestic $ (11,857) Foreign 33,513 Total $ 21,656 As a result of a tax election to be treated as a limited liability company made by the Company under applicable Income Tax Regulations, the Company is treated as a partnership for U.S. federal income tax purposes and is not subject to income taxes. However, the Company holds interest in subsidiary corporations that are subject to income tax at the U.S. federal or foreign jurisdiction level. Therefore, the Company's rate reconciliation begins with a zero percent income tax rate, but taxes are included in the reconciliation for the Company's withholding tax obligations and the tax obligations of its subsidiaries. The following is a reconciliation from tax computed as statutory income tax rates to the Company’s income tax expense for the year ended December 31, 2022: Income tax expense (benefit) at federal statutory rate $ - U.S. federal income tax benefit of subsidiary entities (81) Foreign income tax expense of subsidiary entities 5,080 State and local taxes, net of federal benefit 658 Total income tax expense $ 5,657 Income tax expense (benefit) consisted of the following for the year ended December 31, 2022: Current State $ 425 Federal 910 Foreign 5,340 Total current 6,675 Deferred

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 23 State 233 Federal (991) Foreign (260) Total deferred (1,018) Total income tax expense $ 5,657 The significant components of deferred tax assets and liabilities are as follows for December 31, 2022: Deferred tax assets Accounts receivable allowances $ 87 Operating lease liability 2,828 Property and equipment 40 Other, net 117 Total deferred tax assets 3,072 Deferred tax liabilities Acquired intangibles (25,918) Right-of-use asset (2,708) Total deferred tax liabilities (28,626) Net deferred tax liabilities $ (25,554) The Company’s effective tax rate for the year ended December 31, 2022 was 26.1%. The Company assesses whether a deferred tax asset will be realized, the Company considers whether it is more likely than not that either some or a portion or all of the deferred tax assets will not be realized. The Company considers the reversal of existing taxable temporary differences, projected future taxable income, and tax planning strategies in making this assessment. Based upon the level of existing taxable temporary differences, the Company believes it is more likely than not that it will realize a portion of the benefits of the federal, state, and foreign deductible differences. The Company and its subsidiaries file in income tax returns in the U.S. and in various, state and local and foreign jurisdictions. The statute of limitations related to the consolidated U.S. federal income tax return is closed for all tax years up to and including 2018. The expiration of the statute of limitations related to the various state and foreign income tax returns that the Company and subsidiaries file varies by jurisdiction. As of December 31, 2022, the Company had an estimated $139,640 of undistributed earnings attributable to foreign subsidiaries for which no provision for federal and state income taxes or foreign withholding taxes have been made because it is expected that such earnings will be reinvested outside the U.S. indefinitely unless repatriation can be done substantially tax-free. The Company continues to assert indefinite reinvestment on outside basis differences in our non-U.S. subsidiaries. Additionally, any determination of the amount of the unrecognized deferred tax liability on outside basis differences is not practicable because of the complexity of laws and regulations, the varying tax treatment of alternative repatriation scenarios and the variation due to multiple potential assumptions relating to the timing of any future repatriation. Furthermore, ownership of the foreign subsidiaries is by Omni Newco, LLC (U.S. partnership) which is not subject to income taxes. Foreign remittances are passed-through at the partnership level and allocated to each partner and taxed as applicable. The Company and its subsidiaries did not have any unrecognized tax benefits as of December 31, 2022. 11. Retirement Plan The Company has a 401(k) profit sharing plan that covers certain eligible employees. Contributions to the

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 24 plan are at the discretion of management. For the year ended December 31, 2022, the Company contributed $192 to the plan. 12. Profit Unit Plan Class B Member Units On March 26, 2021, the Board of Managers of Company’s parent created a new profit unit plan with authorized Class B member units (“Class B Units”). The Company accounted for the Units as liabilities under FASB ASC 718, Compensation – Stock Compensation. As such, the fair value of each award would be calculated at each reporting date. However, the Company recognized no compensation cost for Class B Units that are contingent upon continued employment and only vest upon a liquidity event that generates an internal rate of return of 18% or more as the vesting conditions are not considered probable until a liquidity even occurs. The Company granted Class B Units as non-cash compensation in 2022 that are not contingent upon continued employment and a liquidity event. The Company recognizes stock compensation expense based on the fair value of awards on the date of grant. The fair value of awards was measured using income approach and market approach. This expense is recognized in “Selling, general and administrative expenses” on a straight-line basis over the service periods as compensation costs on the consolidated statements of operations and comprehensive income. Our accounting policy is to account for forfeitures as they occur. As of December 31, 2022, there was $1,381 of unrecognized compensation expense related to nonvested grants. The unrecognized compensation costs are expected to be recognized over a weighted-average of 2.3 years. Fair value of the units vested was $273 in 2022. A summary of the status of our nonvested units issued, and the changes during the year ended December 31, 2022, is presented below: Number of Shares Weighted Average Grant-Date Fair Value Nonvested at December 31, 2021 3,635,797 $ 0.30 Granted 454,475 1.24 Vested (908,949) 0.30 Forfeited - - Nonvested at December 31, 2022 3,181,323 $ 0.43 13. Related Parties The Company is party to a management consulting agreement with Eve Omni Advisors, LLC (“EVE”). Pursuant to this agreement, EVE will provide consulting services related to senior management matters as an independent contractor. The Company shall pay in advance a quarterly management fee of $ 375 on the first business day of each fiscal quarter (commencing on January 1, 2021), plus reimbursement of certain expenses. The agreement will continue until terminated by certain triggering events as defined in the agreement. The Company incurred management consulting fees of $1,500 during the year ended December 31, 2022. The Company entered into a management consulting agreement with Ridgemont Partners Management, LLC (“Ridgemont”) in December 2020. Pursuant to the management consulting agreement, Ridgemont provides consulting services related to senior management matters as an independent contractor on an

OMNI NEWCO, LLC AND SUBSIDIARIES Notes to Consolidated Financial Statements (in thousands) December 31, 2022 25 ongoing basis until terminated by certain triggering events as defined in the agreement. The Company shall pay in advance a quarterly management fee of $375 on the first business day of each fiscal quarter (commencing on January 1, 2021), plus reimbursement of certain expenses. The Company incurred management consulting fees of $1,500 during the year ended December 31, 2022. During the year ended December 31, 2022, the Company leased employees via an affiliate and incurred costs of $9,713. Accounts payable to the affiliate at December 31, 2022 was $1,005, included within accounts payable on the consolidated balance sheet. The Company provided transportation and logistics services to an affiliate in 2022 and recorded revenues of approximately $114. Accounts receivable from the affiliate at December 31, 2022 was $10, included within accounts receivable on the consolidated balance sheet. During the year ended December 31, 2022, the Company utilized an affiliate for transportation services and incurred costs of $414. Accounts payable to the affiliate at December 31, 2022 was $2, included within accounts payable on the consolidated balance sheet. 14. Subsequent Events The Company has evaluated all events subsequent through September 16, 2023, the date these consolidated financial statements were available to be issued. In March 2023, the Company borrowed $55,000 under the delayed draw commitment No.2 and $9,000 under the delayed draw commitment No.4. On August 10, 2023, the Company announced that it has entered into a definitive agreement with Forward Air Corporation (“Forward”) under which Forward and the Company will combine in a cash-and-stock transaction. Under the terms of the agreement, the Company’s shareholders will receive $150,000 in cash and Forward common stock and preferred stock.