UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to __________

Commission file number:

(Exact name of registrant as specified in its charter) |

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

| ||

(Address of principal executive offices) |

| (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Trading Symbol |

| Name of Each Exchange on Which Registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date (November 13, 2023):

PALATIN TECHNOLOGIES, INC.

Table of Contents

| 2 |

| Table of Contents |

Special Note Regarding Forward-Looking Statements

In this Quarterly Report on Form 10-Q (this “Quarterly Report”) references to “we,” “our,” “us,” the “Company” or “Palatin” mean Palatin Technologies, Inc. and its subsidiary.

Statements in this Quarterly Report, as well as oral statements that may be made by us or by our officers, directors, or employees acting on our behalf, that are not historical facts constitute “forward-looking statements,” which are made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The forward-looking statements in this Quarterly Report do not constitute guarantees of future performance. Investors are cautioned that statements that are not strictly historical facts contained in this Quarterly Report, including, without limitation, the following are forward looking statements:

| · | our significant operating losses since our inception and our need to obtain additional financing has caused management to determine there is substantial doubt regarding our ability to continue as a going concern; |

|

|

|

| · | our ability to obtain additional financing on terms acceptable to us, or at all, including unavailability of funds or delays in receiving funds as a result of economic disruptions; |

|

|

|

| · | our expectation that we will incur losses for the foreseeable future and may never achieve or maintain profitability; |

|

|

|

| · | our business, financial condition, and results of operations may be adversely affected by increases in costs of and delays in conducting human clinical trials and the performance of our contractors and suppliers, reduction in our productivity or the productivity of our contractors and suppliers, supply chain constraints, and labor shortages; |

|

|

|

| · | our ability to successfully commercialize Vyleesi® (the trade name for bremelanotide) for the treatment of premenopausal women with hypoactive sexual desire disorder (“HSDD”) in the United States; |

|

|

|

| · | our ability to manage the infrastructure to successfully manufacture, through contract manufacturers, Vyleesi, and to successfully market and distribute Vyleesi in the United States; |

|

|

|

| · | our ability to meet post-marketing commitments of the U.S. Food and Drug Administration (“FDA”) for Vyleesi; |

|

|

|

| · | our expectations regarding the potential market size and market acceptance for Vyleesi for HSDD in the United States and elsewhere in the world; |

|

|

|

| · | our expectations regarding performance of our exclusive licensees of Vyleesi for the treatment of premenopausal women with HSDD, which is a type of female sexual dysfunction (“FSD”), including: |

| o | Shanghai Fosun Pharmaceutical Industrial Development Co. Ltd. (“Fosun”), a subsidiary of Shanghai Fosun Pharmaceutical (Group) Co., Ltd., for the territories of the People’s Republic of China, Taiwan, Hong Kong S.A.R. and Macau S.A.R. (collectively, “China”), and |

|

|

|

| o | Kwangdong Pharmaceutical Co., Ltd. (“Kwangdong”) for the Republic of Korea (“Korea”); |

| · | our expectations and the ability of our licensees to timely obtain approvals and successfully commercialize Vyleesi in countries other than the United States; |

|

|

|

| · | the results of clinical trials with our late-stage products, including PL9643, an ophthalmic peptide solution for dry eye disease (“DED”), which entered Phase 3 clinical trials in the fourth quarter of calendar year 2021, with top line results from the first Phase 3 clinical trial projected by December 31, 2023, PL8177, an oral peptide formulation for treatment of ulcerative colitis, which entered Phase 2 clinical trials in the third quarter of calendar year 2022, and a proof-of-concept melanocortin agonist clinical trial for diabetic nephropathy, which entered a Phase 2 clinical in the fourth quarter of calendar year 2022; |

|

|

|

| · | estimates of our expenses, future revenue and capital requirements; |

|

|

|

| · | our ability to achieve profitability; |

|

|

|

| · | our ability to advance product candidates into, and successfully complete, clinical trials; |

|

|

|

| · | the initiation, timing, progress and results of future preclinical studies and clinical trials, and our research and development programs; |

|

|

|

| · | the timing or likelihood of regulatory filings and approvals; |

| 3 |

| Table of Contents |

| · | our expectations regarding the clinical efficacy and utility of our melanocortin agonist product candidates for treatment of inflammatory and autoimmune related diseases and disorders, including ocular indications; |

|

|

|

| · | our ability to compete with other products and technologies treating the same or similar indications as our product candidates; |

|

|

|

| · | the ability of our third-party collaborators to timely carry out their duties under their agreements with us; |

|

|

|

| · | the ability of our contract manufacturers to perform their manufacturing activities for us in compliance with applicable regulations; |

|

|

|

| · | our ability to recognize the potential value of our licensing arrangements with third parties; |

|

|

|

| · | the potential to achieve revenues from the sale of our product candidates; |

|

|

|

| · | our ability to obtain adequate reimbursement from private insurers and other healthcare payers; |

|

|

|

| · | our ability to maintain product liability insurance at a reasonable cost or in sufficient amounts, if at all; |

|

|

|

| · | the performance and retention of our management team, senior staff professionals, other employees, and third-party contractors and consultants; |

|

|

|

| · | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology in the United States and throughout the world; |

|

|

|

| · | our compliance with federal and state laws and regulations; |

|

|

|

| · | the timing and costs associated with obtaining regulatory approval for our product candidates; |

|

|

|

| · | the impact of fluctuations in foreign exchange rates; |

|

|

|

| · | the impact of any geopolitical instability, economic uncertainty, financial markets volatility, or capital markets disruption resulting from the ongoing military conflict between Russia and Ukraine, and any resulting effects on our revenue, financial condition, or results of operations; |

|

|

|

| · | the impact of legislative or regulatory healthcare reforms in the United States; |

|

|

|

| · | our ability to adapt to changes in global economic conditions as well as competing products and technologies; and |

|

|

|

| · | our ability to remain listed on the NYSE American stock exchange. |

Such forward-looking statements involve risks, uncertainties and other factors that could cause our actual results to be materially different from historical results or from any results expressed or implied by such forward-looking statements. Our future operating results are subject to risks and uncertainties and are dependent upon many factors, including, without limitation, the risks identified under the caption “Risk Factors” and elsewhere in this Quarterly Report, and any of those made in our other reports filed with the U.S. Securities and Exchange Commission (the “SEC”). Except as required by law, we do not intend, and undertake no obligation, to publicly update forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events.

Palatin Technologies® and Vyleesi® are registered trademarks of Palatin Technologies, Inc., and Palatin™ and the Palatin logo are trademarks of Palatin Technologies, Inc. Other trademarks referred to in this report are the property of their respective owners.

| 4 |

| Table of Contents |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

PALATIN TECHNOLOGIES, INC. | ||||||||

and Subsidiary | ||||||||

Consolidated Balance Sheets | ||||||||

(unaudited) | ||||||||

|

|

|

|

|

|

| ||

|

| September 30, 2023 |

|

| June 30, 2023 |

| ||

ASSETS |

|

|

|

|

|

| ||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ |

|

| $ |

| ||

Marketable securities |

|

|

|

|

|

| ||

Accounts receivable |

|

|

|

|

|

| ||

Inventories |

|

|

|

|

|

| ||

Prepaid expenses and other current assets |

|

|

|

|

|

| ||

Total current assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

|

|

| ||

Right-of-use assets - operating leases |

|

|

|

|

|

| ||

Other assets |

|

|

|

|

|

| ||

Total assets |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ (DEFICIENCY) EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ |

|

| $ |

| ||

Accrued expenses |

|

|

|

|

|

| ||

Short-term operating lease liabilities |

|

|

|

|

|

| ||

Short-term finance lease liabilities |

|

|

|

|

|

| ||

Other current liabilities |

|

|

|

|

|

| ||

Total current liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Long-term operating lease liabilities |

|

|

|

|

|

| ||

Long-term finance lease liabilities |

|

|

|

|

|

| ||

Other long-term liabilities |

|

|

|

|

|

| ||

Total liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ (deficiency) equity: |

|

|

|

|

|

|

|

|

Preferred stock of $ |

|

|

|

|

|

| ||

Common stock of $ |

|

|

|

|

|

| ||

Additional paid-in capital |

|

|

|

|

|

| ||

Accumulated deficit |

|

| ( | ) |

|

| ( | ) |

Total stockholders’ (deficiency) equity |

|

| ( | ) |

|

|

| |

Total liabilities, and stockholders’ (deficiency) equity |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these consolidated financial statements.

| 5 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC. | ||||||||

and Subsidiary | ||||||||

Consolidated Statements of Operations | ||||||||

(unaudited) | ||||||||

|

|

|

|

|

|

| ||

|

| Three Months Ended September 30, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

|

|

|

|

|

|

| ||

REVENUES |

|

|

|

|

|

| ||

Product revenue, net |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

Cost of products sold |

|

|

|

|

|

| ||

Research and development |

|

|

|

|

|

| ||

Selling, general and administrative |

|

|

|

|

|

| ||

Total operating expenses |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Loss from operations |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

Investment income |

|

|

|

|

|

| ||

Foreign currency (loss) gain |

|

|

|

|

|

| ||

Interest expense |

|

| ( | ) |

|

| ( | ) |

Total other income (expense), net |

|

|

|

|

|

| ||

NET LOSS |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per common share |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding used in computing basic and diluted net loss per common share |

|

|

|

|

|

| ||

The accompanying notes are an integral part of these consolidated financial statements.

| 6 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC. | ||||||||||||||||||||||||||||||||||||||||||||||||

and Subsidiary | ||||||||||||||||||||||||||||||||||||||||||||||||

Consolidated Statements of Changes in Redeemable Convertible Preferred Stock and Stockholders’ (Deficiency) Equity | ||||||||||||||||||||||||||||||||||||||||||||||||

(unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Three Months Ended September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||

|

| Redeemable Convertible Preferred Stock |

|

| Stockholders' (Deficiency) Equity |

| ||||||||||||||||||||||||||||||||||||||||||

|

| Series B |

|

| Series C |

|

|

|

| Series A Convertible Preferred Stock |

|

| Common Stock |

|

| Additional |

|

|

|

|

| |||||||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Escrowed Proceeds |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Paid-in Capital |

|

| Accumulated Deficit |

|

| Total |

| ||||||||||||

Balance June 30, 2023 |

|

| - |

|

| $ | - |

|

|

| - |

|

| $ |

|

| $ |

|

|

|

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||||||

Stock-based compensation |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Withholding taxes related to restricted stock units |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

| ( | ) | |||||

Sale of common stock, net of costs |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Net loss |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | ||||||

Balance September 30, 2023 |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

| Redeemable Convertible Preferred Stock | Stockholders' (Deficiency) Equity |

| ||||||||||||||||||||||||||||||||||||||||||||

|

| Series B |

|

|

| Series C |

|

|

|

|

| Series A Convertible Preferred Stock |

|

| Common Stock | Additional |

| |||||||||||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Escrowed Proceeds |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Paid-in Capital |

|

| Accumulated Deficit |

|

| Total |

| ||||||||||||

Balance June 30, 2022 |

|

|

|

| $ |

|

|

|

|

| $ |

|

| $ | ( | ) |

|

|

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| ||||||||||

Stock-based compensation |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

Reverse stock split fractional shares |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Net loss |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | ||||||

Balance September 30, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

| ||||||||||

The accompanying notes are an integral part of these consolidated financial statements

| 7 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC. | ||||||||

and Subsidiary | ||||||||

Consolidated Statements of Cash Flows | ||||||||

(unaudited) | ||||||||

|

|

|

|

|

|

| ||

|

| Three Months Ended September 30, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| ||

Net loss |

| $ | ( | ) |

| $ | ( | ) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

| ||

Decrease in right-of-use asset |

|

|

|

|

|

| ||

Unrealized foreign currency transaction gain |

|

| ( | ) |

|

| ( | ) |

Stock-based compensation |

|

|

|

|

|

| ||

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

|

|

| ( | ) | |

Prepaid expenses and other assets |

|

|

|

|

| ( | ) | |

Inventories |

|

| ( | ) |

|

|

| |

Accounts payable |

|

| ( | ) |

|

|

| |

Accrued expenses |

|

|

|

|

| ( | ) | |

Operating lease liabilities |

|

| ( | ) |

|

| ( | ) |

Net cash used in operating activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Maturity of marketable securities |

|

|

|

|

|

| ||

Purchases of property and equipment |

|

|

|

|

| ( | ) | |

Net cash provided by (used in) investing activities |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Payment of withholding taxes related to restricted stock units |

|

| ( | ) |

|

| ( | ) |

Proceeds from the sale of common stock and warrants, net of costs |

|

|

|

|

|

| ||

Payment of finance lease obligations |

|

| ( | ) |

|

|

| |

Net cash provided by (used in) financing activities |

|

|

|

|

| ( | ) | |

|

|

|

|

|

|

|

|

|

NET DECREASE IN CASH AND CASH EQUIVALENTS |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS, beginning of period |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS, end of period |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

Cash paid for interest |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these consolidated financial statements

| 8 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(1) ORGANIZATION

Nature of Business- Palatin Technologies, Inc. (“Palatin” or the “Company”) is a biopharmaceutical company developing first-in-class medicines based on molecules that modulate the activity of the melanocortin receptor system. The Company’s product candidates are targeted, receptor-specific therapeutics for the treatment of diseases with significant unmet medical need and commercial potential.

Melanocortin Receptor System. The melanocortin receptor system has effects on food intake, metabolism, sexual function, inflammation, and immune system responses. There are five melanocortin receptors, MC1r through MC5r. Modulation of these receptors, through use of receptor-specific agonists, which activate receptor function, or receptor-specific antagonists, which block receptor function, can have significant pharmacological effects.

The Company’s commercial product, Vyleesi®, was approved by the U.S. Food and Drug Administration (“FDA”) in June 2019 for the treatment of hypoactive sexual desire disorder (“HSDD”) in premenopausal women and is being marketed by the Company in North America.

The Company’s new product development activities focus primarily on MC1r agonists, with potential to treat inflammatory and autoimmune diseases such as dry eye disease, which is also known as keratoconjunctivitis sicca, uveitis, diabetic retinopathy, and inflammatory bowel disease. The Company believes that the MC1r agonist peptides in development have broad anti-inflammatory effects and appear to utilize mechanisms engaged by the endogenous melanocortin system in regulation of the immune system and resolution of inflammatory responses. The Company is also developing peptides that are active at more than one melanocortin receptor, and MC4r peptide and small molecule agonists with potential utility in obesity and metabolic-related disorders, including rare disease and orphan indications.

Business Risks and Liquidity –The Company has incurred operating losses and negative cash flows from operations since inception and will need additional funding to complete its planned product development efforts. As shown in the accompanying consolidated financial statements, the Company had an accumulated deficit as of September 30, 2023 of $

As of September 30, 2023, the Company’s cash and cash equivalents were $

The Company follows the provisions of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 205-40, Presentation of Financial Statements — Going Concern, which requires management to assess the Company’s ability to continue as a going concern for one year after the date the consolidated financial statements are issued. While the Company has raised funding in the past, the ability to raise funding in future periods is not considered probable, as defined under the accounting standards. As such, under the requirements of ASC 205-40, management may not consider the potential for future funding in their assessment of the Company’s ability to meet its obligations for the next year.

| 9 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

Based on our available cash and cash equivalents including the $

The Company will receive a royalty on sales of Vyleesi by its licensees. It has licensed third parties to sell Vyleesi in China and Korea. There may be delays in obtaining regulatory approvals to sell Vyleesi in China and Korea, which would delay when the Company receives royalty income from sales in those countries.

Concentrations – Concentrations in the Company’s assets and operations subject it to certain related risks. Financial instruments that subject the Company to concentrations of credit risk primarily consist of cash, cash equivalents, and accounts receivable. The Company’s cash, cash equivalents, and marketable securities are primarily invested in one investment account sponsored by a large financial institution.

(2) BASIS OF PRESENTATION

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q. Accordingly, they do not include all of the information and footnote disclosures required to be presented for complete financial statements. In the opinion of management, these consolidated financial statements contain all adjustments (consisting of normal recurring adjustments) considered necessary for fair presentation. The results of operations for the three months ended September 30, 2023, may not necessarily be indicative of the results of operations expected for the full fiscal year.

The accompanying unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2023, filed with the U.S. Securities and Exchange Commission (“SEC”), which includes consolidated financial statements as of June 30, 2023, and 2022 and for the fiscal years then ended.

(3) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation – The consolidated financial statements include the accounts of the Company and its wholly-owned inactive subsidiary. All intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates – The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents – Cash and cash equivalents include cash on hand, cash in banks, and all highly liquid investments with a purchased maturity of less than three months. Cash equivalents consisted of $

Marketable Securities - The Company’s marketable securities consist of debt securities with original maturities of greater than 90 days that are classified as available for sale securities.

Fair Value of Financial Instruments – The Company’s financial instruments consist primarily of cash equivalents, marketable securities, accounts receivable, and accounts payable. Management believes that the carrying values of cash equivalents, accounts receivable, and accounts payable are representative of their respective fair values based on the short-term nature of these instruments.

| 10 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

Credit Risk – Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash, cash equivalents, and accounts receivable. Total cash and cash equivalent balances have exceeded balances insured by the Federal Depository Insurance Company. Currently, product revenues and related accounts receivable are generated primarily from one specialty pharmacy.

Trade Accounts Receivable - Trade accounts receivable are amounts owed to the Company by its customers for product that has been delivered. The trade accounts receivable is recorded at the invoice amount, less prompt pay and other discounts, chargebacks, and an allowance for credit losses, if any. Credit losses have not been significant to date.

Inventories– Inventory is stated at the lower of cost or net realizable value, with cost being determined on a first-in, first-out basis.

On a quarterly basis, the Company reviews inventory levels to determine whether any obsolete, expired, or excess inventory exists. If any inventory is expected to expire prior to being sold, has a cost basis in excess of its net realizable value, is in excess of expected sales requirements as determined by internal sales forecasts, or fails to meet commercial sale specifications, the inventory is written down through a charge to operating expenses. Inventory consisting of Vyleesi has a shelf-life of three years from the date of manufacture.

Property and Equipment – Property and equipment consists of office and laboratory equipment, office furniture, and leasehold improvements and includes assets acquired under finance leases. Property and equipment are recorded at cost. Depreciation is recognized using the straight-line method over the estimated useful lives of the related assets, generally five years for laboratory and computer equipment, seven years for office furniture and equipment, and the lesser of the term of the lease or the useful life for leasehold improvements. Amortization of assets acquired under finance leases is included in depreciation expense. Maintenance and repairs are expensed as incurred while expenditures that extend the useful life of an asset are capitalized.

Impairment of Long-Lived Assets – The Company reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable. To determine recoverability of a long-lived asset, management evaluates whether the estimated future undiscounted net cash flows from the asset are less than its carrying amount. If impairment is indicated, the long-lived asset would be written down to fair value. Fair value is determined by an evaluation of available price information at which assets could be bought or sold, including quoted market prices, if available, or the present value of the estimated future cash flows based on reasonable and supportable assumptions.

Leases - At lease inception, the Company determines whether an arrangement is or contains a lease. Operating leases are included in operating lease right-of-use (“ROU”) assets, short-term operating lease liabilities, and long-term operating lease liabilities in the consolidated financial statements. Finance leases are included in property and equipment for ROU assets, short-term finance lease liabilities, and long-term finance lease liabilities in the consolidated financial statements. ROU assets represent the Company’s right to use leased assets over the term of the lease. Lease liabilities represent the Company’s contractual obligation to make lease payments over the lease term. ROU assets and lease liabilities are recognized at the commencement date. The lease liability is measured as the present value of the lease payments over the lease term. The Company uses the rate implicit in the lease if it is determinable. When the rate implicit in the lease is not determinable, the Company uses an estimate based on a hypothetical rate provided by a third party as the Company currently does not have issued debt. Lease terms may include renewal or extension options to the extent they are reasonably certain to be exercised. The assessment of whether renewal or extension options are reasonably certain to be exercised is made at lease commencement. Factors considered in determining whether an option is reasonably certain of exercise include, but are not limited to, the value of any leasehold improvements, the value of renewal rates compared to market rates, and the presence of factors that would cause incremental costs to the Company if the option were not exercised.

The ROU asset is initially measured at cost, which comprises the initial amount of the lease liability adjusted for lease payments made at or before the lease commencement date, plus any initial direct costs incurred less any lease incentives received. For operating leases, the ROU asset is subsequently measured throughout the lease term at the carrying amount of the lease liability, plus initial direct costs, plus (minus) any prepaid (accrued) lease payments, less the unamortized balance of lease incentives received. Lease expense for lease payments is recognized on a straight-line basis over the lease term. For finance leases, the ROU asset is subsequently amortized using the straight-line method from the lease commencement date to the earlier of the end of its useful life or the end of the lease term unless the lease transfers ownership of the underlying asset to the Company or the Company is reasonably certain to exercise an option to purchase the underlying asset. In those cases, the ROU asset is amortized over the useful life of the underlying asset. Amortization of the ROU asset is recognized and presented as an operating expense separately from interest expense on the lease liability.

| 11 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

The Company has elected not to recognize an ROU asset and obligation for leases with an initial term of 12 months or less. The expense associated with short-term leases is included in selling, general and administrative expenses in the statements of operations. To the extent a lease arrangement includes both lease and non-lease components, the Company has elected to account for the components as a single lease component.

Revenue Recognition – The Company recognizes product revenues in accordance with FASB ASC Topic 606, Revenue from Contracts with Customers. The provisions of ASC Topic 606 require the following steps to determine revenue recognition: (1) Identify the contract(s) with a customer; (2) Identify the performance obligations in the contract; (3) Determine the transaction price; (4) Allocate the transaction price to the performance obligations in the contract; and (5) Recognize revenue when (or as) the entity satisfies a performance obligation.

In accordance with ASC Topic 606, the Company recognizes product revenue when its performance obligation is satisfied by transferring control of the product to a customer. Per the Company’s contracts with customers, control of the product is transferred upon the conveyance of title, which occurs when the product is sold to and received by a customer. Trade accounts receivable due to the Company from contracts with its customers are stated separately in the consolidated balance sheet, net of various allowances as described in the Trade Accounts Receivable policy above.

Product revenues consist of sales of Vyleesi in the United States. The Company sells Vyleesi to specialty pharmacies at the wholesale acquisition cost and payment is currently made within approximately 30 days. In addition to distribution agreements with customers, the Company enters into arrangements with healthcare payers that provide for privately negotiated rebates, chargebacks, and discounts with respect to the purchase of the Company’s products.

The Company records product revenues net of allowances for direct and indirect fees, discounts, co-pay assistance programs, estimated chargebacks and rebates. Product sales are also subject to return rights, which have not been significant to date.

Gross product sales offset by product sales allowances for the three months ended September 30, 2023, and 2022 are as follows:

|

| Three Months Ended September 30, |

| |||||

|

| 2023 |

|

| 2022 |

| ||

|

|

|

|

|

|

| ||

Gross product sales |

| $ |

|

| $ |

| ||

Product sales allowances and accruals |

|

| ( | ) |

|

| ( | ) |

Net sales |

| $ |

|

| $ |

| ||

For licenses of intellectual property, the Company assesses at contract inception whether the intellectual property is distinct from other performance obligations identified in the arrangement. If the licensing of intellectual property is determined to be distinct, revenue is recognized for nonrefundable, upfront license fees when the license is transferred to the customer and the customer can use and benefit from the license. If the licensing of intellectual property is determined not to be distinct, then the license is bundled with other promises in the arrangement into one performance obligation. The Company needs to determine if the bundled performance obligation is satisfied over time or at a point in time. If the Company concludes that the nonrefundable, upfront license fees will be recognized over time, the Company will need to assess the appropriate method of measuring proportional performance.

Regulatory milestone payments are excluded from the transaction price due to the inability to estimate the probability of reversal. Revenue relating to achievement of these milestones is recognized in the period in which the milestone is achieved.

Sales-based royalty and milestone payments resulting from customer contracts solely or predominately for the license of intellectual property will only be recognized upon occurrence of the underlying sale or achievement of the sales milestone in the future and such sales-based royalties and milestone payments will be recognized in the same period earned.

| 12 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

The Company recognizes revenue for reimbursements of research and development costs under collaboration agreements as the services are performed. The Company records these reimbursements as revenue and not as a reduction of research and development expenses as the Company is the principal in the research and development activities based upon its control of such activities, which is considered part of its ordinary activities.

Development milestone payments are generally due 30 business days after the milestone is achieved. Sales milestone payments are generally due 45 business days after the calendar year in which the sales milestone is achieved. Royalty payments are generally due on a quarterly basis 20 business days after being invoiced.

Research and Development Costs – The costs of research and development activities are charged to expense as incurred, including the cost of equipment for which there is no alternative future use.

Accrued Expenses – Third parties perform a significant portion of the Company’s development activities. The Company reviews the activities performed under all contracts each quarter and accrues expenses and the amount of any reimbursement to be received from its collaborators based upon the estimated amount of work completed considering milestones achieved. Estimating the value or stage of completion of certain services requires judgment based on available information. If the Company does not identify services performed for it but not billed by the service-provider, or if it underestimates or overestimates the value of services performed as of a given date, reported expenses will be understated or overstated.

Stock-Based Compensation – The Company charges to expense the fair value of stock options and other equity awards granted to employees and nonemployees for services. Compensation costs for stock-based awards with time-based vesting are determined using the quoted market price of the Company’s common stock on the grant date or for stock options, the value determined utilizing the Black-Scholes option pricing model, and are recognized on a straight-line basis, while awards containing a market condition are valued using multifactor Monte Carlo simulations and are recognized over the derived service period. Compensation costs for awards containing a performance condition are determined using the quoted price of the Company’s common stock on the grant date or for stock options, the value determined utilizing the Black Scholes option pricing model and are recognized based on the probability of achievement of the performance condition over the service period. Forfeitures are recognized as they occur.

Income Taxes – The Company and its subsidiary file consolidated federal and separate-company state income tax returns. Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of assets and liabilities and their respective tax basis and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences or operating loss and tax credit carryforwards are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the period that includes the enactment date. The Company has recorded and continues to maintain a full valuation allowance against its deferred tax assets based on the history of losses incurred and lack of experience projecting future product revenue and sales-based royalty and milestone payments.

Net Loss per Common Share – Basic and diluted loss per common share (“EPS”) are calculated in accordance with the provisions of FASB ASC Topic 260, Earnings per Share.

For the three months ended September 30, 2023, and 2022, no additional common shares were added to the computation of diluted EPS because to do so would have been anti-dilutive. The potential number of common shares excluded from diluted EPS during the three months ended September 30, 2023, and 2022 was

Included in the weighted average common shares used in computing basic and diluted net loss per common share are

Translation of foreign currencies – Transactions denominated in currencies other than the Company’s functional currency (US Dollar) are recorded based on exchange rates at the time such transactions arise. Subsequent changes in exchange rates result in transaction gains and losses, which are reflected in the consolidated statements of operations as unrealized (based on the applicable period-end exchange rate) or realized upon settlement of the transactions.

| 13 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(4) NEW AND RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

In June 2016, the FASB issued Accounting Standards Update (“ASU”) No. 2016-13, Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments, which requires an entity to measure and recognize expected credit losses for certain financial instruments held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. This update to the standard requires immediate recognition of credit losses expected to occur over the remaining life of many financial instruments. The Company adopted ASU 2016-13 as of July 1, 2023. The adoption of this standard did not have a material impact on the Company’s consolidated financial statements for the quarter ended September 30, 2023.

(5) MANUFACTURING SUPPLY AGREEMENTS FOR VYLEESI

The Company has Vyleesi manufacturing contracts with Catalent Belgium S.A. (“Catalent”), a subsidiary of Catalent Pharma Solutions, Inc., to manufacture drug product and prefilled syringes and assemble prefilled syringes into an auto-injector device; Ypsomed AG (“Ypsomed”), to manufacture the auto-injector device (the “Ypsomed Agreement”); and Lonza Ltd. (“Lonza”), to manufacture the active pharmaceutical ingredient peptide (the “Lonza Agreement”).

On September 29, 2020, the Company and Catalent entered into an agreement to terminate a prior agreement (the “Original Catalent Agreement”) with Catalent (the “Catalent Termination Agreement”) in consideration for a one-time payment of six million euros (€6,000,000) which was paid in October 2020 and accrued as part of the estimated losses on inventory purchase commitments.

The Company and Catalent then entered into a new Vyleesi manufacturing agreement (the “Catalent Agreement”) which includes reduced minimum annual purchase requirements (see Note 12) as compared to the Original Catalent Agreement and modification of other financial terms. The Catalent Agreement provides that Catalent will provide manufacturing and supply services to Palatin related to production of Vyleesi, including that Catalent will supply specified minimums of Palatin’s requirements for Vyleesi during the term of the Catalent Agreement through August 21, 2025, unless earlier terminated in accordance with the terms of the Catalent Agreement. The initial term of the Catalent Agreement will be automatically extended for one 24-month period unless either party notifies the other of its desire to terminate as of the end of the initial term. The Catalent Agreement also includes customary terms and conditions relating to forecasting and minimum commitments, ordering, delivery, inspection and acceptance, and termination, among other matters (see Note 12).

The initial term of the Ypsomed Agreement is through December 31, 2025, with automatic renewal for successive one-year periods unless either party terminates the Ypsomed Agreement by ten months’ written notice prior to the expiration of the Ypsomed Agreement or any automatic renewal period. There are specified minimum purchase requirements under the Ypsomed Agreement, and under specified circumstances, termination fees may be payable upon termination of the Ypsomed Agreement by the Company (see Note 12).

The term of the Lonza Agreement was set to expire on December 31, 2022. In November 2022, Lonza and the Company amended the Lonza Agreement to extend contract peptide manufacturing services until June 30, 2024. The Company intends to seek to extend contract peptide manufacturing services with Lonza past June 30, 2024, and is also actively evaluating potential new contract manufacturers. Establishing a new contractual relationship and establishing and validating manufacturing in a manner that complies with FDA regulations is a time-consuming and costly process. The amendment reduced certain minimum purchase commitments that were previously accrued for. As a result, the Company recorded a gain on the purchase commitment of $

(6) AGREEMENT WITH FOSUN

On September 6, 2017, the Company entered into a license agreement with Shanghai Fosun Pharmaceutical Industrial Development Co. Ltd. (“Fosun”) for exclusive rights to commercialize Vyleesi in China (the “Fosun License Agreement”). Under the terms of the Fosun License Agreement, the Company received $

| 14 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(7) AGREEMENT WITH KWANGDONG

On November 21, 2017, the Company entered into a license agreement with Kwangdong Pharmaceutical Co., Ltd. (“Kwangdong”) for exclusive rights to commercialize Vyleesi in Korea (the “Kwangdong License Agreement”). Under the terms of the Kwangdong License Agreement, the Company received $

(8) PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid expenses and other current assets consist of the following:

|

| September 30, |

|

| June 30, |

| ||

|

| 2023 |

|

| 2023 |

| ||

Clinical / regulatory costs |

| $ |

|

| $ |

| ||

Insurance premiums |

|

|

|

|

|

| ||

Vyleesi contractual advances |

|

|

|

|

|

| ||

Other |

|

|

|

|

|

| ||

|

| $ |

|

| $ |

| ||

(9) FAIR VALUE MEASUREMENTS

The fair value of cash equivalents is classified using a hierarchy prioritized based on inputs. Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. Level 2 inputs are quoted prices for similar assets and liabilities in active markets or inputs that are observable for the asset or liability, either directly or indirectly through market corroboration, for substantially the full term of the financial instrument. Level 3 inputs are unobservable inputs based on management’s own assumptions used to measure assets and liabilities at fair value. A financial asset’s or liability’s classification within the hierarchy is determined based on the lowest level input that is significant to the fair value measurement.

The following table provides the assets carried at fair value:

|

| Carrying Value |

|

| Quoted prices in active markets (Level 1) |

|

| Other quoted/observable inputs (Level 2) |

|

| Significant unobservable inputs (Level 3) |

| ||||

September 30, 2023: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Cash equivalents - Money market funds |

| $ |

|

| $ |

|

| $ | - |

|

| $ | - |

| ||

June 30, 2023: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents - Money market funds |

| $ |

|

| $ |

|

|

| - |

|

|

| - |

| ||

Cash equivalents - Treasury bill |

|

|

|

|

|

|

|

| - |

|

|

| - |

| ||

Marketable securities - Treasury bill |

|

|

|

|

|

|

|

| - |

|

|

| - |

| ||

Total |

| $ |

|

| $ |

|

| $ | - |

|

| $ | - |

| ||

| 15 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(10) INVENTORIES

Inventories consist of raw materials and work-in-process related to Vyleesi. The following table summarizes the components of inventories:

|

| September 30, 2023 |

|

| June 30, 2023 |

| ||

|

|

|

|

|

|

| ||

Raw materials |

| $ |

|

| $ |

| ||

Work-in-process |

|

|

|

|

|

| ||

|

| $ |

|

| $ |

| ||

(11) ACCRUED EXPENSES

Accrued expenses consist of the following:

|

| September 30, |

|

| June 30, |

| ||

|

| 2023 |

|

| 2023 |

| ||

Clinical / regulatory costs |

| $ |

|

| $ |

| ||

Other research related expenses |

|

|

|

|

|

| ||

Professional Services |

|

|

|

|

|

| ||

Personnel costs |

|

|

|

|

|

| ||

Selling expenses |

|

|

|

|

|

| ||

Inventory purchases |

|

|

|

|

|

| ||

Other |

|

|

|

|

|

| ||

|

| $ |

|

| $ |

| ||

(12) COMMITMENTS AND CONTINGENCIES

Inventory Purchases - The Company has certain supply agreements with manufacturers and suppliers, including the Catalent Agreement, Ypsomed Agreement, and Lonza Agreement. The Company is required to make certain payments for the manufacture and supply of Vyleesi.

The following table summarizes the contractual obligations under the New Catalent Agreement, Yposmed Agreement, and Lonza Agreement as of September 30, 2023:

|

| Total |

|

| Current |

|

| 1 - 3 Years |

|

| 4 - 5 Years |

| ||||

Inventory purchase commitments |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

As of September 30, 2023, the Company has $

The commitment contractual obligation amounts above are denominated in Swiss Francs and Euros and have been translated using period end exchange rates. The Company may experience a negative impact on future earnings and equity solely as a result of future foreign currency exchange rate fluctuations.

Contingencies - The Company accounts for litigation losses in accordance with ASC 450-20, Loss Contingencies. In addition, the Company is subject to other contingencies, such as product liability, arising in the ordinary course of business. Loss contingency provisions are recorded for probable losses when management is able to reasonably estimate the loss. Any outcome upon settlement that deviates from the Company’s best estimate may result in additional expense or in a reduction in expense in a future accounting period. The Company records legal expenses associated with such contingencies as incurred.

| 16 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

The Company is involved, from time to time, in various claims and legal proceedings arising in the ordinary course of its business. The Company is not currently a party to any such claims or proceedings that, if decided adversely to it, would either individually or in the aggregate have a material adverse effect on its business, financial condition, or results of operations.

(13) REDEEMABLE CONVERTIBLE PREFERRED STOCK, ESCROWED PROCEEDS, AND STOCKHOLDERS’ (DEFICIENCY) EQUITY

Series B and C Redeemable Convertible Preferred Stock – On May 11, 2022, Palatin entered into a securities purchase agreement with institutional investors, and on May 12, 2022, Palatin issued and sold

Given that the fee and other costs were not refundable to the Company as of June 30, 2022, regardless of the election selected by the investors, the $

The Company called a meeting of stockholders on June 24, 2022, to seek approval of, among other things, an amendment to its certificate of incorporation authorizing a reverse stock split. Except as otherwise required by law, holders of the Series B Preferred Stock and Series C Preferred Stock were entitled to vote only on the reverse stock split and any adjournment of the meeting relating to the reverse stock split. The Company’s common stock, outstanding Series A Convertible Preferred Stock, the Series B Preferred Stock and the Series C Preferred Stock voted as a single class on an as-if converted basis. The holders of Series B Preferred Stock had votes equal to the number of shares of common stock into which the Series B Preferred Stock is convertible.

Series A Convertible Preferred Stock – As of June 30, 2023,

| 17 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

Financing Transactions – On October 31, 2022, the Company entered into a securities purchase agreement with a certain institutional investor to sell, in a registered direct offering (the “Offering”), an aggregate of (i)

The Common Warrants have an exercise price of $

The proceeds from the Offering, after deducting the placement agent fees and expenses and other estimated offering expenses, were $

On April 12, 2023, the Company entered into a new equity distribution agreement (the “2023 Equity Distribution Agreement”) with Canaccord Genuity LLC (“Canaccord”), pursuant to which the Company may, from time to time, sell shares of the Company’s common stock at market prices by methods deemed to be an “at-the-market offering” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended.

Proceeds raised under the 2023 Equity Distribution Agreement are as follows:

|

| Three Months Ended September 30, 2023 |

|

| Cumulative from inception |

| ||||||||||

|

| Shares |

|

| Proceeds |

|

| Shares |

|

| Proceeds |

| ||||

Gross proceeds |

|

|

|

| $ |

|

|

|

|

| $ |

| ||||

Fees |

|

| - |

|

|

| ( | ) |

|

| - |

|

|

| ( | ) |

Expenses |

|

| - |

|

|

|

|

|

| - |

|

|

| ( | ) | |

Net proceeds |

|

|

|

| $ |

|

|

|

|

| $ |

| ||||

As of September 30, 2023, the Company had outstanding warrants for shares of common stock as follows:

|

| Shares of Common |

|

| Exercise Price per |

|

| Latest Expiration | |||

Description |

| Stock |

|

| Share |

|

| Date | |||

May 2022 Warrants |

|

|

|

| $ |

|

| ||||

November 2022 Common Warrants |

|

|

|

| $ |

|

| ||||

November 2022 Placement Agent Warrants |

|

|

|

| $ |

|

| ||||

Stock Options – For the three months ended September 30, 2023, and 2022, the Company recorded stock-based compensation related to stock options of $

| 18 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

A summary of stock option activity is as follows:

|

| Number of Shares |

|

| Weighted Average Exercise Price |

|

| Weighted Average Remaining Term in Years |

|

| Aggregate Intrinsic Value |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Outstanding - June 30, 2023 |

|

|

|

| $ |

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Granted |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Forfeited |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Exercised |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Expired |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Outstanding - September 30, 2023 |

|

|

|

| $ |

|

|

|

|

| $ | - |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exercisable at September 30, 2023 |

|

|

|

| $ |

|

|

|

|

| $ | - |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expected to vest at September 30, 2023 |

|

|

|

| $ |

|

|

|

|

| $ |

| ||||

On December 16, 2022, Carl Spana, President and CEO of the Company, and Stephen T. Wills, CFO, COO and Executive Vice President of the Company, voluntarily contributed stock options previously issued to them to purchase

Stock options granted to the Company’s executive officers and employees generally vest over a

Included in the outstanding options in the table above are

Restricted Stock Units – For the three months ended September 30, 2023, and 2022, the Company recorded stock-based compensation related to restricted stock units of $

A summary of restricted stock unit activity is as follows:

Outstanding at June 30, 2023 |

|

|

| |

Granted |

|

| - |

|

Forfeited |

|

| ( | ) |

Vested |

|

| ( | ) |

Outstanding at September 30, 2023 |

|

|

|

| 19 |

| Table of Contents |

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

Included in outstanding restricted stock units in the table above are

Time-based restricted stock units granted to the Company’s executive officers, employees, and non-employee directors generally vest over 48 months, 48 months, and 12 months, respectively.

Included in the outstanding restricted stock units in the table above are 217,833 and 37,116 unvested performance-based restricted stock units granted to executive officers and other employees, respectively, which were granted in June 2020, 2021, 2022, and 2023. Grants in June 2020, 2021, 2022, and 2023 were

In connection with the vesting of restricted share units during the three months ended September 30, 2023, the Company withheld

(14) SUBSEQUENT EVENTS

On October 20, 2023, the Company entered into a securities purchase agreement (the “October 2023 Purchase Agreement”) with a certain institutional investor, to sell in a registered direct offering (the “October 2023 RD Offering”), an aggregate of (i)

The October 2023 Private Warrants will be exercisable on the six-month anniversary of issuance for a period of five and one-half years from the issuance date, at an exercise price equal to $

The October 2023 Pre-Funded Warrants have an exercise price of $

The net proceeds from the October 2023 Offering, after deducting the placement agent fees and offering expenses, were $

| 20 |

| Table of Contents |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with the consolidated financial statements and notes to the consolidated financial statements filed as part of this report and the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended June 30, 2023.

The following discussion and analysis contain forward-looking statements within the meaning of the federal securities laws. You are urged to carefully review our description and examples of forward-looking statements included earlier in this Quarterly Report immediately prior to Part I, under the heading “Special Note Regarding Forward-Looking Statements.” Forward-looking statements are subject to risk that could cause actual results to differ materially from those expressed in the forward-looking statements. You are urged to carefully review the disclosures we make concerning risks and other factors that may affect our business and operating results, including those made in this Quarterly Report and our Annual Report on Form 10-K for the year ended June 30, 2023, as well as any of those made in our other reports filed with the SEC. You are cautioned not to place undue reliance on the forward-looking statements included herein, which speak only as of the date of this document. We do not intend, and undertake no obligation, to publish revised forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events.

Critical Accounting Policies and Estimates

Our significant accounting policies, which are described in the notes to our consolidated financial statements included in this report and in our Annual Report on Form 10-K for the year ended June 30, 2023, have not changed during the three months ended September 30, 2023. We believe that our accounting policies and estimates relating to the carrying value of inventory, revenue recognition, accrued expenses, purchase commitment liabilities, and stock-based compensation are the most critical.

Our Business

We are a biopharmaceutical company developing first-in-class medicines based on molecules that modulate the activity of the melanocortin and natriuretic peptide receptor systems. Our product candidates are targeted, receptor-specific therapeutics for the treatment of diseases with significant unmet medical need and commercial potential.

Melanocortin Receptor System. The melanocortin receptor (“MCr”) system has effects on food intake, metabolism, sexual function, inflammation, and immune system responses. There are five melanocortin receptors, MC1r through MC5r. Modulation of these receptors, through use of receptor-specific agonists, which activate receptor function, or receptor-specific antagonists, which block receptor function, can have significant pharmacological effects.

Our commercial product, Vyleesi®, was approved by the U.S. Food and Drug Administration (“FDA”) in June 2019 and was being marketed in the United States by AMAG Pharmaceuticals, Inc. (“AMAG”) for the treatment of hypoactive sexual desire disorder (“HSDD”) in premenopausal women pursuant to a license agreement between them for Vyleesi for North America, which was entered into on January 8, 2017 (the “AMAG License Agreement”). As disclosed in Note 5 to the Financial Statements, the AMAG License Agreement was terminated effective July 24, 2020, and we are now marketing Vyleesi in North America.

Our new product development activities focus primarily on MC1r agonists, with potential to treat inflammatory and autoimmune diseases such as dry eye disease, which is also known as keratoconjunctivitis sicca, uveitis, diabetic retinopathy, and inflammatory bowel disease. We believe that the MC1r agonist peptides in development have broad anti-inflammatory effects and appear to utilize mechanisms engaged by the endogenous melanocortin system in regulation of the immune system and resolution of inflammatory responses. We are also developing peptides that are active at more than one melanocortin receptor, and MC4r peptide and small molecule agonists with potential utility in obesity and metabolic-related disorders, including rare disease and orphan indications.

| 21 |

| Table of Contents |

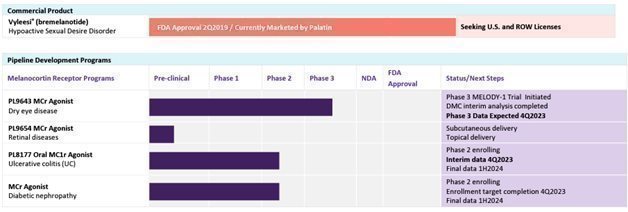

Pipeline Overview

The following chart illustrates the status of our drug development programs and Vyleesi, which has been approved by the FDA for the treatment of premenopausal women with acquired, generalized HSDD.

Our Strategy

Key elements of our business strategy include:

| · | Maximizing revenue from Vyleesi by marketing Vyleesi in the United States, supporting our existing licensees for China and Korea, and licensing Vyleesi for the United States and additional regions; |

|

|

|

| · | Maintaining a team to create, develop and commercialize MCr products addressing unmet medical needs; |

|

|

|

| · | Entering into strategic alliances and partnerships with pharmaceutical companies to facilitate the development, manufacture, marketing, sale, and distribution of product candidates that we are developing; |

|

|

|

| · | Partially funding our product development programs with the cash flow generated from Vyleesi and existing license agreements, as well as any future research, collaboration, or license agreements; and |

|

|

|

| · | Completing development and seeking regulatory approval of certain of our other product candidates. |

Corporate Information

We were incorporated under the laws of the State of Delaware on November 21, 1986 and commenced operations in the biopharmaceutical area in 1996. Our corporate offices are located at 4B Cedar Brook Drive, Cedar Brook Corporate Center, Cranbury, New Jersey 08512, and our telephone number is (609) 495-2200. We maintain an Internet site, where among other things, we make available free of charge on and through this website our Forms 3, 4 and 5, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) and Section 16 of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our website and the information contained in it or connected to it are not incorporated into this Quarterly Report on Form 10-Q. The reference to our website is an inactive textual reference only.

The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC (www.sec.gov).

Results of Operations

Three Months Ended September 30, 2023, Compared to the Three Months Ended September 30, 2022:

Revenues – For the three months ended September 30, 2023, and 2022, we recognized $2,105,977 and $869,654 in product revenue, net of allowances, respectively. The increase in net revenue was a result of increased sales volume of 100% and reduced product sales allowances as a percentage of gross sales during the three months ended September 30, 2023, compared to the three months ended September 30, 2022.

| 22 |

| Table of Contents |

Cost of Products Sold – Cost of products sold was $86,496 for the three months ended September 30, 2022, compared to no cost of products sold, as a result of the sale of fully reserved inventory, for the three months ended September 30, 2023.

Research and Development – Research and development expenses were $5,014,630 and $6,027,031 for the three months ended September 30, 2023, and 2022. The decrease for the three months ended September 30, 2023, as compared to the three months ended September 30, 2022, was related to the overall decrease in spending on our MCr programs.

Research and development expenses related to our Vyleesi, MCr programs and other preclinical programs were $3,459,587 and $4,363,183 for the three months ended September 30, 2023, and 2022, respectively. The decrease was primarily related to a decrease in spending on our MCr programs.