Summary - Earnings Press Release | i - iv |

Investor Information | |

Portfolio Overview | |

Financial Information | |

Balance Sheets | |

Statements of Operations | |

Outstanding Securities and Capitalization | |

Reconciliations to Non-GAAP Financial Measures | |

Reconciliation of Net Income to Funds from Operations | |

Reconciliation of Net Income to Recurring EBITDA | |

Reconciliation of Net Income to Net Operating Income | |

Non-GAAP and Other Financial Measures | |

Financial Highlights | |

Debt Analysis | |

Selected Financial Information | |

Statements of Operations – Same Community | |

Rental Program Summary | |

Home Sales Summary | |

Acquisitions Summary | |

Other Information | |

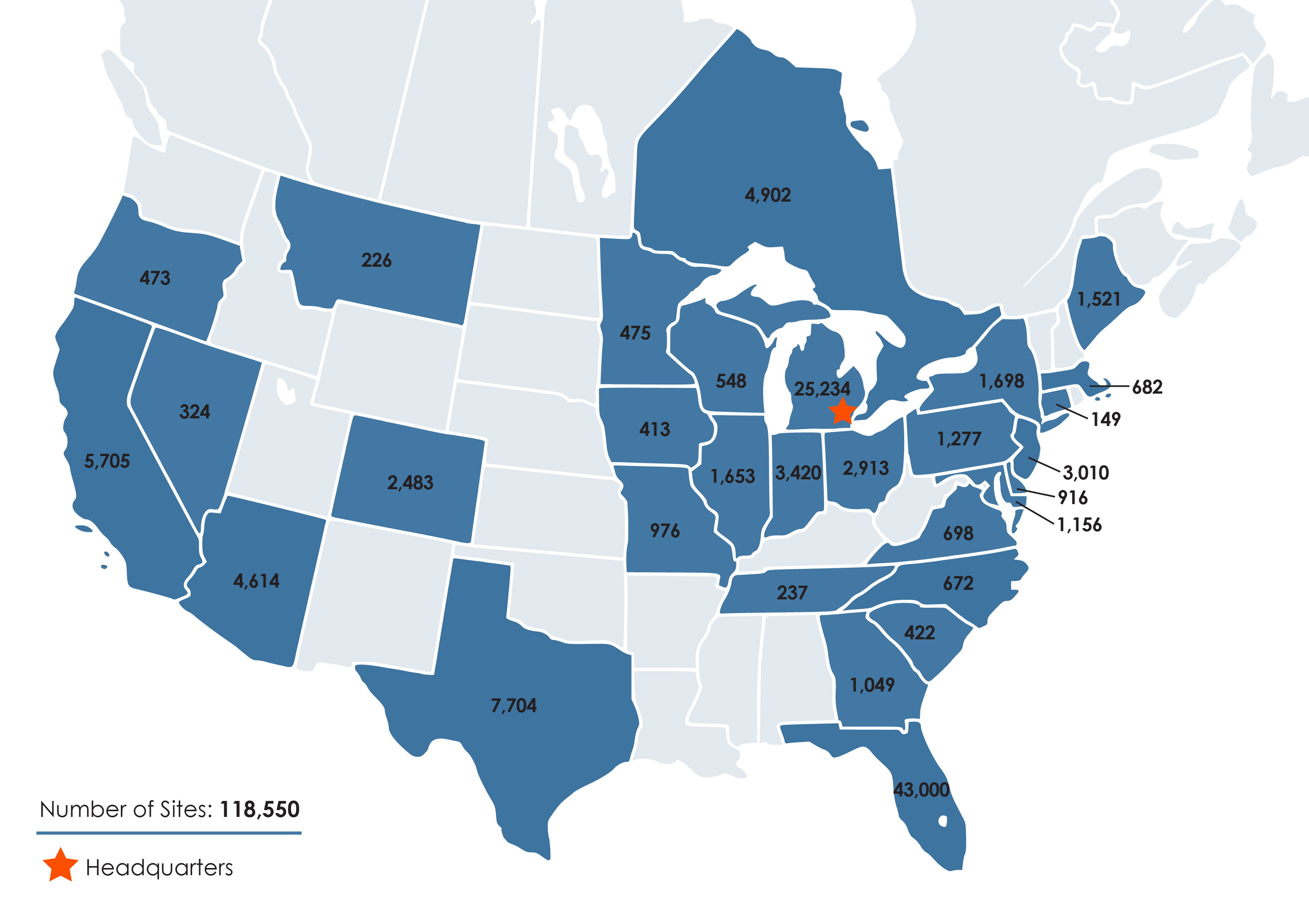

Property Summary | 17 - 18 |

Capital Improvements, Development, and Acquisitions | |

Operating Statistics for Manufactured Homes and Annual/Seasonal RV’s | |

Footnotes and Definitions | 21 - 23 |

• | Funds from Operations ("FFO")(1) excluding certain items was $1.10 per diluted share and OP unit ("Share") as compared to $0.90 for the same period in 2016, an increase of 22.2 percent. |

• | Revenue producing sites increased by 687 sites, as compared to an increase of 592 sites in the same period in 2016. |

• | Home sales volumes increased by 8.0 percent as compared to the same period in 2016. |

• | Same Community Net Operating Income ("NOI")(1) increased by 6.7 percent as compared to the same period in 2016. |

• | Same Community occupancy increased 170 basis points to 96.7 percent, as compared to 95.0 percent(9) at March 31, 2016. |

RESEARCH COVERAGE | |||

Bank of America Merrill Lynch | Jeffrey Spector | ||

(646) 855-1363 | |||

jeff.spector@baml.com | |||

BMO Capital Markets | Paul Adornato | ||

(212) 885-4170 | |||

paul.adornato@bmo.com | |||

Citi Research | Michael Bilerman / Nicholas Joseph | ||

(212) 816-1383 / (212) 816-1909 | |||

michael.bilerman@citi.com / nicholas.joseph@citi.com | |||

Evercore ISI | Steve Sakwa / Gwen Clark | ||

(212) 446-9462 / (212) 446-5611 | |||

steve.sakwa@evercoreisi.com / gwen.clark@evercoreisi.com | |||

Green Street Advisors | Ryan Burke | ||

(949) 640-8780 | |||

rburke@greenstreetadvisors.com | |||

Robert W. Baird & Co. | Drew Babin | ||

(610) 238-6634 | |||

dbabin@rwbaird.com | |||

Wells Fargo | Todd Stender | ||

(562) 637-1371 | |||

todd.stender@wellsfargo.com | |||

INQUIRIES | |||

Sun Communities welcomes questions or comments from shareholders, analysts, investment managers, media, or | |||

any prospective investor. Please address all inquiries to our Investor Relations department. | |||

At Our Website | www.suncommunities.com | ||

By Email | investorrelations@suncommunities.com | ||

By Phone | (248) 208-2500 | ||

3/31/2017 | 12/31/2016 | ||||||||

ASSETS: | |||||||||

Land | $ | 1,052,384 | $ | 1,051,536 | |||||

Land improvements and buildings | 4,880,330 | 4,825,043 | |||||||

Rental homes and improvements | 496,432 | 489,633 | |||||||

Furniture, fixtures and equipment | 133,772 | 130,127 | |||||||

Investment property | 6,562,918 | 6,496,339 | |||||||

Accumulated depreciation | (1,078,949 | ) | (1,026,858 | ) | |||||

Investment property, net | 5,483,969 | 5,469,481 | |||||||

Cash and cash equivalents | 10,919 | 8,164 | |||||||

Inventory of manufactured homes | 23,867 | 21,632 | |||||||

Notes and other receivables, net | 98,468 | 81,179 | |||||||

Collateralized receivables, net (3) | 140,976 | 143,870 | |||||||

Other assets, net | 144,248 | 146,450 | |||||||

Total assets | $ | 5,902,447 | $ | 5,870,776 | |||||

LIABILITIES: | |||||||||

Mortgage loans payable | $ | 2,774,645 | $ | 2,819,567 | |||||

Secured borrowings (3) | 141,671 | 144,477 | |||||||

Preferred OP units - mandatorily redeemable | 45,903 | 45,903 | |||||||

Lines of credit | 178,328 | 100,095 | |||||||

Distributions payable | 52,762 | 51,896 | |||||||

Other liabilities | 284,823 | 279,667 | |||||||

Total liabilities | 3,478,132 | 3,441,605 | |||||||

Series A-4 preferred stock | 48,879 | 50,227 | |||||||

Series A-4 preferred OP units | 16,489 | 16,717 | |||||||

STOCKHOLDERS' EQUITY: | |||||||||

Series A preferred stock | 34 | 34 | |||||||

Common stock | 737 | 732 | |||||||

Additional paid-in capital | 3,346,991 | 3,321,441 | |||||||

Accumulated other comprehensive loss | (2,630 | ) | (3,181 | ) | |||||

Distributions in excess of accumulated earnings | (1,050,141 | ) | (1,023,415 | ) | |||||

Total SUI stockholders' equity | 2,294,991 | 2,295,611 | |||||||

Noncontrolling interests: | |||||||||

Common and preferred OP units | 67,152 | 69,598 | |||||||

Consolidated variable interest entities | (3,196 | ) | (2,982 | ) | |||||

Total noncontrolling interest | 63,956 | 66,616 | |||||||

Total stockholders' equity | 2,358,947 | 2,362,227 | |||||||

Total liabilities & stockholders' equity | $ | 5,902,447 | $ | 5,870,776 | |||||

Three Months Ended March 31, | |||||||||||||||

2017 | 2016 | Change | % Change | ||||||||||||

REVENUES | |||||||||||||||

Income from real property (excluding transient revenue) | $ | 161,876 | $ | 119,084 | $ | 42,792 | 35.9 | % | |||||||

Transient revenue | 21,178 | 10,151 | 11,027 | 108.6 | % | ||||||||||

Revenue from home sales | 27,263 | 24,737 | 2,526 | 10.2 | % | ||||||||||

Rental home revenue | 12,339 | 11,708 | 631 | 5.4 | % | ||||||||||

Ancillary revenues | 6,219 | 4,613 | 1,606 | 34.8 | % | ||||||||||

Interest | 4,646 | 3,945 | 701 | 17.8 | % | ||||||||||

Brokerage commissions and other revenues, net | 879 | 406 | 473 | 116.5 | % | ||||||||||

Total revenues | 234,400 | 174,644 | 59,756 | 34.2 | % | ||||||||||

EXPENSES | |||||||||||||||

Property operating and maintenance | 47,166 | 31,201 | 15,965 | 51.2 | % | ||||||||||

Real estate taxes | 13,143 | 9,585 | 3,558 | 37.1 | % | ||||||||||

Cost of home sales | 20,883 | 18,184 | 2,699 | 14.8 | % | ||||||||||

Rental home operating and maintenance | 5,102 | 5,876 | (774 | ) | (13.2 | )% | |||||||||

Ancillary expenses | 4,668 | 3,649 | 1,019 | 27.9 | % | ||||||||||

Home selling expenses | 3,111 | 2,137 | 974 | 45.6 | % | ||||||||||

General and administrative | 17,932 | 13,792 | 4,140 | 30.0 | % | ||||||||||

Transaction costs | 2,386 | 2,721 | (335 | ) | (12.3 | )% | |||||||||

Depreciation and amortization | 62,766 | 48,412 | 14,354 | 29.7 | % | ||||||||||

Extinguishment of debt | 466 | — | 466 | N/A | |||||||||||

Interest | 31,322 | 26,294 | 5,028 | 19.1 | % | ||||||||||

Interest on mandatorily redeemable preferred OP units | 784 | 787 | (3 | ) | (0.4 | )% | |||||||||

Total expenses | 209,729 | 162,638 | 47,091 | 29.0 | % | ||||||||||

Income before other items | 24,671 | 12,006 | 12,665 | 105.5 | % | ||||||||||

Other income, net (4) | 752 | — | 752 | N/A | |||||||||||

Current tax expense | (178 | ) | (228 | ) | 50 | (21.9 | )% | ||||||||

Deferred tax benefit | 300 | — | 300 | N/A | |||||||||||

Net income | 25,545 | 11,778 | 13,767 | 116.9 | % | ||||||||||

Less: Preferred return to preferred OP units | (1,174 | ) | (1,273 | ) | 99 | 7.8 | % | ||||||||

Less: Amounts attributable to noncontrolling interests | (1,088 | ) | (276 | ) | (812 | ) | (294.2 | )% | |||||||

Less: Preferred stock distribution | (2,179 | ) | (2,354 | ) | 175 | 7.4 | % | ||||||||

NET INCOME ATTRIBUTABLE TO SUI | $ | 21,104 | $ | 7,875 | $ | 13,229 | 168.0 | % | |||||||

Weighted average common shares outstanding: | |||||||||||||||

Basic | 72,677 | 57,736 | 14,941 | 25.9 | % | ||||||||||

Diluted | 73,120 | 58,126 | 14,994 | 25.8 | % | ||||||||||

Earnings per share: | |||||||||||||||

Basic | $ | 0.29 | $ | 0.14 | $ | 0.15 | 107.1 | % | |||||||

Diluted | $ | 0.29 | $ | 0.14 | $ | 0.15 | 107.1 | % | |||||||

Outstanding Securities - As of March 31, 2017 | |||||||||

Number of Units/Shares Outstanding | Conversion Rate* | If Converted | Issuance Price per unit* | Annual Distribution Rate* | |||||

Convertible Securities | |||||||||

Series A-1 preferred OP units | 362 | 2.4390 | 883 | $100 | 6.0% | ||||

Series A-3 preferred OP units | 40 | 1.8605 | 74 | $100 | 4.5% | ||||

Series A-4 preferred OP units | 632 | 0.4444 | 281 | $25 | 6.5% | ||||

Series C preferred OP units | 328 | 1.1100 | 364 | $100 | 4.0% | ||||

Common OP units | 2,751 | 1.0000 | 2,751 | N/A | Mirrors the Common Share distributions | ||||

Series A-4 cumulative convertible preferred stock | 1,637 | 0.4444 | 727 | $25 | 6.5% | ||||

Non-Convertible Securities | |||||||||

Preferred stock (SUI-PrA) | 3,400 | N/A | N/A | $25 | 7.125% | ||||

Common shares | 73,739 | N/A | N/A | N/A | $2.68^ | ||||

^ Annual distribution is based on the last quarterly distribution annualized. | |||||||||

Capitalization - As of 3/31/2017 | |||||||||||

Equity | Shares | Share Price* | Total | ||||||||

Common shares | 73,739 | $ | 80.33 | $ | 5,923,454 | ||||||

Common OP units | 2,751 | $ | 80.33 | 220,988 | |||||||

Subtotal | 76,490 | $ | 6,144,442 | ||||||||

Series A-1 preferred OP units | 883 | $ | 80.33 | 70,931 | |||||||

Series A-3 preferred OP units | 74 | $ | 80.33 | 5,944 | |||||||

Series A-4 preferred OP units | 281 | $ | 80.33 | 22,573 | |||||||

Series C preferred OP units | 364 | $ | 80.33 | 29,240 | |||||||

Total diluted shares outstanding | 78,092 | $ | 6,273,130 | ||||||||

Debt | |||||||||||

Lines of credit | $ | 178,328 | |||||||||

Mortgage loans payable | 2,774,645 | ||||||||||

Preferred OP units - mandatorily redeemable (Aspen) | 45,903 | ||||||||||

Secured borrowing (3) | 141,671 | ||||||||||

Total Debt | $ | 3,140,547 | |||||||||

Preferred | |||||||||||

Perpetual preferred | 3,400 | $ | 25.00 | $ | 85,000 | ||||||

A-4 preferred Stock | 1,637 | $ | 25.00 | $ | 40,925 | ||||||

Total Capitalization | $ | 9,539,602 | |||||||||

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Net income attributable to Sun Communities, Inc. common stockholders | $ | 21,104 | $ | 7,875 | |||

Adjustments: | |||||||

Depreciation and amortization | 62,817 | 48,077 | |||||

Amounts attributable to noncontrolling interests | 900 | 349 | |||||

Preferred return to preferred OP units | 586 | 625 | |||||

Preferred distribution to Series A-4 preferred stock | 665 | — | |||||

Gain on disposition of assets, net | (2,681 | ) | (3,656 | ) | |||

FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities (1) (6) | 83,391 | 53,270 | |||||

Adjustments: | |||||||

Transaction costs | 2,386 | 2,721 | |||||

Other acquisition related costs (5) | 844 | — | |||||

Extinguishment of debt | 466 | — | |||||

Other income, net (4) | (752 | ) | — | ||||

Debt premium write-off | (414 | ) | — | ||||

Deferred tax benefit | (300 | ) | — | ||||

FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities excluding certain items (1) (6) | $ | 85,621 | $ | 55,991 | |||

Weighted average common shares outstanding - basic: | 72,677 | 57,736 | |||||

Add: | |||||||

Common stock issuable upon conversion of stock options | 2 | 13 | |||||

Restricted stock | 561 | 377 | |||||

Common OP units | 2,754 | 2,863 | |||||

Common stock issuable upon conversion of Series A-1 preferred OP units | 892 | 945 | |||||

Common stock issuable upon conversion of Series A-3 preferred OP units | 75 | 75 | |||||

Common stock issuable upon conversion of Series A-4 preferred stock | 727 | — | |||||

Weighted average common shares outstanding - fully diluted | 77,688 | 62,009 | |||||

FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities (1) (6) per share - fully diluted | $ | 1.07 | $ | 0.86 | |||

FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities (1) (6) per share excluding certain items - fully diluted | $ | 1.10 | $ | 0.90 | |||

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Net income attributable to Sun Communities, Inc., common stockholders | $ | 21,104 | $ | 7,875 | |||

Interest | 31,322 | 26,294 | |||||

Interest on mandatorily redeemable preferred OP units | 784 | 787 | |||||

Depreciation and amortization | 62,766 | 48,412 | |||||

Extinguishment of debt | 466 | — | |||||

Transaction costs | 2,386 | 2,721 | |||||

Other income, net (4) | (752 | ) | — | ||||

Current tax expense | 178 | 228 | |||||

Deferred tax benefit | (300 | ) | — | ||||

Net income | 117,954 | 86,317 | |||||

Add: Preferred return to preferred OP units | 1,174 | 1,273 | |||||

Add: Amounts attributable to noncontrolling interests | 1,088 | 276 | |||||

Net income attributable to Sun Communities, Inc. | 120,216 | 87,866 | |||||

Add: Preferred stock distributions | 2,179 | 2,354 | |||||

RECURRING EBITDA (1) | $ | 122,395 | $ | 90,220 | |||

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Net income attributable to Sun Communities, Inc., common stockholders: | $ | 21,104 | $ | 7,875 | |||

Other revenues | (5,525 | ) | (4,351 | ) | |||

Home selling expenses | 3,111 | 2,137 | |||||

General and administrative | 17,932 | 13,792 | |||||

Transaction costs | 2,386 | 2,721 | |||||

Depreciation and amortization | 62,766 | 48,412 | |||||

Extinguishment of debt | 466 | — | |||||

Interest expense | 32,106 | 27,081 | |||||

Other income, net (4) | (752 | ) | — | ||||

Current tax expense | 178 | 228 | |||||

Deferred tax benefit | (300 | ) | — | ||||

Preferred return to preferred OP units | 1,174 | 1,273 | |||||

Amounts attributable to noncontrolling interests | 1,088 | 276 | |||||

Preferred stock distributions | 2,179 | 2,354 | |||||

NOI(1) / Gross Profit | $ | 137,913 | $ | 101,798 | |||

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Real Property NOI (1) | $ | 122,745 | $ | 88,449 | |||

Rental Program NOI (1) | 22,956 | 21,050 | |||||

Home Sales NOI(1) / Gross Profit | 6,380 | 6,553 | |||||

Ancillary NOI(1) / Gross Profit | 1,551 | 964 | |||||

Site rent from Rental Program (included in Real Property NOI) (1)(7) | (15,719 | ) | (15,218 | ) | |||

NOI(1) / Gross profit | $ | 137,913 | $ | 101,798 | |||

Quarter Ended | |||||||||||||||||||

3/31/2017 | 12/31/2016 | 9/30/2016 | 6/30/2016 | 3/31/2016 | |||||||||||||||

OPERATING INFORMATION | |||||||||||||||||||

Total revenues | $ | 234,400 | $ | 218,634 | $ | 249,701 | $ | 190,799 | $ | 174,644 | |||||||||

Net income (loss) | $ | 25,545 | $ | 1,501 | $ | 23,230 | $ | (5,038 | ) | $ | 11,778 | ||||||||

Net income (loss) attributable to common stockholders | $ | 21,104 | $ | (1,600 | ) | $ | 18,897 | $ | (7,803 | ) | $ | 7,875 | |||||||

Earnings (loss) per share basic | $ | 0.29 | $ | (0.02 | ) | $ | 0.27 | $ | (0.12 | ) | $ | 0.14 | |||||||

Earnings (loss) per share diluted | $ | 0.29 | $ | (0.02 | ) | $ | 0.27 | $ | (0.12 | ) | $ | 0.14 | |||||||

Recurring EBITDA (1) | $ | 122,395 | $ | 105,850 | $ | 123,276 | $ | 94,882 | $ | 90,220 | |||||||||

FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities(1) (6) | $ | 83,391 | $ | 57,572 | $ | 78,023 | $ | 37,473 | $ | 53,270 | |||||||||

FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities excluding certain items(1) (6) | $ | 85,621 | $ | 69,192 | $ | 83,181 | $ | 58,452 | $ | 55,991 | |||||||||

FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities (1) (6) per share - fully diluted | $ | 1.07 | $ | 0.75 | $ | 1.06 | $ | 0.54 | $ | 0.86 | |||||||||

FFO attributable to Sun Communities, Inc. common stockholders and dilutive convertible securities (1) (6) per share excluding certain items - fully diluted | $ | 1.10 | $ | 0.91 | $ | 1.13 | $ | 0.85 | $ | 0.90 | |||||||||

BALANCE SHEETS | |||||||||||||||||||

Total assets | $ | 5,902,447 | $ | 5,870,776 | $ | 5,904,706 | $ | 5,823,191 | $ | 4,562,886 | |||||||||

Total debt | $ | 3,140,547 | $ | 3,110,042 | $ | 3,102,993 | $ | 3,340,329 | $ | 2,362,450 | |||||||||

Total liabilities | $ | 3,478,132 | $ | 3,441,605 | $ | 3,429,743 | $ | 3,645,744 | $ | 2,591,903 | |||||||||

Quarter Ended | |||||||||||||||||||

3/31/2017 | 12/31/2016 | 9/30/2016 | 6/30/2016 | 3/31/2016 | |||||||||||||||

DEBT OUTSTANDING | |||||||||||||||||||

Lines of credit | $ | 178,328 | $ | 100,095 | $ | 57,737 | $ | 357,721 | $ | 58,065 | |||||||||

Mortgage loans payable | 2,774,645 | 2,819,567 | 2,854,831 | 2,792,021 | 2,114,818 | ||||||||||||||

Preferred OP units - mandatorily redeemable | 45,903 | 45,903 | 45,903 | 45,903 | 45,903 | ||||||||||||||

Secured borrowing (3) | 141,671 | 144,477 | 144,522 | 144,684 | 143,664 | ||||||||||||||

Total debt | $ | 3,140,547 | $ | 3,110,042 | $ | 3,102,993 | $ | 3,340,329 | $ | 2,362,450 | |||||||||

% FIXED/FLOATING | |||||||||||||||||||

Fixed | 89.4% | 91.8% | 93.1% | 84.5% | 90.7% | ||||||||||||||

Floating | 10.6% | 8.2% | 6.9% | 15.5% | 9.3% | ||||||||||||||

Total | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | ||||||||||||||

WEIGHTED AVERAGE INTEREST RATES | |||||||||||||||||||

Lines of credit | 2.52% | 2.14% | 1.93% | 1.89% | 1.87% | ||||||||||||||

Mortgage loans payable | 4.26% | 4.24% | 4.30% | 4.38% | 4.67% | ||||||||||||||

Preferred OP units - mandatorily redeemable | 6.87% | 6.87% | 6.87% | 6.87% | 6.87% | ||||||||||||||

Average before Secured borrowing | 4.19% | 4.21% | 4.29% | 4.13% | 4.64% | ||||||||||||||

Secured borrowing (3) | 10.01% | 10.03% | 10.06% | 10.09% | 10.12% | ||||||||||||||

Total average | 4.45% | 4.48% | 4.56% | 4.39% | 4.98% | ||||||||||||||

DEBT RATIOS | |||||||||||||||||||

Net Debt / Recurring EBITDA(1) (TTM) | 7.0 | 7.5 | 7.7 | 9.1 | 5.5 | ||||||||||||||

Net Debt / Enterprise Value | 32.8% | 33.8% | 32.8% | 36.6% | 27.7% | ||||||||||||||

Net Debt + Preferred Stock / Enterprise Value | 34.2% | 35.2% | 34.2% | 38.0% | 29.7% | ||||||||||||||

Net Debt / Gross Assets | 44.8% | 45.0% | 44.1% | 49.0% | 35.8% | ||||||||||||||

COVERAGE RATIOS | |||||||||||||||||||

Recurring EBITDA(1) (TTM) / Interest | 3.3 | 3.2 | 3.1 | 3.1 | 3.0 | ||||||||||||||

Recurring EBITDA(1) (TTM) / Interest + Pref. Distributions + Pref. Stock Distribution | 3.0 | 2.9 | 2.9 | 2.8 | 2.7 | ||||||||||||||

MATURITIES/PRINCIPAL AMORTIZATION NEXT FIVE YEARS | 2017 | 2018 | 2019 | 2020 | 2021 | ||||||||||||||

Lines of credit | $ | — | $ | 1,896 | $ | — | $ | 176,665 | $ | — | |||||||||

Mortgage loans payable: | |||||||||||||||||||

Maturities | 3,964 | 26,186 | 64,314 | 58,078 | 270,680 | ||||||||||||||

Weighted average rate of maturities | 6.54 | % | 6.13 | % | 6.24 | % | 5.92 | % | 5.53 | % | |||||||||

Principal amortization | 38,244 | 53,315 | 54,032 | 54,572 | 53,433 | ||||||||||||||

Preferred OP units - mandatorily redeemable | 3,670 | 7,570 | — | — | — | ||||||||||||||

Secured borrowing (3) | 4,189 | 6,057 | 6,586 | 7,188 | 7,729 | ||||||||||||||

Total | $ | 50,067 | $ | 95,024 | $ | 124,932 | $ | 296,503 | $ | 331,842 | |||||||||

Three Months Ended March 31, | ||||||||||||||

2017 | 2016 | Change | % Change | |||||||||||

REVENUES: | ||||||||||||||

Income from real property | $ | 128,756 | $ | 122,443 | $ | 6,313 | 5.2 | % | ||||||

PROPERTY OPERATING EXPENSES: | ||||||||||||||

Payroll and benefits | 10,095 | 9,668 | 427 | 4.4 | % | |||||||||

Legal, taxes & insurance | 1,184 | 1,299 | (115 | ) | (8.9 | )% | ||||||||

Utilities | 6,752 | 6,684 | 68 | 1.0 | % | |||||||||

Supplies and repair | 3,450 | 3,482 | (32 | ) | (0.9 | )% | ||||||||

Other | 3,176 | 3,277 | (101 | ) | (3.1 | )% | ||||||||

Real estate taxes | 9,706 | 9,571 | 135 | 1.4 | % | |||||||||

Property operating expenses | 34,363 | 33,981 | 382 | 1.1 | % | |||||||||

NET OPERATING INCOME (NOI)(1) | $ | 94,393 | $ | 88,462 | $ | 5,931 | 6.7 | % | ||||||

As of March 31, | ||||||||||||||

2017 | 2016 | Change | % Change | |||||||||||

OTHER INFORMATION | ||||||||||||||

Number of properties | 231 | 231 | — | |||||||||||

Overall occupancy (8) | 96.7 | % | 95.0 | % | (9) | 1.7 | % | |||||||

Sites available for development | 6,668 | 6,849 | (181 | ) | (2.6 | )% | ||||||||

Monthly base rent per site - MH | $ | 507 | $ | 491 | $ | 16 | 3.3 | % | ||||||

Monthly base rent per site - RV (10) | $ | 446 | $ | 432 | $ | 14 | 3.2 | % | ||||||

Monthly base rent per site - Total | $ | 499 | $ | 483 | $ | 16 | 3.3 | % | ||||||

Three Months Ended March 31, | ||||||||||||||

2017 | 2016 | Change | % Change | |||||||||||

REVENUES: | ||||||||||||||

Rental home revenue | $ | 12,339 | $ | 11,708 | $ | 631 | 5.4 | % | ||||||

Site rent included in Income from real property | 15,719 | 15,218 | 501 | 3.3 | % | |||||||||

Rental Program revenue | 28,058 | 26,926 | 1,132 | 4.2 | % | |||||||||

EXPENSES: | ||||||||||||||

Commissions | 610 | 775 | (165 | ) | (21.3 | )% | ||||||||

Repairs and refurbishment | 2,281 | 2,666 | (385 | ) | (14.4 | )% | ||||||||

Taxes and insurance | 1,437 | 1,565 | (128 | ) | (8.2 | )% | ||||||||

Marketing and other | 774 | 870 | (96 | ) | (11.0 | )% | ||||||||

Rental Program operating and maintenance | 5,102 | 5,876 | (774 | ) | (13.2 | )% | ||||||||

NET OPERATING INCOME (NOI) (1) | $ | 22,956 | $ | 21,050 | $ | 1,906 | 9.1 | % | ||||||

Occupied rental home information as of March 31, 2017 and 2016: | ||||||||||||||||||||||

Number of occupied rentals, end of period* | 10,888 | 10,815 | 73 | 0.7 | % | |||||||||||||||||

Investment in occupied rental homes, end of period | $ | 465,479 | $ | 447,378 | $ | 18,101 | 4.0 | % | ||||||||||||||

Number of sold rental homes* | 240 | 294 | (54 | ) | (18.4 | )% | ||||||||||||||||

Weighted average monthly rental rate, end of period* | $ | 889 | $ | 865 | $ | 24 | 2.8 | % | ||||||||||||||

Three Months Ended March 31, | ||||||||||||||

2017 | 2016 | Change | % Change | |||||||||||

New home sales | $ | 6,883 | $ | 5,469 | $ | 1,414 | 25.9 | % | ||||||

Pre-owned home sales | 20,380 | 19,268 | 1,112 | 5.8 | % | |||||||||

Revenue from home sales | 27,263 | 24,737 | 2,526 | 10.2 | % | |||||||||

New home cost of sales | 5,848 | 4,844 | 1,004 | 20.7 | % | |||||||||

Pre-owned home cost of sales | 15,035 | 13,340 | 1,695 | 12.7 | % | |||||||||

Cost of home sales | 20,883 | 18,184 | 2,699 | 14.8 | % | |||||||||

NOI / Gross Profit (1) | $ | 6,380 | $ | 6,553 | $ | (173 | ) | (2.6 | )% | |||||

Gross profit – new homes | $ | 1,035 | $ | 625 | $ | 410 | 65.6 | % | ||||||

Gross margin % – new homes | 15.0 | % | 11.4 | % | 3.6 | % | ||||||||

Average selling price – new homes* | $ | 90,566 | $ | 82,864 | $ | 7,702 | 9.3 | % | ||||||

Gross profit – pre-owned homes | $ | 5,345 | $ | 5,928 | $ | (583 | ) | (9.8 | )% | |||||

Gross margin % – pre-owned homes | 26.2 | % | 30.8 | % | (4.6 | )% | ||||||||

Average selling price – pre-owned homes* | $ | 27,173 | $ | 27,565 | $ | (392 | ) | (1.4 | )% | |||||

Home sales volume: | ||||||||||||||

New home sales* | 76 | 66 | 10 | 15.2 | % | |||||||||

Pre-owned home sales* | 750 | 699 | 51 | 7.3 | % | |||||||||

Total homes sold* | 826 | 765 | 61 | 8.0 | % | |||||||||

Three Months Ended March 31, 2017 | ||||

REVENUES: | ||||

Income from real property | $ | 47,501 | ||

PROPERTY AND OPERATING EXPENSES: | ||||

Payroll and benefits | 4,826 | |||

Legal, taxes & insurance | 344 | |||

Utilities | 6,488 | |||

Supplies and repair | 1,249 | |||

Other | 2,805 | |||

Real estate taxes | 3,437 | |||

Property operating expenses | 19,149 | |||

NET OPERATING INCOME (NOI) (1) | $ | 28,352 | ||

As of March 31, 2017 | ||||

Other information: | ||||

Number of properties | 111 | |||

Occupied sites (11) | 20,936 | |||

Developed sites (11) | 21,485 | |||

Occupancy % (11) | 97.4 | % | ||

Transient sites | 7,432 | |||

Monthly base rent per site - MH | $ | 626 | ||

Monthly base rent per site - RV (10) | $ | 402 | ||

Monthly base rent per site - Total (10) | $ | 509 | ||

Ancillary revenues, net (in thousands) | $ | 735 | ||

Home sales: | ||||

Gross profit from home sales (in thousands) | $ | 806 | ||

New homes sales | 20 | |||

Pre-owned homes sales | 92 | |||

Occupied rental home information: | ||||

Rental program NOI (1) (in thousands) | $ | 113 | ||

Number of occupied rentals, end of period | 184 | |||

Investment in occupied rental homes (in thousands) | $ | 4,289 | ||

Weighted average monthly rental rate | $ | 940 | ||

Property Summary | |||||||||||||||

(includes MH and Annual/Seasonal RV’s) | |||||||||||||||

COMMUNITIES | 3/31/2017 | 12/31/2016 | 9/30/2016 | 6/30/2016 | 3/31/2016 | ||||||||||

FLORIDA | |||||||||||||||

Communities | 121 | 121 | 121 | 121 | 61 | ||||||||||

Developed sites (11) | 36,533 | 36,326 | 36,050 | 36,119 | 24,312 | ||||||||||

Occupied (11) | 35,257 | 35,021 | 34,745 | 34,720 | 23,359 | ||||||||||

Occupancy % (11) | 96.5 | % | 96.4 | % | 96.4 | % | 96.1 | % | 96.1 | % | |||||

Sites for development | 1,539 | 1,465 | 1,259 | 1,259 | 823 | ||||||||||

MICHIGAN | |||||||||||||||

Communities | 67 | 67 | 67 | 66 | 66 | ||||||||||

Developed sites (11) | 25,024 | 24,512 | 24,388 | 24,387 | 24,363 | ||||||||||

Occupied (11) | 23,443 | 23,248 | 23,218 | 23,198 | 23,079 | ||||||||||

Occupancy % (11) | 93.7 | % | 94.8 | % | 95.2 | % | 95.1 | % | 94.7 | % | |||||

Sites for development | 1,798 | 2,589 | 2,628 | 2,248 | 2,105 | ||||||||||

TEXAS | |||||||||||||||

Communities | 21 | 21 | 21 | 21 | 17 | ||||||||||

Developed sites (11) | 6,292 | 6,186 | 6,088 | 6,071 | 5,970 | ||||||||||

Occupied (11) | 5,943 | 5,862 | 5,774 | 5,771 | 5,602 | ||||||||||

Occupancy % (11) | 94.5 | % | 94.8 | % | 94.8 | % | 95.1 | % | 93.8 | % | |||||

Sites for development | 1,634 | 1,474 | 1,455 | 1,347 | 1,347 | ||||||||||

CALIFORNIA | |||||||||||||||

Communities | 23 | 22 | 22 | 22 | 3 | ||||||||||

Developed sites (11) | 4,865 | 4,862 | 4,863 | 4,864 | 198 | ||||||||||

Occupied (11) | 4,804 | 4,793 | 4,792 | 4,796 | 192 | ||||||||||

Occupancy % (11) | 98.7 | % | 98.6 | % | 98.5 | % | 98.6 | % | 97.0 | % | |||||

Sites for development | 411 | 332 | 332 | 332 | 332 | ||||||||||

ARIZONA | |||||||||||||||

Communities | 11 | 11 | 11 | 11 | 10 | ||||||||||

Developed sites (11) | 3,582 | 3,565 | 3,567 | 3,532 | 3,302 | ||||||||||

Occupied (11) | 3,370 | 3,338 | 3,305 | 3,281 | 3,102 | ||||||||||

Occupancy % (11) | 94.1 | % | 93.6 | % | 92.7 | % | 92.9 | % | 93.9 | % | |||||

Sites for development | 269 | 358 | 358 | 358 | 393 | ||||||||||

ONTARIO, CANADA | |||||||||||||||

Communities | 15 | 15 | 15 | 15 | — | ||||||||||

Developed sites (11) | 3,451 | 3,368 | 3,453 | 3,375 | — | ||||||||||

Occupied (11) | 3,451 | 3,368 | 3,453 | 3,375 | — | ||||||||||

Occupancy % (11) | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | — | % | |||||

Sites for development | 1,628 | 1,599 | 2,029 | 2,029 | — | ||||||||||

INDIANA | |||||||||||||||

Communities | 11 | 11 | 11 | 11 | 11 | ||||||||||

Developed sites (11) | 2,900 | 2,900 | 2,900 | 2,900 | 2,900 | ||||||||||

Occupied (11) | 2,741 | 2,724 | 2,712 | 2,700 | 2,674 | ||||||||||

Occupancy % (11) | 94.5 | % | 93.9 | % | 93.5 | % | 93.1 | % | 92.2 | % | |||||

Sites for development | 330 | 316 | 316 | 316 | 363 | ||||||||||

Property Summary | |||||||||||||||

(includes MH and Annual/Seasonal RV’s) | |||||||||||||||

COMMUNITIES | 3/31/2017 | 12/31/2016 | 9/30/2016 | 6/30/2016 | 3/31/2016 | ||||||||||

OHIO | |||||||||||||||

Communities | 9 | 9 | 9 | 9 | 9 | ||||||||||

Developed sites (11) | 2,719 | 2,715 | 2,719 | 2,718 | 2,700 | ||||||||||

Occupied (11) | 2,623 | 2,595 | 2,602 | 2,616 | 2,585 | ||||||||||

Occupancy % (11) | 96.5 | % | 95.6 | % | 95.7 | % | 96.2 | % | 95.7 | % | |||||

Sites for development | 75 | — | — | — | — | ||||||||||

COLORADO | |||||||||||||||

Communities | 8 | 8 | 7 | 7 | 7 | ||||||||||

Developed sites (11) | 2,335 | 2,335 | 2,335 | 2,335 | 2,335 | ||||||||||

Occupied (11) | 2,329 | 2,325 | 2,323 | 2,320 | 2,319 | ||||||||||

Occupancy % (11) | 99.7 | % | 99.6 | % | 99.5 | % | 99.4 | % | 99.3 | % | |||||

Sites for development | 656 | 656 | 304 | 304 | 304 | ||||||||||

OTHER STATES | |||||||||||||||

Communities | 56 | 56 | 55 | 54 | 49 | ||||||||||

Developed sites (11) | 14,567 | 14,313 | 14,415 | 14,337 | 13,683 | ||||||||||

Occupied (11) | 14,130 | 13,919 | 13,991 | 13,912 | 13,237 | ||||||||||

Occupancy % (11) | 97.0 | % | 97.3 | % | 97.1 | % | 97.0 | % | 96.7 | % | |||||

Sites for development | 1,977 | 1,827 | 1,823 | 1,728 | 1,514 | ||||||||||

TOTAL - PORTFOLIO | |||||||||||||||

Communities | 342 | 341 | 339 | 337 | 233 | ||||||||||

Developed sites (11) | 102,268 | 101,082 | 100,778 | 100,638 | 79,763 | ||||||||||

Occupied (11) | 98,091 | 97,193 | 96,915 | 96,689 | 76,149 | ||||||||||

Occupancy % (11) | 95.9 | % | 96.2 | % | 96.2 | % | 96.1 | % | 95.5 | % | |||||

Sites for development | 10,317 | 10,616 | 10,504 | 9,921 | 7,181 | ||||||||||

% Communities age restricted | 33.0 | % | 33.1 | % | 33.3 | % | 33.5 | % | 26.2 | % | |||||

TRANSIENT RV PORTFOLIO SUMMARY | |||||||||||||||

Location | |||||||||||||||

Florida | 6,467 | 6,497 | 7,232 | 6,990 | 2,664 | ||||||||||

Ontario, Canada | 1,451 | 1,500 | 1,485 | 1,657 | — | ||||||||||

Texas | 1,412 | 1,407 | 1,446 | 1,455 | 799 | ||||||||||

Arizona | 1,032 | 1,049 | 1,047 | 1,055 | 1,096 | ||||||||||

New Jersey | 1,059 | 1,042 | 1,047 | 1,084 | 995 | ||||||||||

New York | 588 | 830 | 484 | 483 | 489 | ||||||||||

Maine | 543 | 555 | 556 | 571 | 575 | ||||||||||

California | 840 | 513 | 478 | 518 | 296 | ||||||||||

Indiana | 520 | 502 | 501 | 501 | 501 | ||||||||||

Michigan | 210 | 204 | 203 | 126 | 150 | ||||||||||

Ohio | 194 | 198 | 194 | 195 | 213 | ||||||||||

Other locations | 1,966 | 1,997 | 1,801 | 1,864 | 1,803 | ||||||||||

Total transient RV sites | 16,282 | 16,294 | 16,474 | 16,499 | 9,581 | ||||||||||

Recurring | ||||||||||||||||||||||||

Capital | Recurring | |||||||||||||||||||||||

Expenditures | Capital | Lot | Expansion & | Revenue | ||||||||||||||||||||

Average/Site | Expenditures (12) | Modifications (13) | Acquisitions (14) | Development (15) | Producing (16) | |||||||||||||||||||

YTD 2017 | $ | 29 | $ | 2,574 | $ | 4,177 | $ | 27,095 | $ | 18,738 | $ | 253 | ||||||||||||

2016 | $ | 211 | $ | 17,613 | $ | 19,040 | $ | 1,822,564 | $ | 47,958 | $ | 2,631 | ||||||||||||

2015 | $ | 230 | $ | 20,344 | $ | 13,961 | $ | 1,214,482 | $ | 28,660 | $ | 4,497 | ||||||||||||

Resident | Net Leased | New Home | Pre-owned | Brokered | |||||||||||

LOCATIONS | Move-outs | Sites (17) | Sales | Home Sales | Re-sales | ||||||||||

Florida | 186 | 236 | 42 | 129 | 357 | ||||||||||

Michigan | 166 | 195 | 2 | 331 | 21 | ||||||||||

Texas | 51 | 81 | 6 | 89 | 5 | ||||||||||

California | 4 | 11 | 2 | 6 | 3 | ||||||||||

Arizona | 12 | 32 | 12 | 10 | 49 | ||||||||||

Ontario, Canada | 10 | 83 | 3 | 9 | 23 | ||||||||||

Indiana | 11 | 17 | — | 68 | 3 | ||||||||||

Ohio | 27 | 28 | — | 21 | 1 | ||||||||||

Colorado | 1 | 4 | 3 | 24 | 9 | ||||||||||

Other locations | 214 | — | 6 | 63 | 37 | ||||||||||

Three Months Ended March 31, 2017 | 682 | 687 | 76 | 750 | 508 | ||||||||||

Resident | Net Leased | New Home | Pre-owned | Brokered | |||||||||||

TOTAL FOR YEAR ENDED | Move-outs | Sites (17) | Sales | Home Sales | Re-sales | ||||||||||

2016 | 1,722 | 1,686 | 329 | 2,843 | 1,655 | ||||||||||

2015 | 1,344 | 1,905 | 273 | 2,210 | 1,244 | ||||||||||

Resident | Resident | |||||

PERCENTAGE TRENDS | Move-outs | Re-sales | ||||

2017 (TTM) | 2.1 | % | 6.3 | % | ||

2016 | 2.0 | % | 6.1 | % | ||

2015 | 2.0 | % | 5.9 | % | ||

(1) | Investors in and analysts following the real estate industry utilize funds from operations (FFO), net operating income (NOI), and recurring earnings before interest, tax, depreciation and amortization (Recurring EBITDA) as supplemental performance measures. We believe FFO, NOI, and Recurring EBITDA are appropriate measures given their wide use by and relevance to investors and analysts. FFO, reflecting the assumption that real estate values rise or fall with market conditions, principally adjusts for the effects of GAAP depreciation/amortization of real estate assets. NOI provides a measure of rental operations and does not factor in depreciation/amortization and non-property specific expenses such as general and administrative expenses. Recurring EBITDA, a metric calculated as EBITDA exclusive of certain nonrecurring items, provides a further tool to evaluate ability to incur and service debt and to fund dividends and other cash needs. Additionally, FFO, NOI, and Recurring EBITDA are commonly used in various ratios, pricing multiples/yields and returns and valuation calculations used to measure financial position, performance and value. |