Filed by 3D Systems Corporation pursuant to Rule 425 under the U.S. Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: Stratasys Ltd. Commission File No.: 001-35751 The following presentaon was delivered by 3D Systems to Instuonal Shareholder Services Inc. and Glass, Lewis & Co. on September 13, 2023:

+ •Cover style Building a Global Leader in Additive Manufacturing SEPTEMBER 13, 2023

Forward-Looking Statements Certain statements made in this document that are not statements of integration will be successful or synergies will be realized if such historical or current facts are forward-looking statements within the transaction were to be consummated. Business combination proposals, meaning of the Private Securities Litigation Reform Act of 1995. Forward- transactions and integrations are subject to numerous risks and looking statements involve known and unknown risks, uncertainties and uncertainties. Although management believes that the expectations other factors that may cause the actual results, performance or reflected in the forward-looking statements are reasonable, forward-looking achievements of the company to be materially different from historical statements are not, and should not be relied upon as a guarantee of future results or from any future results or projections expressed or implied by performance or results, nor will they necessarily prove to be accurate such forward-looking statements. In many cases, forward-looking indications of the times at which such performance or results will be statements can be identified by terms such as “believes,” “belief,” “expects,” achieved. The forward-looking statements included are made only as of the “may,” “will,” “estimates,” “intends,” “anticipates” or “plans” or the negative date of the statement. 3D Systems undertakes no obligation to update or of these terms or other comparable terminology. Forward-looking revise any forward-looking statements made by management or on its statements are based upon management’s beliefs, assumptions and behalf, whether as a result of future developments, subsequent events or current expectations and may include comments as to the company’s circumstances, or otherwise, except as required by law. beliefs and expectations as to future events and trends affecting its All references to the binding nature of the offer and merger agreement business and are necessarily subject to uncertainties, many of which are being proposed by 3D Systems, whether in a press release, presentation, outside the control of the company. The factors described under the other document or public statement, are subject to the contents of the headings “Forward-Looking Statements” and “Risk Factors” in the escrow letter that has been delivered to Stratasys and will be on file publicly company’s with the SEC. periodic filings with the Securities and Exchange Commission, as well as other factors, could cause actual results to differ materially from those reflected or predicted in forward-looking statements. In particular, we note that there is no assurance that a definitive agreement for the transaction referenced in this document will be entered into or consummated or that 2

Additional Information This communication does not constitute an offer to buy or sell or the This document shall not constitute an offer to buy or sell or the solicitation solicitation of an offer to sell or buy any securities. This communication of an offer to sell or buy any securities, nor shall there be any sale of relates to a proposal which 3D Systems has made for a business securities in any jurisdiction in which such offer, solicitation or sale would combination with Stratasys. In furtherance of this proposal and subject to be unlawful prior to registration or qualification under the securities laws of future developments, 3D Systems (and, if a negotiated transaction is any such jurisdiction. No offering of securities shall be made except by agreed, Stratasys) may file one or more registration statements, proxy means of a prospectus meeting the requirements of Section 10 of the U.S. statements or other documents with the SEC. This communication is not a Securities Act of 1933, as amended. substitute for any proxy statement, registration statement, prospectus or This communication is neither a solicitation of a proxy nor a substitute for other document that 3D Systems and/or Stratasys may file with the SEC in any proxy statement or other filings that may be made with the SEC. connection with the proposed transaction. Nonetheless, 3D Systems and its directors and executive officers and other Investors and security holders of 3D Systems and Stratasys are urged to members of management and employees may be deemed to be read the proxy statement(s), registration statement, prospectus and/or participants in the solicitation of proxies in respect of the proposed other documents filed with the SEC carefully in their entirety if and when transaction. You can find information about 3D Systems’ executive officers they become available as they will contain important information about the and directors in 3D Systems’ definitive proxy statement filed with the SEC proposed transaction. Any definitive proxy statement(s) or prospectus(es) on April 5, 2023. Additional information regarding the interests of such (if and when available) will be mailed to stockholders of 3D Systems and/or potential participants will be included in one or more registration Stratasys, as applicable. Investors and security holders will be able to obtain statements, proxy statements or other documents filed with the SEC if and free copies of these documents (if and when available) and other when they become available. These documents (if and when available) may documents filed with the SEC by 3D Systems through the web site be obtained free of charge from the SEC’s website at http://www.sec.gov. maintained by the SEC at http://www.sec.gov. 3

Executive Summary 4

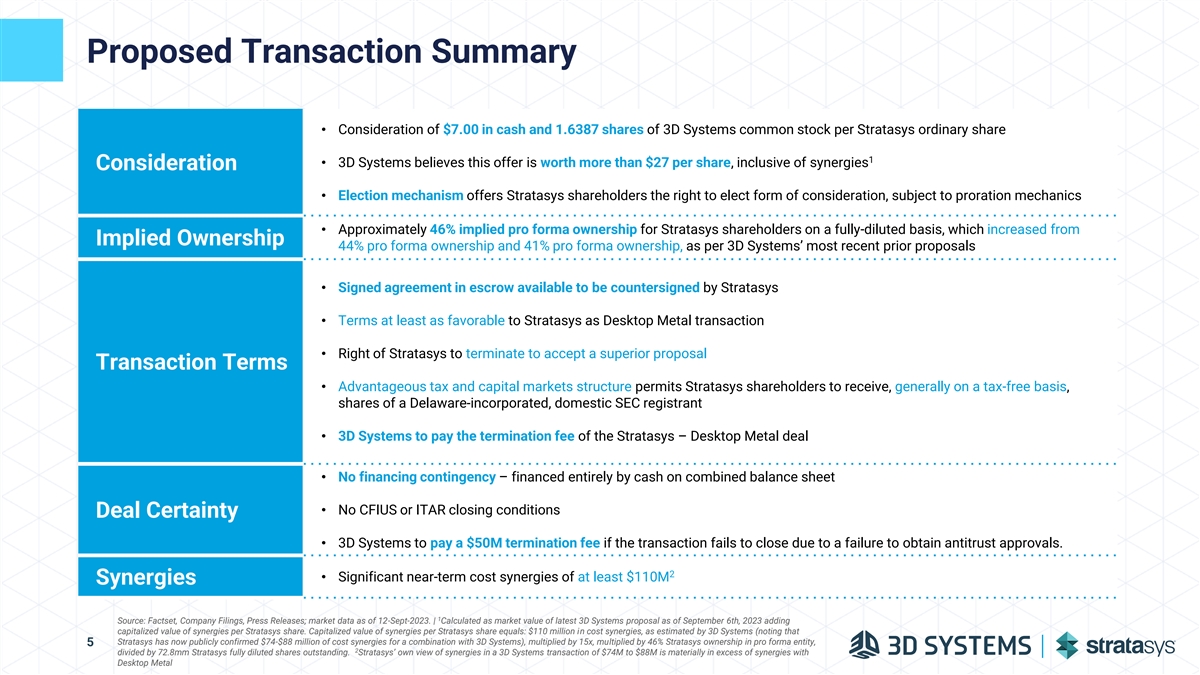

Proposed Transaction Summary • Consideration of $7.00 in cash and 1.6387 shares of 3D Systems common stock per Stratasys ordinary share 1 • 3D Systems believes this offer is worth more than $27 per share, inclusive of synergies Consideration • Election mechanism offers Stratasys shareholders the right to elect form of consideration, subject to proration mechanics • Approximately 46% implied pro forma ownership for Stratasys shareholders on a fully-diluted basis, which increased from Implied Ownership 44% pro forma ownership and 41% pro forma ownership, as per 3D Systems’ most recent prior proposals • Signed agreement in escrow available to be countersigned by Stratasys • Terms at least as favorable to Stratasys as Desktop Metal transaction • Right of Stratasys to terminate to accept a superior proposal Transaction Terms • Advantageous tax and capital markets structure permits Stratasys shareholders to receive, generally on a tax-free basis, shares of a Delaware-incorporated, domestic SEC registrant • 3D Systems to pay the termination fee of the Stratasys – Desktop Metal deal • No financing contingency – financed entirely by cash on combined balance sheet • No CFIUS or ITAR closing conditions Deal Certainty • 3D Systems to pay a $50M termination fee if the transaction fails to close due to a failure to obtain antitrust approvals. 2 • Significant near-term cost synergies of at least $110M Synergies 1 Source: Factset, Company Filings, Press Releases; market data as of 12-Sept-2023. | Calculated as market value of latest 3D Systems proposal as of September 6th, 2023 adding capitalized value of synergies per Stratasys share. Capitalized value of synergies per Stratasys share equals: $110 million in cost synergies, as estimated by 3D Systems (noting that Stratasys has now publicly confirmed $74-$88 million of cost synergies for a combination with 3D Systems), multiplied by 15x, multiplied by 46% Stratasys ownership in pro forma entity, 5 2 divided by 72.8mm Stratasys fully diluted shares outstanding. Stratasys’ own view of synergies in a 3D Systems transaction of $74M to $88M is materially in excess of synergies with Desktop Metal

Attractive and Credible, Combined Financial Profile, Jointly Agreed with Stratasys Combined Company Near-Term Financial Profile Organic Revenue Growth Double-Digit Gross Profit Margin ~50% R&D Spend ~12% SG&A Spend ~25% EBITDA Margin 15%+ Source: Combined Management Estimates from September 2022 Meeting. 6

The Market Continues to Speak Stratasys Three-Day Share Price “We do not believe that the Board can reject the obvious any longer: a 3D Reaction Post-Announcement Systems transaction is significantly more compelling than the current alternatives and warrants immediate engagement.” - The Donerail Group 14.1% 10.6% 8.7% “As the largest shareholder of Stratasys, Nano Dimension intends to support a review of strategic 2.5% alternatives to further enhance shareholder value, including through industry consolidation, possibly through a negotiated combination with -1.5% Second Public Third Public Offer 3D Systems…” Tender Offer First Public Offer Merger Announcement Announcement Confirmation Offer Confirmation (July 13, 2023) (May 25, 2023) (March 9, 2023) (June 2, 2023) (June 27, 2023) Source: Factset, press releases 7

Stratasys' Process Seemed Designed For One Outcome Since 2021 began, 3D Systems has continually reached out to Stratasys about a potential combination Almost every time, Stratasys refused to hold discussions with 3D Systems Stratasys only engaged with 3D Systems when facing a proxy contest from Nano Dimension In its July 17 presentation regarding the proxy contest, Stratasys claimed a key reason to vote for its directors was that “Nano could block SSYS’ ability to engage in discussions with 3D Systems or any other value maximizing transactions for the SSYS shareholders” Stratasys engaged almost immediately with Desktop Metal, on two separate occasions Why are Stratasys’ board and management so focused on one possible outcome? It smells of entrenchment All of our offers, at the time, have been superior to the alternative DM deal Was Stratasys’ board truly open to a merger with 3D Systems? Or was its engagement with us insincere, so that they could tell shareholders, “We tried”? Source: Stratasys and Desktop Metal Combination Conference Call and Webcast on 25 May 2023. 8

Enhanced Our Offer Per Stratasys’ Feedback Stratasys listed more stock consideration, closing certainty, and management as their key concerns. 3D Systems addressed those concerns in our latest proposal. Cumulative 6% increase in combined ownership since May offer, resulting in incremental ✓ 1 exposure to $110M of synergies We have agreed to discuss a key leadership role for Stratasys’ CEO to help ensure a smooth ✓ integration of the two companies and maximize value creation Allocating $10 million specifically to retain key management and employees ✓ 3D Systems will pay a $50 million reverse termination fee to Stratasys if our deal cannot ✓ obtain anti-trust clearance, demonstrating our confidence 1 Stratasys’ own view of synergies in a 3D Systems transaction of $74M to $88M is materially in excess of synergies with Desktop Metal 9

Well-Positioned to Obtain Regulatory Clearances 3D Systems is confident that all applicable regulatory clearances for the proposed combination will be obtained Combined R&D Additive Industry is Capability Will Bring Manufacturing is a Experiencing Better Solutions to Dynamic Space with Accelerated 1 2 3 Consumers Intense Competition Innovation • Combines R&D teams, enhancing • Commoditization of desktop • Additive manufacturing continues innovation and bringing new segment to gain acceptance in new, solutions to customers groundbreaking use cases and • Intensification of competition manufacturers move to support • Leverages complementary skill across printing process and them sets across hardware, software, materials by both smaller players consumables, and services to and larger firms such as EOS, HP, • $2.8bn of global venture capital bring new products to market more Carbon, and GE investment into Additive quickly Manufacturing startups in 2022, up • Multitude of competitors and new 14% YoY • Creates scale to support greater entrants, including emerging number of customers, increasing Chinese players, creates a highly incentive to invest fragmented industry 10

Closing of Stratasys + DM Highly Uncertain Ñ There is NO assurance the Stratasys + DM deal will close The Stratasys + DM merger contains unusual rights to terminate including if an undisclosed list of Desktop Metal’s highly problematic commercial contracts are not Ñ terminated or modified, along with an obligation by Stratasys to pay a $19 million termination fee to exercise this termination right The Stratasys + DM deal requires CFIUS approval; 3D + Stratasys would not Ñ 11

Our Proposed Transaction is Unparalleled + Delivers Significant Value Creation Concerning Impact on Stratasys’ Combined with Exceptional Cost ✓ ? Financial Profile and Cash Generation Synergies Creates Unmatched Global Player in a Questionable Synergies and Highly ✓ ? Rapidly Scaling Industry Speculative Multiple Re-Rating Highly Complementary Portfolio with a Puzzling Thesis Around 28-Year-Old Comprehensive Offering Including Proven ? ✓ Binder Jet Metals Technology Metals Applications 12

Overview of Additive Manufacturing Industry and 3D Systems 13

Shareholders to Benefit from Supportive Industry Trends Compelling Growth Drivers Additive Manufacturing experiencing an inflection point as it transitions from the lab to the factory floor driven by improved economics and supply chain risk reduction $80B+ Continuous expansion of Additive Manufacturing use cases 1 2029 into new industries Increasing software integration that incorporates AI and machine learning will drive 3D printing workflow optimization ~$15B 1 2021 3D printing with advanced materials rapidly expanding use in human applications (dental, orthopedic, biologic) Post-COVID reevaluation of supply chain is driving ~21% increased adoption of Additive Manufacturing CAGR Over 2 Next 5-7 Years 1 2 Based on Fortune Business Insights. Average based on Fortune Business Insights, Grand View Research, Markets and Markets, Modor Research, and Wohlers Report. 14

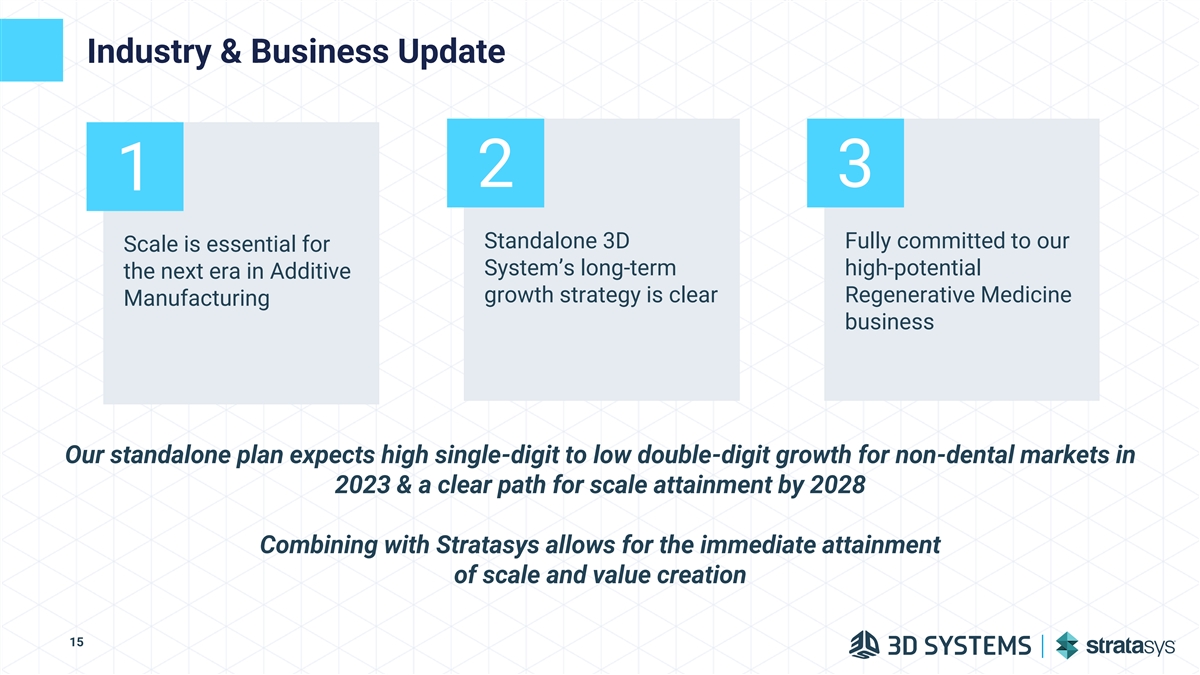

Industry & Business Update 2 3 1 Standalone 3D Fully committed to our Scale is essential for System’s long-term high-potential the next era in Additive growth strategy is clear Regenerative Medicine Manufacturing business Our standalone plan expects high single-digit to low double-digit growth for non-dental markets in 2023 & a clear path for scale attainment by 2028 Combining with Stratasys allows for the immediate attainment of scale and value creation 15

An Attractive Core Business Poised for Further Growth Industrial Solutions Healthcare Solutions Dental Solutions (excl. Dental) • 2% year-over-year growth in 1H’23 • Industry working through high- • Driven by growth and adoption in levels of inventory • 7% year-over-year growth in 1H’23 Aerospace & Defense and other • Seeing stabilization of case • Driven by emergence of Virtual key verticals volumes, not declines Surgical Planning and Orthopedic • Exclusive supplier of #1 player in applications clear aligners space provides confidence in a segment rebound • Business continues to perform in- line with expectations set in early Transportation & Aerospace & FY’23; expecting more favorable Motor Sports Defense Craniomaxillofacial Virtual Surgical Planning comp for 2H’23 Dental & Orthodontic Orthopedic Semiconductor Oil & Gas and Energy Delivering year-to-date organic revenue growth in our non-dental markets 16

An Incredibly Differentiated Position in Regenerative Medicine 3D Systems Human Organs (Lung, Kidney, and Liver) Bioprinting Leadership Most Complex Object Ever 3D Printed: • 2 Lobes • 5,000 kilometers of vasculature • 213 Million Alveoli • 44 Trillion Voxels 35+ Years of developing Targeting First in Human Trials (Lungs) 2026 advanced 3D printing applications 3D printed human lung scaffold Non-Organ Tissues Drug Development Organ development Bioprinted “Organ-on-a-chip” partnership since 2017 can accurately replicate organ-specific drug response in pre-clinical drug trials Acquired in 2021 to expand bioprinting capabilities Vascularized Breast Tissue Scaffold for Implantation & Cellularization h-VIOS chip with perfused vasculature 2 17

The Opportunity in Regenerative Medicine is Vast Organs: • 2,569 lung transplants completed worldwide in 2021 • 3,111 patients were added to the waiting list in the United States alone • The number of patients formally added to the lung transplant waiting list has grown almost 28% compared to the last decade that began in 2010 Drug Development: • Per the FDA, animal testing of new therapeutics is no longer a requirement in order to move into human trials, providing an additive incentive to introduce new, more effective testing methods for new drug therapies • Bringing a new drug to market is estimated at $2.3 billion per drug, with average return on investment of just 1.2% Non-Organ Tissues: • New partnership with Theradaptive for orthopedic regeneration • Theradaptive has already earned three breakthrough medical device designations from the FDA, with human trials targeted for later this year • Their OsteoAdapt product could address a roughly $4 billion annual market 18

3D Systems’ Offer is Far Better for Stratasys Shareholders 19

Scale Drives Greater Profitability “The problem of this industry (…) no one has scale. So we want to scale. We want an inflection point. We want to be in manufacturing, but at the same time, we don't have the scale to do it. It's all about scale. And we can, as an industry, wait for this scale, but we need the power around in order to be able really to scale.” - Yoav Zeif, Stratasys, CEO “Scale is the most important thing in reaching a high level of profitability.” - Ric Fulop, Desktop Metal, CEO Source: Stratasys and Desktop Metal Combination Conference Call and Webcast on 25 May 2023. 20

Best-in-Class Combined Financial Profile ~$1.2bn ~$885mm 1 1 Combined 2023E Revenue Combined 2023E Revenue (More than $1bn in Revenue TODAY, NOT by 2026) ~$150mm ~$55mm 2 3 Combined 2023E EBITDA Combined 2023E EBITDA Assuming run rate cost synergies Assuming run rate cost synergies ~13% ~6% 2 3 Combined 2023E EBITDA Margin Combined 2023E EBITDA Margin Assuming run rate cost synergies Assuming run rate cost synergies 1 2 Sources: Company Filings. Note: Based on midpoint of CY2023E guidance. Based on midpoint of CY2023E EBITDA guidance and $110mm run-rate cost synergies. Stratasys’ own 3 view of synergies in a 3D Systems transaction of $74M to $88M is materially in excess of synergies with Desktop Metal. Assumes no 2023E EBITDA for 3D Systems. Based on midpoint 21 of CY2023E EBITDA guidance and $50mm of run-rate cost synergies as stated in investor presentation published 20-Jun-2023.

3D Systems is the Best Entry into Metals for Stratasys Binder Jet Metals not ready for mass production DMP Metals – Laser Bed û Binder Jet Metals Fusion Metals None of the players in Binder Jet Dental ✓û Metals have achieved consistent û profitability Healthcare – Guides ✓û and Instrumentation Healthcare – Medical Binder Jet Metals output quality ✓û Devices is inconsistent û Aerospace ✓û 3D Systems’ DMP Metals sintering is a proven path into end-use, highly functional, metal part Automotive✓ ✓✓ manufacturing 3D Systems’ DMP has secured Durable Goods ✓✓ regulatory and certification success in Healthcare and ✓ Desktop û✓ Aerospace Source: Public Filings and Investor Presentations. 22

Highly Complementary Portfolio Digital Light Printing (DLP) DP Metals Jetting: Inkjet (Poly) Selective Absorption Selective Laser Sintering (Laser-Based Fusion) Fusion Proven Technologies With Little 1 Overlap Jetting: Inkjet (Wax) Extrusion SSYS Large Format Fused Filament Small-Med Format Fused Fabrication (Pellets) Deposition Modeling Stereolithography (SLA) Combination will Create Best-in-Class Offering of Proven and Complementary Technologies 1 Processes with 5% or less share of total revenue have been excluded. 23

Significant Near-Term Cost Synergies Jointly Identified and Agreed Upon by 3D Systems and Stratasys Teams Breakdown of Expected Synergies SG&A Savings • Supply chain efficiencies COGS • Eliminate overlapping functions • Effective global services support 1 SG&A $110mm+ R&D Integration of cost synergies • Optimizing development opportunities without loss of technological expertise • Design-for-cost initiatives and complementary development R&D opportunities • Ability to leverage combined portfolio of R&D investments • Harmonizing parallel investments in software platforms Synergies Expected COGS Optimization to be Fully Realized in • Optimized supply chain 18 Months Post Close, with • Footprint rationalization ~60% Realized in Year One + Potentially Meaningful Revenue Upside 24 1 Stratasys’ own view of synergies in a 3D Systems transaction of $74M to $88M is materially in excess of synergies with Desktop Metal

Higher, More Certain Near-Term Synergies + 1 ~$110M+ ~$50M vs Cost Synergies Cost Synergies Achieved in 2+ years? ✓ Synergies Expected to be Fully Realized in 18 ? $50 million is incremental to the $100 million of Months Post Close, standalone cost reductions previously announced by with 60% Realized in Year One Desktop Metal, which equates to ~60% of Desktop Metal’s 2022 Operating Expenses ✓ Complementary technologies drive R&D optimization ? Stratasys cites $50 million of revenue synergies as a ✓ ERP compatibility large driver of value creation; should be treated with skepticism 1 Source: Company Filings, Press Releases Stratasys’ own view of synergies in a 3D Systems 25 transaction of $74M to $88M is materially in excess of synergies with Desktop Metal

Clearly Superior Offer + $1.7bn $(0.6) $3.1bn $2.4 $1.0bn $0.7 $2.0bn $1.0 $ 0.5 8 Illustrative 15x 41% (Cash $0.6 Capitalization Consideration) $1.1bn Illustrative 15x Multiple on ~46% Capitalization $110mm Stratasys Multiple on Synergies Ownership $1.4 $1.4 $ 1.4 $50mm (Stock in $1.1 (Stock Synergies Consideration) Combined Consideration) Entity 8 59% 1, 2 1,3 4 2, 5 5, 6 7 Stratasys 3D Systems Illustrative Value Reduction in Combined Value Creation Stratasys Desktop Metal Net Cost Combined Value Creation to Equity Value Equity Value of Cost Combined Cash Equity Value to Stratasys Equity Equity Synergies Equity Value Stratasys Synergies Shareholders Shareholders (Capitalized) 1 1 Value Per Stratasys Share : Value Per Stratasys Share : ~$27 ~ $20 Source: Stratasys proxy and investor presentation as of 20-Jun-2023, equity research, 3D Systems Management, Bloomberg; market data as of 06-Sep-2023. Note: Excludes potential value of NOLs of the combined 1 2 3 company. | Equity values calculated based on 30-day VWAPs for Stratasys and 3D Systems as of 06-Sep-2023. | Assumes Stratasys fully diluted shares outstanding of 72.8mm, per latest public company filings. | 4 5 26 Assumes 3D Systems fully diluted shares outstanding of 140.0mm. | Including cash consideration paid to Stratasys shareholders, Desktop Metal termination fee, and illustrative transaction costs. | Equity values for 6 Desktop Metal and Stratasys are calculated based on 30-day VWAPs for Stratasys and 3D Systems as of 06-Sep-2023. | Assumes Desktop Metal fully diluted shares outstanding of 349.2mm, per latest public company 7 8 filings. | Based on $50mm cost synergies capitalized at 15.0x, net of integration costs and transaction fees of $20mm and $50mm, respectively. | Based on pro forma ownership in Stratasys proxy as of 20-Jun-2023.

Desktop Metal is a Failing Asset 27

Skepticism Around the Merits of a Stratasys + Desktop Metal Combination “Stratasys to Acquire “It feels like I want to be more excited “We believe this combination (SSYS and about the acquisition, but those DM) would never have transpired without Desktop Metal; Our Initial numbers aren't -- they're not that the outside pressure from Nano and now Take: Could Be a Mistake” promising on the surface. (…) it feels like the clean, profitable growth story behind Stratasys is acquiring a company that SSYS gets diluted down with the needed a lifeline.” unprofitable business of DM.” “As a significant individual shareholder of Stratasys, I find myself perplexed by the decision to accept “The proposed stock-for- what appears to be a significant dilution of shares due to the deal with Desktop Metal. stock transaction structure contradicts Stratasys’ claim While I acknowledge that M&A transactions are often complex, and their potential benefits may not that Stratasys’ stock is be immediately apparent, I find myself questioning the rationale behind this move given the track undervalued. By using its record of Desktop Metal and the potential impacts on Stratasys shareholders. ordinary shares as Communication is a key principle in effective corporate governance. I feel it would be beneficial for consideration, cash- Stratasys's management to engage with its shareholders, particularly those of us who have a generating Stratasys would substantial investment in the company.” be paying a premium price to acquire underperforming Desktop Metal…” - Chris Prucha, Co-Founder of Origin (acq. by Stratasys) and Stratasys Shareholder 28 Source: Wall Street Research ; LinkedIn

Unrealistic EBITDA Growth Expectations Given No Basis in Historical Performance STRATASYS MANAGEMENT DESKTOP ACTUAL DESKTOP METAL EBITDA RESULTS 1 METAL EBITDA PROJECTIONS $180 $99 $37 ($73) ($89) ($93) ($96) ($118) 2019A 2020A 2021A 2022A Jun-2023 LTM 2024E 2025E 2026E Source: Factset, Company Filings, Press Releases 29 29 1 Contribution from Desktop Metals to combined company including synergies; based on management base case projections in the Stratasys Investor Presentation as of 20-Jun-2023

Desktop Metal Has a History of Questionable Capital Deployment Leading to Meaningful Impairments ~$230M impairment ~$270M impairment Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 $680M+ cumulative cash burn February 2021 May 2021 ~$500M Beacon Bio cumulative goodwill impairment June 2021 July 2021 June 2021 November 2021 September 2021 Brewer Dental October 2021 September 2021 May Dental October 2021 Source: Factset, Company Filings as of June 2023. Note: Cash burn calculated as Cash Flows from Operations Less CapEx and Payments for Acquisitions. 30

Desktop Metal's Gross Margin is Well Below Peers' 1 DM’s gross margins are the lowest among peers Suggests DM is a low-quality business, with weak pricing power 56.3% 47.4% 47.3% 43.1% 39.7% 28.2% 27.6% 7.5% 6.3% Materialise Markforged Proto Labs voxeljet Kornit Digital Velo3D 1 Based on peers identified in the Aug. 2023 merger proxy statement by Stratasys’ and Desktop Metal’s financial advisors, who have reported 1H 2023 financial results 31

Stratasys’ “Next Big Thing” in Metals is a 28-Year-Old Technology In 8 years as a public company, In 28 years, ExOne Binder Jet û û ExOne never made a profit never approached mass production ExOne Revenue ($mm) ExOne EBITDA ($mm) $ 65 $ 59 $ 53 $(7) $(9) $(10) 2018 2019 2020 2018 2019 2020 1995 2002-2005 2021 Founding of “ProMetal” Extrude Hone entered sand 3D printings Desktop Metal Acquires division of Extrude Hone, a market with the S10 and subsequently ExOne and their Binder Jet business unit for 3D printers launched three new printing systems Technology 2013 1998 Business restructured as The Extrude Hone launched direct ExOne Company and metal 3D printing machine completed IPO on the Nasdaq using binder jetting technology Source: Public company information 32

Conclusion 33

3D Systems Welcomes Constructive Engagement History of Proposals Received by Stratasys Board of Directors Proposal Implied Value Implied Premium to Stratasys Stock Stratasys Board Date Buyer Per Stratasys Share at Market Price Decision Jan-16-2021 $43.48 37% No engagement Feb-9-2021 $ 60.00 13 % Engagement ?! Mar-10-2021 $ 40.24 65% No engagement Nov-24-2021 $ 36.46 30 % No engagement Sep-2022 NA NA Limited Engagement Mar-9-2023 $ 18.00 28 % No engagement Mar-5-2023 $16.04 12% Engagement ?! Mar-22-2023 $ 18.44 27% No engagement Mar 29-2023 $ 19.55 22 % No engagement Apr-3-2023 $ 20.05 22 % No engagement May-25-2023 $18.00 26 % No engagement 1 5 May-30-2023 $ 18.91 27% No engagement 2 5 Jun-27-2023 $19.80 33% No engagement 3 5 Jul-13-2023 $24.07 62% Limited Engagement Facing Proxy Contest 4 6 Sep-6-2023 $16.39 13% No engagement 1 2 34 Source: Company Filings, Press Releases. Note: Implied value per Stratasys share based on 3D Systems 60-Day VWAP as of 24-May-2023. Implied value per Stratasys share based on 3 th 4 3D Systems 10-Day VWAP as of 26-Jun-2023. Implied Value per Stratasys share based on 3D Systems July 12 Closing Price Implied value per Stratasys share based on 3D Systems th 5 6 th September 6 Closing Price Implied premium to closing stock price as of 24-May-2023. Implied premium to closing stock price as of September 6

An Unparalleled Transaction for Stratasys Shareholders 1 2 3 Creates Player with Delivers Exceptional Secures Higher Value Differentiated Scale Cost Synergies that Through Stronger and Broadest Drive Significant Value Financial Profile Capabilities in Rapidly Creation Growing Industry Higher Value. Equal Certainty. The Best Path Forward. 35

S A Vote Against Desktop Metal is a Vote for 3D Systems + 36