Blueprint

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark

One)

☑ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the

quarterly period ended September 30, 2016

or

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the

transition period from ___________ to __________

Commission

file number: 001-15543

________________________

PALATIN TECHNOLOGIES,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

95-4078884

|

|

(State

or other jurisdiction of incorporation or

organization)

|

|

(I.R.S.

Employer Identification No.)

|

|

4B Cedar Brook Drive

Cranbury, New Jersey

|

|

08512

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

(609) 495-2200

(Registrant's

telephone number, including area code)

Indicate

by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

☑ No ☐

Indicate

by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes

☑ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large accelerated

filer

|

☐

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

☐

|

Smaller reporting

company

|

☑

|

|

(Do not check if a

smaller reporting

company)

|

Indicate

by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act). Yes ☐ No

☑

As of

November 10, 2016, 108,039,221 shares of the registrant's common

stock, par value $0.01 per share, were outstanding.

PALATIN TECHNOLOGIES, INC.

Table of Contents

|

|

Page

|

|

PART I – FINANCIAL INFORMATION

|

|

|

|

|

Item 1. Financial Statements (Unaudited)

|

4

|

|

|

|

|

Consolidated

Balance Sheets as of September 30, 2016 and June 30,

2016

|

4

|

|

|

|

|

Consolidated

Statements of Operations for the Three Months Ended

September 30, 2016

and 2015

|

5

|

|

|

|

|

Consolidated

Statements of Comprehensive Loss for the Three Months Ended

September 30, 2016

and 2015

|

6

|

|

|

|

|

Consolidated

Statements of Cash Flows for the Three Months Ended

September 30, 2016

and 2015

|

7

|

|

|

|

|

Notes

to Consolidated Financial Statements

|

8

|

|

|

|

|

Item 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

|

17

|

|

|

|

|

Item 3. Quantitative and Qualitative Disclosures About Market

Risk

|

20

|

|

|

|

|

Item 4. Controls and Procedures

|

20

|

|

|

|

|

PART

II – OTHER INFORMATION

|

|

|

|

|

Item 1. Legal Proceedings

|

21

|

|

|

|

|

Item 1A. Risk Factors

|

21

|

|

|

|

|

Item 2. Unregistered Sales of Equity Securities and Use of

Proceeds

|

23

|

|

|

|

|

Item 3. Defaults Upon Senior Securities

|

23

|

|

|

|

|

Item 4. Mine Safety Disclosures

|

23

|

|

|

|

|

Item 5. Other Information

|

23

|

|

|

|

|

Item 6. Exhibits

|

23

|

|

|

|

|

Signatures

|

24

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this

Quarterly Report on Form 10-Q, as well as oral statements that may

be made by us or by our officers, directors, or employees acting on

our behalf, that are not historical facts constitute

“forward-looking statements”, which are made pursuant

to the safe harbor provisions of Section 21E of the Securities

Exchange Act of 1934, as amended (the Exchange Act). The

forward-looking statements in this Quarterly Report on Form 10-Q do

not constitute guarantees of future performance. Investors are

cautioned that statements that are not strictly historical

statements contained in this Quarterly Report on Form 10-Q,

including, without limitation, the following are forward looking

statements:

●

estimates of our

expenses, future revenue, capital requirements;

●

our ability to

obtain additional financing on terms acceptable to us, or at

all;

●

our ability to

advance product candidates into, and successfully complete,

clinical trials;

●

the initiation,

timing, progress and results of future preclinical studies and

clinical trials, and our research and development

programs;

●

the timing or

likelihood of regulatory filings and approvals;

●

our expectations

regarding the results and the timing of results in our Phase 3

clinical trials of bremelanotide for the treatment of premenopausal

women with hypoactive sexual desire disorder (HSDD), which is a

type of female sexual dysfunction, or FSD;

●

our expectation

regarding the timing of our regulatory submissions for approval of

bremelanotide for HSDD in the United States and

Europe;

●

the potential for

commercialization of bremelanotide for HSDD and other product

candidates, if approved, by us;

●

our expectations

regarding the potential market size and market acceptance for

bremelanotide for HSDD and our other product candidates, if

approved for commercial use;

●

our ability to

compete with other products and technologies similar to our product

candidates;

●

the ability of our

third-party collaborators to timely carry out their duties under

their agreements with us;

●

the ability of our

contract manufacturers to perform their manufacturing activities

for us in compliance with applicable regulations;

●

our ability to

recognize the potential value of our licensing arrangements with

third parties;

●

the potential to

achieve revenues from the sale of our product

candidates;

●

our ability to

obtain adequate reimbursement from Medicare, Medicaid, private

insurers and other healthcare payers;

●

our ability to

maintain product liability insurance at a reasonable cost or in

sufficient amounts, if at all;

●

the retention of

key management, employees and third-party contractors;

●

the scope of

protection we are able to establish and maintain for intellectual

property rights covering our product candidates and

technology;

●

our compliance with

federal and state laws and regulations;

●

the timing and

costs associated with obtaining regulatory approval for our product

candidates;

●

the impact of

fluctuations in foreign exchange rates;

●

the impact of

legislative or regulatory healthcare reforms in the United

States;

●

our ability to

adapt to changes in global economic conditions; and

●

our ability to

remain listed on the NYSE MKT.

Such

forward-looking statements involve risks, uncertainties and other

factors that could cause our actual results to be materially

different from historical results or from any results expressed or

implied by such forward-looking statements. Our future operating

results are subject to risks and uncertainties and are dependent

upon many factors, including, without limitation, the risks

identified in this report, in our Annual Report on Form 10-K for

the year ended June 30, 2016, and in our other Securities and

Exchange Commission (SEC) filings.

We

expect to incur losses in the future as a result of spending on our

planned development programs and results may fluctuate

significantly from quarter to quarter.

PART I - FINANCIAL INFORMATION

Item 1. Financial

Statements

PALATIN TECHNOLOGIES,

INC.

and Subsidiary

Consolidated Balance Sheets

(unaudited)

|

|

|

|

|

ASSETS

|

|

|

|

Current

assets:

|

|

|

|

Cash

and cash equivalents

|

$8,867,930

|

$8,002,668

|

|

Available-for-sale

investments

|

1,377,714

|

1,380,556

|

|

Prepaid

expenses and other current assets

|

1,007,978

|

1,313,841

|

|

Total

current assets

|

11,253,622

|

10,697,065

|

|

|

|

|

|

Property

and equipment, net

|

90,171

|

97,801

|

|

Other

assets

|

56,916

|

63,213

|

|

Total

assets

|

$11,400,709

|

$10,858,079

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIENCY

|

|

|

|

Current

liabilities:

|

|

|

|

Accounts

payable

|

$1,159,427

|

$713,890

|

|

Accrued

expenses

|

12,884,590

|

7,767,733

|

|

Notes

payable, net of discount and debt issuance costs

|

6,399,075

|

5,374,951

|

|

Capital

lease obligations

|

27,827

|

27,424

|

|

Total

current liabilities

|

20,470,919

|

13,883,998

|

|

|

|

|

|

Notes

payable, net of discount and debt issuance costs

|

12,162,471

|

14,106,594

|

|

Capital

lease obligations

|

7,214

|

14,324

|

|

Other

non-current liabilities

|

525,314

|

439,130

|

|

Total

liabilities

|

33,165,918

|

28,444,046

|

|

|

|

|

|

Stockholders’

deficiency:

|

|

|

|

Preferred

stock of $0.01 par value – authorized 10,000,000

shares:

|

|

|

|

Series

A Convertible: issued and outstanding 4,030 shares as of September

30, 2016 and June 30, 2016

|

40

|

40

|

|

Common

stock of $0.01 par value – authorized 300,000,000

shares:

|

|

|

|

issued

and outstanding 92,806,710 shares as of September 30, 2016 and

68,568,055 shares as of June 30, 2016, respectively

|

928,067

|

685,680

|

|

Additional

paid-in capital

|

333,774,227

|

325,142,509

|

|

Accumulated

other comprehensive loss

|

(2,521)

|

(1,944)

|

|

Accumulated

deficit

|

(356,465,022)

|

(343,412,252)

|

|

Total

stockholders’ deficiency

|

(21,765,209)

|

(17,585,967)

|

|

Total

liabilities and stockholders’ deficiency

|

$11,400,709

|

$10,858,079

|

The

accompanying notes are an integral part of these consolidated

financial statements.

PALATIN TECHNOLOGIES,

INC.

and Subsidiary

Consolidated Statements of Operations

(unaudited)

|

|

Three Months Ended September 30,

|

|

|

|

|

|

|

|

|

|

REVENUES:

|

|

|

|

License

revenue

|

$-

|

$-

|

|

|

|

|

|

OPERATING

EXPENSES:

|

|

|

|

Research

and development

|

11,226,084

|

10,597,714

|

|

General

and administrative

|

1,209,346

|

1,199,937

|

|

Total

operating expenses

|

12,435,430

|

11,797,651

|

|

|

|

|

|

Loss

from operations

|

(12,435,430)

|

(11,797,651)

|

|

|

|

|

|

OTHER

INCOME (EXPENSE):

|

|

|

|

Interest

income

|

6,645

|

15,740

|

|

Interest

expense

|

(623,985)

|

(628,008)

|

|

Total

other income (expense), net

|

(617,340)

|

(612,268)

|

|

|

|

|

|

|

|

|

|

NET

LOSS

|

$(13,052,770)

|

$(12,409,919)

|

|

|

|

|

|

Basic

and diluted net loss per common share

|

$(0.08)

|

$(0.08)

|

|

|

|

|

|

Weighted

average number of common shares outstanding used in computing basic

and diluted net loss per common share

|

165,848,269

|

156,176,618

|

The

accompanying notes are an integral part of these consolidated

financial statements.

PALATIN TECHNOLOGIES,

INC.

and Subsidiary

Consolidated Statements of Comprehensive Loss

(unaudited)

|

|

Three Months Ended September 30,

|

|

|

|

|

|

|

|

|

|

Net

loss

|

$(13,052,770)

|

$(12,409,919)

|

|

|

|

|

|

Other

comprehensive loss:

|

|

|

|

Unrealized

loss on available-for-sale investments

|

(577)

|

-

|

|

|

|

|

|

Total

comprehensive loss

|

$(13,053,347)

|

$(12,409,919)

|

The

accompanying notes are an integral part of these consolidated

financial statements.

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Consolidated Statements of Cash Flows

(unaudited)

|

|

Three

Months Ended September 30,

|

|

|

|

|

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

Net loss

|

$(13,052,770)

|

$(12,409,919)

|

|

Adjustments to reconcile net loss to net cash

|

|

|

|

used in operating activities:

|

|

|

|

Depreciation

and amortization

|

7,630

|

10,654

|

|

Non-cash

interest expense

|

82,266

|

80,739

|

|

Stock-based

compensation

|

403,208

|

300,394

|

|

Changes

in operating assets and liabilities:

|

|

|

|

Prepaid

expenses and other assets

|

312,160

|

137,095

|

|

Accounts

payable

|

445,537

|

2,239,604

|

|

Accrued

expenses

|

5,116,857

|

156,062

|

|

Other

non-current liabilities

|

86,184

|

86,957

|

|

Net

cash used in operating activities

|

(6,598,928)

|

(9,398,414)

|

|

|

|

|

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

|

|

Purchases

of property and equipment

|

-

|

(17,695)

|

|

Net

cash used in investing activities

|

-

|

(17,695)

|

|

|

|

|

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

Payments

on capital lease obligations

|

(6,707)

|

(6,328)

|

|

Payment

of withholding taxes reltaed to restricted

|

|

|

|

stock

units

|

-

|

(131,959)

|

|

Payment

on notes payable obligations

|

(1,000,000)

|

-

|

|

Proceeds

from the sale of common stock and

|

|

|

|

warrants,

net of costs

|

8,470,897

|

19,919,883

|

|

Proceeds

from the issuance of notes payable and warrants

|

-

|

10,000,000

|

|

Payment

of debt issuance costs

|

-

|

(140,964)

|

|

Net

cash provided by financing activities

|

7,464,190

|

29,640,632

|

|

|

|

|

|

NET

INCREASE IN CASH

|

|

|

|

AND CASH EQUIVALENTS

|

865,262

|

20,224,523

|

|

|

|

|

|

CASH

AND CASH EQUIVALENTS, beginning of period

|

8,002,668

|

27,299,268

|

|

|

|

|

|

CASH

AND CASH EQUIVALENTS, end of period

|

$8,867,930

|

$47,523,791

|

|

|

|

|

|

SUPPLEMENTAL

CASH FLOW INFORMATION:

|

|

|

|

Cash

paid for interest

|

$457,800

|

$460,313

|

|

Issuance

of warrants in connection with debt financing

|

-

|

305,196

|

|

Unrealized

loss on available-for-sale investments

|

577

|

-

|

|

Non-cash

equity financing costs in accounts payable

|

21,029

|

85,605

|

|

Non-cash

equity financing costs in accrued expenses

|

65,000

|

-

|

|

Non-cash

debt financing costs in accounts payable

|

-

|

5,151

|

The

accompanying notes are an integral part of these consolidated

financial statements.

PALATIN TECHNOLOGIES, INC.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

Nature of Business – Palatin

Technologies, Inc. (Palatin or the Company) is a biopharmaceutical

company developing targeted, receptor-specific peptide therapeutics

for the treatment of diseases with significant unmet medical need

and commercial potential. Palatin’s programs are based on

molecules that modulate the activity of the melanocortin and

natriuretic peptide receptor systems. The melanocortin system is

involved in a large and diverse number of physiologic functions,

and therapeutic agents modulating this system may have the

potential to treat a variety of conditions and diseases, including

sexual dysfunction, obesity and related disorders, cachexia

(wasting syndrome) and inflammation-related diseases. The

natriuretic peptide receptor system has numerous cardiovascular

functions, and therapeutic agents modulating this system may be

useful in treatment of acute asthma, heart failure, hypertension

and other cardiovascular diseases.

The

Company’s primary product in development is bremelanotide for

the treatment of hypoactive sexual desire disorder (HSDD), which is

a type of female sexual dysfunction (FSD). The Company also has

drug candidates or development programs for obesity, erectile

dysfunction, cardiovascular diseases, pulmonary diseases,

inflammatory diseases and dermatologic diseases.

Key

elements of the Company’s business strategy include using its

technology and expertise to develop and commercialize therapeutic

products; entering into alliances and partnerships with

pharmaceutical companies to facilitate the development,

manufacture, marketing, sale and distribution of product candidates

that the Company is developing; and partially funding its product

candidate development programs with the cash flow generated from

third parties.

Going Concern – There is

substantial doubt about the Company’s ability to continue as

a going concern. Since inception, the Company has incurred negative

cash flows from operations, and has expended, and expects to

continue to expend, substantial funds to complete its planned

product development efforts. As shown in the accompanying

consolidated financial statements, the Company had an accumulated

deficit as of September 30, 2016 of $356,465,022 and incurred a net

loss for the three months ended September 30, 2016 of $13,052,770.

The Company anticipates incurring additional losses in the future

as a result of spending on its development programs and will

require substantial additional financing to continue to fund its

planned developmental activities. To achieve profitability, if

ever, the Company, alone or with others, must successfully develop

and commercialize its technologies and proposed products, conduct

successful preclinical studies and clinical trials, obtain required

regulatory approvals and successfully manufacture and market such

technologies and proposed products. The time required to reach

profitability is highly uncertain, and the Company may never be

able to achieve profitability on a sustained basis, if at all. The

accompanying consolidated financial statements have been prepared

assuming that the Company continues as a going concern, which

contemplates the realization of assets and the satisfaction of

liabilities in the normal course of business. The consolidated

financial statements do not include any adjustments relating to the

recoverability and classification of recorded asset amounts or the

amount or classification of liabilities that might result from the

outcome of this uncertainty.

As

discussed in Note 11, on August 4, 2016, the Company closed on an

underwritten offering of units resulting in gross proceeds of

$9,225,000, with net proceeds, after deducting estimated offering

expenses, of $8,470,897.

As of

September 30, 2016, the Company’s cash, cash equivalents and

investments were $10,245,644 and current liabilities were

$20,470,919. The Company intends to utilize existing capital

resources for general corporate purposes and working capital,

including the Phase 3 clinical trial program with bremelanotide for

HSDD and preclinical and clinical development of our other product

candidates and programs, including PL3994 and melanocortin

receptor1 and melanocortin receptor4 programs.

Management believes that the Phase 3 clinical trial program with

bremelanotide for HSDD, including regulatory filings for product

approval, but excluding required ancillary studies and clinical

trials and launch readiness commercialization efforts, will cost at

least $87,000,000.

Management believes

that the Company’s existing capital resources will be

adequate to fund its planned operations through the quarter ending

December 31, 2016. The Company will need additional funding to

complete required ancillary studies and clinical trials of

bremelanotide for HSDD, prepare and submit regulatory filings for

product approval, and establish commercial scale manufacturing

capability. The Company will also need additional funding to

complete required clinical trials for its other product candidates

and, assuming those clinical trials are successful, as to which

there can be no assurance, to complete submission of required

applications to the FDA. If the Company is unable to obtain

approval or otherwise advance in the FDA approval process, the

Company’s ability to sustain its operations would be

materially adversely affected.

The

Company may seek the additional capital necessary to fund its

operations through public or private equity offerings,

collaboration agreements, debt financings or licensing

arrangements. Additional capital that is required by the Company

may not be available on reasonable terms, or at all.

Concentrations – Concentrations

in the Company’s assets and operations subject it to certain

related risks. Financial instruments that subject the Company to

concentrations of credit risk primarily consist of cash and cash

equivalents and availableforsale investments. The

Company’s cash and cash equivalents are primarily invested in

one money market account sponsored by a large financial

institution. For the three months ended September 30, 2016, and

2015, the Company had no revenues reported.

(2)

BASIS

OF PRESENTATION:

The

accompanying unaudited consolidated financial statements have been

prepared in accordance with U.S. generally accepted accounting

principles for interim financial information and with the

instructions to Form 10-Q. Accordingly, they do not include all of

the information and footnote disclosures required to be presented

for complete financial statements. In the opinion of management,

these consolidated financial statements contain all adjustments

(consisting of normal recurring adjustments) considered necessary

for fair presentation. The results of operations for the three

months ended September 30, 2016 may not necessarily be indicative

of the results of operations expected for the full year, except

that the Company expects to incur a significant loss for the fiscal

year ending June 30, 2017.

The

accompanying consolidated financial statements should be read in

conjunction with the audited consolidated financial statements and

notes thereto included in the Company’s Annual Report on Form

10-K for the year ended June 30, 2016, filed with the Securities

and Exchange Commission (SEC), which includes consolidated

financial statements as of June 30, 2016 and 2015 and for each of

the fiscal years in the three-year period ended June 30,

2016.

(3)

SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES:

Principles of Consolidation – The

consolidated financial statements include the accounts of Palatin

and its wholly-owned inactive subsidiary. All intercompany accounts

and transactions have been eliminated in

consolidation.

Use of Estimates – The

preparation of consolidated financial statements in conformity with

accounting principles generally accepted in the United States of

America (U.S. GAAP) requires management to make estimates and

assumptions that affect the reported amount of assets and

liabilities and disclosure of contingent assets and liabilities at

the date of the consolidated financial statements and the reported

amounts of revenues and expenses during the reporting period.

Actual results could differ from those estimates.

Cash and Cash Equivalents – Cash

and cash equivalents include cash on hand, cash in banks and all

highly liquid investments with a purchased maturity of less than

three months. Cash equivalents consist of $8,687,904 and $7,782,243

in a money market account at September 30, 2016 and June 30, 2016,

respectively.

Investments – The Company

determines the appropriate classification of its investments in

debt and equity securities at the time of purchase and reevaluates

such determinations at each balance sheet date. Debt securities are

classified as heldtomaturity when the Company has the

intent and ability to hold the securities to maturity. Debt

securities for which the Company does not have the intent or

ability to hold to maturity are classified as

availableforsale. Heldtomaturity securities

are recorded as either shortterm or longterm on the

balance sheet, based on the contractual maturity date and are

stated at amortized cost. Marketable securities that are bought and

held principally for the purpose of selling them in the near term

are classified as trading securities and are reported at fair

value, with unrealized gains and losses recognized in earnings.

Debt and marketable equity securities not classified as

heldtomaturity or as trading are classified as

availableforsale and are carried at fair market value,

with the unrealized gains and losses, net of tax, included in the

determination of other comprehensive (loss) income.

The

fair value of substantially all securities is determined by quoted

market prices. The estimated fair value of securities for which

there are no quoted market prices is based on similar types of

securities that are traded in the market.

Fair Value of Financial Instruments

– The Company’s financial instruments consist primarily

of cash equivalents, available-for-sale investments, accounts

payable and notes payable. Management believes that the carrying

values of cash equivalents, available-for-sale investments and

accounts payable are representative of their respective fair values

based on the short-term nature of these instruments. Management

believes that the carrying amount of its notes payable approximates

fair value based on the terms of the notes.

Credit Risk – Financial

instruments which potentially subject the Company to concentrations

of credit risk consist principally of cash and cash equivalents.

Total cash and cash equivalent balances have exceeded insured

balances by the Federal Depository Insurance Company

(FDIC).

Property and Equipment – Property

and equipment consists of office and laboratory equipment, office

furniture and leasehold improvements and includes assets acquired

under capital leases. Property and equipment are recorded at cost.

Depreciation is recognized using the straight-line method over the

estimated useful lives of the related assets, generally five years

for laboratory and computer equipment, seven years for office

furniture and equipment and the lesser of the term of the lease or

the useful life for leasehold improvements. Amortization of assets

acquired under capital leases is included in depreciation expense.

Maintenance and repairs are expensed as incurred while expenditures

that extend the useful life of an asset are

capitalized.

Impairment of Long-Lived Assets –

The Company reviews its long-lived assets for impairment whenever

events or changes in circumstances indicate that the carrying

amount of the assets may not be fully recoverable. To determine

recoverability of a long-lived asset, management evaluates whether

the estimated future undiscounted net cash flows from the asset are

less than its carrying amount. If impairment is indicated, the

long-lived asset would be written down to fair value. Fair value is

determined by an evaluation of available price information at which

assets could be bought or sold, including quoted market prices, if

available, or the present value of the estimated future cash flows

based on reasonable and supportable assumptions.

Revenue Recognition – Under our

license, co-development and commercialization agreement with Gedeon

Richter (Note 5), we received consideration in the form of a

license fee and development milestone payment.

Revenue

resulting from license fees is recognized upon delivery of the

license for the portion of the license fee payment that is

non-contingent and non-refundable, if the license has standalone

value. Revenue resulting from the achievement of development

milestones is recorded in accordance with the accounting guidance

for the milestone method of revenue recognition.

Research and Development Costs –

The costs of research and development activities are charged to

expense as incurred, including the cost of equipment for which

there is no alternative future use.

Accrued Expenses – Third parties

perform a significant portion of our development activities. We

review the activities performed under significant contracts each

quarter and accrue expenses and the amount of any reimbursement to

be received from our collaborators based upon the estimated amount

of work completed. Estimating the value or stage of completion of

certain services requires judgment based on available information.

If we do not identify services performed for us but not billed by

the service-provider, or if we underestimate or overestimate the

value of services performed as of a given date, reported expenses

will be understated or overstated.

Stock-Based Compensation – The

Company charges to expense the fair value of stock options and

other equity awards granted. The Company determines the value of

stock options utilizing the Black-Scholes option pricing model.

Compensation costs for share-based awards with pro-rata vesting are

determined using the quoted market price of the Company’s

common stock on the date of grant and allocated to periods on a

straightline basis, while awards containing a market

condition are valued using multifactor Monte Carlo

simulations.

Income Taxes – The Company and

its subsidiary file consolidated federal and separate-company state

income tax returns. Income taxes are accounted for under the asset

and liability method. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to

differences between the financial statement carrying amounts of

assets and liabilities and their respective tax basis and operating

loss and tax credit carryforwards. Deferred tax assets and

liabilities are measured using enacted tax rates expected to apply

to taxable income in the years in which those temporary differences

or operating loss and tax credit carryforwards are expected to be

recovered or settled. The effect on deferred tax assets and

liabilities of a change in tax rates is recognized in the period

that includes the enactment date. The Company has recorded a

valuation allowance against its deferred tax assets based on the

history of losses incurred.

Net Loss per Common Share – Basic

and diluted earnings per common share (EPS) are calculated in

accordance with the provisions of Financial Accounting Standards

Board (FASB) Accounting Standards Codification (ASC) Topic 260,

“Earnings per Share,” which includes guidance

pertaining to the warrants, issued in connection with the July 3,

2012, December 23, 2014, and July 2, 2015 private placement

offerings and the August 4, 2016 underwritten offering, that are

exercisable for nominal consideration and, therefore, are to be

considered in the computation of basic and diluted net loss per

common share. The Series A 2012 warrants issued on July 3, 2012 to

purchase up to 31,988,151 shares of common stock are included in

the weighted average number of common shares outstanding used in

computing basic and diluted net loss per common share for all

periods presented in the consolidated statements of

operations.

The

Series B 2012 warrants issued on July 3, 2012 to purchase up to

35,488,380 shares of common stock are included in the weighted

average number of common shares outstanding used in computing basic

and diluted net loss per common share for all periods presented in

the consolidated statements of operations.

The

Series C 2014 warrants to purchase up to 24,949,325 shares of

common stock were exercisable starting at December 23, 2014 and,

therefore are included in the weighted average number of common

shares outstanding used in computing basic and diluted net loss per

common share starting on December 23, 2014.

The

Series E 2015 warrants to purchase up to 21,917,808 shares of

common stock were exercisable starting at July 2, 2015 and,

therefore are included in the weighted average number of common

shares outstanding used in computing basic and diluted net loss per

common share starting on July 2, 2015.

The

Series I 2016 warrants to purchase up to 2,218,045 shares of common

stock were exercisable starting at August 4, 2016 and, therefore

are included in the weighted average number of common shares

outstanding used in computing basic and diluted net loss per common

share starting on August 4, 2016 (Note 11).

As of

September 30, 2016 and 2015, common shares issuable upon conversion

of Series A Convertible Preferred Stock, the exercise of

outstanding options and warrants (excluding the Series A 2012,

Series B 2012, Series C 2014, Series E 2015 and Series I 2016

warrants issued in connection with the July 3, 2012, December 23,

2014, and July 2, 2015 private placement offerings and the August

4, 2016 underwritten offering), and the vesting of restricted stock

units amounted to an aggregate of 44,479,663, and 32,908,798

shares, respectively. These share amounts have been excluded from

the calculation of net loss per share as the impact would be

antidilutive.

(4)

NEW

AND RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS:

In June

2016, the FASB issued ASU No. 201613, Financial Instruments Credit Losses:

Measurement of Credit Losses on Financial Instruments, which

requires measurement and recognition of expected credit losses for

financial assets held at the reporting date based on historical

experience, current conditions, and reasonable and supportable

forecasts. This is different from the current guidance as this will

require immediate recognition of estimated credit losses expected

to occur over the remaining life of many financial assets. The new

guidance will be effective for the Company on July 1, 2020. Early

adoption will be available on July 1, 2019. The Company is

currently evaluating the effect that the updated standard will have

on its consolidated financial statements and related

disclosures.

In

March 2016, the FASB issued ASU No. 201609, Compensation – Improvement to Employee

ShareBased Payment Accounting, which amends the

current guidance related to stock compensation. The updated

guidance changes how companies account for certain aspects of

sharebased payment awards to employees, including the

accounting for income taxes, forfeitures, and statutory tax

withholding requirements, as well as classification in the

statement of cash flows. The update to the standard is effective

for the Company on July 1, 2017, with early application permitted.

The Company is evaluating the effect that the new guidance will

have on its consolidated financial statements and related

disclosures.

In

February 2016, the FASB issued ASU No. 201602, Leases, Related to the Recognition of Lease

Assets and Lease Liabilities. The new guidance requires

lessees to recognize almost all leases on their balance sheet as a

rightofuse asset and a lease liability, other than

leases that meet the definition of a short term lease, and

requires expanded disclosures about leasing arrangements. The

recognition, measurement, and presentation of expenses and cash

flows arising from a lease by a lessee have not significantly

changed from the current guidance. Lessor accounting is similar to

the current guidance, but updated to align with certain changes to

the lessee model and the new revenue recognition standard. The new

guidance is effective for the Company on July 1, 2019, with early

adoption permitted. The Company is evaluating the impact that the

new guidance will have on its consolidated financial statements and

related disclosures.

In

January 2016, the FASB issued ASU No. 201601, Financial Instruments: Recognition and

Measurement of Financial Assets and Financial Liabilities.

The new guidance relates to the recognition and measurement of

financial assets and liabilities. The new guidance makes targeted

improvements to GAAP impacting equity investments (other than those

accounted for under the equity method or consolidated), financial

liabilities accounted for under the fair value election, and

presentation and disclosure requirements for financial instruments,

among other changes. The new guidance is effective for the Company

on July 1, 2018, with early adoption prohibited other than for

certain provisions. The Company is evaluating the impact that the

new guidance will have on its consolidated financial statements and

related disclosures.

In

November 2015, the FASB issued ASU No. 201517, Income Taxes: Balance Sheet Classification of

Deferred Taxes, which simplifies the balance sheet

classification of deferred taxes. The new guidance requires that

deferred tax liabilities and assets be classified as noncurrent in

a classified statement of financial position. The current

requirement that deferred tax liabilities and assets of a

taxpaying component of an entity be offset and presented as a

single amount is not affected by the new guidance. The new guidance

is effective for the Company on July 1, 2017, with early adoption

permitted as of the beginning of an interim or annual reporting

period. The new guidance may be applied either prospectively to all

deferred tax liabilities and assets or retrospectively to all

periods presented. The Company is evaluating the impact that the

new guidance will have on its consolidated financial statements and

related disclosures. however, at the present time the Company has

recorded a valuation allowance against its deferred tax assets

based on the history of losses incurred.

In

April 2015, the FASB issued ASU No. 2015-03, Simplifying the Presentation of Debt Issuance

Costs, which requires debt issuance costs related to a

recognized debt liability to be presented on the balance sheet as a

direct deduction from the debt liability, similar to the

presentation of debt discounts. In August 2015, the FASB issued a

clarification that debt issuance costs related to line-of-credit

arrangements were not within the scope of the new guidance and

therefore should continue to be accounted for as deferred assets in

the balance sheet, consistent with existing GAAP. The Company

adopted the retrospective guidance as of July 1, 2016. As a result

of the adoption of ASU No. 2015-03, we made the following

adjustments to the June 30, 2016 consolidated balance sheet: a

$110,441 decrease to prepaid expenses and other current assets, a

$83,215 decrease to other assets, a $110,441 decrease to the

current portion of notes payable, net of discounts and debt

issuance costs, and a $83,215 decrease to the long-term portion of

notes payable, net of discounts and debt issuance

costs.

In

August 2014, the FASB issued ASU No. 2014-15, Presentation of Financial Statements-Going

Concern: Disclosures of Uncertainties about an Entity’s

Ability to Continue as a Going Concern. The amendments in

this update provide guidance in U.S. GAAP about management's

responsibility to evaluate whether there is substantial doubt about

an entity's ability to continue as a going concern and to provide

related footnote disclosures. In doing so, the amendments should

reduce diversity in the timing and content of footnote disclosures.

The new standard is effective for the Company for its fiscal year

ending June 30, 2017. The Company is evaluating the effect of the

standard, if any, on its consolidated financial

statements.

In May 2014, the FASB issued ASU No.

2014-09, Revenue from Contracts with

Customers, which requires an

entity to recognize the amount of revenue to which it expects to be

entitled for the transfer of promised goods or services to

customers. The ASU will replace most existing revenue recognition

guidance in U.S. GAAP when it becomes effective. In July 2015, the

FASB voted to defer the effective date of the new standard until

fiscal years beginning after December 15, 2017 with early

application permitted for fiscal years beginning after December 15,

2016. With the deferral, the new standard is effective for the

Company on July 1, 2018, with early adoption permitted one year

prior. The standard permits the use of either the retrospective or

cumulative effect transition method. The Company is evaluating the

effect that ASU 2014-09 will have on its consolidated financial

statements and related disclosures. The Company has not yet

selected a transition method nor has it determined the effect of

the standard on its ongoing financial

reporting.

(5)

AGREEMENT

WITH GEDEON RICHTER:

In

August 2014, the Company entered into a license, co-development and

commercialization agreement with Gedeon Richter on bremelanotide

for FSD in Europe and selected countries. On September 16, 2015,

the Company and Gedeon Richter mutually and amicably agreed to

terminate the license, co-development and commercialization

agreement. In connection with the termination of the license

agreement, all rights and licenses to co-develop and commercialize

bremelanotide for FSD indications granted by the Company under the

license agreement to Gedeon Richter terminated and reverted to the

Company, and neither party is expected to have any future material

obligations under the license agreement. Neither the Company nor

Gedeon Richter incurred any early termination penalties or other

payment or reimbursement obligations as a result of the termination

of the license agreement.

The

Company viewed the delivery of the license for bremelanotide as a

revenue generating activity that is part of its ongoing and central

operations. The other elements of the agreement with Gedeon Richter

were considered non-revenue activities associated with the

collaborative arrangement. The Company believes the license had

standalone value from the other elements of the collaborative

arrangement because it conveyed all of the rights necessary to

develop and commercialize bremelanotide in the licensed territory.

For the three months ended September 30, 2016, and 2015, the

Company had no revenues reported.

(6)

PREPAID EXPENSES AND OTHER CURRENT

ASSETS:

Prepaid

expenses and other current assets consist of the

following:

|

|

|

|

|

Clinical

study costs

|

$860,440

|

$1,146,975

|

|

Insurance

premiums

|

25,764

|

23,010

|

|

Other

|

121,774

|

143,856

|

|

|

$1,007,978

|

$1,313,841

|

The

following summarizes the carrying value of our

availableforsale investments, which consist of

corporate debt securities:

|

|

|

|

|

Cost

|

$1,387,022

|

$1,387,022

|

|

Amortization

of premium

|

(6,787)

|

(4,522)

|

|

Gross

unrealized loss

|

(2,521)

|

(1,944)

|

|

Fair

value

|

$1,377,714

|

$1,380,556

|

(8)

FAIR

VALUE MEASUREMENTS:

The

fair value of cash equivalents is classified using a hierarchy

prioritized based on inputs. Level 1 inputs are quoted prices

(unadjusted) in active markets for identical assets or liabilities.

Level 2 inputs are quoted prices for similar assets and liabilities

in active markets or inputs that are observable for the asset or

liability, either directly or indirectly through market

corroboration, for substantially the full term of the financial

instrument. Level 3 inputs are unobservable inputs based on

management’s own assumptions used to measure assets and

liabilities at fair value. A financial asset or liability’s

classification within the hierarchy is determined based on the

lowest level input that is significant to the fair value

measurement.

The

following table provides the assets carried at fair

value:

|

|

|

Quoted prices in

active markets

(Level 1)

|

Other quoted/observable inputs (Level 2)

|

Significant unobservable inputs

(Level 3)

|

|

September

30, 2016:

|

|

|

|

|

|

Money

market account

|

8,687,904

|

8,687,904

|

-

|

-

|

|

TOTAL

|

$8,687,904

|

$8,687,904

|

$-

|

$-

|

|

June

30, 2016:

|

|

|

|

|

|

Money

market account

|

7,782,243

|

7,782,243

|

-

|

-

|

|

TOTAL

|

$7,782,243

|

$7,782,243

|

$-

|

$-

|

Accrued

expenses consist of the following:

|

|

|

|

|

Bremelanotide

program costs

|

$12,379,580

|

$6,983,581

|

|

Other

research related expenses

|

311,178

|

69,609

|

|

Professional

services

|

40,235

|

231,482

|

|

Other

|

153,597

|

483,061

|

|

|

$12,884,590

|

$7,767,733

|

Notes

payable consist of the following:

|

|

|

|

|

Notes

payable under venture loan

|

$19,000,000

|

$20,000,000

|

|

Unamortized

related debt discount

|

$(275,386)

|

$(324,800)

|

|

Unamortized

debt issuance costs

|

(163,068)

|

(193,655)

|

|

Notes

payable

|

$18,561,546

|

$19,481,545

|

|

|

|

|

|

Less:

current portion

|

6,399,075

|

5,374,951

|

|

|

|

|

|

Long-term

portion

|

$12,162,471

|

$14,106,594

|

On July

2, 2015, the Company closed on a $10,000,000 venture loan led by

Horizon Technology Finance Corporation (Horizon). The debt facility

is a four-year senior secured term loan that bears interest at a

floating coupon rate of one-month LIBOR (floor of 0.50%) plus 8.50%

and provides for interest-only payments for the first eighteen

months followed by monthly payments of principal payments of

$333,333 plus accrued interest through August 1, 2019. The lenders

also received five-year immediately exercisable Series G warrants

to purchase 549,450 shares of Palatin common stock exercisable at

an exercise price of $0.91 per share. The Company has recorded a

debt discount of $305,196 equal to the fair value of these warrants

at issuance, which is being amortized to interest expense over the

term of the related debt. This debt discount will offset against

the note payable balance and is included in additional paid-in

capital on the Company’s balance sheet at September 30, 2016

and June 30, 2016. In addition, a final incremental payment of

$500,000 is due on August 1, 2019, or upon early repayment of the

loan. This final incremental payment is being accreted to interest

expense over the term of the related debt. The Company incurred

approximately $146,000 of costs in connection with the loan

agreement. These costs were capitalized as deferred financing costs

and are offset against the note payable balance. These debt

issuance costs are being amortized to interest expense over the

term of the related debt. In addition, if the Company repays all or

a portion of the loan prior to the applicable maturity date, it

will pay the lenders a prepayment penalty fee, based on a

percentage of the then outstanding principal balance, equal to 3%

if the prepayment occurs on or before 18 months after the funding

date thereof or 1% if the prepayment occurs more than 18 months

after, but on or before 30 months after, the funding

date.

On

December 23, 2014, the Company closed on a $10,000,000 venture loan

which was led by Horizon. The debt facility is a four year senior

secured term loan that bears interest at a floating coupon rate of

one-month LIBOR (floor of 0.50%) plus 8.50%, and provides for

interest-only payments for the first eighteen months followed by

monthly payments of principal payments of $333,333 plus accrued

interest through January 1, 2019. The lenders also received

five-year immediately exercisable Series D 2014 warrants to

purchase 666,666 shares of common stock exercisable at an exercise

price of $0.75 per share. The Company recorded a debt discount of

$267,820 equal to the fair value of these warrants at issuance,

which is being amortized to interest expense over the term of the

related debt. This debt discount is offset against the note payable

balance and included in additional paid-in capital on the

Company’s balance sheet at September 30, 2016, and June 30,

2016. In addition, a final incremental payment of $500,000 is due

on January 1, 2019, or upon early repayment of the loan. This final

incremental payment is being accreted to interest expense over the

term of the related debt. The Company incurred $209,000 of costs in

connection with the loan agreement These costs were capitalized as

deferred financing costs and are offset against the note payable

balance. These debt issuance costs are being amortized to interest

expense over the term of the related debt. In addition, if the

Company repays all or a portion of the loan prior to the applicable

maturity date, it will pay the lenders a prepayment penalty fee,

based on a percentage of the then outstanding principal balance,

equal to 3% if the prepayment occurs on or before 18 months after

the funding date thereof or 1% if the prepayment occurs more than

18 months after, but on or before 30 months after, the funding

date.

The

Company’s obligations under the 2015 amended and restated

loan agreement, which includes the 2014 venture loan, are secured

by a first priority security interest in substantially all of its

assets other than its intellectual property. The Company also has

agreed to specified limitations on pledging or otherwise

encumbering its intellectual property assets.

The

2015 amended and restated loan agreement include customary

affirmative and restrictive covenants, but does not include any

covenants to attain or maintain specified financial metrics. The

loan agreement includes customary events of default, including

payment defaults, breaches of covenants, change of control and a

material adverse change default. Upon the occurrence of an event of

default and following any applicable cure periods, a default

interest rate of an additional 5% may be applied to the outstanding

loan balances, and the lenders may declare all outstanding

obligations immediately due and payable and take such other actions

as set forth in the loan agreement. As of September 30, 2016, the

Company was in compliance with all of its loan

covenants.

(11)

STOCKHOLDERS’

DEFICIENCY:

Financing Transactions – On August 4, 2016, the

Company closed on an underwritten offering of units, with each unit

consisting of a share of common stock and a Series H warrant to

purchase 0.75 of a share of common stock. Investors whose purchase

of units in the offering would result in them beneficially owning

more than 9.99% of the Company’s outstanding common stock

following the completion of the offering had the opportunity to

acquire units with Series I prefunded warrants substituted for any

common stock they would have otherwise acquired. Gross proceeds

were $9,225,000, with net proceeds to the Company, after deducting

offering expenses, of $8,470,897. The Company issued 11,481,481

shares of common stock and ten year prefunded Series I warrants to

purchase 2,218,045 shares of common stock at an exercise price of

$0.01, together with Series H warrants to purchase 10,274,646

shares of common stock at an exercise price of $0.70 per

share.

The

Series I warrants are exercisable at an initial exercise price of

$0.01 per share, exercisable immediately upon issuance and expire

on the tenth anniversary of the date of issuance. The Series I

warrants are subject to limitation on exercise if the holder and

its affiliates would beneficially own more than 9.99% of the total

number of the Company’s shares of common stock following such

exercise. The Series H warrants are exercisable at an initial

exercise price of $0.70 per share, are exercisable commencing six

months following the date of issuance and expire on the fifth

anniversary of the date of issuance. The Series H warrants are

subject to the same beneficial ownership limitation as the Series I

warrants.

On July

2, 2015, the Company closed on a private placement of Series E

warrants to purchase 21,917,808 shares of Palatin common stock and

Series F warrants to purchase 2,191,781 shares of the

Company’s common stock. Certain funds managed by QVT

Financial LP (QVT) invested $5,000,000 and another accredited

investment fund invested $15,000,000. The funds paid $0.90 for each

Series E warrant and $0.125 for each Series F warrant, resulting in

gross proceeds to the Company of $20,000,000, with net proceeds,

after deducting estimated offering expenses, of

$19,834,278.

The

Series E warrants, which may be exercised on a cashless basis, are

exercisable immediately upon issuance at an initial exercise price

of $0.01 per share and expire on the tenth anniversary of the date

of issuance. The Series E warrants are subject to limitation

on exercise if QVT and its affiliates would beneficially own more

than 9.99% (4.99% for the other accredited investment fund holder)

of the total number of the Company's shares of common stock

following such exercise. The Series F warrants are exercisable at

an initial exercise price of $0.91 per share, exercisable

immediately upon issuance and expire on the fifth anniversary of

the date of issuance. The Series F warrants are subject to the same

beneficial ownership limitation as the Series E

warrants.

The

purchase agreement for the private placement provides that the

purchasers have certain rights until the earlier of approval of

bremelanotide for FSD by the U.S. Food and Drug Administration and

July 3, 2018, including rights of first refusal and participation

in any subsequent equity or debt financing. The purchase agreement

also contains certain restrictive covenants so long as the funds

continue to hold specified amounts of warrants or beneficially own

specified amounts of the outstanding shares of common

stock.

During

the three months ended September 30, 2016, and 2015 the Company

issued 12,757,174 shares and 10,890,889 shares, respectively, of

common stock pursuant to the cashless exercise provisions of

warrants at an exercise price of $0.01 per share. As of September

30, 2016, there were 77,546,764 warrants outstanding at an exercise

price of $0.01 per share.

Stock Options – In September

2016, the Company granted 828,000 options to its executive officers

and 336,000 options to its employees under the Company’s 2011

Stock Incentive Plan. The Company is amortizing the fair value of

the options vesting over a 48 month period, consisting of 595,000

options granted to its executive officers and all options granted

to its employees, of $188,245 and $106,303, respectively, over the

vesting period. The Company recognized $5,216 of stock-based

compensation expense related to these options during the three

months ended September 30, 2016. 233,000 options granted to its

executive officers vest 12 months from the date of grant, and the

Company is amortizing the fair value of these options of $67,160

over this vesting period. The Company recognized $4,757 of

stock-based compensation expense related to these options during

the three months ended September 30, 2016.

In June

2016, the Company granted 262,500 options to its nonemployee

directors under the Company’s 2011 Stock Incentive Plan. The

Company is amortizing the fair value of these options of $81,435

over the vesting period. The Company recognized $20,359 of

stock-based compensation expense related to these options during

the three months ended September 30, 2016.

In June

2015, the Company granted 570,000 options to its executive

officers, 185,800 options to its employees and 160,000 options to

its non-employee directors under the Company’s 2011 Stock

Incentive Plan. The Company is amortizing the fair value of these

options of $446,748, $145,439 and $111,876, respectively, over the

vesting period. The Company recognized $32,293, and $57,577,

respectively, of stock-based compensation expense related to these

options during the three months ended September 30, 2016 and

2015.

Unless

otherwise stated, stock options granted to the Company’s

executive officers and employees vest over a 48 month period, while

stock options granted to its non-employee directors vest over a 12

month period.

Restricted Stock Units – In

September 2016, the Company granted 558,000 restricted stock units

to its executive officers, 415,000 of which vest over 24 months and

143,000 of which vest at 12 months, and 336,000 restricted stock

units to its employees under the Company’s 2011 Stock

Incentive Plan. The Company is amortizing the fair value of the

restricted stock units of $284,580, and $171,360, respectively,

over the vesting periods. The Company recognized $20,504 of

stock-based compensation expense related to these restricted stock

units during the three months ended September 30,

2016.

In June

2016, the Company granted 262,500 restricted stock units to its

nonemployee directors under the Company’s 2011 Stock

Incentive Plan. The Company is amortizing the fair value of these

restricted stock units of $131,250 over the vesting period. The

Company recognized $32,812 of stock-based compensation expense

related to these restricted stock units during the three months

ended September 30, 2016.

In

December 2015, the Company granted 625,000 performance-based

restricted stock units to its executive officers and 200,000

performance-based restricted stock units to its employees under the

Company’s 2011 Stock Incentive Plan, which vest during the

performance period, ending December 31, 2017, if and upon the

earlier of: i) achievement of a closing price for the

Company’s common stock equal to or greater than $1.20 per

share for 20 consecutive trading days, which is considered a market

condition, or ii) entering into a collaboration agreement (U.S. or

global) of bremelanotide for FSD, which is considered a performance

condition. The Company determined that the performance condition

was not probable of achievement on the date of grant since such

condition is outside the control of the Company. The

fair value of these awards, as calculated under a multifactor Monte

Carlo simulation, was $338,250. The Company is amortizing the fair

value over the derived service period of 0.96 years. The Company

recognized $86,879 of stock-based compensation expense related to

these restricted stock units during the three ended September 30,

2016.

Also,

in December 2015, the Company granted 625,000 restricted stock

units to its executive officers, 340,000 restricted stock units to

its non-employee directors and 200,000 restricted stock units to

its employees under the Company’s 2011 Stock Incentive Plan.

For executive officers and employees, the restricted stock units

vest 25% on the date of grant and 25% on the first, second and

third anniversary dates from the date of grant. For non-employee

directors, the restricted stock units vest 50% on the first and

second anniversary dates from the date of grant. The fair value of

these restricted stock units is $425,000, $231,200 and $136,000,

respectively. The Company recognized $101,256 of stock-based

compensation expense related to these restricted stock units during

the three months ended September 30, 2016.

In June

2015, the Company granted 400,000 restricted stock units to its

executive officers, 185,800 restricted stock units to its employees

and 160,000 restricted stock units to its non-employee directors

under the Company’s 2011 Stock Incentive Plan. The Company is

amortizing the fair value of these restricted stock units of

$432,000, $200,664, and $172,800, respectively, over the vesting

period. The Company recognized $40,429 and $150,328, respectively,

of stock-based compensation expense related to these restricted

stock units during the three months ended September 30, 2016 and

2015.

Unless

otherwise stated, restricted stock units granted to the

Company’s executive officers, employees and non-employee

directors vest over 24 months, 48 months and 12 months,

respectively.

Stock-based

compensation cost for the three months ended September 30, 2016 for

stock options and equity-based instruments issued other than the

stock options and restricted stock units described above was

$58,703, and $92,489 for the three months ended September 30,

2015.

Bremelanotide Phase 3 HSDD Topline Results

– On November 1, 2016, we announced positive top-line

results in our Phase 3 clinical trial program of bremelanotide as

an on-demand treatment for premenopausal women diagnosed with HSDD.

Bremelanotide 1.75 mg met the pre-specified co-primary efficacy

endpoints of improvement in desire and decrease in distress

associated with low sexual desire as measured using validated

patient-reported outcome instruments.

Outstanding Common Stock –

Between September 30, 2016 and November 10, 2016, the Company

issued 15,232,511 shares of common stock pursuant to the cashless

exercise provisions of warrants at an exercise price of $0.01 per

share. As of November 10, 2016, there are 62,046,764 outstanding

warrants with an exercise price of $0.01 per share, all of which

include cashless exercise provisions.

Item

2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations.

The

following discussion and analysis should be read in conjunction

with the consolidated financial statements and notes to the

consolidated financial statements filed as part of this report and

the audited consolidated financial statements and notes thereto

included in our Annual Report on Form 10-K for the year ended June

30, 2016.

In this

Quarterly Report on Form 10-Q, references to “we”,

“our”, “us” or “Palatin” means

Palatin Technologies, Inc. and its subsidiary.

Critical

Accounting Policies and Estimates

Our

significant accounting policies, which are described in the notes

to our consolidated financial statements included in this report

and in our Annual Report on Form 10-K for the year ended June 30,

2016, have not changed as of September 30, 2016. We believe that

our accounting policies and estimates relating to revenue

recognition, accrued expenses and stock-based compensation are the

most critical.

Overview

We are

a biopharmaceutical company developing targeted,

receptorspecific peptide therapeutics for the treatment of

diseases with significant unmet medical need and commercial

potential. Our programs are based on molecules that modulate the

activity of the melanocortin and natriuretic peptide receptor

systems. Our primary product in clinical development is

bremelanotide for the treatment of premenopausal women with

hypoactive sexual desire disorder, or HSDD, which is a type of

female sexual dysfunction, or FSD, defined as low desire with

associated distress. In addition, we have drug candidates or

development programs for obesity, erectile dysfunction,

cardiovascular diseases, pulmonary diseases, inflammatory diseases

and dermatologic diseases.

The

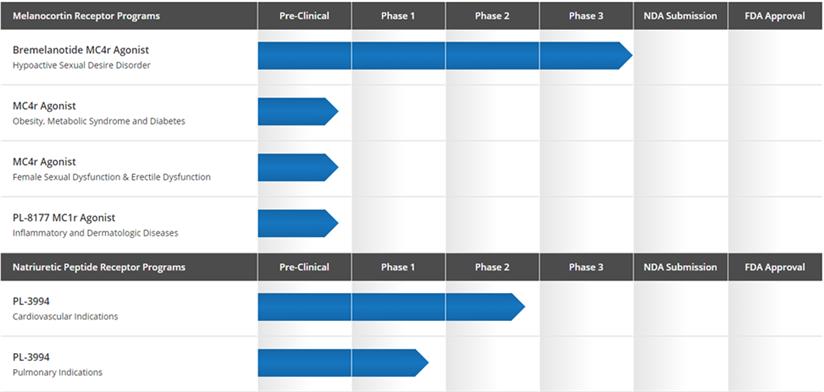

following drug development programs are actively under

development:

●

Bremelanotide,

an-as needed subcutaneous injectable peptide melanocortin receptor

agonist, for treatment of HSDD in premenopausal women.

Bremelanotide, which is a melanocortin agonist, is a synthetic

peptide analog of the naturally occurring hormone alphaMSH

(melanocytestimulating hormone). In two primary Phase 3

clinical studies of bremelanotide for HSDD in premenopausal women,

bremelanotide met the pre-specified co-primary efficacy endpoints

of improvement in desire and decrease in distress associated with

low sexual desire as measured using validated patient-reported

outcome instruments.

●

Melanocortin

receptor4, or MC4r, compounds for treatment of obesity and

diabetes. Results of our studies involving MC4r peptides suggest

that certain of these peptides may have significant commercial

potential for treatment of conditions responsive to MC4r

activation, including FSD, HSDD, erectile dysfunction or ED,

obesity and diabetes.

●

PL3994, a

natriuretic peptide receptorA, or NPRA, agonist, for

treatment of cardiovascular and pulmonary indications. PL3994

is our lead natriuretic peptide receptor product candidate, and is

a synthetic mimetic of the neuropeptide hormone atrial natriuretic

peptide, or ANP. PL3994 is in development for treatment of

heart failure, acute exacerbations of asthma and refractory

hypertension. and

●

Melanocortin

receptor1, or MC1r, agonist peptides for treatment of

inflammatory and dermatologic disease indications. Our MC1r peptide

drug candidates are highly specific, with substantially greater

binding and efficacy at MC1r than at other melanocortin receptors.

We have selected one of our MC1r peptide drug candidates,

designated PL8177, as a clinical trial

candidate.

The

following chart illustrates the status of our drug development

programs.

We are

developing subcutaneously administered bremelanotide for the

treatment of HSDD in premenopausal women. HSDD is characterized by

a decrease in sexual desire with significant personal distress or

interpersonal difficulty as a result of the lack of desire.

Bremelanotide is a melanocortin agonist with a mechanism of action

involving activation of endogenous neuronal pathways regulating

sexual arousal and desire responses.

We

initiated patient screening in our Phase 3 clinical study program

of bremelanotide for the treatment of HSDD in premenopausal women,

called the RECONNECT STUDY, in the fourth quarter of calendar 2014,

completed patient enrollment in the fourth quarter of calendar

2015, and completed the last patient visits in the double blind, or

efficacy, portion of the studies in the third quarter of calendar

2016. There are two Phase 3 clinical trials, Study 301 and Study

302, in the RECONNECT STUDY. The co-primary endpoints for the Phase

3 clinical trials were the Female Sexual Function Index: Desire

Domain (FSFI-D) and Female Sexual Distress

Scale-Desires/Arousal/Orgasm (FSDS-DAO) Item 13. For women taking

bremelanotide compared to placebo, the FSFI-D showed statistically

significant improvement in measures of desire in the context of

overall sexual functioning in both Phase 3 studies, Study 301:

(mean change of 0.54 vs. 0.24, median change of 0.60 vs. 0.00,

p=0.0002) and Study 302: (mean change of 0.63 vs. 0.21, median

change of 0.60 vs. 0.00, p<0.0001). The FSDS-DAO Item 13 showed

statistically significant decreases in measures of distress related

to low sexual desire both Phase 3 studies, Study 301: (mean change

of -0.74 vs. -0.35, median change of -1.0 vs. 0.0, p<0.0001) and

Study 302: (mean change of -0.71 vs. -0.41, median change of -1.0

vs. 0.0, p=0.0057). The openlabel safety extension portion of

the RECONNECT STUDY is continuing. We cannot assure you that a

complete review of the Phase 3 efficacy data will support approval

of bremelanotide for HSDD or that the U.S. Food and Drug

Administration, or FDA, will approve a new drug application, or

NDA, for bremelanotide.

Key

elements of our business strategy include:

●

Using our

technology and expertise to develop and commercialize products in

our active drug development programs;

●

Entering into

strategic alliances and partnerships with pharmaceutical companies