UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07083

Name of Fund: BlackRock MuniYield Arizona Fund, Inc. (MZA)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock MuniYield Arizona Fund, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 07/31/2015

Date of reporting period: 01/31/2015

Item 1 – Report to Stockholders

| SEMI-ANNUAL REPORT (UNAUDITED) |  |

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Table of Contents

| Page | ||||||

The

Markets in Review |

3 | |||||

Semi-Annual Report: |

||||||

Municipal Market Overview |

4 | |||||

The

Benefits and Risks of Leveraging |

5 | |||||

Derivative Financial Instruments |

5 | |||||

Fund Summaries |

6 | |||||

Financial Statements: |

||||||

Schedules of Investments |

16 | |||||

Statements of Assets and Liabilities |

35 | |||||

Statements of Operations |

36 | |||||

Statements of Changes in Net Assets |

37 | |||||

Statements of Cash Flows |

40 | |||||

Financial Highlights |

41 | |||||

Notes to Financial Statements |

46 | |||||

Officers and Directors |

55 | |||||

Additional Information |

56 |

| 2 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| The Markets in Review |

President, BlackRock Advisors,

LLC

|

Rob Kapito

President, BlackRock Advisors, LLC

Total Returns as of January 31, 2015

| 6-month | 12-month | |||||||||

U.S.

large cap equities (S&P 500® Index) |

4.37 | % | 14.22 | % | ||||||

U.S.

small cap equities (Russell 2000® Index) |

4.72 | 4.41 | ||||||||

International equities (MSCI Europe, Australasia, Far East Index) |

(6.97 | ) | (0.43 | ) | ||||||

Emerging market equities (MSCI Emerging Markets Index) |

(9.05 | ) | 5.23 | |||||||

3-month Treasury bill (BofA Merrill Lynch 3-Month U.S. Treasury Bill Index) |

0.01 | 0.03 | ||||||||

U.S.

Treasury securities (BofA Merrill Lynch 10-Year U.S. Treasury Index) |

9.29 | 12.25 | ||||||||

U.S.

investment grade bonds (Barclays U.S. Aggregate Bond Index) |

4.36 | 6.61 | ||||||||

Tax-exempt municipal bonds (S&P Municipal Bond Index) |

4.51 | 8.81 | ||||||||

U.S.

high yield bonds (Barclays U.S. Corporate High Yield 2% Issuer Capped Index) |

(0.89 | ) | 2.41 | |||||||

THIS PAGE NOT PART OF YOUR FUND

REPORT |

3 |

| Municipal Market Overview |

For the Reporting Period Ended January 31, 2015

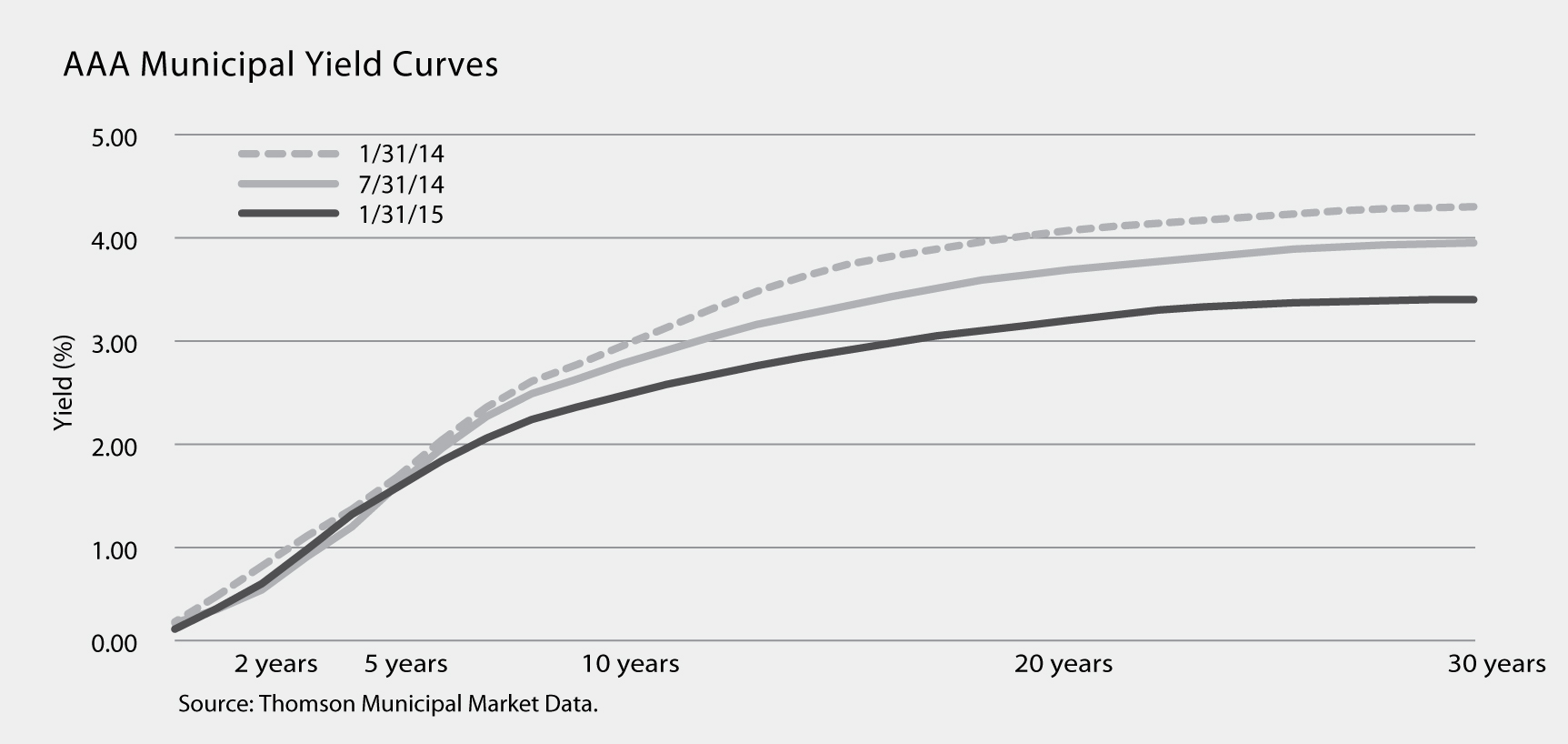

From a historical perspective, total new issuance for the 12 months ended January 31, remained relatively strong at $342 billion (slightly higher than the $326 billion issued in the prior 12-month period). A noteworthy portion of new supply during this period was attributable to refinancing activity (roughly 45%) as issuers took advantage of lower interest rates to reduce their borrowing costs. |

S&P Municipal Bond Index Total Returns as of January 31, 2015 | |

| 6 months: | 4.51% | |

| 12 months: | 8.81% | |

| 4 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| The Benefits and Risks of Leveraging | |

| SEMI-ANNUAL REPORT | JANUARY 31, 2015 | 5 |

| Fund Summary as of January 31, 2015 | BlackRock Muni New York

Intermediate Duration Fund, Inc. |

Fund Overview

Performance

• |

For the six-month period ended January 31, 2015, the Fund returned 8.58% based on market price and 6.70% based on NAV. For the same period, the closed-end Lipper Intermediate Municipal Debt Funds category posted an average return of 7.55% based on market price and 6.22% based on NAV. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

• |

Municipal bonds generally delivered strong performance during the six-month period, with yields declining as prices rose. Longer-term municipal bonds generally outperformed shorter-term issues. In this environment, the Fund’s duration positioning and allocation to longer-dated bonds provided positive returns. The Fund’s exposure to the tax-backed (state and local), education and transportation sectors were positive contributors to performance. Positions in lower-coupon bonds, which tend to have longer durations and more capital appreciation potential than bonds with higher coupons, helped performance as yields fell during the period. (Duration measures sensitivity to interest rate movements.) The Fund’s exposure to higher-yielding bonds in the lower Investment-grade quality category aided performance, as this market segment outperformed during the period. The Fund also benefited from income generated in the form of coupon payments from its portfolio of municipal bond holdings. In addition, the Fund’s limited use of leverage provided both incremental return and income in an environment of declining interest rates. (Bond prices rise as yields fall). |

• |

There were no detractors from performance on an absolute basis as all areas of the Fund’s investment universe appreciated during the period. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Fund Information

Symbol on New York Stock Exchange (“NYSE”) |

MNE |

|||

Initial Offering Date |

August 1, 2003 |

|||

Yield on Closing Market Price as of January 31, 2015 ($14.45)1 |

4.78% |

|||

Tax

Equivalent Yield2 |

9.67% |

|||

Current Monthly Distribution per Common Share3 |

$0.0575 |

|||

Current Annualized Distribution per Common Share3 |

$0.6900 |

|||

Economic Leverage as of January 31, 20154 |

35% |

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal and state tax rate of 50.59%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VRDP Shares and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 5. |

| 6 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| BlackRock Muni New York

Intermediate Duration Fund, Inc. |

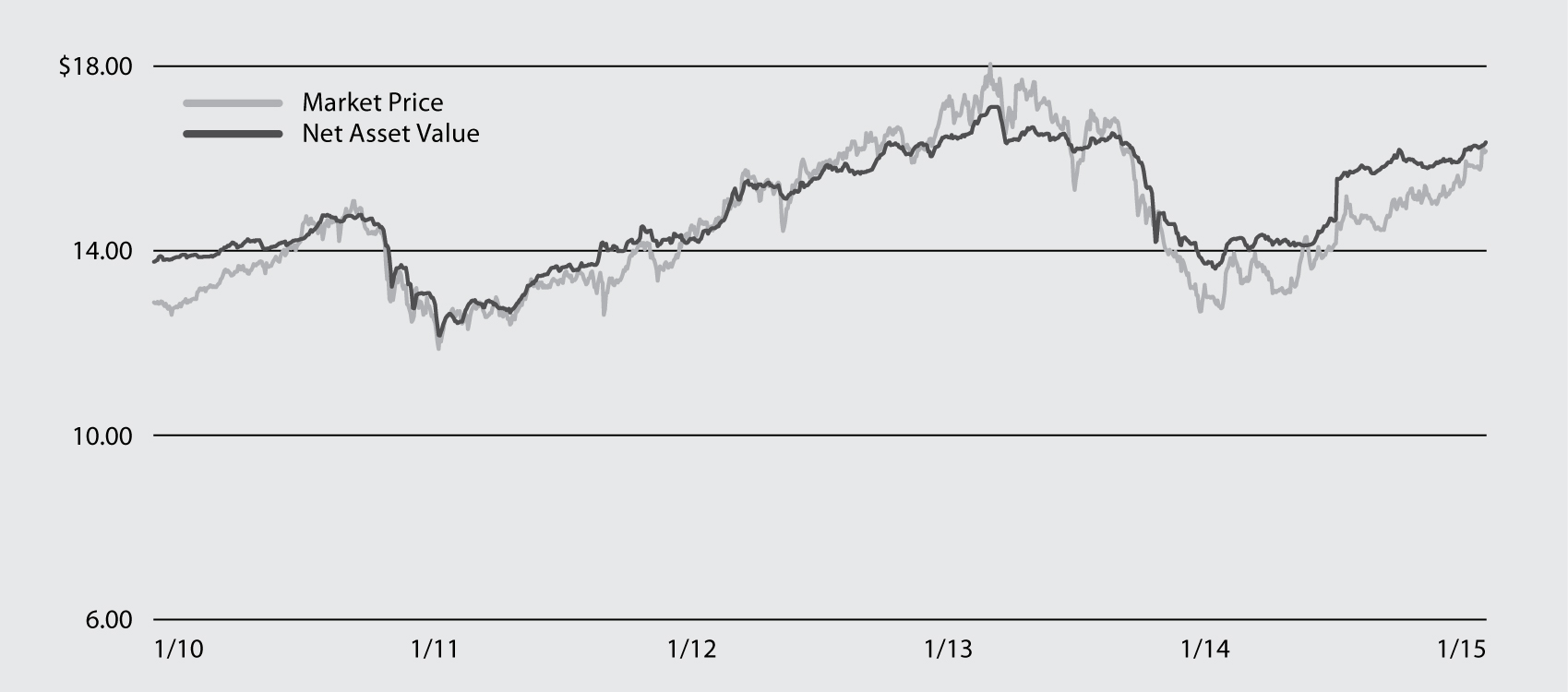

Market Price and Net Asset Value Per Share Summary

| |

1/31/15 |

|

7/31/14 |

|

Change |

|

High |

|

Low |

|||||||||||||

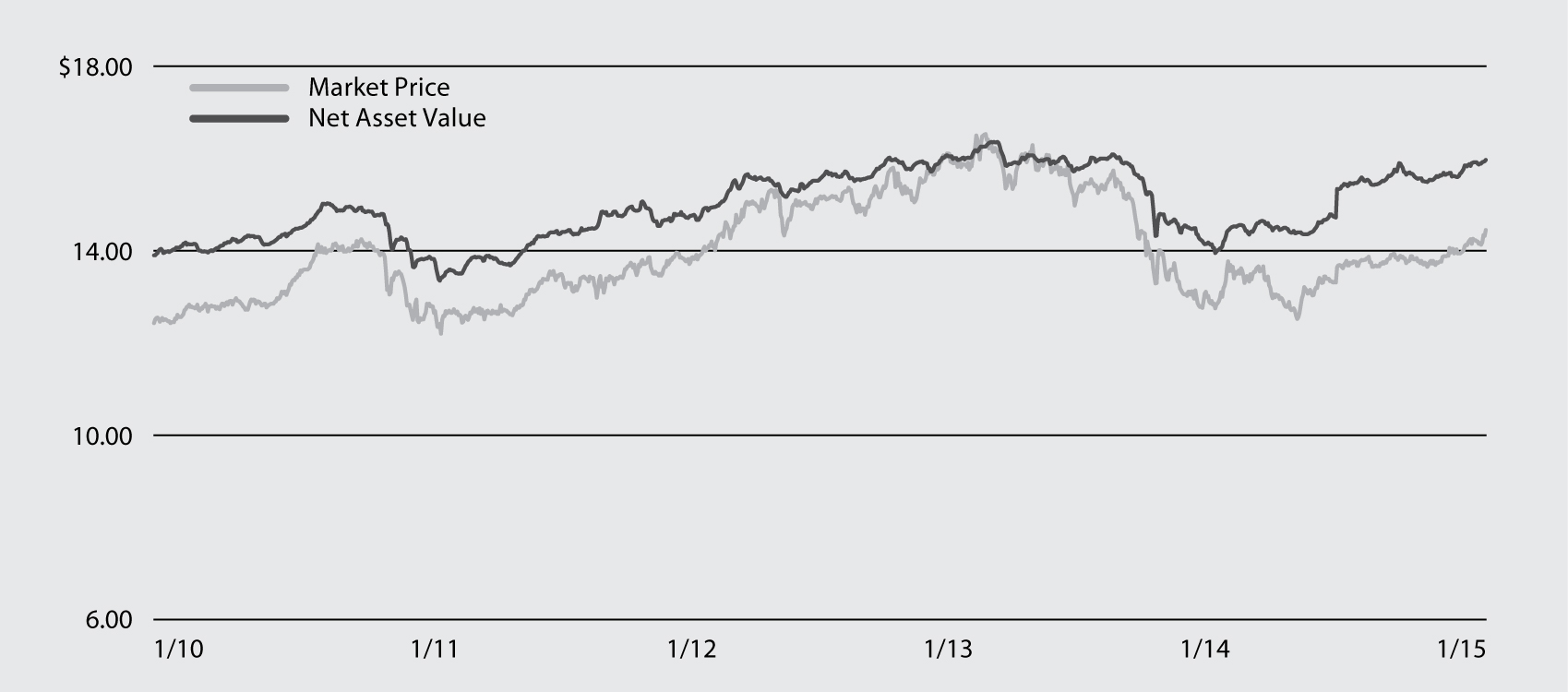

Market Price |

$ | 14.45 | $ | 13.64 | 5.94 | % | $ | 14.49 | $ | 13.61 | ||||||||||||

Net Asset Value |

$ | 15.97 | $ | 15.34 | 4.11 | % | $ | 15.97 | $ | 15.34 | ||||||||||||

Market

Price and Net Asset Value History For the Past Five Years |

Overview of the Fund’s Total Investments*

| Sector Allocation |

|

1/31/15 |

|

7/31/14 |

||||||

Transportation |

19 | % | 20 | % | ||||||

County/City/Special District/School District |

18 | 21 | ||||||||

Education |

15 | 15 | ||||||||

Health |

13 | 13 | ||||||||

Utilities |

12 | 11 | ||||||||

State |

10 | 8 | ||||||||

Corporate |

8 | 8 | ||||||||

Housing |

4 | 4 | ||||||||

Tobacco |

1 | — | ||||||||

| Call/Maturity

Schedule3 |

||||||||

Calendar Year Ended December 31, |

||||||||

2015 |

4 | % | ||||||

2016 |

8 | |||||||

2017 |

5 | |||||||

2018 |

9 | |||||||

2019 |

10 | |||||||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

* |

Excludes short-term securities. |

| Credit Quality

Allocation1 |

|

1/31/15 |

|

7/31/14 |

||||||

AAA/Aaa |

9 | % | 7 | % | ||||||

AA/Aa |

52 | 54 | ||||||||

A

|

21 | 22 | ||||||||

BBB/Baa |

7 | 6 | ||||||||

BB/Ba |

5 | 5 | ||||||||

N/R2 |

6 | 6 | ||||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of January 31, 2015 and July 31, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade was $3,529,147, representing 3%, and $2,266,516, representing 2%, respectively, of the Fund’s total investments. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2015 | 7 |

| Fund Summary as of January 31, 2015 | BlackRock MuniYield

Arizona Fund, Inc. |

Fund Overview

Performance

• |

For the six-month period ended January 31, 2015, the Fund returned 12.73% based on market price and 7.75% based on NAV. For the same period, the closed-end Lipper Other States Municipal Debt Funds category posted an average return of 8.27% based on market price and 7.81% based on NAV. All returns reflect reinvestment of dividends. The Fund’s premium to NAV, which widened during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

• |

The Fund’s duration positioning made the largest contribution to performance, as yields on municipal bonds decreased substantially during the period. (Bond prices rise as yields fall; duration measures sensitivity to interest rate movements). The income generated from the Fund’s holdings of Arizona tax-exempt municipal bonds contributed to performance as well. The Fund’s exposure to the long end of the yield curve helped performance as the yield curve flattened substantially over the period (long-term rates fell much more than intermediate rates, while two-year rates rose). The Fund also benefited from its credit exposure as spreads generally tightened, especially in the corporate sector. In addition, the Fund’s use of leverage amplified the positive effect of falling rates on performance. |

• |

There were no detractors from performance on an absolute basis as all areas of the Fund’s investment universe appreciated during the period. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Fund Information

Symbol on NYSE MKT |

MZA |

|||||

Initial Offering Date |

October 29, 1993 |

|||||

Yield on Closing Market Price as of January 31, 2015 ($16.45)1 |

5.07% |

|||||

Tax

Equivalent Yield2 |

9.38% |

|||||

Current Monthly Distribution per Common Share3 |

$0.0695 |

|||||

Current Annualized Distribution per Common Share3 |

$0.8340 |

|||||

Economic Leverage as of January 31, 20154 |

37% |

|||||

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal and state tax rate of 45.97%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VRDP Shares and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 5. |

| 8 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| BlackRock MuniYield

Arizona Fund, Inc. |

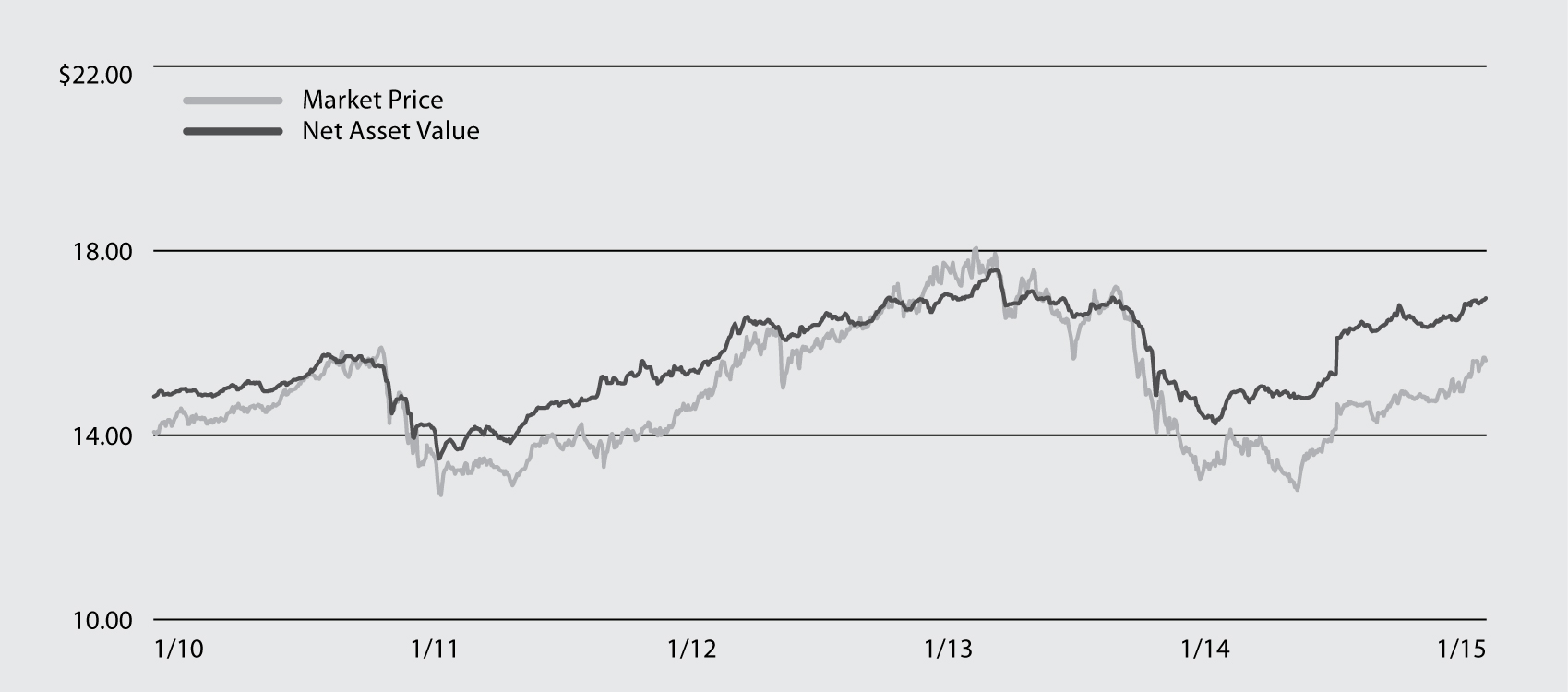

Market Price and Net Asset Value Per Share Summary

| |

1/31/15 |

|

7/31/14 |

|

Change |

|

High |

|

Low |

|||||||||||||

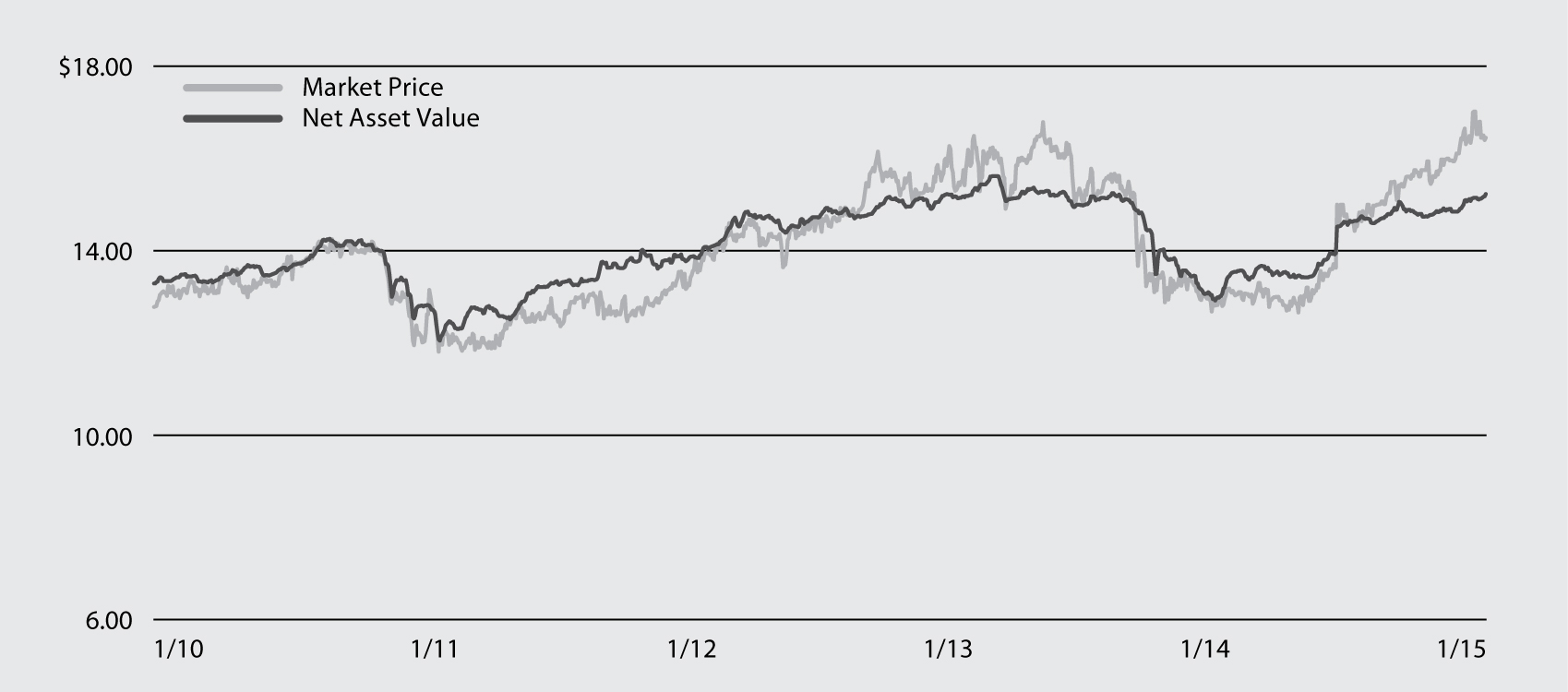

Market Price |

$ | 16.45 | $ | 15.00 | 9.67 | % | $ | 17.46 | $ | 14.42 | ||||||||||||

Net Asset Value |

$ | 15.22 | $ | 14.52 | 4.82 | % | $ | 15.22 | $ | 14.52 | ||||||||||||

Market

Price and Net Asset Value History For the Past Five Years |

Overview of the Fund’s Total Investments*

| Sector Allocation |

|

1/31/15 |

|

7/31/14 |

||||||

County/City/Special District/School District |

26 | % | 25 | % | ||||||

Utilities |

20 | 21 | ||||||||

Education |

15 | 13 | ||||||||

State |

13 | 14 | ||||||||

Health |

12 | 13 | ||||||||

Corporate |

11 | 11 | ||||||||

Transportation |

3 | 3 | ||||||||

| Call/Maturity

Schedule3 |

||||||||

Calendar Year Ended December 31, |

||||||||

2015 |

12 | % | ||||||

2016 |

3 | |||||||

2017 |

2 | |||||||

2018 |

28 | |||||||

2019 |

9 | |||||||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

* |

Excludes short-term securities. |

| Credit Quality

Allocation1 |

|

1/31/15 |

|

7/31/14 |

||||||

AAA/Aaa |

12 | % | 13 | % | ||||||

AA/Aa |

48 | 47 | ||||||||

A

|

28 | 29 | ||||||||

BBB/Baa |

6 | 7 | ||||||||

BB/Ba |

3 | 1 | ||||||||

N/R2 |

3 | 3 | ||||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of January 31, 2015 and July 31, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade was $1,062,100 and $1,066,200, each representing 1%, respectively, of the Fund’s total investments. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2015 | 9 |

| Fund Summary as of January 31, 2015 | BlackRock MuniYield

California Fund, Inc. |

Fund Overview

Performance

• |

For the six-month period ended January 31, 2015, the Fund returned 13.35% based on market price and 6.74% based on NAV. For the same period, the closed-end Lipper California Municipal Debt Funds category posted an average return of 12.10% based on market price and 7.85% based on NAV. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

• |

Municipal bonds generally delivered strong performance during the six-month period, with yields declining as prices rose, and California issues gained an additional boost from the state’s improving credit profile. (Bond prices generally rise as yields fall.) Longer-term municipal bonds generally outperformed shorter-term issues. In this environment, the Fund’s exposure to the long end of the yield curve had a positive impact on performance. Its positions in AA-rated issues, education-related bonds and those issued by school districts helped returns, as did its positions in the transportation health care sectors. Leverage on the Fund’s assets, which was achieved through the use of tender option bonds, amplified the positive effect of falling rates on performance. |

• |

There were no detractors from performance on an absolute basis as all areas of the Fund’s investment universe appreciated during the period. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Fund Information

Symbol on NYSE |

MYC |

|||||

Initial Offering Date |

February 28, 1992 |

|||||

Yield on Closing Market Price as of January 31, 2015 ($16.37)1 |

5.42% |

|||||

Tax

Equivalent Yield2 |

11.05% |

|||||

Current Monthly Distribution per Common Share3 |

$0.074 |

|||||

Current Annualized Distribution per Common Share3 |

$0.888 |

|||||

Economic Leverage as of January 31, 20154 |

36% |

|||||

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal and state tax rate of 50.93%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VRDP Shares and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 5. |

| 10 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| BlackRock MuniYield

California Fund, Inc. |

Market Price and Net Asset Value Per Share Summary

| |

1/31/15 |

|

7/31/14 |

|

Change |

|

High |

|

Low |

|||||||||||||

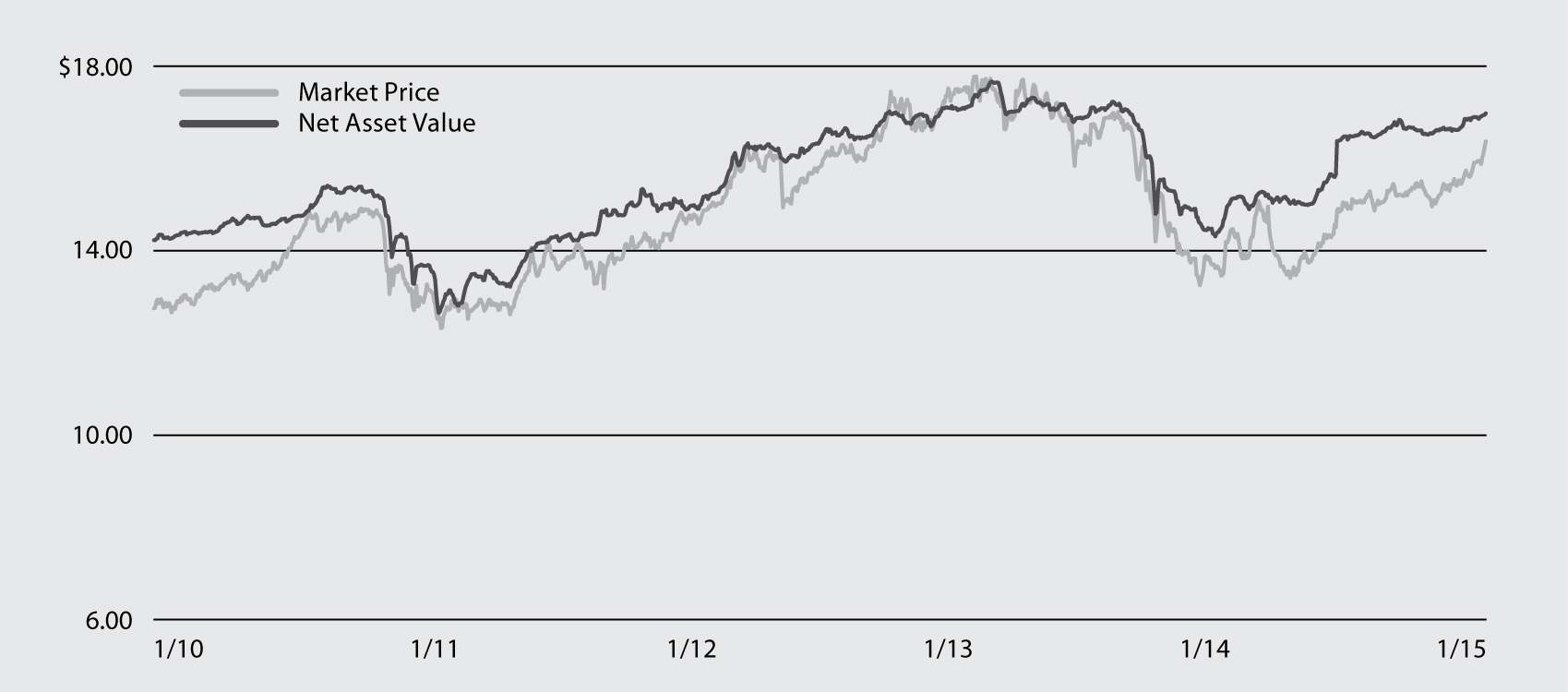

Market Price |

$ | 16.37 | $ | 14.87 | 10.09 | % | $ | 16.42 | $ | 14.82 | ||||||||||||

Net Asset Value |

$ | 16.98 | $ | 16.38 | 3.66 | % | $ | 16.98 | $ | 16.38 | ||||||||||||

Market

Price and Net Asset Value History For the Past Five Years |

Overview of the Fund’s Total Investments*

| Sector Allocation |

|

1/31/15 |

|

7/31/14 |

||||||

County/City/Special District/School District |

41 | % | 38 | % | ||||||

Utilities |

19 | 20 | ||||||||

Education |

13 | 13 | ||||||||

Health |

12 | 12 | ||||||||

State |

6 | 9 | ||||||||

Transportation |

6 | 6 | ||||||||

Tobacco |

1 | — | ||||||||

Corporate |

1 | 1 | ||||||||

Housing |

1 | 1 | ||||||||

| Call/Maturity

Schedule2 |

||||||||

Calendar Year Ended December 31, |

||||||||

2015 |

2 | % | ||||||

2016 |

8 | |||||||

2017 |

10 | |||||||

2018 |

16 | |||||||

2019 |

23 | |||||||

| 2 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

* |

Excludes short-term securities. |

| Credit Quality

Allocation1 |

|

1/31/15 |

|

7/31/14 |

||||||

AAA/Aaa |

6 | % | 7 | % | ||||||

AA/Aa |

73 | 72 | ||||||||

A

|

18 | 19 | ||||||||

BBB/Baa |

2 | 2 | ||||||||

B |

1 | — | ||||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2015 | 11 |

| Fund Summary as of January 31, 2015 | BlackRock MuniYield

Investment Fund |

Fund Overview

Performance

• |

For the six-month period ended January 31, 2015, the Fund returned 14.49% based on market price and 8.39% based on NAV. For the same period, the closed-end Lipper General & Insured Municipal Debt Funds (Leveraged) category posted an average return of 11.69% based on market price and 8.99% based on NAV. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

• |

Municipal bonds generally delivered strong performance during the six-month period, with yields declining as prices rose. (Bond prices generally rise as yields fall.) Long-term bonds outperformed their short-term counterparts, leading to a flattening of the yield curve. In this environment, the Fund’s duration positioning contributed positively to performance. (Duration measures sensitivity to interest rate movements.) The Fund’s longer-dated holdings in the transportation, health care, utilities and tax-backed sectors experienced the best price action on an absolute basis. The income generated from the Fund’s holdings of tax-exempt municipal bonds contributed to performance as well. |

• |

There were no detractors from performance on an absolute basis as all areas of the Fund’s investment universe appreciated during the period. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Fund Information

Symbol on NYSE |

MYF |

|||||

Initial Offering Date |

February 28, 1992 |

|||||

Yield on Closing Market Price as of January 31, 2015 ($16.16)1 |

6.05% |

|||||

Tax

Equivalent Yield2 |

10.69% |

|||||

Current Monthly Distribution per Common Share3 |

$0.0815 |

|||||

Current Annualized Distribution per Common Share3 |

$0.9780 |

|||||

Economic Leverage as of January 31, 20154 |

38% |

|||||

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal tax rate of 43.4%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VRDP Shares and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 5. |

| 12 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| BlackRock MuniYield

Investment Fund |

Market Price and Net Asset Value Per Share Summary

| |

1/31/15 |

|

7/31/14 |

|

Change |

|

High |

|

Low |

|||||||||||||

Market Price |

$ | 16.16 | $ | 14.56 | 10.99 | % | $ | 16.39 | $ | 14.41 | ||||||||||||

Net Asset Value |

$ | 16.35 | $ | 15.56 | 5.08 | % | $ | 16.35 | $ | 15.56 | ||||||||||||

Market

Price and Net Asset Value History For the Past Five Years |

Overview of the Fund’s Total Investments*

| Sector Allocation |

|

1/31/15 |

|

7/31/14 |

||||||

Transportation |

26 | % | 26 | % | ||||||

County/City/Special District/School District |

23 | 21 | ||||||||

Utilities |

16 | 17 | ||||||||

Health |

15 | 15 | ||||||||

State |

7 | 6 | ||||||||

Education |

6 | 7 | ||||||||

Housing |

3 | 3 | ||||||||

Corporate |

3 | 4 | ||||||||

Tobacco |

1 | 1 | ||||||||

| Call/Maturity

Schedule2 |

||||||||

Calendar Year Ended December 31, |

||||||||

2015 |

1 | % | ||||||

2016 |

1 | |||||||

2017 |

3 | |||||||

2018 |

14 | |||||||

2019 |

31 | |||||||

| 2 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

* |

Excludes short-term securities. |

| Credit Quality

Allocation1 |

|

1/31/15 |

|

7/31/14 |

||||||

AAA/Aaa |

7 | % | 7 | % | ||||||

AA/Aa |

61 | 60 | ||||||||

A |

25 | 25 | ||||||||

BBB/Baa |

5 | 5 | ||||||||

BB/Ba |

1 | 1 | ||||||||

N/R |

1 | 2 | ||||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2015 | 13 |

| Fund Summary as of January 31, 2015 | BlackRock MuniYield New

Jersey Fund, Inc. |

Fund Overview

Performance

• |

For the six-month period ended January 31, 2015, the Fund returned 9.71% based on market price and 8.54% based on NAV. For the same period, the closed-end Lipper New Jersey Municipal Debt Funds category posted an average return of 8.91% based on market price and 7.86% based on NAV. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which narrowed during the period, accounts for the difference between performance based on price and performance based on NAV. The following discussion relates to performance based on NAV. |

• |

Municipal bonds generally delivered strong performance during the six-month period, with yields declining as prices rose. (Bond prices generally rise as yields fall.) Long-term bonds outperformed their short-term counterparts, leading to a flattening of the yield curve. In this environment, the Fund’s duration positioning contributed positively to performance. (Duration measures sensitivity to interest rate movements.) The Fund’s longer dated holdings in the tax-backed, transportation and education sectors experienced the best price action on an absolute basis. The income generated from the Fund’s holdings of tax-exempt municipal bonds contributed to performance as well. |

• |

There were no detractors from performance on an absolute basis as all areas of the Fund’s investment universe appreciated during the period. |

| The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results. |

Fund Information

Symbol on NYSE |

MYJ |

|||||

Initial Offering Date |

May 1, 1992 |

|||||

Yield on Closing Market Price as of January 31, 2015 ($15.62)1 |

5.76% |

|||||

Tax

Equivalent Yield2 |

11.18% |

|||||

Current Monthly Distribution per Common Share3 |

$0.075 |

|||||

Current Annualized Distribution per Common Share3 |

$0.900 |

|||||

Economic Leverage as of January 31, 20154 |

37% |

|||||

| 1 | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance does not guarantee future results. |

| 2 | Tax equivalent yield assumes the maximum marginal federal and state tax rate of 48.48%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| 3 | The distribution rate is not constant and is subject to change. |

| 4 | Represents VRDP Shares and TOBs as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOBs, minus the sum of accrued liabilities. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 5. |

| 14 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| BlackRock MuniYield New

Jersey Fund, Inc. |

Market Price and Net Asset Value Per Share Summary

| |

1/31/15 |

|

7/31/14 |

|

Change |

|

High |

|

Low |

|||||||||||||

Market Price |

$ | 15.62 | $ | 14.67 | 6.48 | % | $ | 15.78 | $ | 14.25 | ||||||||||||

Net Asset Value |

$ | 16.97 | $ | 16.11 | 5.34 | % | $ | 16.97 | $ | 16.11 | ||||||||||||

Market

Price and Net Asset Value History For the Past Five Years |

Overview of the Fund’s Total Investments*

| Sector Allocation |

|

1/31/15 |

|

7/31/14 |

||||||

Transportation |

35 | % | 33 | % | ||||||

State |

18 | 20 | ||||||||

Education |

17 | 17 | ||||||||

County/City/Special District/School District |

13 | 12 | ||||||||

Health |

7 | 8 | ||||||||

Corporate |

7 | 7 | ||||||||

Housing |

2 | 2 | ||||||||

Utilities |

1 | 1 | ||||||||

| Call/Maturity

Schedule3 |

||||||||

Calendar Year Ended December 31, |

||||||||

2015 |

5 | % | ||||||

2016 |

1 | |||||||

2017 |

6 | |||||||

2018 |

11 | |||||||

2019 |

12 | |||||||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

* |

Excludes short-term securities. |

| Credit Quality

Allocation1 |

|

1/31/15 |

|

7/31/14 |

||||||

AAA/Aaa |

4 | % | 5 | % | ||||||

AA/Aa |

37 | 38 | ||||||||

A

|

49 | 44 | ||||||||

BBB/Baa |

7 | 10 | ||||||||

BB/Ba |

1 | — | ||||||||

B |

1 | 1 | ||||||||

N/R2 |

1 | 2 | ||||||||

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment advisor evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment advisor has deemed certain of these unrated securities as investment grade quality. As of January 31, 2015 and July 31, 2014, the market value of unrated securities deemed by the investment advisor to be investment grade was $3,719,118, representing 1%, and $7,267,541, representing 2%, respectively, of the Fund’s total investments. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2015 | 15 |

| Schedule of Investments January 31, 2015 (Unaudited) | BlackRock Muni New York

Intermediate Duration Fund, Inc. (MNE) (Percentages shown are based on Net Assets) |

| Municipal Bonds | Par (000) |

Value | ||||||||

New York — 130.9% |

||||||||||

Corporate — 12.2% |

||||||||||

Build NYC Resource Corp., Refunding RB, AMT, 4.50%, 1/01/25 (a) |

$ | 500 | $ | 546,850 | ||||||

City of New York New York Industrial Development Agency, ARB, British Airways PLC Project, AMT, 7.63%, 12/01/32 |

1,000 | 1,005,740 | ||||||||

City of New York New York Industrial Development Agency, Refunding RB, Terminal One Group Association Project, AMT (b): |

||||||||||

5.50%, 1/01/18 |

1,000 | 1,047,420 | ||||||||

5.50%, 1/01/21 |

250 | 261,475 | ||||||||

5.50%, 1/01/24 |

1,000 | 1,044,100 | ||||||||

County of Essex New York Industrial Development Agency, Refunding RB, International Paper Co. Project, Series A, AMT, 5.20%,

12/01/23 |

1,000 | 1,027,510 | ||||||||

New

York State Energy Research & Development Authority, Refunding RB (NPFGC): |

||||||||||

Brooklyn Union Gas/Keyspan, Series A, AMT, 4.70%, 2/01/24 |

500 | 519,200 | ||||||||

Rochester Gas & Electric Corp., Series C, 5.00%, 8/01/32 (b) |

1,000 | 1,056,450 | ||||||||

Niagara Area Development Corp., Refunding RB, Solid Waste Disposal Facility, Covanta Energy Project, Series B, 4.00%, 11/01/24

(a) |

500 | 511,700 | ||||||||

Utility Debt Securitization Authority, Refunding RB, New York Restructuring, Series E, 5.00%, 12/15/32 |

1,000 | 1,219,200 | ||||||||

| 8,239,645 | ||||||||||

County/City/Special District/School District — 23.9% |

||||||||||

Amherst Development Corp., Refunding RB, University at Buffalo Foundation Faculty-Student Housing Corp., Series A (AGM), 4.00%,

10/01/24 |

1,000 | 1,085,830 | ||||||||

City of New York New York, GO, Refunding: |

||||||||||

Fiscal 2013, Series J, 5.00%, 8/01/23 |

1,000 | 1,240,870 | ||||||||

Series E, 5.25%, 8/01/22 |

2,000 | 2,483,440 | ||||||||

Series E, 5.00%, 8/01/30 |

1,250 | 1,480,363 | ||||||||

City of New York New York, GO: |

||||||||||

Sub-Series A-1, 5.00%, 8/01/33 |

700 | 827,421 | ||||||||

Sub-Series B-1, 5.25%, 9/01/22 |

750 | 863,925 | ||||||||

Sub-Series I-1, 5.50%, 4/01/21 |

1,500 | 1,769,460 | ||||||||

Sub-Series I-1, 5.13%, 4/01/25 |

750 | 868,770 | ||||||||

City of New York New York Convention Center Development Corp., RB, Hotel Unit Fee Secured (AMBAC), 5.00%, 11/15/35 |

120 | 123,812 | ||||||||

City of New York New York Industrial Development Agency, RB, PILOT, Queens Baseball Stadium (AMBAC), 5.00%, 1/01/31 |

1,500 | 1,556,940 | ||||||||

City of New York New York Industrial Development Agency, Refunding ARB, Transportation Infrastructure Properties LLC, Series A, AMT, 5.00%,

7/01/22 |

750 | 847,500 | ||||||||

County of Nassau, GO, 5.00%, 10/01/33 |

500 | 592,135 | ||||||||

Hudson Yards Infrastructure Corp., RB, Senior, Fiscal 2012, Series A, 5.75%, 2/15/47 |

1,000 | 1,175,710 | ||||||||

| Municipal Bonds | Par (000) |

Value | ||||||||

New York (continued) |

||||||||||

County/City/Special District/School District (concluded) |

||||||||||

New

York Liberty Development Corp., Refunding RB, 4 World Trade Center Project, 5.00%, 11/15/31 |

$ | 1,000 | $ | 1,149,170 | ||||||

| 16,065,346 | ||||||||||

Education — 22.4% |

||||||||||

Build NYC Resource Corp., RB, Bronx Charter School For Excellence Project, Series A, 3.88%, 4/15/23 |

505 | 501,632 | ||||||||

County of Buffalo & Erie New York Industrial Land Development Corp., Refunding RB, Buffalo State College Foundation Housing, 6.00%,

10/01/31 |

1,000 | 1,199,080 | ||||||||

County of Monroe New York Industrial Development Corp., Refunding RB, Series A, 5.00%, 7/01/30 |

1,000 | 1,191,240 | ||||||||

County of Nassau New York Industrial Development Agency, Refunding RB, New York Institute of Technology Project, Series A, 5.00%,

3/01/21 |

1,000 | 1,135,860 | ||||||||

County of Schenectady New York Capital Resource Corp., Refunding RB, Union College, 5.00%, 7/01/32 |

500 | 580,490 | ||||||||

New

York City Transitional Finance Authority Building Aid Revenue, RB, 5.00%, 7/15/31 |

500 | 607,130 | ||||||||

New

York City Trust for Cultural Resources, Refunding RB, American Museum of Natural History, Series A, 5.00%, 7/01/32 |

500 | 607,595 | ||||||||

New

York State Dormitory Authority, RB: |

||||||||||

Convent of the Sacred Heart (AGM), 4.00%, 11/01/18 |

880 | 976,862 | ||||||||

Convent of the Sacred Heart (AGM), 5.00%, 11/01/21 |

120 | 145,999 | ||||||||

Fordham University, Series A, 5.25%, 7/01/25 |

500 | 599,435 | ||||||||

Mount Sinai School of Medicine, 5.50%, 7/01/25 |

1,000 | 1,173,960 | ||||||||

Mount Sinai School of Medicine, Series A (NPFGC), 5.15%, 7/01/24 |

250 | 295,557 | ||||||||

Series A, 5.00%, 3/15/32 |

1,000 | 1,215,560 | ||||||||

New

York State Dormitory Authority, Refunding RB: |

||||||||||

Fordham University, 5.00%, 7/01/29 |

375 | 444,934 | ||||||||

Fordham University, 5.00%, 7/01/30 |

300 | 354,306 | ||||||||

Pace University, Series A, 5.00%, 5/01/27 |

1,000 | 1,128,830 | ||||||||

The Culinary Institute of America, 5.00%, 7/01/28 |

500 | 567,845 | ||||||||

State of New York Dormitory Authority, RB, Touro College & University System Obligation Group, Series A, 4.13%, 1/01/30 |

1,000 | 1,052,220 | ||||||||

State of New York Dormitory Authority, Refunding RB, State University Dormitory Facilities, Series A, 5.25%, 7/01/30 |

1,050 | 1,283,152 | ||||||||

| 15,061,687 | ||||||||||

Health — 19.6% |

||||||||||

Build NYC Resource Corp., Refunding RB, 5.00%, 7/01/30 |

500 | 584,420 | ||||||||

City of New York New York Industrial Development Agency, RB, PSCH, Inc. Project, 6.20%, 7/01/20 |

1,415 | 1,415,608 | ||||||||

County of Dutchess New York Industrial Development Agency, RB, Vassar Brothers Medical Center (AGC), 5.00%, 4/01/21 |

215 | 254,246 | ||||||||

Portfolio Abbreviations

AGC AGM AMBAC AMT ARB BARB BHAC CAB COP |

Assured Guarantee Corp. Assured Guaranty Municipal Corp. American Municipal Bond Assurance Corp. Alternative Minimum Tax (subject to) Airport Revenue Bonds Building Aid Revenue Bonds Berkshire Hathaway Assurance Corp. Capital Appreciation Bonds Certificates of Participation |

EDA ERB GARB GO HFA IDA IDB ISD |

Economic Development Authority Education Revenue Bonds General Airport Revenue Bonds General Obligation Bonds Housing Finance Agency Industrial Development Authority Industrial Development Board Independent School District |

LRB M/F NPFGC PILOT RB S/F SONYMA Syncora |

Lease Revenue Bonds Multi-Family National Public Finance Guarantee Corp. Payment in Lieu of Taxes Revenue Bonds Single-Family State of New York Mortgage Agency Syncora Guarantee |

| 16 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| Schedule of Investments (continued) | BlackRock Muni New York

Intermediate Duration Fund, Inc. (MNE) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

Par (000) |

Value | |||||||||

New York (continued) |

|||||||||||

Health (concluded) |

|||||||||||

County of Dutchess New York Local Development Corp., Refunding RB, Health Quest System, Inc., Series A (AGM), 5.25%, 7/01/25 |

$ | 1,000 | $ | 1,167,520 | |||||||

County of Erie New York Industrial Development Agency, RB, Episcopal Church Home, Series A, 5.88%, 2/01/18 |

110 | 110,323 | |||||||||

County of Suffolk New York Industrial Development Agency, Refunding RB, Jefferson’s Ferry Project, 4.63%, 11/01/16 |

800 | 842,776 | |||||||||

County of Westchester New York Healthcare Corp., Refunding RB, Senior Lien: |

|||||||||||

Remarketing, Series A, 5.00%, 11/01/24 |

910 | 1,049,485 | |||||||||

Remarketing, Series A, 5.00%, 11/01/30 |

650 | 732,784 | |||||||||

Series B, 6.00%, 11/01/30 |

240 | 284,196 | |||||||||

County of Westchester New York Industrial Development Agency, RB, Special Needs Facilities Pooled Program, Series D-1, 6.80%,

7/01/19 |

515 | 517,498 | |||||||||

County of Westchester New York Local Development Corp., Refunding RB, Kendal On Hudson Project: |

|||||||||||

3.00%, 1/01/18 |

500 | 516,695 | |||||||||

4.00%, 1/01/23 |

250 | 273,225 | |||||||||

5.00%, 1/01/28 |

875 | 994,884 | |||||||||

New

York State Dormitory Authority, RB: |

|||||||||||

New York State Association for Retarded Children, Inc., Series A, 5.30%, 7/01/23 |

450 | 527,805 | |||||||||

New York University Hospitals Center, Series A, 5.00%, 7/01/22 |

1,000 | 1,165,940 | |||||||||

New York University Hospitals Center, Series B, 5.25%, 7/01/17 (c) |

355 | 386,272 | |||||||||

New

York State Dormitory Authority, Refunding RB: |

|||||||||||

Mount Sinai Hospital Series A, 4.25%, 7/01/23 |

250 | 278,550 | |||||||||

North Shore-Long Island Jewish Obligated Group, Series E, 5.00%, 5/01/22 |

650 | 742,905 | |||||||||

State of New York Dormitory Authority, Refunding RB, North Shore-Long Island Jewish Obligated Group, Series A, 5.00%, 5/01/32 |

500 | 566,045 | |||||||||

Yonkers New York Industrial Development Agency, RB, Sacred Heart Association Project, Series A, AMT (SONYMA), 4.80%, 10/01/26 |

750 | 794,520 | |||||||||

| 13,205,697 | |||||||||||

Housing — 3.6% |

|||||||||||

City of New York New York Housing Development Corp., RB, M/F Housing: |

|||||||||||

Class F, 4.50%, 2/15/48 |

500 | 512,095 | |||||||||

Series B1, 5.25%, 7/01/30 |

500 | 596,265 | |||||||||

Series H-2-A, Remarketing, AMT, 5.00%, 11/01/30 |

780 | 813,283 | |||||||||

State of New York Mortgage Agency, Refunding RB, S/F Housing, 143rd Series, AMT, 4.85%, 10/01/27 |

500 | 519,860 | |||||||||

| 2,441,503 | |||||||||||

State — 10.0% |

|||||||||||

New

York City Transitional Finance Authority, BARB, Fiscal 2009, Series S-3, 5.00%, 1/15/23 |

575 | 661,043 | |||||||||

New

York State Dormitory Authority, RB: |

|||||||||||

Haverstraw King’s Daughters Public Library, 5.00%, 7/01/26 |

1,015 | 1,193,254 | |||||||||

Municipal Health Facilities Lease, Sub-Series 2-4, 5.00%, 1/15/27 |

600 | 672,240 | |||||||||

New

York State Thruway Authority, Refunding RB, Series A-1, 5.00%, 4/01/22 |

1,000 | 1,152,850 | |||||||||

New

York State Urban Development Corp., RB: |

|||||||||||

Personal Income Tax, Series A-1, 5.00%, 3/15/32 |

400 | 473,428 | |||||||||

Service Contract, Series B, 5.00%, 1/01/21 |

1,500 | 1,695,030 | |||||||||

| Municipal Bonds | Par (000) |

Value | |||||||||

New York (concluded) |

|||||||||||

State (concluded) |

|||||||||||

Sales Tax Asset Receivable Corp., Refunding RB, Fiscal 2015, Series A, 4.00%, 10/15/32 |

$ | 500 | $ | 564,280 | |||||||

State of New York Thruway Authority, RB, Transportation, Series A, 5.00%, 3/15/32 |

250 | 295,893 | |||||||||

| 6,708,018 | |||||||||||

Tobacco — 0.9% |

|||||||||||

Niagara Tobacco Asset Securitization Corp., Refunding RB, 5.25%, 5/15/34 |

500 | 581,800 | |||||||||

Transportation — 24.7% |

|||||||||||

Metropolitan Transportation Authority, RB: |

|||||||||||

Series A, 5.00%, 11/15/27 |

1,000 | 1,185,860 | |||||||||

Series A (NPFGC), 5.00%, 11/15/24 |

1,010 | 1,093,133 | |||||||||

Series A-1, 5.25%, 11/15/33 |

500 | 601,340 | |||||||||

Series B, 5.25%, 11/15/33 |

1,000 | 1,211,940 | |||||||||

Series B (NPFGC), 5.25%, 11/15/19 |

860 | 1,024,802 | |||||||||

Series H, 5.00%, 11/15/30 |

500 | 592,255 | |||||||||

Sub-Series B-1, 5.00%, 11/15/24 |

460 | 560,146 | |||||||||

Sub-Series B-4, 5.00%, 11/15/24 |

300 | 365,313 | |||||||||

Port Authority of New York & New Jersey, ARB, JFK International Air Terminal LLC Project, 5.00%, 12/01/20 |

1,000 | 1,163,490 | |||||||||

Port Authority of New York & New Jersey, RB, Consolidated, 169th Series, AMT, 5.00%, 10/15/21 |

2,000 | 2,408,000 | |||||||||

Port Authority of New York & New Jersey, Refunding ARB, Consolidated, 152nd Series, AMT, 5.00%, 11/01/23 |

500 | 555,030 | |||||||||

Port Authority of New York & New Jersey, Refunding RB, AMT: |

|||||||||||

178th Series, 5.00%, 12/01/32 |

1,000 | 1,163,470 | |||||||||

Consolidated, 152nd, 5.00%, 11/01/24 |

1,000 | 1,106,370 | |||||||||

State of New York Thruway Authority, Refunding RB, General: |

|||||||||||

Series G (AGM), 5.00%, 1/01/37 |

1,000 | 1,150,390 | |||||||||

Series K, 5.00%, 1/01/32 |

500 | 596,120 | |||||||||

Triborough Bridge & Tunnel Authority, Refunding RB, Series A: |

|||||||||||

5.00%, 11/15/24 |

1,000 | 1,230,720 | |||||||||

5.00%, 1/01/27 |

500 | 600,405 | |||||||||

| 16,608,784 | |||||||||||

Utilities — 13.6% |

|||||||||||

City of New York New York Municipal Water Finance Authority, Refunding RB, 2nd General Resolution: |

|||||||||||

Series DD, 5.00%, 6/15/32 |

500 | 558,430 | |||||||||

Water & Sewer System, Series EE, 5.00%, 6/15/34 |

3,000 | 3,515,400 | |||||||||

Long Island Power Authority, Refunding RB: |

|||||||||||

Electric System, Series A, 5.50%, 4/01/24 |

500 | 568,475 | |||||||||

General, Series D (NPFGC), 5.00%, 9/01/25 |

2,000 | 2,122,540 | |||||||||

Series A, 5.00%, 9/01/34 |

1,000 | 1,163,710 | |||||||||

New

York State Environmental Facilities Corp., Refunding RB, NYC Municipal Water Finance Authority Project, 2nd Resolution, Series B, 5.00%,

6/15/31 |

1,000 | 1,185,821 | |||||||||

| 9,114,376 | |||||||||||

Total Municipal Bonds in New York |

88,026,856 | ||||||||||

Puerto Rico — 2.2% |

|||||||||||

Housing — 2.2% |

|||||||||||

Puerto Rico Housing Finance Authority, Refunding RB, M/F Housing, Subordinate, Capital Fund Modernization,

5.13%, 12/01/27 |

1,405 | 1,498,179 | |||||||||

U.S. Virgin Islands — 0.9% |

|||||||||||

Virgin Islands Public Finance Authority, Refunding RB, Series C, 5.00%, 10/01/30 |

500 | 573,870 | |||||||||

Total Municipal Bonds — 134.0% |

90,098,905 | ||||||||||

| SEMI-ANNUAL REPORT | JANUARY 31, 2015 | 17 |

| Schedule of Investments (continued) | BlackRock Muni New York

Intermediate Duration Fund, Inc. (MNE) (Percentages shown are based on Net Assets) |

| Municipal Bonds Transferred to Tender Option Bond Trusts (d) |

Par (000) |

Value | |||||||||

New York — 18.1% |

|||||||||||

County/City/Special District/School District — 4.1% |

|||||||||||

City of New York New York, GO, Refunding, Series E, 5.00%, 8/01/27 |

$ | 599 | $ | 696,610 | |||||||

City of New York New York, GO: |

|||||||||||

Series I, 5.00%, 3/01/32 |

991 | 1,181,897 | |||||||||

Sub-Series G-1, 5.00%, 4/01/29 |

750 | 882,030 | |||||||||

| 2,760,537 | |||||||||||

State — 4.5% |

|||||||||||

New

York State Urban Development Corp., RB, Personal Income Tax, Series A-1, 5.00%, 3/15/32 |

1,499 | 1,774,084 | |||||||||

Sales Tax Asset Receivable Corp., Refunding RB, Fiscal 2015, Series A, 5.00%, 10/15/31 |

990 | 1,229,145 | |||||||||

| 3,003,229 | |||||||||||

Transportation — 4.3% |

|||||||||||

Metropolitan Transportation Authority, RB, Series B, 5.25%, 11/15/25 |

749 | 889,491 | |||||||||

Port Authority of New York & New Jersey, ARB, Consolidated, 169th Series, AMT, 5.00%, 10/15/26 |

750 | 862,853 | |||||||||

Port Authority of New York & New Jersey, RB, 178th Series, AMT, 5.00%, 12/01/32 |

991 | 1,152,988 | |||||||||

| 2,905,332 | |||||||||||

| Municipal Bonds Transferred to Tender Option Bond Trusts (d) |

Par (000) |

Value | |||||||||

New York (concluded) |

|||||||||||

Utilities — 5.2% |

|||||||||||

City of New York New York Municipal Water Finance Authority, Refunding RB, Water & Sewer System: |

|||||||||||

2nd General Resolution, Fiscal 2011, Series HH, 5.00%, 6/15/32 |

$ | 1,560 | $ | 1,826,947 | |||||||

Series A, 4.75%, 6/15/30 |

1,500 | 1,632,120 | |||||||||

| 3,459,067 | |||||||||||

Total Municipal Bonds Transferred to Tender Option Bond Trusts — 18.1% |

12,128,165 | ||||||||||

Total Investments (Cost — $93,516,493) — 152.1% |

102,227,070 | ||||||||||

Other Assets Less Liabilities — 1.4% |

1,018,403 | ||||||||||

Liability for TOB Trust Certificates, Including Interest Expense and Fees Payable — (9.5%) |

(6,420,014 | ) | |||||||||

VRDP Shares, at Liquidation Value — (44.0%) |

(29,600,000 | ) | |||||||||

Net Assets Applicable to Common Shares — 100.0% |

$ | 67,225,459 | |||||||||

Notes to Schedule of Investments

| (a) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold

in transactions exempt from registration to qualified institutional investors. |

|||

| (b) | Variable rate security. Rate shown is as of report date. |

|||

| (c) | U.S. government securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the

date indicated, typically at a premium to par. |

|||

| (d) | Represent bonds transferred to a TOB. In exchange for which the Fund received cash and residual interest certificates. These bonds

serve as collateral in a financing transaction. See Note 3 of the Notes to Financial Statements for details of municipal bonds transferred to

TOBs. |

|||

| (e) | Represents the current yield as of report date. |

|||

| (f) | During the six months ended January 31, 2015, investments in issuers considered to be an affiliate of the Fund for purposes of

Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| Affiliate |

|

Shares Held at July 31, 2014 |

|

Net Activity |

|

Shares Held at January 31, 2015 |

|

Income |

|

Realized Gains |

||||||||||||

BIF New York Municipal Money Fund |

441,039 |

(441,039) |

— |

— |

$107 |

|||||||||||||||||

| • | As of January 31, 2015, financial futures contracts outstanding were as follows: |

| Contracts Short |

|

Issue |

|

Exchange |

|

Expiration |

|

Notional Value |

|

Unrealized Depreciation |

||||||||||||

(75) |

10-Year U.S. Treasury Note |

Chicago Board of Trade |

March 2015 |

$ | 9,815,625 | $ | (281,054 | ) | ||||||||||||||

| • | For Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used

by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply

for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

|||

| • | Fair Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial

instruments. These inputs to valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement

purposes. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1

measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair

value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value

hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is

significant to the fair value measurement in its entirety. The categorization of a value determined for investments and derivative financial

instruments is based on the pricing transparency of the investment and derivative financial instrument and is not necessarily an indication of the

risks associated with investing in those securities. The three levels of the fair value hierarchy are as follows: |

| • | Level 1 — unadjusted quoted prices in active markets/exchanges for identical assets or liabilities that the Fund has the ability

to access |

|||

| • | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets

that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are

observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and

default rates) or other market-corroborated inputs) |

|||

| • | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are

not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial

instruments) |

| 18 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| Schedule of Investments (concluded) | BlackRock Muni New York

Intermediate Duration Fund, Inc. (MNE) |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In

accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the

beginning of the reporting period. For information about the Fund’s policy regarding valuation of investments and derivative financial

instruments, refer to Note 2 of the Notes to Financial Statements. |

||||

As of January 31, 2015, the following tables summarize the Fund’s investments and derivative financial instruments categorized

in the disclosure hierarchy: |

| |

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|||||||||||

Assets: |

||||||||||||||||||

Investments: |

||||||||||||||||||

Long-Term Investments 1 |

— | $ | 102,227,070 | — | $ | 102,227,070 | ||||||||||||

| 1 | See above Schedule of Investments for values in each sector. |

| |

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|||||||||||

Derivative Financial Instruments 2 |

||||||||||||||||||

Liabilities: |

||||||||||||||||||

Interest rate contracts |

$ | (281,054 | ) | — | — | $ | (281,054 | ) | ||||||||||

| 2 | Derivative financial instruments are financial futures contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement

purposes. As of January 31, 2015, such assets and/or liabilities are categorized within the disclosure hierarchy as follows: |

| |

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|||||||||||

Assets: |

||||||||||||||||||

Cash pledged for financial futures contracts |

$ | 102,000 | — | — | $ | 102,000 | ||||||||||||

Liabilities: |

||||||||||||||||||

Bank overdraft |

— | $ | (81,000 | ) | — | (81,000 | ) | |||||||||||

TOB trust certificates |

— | (6,419,171 | ) | — | (6,419,171 | ) | ||||||||||||

VRDP Shares |

— | (29,600,000 | ) | — | (29,600,000 | ) | ||||||||||||

Total |

$ | 102,000 | $ | (36,100,171 | ) | — | $ | (35,998,171 | ) | |||||||||

During the six months ended January 31, 2015, there were no transfers between levels. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2015 | 19 |

| Schedule of Investments January 31, 2015 (Unaudited) | BlackRock MuniYield

Arizona Fund, Inc. (MZA) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

Par (000) |

Value | |||||||||

Arizona — 140.0% |

|||||||||||

Corporate — 16.4% |

|||||||||||

County of Maricopa Arizona Pollution Control Corp., Refunding RB, Southern California Edison Co., Series A, 5.00%, 6/01/35 |

$ | 4,350 | $ | 4,980,576 | |||||||

County of Pima Arizona IDA, RB, Tucson Electric Power Co. Project, Series A, 5.25%, 10/01/40 |

1,000 | 1,110,350 | |||||||||

County of Pima Arizona IDA, Refunding RB, Tucson Electric Power Co. Project, Series A, 4.00%, 9/01/29 |

1,000 | 1,047,130 | |||||||||

Salt Verde Financial Corp., RB, Senior: |

|||||||||||

5.50%, 12/01/29 |

2,000 | 2,502,060 | |||||||||

5.00%, 12/01/37 |

1,500 | 1,811,835 | |||||||||

| 11,451,951 | |||||||||||

County/City/Special District/School District — 39.2% |

|||||||||||

City of Phoenix Arizona Civic Improvement Corp., RB, Subordinate, Civic Plaza Expansion Project, Series A (NPFGC), 5.00%,

7/01/35 |

3,325 | 3,387,709 | |||||||||

City of Tucson Arizona, COP (AGC), 5.00%, 7/01/29 |

1,000 | 1,128,770 | |||||||||

County of Maricopa Arizona Community College District, GO, Series C, 3.00%, 7/01/22 |

1,000 | 1,064,360 | |||||||||

County of Maricopa Arizona School District No. 28 Kyrene Elementary, GO, School Improvement Project of 2010, Series B (a): |

|||||||||||

1.00%, 7/01/29 |

480 | 574,070 | |||||||||

1.00%, 7/01/30 |

400 | 478,392 | |||||||||

County of Maricopa Arizona Unified School District No. 89 Dysart, GO, School Improvement Project of 2006, Series C, 6.00%,

7/01/28 |

1,000 | 1,175,050 | |||||||||

County of Mohave Arizona Unified School District No. 20 Kingman, GO, School Improvement Project of 2006, Series C (AGC), 5.00%,

7/01/26 |

1,000 | 1,160,110 | |||||||||

County of Pinal Arizona, COP: |

|||||||||||

5.00%, 12/01/26 |

1,250 | 1,254,975 | |||||||||

5.00%, 12/01/29 |

1,250 | 1,252,825 | |||||||||

County of Pinal Arizona, RB, 5.00%, 8/01/33 |

500 | 594,440 | |||||||||

County of Yuma Arizona Library District, GO (Syncora), 5.00%, 7/01/26 |

1,000 | 1,094,930 | |||||||||

Gilbert Public Facilities Municipal Property Corp., RB, 5.50%, 7/01/27 |

2,000 | 2,321,260 | |||||||||

Gladden Farms Community Facilities District, GO, 5.50%, 7/15/31 |

750 | 764,168 | |||||||||

Greater Arizona Development Authority, RB, Santa Cruz County Jail, Series 2, 5.25%, 8/01/31 |

1,155 | 1,257,656 | |||||||||

Marana Municipal Property Corp., RB, Series A, 5.00%, 7/01/28 |

2,500 | 2,788,375 | |||||||||

Phoenix-Mesa Gateway Airport Authority, RB, Mesa Project, AMT, 5.00%, 7/01/38 |

3,600 | 4,042,548 | |||||||||

Scottsdale Municipal Property Corp., RB, Water & Sewer Development Project, Series A, 5.00%, 7/01/24 |

1,000 | 1,134,350 | |||||||||

Vistancia Community Facilities District Arizona, GO: |

|||||||||||

6.75%, 7/15/22 |

1,155 | 1,159,008 | |||||||||

5.75%, 7/15/24 |

750 | 760,148 | |||||||||

| 27,393,144 | |||||||||||

Education — 23.7% |

|||||||||||

Arizona Board of Regents, COP, Refunding, University of Arizona, Series C, 5.00%, 6/01/30 |

2,595 | 3,006,567 | |||||||||

Arizona State University, RB, Series C: |

|||||||||||

6.00%, 7/01/25 |

970 | 1,128,576 | |||||||||

6.00%, 7/01/26 |

745 | 865,429 | |||||||||

6.00%, 7/01/27 |

425 | 493,701 | |||||||||

6.00%, 7/01/28 |

400 | 462,316 | |||||||||

City of Phoenix Arizona IDA, RB: |

|||||||||||

Candeo School, Inc. Project, 6.63%, 7/01/33 |

500 | 570,090 | |||||||||

Great Hearts Academy Project, 5.00%, 7/01/44 (b) |

2,000 | 2,097,940 | |||||||||

| Municipal Bonds | Par (000) |

Value | |||||||||

Arizona (continued) |

|||||||||||

Education (concluded) |

|||||||||||

City of Phoenix Arizona IDA, RB (concluded): |

|||||||||||

Great Hearts Academies—Veritas Project, 6.30%, 7/01/42 |

$ | 500 | $ | 537,735 | |||||||

Legacy Traditional Schools, Series A, 6.75%, 7/01/44 (b) |

440 | 509,991 | |||||||||

County of Maricopa Arizona IDA, RB, Arizona Charter School Project 1, Series A, 6.63%, 7/01/20 |

305 | 298,019 | |||||||||

County of Pima Arizona IDA, Refunding RB, Arizona Charter Schools Project, Series O, 5.00%, 7/01/26 |

985 | 992,062 | |||||||||

Northern Arizona University, RB, Stimulus Plan for Economic and Educational Development, 5.00%, 8/01/38 |

3,000 | 3,486,450 | |||||||||

Student & Academic Services LLC, RB, Northern Arizona Capital Facilities Project, 5.00%, 6/01/39 |

1,400 | 1,624,000 | |||||||||

Town of Florence, Arizona IDA, ERB, Legacy Traditional School Project, Queen Creek and Casa Grande Campuses, 6.00%, 7/01/43 |

500 | 547,290 | |||||||||

| 16,620,166 | |||||||||||

Health — 19.1% |

|||||||||||

Arizona Health Facilities Authority, RB: |

|||||||||||

Catholic Healthcare West, Series B-1, 5.25%, 3/01/39 |

1,500 | 1,689,105 | |||||||||

Catholic Healthcare West, Series B-2 (AGM), 5.00%, 3/01/41 |

500 | 550,560 | |||||||||

Arizona Health Facilities Authority, Refunding RB: |

|||||||||||

Banner Health, Series D, 5.50%, 1/01/38 |

4,800 | 5,255,424 | |||||||||

Phoenix Children’s Hospital, Series A, 5.00%, 2/01/42 |

1,000 | 1,096,350 | |||||||||

City of Tempe Arizona IDA, Refunding RB, Friendship Village of Tempe, Series A, 6.25%, 12/01/42 |

500 | 550,040 | |||||||||

County of Maricopa Arizona IDA, RB, Catholic Healthcare West, Series A, 6.00%, 7/01/39 |

170 | 199,330 | |||||||||

County of Maricopa Arizona IDA, Refunding RB, Samaritan Health Services, Series A (NPFGC), 7.00%, 12/01/16 (c) |

1,000 | 1,062,100 | |||||||||

University Medical Center Corp., RB, 6.50%, 7/01/39 |

500 | 590,990 | |||||||||

University Medical Center Corp., Refunding RB, 6.00%, 7/01/39 |

1,000 | 1,205,050 | |||||||||

County of Yavapai Arizona IDA, Refunding RB, Northern Arizona Healthcare System, 5.25%, 10/01/26 |

1,000 | 1,177,850 | |||||||||

| 13,376,799 | |||||||||||

Housing — 0.5% |

|||||||||||

City of Phoenix & County of Maricopa Arizona IDA, Refunding RB, S/F, AMT (Fannie Mae): |

|||||||||||

Series A-1, 5.75%, 5/01/40 |

30 | 32,252 | |||||||||

Series A-2, 5.80%, 7/01/40 |

45 | 45,773 | |||||||||

City of Phoenix & County of Pima Arizona IDA, RB, S/F, Series 1A, AMT (Fannie Mae), 5.65%, 7/01/39 |

155 | 155,282 | |||||||||

City of Phoenix & County of Pima Arizona IDA, Refunding RB, S/F, Series 1, AMT (Fannie Mae), 5.25%, 8/01/38 |

19 | 19,654 | |||||||||

City of Phoenix Arizona IDA, Refunding RB, S/F, Series 2, AMT (Fannie Mae), 5.50%, 12/01/38 |

39 | 41,301 | |||||||||

County of Maricopa Arizona IDA, RB, S/F, Series 3-B, AMT (Ginnie Mae), 5.25%, 8/01/38 |

79 | 78,849 | |||||||||

| 373,111 | |||||||||||

State — 16.3% |

|||||||||||

Arizona Department of Transportation State Highway Fund, RB, Series B, 5.00%, 7/01/18 (d) |

4,000 | 4,575,760 | |||||||||

Arizona School Facilities Board, COP: |

|||||||||||

5.13%, 9/01/21 |

1,000 | 1,146,360 | |||||||||

5.75%, 9/01/22 |

2,000 | 2,333,600 | |||||||||

| 20 | SEMI-ANNUAL REPORT | JANUARY 31, 2015 |

| Schedule of Investments (continued) | BlackRock MuniYield

Arizona Fund, Inc. (MZA) (Percentages shown are based on Net Assets) |

| Municipal Bonds |

Par (000) |

Value | |||||||||

Arizona (concluded) |

|||||||||||

State (concluded) |

|||||||||||

Arizona Sports & Tourism Authority, Refunding RB, Multipurpose Stadium Facility Project, Series A, 5.00%, 7/01/31 |

$ | 1,000 | $ | 1,105,500 | |||||||

State of Arizona, RB, Lottery Revenue, Series A (AGM), 5.00%, 7/01/29 |

1,930 | 2,216,547 | |||||||||

| 11,377,767 | |||||||||||

Transportation — 4.4% |

|||||||||||

City of Phoenix Arizona Civic Improvement Corp., RB, Senior Lien, Series A, AMT, 5.00%, 7/01/33 |

1,000 | 1,115,000 | |||||||||

City of Phoenix Arizona Civic Improvement Corp., Refunding RB: |

|||||||||||

Junior Lien, Series A, 5.00%, 7/01/40 |

1,000 | 1,130,990 | |||||||||

Senior Lien, AMT, 5.00%, 7/01/32 |

700 | 809,669 | |||||||||

| 3,055,659 | |||||||||||

Utilities — 20.4% |

|||||||||||

City of Phoenix Arizona Civic Improvement Corp., Refunding RB, Senior Lien, 5.50%, 7/01/22 |

2,000 | 2,307,360 | |||||||||

County of Pinal Arizona, RB, Electric District No. 4, 6.00%, 12/01/38 |

2,000 | 2,253,600 | |||||||||

County of Pinal Arizona, Refunding RB, Electric District No. 3, 5.25%, 7/01/36 |

2,500 | 2,855,950 | |||||||||

County of Pinal Arizona IDA, RB, San Manuel Facility Project, AMT, 6.25%, 6/01/26 |

500 | 521,455 | |||||||||

Gilbert Water Resource Municipal Property Corp., RB, Subordinate Lien (NPFGC), 5.00%, 10/01/29 |

900 | 982,296 | |||||||||

Greater Arizona Development Authority, RB, Series B (NPFGC): |

|||||||||||

5.00%, 8/01/30 |

1,600 | 1,632,928 | |||||||||

5.00%, 8/01/35 |

1,000 | 1,021,040 | |||||||||

Salt River Project Agricultural Improvement & Power District, RB, Series A, 5.00%, 1/01/24 |

1,000 | 1,121,570 | |||||||||

Salt River Project Agricultural Improvement & Power District, Refunding RB, Series A, 5.00%, 1/01/35 |

1,500 | 1,562,400 | |||||||||

| 14,258,599 | |||||||||||

Total Municipal Bonds in Arizona |

97,907,196 | ||||||||||

| Municipal Bonds | Par (000) |

Value | |||||||||

Guam — 3.1% |

|||||||||||

State — 3.1% |

|||||||||||

Territory of Guam, RB, Business Privilege Tax: |

|||||||||||

Series A, 5.25%, 1/01/36 |

$ | 65 | $ | 74,163 | |||||||

Series A, 5.13%, 1/01/42 |

800 | 902,296 | |||||||||

Series B-1, 5.00%, 1/01/37 |

80 | 89,557 | |||||||||

Series B-1, 5.00%, 1/01/42 |

1,000 | 1,112,880 | |||||||||

Total Municipal Bonds in Guam |

2,178,896 | ||||||||||

Total Municipal Bonds — 143.1% |

100,086,092 | ||||||||||

Municipal Bonds Transferred to Tender Option Bond Trusts (e) |

|||||||||||

Arizona — 10.8% |

|||||||||||

Utilities — 10.8% |

|||||||||||

City of Mesa Arizona, RB, Utility System, 5.00%, 7/01/35 |

3,000 | 3,447,750 | |||||||||

City of Phoenix Arizona Civic Improvement Corp., Refunding RB, Water System, Junior Lien, Series A, 5.00%, 7/01/34 |

3,000 | 3,425,310 | |||||||||

Salt River Project Agricultural Improvement & Power District, RB, Electric System, Series A, 5.00%,

1/01/38 |

660 | 727,327 | |||||||||

Total Municipal Bonds Transferred to Tender Option Bond Trusts — 10.8% |

7,600,387 | ||||||||||

Total Long-Term Investments (Cost — $97,345,239) — 153.9% |

107,686,479 | ||||||||||

Short-Term Securities |

Shares |

||||||||||

FFI Institutional Tax-Exempt Fund, 0.03% (f)(g) |

2,289,928 | 2,289,928 | |||||||||

Total Short-Term Securities (Cost — $2,289,928) — 3.3% |

2,289,928 | ||||||||||

Total Investments (Cost — $99,635,167) — 157.2% |

109,976,407 | ||||||||||

Other Assets Less Liabilities — 0.9% |

597,194 | ||||||||||

Liability for TOB Trust Certificates, Including Interest Expense and Fees Payable — (4.8%) |

(3,330,094 | ) | |||||||||

VRDP Shares, at Liquidation Value — (53.3%) |

(37,300,000 | ) | |||||||||

Net Assets Applicable to Common Shares — 100.0% |

$ | 69,943,507 | |||||||||

Notes to Schedule of Investments

| (a) | Represents a step-up bond that pays an initial coupon rate for the first period and then a higher coupon rate for the following

periods. Rate shown is as of report date. |

|||

| (b) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold

in transactions exempt from registration to qualified institutional investors. |

|||

| (c) | Security is collateralized by municipal or U.S. Treasury obligations. |

|||

| (d) | U.S. government securities, held in escrow, are used to pay interest on this security, as well as to retire the bond in full at the

date indicated, typically at a premium to par. |

|||

| (e) | Represent bonds transferred to a TOB. In exchange for which the Fund received cash and residual interest certificates. These bonds

serve as collateral in a financing transaction. See Note 3 of the Notes to Financial Statements for details of municipal bonds transferred to

TOBs. |

|||

| (f) | During the six months ended January 31, 2015, investments in issuers considered to be an affiliate of the Fund, for purposes of

Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows: |

| Affiliate |

|

Shares Held at July 31, 2014 |

|

Net Activity |

|

Shares Held at January 31, 2015 |

|

Income |

||||||||||

FFI Institutional Tax-Exempt Fund |

3,656,883 | (1,366,955 | ) | 2,289,928 | $ | 83 | ||||||||||||

| (g) | Represents the current yield as of report date. |

| SEMI-ANNUAL REPORT | JANUARY 31, 2015 | 21 |

| Schedule of Investments (concluded) | BlackRock MuniYield

Arizona Fund, Inc. (MZA) |

| • | As

of January 31, 2015, financial futures contracts outstanding were as follows: |

| Contracts Short |

|

Issue |

|

Exchange |

|

Expiration |

|

Notional Value |

|

Unrealized Depreciation |

||||||||||||

(30) |

10-Year U.S. Treasury Note |

Chicago Board of Trade |

March 2015 |

$ | 3,926,250 | $ | (65,750 | ) | ||||||||||||||

| • | For

Fund compliance purposes, the Fund’s sector classifications refer to any one or more of the sector sub-classifications used by one or more widely

recognized market indexes or rating group indexes, and/or as defined by the investment advisor. These definitions may not apply for purposes of this

report, which may combine such sector sub-classifications for reporting ease. |

|||

| • | Fair

Value Measurements — Various inputs are used in determining the fair value of investments and derivative financial instruments. These inputs to

valuation techniques are categorized into a disclosure hierarchy consisting of three broad levels for financial statement purposes. The hierarchy gives

the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority

to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments

categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure

purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in

its entirety. The categorization of a value determined for investments and derivative financial instruments is based on the pricing transparency of the

investment and derivative financial instrument and is not necessarily an indication of the risks associated with investing in those securities. The

three levels of the fair value hierarchy are as follows: |

| • | Level 1 — unadjusted quoted prices in active markets/exchanges for identical assets or liabilities that the Fund has the ability

to access |

|||

| • | Level 2 — other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets

that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are

observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and

default rates) or other market-corroborated inputs) |

|||

| • | Level 3 — unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are

not available (including the Fund’s own assumptions used in determining the fair value of investments and derivative financial

instruments) |

Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. In

accordance with the Fund’s policy, transfers between different levels of the fair value disclosure hierarchy are deemed to have occurred as of the

beginning of the reporting period. For information about the Fund’s policy regarding valuation of investments and derivative financial

instruments, refer to Note 2 of the Notes to Financial Statements. |

||||

As of January 31, 2015, the following tables summarize the Fund’s investments and derivative financial instruments categorized

in the disclosure hierarchy: |

| |

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|||||||||||

Assets: |

||||||||||||||||||

Investments: |

||||||||||||||||||

Long-Term Investments1 |

$ | 107,686,479 | — | $ | 107,686,479 | |||||||||||||

Short-Term Securities |