SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | ||

| Filed by a Party other than the Registrant [ ] | ||

| Check the appropriate box: | ||

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant to §240.14a-12 | |

| VIAVI SOLUTIONS INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

|

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant) |

| Payment of Filing Fee (Check the appropriate box): | ||||

| [X] | No fee required. | |||

|

[

] |

Fee computed on

table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

|

[

] |

Fee paid previously

with preliminary materials. | |||

|

[

] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

VIAVI SOLUTIONS INC.

430 North McCarthy

Boulevard

Milpitas, California 95035

(408) 404-3600

Notice of Annual Meeting of

Stockholders

and Proxy Statement

2016 Annual Report

|

YOUR VOTE IS IMPORTANT. WHETHER

OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE REFER TO (I) THE

INSTRUCTIONS OF THE NOTICE OF INTERNET AVAILABILITY OF PROXY |

GO GREEN!

REGISTER ELECTRONICALLY FOR STOCKHOLDER MATERIALS

Viavi is pleased to take advantage of the Securities and Exchange Commission (the “SEC”) rules allowing companies to furnish this Proxy Statement and Annual Report over the Internet to our stockholders who hold Common Stock. We believe that this e-proxy process, also known as “Notice and Access” will expedite the receipt of proxy materials by our stockholders, reduce our printing and mailing expenses and reduce the environmental impact of producing the materials required for our Annual Meeting.

You should refer to the “General Information” portion of the following Proxy Statement or contact our Investor Relations hotline at 408-404-6305 for assistance regarding instructions on how to register for and access our Proxy Statement and Annual Report online.

|

Viavi Solutions

Inc. |

September 30, 2016

Dear Viavi Stockholder:

We cordially invite you to attend the Viavi Solutions Inc. 2016 Annual Meeting of Stockholders, which will be held on November 15, 2016 at 9:00 a.m. Pacific Time at 690 North McCarthy Boulevard, Milpitas, California 95035.

This year’s Annual Meeting will consider the following proposals:

| 1. | To elect eight directors to serve until the 2017 annual meeting of stockholders and until their successors are elected and qualified. | |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending July 1, 2017. | |

| 3. | To consider a non-binding advisory vote on the compensation of our named executive officers. | |

| 4. | To consider such other business as may properly come before the annual meeting and any adjournment or postponement thereof. |

These items of business are more fully described in the Proxy Statement which is attached and made a part hereof. Stockholders of record as of the close of business on September 19, 2016 are entitled vote at this year’s Annual Meeting and any adjournment or postponement.

|

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, YOU ARE URGED TO VOTE PROMPTLY. For specific instructions on how to vote your shares please refer to (i) the Notice of Internet Availability of Proxy Materials (the “Notice”) you received in the mail, (ii) the section entitled General Information beginning on page 1 of this Proxy Statement, or (iii) if you requested to receive printed proxy materials, your enclosed Proxy Card. As specified in the Notice you may vote your shares by using the Internet or the telephone. All stockholders may also vote shares by marking, signing, dating and returning the Proxy Card in the enclosed postage-prepaid envelope. If you send in your Proxy Card and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement. |

Sincerely,

Oleg Khaykin

Chief Executive Officer and President

VIAVI SOLUTIONS INC.

430 North McCarthy

Boulevard

Milpitas, California 95035

(408) 404-3600

PROXY STATEMENT

GENERAL INFORMATION

Why am I receiving these proxy materials?

The Board of Directors (the “Board” or “Board of Directors”) of Viavi Solutions Inc., a Delaware corporation (the “Company”), is furnishing these proxy materials to you in connection with the Company’s 2016 Annual Meeting of stockholders (the “Annual Meeting”). The Company has also sent printed copies of the proxy materials by mail to each holder of Common Stock who has requested such copy. The Annual Meeting will be held at 690 North McCarthy Boulevard, Milpitas, California 95035, on November 15, 2016 at 9:00 a.m., Pacific Time. You are invited to attend the Annual Meeting and are entitled and requested to vote on the proposals outlined in this proxy statement (“Proxy Statement”).

What is the Notice of Internet Availability of Proxy Materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide stockholders with access to our proxy materials over the Internet. Most of our stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the “Notice of Internet Availability of Proxy Materials” (the “Notice”), which was mailed on or about September 30, 2016 to our stockholders who held Common Stock as of the record date, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy on the Internet. If you would like to receive a paper or e-mail copy of our proxy materials, you should follow the instructions in the Notice for requesting such materials.

How do I obtain electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to:

| ● | View our proxy materials for the Annual Meeting on the Internet; and |

| ● | Instruct us to send our future proxy materials to you electronically by e-mail. |

Choosing to receive your future proxy materials by e-mail will save us the cost of printing and mailing documents to you and will reduce the impact of printing and mailing these materials on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

2016 Proxy Statement 1

PROXY STATEMENT

What if I prefer to receive paper copies of the materials?

If you would prefer to continue receiving paper copies of proxy materials, please mark the “Paper Copies” box on your Proxy Card (or provide this information when you vote telephonically or via the Internet). The Company must provide paper copies via first class mail to any stockholder who, after receiving the Notice, requests a paper copy. Accordingly, even if you do not check the “Paper Copies” box now, you will still have the right to request delivery of a free set of proxy materials upon receipt of any Notice in the future.

Additionally, you may request a paper copy of the materials by (i) calling 1-800-579-1639; (ii) sending an e-mail to sendmaterial@proxyvote.com; or (iii) logging onto www.ProxyVote.com. There is no charge to receive the materials by mail. If requesting material by e-mail, please send a blank e-mail with the 12 digit “Control Number” (located on the second page of the Notice) in the subject line.

What proposals will be voted on at the Annual Meeting?

The following proposals are scheduled to be voted on at the Annual Meeting:

| 1. | To elect eight directors to serve until the 2017 annual meeting of stockholders and until their successors are elected and qualified. |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm (hereinafter referred to as “independent auditors”) for the fiscal year ending July 1, 2017. |

| 3. | To consider a non-binding advisory vote on the compensation of our named executive officers (“NEOs”). |

| 4. | To consider such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

What are the recommendations of the Company’s Board of Directors?

The Board recommends that you vote “FOR” each of the proposals presented in this Proxy Statement.

Specifically, the Board recommends you vote:

| ● | “FOR” the election of the directors, |

| ● | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for the fiscal year ending July 1, 2017, and |

| ● | “FOR” the approval of the Company’s executive compensation programs. |

What is the record date and what does it mean?

The record date for the Annual Meeting is September 19, 2016. The record date is established by the Board as required by Delaware law. Holders of shares of the Company’s Common Stock at the close of business on the record date are entitled to receive notice of the Annual Meeting and to vote at the Annual Meeting and any adjournments or postponements thereof.

What shares can I vote?

Each holder of the Company’s common stock, par value $.001 per share (“Common Stock”), is entitled to one vote for each share of Common Stock owned as of the record date At the record date, 231,998,230 shares of Common Stock were outstanding.

2 2016 Proxy Statement

PROXY STATEMENT

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding and entitled to vote on the record date will constitute a quorum permitting the Annual Meeting to conduct its business.

How are abstentions and broker non-votes treated?

Under Delaware law, an abstaining vote and a broker non-vote are counted as present and are included for purposes of determining whether a quorum is present at the Annual Meeting.

Broker non-votes are not included in the tabulation of the voting results on the election of directors or issues requiring approval of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting authority with respect to that item and has not received instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held by them as nominee, brokers have the discretion to vote such shares only on routine matters. Where a matter is not considered routine, shares held by your broker will not be voted absent specific instruction from you, which means your shares may go unvoted and not affect the outcome if you do not specify a vote. None of the matters to be voted on at the Annual Meeting are considered routine, except for the ratification of the Company’s independent auditors.

For the purpose of determining whether the stockholders have approved matters, other than the election of directors, abstentions will have the same effect as a vote against the proposal.

What is the voting requirement to approve each of the proposals?

Proposal 1. Each director must be elected by the affirmative vote of a majority of the shares of Common Stock cast with respect to such director by the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. This means that the number of votes cast for a director must exceed the number of votes cast against that director, with abstentions and broker non-votes not counted as votes cast as either for or against such director’s election.

Proposal 2. Ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors requires the affirmative vote of a majority of the shares of Common Stock present or represented by proxy and entitled to vote on this proposal at the Annual Meeting. As a result, abstentions will have the same effect as votes against the proposal. Brokers will have discretion to vote on this proposal.

Proposal 3. Approval of the non-binding advisory vote on the Company’s executive compensation programs requires the affirmative vote of a majority of the shares of Common Stock present or represented by proxy and entitled to vote on this proposal at the Annual Meeting. As a result, abstentions will have the same effect as votes against the proposal. Broker non-votes will have no effect on the outcome of this vote.

All shares of Common Stock represented by valid proxies will be voted in accordance with the instructions contained therein. In the absence of instructions, proxies from holders of Common Stock will be voted in accordance with the recommendations set forth in the Proxy Statement.

How do I vote my shares?

You can either attend the Annual Meeting and vote in person or give a proxy to be voted at the Annual Meeting:

| ● | by mailing the enclosed proxy card or voting instruction form; |

| ● | over the telephone by calling a toll-free number; or |

| ● | electronically, using the Internet and following the instructions provided in the Notice you received by mail. |

2016 Proxy Statement 3

PROXY STATEMENT

The Internet and telephone voting procedures have been set up for your convenience and are designed to authenticate the stockholders’ identities, to allow them to provide their voting instructions, and to confirm that their instructions have been recorded properly. The Company believes the procedures which have been put in place are consistent with the requirements of applicable law. Specific instructions for record holders of Common Stock who wish to use the Internet or telephone voting procedures are set forth on the enclosed proxy card.

If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor by any of the methods listed below:

The Harkins Group

1 Rockefeller Plaza, 10th

Floor

New York, New York 10020

Call Collect: +1 (212)

468-5380

Call Toll-Free: +1 (844) 218-8384

(U.S. and Canada)

Email: viavi@harkinsgroup.com

Who will tabulate the votes?

An automated system administered by Broadridge Financial Services, Inc. (“Broadridge”) will tabulate votes cast by proxy at the Annual Meeting and a representative of the Company will tabulate votes cast in person at the Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except as necessary to meet applicable legal requirements or to allow for the tabulation and/or certification of the vote.

Can I change my vote after submitting my proxy?

You may revoke your proxy at any time before the final vote at the Annual Meeting. You may do so by one of the following ways:

| ● | submitting another proxy card bearing a later date; |

| ● | sending a written notice of revocation to the Company’s Corporate Secretary at 430 North McCarthy Boulevard, Milpitas, California, 95035; |

| ● | submitting new voting instructions via telephone or the Internet; or |

| ● | attending AND voting in person at the Annual Meeting. |

Who is paying for this proxy solicitation?

This solicitation is made by the Company. The Company will bear the cost of soliciting proxies, including preparation, assembly, printing and mailing of the Proxy Statement. If you are a holder of Common Stock and if you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. The Company has retained the services of The Harkins Group as its proxy solicitor for this year for a fee of approximately $15,000 plus reasonable out-of-pocket costs and expenses. In addition, the Company will reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, either personally, by telephone, facsimile, or telegram.

4 2016 Proxy Statement

PROXY STATEMENT

How can I find out the voting results?

The Company will announce the preliminary results at the Annual Meeting and publish the final results in a Current Report on Form 8-K within four business days after the Annual Meeting. Stockholders may also find out the final results by calling the Company’s Investor Relations Department at (408) 404-6305.

How do I receive electronic access to proxy materials for the current and future annual meetings?

Stockholders who have previously elected to receive the Proxy Statement and Annual Report over the Internet will be receiving an e-mail on or about September 30, 2016 with information on how to access stockholder information and instructions for voting over the Internet. Stockholders of record may vote via the Internet until 11:59 p.m. Eastern Time, November 14, 2016.

If your shares are registered in the name of a brokerage firm and you have not elected to receive your Proxy Statement and Annual Report over the Internet, you still may be eligible to vote your shares electronically over the Internet. A large number of brokerage firms are participating in the ADP online program, which provides eligible stockholders who receive a paper copy of this Proxy Statement the opportunity to vote via the Internet. If your brokerage firm is participating in ADP’s program, your proxy card will provide instructions for voting online.

Stockholders can elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies, which results in cost savings for the Company. If you are a stockholder of record and would like to receive future stockholder materials electronically, you can elect this option by following the instructions provided when you vote your proxy over the Internet at www.ProxyVote.com.

If you chose to view future proxy statements and annual reports over the Internet, you will receive an e-mail notification next year with instructions containing the Internet address of those materials. Your choice to view future proxy statements and annual reports over the Internet will remain in effect until you contact either your broker or the Company to rescind your instructions. You do not have to elect Internet access each year.

If you elected to receive this Proxy Statement electronically over the Internet and would now like to receive a paper copy of this Proxy Statement so that you may submit a paper proxy in lieu of an electronic proxy, you should contact your broker or the Company.

How can I avoid having duplicate copies of the Proxy Statement sent to my household?

Some brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports, which results in cost savings for the Company. Householding means that only one copy of the Proxy Statement and Annual Report, or notice of internet availability of proxy materials will be sent to multiple stockholders who share an address. The Company will promptly deliver a separate copy of either document to any stockholder who contacts the Company’s Investor Relations Department at (408) 404-6305 or 430 North McCarthy Boulevard, Milpitas, California, 95035 Attention: Investor Relations, requesting such copies. If a stockholder is receiving multiple copies of the Proxy Statement and Annual Report at the stockholder’s household and would like to receive a single copy of those documents for a stockholder’s household in the future, that stockholder should contact their broker, other nominee record holder, or the Company’s Investor Relations Department to request mailing of a single copy of the Proxy Statement and Annual Report.

2016 Proxy Statement 5

PROXY STATEMENT

When are stockholder proposals due for next year’s annual meeting?

In order for stockholder proposals to be considered properly brought before an annual meeting, the stockholder must have given timely notice in writing to the Secretary of the Company. To be timely for the 2017 annual meeting of stockholders (the “2017 Annual Meeting”), a stockholder’s notice must be received by the Company at its principal executive offices not less than 60 days nor more than 90 days prior to first anniversary of the date of the prior year’s annual meeting; provided, however, that if no meeting was held the prior year, or if the date of the annual meeting is advanced by more than 30 days or delayed (other than as a result of adjournment) by more than 60 days, notice must be received by the Company no later than the 90th day prior to the annual meeting or the 10th day following the public announcement of the meeting date. A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the 2017 Annual Meeting: (i) a brief description of the business desired to be brought before the 2017 Annual Meeting and the text of the proposal or business; (ii) the name and record address of the stockholder proposing such business and the beneficial owner, if any, on whose behalf the proposal is being made; (iii) a representation that the stockholder is a holder of record of the Company’s stock, is entitled to vote at the meeting and intends to appear in person or by proxy to propose the business specified in the notice; (iv) any material interest of the stockholder or any proposing person in such business; (v) the number of shares owned beneficially and of record by the stockholder or proposing person, including derivative interests, contracts or other agreements related to ownership or rights to vote the Company’s shares and other economic interests in the Company’s securities; and (vi) any other information required pursuant to Section 14 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). Our Bylaws specify in greater detail the requirements as to the form and content of a stockholder’s notice. We recommend that any stockholder wishing to bring any item before an annual meeting review a copy of our Bylaws, as amended and restated to date, which can be found at www.viavisolutions.com. We will not entertain any proposals at the 2017 Annual Meeting that do not meet the requirements set forth in our Bylaws. Subject to applicable laws and regulations, the Company has discretion over what stockholder proposals will be included in the agenda for the 2017 Annual Meeting and/or in the related proxy materials. If the stockholder does not also comply with the requirements of Rule 14a-4(c)(2) under the Exchange Act, we may exercise discretionary voting authority under proxies that we solicit to vote in accordance with our best judgment on any such stockholder proposal.

Proposals that a stockholder intends to present at the 2017 Annual Meeting and wishes to be considered for inclusion in the Company’s Proxy Statement for the 2017 Annual Meeting must be received by the Company at its principal executive offices not less than 120 days prior to the date the Proxy Statement for the 2016 Annual Meeting was made available to stockholders. If we change the date of the 2017 Annual Meeting by more than 30 days from the anniversary of the date of this year’s meeting, then the deadline to submit proposals will be a reasonable time before we begin to print and mail our proxy materials. All such proposals must comply with Rule 14a-8 under the Exchange Act, which lists the requirements for the inclusion of stockholder proposals in Company-sponsored proxy materials.

6 2016 Proxy Statement

PROPOSAL 1

Election of Directors

At this Annual Meeting, the stockholders will elect seven directors recommended by the Governance Committee (which serves as the Company’s Nominating Committee) and nominated by the Board, each to serve a one-year term until the 2017 Annual Meeting of Stockholders and until a qualified successor is elected and qualified or until the director’s earlier resignation or removal. The Board has no reason to believe that the nominees named below will be unable or unwilling to serve as a director if elected.

Considerations in Director Selection

The Company’s Governance Committee is responsible for reviewing, evaluating and nominating individuals for election to the Company’s Board. The Governance Committee selects nominees from a broad base of potential candidates. The Governance Committee’s charter instructs it to seek qualified candidates regardless of race, color, religion, ancestry, national origin, gender, sexual orientation, etc. It is the Governance Committee’s goal to nominate candidates with diverse backgrounds and capabilities, to reflect the diverse nature of the Company’s stakeholders (security holders, employees, customers and suppliers), while emphasizing core excellence in areas relevant to the Company’s long term business and strategic objectives.

The Board believes that it is necessary for each of the Company’s directors to possess many qualities and skills. When searching for new candidates, the Governance Committee seeks individuals of the highest ethical and professional character who will exercise sound business judgment. The Governance Committee also seeks people who are accomplished in their respective field and have superior credentials. In selecting nominees, the Governance Committee seeks individuals who can work effectively together to further the interests of the Company, while preserving their ability to differ with each other on particular issues. A candidate’s specific background and qualifications are also reviewed in light of the particular needs of the Board at the time of an opening.

Each candidate must have an employment and professional record which demonstrates, in the judgment of the Governance Committee, that the candidate has sufficient and relevant experience and background, taking into account positions held and industries, markets and geographical locations served, to serve on the Board in the proposed capacity. In particular, the Governance Committee seeks candidates with at least two years of experience serving as the Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Director, or the equivalent of such positions, of a well-respected, publicly-traded company.

Certain individual qualifications and skills of our directors that contribute to the Board’s effectiveness as a whole are described below.

2016 Proxy Statement 7

PROPOSAL 1

| 2016 Director Nominees |

| Richard E. Belluzzo |

|

Age 62 Experience:

Qualifications: |

| Keith Barnes |

Age 65 Experience:

Qualifications: |

| Tor Braham |

|

Age 59 Experience:

Qualifications: |

8 2016 Proxy Statement

PROPOSAL 1

| Timothy Campos |

|

Age 43 Experience:

Qualifications: |

| Donald Colvin |

|

Age 63 Experience:

Qualifications: |

| Masood A. Jabbar |

|

Age 66 Experience:

Qualifications: |

2016 Proxy Statement 9

PROPOSAL 1

| Pamela Strayer |

|

Age 48 Experience:

Qualifications: |

|

Oleg Khaykin |

|

Age 51 Experience:

Qualifications: |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION TO THE BOARD OF EACH OF THE NOMINEES NAMED ABOVE.

10 2016 Proxy Statement

CORPORATE GOVERNANCE

Corporate Governance and Ethics

The Board and management of the Company believe that good corporate governance is an important component in enhancing investor confidence in the Company and increasing stockholder value. Continuing to develop and implement best practices throughout our corporate governance structure is a fundamental part of our strategy to enhance performance by creating an environment that increases operational efficiency and ensures long-term productivity growth. Good corporate governance practices also ensure alignment with stockholder interests by promoting fairness, transparency and accountability in business activities among employees, management and the Board.

Our corporate governance practices represent our commitment to the highest standards of corporate ethics, compliance with laws, financial transparency and reporting with objectivity and the highest degree of integrity. Steps we have taken to fulfill this commitment include, among others:

| ● | Directors are elected on an annual basis. |

| ● | Election of directors requires the affirmative vote of a majority of the shares of Common Stock cast with respect to a director by the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal, except in the case of contested elections. |

| ● | Our non-employee directors have an average tenure of 4.7 years, and half of the directors have been on the board for less than 2.5 years. |

| ● | All members of the Board are independent with the exception of the Company’s Chief Executive Officer. |

| ● | All members of our Board committees are independent. |

| ● | Our Board committee charters clearly establish the roles and responsibilities of each committee. |

| ● |

All employees and members of the Board are responsible for complying with our Code of Business Conduct and our Insider Trading Policy. |

| ● | We have an anonymous hotline to encourage employees to report questionable activities to our Internal Audit and Legal Departments, and the Audit Committee. |

| ● | Our independent public accountants report directly to the Audit Committee. |

| ● | Our internal audit control function maintains critical supervision over the key areas of our business and financial controls and reports directly to our Audit Committee. |

| ● |

We have established procedures for stockholders to communicate with the Board by contacting the Investor Relations Department. |

| ● |

The independent members of our Board and Board committees meet regularly without the presence of management. |

The Company has adopted a Code of Ethics (known as the Code of Business Conduct) for its directors, officers and other employees. The Company will post on its website any amendments to, or waivers from, any provision of its Code of Business Conduct. A copy of the Code of Business Conduct is available on the Company’s website at www.viavisolutions.com.

Director Independence

In accordance with current NASDAQ listing standards, the Board, on an annual basis, affirmatively determines the independence of each director and nominee for election as a director. Our director independence standards include all elements of independence set forth in the NASDAQ listing standards, and can be found in our Corporate Governance Guidelines, which are included in the “Corporate Governance” section of our website at www.viavisolutions.com. The Board has determined that each of its non-employee directors was independent as determined by the relevant NASDAQ listing standard for board independence and for any committee on which such director served during fiscal year 2016. From August 2015 to February 2016, Richard Belluzzo assumed the role of Interim President and Chief Executive Officer. Pursuant to the NASDAQ listing standards, Mr. Belluzzo was not considered to be independent while acting this capacity, but is not disqualified from later being considered an independent director by virtue of his employment status provided that he does not serve in such capacity for more than one year.

The Company is not aware of any agreements or arrangements between any director and any person or entity other than the Company relating to compensation or other payment in connection with such director’s candidacy or service as a member of the Board.

2016 Proxy Statement 11

CORPORATE GOVERNANCE

Board Leadership

The Board has determined that it is in the best interests of the Company to maintain the Board chairperson and chief executive officer positions separately. The Board believes that having an outside, independent director serve as chairperson is the most appropriate leadership structure, as this enhances its independent oversight of management and the Company’s strategic planning, reinforces the Board’s ability to exercise its independent judgment to represent stockholder interests, and strengthens the objectivity and integrity of the Board. Moreover, we believe an independent chairperson can more effectively lead the Board in objectively evaluating the performance of management, including the chief executive officer, and guide it through appropriate Board governance processes. While Mr. Belluzzo held the position of Interim President and Chief Executive Officer the Board appointed Masood Jabbar as lead independent director.

Board Oversight of Risk

The Company takes a comprehensive approach to risk management. We believe risk can arise in every decision and action taken by the Company, whether strategic or operational. The Company, therefore, seeks to include risk management principles in all of its management processes and in the responsibilities of its employees at every level. Our comprehensive approach is reflected in the reporting processes by which our management provides timely and comprehensive information to the Board to support the Board’s role in oversight, approval and decision-making.

Management is responsible for the day-to-day supervision of risk, while the Board, as a whole and through its committees, has the ultimate responsibility for the oversight of risk management. Senior management attends Board meetings, provides presentations on operations including significant risks, and is available to address any questions or concerns raised by the Board. Additionally, our committees assist the Board in fulfilling its oversight responsibilities. Generally, the committee with subject matter expertise in a particular area is responsible for overseeing the management of risk in that area. For example, the Audit Committee coordinates the Board’s oversight of the Company’s internal controls over financial reporting and disclosure controls and procedures. Management regularly reports to the Audit Committee on these areas. Additionally, the Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs as well as succession planning for senior executives. The Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, and corporate governance topics. When any of the committees receives a report related to material risk oversight, the chairman of the relevant committee reports on the discussion to the full Board.

Compensation Program Risk Assessment

Consistent with SEC disclosure requirements, in fiscal year 2016 a team composed of senior members of our human resources, finance and legal departments and our compensation consultant, Compensia, inventoried and reviewed elements of our compensation policies and practices. This team then reviewed these policies and practices with Company’s management in an effort to assess whether any of our policies or practices create risks that are reasonably likely to have a material adverse effect on the Company. This assessment included a review of the primary design features of the Company’s compensation policies and practices, the process for determining executive and employee compensation and consideration of features of our compensation program that help to mitigate risk. Management reviewed and discussed the results of this assessment with the Compensation Committee, which consulted with Compensia. Based on this review, we believe that our compensation policies and practices, individually and in the aggregate, do not create risks that are reasonably likely to have a material adverse effect on the Company.

12 2016 Proxy Statement

CORPORATE GOVERNANCE

Board Committees and Meetings

During fiscal year 2016, the Board held 6 meetings. The Board has four regular committees: an Audit Committee, Compensation Committee, Governance Committee, and Corporate Development Committee. The members of the committees during fiscal year 2016 are identified below.

Each director attended at least 75% of the aggregate of all meetings of the Board and any committees on which he or she served during fiscal year 2016 after becoming a member of the Board or after being appointed to a particular committee. The Company encourages, but does not require, its Board members to attend the Annual Meeting. All then-current directors attended the 2015 Annual Meeting, except Timothy Campos.

| Audit Committee | |

|

The

Audit Committee is responsible for assisting the full Board in fulfilling

its oversight responsibilities relative to:

●the Company’s financial

statements;

●financial reporting

practices;

●systems of internal accounting

and financial control;

●internal audit

function;

●annual independent audits of the

Company’s financial statements; and

●such legal and ethics programs as

may established from time to time by the Board. |

Members: Meetings: 9 |

|

The Audit Committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities, and personnel of the Company and may retain external consultants at its sole discretion. In addition, the Audit Committee considers whether the Company’s independent auditors’ provision of non-audit services is compatible with maintaining the independence of the independent auditors. The Board has determined that all members of the Audit Committee are “independent” as defined in the applicable rules and regulations of the SEC and NASDAQ. The Board has further determined that Keith Barnes, Pamela Strayer and Masood A. Jabbar are “audit committee financial expert(s)” as defined by Item 401(h) of Regulation S-K of the Exchange Act. A copy of the Audit Committee charter can be viewed at the Company’s website at www.viavisolutions.com. | |

| Compensation Committee | |

|

The

Compensation Committee is responsible for:

●ensuring that the Company adopts

and maintains responsible and responsive compensation programs for its

employees, officers and directors consistent with the long-range interests

of stockholders; and

●the administration of the

Company’s employee stock purchase plans and equity incentive

plans. |

Members: Meetings: 5 |

|

The chair of the Compensation Committee reports on the Compensation Committee’s actions and recommendations at Board meetings. In addition, the Compensation Committee has the authority to engage the services of outside advisors, experts and others to provide assistance as needed. During fiscal year 2016, the Compensation Committee engaged Compensia, Inc. (“Compensia”), a national compensation consulting firm, to assist with the Committee’s analysis and review of the compensation of our executive officers. Compensia attends all Compensation Committee meetings, works directly with the Committee Chair and Committee members, and sends all invoices, including descriptions of services rendered, to the Committee Chair for review and payment approval. Compensia performed no work for the Company that was not in support of the Committee’s charter nor authorized by the Committee Chair during fiscal year 2016. All members of the Compensation Committee are “independent” as that term is defined in the applicable NASDAQ rules and regulations. A copy of the Compensation Committee charter can be viewed at the Company’s website at www.viavisolutions.com. Additional information on the Compensation Committee’s processes and procedures for consideration of executive compensation are addressed in the “Compensation Discussion and Analysis” below. Pamela Strayer temporarily replaced Mr. Belluzzo as a member of the Compensation Committee during his service as Interim President and Chief Executive Officer from August 2015 to February 2016. | |

2016 Proxy Statement 13

CORPORATE GOVERNANCE

| Corporate Development Committee | |

|

The

Corporate Development Committee is responsible for:

●oversight of the Company’s

strategic transaction and investment activities. |

Members: Meetings: 4 |

|

The Corporate Development Committee reviews and approves certain strategic transactions for which approval of the full Board is not required and makes recommendations to the Board regarding those transactions for which the consideration of the full Board is appropriate. A copy of the Corporate Development Committee charter can be viewed at the Company’s website at www.viavisolutions.com. Messrs. Colvin and Braham were added to the Corporate Development Committee in October 2015. | |

| Governance Committee | |

|

The

Governance Committee:

●serves as the Company’s

nominating committee;

●reviews current trends and

practices in corporate governance; and

●recommends to the Board the

adoption of governance programs. |

Members: Meetings: 4 |

|

As provided in the charter of the Governance Committee, nominations for director may be made by the Governance Committee or by a stockholder of record entitled to vote. The Governance Committee will consider and make recommendations to the Board regarding any stockholder recommendations for candidates to serve on the Board. Stockholders wishing to recommend candidates for consideration by the Governance Committee may do so by writing to the Company’s Corporate Secretary at 430 North McCarthy Boulevard, Milpitas, California 95035 providing the candidate’s name, biographical data and qualifications, a document indicating the candidate’s willingness to act if elected, and evidence of the nominating stockholder’s ownership of Company’s stock not less than 60 days nor more than 90 days prior to the first anniversary of the date of the preceding year’s annual meeting to assure time for meaningful consideration by the Governance Committee. Our Bylaws specify in greater detail the requirements as to the form and content of the stockholder’s notice. We recommend that any stockholder wishing to nominate a director review a copy of our Bylaws, as amended and restated to date, which can be found at www.viavisolutions.com. There are no differences in the manner in which the Governance Committee evaluates nominees for director based on whether the nominee is recommended by a stockholder. All members of the Governance Committee are “independent” as that term is defined in the applicable NASDAQ rules and regulations. In reviewing potential candidates for the Board, the Governance Committee considers the individual’s experience in the Company’s industry, the general business or other experience of the candidate, the needs of the Company for an additional or replacement director, the personality of the candidate, the candidate’s interest in the business of the Company, as well as numerous other subjective criteria. Of greatest importance is the individual’s integrity, willingness to be involved and ability to bring to the Company experience and knowledge in areas that are most beneficial to the Company. The Governance Committee intends to continue to evaluate candidates for election to the Board on the basis of the foregoing criteria. A detailed description of the criteria used by the Governance Committee in evaluating potential candidates may be found in the charter of the Governance Committee. The Governance Committee operates under a written charter setting forth the functions and responsibilities of the committee. A copy of the charter can be viewed at the Company’s website at www.viavisolutions.com. Nominees for the 2016 Annual Meeting were selected by a majority of the independent directors in office. Mr. Jabbar temporarily replaced Mr. Belluzzo as a member of the Compensation Committee during his service as Interim President and Chief Executive Officer from August 2015 to February 2016. | |

14 2016 Proxy Statement

CORPORATE GOVERNANCE

Compensation Committee Interlocks and Insider Participation

No interlocking relationship exists between any member of the Company’s Board or Compensation Committee and any member of the board of directors or compensation committee of any other companies, nor has such interlocking relationship existed in the past. None of Messrs. Barnes or Campos or Ms. Strayer, who served on the Company’s Compensation Committee during fiscal year 2016, were at any time during or prior to fiscal year 2016 an officer or employee of Viavi. Mr. Belluzzo served as the Company’s Interim Chief Executive Officer for a portion of fiscal year 2016, but did not serve on the Compensation Committee during such time. In addition, none of our executive officers serves as a member of the board of directors or compensation committee of any company that has one or more of its executive officers serving as a member of our Board or Compensation Committee.

Communication between Stockholders and Directors

Stockholders may communicate with the Company’s Board through the Company’s Secretary by sending an email to bod@viavisolutions.com, or by writing to the following address: Chairman of the Board, c/o Company Secretary, Viavi Solutions, 430 North McCarthy Boulevard, Milpitas, California 95035. The Company’s Secretary will forward all correspondence to the Board, except for spam, junk mail, mass mailings, product complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate material. The Company’s Secretary may forward certain correspondence, such as product-related inquiries, elsewhere within the Company for review and possible response.

Director Compensation

Each non-employee director of the Company is entitled to receive an annual cash retainer of $60,000 which is paid in quarterly installments of $15,000. During fiscal year 2016, each non-employee director received an annual grant of restricted stock units having a value of $200,000. This initial grant was pro rated for directors who joined mid-year. The restricted stock units are subject to a grant agreement which provides for vesting on the first anniversary of the grant date. Upon vesting each restricted stock unit is converted into one share of the Company’s Common Stock. Upon retirement of a non-employee director, any unvested options and restricted shares of the Company’s Common Stock will automatically become fully vested, and the exercise period for any such options will be extended to expire on the expiration date of such options, which is generally eight years from the date of grant. Upon initial appointment to the Board, each non-employee director receives a pro-rated portion of the annual non-employee director grant.

In addition, each non-employee director serving on the Audit Committee received an annual cash retainer of $15,000, whereas the director serving as the Audit Committee chair received an annual cash retainer of $30,000. Each non-employee director serving on the Compensation Committee received an annual cash retainer of $10,000, whereas the director serving as the Compensation Committee chair received an annual cash retainer of $20,000. Each non-employee director serving on the Governance or Corporate Development Committees received an annual cash retainer of $7,500, whereas the directors serving as the Governance or Corporate Development Committee chairs received an annual cash retainer of $15,000.

Mr. Jabbar, who served as Lead Independent Director from November 2015 to February 2016, received a pro-rated cash retainer of $18,750 as compensation for his services. Additionally, Mr. Belluzzo received a pro-rated cash retainer of $39,549 for the portion of fiscal 2016 during which he served as Chairman of the Board but not as Interim Chief Executive Officer.

A special CEO search committee was formed in August 2015. The committee members were Timothy Campos, Masood Jabbar and Keith Barnes, who served as chairman of the committee. Mr. Jabbar and Mr. Campos quarterly received cash retainers of $7,500 and Mr. Barnes received a quarterly cash retainer of $15,000. Committee members received additional compensation for any meeting attended in excess of the first 10 meetings at a rate of $500 for meetings that were shorter than an hour and $1,000 for meetings that were longer than an hour. This resulted in an additional $5,000 in fees paid to each committee member.

Directors who are also employed by the Company do not receive any compensation for their services as directors. Accordingly, Mr. Belluzzo did not receive compensation as a member of the Board while he served as Interim President and Chief Executive Officer. All directors are reimbursed for expenses incurred in connection with attending Board and committee meetings.

2016 Proxy Statement 15

CORPORATE GOVERNANCE

Director compensation described above is summarized in the following table:

| Compensation Element for Role | Board Compensation | ||||

| General Board Service – Cash | |||||

|

▷Retainer

▷Meeting Fees |

▷$60,000

▷Not applicable (“NA”) |

||||

| General Board Service – Equity | |||||

|

▷RSU Value

▷Vesting Schedule |

▷$200,000

▷Vest on the first anniversary of the grant

date

▷Number of shares determined using 30 calendar day average stock

price prior to date of grant | ||||

| Chair | Member | ||||

| Committee

Service (No meeting fees) |

Audit

Compensation

Governance/Corporate Development |

$30,000 | $15,000 | ||

| $20,000 | $10,000 | ||||

| $15,000 | $7,500 | ||||

| Non-Employee Board Chair | |||||

|

▷Additional Board Retainer

▷Additional Equity |

▷$75,000

▷NA |

||||

The director compensation policies summarized above resulted in the following total compensation for our non-management directors in fiscal year 2016:

Director Compensation Table

| Name (1) | Fees

Earned-or Paid in Cash ($) |

Stock

Awards ($) (2) |

Option

Awards ($) (2) |

Total ($) |

|||||

| Keith Barnes (3) | 137,500 | 246,620 | 0 | 384,120 | |||||

| Richard E. Belluzzo (4) | 89,732 | 614,589 | 596 | 704,918 | |||||

| Tor Braham (5) | 62,511 | 225,469 | 0 | 287,979 | |||||

| Timothy Campos (6) | 97,500 | 242,257 | 0 | 339,757 | |||||

| Donald Colvin (7) | 62,511 | 225,469 | 0 | 287,979 | |||||

| Masood A. Jabbar (8) | 143,750 | 246,620 | 458 | 390,828 | |||||

| Pamela Strayer (9) | 86,069 | 387,148 | 0 | 473,216 |

| (1) | Thomas Waechter and Oleg Khaykin, both of whom served as the Company’s Chief Executive Officer and President during fiscal year 2016, are not included in this table as they were employees of the Company and as such received no compensation for their services as a director. Their compensation is disclosed in the Summary Compensation Table. |

| (2) | The amounts shown in this column are the grant date fair value in the period presented as determined pursuant to stock-based compensation accounting rule FASB ASC Topic 718, excluding the effect of estimated forfeitures, as well as the incremental fair value attributable to stock awards that were modified in fiscal year 2016 in connection with the separation of the Lumentum business. The assumptions used to calculate these amounts are set forth under Note 15 of the Notes to Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for fiscal year 2016 filed with the SEC on August 30, 2016. |

| (3) | Mr. Barnes had no options and 52,527 restricted stock units outstanding at the end of fiscal year 2016. |

| (4) | Mr. Belluzzo had no options and 46,275 restricted stock units outstanding at the end of fiscal year 2016. Compensation reflects only cash and stock awards granted to Mr. Belluzzo in connection with his service a member of the Board. Mr. Belluzzo’s full compensation, including amounts received while he served as Interim Chief Executive Officer is disclosed in the Summary Compensation Table. |

| (5) | Mr. Braham had no options and 36,919 restricted stock units outstanding at the end of fiscal year 2016. |

| (6) | Mr. Campos had no options and 54,782 restricted stock units outstanding at the end of fiscal year 2016. |

| (7) | Mr. Colvin had no options and 36,919 restricted stock units outstanding at the end of fiscal year 2016. |

| (8) | Mr. Jabbar had no options and 52,527 restricted stock units outstanding at the end of fiscal year 2016. |

| (9) | Ms. Strayer had no options and 67,401 restricted stock units outstanding at the end of fiscal year 2016. |

16 2016 Proxy Statement

CORPORATE GOVERNANCE

Relationships Among Directors or Executive Officers

There are no family relationships among any of the Company’s directors or executive officers.

Certain Relationships and Related Person Transactions

Review and Approval of Related Person Transactions

We review all relationships and transaction in which the Company and our directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest. The Company’s legal staff is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related person transactions and for then determining, based on the facts and circumstances, whether the Company or a related person has a direct or indirect material interest in the transaction. On an annual basis, all directors and executive officers must respond to a questionnaire requiring disclosure about any related person transactions, arrangements or relationships (including indebtedness). As required under SEC rules, any transactions that are determined to be directly or indirectly material to the Company or a related person are disclosed in the Company’s Proxy Statement. The Audit Committee reviews and approves or ratifies any related person transaction that is required to be disclosed. This review and approval process is evidenced in the minutes of the Audit Committee meetings.

Executive Officers

The following sets forth certain information regarding the Company’s executive officers as of the date of this Proxy Statement:

| Executive Officer | Age | Position | ||

| Oleg Khaykin | 51 | Chief Executive Officer and President | ||

| Amar Maletira | 46 | Chief Financial Officer, Executive Vice President | ||

| Dion Joannou | 51 | Senior Vice President, Global Sales, Network Enablement and Service Enablement | ||

| Paul McNab | 54 | Executive Vice President, Chief Marketing and Strategy Officer | ||

| Ralph Rondinone | 54 | Senior Vice President, Global Operations, Network Service Enablement | ||

| Luke Scrivanich | 54 | Senior Vice President & General Manager, Optical Security & Performance Products | ||

| Kevin Siebert | 47 | Vice President, General Counsel and Secretary | ||

| Susan Spradley | 55 | Executive Vice President & General Manager Product Line Management & Design, Network Enablement and Service Enablement |

Oleg Khaykin joined Viavi in February 2016 as President and CEO. Prior to joining the Company, Mr. Khaykin was a Senior Advisor with Silver Lake Partners from February 2015 to February 2016. Before that, Mr. Khaykin was President and CEO of International Rectifier from 2008 until its acquisition by Infineon AG in the January of 2015. He has also served as Chief Operating Officer of Amkor Technology and Vice President of Strategy & Business Development at Conexant Systems. Earlier in his career he spent eight years with The Boston Consulting Group and prior to that, he was an engineer at Motorola. Mr. Khaykin holds an MBA from Kellogg School of Management at Northwestern University and a B.S. in Electrical and Computer Engineering with honors from Carnegie-Mellon University.

Amar Maletira joined the Company in September 2015 as Chief Financial Officer. Prior to joining the Company, Mr. Maletira spent 14 years at Hewlett Packard serving in a number of senior positions in Finance, most recently as Chief Financial Officer & Vice President, Enterprise Services Americas. From 1998 to 2000, Mr. Maletira was Chief Operating Officer and Vice President of a start-up IT consulting company, DPP Incorporated. Prior to that, Mr. Maletira led sales teams at Siemens and HCL in India. Mr. Maletira holds a B.S. in Electronics & Communication Engineering from Gogte Institute of Technology at Karnataka University in India and an M.B.A. from the Ross School of Business in Ann Arbor, Michigan.

2016 Proxy Statement 17

CORPORATE GOVERNANCE

Dion Joannou joined the Company as Senior Vice President of global sales in January 2015. Prior to joining the Company, Mr. Joannou served as Chief Executive Officer of Advantix Systems from 2011 to 2013. From 2009 to 2010, Mr. Joannou served as Chief Executive Officer at The Neptune Society. Mr. Joannou also held a number of executive positions during his 15-year career at Nortel Networks, including roles as president for North America for both the enterprise and carrier markets, chief strategy officer, president for the Caribbean and Latin America, and vice president of Vodafone global account. Mr. Joannou holds a B.A. in business administration from Southern Illinois University and an M.B.A from the University of Miami.

Paul McNab joined the Company in September 2014 as Executive Vice President and Chief Marketing and Strategy Officer. Prior to joining the Company, Mr. McNab was CEO of Puro Networks from 2013 to 2014. Before that, Mr. McNab was with Cisco Systems, Inc. for sixteen years where he held increasingly senior roles including Vice President and Chief Technology Officer, Data Center Switching and Vice President, Enterprise Marketing. Mr. McNab holds a B.S. in Engineering from Manchester Metropolitan University in the United Kingdom.

Ralph Rondinone joined the Company in April 2012 as Senior Vice President of Global Operations and Services. Prior to joining the Company, Mr. Rondinone served as Senior Vice President of Operations at BigBand Networks from 2006 to 2012. Prior to that, Mr. Rondinone held executive positions in operations at Lucent Technologies, Ascend Communications, and Digital Equipment Corporation. Mr. Rondinone holds a B.S. in mechanical engineering from Worcester Polytechnic Institute.

Luke Scrivanich became the Vice President and General Manager of Optical Security and Performance Products (OSP) in June 2012 and became Senior Vice President and General Manager of OSP in August 2012. Mr. Scrivanich joined the Company in April 2008 as Vice President and General Manager of Flex Products. Prior to joining the Company in 2008, Mr. Scrivanich was with PPG Industries where he served in general management, marketing and strategic planning positions for various divisions, including fine chemicals, optical products and coatings. He previously held senior marketing positions at AGR International, Inc., a manufacturer of packaging inspection equipment. Mr. Scrivanich holds a B.S. in Chemical Engineering from Cornell University and an M.B.A. from the Harvard Graduate School of Business Administration.

Kevin Siebert joined the Company in September 2007 and became Vice President, General Counsel and Secretary in February 2015. Before assuming the General Counsel role, Mr. Siebert held increasingly senior roles within the Company’s legal department. Before joining the Company, Mr. Siebert was Senior Counsel at France Telecom from 2004 to 2007 where he primarily had legal responsibility for North American operations and also handled mergers and acquisitions, among other functions. Prior to that, Mr. Siebert served as in-house counsel at a technology company and held associate roles in private practice, focusing on mergers and acquisitions, corporate and telecommunications matters. Mr. Siebert holds a B.A. in Political Science from the University of Richmond and a J.D. from the Washington University School of Law.

Susan Spradley joined the Company in January 2013 and became Executive Vice President and General Manager NSE Solutions and R&D in July 2015. Before joining the Company, Ms. Spradley served as executive director at US-Ignite from April 2011 to December 2012. Prior to that, Ms. Spradley was President of the North America region at Nokia Siemens Networks from 2007 to 2011 responsible for regional p&l, sales and service. From 1997 to 2005 she held executive positions at Nortel. She is also chair of a White House and National Science Foundation initiative, called U.S. Ignite. Ms. Spradley holds a B.S. in Computer Science from University of Kansas, Lawrence and completed an Advanced Management Program at Harvard Business School.

18 2016 Proxy Statement

PROPOSAL 2

Ratification of Independent Auditors

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP as the Company’s independent auditors for the fiscal year ending July 1, 2017, and the Board has directed that the selection of the independent auditors be submitted for ratification by the stockholders at the Annual Meeting.

Although the Company is not required to seek stockholder approval of its selection of the independent auditors, the Board believes it to be sound corporate governance to do so. If the appointment is not ratified, the Board will investigate the reasons for stockholder rejection and will reconsider its selection of the independent auditors. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the fiscal year if the Audit Committee determines that such a change would be in the Company’s and its stockholders’ best interests.

Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Audit and Non-Audit Fees

The following table presents fees billed for professional audit services rendered by PricewaterhouseCoopers LLP for the audit of the Company’s annual financial statements for the years ended July 2, 2016 and June 27, 2015, respectively, and fees billed for other services rendered by PricewaterhouseCoopers LLP and during those periods.

| Fiscal 2016 | Fiscal 2015 | |||

| Audit Fees (1) | $2,963,443 | $ 5,442,605 | ||

| Audit-Related Fees | 0 | 0 | ||

| Tax Fees (2) | 1,023,866 | 501,785 | ||

| All Other Fees (3) | 0 | 100,165 | ||

| Total | $3,987,309 | $ 6,044,555 |

| (1) | Audit Fees are related to professional services rendered in connection with the audit of the Company’s annual financial statements, the audit of internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002, reviews of financial statements included in the Company’s Quarterly Reports on Form 10-Q, and audit services provided in connection with other statutory and regulatory filings. Fees include $692,000 and $2,320,000 for fiscal 2016 and 2015, respectively, for services performed by PricewaterhouseCoopers LLP in connection with the separation and spin-off of Lumentum Holdings Inc. |

| (2) | Tax Fees for fiscal 2016 and 2015 include professional services rendered in connection with transfer pricing consulting, tax audits, planning services and other tax consulting. The fees include $860,000 and $397,000 for fiscal 2016 and 2015, respectively, for services performed by PricewaterhouseCoopers LLP in connection with the separation and spin-off of Lumentum Holdings Inc. |

| (3) | All Other Fees in fiscal 2015 are related to the annual Workforce Engagement Survey and other non-audit related services. |

For fiscal year 2016, the Audit Committee considered whether audit-related services and services other than audit-related services provided by PricewaterhouseCoopers LLP are compatible with maintaining the independence of PricewaterhouseCoopers LLP and concluded that the independence of PricewaterhouseCoopers LLP was maintained.

2016 Proxy Statement 19

PROPOSAL 2

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services and other services. The Audit Committee has adopted a policy for the pre-approval of services provided by the independent auditors. Under the policy, pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is subject to a specific budget. In addition, the Audit Committee may also pre-approve particular services on a case-by-case basis. For each proposed service, the independent auditors are required to provide detailed back-up documentation at the time of approval. Pursuant to the Sarbanes-Oxley Act of 2002, the fees and services provided as noted in the table above were authorized and approved by the Audit Committee in compliance with the pre-approval policies and procedures described herein.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE YEAR ENDING JULY 1, 2017.

20 2016 Proxy Statement

PROPOSAL 3

Advisory Vote on Executive Compensation

The Company’s goal for its executive compensation program is to attract, motivate and retain the executive talent necessary to achieve its business objectives. The Company believes that it can best drive long-term stockholder value by establishing a strong pay-for-performance system.

At the Company’s 2015 annual meeting of stockholders, approximately 73% of the votes cast were voted in favor of approving the compensation of the Company’s Named Executive Officers (“NEOs”). In the months leading up to and following the vote, the Company reached out to a significant number of its major stockholders. After considering their feedback, as well as current market practices, in May 2015 the Company modified its stock ownership guidelines so that unvested restricted stock units would no longer count towards the ownership requirements for directors and executive officers.

The Compensation Discussion and Analysis (“CD&A”) section of this Proxy Statement includes a detailed description of the Company’s compensation philosophy, as well as an analysis of how the compensation of its NEOs in fiscal year 2016 aligned with that philosophy. Highlights of the Company’s compensation practices include:

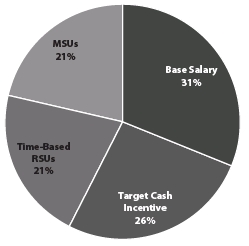

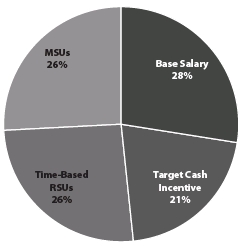

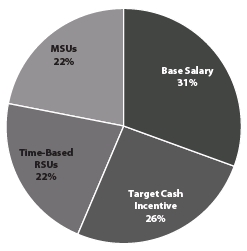

| ● |

Approximately 50% of each NEO’s total target compensation is performance-based, consisting of cash incentive compensation and RSUs with performance-based vesting conditions, as described below. |

| ● |

The Company emphasizes pay for performance. Cash incentive compensation paid to its NEOs is generally paid pursuant to the Company’s Variable Pay Plan (the “VPP”), with payments directly tied to attainment of the Company’s operating income objective. |

| ● |

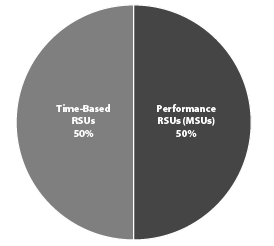

50% of the RSUs awarded to the Company’s NEOs have time-based vesting requirements – the ultimate value of these awards is directly tied to the performance of the Company’s stock, encouraging management to drive stockholder value which also encouraging retention of key employees. The other 50% of RSUs awarded to the Company’s NEOs have vesting requirements tied to the performance of the Company’s stock as compared to the NASDAQ telecommunications index, and could vest at a higher or lower rate or not at all, based on this relative performance. We refer to these performance-based RSUs as market stock units, or “MSUs.” |

| ● |

The Company does not generally provide perquisites or other benefits to its NEOs that are not available to all employees. |

| ● |

We regularly evaluate our compensation practices and modify our programs as appropriate to address evolving best practices. For example, in fiscal year 2016 we modified the vesting conditions for the MSUs to make them more difficult to achieve and modified our stock ownership guidelines to further align executive compensation with stockholder interests. |

We urge stockholders to read the CD&A section of this Proxy Statement beginning on page 23 which describes in more detail how our executive compensation practices operate and are designed to achieve our compensation objectives.

In accordance with section 14A of the Securities Exchange Act, stockholders will have the opportunity to cast a non-binding, advisory vote on the compensation of our NEOs. You are encouraged to read the Executive Compensation section of this Proxy Statement, including the CD&A, along with the accompanying tables and narrative disclosure. Accordingly, we are asking you to approve, on an advisory basis, the compensation of the Company’s NEOs, as described in the CD&A, the accompanying tables and the related narrative disclosure contained therein.

The following resolution will be submitted for stockholder vote at the Annual Meeting: “RESOLVED, that the stockholders approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Company’s proxy statement for the 2016 Annual Meeting of stockholders pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, compensation tables and related narrative discussion.” Although the advisory vote is non-binding, the Compensation Committee and the Board will review the results of the vote and the Compensation Committee will consider the results of the vote when making future compensation decisions. Unless the Board of Directors modifies its determination on the frequency of future advisory votes, the next advisory vote on the compensation of the Company’s NEOs will be held at the fiscal 2017 annual meeting of stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE, ON AN ADVISORY BASIS, “FOR” THE APPROVAL OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS, AS DESCRIBED IN THE CD&A, THE COMPENSATION TABLES AND THE RELATED NARRATIVE DISCUSSION IN THIS PROXY STATEMENT.

2016 Proxy Statement 21

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to the Company with respect to the beneficial ownership as of August 31, 2016, by (i) all persons who are beneficial owners of five percent (5%) or more of the Company’s Common Stock, (ii) each director and nominee, (iii) the Company’s named executive officers, and (iv) all current directors and executive officers as a group.

As of August 31, 2016, there were 232,733,763 shares of the Company’s Common Stock outstanding. The amounts and percentages of Common Stock beneficially owned are reported on the basis of regulations of the Securities and Exchange Commission (“SEC”) governing the determination of beneficial ownership of securities. Under the SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Under these rules, more than one person may be deemed a beneficial owner of securities as to which such person has no economic interest.

| Number of Shares | ||||

| Beneficially Owned | ||||

| Name | Number | Percentage | ||

| 5% or more Stockholders (1) | ||||

| Capital Research Global Investor 333 South Hope Street Los Angeles, CA 90071 | 27,669,274 | 11.90% | ||

| The Bank of New York Mellon Corporation One Wall Street, 31st Floor New York, NY 10022 | 16,693,348 | 7.17% | ||

| BlackRock, Inc. 40 East 52nd Street New York, NY 10022 | 23,443,879 | 10.07% | ||

| The Vanguard Group 100 Vanguard Boulevard Malvern, PA 19355-2331 | 17,461,158 | 7.50% | ||

| Goldman Sachs Asset Management 200 West Street c/o Goldman Sachs & Co. New York, NY 10282 | 16,802,154 | 7.22% | ||

| Directors and Executive Officers | ||||

| Oleg Khaykin | 0 | * | ||

| Amar Maletira (2) | 95,454 | * | ||

| Susan Spradley (3) | 68,383 | * | ||

| Dion Joannou (4) | 17,333 | * | ||

| Luke Scrivanich (5) | 155,287 | * | ||

| Thomas Waechter (6) | 537,060 | * | ||

| Rex S. Jackson (7) | 201,397 | * | ||

| Richard E. Belluzzo | 140,128 | * | ||

| Keith Barnes | 44,164 | * | ||

| Tor Braham (8) | 4,186 | * | ||

| Timothy Campos | 20,092 | * | ||

| Donald Colvin (9) | 4,186 | * | ||

| Masood A. Jabbar | 96,201 | * | ||

| Pamela Strayer | 11,556 | * | ||

| All directors and executive officers as a group (15 persons) (10) | 825,891 | * | ||

| * | Less than 1%. |

| (1) | Based on information set forth in various Schedule 13 filings with the SEC current as of August 31, 2016 and the Company’s outstanding common stock data as of August 31, 2016. |

| (2) | Includes (i) 47,727 RSUs which vest within 60 days of August 31, 2016 and (ii) 47,727 market stock units (“MSUs”). MSUs are reported at 100% of the target number of shares scheduled to vest within 60 days of August 31, 2016. The actual number of shares that vest will range from 0% to 150% of the target amount. Details of the conditions and terms under which the MSUs will vest begin on page 32 of this Proxy Statement. |

| (3) | Includes 50,865 MSUs which vest within 60 days of August 31, 2016 |

| (4) | Includes 17,333 MSUs which vest within 60 days of August 31, 2016. |

| (5) | Includes (i) 88,530 shares subject to stock options currently exercisable within 60 days of August 31, 2016 and (ii) 47,819 MSUs which vest within 60 days of August 31, 2016. |

| (6) | Includes 537,060 shares subject to stock options currently exercisable within 60 days of August 31, 2016. |

| (7) | Includes 201,397 shares subject to stock options currently exercisable within 60 days of August 31, 2016. |

| (8) | Includes 4,186 RSUs which vest within 60 days of August 31, 2016. |

| (9) | Includes 4,186 RSUs which vest within 60 days of August 31, 2016. |

| (10) | Includes (i) 88,530 shares subject to stock options currently exercisable within 60 days of August 31, 2016, (ii) 100,854 RSUs which vest within 60 days of August 31, 2016, and (iii) 279,156 MSUs which vest within 60 days of August 31, 2016. |

22 2016 Proxy Statement

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

| Performance Overview |

Fiscal year 2016 was a transformative year for the Company, beginning with the successful spin-off of Lumentum in the first fiscal quarter and the hiring of a new executive team, including our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”). When setting executive compensation for fiscal year 2016, the Compensation Committee of the Board (the “Committee”) considered a comprehensive set of factors, including:

| ● |

The Company’s prior fiscal year performance and the prior three-year period, in keeping with the Company’s focus on long-term growth and performance. |

| ● |

The achievements of the Company’s named executive officers’ (“NEOs”) and others in completing the spin-off. |

| ● |

The importance of retaining certain individuals in light of their prior contributions and in recognition of the importance of continuity in achieving the Company’s goals during fiscal year 2016. |