UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

|

|

For the Fiscal Year Ended

or

|

|

For the Transition Period from to

Commission File Number

(Exact name of registrant as specified in its charter)

|

|

||

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the registrant’s outstanding common stock held by non-affiliates on February 28, 2021 was $

The registrant had

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the January 2022 Annual Meeting of Shareholders are incorporated by reference into Part III of this report.

SCHNITZER STEEL INDUSTRIES, INC.

FORM 10-K

TABLE OF CONTENTS

|

|

|

|

|

PAGE |

|

|

|

|

|

|

|

|

1 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1 |

|

|

2 |

|

|

|

|

|

|

|

|

Item 1A |

|

|

14 |

|

|

|

|

|

|

|

|

Item 1B |

|

|

28 |

|

|

|

|

|

|

|

|

Item 2 |

|

|

29 |

|

|

|

|

|

|

|

|

Item 3 |

|

|

30 |

|

|

|

|

|

|

|

|

Item 4 |

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5 |

|

|

32 |

|

|

|

|

|

|

|

|

Item 6 |

|

|

33 |

|

|

|

|

|

|

|

|

Item 7 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

34 |

|

|

|

|

|

|

|

Item 7A |

|

|

50 |

|

|

|

|

|

|

|

|

Item 8 |

|

|

51 |

|

|

|

|

|

|

|

|

Item 9 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

90 |

|

|

|

|

|

|

|

Item 9A |

|

|

90 |

|

|

|

|

|

|

|

|

Item 9B |

|

|

90 |

|

|

|

|

|

|

|

|

Item 9C |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10 |

|

|

91 |

|

|

|

|

|

|

|

|

Item 11 |

|

|

91 |

|

|

|

|

|

|

|

|

Item 12 |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

91 |

|

|

|

|

|

|

|

Item 13 |

|

Certain Relationships and Related Transactions, and Director Independence |

|

91 |

|

|

|

|

|

|

|

Item 14 |

|

|

91 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15 |

|

|

92 |

|

|

|

|

|

|

|

|

Item 16 |

|

|

95 |

|

|

|

|

|

||

|

|

96 |

|||

FORWARD-LOOKING STATEMENTS

Statements and information included in this Annual Report on Form 10-K by Schnitzer Steel Industries, Inc. that are not purely historical are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and are made pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Except as noted herein or as the context may otherwise require, all references to “we,” “our,” “us,” “the Company” and “SSI” refer to Schnitzer Steel Industries, Inc. and its consolidated subsidiaries.

Forward-looking statements in this Annual Report on Form 10-K include statements regarding future events or our expectations, intentions, beliefs and strategies regarding the future, which may include statements regarding the impact of pandemics, epidemics or other public health emergencies, such as the coronavirus disease 2019 (“COVID-19”) pandemic; the impact of equipment upgrades, equipment failures and facility damage on production, including timing of repairs and resumption of operations; the realization of insurance recoveries; the Company’s outlook, growth initiatives or expected results or objectives, including pricing, margins, sales volumes and profitability; completion of acquisitions and integration of acquired businesses; liquidity positions; our ability to generate cash from continuing operations; trends, cyclicality and changes in the markets we sell into; strategic direction or goals; targets; changes to manufacturing and production processes; the realization of deferred tax assets; planned capital expenditures; the cost of and the status of any agreements or actions related to our compliance with environmental and other laws; expected tax rates, deductions and credits; the impact of sanctions and tariffs, quotas and other trade actions and import restrictions; the potential impact of adopting new accounting pronouncements; the impact of labor shortages or increased labor costs; obligations under our retirement plans; benefits, savings or additional costs from business realignment, cost containment and productivity improvement programs; and the adequacy of accruals.

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as “outlook,” “target,” “aim,” “believes,” “expects,” “anticipates,” “intends,” “assumes,” “estimates,” “evaluates,” “may,” “will,” “should,” “could,” “opinions,” “forecasts,” “projects,” “plans,” “future,” “forward,” “potential,” “probable,” and similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking.

We may make other forward-looking statements from time to time, including in reports filed with the Securities and Exchange Commission, press releases, presentations and on public conference calls. All forward-looking statements we make are based on information available to us at the time the statements are made, and we assume no obligation to update any forward-looking statements, except as may be required by law. Our business is subject to the effects of changes in domestic and global economic conditions and a number of other risks and uncertainties that could cause actual results to differ materially from those included in, or implied by, such forward-looking statements. Some of these risks and uncertainties are discussed in “Item 1A. Risk Factors” of Part I of this Form 10-K. Examples of these risks include: the impact of pandemics, epidemics or other public health emergencies, such as the COVID-19 pandemic; the impact of equipment upgrades, equipment failures and facility damage on production; potential environmental cleanup costs related to the Portland Harbor Superfund site or other locations; the cyclicality and impact of general economic conditions; changing conditions in global markets including the impact of sanctions and tariffs, quotas and other trade actions and import restrictions; volatile supply and demand conditions affecting prices and volumes in the markets for raw materials and other inputs we purchase; significant decreases in recycled metal prices; imbalances in supply and demand conditions in the global steel industry; difficulties associated with acquisitions and integration of acquired businesses; supply chain disruptions; reliance on third-party shipping companies, including with respect to freight rates and the availability of transportation; inability to obtain or renew business licenses and permits; the impact of goodwill impairment charges; the impact of long-lived asset and equity investment impairment charges; failure to realize or delays in realizing expected benefits from investments in processing and manufacturing technology improvements; inability to achieve or sustain the benefits from productivity, cost savings and restructuring initiatives; inability to renew facility leases; customer fulfillment of their contractual obligations; increases in the relative value of the U.S. dollar; the impact of foreign currency fluctuations; potential limitations on our ability to access capital resources and existing credit facilities; restrictions on our business and financial covenants under the agreement governing our bank credit facilities; the impact of consolidation in the steel industry; product liability claims; the impact of legal proceedings and legal compliance; the adverse impact of climate change; the impact of not realizing deferred tax assets; the impact of tax increases and changes in tax rules; the impact of one or more cybersecurity incidents; environmental compliance costs and potential environmental liabilities; compliance with climate change and greenhouse gas emission laws and regulations; the impact of labor shortages or increased labor costs; reliance on employees subject to collective bargaining agreements; and the impact of the underfunded status of multiemployer plans in which we participate.

1 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

PART I

ITEM 1. BUSINESS

General

Founded in 1906, Schnitzer Steel Industries, Inc. is one of North America’s largest recyclers of ferrous and nonferrous metal, including end-of-life vehicles, and a manufacturer of finished steel products. As a vertically integrated organization, we offer a range of products and services to meet global demand through our network that includes 50 retail self-service auto parts stores, 52 metals recycling facilities and an electric arc furnace (“EAF”) steel mill.

Worldwide demand for recycled ferrous and nonferrous metal is driven primarily by production levels for finished steel and for products using nonferrous metal. Recycled ferrous metal is the primary feedstock for steel mill production using EAF technology and one of the raw materials utilized for steel manufacturing using blast furnace technology. Steel mills around the world, including those in the North American domestic market in which our own steel mill operates, are the primary end markets for our recycled ferrous metal products. Specialty steelmakers, foundries, refineries, smelters, wholesalers, and other recycled metal processors globally are the primary end markets for our recycled nonferrous metal products. Our steel mill produces finished steel products using internally sourced recycled ferrous metal as the primary raw material and sells to customers located primarily in the Western United States and Western Canada.

We believe long-term demand for recycled metals will continue to be driven by factors including global economic growth and an increased focus on environmental policies promoting natural resource conservation, lower greenhouse gas emissions, and lower energy usage. We believe the significant environmental benefits and production efficiencies associated with steelmaking that maximizes the use of recycled metal as a raw material, compared to iron ore mined from natural resources, will positively contribute to worldwide long-term demand for recycled ferrous metal. Further, we believe decarbonization efforts by companies, industries, and governments around the world, including investments in low carbon technologies that are more metal intensive and minimize carbon dioxide emissions from the use of fossil fuels, among other factors, support global long-term demand for recycled nonferrous metal such as aluminum and copper.

Segment Reporting

Prior to the first quarter of fiscal 2021, our internal organizational and reporting structure included two operating and reportable segments: the Auto and Metals Recycling (“AMR”) business and the Cascade Steel and Scrap (“CSS”) business. In the first quarter of fiscal 2021, in accordance with our plan announced in April 2020, we completed the transition to a new internal organizational and reporting structure reflecting a functionally-based, integrated model (“One Schnitzer”), supporting a single segment. We consolidated our operations, sales, services, and other functional capabilities at an enterprise level reflecting enhanced focus by management on optimizing our vertically integrated value chain. This change in structure has resulted in a more agile organization and solidified achievement of recent productivity improvements and cost efficiency initiatives. We began reporting on this new single-segment structure in the first quarter of fiscal 2021.

Revenue-Generating Activities

We acquire, process, and recycle end-of-life (salvaged) vehicles, rail cars, home appliances, industrial machinery, manufacturing scrap, and construction and demolition scrap through our facilities. Our retail self-service auto parts stores located across the United States (“U.S.”) and Western Canada, which operate under the commercial brand-name Pick-n-Pull, procure the significant majority of our salvaged vehicles and sell serviceable used auto parts from these vehicles. Upon acquiring a salvaged vehicle, we remove catalytic converters, aluminum wheels, and batteries for separate processing and sale prior to placing the vehicle in our retail lot. After retail customers have removed desired parts from a vehicle, we may remove remaining major component parts containing ferrous and nonferrous metals, which are primarily sold to wholesalers. The remaining auto bodies are crushed and shipped to our metals recycling facilities to be shredded or sold to third parties where geographically more economical. At our metals recycling facilities, we process mixed and large pieces of scrap metal into smaller pieces by crushing, torching, shearing, shredding, separating, and sorting, resulting in recycled ferrous, nonferrous, and mixed metal pieces of a size, density, and metal content required by customers to meet their production needs. Each of our shredding, nonferrous processing, and separation systems is designed to optimize the recovery of valuable recycled metal.

2 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

We operate seven deepwater port locations, six of which are equipped with large-scale shredders. Our largest port facilities in Everett, Massachusetts; Portland, Oregon; Oakland, California; and Tacoma, Washington each operate a mega-shredder with 7,000 to 9,000 horsepower. Our port facilities in Salinas, Puerto Rico, and Kapolei, Hawaii operate shredders with 1,500 and 4,000 horsepower, respectively. Our port facility in Providence, Rhode Island does not operate a shredder, but exports recycled ferrous metal acquired in the regional market. Our shredders are designed to provide a denser product and, in conjunction with advanced separation equipment, a more refined form of recycled ferrous metal which can be used efficiently by steel mills in the production of new steel. The shredding process reduces auto bodies and other scrap metal into fist-size pieces of shredded recycled metal. The shredded material is then carried by conveyor under magnetized drums that attract the ferrous metal and separate it from the mixed nonferrous metal and other residue, resulting in a consistent and high-quality shredded ferrous product. The mixed nonferrous metal and residue then pass through a series of additional mechanical systems designed to recover and separate the nonferrous metal from the residue. The remaining mixed nonferrous metal is then further sorted by product and size grade before being sold as joint products, which include mainly zorba (primarily aluminum), zurik (primarily stainless steel), and shredded insulated wire (primarily copper and aluminum). We sell further separated products with higher metal content such as twitch (light gauge recycled aluminum) and shredded copper and brass. We also purchase nonferrous metal directly from industrial vendors and other suppliers and aggregate and prepare this metal for shipment to customers by ship, rail, or truck.

We invest in nonferrous metal extraction and separation technologies in order to maximize the recoverability of valuable nonferrous metal and to meet the metal purity requirements of customers. We have a major strategic initiative currently underway and partially complete to replace, upgrade and add to our existing nonferrous metal recovery technologies that is expected to increase metal recovery yields, provide for additional product optionality, create higher quality furnace-ready products, and reduce the metallic portion of shredder residue disposed in landfills. The rollout of these new technologies is anticipated to be completed in fiscal 2022, with total capital expenditures estimated to be $115 million, of which $77 million has been incurred, including $36 million during fiscal 2021.

In addition to the sale of recycled metal processed at our facilities, we also provide a variety of recycling and related services including brokering the sale of ferrous and nonferrous scrap metal generated by industrial entities and demolition projects to customers in the domestic market, among other services.

Our steel mill melt shop includes an EAF, a ladle refining furnace with enhanced steel chemistry refining capabilities, and a five-strand continuous billet caster, permitting the mill to produce special alloy grades of steel not currently produced by other mills on the West Coast of the U.S. The substantial majority of billets produced are reheated in a natural gas-fueled furnace and are then hot-rolled through the rolling mill to produce finished steel long products. The rolling mill has an effective annual production capacity under current conditions of approximately 580 thousand tons of finished steel products.

Products and Services

Recycled ferrous metal is a key feedstock used in the production of finished steel and is largely categorized into heavy melting steel (“HMS”), plate and structural (“bonus”), and shredded scrap (“shred”), although there are various grades of each category depending on metal content and the size and consistency of individual pieces. These attributes affect the product’s relative value.

Our nonferrous products include mixed metal joint products recovered from the shredding process, as well as aluminum, copper, stainless steel, nickel, brass, titanium, lead, and high temperature alloys. We also sell catalytic converters to specialty processors that extract the nonferrous precious metals including platinum, palladium and rhodium.

We provide recycling and related services involving scrap metal and other recyclable materials to a range of customers, including large retailers, industrial manufacturers, original equipment manufacturers and owners of end-of-life railcars. These services include primarily scrap brokerage, certified destruction, automotive parts recycling, railcar dismantling, and reverse logistics.

Each retail self-service auto parts store offers an extensive selection of vehicles (including domestic and foreign cars, vans, and light trucks) from which customers can remove and purchase parts. We employ proprietary information technology systems to centrally manage and operate the geographically diverse network of auto parts stores, and we regularly rotate the inventory to provide customers with greater access to parts. Our used auto parts inventory is also searchable on our Pick-n-Pull public website. We enter into limited duration contracts with public entities and other third parties for vehicle dismantling and asset recovery services, which provide a source of low-cost salvage vehicles.

3 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

Our steel mill produces semi-finished goods (billets) and finished goods, consisting of rebar, coiled rebar, wire rod, merchant bar, and other specialty products, using recycled ferrous metal sourced internally from our recycling and joint venture operations and other raw materials. Semi-finished goods are predominantly used for the manufacturing of finished products. Rebar is produced in either straight length steel bars or coils and used to increase the strength of poured concrete. Coiled rebar is preferred by some manufacturers because it reduces the waste generated by cutting individual lengths to meet customer specifications and, therefore, improves yield. Wire rod is steel rod, delivered in coiled form, used by manufacturers to produce a variety of products such as chain link fencing, nails, wire, stucco netting, and pre-stressed concrete strand. Merchant bar consists of rounds and square steel bars used by manufacturers to produce a wide variety of products, including bolts, threaded bars, and dowel bars. Our steel mill is also an approved supplier of high-quality rebar to support nuclear power plant construction and has a license to produce certain patented high-strength specialty steels.

Active Facilities

Tabular presentation of our active facilities by geographic region is as follows:

|

|

|

Auto Parts Stores |

|

|

Metals Recycling Facilities(1) |

|

|

Total Recycling Facilities |

|

|

Large-Scale Shredders(2) |

|

|

Deepwater Ports |

|

|

Steel Facilities(3) |

|

||||||

|

Northwest (WA, OR, MT) |

|

|

7 |

|

|

|

8 |

|

|

|

15 |

|

|

|

2 |

|

|

|

2 |

|

|

|

1 |

|

|

Southwest and Hawaii (CA, NV, UT, HI) |

|

|

22 |

|

|

|

7 |

|

|

|

29 |

|

|

|

2 |

|

|

|

2 |

|

|

|

1 |

|

|

Midwest and South (AR, IL, IN, OH, MO, KS, TX) |

|

|

13 |

|

|

|

— |

|

|

|

13 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Northeast (MA, ME, NH, RI) |

|

|

2 |

|

|

|

9 |

|

|

|

11 |

|

|

|

1 |

|

|

|

2 |

|

|

|

— |

|

|

Southeast and Puerto Rico (GA, AL, TN, FL, VA, KY, MS, PR) |

|

|

2 |

|

|

|

24 |

|

|

|

26 |

|

|

|

1 |

|

|

|

1 |

|

|

|

— |

|

|

Western Canada (BC, AB) |

|

|

4 |

|

|

|

4 |

|

|

|

8 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total |

|

|

50 |

|

|

|

52 |

|

|

|

102 |

|

|

|

6 |

|

|

|

7 |

|

|

|

2 |

|

|

(1) |

Excludes joint venture facilities. Includes eight metals recycling facilities located in the Southeast which we acquired on October 1, 2021. See “Acquisition of Columbus Recycling” below in this Item 1 for further detail. |

|

(2) |

All large-scale shredding operations employ nonferrous extraction and separation equipment. |

|

(3) |

Includes one steel mill in Oregon and one distribution center in California. |

Pricing

Domestic and foreign prices for recycled ferrous and nonferrous metal are generally based on prevailing market rates, which differ by region, and are subject to market cycles that are influenced by worldwide demand from steel and other metal producers, the availability of materials that can be processed into saleable recycled metal, and regulatory policies, among other factors. Sanctions, trade actions, and licensing and inspection requirements can also impact pricing for the affected products. Recycled ferrous and nonferrous metal sales contracts generally provide for shipment within 30 to 60 days after the price is agreed to which, in most cases, includes freight.

We respond to changes in selling prices for processed metal by seeking to adjust purchase prices for unprocessed scrap metal in order to manage the impact on our operating income. The spread between selling prices and the cost of purchased scrap metal (metal spread) is subject to a number of factors, including differences in the market conditions between the domestic regions where scrap metal is acquired and the areas in the world to which the processed metals are sold, market volatility from the time the selling price is agreed upon with the customer until the time the scrap metal is purchased, and changes in transportation costs. We generally benefit from sustained periods of stable or rising recycled metal selling prices, which allow us to better maintain or increase both operating income and unprocessed scrap metal flow into our facilities. When recycled metal selling prices decline, either sharply or for a sustained period, our operating margins typically compress.

The sales prices for auto parts from salvaged vehicles are deeply discounted from prevailing national new and refurbished sales prices offered at full-service auto dismantlers, retail auto parts stores, and car dealerships. Our stores provide a list price, available at each location and online. Prices for auto bodies sold to third parties and for major component parts, such as engines, transmissions, and alternators sold to wholesalers, are based on prevailing recycled metal market rates which differ by region and are subject to market cycles. Prices for catalytic converters sold to third-party processors are based on prevailing market rates for the extracted precious metals including platinum, palladium, and rhodium. By consolidating shipments of auto bodies and component parts, we are able to optimize prices by focusing on larger wholesale customers that pay a premium for volume and consistency of shipments.

4 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

Our finished steel product prices differ by product size and grade. Selling prices are influenced by the price of raw materials, including the cost of recycled ferrous metal and required consumables including graphite electrodes and alloys, as well as regional demand in the West Coast and Western Canadian markets. Selling prices for our finished steel products may also be affected by the price and availability of steel imports.

Customers and Markets

Approximately 95% of our consolidated revenues are derived from sales of recycled ferrous and nonferrous metal products and finished steel products. We sell our recycled ferrous and nonferrous metal products globally to steel mills, foundries, refineries, smelters, wholesalers, and other recycled metal processors. Our finished steel customers are primarily steel service centers, construction industry subcontractors, steel fabricators, wire drawers, and major farm and wood products suppliers. We had no external customers that accounted for 10% or more of our consolidated revenues in fiscal 2021, 2020, or 2019.

Recycled Ferrous Metal

The table below sets forth, on a revenue and volume basis, the amount of recycled ferrous metal sold to foreign and domestic customers, during the last three fiscal years ended August 31:

|

|

|

For the Year Ended August 31, |

|

|

% Increase (Decrease) |

|

||||||||||||||

|

($ in thousands) |

|

2021 |

|

|

2020 |

|

|

2019 |

|

|

2021 vs. 2020 |

|

|

2020 vs. 2019 |

|

|||||

|

Ferrous revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic |

|

$ |

289,742 |

|

|

$ |

167,060 |

|

|

$ |

288,641 |

|

|

|

73 |

% |

|

|

(42 |

)% |

|

Foreign |

|

|

1,268,149 |

|

|

|

695,430 |

|

|

|

876,078 |

|

|

|

82 |

% |

|

|

(21 |

)% |

|

Total ferrous revenues |

|

$ |

1,557,891 |

|

|

$ |

862,490 |

|

|

$ |

1,164,719 |

|

|

|

81 |

% |

|

|

(26 |

)% |

|

Ferrous volumes (LT, in thousands)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic(2) |

|

|

1,500 |

|

|

|

1,429 |

|

|

|

1,699 |

|

|

|

5 |

% |

|

|

(16 |

)% |

|

Foreign |

|

|

2,908 |

|

|

|

2,525 |

|

|

|

2,621 |

|

|

|

15 |

% |

|

|

(4 |

)% |

|

Total ferrous volumes (LT, in thousands)(3) |

|

|

4,408 |

|

|

|

3,954 |

|

|

|

4,319 |

|

|

|

11 |

% |

|

|

(8 |

)% |

LT = Long Ton, which is equivalent to 2,240 pounds.

|

(1) |

Ferrous volumes sold externally and delivered to our steel mill for finished steel production. |

|

(2) |

Domestic includes volumes delivered to our steel mill for finished steel production. |

|

(3) |

May not foot due to rounding. |

We export recycled ferrous metal primarily to countries in Asia, the Mediterranean region, and North, Central, and South America. Ferrous exports made up 66%, 64%, and 61% of our total ferrous volumes in fiscal 2021, 2020, and 2019, respectively. In fiscal 2021, the three countries from which we derived our largest ferrous export revenues from external customers were Bangladesh, Turkey, and Vietnam which collectively accounted for 63% of our total ferrous export revenues. In fiscal 2020 and 2019, the three countries from which we derived our largest ferrous export revenues from external customers accounted for 69% and 64%, respectively, of our total ferrous export revenues. We generally attribute revenues from external customers to individual countries based on the country in which the customer is located. Our three largest external recycled ferrous metal customers accounted for 25% of total ferrous revenues in fiscal 2021, compared to 32% and 29% in fiscal 2020 and 2019, respectively.

5 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

Recycled Nonferrous Metal

The table below sets forth, on a revenue and volume basis, the amount of recycled nonferrous metal sold to foreign and domestic customers during the last three fiscal years ended August 31:

|

|

|

For the Year Ended August 31, |

|

|

% Increase (Decrease) |

|

||||||||||||||

|

($ in thousands) |

|

2021 |

|

|

2020 |

|

|

2019 |

|

|

2021 vs. 2020 |

|

|

2020 vs. 2019 |

|

|||||

|

Nonferrous revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic |

|

$ |

367,744 |

|

|

$ |

195,880 |

|

|

$ |

216,992 |

|

|

|

88 |

% |

|

|

(10 |

)% |

|

Foreign |

|

|

317,118 |

|

|

|

194,418 |

|

|

|

251,031 |

|

|

|

63 |

% |

|

|

(23 |

)% |

|

Total nonferrous revenues |

|

$ |

684,862 |

|

|

$ |

390,298 |

|

|

$ |

468,023 |

|

|

|

75 |

% |

|

|

(17 |

)% |

|

Nonferrous volumes (pounds, in thousands)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic |

|

|

219,126 |

|

|

|

194,554 |

|

|

|

262,024 |

|

|

|

13 |

% |

|

|

(26 |

)% |

|

Foreign |

|

|

374,252 |

|

|

|

356,012 |

|

|

|

405,310 |

|

|

|

5 |

% |

|

|

(12 |

)% |

|

Total nonferrous volumes (pounds, in thousands)(2) |

|

|

593,378 |

|

|

|

550,566 |

|

|

|

667,334 |

|

|

|

8 |

% |

|

|

(17 |

)% |

|

(1) |

All nonferrous volumes sold externally. |

|

(2) |

May not foot due to rounding. |

Nonferrous exports made up 63%, 65%, and 61% of our total nonferrous sales volumes in fiscal 2021, 2020, and 2019, respectively. The substantial majority of our nonferrous joint products recovered from the shredding process are sold to the export market currently and made up 44%, 47%, and 43% of our total nonferrous sales volumes in fiscal 2021, 2020, and 2019, respectively. In fiscal 2021, the three countries from which we derived our largest nonferrous export revenues from external customers were India, Malaysia, and China which collectively accounted for 69% of our total nonferrous export revenues. In fiscal 2020 and 2019, the three countries from which we derived our largest nonferrous export revenues from external customers accounted for 58% and 68%, respectively, of our total nonferrous export revenues.

Finished Steel Products

The table below sets forth, on a revenue and volume basis, the amount of finished steel products sold during the last three fiscal years ended August 31:

|

|

|

For the Year Ended August 31, |

|

|

% Increase (Decrease) |

|

||||||||||||||

|

($ in thousands) |

|

2021 |

|

|

2020 |

|

|

2019 |

|

|

2021 vs. 2020 |

|

|

2020 vs. 2019 |

|

|||||

|

Steel revenues(1) |

|

$ |

379,203 |

|

|

$ |

336,980 |

|

|

$ |

367,956 |

|

|

|

13 |

% |

|

|

(8 |

)% |

|

Finished steel sales volumes (ST, in thousands) |

|

|

488 |

|

|

|

505 |

|

|

|

478 |

|

|

|

(3 |

)% |

|

|

6 |

% |

ST = Short Ton, which is equivalent to 2,000 pounds.

|

(1) |

Steel revenues include predominantly sales of finished steel products, in addition to sales of semi-finished goods (billets) and steel manufacturing scrap. |

We sell finished steel products to customers located primarily in the Western United States and Western Canada. Customers in California accounted for 52%, 55%, and 54% of our steel revenues in fiscal 2021, 2020, and 2019, respectively.

Distribution

We deliver recycled ferrous and nonferrous metal to foreign customers by ship and to domestic customers by barge, rail, and road transportation networks. Cost efficiencies are achieved by operating deepwater terminal facilities in Everett, Massachusetts; Portland, Oregon; Oakland, California; Tacoma, Washington; and Providence, Rhode Island, all of which are owned, except for the Providence, Rhode Island facility which is operated under a long-term lease. We also have access to deepwater terminal facilities at Kapolei, Hawaii and Salinas, Puerto Rico through public docks. The use of deepwater terminals enables us to load ferrous material in large vessels capable of holding up to 50,000 tons for trans-oceanic shipments. We believe the use of our owned and leased terminal facilities is advantageous because it allows us to more effectively manage loading costs and minimize the berthing delays often experienced by users of unaffiliated terminals. From time to time, we may enter into contracts of affreightment, which guarantee the availability of ocean-going vessels, in order to manage the risks associated with ship availability and freight costs.

Our nonferrous products are shipped in 20- to 30-ton capacity containers from ports and rail ramps located in close proximity to our recycling facilities. Containerized shipments are exported by marine vessels to customers globally, and domestic shipments are typically shipped to customers by rail or by truck.

6 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

We sell used auto parts from our self-service retail stores. Both before and after retail customers have removed desired parts from acquired salvaged vehicles, we extract and consolidate certain valuable ferrous and nonferrous components from auto bodies for shipment by truck primarily to wholesale customers. We also remove and collect catalytic converters from salvaged vehicles for shipment by truck to specialty processers which extract the nonferrous precious metals. The salvaged auto bodies are crushed and shipped by truck to our metals recycling facilities where geographically feasible, or to third-party recyclers, for shredding.

We sell finished steel products directly from our steel mill in McMinnville, Oregon and our distribution center in City of Industry, California (Los Angeles area). Finished steel products are shipped from the mill to the distribution center primarily by rail. The distribution center facilitates sales by maintaining an inventory of products close to major customers for just-in-time delivery. We communicate regularly with major customers to determine their anticipated needs and plan our rolling mill production schedule accordingly. Finished steel shipments to customers are made by common carrier, primarily truck or rail.

Sources of Unprocessed Metal

The most common forms of purchased unprocessed metal are obsolete machinery and equipment, such as automobiles, railroad cars, railroad tracks, home appliances and other consumer goods, scrap metal from manufacturing operations and retailers, and demolition metal from buildings and other infrastructure. Unprocessed metal is acquired from a diverse base of suppliers who unload at our facilities, from drop boxes at suppliers’ industrial sites, and through negotiated purchases from other large suppliers, including railroads, manufacturers, automobile salvage facilities, metal dealers, various government entities, and individuals. We typically seek to locate our retail auto parts stores in major population centers with convenient road access. Our auto parts store network spans 15 states in the U.S. and two provinces in Western Canada, with a majority of the stores concentrated in regions where our large shredders are located. Through our network of auto parts stores, we seek to obtain salvaged vehicles from five primary sources: private parties, tow companies, charities, auto auctions, and municipal and other contracts. We have a program to purchase vehicles from private parties called “Cash for Junk Cars” which is advertised in local markets. Private parties either call a toll-free number and receive a quote for their vehicle or obtain an instant online quote. The private party can either deliver the vehicle to one of our retail locations or arrange for the vehicle to be picked up. We also employ car buyers who travel to vendors and bid on vehicles. Further, we enter into limited duration contracts with public entities and other third parties for vehicle dismantling and asset recovery services, which provide a source of low-cost salvage vehicles. The expiration of such contracts may lead us to seek alternative sources of vehicles, potentially at a higher cost. We also source scrap metal and other recyclable materials through our recycling services from a range of customers including large retailers, industrial manufacturers, original equipment manufacturers, and railcar owners.

The majority of our metal collection and processing facilities receive unprocessed metal via major railroad routes, waterways, or highways. Metals recycling facilities situated near industrial manufacturing and major transportation routes have the competitive advantage of reduced freight costs because of the significant cost of freight relative to the cost of metal. The locations of our West Coast facilities provide access to sources of unprocessed metal in the Northern California region, northward to Western Canada and Alaska, and to the East, including Idaho, Montana, Utah, Colorado, and Nevada. The locations of our East Coast facilities provide access to sources of unprocessed metal in New York, Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont, Eastern Canada, and, from time to time, the Midwest. The locations of our facilities in Hawaii and Puerto Rico provide access to sources of unprocessed metal in the respective local markets. In the Southeastern U.S., approximately half of our ferrous and nonferrous unprocessed metal volume is purchased from industrial companies, including auto manufacturers, with the remaining volume being purchased from smaller dealers and individuals. These industrial companies provide us with metals that are by-products of their manufacturing processes.

The supply of scrap metal from these various sources can fluctuate with the level of economic activity in the U.S. and can be sensitive to variability in recycled metal prices, particularly in the short term. The supply of scrap metal can also fluctuate, to a lesser degree, due to seasonal factors, such as severe weather conditions, which can inhibit scrap metal collections at our facilities and production levels in our facilities. Severe weather conditions can also adversely impact the timing of shipments of our products, the level of manufacturing activity utilizing our products, and retail admissions at our auto parts stores.

We believe we operate the only EAF steel mill in the Western U.S. that obtains substantially all its recycled metal requirements from integrated metals recycling and joint venture operations. Our metals recycling operations provide our steel mill with a mix of recycled metal grades, which allow the mill to achieve optimum efficiency in its melting operations.

7 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

Energy Supply

We require electricity to run our steel manufacturing operations, primarily its EAF. We purchase electricity under a long-term contract with McMinnville Water & Light (“MW&L”), which in turn relies on the Bonneville Power Administration. We entered into our current contract with MW&L in October 2011 that will expire in September 2028. Our steel manufacturing operations also need natural gas to operate the reheat furnace, which is used to reheat billets prior to running them through the rolling mill. We meet this demand through a natural gas agreement with a utility provider that obligates us at each month-end to purchase a volume of gas based on our projected needs for the immediately subsequent month on a take-or-pay basis priced using published natural gas indices. The combined electricity and natural gas costs for our steel mill represented approximately 1% of our consolidated cost of goods sold in each of fiscal 2021, 2020, and 2019.

Competition

We compete in the U.S. and in Western Canada for the purchase of scrap metal with large, well-financed recyclers of scrap metal, steel mills that own metal recycling facilities, and with smaller metals facilities and dealers. Our auto stores compete for the purchase of end-of-life vehicles with other auto dismantlers, used car dealers, auto auctions, and metals recyclers. In general, the competitive factors impacting the purchase of scrap metal and end-of-life vehicles are the price offered by the purchaser, the proximity of the purchaser to the source of scrap metal and end-of-life vehicles, and the purchaser’s ability to efficiently collect the scrap metal and end-of-life vehicles from certain suppliers’ locations. We also compete with brokers that buy scrap or recycled metal on behalf of domestic and foreign steel mills.

Demand for our products is cyclical in nature and sensitive to general economic conditions, structural and cyclical changes in markets, and other factors. We compete globally for the sale of processed recycled metal to finished steel and other metal product producers. The predominant competitive factors that impact recycled metal sales are price (including duties and shipping cost), reliability of service, product quality, the relative value of the U.S. dollar, and the availability and price of raw material alternatives, including recycled metal substitutes, such as pig iron, direct reduced iron, and hot briquetted iron (all three derived from iron ore), and semi-finished products, such as steel billets. Our ability to compete in certain export markets may be impacted by sanctions and trade actions, such as tariffs, quotas, and other import restrictions, and by licensing and inspection requirements. Further, our ability to sell into certain countries may be subject to product quality requirements. Such restrictions may require us to perform additional processing and packaging of certain recycled nonferrous metal products, as well as engage in increased inspection and certification activities, in order to continue selling into the affected markets.

We also compete for the sale of used auto parts to retail customers with other self-service and full-service auto dismantlers. The auto parts industry is characterized by diverse and fragmented competition and comprises a large number of aftermarket and used auto parts suppliers of all sizes, ranging from large, multinational corporations which serve both original equipment manufacturers and the aftermarket on a worldwide basis to small, local entities which have more limited supply. The main competitive factors impacting the retail sale of auto parts are price, availability and visibility of product, quality, and convenience of the retail stores to customers.

Our ability to process substantial volumes of recycled metal products, our use of advanced processing and separation equipment, the number and geographic dispersion of our locations, our access to a variety of different modes of transportation, and the operating synergies of our integrated platform provide our business with the ability to compete successfully in varying market conditions.

Our primary domestic competitors for the sale of finished steel products include Nucor Corporation’s manufacturing facilities in Arizona, Utah, and Washington, and Commercial Metals Company’s manufacturing facility in Arizona. In addition to domestic competition, we compete with foreign steel producers, principally located in Asia, Canada, Mexico, and Central and South America, primarily in shorter length rebar and certain wire rod grades. The principal competitive factors in the steel market currently are price, quality, service, product availability, and the relative value of the U.S. dollar.

For more than a decade, our steel manufacturing operation, as part of a U.S. industry coalition, petitioned the U.S. Government under our international trade laws for relief in the form of antidumping and countervailing duties against wire rod and rebar products from a number of foreign countries. Many of those cases were successful and led to a decrease in finished steel imports into our domestic markets from the peak reached in fiscal 2016. During fiscal 2021, antidumping and countervailing duty orders were in effect related to imports of rebar and wire rod from many countries. The duties imposed as part of these orders are periodically reassessed through the administrative review process. In addition, every five years the U.S. Government conducts sunset reviews to determine whether revocation of the orders would likely lead to resumption of dumping and subsidization and negatively impact the U.S. domestic industry. Affirmative decisions allow the orders to continue for an additional five years, and all current orders have completed at least one sunset review.

8 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

There are also a number of antidumping and countervailing duty orders in effect in Canada covering rebar from many countries that we expect will continue to lead to a reduction in the volume of imports into Canada from these countries.

The long-term effectiveness of existing antidumping and countervailing duty orders related to imports of wire rod and rebar products is largely uncertain and is impacted by the level and pricing of imports and the U.S. Government’s assessment of antidumping and countervailing duty margins as well as its assessment of continued injury to the U.S. industry as part of the sunset review process.

In March 2018, the United States imposed tariffs in the amount of 25 percent and 10 percent on imports of certain steel and aluminum products, respectively. The imposition of the tariffs was the conclusion of an investigation started in April 2017 under Section 232 of the Trade Expansion Act of 1962 that allows for an exemption from normal international trade rules if imports of a product are harming national security. Currently, imports from Argentina, Australia, Brazil, Canada, Mexico, and South Korea are exempt from these duties pursuant to various agreements, including quotas. The Department of Commerce also implemented an exclusion process whereby U.S. entities can request that certain products be excluded from the Section 232 tariffs. We review any exclusion requests relevant to our product line to determine whether an objection might be appropriate. To date, the Biden Administration has allowed all Section 232 duties and procedures to remain in place.

Coronavirus Disease 2019 (“COVID-19”)

We continue to monitor the impact of COVID-19 on all aspects of our business. We are a company operating in a critical infrastructure industry, as defined by the U.S. Department of Homeland Security. Consistent with federal guidelines and with state and local orders to date, we have continued to operate across our footprint throughout the COVID-19 pandemic. Following the onset of COVID-19 and its negative effects on our business, most prominently reflected in our third quarter fiscal 2020 results, global economic conditions improved during fiscal 2021, resulting in increased demand for our products and services, which led to our earnings for fiscal 2021 substantially exceeding the results for fiscal 2020.

Acquisition of Columbus Recycling

On August 12, 2021, we entered into a definitive agreement with Columbus Recycling, a leading provider of recycled ferrous and nonferrous metal products and recycling services, to acquire eight metals recycling facilities across several states in the Southeast, including Mississippi, Tennessee, and Kentucky. The transaction closed on October 1, 2021, during the first quarter of our fiscal 2022. The acquired Columbus Recycling operations purchase and process scrap metal from industrial manufacturers, local recycling companies, and individuals, and sell the recycled products to regional foundries and steel mills. Combined with our twelve existing metals recycling facilities in Georgia, Alabama, and Tennessee, the acquired operations offer additional recycling products, services, and logistics solutions to customers and suppliers across the Southeast, a region that is expected to see a significant increase in EAF steelmaking capacity in the coming years. The cash purchase price was approximately $107 million, subject to adjustment for acquired net working capital relative to an agreed-upon benchmark, as well as other adjustments. We funded the business acquisition using cash on hand and borrowings under our existing credit facilities.

Regulatory Matters

Impact of Legislation and Regulation

Compliance with environmental laws and regulations is a significant factor in our operations. Our businesses are subject to extensive local, state, and federal environmental protection, health, safety, and transportation laws and regulations relating to, among others:

|

|

• |

Remediation under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”); |

|

|

• |

The discharge of materials and emissions into the air; |

|

|

• |

The prevention and remediation of soil and groundwater contamination; |

|

|

• |

The management, treatment and discharge of wastewater and storm water; |

|

|

• |

Climate change; |

|

|

• |

The generation, discharge, storage, handling and disposal of hazardous materials and secondary materials; and |

|

|

• |

The protection of our employees’ health and safety. |

9 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

These environmental laws regulate, among other things, the release and discharge of hazardous materials into the air, water, and ground; exposure to hazardous materials; and the identification, storage, treatment, handling and disposal of hazardous materials.

Concern over climate change, including the impact of global warming, has led to significant U.S. and international regulatory and legislative initiatives to limit greenhouse gas (“GHG”) emissions. In 2007, the U.S. Supreme Court ruled that the United States Environmental Protection Agency (“EPA”) was authorized to regulate carbon dioxide under the U.S. Clean Air Act. The EPA subsequently initiated a series of regulatory efforts aimed at addressing GHGs as pollutants, including finding that GHG emissions endanger public health, implementing mandatory GHG emission reporting requirements, and setting carbon emission standards for light-duty vehicles.

Environmental legislation and regulations have changed rapidly in recent years, and it is likely that we will be subject to even more stringent environmental standards in the future. Legislation has been proposed in the U.S. Congress to address GHG emissions and global climate change, including “cap and trade” programs, and some form of federal climate change legislation or additional federal regulation is possible. A number of states, including states in which we have operations and facilities, have considered, are considering, or have already enacted legislation or executive action to develop information or address climate change and GHG emissions, including state-level “cap and trade” programs. Currently, we are required to annually report GHG emissions from our steel mill to the State of Oregon Department of Environmental Quality (“ODEQ”) and the EPA, and in March 2020, the Governor of Oregon issued an executive order directing state agencies to take certain actions to reduce and regulate GHG emissions. Pursuant to this executive order, ODEQ issued a notice of proposed rulemaking in August 2021 that would establish a new Climate Protection Program to limit GHG emissions in the state including from large stationary sources such as our steel mill. In addition, the ODEQ Cleaner Air Oregon (“CAO”) program regulates toxic air emissions from manufacturing facilities located in Oregon. The ODEQ has published a prioritization list of the facilities within the state subject to the CAO program based on emissions inventories that facilities submitted to the ODEQ. The prioritization list established four tiers of risk groups. Our steel mill has been assigned to the first-tier risk group and was selected into the CAO program in 2020. To comply with the CAO program rules, including as they may be revised in the future, facilities may incur expenses to evaluate the risk to the public and may be required to incur additional operating or capital expenditures to mitigate any significant identified risks.

Federal, state, and local regulators have increased their focus on metals recycling and auto dismantling facilities that has or could lead to new or expanding regulatory requirements. In July 2021, the EPA issued an enforcement alert reflecting a national enforcement initiative in conjunction with state regulators focused on Clean Air Act compliance at metal recycling facilities that operate auto and scrap metal shredders. While we believe we are an industry leader in emission controls and have been working with state and local regulators on compliance and permitting matters, we have in the past and may in the future be subject to enforcement actions or litigation by regulators or private parties that could result in additional penalties, compliance requirements, or capital investments. See “Legal Proceedings” in Part I, Item 3 of this report. In addition, on October 15, 2021, the California State Department of Toxic Substance Control (DTSC) submitted proposed emergency regulations to the Office of Administrative Law (OAL) that would require metal shredding facilities in California, including our Oakland facility, to operate under state hazardous waste facility permits. OAL has 10 calendar days within which to review and make a decision on the proposed emergency rulemaking. If the emergency regulations are approved, metal shredding facilities in California would have 30 days to file to obtain “interim status” that, according to DTSC, is necessary for facilities to continue operating through the permit application process, which could take as long as five years. The California metal recycling industry is working with DTSC to identify an alternative regulatory framework and permitting regime under existing law that could accommodate the unique aspects of metal shredding facility operations. Operating under DTSC’s hazardous waste permitting requirements, including under interim status regulations, or under an alternative permitting structure could require substantial additional capital expenditures, impose financial assurance obligations, subject us to increased compliance and penalty risks, severely limit operational flexibility and increase operating costs, or adversely impact our ability to acquire or sell materials at our California facilities.

The Biden Administration and state and local regulators are also emphasizing efforts to strengthen environmental compliance and enforcement, including with respect to clean-up actions under superfund and hazardous waste laws, in overburdened communities that may be disproportionately impacted by adverse health and environmental effects. On September 10, 2021, U.S. EPA Region 9 and the California Environmental Protection Agency announced a joint effort to expand environmental enforcement in overburdened California communities. These initiatives could result in increased enforcement, compliance, and clean-up costs, including increased capital expenditures, at our facilities located at or near such communities.

10 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

Although our objective is to maintain compliance with applicable environmental laws and regulations, we have, in the past, been found to be not in compliance with certain environmental laws and regulations and have incurred liabilities, expenditures, fines, and penalties associated with such violations. In December 2000, we were notified by the EPA that we are one of the potentially responsible parties that owns or operates, or formerly owned or operated, sites which are part of or adjacent to the Portland Harbor Superfund site. Further, we have been notified that we are or may be a potentially responsible party at sites other than Portland Harbor currently or formerly owned or operated by us or at other sites where we may have responsibility for such costs due to past disposal or other activities.

See further discussion of the Portland Harbor Superfund and other environmental-related matters in Part I, Item 1A. Risk Factors and Note 9 - Commitments and Contingencies in the Notes to the Consolidated Financial Statements in Part II, Item 8 of this report.

We incurred capital expenditures related to environmental projects of $21 million, $10 million, and $36 million in fiscal 2021, 2020, and 2019, respectively, and we expect to spend in the range of $30 million to $40 million on capital expenditures related to environmental projects in fiscal 2022.

Our steel mill has an operating permit issued under Title V of the Clean Air Act Amendments of 1990, which governs certain air quality standards. The permit is based on an annual production capacity of approximately 950 thousand tons. The permit was first issued in 1998 and has since been renewed multiple times, most recently in April 2020 extending the permit through April 1, 2025.

Indirect Consequences of Future Legislation and Regulation

Future legislation or increased regulation regarding climate change and GHG emissions could impose significant costs on our business and our customers and suppliers, including increased energy, capital equipment, emissions controls, environmental monitoring and reporting, and other costs in order to comply with laws and regulations concerning and limitations imposed on climate change and GHG emissions. The potential costs of allowances, taxes, fees, offsets, or credits that may be part of “cap and trade” programs or similar future legislative or regulatory measures are still uncertain, and the future of these programs or measures is unknown. Any adopted future climate change and GHG laws or regulations could negatively impact our ability (and that of our customers and suppliers) to compete with companies situated in areas not subject to or complying with such requirements. Furthermore, even without such laws or regulations, increased awareness and any adverse publicity in the global marketplace about the GHGs emitted by companies in the metals recycling and steel manufacturing industries could harm our reputation and reduce customer demand for our products.

GHG legislation and regulation are expected to have an effect on the future price of transportation fuels, natural gas used in the manufacturing process, and electricity, especially electricity generated using carbon-based fuels. Since the electricity supply for our steel mill includes a significant element of hydro-generated production which is not subject to GHG legislation and regulation, its energy costs are less likely to be impacted than those of competitors using electricity generated by carbon-based fuels. In addition, demand for recycled metal may increase from mills with blast furnaces as they seek to maximize the recycled metal component of raw material infeed, which requires less energy than melting iron ore.

Because the use of recycled iron and steel instead of iron ore to make new steel results in savings in the consumption of energy, virgin materials, and water and reduces mining wastes, we believe our recycled metal products position us to be more competitive in the future for business from companies wishing to reduce their carbon footprint and impact on the environment. In addition, the EAF at our steel mill generates significantly less GHG emissions than traditional blast furnaces.

Physical Impacts of Climate Change on Our Costs and Operations

There has been public discussion that climate change may be associated with higher temperatures, lower snowpack, drier forests, rising sea levels as well as extreme weather events and conditions such as more intense hurricanes, thunderstorms, tornadoes, wildfires, and snow or ice storms. Extreme weather conditions may increase our costs or cause damage to our facilities, and any damage resulting from extreme weather may not be fully insured. As many of our recycling facilities are located near deepwater ports, rising sea levels may disrupt our ability to receive scrap metal, process the scrap metal through our shredders, and ship products to our customers. Periods of extended adverse weather conditions may inhibit construction activity utilizing our products, scrap metal inflows to our recycling facilities, and retail admissions and parts sales at our auto parts stores. Potential adverse impacts from climate change, including rising temperatures and extreme weather events and conditions, may create health and safety issues for employees operating at our facilities and may lead to an inability to maintain standard operating hours.

11 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

Human Capital Resources

Employees

We hire employees from across the United States, Puerto Rico, and Canada and have employees residing in all states, territories, and provinces in which we operate. We aim to offer a competitive compensation package and suite of benefits that align our employees with the interests of our strategic long-term growth and our customers, communities, and shareholders. As of August 31, 2021, we had 3,167 full-time employees, 691 of whom were covered by collective bargaining agreements. Of our full-time employees as of August 31, 2021, approximately 93% resided in the United States.

Engagement

We believe employee engagement contributes significantly to our operational performance, achievement of our strategic goals, and the growth and development of our employees. Our leaders sponsor and, in many cases, lead employee engagement initiatives focusing on diversity, equity, inclusion, volunteering, community involvement, and job satisfaction. For example, our numerous Employee Resource Groups aim to broaden awareness of the diverse characteristics of our workforce and others, and we often survey our employees to gain feedback about our culture, employee experience, and leadership behaviors. In fiscal 2021, we became a certified Great Place to Work®. Achieving this prominent designation followed an all-employee Trust Index Survey process which had requested the views and beliefs of our employees.

Health & Safety

Safety is one of our core values. Our approach to safety is proactive and focuses on active leadership, risk and hazard identification, training, frequent checks of high-risk processes, and other monitoring activities. Creating a positive health and safety culture takes time and visible leadership that demonstrate care and concern for the health and safety of our employees.

We regularly track and evaluate numerous leading indicators, which are proactive, preventive, and predictive measures that provide information about the effective performance of our health and safety systems and processes, and which allow us to take preventive action to address failures or hazards before they turn into an incident. Leading indicators that we use in connection with our health and safety programs include among others employee training and attendance, workplace inspections, corrective action closure rates, hazard response time analysis, and frequency and quality of layered safety observations conducted at all levels of the organization.

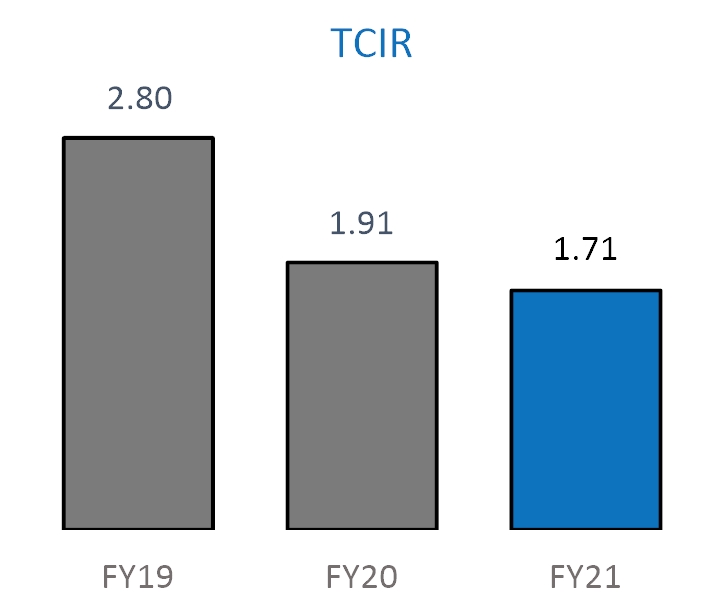

We also track health and safety performance using industry-standard metrics including but not limited to the following:

|

|

• |

Total Case Incident Rate (“TCIR”) |

|

|

• |

Days Away, Restricted, or Transferred (“DART”) Rate |

|

|

• |

Lost Time Incident Rate (“LTIR”) |

We work continuously to improve all aspects of our health and safety performance. Our safety strategy emphasizes prevention of serious injuries and fatalities, works toward achievement of zero injuries, and empowers employees to cultivate personal safety leadership. With zero injuries as our ultimate aspiration, we are working toward a near-term goal of a 1.00 TCIR by the end of fiscal 2025 (one recordable injury per 200,000 working hours). We recorded the lowest TCIR in our history in fiscal 2021. We attribute our continued improved performance to the work we have done over the past several years to engage leaders and front-line employees in proactively preventing workplace injuries and illnesses through training, education, and monitoring programs, in identifying and addressing the root causes of health and safety incidents, and in optimizing overall health and safety performance.

12 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

Our TCIR, DART Rate and LTIR for the fiscal years ended August 31, 2019, 2020 and 2021 are as follows:

COVID-19 cases for which contact tracing could not identify a source of exposure outside of work are included in OHSA reporting in accordance with OHSA reporting requirements using a designated special code for the nature of the illness. These cases are excluded from the TCIR and LTIR metrics shown above.

COVID-19

We implemented and managed a wide range of controls and other protective measures at our sites to detect and prevent the transmission of COVID-19. A key control established as part of our COVID-19 response is monitoring employee health. We utilize an independent 24-hour telemedicine service that allows any employee who exhibits COVID-like symptoms, who has been exposed to a confirmed COVID-19 case, or who tests positive for COVID-19, to be connected with a licensed medical professional who will perform an assessment, offer direction for quarantining as appropriate and access to testing facilities, and establish a connection to healthcare providers. We provide six hours of paid time for our employees to receive the vaccination and booster. In addition, we cover time away for any complications arising from being vaccinated or the booster.

Throughout the COVID-19 health crisis, we compensated employees who tested positive at their regular rate of pay while also retaining health and welfare benefits during their recovery, and until returning to their work schedule. At our facilities, we have instituted a range of safety practices and COVID-19 prevention controls, such as temperature screening, symptom checks, wearing face coverings, hygiene and sanitation procedures, social and physical distancing, installing touchless equipment, and other physical contact reduction processes. We have also supported work-from-home when feasible. To monitor the effectiveness of these controls, our Health and Safety team created a protocol for auditing facilities on their performance against our COVID-19 controls. The results of these audits are reported to senior leadership and used to make any necessary performance improvements. Regular and transparent employee communication also has been critical to our response, including weekly messages of support to help keep safe behaviors top of mind.

Ethics

Our employees, both union and non-union, participate in annual training on our Company’s Core Values, which includes instruction on our Code of Conduct and ethical behavior. The training includes important topics such as reporting misconduct, prohibition against retaliation, unconscious bias, and diversity, equity, and inclusion. We empower employees to raise issues and concerns regarding compliance with our Code of Conduct, Company policies, and the law by offering multiple reporting channels, including a third-party, confidential, multi-lingual misconduct hotline where employees may choose to remain anonymous. We investigate all reports. In addition to our Code of Conduct and related training, we have a comprehensive Anticorruption Program, inclusive of an overarching Anticorruption Policy available to all employees that details prohibitions against bribery, money laundering, and engaging with terrorists or other sanctioned entities, as well as internal controls, a third-party vetting and monitoring system, and employee engagement and training.

For the seventh consecutive year, we were named one of the 2021 World’s Most Ethical Companies by the Ethisphere Institute. This award is given to companies that foster a culture of ethics and transparency at every level of the company by demonstrating leadership across five key categories: ethics and compliance programs; environmental and societal impacts; culture of ethics; governance; and leadership and reputation. Through the annual process of applying for this award and analyzing our scores across all categories, we gain significant insight into current best practices and can plan and implement improvements to our Company-wide communications, training programs, and other initiatives.

13 / Schnitzer Steel Industries, Inc. Form 10-K 2021

|

SCHNITZER STEEL INDUSTRIES, INC. |

|

Executive Officers of the Company

The executive officers of the Company are elected each year at the organizational meeting of the Board of Directors, which follows the annual meeting of the shareholders, and at other Board of Directors meetings, as appropriate. Each of the executive officers has been employed by the Company for more than five years.

At October 21, 2021, the executive officers of the Company were as follows:

|

Name |

|

Age |

|

Office |

|

Tamara L. Lundgren |

|

64 |

|

Chairman, President and Chief Executive Officer(1) |

|

Richard D. Peach |

|

58 |

|

Executive Vice President, Chief Financial Officer and Chief Strategy Officer(2) |

|

Michael R. Henderson |

|

62 |

|

Senior Vice President and President, Operations(3) |

|

Steven G. Heiskell |

|

52 |

|

Senior Vice President and President, Recycling Products & Services(4) |

|

Peter B. Saba |

|

60 |

|

Senior Vice President, General Counsel and Corporate Secretary(5) |

|

Erich D. Wilson |

|

53 |

|