Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number 1-12874

TEEKAY CORPORATION

(Exact name of Registrant as specified in its charter)

Republic of The Marshall Islands

(Jurisdiction of incorporation or organization)

Not Applicable

(Translation of Registrant’s name into English)

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Telephone: (441) 298-2530

(Address and telephone number of principal executive offices)

Edith Robinson

4th Floor, Belvedere Building, 69 Pitts Bay Road, Hamilton, HM 08, Bermuda

Telephone: (441) 298-2530

Fax: (441) 292-3931

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered, or to be registered, pursuant to Section 12(b) of the Act.

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, par value of $0.001 per share | New York Stock Exchange |

Securities registered, or to be registered, pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

72,500,502 shares of Common Stock, par value of $0.001 per share.

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if the registrant (1) has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer x Accelerated Filer ¨ Non-Accelerated Filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP x | International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ |

Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Table of Contents

INDEX TO REPORT ON FORM 20-F

INDEX

| PAGE | ||||||

| Item 1. |

4 | |||||

| Item 2. |

4 | |||||

| Item 3. |

4 | |||||

| 4 | ||||||

| 7 | ||||||

| 17 | ||||||

| Item 4. |

18 | |||||

| 18 | ||||||

| 21 | ||||||

| 25 | ||||||

| 25 | ||||||

| 26 | ||||||

| 26 | ||||||

| 27 | ||||||

| 27 | ||||||

| 27 | ||||||

| 31 | ||||||

| 33 | ||||||

| 33 | ||||||

| 33 | ||||||

| 34 | ||||||

| 34 | ||||||

| Item 4A. |

34 | |||||

| Item 5. |

34 | |||||

| 34 | ||||||

| 35 | ||||||

| 36 | ||||||

| 37 | ||||||

| 58 | ||||||

| 62 | ||||||

| 63 | ||||||

| 63 | ||||||

| Item 6. |

67 | |||||

| 67 | ||||||

| 69 | ||||||

| Options to Purchase Securities from Registrant or Subsidiaries |

69 | |||||

| 69 | ||||||

| 71 | ||||||

| 71 | ||||||

1

Table of Contents

| Item 7. | Major Shareholders and Certain Relationships and Related Party Transactions | 71 | ||||

| 71 | ||||||

| 72 | ||||||

| 72 | ||||||

| 72 | ||||||

| Item 8. |

75 | |||||

| Item 9. |

75 | |||||

| Item 10. |

76 | |||||

| 76 | ||||||

| 76 | ||||||

| Exchange Controls and Other Limitations Affecting Security Holders |

77 | |||||

| 77 | ||||||

| 77 | ||||||

| 81 | ||||||

| 81 | ||||||

| Item 11. |

81 | |||||

| Item 12. |

83 | |||||

| Item 13. |

83 | |||||

| Item 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds |

83 | ||||

| Item 15. |

83 | |||||

| Management’s Report on Internal Control over Financial Reporting |

84 | |||||

| Item 16A. |

84 | |||||

| Item 16B. |

84 | |||||

| Item 16C. |

84 | |||||

| Item 16D. |

85 | |||||

| Item 16E. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

85 | ||||

| Item 16F. |

85 | |||||

| Item 16G. |

85 | |||||

| Item 16H. |

85 | |||||

| Item 17. |

85 | |||||

| Item 18. |

85 | |||||

| Item 19. |

86 | |||||

| 88 | ||||||

2

Table of Contents

This annual report of Teekay Corporation on Form 20-F for the year ended December 31, 2014 (or Annual Report) should be read in conjunction with the consolidated financial statements and accompanying notes included in this report.

Unless otherwise indicated, references in this Annual Report to “Teekay,” “the Company,” “we,” “us” and “our” and similar terms refer to Teekay Corporation and its subsidiaries.

In addition to historical information, this Annual Report contains forward-looking statements that involve risks and uncertainties. Such forward-looking statements relate to future events and our operations, objectives, expectations, performance, financial condition and intentions. When used in this Annual Report, the words “expect,” “intend,” “plan,” “believe,” “anticipate,” “estimate” and variations of such words and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this Annual Report include, in particular, statements regarding:

| • | the timing for implementation of the new Teekay dividend policy; |

| • | the anticipated sale of the Petrojarl Knarr floating production, storage and offloading (or FPSO) unit to Teekay Offshore, including the purchase price, the timing of completion of field installation, contract start-up at full charter rate and the sale, and Teekay Offshore’s ability to finance the purchase price; |

| • | our future financial condition or results of operations and future revenues and expenses; |

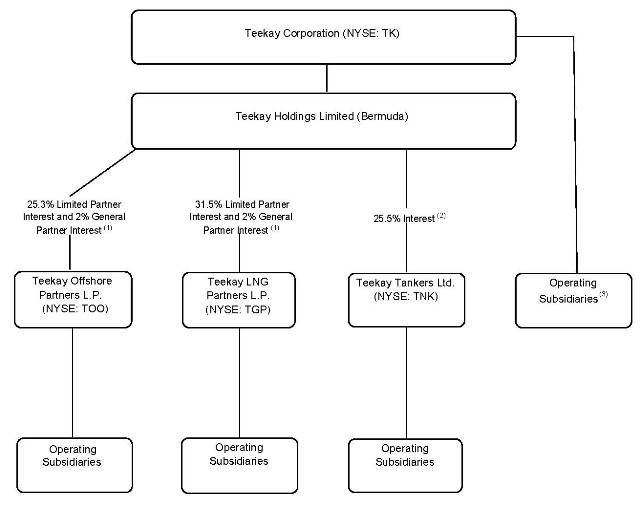

| • | our plans for Teekay Parent, which excludes our controlling interests in our publicly-listed subsidiaries, Teekay Offshore, Teekay LNG and Teekay Tankers (or the Daughter Companies), and includes Teekay and its remaining subsidiaries, not to have a direct ownership in any conventional tankers and FPSO units, to increase its free cash flow per share and to grow distributions of Teekay Offshore and Teekay LNG; |

| • | tanker market conditions and fundamentals, including the balance of supply and demand in these markets and spot tanker charter rates and oil production; |

| • | the expected positive impact of floating storage on tanker demand in the first half of 2015; |

| • | the relative size of the newbuilding orderbook and the pace of future newbuilding orders in the tanker industry generally; |

| • | offshore, liquefied natural gas (or LNG) and liquefied petroleum gas (or LPG) market conditions and fundamentals, including the balance of supply and demand in these markets; |

| • | our future growth prospects; |

| • | future capital expenditure commitments and the financing requirements for such commitments; |

| • | expected costs, capabilities, delivery dates of and financing for newbuildings, acquisitions and conversions including the floating accommodation units (or FAUs), the LNG carriers for Teekay LNG’s new 50/50 joint venture with China LNG (or the Yamal LNG Joint Venture), the LNG carriers acquired by Teekay LNG from BG International Limited, towage vessels, Libra FPSO conversion, and the commencement of service of newbuildings under long-term time-charter contracts; |

| • | the ability to recover from insurance or the charterer certain costs associated with the repair, emergency response and capital upgrades relating to the Petrojarl Banff FPSO unit and the Apollo Spirit storage tanker related to storm damage to the vessels which occurred in December 2011; |

| • | our expectation that the Petrojarl Banff FPSO unit will remain under contract until the end of 2020; |

| • | the ability of Tanker Investments Ltd. (or TIL) to benefit from the cyclical tanker market; |

| • | our ability to obtain charter contracts for newbuildings; |

| • | the exercise of options to order additional M-type, Electronically Controlled, Gas Injection (or MEGI) LNG carrier newbuildings, and the chartering of any such vessels; |

| • | expected financing for the Yamal LNG Joint Venture; |

| • | the cost of supervision contract and crew training in relation to, and expected financing of future shipyard installment payments for the BG Joint Venture; |

| • | the exercise of any counterparty’s rights to terminate a lease, or to obligate us to purchase a leased vessel, or failure to exercise such rights, including the rights under the leases and charters for two of Teekay LNG’s Suezmax tankers; |

| • | the future valuation or impairment of goodwill; |

| • | our expectations as to any impairment of our vessels; |

| • | the adequacy of restricted cash deposits to fund capital lease obligations; |

| • | future debt refinancings and our ability to fulfill our debt obligations; |

| • | compliance with financing agreements and the expected effect of restrictive covenants in such agreements; |

| • | operating expenses, availability of crew and crewing costs, number of off-hire days, dry-docking requirements and durations and the adequacy and cost of insurance; |

3

Table of Contents

| • | the effectiveness of our risk management policies and procedures and the ability of the counterparties to our derivative contracts to fulfill their contractual obligations; |

| • | the impact of recent and future regulatory changes or environmental liabilities; |

| • | the impact of future changes in the demand and price of oil; |

| • | the expected resolution of legal claims against us; |

| • | payment of additional consideration for our acquisitions of ALP Maritime Services B.V. (or ALP) and Logitel Offshore Holding AS (or Logitel) and the capabilities of the ALP vessels and FAUs; |

| • | the expected purchase by Teekay Offshore, through ALP, of six modern on-the-water long-distance towing and offshore installation vessels and our expectation that ALP will become the world’s largest owner and operator of such vessels; |

| • | the ability of Teekay Offshore to grow its long-distance ocean towage and offshore installation services business; |

| • | expected uses of proceeds from vessel or securities transactions; |

| • | features and performance of next generation HiLoad dynamic positioning (or DP) units and Teekay Offshore’s ability to successfully secure a contract for the HiLoad DP unit; |

| • | the impact of our restructuring activities; |

| • | anticipated funds for liquidity needs and the sufficiency of cash flows; |

| • | our expectations regarding whether the UK taxing authority can successfully challenge the tax benefits available under certain of our former and current leasing arrangements, and the potential financial exposure to us if such a challenge is successful; |

| • | our hedging activities relating to foreign exchange, interest rate and spot market risks; |

| • | our business strategy and other plans and objectives for future operations; and |

| • | our ability to pay dividends on our common stock. |

Forward-looking statements involve known and unknown risks and are based upon a number of assumptions and estimates that are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially include, but are not limited to, those factors discussed below in “Item 3. Key Information—Risk Factors” and other factors detailed from time to time in other reports we file with the U.S. Securities and Exchange Commission (or SEC).

We do not intend to revise any forward-looking statements in order to reflect any change in our expectations or events or circumstances that may subsequently arise. You should carefully review and consider the various disclosures included in this Annual Report and in our other filings made with the SEC that attempt to advise interested parties of the risks and factors that may affect our business, prospects and results of operations.

| Item 1. | Identity of Directors, Senior Management and Advisors |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

| Item 3. | Key Information |

Set forth below is selected consolidated financial and other data of Teekay for fiscal years 2010 through 2014, which have been derived from our consolidated financial statements. The data below should be read in conjunction with the consolidated financial statements and the notes thereto and the Reports of the Independent Registered Public Accounting Firm therein with respect to fiscal years 2014, 2013, and 2012 (which are included herein) and “Item 5. Operating and Financial Review and Prospects.”

Our consolidated financial statements are prepared in accordance with United States generally accepted accounting principles (or GAAP).

4

Table of Contents

| Years Ended December 31, | ||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

| (in thousands of U.S. Dollars, except share, per share, and fleet data) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Revenues |

$ | 2,113,604 | $ | 1,976,022 | $ | 1,980,771 | $ | 1,830,085 | $ | 1,993,920 | ||||||||||

| Income (loss) from vessel operations(1) |

234,123 | 108,412 | (150,393 | ) | 62,746 | 427,159 | ||||||||||||||

| Interest expense |

(136,107 | ) | (137,604 | ) | (167,615 | ) | (181,396 | ) | (208,529 | ) | ||||||||||

| Interest income |

12,999 | 10,078 | 6,159 | 9,708 | 6,827 | |||||||||||||||

| Realized and unrealized (loss) gain on non-designated derivative instruments |

(299,598 | ) | (342,722 | ) | (80,352 | ) | 18,414 | (231,675 | ) | |||||||||||

| Equity (loss) income from joint ventures |

(11,257 | ) | (35,309 | ) | 79,211 | 136,538 | 128,114 | |||||||||||||

| Foreign exchange gain (loss) |

31,983 | 12,654 | (12,898 | ) | (13,304 | ) | 13,431 | |||||||||||||

| Other (loss) income |

(5,118 | ) | 12,360 | 366 | 5,646 | (1,152 | ) | |||||||||||||

| Income tax recovery (expense) |

6,340 | (4,290 | ) | 14,406 | (2,872 | ) | (10,173 | ) | ||||||||||||

| Net (loss) income |

(166,635 | ) | (376,421 | ) | (311,116 | ) | 35,480 | 124,002 | ||||||||||||

| Less: Net (income) loss attributable to non-controlling interests |

(100,652 | ) | 17,805 | 150,936 | (150,218 | ) | (178,759 | ) | ||||||||||||

| Net loss attributable to shareholders of Teekay Corporation |

(267,287 | ) | (358,616 | ) | (160,180 | ) | (114,738 | ) | (54,757 | ) | ||||||||||

| Per Common Share Data: |

||||||||||||||||||||

| Basic loss attributable to shareholders of Teekay Corporation |

(3.67 | ) |

|

(5.11 |

) |

(2.31 | ) | (1.63 | ) | (0.76 | ) | |||||||||

| Diluted loss attributable to shareholders of Teekay Corporation |

(3.67 | ) | (5.11 | ) | (2.31 | ) | (1.63 | ) | (0.76 | ) | ||||||||||

| Cash dividends declared |

1.2650 | 1.2650 | 1.2650 | 1.2650 | 1.2650 | |||||||||||||||

| Balance Sheet Data (at end of year): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 779,748 | $ | 692,127 | $ | 639,491 | $ | 614,660 | $ | 806,904 | ||||||||||

| Restricted cash |

576,271 | 500,154 | 533,819 | 502,732 | 119,351 | |||||||||||||||

| Vessels and equipment |

6,771,375 | 7,890,761 | 7,321,058 | 7,351,144 | 8,106,247 | |||||||||||||||

| Net investments in direct financing leases |

487,516 | 459,908 | 436,601 | 727,262 | 704,953 | |||||||||||||||

| Total assets |

9,912,348 | 11,137,677 | 11,002,025 | 11,555,701 | 11,864,212 | |||||||||||||||

| Total debt (including capital lease obligations) |

5,170,198 | 6,091,420 | 6,197,288 | 6,707,799 | 6,800,048 | |||||||||||||||

| Capital stock and additional paid-in capital |

672,684 | 660,917 | 681,933 | 713,760 | 770,759 | |||||||||||||||

| Non-controlling interest |

1,353,561 | 1,863,798 | 1,876,085 | 2,071,262 | 2,290,305 | |||||||||||||||

| Total equity |

3,332,008 | 3,303,794 | 3,191,474 | 3,203,050 | 3,388,633 | |||||||||||||||

| Number of outstanding shares of common stock |

72,012,843 | 68,732,341 | 69,704,188 | 70,729,399 | 72,500,502 | |||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Net revenues (2) |

$ | 1,868,507 | $ | 1,799,408 | $ | 1,842,488 | $ | 1,717,867 | $ | 1,866,073 | ||||||||||

| EBITDA (3) |

390,838 | 184,003 | 291,832 | 641,126 | 758,781 | |||||||||||||||

| Adjusted EBITDA (3) |

729,695 | 686,795 | 830,676 | 817,382 | 1,037,284 | |||||||||||||||

| Total debt to total capitalization(4) |

60.8 | % | 64.9 | % | 66.0 | % | 67.7 | % | 66.7 | % | ||||||||||

| Net debt to total net capitalization (5) |

53.4 | % | 59.8 | % | 61.2 | % | 63.6 | % | 63.4 | % | ||||||||||

| Capital expenditures: |

||||||||||||||||||||

| Vessel and equipment purchases (6) |

$ | 343,091 | $ | 755,045 | $ | 523,597 | $ | 753,755 | $ | 994,931 | ||||||||||

| (1) Income (loss) from vessel operations include, among other things, the following: |

| |||||||||||||||||||

| Years Ended December 31, | ||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Asset impairments, loan loss provisions and net (loss) gain on sale of vessels and equipment |

($ | 49,150 | ) | ($ | 151,059 | ) | ($ | 441,057 | ) | ($ | 166,358 | ) | $ | 11,271 | ||||||

| Unrealized losses on derivative instruments |

(4,875 | ) | (791 | ) | (660 | ) | (130 | ) | — | |||||||||||

| Restructuring charges |

(16,396 | ) | (5,490 | ) | (7,565 | ) | (6,921 | ) | (9,826 | ) | ||||||||||

| Goodwill impairment charge |

— | (36,652 | ) | — | — | — | ||||||||||||||

| Bargain purchase gain |

— | 68,535 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| $ | (70,421 | ) | $ | (125,457 | ) | $ | (449,282 | ) | $ | (173,409 | ) | $ | 1,445 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (2) | Consistent with general practice in the shipping industry, we use net revenues (defined as revenues less voyage expenses) as a measure of equating revenues generated from voyage charters to revenues generated from time-charters, which assists us in making operating decisions about the deployment of our vessels and their performance. Under time-charters the charterer pays the voyage expenses, which are all expenses unique to a particular voyage, including any bunker fuel expenses, port fees, cargo loading and unloading expenses, canal tolls, agency fees and commissions, whereas under voyage-charter contracts the ship-owner pays these expenses. Some voyage expenses are fixed, and the remainder can be estimated. If we, as the ship-owner, pay the voyage expenses, we typically pass the approximate amount of these expenses on to our customers by charging higher rates under the contract or billing the expenses to them. |

5

Table of Contents

| As a result, although revenues from different types of contracts may vary, the net revenues after subtracting voyage expenses, which we call “net revenues,” are comparable across the different types of contracts. We principally use net revenues, a non-GAAP financial measure, because it provides more meaningful information to us than revenues, the most directly comparable GAAP financial measure. Net revenues are also widely used by investors and analysts in the shipping industry for comparing financial performance between companies and to industry averages. The following table reconciles net revenues with revenues. |

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

| (in thousands of U.S. Dollars) | ||||||||||||||||||||

| Revenues |

$ | 2,113,604 | $ | 1,976,022 | $ | 1,980,771 | $ | 1,830,085 | $ | 1,993,920 | ||||||||||

| Voyage expenses |

($ | 245,097 | ) | ($ | 176,614 | ) | ($ | 138,283 | ) | ($ | 112,218 | ) | ($ | 127,847 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net revenues |

$ | 1,868,507 | $ | 1,799,408 | $ | 1,842,488 | $ | 1,717,867 | $ | 1,866,073 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (3) | EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA represents EBITDA before restructuring charges, unrealized foreign exchange (gain) loss, asset impairments, loan loss provisions, net loss (gain) on sale of vessels and equipment, goodwill impairment charge, bargain purchase gain, amortization of in-process revenue contracts, unrealized losses (gains) on derivative instruments, realized losses on interest rate swaps, realized losses on interest rate swap amendments and terminations, and share of the above items in non-consolidated joint ventures. EBITDA and Adjusted EBITDA are used as supplemental financial measures by management and by external users of our financial statements, such as investors, as discussed below. |

| • | Financial and operating performance. EBITDA and Adjusted EBITDA assist our management and security holders by increasing the comparability of our fundamental performance from period to period and against the fundamental performance of other companies in our industry that provide EBITDA or Adjusted EBITDA-based information. This increased comparability is achieved by excluding the potentially disparate effects between periods or companies of interest expense, taxes, depreciation or amortization (or other items in determining Adjusted EBITDA), which items are affected by various and possibly changing financing methods, capital structure and historical cost basis and which items may significantly affect net income between periods. We believe that including EBITDA and Adjusted EBITDA as a financial and operating measures benefits security holders in (a) selecting between investing in us and other investment alternatives and (b) monitoring our ongoing financial and operational strength and health in assessing whether to continue to hold our equity, or debt securities, as applicable. |

| • | Liquidity. EBITDA and Adjusted EBITDA allow us to assess the ability of assets to generate cash sufficient to service debt, pay dividends and undertake capital expenditures. By eliminating the cash flow effect resulting from our existing capitalization and other items such as dry-docking expenditures, working capital changes and foreign currency exchange gains and losses (which may vary significantly from period to period), EBITDA and Adjusted EBITDA provide a consistent measure of our ability to generate cash over the long term. Management uses this information as a significant factor in determining (a) our proper capitalization (including assessing how much debt to incur and whether changes to the capitalization should be made) and (b) whether to undertake material capital expenditures and how to finance them, all in light of our dividend policy. Use of EBITDA and Adjusted EBITDA as liquidity measures also permits security holders to assess the fundamental ability of our business to generate cash sufficient to meet cash needs, including dividends on shares of our common stock and repayments under debt instruments. |

Neither EBITDA nor Adjusted EBITDA should be considered as an alternative to net income, operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. EBITDA and Adjusted EBITDA exclude some, but not all, items that affect net income and operating income, and these measures may vary among other companies. Therefore, EBITDA and Adjusted EBITDA as presented below may not be comparable to similarly titled measures of other companies.

6

Table of Contents

The following table reconciles our historical consolidated EBITDA and Adjusted EBITDA to net (loss) income, and our historical consolidated Adjusted EBITDA to net operating cash flow.

| Year Ended December 31, | ||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

| (in thousands of U.S. Dollars) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Reconciliation of EBITDA and Adjusted EBITDA to Net (Loss) Income |

||||||||||||||||||||

| Net (loss) income |

$ | (166,635 | ) | $ | (376,421 | ) | $ | (311,116 | ) | $ | 35,480 | $ | 124,002 | |||||||

| Income tax (recovery) expense |

(6,340 | ) | 4,290 | (14,406 | ) | 2,872 | 10,173 | |||||||||||||

| Depreciation and amortization |

440,705 | 428,608 | 455,898 | 431,086 | 422,904 | |||||||||||||||

| Interest expense, net of interest income |

123,108 | 127,526 | 161,456 | 171,688 | 201,702 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

390,838 | 184,003 | 291,832 | 641,126 | 758,781 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Restructuring charges |

16,396 | 5,490 | 7,565 | 6,921 | 9,826 | |||||||||||||||

| Foreign exchange (gain) loss |

(31,983 | ) | (12,654 | ) | 12,898 | 13,304 | (13,431 | ) | ||||||||||||

| Loss on notes repurchased |

12,645 | — | — | — | 7,699 | |||||||||||||||

| Asset impairments, loan loss provisions and net loss (gain) on sale of vessels and equipment |

49,150 | 151,059 | 441,057 | 166,358 | (11,271 | ) | ||||||||||||||

| Goodwill impairment charge |

— | 36,652 | — | — | — | |||||||||||||||

| Bargain purchase gain |

— | (68,535 | ) | — | — | — | ||||||||||||||

| Amortization of in-process revenue contracts |

(48,254 | ) | (46,436 | ) | (72,933 | ) | (61,700 | ) | (40,939 | ) | ||||||||||

| Unrealized losses (gains) on derivative instruments |

140,187 | 70,822 | (29,658 | ) | (178,731 | ) | 100,496 | |||||||||||||

| Realized losses on interest rate swaps |

154,098 | 132,931 | 123,277 | 122,439 | 125,424 | |||||||||||||||

| Realized losses on interest rate swap amendments and terminations |

— | 149,666 | — | 35,985 | 1,319 | |||||||||||||||

| Write-down of equity-accounted investments |

— | 19,411 | 1,767 | — | — | |||||||||||||||

| Items related to non-consolidated joint ventures(a) |

46,618 | 64,386 | 54,871 | 71,680 | 99,380 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

729,695 | 686,795 | 830,676 | 817,382 | 1,037,284 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reconciliation of Adjusted EBITDA to net operating cash flow |

||||||||||||||||||||

| Net operating cash flow |

411,750 | 107,193 | 288,936 | 292,584 | 446,317 | |||||||||||||||

| Expenditures for drydocking |

57,483 | 55,620 | 35,023 | 72,205 | 74,379 | |||||||||||||||

| Interest expense, net of interest income |

123,108 | 127,526 | 161,456 | 171,688 | 201,702 | |||||||||||||||

| Change in non-cash working capital items related to operating activities |

(45,415 | ) | 84,347 | 115,209 |

|

(64,184 |

) |

(60,631 | ) | |||||||||||

| Equity (loss) income, net of dividends received |

(11,257 | ) | (31,376 | ) | 65,639 | 121,144 | 94,726 | |||||||||||||

| Other (loss) income |

(23,086 | ) | (8,988 | ) | (21,300 | ) | (13,080 | ) | 44,842 | |||||||||||

| Restructuring charges |

16,396 | 5,490 | 7,565 | 6,921 | 9,826 | |||||||||||||||

| Realized losses on interest rate swaps |

154,098 | 132,931 | 123,277 | 122,439 | 125,424 | |||||||||||||||

| Realized losses on interest rate swap resets and terminations |

— | 149,666 | — | 35,985 | 1,319 | |||||||||||||||

| Items related to non-consolidated joint ventures(a) |

46,618 | 64,386 | 54,871 | 71,680 | 99,380 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

729,695 | 686,795 | 830,676 | 817,382 | 1,037,284 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Equity income from non-consolidated joint ventures is adjusted for income tax expense (recovery), depreciation and amortization, interest expense, net of interest income, foreign exchange loss (gain), amortization of in-process revenue contracts, and unrealized and realized (gains) losses on derivative instruments. |

| (4) | Total capitalization represents total debt and total equity. |

| (5) | Net debt represents total debt less cash, cash equivalents and restricted cash. Total net capitalization represents net debt and total equity. |

| (6) | Excludes our acquisition of FPSO units and investment in Sevan Marine ASA (or Sevan) in 2011, our acquisition of LNG carriers through our 52% interest in the joint venture between Teekay LNG and Marubeni Corporation in 2012 (or the Teekay LNG-Marubeni Joint Venture), and us and Teekay Tankers taking ownership of three Very Large Crude Carriers (or VLCCs) and Teekay LNG’s acquisition of an LPG carrier in 2014. Please read “Item 5. Operating and Financial Review and Prospects.” The expenditures for vessels and equipment exclude non-cash investing activities. Please read “Item 18. Financial Statements: Note 17 Supplemental Cash Flow Information.” |

Some of the following risks relate principally to the industry in which we operate and to our business in general. Other risks relate principally to the securities market and to ownership of our common stock. The occurrence of any of the events described in this section could materially and adversely affect our business, financial condition, operating results and ability to pay dividends on, and the trading price of our common stock.

Changes in the oil and natural gas markets could result in decreased demand for our vessels and services.

Demand for our vessels and services in transporting, production and storage of oil, petroleum products, LNG and LPG depend upon world and regional oil, petroleum and natural gas markets. Any decrease in shipments of oil, petroleum products, LNG or LPG in those markets could have a material adverse effect on our business, financial condition and results of operations. Historically, those markets have been volatile as a result of the many conditions and events that affect the price, production and transport of oil, petroleum products, LNG or LPG, and competition from alternative energy sources. A slowdown of the U.S. and world economies may result in reduced consumption of oil, petroleum products and natural gas and decreased demand for our vessels and services, which would reduce vessel earnings.

A continuation of the recent significant declines in oil prices may adversely affect our growth prospects and results of operations.

Global crude oil prices have significantly declined since mid-2014. The significant decline in oil prices has also contributed to depressed natural gas prices. A continuation of lower oil prices or a further decline in oil prices may adversely affect our business, results of operations and financial condition and our ability to make cash distributions, as a result of, among other things:

| • | a reduction in exploration for or development of new offshore oil fields, or the delay or cancelation of existing offshore projects as energy companies lower their capital expenditures budgets, which may reduce our growth opportunities; |

| • | a reduction in or termination of production of oil at certain fields we service, which may reduce our revenues under volume-based contracts of affreightment, production-based components of our FPSO unit contracts or life-of-field contracts; |

7

Table of Contents

| • | negatively affecting both the competitiveness of natural gas as a fuel for power generation and the market price of natural gas, to the extent that natural gas prices are benchmarked to the price of crude oil; |

| • | lower demand for vessels of the types we own and operate, which may reduce available charter rates and revenue to us upon redeployment of our vessels following expiration or termination of existing contracts or upon the initial chartering of vessels; |

| • | customers potentially seeking to renegotiate or terminate existing vessel contracts, or failing to extend or renew contracts upon expiration; |

| • | the inability or refusal of customers to make charter payments to us due to financial constraints or otherwise; or |

| • | declines in vessel values, which may result in losses to us upon vessel sales or impairment charges against our earnings. |

The cyclical nature of the tanker industry may lead to volatile changes in charter rates and significant fluctuations in the utilization of our vessels, which may adversely affect our earnings and profitability.

Historically, the tanker industry has been cyclical, experiencing volatility in profitability due to changes in the supply of and demand for tanker capacity and changes in the supply of and demand for oil and oil products. The cyclical nature of the tanker industry may cause significant increases or decreases in the revenue we earn from our vessels and may also cause significant increases or decreases in the value of our vessels. If the tanker market is depressed, our earnings may decrease, particularly with respect to the conventional tanker vessels owned by our publicly-listed subsidiary, Teekay Tankers Ltd. (NYSE: TNK) (or Teekay Tankers), which accounted for approximately 12% and 9% of our net revenues during 2014 and 2013, respectively. These vessels are primarily employed on the spot-charter market, which is highly volatile and fluctuates based upon tanker and oil supply and demand. Declining spot rates in a given period generally will result in corresponding declines in operating results for that period. The successful operation of our vessels in the spot-charter market depends upon, among other things, obtaining profitable spot charters and minimizing, to the extent possible, time spent waiting for charters and time spent traveling unladen to pick up cargo. Future spot rates may not be sufficient to enable our vessels trading in the spot tanker market to operate profitably or to provide sufficient cash flow to service our debt obligations. The factors affecting the supply of and demand for tankers are outside of our control, and the nature, timing and degree of changes in industry conditions are unpredictable.

Factors that influence demand for tanker capacity include:

| • | demand for oil and oil products; |

| • | supply of oil and oil products; |

| • | regional availability of refining capacity; |

| • | global and regional economic and political conditions; |

| • | the distance oil and oil products are to be moved by sea; and |

| • | changes in seaborne and other transportation patterns. |

Factors that influence the supply of tanker capacity include:

| • | the number of newbuilding deliveries; |

| • | the scrapping rate of older vessels; |

| • | conversion of tankers to other uses; |

| • | the number of vessels that are out of service; and |

| • | environmental concerns and regulations. |

Changes in demand for transportation of oil over longer distances and in the supply of tankers to carry that oil may materially affect our revenues, profitability and cash flows.

Reduction in oil produced from offshore oil fields could harm our shuttle tanker and FPSO businesses.

As at December 31, 2014, we had 33 vessels operating in our shuttle tanker fleet, nine FPSO units operating in our FPSO fleet (of which one is operating in a joint venture and one was not yet in service), one FPSO unit under upgrade and one FPSO unit under conversion. Certain of our shuttle tankers and our FPSO units earn revenue that depends upon the volume of oil we transport or the volume of oil produced from offshore oil fields. Oil production levels are affected by several factors, all of which are beyond our control, including:

| • | geologic factors, including general declines in production that occur naturally over time; |

| • | the rate of technical developments in extracting oil and related infrastructure and implementation costs; and |

| • | operator decisions based on revenue compared to costs from continued operations. |

Factors that may affect an operator’s decision to initiate or continue production include: changes in oil prices; capital budget limitations; the availability of necessary drilling and other governmental permits; the availability of qualified personnel and equipment; the quality of drilling prospects in the area; and regulatory changes. In addition, the volume of oil we transport may be adversely affected by extended repairs to oil field installations or suspensions of field operations as a result of oil spills, operational difficulties, strikes, employee lockouts or other labor unrest. The rate of oil production at fields we service may decline from existing or future levels, and may be terminated, all of which could harm our business and operating results. In addition, if such a reduction or termination occurs, the spot tanker market rates, if any, in the conventional oil tanker trades at which we may be able to redeploy the affected shuttle tankers may be lower than the rates previously earned by the vessels under contracts of affreightment, which would also harm our business and operating results.

8

Table of Contents

The redeployment risk of FPSO units is high given their lack of alternative uses and significant costs.

FPSO units are specialized vessels that have very limited alternative uses and high fixed costs. In addition, FPSO units typically require substantial capital investments prior to being redeployed to a new field and production service agreement. Unless extended, certain of our FPSO production service agreements will expire during the next seven years, commencing in 2016. Our clients may also terminate certain of our FPSO production service agreements prior to their expiration under specified circumstances. Any idle time prior to the commencement of a new contract or our inability to redeploy the vessels at acceptable rates may have an adverse effect on our business and operating results.

The duration of many of our shuttle tanker and FSO contracts is the life of the relevant oil field or is subject to extension by the field operator or vessel charterer. If the oil field no longer produces oil or is abandoned or the contract term is not extended, we will no longer generate revenue under the related contract and will need to seek to redeploy affected vessels.

Some of our shuttle tanker contracts have a “life-of-field” duration, which means that the contract continues until oil production at the field ceases. If production terminates for any reason, we no longer will generate revenue under the related contract. Other shuttle tanker and FSO contracts under which our vessels operate are subject to extensions beyond their initial term. The likelihood of these contracts being extended may be negatively affected by reductions in oil field reserves, low oil prices generally or other factors. If we are unable to promptly redeploy any affected vessels at rates at least equal to those under the contracts, if at all, our operating results will be harmed. Any potential redeployment may not be under long-term contracts, which may affect the stability of our business and operating results.

Charter rates for conventional oil and product tankers and towage vessels may fluctuate substantially over time and may be lower when we are attempting to re-charter these vessels, which could adversely affect our operating results. Any changes in charter rates for LNG or LPG carriers, shuttle tankers or FSO or FAU or FPSO units could also adversely affect redeployment opportunities for those vessels.

Our ability to re-charter our conventional oil and product tankers following expiration of existing time-charter contracts and the rates payable upon any renewal or replacement charters will depend upon, among other things, the state of the conventional tanker market. Conventional oil and product tanker trades are highly competitive and have experienced significant fluctuations in charter rates based on, among other things, oil, refined petroleum product and vessel demand. For example, an oversupply of conventional oil tankers can significantly reduce their charter rates. Our ability to charter our towage vessels will depend, among other things, the state of the towage market. Towage contracts are highly competitive and are based on the level of projects undertaken by the customer base. There also exists some volatility in charter rates for LNG and LPG carriers, shuttle tankers, FSO and FPSO units and FAUs, which could also adversely affect redeployment opportunities for those vessels.

Over time, the value of our vessels may decline, which could adversely affect our operating results.

Vessel values for oil and product tankers, LNG and LPG carriers and FPSO and FSO units can fluctuate substantially over time due to a number of different factors. Vessel values may decline from existing levels. If operation of a vessel is not profitable, or if we cannot redeploy a chartered vessel at attractive rates upon charter termination, rather than continue to incur costs to maintain and finance the vessel, we may seek to dispose of it. Our inability to dispose of the vessel at a fair market value or the disposition of the vessel at a fair market value that is lower than its book value could result in a loss on its sale and adversely affect our results of operations and financial condition. Further, if we determine at any time that a vessel’s future useful life and earnings require us to impair its value on our financial statements, we may need to recognize a significant charge against our earnings. Vessel values, particularly of tankers, have declined over the past few years, and have contributed to charges against our earnings.

Our growth depends on continued growth in demand for LNG and LPG, and LNG and LPG shipping, as well as offshore oil transportation, production, processing and storage services.

A significant portion of our growth strategy focuses on continued expansion in the LNG and LPG shipping sectors and on expansion in the FPSO, shuttle tanker, and FSO sectors.

Expansion of the LNG and LPG shipping sectors depends on continued growth in world and regional demand for LNG and LPG and marine transportation of LNG and LPG, as well as the supply of LNG and LPG. Demand for LNG and LPG and for the marine transportation of LNG and LPG could be negatively affected by a number of factors, such as increases in the costs of natural gas derived from LNG relative to the cost of natural gas generally, increases in the production of natural gas in areas linked by pipelines to consuming areas, increases in the price of LNG and LPG relative to other energy sources, the availability of new energy sources, and negative global or regional economic or political conditions. Reduced demand for LNG or LPG and LNG or LPG shipping would have a material adverse effect on future growth of our publicly-listed subsidiary Teekay LNG Partners L.P. (NYSE: TGP) (or Teekay LNG), and could harm its results. Growth of the LNG and LPG markets may be limited by infrastructure constraints and community and environmental group resistance to new LNG and LPG infrastructure over concerns about the environment, safety and terrorism. If the LNG or LPG supply chain is disrupted or does not continue to grow, or if a significant LNG or LPG explosion, spill or similar incident occurs, it could have a material adverse effect on growth and could harm our business, results of operations and financial condition.

Expansion of the FPSO, shuttle tanker, and FSO sectors depends on continued growth in world and regional demand for these offshore services, which could be negatively affected by a number of factors, such as:

| • | decreases in the actual or projected price of oil, which could lead to a reduction in or termination of production of oil at certain fields we service, delays or cancellations of projects under development or a reduction in exploration for or development of new offshore oil fields; |

| • | increases in the production of oil in areas linked by pipelines to consuming areas, the extension of existing, or the development of new, pipeline systems in markets we may serve, or the conversion of existing non-oil pipelines to oil pipelines in those markets; |

| • | decreases in the consumption of oil due to increases in its price relative to other energy sources, other factors making consumption of oil less attractive or energy conservation measures; |

9

Table of Contents

| • | availability of new, alternative energy sources; and |

| • | negative global or regional economic or political conditions, particularly in oil consuming regions, which could reduce energy consumption or its growth. |

Reduced demand for offshore marine transportation, production, processing or storage services would have a material adverse effect on our future growth and could harm our business, results of operations and financial condition.

The intense competition in our markets may lead to reduced profitability or reduced expansion opportunities.

Our vessels operate in highly competitive markets. Competition arises primarily from other vessel owners, including major oil companies and independent companies. We also compete with owners of other size vessels. Our market share is insufficient to enforce any degree of pricing discipline in the markets in which we operate and our competitive position may erode in the future. Any new markets that we enter could include participants that have greater financial strength and capital resources than we have. We may not be successful in entering new markets.

One of our objectives is to enter into additional long-term, fixed-rate charters for our LNG and LPG carriers, shuttle tankers, FPSO and FSO units. The process of obtaining new long-term time charters is highly competitive and generally involves an intensive screening process and competitive bids, and often extends for several months. We expect substantial competition for providing services for potential LNG, LPG, FPSO, shuttle tanker and FSO projects from a number of experienced companies, including state-sponsored entities and major energy companies. Some of these competitors have greater experience in these markets and greater financial resources than do we. We anticipate that an increasing number of marine transportation companies, including many with strong reputations and extensive resources and experience, will enter the LNG and LPG transportation, shuttle tanker, FSO and FPSO sectors. This increased competition may cause greater price competition for charters. As a result of these factors, we may be unable to expand our relationships with existing customers or to obtain new customers on a profitable basis, if at all, which would have a material adverse effect on our business, results of operations and financial condition.

The loss of any key customer or its inability to pay for our services could result in a significant loss of revenue in a given period.

We have derived, and believe that we will continue to derive, a significant portion of our revenues from a limited number of customers. Three customers, international oil companies, accounted for an aggregate of 33%, or $664.1 million, of our consolidated revenues during 2014 (2013 – three customers for 37%, or $677.3 million, 2012 – three customers for 38% or $760.3 million). The loss of any significant customer or a substantial decline in the amount of services requested by a significant customer, or the inability of a significant customer to pay for our services, could have a material adverse effect on our business, financial condition and results of operations.

Petroleo Brasileiro SA (or Petrobras), the Brazil state-controlled oil company, is our largest customer. Petrobras is alleged to have participated in a widespread corruption scandal involving improper payments to Brazilian politicians and political parties. Petrobras has also announced that it may decrease its five-year capital expenditure budget for 2015 to 2019 and that it is reducing the pace of some projects. It is uncertain at this time how these factors may affect Petrobras, its performance of existing contracts with us or the development of new projects offshore of Brazil. Any adverse effect on Petrobras’ ability to develop new offshore projects or to perform under existing contracts with us could harm us.

Future adverse economic conditions, including disruptions in the global credit markets, could adversely affect our results of operations.

Economic downturns and financial crises in the global markets could produce illiquidity in the capital markets, market volatility, heightened exposure to interest rate and credit risks and reduced access to capital markets. If global financial markets and economic conditions significantly deteriorate in the future, we may face restricted access to the capital markets or bank lending, which may make it more difficult and costly to fund future growth. Decreased access to such resources could have a material adverse effect on our business, financial condition and results of operations.

Our operations are subject to substantial environmental and other regulations, which may significantly increase our expenses.

Our operations are affected by extensive and changing international, national and local environmental protection laws, regulations, treaties and conventions in force in international waters, the jurisdictional waters of the countries in which our vessels operate, as well as the countries of our vessels’ registration, including those governing oil spills, discharges to air and water, and the handling and disposal of hazardous substances and wastes. Many of these requirements are designed to reduce the risk of oil spills and other pollution. In addition, we believe that the heightened environmental, quality and security concerns of insurance underwriters, regulators and charterers will lead to additional regulatory requirements, including enhanced risk assessment and security requirements and greater inspection and safety requirements on vessels. We expect to incur substantial expenses in complying with these laws and regulations, including expenses for vessel modifications and changes in operating procedures.

These requirements can affect the resale value or useful lives of our vessels, require a reduction in cargo capacity, ship modifications or operational changes or restrictions, lead to decreased availability of insurance coverage for environmental matters or result in the denial of access to certain jurisdictional waters or ports, or detention in, certain ports. Under local, national and foreign laws, as well as international treaties and conventions, we could incur material liabilities, including cleanup obligations, in the event that there is a release of petroleum or other hazardous substances from our vessels or otherwise in connection with our operations. We could also become subject to personal injury or property damage claims relating to the release of or exposure to hazardous materials associated with our operations. In addition, failure to comply with applicable laws and regulations may result in administrative and civil penalties, criminal sanctions or the suspension or termination of our operations, including, in certain instances, seizure or detention of our vessels. For further information about regulations affecting our business and related requirements on us, please read “Item 4. Information on the Company—B. Operations—Regulations.”

We may be unable to make or realize expected benefits from acquisitions, and implementing our strategy of growth through acquisitions may harm our financial condition and performance.

A principal component of our strategy is to continue to grow by expanding our business both in the geographic areas and markets where we have historically focused as well as into new geographic areas, market segments and services. We may not be successful in expanding our operations and any expansion may not be profitable.

10

Table of Contents

Our strategy of growth through acquisitions involves business risks commonly encountered in acquisitions of companies, including:

| • | interruption of, or loss of momentum in, the activities of one or more of an acquired company’s businesses and our businesses; |

| • | additional demands on members of our senior management while integrating acquired businesses, which would decrease the time they have to manage our existing business, service existing customers and attract new customers; |

| • | difficulties in integrating the operations, personnel and business culture of acquired companies; |

| • | difficulties of coordinating and managing geographically separate organizations; |

| • | adverse effects on relationships with our existing suppliers and customers, and those of the companies acquired; |

| • | difficulties entering geographic markets or new market segments in which we have no or limited experience; and |

| • | loss of key officers and employees of acquired companies. |

Acquisitions may not be profitable to us at the time of their completion and may not generate revenues sufficient to justify our investment. In addition, our acquisition growth strategy exposes us to risks that may harm our results of operations and financial condition, including risks that we may: fail to realize anticipated benefits, such as cost-savings, revenue and cash flow enhancements and earnings accretion; decrease our liquidity by using a significant portion of our available cash or borrowing capacity to finance acquisitions; incur additional indebtedness, which may result in significantly increased interest expense or financial leverage, or issue additional equity securities to finance acquisitions, which may result in significant shareholder dilution; incur or assume unanticipated liabilities, losses or costs associated with the business acquired; or incur other significant charges, such as impairment of goodwill or other intangible assets, asset devaluation or restructuring charges.

Unlike newbuildings, existing vessels typically do not carry warranties as to their condition. While we generally inspect existing vessels prior to purchase, such an inspection would normally not provide us with as much knowledge of a vessel’s condition as we would possess if it had been built for us and operated by us during its life. Repairs and maintenance costs for existing vessels are difficult to predict and may be substantially higher than for vessels we have operated since they were built. These costs could decrease our cash flow and reduce our liquidity.

We may not be successful in our recent entry into the long-distance ocean towage and offshore installation market or the floating accommodation market. These markets have competitive dynamics that may differ from markets in which we already participate, and we may be unsuccessful in securing contracts for the FAUs and towage vessels which are currently unchartered, gaining acceptance in these markets from customers or competing against other companies with more experience or larger fleets or resources in these markets. We also may not be successful in employing the HiLoad DP unit on contracts sufficient to recover our investment in the unit.

The strain that growth places upon our systems and management resources may harm our business.

Our growth has placed, and we believe it will continue to place, significant demands on our management, operational and financial resources. As we expand our operations, we must effectively manage and monitor operations, control costs and maintain quality and control in geographically dispersed markets. In addition, our three publicly-traded subsidiaries and TIL have increased our complexity and placed additional demands on our management. Our future growth and financial performance will also depend on our ability to recruit, train, manage and motivate our employees to support our expanded operations and continue to improve our customer support, financial controls and information systems.

These efforts may not be successful and may not occur in a timely or efficient manner. Failure to effectively manage our growth and the system and procedural transitions required by expansion in a cost-effective manner could have a material adverse effect on our business.

Our insurance may not be sufficient to cover losses that may occur to our property or as a result of our operations.

The operation of oil and product tankers, LNG and LPG carriers, and FPSO and FSO units is inherently risky. Although we carry hull and machinery (marine and war risk) and protection and indemnity insurance, all risks may not be adequately insured against, and any particular claim may not be paid. In addition, we do not generally carry insurance on our vessels covering the loss of revenues resulting from vessel off-hire time based on its cost compared to our off-hire experience. Any significant off-hire time of our vessels could harm our business, operating results and financial condition. Any claims relating to our operations covered by insurance would be subject to deductibles, and since it is possible that a large number of claims may be brought, the aggregate amount of these deductibles could be material. Certain of our insurance coverage is maintained through mutual protection and indemnity associations and as a member of such associations we may be required to make additional payments over and above budgeted premiums if member claims exceed association reserves.

We may be unable to procure adequate insurance coverage at commercially reasonable rates in the future. For example, more stringent environmental regulations have led in the past to increased costs for, and in the future may result in the lack of availability of, insurance against risks of environmental damage or pollution. A catastrophic oil spill, marine disaster or natural disasters could result in losses that exceed our insurance coverage, which could harm our business, financial condition and operating results. Any uninsured or underinsured loss could harm our business and financial condition. In addition, our insurance may be voidable by the insurers as a result of certain of our actions, such as our ships failing to maintain certification with applicable maritime regulatory organizations.

Changes in the insurance markets attributable to terrorist attacks may also make certain types of insurance more difficult for us to obtain. In addition, the insurance that may be available may be significantly more expensive than our existing coverage.

Past port calls by our vessels, or third-party vessels from which we derived pooling revenues, to countries that are subject to sanctions imposed by the United States and the European Union may impact investors’ decisions to invest in our securities.

The United States government has imposed sanctions on Iran, Syria and Sudan. The European Union (or EU) has also imposed sanctions on trade with Iran. In the past, conventional oil tankers owned or chartered-in by us, or third-party vessels participating in commercial pooling arrangements from which we derive revenue, made limited port calls to those countries for the loading and discharging of oil products. Those port calls did not violate U.S. or EU sanctions at the time and we intend to maintain our compliance with all U.S. and EU sanctions.

11

Table of Contents

In addition, we have no future contracted loadings or discharges in any of those countries and intend not to enter into voyage charter contracts for the transport of oil or gas to or from Iran, Syria or Sudan. We believe that our compliance with these sanctions and our lack of any future port calls to those countries does not and will not adversely impact our revenues, because port calls to these countries have never accounted for any material amount of our revenues. However, some investors might decide not to invest in us simply because we have previously called on, or through our participation in pooling arrangements have previously received revenue from calls on, ports in these sanctioned countries. Any such investor reaction could adversely affect the market for our common shares.

Marine transportation is inherently risky, and an incident involving significant loss of or environmental contamination by any of our vessels could harm our reputation and business.

Our vessels and their cargoes are at risk of being damaged or lost because of events such as:

| • | marine disaster; |

| • | bad weather or natural disasters; |

| • | mechanical failures; |

| • | grounding, fire, explosions and collisions; |

| • | piracy; |

| • | human error; and |

| • | war and terrorism. |

An accident involving any of our vessels could result in any of the following:

| • | death or injury to persons, loss of property or environmental damage or pollution; |

| • | delays in the delivery of cargo; |

| • | loss of revenues from or termination of charter contracts; |

| • | governmental fines, penalties or restrictions on conducting business; |

| • | higher insurance rates; and |

| • | damage to our reputation and customer relationships generally. |

Any of these results could have a material adverse effect on our business, financial condition and operating results.

Our operating results are subject to seasonal fluctuations.

We operate our conventional tankers in markets that have historically exhibited seasonal variations in demand and, therefore, in charter rates. This seasonality may result in quarter-to-quarter volatility in our results of operations. Tanker markets are typically stronger in the winter months as a result of increased oil consumption in the Northern Hemisphere. In addition, unpredictable weather patterns in these months tend to disrupt vessel scheduling, which historically has increased oil price volatility and oil trading activities in the winter months. As a result, our revenues have historically been weaker during the fiscal quarters ended June 30 and September 30, and stronger in our fiscal quarters ended March 31 and December 31.

Due to harsh winter weather conditions, oil field operators in the North Sea typically schedule oil platform and other infrastructure repairs and maintenance during the summer months. Because the North Sea is our primary existing offshore oil market, this seasonal repair and maintenance activity contributes to quarter-to-quarter volatility in our results of operations, as oil production typically is lower in the fiscal quarters ended June 30 and September 30 in this region compared with production in the fiscal quarters ended March 31 and December 31. Because a number of our North Sea shuttle tankers operate under contracts of affreightment, under which revenue is based on the volume of oil transported, the results of our shuttle tanker operations in the North Sea under these contracts generally reflect this seasonal production pattern. When we redeploy affected shuttle tankers as conventional oil tankers while platform maintenance and repairs are conducted, the overall financial results for our North Sea shuttle tanker operations may be negatively affected if the rates in the conventional oil tanker markets are lower than the contract of affreightment rates. In addition, we seek to coordinate some of the general dry docking schedule of our fleet with this seasonality, which may result in lower revenues and increased dry docking expenses during the summer months.

We expend substantial sums during construction of newbuildings and the conversion of tankers to FPSO or FSO units without earning revenue and without assurance that they will be completed.

We are typically required to expend substantial sums as progress payments during construction of a newbuilding or vessel conversion, but we do not derive any revenue from the vessel until after its delivery. In addition, under some of our time charters if our delivery of a vessel to a customer is delayed, we may be required to pay liquidated damages in amounts equal to or, under some charters, almost double the hire rate during the delay. For prolonged delays, the customer may terminate the time charter and, in addition to the resulting loss of revenues, we may be responsible for additional substantial liquidated charges.

Our newbuilding financing commitments typically have been pre-arranged. However, if we are unable to obtain financing required to complete payments on any of our newbuilding orders, we could effectively forfeit all or a portion of the progress payments previously made. As of December 31, 2014, we had on order 18 LNG carriers, nine LPG carriers, one FSO conversion, one FPSO conversion, one FPSO upgrade, three FAUs and four long-distance towing and offshore installation vessels. The 18 LNG carriers are scheduled for delivery between 2016 and 2020. Nine LPG carriers are scheduled for delivery between 2015 and 2018. One FSO conversion is scheduled for completion in early-2017. One FPSO conversion is scheduled for completion in late 2016.

12

Table of Contents

One FPSO upgrade is scheduled for completion in early-2016. One floating accommodation unit delivered in 2015 and two are scheduled to deliver in 2016. Four long-distance towing and offshore installation vessels are scheduled to deliver in 2016. As of December 31, 2014, progress payments made towards these newbuildings, excluding payments made by our joint venture partners, totaled $586.7 million.

In addition, conversion of tankers to FPSO and FSO units expose us to a numbers of risks, including lack of shipyard capacity and the difficulty of completing the conversions in a timely and cost effective manner. During conversion of a vessel, we do not earn revenue from it. In addition, conversion projects may not be successful.

We make substantial capital expenditures to expand the size of our fleet. Depending on whether we finance our expenditures through cash from operations or by issuing debt or equity securities, our financial leverage could increase or our shareholders could be diluted.

We regularly evaluate and pursue opportunities to provide the marine transportation requirements for various projects, and we have recently submitted bids to provide transportation solutions for LNG and LPG, FPSO and FSO projects. We may submit additional bids from time to time. The award process relating to LNG and LPG transportation, FPSO and FSO opportunities typically involves various stages and takes several months to complete. If we bid on and are awarded contracts relating to any LNG and LPG, FPSO and FSO projects, we will need to incur significant capital expenditures to build the related LNG and LPG carriers, FPSO and FSO units.

To fund the remaining portion of existing or future capital expenditures, we will be required to use cash from operations or incur borrowings or raise capital through the sale of debt or additional equity securities. Our ability to obtain bank financing or to access the capital markets for future offerings may be limited by our financial condition at the time of any such financing or offering as well as by adverse market conditions resulting from, among other things, general economic conditions and contingencies and uncertainties that are beyond our control. Our failure to obtain the funds for necessary future capital expenditures could have a material adverse effect on our business, results of operations and financial condition. Even if we are successful in obtaining necessary funds, incurring additional debt may significantly increase our interest expense and financial leverage, which could limit our financial flexibility and ability to pursue other business opportunities. Issuing additional equity securities may result in significant shareholder dilution and would increase the aggregate amount of cash required to pay quarterly dividends.

Exposure to currency exchange rate and interest rate fluctuations results in fluctuations in our cash flows and operating results.

Substantially all of our revenues are earned in U.S. Dollars, although we are paid in Euros, Australian Dollars, Norwegian Kroner and British Pounds under some of our charters. A portion of our operating costs are incurred in currencies other than U.S. Dollars. This partial mismatch in operating revenues and expenses leads to fluctuations in net income due to changes in the value of the U.S. Dollar relative to other currencies, in particular the Norwegian Kroner, the Australian Dollar, the British Pound and the Euro. We also make payments under two Euro-denominated term loans. If the amount of these and other Euro-denominated obligations exceeds our Euro-denominated revenues, we must convert other currencies, primarily the U.S. Dollar, into Euros. An increase in the strength of the Euro relative to the U.S. Dollar would require us to convert more U.S. Dollars to Euros to satisfy those obligations.

Because we report our operating results in U.S. Dollars, changes in the value of the U.S. Dollar relative to other currencies also result in fluctuations of our reported revenues and earnings. Under U.S. accounting guidelines, all foreign currency-denominated monetary assets and liabilities, such as cash and cash equivalents, accounts receivable, restricted cash, accounts payable, long-term debt and capital lease obligations, are revalued and reported based on the prevailing exchange rate at the end of the period. This revaluation historically has caused us to report significant unrealized foreign currency exchange gains or losses each period. The primary source of these gains and losses is our Euro-denominated term loans and our Norwegian Kroner-denominated bonds. We have entered into foreign currency forward contracts to economically hedge portions of our forecasted expenditures denominated in Norwegian Kroner. We also incur interest expense on our Norwegian Kroner-denominated bonds. We have entered into cross-currency swaps to economically hedge the foreign exchange risk on the principal and interest payments of our Norwegian Kroner bonds.

Many of our seafaring employees are covered by collective bargaining agreements and the failure to renew those agreements or any future labor agreements may disrupt operations and adversely affect our cash flows.

A significant portion of our seafarers are employed under collective bargaining agreements. We may become subject to additional labor agreements in the future. We may suffer labor disruptions if relationships deteriorate with the seafarers or the unions that represent them. Our collective bargaining agreements may not prevent labor disruptions, particularly when the agreements are being renegotiated. Salaries are typically renegotiated annually or bi-annually for seafarers and annually for onshore operational staff and may increase our cost of operation. Any labor disruptions could harm our operations and could have a material adverse effect on our business, results of operations and financial condition.

We may be unable to attract and retain qualified, skilled employees or crew necessary to operate our business.

Our success depends in large part on our ability to attract and retain highly skilled and qualified personnel. In crewing our vessels, we require technically skilled employees with specialized training who can perform physically demanding work. Competition to attract and retain qualified crew members is intense. If crew costs increase, and we are not able to increase our rates to customers to compensate for any crew cost increases, our financial condition and results of operations may be adversely affected. Any inability we experience in the future to hire, train and retain a sufficient number of qualified employees could impair our ability to manage, maintain and grow our business.

Terrorist attacks, piracy, increased hostilities or war could lead to further economic instability, increased costs and disruption of business.

Terrorist attacks, piracy and the current conflicts in the Middle East, and other current and future conflicts, may adversely affect our business, operating results, financial condition, and ability to raise capital and future growth. Continuing hostilities in the Middle East may lead to additional armed conflicts or to further acts of terrorism and civil disturbance in the United States or elsewhere, which may contribute to economic instability and disruption of oil production and distribution, which could result in reduced demand for our services.

In addition, oil facilities, shipyards, vessels, pipelines and oil fields could be targets of future terrorist attacks and our vessels could be targets of pirates or hijackers. Any such attacks could lead to, among other things, bodily injury or loss of life, vessel or other property damage, increased vessel operational costs, including insurance costs, and the inability to transport oil to or from certain locations. Terrorist attacks, war, piracy, hijacking or other events beyond our control that adversely affect the distribution, production or transportation of oil to be shipped by us could entitle customers to terminate charters, which would harm our cash flow and business.

13

Table of Contents

Acts of piracy on ocean-going vessels have recently increased in frequency, which could adversely affect our business.

Acts of piracy have historically affected ocean-going vessels trading in regions of the world such as the South China Sea and the Indian Ocean off the coast of Somalia. While there continue to be significant numbers of piracy incidents in the Gulf of Aden and Indian Ocean, recently there have been increases in the frequency and severity of piracy incidents off the coast of West Africa. If these piracy attacks result in regions in which our vessels are deployed being named on the Joint War Committee Listed Areas, war risk insurance premiums payable for such coverage can increase significantly and such insurance coverage may be more difficult to obtain. In addition, crew costs, including costs which may be incurred to the extent we employ on-board security guards, could increase in such circumstances. We may not be adequately insured to cover losses from these incidents, which could have a material adverse effect on us. In addition, hijacking as a result of an act of piracy against our vessels, or an increase in cost or unavailability of insurance for our vessels, could have a material adverse impact on our business, financial condition and results of operations.

Our substantial operations outside the United States expose us to political, governmental and economic instability, which could harm our operations.