Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

| AMERISTAR CASINOS, INC. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials: |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 13, 2012

To the Stockholders of Ameristar Casinos, Inc.

Our 2012 Annual Meeting of Stockholders will be held at 8:00 a.m. (local time) on Wednesday, June 13, 2012, at the Renoir 1 Room at Bellagio Las Vegas, 3600 Las Vegas Boulevard South, Las Vegas, Nevada 89109, for the following purposes:

- 1.

- To

elect the two Class B Directors named in the proxy statement to serve for a three-year term;

- 2.

- To

ratify the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for 2012;

- 3.

- To

reapprove the Company's Performance-Based Annual Bonus Plan;

- 4.

- To

approve, on an advisory basis, the compensation of our named executive officers; and

- 5.

- To transact any other business that may properly come before the meeting or any adjournments or postponements thereof.

A proxy statement containing information for stockholders is annexed hereto and a copy of our 2011 Annual Report is enclosed herewith.

Our Board of Directors has fixed the close of business on May 1, 2012 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting.

Whether or not you expect to attend the meeting in person, please date and sign the accompanying proxy card and return it promptly in the envelope enclosed for that purpose.

| By order of the Board of Directors | ||

|

|

|

LUTHER P. COCHRANE Chairman of the Board |

GORDON R. KANOFSKY Chief Executive Officer |

Las

Vegas, Nevada

April 30, 2012

i

3773 Howard Hughes Parkway

Suite 490 South

Las Vegas, Nevada 89169

(702) 567-7000

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Ameristar Casinos, Inc., a Nevada corporation ("we," "Ameristar" or the "Company"), for use only at our 2012 Annual Meeting of Stockholders (the "Annual Meeting") to be held at 8:00 a.m. (local time) on Wednesday, June 13, 2012, at the Renoir 1 Room, Bellagio Las Vegas, 3600 Las Vegas Boulevard South, Las Vegas, Nevada 89109, or any adjournments or postponements thereof. We anticipate that this proxy statement and accompanying proxy card will first be mailed to stockholders on or about May 4, 2012.

You may not vote your shares unless the signed proxy card is returned or you make other specific arrangements to have the shares represented at the Annual Meeting. Any stockholder of record giving a proxy may revoke it at any time before it is voted by filing with the Secretary of Ameristar a notice in writing revoking it, by executing a proxy bearing a later date or by attending the Annual Meeting and expressing a desire to revoke the proxy and vote the shares in person. If your shares are held in "street name," you should consult with your broker or other nominee concerning procedures for revocation. Subject to any revocation, all shares represented by a properly executed proxy card will be voted as directed on the proxy card. If no choice is specified, proxies will be voted "FOR" the election as Directors of the persons nominated by our Board of Directors, "FOR" the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for 2012, "FOR" the reapproval of the Company's Performance-Based Annual Bonus Plan and "FOR" the approval, on an advisory basis, of the compensation of our named executive officers.

In addition to soliciting proxies by mail, Ameristar officers, Directors and other regular employees, without additional compensation, may solicit proxies personally or by other appropriate means. We will bear the total cost of solicitation of proxies. Although there are no formal agreements to do so, we anticipate that we will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding any proxy soliciting materials to their principals. We have retained Georgeson Inc. to assist in soliciting proxies for a fee of $7,500 plus costs and expenses.

Only stockholders of record at the close of business on May 1, 2012 are entitled to receive notice of and to vote at the Annual Meeting. As of April 16, 2012, there were 32,963,900 shares of our common stock (the "Common Stock") outstanding, which constituted all of our outstanding voting securities. Each share outstanding on the record date is entitled to one vote on each matter. A majority of the shares of Common Stock outstanding on the record date and represented at the Annual Meeting in person or by proxy will constitute a quorum for the transaction of business.

Directors are elected by a plurality of votes cast, which means the two Director nominees who receive the most votes will be elected. You may not cumulate your votes in the election of Directors. Under Nevada law and the Company's Bylaws, the affirmative vote of a majority of the votes actually cast on the proposal to ratify the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for 2012, the proposal to reapprove of the Company's Performance-Based Annual Bonus Plan and the proposal to approve, on an advisory basis, the compensation of our named executive officers will constitute the approval of the stockholders.

A broker "non-vote" occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal or matter, and so notifies us, because the nominee does not have discretionary voting power with respect to that proposal or matter and has not received voting instructions from the beneficial owner. Nominees will have discretion to vote only with respect to the proposal to ratify the selection of our

1

independent registered public accounting firm. Abstentions and broker "non-votes" will be counted for purposes of determining the presence or absence of a quorum for the transaction of business, but because neither is counted as a vote cast, neither abstentions nor broker "non-votes" will be counted in any of the matters being voted upon at the Annual Meeting. Thus, abstentions and broker "non-votes" will not have any effect on the proposals outlined in this proxy statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE

HELD ON JUNE 13, 2012

The Notice of Annual Meeting of Stockholders, this proxy statement and accompanying proxy card and our 2011 Annual Report to stockholders are also available on our website at www.ameristar.com/investors. You will not be able to vote your shares or execute a proxy on the Internet.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Information Concerning the Nominees

Our Articles of Incorporation provides that the Board of Directors shall be classified, with respect to the time for which the Directors hold office, into three classes, as nearly equal in number as the total number of Directors constituting the entire Board of Directors permits. The Board of Directors is authorized to fix the number of Directors from time to time at not less than three and not more than 15. The authorized number of Directors is currently fixed at seven. Of the seven incumbent Directors, two are Class B Directors whose terms are expiring at the Annual Meeting and whom our Board of Directors has nominated for re-election as described below. Biographical information concerning the nominees and our other Directors is set forth under the caption "Directors and Executive Officers." See "Security Ownership of Certain Beneficial Owners and Management" for information regarding each such person's holdings of Common Stock.

The Board of Directors has nominated the two incumbent Class B Directors, Thomas M. Steinbauer and Leslie Nathanson Juris, to be elected for a term expiring at the 2015 Annual Meeting of Stockholders and until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation or removal.

The Board of Directors has no reason to believe that its nominees will be unable or unwilling to serve if elected. However, should these nominees become unable or unwilling to accept nomination or election, the persons named as proxies will vote instead for such other persons as the Board of Directors may recommend.

The Board of Directors unanimously recommends a vote "FOR" the election of each of the above-named nominees as Directors.

2

Directors and Executive Officers

The following sets forth information as of April 15, 2012 with regard to each of our Directors and executive officers. The terms of office of the Class A, B and C Directors expire at the annual meeting of stockholders in 2014, 2012 and 2013, respectively.

Name

|

Age | Position | |||

|---|---|---|---|---|---|

Gordon R. Kanofsky |

56 | Chief Executive Officer and Class C Director | |||

Larry A. Hodges |

63 | President, Chief Operating Officer and Class A Director | |||

Thomas M. Steinbauer |

61 | Senior Vice President of Finance, Chief Financial Officer, Treasurer, Secretary and Class B Director | |||

Peter C. Walsh |

55 | Senior Vice President, General Counsel and Chief Administrative Officer | |||

Carl Brooks*† |

62 | Class C Director | |||

Luther P. Cochrane*† |

63 | Chairman of the Board and Class A Director | |||

Leslie Nathanson Juris† |

65 | Class B Director | |||

J. William Richardson*† |

64 | Class C Director | |||

- *

- Member

of the Audit Committee.

- †

- Member of the Compensation Committee and the Nominating Committee.

Mr. Kanofsky joined the Company in September 1999 and has been Chief Executive Officer since May 2008 and a member of the Board of Directors since November 2006. He was also Co-Chairman of the Board from November 2006 to May 2008 and then Vice Chairman of the Board until May 2011. Prior to that, he was Executive Vice President since March 2002 after having initially served as Senior Vice President of Legal Affairs. Mr. Kanofsky was in private law practice in Washington, D.C. and Los Angeles, California from 1980 to September 1999, primarily focused on corporate and securities matters. While in private practice, he represented the Company beginning in 1993. Mr. Kanofsky is co-executor of the Estate of Craig H. Neilsen, our former Chairman of the Board, Chief Executive Officer and majority stockholder (the "Neilsen Estate"), and he is co-trustee and a member of the board of directors of the Craig H. Neilsen Foundation (the "Neilsen Foundation"), a private charitable foundation that is primarily dedicated to spinal cord injury research and treatment. He also has been actively involved as an advisory board member of the Neilsen Foundation since its inception in 2003. In addition, he serves on the board of directors of the American Gaming Association and previously served on the Association's Task Force on Diversity. Mr. Kanofsky has served in various volunteer capacities for the Cystic Fibrosis Foundation. Mr. Kanofsky is a graduate of the Duke University School of Law and holds an undergraduate degree in History from Washington University in St. Louis.

Mr. Kanofsky's long service as a senior executive officer of Ameristar, both during and after the tenure of Craig H. Neilsen, gives him broad experience in all aspects of the Company's business. His background in corporate transactional and securities law prior to joining Ameristar is valuable in many aspects of the Company's business, including legal affairs, corporate development, finance, government relations and regulatory compliance.

Mr. Hodges has been a Director of the Company since March 1994 and was elected President and Chief Operating Officer of the Company in May 2008. From September 2005 to May 2008, he was a consultant for CRG Partners Group LLC (formerly known as Corporate Revitalization Partners, LLC) ("CRP"), a privately held business management firm. From July 2003 to September 2005, he was a Managing Director of RKG Osnos Partners, LLC, a privately held business management firm that merged with CRP. Mr. Hodges has more than 35 years' experience in the retail food business. He was President

3

and Chief Executive Officer of Mrs. Fields Original Cookies, Inc. from April 1994 to May 2003, after serving as President of Food Barn Stores, Inc. from July 1991 to March 1994. From February 1990 to October 1991, Mr. Hodges served as president of his own company, Branshan Inc., which engaged in the business of providing management consulting services to food makers and retailers. Earlier, Mr. Hodges was with American Stores Company for 25 years, where he rose to the position of President of two substantial subsidiary corporations. Mr. Hodges holds a Bachelor of Arts degree from California State University, San Bernardino and is a graduate of the Harvard Business School Program for Management Development.

Mr. Hodges benefits Ameristar with his executive management experience operating large consumer-oriented businesses, in addition to his extensive knowledge of the Company's business gained from his 18 years as a Director of the Company and four years in his current position.

Mr. Steinbauer has been Senior Vice President of Finance of the Company since 1995 and Treasurer and a Director since our inception. He was elected Secretary of the Company in June 1998 and Chief Financial Officer in July 2003. Mr. Steinbauer has more than 35 years of experience in the gaming industry in Nevada and elsewhere. From April 1989 to January 1991, he was Vice President of Finance of Las Vegas Sands, Inc., the owner of the Sands Hotel & Casino in Las Vegas. From August 1988 to April 1989, he worked for McClaskey Enterprises as the General Manager of the Red Lion Inn & Casino, handling the day-to-day operations of seven hotel and casino properties in northern Nevada. Mr. Steinbauer was Property Controller of Bally's Reno from 1987 to 1988. Prior to that time, he was employed for 11 years by the Hilton Corporation and rose from an auditor to be the Casino Controller of the Flamingo Hilton in Las Vegas and later the Property Controller of the Reno Hilton. Mr. Steinbauer holds Bachelor of Science degrees in Business Administration and Accounting from the University of Nebraska-Omaha.

Mr. Steinbauer, our longest-serving executive officer, has unique knowledge and understanding of the Company's development and finances as well as expertise gained from many years of experience in the financial and operational areas of the gaming industry.

Mr. Walsh joined the Company as Senior Vice President and General Counsel in April 2002 and was elected to the additional position of Chief Administrative Officer in May 2008. From June 2001 to April 2002, he was in private law practice in Las Vegas, Nevada. Mr. Walsh was Assistant General Counsel of MGM MIRAGE from June 2000 to June 2001, also serving as Vice President of that company from December 2000 to June 2001. He was Assistant General Counsel of Mirage Resorts, Incorporated from 1992 until its acquisition by MGM MIRAGE in May 2000. Prior to joining Mirage Resorts, he was in private law practice in Los Angeles, California from 1981 to 1992. Mr. Walsh is President and chairman of the board of directors of Ameristar Cares Foundation, Inc., the Company's non-profit charitable foundation. Mr. Walsh is a graduate of UCLA School of Law and holds an undergraduate degree in English from Loyola Marymount University in Los Angeles.

Mr. Brooks was elected as a Director of the Company in October 2006. He was President of The Executive Leadership Council starting in 2001 and then Chief Executive Officer from 2004 to 2010. Founded in 1986, The Executive Leadership Council is the nation's premier leadership organization of African-American senior executives of Fortune 500 companies. Prior to joining The Executive Leadership Council, Mr. Brooks had more than 25 years' experience in the utility industry, including as Vice President, Human & Technical Resources of GPU Energy in Reading, Pennsylvania, one of the largest publicly traded electric utilities in the United States, and Chief Financial Officer of GENCO, a wholly owned subsidiary of GPU Energy. He served on the Financial Services Diversity Council of Chrysler LLC and was Vice Chair of the board of directors of the Howard University School of Business and the board of advisers of Hampton Institute. Mr. Brooks holds an undergraduate degree from Hampton Institute and a Master in Business Administration degree from Southern Illinois University. He is a graduate of the Tuck Executive Program (President Program) at Dartmouth College and the recipient of an Honorary Doctorate of Humane Letters from the Richmond Virginia Seminary.

4

Mr. Brooks brings to the Board an impressive executive career within aerospace and the utility and non-profit sectors with significant experience in operations, materials management, finance leadership and corporate strategy, all of which are relevant to the Company's daily operations.

Mr. Cochrane was elected as a Director of the Company in January 2006 and non-executive Chairman of the Board in May 2011. He is Chairman of KBR Building Group (formerly BE&K Building Group, LLC), a diversified commercial, hospitality, healthcare, industrial and institutional construction firm in the Southeast and Mid-Atlantic regions for which he also served as Chief Executive Officer from June 2004 to July 2011. Mr. Cochrane has announced his intention to retire from KBR Building Group in 2012. He is also Chief Executive Officer of the Cochrane Group, a consulting company. From 1998 to March 2003, Mr. Cochrane was Chairman and Chief Executive Officer or Chairman of Bovis, a global real estate and construction service company that provided a full range of construction, development, capital structuring and consulting services. Bovis was acquired by Lend Lease, an Australian real estate and asset management firm, in 1999 and changed its name to Bovis Lend Lease. Mr. Cochrane has held a variety of senior executive positions within the Bovis Group, beginning in 1990 as Chairman and Chief Executive Officer of McDevitt Street Bovis and later as Chairman and Chief Executive Officer of Bovis Americas, the Bovis entity responsible for all operations in North and South America. Mr. Cochrane was formerly a senior partner in Griffin, Cochrane and Marshall in Atlanta, Georgia, a firm that specialized in real estate and construction law. He is a graduate of the University of North Carolina at Chapel Hill and the University of North Carolina School of Law at Chapel Hill.

In addition to his management skills and experience as a chief executive officer, Mr. Cochrane's background in construction services and law is valuable to the Company in managing relationships with contractors and analyzing and completing construction projects.

Ms. Nathanson Juris became a Director of the Company in May 2003. She has more than 30 years of experience as a consultant in the areas of implementing strategy and managing complex organizational change. She works with executives to develop strategy, structure, succession, culture and practices to improve organizational performance. Since June 1999, she has been Managing Director or President of Nathanson/Juris Consulting, where she advises executives of both publicly and privately held companies in a broad range of industries. From 1994 to June 1999, she was Managing Partner of Roberts, Nathanson & Wolfson Consulting, Inc. (now known as RNW Consulting), a management consulting firm. She was also a lecturer at the Kellogg School of Management at Northwestern University over a 20-year period. Ms. Nathanson Juris holds a Bachelor of Science degree from Tufts University, a Master of Arts degree specializing in management and education from Northwestern University and a Ph.D. degree specializing in organizational behavior from Northwestern University.

By virtue of her extensive management consulting experience in the areas of leadership, strategy and organizational change and her academic background in organizational development, Ms. Nathanson Juris provides important insights and assistance to the Board and management on leadership development and other matters of critical importance to Ameristar.

Mr. Richardson became a Director of the Company in July 2003. From August 2007 until August 2011, he was a member in Forterra Real Estate Advisors I, LLC, which invests in and advises with respect to the construction and acquisition of telephone call centers in the United States. Mr. Richardson has more than 30 years' experience in the hotel industry. From February 2004 until his retirement in May 2006, Mr. Richardson was Chief Financial Officer of Interstate Hotels & Resorts, Inc. ("IHR"), the nation's largest independent hotel management company. IHR manages more than 300 hotels for third-party owners, including REITs, institutional real estate owners and privately held companies. From 1988 to July 2002, he held several executive positions with Interstate Hotels Corporation (a predecessor of IHR), including Chief Executive Officer and most recently Vice Chairman/Chief Financial Officer. Mr. Richardson began his hotel finance career in 1970 as Hotel Controller with Marriott Corporation, then became Vice President and Corporate Controller of Interstate Hotels Corporation in 1981 and

5

Partner and Vice President of Finance of the start-up hotelier Stormont Company in 1984, before re-joining Interstate Hotels in 1988. Mr. Richardson holds a Bachelor of Arts degree in Business/Finance from the University of Kentucky.

Mr. Richardson brings to the Board more than 30 years of experience in the hospitality industry and experience as Chief Financial Officer of a public company that is highly relevant to Ameristar's operations, and he meets the qualifications of an "audit committee financial expert" under Securities and Exchange Commission ("SEC") rules.

Officers serve at the discretion of the Board of Directors.

Corporate Governance

The Board of Directors currently consists of seven members. All Directors are elected to serve staggered three-year terms and until their successors are duly elected and qualified. The Board of Directors held seven meetings during 2011.

Director Independence. The Board of Directors has determined that each of the current non-employee Directors (i.e., Messrs. Brooks, Cochrane and Richardson and Ms. Nathanson Juris) are "independent," as that term is defined in Rule 5605(a)(2) of The Nasdaq Stock Market, Inc.'s listing requirements. In making these determinations, the Board of Directors did not rely on any exemptions to The Nasdaq Stock Market, Inc.'s requirements.

Stockholder Communications with Directors. Stockholders may communicate with the Board of Directors, committees of the Board of Directors, our independent Directors as a group or individual Directors by mail addressed to them at our principal office: Ameristar Casinos, Inc., 3773 Howard Hughes Parkway, Suite 490 South, Las Vegas, Nevada 89169. The Company transmits these communications directly to the Director(s) without screening them.

Audit Committee. The Audit Committee consists of Messrs. Richardson, Brooks and Cochrane, with Mr. Richardson serving as Chairman of the Committee. The Board of Directors has determined that each member of the Committee is "independent," as that term is defined in Rule 5605(a)(2) of The Nasdaq Stock Market, Inc.'s listing requirements, and also meets the requirements set forth in Rule 10A-3(b) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The Board of Directors has determined that Mr. Richardson is an "audit committee financial expert," as defined in Item 407(d)(5) of Regulation S-K promulgated by the SEC. The Board of Directors has adopted a written charter for the Audit Committee, and reviews and reassesses the adequacy of the charter on an annual basis. The Audit Committee Charter is posted on our website at www.ameristar.com/investors. The functions of the Audit Committee include: selecting the Company's independent registered public accounting firm and approving the terms of its engagement; approving the terms of any other services to be rendered by the independent registered public accounting firm; discussing with the independent registered public accounting firm the scope and results of its audit; reviewing our audited financial statements; considering matters pertaining to our accounting policies; reviewing the adequacy of our system of internal control over financial reporting; overseeing certain aspects of enterprise risk management; and providing a means for direct communication between the independent registered public accounting firm and the Board of Directors. The Audit Committee held four meetings during 2011.

Compensation Committee. The Compensation Committee consists of Ms. Nathanson Juris and Messrs. Brooks, Cochrane and Richardson, with Ms. Nathanson Juris serving as Chair of the Committee. The Board of Directors has determined that each member of the Committee is "independent," as that term is defined in Rule 5605(a)(2) of The Nasdaq Stock Market, Inc.'s listing requirements. The Board of Directors has adopted a written charter for the Compensation Committee, which is posted on our website at www.ameristar.com/investors. The functions of the Compensation Committee include: reviewing and approving compensation for the Chief Executive Officer and other executive officers; reviewing and

6

making recommendations with respect to the executive compensation and benefits philosophy and strategy of the Company; and administering our stock-based incentive compensation plans. The Compensation Committee held eight meetings during 2011.

Nominating Committee The Board of Directors established the Nominating Committee on April 19, 2011. The Nominating Committee

consists of

Messrs. Cochrane, Brooks and Richardson and Ms. Nathanson Juris, with Mr. Cochrane serving as Chairman of the Committee. The Board of Directors has

determined that each member of the Committee is "independent," as that term is defined in Rule 5605 (a)(2) of The Nasdaq Stock Market, Inc.'s listing requirements. The Board of Directors

has adopted a written charter for the Nominating Committee, which is posted on our website at

www.ameristar.com/investors. The functions of the Nominating Committee include: identifying individuals qualified to become members of the Board of Directors (consistent

with criteria approved by the Board); and recommending to the Board Director candidates for election at annual meetings of stockholders. The Nominating Committee held one meeting in 2011.

The Nominating Committee has not adopted a formal policy with respect to consideration of any Director candidates recommended by stockholders. We believe that such a policy is unnecessary because we do not limit the sources from which we may receive nominations. The Nominating Committee will consider candidates recommended by stockholders. Stockholders may submit such recommendations by mail to the attention of the Nominating Committee or the Secretary of the Company at our principal office in Las Vegas. The Nominating Committee has not established any specific minimum qualifications that must be met by a nominee for a position on the Board of Directors, but takes into account a candidate's education, business or other experience, independence, character and any particular expertise or knowledge the candidate possesses that may be relevant to service on the Board of Directors or its committees. The Nominating Committee does not have a formal policy with regard to the consideration of diversity in identifying Director nominees but, in evaluating potential nominees, it takes into account the backgrounds and experience of the existing Directors with the goal that the Board should consist of individuals with diverse backgrounds and experience. The Nominating Committee assesses the effectiveness of these efforts when evaluating potential nominees and considering the composition of the Board. The Nominating Committee evaluates potential nominees without regard to the source of the recommendation. The Nominating Committee identifies potential nominees through recommendations from individual Directors and management, and from time to time we also retain and pay third-party professional search firms to assist the Board of Directors in identifying and evaluating potential nominees. The foregoing disclosure applied to the full Board of Directors prior to the establishment of our Nominating Committee in April 2011.

Board Leadership Structure. In accordance with our Bylaws, the Board of Directors elects our Chairman of the Board and our Chief Executive Officer, or CEO, and each of these positions may be held by the same person or may be held by different people. After the death in 2006 of Craig H. Neilsen, our former Chairman of the Board, Chief Executive Officer and majority stockholder, the Board of Directors separated the roles of Chairman and CEO. From June 2008 until May 2011, the positions were filled by Ray H. Neilsen and Mr. Kanofsky, respectively, each of whom was a member of our management and also a representative of the Neilsen Estate, our then largest stockholder. Under that structure, the CEO was responsible for the day to day management and performance of the Company while the Chairman provided oversight of management functions and input on corporate strategy. Mr. Kanofsky was also Vice Chairman of the Board. In light of the changes in shareholdings of the Company's Common Stock that occurred in April 2011 and Mr. Neilsen's subsequent resignation from his positions with the Company, in May 2011 Mr. Kanofsky resigned as Vice Chairman and the Board of Directors elected Mr. Cochrane as non-executive Chairman of the Board. The Board believes this leadership structure is appropriate for the Company at this time.

7

The non-employee members of the Board of Directors have not chosen to designate a lead independent director. Mr. Cochrane fills that role as non-executive Chairman of the Board. In addition to these actions, the Board's belief in independent Board leadership is illustrated by several of our governance practices. Each of our non-employee Directors stays actively informed about matters before the Board of Directors and typically participates as a guest in all meetings of committees of the Board of which he or she is not a member. The Chair of each committee provides focused leadership in the areas of responsibility of such committee. The non-employee Directors meet periodically in executive session outside the presence of management. Any non-employee Director may request that an executive session of the non-employee members of the Board be scheduled.

Director Attendance of Meetings. During 2011, each Director attended at least 75% of the total number of meetings of the Board of Directors and each committee on which he or she served. We have not adopted a formal policy with regard to Directors' attendance at annual meetings of stockholders, but we encourage all Directors to attend annual meetings. Each member of the Board of Directors attended the 2011 Annual Meeting of Stockholders.

The Role of the Board of Directors in Risk Oversight

Although day-to-day management of enterprise risk is the responsibility of the Company's management, our Board of Directors, as a whole and also at the committee level, has an active role in general oversight of the management of the Company's risks.

While the full Board of Directors retains general responsibility for risk oversight, its committees are specifically charged with oversight of certain significant aspects of risk management. Among the Audit Committee's primary functions is oversight of the management of risks related to internal control over financial reporting. Between quarterly Committee meetings, the Chair of the Audit Committee maintains frequent communications with the Chief Executive Officer, the Chief Financial Officer, the General Counsel, the Vice President of Internal Audit, others in senior management and our independent auditor. In addition, the Vice President of Internal Audit reports directly to the Chair of the Audit Committee. The Compensation Committee, which generally meets quarterly, oversees risks related to our compensation of management. The Chair of the Compensation Committee and senior management confer regularly between Committee meetings. Pursuant to various state gaming regulatory requirements, the Company has a four-member Compliance Committee that meets quarterly, one of which members is required to be an outside Director of the Company.

The outside Director member of the Compliance Committee typically provides an oral report to the entire Board of Directors within a short period following each meeting of the Compliance Committee. In the case of the Audit Committee, the non-member outside Director typically participates as a guest in Committee meetings. To the extent that any outside Director does not attend any such meeting, he or she is generally briefed on the Committee meeting by the Chair of the Committee or another member.

The Board of Directors receives periodic reports from the Company's management, including evaluations of present or emerging risks, and regularly invites key members of management to its meetings, which include discussions of relevant risks, the extent to which mitigation of those risks is feasible and the processes, policies and persons employed to mitigate those risks.

Code of Ethics

The Board of Directors has adopted a Code of Ethics, in accordance with Item 406 of SEC Regulation S-K, that applies to our principal executive officer, principal financial and accounting officer and persons performing similar functions. The Code of Ethics is posted on our website at www.ameristar.com/investors. Any amendment to, or waiver from, a provision of our Code of Ethics requiring disclosure under applicable rules with respect to our principal executive officer, principal financial and accounting officer or controller will be posted on our website.

8

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information as of March 31, 2012 concerning "beneficial" ownership of our Common Stock, as that term is defined in the rules and regulations of the SEC, by: (i) all persons known by us to be beneficial owners of more than 5% of our outstanding Common Stock; (ii) each Director; (iii) each "named executive officer," as that term is defined in Item 402(a)(3) of Regulation S-K; and (iv) all executive officers and Directors as a group. The persons named in the table have sole voting and dispositive power with respect to all shares beneficially owned, unless otherwise indicated and except to the extent authority is shared by spouses under applicable law. The applicable ownership percentages shown are based on 32,962,481 shares of Common Stock outstanding as of March 31, 2012 and the relevant number of shares of Common Stock issuable upon exercise of stock options or other awards that are exercisable or have vested or that will become exercisable or vest within 60 days of March 31, 2012.

Name of Beneficial Owner

|

Common Stock Beneficially Owned |

Percent of Outstanding Common Stock |

|||||

|---|---|---|---|---|---|---|---|

Addison Clark Management, L.L.C. |

3,154,962 | (1) | 9.6 | % | |||

PAR Investment Partners, L.P. |

2,636,538 | (2) | 8.0 | % | |||

The Vanguard Group, Inc. |

2,139,121 | (3) | 6.5 | % | |||

BlackRock, Inc. |

1,836,485 | (4) | 5.6 | % | |||

Kornitzer Capital Management, Inc. |

1,658,996 | (5) | 5.0 | % | |||

Gordon R. Kanofsky |

610,213 | (6) | 1.8 | % | |||

Thomas M. Steinbauer |

272,265 | (7) | (8) | ||||

Larry A. Hodges |

255,189 | (9) | (8) | ||||

Peter C. Walsh |

245,120 | (10) | (8) | ||||

Carl Brooks |

51,874 | (11) | (8) | ||||

Luther P. Cochrane |

51,874 | (11) | (8) | ||||

Leslie Nathanson Juris |

90,374 | (12) | (8) | ||||

J. William Richardson |

90,199 | (13) | (8) | ||||

Ray H. Neilsen |

131,567 | (14) | (8) | ||||

All executive officers and Directors as a group (9 persons) |

1,798,675 | (15)(16) | 5.2 | % | |||

- (1)

- Addison

Clark Management, L.L.C. ("Addison Clark"), an investment adviser whose mailing address is 10 Wright Street, Suite 100, Westport, Connecticut

06880, and an affiliate have reported shared voting and dispositive power as to all of these shares.This information is derived from a Schedule 13G filed by Addison Clark and an affiliate with

the SEC on February 14, 2012.

- (2)

- PAR

Investment Partners, L.P. ("PAR"), an investment partnership whose mailing address is One International Place, Suite 2401, Boston,

Massachusetts 02110, and affiliates have reported sole voting and dispositive power as to all of these shares. This information is derived from a Schedule 13G/A filed by PAR and affiliates with

the SEC on February 14, 2012.

- (3)

- The

Vanguard Group, Inc. ("Vanguard"), an investment adviser whose mailing address is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355, has

reported sole voting power and shared dispositive power as to 48,340 of these shares and sole dispositive power as to 2,090,781 of these shares. This information is derived from a Schedule 13G

filed by Vanguard with the SEC on February 8, 2012.

- (4)

- BlackRock, Inc.

("BlackRock"), a holding company whose mailing address is 40 East 52nd Street, New York, New York 10022, has reported sole

voting and dispositive power as to all of these shares. This information is derived from a Schedule 13G filed by BlackRock with the SEC on February 9, 2012.

- (5)

- Kornitzer Capital Management, Inc. ("Kornitzer"), a registered investment adviser whose mailing address is 5420 West 61st Place, Shawnee Mission, Kansas 66205, has reported sole voting power as to

9

all of these shares, sole dispositive power as to 1,608,530 of these shares and shared dispositive power as to 50,466 of these shares. This information is derived from a Schedule 13G/A filed by Kornitzer with the SEC on January 20, 2012.

- (6)

- Includes

97,332 shares held by a family trust of which Mr. Kanofsky is co-trustee with his wife, with whom he shares voting and

dispositive power. Includes 452,381 shares that may be acquired within 60 days of March 31, 2012 upon exercise of stock options held by Mr. Kanofsky's family trust. Includes

60,500 shares that may become distributable to Mr. Kanofsky under certain circumstances within 60 days of March 31, 2012 in respect of vested restricted stock units.

- (7)

- Includes

91,090 shares held jointly by Mr. Steinbauer and his wife, with respect to which they share voting and dispositive power. Includes 181,175

shares that may be acquired within 60 days of March 31, 2012 upon exercise of stock options.

- (8)

- Represents

less than 1% of the outstanding shares of Common Stock.

- (9)

- Includes

164,390 shares that may be acquired upon exercise of stock options and 10,444 shares that may be acquired upon the vesting of restricted stock

units, in each case within 60 days of March 31, 2012. Shares and options are held by a family trust of which Mr. Hodges is the trustee.

- (10)

- Includes

202,484 shares that may be acquired within 60 days of March 31, 2012 upon exercise of stock options. Shares and options are held by

a family trust of which Mr. Walsh is co-trustee with his wife, with whom he shares voting and dispositive power.

- (11)

- Includes

43,437 shares that may be acquired within 60 days of March 31, 2012 upon exercise of stock options.

- (12)

- Includes

81,937 shares that may be acquired within 60 days of March 31, 2012 upon exercise of stock options. Shares and options are held by a

family trust of which Ms. Nathanson Juris is co-trustee with her husband, with whom she shares voting and dispositive power.

- (13)

- Includes

80,937 shares that may be acquired within 60 days of March 31, 2012 upon exercise of stock options.

- (14)

- Includes

130,567 shares that may be acquired within 60 days of March 31, 2012 upon exercise of stock options.

- (15)

- Includes

1,380,745 shares that may be acquired within 60 days of March 31, 2012 upon exercise of stock options or vesting or settlement of

restricted stock units.

- (16)

- Some of these shares beneficially owned by executive officers and Directors are held in margin accounts and subject to being borrowed and pledged as security.

10

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under SEC rules, our officers and Directors, as well as beneficial owners of more than 10% of our Common Stock, are required to file with the SEC reports of their holdings and changes in beneficial ownership of our Common Stock. We have reviewed copies of reports provided to the Company, as well as other records and information. Based on our review, we concluded that all required reports for 2011 were timely filed.

PROPOSAL NO. 2

RATIFICATION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and the Audit Committee are requesting stockholders to ratify the selection by the Audit Committee of Ernst & Young LLP as the Company's independent registered public accounting firm for the year ending December 31, 2012.

Ernst & Young LLP was our independent registered accounting firm for the fiscal year ended December 31, 2011 and has been selected by the Audit Committee to serve in such capacity during 2012. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting with the opportunity to make a statement if he or she desires and to respond to appropriate questions.

In addition to performing the audit of our consolidated financial statements, Ernst & Young LLP provided various other services to the Company and our subsidiaries during 2011 and 2010.

The aggregate fees billed by Ernst & Young LLP for 2011 and 2010 for each of the following categories of services are set forth below:

| |

|

2011 | 2010 | ||||||

|---|---|---|---|---|---|---|---|---|---|

Audit Fees |

|||||||||

• |

Annual audit of consolidated and subsidiary financial statements, including Sarbanes-Oxley Act Section 404 attestation |

||||||||

• |

Reviews of quarterly financial statements | ||||||||

• |

Other services normally provided by the auditor in connection with regulatory filings |

$ | 1,007,401 | $ | 1,088,569 | ||||

Audit-Related Fees |

|||||||||

• |

Assurance and related services reasonably related to the performance of the audit or reviews of the financial statements: |

||||||||

|

—2011 and 2010: employee benefit plan audit | 19,000 | 18,273 | ||||||

Tax Fees |

|||||||||

• |

2011 and 2010: primarily related to tax planning and advice and various tax compliance services | 308,934 | 372,652 | ||||||

All Other Fees |

|||||||||

• |

2011: services related to debt issuances and development initiatives | ||||||||

• |

2010: services related to evaluation of strategic alternatives | 88,520 | 14,560 | ||||||

|

Total | $ | 1,423,855 | $ | 1,494,054 | ||||

The Audit Committee has not adopted a pre-approval policy with respect to any general classes of audit or non-audit services of the independent registered public accounting firm. The Audit Committee's policy is that all proposals for specific services must be approved by the Audit Committee or by the Chairman of the Committee pursuant to delegated authority. All fees reflected in the table above were pre-approved by the Audit Committee or the Chairman of the Committee.

The Audit Committee has concluded that the provision of non-audit services by our independent registered public accounting firm is compatible with maintaining auditor independence.

11

The Board of Directors and the Audit Committee unanimously recommend a vote "FOR" the ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm for the year 2012. The Company is not required to submit the selection of the independent registered public accounting firm to the stockholders for approval, but is doing so as a matter of good corporate governance. If stockholders do not ratify the selection of Ernst & Young LLP, the Audit Committee will take that into account in selecting an independent registered public accounting firm for the year 2013.

PROPOSAL NO. 3

REAPPROVAL OF PERFORMANCE-

BASED ANNUAL BONUS PLAN

On January 26, 2007, the Compensation Committee unanimously adopted, subject to stockholder approval, the Ameristar Casinos, Inc. Performance-Based Annual Bonus Plan (the "Bonus Plan"). The Bonus Plan was approved by the stockholders of the Company on June 8, 2007. We are asking stockholders to reapprove the Bonus Plan so that the Company can continue to utilize it to attract, retain and motivate key executives. The Bonus Plan provides short-term incentives in the form of cash compensation.

Stockholder approval of the material terms of the performance goals under which compensation may be paid under the Bonus Plan is required every five years in order for the Bonus Plan to qualify as "performance-based compensation" under Section 162(m) of the Internal Revenue Code (the "Code"), which provides a federal income tax deduction for performance-based compensation. For purposes of Section 162(m), the material terms include (i) the individuals eligible to receive compensation, (ii) a description of the business criteria on which the performance goal is based and (iii) the maximum amount of compensation that can be paid to an individual for achievement of performance goal. Each of these aspects is discussed below, and stockholder approval of this proposal constitutes approval of each of these aspects of the Bonus Plan for purposes of the approval requirements of Section 162(m). The Bonus Plan must be reapproved by stockholders in order for it to continue to qualify as performance-based under Section 162(m). If the Bonus Plan is not reapproved by stockholders, it will be terminated and, in that event, we will likely consider other forms of incentive pay for executives as may be necessary or appropriate in order to attract and retain key executive talent, with no assurance that we will receive a full federal income tax deduction for the compensation paid.

The Board of Directors unanimously recommends a vote "FOR" the reapproval of the Bonus Plan.

Principal Provisions of the Bonus Plan

The following summary is qualified in its entirety by reference to the full text of the Bonus Plan, which is attached as Appendix A to this proxy statement.

Purpose. The purpose of the Bonus Plan is to provide a more direct alignment between the annual bonus compensation paid to participating employees and the performance of the Company. The Bonus Plan is designed to accomplish this by paying awards only after the achievement of specified performance goals that are established within the first three months of the year as determined by the Compensation Committee.

The Bonus Plan is also designed to qualify as "performance-based" compensation under Section 162(m) of the Code. Under Section 162(m), the Company may not receive a federal income tax deduction for compensation paid to our Chief Executive Officer or certain other executive officers to the extent that any of these persons receives more than $1,000,000 in any one year, unless the compensation is performance-based. If the compensation qualifies as performance-based, the Company will receive a federal income tax deduction for the compensation even if it is more than $1,000,000 during a single year. The Bonus Plan is designed to afford the Company a full federal income tax deduction for annual cash bonuses paid to key executives. However, there can be no guarantee that the amounts payable under the Bonus Plan will be treated as qualified performance-based compensation under Section 162(m).

12

Eligibility. The Compensation Committee will select the members of management and other key employees of the Company or its subsidiaries who are eligible to receive awards under the Bonus Plan. The actual number of employees who are eligible to receive an award for any particular fiscal year cannot be determined in advance because the Compensation Committee has discretion to select the participants during the first 90 days of the year. In February 2012, the Compensation Committee selected the four current executive officers of the Company as the participants in the Bonus Plan for 2012.

Bonus Opportunities and Performance Goals. During the first 90 days of each year, the Compensation Committee assigns each participant a bonus opportunity and the performance goal or goals that must be achieved before an award actually will be paid to the participant for the year. The bonus opportunity may be either a fixed dollar amount or a percentage of the participant's base salary in effect on the date the Compensation Committee assigns the bonus opportunity. In addition to a target level of achievement, the Compensation Committee may specify a minimum acceptable level of achievement of the relevant performance goal(s) as well as one or more higher levels of achievement, and a formula to determine the percentage of the bonus opportunity earned by the participant upon attainment of each level of achievement, which percentage may exceed 100%. The bonus opportunity earned under the Bonus Plan by any participant for any single fiscal year may not exceed the lesser of $3,000,000 or 200% of the participant's base salary, even if the formula would otherwise result in a larger award. The performance goals shall be based on one or more of the following business criteria:

- •

- sales or other sales or revenue measures;

- •

- operating income, earnings from operations, earnings before or after taxes, or earnings before or after interest, taxes,

depreciation, amortization or extraordinary or designated items;

- •

- net income or net income per common share (basic or diluted);

- •

- operating efficiency ratio;

- •

- return on average assets, return on investment, return on capital or return on average equity;

- •

- cash flow, free cash flow, cash flow return on investment or net cash provided by operations;

- •

- economic profit or value created;

- •

- operating margin;

- •

- stock price or total stockholder return; and

- •

- strategic business criteria, consisting of one or more objectives based on meeting specified business goals, such as market share or geographic business expansion goals, cost targets, customer satisfaction and goals relating to acquisitions, divestitures or joint ventures.

Awards for 2012 will be based on consolidated earnings before interest, taxes, depreciation, amortization and non-recurring and certain other items (Adjusted EBITDA).

Determination and Payment of Awards. After fiscal year-end, the Compensation Committee will determine and certify in writing the extent to which the bonus opportunity for that year has been earned, through the achievement of the applicable performance goal(s), by each participant. The Compensation Committee, in its sole and absolute discretion, may reduce or eliminate, but not increase, the amount of the award payable to any participant, to reflect subjective evaluations of the participant's performance, the Compensation Committee's determination that the performance goal(s) have become an inappropriate measure of achievement or for such other reason as it may determine. The Compensation Committee will consider, but not be bound by, the performance evaluations of participants submitted by management. Unless the Compensation Committee, in its sole and absolute discretion, determines otherwise, a participant who is not employed by the Company or one of its subsidiaries or affiliates on the last day of the fiscal year will not be entitled to receive payment of an award for that year.

13

Awards will be paid in cash within two and one-half months after the end of the fiscal year.

Administration, Amendment and Termination. The Bonus Plan is administered by the Compensation Committee. Subject to the terms of the Bonus Plan, the Compensation Committee has full authority and discretion to:

- •

- select the employees who will participate in the Bonus Plan;

- •

- grant bonus opportunities and establish performance goals;

- •

- compute the amount of the award payable to any participant;

- •

- adopt, alter and repeal administrative rules, guidelines and practices;

- •

- conclusively interpret the provisions of the Bonus Plan and any performance goals established under the Bonus Plan, and

remedy any ambiguities, inconsistencies or omissions;

- •

- conclusively decide all questions of fact arising under the Bonus Plan; and

- •

- make all other determinations necessary or advisable for the administration of the Bonus Plan.

The Compensation Committee may amend or terminate the Bonus Plan at any time. Amendments may be made without stockholder approval except as required under Section 162(m) or other applicable law. The Bonus Plan will terminate on the day after the first meeting of the Company's stockholders held in 2012 if it is not reapproved by the stockholders at or before that meeting (the first meeting of stockholders held in 2017 if it is reapproved by the stockholders at the 2012 Annual Meeting).

Other Compensation Programs. The Bonus Plan will not limit the authority of the Company to compensate employees, whether under other plans currently in effect or by adopting additional compensation plans or arrangements, including other bonus arrangements.

Awards Granted to Executive Officers. The payment of awards under the Bonus Plan is determined based on future performance. Because actual payments cannot be determined until the completion of the performance period, the following table sets forth the minimum, target and maximum awards that could be paid to the persons and groups shown below for 2012, depending on the extent to which the performance goal established by the Compensation Committee is achieved. There is no assurance that the pre-established performance goal will actually be achieved, and therefore there is no assurance that any awards will actually be paid for 2012 or any future fiscal year.

| |

Minimum Award for 2012 ($) |

Target Award for 2012 ($) |

Maximum Possible Award for 2012 ($) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Gordon R. Kanofsky |

$ | 0 | $ | 900,000 | $ | 1,350,000 | ||||

Larry A. Hodges |

$ | 0 | $ | 735,000 | $ | 1,102,500 | ||||

Thomas M. Steinbauer |

$ | 0 | $ | 408,000 | $ | 612,000 | ||||

Peter C. Walsh |

$ | 0 | $ | 408,000 | $ | 612,000 | ||||

All current executive officers as a group (4 persons) |

$ | 0 | $ | 2,451,000 | $ | 3,676,500 | ||||

All Directors who are not executive officers as a group* |

— | — | — | |||||||

All employees who are not executive officers as a group* |

— | — | — | |||||||

- *

- These groups did not participate in the Bonus Plan in 2012.

Our

executive officers have a financial interest in this proposal because the Compensation Committee has selected each executive officer as eligible to receive awards under the Bonus

Plan for 2012.

14

PROPOSAL NO. 4

ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION

We are asking stockholders to approve an advisory resolution on the Company's executive compensation as reported in this proxy statement. As described below in the "Executive Compensation—Compensation Discussion and Analysis" section of this proxy statement, the Compensation Committee has structured our executive compensation program to achieve the following key objectives:

- •

- attracting and retaining executive officers with needed skills and qualities to successfully implement our strategy in a

way that exemplifies the Company's core values, including integrity, quality, collaboration, inclusion and continuous improvement, and who work well within our culture, and

- •

- enhancing long-term stockholder value by motivating achievement of the near- and long-term goals that enable us to succeed in each of our markets through high-quality facilities and products and a strong focus on superior guest service, and through the pursuit of attractive growth opportunities.

In order to achieve these goals, the Company compensates the named executive officers at levels that are generally competitive with market practices and that provide opportunities for above-market compensation for superior performance.

We urge stockholders to read the "Compensation Discussion and Analysis" beginning on page 16 of this proxy statement, which describes in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as the Summary Compensation Table and related compensation tables and narrative, appearing on pages 31 through 40, which provide detailed information on the compensation of our named executive officers. The Compensation Committee and the Board of Directors believe that the policies and procedures articulated in the "Compensation Discussion and Analysis" are effective in achieving our goals and that the compensation of our named executive officers reported in this proxy statement reflects and supports these compensation policies and procedures.

In accordance with Section 14A of the Exchange Act, and as a matter of good corporate governance, we are asking stockholders to approve the following advisory resolution at the 2012 Annual Meeting:

RESOLVED, that the stockholders of Ameristar Casinos, Inc. (the "Company") approve, on an advisory basis, the compensation of the Company's named executive officers disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables and narrative in the proxy statement for the Company's 2012 Annual Meeting of Stockholders.

This advisory resolution, commonly referred to as a "say-on-pay" resolution, is non-binding on the Board of Directors. Although non-binding, the Board and the Compensation Committee will review and consider the voting results when evaluating our executive compensation program. Unless the Board modifies its policy on the frequency of future "say-on-pay" votes, the next "say-on-pay" vote will be held at our 2013 Annual Meeting of Stockholders.

The Board of Directors unanimously recommends a vote "FOR" the approval of the advisory resolution on executive compensation.

15

COMPENSATION DISCUSSION AND ANALYSIS

This section explains the Company's executive compensation program for the following "named executive officers" (or "NEOs") whose compensation information is presented in the tables following this discussion in accordance with SEC rules:

| Gordon R. Kanofsky | Chief Executive Officer | |

| Larry A. Hodges | President and Chief Operating Officer | |

| Thomas M. Steinbauer | Senior Vice President of Finance and Chief Financial Officer | |

| Peter C. Walsh | Senior Vice President, General Counsel and Chief Administrative Officer | |

| Ray H. Neilsen | Former Chairman of the Board |

The Compensation Committee of the Board of Directors (referred to in this section as the "Committee") has responsibility for establishing and administering our executive compensation program.

Executive Summary

The Company began a new era in its corporate development in 2011 as it transitioned from being controlled by a majority stockholder to having no single stockholder with a controlling stake. On March 25, 2011, we entered into a definitive Stock Purchase Agreement with the representatives of the Estate of Craig H. Neilsen, the Company's majority stockholder, pursuant to which, on April 19, 2011, the Company repurchased 83% of the shares of the Company's common stock held by the Estate, representing 45% of our total shares outstanding at that time. With the exception of the departure of former executive Chairman of the Board Ray H. Neilsen on May 5, 2011 and the subsequent election of Board member Luther P. Cochrane as non-executive Chairman of the Board, our successful senior management team and Board of Directors continued unchanged to guide the Company in this new era. We remain committed to our stockholder value creation strategy of employing our high-quality facilities and products and dedication to superior guest service to compete effectively in each of our markets and to drive growth from our existing and additionally developed or acquired properties.

In the face of competitive pressures and a challenging economic environment, we completed a successful year in 2011. While generally weak economic conditions continued in 2011, the management team's ability to improve revenues on lower promotional expense was a substantial factor underlying the increase in operating income from $140.1 million in 2010 to $227.2 million in 2011 while net revenues increased only 2.1% (2010 operating income includes impairment charges related to goodwill and other intangible assets of $56.2 million). Management and the Board of Directors use the Company's Adjusted EBITDA and Adjusted EBITDA margin (as reported in its publicly issued earnings releases) as key metrics of the Company's success in operating its properties and its operating efficiency. The Company's Adjusted EBITDA improved from 2010 to 2011 at rate greatly exceeding its growth in net revenues, while its Adjusted EBITDA margin also improved year-over-year and was very strong in comparison to that of the Company's principal competitors.

These results were possible due to the management team's consistent delivery of a superior guest experience, focus on cost management and effective marketing, despite the demands of the ownership transition, the refinancing of substantially all of the Company's long-term debt and related efforts. In addition, the management team renewed the Company's pursuit of value-enhancing growth opportunities, including acquiring a development site and otherwise positioning itself for a bid to obtain a license for a casino in Springfield, Massachusetts.

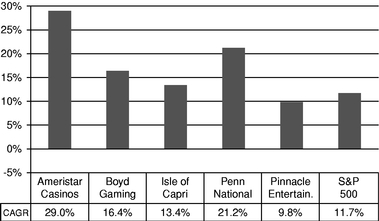

The Company's high quality properties and guest experience combined with its continued operational excellence have contributed to significant returns for Ameristar stockholders. Our total stockholder return was 13.2% in the past year and 114.8% over the past three years under the current management team. Our

16

performance in that metric leads our segment of the gaming industry and the S&P 500 Index for that time frame.

The following graph illustrates the compound average share price growth rate (assuming reinvestment of dividends) for Ameristar, Boyd Gaming Corporation, Isle of Capri Casinos, Inc., Penn National Gaming, Inc., Pinnacle Entertainment, Inc. and the S&P 500 Index over the past three years.

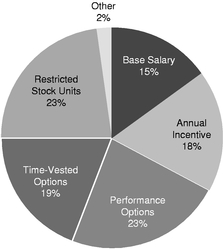

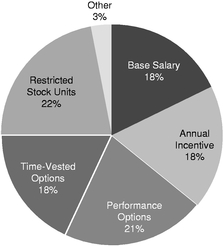

Ameristar Investment Performance

12/31/2008 - 12/30/2011

For 2011, as reflected in the Summary Compensation Table, 83% of CEO compensation was provided in the form of annual and long-term incentives that are tied to Ameristar's Adjusted EBITDA results or stock price. Those incentives include performance-based stock options that were granted in 2011 in lieu of other annual equity grants that would have been granted in 2012-2015, as further explained below. For the other named continuing executive officers as a group, 80% of total compensation was similarly based on such incentives.

| CEO | Other NEOs | |

|

|

Comprehensive Program of Compensation Best Practices

During 2011, the Committee conducted a comprehensive review of the Company's executive compensation program to align it with the Company's business strategy and to update certain pay practices in light of current compensation best practices.

17

- •

- Emphasis on performance-based equity. The most prominent

change resulting from the review is the placing of greater emphasis on performance-based compensation through a grant of performance-based stock options that vest in three tranches

contingent upon the achievement of targeted share prices ranging from $41 to $51 by December 31, 2018, or realization of the best total stockholder return among the Company's gaming peers

during the same period. This one-time grant was made on November 21, 2011 in an amount equal to 20% of each NEO's targeted annual long-term incentive grant value over

the next four years. In addition, beginning with 2012, the balance of each NEO's targeted annual long-term incentive grant value will be reallocated between time-vested stock

options and time-vested restricted stock units ("RSUs") from 25% options/75% RSUs prior to 2012 to 60% options/40% RSUs. Thus, as a result of the long-term performance-based

option grant and the remix of stock option and RSU grant values, the annualized percentage of long-term incentives tied to performance-based equity (time-vested and

performance-based stock options) will increase from 25% to 68% of each NEO's total grant value in 2012.

- •

- Stock ownership guidelines. We adopted guidelines that

require our NEOs to acquire and maintain ownership of Company shares or other qualifying equity with a value of at least 400% of annual base salary for the Chief Executive Officer, 300% for the

President and Chief Operating Officer and 200% for our Senior Vice Presidents.

- •

- Equity treatment at retirement. For executives meeting

certain age and service requirements, we modified Company policy to continue service-based vesting of equity grants into retirement and extended the exercise period for stock options in retirement to

the lesser of four years or the remaining option term. We believe this is a good compensation practice that motivates executives to make decisions in the long-term best interests of the

Company and otherwise to develop prudent succession plans as they approach retirement, enabling them to realize the benefits of their actions in their equity awards.

- •

- Deferred Compensation Plan termination. We terminated the

Company's Deferred Compensation Plan, which had allowed highly compensated employees including our NEOs to defer base salary and annual bonus amounts and receive a Company matching contribution equal

to 100% of the first 5% of compensation deferred. The plan termination reduces non-performance-based compensation for our NEOs, subject to a transitional award of RSUs in lieu of the

foregone Company matching amount projected for the next five years.

- •

- Prohibition of option repricing. In early 2012, we amended

our 2009 Stock Incentive Plan to formally prohibit any form of option repricing without prior approval of stockholders, which the Committee informally adhered to previously as an internal policy.

- •

- Prohibition of speculative and hedging transactions. Our

Insider Trading Policy, which has been in effect for many years, prohibits short sales of, and trading in put and call options on, the Company's securities.

- •

- Equity grant policy. Our policy is to make annual grants

at a predetermined date each year that coincides with the July meeting of the Board of Directors. Grant amounts are denominated in dollars and converted to a number of shares using

per-share grant values based on the closing stock price on the date of grant or the average of the closing stock prices for a predetermined period prior to the date of grant.

- •

- Tax gross-ups. We provide no tax

gross-ups other than with respect to benefits payable to our NEOs for termination following a change in control, as provided in our Change in Control Severance Plan (the "CIC Plan").

- •

- Limited supplemental benefits and perquisites. We provide limited supplemental benefits and perquisites deemed valuable to meet competitive practices or to reinforce executive health.

18

- •

- No supplemental retirement. We do not provide supplemental retirement benefits to our NEOs.

Executive Compensation Program Philosophy and Objectives

The Committee is guided by several philosophical principles and objectives in developing our executive compensation program:

- •

- Leadership—Our program is designed to attract and gain a

long-term commitment from experienced, successful executives that form a high-performing management team to lead our business.

- •

- Focus on total compensation—We consider total compensation in

relation to the pay practices of our gaming company peers and other competitors for key talent.

- •

- Pay for performance—Our total compensation package enables our

executives to realize superior pay for superior performance by tying a high proportion of their total compensation to their achievement of challenging annual operating goals and industry-leading

increases in stockholder value over time.

- •

- Balanced performance orientation—The mix of incentives

motivates long-term sustainable growth as well as achievement of annual operating goals.

- •

- Core values—In addition to competitive considerations, individual pay opportunities and decisions reflect how well an executive exemplifies Ameristar's core values, including integrity, quality, collaboration, inclusion and continuous improvement.

19

2011 Program Overview

Ameristar's total compensation program incorporates these elements:

| Element |

Role and Purpose |

|

|---|---|---|

| Base salary | Provides foundation for competitive total compensation. | |

Provides guaranteed element of compensation under all economic conditions. |

||

Recognizes an executive's sustained performance, capabilities, job scope and experience, expected level of contribution and modeling of our core values. |

||

| Annual incentives | Motivates and rewards achievement of challenging annual performance targets, which drive the value of our stock. | |

| Performance options | Motivates achievement of significant share price increases over an extended period. | |

| Stock options | Requires increases in share prices to provide gains to executives, thereby aligning executive and stockholder interests. | |

| Restricted stock units | Aligns executives with stockholders on share price increases and decreases from the date of grant while motivating executive retention, especially during periods of market uncertainty. | |

| Deferred compensation | Through 2011, provided an incentive for retirement savings by matching up to 5% of executive elective deferrals of base salary and bonus. | |

Plan was terminated with respect to compensation earned after 2011 and the Company's match of a portion of deferrals was replaced by a one-time grant of RSUs, resulting in greater emphasis on performance-based compensation. |

||

| Executive health benefits | Promotes executive health through premium subsidy for basic and supplemental health benefits. | |

Supports attraction and retention of executives in highly competitive gaming industry. |

||

| Executive perquisites | Offers minor discounts and complimentary privileges incident to executive's presence at the Company's properties. | |

| Termination and Change in Control Payments | Each of the named executive officers is entitled to receive certain severance payments and other benefits upon a termination of his employment in specified circumstances. The CIC Plan recognizes the executive's ongoing value to Ameristar and helps to provide our executives with a smooth transition in the case of a change in control. | |

Role of Executive Officers in Setting Compensation

The Committee establishes the plan design and amounts of all elements of compensation for the Chief Executive Officer and the Company's other NEOs. The NEOs participate in Committee meetings at the Committee's request to provide background information regarding the Company's strategic objectives and performance. The Chief Executive Officer formulates and discusses with the Committee his views on plan design. In considering his views and otherwise in the performance of its duties, the Committee seeks independent advice as appropriate. The Chief Executive Officer also provides the Committee with his performance assessments and compensation recommendations for each of the NEOs, which may include a

20

self-assessment. His recommendations are considered by the Committee and approved or modified as the Committee deems appropriate.

Compensation Consultant

The Committee has the authority to retain compensation consultants exclusively to assist it in the evaluation of NEO and employee compensation and benefit programs. During 2011, the Committee retained Pay Governance LLC, a nationally recognized independent compensation consulting firm, to assist in performing its duties. In 2011, Pay Governance assisted with a review and revision of the executive compensation peer group and advised the Committee with respect to compensation trends and best practices, competitive pay levels, long-term incentive design and policies, equity grant practices and competitive levels, stock ownership guidelines and proxy disclosure. While the advisor regularly confers with management in performing work requested by the Committee, Pay Governance did not perform any additional services for management.

Setting Executive Compensation

In determining base salary, target annual incentives and guidelines for equity awards, the Committee uses the NEOs' current level of compensation as the starting point. Our compensation decisions consider the scope and complexity of the functions executives oversee, the contribution of those functions to our overall performance, their experience and capabilities and individual performance, taking into consideration the compensation practices of our peers in order to obtain a general understanding of competitive compensation practices.

In 2011, the Committee engaged in a comprehensive review of our executive compensation program in light of the Company's transition away from being a controlled corporation. The review included an update of the peer group that had been used to monitor competitive pay trends since 2007. (In 2010, the Company used pay data for the Company's four gaming company peers only.) The Committee believes that the companies in its revised peer group are highly representative of the group of companies with which the Company currently competes for talent and stockholder investment. Please refer to the section "Peer Group" below for a more detailed discussion of our peer group.

The Committee reviews the total compensation of the NEOs annually to assess the need for changes. A review process conducted in 2010 concluded that pay for our named executive officers was generally competitive and reasonable considering the factors listed above. The only pay increase at that time was to the base salary of Mr. Steinbauer, as described below. Otherwise, no changes were made to base salaries, target annual incentive levels or long-term incentive grant guidelines for our named executive officers for 2011.