Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 1-475

A. O. Smith Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 39-0619790 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

| 11270 West Park Place, Milwaukee, Wisconsin | 53224-9508 | |

| (Address of Principal Executive Office) | (Zip Code) |

(414) 359-4000

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Shares of Stock Outstanding January 31, 2012 |

Name of Each Exchange on Which Registered | ||

| Class A Common Stock (par value $5.00 per share) |

6,679,997 | Not listed | ||

| Common Stock (par value $1.00 per share) |

39,266,453 | New York Stock Exchange | ||

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

þYes ¨No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨Yes þNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þYes ¨No.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

þYes ¨No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

þ |

Accelerated filer ¨ | ||

| Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.)

¨Yes þNo

The aggregate market value of voting stock held by non-affiliates of the registrant was $37,497,159 for Class A Common Stock and $1,586,129,826 for Common Stock as of June 30, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

| 1. | Portions of the company’s definitive Proxy Statement for the 2012 Annual Meeting of Stockholders (to be filed with the Securities and Exchange Commission under Regulation 14A within 120 days after the end of the registrant’s fiscal year and, upon such filing, to be incorporated by reference in Part III). |

Table of Contents

A. O. Smith Corporation

Index to Form 10-K

Year Ended December 31, 2011

| Page | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

5 | |||||

| Item 1B. |

10 | |||||

| Item 2. |

10 | |||||

| Item 3. |

10 | |||||

| Item 4. |

10 | |||||

| Item 5. |

13 | |||||

| Item 6. |

15 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 | ||||

| Item 7A. |

25 | |||||

| Item 8. |

26 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

60 | ||||

| Item 9A. |

60 | |||||

| Item 9B. |

61 | |||||

| Item 10. |

63 | |||||

| Item 11. |

63 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

63 | ||||

| Item 13. |

Certain Relationships and Related Transactions and Director Independence |

64 | ||||

| Item 14. |

64 | |||||

| Item 15. |

65 | |||||

2

Table of Contents

We are a leading manufacturer of water heaters and boilers, serving a diverse mix of residential and commercial end markets principally in the United States with a strong and growing international presence. During the fourth quarter of 2011 we reorganized our management reporting structure to reflect our current business activities and reconsidered our reporting segments. Historical information has been revised to reflect our new structure. Our company is comprised of two reporting segments: North America and Rest of World. Both segments manufacture and market comprehensive lines of residential gas, gas tankless, oil and electric water heaters and commercial water heating equipment. Both segments primarily serve their respective regions of the world. The North America segment also manufactures and markets specialty commercial water heating equipment, condensing and non-condensing boilers and water systems tanks. The Rest of World segment also manufactures and markets water treatment products, primarily for Asia.

On August 22, 2011, we sold our Electrical Products business (EPC) to Regal Beloit Corporation (RBC) for approximately $760 million in cash and approximately 2.83 million shares of RBC common stock valued at $140.6 million as of that date. Due to the sale, EPC has been reflected as a discontinued operation in the accompanying financial statements for all periods presented. For further information about EPC, see Note 2 to the Consolidated Financial Statements.

The following table summarizes our sales from continuing operations. This summary and all other information presented in this section should be read in conjunction with the Consolidated Financial Statements and Notes to Consolidated Financial Statements, which appear in Item 8 in this document.

| Years Ended December 31 (dollars in millions) | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| North America |

$ | 1,289.5 | $ | 1,155.4 | $ | 1,135.9 | $ | 1,245.1 | $ | 1,263.5 | ||||||||||

| Rest of World |

455.6 | 368.9 | 256.5 | 223.0 | 175.2 | |||||||||||||||

| Inter-segment Sales |

(34.6 | ) | (35.0 | ) | (17.4 | ) | (16.8 | ) | (15.6 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Sales |

$ | 1,710.5 | $ | 1,489.3 | $ | 1,375.0 | $ | 1,451.3 | $ | 1,423.1 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

NORTH AMERICA

In our North America segment, sales increased 11.6 percent or $134.1 million in 2011 compared with the prior year. On August 26, 2011, we acquired Lochinvar Corporation, of Lebanon, Tennessee (Lochinvar) which added $75.9 million to sales. The impact of the Lochinvar acquisition and pricing actions related to higher raw material costs represent the majority of the increase in sales from the prior year.

We serve residential and commercial end markets in North America with a broad range of products including:

Gas, gas tankless, oil and electric water heaters. Our residential and commercial water heaters come in sizes ranging from 2.5 gallon (point-of-use) models to 594 gallon appliances with varying efficiency ranges. We offer electric, natural gas, oil and liquid propane models as well as solar tanks and gas tankless units for today’s energy efficient homes. North American residential water heater sales in 2011 were approximately $875 million or 67.9 percent of North America revenues. Typical applications include residences, restaurants, hotels and motels, laundries, car washes and small businesses.

Boilers. Our residential and commercial boilers range in size from 45,000 British Thermal Units (BTUs) to 3.5 million BTUs. Our commercial boilers are used primarily in space heating applications including buildings, hospitals, schools, hotels and other large commercial buildings.

Other. Our North America segment also manufactures copper-tube boilers and expansion tanks, commercial solar systems, swimming pool and spa heaters, and related products and parts.

A significant portion of the segment’s business is derived from the replacement of existing products, and we believe that the sale of products to the North America residential new housing construction market since 2008 represents less than ten percent of the segment’s total residential water heater sales.

We are the largest manufacturer and marketer of water heaters in North America, and we have a leading share in both the residential and commercial markets. As the leader in the residential water heating market, we offer an extensive line of high-efficiency gas and electric water heaters and boilers. In the commercial market, we believe our comprehensive product line, including boilers, as well as our high-efficiency products, give us a competitive advantage in this higher margin portion of the water heating industry.

3

Table of Contents

Our wholesale distribution channel includes more than 1,100 independent wholesale plumbing distributors with more than 4,400 selling locations serving residential and commercial end markets. We also sell our residential water heaters through the retail channel. In this channel, our customers include five of the seven largest national hardware and home center chains, including long-standing exclusive branding relationships with both Lowe’s Companies, Inc. and Sears, Roebuck and Co. Our boiler distribution channel is comprised of manufacturer representative firms.

We acquired Lochinvar for approximately $421 million plus an earnout of up to $35 million if certain objectives are achieved by November 2012. Lochinvar is one of the leading manufacturers of residential and commercial boilers in the United States. Lochinvar’s sales for the twelve months ended November 30, 2011 (Lochinvar’s former fiscal year end), were approximately $200 million and have grown at an eight percent compound annual growth rate over the last five years. Lochinvar is a leader in the manufacture of high-efficiency, hydronic boilers used in commercial and residential applications, and in the manufacture of commercial and industrial water heaters.

On July 1, 2010, we acquired the rights from Takagi Industrial Co., Ltd. of Fuji-City, Shizuoka, Japan (Takagi), to market tankless water heaters in North America and entered into a long-term agreement with Takagi to supply tankless water heaters. As part of the venture, we took over the management of Takagi’s North American sales and distribution organization. Through this venture, we offer a full line of gas tankless water heaters under our own brands in association with the Takagi brand.

Our energy efficient product offerings continue to be a growing driver of our business. Our Cyclone product family continues to be the preferred choice for commercial customers looking for high efficiency water heating with a short payback period through energy savings. We now offer the iCOMM remote monitoring service that allows customers to view their Cyclone water heaters’ operation via the internet allowing them to track the energy usage and savings. In 2010, we introduced residential solar and heat pump water heaters in the U.S. as well as other higher efficiency water heating solutions to round out our energy efficient product offerings.

We sell our water heating products in highly competitive markets. We compete in each of our targeted market segments based on product design, quality of products and services, performance and price. Our principal water heating and boiler competitors in the U.S. include Rheem, Bradford-White, Aerco, Weil-McLain, and HTP. Additionally, we compete with numerous other private water heater and boiler manufacturing companies.

REST OF WORLD

Sales in our Rest of World segment increased 23.5 percent, or $86.7 million compared with the prior year. A 29.0 percent increase in sales of A. O. Smith branded products in China to $371.7 million was the primary source of the increase in sales.

We entered the Chinese water heater market through a joint venture in 1995, buying out our partner three years later. Since that time, we have been aggressively expanding our presence while building A. O. Smith brand recognition in the Chinese residential and commercial markets. We believe we are one of the leading suppliers of water heaters to the residential market in China, with a broad product offering including electric, gas tankless, heat pump and solar units.

In 2008, we established a sales office in India and began importing products specifically designed for India from our Nanjing, China facility. We began manufacturing water heaters in India in the second quarter of 2010. Our sales in India more than doubled to $18.1 million in 2011 compared with the prior year.

In November 2009, we purchased 80 percent of the water treatment business of Tianlong Holding Co., Ltd. of Hong Kong, (Tianlong) and we are operating the business as A. O. Smith (Shanghai) Water Treatment Products Co. Ltd. (SWT). We manufacture, and through our current water heater distribution channels, supply water treatment products such as reverse osmosis units to the China residential and commercial markets, as well as export markets throughout the world. In the fourth quarter of 2010, we purchased the remaining 20 percent interest in Tianlong and now own 100 percent of the company.

Our primary competitor in China is Haier Appliances, a Chinese company, but we also compete with Ariston, Siemens and Midea in the electric water heater market and Rinnai and Noritz in the gas tankless water heater market. Additionally, we compete with numerous other Chinese private and state-owned water heater and water treatment companies in China. In India, we compete with Bajaj and MTS-Racold and numerous other companies.

In addition we sell water heaters to the European and Middle Eastern markets which are less than three percent of total sales.

4

Table of Contents

RAW MATERIAL

Raw materials for our manufacturing operations, primarily consisting of steel, are generally available from several sources in adequate quantities. A portion of our customers are contractually obligated to accept price changes based on fluctuations in steel prices. Significant volatility in steel costs has occurred over the last several years.

RESEARCH AND DEVELOPMENT

To improve competitiveness by generating new products and processes, we conduct research and development at our Corporate Technology Center in Milwaukee, Wisconsin, our Global Engineering Center in Nanjing, China, and at our operating locations. Total expenditures for research and development in 2011, 2010 and 2009 were $42.7 million, $37.1 million and $31.0 million, respectively.

PATENTS AND TRADEMARKS

We own and use in our businesses various trademarks, trade names, patents, trade secrets and licenses. We do not believe that our business as a whole is materially dependent upon any such trademark, trade name, patent, trade secret or license. However, our trade name is important with respect to our products, particularly in China, India and the U.S.

EMPLOYEES

Our operations employed approximately 10,600 employees as of December 31, 2011, primarily non-union.

BACKLOG

Due to the short-cycle nature of our businesses, none of our operations sustain significant backlogs.

ENVIRONMENTAL LAWS

Our operations are governed by a variety of federal, foreign, state and local laws intended to protect the environment. Compliance with the environmental laws has not had and is not expected to have a material effect upon the capital expenditures, earnings, or competitive position of our company. See Item 3.

AVAILABLE INFORMATION

We maintain a website with the address www.aosmith.com. The information contained on our website is not included as a part of, or incorporated by reference into, this Annual Report on Form 10-K. Other than an investor’s own internet access charges, we make available free of charge through our website our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports as soon as reasonably practical after we have electronically filed such material with, or furnished such material to, the Securities and Exchange Commission.

The company is committed to sound corporate governance and has documented its corporate governance practices by adopting the A. O. Smith Corporate Governance Guidelines. The Corporate Governance Guidelines, Criteria for Selection of Directors, Financial Code of Ethics, the A. O. Smith Guiding Principles, as well as the charters for the Audit, Personnel and Compensation, Nominating and Governance and the Investment Policy Committees and other corporate governance materials may be viewed on the company’s website. Any waiver of or amendments to the Financial Code of Conduct or the A. O. Smith Guiding Principles also would be posted on this website; to date there have been none. Copies of these documents will be sent to stockholders free of charge upon written request of the corporate secretary at the address shown on the cover page of this Annual Report on Form 10-K.

You should carefully consider the risk factors set forth below and all other information contained in this Annual Report on Form 10-K, including the documents incorporated by reference, before making an investment decision regarding our common stock. If any of the events contemplated by the following risks actually occurs, then our business, financial condition, or results of operations could be materially adversely affected. As a result, the trading price of our common stock could decline, and you may lose all or part of your investment. The risks and uncertainties below are not the only risks facing our company.

5

Table of Contents

| • | The effects of the global economic downturn could have a material adverse effect on our business |

The global credit and capital markets are still showing signs of stress, and threaten to stall or reverse the course of any recovery. If this were to occur it could adversely affect consumer confidence and spending patterns which could result in decreased demand for the products we sell, a delay in purchases, increased price competition, or slower adoption of energy efficient water heaters or boilers which could negatively impact our profitability and/or cash flow. In addition, a deterioration in current economic conditions, including the credit market conditions, could negatively impact our vendors and customers, which could result in an increase in bad debt expense, customer and vendor bankruptcies, interruption or delay in supply of materials, or increased material prices, which could negatively impact our ability to distribute, market and sell our products and our financial condition, results of operations and cash flows.

| • | A portion of our business could continue to be adversely affected by a decline in new commercial construction |

Commercial construction activity could continue the decline that began in the second half of 2008 and declined further in 2009 and 2010 before leveling off in 2011. Though we believe that the majority of the commercial business we serve is for replacement, we could also be affected by changes in the commercial construction market.

| • | A portion of our business could be affected by a slowing Chinese economy |

Approximately 78 percent of our growth over the past five years has occurred in China. In 2012, we are commencing construction on a facility which will expand our manufacturing capacity by 50 percent. If the Chinese economy were to experience a significant slowdown, it could adversely affect our financial condition, results of operations and cash flows.

| • | A material loss, cancellation, reduction, or delay in purchases by one or more of our largest customers could harm our business |

Net sales to our five largest customers represented approximately 38 percent of our 2011 net sales from continuing operations. We expect that customer concentration will continue for the foreseeable future. Our dependence on sales from a relatively small number of customers makes our relationship with each of these customers important to our business. We cannot assure that we will be able to retain our largest customers. Some of our customers may in the future shift their purchases of products to our competitors. The loss of one or more of our largest customers, any material reduction or delay in sales to these customers, our inability to successfully develop relationships with additional customers, or our inability to execute on pricing actions could have a material adverse effect on our financial position, results of operations and cash flows.

| • | Our newly acquired Lochinvar business’ growth could stall or our stated synergies could fail to materialize resulting in lower than expected accretion from the acquisition |

The compound annual growth rate of Lochinvar’s revenues has been eight percent over the past five years, largely due to the transition in the boiler industry from lower efficiency, non-condensing boilers to higher efficiency, condensing boilers and Lochinvar is a leading residential and commercial condensing boiler company. In 2003, approximately five percent of the boilers sold in the U.S. were condensing boilers and by 2010, the percentage had grown to approximately 25 percent. We expect the transition to continue, which would result in greater than ten percent growth in Lochinvar’s sales in 2012 and greater than eight percent growth in Lochinvar sales for the foreseeable future after 2012. If the transition to higher efficiency, condensing boilers stalls as a result of lower energy costs, another recession occurs or our competitors’ technologies surpassing Lochinvar’s, our growth rate could be lower than expected. In addition, we have stated that we expect to achieve synergies from the Lochinvar acquisition of $10 to $15 million in the next several years. If our growth rate slows or our synergies fail to materialize, our stated accretion from the Lochinvar acquisition in 2012 of $.40 to $.50 per share could be materially impacted.

| • | Because we participate in markets that are highly competitive, our revenues could decline as we respond to competition |

We sell all of our products in highly competitive markets. We compete in each of our targeted markets based on product design, reliability, quality of products and services, advanced technologies, product performance, maintenance costs and price. We compete against manufacturers located, primarily, in North America and China. Some of our competitors may have greater financial, marketing, manufacturing, research and development and distribution resources than we have. We cannot assure that our products and services will continue to compete successfully with those of our competitors or that we will be able to retain our customer base or improve or maintain our profit margins on sales to our customers, all of which could materially and adversely affect our financial condition, results of operations and cash flows.

6

Table of Contents

| • | We increasingly manufacture and sell our products outside the U.S., which may present additional risks to our business |

Approximately 35 percent of our 2011 net sales was attributable to products manufactured and sold outside of the U.S., principally in China. Approximately 5,800 of our 10,600 total employees as of December 31, 2011 were located in China. At December 31, 2011, nearly $300 million of our cash balances were located in China. In 2010, we opened a manufacturing plant in India. International operations generally are subject to various risks, including political, religious, and economic instability, local labor market conditions, the imposition of foreign tariffs and other trade restrictions, the impact of foreign government regulations, the effects of income and withholding taxes, governmental expropriation, imposition or increase in withholding and other taxes on remittances and other payments by foreign subsidiaries, labor relations problems, the imposition of environmental or employment laws, or other restrictions by foreign governments and differences in business practices. We may incur increased costs and experience delays or disruptions in product deliveries and payments in connection with international manufacturing and sales that could cause loss of revenue. Unfavorable changes in the political, regulatory, and business climate could have a material adverse effect on our financial condition, results of operations and cash flows or our ability to repatriate funds to the U.S.

| • | Our international operations are subject to risks related to foreign currencies |

We have significant operations outside of the U.S., primarily in China and Canada and to a lesser extent India and Mexico, and therefore, hold assets, incur liabilities, earn revenues and pay expenses in a variety of currencies other than the U. S. dollar. The financial statements of our foreign subsidiaries are translated into U.S. dollars. As a result, we are subject to risks associated with operating in foreign countries, including fluctuations in currency exchange rates and interest rates, or hyperinflation in some foreign countries. Furthermore, we typically price our products in our foreign operations in local currencies. As a result, an increase in the value of the U.S. dollar relative to the local currencies of our profitable foreign subsidiaries could have a negative effect on our profitability. In addition to currency translation risks, we incur a currency transaction risk whenever one of our operating subsidiaries enters into either a purchase or sale transaction using a currency different from the operating subsidiaries’ functional currency. The above mentioned risks in North America and Asia may hurt our ability to generate revenue and profits in those regions in the future.

| • | We are subject to regulation of our international operations that could adversely affect our business and results of operations |

Due to our global operations, we are subject to many laws governing international relations, including those that prohibit improper payments to government officials and restrict where we can do business, what information or products we can supply to certain countries and what information we can provide to a non-U.S. government, including but not limited to the Foreign Corrupt Practices Act and the U.S. Export Administration Act. Violations of these laws, which are complex, may result in criminal penalties or sanctions that could have a material adverse effect on our financial condition, results of operations and cash flows.

| • | Our operations could be adversely impacted by material price volatility and supplier concentration |

The market prices for certain raw materials we purchase, primarily steel, have been very volatile in the recent past. Significant increases in the cost of any of the key materials we purchase could increase our cost of doing business and ultimately could lead to lower operating earnings if we are not able to recover these cost increases through price increases to our customers. Historically, there has been a lag in our ability to recover increased material costs from customers, and that lag could negatively impact our profitability. In addition, in some cases we are dependent on a limited number of suppliers for some of the raw materials and components required in the manufacture of our product. A significant disruption or termination of the supply from one of these suppliers could delay sales or increase costs which could result in a material adverse effect on our financial condition, results of operations and cash flows.

| • | Our business may be adversely impacted by product defects |

Product defects can occur through our own product development, design and manufacturing processes or through our reliance on third parties for component design and manufacturing activities. We may incur various expenses related to product defects, including product warranty costs, product recall and retrofit costs and product liability costs. While we maintain a reserve for our product warranty costs based on certain estimates and our knowledge of current events and actions, our actual warranty costs may exceed our reserve, resulting in current period expenses and a need to increase our accruals for warranty charges. In

7

Table of Contents

addition, the reputation of our brand may be diminished by product defects and recalls. Further, our inability to cure a product defect could result in the failure of a product line or the temporary or permanent withdrawal from a product or market. Any of these events may have a material adverse impact on our financial condition, results of operations and cash flows.

| • | Our underfunded pension plans require future pension contributions which could limit our flexibility in managing our company |

Due to the significant negative investment returns in 2008 and falling interest rates in recent years, the projected benefit obligations of our defined benefit pension plans exceeded the fair value of the plan assets by approximately $138 million at December 31, 2011. Beginning in 2008, our minimum required pension contributions equal our target normal cost plus a seven year amortization of any funding shortfall, offset by any Employee Retirement Income Security Act of 1974 (ERISA) credit balance. We are forecasting that there will be no required contributions to the plan in 2012, and we do not plan to make any voluntary contributions. However, we cannot provide any assurance that contributions will not be required in the future. Among the key assumptions inherent in our actuarially calculated pension plan obligation and pension plan expense are the discount rate and the expected rate of return on plan assets. If interest rates and actual rates of return on invested plan assets were to decrease significantly, our pension plan obligations could increase materially. The size of future required pension contributions could result in us dedicating a substantial portion of our cash flows from operations to making the contributions which could negatively impact our flexibility in managing the company.

| • | We have significant goodwill and an impairment of our goodwill could cause a decline in our net worth |

Our total assets include significant goodwill. Our goodwill results from our acquisitions, representing the excess of the purchase prices we paid over the fair value of the net tangible and intangible assets we acquired. We assess whether there has been impairment in the value of our goodwill during the fourth quarter of each calendar year or sooner if triggering events warrant. If future operating performance at our businesses do not meet expectations, we may be required to reflect a non-cash charge to operating results for goodwill impairment. The recognition of an impairment of a significant portion of goodwill would negatively affect our results of operations and total capitalization, the affect of which could be material. A significant reduction in our stockholders’ equity due to an impairment of goodwill may affect our ability to maintain the debt-to-capital ratio required under our existing debt arrangements. We have identified the valuation of goodwill and indefinite-lived intangible assets as a critical accounting policy. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies—Goodwill and Indefinite-lived Intangible Assets” included in Item 7 of this Annual Report on Form 10-K.

| • | We purchased a water treatment company in late 2009 and we may encounter additional operational difficulties |

We purchased 80 percent of the water treatment business of Tianlong in November 2009, and purchased the remaining 20 percent in the fourth quarter of 2010. We are operating the business as SWT. The successful operation of SWT will require substantial attention from our management which could decrease the time our management has to serve and attract customers. We cannot provide assurance that this acquisition will operate profitably or that it will be able to achieve the financial or operational success we expect from the acquisition. The progress of our water treatment business has been slower than anticipated due to a number of unforeseen challenges including lower than anticipated sales and the need to move the manufacturing facility sooner than planned. Our financial condition, results of operations and cash flows could be adversely affected if our other businesses suffer on account of the increased focus on the acquired business.

| • | A substantial contribution to our financial results has come through acquisitions and we intend to grow by acquisitions using a portion of the cash proceeds from the sale of EPC, and we may not be able to identify or complete future acquisitions, which could adversely affect our future growth |

Acquisitions we have made over the last several years have had a significant impact on our results of operations. While we will continue to evaluate potential acquisitions and we intend to use a portion of the cash proceeds from the sale of EPC for future acquisitions, we may not be able to identify and successfully negotiate suitable acquisitions, obtain financing for future acquisitions on satisfactory terms, utilize cash flows from operations, obtain regulatory approval for certain acquisitions, or otherwise complete acquisitions in the future. If we complete any future acquisitions, then we may not be able to successfully integrate the acquired businesses or operate them profitably or accomplish our strategic objectives for those acquisitions. Our level of indebtedness may increase in the future if we finance acquisitions with debt, which would cause us to incur additional interest expense and could increase our vulnerability to general adverse economic and industry conditions and limit our ability to service our debt or obtain additional financing. We cannot assure you that future acquisitions will not have a material adverse affect on our financial condition, results of operations and cash flows.

8

Table of Contents

| • | We own a significant number of shares of RBC, and a decline in market value could occur prior to our sale of the shares |

In addition to cash proceeds of approximately $760 million from the sale of EPC to RBC, we received approximately 2.83 million shares of RBC common stock. In 2011, we entered into an equity collar contract for 50 percent of the shares to protect a portion of the value of the stock. We are exposed to market fluctuations for the remaining 50 percent of the unhedged RBC shares. We do not intend to be long-term shareholders of RBC, and a decline in the market value of RBC shares prior to our sale of these shares could have a material adverse impact on the value of our holdings.

| • | Our results of operations may be negatively impacted by product liability lawsuits and claims |

Our water heating and boiler products expose us to potential product liability risks that are inherent in the design, manufacture, sale and use of our products. While we currently maintain what we believe to be suitable product liability insurance, we cannot assure you that we will be able to maintain this insurance on acceptable terms, that this insurance will provide adequate protection against potential liabilities or that our insurance providers will successfully weather the current economic downturn. In addition, we self-insure a portion of product liability claims. A series of successful claims against us could materially and adversely affect our reputation and our financial condition, results of operations and cash flows.

| • | Changes in regulations or standards could adversely affect our business |

Our products are subject to a wide variety of statutory, regulatory and industry standards and requirements. These include energy efficiency, climate emissions, labeling and safety-related requirements. While we believe our products are currently some of the most efficient, safest, and environment-friendly products available, a significant change to these regulatory requirements, whether federal, foreign, state or local, or otherwise to industry standards could substantially increase manufacturing costs, impact the size and timing of demand for our products, or put us at a competitive disadvantage, any of which could harm our business and have a material adverse effect on our financial condition, results of operations and cash flow.

| • | If we are unable to develop product innovations and improve our technology and expertise, we could lose customers or market share |

Our success may depend on our ability to adapt to technological changes in the water heating, boiler and water treatment industry. If we are unable to timely develop and introduce new products, or enhance existing products, in response to changing market conditions or customer requirements or demands, our competitiveness could be materially and adversely affected.

| • | Certain members of the founding family of our company and trusts for their benefit have the ability to influence all matters requiring stockholder approval |

We have two classes of common equity: our Common Stock and our Class A Common Stock. The holders of Common Stock currently are entitled, as a class, to elect only one-third of our board of directors. The holders of Class A Common Stock are entitled, as a class, to elect the remaining directors. Certain members of the founding family of our company and trusts for their benefit (Smith Family) have entered into a voting trust agreement with respect to shares of our Class A Common Stock and shares of our Common Stock they own. As of December 31, 2011 these members of the Smith Family own approximately 57.4 percent of the total voting power of our outstanding shares of Class A Common Stock and Common Stock, taken together as a single class, and approximately 87.1 percent of the voting power of the outstanding shares of our Class A Common Stock, as a separate class. Due to the differences in the voting rights between shares of our Common Stock and shares of our Class A Common Stock, the Smith Family is in a position to control to a large extent the outcome of matters requiring a stockholder vote, including the adoption of amendments to our certificate of incorporation or bylaws or approval of transactions involving a change of control. This ownership position may increase if other members of the Smith Family enter into the voting trust agreement, and the voting power relating to this ownership position may increase if shares of our Class A Common Stock held by stockholders who are not parties to the voting trust agreement are converted into shares of our Common Stock. The voting trust agreement provides that in the event one of the parties to the voting trust agreement wants to withdraw from the trust or transfer any of its shares of our Class A Common Stock, such shares of our Class A Common Stock are automatically exchanged for shares of our Common Stock held by the trust to the extent available in the trust. In addition, the trust will have the right to purchase the shares of our Class A Common Stock and our Common Stock proposed to be withdrawn or transferred from the trust. As a result, the Smith Family members that are parties to the voting trust agreement have the ability to maintain their collective voting rights in our company even if certain members of the Smith Family decide to transfer their shares.

9

Table of Contents

ITEM 1B - UNRESOLVED STAFF COMMENTS

None.

Properties utilized by us at December 31, 2011 were as follows:

North America

This segment has 13 manufacturing plants located in six states and two non-U.S. countries, of which 11 are owned directly by us or our subsidiaries and two are leased from outside parties. Lease terms generally provide for minimum terms of one to ten years and have one or more renewal options. The terms of leases in effect at December 31, 2011 expire in 2012 and 2019.

Rest of World

This segment has six manufacturing plants located in three non-U.S. countries, of which three are owned directly by us or our subsidiaries and three are leased from outside parties. Lease terms generally provide for minimum terms of one to ten years and have one or more renewal options. The terms of leases in effect at December 31, 2011 expire between 2012 and 2018.

Corporate and General

We consider our plants and other physical properties to be suitable, adequate, and of sufficient productive capacity to meet the requirements of our business. The manufacturing plants operate at varying levels of utilization depending on the type of operation and market conditions. The executive offices of the company, which are leased, are located in Milwaukee, Wisconsin.

We are involved in various unresolved legal actions, administrative proceedings and claims in the ordinary course of our business involving product liability, property damage, insurance coverage, exposure to asbestos and other substances, patents and environmental matters, including the disposal of hazardous waste. Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of possible loss or recovery, we believe, based on past experience, adequate reserves and insurance availability, that these unresolved legal actions will not have a material effect on our financial position or results of operations. A more detailed discussion of certain of these matters appears in Note 16 of Notes to Consolidated Financial Statements.

ITEM 4 - MINE SAFETY DISCLOSURES

Not applicable.

10

Table of Contents

EXECUTIVE OFFICERS OF THE COMPANY

Pursuant to General Instruction of G(3) of Form 10-K, the following is a list of the executive officers which is included as an unnumbered Item in Part I of this report in lieu of being included in our Proxy Statement for our 2012 Annual Meeting of Stockholders.

| Name (Age) | Positions Held | Period Position Was Held | ||

| Stephen S. Anderson (63) |

Senior Vice President – Manufacturing and Supply Chain | 2011 to Present | ||

| Senior Vice President – Manufacturing and Supply Chain – A. O. Smith Water Products Company | 2004 to 2011 | |||

| Randall S. Bednar (59) |

Senior Vice President - Chief Information Officer | 2007 to Present | ||

| Senior Vice President – Information Technology | 2006 | |||

| Vice President – Information Technology | 2001 to 2006 | |||

| Vice President and Chief Information Officer – Gates Corporation | 1996 to 2000 | |||

| Wilfridus M. Brouwer (53) |

President and General Manager - A. O. Smith (China) Investment Co., Ltd. | 2009 to Present | ||

| Senior Vice President – Asia | 2009 to Present | |||

| Executive Project Leader – Akzo Nobel | 2007 to 2008 | |||

| Vice President Decorative Coatings; President Asia Operations - Akzo Nobel | 2005 to 2007 | |||

| Global Sub Business Unit Manager - Akzo Nobel | 2004 to 2005 | |||

| Robert J. Heideman (45) |

Senior Vice President – Engineering & Technology | 2011 to Present | ||

| Senior Vice President – Corporate Technology | 2010 to 2011 | |||

| Vice President - Corporate Technology | 2007 to 2010 | |||

| Director - Materials | 2005 to 2007 | |||

| Section Manager | 2002 to 2005 | |||

| Engineering Supervisor - Kohler Company | 2001 | |||

| Paul W. Jones (63) |

Chairman and Chief Executive Officer | 2005 to Present | ||

| President | 2004 to 2011 | |||

| Chief Operating Officer | 2004 to 2005 | |||

| Chairman and Chief Executive Officer - U.S. Can Company | 1998 to 2002 | |||

| John J. Kita (56) |

Executive Vice President and Chief Financial Officer | 2011 to Present | ||

| Senior Vice President, Corporate Finance and Controller | 2006 to 2011 | |||

| Vice President, Treasurer and Controller | 1996 to 2006 | |||

| Treasurer and Controller | 1995 to 1996 | |||

| Assistant Treasurer | 1988 to 1994 | |||

11

Table of Contents

| Name (Age) | Positions Held | Period Position Was Held | ||

| Mark A. Petrarca (48) |

Senior Vice President – Human Resources and Public Affairs | 2006 to Present | ||

| Vice President – Human Resources and Public Affairs | 2005 to 2006 | |||

| Vice President – Human Resources – A. O. Smith Water Products Company | 1999 to 2004 | |||

| Ajita G. Rajendra (60) |

President and Chief Operating Officer | 2011 to Present | ||

| Executive Vice President | 2006 to 2011 | |||

| President – A. O. Smith Water Products Company | 2005 to 2011 | |||

| Senior Vice President | 2005 to 2006 | |||

| Senior Vice President – Industrial Products Group, Kennametal Inc. | 1998 to 2004 | |||

| Steve W. Rettler (57) |

Senior Vice President – Corporate Development | 2006 to Present | ||

| Vice President – Business Development | 1998 to 2006 | |||

| James F. Stern (49) |

Executive Vice President, General Counsel and Secretary | 2007 to Present | ||

| Partner - Foley & Lardner LLP | 1997 to 2006 | |||

12

Table of Contents

ITEM 5 - MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

On October 11, 2010, our board of directors declared a three-for-two stock split of our Class A Common Stock and Common Stock in the form of a 50 percent stock dividend to stock holders of record on October 29, 2010 and payable on November 15, 2010. All references in this Item 5 to number of A. O. Smith shares or price per share have been adjusted to reflect the split.

| (a) | Market Information. Our Common Stock is listed on the New York Stock Exchange under the symbol AOS. Our Class A Common Stock is not listed. Wells Fargo Shareowner Services, N.A., P.O. Box 64854, St. Paul, Minnesota, 55164-0854 serves as the registrar, stock transfer agent and the dividend reinvestment agent for our Common Stock and Class A Common Stock. |

Quarterly Common Stock Price Range

| 2011 | 1st Qtr. | 2nd Qtr. | 3rd Qtr. | 4th Qtr. | ||||||||||||

| High |

$ | 44.66 | $ | 44.82 | $ | 44.74 | $ | 41.04 | ||||||||

| Low |

37.58 | 38.75 | 31.94 | 29.81 | ||||||||||||

| 2010 | 1st Qtr. | 2nd Qtr. | 3rd Qtr. | 4th Qtr. | ||||||||||||

| High |

$ | 35.68 | $ | 37.76 | $ | 39.28 | $ | 42.89 | ||||||||

| Low |

27.39 | 29.24 | 31.15 | 36.39 | ||||||||||||

| (b) | Holders. As of January 31, 2012, the approximate number of shareholders of record of Common Stock and Class A Common Stock were 800 and 70, respectively. |

| (c) | Dividends. Dividends declared on the common stock are shown in Note 18 of Notes to Consolidated Financial Statements appearing elsewhere herein. |

| (d) | Stock Repurchases. On December 14, 2007 and further ratified on December 14, 2010, our board of directors approved a stock repurchase program authorizing the purchase of up to 1.5 million shares of our common stock. This stock repurchase authorization remains effective until terminated by our board of directors. As of December 31, 2011, we repurchased approximately 612,000 shares at an average price of $38.69 per share at a total cost of $23.5 million, and approximately 888,000 shares remain on the existing repurchase authorization. |

| ISSUER PURCHASES OF EQUITY SECURITIES |

||||||||||||||||

| Period |

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Maximum Number of Shares that may yet be Purchased Under the Plans or Programs |

||||||||||||

| October 1 – October 31, 2011 |

- | - | - | 1,363,800 | ||||||||||||

| November 1 – November 30, 2011 |

292,689 | 37.19 | 292,689 | 1,071,111 | ||||||||||||

| December 1 – December 31, 2011 |

182,700 | 37.82 | 182,700 | 888,411 | ||||||||||||

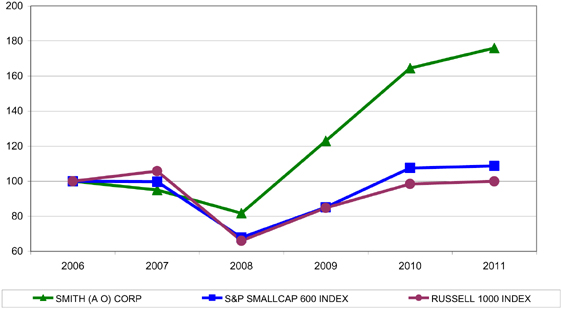

| (e) | Performance Graph. The following information in this Item 5 of this Annual Report on form 10-K is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Securities Exchange Act of 1934, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by reference into such a filing. |

13

Table of Contents

The graph below shows a five-year comparison of the cumulative shareholder return on our Common Stock with the cumulative total return of the S&P Small Cap 600 Index and the Russell 1000 Index, both of which are published indices.

Comparison of Five-Year Cumulative Total Return

From December 31, 2006 to December 31, 2011

Assumes $100 Invested with Reinvestment of Dividends

| Base Period |

INDEXED RETURNS | |||||||||||||||||||||||

| Company/Index |

12/31/06 | 12/31/07 | 12/31/08 | 12/31/09 | 12/31/10 | 12/31/11 | ||||||||||||||||||

| A. O. SMITH CORP |

100.0 | 95.0 | 81.7 | 122.9 | 164.5 | 176.0 | ||||||||||||||||||

| S&P SMALL CAP 600 INDEX |

100.0 | 99.7 | 67.8 | 85.1 | 107.5 | 108.6 | ||||||||||||||||||

| RUSSELL 1000 INDEX |

100.0 | 105.8 | 66.0 | 84.8 | 98.4 | 99.9 | ||||||||||||||||||

14

Table of Contents

ITEM 6 – SELECTED FINANCIAL DATA

The data presented below includes the impact of our merger transaction with Smith Investment Company (SICO) which closed on April 22, 2009 and is discussed further in the Consolidation section of Note 1 of the Notes to Consolidated Financial Statements.

(dollars in millions, except per share amounts)

| Years ended December 31 | ||||||||||||||||||||

| 2011(1),(2) | 2010(3) | 2009(4) | 2008 | 2007 | ||||||||||||||||

| Net sales – continuing operations |

$ | 1,710.5 | $ | 1,489.3 | $ | 1,375.0 | $ | 1,451.3 | $ | 1,423.1 | ||||||||||

| Earnings |

||||||||||||||||||||

| Continuing operations |

111.2 | 57.1 | 60.5 | 47.2 | 62.5 | |||||||||||||||

| Discontinued operations |

194.5 | 54.4 | 29.1 | 30.1 | 28.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net earnings |

305.7 | 111.5 | 89.6 | 77.3 | 90.8 | |||||||||||||||

| Net loss (earnings) attributable to noncontrolling interest: |

||||||||||||||||||||

| Continuing operations |

- | 0.2 | (9.6 | ) | (35.0 | ) | (44.1 | ) | ||||||||||||

| Discontinued operations |

- | - | 1.3 | (20.6 | ) | (16.3 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net earnings attributable to A. O. Smith Corporation |

$ | 305.7 | $ | 111.7 | $ | 81.3 | $ | 21.7 | $ | 30.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic earnings per share of common stock(3) |

||||||||||||||||||||

| Continuing operations |

$ | 2.41 | $ | 1.25 | $ | 1.48 | $ | 0.86 | $ | 1.29 | ||||||||||

| Discontinued operations |

4.22 | 1.19 | 0.89 | 0.67 | 0.85 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net earnings |

$ | 6.63 | $ | 2.44 | $ | 2.37 | $ | 1.53 | $ | 2.14 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted earnings per share of common stock(3) |

||||||||||||||||||||

| Continuing operations |

$ | 2.39 | $ | 1.24 | $ | 1.48 | $ | 0.86 | $ | 1.29 | ||||||||||

| Discontinued operations |

4.18 | 1.18 | 0.88 | 0.67 | 0.85 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net earnings |

$ | 6.57 | $ | 2.42 | $ | 2.36 | $ | 1.53 | $ | 2.14 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash dividends per common share(3) |

$ | 0.60 | $ | 0.54 | $ | 0.51 | $ | 0.49 | $ | 0.47 | ||||||||||

| December 31 | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Total assets |

$ | 2,349.0 | $ | 2,110.6 | $ | 1,973.0 | $ | 1,982.7 | $ | 1,973.0 | ||||||||||

| Long-term debt(5) |

443.0 | 242.4 | 232.1 | 317.3 | 387.6 | |||||||||||||||

| Total stockholders’ equity |

1,085.8 | 881.4 | 789.8 | 663.2 | 793.7 | |||||||||||||||

| (1) | In August 2011, we sold EPC which is reflected as a discontinued operation for all periods presented. |

| (2) | In August 2011, we acquired Lochinvar. |

| (3) | In October 2010, we declared a 50 percent stock dividend to holders of Common Stock and Class A Common Stock which is not included in cash dividends. Basic and Diluted earnings per share are calculated using the weighted average shares outstanding which were restated for all periods presented to reflect the stock dividend. |

| (4) | In November 2009, we acquired an 80 percent interest in the water treatment business of Tianlong. In the fourth quarter of 2010, we acquired the remaining 20 percent interest in the water treatment business of Tianlong. We are operating the business as SWT. |

| (5) | Excludes the current portion of long-term debt. |

15

Table of Contents

ITEM 7 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

We are a leading manufacturer of water heaters and boilers, serving a diverse mix of residential and commercial end markets principally in the U.S. with a strong and growing international presence. During the fourth quarter of 2011, we reorganized our management reporting structure to reflect our current business activities. Historical information has been revised to reflect our new structure. Our company is comprised of two reporting segments: North America and Rest of World. Both segments manufacture and market comprehensive lines of residential and commercial gas, gas tankless, oil and electric water heaters. Both segments primarily manufacture and market in their respective region of the world. The North America segment also manufactures and globally markets specialty commercial water heating equipment, condensing and non-condensing boilers and water systems tanks. The Rest of World segment also manufactures and markets water treatment products, primarily for Asia. On August 22, 2011, we sold EPC to RBC for approximately $760 million in cash and approximately 2.83 million shares of RBC common stock valued at $140.6 million as of that date. Due to the sale, EPC has been reflected as discontinued operations in the accompanying financial statements for all periods presented. In 2011, sales for our North America segment were $1,289.5 million, sales for our Rest of World segment were $455.6 million and discontinued operations EPC sales were $531.8 million.

Sales of our Rest of World A. O. Smith branded products in China grew significantly in 2011. We expect sales of A. O. Smith branded products in China to grow approximately twice as fast as the rate of China’s Gross Domestic Product (GDP) in 2012, as geographic expansion, market share gains and new product introductions contribute to our growth. The residential and commercial markets for our North America segment remain weak due to the relatively low number of housing starts and lack of commercial construction activity, although residential and commercial replacement demand significantly supported our sales in 2011. Our 2011 North America residential sales were essentially flat compared to the prior year and commercial sales showed slight growth, largely in anticipation of a regulatory change in 2012. We expect the North America residential water heater industry unit growth to be flat for 2012 and expect a modest decline in commercial industry units. Our recently acquired residential and commercial boiler operations (more completely described below) added approximately $76 million to our North America sales in 2011, and we expect this business to grow over ten percent in 2012, driven by sales of energy efficient products.

We recognized a pretax charge of $35.4 million in 2010 for expenses related to damages to our water heater manufacturing facility located in Ashland City, TN caused by flooding of the Cumberland River. This facility was temporarily shut down and production of water heaters was transferred to our other water heater manufacturing facilities in the U.S., Canada and Mexico. Our recovery from the impact of the flood was essentially completed by year end 2010. We lost some sales orders in 2010 due to the flood, however, we retained all customers from which we lost orders.

We purchased the remaining 20 percent interest in SWT from our former partner in the fourth quarter of 2010 and now own 100 percent of this company. The progress of our water treatment business has been slower than anticipated due to a number of unforeseen challenges including the need to move the manufacturing facility sooner than planned. We incurred losses in 2011 and in 2010. We continue to expect strong long term sales growth opportunities in the water treatment industry in China. We introduced A. O. Smith branded water treatment products into our China distribution network during 2010 and now sell these products in over 900 outlets.

During the second quarter of 2010, we began production of residential water heaters for the Indian market at our new plant located just outside of Bangalore, India. In 2011, sales in our India water heater operations more than doubled to $18.1 million compared to the prior year.

On July 1, 2010, we acquired the rights from Takagi to market tankless water heaters in North America and entered into a long-term agreement with Takagi to supply tankless water heaters. As part of the venture, we took over the management of Takagi’s North American sales and distribution organization. Through this venture, we offer a full line of gas tankless water heaters under our own brands in association with the Takagi brand. In 2011, we estimate the industry sold approximately 440,000 tankless water heaters in North America.

On October 11, 2010, our board of directors declared a three-for-two stock split of our Class A Common Stock and Common Stock in the form of a 50 percent stock dividend to stock holders of record on October 29, 2010 and payable on November 15, 2010.

We intend to take advantage of our strong balance sheet and the remaining proceeds from the sale of EPC to execute on a number of our water related strategic initiatives. We will look to continue to grow our core residential and commercial water heating, boiler and water treatment businesses in our existing operations in the high growth regions of China and India. We will look to expand into additional fast growing geographic markets such as South America, Southeast Asia and Africa via acquisition or via using our existing manufacturing locations in China and India as export platforms.

16

Table of Contents

We intend to expand our core product lines in the areas of water heaters, boilers and water treatment products through acquisitions, joint ventures or other business relationships. Finally, we will pursue opportunities in new and unique technologies as well as water themed adjacencies that will be attractive to our customers and channel partners and will leverage our core competencies to create shareholder value.

Consistent with our stated strategy to expand our core product offering with new technologies, on August 26, 2011, we acquired Lochinvar for approximately $421 million plus an earnout of up to $35 million if certain revenue objectives are achieved by November 2012. Lochinvar, one of the leading manufacturers of residential and commercial boilers in the U.S., fits squarely within our stated strategic growth initiative to expand our core water heating business. Lochinvar’s sales for the twelve months ended November 30, 2011 (Lochinvar’s former fiscal year end) were approximately $200 million and have grown at an eight percent compound annual growth rate over the last five years. The boiler market in the U.S. has been transitioning to higher efficiency, condensing boilers for the last several years. In 2010, about 25 percent of boilers sold in the U.S. were condensing boilers, compared with five percent eight years ago. Lochinvar is a leading manufacturer of condensing boilers as well as an innovator of new, higher efficiency boilers. We expect the transition in the U.S. to higher efficiency boilers will continue into the foreseeable future and, as a result, we expect sales of Lochinvar’s products will likely continue to grow more than ten percent in 2012. We paid the purchase price for Lochinvar using a combination of cash on hand and amounts that we borrowed under our $425 million credit facility.

LIQUIDITY AND CAPITAL RESOURCES

We achieved net earnings inclusive of discontinued operations and noncontrolling interest of $305.7 million or $6.57 per diluted share in 2011 compared with $111.7 million or $2.42 per diluted share in 2010 and $81.3 million or $2.36 per diluted share in 2009. Our 2011 earnings include $194.5 million, or $4.18 per diluted share, related to EPC, as well as an after-tax gain of $12.9 million, or $.28 per diluted share, associated with our shares of RBC, a legal settlement with a component supplier and an increase to a warranty reserve associated with a similar component in Canada. Our newly acquired Lochinvar business contributed $.07 per diluted share to full year earnings, which included interest expense and $.10 per diluted share of non-recurring professional fees and purchase accounting charges. Our 2010 earnings include an after-tax $21.6 million or $0.47 per diluted share charge for the flooding of our Ashland City, TN water heater plant in May 2010 as well as $54.4 million or $1.18 per diluted share from EPC. Our 2009 reported earnings and earnings per share include $29.1 million or $.88 per diluted share from EPC and have been impacted by required accounting related to our transaction with Smith Investment Company (SICO), which closed on April 22, 2009 and is discussed in more detail in Note 1 of the Notes to Consolidated Financial Statements. For accounting purposes, the former controlling shareholder, SICO, is treated as the acquirer even though we (A. O. Smith Corporation) are the surviving corporation from a legal standpoint. Earnings and earnings per share amounts reported by us for 2009 include SICO earnings and shares outstanding as adjusted for the exchange ratio of the merger transaction prior to the closing date.

The primary accounting impact of the SICO transaction is in the calculation of earnings per share because the accounting rules require the use of SICO adjusted average shares outstanding prior to closing. The SICO transaction did not impact 2011 or 2010 results. Eliminating the impact of the transaction as set forth in the table below, non generally accepted accounting principles (GAAP) net earnings (including net earnings from discontinued operations) in 2009 were $89.7 million or $1.97 per diluted share.

We believe that presenting non-GAAP financial information permits investors to compare our financial results for the current period to our historical results for the periods reported. Although 2011 and 2010 financial information was not affected by the transaction, 2009 full year and previously reported periods were impacted. Management also uses the non-GAAP information for all internal purposes of reporting results of operations including return on investment measures utilized in determining certain incentive-based compensation and employee profit sharing amounts. Below is a reconciliation of GAAP to non-GAAP earnings and earnings per share as discussed above.

17

Table of Contents

A. O. Smith Corporation

Reconciliation of Non-GAAP Data

In millions, except per share amounts

| Total Year |

||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| Continuing earnings, as reported |

$ | 60.5 | $ | 47.2 | $ | 62.5 | ||||||

| Deduct: Net earnings attributable to non-controlling interest for continuing operations |

(9.6 | ) | (35.0 | ) | (44.1 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Continuing earnings used to calculate earnings per share as reported |

$ | 50.9 | $ | 12.2 | $ | 18.4 | ||||||

| Add: Non-GAAP adjustments attributable to net earnings of non-controlling interest for continuing operations and SICO expenses |

9.7 | 39.3 | 45.8 | |||||||||

|

|

|

|

|

|

|

|||||||

| Continuing earnings as adjusted |

$ | 60.6 | $ | 51.5 | $ | 64.2 | ||||||

|

|

|

|

|

|

|

|||||||

| Net earnings, as reported |

$ | 81.3 | $ | 21.7 | $ | 30.4 | ||||||

| Add: Non-GAAP adjustments attributable to net earnings of non-controlling interest and SICO expenses |

8.4 | 60.2 | 57.8 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net earnings as adjusted |

$ | 89.7 | $ | 81.9 | $ | 88.2 | ||||||

|

|

|

|

|

|

|

|||||||

| Average common shares outstanding, as reported |

34.5 | 14.2 | 14.2 | |||||||||

| Add:Non-GAAP adjustments to weighted average common shares attributable to non-controlling interest |

11.0 | 31.2 | 32.3 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted average common shares outstanding |

45.5 | 45.4 | 46.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Earnings per diluted share: |

||||||||||||

| Continuing earnings per share, as reported |

$ | 1.48 | $ | 0.86 | $ | 1.29 | ||||||

|

|

|

|

|

|

|

|||||||

| Continuing earnings per share, as adjusted |

$ | 1.33 | $ | 1.13 | $ | 1.38 | ||||||

|

|

|

|

|

|

|

|||||||

| Net earnings per share, as reported |

$ | 2.36 | $ | 1.53 | $ | 2.14 | ||||||

|

|

|

|

|

|

|

|||||||

| Net earnings per share, as adjusted |

$ | 1.97 | $ | 1.80 | $ | 1.90 | ||||||

|

|

|

|

|

|

|

|||||||

Although 2011 and 2010 financial information was not affected by the transaction, 2009 full year and previously reported periods were impacted. The non-GAAP presentation of adjusted earnings per share should not be construed as an alternative to the results reported in accordance with U.S. GAAP. It is provided solely to assist in the investor’s understanding of the impact of these items on the comparability of the company’s operations

| (1) | Reported shares are calculated as the weighted average of SICO shares prior to the closing and A. O. Smith shares after the closing. All share amounts were adjusted to retroactively reflect in all periods presented our 50 percent stock dividend which occurred on October 11, 2010. |

Our results of continuing operations will be discussed later in this section and our discontinued operation’s financial information is provided in Note 2 of the Notes to Consolidated Financial Statements.

Our working capital was $720.3 million at December 31, 2011 compared with $209.5 million and $121.7 million at December 31, 2010 and December 31, 2009 respectively. The majority of the $510.8 million increase in working capital in 2011 was due to the receipt of cash and RBC shares from the sale of EPC, which closed in the third quarter, less the cash used in the acquisition of Lochinvar, and, to a lesser extent, the working capital related to the purchase of Lochinvar. The $87.8 million increase in working capital in 2010 resulted from higher cash levels outside the U.S., sales related increases late in the year in accounts receivable and higher inventory levels to support higher sales, new businesses and new product launches, which were partially offset by higher accounts payable balances related to higher sales. As of December 31, 2011, $463.3 million of cash and cash equivalents were held by our foreign subsidiaries.

Operating cash provided by continuing operations during 2011 was $61.0 million compared with $63.3 million during 2010 and $122.9 million during 2009. Higher earnings in 2011 and improved working capital were more than offset by $107 million of after tax pension contributions, resulting in lower operating cash flows in 2011 than in 2010. The increase in our working capital needs in 2010 compared with a decline in the previous year explain the majority of the decline in 2010 operating cash flows as compared with 2009. We expect our cash provided by operating activities less the expected earn-out related to Lochinvar in 2012 to be approximately $145 to $155 million, an improvement from 2011 primarily due to the expected absence of pension contributions.

18

Table of Contents

Our capital expenditures for continuing operations were $53.5 million in 2011, the same as in 2010. Capital expenditures in 2010 were higher than the $42.7 million spent in 2009 as a result of $18.5 million in capital spending related to the flooding in May 2010. We are projecting 2012 capital expenditures of between $80 and $90 million and 2012 depreciation and amortization of approximately $55 million. Capital spending in 2012 will include approximately $40 million to begin construction of a second water heater manufacturing plant in Nanjing, China to meet local demand. The new plant is expected to add 50 percent more capacity to our China water heater operations. We also plan to expand our India plant to accommodate more water heater models, in-source some component manufacturing and meet local demand. We expect our 2012 depreciation and amortization will be approximately $8 million higher than 2011 primarily related to Lochinvar.

In November 2010, we completed a $425 million multi-currency three year revolving credit facility with a group of eight banks. The facility has an accordion provision which allows it to be increased up to $525 million if certain conditions (including lender approval) are satisfied. Borrowing rates under the facility are determined by our leverage ratio. The facility requires us to maintain two financial covenants, a leverage ratio test and an interest coverage test, and we were in compliance with the covenants as of December 31, 2011.

The facility backs up commercial paper and credit line borrowings, and it expires on November 12, 2013. As a result of the long-term nature of this facility, the commercial paper and credit line borrowings, as well as drawings under the facility are classified as long-term debt. At December 31, 2011, we had available borrowing capacity of $61.1 million under this facility. In addition, the value of our RBC shares as of December 31, 2011 was $144.4 million and we do not intend to be long-term shareholders of RBC. We believe that the combination of cash, available borrowing capacity, proceeds from the sale of RBC shares and operating cash flow will provide sufficient funds to finance our existing operations for the foreseeable future.

Our total debt increased to $461.6 million at December 31, 2011 compared with $261.0 million at December 31, 2010, due to the purchase of Lochinvar. As a result, our leverage, as measured by the ratio of total debt to total capitalization, was 29.8 percent at the end of 2011 compared with 22.8 percent at the end of 2010.

Our U.S. pension plan continues to meet all funding requirements under ERISA regulations. While we were required to make a minimal contribution to the plan in 2011, we elected to make contributions of $175.0 million. We are forecasting that there will be no required contributions to the plan in 2012, and we do not plan to make any voluntary contributions. For further information on our pension plans, see Note 12 of the Notes to Consolidated Financial Statements.

In December 2010, our board of directors ratified its authorization of a stock repurchase program in the amount of 1.5 million shares of our common stock. During 2011, we repurchased approximately 612,000 shares at an average price of $38.69 per share for a total amount of $23.5 million. A total of approximately 888,000 remain in the existing repurchase authority.

We have paid dividends for 72 consecutive years with payments increasing each of the last 20 years. We paid total dividends of $.60 per share in 2011 compared with $.54 per share in 2010.

Aggregate Contractual Obligations

A summary of our contractual obligations as of December 31, 2011, is as follows:

| (dollars in millions) | Payments due by period | |||||||||||||||||||

| Contractual Obligations |

Total | Less Than 1 year |

1 - 2 Years |

3 - 5 Years |

More than 5 years |

|||||||||||||||

| Long-term debt |

$ | 461.6 | $ | 18.6 | $ | 396.9 | $ | 28.9 | $ | 17.2 | ||||||||||

| Fixed rate interest |

16.1 | 5.0 | 6.9 | 3.4 | 0.8 | |||||||||||||||

| Operating leases |

50.5 | 12.4 | 16.1 | 11.1 | 10.9 | |||||||||||||||

| Purchase obligations |

76.1 | 76.1 | - | - | - | |||||||||||||||

| Pension and post-retirement obligations |

81.9 | 1.0 | 46.6 | 14.8 | 19.5 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 686.2 | $ | 113.1 | $ | 466.5 | $ | 58.2 | $ | 48.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

As of December 31, 2011, our liability for uncertain income tax positions was $1.8 million. Due to the high degree of uncertainty regarding timing of potential future cash flows associated with these liabilities, we are unable to make a reasonably reliable estimate of the amount and period in which these liabilities might be paid.

We utilize blanket purchase orders to communicate expected annual requirements to many of our suppliers. Requirements under blanket purchase orders generally do not become committed until several weeks prior to our scheduled unit production. The purchase obligation amount presented above represents the value of commitments that we consider firm.

19

Table of Contents

RESULTS OF OPERATIONS

Our sales from continuing operations in 2011 were $1,710.5 million, surpassing 2010 sales of $1,489.3 million by 14.9 percent. The increase in sales was attributable mostly to our recently acquired Lochinvar business which added $75.9 million in sales and higher sales of A. O. Smith branded products in China which grew 29.0 percent to $371.7 million for the year. Pricing actions related to higher raw material costs, higher commercial water heater volumes and a full year of sales of gas tankless products in North America also contributed to the increased sales. Our sales from continuing operations were $1,375.0 million in 2009. The $114.3 million increase in sales from 2009 to 2010 was due to higher sales in China resulting from geographic expansion, market share gains and new product introductions as well as additional sales from our water treatment business acquired in November of 2009.

In the fourth quarter of 2011, we evaluated our segment reporting subsequent to the sale of EPC and the purchase of Lochinvar and reorganized our management reporting structure to reflect our current business activities and concluded that reporting two geographic segments would more closely align our financial reporting with how we manage our overall business. Commencing with this Annual Report on Form 10-K, our company is comprised of two reporting segments: North America and Rest of World. Sales and earnings results for these new reporting segments are discussed later in the Results of Operations and have been restated for all periods presented.

Our gross profit margin for continuing operations in 2011 was 30.0 percent, about equal to the 29.9 percent margin in 2010. The impact of the addition of relatively higher margin sales from our Lochinvar acquisition and increased sales of A. O. Smith branded products in China in 2011 was offset by a decline in margin in our water treatment products and higher material costs. Our gross profit margin increased from 28.7 percent in 2009 to 29.9 percent in 2010. The improved margins were due to increased volume, cost containment activities and lower warranty costs which more than offset certain inefficiencies resulting from the May 2010 flood in our Ashland, TN manufacturing facility.