form10q_093011.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

|

[X]

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended September 30, 2011

or

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ___________ to __________

Commission file number: 001-15543

________________________

PALATIN TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

95-4078884

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

| |

|

|

|

4C Cedar Brook Drive

Cranbury, New Jersey

|

|

08512

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(609) 495-2200

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ Smaller reporting company x

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of November 11, 2011, 34,900,591 shares of the registrant's common stock, par value $.01 per share, were outstanding.

Table of Contents

| |

Page

|

|

PART I – FINANCIAL INFORMATION

|

|

Item 1. Financial Statements (Unaudited)

|

|

|

|

2

|

|

|

3

|

|

|

4

|

|

|

5

|

|

|

9

|

|

|

12

|

|

|

12

|

|

PART II – OTHER INFORMATION

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

13

|

|

|

13

|

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

and Subsidiary

Consolidated Balance Sheets

(unaudited)

| |

|

September 30,

2011

|

|

June 30,

2011

|

|

ASSETS

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ 14,883,613

|

|

$ 18,869,639

|

|

Accounts receivable

|

|

-

|

|

131,149

|

|

Prepaid expenses and other current assets

|

|

403,062

|

|

261,947

|

|

Total current assets

|

|

15,286,675

|

|

19,262,735

|

| |

|

|

|

|

|

Property and equipment, net

|

|

1,050,329

|

|

1,305,331

|

|

Restricted cash

|

|

350,000

|

|

350,000

|

|

Other assets

|

|

155,069

|

|

254,787

|

|

Total assets

|

|

$ 16,842,073

|

|

$ 21,172,853

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

Capital lease obligations

|

|

$ 30,078

|

|

$ 34,923

|

|

Accounts payable

|

|

336,206

|

|

496,908

|

|

Accrued compensation

|

|

-

|

|

374,094

|

|

Unearned revenue

|

|

18,888

|

|

46,105

|

|

Accrued expenses

|

|

1,271,970

|

|

1,854,007

|

|

Total current liabilities

|

|

1,657,142

|

|

2,806,037

|

| |

|

|

|

|

|

Capital lease obligations

|

|

36,775

|

|

42,186

|

|

Deferred rent

|

|

100,589

|

|

132,855

|

|

Total liabilities

|

|

1,794,506

|

|

2,981,078

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

Preferred stock of $.01 par value – authorized 10,000,000 shares;

|

|

|

|

|

|

Series A Convertible; issued and outstanding 4,997 shares as of September 30, 2011 and June 30, 2011, respectively

|

|

50

|

|

50

|

|

Common stock of $.01 par value – authorized 100,000,000 shares; issued and outstanding 34,900,591 shares as of September 30, 2011 and June 30, 2011, respectively

|

|

349,006

|

|

349,006

|

|

Additional paid-in capital

|

|

240,043,099

|

|

239,832,826

|

|

Accumulated deficit

|

|

(225,344,588)

|

|

(221,990,107)

|

|

Total stockholders’ equity

|

|

15,047,567

|

|

18,191,775

|

|

Total liabilities and stockholders’ equity

|

|

$ 16,842,073

|

|

$ 21,172,853

|

The accompanying notes are an integral part of these consolidated financial statements.

and Subsidiary

Consolidated Statements of Operations

(unaudited)

| |

|

|

Three Months Ended September 30,

|

| |

|

|

2011

|

|

2010

|

| |

|

|

|

|

|

|

REVENUES

|

|

|

$ 27,217

|

|

$ 216,147

|

| |

|

|

|

|

|

|

OPERATING EXPENSES:

|

|

|

|

|

|

|

Research and development

|

|

|

2,284,383

|

|

3,452,762

|

|

General and administrative

|

|

|

1,109,382

|

|

1,381,776

|

|

Total operating expenses

|

|

|

3,393,765

|

|

4,834,538

|

| |

|

|

|

|

|

|

Loss from operations

|

|

|

(3,366,548)

|

|

(4,618,391)

|

| |

|

|

|

|

|

|

OTHER INCOME (EXPENSE):

|

|

|

|

|

|

|

Investment income

|

|

|

15,040

|

|

20,375

|

|

Interest expense

|

|

|

(2,973)

|

|

(2,304)

|

|

Total other income, net

|

|

|

12,067

|

|

18,071

|

| |

|

|

|

|

|

|

NET LOSS

|

|

|

$ (3,354,481)

|

|

$ (4,600,320)

|

| |

|

|

|

|

|

|

Basic and diluted net loss per common share

|

|

|

$ (0.10)

|

|

$ (0.39)

|

| |

|

|

|

|

|

|

Weighted average number of common shares outstanding used in computing basic and diluted net loss per common share

|

|

|

34,900,591

|

|

11,730,308

|

The accompanying notes are an integral part of these consolidated financial statements.

and Subsidiary

Consolidated Statements of Cash Flows

(unaudited)

| |

|

Three Months Ended September 30,

|

| |

|

2011

|

|

2010

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

Net loss

|

|

$ (3,354,481)

|

|

$ (4,600,320)

|

|

Adjustments to reconcile net loss to net cash

|

|

|

|

|

|

used in operating activities:

|

|

|

|

|

|

Depreciation and amortization

|

|

255,002

|

|

298,944

|

|

Stock-based compensation

|

|

210,273

|

|

310,443

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

Accounts receivable

|

|

131,149

|

|

(525,343)

|

|

Prepaid expenses and other assets

|

|

(41,397)

|

|

66,024

|

|

Accounts payable

|

|

(160,702)

|

|

(2,599)

|

|

Accrued expenses and compensation

|

|

(988,397)

|

|

(86,015)

|

|

Unearned revenues

|

|

(27,217)

|

|

327,498

|

|

Net cash used in operating activities

|

|

(3,975,770)

|

|

(4,211,368)

|

| |

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

Net cash provided by investing activities

|

|

-

|

|

-

|

| |

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

Payments on capital lease obligations

|

|

(10,256)

|

|

(4,730)

|

|

Payment of withholding taxes related to restricted stock units

|

|

-

|

|

(18,993)

|

|

Proceeds from sale of common stock units and warrant exercise

|

|

-

|

|

64,400

|

|

Net cash provided by (used in) financing activities

|

|

(10,256)

|

|

40,677

|

| |

|

|

|

|

|

NET DECREASE IN CASH AND

|

|

|

|

|

|

CASH EQUIVALENTS

|

|

(3,986,026)

|

|

(4,170,691)

|

| |

|

|

|

|

|

CASH AND CASH EQUIVALENTS, beginning

|

|

|

|

|

|

of period

|

|

18,869,639

|

|

5,405,430

|

| |

|

|

|

|

|

CASH AND CASH EQUIVALENTS, end of period

|

|

$ 14,883,613

|

|

$ 1,234,739

|

| |

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

|

|

|

|

|

Cash paid for interest

|

|

$ 2,973

|

|

$ 2,304

|

|

Unrealized gain on available-for-sale investments

|

|

$ -

|

|

$ 10,010

|

The accompanying notes are an integral part of these consolidated financial statements.

and Subsidiary

Notes to Consolidated Financial Statements

(unaudited)

(1) ORGANIZATION:

Nature of Business – Palatin Technologies, Inc. (Palatin or the Company) is a biopharmaceutical company dedicated to developing targeted, receptor-specific peptide therapeutics for the treatment of diseases with significant unmet medical need and commercial potential. Palatin’s programs are based on molecules that modulate the activity of the melanocortin and natriuretic peptide receptor systems. The melanocortin system is involved in a large and diverse number of physiologic functions, and therapeutic agents modulating this system may have the potential to treat a variety of conditions and diseases, including sexual dysfunction, obesity and related disorders, cachexia (wasting syndrome) and inflammation-related diseases. The natriuretic peptide receptor system has numerous cardiovascular functions, and therapeutic agents modulating this system may be useful in treatment of acute asthma, heart failure, hypertension and other cardiovascular diseases.

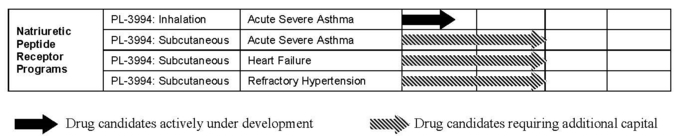

The Company’s primary product in development is bremelanotide for the treatment of female sexual dysfunction (FSD). The Company is also developing an inhalation formulation of PL-3994, an agonist peptide mimetic which binds to natriuretic peptide receptor A, for treatment of acute exacerbations of asthma. The Company also has drug candidates or development programs for sexual dysfunction, including erectile dysfunction, pulmonary diseases, heart failure, obesity and inflammatory diseases. The Company has an exclusive global research collaboration and license agreement with AstraZeneca AB (AstraZeneca) to commercialize compounds that target melanocortin receptors for the treatment of obesity, diabetes and related metabolic syndrome.

Key elements of the Company’s business strategy include using its technology and expertise to develop and commercialize therapeutic products; entering into alliances and partnerships with pharmaceutical companies to facilitate the development, manufacture, marketing, sale and distribution of product candidates that the Company is developing; and partially funding its product candidate development programs with the cash flow generated from the Company’s license agreements with AstraZeneca and any other companies.

Business Risk and Liquidity – The Company has incurred negative cash flows from operations since its inception, and has expended, and expects to continue to expend in the future, substantial funds to complete its planned product development efforts. As shown in the accompanying consolidated financial statements, the Company has an accumulated deficit as of September 30, 2011 and incurred a net loss for the three months ended September 30, 2011. The Company anticipates incurring additional losses in the future as a result of spending on its development programs. To achieve profitability, the Company, alone or with others, must successfully develop and commercialize its technologies and proposed products, conduct successful preclinical studies and clinical trials, obtain required regulatory approvals and successfully manufacture and market such technologies and proposed products. The time required to reach profitability is highly uncertain, and there can be no assurance that the Company will be able to achieve profitability on a sustained basis, if at all.

As of September 30, 2011, the Company’s cash and cash equivalents were $14.9 million. Management believes that the Company’s existing capital resources will be adequate to fund its currently planned operations, focusing on clinical trials of bremelanotide for FSD, through at least calendar year 2012. Phase 3 clinical trials of bremelanotide for FSD, which will not commence before calendar year 2013, will require significant additional resources and capital.

The Company intends to utilize existing capital resources to fund its planned operations, including its Phase 2B clinical trial with bremelanotide for FSD, and to seek additional capital, through collaborative arrangements or other sources, for development of its other product candidates. However, sufficient additional funding to support other product candidates, including PL-3994 for acute asthma or other indications, may not be available on acceptable terms, or at all. The Company will not expend significant amounts for other product candidates unless additional sources of capital, including collaboration agreements, are identified for these programs.

Concentrations – Concentrations in the Company’s assets and operations subject it to certain related risks. Financial instruments that subject the Company to concentrations of credit risk primarily consist of cash and cash equivalents. The Company’s cash and cash equivalents are primarily invested in one money market fund sponsored by a large financial institution. For the three months ended September 30, 2011 and 2010, 100% of revenues were from AstraZeneca.

(2) BASIS OF PRESENTATION:

The accompanying unaudited consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q. Accordingly, they do not include all of the information and footnote disclosures required to be presented for complete financial statements. In the opinion of management, these consolidated financial statements contain all adjustments (consisting of normal recurring adjustments) considered necessary to present fairly the Company’s financial position as of September 30, 2011, and its results of operations and its cash flows for the three months ended September 30, 2011 and 2010. The results of operations for the three months ended September 30, 2011 may not necessarily be indicative of the results of operations expected for the full year, except that the Company expects to incur a significant loss for the fiscal year ending June 30, 2012.

The accompanying consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s annual report on Form 10-K for the year ended June 30, 2011, filed with the Securities and Exchange Commission (SEC), which includes consolidated financial statements as of June 30, 2011 and 2010 and for each of the fiscal years in the three-year period ended June 30, 2011.

(3) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

Principles of Consolidation – The consolidated financial statements include the accounts of Palatin and its wholly-owned inactive subsidiary. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates – The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents – Cash and cash equivalents include cash on hand, cash in banks and all highly liquid investments with a purchased maturity of less than three months. Cash equivalents consist of $14,326,142 and $18,383,284 in a money market fund at September 30, 2011 and June 30, 2011, respectively. Restricted cash secures letters of credit for security deposits on leases.

Fair Value of Financial Instruments – The Company’s financial instruments consist primarily of cash equivalents, accounts receivable, accounts payable, and capital lease obligations. Management believes that the carrying value of these assets and liabilities are representative of their respective fair values based on the short-term nature of these instruments.

Property and Equipment – Property and equipment consists of office and laboratory equipment, office furniture and leasehold improvements and includes assets acquired under capital leases. Property and equipment are recorded at cost. Depreciation is recognized using the straight-line method over the estimated useful lives of the related assets, generally five years for laboratory and computer equipment, seven years for office furniture and equipment and the lesser of the term of the lease or the useful life for leasehold improvements. Amortization of assets acquired under capital leases is included in depreciation expense. Maintenance and repairs are expensed as incurred while expenditures that extend the useful life of an asset are capitalized.

Impairment of Long-Lived Assets – The Company reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable. To determine recoverability of a long-lived asset, management evaluates whether the estimated future undiscounted net cash flows from the asset are less than its carrying amount. If impairment is indicated, the long-lived asset would be written down to fair value. Fair value is determined by an evaluation of available price information at which assets could be bought or sold, including quoted market prices if available, or the present value of the estimated future cash flows based on reasonable and supportable assumptions.

Deferred Rent – The Company’s operating leases provide for rent increases over the terms of the leases. Deferred rent consists of the difference between periodic rent payments and the amount recognized as rent expense on a straight-line basis, as well as tenant allowances for leasehold improvements. Rent expenses are being recognized ratably over the terms of the leases.

Revenue Recognition – Revenue from corporate collaborations and licensing agreements consists of up-front fees, research and development funding, and milestone payments. Non-refundable up-front fees are deferred and amortized to revenue over the related performance period. The Company estimates the performance period as the period in which it performs certain development activities under the applicable agreement. Reimbursements for research and development activities are recorded in the period that the Company performs the related activities under the terms of the applicable agreements. Revenue resulting from the achievement of milestone events stipulated in the applicable agreements is recognized when the milestone is achieved, provided that such milestone is substantive in nature.

Research and Development Costs – The costs of research and development activities are charged to expense as incurred, including the cost of equipment for which there is no alternative future use.

Stock-Based Compensation – The Company charges to expense the fair value of stock options and other equity awards granted. The Company determines the value of stock options utilizing the Black-Scholes option pricing model. Compensation costs for share-based awards with pro rata vesting are allocated to periods on a straight-line basis.

Income Taxes – The Company and its subsidiary file consolidated federal and separate-company state income tax returns. Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of assets and liabilities and their respective tax basis and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences or operating loss and tax credit carryforwards are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the period that includes the enactment date. The Company has recorded a valuation allowance against its deferred tax assets based on the history of losses incurred.

Net Loss per Common Share – Basic and diluted earnings per common share (EPS) are calculated in accordance with the provisions of Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 260, “Earnings per Share.”

As of September 30, 2011 and 2010, common shares issuable upon conversion of Series A Convertible Preferred Stock, the exercise of outstanding options and warrants and the vesting of restricted stock units amounted to an aggregate of 27,127,955 and 2,625,810 shares, respectively. These share amounts have been excluded in the calculation of net loss per share as the impact would be anti-dilutive.

(4) AGREEMENT WITH ASTRAZENECA:

In January 2007, the Company entered into an exclusive global research collaboration and license agreement with AstraZeneca to discover, develop and commercialize compounds that target melanocortin receptors for the treatment of obesity, diabetes and related metabolic syndrome. In June 2008, the collaboration agreement was amended to include additional compounds and associated intellectual property developed by the Company. In December 2008, the collaboration agreement was further amended to include additional compounds and associated intellectual property developed by the Company and extended the research collaboration for an additional year through January 2010. In September 2009, the collaboration agreement was further amended to modify royalty rates and milestone payments. The collaboration is based on the Company’s melanocortin receptor obesity program and includes access to compound libraries, core technologies and expertise in melanocortin receptor drug discovery and development. As part of the September 2009 amendment to the research collaboration and license agreement, the Company agreed to conduct additional studies on the effects of melanocortin receptor specific compounds on food intake, obesity and other metabolic parameters.

In December 2009 and 2008, the Company also entered into clinical trial sponsored research agreements with AstraZeneca, under which the Company agreed to conduct studies of the effects of melanocortin receptor specific compounds on food intake, obesity and other metabolic parameters. Under the terms of these clinical trial agreements, AstraZeneca paid $5,000,000 as of March 31, 2009 upon achieving certain objectives and paid all costs associated with these studies. The Company recognized $27,217 and $216,147, respectively, as revenue in the three months ended September 30, 2011 and 2010 under these clinical trial sponsored research agreements.

The Company received an up-front payment of $10,000,000 from AstraZeneca on execution of the research collaboration and license agreement. Under the September 2009 amendment the Company was paid an additional $5,000,000 in consideration of reduction of future milestones and royalties and providing specific materials to AstraZeneca. The Company is now eligible for milestone payments totaling up to $145,250,000, with up to $85,250,000 contingent on development and regulatory milestones and the balance contingent on achievement of sales targets. In addition, the Company is eligible to receive mid to high single digit royalties on sales of any approved products. AstraZeneca assumed responsibility for product commercialization, product discovery and development costs, with both companies contributing scientific expertise in the research collaboration. The Company provided research services to AstraZeneca through January 2010, the expiration of the research collaboration portion of the research collaboration and license agreement, at a contractual rate per full-time-equivalent employee.

(5) FAIR VALUE MEASUREMENTS:

The fair value of investments and cash equivalents are classified using a hierarchy prioritized based on inputs. Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. Level 2 inputs are quoted prices for similar assets and liabilities in active markets or inputs that are observable for the asset or liability, either directly or indirectly through market corroboration, for substantially the full term of the financial instrument. Level 3 inputs are unobservable inputs based on management’s own assumptions used to measure assets and liabilities at fair value. A financial asset or liability’s classification within the hierarchy is determined based on the lowest level input that is significant to the fair value measurement.

The following table provides the assets carried at fair value:

| |

Fair Value

|

Quoted prices in active markets (Level 1)

|

Quoted prices in active markets (Level 2)

|

Quoted prices in active markets (Level 3)

|

|

September 30, 2011:

|

|

|

|

|

|

Money Market Fund

|

$ 14,326,142

|

$ 14,326,142

|

$ -

|

$ -

|

|

June 30, 2011:

|

|

|

|

|

|

Money Market Fund

|

$ 18,383,284

|

$ 18,383,284

|

$ -

|

$ -

|

(6) STOCKHOLDERS’ EQUITY:

Restricted Stock Units – In June 2011, the Company granted 500,000 restricted stock units to its executive management under the Company’s 2011 Stock Incentive Plan. Half of these restricted stock units vest 12 months from the date of grant and the remainder 24 months from the date of grant. The grant date fair value of these restricted stock units of $430,000 is being amortized over the 24 month vesting period of the award. The Company recognized $80,625 of stock-based compensation expense related to these restricted stock units during the three months ended September 30, 2011.

In July 2010, the Company granted 205,000 restricted stock units to its employees under the Company’s 2005 Stock Plan. On September 15, 2010, 99,500 shares of common stock vested. The Company recognized $209,525 of stock-based compensation expense related to these restricted stock units during the three months ended September 30, 2010.

Stock-based compensation costs for the three ended September 30, 2011 and 2010 for stock options and equity-based instruments issued other than the restricted stock units described above was $129,648 and $100,918, respectively.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with the consolidated financial statements and notes to the consolidated financial statements filed as part of this report and the audited consolidated financial statements and notes thereto included in our annual report on Form 10-K for the year ended June 30, 2011.

Statements in this quarterly report on Form 10-Q, as well as oral statements that may be made by us or by our officers, directors, or employees acting on our behalf, that are not historical facts constitute “forward-looking statements”, which are made pursuant to the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934 as amended (the Exchange Act). The forward-looking statements in this quarterly report on Form 10-Q do not constitute guarantees of future performance. Investors are cautioned that statements that are not strictly historical statements contained in this quarterly report on Form 10-Q, including, without limitation, current or future financial performance, management’s plans and objectives for future operations, clinical trials and results, product plans and performance, management’s assessment of market factors, as well as statements regarding our strategy and plans and our strategic partners, constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to be materially different from historical results or from any results expressed or implied by such forward-looking statements. Our future operating results are subject to risks and uncertainties and are dependent upon many factors, including, without limitation, the risks identified in this report, in our annual report on Form 10-K for the year ended June 30, 2011 and in our other Securities and Exchange Commission (SEC) filings.

We expect to incur losses in the future as a result of spending on our planned development programs and losses may fluctuate significantly from quarter to quarter.

In this quarterly report on Form 10-Q, references to “we”, “our”, “us” or “Palatin” means Palatin Technologies, Inc. and its subsidiary.

Critical Accounting Policies and Estimates

Our significant accounting policies are described in the notes to our consolidated financial statements included in this report and in our annual report on Form 10-K for the year ended June 30, 2011, and except for the disposition of our investments as of June 30, 2011, have not changed as of September 30, 2011. We believe that our accounting policies and estimates relating to revenue recognition, accrued expenses and stock-based compensation are the most critical.

Overview

We are a biopharmaceutical company developing targeted, receptor-specific peptide therapeutics for the treatment of diseases with significant unmet medical need and commercial potential. Our programs are based on molecules that modulate the activity of the melanocortin and natriuretic peptide receptor systems. Our primary product in development is bremelanotide for the treatment of female sexual dysfunction (FSD). In addition, we have drug candidates or development programs for obesity, erectile dysfunction, pulmonary diseases, heart failure and inflammatory diseases.

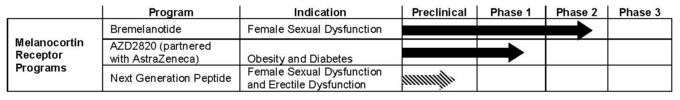

The following drug candidates are actively under development:

|

|

·

|

Bremelanotide, a peptide melanocortin receptor agonist, for treatment of FSD. This drug candidate is in Phase 2B clinical trials.

|

|

|

·

|

AZD2820, a melanocortin receptor-based compound for treatment of obesity, under development by AstraZeneca AB (AstraZeneca) pursuant to our research collaboration and license agreement. This drug candidate is in Phase 1 clinical trials.

|

|

|

·

|

An inhalation formulation of PL-3994, a peptide mimetic natriuretic peptide receptor A (NPR-A) agonist, for treatment of acute exacerbations of asthma. This PL-3994 formulation is in preclinical research.

|

The following chart shows the status of our drug candidates, including drug candidates being developed by AstraZeneca and drug candidates for which we are seeking additional capital from licensing or development agreements or other sources.

We intend to utilize our existing capital resources primarily for development of bremelanotide for FSD, and secondarily for limited development work on PL-3994. We will not initiate the preclinical activities that are required to start clinical trials with an inhaled formulation of PL-3994, initiate clinical trials with subcutaneous formulations of PL-3994, or initiate preclinical toxicity and other studies with new peptide drug candidates for sexual dysfunction unless we obtain additional capital, through collaborative arrangements or other sources, to support such activities.

Key elements of our business strategy include: using our technology and expertise to develop and commercialize innovative therapeutic products; entering into alliances and partnerships with pharmaceutical companies to facilitate the development, manufacture, marketing, sale and distribution of product candidates that we are developing; and, partially funding our product development programs with the cash flow generated from our license agreement with AstraZeneca and any other companies.

We incorporated in Delaware in 1986 and commenced operations in the biopharmaceutical area in 1996. Our corporate offices and research and development facility are located at 4C Cedar Brook Drive, Cranbury, New Jersey 08512 and our telephone number is (609) 495-2200. We maintain an Internet site at http://www.palatin.com, where among other things, we make available free of charge on and through this website our Forms 3, 4 and 5, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) and Section 16 of the Securities Exchange Act of 1934, as amended (the Exchange Act of 1934) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our website and the information contained in it or connected to it are not incorporated into this quarterly report on Form 10-Q.

Results of Operations

Three Months Ended September 30, 2011 Compared to the Three Months Ended September 30, 2010

Revenue – For the three months ended September 30, 2011, we recognized $27,217 in revenue compared to $0.2 million for three months ended September 30, 2010 pursuant to our license agreement with AstraZeneca. Revenue for the three months ended September 30, 2011 and 2010 consisted entirely of reimbursement of development costs and per-employee compensation, earned at the contractual rate.

Research and Development – Research and development expenses decreased to $2.3 million for the three months ended September 30, 2011 from $3.5 million for the three months ended September 30, 2010. The decrease is the result of reducing staffing levels pursuant to our strategic decision announced in September 2010 to focus resources and efforts on clinical trials of bremelanotide and PL-3994 and preclinical development of an inhaled formula of PL-3994 and a new peptide drug candidate for sexual dysfunction.

Research and development expenses related to our bremelanotide, PL-3994, peptide melanocortin agonist, obesity, NeutroSpec (a previously marketed imaging product on which all work is suspended) and other preclinical programs were $1.3 million for the three months ended September 30, 2011 compared to $0.8 million for the three months ended September 30, 2010. Spending to date has been primarily related to our Phase 2B clinical trial evaluating the efficacy and safety of bremelanotide for the treatment of FSD. The amount of such spending and the nature of future development activities are dependent on a number of factors, including primarily the availability of funds to support future development activities, success of our clinical trials and preclinical and discovery programs, and our ability to progress compounds in addition to bremelanotide and PL-3994 into human clinical trials.

The historical amounts of project spending above exclude general research and development spending, which decreased to $1.0 million for three months ended September 30, 2011 compared to $2.7 million for three months ended September 30, 2010. The decrease is the result of reducing staffing levels pursuant to our strategic decision announced in September 2010 to focus resources and efforts on clinical trials of bremelanotide and PL-3994 and preclinical development of an inhaled formula of PL-3994 and a new peptide drug candidate for sexual dysfunction.

Cumulative spending from inception to September 30, 2011 on our bremelanotide, NeutroSpec and other programs (which include PL-3994, other melanocortin receptor agonists, obesity, and other discovery programs) amounts to approximately $143.6 million, $55.6 million and $59.0 million, respectively. Due to various risk factors described in our periodic filings with the SEC, including the difficulty in currently estimating the costs and timing of future Phase 1 clinical trials and larger-scale Phase 2 and Phase 3 clinical trials for any product under development, we cannot predict with reasonable certainty when, if ever, a program will advance to the next stage of development or be successfully completed, or when, if ever, net cash inflows will be generated.

General and Administrative – General and administrative expenses decreased to $1.1 million for the three months ended September 30, 2011 compared to $1.4 million for the three months ended September 30, 2010. The decrease is the result of reducing staffing levels pursuant to our strategic decision announced in September 2010 to focus resources and efforts on clinical trials of bremelanotide and PL-3994 and preclinical development of an inhaled formula of PL-3994 and a new peptide drug candidate for sexual dysfunction.

Liquidity and Capital Resources

Since inception, we have incurred net operating losses, primarily related to spending on our research and development programs. We have financed our net operating losses primarily through equity financings and amounts received under collaborative agreements.

Our product candidates are at various stages of development and will require significant further research, development and testing and some may never be successfully developed or commercialized. We may experience uncertainties, delays, difficulties and expenses commonly experienced by early stage biopharmaceutical companies, which may include unanticipated problems and additional costs relating to:

• the development and testing of products in animals and humans;

• product approval or clearance;

• regulatory compliance;

• good manufacturing practices;

• intellectual property rights;

• product introduction;

• marketing, sales and competition; and

• obtaining sufficient capital.

Failure to enter into collaboration agreements and obtain timely regulatory approval for our product candidates and indications would impact our ability to increase revenues and could make it more difficult to attract investment capital for funding our operations. Any of these possibilities could materially and adversely affect our operations and require us to curtail or cease certain programs.

During the three months ended September 30, 2011, we used $4.0 million of cash for our operating activities, compared to $4.2 million used in the three months ended September 30, 2010. Lower net cash outflows from operations in the three months ended September 30, 2011 was the result of reducing staffing levels pursuant to our strategic decision announced in September 2010 to focus resources and efforts on clinical trials of bremelanotide and PL-3994 and preclinical development of an inhaled formula of PL-3994 and a new peptide drug candidate for sexual dysfunction. Our periodic accounts receivable balances will continue to be highly dependent on the timing of receipts from collaboration partners and the division of development responsibilities between us and our collaboration partners.

During the three months ended September 30, 2011, cash used by financing activities of $10,256 consisted of payments on capital lease obligations during the quarter. During the three months ended September 30, 2010, cash provided by financing activities of $41,000 was derived primarily from the exercise of warrants during the quarter.

As of September 30, 2011, our cash and cash equivalents were $14.9 million and our current liabilities were $1.7 million. We believe that our cash and cash equivalents are adequate to fund our planned operations, including completion of our ongoing Phase 2B clinical trial with bremelanotide for FSD, through at least calendar year 2012. We have made the strategic decision to focus resources and efforts on our Phase 2B clinical trial with bremelanotide for FSD, while conducting limited development work on PL-3994, including development of an

inhaled formulation of PL-3994. We have ceased research and development efforts on new product candidates. However, we do not intend to expend substantial amounts on PL-3994, new peptide drug candidates for sexual dysfunction or other programs unless we obtain additional capital, through collaborative arrangements or other sources, to support such activities.

These funds are not sufficient to complete all of the clinical trials required for product approval for any of our products. We expect that the Phase 3 bremelanotide clinical trial program for FSD, which will not commence before calendar year 2013, will require significant additional resources and capital. We intend to seek additional capital through public or private equity or debt financings, collaborative arrangements on our product candidates, or other sources. However, sufficient additional funding to support projected operations, including Phase 3 clinical trials with bremelanotide or preclinical studies and clinical trials with PL-3994, or both, may not be available on acceptable terms or at all. If additional funding is not available, we will be required to seek collaborators for our product candidates at an earlier stage than otherwise would be desirable and on terms that are less favorable than might otherwise be available, and relinquish, license or otherwise dispose of rights on unfavorable terms to technologies and product candidates that we would otherwise seek to develop or commercialize ourselves. The nature and timing of our development activities are highly dependent on our financing activities.

We anticipate incurring additional losses over at least the next few years. To achieve profitability, if ever, we, alone or with others, must successfully develop and commercialize our technologies and proposed products, conduct preclinical studies and clinical trials, obtain required regulatory approvals and successfully manufacture and market such technologies and proposed products. The time required to reach profitability is highly uncertain, and we do not know whether we will be able to achieve profitability on a sustained basis, if at all.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

Not required to be provided by smaller reporting companies.

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures, as defined in Exchange Act Rules 13a-15(e) and 15d-15(e), as of the end of the period covered by this report. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were effective as of September 30, 2011. There were no changes in our internal control over financial reporting that occurred during our most recent fiscal quarter that materially affected, or that are reasonably likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

We may be involved, from time to time, in various claims and legal proceedings arising in the ordinary course of our business. We are not currently a party to any claim or legal proceeding.

There have been no material changes to our risk factors disclosed in Part I, Item 1A. of our annual report on Form 10-K for the fiscal year ended June 30, 2011.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

None.

Item 3. Defaults Upon Senior Securities.

None.

Item 5. Other Information.

None.

Exhibits filed or furnished with this report:

| |

10.01

|

Letter agreement dated October 7, 2011 between Palatin and Biotechnology Value Fund, L.P., incorporated by reference to Exhibit 10.01 of our Current Report on Form 8-K, filed with the SEC on October 7, 2011.

|

| |

31.1

|

Certification of Chief Executive Officer.

|

| |

31.2

|

Certification of Chief Financial Officer.

|

| |

32.1

|

Certification by Chief Executive Officer pursuant to 18 U.S.C. Section 1350.

|

| |

32.2

|

Certification by Chief Financial Officer pursuant to 18 U.S.C. Section 1350.

|

| |

101.INS

|

XBRL Instance Document

|

| |

101.SCH

|

XBRL Taxonomy Extension Schema Document

|

| |

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

| |

101.LAB

|

XBRL Taxonomy Extension Label Linkbase Document

|

| |

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

| |

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

Palatin Technologies, Inc.

|

|

| |

|

(Registrant) |

|

| |

|

|

| |

| |

| |

|

/s/ Carl Spana |

|

| Date: November 14, 2011 |

|

Carl Spana, Ph.D.

President and

Chief Executive Officer (Principal

Executive Officer)

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

/s/ Stephen T. Wills

|

|

|

Date: November 14, 2011

|

|

Stephen T. Wills, CPA, MST

Executive Vice President, Chief Financial Officer and Chief Operating Officer

|

|

EXHIBIT INDEX

| |

10.01

|

Letter agreement dated October 7, 2011 between Palatin and Biotechnology Value Fund, L.P., incorporated by reference to Exhibit 10.01 of our Current Report on Form 8-K, filed with the SEC on October 7, 2011.

|

| |

31.1

|

Certification of Chief Executive Officer.

|

| |

31.2

|

Certification of Chief Financial Officer.

|

| |

32.1

|

Certification by Chief Executive Officer pursuant to 18 U.S.C. Section 1350.

|

| |

32.2

|

Certification by Chief Financial Officer pursuant to 18 U.S.C. Section 1350.

|

| |

101.INS

|

XBRL Instance Document

|

| |

101.SCH

|

XBRL Taxonomy Extension Schema Document

|

| |

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

| |

101.LAB

|

XBRL Taxonomy Extension Label Linkbase Document

|

| |

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

| |

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document

|