Preliminary Copy

May [ ], 2024

Dear Shareholder:

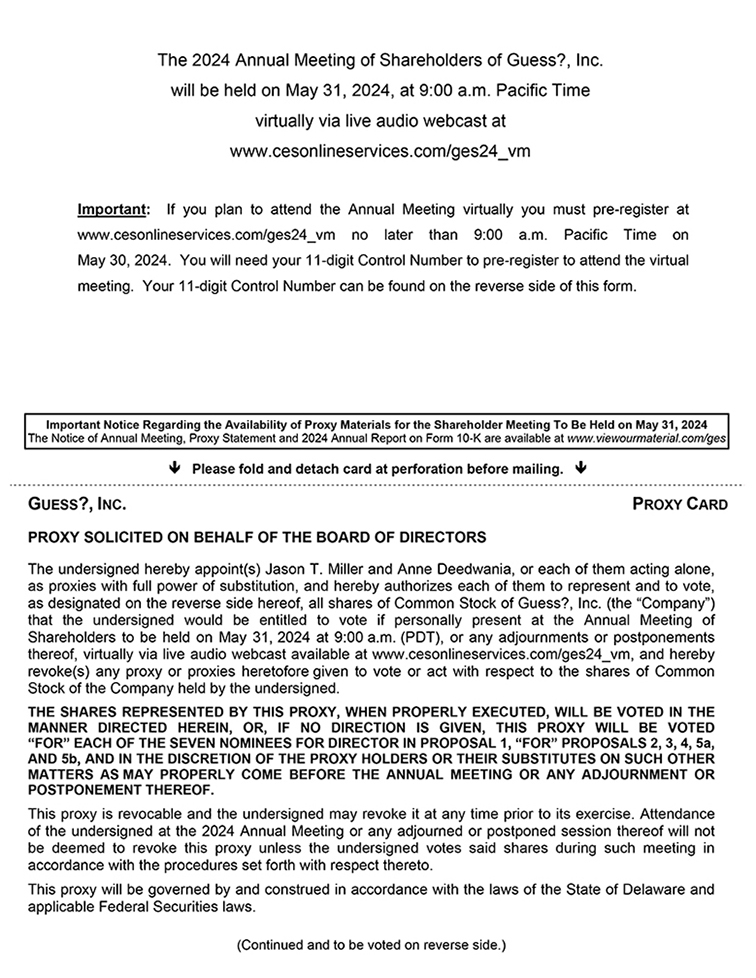

We are pleased to invite you to the 2024 annual meeting of shareholders (including any adjournments or postponements thereto, the “Annual Meeting”) of Guess?, Inc. (the “Company”) to be held on Friday, May 31, 2024, at 9:00 a.m. (PDT). The Annual Meeting will be conducted completely virtually, via a live audio webcast; there will be no physical meeting location. You will be able to attend and participate in the Annual Meeting by visiting www.cesonlineservices.com/ges24_vm, where you will be able to listen to the Annual Meeting live, submit questions, and vote.

Shareholders of record of the Company at the close of business on April 5, 2024 are entitled to notice of, and to vote at, the Annual Meeting. Details of the business to be conducted at the Annual Meeting are given in the accompanying Notice of Annual Meeting of Shareholders and the Proxy Statement. The Proxy Statement, accompanying Proxy Card, and Fiscal 2024 Annual Report to Shareholders (including the Company’s Annual Report on Form 10-K) were first sent or given to our shareholders on or about May [ ], 2024. You should also have received a Proxy Card or Voting Instruction Form and postage-paid return envelope, through which your vote is being solicited on behalf of our Board of Directors (the “Board”).

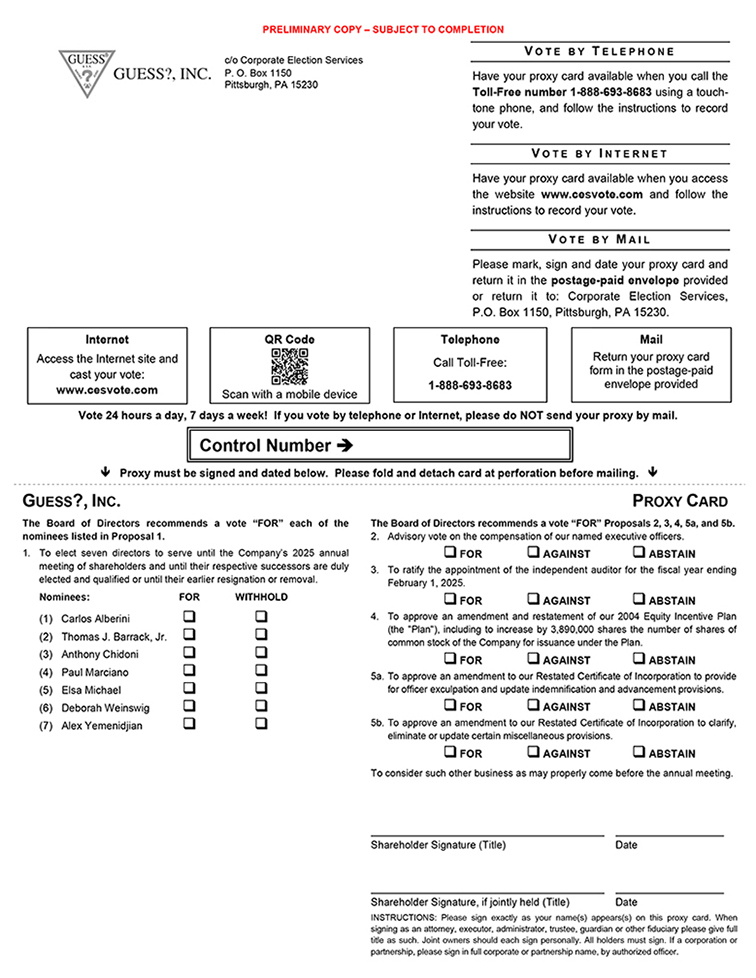

At the Annual Meeting, you will be asked to: (i) elect seven directors to serve until the Company’s 2025 annual meeting of shareholders, (ii) cast an advisory vote on the compensation of our named executive officers, (iii) ratify the appointment of the independent auditor for the fiscal year ending February 1, 2025, (iv) approve an amendment and restatement of our 2004 Equity Incentive Plan, (v) approve amendments to our Restated Certificate of Incorporation (comprising two proposals), and (vi) consider such other business as may properly come before the Annual Meeting. The enclosed Proxy Statement more fully describes the details of the business to be conducted at the Annual Meeting.

We are confident that our slate of Board candidates has the right mix of professional achievement, skills and experiences that qualifies each of them to serve as shareholder representatives overseeing the management of the Company. We are committed to engaging with our shareholders and continuing to solicit feedback about, and understand our shareholders’ perspectives on, the Company. The Board of Directors is well positioned to oversee the execution of our long-term strategic plans to grow and realize shareholder value. Our Board recommends that you vote “FOR” each of Mr. Carlos Alberini, Mr. Thomas J. Barrack, Jr., Mr. Anthony Chidoni, Mr. Paul Marciano, Ms. Elsa Michael, Ms. Deborah Weinswig and Mr. Alex Yemenidjian for election to our Board.

It is very important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend the virtual Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet, by telephone, or by mailing the Proxy Card or Voting Instruction Form in the postage-paid envelope provided. Returning your proxy or Voting Instruction Form by mail or voting by Internet or telephone does not deprive you of your right to attend the Annual Meeting virtually and to vote your shares at the Annual Meeting. Please vote by whichever method is most convenient for you to ensure that your shares are represented at the Annual Meeting.

Your vote and participation, no matter how many or how few shares you own, are very important to us. Your cooperation is greatly appreciated.

Thank you for your ongoing support of and continued interest in Guess?, Inc.

|

|

| Carlos Alberini Chief Executive Officer and Director |